Mint Measure: Difference between revisions

(Created page with "'''Making ad spend analytics easy to understand for every marketer''' == Summary == * $930K lifetime revenue (historical & contracted) * Hired first two full-time employees in 2022 (Engineer & BDR) * Raised $200K in pre-seed round in late 2021 * Four active clients, two signed LOIs, $350k in weighted sales pipeline * Fully automated reporting UI launched Q4 2021 (manual work cut 90% YoY) * Approached by two companies for acquisition in 2022 (both declined) * Added 5x C...") |

No edit summary |

||

| Line 1: | Line 1: | ||

'''Making ad spend analytics easy to understand for every marketer''' | '''Making ad spend analytics easy to understand for every marketer''' | ||

[[File:Mintmeasurelogo.png|thumb]] | |||

== Summary == | == Summary == | ||

| Line 30: | Line 31: | ||

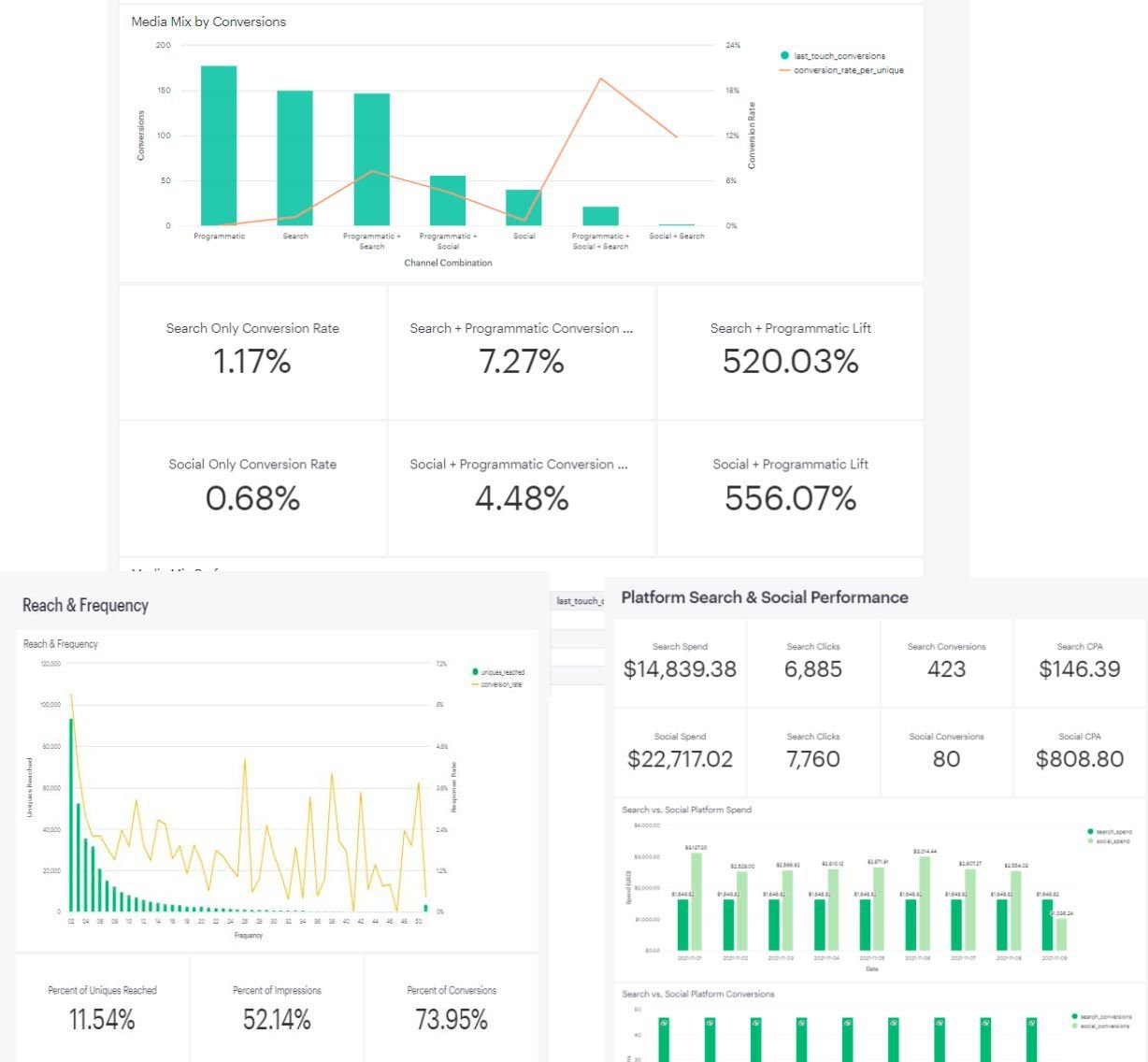

Here's a look at our UI and reports: | Here's a look at our UI and reports: | ||

[[File:81dac9f2fad9c07adc328ba9105eefb787c70cf.png]] | |||

== Product == | == Product == | ||

| Line 37: | Line 40: | ||

This data is cleaned and transformed into easy-to-read charts. Insights give context, and recommendations are provided for the client to take action. | This data is cleaned and transformed into easy-to-read charts. Insights give context, and recommendations are provided for the client to take action. | ||

[[File:C416b18259c182cb277a2fc8f44690b085b1fa79.png]] | |||

=== Mint Measure’s unfair advantage === | === Mint Measure’s unfair advantage === | ||

