Sea Limited

Summary edit edit source

Sea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as eSports operations; and access to other entertainment content, including livestreaming of gameplay and social features, such as user chat and online forums. The company also operates Shopee e-commerce platform, a mobile-centric marketplace that provides integrated payment and logistics infrastructure and seller services. In addition, it offers SeaMoney digital financial services to individuals and businesses, including offline and online mobile wallet, and payment processing services, as well as other offerings across credit, insurtech, and digital bank services under the ShopeePay, SPayLater, SeaBank, and other digital financial services brands; and payment processing services for Shopee. The company was formerly known as Garena Interactive Holding Limited and changed its name to Sea Limited in April 2017. Sea Limited was incorporated in 2009 and is headquartered in Singapore.

Strategy and Outlook edit edit source

History edit edit source

Sea Limited was founded in 2009, initially as Garena, by Singaporean entrepreneur Forrest Li.[1] The company was specialising in video game development, publishment and distribution. Through its platform, Garena+, it distributed major game titles across Taiwan and Southeast Asia including League of Legends[2], Heroes of Newerth[3], FIFA Online 4 and Call of Duty: Mobile[4]. By 2014 it was valued at $1bn and was named the biggest internet company in Singapore.[5] In 2017 the company acquired $550 million through a round of funding and rebranded itself as Sea Limited, maintaining the Garena digital entertainment branch, and additionally introducing the e-commerce and online financial services platforms, Shopee and SeaMoney. [6] The same year, it went public starting at $15 per share[7],aiming to raise $1 bn [8]. In 2020, Sea Limited acquired Singaporean football club Home United FC and rebranded it as Lion City Sailors FC[9], which made its debut in the upcoming Singaporean Premier League (SPL) season. In 2021, Sea Limited secured Southeast Asia's largest ever funding, raising $6bn by selling $3.5bn of equity and $2.5bn of convertible bond.[10] In 2021, the Chinese company Tencent that owned 21.3% of Sea Limited's shares, announced a divesting of almost 15 million class A shares to raise a $3bn fund for other investments and activities.[11] In 2023, a variety of factors including macroeconomic instability, increased interest rates and failed investments such as FTX, led Sea Limited to disband its investment arm.[12]

Mission Statement edit edit source

As mentioned in Sea Limited's website, the mission of the company is to "to better the lives of consumers and small businesses with technology"[13]. The company highlights its commitment to driving innovation, growth, and positive impact in the markets it operates. Moreover Sea Limited strives to empower individuals and communities across Southeast Asia and beyond, by aiming on a culture of continuous innovation, fostering meaningful connections, and enhancing financial inclusion.[14]

Marketing and growth strategy edit edit source

Product diversification and ecosystem edit edit source

Sea Limited focuses on product diversification, which enables the company to target a wide range of consumer groups, and attract an extensive amount of total customers. At the same time, the company has interconnected its platforms in a way that introduces customers of one sector to the others, integrating them into the Sea ecosystem. A great example of that strategy is the Free Fire, Garena's extremely popular mobile game, and Shopee's interconnection, as users of Free Fire are offered promotions and discounts for Shopee through the game. This proved successful, with Shopee increasing its quarterly revenue by $200 million in the second quarter of 2021.[15]

Investments and game development edit edit source

Sea Limited was built in the success and currently relying on its digital entertainment brand, Garena. The company was the first to acquire licenses to distribute third-party, extremely popular video games to a massive geographical region. They were therefore much anticipated and Garena automatically established a monopoly in the market. However, the company's investments didn't only focus on distributing third-party games, as Garena has published many original games such as Free Fire, which was the most downloaded mobile game worldwide in 2019 and 2020 and continues to be a major revenue stream.[16]

Another notable investment was in subsidies to local express delivery services that led to rapid development of the industry. Until Shopee's emergence in 2017, delivery in Southeast Asia was very expensive and slow, ranging from a week for e-commerce purchases to a year for international parcels. With this investment, Shopee managed to provide delivery of 1-3 days and even offered free shipping, attracting an extensive amount of customers and led users to order via the platform even if they had originally seen the product advertised in other e-commerce companies.[17]

Innovation edit edit source

On top of that, the innovation of the company is notable, as it adapted the platform to regions it is operating and included exclusive features. It adjusted the prices for in-game purchases depending on the country, introduced its own platform currency "Garena Shells"[18] and created game characters that represent the cultures of the countries it is targeting.

Shopee has also shown a great deal of innovation, by offering the shopping security feature "Shopee Guarantee", that freezes the payment to the seller until the buyer has confirmed they received the order in good condition. The importance of this feature is highlighted by a 14.7% increase in customer complaints for e-commerce purchases that was reported by the Consumers Association of Singapore (CASE), differentiating Shopee from other e-commerce giants, such as AliExpress and Lazada.[19]

Sector and Income Breakdown edit edit source

Subsidiaries edit edit source

Sea Limited, as mentioned, owns several subsidiaries including the digital entertainment company Garena, the e-commerce platform Shopee and the digital financial services company SeaMoney, therefore operating in 3 different markets. [20]

Garena edit edit source

Garena is a renowned digital entertainment firm that is associated with the Sea Limited group. Garena, which was established in 2009, has quickly evolved to establish itself as a prominent participant in the gaming business throughout Southeast Asia as well as other countries. Garena is most recognized for creating and releasing captivating multiplayer games online for a wide range of users.

Shopee edit edit source

Shopee is a platform for e-commerce in the holdings of Sea Limited. Shopee, which was founded in 2015, has quickly grown to become one of the major marketplaces for online products and services in Southeast Asia along with additional regions. It offers a wide choice of items and services to consumers, as well as novel functions to improve the shopping experience while online.

SeaMoney edit edit source

SeaMoney is Sea Limited's electronic monetary services subsidiary, focused on offering unique financial assistance and products to individuals and companies throughout Southeast Asia. SeaMoney, which was founded to improve financial stability and convenience, has quickly risen to become a major participant in the region's electronic finance environment.

