The Goldman Sachs Group, Inc.

| |

Headquarters at 200 West Street in Lower Manhattan | |

| Type | Public |

|---|---|

| ISIN | [https://stockhub.co/index.php?title=Toollabs:isin/&language=en&isin=US38141G1040 US38141G1040] |

| Industry | Financial services |

| Founded | 1869 |

| Founders | |

| Headquarters | 200 West Street, , U.S. |

Area served | Worldwide |

Key people |

|

| Revenue | |

| AUM | |

| Total assets | |

| Total equity | |

Number of employees | |

| Divisions | |

| Subsidiaries |

|

| Capital ratio | Tier 1 15.0% (2022; Basel III Advanced) |

| Rating |

|

| Website |

|

| Footnotes / references [1] | |

Goldman Sachs Group, Inc. is a leading global financial institution offering a comprehensive suite of services to a diverse client base, encompassing corporations, financial institutions, governments, and private individuals worldwide.

The company operates across four primary sectors: Investment Banking, Global Markets, Asset Management, and Consumer & Wealth Management. In the Investment Banking sector, Goldman Sachs delivers a range of strategic financial advisory services encompassing M&A, divestitures, corporate defence, restructurings, and spin-offs. It also extends a variety of lending services, from middle-market and relationship lending to acquisition financing, supplemented by comprehensive transaction banking services. Additionally, the segment provides robust underwriting services for equity and debt, alongside structured securities origination.

Goldman Sachs' Global Markets division focuses on client execution activities for a plethora of financial instruments. This includes cash and derivatives, credit and interest rate products, along with equity intermediation and financing. This division also offers a range of support services such as clearing, settlement, and custody while dealing in mortgages, currencies, commodities, and equities.

In the Asset Management division, the company demonstrates broad expertise across diverse asset classes, from equities, fixed income, hedge funds, and private equity, to real estate, currencies, and commodities. Alongside these, it delivers tailored investment advisory solutions, and maintains investments in corporate, real estate, and infrastructure entities.

The Consumer & Wealth Management division provides comprehensive wealth advisory and banking services, including financial planning, investment management, deposit and lending services, as well as private banking. Furthermore, it offers unsecured loans and accepts savings and time deposits.

Since its inception in 1869, Goldman Sachs has been committed to creating client value, with its headquarters located in New York, New York.

Industry Overview edit edit source

Introduction:

Goldman Sachs Group, Inc. is a prominent global investment banking, securities, and investment management firm that has been a key player in the financial services industry since its founding in 1869. The company has established a strong reputation for providing a wide array of financial services to a diverse range of clients worldwide.

Markets and Size:

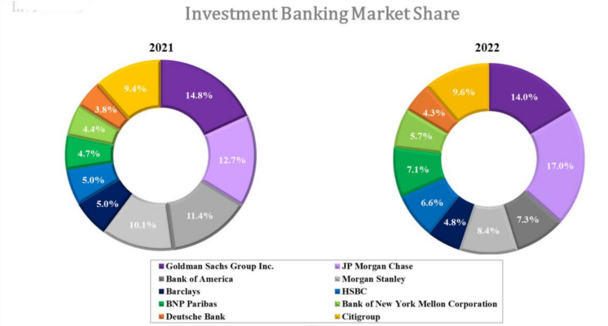

- Investment Banking: Goldman Sachs operates in the investment banking market, offering strategic advisory services for mergers and acquisitions, capital raising through debt and equity offerings, and restructuring transactions. The investment banking market is substantial, with global revenues exceeding hundreds of billions of dollars annually.

- Trading and Sales: In the institutional client services segment, Goldman Sachs participates in various financial markets, including equities, fixed income, currencies, and commodities. These markets are highly liquid and witness massive daily trading volumes, reaching trillions of dollars.

- Investment Management: Goldman Sachs Asset Management (GSAM) competes in the investment management industry, managing assets for institutional investors, corporations, pension funds, sovereign wealth funds, and individual clients. The size of the global investment management industry is substantial, with assets under management (AUM) amounting to tens of trillions of dollars.