| Line 50: | Line 55: | ||

== Traction == | == Traction == | ||

== By the numbers == | === By the numbers === | ||

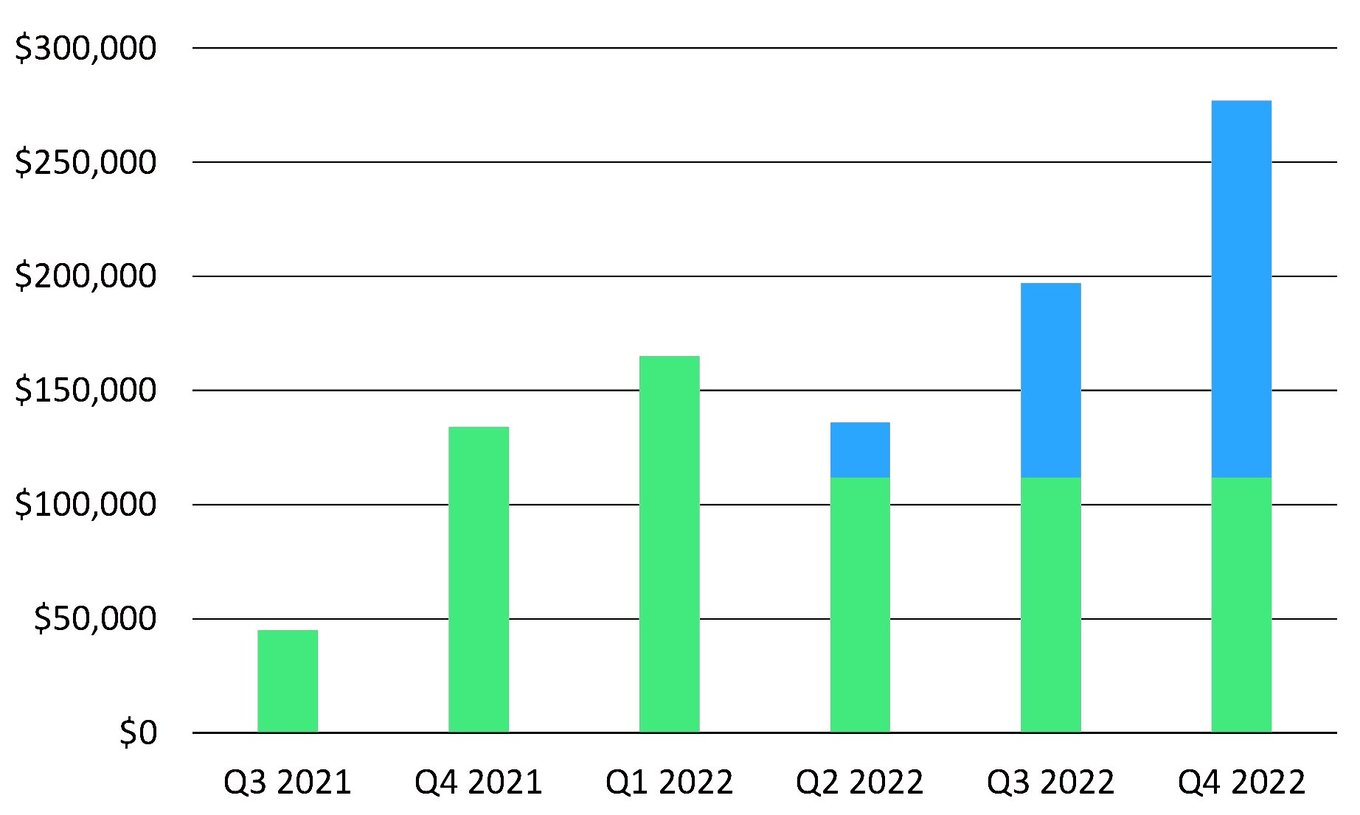

=== Revenue === | ==== Revenue ==== | ||

* 2020 revenue - $47,500 | * 2020 revenue - $47,500 | ||

| Line 58: | Line 63: | ||

* 2022 bookings - $506,000 (+53% YoY) | * 2022 bookings - $506,000 (+53% YoY) | ||

** $149K ARR + $357K Pay-per-use | ** $149K ARR + $357K Pay-per-use | ||

[[File:36d80221b9f374b46716da358c69259a13a57498.png]] | |||

=== Customers === | ==== Customers ==== | ||

* 4 active clients | * 4 active clients | ||

| Line 67: | Line 73: | ||

=== Where we are today === | === Where we are today === | ||

==== Core Analytics Platform ==== | |||

Serving clients for ~18 months | Serving clients for ~18 months | ||

| Line 74: | Line 80: | ||

* $506K booked so far for 2022 | * $506K booked so far for 2022 | ||

Repackage products | ==== Repackage products ==== | ||

* Parsed analytics into 3 SaaS products to align with client needs and stages of growth | * Parsed analytics into 3 SaaS products to align with client needs and stages of growth | ||

* Launched new SaaS website in February, with ability for customer to purchase online | * Launched new SaaS website in February, with ability for customer to purchase online | ||

Data Sales | ==== Data Sales ==== | ||

* Upsold a current client to begin using audience data | * Upsold a current client to begin using audience data | ||

* 3 upcoming pilot campaigns with brands for data sales | * 3 upcoming pilot campaigns with brands for data sales | ||

Staff & Growth | ==== Staff & Growth ==== | ||

Hired first 2 staff | Hired first 2 staff | ||

| Line 91: | Line 94: | ||

* Lead Engineer | * Lead Engineer | ||

Partnerships | ==== Partnerships ==== | ||

* Developing long term partnership with High There/CannaGrowth platform to serve as their dedicated analytics provider | * Developing long term partnership with High There/CannaGrowth platform to serve as their dedicated analytics provider | ||

* Expanding relationships with ad agencies to gain client referrals | * Expanding relationships with ad agencies to gain client referrals | ||

