Sea Limited: Difference between revisions

| Line 67: | Line 67: | ||

=== Ownership Structure === | === Ownership Structure === | ||

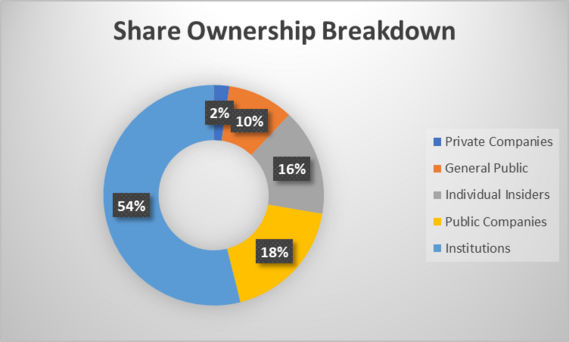

Sea Limited is currently distributed in 566,758,842 shares, valued at $36.85 as of Aug 23, 2023. The majority of shares is owned by institutions, and a complete breakdown is shown in the figure below. | |||

[[File:Share Ownership Breakdown.png|none|thumb|569x569px|Sea Limited's share ownership distribution<ref>Sea Limited Insider Trading & Ownership Structure - Simply Wall St</ref>]] | |||

The top 25 shareholders, as listed below, currently own 67.93% of Sea Limited.<ref>Sea Limited Insider Trading & Ownership Structure - Simply Wall St</ref> The most notable shareholder is Tencent, holding 18.4% of the total shares, a value that was 21.3% until 2021, when Tencent divested $3bn worth of shares to raise funds for other projects. | |||

{| class="wikitable" | |||

!Ownership | |||

!Name | |||

!Shares | |||

!Current Value | |||

|- | |||

|18.4% | |||

|Tencent Holdings Limited | |||

|104,264,743 | |||

|US$3.8b | |||

|- | |||

|8.53% | |||

|Xiaodong Li | |||

|48,336,624 | |||

|US$1.8b | |||

|- | |||

|7.83% | |||

|Capital Research and Management Company | |||

|44,386,483 | |||

|US$1.6b | |||

|- | |||

|5.29% | |||

|Gang Ye | |||

|29,968,937 | |||

|US$1.1b | |||

|- | |||

|3.85% | |||

|Baillie Gifford & Co. | |||

|21,795,993 | |||

|US$803.2m | |||

|- | |||

|2.91% | |||

|BlackRock, Inc. | |||

|16,515,843 | |||

|US$608.6m | |||

|- | |||

|2.75% | |||

|Sands Capital Management, LLC | |||

|15,576,947 | |||

|US$574.0m | |||

|- | |||

|2.75% | |||

|FMR LLC | |||

|15,573,573 | |||

|US$573.9m | |||

|- | |||

|1.82% | |||

|T. Rowe Price Group, Inc. | |||

|10,307,631 | |||

|US$379.8m | |||

|- | |||

|1.8% | |||

|Kerry Group Limited | |||

|10,208,127 | |||

|US$376.2m | |||

|- | |||

|1.46% | |||

|Chen Jingye | |||

|8,289,101 | |||

|US$305.5m | |||

|- | |||

|1.12% | |||

|State Street Global Advisors, Inc. | |||

|6,373,278 | |||

|US$234.9m | |||

|- | |||

|1.03% | |||

|Aspex Management (HK) Limited | |||

|5,846,284 | |||

|US$215.4m | |||

|- | |||

|0.9% | |||

|Goldman Sachs Group, Investment Banking and Securities Investments | |||

|5,101,620 | |||

|US$188.0m | |||

|- | |||

|0.88% | |||

|Charles-Lim Capital Ltd | |||

|5,000,000 | |||

|US$184.3m | |||

|- | |||

|0.81% | |||

|Norges Bank Investment Management | |||

|4,562,488 | |||

|US$168.1m | |||

|- | |||

|0.71% | |||

|Artisan Partners Limited Partnership | |||

|4,040,204 | |||

|US$148.9m | |||

|- | |||

|0.7% | |||

|JP Morgan Asset Management | |||

|3,972,940 | |||

|US$146.4m | |||

|- | |||

|0.69% | |||

|Ward Ferry Management (BVI) Limited | |||

|3,904,986 | |||

|US$143.9m | |||

|- | |||

|0.68% | |||

|Kora Management LP | |||

|3,854,500 | |||

|US$142.0m | |||

|- | |||

|0.63% | |||

|Temasek Holdings (Private) Limited | |||

|3,564,826 | |||

|US$131.4m | |||

|- | |||

|0.61% | |||

|Teachers Insurance and Annuity Association-College Retirement Equities Fund | |||