Segments of operation edit edit source

Main streams of income edit edit source

Garena edit edit source

Garena's primary income stems from various strategies linked to its online gaming platform:

- In-Game Purchases: Garena's primary revenue stream arises from the in-game purchases. Gamers can purchase several features such as virtual items, skins, upgrades, and other in-game content using real money. These transactions enhance the gaming experience and allow players to personalize their gameplay.

- Gaming Currency: Garena introduces its gaming currency, such as Garena Shells, purchasable by the aid of actual currency. These shells can then be employed to obtain in-game items across different games accessible on the platform.

- Esports and Tournaments: Garena orchestrates esports tournaments and competitions for its games. Revenue is generated through sponsorships, ticket sales for live events, merchandise transactions, and broadcasting rights.

Shopee edit edit source

Shopee generates its core revenue primarily through its e-commerce platform and related services:

- Seller Fees: Shopee imposes charges on sellers for each transaction conducted on the platform. These charges are typically calculated as a percentage of the transaction's value.

- Marketing and Promotions: Sellers have the option to utilize advertising and promotional functionalities on the platform to augment the visibility of their products. This action results in revenue accrual for Shopee.

- Value-Added Offerings: Shopee provides supplementary services to sellers, encompassing premium store subscriptions, enhanced product listings, and fulfillment services. These provisions come at a certain expense and contribute to the overall revenue stream.

SeaMoney

SeaMoney garners its key revenue through digital financial services and transactions:

- Funds Transfer Fees: SeaMoney generates income by imposing fees on various financial services, including money transfers, bill payments, and other digital transactions conducted through its platform.

- Revenue from Financial Services: SeaMoney presents microloans and insurance products to individuals and small enterprises. The interest and charges tied to these offerings constitute a substantial portion of its revenue.

- Mobile Wallet Charges: SeaMoney may levy charges for specific services within its mobile wallet platform, such as currency conversion or withdrawal fees.

Corporate Governance edit edit source

The Team edit edit source

Forrest Li - Chairman and Group CEO edit edit source

Forrest Li has been the founder, chairman, and group CEO since Sea Limited's establishment in 2009. He's a board member of the Singapore Economic Development Board, an independent non-executive director of Shangri-La Asia Limited, and part of the National University of Singapore's board of trustees. He's also on Stanford University’s Graduate School of Business advisory council. Li holds an M.B.A. from Stanford University and a bachelor’s degree in Engineering from Shanghai Jiaotong University.

Gang Ye - Group Chief Operating Officer edit edit source

Gang Ye is Sea Limited's co-founder and has been on theboard since March 2010. He's been the COO since January 2017, having previously held the role of CTO from March 2010 to December 2016. Prior, he worked at Wilmar International and Singapore's Economic Development Board. Ye holds B.S. degrees in Computer Science and Economics from Carnegie Mellon University.

Chris Feng - Group President edit edit source

Chris Feng became part of Sea Limited in March 2014 and has been Group President since January 2022. Earlier, he was CEO of Shopee starting from July 2015 and held the position of CEO of SeaMoney from March 2020. He was also previously the head of mobile business. Feng gained experience at Rocket Internet SE, managing Zalora and Lazada, as well as at McKinsey & Company. He holds a first-class honours bachelor's degree in Computer Science from the National University of Singapore.

Tony Hou - Group Chief Financial Officer edit edit source

Tony Hou joined Sea Limited in September 2010 and has been the group CFO since January 2013. Before this, he was the company's financial controller. He brought experience from Ernst & Young, where he worked from October 2000 to September 2010 in China and the U.S. Hou is a non-practicing U.S. Certified Public Accountant and a non-practicing member of the Chinese Institute of Certified Public Accountants. He holds an M.B.A. from the University of Chicago’s Booth School of Business and a bachelor’s degree in Accounting from Fudan University.

Terry Zhao - President, Garena edit edit source

Terry Zhao has been part of Sea Limited since its start in 2009 and has been Garena's President since November 2018. Before this, he held various senior positions in our digital entertainment business across key markets. Zhao holds a first-class honors bachelor's degree in Computer Engineering from Nanyang Technological University.

Yanjun Wang - Group Chief Corporate Officer edit edit source

Yanjun Wang holds the roles of group chief corporate officer, group general counsel, and company secretary. Since May 2019, she has been group chief corporate officer, since November 2017, the company secretary, and since March 2014, the group general counsel. Before joining Sea Limited, she practiced law at Skadden, Arps, Slate, Meagher & Flom LLP and Kirkland & Ellis. Wang is a qualified lawyer in the State of New York and holds a J.D. degree from Harvard Law School and a B.A. degree in Economics from Harvard University.

David Chen - Chief Product Officer, Shopee edit edit source

David Chen, also a co-founder, currently holds the role of Shopee's chief product officer. He was previously group chief of staff from January 2017 to December 2019, and prior to that, group chief operating officer from May 2009 to December 2016. Chen also has a background at PSA Corporation Limited. He graduated with a first-class honors bachelor’s degree in Computer Engineering from the National University of Singapore.

Ownership Structure edit edit source

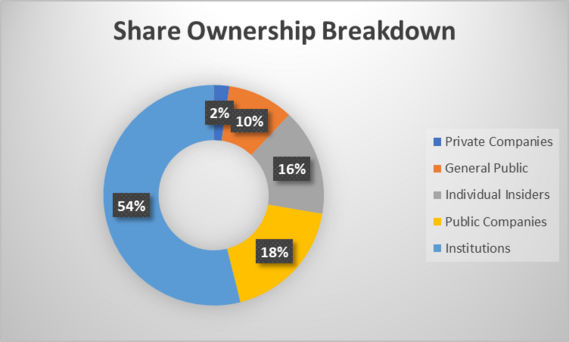

Sea Limited is currently distributed in 566,758,842 shares, valued at $36.85 as of Aug 23, 2023. The majority of shares is owned by institutions, and a complete breakdown is shown in the figure below.