| Line 101: | Line 103: | ||

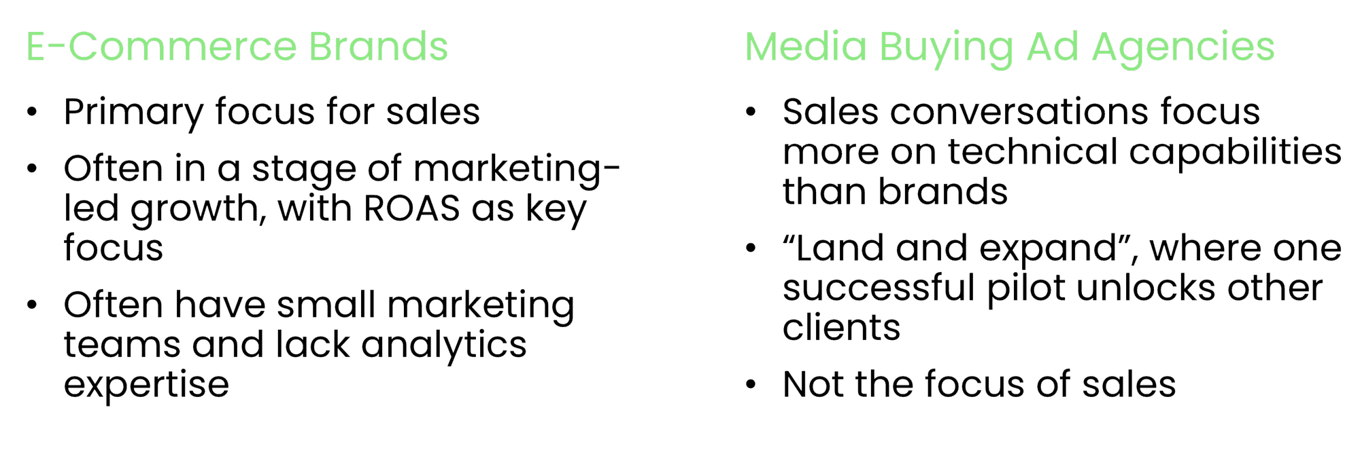

=== We service brands spending $400k–$30M per year on advertising. === | === We service brands spending $400k–$30M per year on advertising. === | ||

[[File:1695e004504aa2cec410d737a7517bbda9329bc.png]] | |||

=== Facts about attribution === | === Facts about attribution === | ||

* 70% say cost justification is a challenge | * '''70%''' say cost justification is a challenge | ||

* 78% of marketers plan to adapt of increase their use of cross channel attribution | * '''78%''' of marketers plan to adapt of increase their use of cross channel attribution | ||

* Only 39% of companies are carrying out attribution on ‘all or most’ of their marketing activities (Source: econsultancy) | * Only '''39%''' of companies are carrying out attribution on ‘all or most’ of their marketing activities (Source: '''econsultancy''') | ||

* 70% of businesses are now struggling to act on the insights they gain from attribution (Source: AdRoll) | * '''70%''' of businesses are now struggling to act on the insights they gain from attribution (Source: '''AdRoll''') | ||

* 42% of marketers report attribution manually using spreadsheets (Source: econsultancy) | * '''42%''' of marketers report attribution manually using spreadsheets (Source: econsultancy) | ||

* 53.3% say a minimal understanding is the main challenge of effective marketing attribution (Source: Ruler Analytics) | * '''53.3%''' say a minimal understanding is the main challenge of effective marketing attribution (Source: Ruler Analytics) | ||

== Business model == | == Business model == | ||

== Monthly fee and pay-per-use options == | === Monthly fee and pay-per-use options === | ||

=== Option 1: Monthly Fee (SaaS) === | ==== Option 1: Monthly Fee (SaaS) ==== | ||