|3,456,932 | |||

|US$127.4m | |||

|- | |||

|0.6% | |||

|Eastspring Investments (Singapore) Limited | |||

|3,374,004 | |||

|US$124.3m | |||

|- | |||

|0.59% | |||

|Tiger Global Management, LLC | |||

|3,371,611 | |||

|US$124.2m | |||

|- | |||

|0.59% | |||

|Marshall Wace LLP | |||

|3,338,448 | |||

|US$123.0m | |||

|} | |||

== Market == | == Market == | ||

Revision as of 18:16, 24 August 2023

Summary

Sea Limited, together with its subsidiaries, engages in the digital entertainment, e-commerce, and digital financial service businesses in Southeast Asia, Latin America, rest of Asia, and internationally. It offers Garena digital entertainment platform for users to access mobile and PC online games, as well as eSports operations; and access to other entertainment content, including livestreaming of gameplay and social features, such as user chat and online forums. The company also operates Shopee e-commerce platform, a mobile-centric marketplace that provides integrated payment and logistics infrastructure and seller services. In addition, it offers SeaMoney digital financial services to individuals and businesses, including offline and online mobile wallet, and payment processing services, as well as other offerings across credit, insurtech, and digital bank services under the ShopeePay, SPayLater, SeaBank, and other digital financial services brands; and payment processing services for Shopee. The company was formerly known as Garena Interactive Holding Limited and changed its name to Sea Limited in April 2017. Sea Limited was incorporated in 2009 and is headquartered in Singapore.

Strategy and Outlook

History

Sea Limited was founded in 2009, initially as Garena, by Singaporean entrepreneur Forrest Li.[1] The company was specialising in video game development, publishment and distribution. Through its platform, Garena+, it distributed major game titles across Taiwan and Southeast Asia including League of Legends[2], Heroes of Newerth[3], FIFA Online 4 and Call of Duty: Mobile[4]. By 2014 it was valued at $1bn and was named the biggest internet company in Singapore.[5] In 2017 the company acquired $550 million through a round of funding and rebranded itself as Sea Limited, maintaining the Garena digital entertainment branch, and additionally introducing the e-commerce and online financial services platforms, Shopee and SeaMoney. [6] The same year, it went public starting at $15 per share[7],aiming to raise $1 bn [8]. In 2020, Sea Limited acquired Singaporean football club Home United FC and rebranded it as Lion City Sailors FC[9], which made its debut in the upcoming Singaporean Premier League (SPL) season. In 2021, Sea Limited secured Southeast Asia's largest ever funding, raising $6bn by selling $3.5bn of equity and $2.5bn of convertible bond.[10] In 2021, the Chinese company Tencent that owned 21.3% of Sea Limited's shares, announced a divesting of almost 15 million class A shares to raise a $3bn fund for other investments and activities.[11] In 2023, a variety of factors including macroeconomic instability, increased interest rates and failed investments such as FTX, led Sea Limited to disband its investment arm.[12]

Mission Statement

As mentioned in Sea Limited's website, the mission of the company is to "to better the lives of consumers and small businesses with technology"[13]. The company highlights its commitment to driving innovation, growth, and positive impact in the markets it operates. Moreover Sea Limited strives to empower individuals and communities across Southeast Asia and beyond, by aiming on a culture of continuous innovation, fostering meaningful connections, and enhancing financial inclusion.[14]

Marketing and growth strategy

Product diversification and ecosystem

Sea Limited focuses on product diversification, which enables the company to target a wide range of consumer groups, and attract an extensive amount of total customers. At the same time, the company has interconnected its platforms in a way that introduces customers of one sector to the others, integrating them into the Sea ecosystem. A great example of that strategy is the Free Fire, Garena's extremely popular mobile game, and Shopee's interconnection, as users of Free Fire are offered promotions and discounts for Shopee through the game. This proved successful, with Shopee increasing its quarterly revenue by $200 million in the second quarter of 2021.[15]