- Consumer and Wealth Management: With its digital platform, Marcus by Goldman Sachs, the firm operates in the consumer banking and wealth management markets, offering savings accounts, personal loans, and wealth advisory services. The consumer banking industry represents trillions of dollars in assets, while the wealth management sector serves high-net-worth individuals with assets in the multi-trillions.

Challenges Facing the Industry:

- Regulatory Compliance: The financial services industry operates in a highly regulated environment, and Goldman Sachs faces challenges in navigating and complying with complex and ever-changing regulations across different jurisdictions.

- Market Volatility: Financial markets are susceptible to fluctuations and economic uncertainties, impacting Goldman Sachs' trading revenues and investment decisions.

- Geopolitical Risks: Political events and geopolitical tensions can introduce volatility and risk into global markets, affecting Goldman Sachs' operations and client activity.

- Technological Disruptions: The rise of financial technology (FinTech) has disrupted traditional financial services. Goldman Sachs needs to stay at the forefront of technological advancements to remain competitive and address changing customer expectations.

- Talent Management: Attracting and retaining top talent in the highly competitive financial industry is a persistent challenge for Goldman Sachs.

Opportunities:

- Emerging Markets: Expanding into high-growth emerging markets presents opportunities for Goldman Sachs to diversify its revenue streams and access new clients and investment opportunities.

- Sustainable Finance: The increasing demand for environmentally and socially responsible investments creates a growth opportunity for Goldman Sachs to develop and offer sustainable finance products and services.

- Digital Transformation: Investing in digital technologies and enhancing digital platforms allows Goldman Sachs to improve client experiences, streamline operations, and access new customer segments.

Company Overview edit edit source

Goldman Sachs is a leading global financial institution that delivers a broad range of financial services to a large and diversified client base that includes corporations, financial institutions, governments and individuals. Its purpose is to advance sustainable economic growth and financial opportunity. Its goal, reflected in its One Goldman Sachs initiative, is to deliver the full range of its services and expertise to support its clients in a more accessible, comprehensive and efficient manner, across businesses and product areas.

Group Inc. is a bank holding company (BHC) and a financial holding company (FHC) regulated by the Board of Governors of the Federal Reserve System (FRB). Its U.S. depository institution subsidiary, Goldman Sachs Bank USA (GS Bank USA), is a New York State-chartered bank.

The company's mission is 'to be the world’s most exceptional financial institution, united by our shared values of partnership, client service, integrity and excellence'. This is reflected by their commitment to their purpose and values.

Business Segments edit edit source

Goldman Sachs manages and reports its activities in three business segments: Global Banking & Markets, Asset & Wealth Management and Platform Solutions. Global Banking & Markets generates revenues from investment banking fees, including advisory, and equity and debt underwriting fees, Fixed Income, Currency and Commodities (FICC) intermediation and financing activities and Equities intermediation and financing activities, as well as relationship lending and acquisition financing (and related hedges) and investing activities related to its Global Banking & Markets activities. Asset & Wealth Management generates revenues from management and other fees, incentive fees, private banking and lending, equity investments and debt investments. Platform Solutions generates revenues from consumer platforms, and transaction banking and other platform businesses.

The chart below presents its three business segments and their revenue sources.

Prior to the fourth quarter of 2022, Goldman Sachs managed and reported its activities in the following fits business segments: Investment Banking, Global Markets, Asset Management and Consumer & Wealth Management. Beginning with the fourth quarter of 2022, consistent with its previously announced organizational changes, Goldman Sachs began managing and reporting its activities in three new segments: Global Banking & Markets, Asset & Wealth Management and Platform Solutions. Its new segments reflect the following primary changes:

- Global Banking & Markets is a new segment that includes the results previously reported in Investment Banking and Global Markets, and additionally includes the results from equity and debt investments related to its Global Banking & Markets activities, previously reported in Asset Management.

- Asset & Wealth Management is a new segment that includes the results previously reported in Asset Management and Wealth Management (previously included in Consumer & Wealth Management), and additionally includes the results from its direct-to-consumer banking business, which includes lending, deposit-taking and investing, previously reported in Consumer & Wealth Management, as well as the results from middle-market lending related to its asset management activities, previously reported in Investment Banking.

