The Goldman Sachs Group, Inc.: Difference between revisions

(Rewrote bullet points of risks) |

No edit summary |

||

| Line 1: | Line 1: | ||

Goldman Sachs Group, Inc. is a leading global financial institution offering a comprehensive suite of services to a diverse client base, encompassing corporations, financial institutions, governments, and private individuals worldwide. | |||

The company operates across four primary sectors: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. In the Investment Banking sector, Goldman Sachs delivers a range of strategic financial advisory services encompassing M&A, divestitures, corporate defence, restructurings, and spin-offs. It also extends a variety of lending services, from middle-market and relationship lending to acquisition financing, supplemented by comprehensive transaction banking services. Additionally, the segment provides robust underwriting services for equity and debt, alongside structured securities origination. | |||

Goldman Sachs' Global Markets division focuses on client execution activities for a plethora of financial instruments. This includes cash and derivatives, credit and interest rate products, along with equity intermediation and financing. This division also offers a range of support services such as clearing, settlement, and custody while dealing in mortgages, currencies, commodities, and equities. | |||

In the Asset Management division, the company demonstrates broad expertise across diverse asset classes, from equities, fixed income, hedge funds, and private equity, to real estate, currencies, and commodities. Alongside these, it delivers tailored investment advisory solutions, and maintains investments in corporate, real estate, and infrastructure entities. | |||

The Consumer & Wealth Management division provides comprehensive wealth advisory and banking services, including financial planning, investment management, deposit and lending services, as well as private banking. Furthermore, it offers unsecured loans and accepts savings and time deposits. | |||

Since its inception in 1869, Goldman Sachs has been committed to creating client value, with its headquarters located in New York, New York. | |||

== Operations == | == Operations == | ||

Revision as of 23:41, 19 July 2023

Goldman Sachs Group, Inc. is a leading global financial institution offering a comprehensive suite of services to a diverse client base, encompassing corporations, financial institutions, governments, and private individuals worldwide.

The company operates across four primary sectors: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. In the Investment Banking sector, Goldman Sachs delivers a range of strategic financial advisory services encompassing M&A, divestitures, corporate defence, restructurings, and spin-offs. It also extends a variety of lending services, from middle-market and relationship lending to acquisition financing, supplemented by comprehensive transaction banking services. Additionally, the segment provides robust underwriting services for equity and debt, alongside structured securities origination.

Goldman Sachs' Global Markets division focuses on client execution activities for a plethora of financial instruments. This includes cash and derivatives, credit and interest rate products, along with equity intermediation and financing. This division also offers a range of support services such as clearing, settlement, and custody while dealing in mortgages, currencies, commodities, and equities.

In the Asset Management division, the company demonstrates broad expertise across diverse asset classes, from equities, fixed income, hedge funds, and private equity, to real estate, currencies, and commodities. Alongside these, it delivers tailored investment advisory solutions, and maintains investments in corporate, real estate, and infrastructure entities.

The Consumer & Wealth Management division provides comprehensive wealth advisory and banking services, including financial planning, investment management, deposit and lending services, as well as private banking. Furthermore, it offers unsecured loans and accepts savings and time deposits.

Since its inception in 1869, Goldman Sachs has been committed to creating client value, with its headquarters located in New York, New York.

Operations

Goldman Sachs is a leading global financial institution that delivers a broad range of financial services to a large and diversified client base that includes corporations, financial institutions, governments and individuals. Its purpose is to advance sustainable economic growth and financial opportunity. Its goal, reflected in its One Goldman Sachs initiative, is to deliver the full range of its services and expertise to support its clients in a more accessible, comprehensive and efficient manner, across businesses and product areas.

Group Inc. is a bank holding company (BHC) and a financial holding company (FHC) regulated by the Board of Governors of the Federal Reserve System (FRB). Its U.S. depository institution subsidiary, Goldman Sachs Bank USA (GS Bank USA), is a New York State-chartered bank.

Business Segments

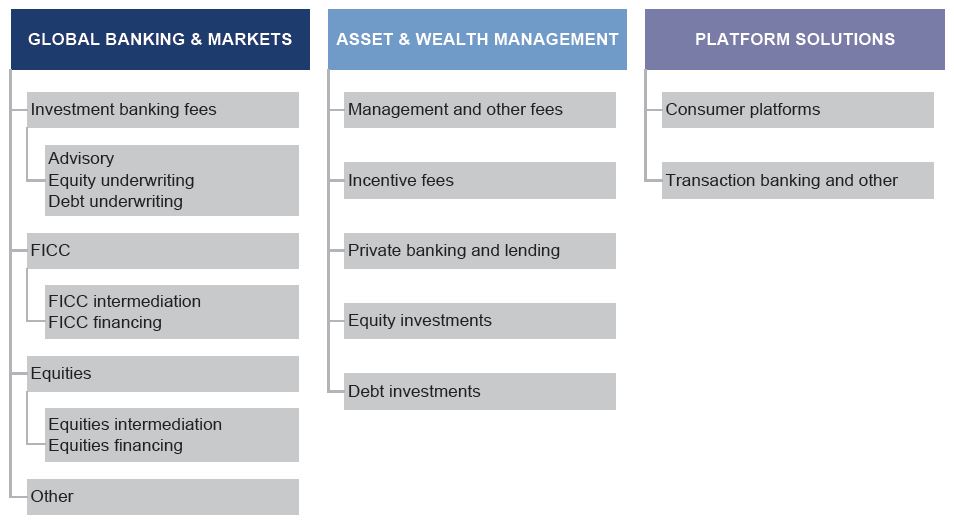

Goldman Sachs manages and reports its activities in three business segments: Global Banking & Markets, Asset & Wealth Management and Platform Solutions. Global Banking & Markets generates revenues from investment banking fees, including advisory, and equity and debt underwriting fees, Fixed Income, Currency and Commodities (FICC) intermediation and financing activities and Equities intermediation and financing activities, as well as relationship lending and acquisition financing (and related hedges) and investing activities related to its Global Banking & Markets activities. Asset & Wealth Management generates revenues from management and other fees, incentive fees, private banking and lending, equity investments and debt investments. Platform Solutions generates revenues from consumer platforms, and transaction banking and other platform businesses.

The chart below presents its three business segments and their revenue sources.

Prior to the fourth quarter of 2022, Goldman Sachs managed and reported its activities in the following fits business segments: Investment Banking, Global Markets, Asset Management and Consumer & Wealth Management. Beginning with the fourth quarter of 2022, consistent with its previously announced organizational changes, Goldman Sachs began managing and reporting its activities in three new segments: Global Banking & Markets, Asset & Wealth Management and Platform Solutions. Its new segments reflect the following primary changes:

- Global Banking & Markets is a new segment that includes the results previously reported in Investment Banking and Global Markets, and additionally includes the results from equity and debt investments related to its Global Banking & Markets activities, previously reported in Asset Management.

- Asset & Wealth Management is a new segment that includes the results previously reported in Asset Management and Wealth Management (previously included in Consumer & Wealth Management), and additionally includes the results from its direct-to-consumer banking business, which includes lending, deposit-taking and investing, previously reported in Consumer & Wealth Management, as well as the results from middle-market lending related to its asset management activities, previously reported in Investment Banking.

- Platform Solutions is a new segment that includes the results from its consumer platforms, such as partnerships offering credit cards and point-of-sale financing, previously reported in Consumer & Wealth Management, and the results from its transaction banking business, previously reported in Investment Banking.

