Summary

Rolls-Royce Holdings plc operates as an industrial technology company in the United Kingdom and internationally. The company operates in four segments: Civil Aerospace, Power Systems, Defence, and New Markets. The Civil Aerospace segment develops, manufactures, and sells aero engines for large commercial aircraft, regional jet, and business aviation markets, as well as provides aftermarket services. The Power Systems segment engages in the development, manufacture, marketing, and sale of integrated solutions for onsite power and propulsion for the marine, defense, power generation, and industrial markets. The Defence segment offers aero engines for military transport and patrol aircraft applications; and naval engines and submarine nuclear power plants, as well as aftermarket services. The New Markets segment develops, manufactures, and sells small modular reactor and new electrical power solutions. It also provides maintenance, repair, and overhaul services. Rolls-Royce Holdings plc was founded in 1884 and is headquartered in London, the United Kingdom.

Company History

Segments

Rolls-Royce Holdings plc operates as an industrial technology company in the United Kingdom and internationally. The company operates in four segments: Civil Aerospace, Power Systems, Defence, and New Markets.

Civil Aerospace

Defence

Power Systems

New Markets

The Rolls-Royce New markets segments consists of 2 early stage businesses with high growth potential: Rolls-Royce Electrical and Rolls-Royce SMR.

Rolls-Royce Electrical

Electrification will contribute to decarbonisation of aviation and electrical technologies and capabilities can also be leveraged for civil, defence and marine applications. Smaller, all-electric aircraft will enable more efficient, quieter and zero-emission air mobility, while hybrid-electric systems increase range and enable more sustainable solutions for larger regional aircraft. The emerging market of advanced air mobility, which includes electrical vertical take-off (eVTOL) aircraft as well more conventional electric commuter aircraft, is aiming to enable a new way of using air mobility on urban and regional routes.

RR are championing aircraft electrification to deliver the clean, sustainable, safe, and silent propulsion and energy systems for the urban and regional air mobility markets of tomorrow.

RR develop complete power and propulsion systems for all-electric and hybrid-electric applications. Our systems under design feature the latest technology, from power generation and energy storage via power electronics and control systems to electric motors.

Electric propulsion unit for Urban Air Mobility

- Direct-drive, air-cooled 150 kW electric motor with integrated power electronics and control

- High external load capability with vertical, horizontal and tilting installation possible

- Torque to weight ratio of up to 28 Nm/kg thanks to integrated design, advanced thermal management and innovative topology

- Modular design & adaptive interface with integrated propeller bearing system

- High integrity design with using dual-lane concept

Electric propulsion unit for Regional Air Mobility

- Direct-drive, air-cooled 320 kW electric motor with integrated power electronics and control

- Power dense, compact modular & adaptable design for single, twin and quad engine aircraft platforms

- Patented multi-lane system architecture to meet highest safety standards for CS-23 applications

Energy Storage System

- Modular lithium-ion battery system for scalable configuration based on application demand

- Combination of 2-10 modules for system with 60 to 300 kWh capacity and 520 to 860 V nominal voltage

- Designed to meet highest safety levels

- State-of-the art cells with integrated aerospace battery management system packaged for safety and minimal weight

- Advanced thermal design enabling high performance, safety and cycle life

Turbogenerator system

- High efficiency, dual-fuel capable turbogenerator system for hybrid-electric aircraft platforms

- 600 kW to > 1 MW scalable power output adaptable platform requirement

- Highly integrated design with power to weight ration <= 4 kW/kg

- SAF capable, provision for H2

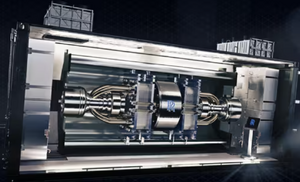

Rolls-Royce Small Modular Reactors (SMR)

Rolls-Royce SMR Ltd is a factory built nuclear power plant that offers clean, affordable energy for all.

With an unprecedented demand for clean energy as global markets seek solutions to support their journey to net zero. The demand is for energy that is always on and which generates virtually no emissions. Nuclear energy is the most powerful source of ‘always on’ clean energy, however, it must be deliverable, scalable and cost competitive for it to be widely embraced.