* 3 tiers of product | * 3 tiers of product | ||

| Line 123: | Line 126: | ||

* Currently our GTM for 2022 | * Currently our GTM for 2022 | ||

=== Option 2: Pay-Per-Use === | ==== Option 2: Pay-Per-Use ==== | ||

* For ad agencies only | * For ad agencies only | ||

| Line 131: | Line 134: | ||

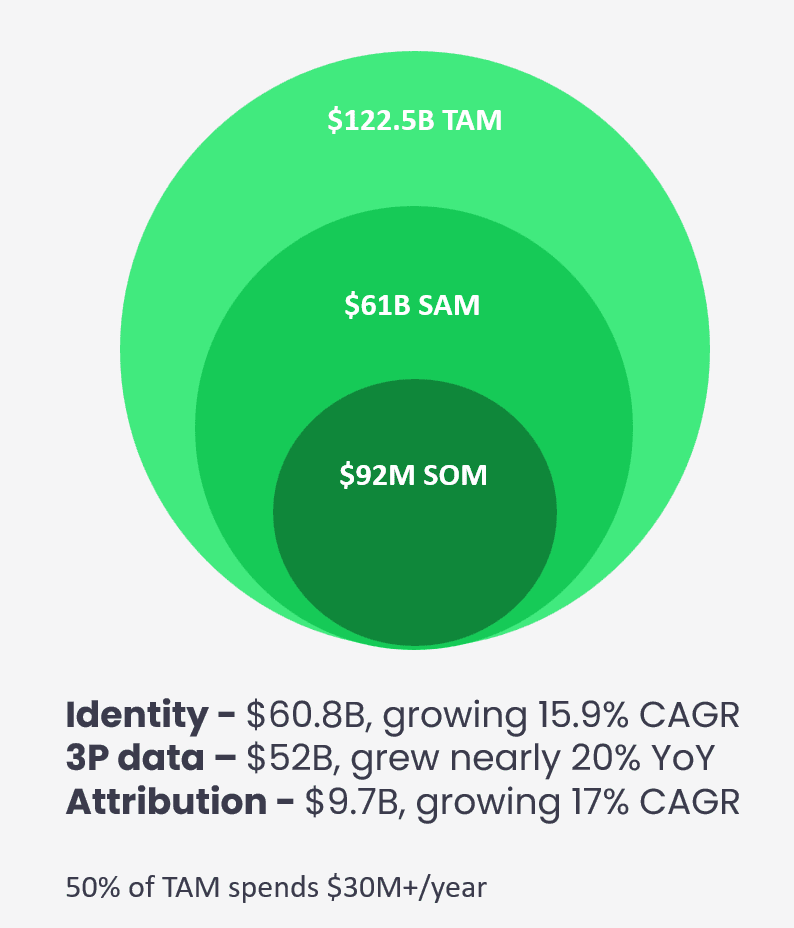

== Market == | == Market == | ||

== Attribution companies intersect: == | === Attribution companies intersect: === | ||

=== Analytics + digital identity + data sales === | ==== Analytics + digital identity + data sales ==== | ||

* Nielsen – $6B Revenue | * Nielsen – $6B Revenue | ||

| Line 143: | Line 146: | ||

* 18 month SOM* - $2M ARR | * 18 month SOM* - $2M ARR | ||

* 6 year SOM* - $92M ARR | * 6 year SOM* - $92M ARR | ||

[[File:5f40067d93a8cebfcf709cd3b5215e5401b8986.png]] | |||

<nowiki>*</nowiki>SOM is project growth | <nowiki>*</nowiki>SOM is project growth | ||

| Line 148: | Line 152: | ||

== Competition == | == Competition == | ||

== Competitive landscape == | === Competitive landscape === | ||

[[File:010b502a817b5d16e3c37db3a05eaed232a0b9c6.png]] | |||

== Vision and strategy == | == Vision and strategy == | ||

== What we'll achieve with your investment == | === What we'll achieve with your investment === | ||

==== Core Analytics (SaaS) ==== | |||

* Finalize product market fit; repeatable sales processes | * Finalize product market fit; repeatable sales processes | ||

* Add $750K ARR in 12 months | * Add $750K ARR in 12 months | ||

