Supply@ME Capital: Difference between revisions

No edit summary |

No edit summary |

||

| Line 6: | Line 6: | ||

===What's the company's main offering(s)? === | ===What's the company's main offering(s)? === | ||

===Who’s the target audience of the company’s flagship/first product?=== | ===Who’s the target audience of the company’s flagship/first product?=== | ||

The audience is companies that hold inventory, such as | The audience is manufacturing companies (i.e. companies that hold a large amount of inventory), such as Apple, Inc. Note, here, inventory refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation. | ||

Most companies hold some amount of inventory. Which companies in | Most companies hold some amount of inventory. Which companies in particular? I suggest targeting companies that hold a large amount of inventory. For me, it makes sense to sell the unwanted inventory (or any inventory for that matter) back to the place/company that the inventory was bought. | ||

=== What's a major problem that the target audience experience? === | === What's a major problem that the target audience experience? === | ||

| Line 16: | Line 16: | ||

The solution is xxx. | The solution is xxx. | ||

xxx is a platform that is designed to enable | xxx is a platform that is designed to enable manufacturing companies to sell its unwanted inventory faster than ever, allowing the company to maximise its profits. | ||

What makes the platform unique is that it's the only platform that xxx. | What makes the platform unique is that it's the only platform that xxx. | ||

Revision as of 14:58, 25 November 2022

Supply@ME Capital plc operates a platform that provides inventory monetisation services to manufacturing and trading companies in the United Kingdom, the Middle East, Italy, North Africa, the United States, and internationally. The company is based in London, the United Kingdom.

Operations

How did the idea of the company come about?

What's the mission of the company?

What's the company's main offering(s)?

Who’s the target audience of the company’s flagship/first product?

The audience is manufacturing companies (i.e. companies that hold a large amount of inventory), such as Apple, Inc. Note, here, inventory refers to the goods and materials that a business holds for the ultimate goal of resale, production or utilisation.

Most companies hold some amount of inventory. Which companies in particular? I suggest targeting companies that hold a large amount of inventory. For me, it makes sense to sell the unwanted inventory (or any inventory for that matter) back to the place/company that the inventory was bought.

What's a major problem that the target audience experience?

The problem is that holding inventory costs money, mainly in terms of 1) acquiring the inventory in the first place and 2) then storing the inventory until its eventual use and 3) depreciation (most inventory depreciates over time).

What's a key solution to the problem/what's the product?

The solution is xxx.

xxx is a platform that is designed to enable manufacturing companies to sell its unwanted inventory faster than ever, allowing the company to maximise its profits.

What makes the platform unique is that it's the only platform that xxx.

What makes the product unique?

Which are the main competitors of the product?

What is the main way that the product expects to make money?

What’s the size of the company target market?

Total Addressable Market

Here, the total addressable market (TAM) is defined as the global automotive market, and based on a number of assumptions, it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $3.0 trillion.

It can be strongly argued that given the company's mission, the total addressable market is actually the global energy market; and research suggests that the estimated size of that market is $6.1 trillion.[1]

Serviceable Available Market

Here, the serviceable available market (SAM) is defined as the global car market, and based on a number of assumptions, it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $1.0 trillion.

Serviceable Obtainable Market

Here, the serviceable obtainable market (SOM) is defined as the US car market, and based on a number of assumptions, it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $262 billion.

What's the biggest achievement of the company?

What's the next key milestone of the company?

Who are the key members of the team?

Directors

Alessandro Zamboni – Chief Executive Officer and Executive Director

Alessandro is a director who specialises in the financial services industry and related strategic and digital models. Since 2008, he has been managing the delivery and the sales operations of a consulting company specialising in Regulatory & Internal Controls for Banks and Insurance Firms. He founded TAG, the former parent company of Supply@ME S.r.l., in 2014. He holds a BA degree in Economics from the University of Turin.

Albert Ganyushin – Independent Chairperson and Non-Executive Director

Albert was appointed as independent chairperson and a Non-Executive Director in 2022 following a long career in capital markets. Since 2017, he has served as Head of Capital Markets at Dr. Peters Group with responsibility for international institutional business, including investment management, capital markets, financing and investor relations. Prior to joining Dr. Peters Group, between 2010 and 2016, he worked in leadership roles in the listings business of NYSE Euronext Group after a career in investment banking that started with Deutsche Bank A.G. (London Branch) in 2000. He graduated with an MBA degree from London Business School in 2000 and began his professional career as a management consultant with Accenture in London in 1995.

Enrico Camerinelli – Independent Non-Executive Director

Mr. Camerinelli keeps abreast of market trends and business practices by taking an active part in projects launched by the United Nations Economic Commission for Europe, the World Bank, the World Trade Board, and the Council of Supply Chain Management Professionals. He regularly attends major industry events as invited guest speaker and writes on specialized magazines and papers. He holds an MSc in Electronic Engineering from Università degli Studi "La Sapienza", Rome, Italy.

David Bull – Independent Non-Executive Director

Mr. Bull, a Chartered Accountant, is a technology-driven experienced financial services professional with a banking and financial services digitisation mindset. He has held a number of senior board roles within banking, asset finance, treasury and credit management institutions, including several years as Chief Financial Accountant at The Bank of England, and is currently non-executive director of Epsion Capital Limited, an independent corporate advisory firm based in London. He holds a BSc (First Class) in Mathematics and Statistics from the University of Bradford.

Andrew Thomas – Independent Non-Executive Director

Andrew has over 20 years' experience in various business advisory roles and during this time has worked across the US, UK, EU and APAC regions, acquiring expertise of onshore and offshore fund structuring and oversight, particularly in relation to regulatory issues. He also has extensive experience in mitigating ESG risks while helping organisations to maximise ESG opportunities. He holds BA in History and Politics from the University of Exeter.