Investments and game development

Sea Limited was built in the success and currently relying on its digital entertainment brand, Garena. The company was the first to acquire licenses to distribute third-party, extremely popular video games to a massive geographical region. They were therefore much anticipated and Garena automatically established a monopoly in the market. However, the company's investments didn't only focus on distributing third-party games, as Garena has published many original games such as Free Fire, which was the most downloaded mobile game worldwide in 2019 and 2020 and continues to be a major revenue stream.[16]

Another notable investment was in subsidies to local express delivery services that led to rapid development of the industry. Until Shopee's emergence in 2017, delivery in Southeast Asia was very expensive and slow, ranging from a week for e-commerce purchases to a year for international parcels. With this investment, Shopee managed to provide delivery of 1-3 days and even offered free shipping, attracting an extensive amount of customers and led users to order via the platform even if they had originally seen the product advertised in other e-commerce companies.[17]

Innovation

On top of that, the innovation of the company is notable, as it adapted the platform to regions it is operating and included exclusive features. It adjusted the prices for in-game purchases depending on the country, introduced its own platform currency "Garena Shells"[18] and created game characters that represent the cultures of the countries it is targeting.

Shopee has also shown a great deal of innovation, by offering the shopping security feature "Shopee Guarantee", that freezes the payment to the seller until the buyer has confirmed they received the order in good condition. The importance of this feature is highlighted by a 14.7% increase in customer complaints for e-commerce purchases that was reported by the Consumers Association of Singapore (CASE), differentiating Shopee from other e-commerce giants, such as AliExpress and Lazada.[19]

Sector and Income Breakdown

Subsidiaries

Sea Limited, as mentioned, owns several subsidiaries including the digital entertainment company Garena, the e-commerce platform Shopee and the digital financial services company SeaMoney, therefore operating in 3 different markets. [20]

Garena

Shopee

SeaMoney

Segments of operation

Main streams of income

Corporate Governance

The Team

Forrest Li - Chairman and Group CEO

Forrest Li has been the founder, chairman, and group CEO since Sea Limited's establishment in 2009. He's a board member of the Singapore Economic Development Board, an independent non-executive director of Shangri-La Asia Limited, and part of the National University of Singapore's board of trustees. He's also on Stanford University’s Graduate School of Business advisory council. Li holds an M.B.A. from Stanford University and a bachelor’s degree in Engineering from Shanghai Jiaotong University.

Gang Ye - Group Chief Operating Officer

Gang Ye is Sea Limited's co-founder and has been on theboard since March 2010. He's been the COO since January 2017, having previously held the role of CTO from March 2010 to December 2016. Prior, he worked at Wilmar International and Singapore's Economic Development Board. Ye holds B.S. degrees in Computer Science and Economics from Carnegie Mellon University.

Chris Feng - Group President

Chris Feng became part of Sea Limited in March 2014 and has been Group President since January 2022. Earlier, he was CEO of Shopee starting from July 2015 and held the position of CEO of SeaMoney from March 2020. He was also previously the head of mobile business. Feng gained experience at Rocket Internet SE, managing Zalora and Lazada, as well as at McKinsey & Company. He holds a first-class honours bachelor's degree in Computer Science from the National University of Singapore.

Tony Hou - Group Chief Financial Officer

Tony Hou joined Sea Limited in September 2010 and has been the group CFO since January 2013. Before this, he was the company's financial controller. He brought experience from Ernst & Young, where he worked from October 2000 to September 2010 in China and the U.S. Hou is a non-practicing U.S. Certified Public Accountant and a non-practicing member of the Chinese Institute of Certified Public Accountants. He holds an M.B.A. from the University of Chicago’s Booth School of Business and a bachelor’s degree in Accounting from Fudan University.

Terry Zhao - President, Garena

Terry Zhao has been part of Sea Limited since its start in 2009 and has been Garena's President since November 2018. Before this, he held various senior positions in our digital entertainment business across key markets. Zhao holds a first-class honors bachelor's degree in Computer Engineering from Nanyang Technological University.

