Sea Limited: Difference between revisions

| Line 19: | Line 19: | ||

Sea Limited was built in the success and currently relying on its digital entertainment brand, Garena. The company was the first to acquire licenses to distribute third-party, extremely popular video games to a massive geographical region. They were therefore much anticipated and Garena automatically established a monopoly in the market. However, the company's investments didn't only focus on distributing third-party games, as Garena has published many original games such as Free Fire, which was the most downloaded mobile game worldwide in 2019 and 2020 and continues to be a major revenue stream.<ref>Sea Limited Stock: This Digital Ecosystem Still Has Upside (NYSE:SE) | Seeking Alpha</ref> | Sea Limited was built in the success and currently relying on its digital entertainment brand, Garena. The company was the first to acquire licenses to distribute third-party, extremely popular video games to a massive geographical region. They were therefore much anticipated and Garena automatically established a monopoly in the market. However, the company's investments didn't only focus on distributing third-party games, as Garena has published many original games such as Free Fire, which was the most downloaded mobile game worldwide in 2019 and 2020 and continues to be a major revenue stream.<ref>Sea Limited Stock: This Digital Ecosystem Still Has Upside (NYSE:SE) | Seeking Alpha</ref> | ||

Another notable investment was in subsidies | Another notable investment was in subsidies to local express delivery services that led to rapid development of the industry. Until Shopee's emergence in 2017, delivery in Southeast Asia was very expensive and slow, ranging from a week for e-commerce purchases to a year for international parcels. With this investment, Shopee managed to provide delivery of 1-3 days and even offered free shipping, attracting an extensive amount of customers and led users to order via the platform even if they had originally seen the product advertised in other e-commerce companies.<ref>Here’s how Lazada lost its lead to Shopee in Southeast Asia (Part 2 of 2) | KrASIA (kr-asia.com)</ref> | ||

==== Innovation ==== | ==== Innovation ==== | ||

Revision as of 17:25, 24 August 2023

Summary

Sea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as eSports operations; and access to other entertainment content, including livestreaming of gameplay and social features, such as user chat and online forums. The company also operates Shopee e-commerce platform, a mobile-centric marketplace that provides integrated payment and logistics infrastructure and seller services. In addition, it offers SeaMoney digital financial services to individuals and businesses, including offline and online mobile wallet, and payment processing services, as well as other offerings across credit, insurtech, and digital bank services under the ShopeePay, SPayLater, SeaBank, and other digital financial services brands; and payment processing services for Shopee. The company was formerly known as Garena Interactive Holding Limited and changed its name to Sea Limited in April 2017. Sea Limited was incorporated in 2009 and is headquartered in Singapore.

Strategy and Outlook

History

Sea Limited was founded in 2009, initially as Garena, by Singaporean entrepreneur Forrest Li.[1] The company was specialising in video game development, publishment and distribution. Through its platform, Garena+, it distributed major game titles across Taiwan and Southeast Asia including League of Legends[2], Heroes of Newerth[3], FIFA Online 4 and Call of Duty: Mobile[4]. By 2014 it was valued at $1bn and was named the biggest internet company in Singapore.[5] In 2017 the company acquired $550 million through a round of funding and rebranded itself as Sea Limited, maintaining the Garena digital entertainment branch, and additionally introducing the e-commerce and online financial services platforms, Shopee and SeaMoney. [6] The same year, it went public starting at $15 per share[7],aiming to raise $1 bn [8]. In 2020, Sea Limited acquired Singaporean football club Home United FC and rebranded it as Lion City Sailors FC[9], which made its debut in the upcoming Singaporean Premier League (SPL) season. In 2021, Sea Limited secured Southeast Asia's largest ever funding, raising $6bn by selling $3.5bn of equity and $2.5bn of convertible bond.[10] In 2021, the Chinese company Tencent that owned 21.3% of Sea Limited's shares, announced a divesting of almost 15 million class A shares to raise a $3bn fund for other investments and activities.[11] In 2023, a variety of factors including macroeconomic instability, increased interest rates and failed investments such as FTX, led Sea Limited to disband its investment arm.[12]