Dr. Thomas (Tom) James – Executive Director

Tom is an Executive Director, and the CIO, CEO and co-founder of the Trade Flow Funds and FinTech solutions. He has over 30 years of commercial expertise in the commodity and energy industry and is the business and system architect for this unique and innovative digitised trade finance solution for bulk physical commodity transactions. He has experience of senior regulated roles in financial institutions (including Bank of Tokyo Mitsubishi UFJ, Credit Agricole and Credit Lyonnais) and various trading firms including BHP Billiton, covering a full range of functional areas including trade finance, project finance, investment banking, supply chain/operations, derivatives, physical markets, and fund management. During his career he has operated in many countries in Africa, Europe, Middle East, and Asia Pacific. He has authored over nine books in the energy and commodity trading and risk management field and served as Chair Professor and Adjunct Professor at various universities around the world and is a former member of the United Nations FAO Commodity Risk Management Advisory Group, and a former Senior Energy Advisor to the United States Department of Defense (TFBSO). He holds a PhD in Practices for the Global Commodity Markets within the Functional Disciplines of Trading and Risk Management and a Masters in Energy Price Risk Management from Middlesex University London.

John Collis – Executive Director

John is an Executive Director, and is co-founder of the Trade Flow Funds and FinTech solution where he holds the position of Chief Risk Officer (CRO). As well as overseeing the development of the fund’s critical legal infrastructure and working with leading counsel on its enforceability, John has overseen the classification of the specialist intellectual property developed and acquired by TradeFlow and its licensing. John is a commercial lawyer with expertise in regulatory, compliance, structuring, and transactional matters. John operated his own law firm from 2003, specialising in international commercial work. John has written and lectured about the rule of law, Eurasia Economic Union, CSTO, and International Commercial Enforcement. Before becoming a lawyer, John worked for Ernst & Young, he was educated at Oxford University and is chairman of Hertford College RFC.

Senior management

Amy Benning – Chief Financial Officer

Amy gained Chartered Accountancy qualifications in New Zealand while working with KPMG on a range of clients across various industry sectors. On moving to the United Kingdom, Amy worked briefly with BP’s shipping arm, before moving to PwC’s London Capital Markets Team where she spent 12 years focusing on technical accounting, mergers and acquisitions and initial public offerings for a wide range of clients. In 2018, Amy moved to Alfa Financial Software Holdings plc, a developer and provider of software for the automotive leasing sector company with ordinary shares admitted to a Premium Listing and to trading on the Main Market. As Finance Director, Amy was responsible for the team managing accounting, reporting (internal & external), corporate governance, audit, systems, process improvement, controls and transactional accounting. Amy joined the Group in June 2021. She holds a BCA in Accountancy, a BSc in Genetics, Biochemistry and Molecular Biology and a post-graduate diploma in Professional Accounting from Victoria University of Wellington, New Zealand.

Stuart Nelson – Group Head of Enterprise Risk Management

Stuart is an experienced credit risk analyst, with global experience of assessing the risk of financing solutions across multiple asset classes. Having begun his career at JPMorgan in the EMEA Emerging Markets Team in 2000, he then spent almost two decades in leadership roles at S&P Global Ratings. During his time at S&P, he managed multiple teams across the European office network in London, Milan, Frankfurt, Madrid and Paris, focusing on the assessment of asset securitisation in all sectors, with oversight of ratings on securities of more than €50 billion equivalent over that period. From 2015, he concentrated his attention on the refinement and validation of risk methodologies across a global spectrum of asset classes. He joined the Group in 2020, where he currently monitors all aspects of the risk and operational functions. He holds a Masters in History from the University of Cambridge.

Alice Buxton – Chief People Officer

Alice is a human resources leader motivated to help businesses succeed by creating environments which enable individuals, teams and leaders to thrive. She has considerable experience in the Financial Services and FinTech industries. Most recently she built the Global Talent function at Greensill, helping the business grow its workforce from approx. 250 to over 1200 in multiple jurisdictions in just over 2 years. Previously she worked as an Executive Director in Goldman Sachs Human Capital Management Division, focusing on the EMEA Trading floor and Risk, Audit and Compliance teams attracting and developing high potential talent. Before this she worked in Talent Acquisition for Ernst and Young’s London office, recruiting for their risk and advisory business. Alice holds a BSc in Psychology, MSc in Human Resource Management and is a qualified corporate and executive coach.

Mark Kavanagh – Group Head of Operations and Transformation

Mark is an experienced Risk Leader with over 25 years in Credit & Risk functions. Before joining the Group, Mark worked for Greensill Capital as Head of Product Risk. Whilst there, he implemented Accounts Receivable policies and procedures, installed an AR platform, helped Greensill Capital expand territorially, and trained the Credit team on any new product offerings, acquisitions and integrations. Prior to that, he worked for GE Working Capital Solutions (the monetisation arm of General Electric group) for 15 years, heading up their European Credit Team, managing the auto scoring and decisioning system, and ensuring processes were safe and efficient.

Nicola Bonini – Group Head of Origination

Nicola has more than 20 years' experience in balance sheet lending and cashflow finance, gained during her time at some of the UK’s most prominent banking institutions. Previously, she was Vice President and Head of Commercial Finance at Bank Leumi (UK) plc, where she managed a portfolio of companies with turnover of up to £1bn. Before this, Nicola served as Executive Director at Falcon Group UK, where she joined the newly formed UK inventory finance team. Nicola has also held senior, highprofile business development and relationship management roles at major banks, including BNP Paribas, The Royal Bank of Scotland and Bank of Scotland Corporate. Nicola joined the Group in September 2021 to take a leading role in business development, client onboarding and retention. She holds a BA in Business Studies from the University of East London.