Yanjun Wang - Group Chief Corporate Officer

Yanjun Wang holds the roles of group chief corporate officer, group general counsel, and company secretary. Since May 2019, she has been group chief corporate officer, since November 2017, the company secretary, and since March 2014, the group general counsel. Before joining Sea Limited, she practiced law at Skadden, Arps, Slate, Meagher & Flom LLP and Kirkland & Ellis. Wang is a qualified lawyer in the State of New York and holds a J.D. degree from Harvard Law School and a B.A. degree in Economics from Harvard University.

David Chen - Chief Product Officer, Shopee

David Chen, also a co-founder, currently holds the role of Shopee's chief product officer. He was previously group chief of staff from January 2017 to December 2019, and prior to that, group chief operating officer from May 2009 to December 2016. Chen also has a background at PSA Corporation Limited. He graduated with a first-class honors bachelor’s degree in Computer Engineering from the National University of Singapore.

Ownership Structure

Sea Limited is currently distributed in 566,758,842 shares, valued at $36.85 as of Aug 23, 2023. The majority of shares is owned by institutions, and a complete breakdown is shown in the figure below.

The top 25 shareholders, as listed below, currently own 67.93% of Sea Limited.[22] The most notable shareholder is Tencent, holding 18.4% of the total shares, a value that was 21.3% until 2021, when Tencent divested $3bn worth of shares to raise funds for other projects.

| Ownership | Name | Shares | Current Value |

|---|---|---|---|

| 18.4% | Tencent Holdings Limited | 104,264,743 | US$3.8b |

| 8.53% | Xiaodong Li | 48,336,624 | US$1.8b |

| 7.83% | Capital Research and Management Company | 44,386,483 | US$1.6b |

| 5.29% | Gang Ye | 29,968,937 | US$1.1b |

| 3.85% | Baillie Gifford & Co. | 21,795,993 | US$803.2m |

| 2.91% | BlackRock, Inc. | 16,515,843 | US$608.6m |

| 2.75% | Sands Capital Management, LLC | 15,576,947 | US$574.0m |

| 2.75% | FMR LLC | 15,573,573 | US$573.9m |

| 1.82% | T. Rowe Price Group, Inc. | 10,307,631 | US$379.8m |

| 1.8% | Kerry Group Limited | 10,208,127 | US$376.2m |

| 1.46% | Chen Jingye | 8,289,101 | US$305.5m |

| 1.12% | State Street Global Advisors, Inc. | 6,373,278 | US$234.9m |

| 1.03% | Aspex Management (HK) Limited | 5,846,284 | US$215.4m |

| 0.9% | Goldman Sachs Group, Investment Banking and Securities Investments | 5,101,620 | US$188.0m |

| 0.88% | Charles-Lim Capital Ltd | 5,000,000 | US$184.3m |

| 0.81% | Norges Bank Investment Management | 4,562,488 | US$168.1m |

| 0.71% | Artisan Partners Limited Partnership | 4,040,204 | US$148.9m |

| 0.7% | JP Morgan Asset Management | 3,972,940 | US$146.4m |

| 0.69% | Ward Ferry Management (BVI) Limited | 3,904,986 | US$143.9m |

| 0.68% | Kora Management LP | 3,854,500 | US$142.0m |

| 0.63% | Temasek Holdings (Private) Limited | 3,564,826 | US$131.4m |

| 0.61% | Teachers Insurance and Annuity Association-College Retirement Equities Fund | 3,456,932 | US$127.4m |