The top 25 shareholders, as listed below, currently own 67.93% of Sea Limited.[22] The most notable shareholder is Tencent, holding 18.4% of the total shares, a value that was 21.3% until 2021, when Tencent divested $3bn worth of shares to raise funds for other projects.

| Ownership | Name | Shares | Current Value |

|---|---|---|---|

| 18.4% | Tencent Holdings Limited | 104,264,743 | US$3.8b |

| 8.53% | Xiaodong Li | 48,336,624 | US$1.8b |

| 7.83% | Capital Research and Management Company | 44,386,483 | US$1.6b |

| 5.29% | Gang Ye | 29,968,937 | US$1.1b |

| 3.85% | Baillie Gifford & Co. | 21,795,993 | US$803.2m |

| 2.91% | BlackRock, Inc. | 16,515,843 | US$608.6m |

| 2.75% | Sands Capital Management, LLC | 15,576,947 | US$574.0m |

| 2.75% | FMR LLC | 15,573,573 | US$573.9m |

| 1.82% | T. Rowe Price Group, Inc. | 10,307,631 | US$379.8m |

| 1.8% | Kerry Group Limited | 10,208,127 | US$376.2m |

| 1.46% | Chen Jingye | 8,289,101 | US$305.5m |

| 1.12% | State Street Global Advisors, Inc. | 6,373,278 | US$234.9m |

| 1.03% | Aspex Management (HK) Limited | 5,846,284 | US$215.4m |

| 0.9% | Goldman Sachs Group, Investment Banking and Securities Investments | 5,101,620 | US$188.0m |

| 0.88% | Charles-Lim Capital Ltd | 5,000,000 | US$184.3m |

| 0.81% | Norges Bank Investment Management | 4,562,488 | US$168.1m |

| 0.71% | Artisan Partners Limited Partnership | 4,040,204 | US$148.9m |

| 0.7% | JP Morgan Asset Management | 3,972,940 | US$146.4m |

| 0.69% | Ward Ferry Management (BVI) Limited | 3,904,986 | US$143.9m |

| 0.68% | Kora Management LP | 3,854,500 | US$142.0m |

| 0.63% | Temasek Holdings (Private) Limited | 3,564,826 | US$131.4m |

| 0.61% | Teachers Insurance and Annuity Association-College Retirement Equities Fund | 3,456,932 | US$127.4m |

| 0.6% | Eastspring Investments (Singapore) Limited | 3,374,004 | US$124.3m |

| 0.59% | Tiger Global Management, LLC | 3,371,611 | US$124.2m |

| 0.59% | Marshall Wace LLP | 3,338,448 | US$123.0m |

Market edit edit source

Total Addressable Market edit edit source

Sea Limited operates digital entertainment, e-commerce, and digital financial services businesses primarily in Southeast Asia. Its main sector is communication services and within that sector it operates in the interactive home entertainment industry. Its primary markets include Indonesia, Thailand, Vietnam, the Philippines, Malaysia, and Singapore.

- Revenue in the Home Entertainment segment reached US$176m in 2022.

- Revenue is expected to show an annual growth rate (CAGR 2022-2027) of 7.71%, resulting in a projected market volume of US$276m by 2027.

Key Market Drivers and opportunities edit edit source

The main market drivers include GDP/capita, level of digitization, and consumer attitudes toward apps.

Moreover non-financial market drivers include the following:

- Artificial intelligence and machine learning presents vast opportunities for media and entertainment firms to understand what content, shows, movies and music consumers want.

- The upcoming mass 5G rollout in countries such as Singapore and Malaysia, will allow firms to expect more entertainment and gaming innovations such as virtual and augmented reality will be introduced to the market. As such, the demand for hyper-personalised content and immersive entertainment will continue to increase.

- With the help of platforms and data analytics technologies, companies can scale their use of data while complying with consumer privacy regulations and reducing their costs. Through data-driven decision-making, companies within the media and entertainment sector can deliver personalised content and experiences, retain customers, grow their business, and build a data-driven future.

- This success is fuelled by substantial financial backing from central governments. For example, China plans to build a USD 30 billion fund to ensure they are a world leader in AI by 2030. At the same time, India is making headway with mobile wallets and Progressive Web Applications to streamline in-app experiences (especially for places with slow mobile broadband). Such holistic developments in the infrastructure, which acts as a technical backbone to the market will result in growth opportunities and improved customer retention.

Key Market Challenges and Risks edit edit source

Some of the main challenges and risks that can affect Sea Limited, as mentioned in their Q2-2023 earnings report include the following.

- Expected changes or guidance in its revenue, costs, or expenditures.

- Ability to continue sourcing, developing, and offering new and attractive online games.

- Ability to offer other engaging digital entertainment content.

- Expected growth of its digital entertainment, e-commerce, and digital financial services businesses.

- Expectations regarding growth in its user base, level of engagement, and monetization.

- Ability to continue developing new technologies and upgrading existing technologies.

- Expectations regarding the use of proceeds from financing activities, including follow-on equity offerings and convertible notes offerings.

- Growth and trends of its markets and competition in its industries.

- Government policies and regulations relating to its industries, including effects of government orders or actions on its businesses.

- General economic, political, social, and business conditions in its markets.

- Impact of widespread health developments, including the COVID-19 pandemic, and responses thereto (such as voluntary and mandatory quarantines, shut downs, restrictions on travel and activities, and availability of effective vaccines or treatments).

- Impact of economies reopening further in response to the COVID-19 pandemic.