How much does the company expect to make over the next five years?

Historic

Most recent quarter

During the three months ended 31st March 2022, net income increased to $3.32 billion on revenues of $18.76 billion, representing a respective increase of 7x and 81% compared to the prior year, and equating to a net income margin of 18%. The company ended the quarter with cash of $18.01 billion, representing an increase of 2% from the end of 2021.

Most recent year

For the fiscal (and calendar) year 2021, Supply@ME Capital reported a net income of $5.52 billion.[2] The annual revenue was $53.8 billion, an increase of 71% over the previous fiscal year.[2]

The Company is of the opinion that the group has sufficient working capital for its present requirements, that is, for at least 12 months from the date of its recent prospectus (i.e. 3rd October 2022).

All periods

| Year | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | 11 | 12 | 13 | 14 | 15 | 16 | 17 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year end date | 31/12/2005 | 31/12/2006[4][5] | 31/12/2007 | 31/12/2008 | 31/12/2009 | 31/12/2010[5] | 31/12/2011[5] | 31/12/2012[5] | 31/12/2013[5] | 31/12/2014[5] | 31/12/2015[5] | 31/12/2016[5] | 31/12/2017[5] | 31/12/2018[5] | 31/12/2019[5] | 31/12/2020[5] | 31/12/2021[5] |

Income statement

| |||||||||||||||||

| Revenues ($'million) | 0 | 0 | 0.073 | 15 | 112 | 117 | 204 | 413 | 2,013 | 3,198 | 4,046 | 7,000 | 11,759 | 21,461 | 24,578 | 31,536 | 53,823 |

| Net profits ($'million) | -12 | -30 | -78 | -83 | −56 | −154 | −254 | −396 | −74 | −294 | −889 | −675 | −1,962 | −976 | −862 | 721 | 5,519 |

Balance sheet

| |||||||||||||||||

| Total assets ($'million) |

8 | 44 | 34 | 52 | 130 | 386 | 713 | 1,114 | 2,417 | 5,831 | 8,068 | 22,664 | 28,655 | 29,740 | 34,309 | 52,148 | 62,131 |

Other

| |||||||||||||||||

| Employees | NA | 70 | 268 | 252 | 514 | 899 | 1,417 | 2,914 | 5,859 | 10,161 | 13,058 | 17,782 | 37,543 | 48,817 | 48,016 | 70,757 | 99,290 |

Forward

What are the financial forecasts?

| Year | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 | 31 | 32 | 33 | 34 | 35 | 36 | 37 | 38 | 39 | 40 | 41 | 42 | 43 | 44 | 45 | 46 | 47 | 48 | 49 | 50 | 51 | 52 | 53 | 54 | 55 | 56 | 57 | 58 | 59 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Year end date | 31/12/2022 | 31/12/2023 | 31/12/2024 | 31/12/2025 | 31/12/2026 | 31/12/2027 | 31/12/2028 | 31/12/2029 | 31/12/2030 | 31/12/2031 | 31/12/2032 | 31/12/2033 | 31/12/2034 | 31/12/2035 | 31/12/2036 | 31/12/2037 | 31/12/2038 | 31/12/2039 | 31/12/2040 | 31/12/2041 | 31/12/2042 | 31/12/2043 | 31/12/2044 | 31/12/2045 | 31/12/2046 | 31/12/2047 | 31/12/2048 | 31/12/2049 | 31/12/2050 | 31/12/2051 | 31/12/2052 | 31/12/2053 | 31/12/2054 | 31/12/2055 | 31/12/2056 | 31/12/2057 | 31/12/2058 | 31/12/2059 | 31/12/2060 | 31/12/2061 | 31/12/2062 | 31/12/2063 |

Income statement

| ||||||||||||||||||||||||||||||||||||||||||

| Revenues ($'million) | $78,935 | $112,257 | $154,816 | $207,049 | $268,527 | $337,721 | $411,894 | $487,157 | $558,739 | $621,448 | $670,282 | $701,078 | $711,102 | $699,445 | $667,163 | $617,116 | $553,551 | $481,510 | $406,171 | $332,253 | $263,564 | $202,749 | $151,247 | $109,414 | $76,757 | $52,217 | $34,448 | $22,038 | $13,673 | $8,226 | $4,799 | $2,715 | $1,490 | $793 | $409 | $205 | $99 | $47 | $21 | $9 | $4 | $2 |

| Gross profits ($'million) | $23,680 | $33,677 | $46,445 | $62,115 | $80,558 | $101,316 | $185,352 | $219,221 | $251,432 | $279,652 | $301,627 | $315,485 | $319,996 | $314,750 | $300,223 | $277,702 | $249,098 | $216,679 | $182,777 | $149,514 | $118,604 | $91,237 | $68,061 | $49,236 | $34,541 | $23,498 | $15,502 | $9,917 | $6,153 | $3,702 | $2,160 | $1,222 | $670 | $357 | $184 | $92 | $45 | $21 | $10 | $4 | $2 | $1 |

| Operating profits ($'million) | $11,840 | $16,839 | $23,222 | $31,057 | $40,279 | $50,658 | $123,568 | $146,147 | $167,622 | $186,434 | $201,085 | $210,323 | $213,331 | $209,834 | $200,149 | $185,135 | $166,065 | $144,453 | $121,851 | $99,676 | $79,069 | $60,825 | $45,374 | $32,824 | $23,027 | $15,665 | $10,335 | $6,612 | $4,102 | $2,468 | $1,440 | $815 | $447 | $238 | $123 | $61 | $30 | $14 | $6 | $3 | $1 | $1 |

| Net profits ($'million) | $9,354 | $13,302 | $18,346 | $24,535 | $31,820 | $40,020 | $97,619 | $115,456 | $132,421 | $147,283 | $158,857 | $166,156 | $168,531 | $165,769 | $158,118 | $146,256 | $131,192 | $114,118 | $96,263 | $78,744 | $62,465 | $48,052 | $35,846 | $25,931 | $18,191 | $12,376 | $8,164 | $5,223 | $3,240 | $1,949 | $1,137 | $643 | $353 | $188 | $97 | $48 | $24 | $11 | $5 | $2 | $1 | $0 |