- Platform Solutions is a new segment that includes the results from its consumer platforms, such as partnerships offering credit cards and point-of-sale financing, previously reported in Consumer & Wealth Management, and the results from its transaction banking business, previously reported in Investment Banking.

Global Banking & Markets edit edit source

Global Banking & Markets serves public and private sector clients and Goldman Sachs seek to develop and maintain long-term relationships with a diverse global group of institutional clients, including corporations, governments, states and municipalities. Its goal is to deliver to its institutional clients all of its resources in a seamless fashion, with its advisory and underwriting activities serving as the main initial point of contact. Goldman Sachs makes markets and facilitate client transactions in fixed income, currency, commodity and equity products and offer market expertise on a global basis. In addition, Goldman Sachs makes markets in, and clear client transactions on, major stock, options and futures exchanges worldwide. Its clients include companies that raise capital and funding to grow and strengthen their businesses, and engage in mergers and acquisitions, divestitures, corporate defense, restructurings and spin-offs, as well as companies that are professional market participants, who buy and sell financial products and manage risk, and investment entities whose ultimate clients include individual investors investing for their retirement, buying insurance or saving surplus cash.

As a market maker, Goldman Sachs provides prices to clients globally across thousands of products in all major asset classes and markets. At times, Goldman Sachs takes the other side of transactions itself if a buyer or seller is not readily available, and at other times Goldman Sachs connect its clients to other parties who want to transact. Its willingness to make markets, commit capital and take risk in a broad range of products is crucial to its client relationships. Market makers provide liquidity and play a critical role in price discovery, which contributes to the overall efficiency of the capital markets. In connection with its market-making activities, Goldman Sachs maintains (i) market-making positions, typically for a short period of time, in response to, or in anticipation of, client demand, and (ii) positions to actively manage its risk exposures that arise from these market-making activities (collectively, inventory).

Goldman Sachs executes a high volume of transactions for its clients in large, highly liquid markets (such as markets for U.S. Treasury securities, stocks and certain agency mortgage pass-through securities[2]). Goldman Sachs also executes transactions for its clients in less liquid markets (such as mid-cap corporate bonds, emerging market currencies and certain non-agency mortgage-backed securities) for spreads and fees that are generally somewhat larger than those charged in more liquid markets. Additionally, Goldman Sachs structures and executes transactions involving customized or tailor-made products that address its clients’ risk exposures, investment objectives or other complex needs, as well as derivative transactions related to client advisory and underwriting activities.

Through its global sales force, Goldman Sachs maintains relationships with its clients, receiving orders and distributing investment research, trading ideas, market information and analysis. Much of this connectivity between Goldman Sachs and its clients is maintained on technology platforms, including Marquee, and operates globally where markets are open for trading. Marquee provides institutional investors with market intelligence, risk analytics, proprietary datasets and trade execution across multiple asset classes.

Its businesses are supported by its Global Investment Research business, which, as of December 2022, provided fundamental research on approximately 3,000 companies worldwide and on approximately 50 national economies, as well as on industries, currencies and commodities.

Its activities are organized by asset class and include both “cash” and “derivative” instruments. “Cash” refers to trading the underlying instrument (such as a stock, bond or barrel of oil). “Derivative” refers to instruments that derive their value from underlying asset prices, indices, reference rates and other inputs, or a combination of these factors (such as an option, which is the right or obligation to buy or sell a certain bond, stock or other asset on a specified date in the future at a certain price, or an interest rate swap, which is the agreement to convert a fixed rate of interest into a floating rate or vice versa).

Global Banking & Markets generates revenues from the following:

Investment banking fees - Goldman Sachs provides advisory and underwriting services to its clients.

Investment banking fees includes the following:

- Advisory - Goldman Sachs has been a leader for many years in providing advisory services, including strategic advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense activities, restructurings and spin-offs. In particular, Goldman Sachs help clients execute large, complex transactions for which Goldman Sachs provides multiple services, including cross-border structuring expertise. Goldman Sachs also assists its clients in managing their asset and liability exposures and their capital.