Financials edit edit source

Historic edit edit source

Most recent quarter edit edit source

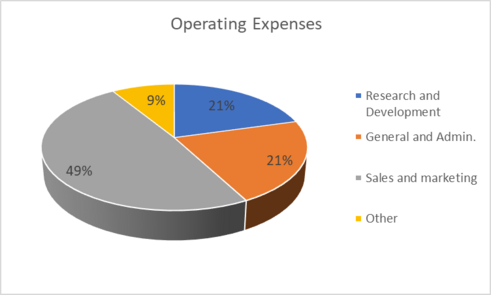

Sea Limited released its 2Q23 results in June 2023[23], the most notable of which contained in the table below. The company reported just a 5.2% raise in overall revenues, which is mostly due to a 41.1% steep decline in Garena's revenues. The company attributed that to moderation in user engagement and monetization year-on-year, which is likely related to India's ban of Free Fire, Garena's most profitable game, in 2022. Free Fire was the second most downloadable app in India, and had the highest consumer spend.[24] Despite the small increase in overall revenue, the company made a significant cut on operating expenses as it reported a 49.3% decrease in sales and marketing expenses and 23.6% decrease in R&D expenses, which resulted in the company turning profitable after many years of reporting losses.

| For the Three Months ended June 30, | |||

|---|---|---|---|

| 2022 | 2023 | YOY% | |

| Digital Entertainment Revenue ($thousands) | 900,258 | 529,397 | -41.20% |

| E-commerce and other services revenue ($thousands) | 1,755,686 | 2,322,496 | 32.30% |

| Sales of goods ($thousands) | 286,655 | 243,767 | -15% |

| Total Revenue ($thousands) | 2,942,599 | 3,095,660 | 5.20% |

| Gross Profit ($thousands) | 1,090,218 | 1,450,878 | 33.10% |

| Operating expenses | |||

| Sales and marketing ($thousands) | -973,767 | -493,601 | -49.30% |

| General and admin. ($thousands) | -364,447 | -295,169 | -19% |

| Research and development ($thousands) | -370,926 | -283,297 | -23.60% |

| Other ($thousands) | -3,636,054 | -2,239,132 | |

| Total operating expenses ($thousands) | -1,926,914 | -1,167,065 | -39.40% |

| Net income/loss ($thousands) | -931,199 | 330,983 | -135.50% |

Most recent year edit edit source

The decreasing trend in Garena's revenues was evident from 2022, as the company saw a 10.25% decrease since 2021. However, there is steep growth both in the e-commerce and digital financial services sectors, which seems to become the company's main focus. There was a modest decrease in sales and marketing expenses (14.64%) but increase in administrative and R&D expenses, which led total operating expenses increasing by 21.79%. Nevertheless, the 33.1% increase in gross profit outweighed the higher operating expenses that led to a 18.86% decrease in the net loss.

| For the fiscal year ended, | |||

|---|---|---|---|

| 2021 | 2022 | YOY% | |

| Digital Entertainment Revenue ($thousands) | 4,320,013 | 3,877,163 | -10.25% |

| E-commerce ($thousands) | 5,122,959 | 7,288,677 | 42.27% |

| Digital Financial Services ($thousands) | 469,774 | 1,221,996 | 160.12% |

| Other services ($thousands) | 42,444 | 61,869 | 45.77% |

| Total Revenue ($thousands) | 9,955,190 | 12,449,705 | 25.06% |

| Gross Profit ($thousands) | 3,895,735 | 5,185,277 | 33.10% |

| Operating expenses | |||

| Sales and marketing ($thousands) | -3,829,743 | -3,269,223 | -14.64% |

| General and admin. ($thousands) | -987,868 | -1,437,612 | 45.53% |

| Research and development ($thousands) | -831,703 | -1,376,501 | 65.50% |

| Other ($thousands) | 170,519 | -589,449 | -445.68% |

| Total operating expenses ($thousands) | -5,478,795 | -6,672,785 | 21.79% |

| Net income/loss ($thousands) | -2,043,030 | -1,657,772 | -18.86% |

Last 5 years edit edit source

| Year | Year end date | Income Statement | Balance Sheet | |

|---|---|---|---|---|

| Revenues($thousands) | Net losses ($thousands) | Total Assets($million) | ||

| 22 | 31/12/2018 | 826,968 | -961,241 | N/A |

| 23 | 31/12/2019 | 2,175,378 | -1,462,799 | 5,224,169 |

| 24 | 31/12/2020 | 4,375,664 | -1,618,056 | 10,455,671 |

| 25 | 31/12/2021 | 9,955,190 | -2,046,759 | 18,756,025 |

| 26 | 31/12/2022 | 12,449,705 | -1,651,421 | 17,002,796 |

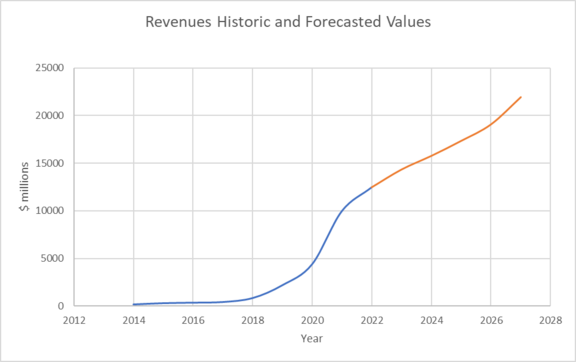

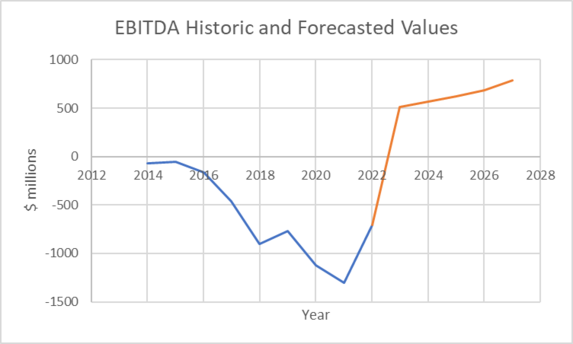

Revenues and gross profit are steeply increasing, but after applying operating expenses, the company reports an increasing loss every year. This is attributed to disproportionate increase of operating expenses year by year, which outweigh the increase in revenues.

Sea Limited's great investment in subsidies to local express delivery companies were one of the major operational expenses that kept Shopee, and by extension the entire company from being profitable until 2023.[25] However, based on the most recent results, operational expenses were significantly reduced, Garena's revenues declined, and the most promising and profitable branch is Shopee.