| 0.6% | Eastspring Investments (Singapore) Limited | 3,374,004 | US$124.3m |

| 0.59% | Tiger Global Management, LLC | 3,371,611 | US$124.2m |

| 0.59% | Marshall Wace LLP | 3,338,448 | US$123.0m |

Market

Total Addressable Market

Key Market Drivers

Key Market Challenges and Risks

Financials

Historic

Most recent quarter

Most recent year

All periods

| Year | Year end date | Income Statement | Balance Sheet | |

|---|---|---|---|---|

| Revenues($thousands) | Net losses ($thousands) | Total Assets($million) | ||

| 22 | 31/12/2018 | 826,968 | -961,241 | N/A |

| 23 | 31/12/2019 | 2,175,378 | -1,462,799 | 5,224,169 |

| 24 | 31/12/2020 | 4,375,664 | -1,618,056 | 10,455,671 |

| 25 | 31/12/2021 | 9,955,190 | -2,046,759 | 18,756,025 |

| 26 | 31/12/2022 | 12,449,705 | -1,651,421 | 17,002,796 |

Forward

Method

Financial Forecasts

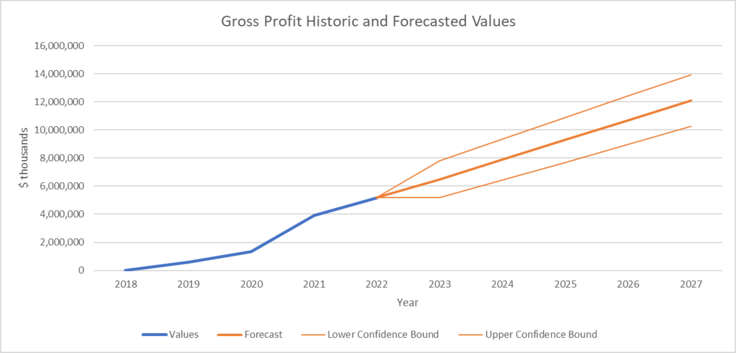

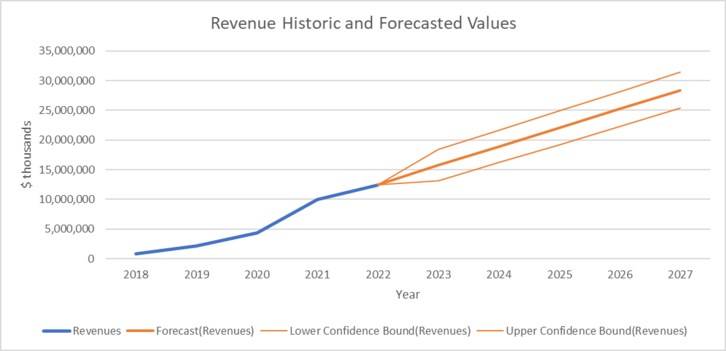

| Year | Revenue ($thousands) | Gross Profit ($thousands) | ||||

|---|---|---|---|---|---|---|

| Forecast | Lower-bound value | Upper-bound value | Forecast | Lower-bound value | Upper-bound value | |

| 2024 | 15,744,835 | 13,081,969 | 18,407,702 | 6,489,624 | 5,187,205 | 7,792,042 |

| 2025 | 18,910,452 | 16,164,985 | 21,655,918 | 7,891,384 | 6,434,652 | 9,348,115 |

| 2026 | 22,076,068 | 19,249,784 | 24,902,353 | 9,293,143 | 7,696,416 | 10,889,871 |

| 2027 | 25,241,685 | 22,336,213 | 28,147,156 | 10,694,903 | 8,969,007 | 12,420,799 |

| 2028 | 28,407,301 | 25,424,142 | 31,390,460 | 12,096,663 | 10,250,152 | 13,943,173 |

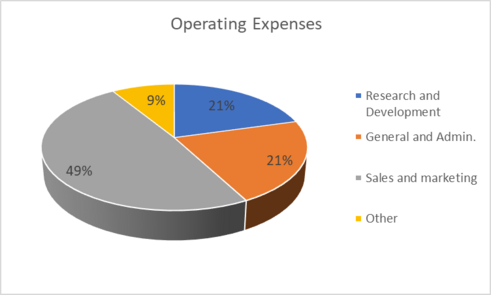

Revenues and gross profit are steeply increasing, but after applying operating expenses, the company reports an increasing loss every year. This is attributed to disproportionate increase of operating expenses year by year, which outweigh the increase in revenues.