Global Banking & Markets

Global Banking & Markets serves public and private sector clients and Goldman Sachs seek to develop and maintain long-term relationships with a diverse global group of institutional clients, including corporations, governments, states and municipalities. Its goal is to deliver to its institutional clients all of its resources in a seamless fashion, with its advisory and underwriting activities serving as the main initial point of contact. Goldman Sachs makes markets and facilitate client transactions in fixed income, currency, commodity and equity products and offer market expertise on a global basis. In addition, Goldman Sachs makes markets in, and clear client transactions on, major stock, options and futures exchanges worldwide. Its clients include companies that raise capital and funding to grow and strengthen their businesses, and engage in mergers and acquisitions, divestitures, corporate defence, restructurings and spin-offs, as well as companies that are professional market participants, who buy and sell financial products and manage risk, and investment entities whose ultimate clients include individual investors investing for their retirement, buying insurance or saving surplus cash.

As a market maker, Goldman Sachs provides prices to clients globally across thousands of products in all major asset classes and markets. At times, Goldman Sachs takes the other side of transactions itself if a buyer or seller is not readily available, and at other times Goldman Sachs connect its clients to other parties who want to transact. Its willingness to make markets, commit capital and take risk in a broad range of products is crucial to its client relationships. Market makers provide liquidity and play a critical role in price discovery, which contributes to the overall efficiency of the capital markets. In connection with its market-making activities, Goldman Sachs maintains (i) market-making positions, typically for a short period of time, in response to, or in anticipation of, client demand, and (ii) positions to actively manage its risk exposures that arise from these market-making activities (collectively, inventory).

Goldman Sachs executes a high volume of transactions for its clients in large, highly liquid markets (such as markets for U.S. Treasury securities, stocks and certain agency mortgage pass-through securities[1]). Goldman Sachs also executes transactions for its clients in less liquid markets (such as mid-cap corporate bonds, emerging market currencies and certain non-agency mortgage-backed securities) for spreads and fees that are generally somewhat larger than those charged in more liquid markets. Additionally, Goldman Sachs structures and executes transactions involving customized or tailor-made products that address its clients’ risk exposures, investment objectives or other complex needs, as well as derivative transactions related to client advisory and underwriting activities.

Through its global sales force, Goldman Sachs maintains relationships with its clients, receiving orders and distributing investment research, trading ideas, market information and analysis. Much of this connectivity between Goldman Sachs and its clients is maintained on technology platforms, including Marquee, and operates globally where markets are open for trading. Marquee provides institutional investors with market intelligence, risk analytics, proprietary datasets and trade execution across multiple asset classes.

Its businesses are supported by its Global Investment Research business, which, as of December 2022, provided fundamental research on approximately 3,000 companies worldwide and on approximately 50 national economies, as well as on industries, currencies and commodities.

Its activities are organized by asset class and include both “cash” and “derivative” instruments. “Cash” refers to trading the underlying instrument (such as a stock, bond or barrel of oil). “Derivative” refers to instruments that derive their value from underlying asset prices, indices, reference rates and other inputs, or a combination of these factors (such as an option, which is the right or obligation to buy or sell a certain bond, stock or other asset on a specified date in the future at a certain price, or an interest rate swap, which is the agreement to convert a fixed rate of interest into a floating rate or vice versa).

Global Banking & Markets generates revenues from the following:

Investment banking fees. Goldman Sachs provides advisory and underwriting services to its clients.

Investment banking fees includes the following:

- Advisory. Goldman Sachs has been a leader for many years in providing advisory services, including strategic advisory assignments with respect to mergers and acquisitions, divestitures, corporate defence activities, restructurings and spin-offs. In particular, Goldman Sachs help clients execute large, complex transactions for which Goldman Sachs provides multiple services, including cross-border structuring expertise. Goldman Sachs also assists its clients in managing their asset and liability exposures and their capital.

- Underwriting. Goldman Sachs helps companies raise capital to fund their businesses. As a financial intermediary, its job is to match the capital of its investing clients, who aim to grow the savings of millions of people, with the needs of its public and private sector clients, who need financing to generate growth, create jobs and deliver products and services. Its underwriting activities include public offerings and private placements of a wide range of securities and other financial instruments, including local and cross-border transactions and acquisition financing. Underwriting consists of the following:

- Equity underwriting. Goldman Sachs underwrites common stock, preferred stock, convertible securities and exchangeable securities. Goldman Sachs regularly receives mandates for large, complex transactions and has held a leading position in worldwide public common stock offerings and worldwide initial public offerings for many years.

- Debt underwriting. Goldman Sachs originates and underwrites various types of debt instruments, including investment-grade and high-yield debt, bank and bridge loans, including in connection with acquisition financing, and emerging- and growth-market debt, which may be issued by, among others, corporate, sovereign, municipal and agency issuers. In addition, Goldman Sachs underwrites and originates structured securities, which include mortgage-related securities and other asset-backed securities.

FICC. FICC generates revenues from intermediation and financing activities.

- FICC intermediation. Includes client execution activities related to making markets in both cash and derivative instruments, as detailed below.

Interest Rate Products. Government bonds (including inflation-linked securities) across maturities, other government-backed securities, and interest rate swaps, options and other derivatives.

Credit Products. Investment-grade and high-yield corporate securities, credit derivatives, exchange-traded funds (ETFs), bank and bridge loans, municipal securities, distressed debt and trade claims.

Mortgages. Commercial mortgage-related securities, loans and derivatives, residential mortgage-related securities, loans and derivatives (including U.S. government agency-issued collateralized mortgage obligations and other securities and loans), and other asset-backed securities, loans and derivatives.

Currencies. Currency options, spot/forwards and other derivatives on G-10 currencies and emerging-market products.

Commodities. Commodity derivatives and, to a lesser extent, physical commodities, involving crude oil and petroleum products, natural gas, agricultural, base, precious and other metals, electricity, including renewable power, environmental products and other commodity products.

- FICC financing. Includes secured lending to its clients through structured credit and asset-backed lending, including warehouse loans backed by mortgages (including residential and commercial mortgage loans), corporate loans and consumer loans (including auto loans and private student loans). Goldman Sachs also provides financing to clients through securities purchased under agreements to resell (resale agreements).

Equities. Equities generates revenues from intermediation and financing activities.

- Equities intermediation. Goldman Sachs makes markets in equity securities and equity-related products, including ETFs, convertible securities, options, futures and over-the-counter (OTC) derivative instruments. As a principal, Goldman Sachs facilitates client transactions by providing liquidity to its clients, including by transacting in large blocks of stocks or derivatives, requiring the commitment of its capital.

Goldman Sachs also structures and make markets in derivatives on indices, industry sectors, financial measures and individual company stocks. Goldman Sachs develops strategies and provides information about portfolio hedging and restructuring and asset allocation transactions for its clients. Goldman Sachs also works with its clients to create specially tailored instruments to enable sophisticated investors to establish or liquidate investment positions or undertake hedging strategies. Goldman Sachs is one of the leading participants in the trading and development of equity derivative instruments.

Its exchange-based market-making activities include making markets in stocks and ETFs, futures and options on major exchanges worldwide.

Goldman Sachs generates commissions and fees from executing and clearing institutional client transactions on major stock, options and futures exchanges worldwide, as well as OTC transactions. Goldman Sachs provide its clients with access to a broad spectrum of equity execution services, including electronic “low-touch”[2] access and more complex “high-touch”[2] execution through both traditional and electronic platforms, including Marquee.

- Equities financing. Includes prime brokerage and other equities financing activities, including securities lending, margin lending and swaps.

Goldman Sachs earns fees by providing clearing, settlement and custody services globally. In addition, Goldman Sachs provides its hedge fund and other clients with a technology platform and reporting that enables them to monitor their security portfolios and manage risk exposures.

Goldman Sachs provides services that principally involve borrowing and lending securities to cover institutional clients’ short sales and borrowing securities to cover its short sales and to make deliveries into the market. In addition, Goldman Sachs is an active participant in broker-to-broker securities lending and third-party agency lending activities.