What are the assumptions used to estimate the financial forecasts?

| Description | Value | Commentary |

|---|---|---|

Revenue

| ||

| What's the estimated current size of the total addressable market? | $2,975,000,000 | Here, the total addressable market (TAM) is defined as the global automotive market, and based on a number of assumptions[Note 2], it is estimated that the size of the market as of today (30th May 2022), in terms of revenue, is $2.975 trillion.

|

| What is the estimated company lifespan? | 60 years | Supply@ME Capital employs around 110,000, making the company a large organisation (more than 10,000 employees), and research shows that the average lifespan of a large corporation is around 50 years.[7] |

| What's the estimated annual growth rate of the total addressable market over the lifecycle of the company? | 3% | Research shows that the growth rate of the global automotive market (i.e. the total addressable market) is similar to the growth rate of global gross domestic product[8], which has averaged (medium) around 3% per year in the last 20 years (2001 to 2022)[9]. |

| What's the estimated company peak market share? | 10% | We estimate that especially given the leadership of the company, the peak market share of Supply@ME Capital is around 10%, and, therefore, suggests using the share amount here. As of 31st December 2021, Supply@ME Capital's current share of the market is estimated at around 1.8%. |

| Which distribution function do you want to use to estimate company revenue? | Gaussian | Research suggests that the revenue pattern of companies is similar to the pattern produced by the Gaussian distribution function (i.e. the revenue distribution is bell shaped)[10], so we suggest using that function here. |

| What's the estimated standard deviation of company revenue? | 6 years | Another way of asking this question is this way: within how many years either side of the mean does 68% of revenue occur? Based on Supply@ME Capital's current revenue amount (i.e. $54 billion) and Supply@ME Capital's estimated lifespan (i.e. 60 years) and Supply@ME Capital's estimated current stage of its lifecycle (i.e. growth stage), the we suggest using 6 years (i.e. 68% of all sales happen within 6 years either side of the mean year), so that's what's used here. |

Growth stages

| ||

| How many main stages of growth is the company expected to go through? | 4 stages | Research suggests that a company typically goes through four distinct stages of cash flow growth.[11] Research also shows that incorporating those stages into the discounted cash flow model improves the quality of the model and, ultimately, the quality of the value estimation.[12]

In addition, research shows that a key way to determine the stage which a company is in is by examining the cash flow patterns of the company.[13] A summary of the economic links to cash flow patterns can be found in the appendix of this report. We estimate that with Supply@ME Capital's operating cash flows positive (+), investing cash flows negative (-) and its financing cash flows positive (+), the company is in the second stage of growth (i.e. the 'growth' stage), and, therefore, it has a total of three main stages of growth. Note, to account for one-off events, the three-year average (median) amount was used to calculate the cash flows. |

| What proportion of the company lifecycle is represented by growth stage 1? | 30% | Research suggests 30%.[14] |

| What proportion of the company lifecycle is represented by growth stage 2? | 10% | Research suggests 10%.[14] |

| What proportion of the company lifecycle is represented by growth stage 3? | 20% | Research suggests 20%.[14] |

| What proportion of the company lifecycle is represented by growth stage 4? | 40% | Research suggests 40%.[14] |

Growth stage 2

| ||

| Cost of goods sold as a proportion of revenue (%) | 79% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[15], and the margin for its peers is 79%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Operating expenses as a proportion of revenue (%) | 15% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[15], and the margin for its peers is 15%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Tax rate (%) | 11% | Research suggests that it's best to use a similar rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[15], and the rate for its peers is 11%. |

| Depreciation and amortisation as a proportion of revenue (%) | 7% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 2)[15], and the margin for its peers is 7%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Fixed capital as a proportion of revenue (%) | 10% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 2)[15], and the amount for its peers is 10%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Working capital as a proportion of revenue (%) | 15% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 2)[15], and the amount for its peers is 15%. |

| Net borrowing ($000) | Zero | We suggest that for simplicity, the net borrowing figure is zero. |

| Interest amount ($000) | Zero | We suggest that for simplicity, the interest amount figure is zero. |

Growth stage 3

| ||

| Cost of goods sold as a proportion of revenue (%) | 62% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[15], and the margin for its peers is 62%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Operating expenses as a proportion of revenue (%) | 13% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[15], and the margin for its peers is 13%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Tax rate (%) | 14% | Research suggests that it's best to use a similar rate as the one used by peers that are in the same growth stage (i.e. growth stage 3)[15], and the rate for its peers is 14%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Depreciation and amortisation as a proportion of revenue (%) | 4% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 3)[15], and the amount for its peers is 4%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Fixed capital as a proportion of revenue (%) | 3% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 3)[15], and the amount for its peers is 3%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Working capital as a proportion of revenue (%) | 10% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[15], and the amount for its peers is 10%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Net borrowing ($000) | Zero | We suggest that for simplicity, the net borrowing figure is zero. |

| Interest amount ($000) | Zero | We suggest that for simplicity, the interest amount figure is zero. |