Mission Statement

As mentioned in Sea Limited's website, the mission of the company is to "to better the lives of consumers and small businesses with technology"[13]. The company highlights its commitment to driving innovation, growth, and positive impact in the markets it operates. Moreover Sea Limited strives to empower individuals and communities across Southeast Asia and beyond, by aiming on a culture of continuous innovation, fostering meaningful connections, and enhancing financial inclusion.[14]

Marketing and growth strategy

Product diversification and ecosystem

Sea Limited focuses on product diversification, which enables the company to target a wide range of consumer groups, and attract an extensive amount of total customers. At the same time, the company has interconnected its platforms in a way that introduces customers of one sector to the others, integrating them into the Sea ecosystem. A great example of that strategy is the Free Fire, Garena's extremely popular mobile game, and Shopee's interconnection, as users of Free Fire are offered promotions and discounts for Shopee through the game. This proved successful, with Shopee increasing its quarterly revenue by $200 million in the second quarter of 2021.[15]

Investments and game development

Sea Limited was built in the success and currently relying on its digital entertainment brand, Garena. The company was the first to acquire licenses to distribute third-party, extremely popular video games to a massive geographical region. They were therefore much anticipated and Garena automatically established a monopoly in the market. However, the company's investments didn't only focus on distributing third-party games, as Garena has published many original games such as Free Fire, which was the most downloaded mobile game worldwide in 2019 and 2020 and continues to be a major revenue stream.[16]

Another notable investment was in subsidies to local express delivery services that led to rapid development of the industry. Until Shopee's emergence in 2017, delivery in Southeast Asia was very expensive and slow, ranging from a week for e-commerce purchases to a year for international parcels. With this investment, Shopee managed to provide delivery of 1-3 days and even offered free shipping, attracting an extensive amount of customers and led users to order via the platform even if they had originally seen the product advertised in other e-commerce companies.[17]

Innovation

On top of that, the innovation of the company is notable, as it adapted the platform to regions it is operating and included exclusive features. It adjusted the prices for in-game purchases depending on the country, introduced its own platform currency "Garena Shells"[18] and created game characters that represent the cultures of the countries it is targeting.

Shopee has also shown a great deal of innovation, by offering the shopping security feature "Shopee Guarantee", that freezes the payment to the seller until the buyer has confirmed they received the order in good condition. The importance of this feature is highlighted by a 14.7% increase in customer complaints for e-commerce purchases that was reported by the Consumers Association of Singapore (CASE), differentiating Shopee from other e-commerce giants, such as AliExpress and Lazada.[19]

Sector and Income Breakdown

Subsidiaries

Sea Limited, as mentioned, owns several subsidiaries including the digital entertainment company Garena, the e-commerce platform Shopee and the digital financial services company SeaMoney, therefore operating in 3 different markets. [20]