Goldman Sachs provides financing to its clients for their securities trading activities through margin loans that are collateralized by securities, cash or other acceptable collateral. Goldman Sachs earns a spread equal to the difference between the amount Goldman Sachs pays for funds and the amount Goldman Sachs receives from its client.

Goldman Sachs executes swap transactions to provide its clients with exposure to securities and indices.

Goldman Sachs also provides securities-based loans to individuals.

Other. Goldman Sachs lends to corporate clients, including through relationship lending[3] and acquisition financing. The hedges related to this lending and financing activity are also reported as part of Other. Other also includes equity and debt investing activities related to its Global Banking & Markets activities.

Asset & Wealth Management

Asset & Wealth Management provides investment services to help clients preserve and grow their financial assets and achieve their financial goals. Goldman Sachs provides these services to its clients, both institutional and individuals, including investors who primarily access its products through a network of third-party distributors around the world.

Goldman Sachs manages client assets across a broad range of investment strategies and asset classes, including equity, fixed income and alternative investments. Alternative investments primarily includes hedge funds, credit funds, private equity, real estate, currencies, commodities and asset allocation strategies. Its investment offerings include those managed on a fiduciary basis by its portfolio managers, as well as those managed by third-party managers. Goldman Sachs offers its investment solutions in a variety of structures, including separately managed accounts, mutual funds, private partnerships and other commingled vehicles.

Goldman Sachs also provides customised investment advisory solutions designed to address its clients’ investment needs. These solutions begin with identifying clients’ objectives and continue through portfolio construction, ongoing asset allocation and risk management and investment realisation. Goldman Sachs draws from a variety of third-party managers, as well as its proprietary offerings, to implement solutions for clients.

Goldman Sachs provides tailored wealth advisory services to clients across the wealth spectrum. Goldman Sachs operates globally serving individuals, families, family offices, and foundations and endowments. Its relationships are established directly or introduced through companies that sponsor financial wellness programs for their employees.

Goldman Sachs offers personalised financial planning to individuals inclusive of income and liability management, compensation and benefits analysis, trust and estate structuring, tax optimization, philanthropic giving, and asset protection. Goldman Sachs also provides customised investment advisory solutions, and offers structuring and execution capabilities in securities and derivative products across all major global markets. Goldman Sachs leverages a broad, open-architecture investment platform and its global execution capabilities to help clients achieve their investment goals. In addition, Goldman Sachs offers clients a full range of private banking services, including a variety of deposit alternatives and loans that its clients use to finance investments in both financial and nonfinancial assets, bridge cash flow timing gaps or provide liquidity and flexibility for other needs.

In addition to managing client assets, Goldman Sachs invests in alternative investments across a range of asset classes that seek to deliver long-term accretive risk-adjusted returns. Its investing activities, which are typically longer-term, include investments in corporate equity, credit, real estate and infrastructure assets.

Goldman Sachs also raises deposits and has issued unsecured loans to consumers through Marcus by Goldman Sachs (Marcus). Goldman Sachs has started a process to cease offering new loans through Marcus.

Asset & Wealth Management generates revenues from the following:

- Management and other fees. Goldman Sachs receives fees related to managing assets for institutional and individual clients, providing investing and wealth advisory solutions, providing financial planning and counseling services via Ayco Personal Financial Management, and executing brokerage transactions for wealth management clients. The fees that Goldman Sachs charge vary by asset class, client channel and the types of services provided, and are affected by investment performance, as well as asset inflows and redemptions.

- Incentive fees. In certain circumstances, Goldman Sachs also receives incentive fees based on a percentage of a fund’s or a separately managed account's return, or when the return exceeds a specified benchmark or other performance targets. Such fees include overrides, which consist of the increased share of the income and gains derived primarily from its private equity and credit funds when the return on a fund’s investments over the life of the fund exceeds certain threshold returns.

- Private banking and lending. Its private banking and lending activities include issuing loans to its wealth management clients. Such loans are generally secured by commercial and residential real estate, securities and other assets. Goldman Sachs also accepts deposits (including savings and time deposits) from wealth management clients, including through Marcus, in GS Bank USA and Goldman Sachs International Bank (GSIB). Goldman Sachs has also issued unsecured loans to consumers through Marcus and have started a process to cease offering new loans. Additionally, Goldman Sachs provides investing services through Marcus Invest to U.S. customers. Private banking and lending revenues include net interest income allocated to deposits and net interest income earned on loans to individual clients.

- Equity investments. Includes investing activities related to its asset management activities primarily related to public and private equity investments in corporate, real estate and infrastructure assets. Goldman Sachs also makes investments through consolidated investment entities, substantially all of which are engaged in real estate investment activities.

- Debt investments. Includes lending activities related to its asset management activities, including investing in corporate debt, lending to middle-market clients, and providing financing for real estate and other assets. These activities include investments in mezzanine debt, senior debt and distressed debt securities.

Platform Solutions

Platform Solutions includes its consumer platforms, such as partnerships offering credit cards and point-of-sale financing, and transaction banking and other platform businesses.

Platform Solutions generates revenues from the following:

Consumer platforms. Its Consumer platforms business issues credit cards and provides point-of-sale financing to consumers to finance the purchases of goods or services. Consumer platforms revenues primarily includes net interest income earned on credit card lending and point-of-sale financing activities.

Transaction banking and other. Goldman Sachs provide transaction banking and other services, including cash management services, such as deposit-taking and payment solutions for corporate and institutional clients. Transaction banking revenues include net interest income attributed to transaction banking deposits.

Business Continuity and Information Security

Business continuity and information security, including cybersecurity, are high priorities for us. Their importance has been highlighted by (i) the coronavirus (COVID-19) pandemic and the work-from-home arrangements implemented by companies worldwide in response, including us, (ii) numerous highly publicized events in recent years, including cyber attacks against financial institutions, governmental agencies, large consumer-based companies, software and information technology service providers and other organizations, some of which have resulted in the unauthorized access to or disclosure of personal information and other sensitive or confidential information, the theft and destruction of corporate information and requests for ransom payments, and (iii) extreme weather events.

Its Business Continuity & Technology Resilience Program has been developed to provide reasonable assurance of business continuity in the event of disruptions at its critical facilities or of its systems, and to comply with regulatory requirements, including those of FINRA. Because Goldman Sachs is a BHC, its Business Continuity & Technology Resilience Program is also subject to review by the FRB. The key elements of the program are crisis management, business continuity, technology resilience, business recovery, assurance and verification, and process improvement. In the area of information security, Goldman Sachs have developed and implemented a framework of principles, policies and technology designed to protect the information provided to us by its clients and its own information from cyber attacks and other misappropriation, corruption or loss. Safeguards are designed to maintain the confidentiality, integrity and availability of information.

Human Capital Management

Its people are its greatest asset. Goldman Sachs believe that a major strength and principal reason for its success is the quality, dedication, determination and collaboration of its people, which enables us to serve its clients, generate long-term value for its shareholders and contribute to the broader community. Goldman Sachs invests heavily in developing and supporting its people throughout their careers, and Goldman Sachs strives to maintain a work environment that fosters professionalism, excellence, high standards of business ethics, diversity, teamwork and cooperation among its employees worldwide.

Diversity and Inclusion

The strength of its culture, its ability to execute its strategy, and its relationships with clients all depend on a diverse workforce and an inclusive work environment that encourages a wide range of perspectives. Goldman Sachs believes that diversity at all levels of its organization, from entry-level analysts to senior management, as well as the Board of Directors of Group Inc. (Board) is essential to its sustainability. As of December 2022, approximately 57% of its Board was diverse by race, gender or sexual orientation. Its management team works closely with its Global Inclusion and Diversity Committee to continue to increase diversity of its global workforce at all levels. In addition, Goldman Sachs has Inclusion and Diversity Committees across regions, which promote an environment that values different perspectives, challenges conventional thinking and maximizes the potential of all its people.