Forward edit edit source

Method edit edit source

The forecasted values for revenues and EBITDA were calculated using straight line forecasting. The growth rates used for revenues were retrieved from Yahoo Finance and CIQ as predicted by analysts, and for EBITDA the average growth rate of the previous years was used.

Financial Forecasts edit edit source

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenues | 160.756 | 292.124 | 345.67 | 414.19 | 826.968 | 2175.378 | 4375.664 | 9955.19 | 12449.71 | 14317.16 | 15748.88 | 17323.76 | 19056.14 | 21914.56 |

| EBITDA | -69.3 | -52.1 | -160.3 | -460.5 | -904.9 | -769.6 | -1122.6 | -1304 | -704.2 | 514.3483 | 565.7832 | 622.3615 | 684.5976 | 787.2873 |

Valuation edit edit source

A Discounted Cash Flow (DCF) model was used for Sea Limited's valuation. The yearly revenue growth rate values estimated by Yahoo Finance and CIQ were used to predict revenues until 2027, while for the expenses, the average rates of previous years were used. The full table for the FCF calculation can be found on the Appendix.

| WACC | LTM |

|---|---|

| Weights | |

| Total Debt | 4262.053 |

| Market Cap | 20026 |

| Total | 24288.053 |

| Wd | 18% |

| We | 82% |

| Debt | |

| Total Debt | 4262.053 |

| Interest Expense | -43.1 |

| Rate | 1% |

| Effective Tax Rate | 5% |

| Rd(1-t) | 1.0% |

| Equity | |

| Risk Free Rate | 4.2% |

| Beta | 1.67 |

| Market Rate | 10% |

| Re | 13.9% |

| Discount Rate | 11.60% |

| Perpetuity Growth Rate | 2.0% |

| Terminal Value | |

|---|---|

| Perpetuity Growth | |

| FCFn | 1,665.98 |

| Growth Rate | 2.0% |

| WACC | 12% |

| PG Terminal Value | 17,698.7 |

| Exit Multiple | |

| EBITDA | - |

| EV/EBITDA Multiple | - |

| Exit Multiple TV | - |

| Average | 17,698.7 |

| DCF | 2023 | 2024 | 2025 | 2026 | 2027 | Terminal Value | |

|---|---|---|---|---|---|---|---|

| FCF | 1,088.4 | 1,197.3 | 1,317.0 | 1,448.7 | 1,666.0 | 17,698.7 | |

| Net Present Value of FCF | 4780.26 | ||||||

| Terminal Value | 17,698.69 | ||||||

| Present Value of TV | 10223.39 | ||||||

| Enterprise Value | 15003.65 | ||||||

| Net Debt | -1137.8 | ||||||

| Equity Value | 16141.4 | ||||||

| Shares Out | 477 | ||||||

| Equity Value per Share | $ 33.83 | ||||||

| Current share price | $ 35.21 | ||||||

| Difference | -3.9% |

| Sensitivity Analysis | ||||||

|---|---|---|---|---|---|---|

| Perpetuity Growth Rate | ||||||

| WACC | $33.83 | 1.0% | 1.5% | 2.0% | 2.5% | 3.0% |

| 10.0% | £37.17 | £38.73 | £40.48 | £42.47 | £44.74 | |

| 10.5% | £35.23 | £36.60 | £38.13 | £39.86 | £41.81 | |

| 11.0% | £33.49 | £34.70 | £36.05 | £37.55 | £39.24 | |

| 11.6% | £31.62 | £32.67 | £33.83 | £35.12 | £36.56 | |

| 12.0% | £30.48 | £31.45 | £32.50 | £33.67 | £34.97 | |

| 12.5% | £29.18 | £30.04 | £30.98 | £32.02 | £33.17 | |

| 13.0% | £27.99 | £28.76 | £29.61 | £30.53 | £31.55 | |

Appendix edit edit source

All data in financial statements were retrieved from Sea Limited's published annual reports since 2017.[26]

Financial statements edit edit source

Income Statement edit edit source

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

|---|---|---|---|---|---|

| Total Revenue ($million) | 12,449,705 | 9,955,190 | 4,375,664 | 2,175,378 | 826,968 |

| Cost of Revenue ($million) | -7,264,428 | -6,059,455 | -3,026,759 | -1,570,458 | -812,210 |

| Gross Profit ($million) | 5,185,277 | 3,895,735 | 1,348,905 | 604,920 | 14,758 |

| Operating Income/Expenses | |||||

| Research and Development ($million) | -1,376,501 | -831,703 | -353,785 | -156,634 | -67,529 |

| General and Admin. ($million) | -1,437,612 | -987,868 | -599,706 | -385,865 | -240,781 |

| Sales and marketing ($million) | -3,269,223 | -3,829,743 | -1,830,875 | -969,543 | -705,015 |

| Other Operating Income ($million) | 279,184 | 287,946 | 189,645 | 15,890 | 9,799 |

| Provision for credit losses ($million) | -513,690 | -117,427 | -57,509 | -- | -- |

| Goodwill ($million) | -354,943 | -- | -- | -- | -- |

| Total operating expenses ($million) | -6,672,785 | -5,478,795 | -2,652,230 | -1,496,152 | -1,003,526 |

| Operating Loss ($million) | -1,487,508 | -1,583,060 | -1,303,325 | -891,232 | -988,768 |

| Interest income/expense and others ($million) | -13,025 | -132,124 | -179,913 | -477,387 | 34,888 |

| Earnings/Losses Before Tax ($million) | -1,500,533 | -1,715,184 | -1,483,238 | -1,368,619 | -953,880 |

| Income Tax ($million) | -168,395 | -332,865 | -141,640 | -85,864 | -4,088 |

| Share of results of equity investees ($million) | 11,156 | 5,019 | 721 | -3,239 | 3,066 |

| Net loss ($million) | -1,657,772 | -2,043,030 | -1,624,157 | -1,457,722 | -961,034 |

| Net income/loss attributable to non-controlling interests ($million) | 6,351 | -3,729 | 6,101 | -5,077 | -207 |

| Net Loss Applicable to Common Shareholders ($million) | -1,651,421 | -2,046,759 | -1,618,056 | -1,462,799 | -961,241 |