Rolls-Royce's nuclear experience is complemented by their unique aerospace know-how of manufacturing, supply chain management and logistics. Together, that heritage and experience is at the core of the SMR program.

Rolls-Royce expects SMR to receive government approval by 2024 and expected to be fully integrated into the grid by 2030.

The Rolls-Royce SMR has the following benefits:

- Low cost

A highly competitive source of ‘always on’ clean energy, meeting global challenges in an affordable and investable way. Rolls-Royce SMR is a low-cost clean energy solution, using proven and commercially available technology to deliver a fully integrated, factory built nuclear power plant.

- Deliverable

Rolls Royce SMR will use the breadth of the UK supply chain, which is able to contribute more than 80% of each SMR by value – focusing on standardised, commercially available and off-the-shelf components. Approximately 90% of manufacturing and assembly activities are carried out in factory conditions, helping to maintain an extremely high-quality product - reducing on-site disruption and supporting international roll out.

- Global and Scalable

The need for clean energy has created a global demand for SMR as countries look for ways to provide reliable ways to achieve net zero.

The factory-built model is entirely scalable. Rolls-Royce SMR will support international efforts to decarbonise energy systems, with a forecast to target £250bn of exports. Memorandums of Understanding are already in place with Estonia, Turkey and the Czech Republic. The Rolls-Royce SMR programme is forecast to create 40,000 regional UK jobs by 2050 and generate £52bn in economic benefit.

The compact footprint increases site flexibility and maximises potential plant locations, including replacement for existing coal or gas-fired plants. It will occupy approximately one tenth of the size of a conventional nuclear generation site, helping to reduce local environmental impacts.

- Investable

By design, SMR is focused on attracting all forms of private capital to support the build out of global SMR demand. With a proven factory built commoditised approach, our SMR will offer investors and lenders a degree of confidence that will enable future customers to access a range of capital options to finance their SMR purchase.

For nuclear energy to play a meaningful and more significant role in net zero ambitions, it must be financeable without the need for Government intervention in the long term. A Rolls-Royce SMR power station will have the capacity to generate 470MW of low carbon energy, equivalent to more than 150 onshore wind turbines. It will provide consistent baseload generation for at least 60 years, helping to support the roll-out of renewable generation.

Projects

Rolls Royce have a plethora of fascinating projects underway at the moment- we have selected a few to highlight the innovative and adaptive nature of the company.

Space:

Rolls Royce is working on a two-stage-to-orbit system eg. gas turbines to power hypersonic planes that will take payloads to low Earth orbit, as well as nuclear thermal propulsion* solutions to power fast, efficient rockets for space travel. The gas turbines will take the aircraft into low Earth orbit by combining propulsion systems with a gas turbine and ramjet technologies*.

They are also working on producing small reactors (micro reactors) which will use clean, nuclear energy to power the bases that will be set up on the moon. A regular rocket would require tonnes of fuel to reach the demands of Moon/Mars inhabitants however Rolls Royce’s nuclear reactors only use a few grams of uranium so the systems are lighter and can carry a higher payload whilst maintaining clean energy standards. The reactors will also have an extremely long product life-span as it relies on the natural decay of Uranium which takes decades.

Rolls Royce is undertaking this project since the current goal for space exploration is to inhabit the Moon/ Mars by 2030. Rolls Royce are currently in their product development and testing phase with this project which are showing promising results. This project is funded by the UK Space Agency

* Nuclear propulsion: A force which provides propellant efficiency in rockets

* Ramjet technology: A type of air breathing jet engine which uses the engine’s forward motion to compress incoming air

Small Molecular Reactors (SMR):

In light of the Russia-Ukraine war the UK government has increased investments into the UK energy sector, especially clean energy with the aim of reducing energy dependency on other countries. Rolls Royce are attempting to distribute nuclear reactors which provide scalable, cost competitive and widely available nuclear energy.

Rolls Royce SMR have produced a repeatable factory-built power station which has been tested for its usage of nuclear power. The factory’s reproducible status has allowed Rolls Royce to hopefully have the same factory design internationally in Estonia, Turkey and the Czech Republic. The project is predicted to generate £52 billion in economic benefit and 40,000 regional UK jobs by 2050.