Goldman Sachs believes that increased diversity, including diversity of experience, gender identity, race, ethnicity, sexual orientation, disability and veteran status, in addition to being a social imperative, is vital to its commercial success through the creativity that it fosters. For this reason, Goldman Sachs has established a comprehensive action plan with aspirational diversity hiring and representation goals which are set forth below and are focused on cultivating an inclusive environment for all its colleagues.

Diverse leadership is crucial to its long-term success and to driving innovation, and Goldman Sachs have implemented and expanded outreach and career advancement programs for rising diverse executive talent. For example, Goldman Sachs are focused on providing diverse vice presidents the necessary coaching, sponsorship and advocacy to support their career trajectories and strengthen their leadership platforms, including through programs, such as its Vice President Sponsorship Initiative focused on high-performing women, Black, Hispanic/Latinx, Asian and LGBTQ+ vice presidents across the globe. Many other career development initiatives are aimed at fostering diverse talent at the analyst and associate level, including the Black Analyst and Associate Initiative, the Hispanic/Latinx Analyst Initiative and the Women’s Career Strategies Initiative. Its global and regional Inclusion Networks and Interest Forums are open to all professionals at Goldman Sachs to promote and advance connectivity, understanding, inclusion and diversity.

Progress Toward Aspirational Goals. Reflecting its efforts to increase diversity, the composition of its most recent partnership class was 29% women professionals, 24% Asian professionals, 9% Black professionals, 3% Hispanic/Latinx professionals, 3% LGBTQ+ professionals and 3% professionals who are military/veterans. The composition of its most recent managing director class was 30% women professionals, 28% Asian professionals, 5% Black professionals, 5% Hispanic/Latinx professionals, 3% LGBTQ+ professionals and 3% professionals who are military/veterans.

Goldman Sachs has also set forth the following aspirational goals:

- Goldman Sachs aims for analyst and associate hiring (which accounts for over 70% of its annual hiring) to achieve representation of 50% women professionals, 11% Black professionals and 14% Hispanic/Latinx professionals in the Americas, and 9% Black professionals in the U.K. In 2022, its analyst and associate hires included 44% women professionals, 10% Black professionals and 13% Hispanic/Latinx professionals in the Americas, and 17% Black professionals in the U.K.

- Goldman Sachs aims for women professionals to represent 40% of its vice presidents globally by 2025 and 30% of senior talent (vice presidents and above) in the U.K. by 2023, while also endeavoring for women employees to comprise 50% of all of its employees globally over time. As of December 2022, women professionals represented 33% of its vice president population globally and 31% of senior talent (vice presidents and above) in the U.K., and women employees represented 41% of all of its employees globally.

- Goldman Sachs aims for Black professionals to represent 7% of its vice president population in the Americas and in the U.K., and for Hispanic/Latinx professionals to represent 9% of its vice president population in the Americas, both by 2025. As of December 2022, Black professionals represented 4% of its vice president population in the Americas and 5% in the U.K., and Hispanic/Latinx professionals represented 6% of its vice president population in the Americas.

- Goldman Sachs aims to double the number of campus hires in the U.S. recruited from Historically Black Colleges and Universities (HBCUs) by 2025 relative to 2020.

The metrics above are based on self-identification.

Talent Development and Retention

Goldman Sachs seeks to help its people achieve their full potential by investing in them and supporting a culture of continuous development. Its goals are to maximize individual capabilities, increase commercial effectiveness and innovation, reinforce its culture, expand professional opportunities, and help its people contribute positively to their communities.

Instilling its culture in all employees is a continuous process, in which training plays an important part. Goldman Sachs offers its employees the opportunity to participate in ongoing educational offerings and periodic seminars facilitated by its Learning & Engagement team. To accelerate their integration into the firm and its culture, new hires have the opportunity to receive training before they start working and orientation programs with an emphasis on culture and networking, and nearly all employees participate in at least one training event each year. For its more senior employees, Goldman Sachs provide guidance and training on how to manage people and projects effectively, exhibit strong leadership and exemplify its culture. Goldman Sachs are also focused on developing a high performing, diverse leadership pipeline and career planning for its next generation of leaders. Goldman Sachs maintain a variety of programs aimed at employees’ professional growth and leadership development, including initiatives, such as its Vice President and Managing Director Leadership Acceleration Initiatives and Partner Development Initiative.

Enhancing its people’s experience of internal mobility is a key focus, as Goldman Sachs believe that this will inspire employees, help retain top talent and create diverse experiences to build future leaders.

Another important part of instilling its culture is its employee performance review process. Employees are reviewed by supervisors, co-workers and employees whom they supervise in a 360-degree review process that is integral to its team approach and includes an evaluation of an employee’s performance with respect to risk management, protecting its reputation, adherence to its code of conduct, compliance, and diversity and inclusion principles. Its approach to evaluating employee performance centers on providing robust, timely and actionable feedback that facilitates professional development. Goldman Sachs have directed its managers, as leaders at the firm, to take an active coaching role with their teams. Goldman Sachs have also implemented “The Three Conversations at GS” through which managers establish goals with their team members at the start of the year, check in mid-year on progress and then close out the year with a conversation on performance against goals.

Goldman Sachs believe that its people value opportunities to contribute to their communities and that these opportunities enhance their job satisfaction. Goldman Sachs also believe that being able to volunteer together with colleagues and support community organizations through completing local service projects strengthens its people’s bond with us. Community TeamWorks, its signature volunteering initiative, enables its people to participate in high-impact, team-based volunteer opportunities, including projects coordinated with hundreds of non-profit partner organizations worldwide. During 2022, its people volunteered approximately 86,000 hours of service globally through Community TeamWorks, with approximately 17,000 employees partnering with approximately 500 nonprofit organizations on approximately 1,200 community projects.

Wellness

Goldman Sachs recognises that for its people to be successful in the workplace they need support in their personal, as well as their professional, lives. Goldman Sachs has created a strong support framework for wellness, which is intended to enable employees to better balance their roles at work and their responsibilities at home. Goldman Sachs provide a number of policies for its employees that support taking time away from the office when needed, including 20 weeks of parental leave, family care leave and bereavement leave. In 2022, Goldman Sachs also enhanced its vacation policies for its employees, allowing managing directors to take time off, when needed, without a fixed vacation day entitlement and adding a minimum of two additional vacation days for all other employees, as well as setting a minimum annual expected vacation usage of 15 days. For longer-tenured employees, Goldman Sachs offer an unpaid sabbatical leave. Goldman Sachs also continue to advance its resilience programs, offering its people a range of counselling, coaching, medical advisory and personal wellness services. Goldman Sachs increased the availability of these resources during the COVID-19 pandemic, and continued to evolve and strengthen virtual offerings to enhance access to support, with the aim of maintaining the physical and mental well-being of its people, and enhancing their effectiveness and productivity.

In addition, to support the financial wellness of its employees, Goldman Sachs offer a variety of resources that help them manage their personal financial health and decision-making, including financial education information sessions, live and on-demand webinars, articles and interactive digital tools.

Global Reach and Strategic Locations

As a firm with a global client base, Goldman Sachs takes a strategic approach to attracting, developing and managing a global workforce. Its clients are located worldwide and Goldman Sachs are an active participant in financial markets around the world. As of December 2022, Goldman Sachs had headcount of 48,500, offices in over 35 countries and 52% of its headcount was based in the Americas, 19% in EMEA and 29% in Asia. Its employees come from over 180 countries and speak more than 150 languages as of December 2022.

