| File:-image of factory- -caption- | |

| Type | Public |

|---|---|

| |

| Industry |

|

| Founded | April 5, 1993 |

| Founders |

|

| Headquarters | Santa Clara, California , U.S. |

Areas served | Worldwide |

Key people | Jensen Huang (President and CEO) |

| Products |

|

| Services |

|

| Revenue | US$26.974 billion (2023) |

| US$4.224 billion (2023) | |

| US$4.368 billion (2023) | |

| Total assets | US$41.18 billion (2023) |

| Total equity | US$22.10 billion (2023) |

| Owner | Jensen Huang |

Number of employees | 26,196 (2023) |

| Website | https://www.nvidia.com/ |

| Footnotes / references 'footnotes' | |

Summary

NVIDIA Corporation provides graphics, and compute and networking solutions in the United States, Taiwan, China, and internationally. The company's Graphics segment offers GeForce GPUs for gaming and PCs, the GeForce NOW game streaming service and related infrastructure, and solutions for gaming platforms; Quadro/NVIDIA RTX GPUs for enterprise workstation graphics; vGPU software for cloud-based visual and virtual computing; automotive platforms for infotainment systems; and Omniverse software for building 3D designs and virtual worlds. Its Compute & Networking segment provides Data Center platforms and systems for AI, HPC, and accelerated computing; Mellanox networking and interconnect solutions; automotive AI Cockpit, autonomous driving development agreements, and autonomous vehicle solutions; cryptocurrency mining processors; Jetson for robotics and other embedded platforms; and NVIDIA AI Enterprise and other software. The company's products are used in gaming, professional visualization, datacenter, and automotive markets. NVIDIA Corporation sells its products to original equipment manufacturers, original device manufacturers, system builders, add-in board manufacturers, retailers/distributors, independent software vendors, Internet and cloud service providers, automotive manufacturers and tier-1 automotive suppliers, mapping companies, start-ups, and other ecosystem participants. It has a strategic collaboration with Kroger Co. NVIDIA Corporation was incorporated in 1993 and is headquartered in Santa Clara, California.

About the company

What is the mission of the company?

Nvidia mission statement is “to provide the latest NVIDIA news on products, technologies, and events. To highlight and engage with our fans.” And their goal is to create the future of computing by accelerating AI everywhere and committing to creating innovative technologies.

What does the company offer?

Macroeconomic Analysis

Philadelphia Semiconductor Index (SOX)

Philadelphia Semiconductor Index (SOX) measures the performance of 30 largest United States semiconductor companies involved in the distribution, manufacturing and design of the product.

| Company | Ticker | Stock Price ($) (as of 04/08/2023) | Market Capitalisation ($, in billions) | Trailing Price to Earnings Ratio |

|---|---|---|---|---|

| Analog Devices, Inc. | ADI | 185.4 | 93.958 | 26.63 |

| Allegro MicroSystems, Inc | ALGM | 42.61 | 8.326 | 44.58 |

| Applied Materials, Inc. | AMAT | 146.22 | 123.626 | 19.42 |

| Advanced Micro Devices | AMD | 114.69 | 186.955 | 645.69 |

| ASML Holding N.V. | ASML | 679.81 | 273.87 | 33.04 |

| Broadcom Inc. | AVGO | 874.92 | 362.985 | 27.59 |

| Coherent Corp. | COHR | 47.47 | 6.708 | (negative) |

| Entegris, Inc. | ENTG | 101.02 | 15.209 | (negative) |

| GlobalFoundries Inc. | GFS | 58.64 | 32.818 | 21.37 |

| Intel Corporation | INTC | 34.73 | 146.035 | (negative) |

| IPG Photonics Corporation | IPGP | 110.93 | 5.226 | 51.85 |

| KLA Corporation | KLAC | 494.32 | 68.505 | 20.37 |

| Lam Research Corporation | LRCX | 689.13 | 93.092 | 19.28 |

| Lattice Semiconductor Corporation | LSCC | 90.71 | 12.673 | 68.91 |

| Microchip Technolog Incorporated | MCHP | 82.94 | 45.114 | 20.68 |

| Monolithic Power Systems, Inc. | MPWR | 522.18 | 24.99 | 54.83 |

| Marvell Technology, Inc. | MRVL | 62.01 | 53.974 | (negative) |

| Micron Technology, Inc. | MU | 69.27 | 76.167 | (negative) |

| Novanta Inc. | NOVT | 173.06 | 6.265 | 87.04 |

| NVIDIA Corporation | NVDA | 445.83 | 1110 | 235.39 |

| NXP Semiconductors N.V. | NXPI | 209.91 | 55.015 | 20.31 |

| ON Semiconductor Corporation | ON | 101.04 | 44.323 | 25.24 |

| QUALCOMM Incorporated | QCOM | 119.4 | 113.725 | 12.8 |

| Qorvo, Inc. | QRVO | 106.12 | 10.506 | 108.15 |

| Skyworks Solutions, Inc. | SWKS | 108.58 | 17.399 | 15.78 |

| Synaptics Incorporated | SYNA | 87.75 | 3.498 | 19.33 |

| Teradyne, Inc. | TER | 106.53 | 16.702 | 28.35 |

| Taiwan Semiconductor Manufacturing Company (TSMC) | TSM | 95.47 | 500.277 | 15.71 |