The SMR will generate roughly 470 MW of low carbon energy which is equivalent to more than 150 onshore wind turbines. It will provide consistent base load generation for at least 60 years, unlike wind turbines which have an average lifespan of ~ 20 years. The power station will be able to support both on-grid electricity and a range of off-grid clean energy solutions on top of providing clean energy for ~ 1 million homes.

Hydrogen Engines:

Rolls Royce is also releasing a brand new hydrogen engine programme. They will be carrying out a series of rig and engine tests which validate the efficiency of hydrogen engines for small-mid sized aircrafts. If this programme is successful the firm will move to phase II- the flight test phase. The programme began in 2022 with testing on the Rolls-Royce AE 2100 engine in the UK with a followup with the Rolls-Royce Pearl 15 jet engine with an indefinite date. This project was inspired by market research carried out at UK Aerospace Technology Institute’s Fly Zero team which emphasised the market value of hydrogen engines in aircraft.

Urban Air Mobility:

Urban air mobility represents a revolutionary market which has not yet been commercialised but is in its growth stage. The market is predicted to be worth over one billion pounds by the mid 2020s (hopefully 2027). The products are air taxis and electric, plane like vehicles which can transport up to four people at a time. The aim of these vehicles is to cover distances in a shorter amount of time, in a clear and more cost effective manner- the propulsion systems put in place by Rolls Royce will help meet these standards.

The electric propulsion unit for urban air mobility will be the direct-drive, air cooled 320 kW electric motor. The Torque* to weight ratio of up to 28 Nm/kg because of the engines integrated design and thermal management. This makes the engine highly adaptive and reliable. The energy storage system has been designed for utmost safety- it is composed of a lithium-ion battery with 2-10 module modules with 60-300 kWh capacity and 520-860V nominal voltage.

Although there is a lot of competition amongst large firms like Rolls Royce and also smaller start-ups, when Rolls Royce’s profound history in the aerospace industry is taken into consideration they are much more inclined to deliver more reliable, scalable and safe vehicles.

*Torque is the amount of force required to cause an object to rotate on the axis

Competitor Analysis

| Competing Company | Description | Company Logo |

|---|---|---|

| SpaceX: SpaceX is a private company whose mission is to produce the most powerful next generation of fully reusable launch vehicles which will be capable of carrying humans to Mars and hopefully other destinations in the solar system. |

|

|

| Joby Aviation: Joby Aviation is a company determined to pioneer the next big thing- Air mobility vehicles. The futuristic aircraft takes off and lands vertically while carrying up to four passengers. |

|

|

| NuScale Power: A company which has 48 small modular nuclear reactor plants around the US with significant interest from the United Kingdom, Europe, the Middle East, Africa, and Asia. |

|

|

| Airbus: The company is an aircraft manufacturer focused on increasing the volume of hydrogen-powered flights. |

|

Financials

5-year historical financials

| Income Statement | FY-22 | FY-21 | FY-20 | FY-19 | FY-18 |

|---|---|---|---|---|---|

| Revenue unit | 13520 | 11218 | 11491 | 16587 | 15729 |

| Gross Profit | 2757 | 2136 | 1113 | 942 | 1198 |

| EBITDA | 1285 | 996 | 222 | -344 | -499 |

| Operating Income | 787 | 465 | -382 | -933 | -1142 |

| Net Income | -1269 | 120 | -3170 | -1315 | -2401 |

| Balance sheet | FY-22 | FY-21 | FY-20 | FY-19 | FY-18 |

|---|---|---|---|---|---|

| Total asset (£m) | 29450 | 28674 | 29517 | 32266 | 31857 |

| Total liabilities (£m) | 35466 | 33310 | 34392 | 35620 | 32909 |

| Net assets (£m) | -6016 | -4636 | -4875 | -3354 | -1052 |

5-year forecasted financials

| Income Statement | FY-23 | FY-24 | FY-25 | FY-26 | FY-27 |

|---|---|---|---|---|---|

| Revenue unit | 13790 | 14894 | 15787 | 17050 | 17391 |

| Gross Profit | 2758 | 2979 | 3157 | 3410 | 3478 |

| EBITDA | 1302 | 1407 | 1491 | 1610 | 1642 |

| Operating Income | 792 | 855 | 907 | 979 | 999 |

| Net Income |

Valuation

What's the expected return of an investment in the company?