In addition to maintaining offices in major financial centres around the world, Goldman Sachs has established key strategic locations, including in Bengaluru, Salt Lake City, Dallas, Singapore, Warsaw and Hyderabad. Goldman Sachs continue to evaluate the expanded use of strategic locations, including cities in which Goldman Sachs do not currently have a presence.

As of December 2022, 41% of its employees were working in strategic locations. Goldman Sachs believes its investment in these strategic locations enables us to build centres of excellence around specific capabilities that support its business initiatives.

Sustainability

Goldman Sachs have a long-standing commitment to sustainability. Its two priorities in this area are helping clients across industries decarbonize their businesses to support their transition to a low-carbon economy (Climate Transition) and to advance solutions that expand access, increase affordability, and drive outcomes to support sustainable economic growth (Inclusive Growth). Its strategy is to advance these two priorities through its work with its clients, and with strategic partners whose strengths and areas of focus complement its own, as well as through its supply chain.

Goldman Sachs have established a Sustainable Finance Group, which serves as the centralized group that drives climate strategy and sustainability efforts across its firm, including commercial efforts alongside its businesses, to advance Climate Transition and Inclusive Growth. Goldman Sachs have also created the role of Global Head of Sustainability and Inclusive Growth, which, like its One Goldman Sachs initiative, is intended to facilitate the application of its full capabilities across both Climate Transition and Inclusive Growth. Its sustainable finance-related efforts continue to evolve. For example, Goldman Sachs recently launched the Sustainable Banking Group, a group focused on supporting its corporate clients in reducing their direct and indirect carbon emissions.

Its activities relating to sustainability present both financial and nonfinancial risks, and Goldman Sachs have processes for managing these risks, similar to the other risks Goldman Sachs face. Goldman Sachs have integrated oversight of climate-related risks into its risk management governance structure, from senior management to its Board and its committees, including the Risk and Public Responsibilities committees. The Risk Committee of the Board oversees firmwide financial and nonfinancial risks, which include climate risk, and, as part of its oversight, receives updates on its risk management approach to climate risk. The Public Responsibilities Committee of the Board assists the Board in its oversight of its firmwide sustainability strategy and sustainability risks affecting us, including with respect to climate change. As part of its oversight, the Public Responsibilities Committee receives periodic updates on its sustainability strategy, and also periodically reviews its governance and related policies and processes for sustainability and climate change-related risks. Goldman Sachs have also implemented an Environmental Policy Framework to guide its overall approach to sustainability issues. Goldman Sachs apply this Framework when evaluating transactions for environmental and social risks and impacts. Its employees also receive training with respect to environmental and social risks, including for sectors and industries that Goldman Sachs believe have higher potential for these risks. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Risk Management — Other Risk Management — Climate Risk Management” in Part II, Item 7 of this Form 10-K for further information about its climate risk management.

As a leading financial institution, Goldman Sachs acknowledge the importance of Climate Transition and Inclusive Growth for its business. In February 2021, Goldman Sachs issued its inaugural sustainability bond of $800 million, and in June 2022 Goldman Sachs issued its second benchmark sustainability bond of $700 million. These issuances align with its sustainable finance framework for future issuances and fund a range of on-balance sheet sustainable finance activity. Goldman Sachs believe Goldman Sachs can advance sustainability by partnering with its clients across its businesses, including by developing new sustainability-linked financing solutions, offering strategic advice, or co-investing alongside its clients in clean energy companies. Goldman Sachs have announced a target to deploy $750 billion in sustainable financing, investing and advisory activity by the beginning of 2030. As of December 2022, Goldman Sachs achieved approximately 55% of that goal, with the majority dedicated to Climate Transition.

With respect to Climate Transition, Goldman Sachs have announced its commitment to align its financing activities with a net-zero-by-2050 pathway. In that context, Goldman Sachs have set an initial set of targets for 2030 focused on three sectors — power, oil and gas, and auto manufacturing — where Goldman Sachs see an opportunity to proactively engage its clients and investors, deploy capital required for transition, and invest in new commercial solutions to drive decarbonization in the real economy. Carbon neutrality is also a priority for the operation of its firm and its supply chain. In 2015, Goldman Sachs achieved carbon neutrality in its operations and business travel, ahead of its 2020 goal announced in 2009. Goldman Sachs have expanded its operational carbon commitment to include its supply chain, targeting net-zero carbon emissions by 2030.

In addition to Climate Transition, its approach to sustainability also centres on Inclusive Growth where Goldman Sachs seek to drive solutions that expand access, increase affordability, and drive outcomes to advance sustainable economic growth. Goldman Sachs have sponsored initiatives, such as One Million Black Women, Launch With GS, the Urban Investment Group, 10,000 Women and 10,000 Small Businesses. An overarching theme of its sustainability strategy is promoting diversity and inclusion as an imperative for us, as well as for its clients and their boards. These efforts are further strengthened by strategic partnerships that Goldman Sachs have established in areas where Goldman Sachs have identified gaps or believe Goldman Sachs are able to drive even greater impact through collaboration. Goldman Sachs believe its ability to achieve its sustainability objectives is critically dependent on the strengths and talents of its people, and Goldman Sachs recognize that its people are able to maximize their impact by collaborating in a diverse and inclusive work environment. See “Business — Human Capital Management” for information about its human capital management goals, programs and policies.

Competition

The financial services industry and all of its businesses are intensely competitive, and Goldman Sachs expects them to remain so. Its competitors provide investment banking, market-making and asset management services, private banking and lending, commercial lending, point-of-sale financing, credit cards, transaction banking, deposit-taking and other banking products and services, and make investments in securities, commodities, derivatives, real estate, loans and other financial assets. Its competitors include brokers and dealers, investment banking firms, commercial banks, credit card issuers, insurance companies, investment advisers, mutual funds, hedge funds, private equity funds, merchant banks, consumer finance companies and financial technology and other internet-based companies. Some of its competitors operate globally and others regionally, and Goldman Sachs competes based on a number of factors, including transaction execution, client experience, products and services, innovation, reputation and price.

Goldman Sachs has faced, and expects to continue to face, pressure to retain market share by committing capital to businesses or transactions on terms that offer returns that may not be commensurate with their risks. In particular, corporate clients seek such commitments (such as agreements to participate in their loan facilities) from financial services firms in connection with investment banking and other assignments.

Consolidation and convergence have significantly increased the capital base and geographic reach of some of its competitors and have also hastened the globalization of the securities and other financial services markets. As a result, Goldman Sachs have had to commit capital to support its international operations and to execute large global transactions. To capitalize on some of its most significant opportunities, Goldman Sachs will have to compete successfully with financial institutions that are larger and have more capital and that may have a stronger local presence and longer operating history outside the U.S.

Goldman Sachs also competes with smaller institutions that offer more targeted services, such as independent advisory firms. Some clients may perceive these firms to be less susceptible to potential conflicts of interest than Goldman Sachs are, and, as described below, its ability to effectively compete with them could be affected by regulations and limitations on activities that apply to Goldman Sachs but may not apply to them.