| Texas Instruments Incorporated | TXN | 167.52 | 152.998 | 18.91 |

| Wolfspeed, Inc. | WOLF | 58.71 | 7.404 | (negative) |

Macro sensitivity

US Semiconductor companies are sensitive to economic conditions and market activities, with high beta. S&P 500 and SOX are heavily correlated. Nvidia has a high beta of 1.75[4] which measures the sensitivity to the market activity. This strong correlation indicate the performance of the semiconductor companies being heavily influenced by the general market activies, being affected by macroeconomic factors including the monetary policies, inflation rates, federal funds rate and many more.

Recession

Highly sensitive to economic growth and stagnation. (To follow)

Credit Ratings

Credit ratings of the United States is a major catalyst for market activites. On 1st of August, Fitch downgraded the credit rating of the United States from the highest rating of AAA, to AA+. Fiscal deterioration and growing government deficit burden were the reasons behind this downgrade.[5] Previously, the credit rating downgrade of the US only occured once in 2011, following the aftermath of 2008 Financial Crisis and the Federal Reserve's attempt to revive the economy with vast amount of quantitative easing and increased balance sheet.

This downgrade is significant as investors began to question the economic strength of the US. With high macroeconomic sensitivity, the SOX index plummeted by 6% after the announcement.

Debt Crisis

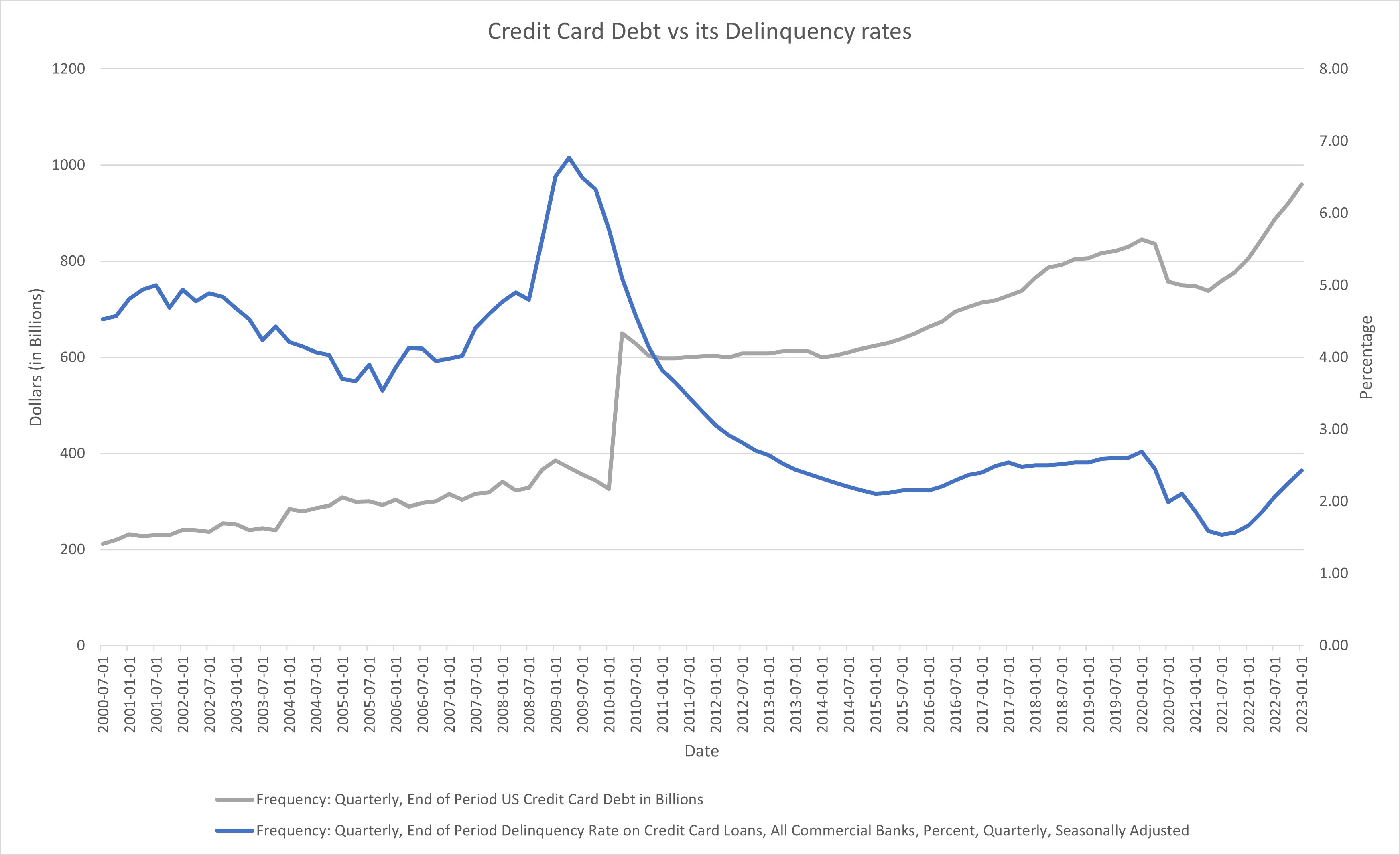

Credit ratings downgrade of the US was mainly due to potential defaults on current governmental and individual debt levels amid economic uncertainty and tightened credit conditions. In terms of consumer loans, often refered as the credit card debt, has reached an all time high near $1 trillion, and delinquency rates on those debt has been increasing for the last two years. Upward trends on both data are a reliable leading indicator of an economic recession, as evident on 2000 dot-com crash, 2008 financial crisis and 2020 Covid.

Competition

AMD

AMD is the largest direct competitor to Nvidia. It is an American semiconductor company that is mainly specialised in CPUs and is the largest competitor to intel. AMD ventured into the GPU market after acquiring ATI in 2006 and since then it has produced a line of products including gaming GPUs. It is known for its Accelerated processing units (APUs) which fuse both CPUs and GPUs onto a single chip. Additionally its gaming GPUs are known for being more cost effective that a Nvidia GPUs whilst having comparable performance.

The long standing rivalry between AMD and Nvidia is the primary driving force for GPU innovation in the gaming GPU market space.

AMD boasts a revenue of 5.35 billion USD last quarter with yearly revenues of around 20 billion USD with around 25% of AMD's revenue coming from GPU sales.

Moore Threads