Garena

Shopee

SeaMoney

Segments of operation

Main streams of income

Corporate Governance

The Team

Ownership Structure

Market

Total Addressable Market

Key Market Drivers

Key Market Challenges and Risks

Financials

Historic

Most recent quarter

Most recent year

All periods

| Year | Year end date | Income Statement | Balance Sheet | |

|---|---|---|---|---|

| Revenues($thousands) | Net losses ($thousands) | Total Assets($million) | ||

| 22 | 31/12/2018 | 826,968 | -961,241 | N/A |

| 23 | 31/12/2019 | 2,175,378 | -1,462,799 | 5,224,169 |

| 24 | 31/12/2020 | 4,375,664 | -1,618,056 | 10,455,671 |

| 25 | 31/12/2021 | 9,955,190 | -2,046,759 | 18,756,025 |

| 26 | 31/12/2022 | 12,449,705 | -1,651,421 | 17,002,796 |

Forward

Method

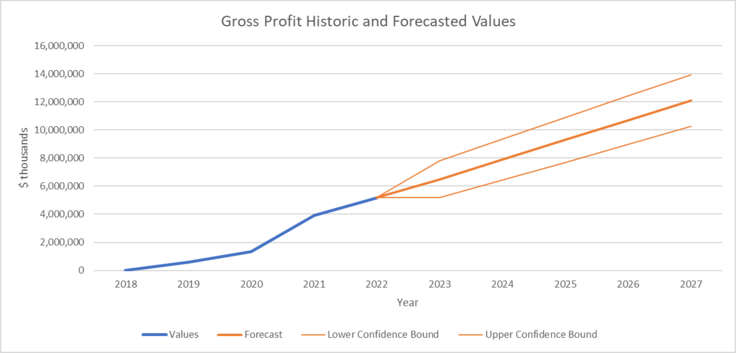

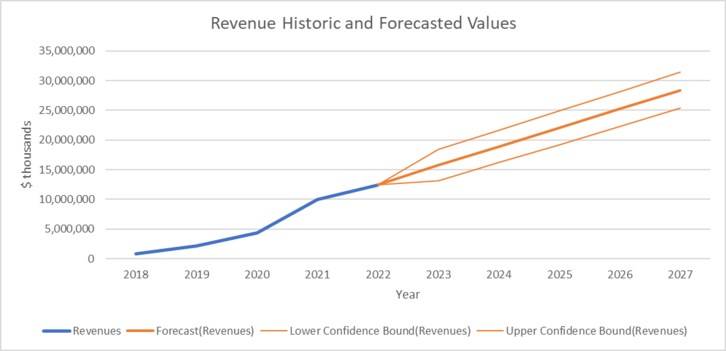

Financial Forecasts

| Year | Revenue ($thousands) | Gross Profit ($thousands) | ||||

|---|---|---|---|---|---|---|

| Forecast | Lower-bound value | Upper-bound value | Forecast | Lower-bound value | Upper-bound value | |

| 2024 | 15,744,835 | 13,081,969 | 18,407,702 | 6,489,624 | 5,187,205 | 7,792,042 |

| 2025 | 18,910,452 | 16,164,985 | 21,655,918 | 7,891,384 | 6,434,652 | 9,348,115 |

| 2026 | 22,076,068 | 19,249,784 | 24,902,353 | 9,293,143 | 7,696,416 | 10,889,871 |

| 2027 | 25,241,685 | 22,336,213 | 28,147,156 | 10,694,903 | 8,969,007 | 12,420,799 |

| 2028 | 28,407,301 | 25,424,142 | 31,390,460 | 12,096,663 | 10,250,152 | 13,943,173 |

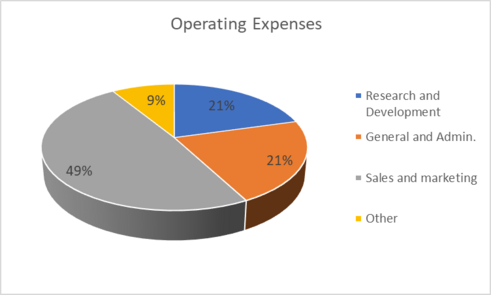

Revenues and gross profit are steeply increasing, but after applying operating expenses, the company reports an increasing loss every year. This is attributed to disproportionate increase of operating expenses year by year, which outweigh the increase in revenues.

Sea Limited's great investment in subsidies to local express delivery companies were one of the major operational expenses that keep Shopee, and by extension the entire company from being profitable.[21]