| Line 160: | Line 165: | ||

* Continue automating workflows and scale prep | * Continue automating workflows and scale prep | ||

Data Sales & Identity | ==== Data Sales & Identity ==== | ||

* Build pipes & automate data workflows for data sales | * Build pipes & automate data workflows for data sales | ||

** Create integrations into top 5 DSPs | ** Create integrations into top 5 DSPs | ||

| Line 168: | Line 172: | ||

=== Use of Funds === | === Use of Funds === | ||

=== Team Marketing === | ==== Team Marketing ==== | ||

* Biz Dev & Account Executives (23%) | * Biz Dev & Account Executives (23%) | ||

| Line 174: | Line 178: | ||

* Data Analyst (11%) | * Data Analyst (11%) | ||

=== Capx === | ==== Capx ==== | ||

* Databricks & Azure (7%) | * Databricks & Azure (7%) | ||

* ID5 & Experian (4%) | * ID5 & Experian (4%) | ||

=== Marketing === | ==== Marketing ==== | ||

* SEO & paid search (7%) | * SEO & paid search (7%) | ||

| Line 185: | Line 189: | ||

* Industry conferences (3%) | * Industry conferences (3%) | ||

=== Other === | ==== Other ==== | ||

* Legal (2%) | * Legal (2%) | ||

| Line 193: | Line 197: | ||

== Funding == | == Funding == | ||

* Joe Zawadzki - Former CEO & Co-Founder at MediaMath, GP at Aperiam Ventures (<nowiki>https://www.linkedin.com/in/jzawadzki/</nowiki>) | * Joe Zawadzki - Former CEO & Co-Founder at MediaMath, GP at Aperiam Ventures [https://www.linkedin.com/in/jzawadzki/ (<nowiki>https://www.linkedin.com/in/jzawadzki/</nowiki>)] | ||