Moore Threads is a Chinese technology company specializing in graphics processing unit (GPU) design, established in October 2020 by, Zhang Jianzhong (张建中), the former global vice-president of Nvidia and general manager of Nvidia China. The company claims to be the first Chinese company to introduce a domestic, "fully-featured" GPU solution. Whilst Moore threads seems to still be in the start up stage of development, the company has a large market to sell to and its 1st line of GPUs was shown to be promising by reviews. Additionally, this firm will be able to exploit the deterioration of US-China trade relations because as of 2023 no established GPU manufacturers are based in China. As a result, the trade embargoes placed by the US government on US chip manufacturers selling to China has a left a shortfall of supply and in an market with a high demand for GPUs. Therefore, it will only be a matter of time before a Chinese GPU manufacturer rises.

Innosilicon

Innosilicon is another Chinese GPU manufacturer. It unveiled its 1st line-up of the fantasy one series GPUs in 2021 which were fully domestically produced in China. Like Moore threads it is still in the start-up stage of it life-cycle so time will need to be given to see if Innosilicon will be a competitor to Nvidia.

Intel

Like AMD, Intel is better known for its CPUs, but its graphics cards have also gained popularity in lower end performance requirements. Intel is known for integrated HD/UHD GPUs embedded with the CPUs on a single chip. Intel’s graphics have not been the go-to option for gaming in the past, but things have changed after the release of Intel Xe. This recent release of Intel graphics have finally been recognised as somewhat gaming ready by reviews. Therefore, whilst it is not a direct competitor to Nvidia, it may compete with Nvidia in the integrated CPU-GPU markets.

But the CPU frontrunner is getting more ambitious as it is set to release its own discrete GPUs (the ARC series).

It will take some time before Intel can get a foothold in the gaming and high-computing GPU market, but joining in the competition could prove vexing for Nvidia down the road.

Apple

Apple is also considering a boost to its GPU chips to match Nvidia’s high computing graphics cards. Apple’s power-efficient M1 Pro and M1 Max chips are behind the impressive graphics of MacBook Pro 14 and 16.

It seems that the two chips are just a start for Apple’s venture in gaming GPU. Recently, the company released M1 Ultra, which has massive improvements over the previous chips and is available in the new Mac Studio. As Apple claims, M1 Ultra has two M1 chips with 64 GPU cores, “faster performance than even the highest-end PC GPU available while using 200 fewer watts of power”. This claim compares M1 Ultra with Nvidia’s RTX 3090, the most powerful GPU before the release of RTX 3090 Ti.

However, currently Apple's GPUs appears to integrated into its own Apple product therefore, for now , apple will not be a direct competitor to nvidia.