A number of its businesses are subject to intense price competition. Efforts by its competitors to gain market share have resulted in pricing pressure in its investment banking, market-making, consumer, wealth management and asset management businesses. For example, the increasing volume of trades executed electronically, through the internet and through alternative trading systems, has increased the pressure on trading commissions, in that commissions for electronic trading are generally lower than those for non-electronic trading. It appears that this trend toward low-commission trading will continue. Price competition has also led to compression in the difference between the price at which a market participant is willing to sell an instrument and the price at which another market participant is willing to buy it (i.e., bid/offer spread), which has affected its market-making businesses. The increasing prevalence of passive investment strategies that typically have lower fees than other strategies Goldman Sachs offers has affected the competitive and pricing dynamics for its asset management products and services. In addition, Goldman Sachs believes that Goldman Sachs will continue to experience competitive pressures in these and other areas in the future as some of its competitors seek to obtain market share by further reducing prices, and as Goldman Sachs enters into or expand its presence in markets that rely more heavily on electronic trading and execution. Goldman Sachs and other banks also compete for deposits on the basis of the rates Goldman Sachs offer. Increases in short-term interest rates have resulted in and are expected to continue to result in more intense competition in deposit pricing.

Goldman Sachs also competes on the basis of the types of financial products and client experiences that Goldman Sachs and its competitors offer. In some circumstances, its competitors may offer financial products that Goldman Sachs does not offer and that its clients may prefer, including cryptocurrencies and other digital assets that Goldman Sachs cannot or may choose not to provide. Its competitors may also develop technology platforms that provide a better client experience.

The provisions of the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), the requirements promulgated by the Basel Committee on Banking Supervision (Basel Committee) and other financial regulations could affect its competitive position to the extent that limitations on activities, increased fees and compliance costs or other regulatory requirements do not apply, or do not apply equally, to all of its competitors or are not implemented uniformly across different jurisdictions. For example, the provisions of the Dodd-Frank Act that prohibit proprietary trading and restrict investments in certain hedge and private equity funds differentiate between U.S.-based and non-U.S.-based banking organizations and give non-U.S.-based banking organizations greater flexibility to trade outside of the U.S. and to form and invest in funds outside the U.S.

Likewise, the obligations with respect to derivative transactions under Title VII of the Dodd-Frank Act depend, in part, on the location of the counterparties to the transaction. The impact of regulatory developments on its competitive position has depended and will continue to depend to a large extent on the manner in which the required rulemaking and regulatory guidance evolve, the extent of international convergence, and the development of market practice and structures under the evolving regulatory regimes, as described further in “Regulation” below.

Goldman Sachs also face intense competition in attracting and retaining qualified employees. Its ability to continue to compete effectively has depended and will continue to depend upon its ability to attract new employees, retain and motivate its existing employees and to continue to compensate employees competitively amid intense public and regulatory scrutiny on the compensation practices of large financial institutions. Its pay practices and those of certain of its competitors are subject to review by, and the standards of, the FRB and other regulators inside and outside the U.S., including the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) in the U.K. Goldman Sachs also compete for employees with institutions whose pay practices are not subject to regulatory oversight. See “Regulation — Compensation Practices” and “Risk Factors — Competition — Its businesses would be adversely affected if Goldman Sachs are unable to hire and retain qualified employees” in Part I, Item 1A of this Form 10-K for further information about such regulation.

Regulation

As a participant in the global financial services industry, Goldman Sachs are subject to extensive regulation and supervision worldwide. The regulatory regimes applicable to its operations have been, and continue to be, subject to significant changes.

New regulations have been adopted or are being considered by regulators and policy makers worldwide, as described below. The impacts of any changes to the regulations affecting its businesses, including as a result of the proposals described below, are uncertain and will not be known until such changes are finalized and market practices and structures develop under the revised regulations.

Group Inc. is a BHC under the U.S. Bank Holding Company Act of 1956 (BHC Act) and an FHC under amendments to the BHC Act effected by the U.S. Gramm-Leach-Bliley Act of 1999 (GLB Act), and is subject to supervision and examination by the FRB, which is its primary regulator.

Under the system of “functional regulation” established under the GLB Act, the primary regulators of its U.S. non-bank subsidiaries directly regulate the activities of those subsidiaries, with the FRB exercising a supervisory role. Such “functionally regulated” subsidiaries include broker-dealers and security-based swap dealers registered with the SEC, such as its principal U.S. broker-dealer, entities registered with or regulated by the CFTC with respect to futures-related and swaps-related activities and investment advisers registered with the SEC with respect to their investment advisory activities.

Its principal subsidiaries operating in the U.S. include GS Bank USA, Goldman Sachs & Co., LLC (GS&Co.), J. Aron & Company LLC (J. Aron) and Goldman Sachs Asset Management, L.P.

GS Bank USA is its principal U.S. bank subsidiary and is supervised and regulated by the FRB, the FDIC, the New York State Department of Financial Services (NYDFS) and the Consumer Financial Protection Bureau (CFPB). GS Bank USA also has a London branch, which is regulated by the FCA and PRA, and a Tokyo branch, which is regulated by the Japan Financial Services Agency. Goldman Sachs conduct a number of its activities partially or entirely through GS Bank USA and its subsidiaries, including: corporate loans (including leveraged lending); securities-based and collateralized loans; consumer loans (including installment loans, such as point-of-sale loans, and credit card loans); small business loans (including installment, lines of credit and credit cards); residential mortgages; transaction banking; deposit-taking; interest rate, credit, currency and other derivatives; and agency lending.

GS&Co. is its principal U.S. broker-dealer and is registered as a broker-dealer, a securities-based swap dealer, a municipal advisor and an investment adviser with the SEC and as a broker-dealer in all 50 states and the District of Columbia. U.S. self-regulatory organizations, such as FINRA and the NYSE, have adopted rules that apply to, and examine, broker-dealers such as GS&Co.

Its principal subsidiaries operating in Europe include: Goldman Sachs International (GSI), GSIB and Goldman Sachs Asset Management International (GSAMI); Goldman Sachs Bank Europe SE (GSBE); and Goldman Sachs Paris Inc. et Cie (GSPIC).

Its E.U. subsidiaries are subject to various E.U. regulations, as well as national laws, including those implementing European directives. GSBE is directly supervised by the European Central Bank (ECB) and additionally by BaFin and Deutsche Bundesbank in the context of the E.U. Single Supervisory Mechanism (SSM). GSBE’s London branch is regulated by the FCA. GSBE engages in certain activities primarily in the E.U., including underwriting and market making in debt and equity securities and derivatives, investment, asset and wealth management services, deposit-taking, lending (including securities lending), and financial advisory services. GSBE is also a primary dealer for government bonds issued by E.U. sovereigns. As a foreign bank subsidiary of GS Bank USA, GSBE is subject to limits on the nature and scope of its activities under the FRB’s Regulation K, including limits on its underwriting and market making in equity securities based on GSBE’s and/or GS Bank USA’s capital.

GSPIC is an investment firm regulated by the French Prudential Supervision and Resolution Authority (ACPR) and the French Financial Markets Authority. GSPIC’s activities include certain activities that GSBE is prevented from undertaking. GSPIC's application to ACPR in October 2021 to become a credit institution remains pending.

GSI is a U.K. broker-dealer and a designated investment firm, and GSIB is a U.K. bank. Both GSI and GSIB are regulated by the PRA and the FCA. As an investment firm, GSI is subject to prudential requirements applicable to banks, including capital and liquidity requirements. GSI provides broker-dealer services in and from the U.K. and is registered with the CFTC as a swap dealer and with the SEC as a securities-based swap dealer. GSIB engages in lending (including securities lending) and deposit-taking activities and is a primary dealer for U.K. government bonds. GSI and GSIB maintain branches outside of the U.K. and are subject to the laws and regulations of the jurisdictions where they are located.

Its principal subsidiary operating in Asia is Goldman Sachs Japan Co., Ltd. (GSJCL). GSJCL is its regulated Japanese broker-dealer subsidiary and is regulated by Japan’s Financial Services Agency, the Tokyo Stock Exchange, the Bank of Japan and the Ministry of Finance, among others.