Growth stage 4

| ||

| Cost of goods sold as a proportion of revenue (%) | 99% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[15], and the margin for its peers is 99%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Operating expenses as a proportion of revenue (%) | 15% | Research suggests that it's best to use a similar margin rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[15], and the margin for its peers is 15%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Tax rate (%) | 0% | Research suggests that it's best to use a similar rate as the one used by peers that are in the same growth stage (i.e. growth stage 4)[15], and the rate for its peers is 0%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Depreciation and amortisation as a proportion of revenue (%) | 37% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[15], and the amount for its peers is 37%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Fixed capital as a proportion of revenue (%) | 1% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[15], and the amount for its peers is 1%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Working capital as a proportion of revenue (%) | 10% | Research suggests that it's best to use a similar amount as the one used by peers that are in the same growth stage (i.e. growth stage 4)[15], and the amount for its peers is 10%. Information on the peers and the calculation of the figure used here can be found in the appendix of this report. |

| Net borrowing ($000) | Zero | We suggest that for simplicity, the net borrowing figure is zero. |

| Interest amount ($000) | Zero | We suggest that for simplicity, the interest amount figure is zero. |

What are the key risks of investing in the company?

As with any investment, investing in Supply@ME Capital carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in Supply@ME Capital is high.

Risk factors specific and material to the group

- The group is at the early stage of its development, has not generated consistent revenues from its operations to date and is not currently profitable.

- If the group is unable to maintain or increase originations through the platform or if existing customers or IM funders do not continue to participate on the platform, its business, results of operations, financial condition or prospects will be adversely affected.

- If the scoring models and processes that the group uses contain errors or are otherwise ineffective, or if customer data is incorrect or becomes unavailable, the group’s business may suffer.

- The group has built value into its business through the TradeFlow Acquisition.

- Any failure of the platform or the group's future platforms, software and technology infrastructure could materially adversely affect its business, results of operations, financial condition or prospects.

- The group's ability to protect the confidential information of its customers and IM funders may be adversely affected by cyber-attacks, computer viruses, physical or electronic break-ins or similar disruptions or faults with its systems.

- The group may be unable to retain or hire appropriately skilled personnel required to support its operations.

- The group’s success and future growth depend significantly on its successful marketing efforts, increasing its brand awareness, and its ability to attract new IM funders and customers.

- The supply chain financing market is competitive and evolving.

- Unfavourable general economic conditions may have a negative impact on the results of operations, financial condition and prospects of the group.

- The group may need additional financial resources to develop the platform for future success.

- Uncertainties in the interpretation or application of, or changes in, IFRS or local GAAP could adversely affect the "derecognition treatment" for customers that comply with IFRS or local GAAP and accordingly reduce customers’ or IM funders’ participation on the platform.

- The ownership and use of intellectual property by the group may be challenged by third parties or otherwise disputed.

- Shareholders’ interests may be diluted by future issues of Secondary Admission Shares and Further Admission Shares.

- Prospective investors and Shareholders should be aware that there may be possible volatility in the price of the Ordinary Shares.

- A Standard Listing affords Shareholders a lower level of regulatory protection than a Premium Listing.

- Dividend payments on the Ordinary Shares are not guaranteed, and the Company does not intend to pay dividends for the foreseeable future.

- The group is subject to complex taxation in multiple jurisdictions, which often requires subjective interpretation and determinations. As a result, the group could be subject to additional tax risks attributable to previous assessment periods.

- Changes in tax law or the interpretation of tax law, or the expansion of the group’s business into jurisdictions with less favourable tax regimes, could increase the group’s effective tax rate and in turn adversely affect its business, results of operations, financial condition and prospects.

- There can be no assurance that the company will be able to make returns to Shareholders in a tax-efficient manner.

How much can I expect to make from an investment in the company?

What's the expected return of an investment in the company?

We estimate that the expected return of an investment in the company over the next five years is negative 24%. In other words, an £1,000 investment in the company is expected to return £760 in five years time. The assumptions used to estimate the return figure can be found in the table below.

Assuming that a suitable return level over five years is 10% per year and Supply@ME Capital achieves its expected return level (of negative 24%), then an investment in the company is considered to be an 'unsuitable' one.

What are the assumptions used to estimate the return?

| Description | Value | Commentary |

|---|---|---|

| Which valuation model do you want to use? | Discounted cash flow | There are two main approaches to estimate the value of an investment:

Research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more accurate is the discounted cash flow approach[16], so that's the approach that we suggest to use here; nevertheless, for completeness purposes, separately, the valuation of the company is also estimated using the using the relative valuation approach (the valuation based on the relative approach can be found in the appendix of this report). Supply@ME Capital has never paid cash dividends, and on 7th February 2022, it said that it currently does not anticipate paying any cash dividends in the foreseeable future. Accordingly, we suggest using the free cash flow valuation method (rather than the dividend discount model). |

| Which financial forecasts to use? | Proactive Investors | The only available long-term forecasts (i.e. >15 years) are the ones that are supplied by us (the forecasts can be found in the financials section of this report), so we suggests using those. |

Growth stage 2

| ||

| Discount rate (%) | 15% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 90% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 2) is 90%. |

Growth stage 3

| ||

| Discount rate (%) | 10% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 100% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 3) is 100%. |

Growth stage 4

| ||

| Discount rate (%) | 10% | There are two key risk parameters for a firm that need to be estimated: its cost of equity and its cost of debt. A key way to estimate the cost of equity is by looking at the beta (or betas) of the company in question, the cost of debt from a measure of default risk (an actual or synthetic rating) and apply the market value weights for debt and equity to come up with the cost of capital. |

| Probability of success (%) | 100% | Research suggests that a suitable rate for a company in this growth stage (i.e. stage 4) is 100%. |

Other key inputs

| ||

| What's the current value of the company? | $950.54 billion | As at 5th June 2022, the current value of the Supply@Me Capital company is $950.54 billion. |

| Which time period do you want to use to estimate the expected return? | Between now and five years time | Research suggests that following a market crash, the average amount of time it takes for the price of a stock market to return to its pre-crash level (i.e. the recovery period) is at least three years.[17] Accordingly, we suggest that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. |

Sensitive analysis

The main inputs that result in the greatest change in the expected return of the Supply@Me Capital investment are, in order of importance (from highest to lowest):

- The size of the total addressable market (the default size is $3.0 trillion);

- Supply@Me Capital peak market share (the default share is 10%); and

- The discount rate (the default time-weighted average rate is 10%).