Risk Analysis

Valuation

Appendix

Income Statement

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

|---|---|---|---|---|---|

| Total Revenue ($million) | 12,449,705 | 9,955,190 | 4,375,664 | 2,175,378 | 826,968 |

| Cost of Revenue ($million) | -7,264,428 | -6,059,455 | -3,026,759 | -1,570,458 | -812,210 |

| Gross Profit ($million) | 5,185,277 | 3,895,735 | 1,348,905 | 604,920 | 14,758 |

| Operating Income/Expenses | |||||

| Research and Development ($million) | -1,376,501 | -831,703 | -353,785 | -156,634 | -67,529 |

| General and Admin. ($million) | -1,437,612 | -987,868 | -599,706 | -385,865 | -240,781 |

| Sales and marketing ($million) | -3,269,223 | -3,829,743 | -1,830,875 | -969,543 | -705,015 |

| Other Operating Income ($million) | 279,184 | 287,946 | 189,645 | 15,890 | 9,799 |

| Provision for credit losses ($million) | -513,690 | -117,427 | -57,509 | -- | -- |

| Goodwill ($million) | -354,943 | -- | -- | -- | -- |

| Total operating expenses ($million) | -6,672,785 | -5,478,795 | -2,652,230 | -1,496,152 | -1,003,526 |

| Operating Loss ($million) | -1,487,508 | -1,583,060 | -1,303,325 | -891,232 | -988,768 |

| Interest income/expense and others* ($million) | -13,025 | -132,124 | -179,913 | -477,387 | 34,888 |

| Earnings/Losses Before Tax ($million) | -1,500,533 | -1,715,184 | -1,483,238 | -1,368,619 | -953,880 |

| Income Tax ($million) | -168,395 | -332,865 | -141,640 | -85,864 | -4,088 |

| Share of results of equity investees ($million) | 11,156 | 5,019 | 721 | -3,239 | 3,066 |

| Net loss ($million) | -1,657,772 | -2,043,030 | -1,624,157 | -1,457,722 | -961,034 |

| Net income/loss attributable to non-controlling interests ($million) | 6,351 | -3,729 | 6,101 | -5,077 | -207 |

| Net Loss Applicable to Common Shareholders ($million) | -1,651,421 | -2,046,759 | -1,618,056 | -1,462,799 | -961,241 |

Cash Flow Statement

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

| Net Income ($ thousands) | -1,657,772 | -2,043,030 | -1,624,157 | -1,457,722 | -961,034 |

| Cash Flows-Operating Activities | |||||

| Depreciation ($ thousands) | 428,344 | 279,032 | 169,067 | 116,783 | 54,902 |

| Other Adjustments ($thousands)* | 1,543,364 | 696,427 | 484,793 | 628,741 | 38,100 |

| Operating cash flows before changes in working capital ($ thousands) | 313,936 | -1,067,571 | -970,297 | -712,198 | -868,032 |

| Changes in Operating Activities | |||||

| Accounts Receivable ($ thousands) | 98,981 | -37,066 | -174,767 | -86,546 | -38,524 |

| Accounts Payable ($ thousands) | 43,311 | 99,639 | 50,860 | 31,381 | 29,733 |

| Changes in Inventories ($ thousands) | 1,441 | -62,735 | -38,528 | 11,762 | -28,465 |

| Deferred revenue ($ thousands) | -1,093,229 | 314,048 | 1,162,399 | 637,214 | 204,161 |

| Lease Liabilities ($ thousands) | 385,911 | 429,366 | 46,352 | 70,901 | -- |

| Other Operating Activities ($ thousands) * | -492,107 | -534,603 | -490,448 | -594,847 | -662,125 |

| Net Cash Flow-Operating ($ thousands) | -1,055,692 | 208,649 | 555,868 | 69,865 | -495,220 |

| Cash Flows-Investing Activities | |||||

| Capital Expenditures ($ thousands) | -924,178 | -772,177 | -336,274 | -239,844 | -177,343 |

| Investments($ thousands) | -2,630,842 | -2,505,358 | -219,548 | -118,462 | -69,641 |

| Other Investing Activities ($ thousands) | 1,126,211 | -489,738 | -331,090 | -4,913 | 22,456 |

| Net Cash Flows-Investing ($ thousands) | -2,428,809 | -3,767,273 | -886,912 | -363,219 | -224,528 |

| Cash Flows-Financing Activities | |||||

| Proceeds from issuance of convertible notes ($ thousands) | -- | 2,846,250 | 1,141,362 | 1,138,500 | 564,938 |