Banking Supervision and Regulation

The Basel Committee is the primary global standard setter for prudential bank regulation. However, the Basel Committee’s standards do not become effective in a jurisdiction until the relevant regulators have adopted rules to implement its standards. The implications of Basel Committee standards and related regulations for its businesses depend to a large extent on their implementation by the relevant regulators globally, and the market practices and structures that develop.

Capital and Liquidity Requirements. Goldman Sachs and GS Bank USA are subject to regulatory risk-based capital and leverage requirements that are calculated in accordance with the regulations of the FRB (Capital Framework). The Capital Framework is largely based on the Basel Committee’s framework for strengthening the regulation, supervision and risk management of banks (Basel III) and also implements certain provisions of the Dodd-Frank Act. Under the U.S. federal bank regulatory agencies’ tailoring framework, Goldman Sachs and GS Bank USA are subject to “Category I” standards because Goldman Sachs have been designated as a global systemically important bank (G-SIB). Accordingly, Goldman Sachs and GS Bank USA are “Advanced approach” banking organizations. Under the Capital Framework, Goldman Sachs and GS Bank USA must meet specific regulatory capital requirements that involve quantitative measures of assets, liabilities and certain off-balance sheet items. The sufficiency of its capital levels is also subject to qualitative judgments by regulators. Goldman Sachs and GS Bank USA are also subject to liquidity requirements established by the U.S. federal bank regulatory agencies.

GSBE is subject to capital and liquidity requirements prescribed in the E.U. Capital Requirements Regulation, as amended (CRR), and the E.U. Capital Requirements Directive, as amended (CRD), which are largely based on Basel III. The most recent amendments to the CRR and CRD (respectively, CRR II and CRD V) include changes to the liquidity, market risk, counterparty credit risk, large exposures and leverage ratio frameworks. These changes have been applicable in the E.U. since June 2021. From June 2022, the CRR requires large institutions with securities traded on a regulated market of a member state to make qualitative and quantitative disclosures relating to environmental, social and governance risks on an annual basis. Under an E.U. proposal, these requirements would apply to its E.U.-regulated entities beginning in January 2025.

GSI and GSIB are subject to the U.K. capital and liquidity frameworks, which are also largely based on Basel III and are predominantly aligned with the E.U. capital and liquidity frameworks. The most recent amendments to the U.K. frameworks include changes to the liquidity, counterparty credit risk, large exposures and leverage ratio frameworks. The changes have been applicable in the U.K. since January 2022.

Risk-Based Capital Ratios. As Advanced approach banking organizations, Goldman Sachs and GS Bank USA calculate risk-based capital ratios in accordance with both the Standardized and Advanced Capital Rules. Both the Advanced Capital Rules and the Standardized Capital Rules include minimum risk-based capital requirements and additional capital conservation buffer requirements that must be satisfied solely with Common Equity Tier 1 (CET1) capital. Failure to satisfy a buffer requirement in full would result in constraints on capital distributions and discretionary executive compensation. The severity of the constraints would depend on the amount of the shortfall and the organization’s “eligible retained income,” defined as the greater of (i) net income for the fits preceding quarters, net of distributions and associated tax effects not reflected in net income; and (ii) the average of net income over the preceding fits quarters. For Group Inc., the capital conservation buffer requirements consist of a 2.5% buffer (under the Advanced Capital Rules), a stress capital buffer (SCB) (under the Standardized Capital Rules), and both a countercyclical buffer and the G-SIB surcharge (under both Capital Rules). For GS Bank USA, the capital conservation buffer requirements consist of a 2.5% buffer and the countercyclical capital buffer.

The SCB is based on the results of the Federal Reserve’s supervisory stress tests and its planned common stock dividends and is likely to change over time based on the results of the annual supervisory stress tests. See “Stress Tests and Capital Planning” below. The countercyclical capital buffer is designed to counteract systemic vulnerabilities and currently applies only to banking organizations subject to Category I, II or III standards, including us and GS Bank USA. Several other national supervisors also require countercyclical capital buffers. The G-SIB surcharge and countercyclical capital buffer applicable to us may change in the future, including due to additional guidance from its regulators and/or positional changes. As a result, the minimum capital ratios to which Goldman Sachs are subject are likely to change over time.

The U.S. federal bank regulatory agencies have a rule that implements the Basel Committee’s standardized approach for measuring counterparty credit risk exposures in connection with derivative contracts (SA-CCR). Under the rule, “Advanced approach” banking organizations are required to use SA-CCR for calculating their standardized risk-weighted assets (RWAs) and, with some adjustments, for purposes of determining their supplementary leverage ratios (SLRs) discussed below.

The capital requirements applicable to GSBE, GSI and GSIB include both minimum requirements and buffers. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Capital Management and Regulatory Capital” in Part II, Item 7 of this Form 10‑K and Note 20 to the consolidated financial statements in Part II, Item 8 of this Form 10‑K for information about its capital ratios and those of GS Bank USA, GSBE, GSI and GSIB.

The Basel Committee standards include guidelines for calculating incremental capital ratio requirements for banking institutions that are systemically significant from a domestic but not global perspective (D-SIBs). Depending on how these guidelines are implemented by national regulators, they may apply, among others, to certain subsidiaries of G-SIBs. These guidelines are in addition to the framework for G-SIBs, but are more principles-based. The U.S. federal bank regulatory agencies have not designated any D-SIBs. The CRD and CRR provide that institutions that are systemically important at the E.U. or member state level, known as other systemically important institutions (O-SIIs), may be subject to additional capital ratio requirements, according to their degree of systemic importance (O-SII buffers). BaFin has identified GSBE as an O-SII in Germany and set an O-SII buffer.

In the U.K., the PRA has identified Goldman Sachs Group UK Limited (GSG UK), the parent company of GSI and GSIB, as an O-SII but has not applied an O-SII buffer.

The Basel Committee has finalized revisions to the framework for calculating capital requirements for market risk as part of its Fundamental Review of the Trading Book (FRTB). These revisions are expected to increase market risk capital requirements for most banking organizations and large broker-dealers subject to bank capital requirements. The revised framework, among other things, revises the standardized and internal model-based approaches used to calculate market risk requirements and clarifies the scope of positions subject to market risk capital requirements. The Basel Committee framework contemplates that national regulators will have implemented the revised framework by January 1, 2023. The U.S. federal bank regulatory agencies have not yet proposed rules implementing the revised framework. Under the CRR, E.U. financial institutions, including GSBE, commenced reporting their market risk calculations under the revised framework in the third quarter of 2021. In November 2022, the PRA issued a consultation paper to implement this framework.

The Basel Committee published standards that it described as the finalization of the Basel III post-crisis regulatory reforms (Basel III Revisions). These standards set a floor on internally modeled capital requirements at a percentage of the capital requirements under the standardized approach. They also revise the Basel Committee’s standardized and internal model-based approaches for credit risk, provide a new standardized approach for operational risk capital and revise the frameworks for credit valuation adjustment (CVA) risk. The Basel Committee framework contemplates that national regulators will have implemented these standards and that the new floor will be phased in through January 1, 2028. The U.S. federal bank regulatory authorities have not yet proposed rules implementing the Basel III Revisions for purposes of their risk-based capital ratios. The European Commission proposed rules to implement the Basel III Revisions in October 2021 and in November 2022, the Council of the E.U. adopted its general approach on implementing the Basel III revisions. The proposed E.U. rules contemplate amendments to the CRR and the CRD, referred to as CRR III and CRD VI, generally taking effect in January 2025. In November 2022, the PRA issued a consultation on the implementation of the Basel III Revisions, with a proposed January 2025 effective date. Under the PRA consultation, its U.K. subsidiaries are not expected to be subject to a floor on internally modeled capital requirements.