The Stockhub users estimate that the expected return of an investment in Rolls-Royce Holdings plc over the next five years is positive 1%. This value was arrived at through the use an intrinsic valuation in the form of a discounted cash flow model.

Assuming that a suitable return level of five years is 10% per year (based of the S&P 500 returns) and Rolls-Royce achieves its return level of 1%, then the company can be considered, within fair margins, as fair-valued.

What are the assumptions used to estimate the return?

Key Inputs

| Description | Value | Commentary |

|---|---|---|

| Valuation Model | Discounted Cash Flow and Comparable Company Analysis | Two main approaches can be used to estimate the value of an investment:

Research has suggested that to estimate the expected return of an investment over a long-term investment horizon, a discounted cash flow model provides an accurate projection. |

| Financial Projections | Stockhub, CapitalIQ, Yahoo Finance | To improve the reliability of financial projections, a mixture of sources was used when projecting key financial metrics such as revenue. |

| Discount Rate | WACC | The weighted average cost of capital was used as the discount rate as it expresses the return that both bondholders and shareholders demand to provide the company with capital. The cost of equity and cost of debt have been calculated in the tables provided below using values taken from the company's financial statements, beta for the stock, and expected market returns. |

Discounted Cash Flow Model

| Current Share Price: £2.10 update latest | |||||||||||||

| £ million | Historical | Projected | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

| Income Statement | |||||||||||||

| Revenue | 13725 | 14955 | 14747 | 15729 | 16587 | 11491 | 11218 | 13520 | 14430 | 15338 | 16269 | 17625 | 18690 |

| % growth | 9% | -1% | 7% | 5% | -31% | -2% | 21% | 7% | 6% | 6% | 8% | 6% | |

| Cost Of Goods Sold | 10448 | 11876 | 12325 | 14531 | 15645 | 10378 | 9082 | 10763 | 11544 | 12270 | 13015 | 14100 | 14952 |

| % of revenue | 76% | 79% | 84% | 92% | 94% | 90% | 81% | 80% | 80% | 80% | 80% | 80% | 80% |

| Gross Profit | 3277 | 3079 | 2422 | 1198 | 942 | 1113 | 2136 | 2757 | 2886 | 3068 | 3254 | 3525 | 3738 |

| Selling General & Admin Exp. | 1038 | 1765 | 1117 | 1572 | 1105 | 772 | 893 | 1079 | 1240 | 1318 | 1398 | 1515 | 1607 |

| % of revenue | 8% | 12% | 8% | 10% | 7% | 7% | 8% | 8% | 9% | 9% | 9% | 9% | 9% |

| Depreciation & Amort. | 512 | 538 | 524 | 643 | 589 | 604 | 531 | 498 | 534 | 568 | 602 | 652 | 692 |

| % of revenue | 4% | 4% | 4% | 4% | 4% | 5% | 5% | 4% | 4% | 4% | 4% | 4% | 4% |

| R & D Exp. | 818 | 923 | 843 | 768 | 770 | 723 | 778 | 891 | 817 | 868 | 921 | 998 | 1058 |

| % of revenue | 6% | 6% | 6% | 5% | 5% | 6% | 7% | 7% | 6% | 6% | 6% | 6% | 6% |

| Total Operating Expenses | 1846 | 2688 | 1960 | 2340 | 1875 | 1495 | 1671 | 1970 | 2057 | 2187 | 2319 | 2513 | 2665 |

| Operating Income/ EBIT | 1431 | 391 | 462 | -1142 | -933 | -382 | 465 | 787 | 829 | 881 | 934 | 1012 | 1073 |

| EBITDA | 1943 | 929 | 986 | -499 | -344 | 222 | 996 | 1285 | 1363 | 1448 | 1536 | 1665 | 1765 |

| Tax Expense | 76 | -604 | 515 | -554 | 420 | 302 | -418 | -308 | 157 | 175 | 186 | 195 | 211 |

| Effective tax rate | 5% | -154% | 111% | 49% | -45% | -79% | -90% | -39% | 20% | 20% | 20% | 20% | 20% |