Cash Flow Statement edit edit source

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

| Net Income ($ thousands) | -1,657,772 | -2,043,030 | -1,624,157 | -1,457,722 | -961,034 |

| Cash Flows-Operating Activities | |||||

| Depreciation ($ thousands) | 428,344 | 279,032 | 169,067 | 116,783 | 54,902 |

| Other Adjustments ($thousands) | 1,543,364 | 696,427 | 484,793 | 628,741 | 38,100 |

| Operating cash flows before changes in working capital ($ thousands) | 313,936 | -1,067,571 | -970,297 | -712,198 | -868,032 |

| Changes in Operating Activities | |||||

| Accounts Receivable ($ thousands) | 98,981 | -37,066 | -174,767 | -86,546 | -38,524 |

| Accounts Payable ($ thousands) | 43,311 | 99,639 | 50,860 | 31,381 | 29,733 |

| Changes in Inventories ($ thousands) | 1,441 | -62,735 | -38,528 | 11,762 | -28,465 |

| Deferred revenue ($ thousands) | -1,093,229 | 314,048 | 1,162,399 | 637,214 | 204,161 |

| Lease Liabilities ($ thousands) | 385,911 | 429,366 | 46,352 | 70,901 | -- |

| Other Operating Activities ($ thousands) | -492,107 | -534,603 | -490,448 | -594,847 | -662,125 |

| Net Cash Flow-Operating ($ thousands) | -1,055,692 | 208,649 | 555,868 | 69,865 | -495,220 |

| Cash Flows-Investing Activities | |||||

| Capital Expenditures ($ thousands) | -924,178 | -772,177 | -336,274 | -239,844 | -177,343 |

| Investments($ thousands) | -2,630,842 | -2,505,358 | -219,548 | -118,462 | -69,641 |

| Other Investing Activities ($ thousands) | 1,126,211 | -489,738 | -331,090 | -4,913 | 22,456 |

| Net Cash Flows-Investing ($ thousands) | -2,428,809 | -3,767,273 | -886,912 | -363,219 | -224,528 |

| Cash Flows-Financing Activities | |||||

| Proceeds from issuance of convertible notes ($ thousands) | -- | 2,846,250 | 1,141,362 | 1,138,500 | 564,938 |

| Proceeds from issuance of shares ($ thousands) | 50,211 | 4,050,055 | 2,970,248 | 1,538,802 | 4,574 |

| Net Borrowings ($ thousands) | -68238 | 114035 | -30609 | -2003 | -643 |

| Other Financing Activities ($ thousands) | 418,283 | 391,249 | -347,869 | -95,704 | -22,241 |

| Net Cash Flows-Financing ($ thousands) | 400,256 | 7,401,589 | 3,733,132 | 2,579,595 | 546,628 |

| Effect of Exchange Rate ($million) | -143,511 | -58,218 | 80,727 | 25,025 | -12,546 |

| Net Increase/Decrease in Cash Flow ($ thousands) | -3,227,756 | 3,784,747 | 3,482,815 | 2,311,266 | -185,666 |

| Cash flow at beginning of year ($ thousands) | 10838140 | 7053393 | 3570578 | 1259312 | 1,444,978 |

| Cash flow at end of year ($ thousands) | 7,610,384 | 10,838,140 | 7,053,393 | 3,570,578 | 1,259,312 |

Balance Sheet edit edit source

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 |

|---|---|---|---|---|

| Current Assets | ||||

| Cash and Cash Equivalents ($thousands) | 6,029,859 | 9,247,762 | 6,166,880 | 3,118,988 |

| Short-Term Investments ($thousands) | 864,258 | 911,281 | 126,099 | 102,324 |

| Net Receivables ($thousands) | 2322581 | 1,889,262 | 648,936 | 187,035 |

| Inventory ($thousands) | 109,668 | 117,499 | 64,219 | 26,932 |

| Other Current Assets ($thousands) | 3,361,646 | 2,969,593 | 1,932,870 | 974,860 |

| Total Current Assets ($thousands) | 12,688,012 | 15,135,397 | 8,939,004 | 4,410,139 |

| Long-Term Assets | ||||

| Long-Term Investments ($thousands) | 1,253,593 | 1,052,861 | 190,482 | 113,797 |

| Fixed Assets ($thousands) | 1,387,895 | 1,029,963 | 386,401 | 318,620 |

| Goodwill ($thousands) | 230,208 | 539,624 | 216,278 | 30,952 |

| Intangible Assets ($thousands) | 65,019 | 52,517 | 39,773 | 15,020 |

| Other Assets ($thousands) | 1,132,843 | 841,908 | 583,829 | 265,301 |

| Deferred Asset Charges ($thousands) | 245,226 | 103,755 | 99,904 | 70,340 |

| Total Long-Term Assets ($thousands) | 4,314,784 | 3,620,628 | 1,516,667 | 814,030 |

| Total Assets ($thousands) | 17,002,796 | 18,756,025 | 10,455,671 | 5,224,169 |

| Current Liabilities | ||||

| Accounts Payable ($thousands) | 258,648 | 213,580 | 121,637 | 69,370 |

| Short-Term Debt / Current Portion of Long-Term Debt ($thousands) | 88,410 | 100,000 | -- | 1,258 |

| Accrued expenses and other payables ($thousands) | 1,396,613 | 1,519,938 | 2,033,461 | 980,805 |

| Escrow payables and advances from customers($thousands) | 1,862,325 | 1,789,973 | 161,379 | 65,062 |

| Deferred revenue ($thousands) | 1,535,083 | 2,644,463 | 2,150,165 | 1,097,868 |

| Other Current Liabilities ($thousands) | 1,794,613 | 908,482 | 169,425 | 148,003 |