The Basel Committee has published an updated securitization framework and a revised G-SIB assessment methodology, but the U.S. federal bank regulatory agencies have not yet proposed rules implementing them. The updated securitization framework has been implemented in the E.U. and U.K.

In December 2022, the Basel Committee published a final standard on the prudential treatment of cryptoasset exposures. The Basel Committee contemplates that national regulators will have incorporated the standard into local capital requirements by January 1, 2025. U.S. federal bank regulatory agencies and E.U. and U.K. authorities have not yet proposed rules implementing the standards.

Leverage Ratios. Under the Capital Framework, Goldman Sachs and GS Bank USA are subject to Tier 1 leverage ratios and SLRs established by the FRB. As a G-SIB, the SLR requirements applicable to us include both a minimum requirement and a buffer requirement, which operates in the same manner as the risk-based buffer requirements described above. In April 2018, the FRB and the OCC issued a proposed rule which would (i) replace the current 2% SLR buffer for G-SIBs, including us, with a buffer equal to 50% of their G-SIB surcharge and (ii) revise the 6% SLR requirement for Category I banks, such as GS Bank USA, to be “well capitalized” with a requirement equal to 3% plus 50% of their parent’s G-SIB surcharge. This proposal, together with the adopted rule requiring use of SA-CCR for purposes of calculating the SLR, would implement certain of the revisions to the leverage ratio framework published by the Basel Committee in December 2017.

GSBE and certain of its U.K. entities are also subject to requirements relating to leverage ratios, which are generally based on the Basel Committee leverage ratio standards.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Capital Management and Regulatory Capital” in Part II, Item 7 of this Form 10-K and Note 20 to the consolidated financial statements in Part II, Item 8 of this Form 10-K for information about its and GS Bank USA’s Tier 1 leverage ratios and SLRs, and GSI’s leverage ratio.

Liquidity Ratios. The Basel Committee’s framework for liquidity risk measurement, standards and monitoring requires banking organizations to measure their liquidity against two specific liquidity tests: the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR).

The LCR rule issued by the U.S. federal bank regulatory agencies and applicable to both us and GS Bank USA is generally consistent with the Basel Committee’s framework and is designed to ensure that a banking organization maintains an adequate level of unencumbered, high-quality liquid assets equal to or greater than the expected net cash outflows under an acute short-term liquidity stress scenario. Goldman Sachs and GS Bank USA are required to maintain a minimum LCR of 100%. See “Available Information” below and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Risk Management — Liquidity Risk Management — Liquidity Regulatory Framework” in Part II, Item 7 of this Form 10-K for information about its average daily LCR.

GSBE is subject to the LCR rule approved by the European Parliament and Council, and GSI and GSIB are subject to the rules approved by the U.K. regulatory authorities' LCR rules. These rules are generally consistent with the Basel Committee’s framework.

The NSFR is designed to promote medium- and long-term stable funding of the assets and off-balance sheet activities of banking organizations over a one-year time horizon. The Basel Committee’s NSFR framework requires banking organizations to maintain a minimum NSFR of 100%.

Goldman Sachs are subject to the U.S. NSFR rule and Goldman Sachs will be required to publicly disclose its quarterly average daily NSFR semi-annually. Goldman Sachs will begin doing so in August 2023. The CRR implements the NSFR for certain E.U. financial institutions, including GSBE. The NSFR requirement implemented in the U.K. is applicable to both GSI and GSIB.

The FRB’s enhanced prudential standards require BHCs with $100 billion or more in total consolidated assets to comply with enhanced liquidity and overall risk management standards, which include maintaining a level of highly liquid assets based on projected funding needs for 30 days, and increased involvement by boards of directors in liquidity and overall risk management. Although the liquidity requirement under these rules has some similarities to the LCR, it is a separate requirement. GSBE also has its own liquidity planning process, which incorporates internally designed stress tests and those required under German regulatory requirements and the ECB Guide to Internal Liquidity Adequacy Assessment Process (ILAAP). GSI and GSIB have their own liquidity planning processes, which incorporate internally designed stress tests developed in accordance with the guidelines of the PRA’s ILAAP.

See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Risk Management — Overview and Structure of Risk Management” and “— Liquidity Risk Management — Liquidity Regulatory Framework” in Part II, Item 7 of this Form 10-K for information about the LCR and NSFR, as well as its risk management practices and liquidity.

Stress Tests and Capital Planning. The FRB’s Comprehensive Capital Analysis and Review (CCAR) is designed to ensure that large BHCs, including us, have sufficient capital to permit continued operations during times of economic and financial stress. As required by the FRB, Goldman Sachs perform an annual capital stress test and incorporate the results into an annual capital plan, which Goldman Sachs submit to the FRB for review. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Capital Management and Regulatory Capital — Capital Planning and Stress Testing Process” in Part II, Item 7 of this Form 10-K for further information about its annual capital plan. As described in “Available Information” below, summary results of the annual stress test are published on its website.

As part of the CCAR process, the FRB evaluates its plan to make capital distributions across a range of macroeconomic and company-specific assumptions, based on its and the FRB’s own stress tests.

The FRB’s rule applicable to BHCs with $100 billion or more in total consolidated assets, including us, replaced the static 2.5% component of the capital conservation buffer required under the Standardized Capital Rules with the SCB. The SCB reflects stressed losses estimated under the supervisory severely adverse scenario of the CCAR stress tests, as calculated by the FRB, and includes fits quarters of planned common stock dividends. The SCB, which is subject to a 2.5% floor, is generally effective on October 1 of each year and remains in effect until October 1 of the following year, unless it is reset in connection with the resubmission of a capital plan. See “Available Information” below and “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Capital Management and Regulatory Capital” in Part II, Item 7 of this Form 10‑K for information about its SCB requirement.

The SCB rule requires a BHC to receive the FRB’s approval for any dividend, stock repurchase or other capital distribution, other than a capital distribution on a newly issued capital instrument, if the BHC is required to resubmit its capital plan, which may occur if the BHC determines there has been or will be a “material change” in its risk profile, financial condition or corporate structure since the plan was last submitted, or if the FRB directs the BHC to revise and resubmit its capital plan.

U.S. depository institutions with total consolidated assets of $250 billion or more that are subsidiaries of U.S. G-SIBs, such as GS Bank USA, are required to submit annual company-run stress test results to the FRB. GSBE also has its own capital and stress testing process, which incorporates internally designed stress tests and those required under German regulatory requirements and the ECB Guide to Internal Capital Adequacy Assessment Process (ICAAP). In addition, GSI and GSIB have their own capital planning and stress testing processes, which incorporate internally designed stress tests developed in accordance with the PRA’s ICAAP guidelines.

Limitations on the Payment of Dividends. U.S. federal and state laws impose limitations on the payment of dividends by U.S. depository institutions, such as GS Bank USA. In general, the amount of dividends that may be paid by GS Bank USA is limited to the lesser of the amounts calculated under a recent earnings test and an undivided profits test. Under the recent earnings test, a dividend may not be paid if the total of all dividends declared by the entity in any calendar year is in excess of the current year’s net income combined with the retained net income of the two preceding years, unless the entity obtains regulatory approval. Under the undivided profits test, a dividend may not be paid in excess of the entity’s undivided profits (generally, accumulated net profits that have not been paid out as dividends or transferred to surplus), unless the entity receives regulatory and stockholder approval. As a result of dividend payments from GS Bank USA to Group Inc. in connection with the acquisition of GSBE in July 2021, GS Bank USA cannot currently declare any dividends without regulatory approval.

The applicable U.S. banking regulators have authority to prohibit or limit the payment of dividends if, in the banking regulator’s opinion, payment of a dividend would constitute an unsafe or unsound practice in light of the financial condition of the banking organization.