- Underwriting - Goldman Sachs helps companies raise capital to fund their businesses. As a financial intermediary, its job is to match the capital of its investing clients, who aim to grow the savings of millions of people, with the needs of its public and private sector clients, who need financing to generate growth, create jobs and deliver products and services. Its underwriting activities include public offerings and private placements of a wide range of securities and other financial instruments, including local and cross-border transactions and acquisition financing. Underwriting consists of the following:

- Equity underwriting. Goldman Sachs underwrites common stock, preferred stock, convertible securities and exchangeable securities. Goldman Sachs regularly receives mandates for large, complex transactions and has held a leading position in worldwide public common stock offerings and worldwide initial public offerings for many years.

- Debt underwriting. Goldman Sachs originates and underwrites various types of debt instruments, including investment-grade and high-yield debt, bank and bridge loans, including in connection with acquisition financing, and emerging- and growth-market debt, which may be issued by, among others, corporate, sovereign, municipal and agency issuers. In addition, Goldman Sachs underwrites and originates structured securities, which include mortgage-related securities and other asset-backed securities.

FICC - FICC generates revenues from intermediation and financing activities.

- FICC intermediation - Includes client execution activities related to making markets in both cash and derivative instruments, as detailed below.

Interest Rate Products. Government bonds (including inflation-linked securities) across maturities, other government-backed securities, and interest rate swaps, options and other derivatives.

Credit Products. Investment-grade and high-yield corporate securities, credit derivatives, exchange-traded funds (ETFs), bank and bridge loans, municipal securities, distressed debt and trade claims.

Mortgages. Commercial mortgage-related securities, loans and derivatives, residential mortgage-related securities, loans and derivatives (including U.S. government agency-issued collateralized mortgage obligations and other securities and loans), and other asset-backed securities, loans and derivatives.

Currencies. Currency options, spot/forwards and other derivatives on G-10 currencies and emerging-market products.

Commodities. Commodity derivatives and, to a lesser extent, physical commodities, involving crude oil and petroleum products, natural gas, agricultural, base, precious and other metals, electricity, including renewable power, environmental products and other commodity products.

- FICC financing - Includes secured lending to its clients through structured credit and asset-backed lending, including warehouse loans backed by mortgages (including residential and commercial mortgage loans), corporate loans and consumer loans (including auto loans and private student loans). Goldman Sachs also provides financing to clients through securities purchased under agreements to resell (resale agreements).

Equities - Equities generates revenues from intermediation and financing activities.

- Equities intermediation - Goldman Sachs makes markets in equity securities and equity-related products, including ETFs, convertible securities, options, futures and over-the-counter (OTC) derivative instruments. As a principal, Goldman Sachs facilitates client transactions by providing liquidity to its clients, including by transacting in large blocks of stocks or derivatives, requiring the commitment of its capital.

Goldman Sachs also structures and make markets in derivatives on indices, industry sectors, financial measures and individual company stocks. Goldman Sachs develops strategies and provides information about portfolio hedging and restructuring and asset allocation transactions for its clients. Goldman Sachs also works with its clients to create specially tailored instruments to enable sophisticated investors to establish or liquidate investment positions or undertake hedging strategies. Goldman Sachs is one of the leading participants in the trading and development of equity derivative instruments.

Its exchange-based market-making activities include making markets in stocks and ETFs, futures and options on major exchanges worldwide.

Goldman Sachs generates commissions and fees from executing and clearing institutional client transactions on major stock, options and futures exchanges worldwide, as well as OTC transactions. Goldman Sachs provide its clients with access to a broad spectrum of equity execution services, including electronic “low-touch”[3] access and more complex “high-touch”[3] execution through both traditional and electronic platforms, including Marquee.

- Equities financing - Includes prime brokerage and other equities financing activities, including securities lending, margin lending and swaps.