| Total Current Liabilities ($thousands) | 6,935,692 | 7,176,436 | 4,636,067 | 2,362,366 |

| Long-term Liabilities | ||||

| Accrued expenses and other payables ($thousands) | 87,072 | 76,234 | 36,159 | 25,802 |

| Operating Lease Liabilities ($thousands) | 756,818 | 491,313 | 177,870 | 144,000 |

| Other Liabilities ($thousands) | 107 | 107 | 107 | 1,334 |

| Deferred Liability Charges ($thousands) | 73,533 | 111,818 | 344,823 | 161,683 |

| Convertible notes ($thousands) | 3,338,750 | 3,475,708 | 1,840,406 | 1,356,332 |

| Total long-term liabilities ($thousands) | 4,256,280 | 4,155,180 | 2,399,365 | 1,689,151 |

| Total Liabilities ($thousands) | 11,191,972 | 11,331,616 | 7,035,432 | 4,051,517 |

| Stock Holders Equity | ||||

| Common Stocks ($thousands) | 281 | 278 | 225 | 230 |

| Capital Surplus ($thousands) | 14,559,690 | 14,622,292 | 8,526,571 | 4,687,284 |

| Statutory reserves ($thousands) | 12,490 | 6,144 | 2,363 | 46 |

| Accumulated deficit ($thousands) | -8,745,541 | -7,201,498 | -5,150,958 | -3,530,585 |

| Other Equity ($thousands) | -16,096 | -2,807 | 42,038 | 15,677 |

| Total Equity ($thousands) | 5,810,824 | 7,424,409 | 3,420,239 | 1,172,652 |

| Total Liabilities & Equity ($thousands) | 17,002,796 | 18,756,025 | 10,455,671 | 5,224,169 |

Financial Ratios edit edit source

| Year End Date | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Current Ratio | 183% | 211% | 193% | 187% | N/A |

| Quick Ratio | 120% | 155% | 147% | 140% | N/A |

| Cash Ratio | 87% | 129% | 133% | 132% | N/A |

| Gross Margin | 42% | 39% | 31% | 28% | 2% |

| Operating Margin | -12% | -16% | -30% | -41% | -120% |

| Pre-Tax Margin | -12% | -17% | -34% | -63% | -115% |

| Profit Margin | -13% | -21% | -37% | -67% | -116% |

| Pre-Tax ROE | -100% | -45% | -78% | -382% | N/A |

| After Tax ROE | -111% | -54% | -85% | -406% | N/A |

Valuation inputs edit edit source

(Figures in $millions)

| 1. Income Statement | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 160.756 | 292.124 | 345.67 | 414.19 | 826.968 | 2175.378 | 4375.664 | 9955.19 | 12449.705 | 14317 | 15749 | 17324 | 19056 | 21915 |

| % growth | 82% | 18% | 20% | 100% | 163% | 101% | 128% | 25% | 15% | 10% | 10% | 10% | 15% | |

| Cost Of Goods Sold | 124.573 | 184.298 | 232.598 | 326.878 | 812.21 | 1570.458 | 3026.759 | 6059.455 | 7264.428 | 8590 | 9449 | 10394 | 11434 | 13149 |

| % of revenue | 77% | 63% | 67% | 79% | 98% | 72% | 69% | 61% | 58% | 60% | 60% | 60% | 60% | 60% |

| Gross Profit | 36.183 | 107.826 | 113.072 | 87.312 | 14.758 | 604.92 | 1348.905 | 3895.735 | 5185.277 | 5727 | 6300 | 6930 | 7622 | 8766 |

| Selling General & Admin Exp. | 112.958 | 174.547 | 294.187 | 562.92 | 940.63 | 1355.408 | 2430.581 | 4817.611 | 4706.835 | 5441 | 5985 | 6583 | 7241 | 8328 |

| % of revenue | 70% | 60% | 85% | 136% | 114% | 62% | 56% | 48% | 38% | 38% | 38% | 38% | 38% | 38% |

| Provision for bad debts | - | - | - | - | - | - | 57.509 | 117.427 | 513.69 | 0 | 0 | 0 | 0 | 0 |

| % of revenue | #VALUE! | #VALUE! | #VALUE! | #VALUE! | #VALUE! | #VALUE! | 1.3% | 1.2% | 4.1% | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% |

| R&D Exp | 11.053 | 17.732 | 20.809 | 29.323 | 67.529 | 156.634 | 353.785 | 831.703 | 1376.501 | 1096 | 1206 | 1326 | 1459 | 1678 |

| % of revenue | 7% | 6% | 6% | 7% | 8% | 7% | 8% | 8% | 11% | 8% | 8% | 8% | 8% | 8% |

| Depreciation & Amort. | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| % of revenue | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Other Operating Expense/(Income) | -0.7 | -3.1 | -2.1 | -3.5 | -9.8 | -15.9 | -189.6 | -287.9 | -279.2 | -228 | -251 | -276 | -303 | -349 |

| % of revenue | 0% | -1% | -1% | -1% | -1% | -1% | -4% | -3% | -2% | -2% | -2% | -2% | -2% | -2% |

| Total Operating Expenses | 123.269 | 189.216 | 312.893 | 588.746 | 998.36 | 1496.152 | 2652.23 | 5478.795 | 6317.842 | 5213 | 5734 | 6307 | 6938 | 7979 |

| Operating Income / EBIT | -87.1 | -81.4 | -199.8 | -501.4 | -983.6 | -891.2 | -1303.3 | -1583.1 | -1132.6 | 514 | 566 | 622 | 685 | 787 |

| EBITDA | -69.3 | -52.1 | -160.3 | -460.5 | -904.9 | -769.6 | -1122.6 | -1304 | -704.2 | 514 | 566 | 622 | 685 | 787 |

| Tax Expense | 2.521 | 11.73 | 8.546 | 10.745 | 4.088 | 85.864 | 141.64 | 332.865 | 168.395 | 26 | 28 | 31 | 34 | 39 |