Sea Limited's great investment in subsidies to local express delivery companies were one of the major operational expenses that keep Shopee, and by extension the entire company from being profitable.[23]

Risk Analysis

Valuation

Appendix

Income Statement

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

|---|---|---|---|---|---|

| Total Revenue ($million) | 12,449,705 | 9,955,190 | 4,375,664 | 2,175,378 | 826,968 |

| Cost of Revenue ($million) | -7,264,428 | -6,059,455 | -3,026,759 | -1,570,458 | -812,210 |

| Gross Profit ($million) | 5,185,277 | 3,895,735 | 1,348,905 | 604,920 | 14,758 |

| Operating Income/Expenses | |||||

| Research and Development ($million) | -1,376,501 | -831,703 | -353,785 | -156,634 | -67,529 |

| General and Admin. ($million) | -1,437,612 | -987,868 | -599,706 | -385,865 | -240,781 |

| Sales and marketing ($million) | -3,269,223 | -3,829,743 | -1,830,875 | -969,543 | -705,015 |

| Other Operating Income ($million) | 279,184 | 287,946 | 189,645 | 15,890 | 9,799 |

| Provision for credit losses ($million) | -513,690 | -117,427 | -57,509 | -- | -- |

| Goodwill ($million) | -354,943 | -- | -- | -- | -- |

| Total operating expenses ($million) | -6,672,785 | -5,478,795 | -2,652,230 | -1,496,152 | -1,003,526 |

| Operating Loss ($million) | -1,487,508 | -1,583,060 | -1,303,325 | -891,232 | -988,768 |

| Interest income/expense and others* ($million) | -13,025 | -132,124 | -179,913 | -477,387 | 34,888 |

| Earnings/Losses Before Tax ($million) | -1,500,533 | -1,715,184 | -1,483,238 | -1,368,619 | -953,880 |

| Income Tax ($million) | -168,395 | -332,865 | -141,640 | -85,864 | -4,088 |

| Share of results of equity investees ($million) | 11,156 | 5,019 | 721 | -3,239 | 3,066 |

| Net loss ($million) | -1,657,772 | -2,043,030 | -1,624,157 | -1,457,722 | -961,034 |

| Net income/loss attributable to non-controlling interests ($million) | 6,351 | -3,729 | 6,101 | -5,077 | -207 |

| Net Loss Applicable to Common Shareholders ($million) | -1,651,421 | -2,046,759 | -1,618,056 | -1,462,799 | -961,241 |

Cash Flow Statement

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 | 31/12/2018 |

| Net Income ($ thousands) | -1,657,772 | -2,043,030 | -1,624,157 | -1,457,722 | -961,034 |

| Cash Flows-Operating Activities | |||||

| Depreciation ($ thousands) | 428,344 | 279,032 | 169,067 | 116,783 | 54,902 |

| Other Adjustments ($thousands)* | 1,543,364 | 696,427 | 484,793 | 628,741 | 38,100 |

| Operating cash flows before changes in working capital ($ thousands) | 313,936 | -1,067,571 | -970,297 | -712,198 | -868,032 |

| Changes in Operating Activities | |||||

| Accounts Receivable ($ thousands) | 98,981 | -37,066 | -174,767 | -86,546 | -38,524 |

| Accounts Payable ($ thousands) | 43,311 | 99,639 | 50,860 | 31,381 | 29,733 |

| Changes in Inventories ($ thousands) | 1,441 | -62,735 | -38,528 | 11,762 | -28,465 |

| Deferred revenue ($ thousands) | -1,093,229 | 314,048 | 1,162,399 | 637,214 | 204,161 |

| Lease Liabilities ($ thousands) | 385,911 | 429,366 | 46,352 | 70,901 | -- |

| Other Operating Activities ($ thousands) * | -492,107 | -534,603 | -490,448 | -594,847 | -662,125 |

| Net Cash Flow-Operating ($ thousands) | -1,055,692 | 208,649 | 555,868 | 69,865 | -495,220 |

| Cash Flows-Investing Activities | |||||

| Capital Expenditures ($ thousands) | -924,178 | -772,177 | -336,274 | -239,844 | -177,343 |

| Investments($ thousands) | -2,630,842 | -2,505,358 | -219,548 | -118,462 | -69,641 |

| Other Investing Activities ($ thousands) | 1,126,211 | -489,738 | -331,090 | -4,913 | 22,456 |

| Net Cash Flows-Investing ($ thousands) | -2,428,809 | -3,767,273 | -886,912 | -363,219 | -224,528 |