| Proceeds from issuance of shares ($ thousands) | 50,211 | 4,050,055 | 2,970,248 | 1,538,802 | 4,574 |

| Net Borrowings ($ thousands) | -68238 | 114035 | -30609 | -2003 | -643 |

| Other Financing Activities ($ thousands) | 418,283 | 391,249 | -347,869 | -95,704 | -22,241 |

| Net Cash Flows-Financing ($ thousands) | 400,256 | 7,401,589 | 3,733,132 | 2,579,595 | 546,628 |

| Effect of Exchange Rate ($million) | -143,511 | -58,218 | 80,727 | 25,025 | -12,546 |

| Net Increase/Decrease in Cash Flow ($ thousands) | -3,227,756 | 3,784,747 | 3,482,815 | 2,311,266 | -185,666 |

| Cash flow at beginning of year ($ thousands) | 10838140 | 7053393 | 3570578 | 1259312 | 1,444,978 |

| Cash flow at end of year ($ thousands) | 7,610,384 | 10,838,140 | 7,053,393 | 3,570,578 | 1,259,312 |

Balance Sheet

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 |

|---|---|---|---|---|

| Current Assets | ||||

| Cash and Cash Equivalents ($thousands) | 6,029,859 | 9,247,762 | 6,166,880 | 3,118,988 |

| Short-Term Investments ($thousands) | 864,258 | 911,281 | 126,099 | 102,324 |

| Net Receivables ($thousands) | 2322581 | 1,889,262 | 648,936 | 187,035 |

| Inventory ($thousands) | 109,668 | 117,499 | 64,219 | 26,932 |

| Other Current Assets ($thousands) | 3,361,646 | 2,969,593 | 1,932,870 | 974,860 |

| Total Current Assets ($thousands) | 12,688,012 | 15,135,397 | 8,939,004 | 4,410,139 |

| Long-Term Assets | ||||

| Long-Term Investments ($thousands) | 1,253,593 | 1,052,861 | 190,482 | 113,797 |

| Fixed Assets ($thousands) | 1,387,895 | 1,029,963 | 386,401 | 318,620 |

| Goodwill ($thousands) | 230,208 | 539,624 | 216,278 | 30,952 |

| Intangible Assets ($thousands) | 65,019 | 52,517 | 39,773 | 15,020 |

| Other Assets ($thousands) | 1,132,843 | 841,908 | 583,829 | 265,301 |

| Deferred Asset Charges ($thousands) | 245,226 | 103,755 | 99,904 | 70,340 |

| Total Long-Term Assets ($thousands) | 4,314,784 | 3,620,628 | 1,516,667 | 814,030 |

| Total Assets ($thousands) | 17,002,796 | 18,756,025 | 10,455,671 | 5,224,169 |

| Current Liabilities | ||||

| Accounts Payable ($thousands) | 258,648 | 213,580 | 121,637 | 69,370 |

| Short-Term Debt / Current Portion of Long-Term Debt ($thousands) | 88,410 | 100,000 | -- | 1,258 |

| Accrued expenses and other payables ($thousands) | 1,396,613 | 1,519,938 | 2,033,461 | 980,805 |

| Escrow payables and advances from customers($thousands) | 1,862,325 | 1,789,973 | 161,379 | 65,062 |

| Deferred revenue ($thousands) | 1,535,083 | 2,644,463 | 2,150,165 | 1,097,868 |

| Other Current Liabilities ($thousands) | 1,794,613 | 908,482 | 169,425 | 148,003 |

| Total Current Liabilities ($thousands) | 6,935,692 | 7,176,436 | 4,636,067 | 2,362,366 |

| Long-term Liabilities | ||||

| Accrued expenses and other payables ($thousands) | 87,072 | 76,234 | 36,159 | 25,802 |

| Operating Lease Liabilities ($thousands) | 756,818 | 491,313 | 177,870 | 144,000 |

| Other Liabilities ($thousands) | 107 | 107 | 107 | 1,334 |

| Deferred Liability Charges ($thousands) | 73,533 | 111,818 | 344,823 | 161,683 |