| Effective tax rate | -3% | -14% | -4% | -2% | 0% | -10% | -11% | -21% | -15% | 5% | 5% | 5% | 5% | 5% |

| 2. Cashflow Statement | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Depreciation & Amort. | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| % of revenue | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Capital Expenditure | -19.3 | -25.8 | -17 | -67.4 | -177.3 | -239.8 | -336.3 | -772.2 | -924.2 | -1778 | -1955 | -2151 | -2366 | -2721 |

| % of revenue | 12% | 9% | 5% | 16% | 21% | 11% | 8% | 8% | 7% | 12% | 12% | 12% | 12% | 12% |

| Change in NWC | 0 | -4 | 19.189 | -158.2 | -198.1 | -606.1 | -831 | 3.412 | 1163.028 | -2377 | -2615 | -2877 | -3164 | -3639 |

| % of revenue | 0% | -1% | 6% | -38% | -24% | -28% | -19% | 0% | 9% | -17% | -17% | -17% | -17% | -17% |

| 3. 3SM | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 160.756 | 292.124 | 345.67 | 414.19 | 826.968 | 2175.378 | 4375.664 | 9955.19 | 12450 | 14317 | 15749 | 17324 | 19056 | 21915 |

| % growth | 0 | 82% | 18% | 20% | 100% | 163% | 101% | 128% | 25% | 15% | 10% | 10% | 10% | 15% |

| EBIT | -87 | -81 | -200 | -501 | -984 | -891 | -1303 | -1583 | -1133 | 514 | 566 | 622 | 685 | 787 |

| % margin | -54% | -28% | -58% | -121% | -119% | -41% | -30% | -16% | -9% | 4% | 4% | 4% | 4% | 4% |

| EBITDA | -87 | -81 | -200 | -501 | -984 | -891 | -1303 | -1583 | -1133 | 514 | 566 | 622 | 685 | 787 |

| % margin | -54% | -28% | -58% | -121% | -119% | -41% | -30% | -16% | -9% | 4% | 4% | 4% | 4% | 4% |

| Taxes | 3 | 12 | 9 | 11 | 4 | 86 | 142 | 333 | 168 | 26 | 28 | 31 | 34 | 39 |

| % of EBIT | -3% | -14% | -4% | -2% | 0% | -10% | -11% | -21% | -15% | 5% | 5% | 5% | 5% | 5% |

| EBIAT | -90 | -93 | -208 | -512 | -988 | -977 | -1445 | -1916 | -1301 | 489 | 537 | 591 | 650 | 748 |

| D&A | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

| % of revenue | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% | 0% |

| Capital Expenditure | -19.3 | -25.8 | -17 | -67.4 | -177.3 | -239.8 | -336.3 | -772.2 | -924.2 | -1777.51097 | -1955.26207 | -2150.78827 | -2365.8671 | -2720.74717 |

| % of revenue | 12% | 9% | 5% | 16% | 21% | 11% | 8% | 8% | 7% | 12% | 12% | 12% | 12% | 12% |

| Change in NWC | 0 | -4 | 19.189 | -158.2 | -198.1 | -606.1 | -831 | 3.412 | 1163.028 | -2377.29657 | -2615.02623 | -2876.52885 | -3164.18174 | -3638.809 |

| % of revenue | 0% | -1% | 6% | -38% | -24% | -28% | -19% | 0% | 9% | -17% | -17% | -17% | -17% | -17% |

| Unlevered Free Cash Flow | -109 | -115 | -245 | -421 | -967 | -611 | -950 | -2692 | 1088 | 1197 | 1317 | 1449 | 1666 |

- ↑ Tech company Garena raises US$550m, rebrands as Sea | The Straits Times

- ↑ Garena Server: What Is It? | League Of Legends Official Amino (aminoapps.com)

- ↑ Heroes of Newerth and its team acquired by Garena Online | GamesIndustry.biz

- ↑ Garena Launches Call of Duty Mobile | Back2Gaming

- ↑ Valued at $1bn, Garena is Singapore’s biggest internet company (techinasia.com)

- ↑ Tech company Garena raises US$550m, rebrands as Sea | The Straits Times

- ↑ Where Will Sea Limited Be in 5 Years? | The Motley Fool

- ↑ Southeast Asia gaming and e-commerce firm Sea ends first day on NYSE up 8% | TechCrunch

- ↑ Sea acquires SG-based football club Home United, rebrands it to Lion City Sailors FC | Marketing-Interactive

- ↑ Singapore's Sea Ltd secures $6 billion in mega fund raising | Reuters

- ↑ Tencent divests 2.6% of equity interest in Sea Limited - Tencent 腾讯

- ↑ Singapore tech giant Sea disbands investment arm: Sources | The Straits Times

- ↑ https://www.sea.com/investor/home

- ↑ https://www.sea.com/aboutus/ourvalues

- ↑ How Sea Limited Is Growing Larger Than Life | The Motley Fool

- ↑ Sea Limited Stock: This Digital Ecosystem Still Has Upside (NYSE:SE) | Seeking Alpha

- ↑ Here’s how Lazada lost its lead to Shopee in Southeast Asia (Part 2 of 2) | KrASIA (kr-asia.com)

- ↑ Garena Server: What Is It? | League Of Legends Official Amino (aminoapps.com)

- ↑ Shopee’s new consumer protection initiative lets you shop with peace of mind (channelnewsasia.com)

- ↑ https://www.sea.com/products/

- ↑ Sea Limited Insider Trading & Ownership Structure - Simply Wall St

- ↑ Sea Limited Insider Trading & Ownership Structure - Simply Wall St

- ↑ https://www.sea.com/investor/quarterlyresults

- ↑ Free Fire Revenue and Usage Statistics (2023) - Business of Apps

- ↑ Here’s how Lazada lost its lead to Shopee in Southeast Asia (Part 2 of 2) | KrASIA (kr-asia.com)

- ↑ https://www.sea.com/investor/annualreports