| Cash Flows-Financing Activities | |||||

| Proceeds from issuance of convertible notes ($ thousands) | -- | 2,846,250 | 1,141,362 | 1,138,500 | 564,938 |

| Proceeds from issuance of shares ($ thousands) | 50,211 | 4,050,055 | 2,970,248 | 1,538,802 | 4,574 |

| Net Borrowings ($ thousands) | -68238 | 114035 | -30609 | -2003 | -643 |

| Other Financing Activities ($ thousands) | 418,283 | 391,249 | -347,869 | -95,704 | -22,241 |

| Net Cash Flows-Financing ($ thousands) | 400,256 | 7,401,589 | 3,733,132 | 2,579,595 | 546,628 |

| Effect of Exchange Rate ($million) | -143,511 | -58,218 | 80,727 | 25,025 | -12,546 |

| Net Increase/Decrease in Cash Flow ($ thousands) | -3,227,756 | 3,784,747 | 3,482,815 | 2,311,266 | -185,666 |

| Cash flow at beginning of year ($ thousands) | 10838140 | 7053393 | 3570578 | 1259312 | 1,444,978 |

| Cash flow at end of year ($ thousands) | 7,610,384 | 10,838,140 | 7,053,393 | 3,570,578 | 1,259,312 |

Balance Sheet

| Year end date | 31/12/2022 | 31/12/2021 | 31/12/2020 | 31/12/2019 |

|---|---|---|---|---|

| Current Assets | ||||

| Cash and Cash Equivalents ($thousands) | 6,029,859 | 9,247,762 | 6,166,880 | 3,118,988 |

| Short-Term Investments ($thousands) | 864,258 | 911,281 | 126,099 | 102,324 |

| Net Receivables ($thousands) | 2322581 | 1,889,262 | 648,936 | 187,035 |

| Inventory ($thousands) | 109,668 | 117,499 | 64,219 | 26,932 |

| Other Current Assets ($thousands) | 3,361,646 | 2,969,593 | 1,932,870 | 974,860 |

| Total Current Assets ($thousands) | 12,688,012 | 15,135,397 | 8,939,004 | 4,410,139 |

| Long-Term Assets | ||||

| Long-Term Investments ($thousands) | 1,253,593 | 1,052,861 | 190,482 | 113,797 |

| Fixed Assets ($thousands) | 1,387,895 | 1,029,963 | 386,401 | 318,620 |

| Goodwill ($thousands) | 230,208 | 539,624 | 216,278 | 30,952 |

| Intangible Assets ($thousands) | 65,019 | 52,517 | 39,773 | 15,020 |

| Other Assets ($thousands) | 1,132,843 | 841,908 | 583,829 | 265,301 |

| Deferred Asset Charges ($thousands) | 245,226 | 103,755 | 99,904 | 70,340 |

| Total Long-Term Assets ($thousands) | 4,314,784 | 3,620,628 | 1,516,667 | 814,030 |

| Total Assets ($thousands) | 17,002,796 | 18,756,025 | 10,455,671 | 5,224,169 |

| Current Liabilities | ||||

| Accounts Payable ($thousands) | 258,648 | 213,580 | 121,637 | 69,370 |

| Short-Term Debt / Current Portion of Long-Term Debt ($thousands) | 88,410 | 100,000 | -- | 1,258 |

| Accrued expenses and other payables ($thousands) | 1,396,613 | 1,519,938 | 2,033,461 | 980,805 |

| Escrow payables and advances from customers($thousands) | 1,862,325 | 1,789,973 | 161,379 | 65,062 |

| Deferred revenue ($thousands) | 1,535,083 | 2,644,463 | 2,150,165 | 1,097,868 |

| Other Current Liabilities ($thousands) | 1,794,613 | 908,482 | 169,425 | 148,003 |

| Total Current Liabilities ($thousands) | 6,935,692 | 7,176,436 | 4,636,067 | 2,362,366 |

| Long-term Liabilities | ||||

| Accrued expenses and other payables ($thousands) | 87,072 | 76,234 | 36,159 | 25,802 |

| Operating Lease Liabilities ($thousands) | 756,818 | 491,313 | 177,870 | 144,000 |