* Erich Wasserman - Co-Founder at MediaMath & Rigor (<nowiki>https://www.linkedin.com/in/erichwasserman/</nowiki>) | * Erich Wasserman - Co-Founder at MediaMath & Rigor [https://www.linkedin.com/in/erichwasserman/ (<nowiki>https://www.linkedin.com/in/erichwasserman/</nowiki>)] | ||

* Andy Kemp - Managing Partner at KORTX (<nowiki>https://www.linkedin.com/in/kemperdrew/</nowiki>) | * Andy Kemp - Managing Partner at KORTX [https://www.linkedin.com/in/kemperdrew/ (<nowiki>https://www.linkedin.com/in/kemperdrew/</nowiki>)] | ||

* Erik Stubenvoll - Managing Director at KORTX (<nowiki>https://www.linkedin.com/in/erik-stubenvoll/</nowiki>) | * Erik Stubenvoll - Managing Director at KORTX [https://www.linkedin.com/in/erik-stubenvoll/ (<nowiki>https://www.linkedin.com/in/erik-stubenvoll/</nowiki>)] | ||

== Founders == | == Founders == | ||

[[File:Scott Konopasek.png|250x250px]] | |||

'''Scott Konopasek''' | '''Scott Konopasek''' | ||

| Line 209: | Line 215: | ||

* Track record driving double-digit growth for clients | * Track record driving double-digit growth for clients | ||

* Process-driven thinker | * Process-driven thinker | ||

[[File:Alex Netelkos.png|268x268px]] | |||

'''Alex Netelkos''' | '''Alex Netelkos''' | ||

Revision as of 13:00, 17 July 2022

Making ad spend analytics easy to understand for every marketer

Summary

- $930K lifetime revenue (historical & contracted)

- Hired first two full-time employees in 2022 (Engineer & BDR)

- Raised $200K in pre-seed round in late 2021

- Four active clients, two signed LOIs, $350k in weighted sales pipeline

- Fully automated reporting UI launched Q4 2021 (manual work cut 90% YoY)

- Approached by two companies for acquisition in 2022 (both declined)

- Added 5x CEO Bill Eichen as advisor in Jan 2022 (MD @ GimmelFund)

Problem

79% of marketers struggle to interpret and apply data analytics to improve marketing ROAS.

This is due to specialized knowledge requirements and lack of analytical staff.*

As a result, advertisers either forego buying analytics tools or use biased platform data to evaluate ad spend effectiveness.

*emarketer study 2019

Solution

Simple, actionable ad analytics

Mint Measure’s ad analytics platform provides easy-to-read charts and pre-analyzed insights so any marketer knows what’s working.

Prescriptive recommendations make optimizations easy and actionable.

We help brands know which ad channels are driving results and how to optimize.

Here's a look at our UI and reports:

Product

How it works

Mint Measure's tech is placed in each ad platform for a brand, and we monitor ad delivery and actions taken by users.

This data is cleaned and transformed into easy-to-read charts. Insights give context, and recommendations are provided for the client to take action.

Mint Measure’s unfair advantage

We created a new way to process data to deliver 80% of the value of the enterprise solutions at 20% of the cost.