The impact of a 50% change in those main inputs to the expected return of the Supply@ME Capital investment is shown in the table below.

| Main input | 50% worse | Unchanged | 50% better |

|---|---|---|---|

| The size of the total addressable market | N/A | (24%) | N/A |

| Supply@ME Capital peak market share | N/A | (24%) | N/A |

| The discount rate | N/A | (24%) | N/A |

Appendix

Relative valuation approach

As noted earlier in this report, research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more accurate is the discounted cash flow approach, so that's the approach that we suggest using to determine the estimated value of the company (the valuation based on the discounted cash flow approach can be found in the valuation section of this report); nevertheless, for completeness purposes, separately, the valuation of the company is also estimated using the relative valuation approach.

What's the expected return of an investment in the company using the relative valuation approach?

Accordingly, We estimate that the expected return of an investment in Supply@ME Capital over the next five years is 4.4x. In other words, an £1,000 investment in the company is expected to return £4,400 in five years time. The assumptions used to estimate the return figure can be found in the table below.

Assuming that a suitable return level over five years is 10% per year and Supply@ME Capital achieves its expected return level (of 4.4x), then an investment in the company is considered to be a 'suitable' one.

What are the assumptions used to estimate the return figure?

| Description | Value | Commentary |

|---|---|---|

| Which type of multiple do you want to use? | Growth-adjusted EV/sales | For the numerator, we believe that to account for the different financial leverage levels of its peers, it's best to use enterprise value (EV), rather than price. For the denominator, we believe that because it expects Supply@ME Capital to reinvest almost all of its revenue back into the business over the five year forecast period and therefore its earnings are expected to be abnormally low over the period, it's best to use sales. Accordingly, we suggest valuing its company using the EV/sales ratio. However, we feel that to take into account the different business lifecycle stages of its peers, the most suitable valuation multiple to use is the growth-adjusted EV/sales multiple[Note 3], rather than the EV/sales multiple. |

| In regards to the growth-adjusted EV/sales multiple, for the sales figure, which year to you want to use? | Year 5 | We suggest that with sales forecast to grow exponential over the five year forecast period, it's best to use forward-looking data, rather than historic data.

|

| In regards to the growth-adjusted EV/sales multiple, for the sales growth figure, which year(s) do you want to use? | Year 6 to 8, from now | We suggest that for the sales growth figure, it's best to use Year 6 to 8. |

| In regards to the growth-adjusted EV/sales multiple, what multiple figure do you want to use? | 89x | In our view, Supply@ME Capital's closest peer is Apple, Inc. Apple, Inc trades on a multiple of 89x. |

| Which financial forecasts to use? | Proactive Investors | The only available forecasts are the ones that are supplied by us (the forecasts can be found in the financials section of this report), so we suggest using those. |

| What's the current value of the company? | $688 billion | As at 21st May 2022, the current value of its company at $688 billion. |

| Which time period do you want to use to estimate the expected return? | Between now and five years time | We suggest that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. |

Sensitive analysis

The two main inputs that result in the greatest change in the expected return of the Sirius Real Estate Limited investment are, in order of importance (from highest to lowest):

- The P/AFFO multiple (the default multiple is 15x); and

- The Year-five AFFO forecast (the default forecast is $xxx million); and

The impact of a 10% change in those main inputs to the expected return of the Sirius Real Estate Limited investment is shown in the table below.

| Main input | 10% worse | Unchanged | 10% better |

|---|---|---|---|

| The P/AFFO multiple | |||

| The Year-five AFFO forecast |

Key principal activities

The Platform

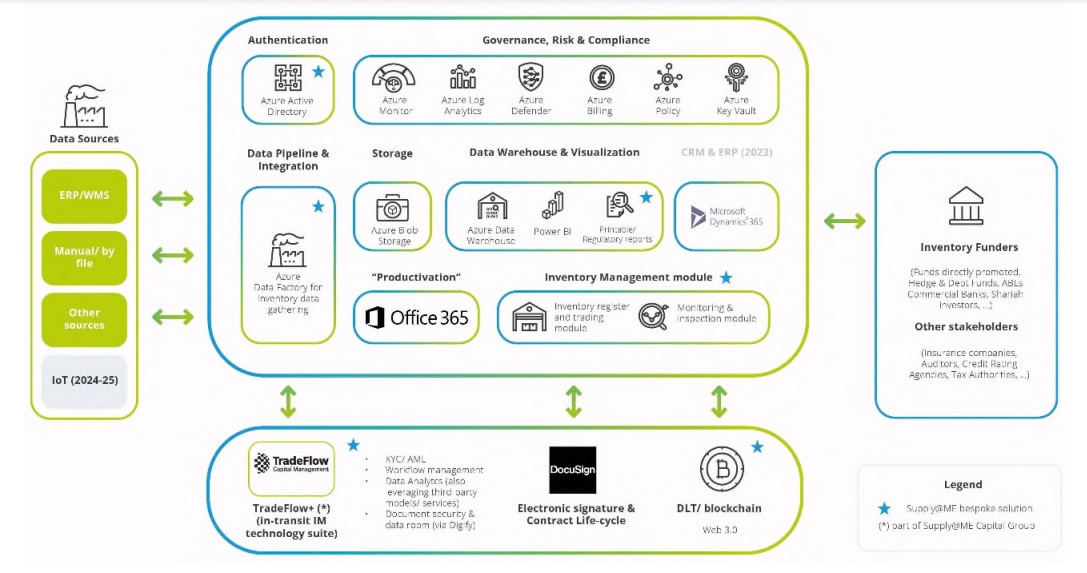

The group is a fintech company providing a inventory monetisation (IM) service to companies in a wide range of industrial sectors utilising the platform, which comprises a unique combination of software modules, exponential technology components (such as AI, IoT) and Blockchain), dedicated legal and accounting frameworks and business rules/methodologies delivered via a hybrid ICT architecture.