| EBIAT | 1355 | 995 | -53 | -588 | -1353 | -684 | 883 | 1095 | 663 | 705 | 747 | 810 | 859 |

| Cashflow | |||||||||||||

| D&A | 512 | 538 | 524 | 643 | 589 | 604 | 531 | 498 | 534 | 568 | 602 | 652 | 692 |

| % of revenue | 4% | 4% | 4% | 4% | 4% | 5% | 5% | 4% | 4% | 4% | 4% | 4% | 4% |

| Capital Expenditure | -487 | -585 | -730 | -905 | -747 | -585 | -328 | -359 | -609 | -647 | -687 | -744 | -789 |

| % of revenue | 4% | 4% | 5% | 6% | 5% | 5% | 3% | 3% | 4% | 4% | 4% | 4% | 4% |

| Change in NWC | 489 | -463 | -2910 | -344 | -107 | 1119 | 3323 | -1974 | -883 | -938 | -995 | -1078 | -1143 |

| % of revenue | 4% | -3% | -20% | -2% | -1% | 10% | 30% | -15% | -6% | -6% | -6% | -6% | -6% |

| Unlevered FCF | 891 | 1411 | 2651 | -506 | -1404 | -1784 | -2237 | 3208 | 1471 | 1563 | 1658 | 1796 | 1905 |

| WACC | Notes | |

|---|---|---|

| Weights | ||

| Total Debt | 6079 | |

| Market Cap | 15651 | |

| Total | 21730 | |

| Wd | 28% | Weight of debt calculated as the total debt as a proportion of total capital. |

| We | 72% | Weight of equity calculated as the market cap as a proportion of total capital |

| Debt | ||

| Total Debt | 6079 | Cost of debt was calculated by taking interest expenses from the income statement and dividing this by the total debt making note of the fact that debt is a tax deductable item. |

| Interest Expense | -153 | |

| Rate | 2.5% | |

| Effective Tax Rate | 20% | |

| Rd(1-t) | 2.0% | |

| Equity | ||

| Risk Free Rate | 4.05% | Capital asset pricing model was used to calculate the cost of equity. Risk free rate of the US Treasury 10 Year was used. |

| Beta | 1.7 | Beta for the stock was found from Yahoo Finance |

| Market Rate | 10% | Current market rate was calculated as the average returns of the S&P 500 over the past 50 years. |

| Re | 14.2% | |

| Discount Rate | 10.8% | |

| Perpetuity Growth Rate | 2.0% | A perpetuity growth rate of 2% was used as this is sufficiently low to ensure that the company is not projected to increase in size far faster than the global economy in the very long term. |

| DCF | 2023 | 2024 | 2025 | 2026 | 2027 | Terminal Value (Perpetuity Growth) | Notes | |

|---|---|---|---|---|---|---|---|---|

| £ million | ||||||||

| FCF | 1471 | 1563 | 1658 | 1796 | 1905 | 22164 | The terminal value of the company was calculated using the Gordon Growth Model. | |

| PV of FCF | 6157 | |||||||

| Terminal Value | 22164 | |||||||

| NPV of TV | 13293 | |||||||

| Enterprise Value | 19451 | |||||||

| Net Debt | 1596 | |||||||

| Equity Value | 17855 | |||||||

| Shares Out | 8420 | |||||||

| Equity Value per Share | 2.12 | |||||||

| Current share price | 2.10 update | |||||||

| Difference | 1% update | |||||||

Sensitivity Analysis

A sensitivity analysis was also conducted to reflect how changes in the discount rate and perpetuity growth rate would affect the intrinsic value of the company.

| £2.12 | Perpetuity Growth | |||||

|---|---|---|---|---|---|---|

| 1.0% | 1.5% | 2.0% | 2.5% | 3.0% | ||

| WACC | 9.5% | £2.27 | £2.39 | £2.52 | £2.67 | £2.84 |

| 10.0% | £2.13 | £2.23 | £2.35 | £2.48 | £2.62 | |

| 10.5% | £2.01 | £2.10 | £2.19 | £2.31 | £2.43 | |

| 10.8% | £1.94 | £2.03 | £2.12 | £2.22 | £2.34 | |

| 11.0% | £1.89 | £1.97 | £2.06 | £2.16 | £2.27 | |

| 11.5% | £1.79 | £1.86 | £1.94 | £2.02 | £2.12 | |

| 12.0% | £1.70 | £1.76 | £1.83 | £1.90 | £1.99 | |