Our unique methodology quantifies what's working and where marketers should allocate ad budgets to drive growth with these proprietary metrics:

- Incremental reach

- iCPM - cost of incremental reach

- Incremental conversions

- iCPA - cost per incremental conversion

Traction

By the numbers

Revenue

- 2020 revenue - $47,500

- 2021 revenue - $321,000

- 2022 bookings - $506,000 (+53% YoY)

- $149K ARR + $357K Pay-per-use

Customers

- 4 active clients

- Q4 2021 closed 2 new deals

- Q2 2022 forecast – 4 new deals ($10k MRR)

- 4 proposals out for approval; strong sales pipeline

Where we are today

Core Analytics Platform

Serving clients for ~18 months

- $930K lifetime revenue

- $506K booked so far for 2022

Repackage products

- Parsed analytics into 3 SaaS products to align with client needs and stages of growth

- Launched new SaaS website in February, with ability for customer to purchase online

Data Sales

- Upsold a current client to begin using audience data

- 3 upcoming pilot campaigns with brands for data sales

Staff & Growth

Hired first 2 staff

- Sales Rep; has been 1st sales rep 3x

- Lead Engineer

Partnerships

- Developing long term partnership with High There/CannaGrowth platform to serve as their dedicated analytics provider

- Expanding relationships with ad agencies to gain client referrals

Customers

Customer segments

We service brands spending $400k–$30M per year on advertising.

Facts about attribution

- 70% say cost justification is a challenge

- 78% of marketers plan to adapt of increase their use of cross channel attribution

- Only 39% of companies are carrying out attribution on ‘all or most’ of their marketing activities (Source: econsultancy)

- 70% of businesses are now struggling to act on the insights they gain from attribution (Source: AdRoll)

- 42% of marketers report attribution manually using spreadsheets (Source: econsultancy)

- 53.3% say a minimal understanding is the main challenge of effective marketing attribution (Source: Ruler Analytics)

Business model

Monthly fee and pay-per-use options

Option 1: Monthly Fee (SaaS)

- 3 tiers of product

- $699 ($500K ad spend)

- $1,249 ($1M ad spend)

- $2,499 ($2M+ ad spend)

- Currently our GTM for 2022

Option 2: Pay-Per-Use

- For ad agencies only

- Rates range from $0.50-$1.00 CPM

- Yields 30% increased profit

Market

Attribution companies intersect:

Analytics + digital identity + data sales

- Nielsen – $6B Revenue

- Neustar – $575M Revenue

- LiveRamp – $443M Revenue

Companies that offer all 3 earn 20–50x higher revenues than single-service companies

- 18 month SOM* - $2M ARR

- 6 year SOM* - $92M ARR

*SOM is project growth

Competition

Competitive landscape

Vision and strategy

What we'll achieve with your investment

Core Analytics (SaaS)

- Finalize product market fit; repeatable sales processes

- Add $750K ARR in 12 months

- Incorporate client feedback to improve platform usability

- Continue automating workflows and scale prep

Data Sales & Identity

- Build pipes & automate data workflows for data sales

- Create integrations into top 5 DSPs

- Add $150k in data sales revenue

Use of Funds

Team Marketing

- Biz Dev & Account Executives (23%)

- Data engineer (22%)

- Data Analyst (11%)

Capx

- Databricks & Azure (7%)

- ID5 & Experian (4%)

Marketing

- SEO & paid search (7%)

- Content marketing (5%)

- Industry conferences (3%)

Other

- Legal (2%)

- Office supplies (1%)

- Discretionary (15%)

Funding

- Joe Zawadzki - Former CEO & Co-Founder at MediaMath, GP at Aperiam Ventures (https://www.linkedin.com/in/jzawadzki/)

- Erich Wasserman - Co-Founder at MediaMath & Rigor (https://www.linkedin.com/in/erichwasserman/)

- Andy Kemp - Managing Partner at KORTX (https://www.linkedin.com/in/kemperdrew/)

- Erik Stubenvoll - Managing Director at KORTX (https://www.linkedin.com/in/erik-stubenvoll/)

Founders

Scott Konopasek

CEO / Platform Creator

11 years in Adtech

- Built Mint to solve the pain points he experienced

- Performance marketer & analytics expert

- Track record driving double-digit growth for clients

- Process-driven thinker

Alex Netelkos

CPO / Product, Data, and Analytics

7 years in AdTech

- Analytics Lead at DSP MediaMath for clients Walmart, Home Depot and Proctor & Gamble

- Led creation of MediaMath’s SOURCE Reporting Dashboard

- Experience in analytics, client services and product development

Mint Measure Team

Scott Konopasek

Founder

Alex Netelkos

Head of Product & Analytics

Keoni Murray

Lead Engineer

Brandon Beck

Business Development Representative