| Other Liabilities ($thousands) | 107 | 107 | 107 | 1,334 |

| Deferred Liability Charges ($thousands) | 73,533 | 111,818 | 344,823 | 161,683 |

| Convertible notes ($thousands) | 3,338,750 | 3,475,708 | 1,840,406 | 1,356,332 |

| Total long-term liabilities ($thousands) | 4,256,280 | 4,155,180 | 2,399,365 | 1,689,151 |

| Total Liabilities ($thousands) | 11,191,972 | 11,331,616 | 7,035,432 | 4,051,517 |

| Stock Holders Equity | ||||

| Common Stocks ($thousands) | 281 | 278 | 225 | 230 |

| Capital Surplus ($thousands) | 14,559,690 | 14,622,292 | 8,526,571 | 4,687,284 |

| Statutory reserves ($thousands) | 12,490 | 6,144 | 2,363 | 46 |

| Accumulated deficit ($thousands) | -8,745,541 | -7,201,498 | -5,150,958 | -3,530,585 |

| Other Equity ($thousands) | -16,096 | -2,807 | 42,038 | 15,677 |

| Total Equity ($thousands) | 5,810,824 | 7,424,409 | 3,420,239 | 1,172,652 |

| Total Liabilities & Equity ($thousands) | 17,002,796 | 18,756,025 | 10,455,671 | 5,224,169 |

Financial Ratios

| Year End Date | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Current Ratio | 183% | 211% | 193% | 187% | N/A |

| Quick Ratio | 120% | 155% | 147% | 140% | N/A |

| Cash Ratio | 87% | 129% | 133% | 132% | N/A |

| Gross Margin | 42% | 39% | 31% | 28% | 2% |

| Operating Margin | -12% | -16% | -30% | -41% | -120% |

| Pre-Tax Margin | -12% | -17% | -34% | -63% | -115% |

| Profit Margin | -13% | -21% | -37% | -67% | -116% |

| Pre-Tax ROE | -100% | -45% | -78% | -382% | N/A |

| After Tax ROE | -111% | -54% | -85% | -406% | N/A |

- ↑ Tech company Garena raises US$550m, rebrands as Sea | The Straits Times

- ↑ Garena Server: What Is It? | League Of Legends Official Amino (aminoapps.com)

- ↑ Heroes of Newerth and its team acquired by Garena Online | GamesIndustry.biz

- ↑ Garena Launches Call of Duty Mobile | Back2Gaming

- ↑ Valued at $1bn, Garena is Singapore’s biggest internet company (techinasia.com)

- ↑ Tech company Garena raises US$550m, rebrands as Sea | The Straits Times

- ↑ Where Will Sea Limited Be in 5 Years? | The Motley Fool

- ↑ Southeast Asia gaming and e-commerce firm Sea ends first day on NYSE up 8% | TechCrunch

- ↑ Sea acquires SG-based football club Home United, rebrands it to Lion City Sailors FC | Marketing-Interactive

- ↑ Singapore's Sea Ltd secures $6 billion in mega fund raising | Reuters

- ↑ Tencent divests 2.6% of equity interest in Sea Limited - Tencent 腾讯

- ↑ Singapore tech giant Sea disbands investment arm: Sources | The Straits Times

- ↑ https://www.sea.com/investor/home

- ↑ https://www.sea.com/aboutus/ourvalues

- ↑ How Sea Limited Is Growing Larger Than Life | The Motley Fool

- ↑ Sea Limited Stock: This Digital Ecosystem Still Has Upside (NYSE:SE) | Seeking Alpha

- ↑ Here’s how Lazada lost its lead to Shopee in Southeast Asia (Part 2 of 2) | KrASIA (kr-asia.com)

- ↑ Garena Server: What Is It? | League Of Legends Official Amino (aminoapps.com)

- ↑ Shopee’s new consumer protection initiative lets you shop with peace of mind (channelnewsasia.com)

- ↑ https://www.sea.com/products/garena

- ↑ Sea Limited Insider Trading & Ownership Structure - Simply Wall St

- ↑ Sea Limited Insider Trading & Ownership Structure - Simply Wall St

- ↑ Here’s how Lazada lost its lead to Shopee in Southeast Asia (Part 2 of 2) | KrASIA (kr-asia.com)