Specifically, the ICT architecture envisages the use of two cloud environments (Microsoft Azure for warehoused goods monetisation and Amazon Web Services for the in-transit model delivered by TradeFlow) plus an external integration with distributed ledger frameworks.

Diagrammatic illustration of the Platform:

Source: 2021 Annual Report

The stakeholders of the platform are:

- the Fund, via dedicated compartments and their StockCos, the trading vehicles who purchase inventory from corporate clients;

- potential IM funders, who can invest in the Fund and/or act as direct lenders to the StockCos;

- TradeFlow acting as investment advisory company of the Fund;

- corporate clients, as commercial counterparties of the StockCos or directly of the Fund; or

- banks, as white-label users of the Platform as a service (underpinning their inventory based and/or backed financial products directly provided by the banks to their clients).

The platform’s road-map envisages that data sources have a key role for the platform, triggering the value-added service provided by the group (whether inventory data analysis or IM provided by the Fund. Accordingly, data ingestion services have a critical role in the overall platform operations. Additionally, the inventory register and trading modules are able to produce the data analysis and support the creation of the security package in favour of the IM funders involved in each IM deal.

The monitoring component of the platform is constructed by business rules (which support the creation of specific key risk and performance indicators) and are expected to be underpinned by software modules able to enable the user to visualise early warnings, trigger inspections (to report digitally) and track the action plan/remediation plan agreed with the corporate client. The Platform’s road-map further envisages the adoption of IoT frameworks in order to improve the effectiveness and the efficiency of the monitoring and inspections activities.

TradeFlow uses a dedicated suite (TradeFlow+) made of multiple software modules reflecting the expertise of the team in the trade finance space, delivering a unique non-credit approach aimed at monetising inventory in-transit (import/export transactions where the buyer is supported to optimise its supply chain relationship).

The revenue model

Over recent months, the group has clarified and fine-tuned its overall business model, distinguishing the pure FinTech business (the platform being the group's people and software) from the inventory funding structure. In this regard:

- the platform has, by definition, an intrinsic value and accordingly can also be used by other operators (such as banks or other debt funders) to improve inventory backed or based facilities. The company considers it to be an enabler of each transaction. For this reason, the group officially launched its white-label initiative at the end of August 2020, invested further time in upgrading ICT architecture, selected and started new tech streams, while leveraging and understanding the components used by TradeFlow Capital within its TradeFlow+ system; and

- the areas of improvement suggested by IM funders in the last year regarding the introduction of an equity (first loss) line in the capital structure of each IM transaction was addressed with the launch of the Fund compartments, which can work as an equity provider and/or on a standalone basis (the Fund able to deliver by itself an IM transaction).

As such, the group is now focused on establishing and growing the following active, and future, revenue streams:

- "Captive" IM platform servicing ("C.IM"): revenue generated through the use of the platform to facilitate IM transactions performed by the Fund and its IM funders. This revenue is generated by the group’s operating subsidiaries, and in the future is expected to be supplemented by Tijara Pte Limited, a technology subsidiary company of TradeFlow. Revenue is expected to be earned in relation to the following activities:

- origination and due diligence (pre-IM); and

- monitoring, controlling and reporting (post-IM).

During the year ended 31 December 2021, the group recognised £0.3m of C.IM revenue relating to due diligence fees. During the six month interim period ended 30 June 2022, the C.IM revenue relating to due diligence fees was nil. When fully delivered, this stream is expected to generate revenues of approximately 1-3% of the gross value of the inventories monetised (purchase price plus VAT).

- "White-label" IM platform servicing ("WL.IM"): revenue to be generated through the use of the platform by third parties who choose to employ the self-funding model. When delivered, this stream is expected to generate recurring software-as-a-service revenues of approximately 0.5-1.5% of the value of each IM transaction (the amount of funding provided). No WL.IM revenue was recognised by the group during the year ended 31 December 2021 or during the six month interim period ended 30 June 2022.

- Investment Advisory ("IA"): the revenue stream currently being generated by TradeFlow in its capacity as investment advisor to its well-established funds, as well as its anticipated role as investment advisor to the Fund going forward. This stream is expected to generate recurring revenues of approximately 1.25% of Assets Under Management for which TradeFlow acts as advisor. Additionally, TradeFlow could receive a further performance incentive fee of up to 15% of the profits generated by the Fund, based on performance. During the year ended 31 December 2021, the group recognised £0.2m of IA revenue, representing TradeFlow’s addition to the group’s revenue from 1st July to 31st December 2021. During the six month interim period ended 30th June 2022, the group recognised £0.2m of IA revenue.

Operational and principal activities

Recently introduced significant new products or services

Since 31th December 2021 (being the date to which the last published audited financial statements for the company and the group were made up), the group announced the execution of a strategic alliance agreement on 28th June 2022 (the "VeChain Agreement") with the VeChain Foundation ("VeChain"), a blockchain enterprise service provider focused on supply chain and sustainability, to fund the first inaugural IM transaction and kick off the "Web3" stream.