| Convertible notes ($thousands) | 3,338,750 | 3,475,708 | 1,840,406 | 1,356,332 |

| Total long-term liabilities ($thousands) | 4,256,280 | 4,155,180 | 2,399,365 | 1,689,151 |

| Total Liabilities ($thousands) | 11,191,972 | 11,331,616 | 7,035,432 | 4,051,517 |

| Stock Holders Equity | ||||

| Common Stocks ($thousands) | 281 | 278 | 225 | 230 |

| Capital Surplus ($thousands) | 14,559,690 | 14,622,292 | 8,526,571 | 4,687,284 |

| Statutory reserves ($thousands) | 12,490 | 6,144 | 2,363 | 46 |

| Accumulated deficit ($thousands) | -8,745,541 | -7,201,498 | -5,150,958 | -3,530,585 |

| Other Equity ($thousands) | -16,096 | -2,807 | 42,038 | 15,677 |

| Total Equity ($thousands) | 5,810,824 | 7,424,409 | 3,420,239 | 1,172,652 |

| Total Liabilities & Equity ($thousands) | 17,002,796 | 18,756,025 | 10,455,671 | 5,224,169 |

Financial Ratios

| Year End Date | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Current Ratio | 183% | 211% | 193% | 187% | N/A |

| Quick Ratio | 120% | 155% | 147% | 140% | N/A |

| Cash Ratio | 87% | 129% | 133% | 132% | N/A |

| Gross Margin | 42% | 39% | 31% | 28% | 2% |

| Operating Margin | -12% | -16% | -30% | -41% | -120% |

| Pre-Tax Margin | -12% | -17% | -34% | -63% | -115% |

| Profit Margin | -13% | -21% | -37% | -67% | -116% |

| Pre-Tax ROE | -100% | -45% | -78% | -382% | N/A |

| After Tax ROE | -111% | -54% | -85% | -406% | N/A |

- ↑ Tech company Garena raises US$550m, rebrands as Sea | The Straits Times

- ↑ Garena Server: What Is It? | League Of Legends Official Amino (aminoapps.com)

- ↑ Heroes of Newerth and its team acquired by Garena Online | GamesIndustry.biz

- ↑ Garena Launches Call of Duty Mobile | Back2Gaming

- ↑ Valued at $1bn, Garena is Singapore’s biggest internet company (techinasia.com)

- ↑ Tech company Garena raises US$550m, rebrands as Sea | The Straits Times

- ↑ Where Will Sea Limited Be in 5 Years? | The Motley Fool

- ↑ Southeast Asia gaming and e-commerce firm Sea ends first day on NYSE up 8% | TechCrunch

- ↑ Sea acquires SG-based football club Home United, rebrands it to Lion City Sailors FC | Marketing-Interactive

- ↑ Singapore's Sea Ltd secures $6 billion in mega fund raising | Reuters

- ↑ Tencent divests 2.6% of equity interest in Sea Limited - Tencent 腾讯

- ↑ Singapore tech giant Sea disbands investment arm: Sources | The Straits Times

- ↑ https://www.sea.com/investor/home

- ↑ https://www.sea.com/aboutus/ourvalues

- ↑ How Sea Limited Is Growing Larger Than Life | The Motley Fool

- ↑ Sea Limited Stock: This Digital Ecosystem Still Has Upside (NYSE:SE) | Seeking Alpha

- ↑ Here’s how Lazada lost its lead to Shopee in Southeast Asia (Part 2 of 2) | KrASIA (kr-asia.com)

- ↑ Garena Server: What Is It? | League Of Legends Official Amino (aminoapps.com)

- ↑ Shopee’s new consumer protection initiative lets you shop with peace of mind (channelnewsasia.com)

- ↑ https://www.sea.com/products/garena

- ↑ Here’s how Lazada lost its lead to Shopee in Southeast Asia (Part 2 of 2) | KrASIA (kr-asia.com)