Goldman Sachs earns fees by providing clearing, settlement and custody services globally. In addition, Goldman Sachs provides its hedge fund and other clients with a technology platform and reporting that enables them to monitor their security portfolios and manage risk exposures.

Goldman Sachs provides services that principally involve borrowing and lending securities to cover institutional clients’ short sales and borrowing securities to cover its short sales and to make deliveries into the market. In addition, Goldman Sachs is an active participant in broker-to-broker securities lending and third-party agency lending activities.

Goldman Sachs provides financing to its clients for their securities trading activities through margin loans that are collateralized by securities, cash or other acceptable collateral. Goldman Sachs earns a spread equal to the difference between the amount Goldman Sachs pays for funds and the amount Goldman Sachs receives from its client.

Goldman Sachs executes swap transactions to provide its clients with exposure to securities and indices.

Goldman Sachs also provides securities-based loans to individuals.

Other - Goldman Sachs lends to corporate clients, including through relationship lending[4] and acquisition financing. The hedges related to this lending and financing activity are also reported as part of Other. Other also includes equity and debt investing activities related to its Global Banking & Markets activities.

Asset & Wealth Management edit edit source

Asset & Wealth Management provides investment services to help clients preserve and grow their financial assets and achieve their financial goals. Goldman Sachs provides these services to its clients, both institutional and individuals, including investors who primarily access its products through a network of third-party distributors around the world.

Goldman Sachs manages client assets across a broad range of investment strategies and asset classes, including equity, fixed income and alternative investments. Alternative investments primarily includes hedge funds, credit funds, private equity, real estate, currencies, commodities and asset allocation strategies. Its investment offerings include those managed on a fiduciary basis by its portfolio managers, as well as those managed by third-party managers. Goldman Sachs offers its investment solutions in a variety of structures, including separately managed accounts, mutual funds, private partnerships and other commingled vehicles.

Goldman Sachs also provides customized investment advisory solutions designed to address its clients’ investment needs. These solutions begin with identifying clients’ objectives and continue through portfolio construction, ongoing asset allocation and risk management and investment realization. Goldman Sachs draws from a variety of third-party managers, as well as its proprietary offerings, to implement solutions for clients.

Goldman Sachs provides tailored wealth advisory services to clients across the wealth spectrum. Goldman Sachs operates globally serving individuals, families, family offices, and foundations and endowments. Its relationships are established directly or introduced through companies that sponsor financial wellness programs for their employees.

Goldman Sachs offers personalized financial planning to individuals inclusive of income and liability management, compensation and benefits analysis, trust and estate structuring, tax optimization, philanthropic giving, and asset protection. Goldman Sachs also provides customized investment advisory solutions, and offers structuring and execution capabilities in securities and derivative products across all major global markets. Goldman Sachs leverages a broad, open-architecture investment platform and its global execution capabilities to help clients achieve their investment goals. In addition, Goldman Sachs offers clients a full range of private banking services, including a variety of deposit alternatives and loans that its clients use to finance investments in both financial and nonfinancial assets, bridge cash flow timing gaps or provide liquidity and flexibility for other needs.

In addition to managing client assets, Goldman Sachs invests in alternative investments across a range of asset classes that seek to deliver long-term accretive risk-adjusted returns. Its investing activities, which are typically longer-term, include investments in corporate equity, credit, real estate and infrastructure assets.

Goldman Sachs also raises deposits and has issued unsecured loans to consumers through Marcus by Goldman Sachs (Marcus). Goldman Sachs has started a process to cease offering new loans through Marcus.

Asset & Wealth Management generates revenues from the following:

- Management and other fees - Goldman Sachs receives fees related to managing assets for institutional and individual clients, providing investing and wealth advisory solutions, providing financial planning and counseling services via Ayco Personal Financial Management, and executing brokerage transactions for wealth management clients. The fees that Goldman Sachs charge vary by asset class, client channel and the types of services provided, and are affected by investment performance, as well as asset inflows and redemptions.