The objective of the VeChain Agreement is to create a sustainable Web3 environment that will allow direct participation in the IM journey combining traditional finance with the blockchain space. According to Messari research, the top 100 digital assets in circulation capitalise over US$1.2 trillion, of which approximately 60% are currencies, like Bitcoin, and stablecoins, like Tether.

The VeChain Agreement has two phases, both in terms of investment opportunities and technology development.

In Phase One, a proof-of-concept real transaction involving a client company already selected by SYME from its existing Italian portfolio, with the VeChain Foundation serving as provider of its VeChain Thor blockchain and non-fungible token ("NFT") investor.

Following the successful completion of the first transaction and an assessment of the innovative process designed to link digital assets to the real economy, Phase Two will build up an "IM Platform 3.0" with an expected roadmap of Web3 features, including the issuance of NFTs, digital ownership and B2B marketplaces, decentralised finance (DEFI) and, overall, a governance protocol. For this phase, to be completed by end of December 2022, it’s expected the IM transactions will be also funded by further multiple liquidity providers (crypto asset managers and direct IM investors through liquidity pools partnerships).

The commitment budgeted by VeChain within the VeChain Agreement to directly subscribe the Inventory (NFT-based) Monetisation Transactions is up to US$10m, of which approximately US$1.6m immediately releasable to fund the available eligible inventory of the first Italian client selected and the rest, during the Phase Two, for one or more further client companies, also including the current UK portfolio.

Recent commercial developments

On 12th September 2022, the company announced the execution of the group's first IM transaction in connection with Phase One of the VeChain Agreement. The client company to this inaugural IM transaction is a well-established business with significant market presence in Europe (mainly in Italy), Africa and the United States. The client company is involved in the design and manufacture of industrial and specialised vehicles as well as electronic systems, electrical wiring, and other components.

The inaugural IM transaction has been structured as follows:

- a StockCo, an overview of which was given in the SYME Business Model Canvas in the 2021 Annual Report, entered into the commercial contractual package, with a duration of three years, with the client company to execute the inaugural IM transaction. The total value of the initial warehoused goods to be monetised is approximately €1.6m;

- with reference to the fully owned SYME subsidiaries:

- Supply@ME Italy, acting as originator and servicer, signed an operating agreement with StockCo which includes an annual inventory servicing fee and, additionally, will charge the client company an up-front origination fee;

- NewCoTech, owner of the IM intellectual property rights and acting as platform provider, has signed a license agreement with the StockCo and will charge an annual platform fee. The platform will be used by the client company to upload inventory to be monetised (and, accordingly, minting the NFTs), integrate and transfer the Enterprise-Resource-Planning data to allow the necessary monitoring and inspection activities by the StockCo, supported by Supply@ME Italy; and

- StockCo, in turn, mints NFTs to be subscribed by VeChain under the VeChain Agreement. Each NFT represents a basket of rights over the inventory, including the opportunity to achieve monthly returns generated by the inventory trading activities performed by the StockCo and the right of the NFT holder, as ultimate owner of the goods, to take possession of the physical goods if certain conditions are met.

Major shareholders

The table below shows those who hold 3% or more of the company's share capital, as of 14th October 2022.

| Shareholder | Number of Ordinary Shares | Percentage of the issued share capital |

|---|---|---|

| The AvantGarde Group S.p.A. | 12,742,513,009 | 22.51% |

| Venus Capital S.A. | 7,900,000,000 | 13,95% |

Note, the total number of issued share capital is as follows: 56,617,688,143 ordinary shares.

Other

Dividends

To date, the company has not declared or paid any dividends on the Ordinary Shares. The Company’s current intention is to retain earnings, if any, to finance the operation and expansion of the Group’s business, and does not expect to declare or pay any cash dividends in the foreseeable future.

- ↑ 1.0 1.1 https://www.ucl.ac.uk/bartlett/sustainable/sites/bartlett/files/an_exploration_of_energy_cost_ranges_limits_and_adjustment_process.pdf

- ↑ 2.0 2.1 Cite error: Invalid

<ref>tag; no text was provided for refs namedTesla4Q2021final - ↑ Source: Stockhub Limited

- ↑

- ↑ 5.00 5.01 5.02 5.03 5.04 5.05 5.06 5.07 5.08 5.09 5.10 5.11 5.12

- ↑ Source: Stockhub Limited

- ↑ Stadler, Enduring Success, 3–5.

- ↑ http://www.robertpicard.net/files/econgrowthandadvertising.pdf

- ↑ https://www.macrotrends.net/countries/WLD/world/gdp-growth-rate

- ↑ http://escml.umd.edu/Papers/ObsCPMT.pdf

- ↑ Levie J, Lichtenstein BB (2010) A terminal assessment of stages theory: Introducing a dynamic approach to entrepreneurship. Entrepreneurship: Theory & Practice 34(2): 317–350. https://doi.org/10.1111/j.1540-6520.2010.00377.x

- ↑ Stef Hinfelaar et al.:, 2019.

- ↑ Dickinson, 2010.

- ↑ 14.0 14.1 14.2 14.3 http://escml.umd.edu/Papers/ObsCPMT.pdf

- ↑ 15.00 15.01 15.02 15.03 15.04 15.05 15.06 15.07 15.08 15.09 15.10 15.11 15.12 15.13 15.14 15.15 15.16 15.17 http://people.stern.nyu.edu/adamodar/pdfiles/papers/younggrowth.pdf

- ↑ Demirakos et al., 2010; Gleason et al., 2013

- ↑ https://www.newyorkfed.org/mediabrary/media/medialibrary/media/research/staff_reports/research_papers/9809.pdf

Cite error: <ref> tags exist for a group named "Note", but no corresponding <references group="Note"/> tag was found