- Incentive fees - In certain circumstances, Goldman Sachs also receives incentive fees based on a percentage of a fund’s or a separately managed account's return, or when the return exceeds a specified benchmark or other performance targets. Such fees include overrides, which consist of the increased share of the income and gains derived primarily from its private equity and credit funds when the return on a fund’s investments over the life of the fund exceeds certain threshold returns.

- Private banking and lending - Its private banking and lending activities include issuing loans to its wealth management clients. Such loans are generally secured by commercial and residential real estate, securities and other assets. Goldman Sachs also accepts deposits (including savings and time deposits) from wealth management clients, including through Marcus, in GS Bank USA and Goldman Sachs International Bank (GSIB). Goldman Sachs has also issued unsecured loans to consumers through Marcus and have started a process to cease offering new loans. Additionally, Goldman Sachs provides investing services through Marcus Invest to U.S. customers. Private banking and lending revenues include net interest income allocated to deposits and net interest income earned on loans to individual clients.

- Equity investments - Includes investing activities related to its asset management activities primarily related to public and private equity investments in corporate, real estate and infrastructure assets. Goldman Sachs also makes investments through consolidated investment entities, substantially all of which are engaged in real estate investment activities.

- Debt investments - Includes lending activities related to its asset management activities, including investing in corporate debt, lending to middle-market clients, and providing financing for real estate and other assets. These activities include investments in mezzanine debt, senior debt and distressed debt securities.

Platform Solutions edit edit source

Platform Solutions includes its consumer platforms, such as partnerships offering credit cards and point-of-sale financing, and transaction banking and other platform businesses.

Platform Solutions generates revenues from the following:

Consumer platforms - Its consumer platforms business issues credit cards and provides point-of-sale financing to consumers to finance the purchases of goods or services. Consumer platforms revenues primarily includes net interest income earned on credit card lending and point-of-sale financing activities.

Transaction banking and other - Goldman Sachs provide transaction banking and other services, including cash management services, such as deposit-taking and payment solutions for corporate and institutional clients. Transaction banking revenues include net interest income attributed to transaction banking deposits.

Business Continuity and Information Security

Business continuity and information security, including cybersecurity, are high priorities for us. Their importance has been highlighted by (i) the coronavirus (COVID-19) pandemic and the work-from-home arrangements implemented by companies worldwide in response, including us, (ii) numerous highly publicized events in recent years, including cyber attacks against financial institutions, governmental agencies, large consumer-based companies, software and information technology service providers and other organizations, some of which have resulted in the unauthorized access to or disclosure of personal information and other sensitive or confidential information, the theft and destruction of corporate information and requests for ransom payments, and (iii) extreme weather events.

Its Business Continuity & Technology Resilience Program has been developed to provide reasonable assurance of business continuity in the event of disruptions at its critical facilities or of its systems, and to comply with regulatory requirements, including those of FINRA. Because Goldman Sachs is a BHC, its Business Continuity & Technology Resilience Program is also subject to review by the FRB. The key elements of the program are crisis management, business continuity, technology resilience, business recovery, assurance and verification, and process improvement. In the area of information security, Goldman Sachs have developed and implemented a framework of principles, policies and technology designed to protect the information provided to us by its clients and its own information from cyber attacks and other misappropriation, corruption or loss. Safeguards are designed to maintain the confidentiality, integrity and availability of information.

Commitments edit edit source

Human Capital Management

Its people are its greatest asset. Goldman Sachs believe that a major strength and principal reason for its success is the quality, dedication, determination and collaboration of its people, which enables us to serve its clients, generate long-term value for its shareholders and contribute to the broader community. Goldman Sachs invests heavily in developing and supporting its people throughout their careers, and Goldman Sachs strives to maintain a work environment that fosters professionalism, excellence, high standards of business ethics, diversity, teamwork and cooperation among its employees worldwide.

Diversity and Inclusion

The strength of its culture, its ability to execute its strategy, and its relationships with clients all depend on a diverse workforce and an inclusive work environment that encourages a wide range of perspectives. Goldman Sachs believes that diversity at all levels of its organization, from entry-level analysts to senior management, as well as the Board of Directors of Group Inc. (Board) is essential to its sustainability. As of December 2022, approximately 57% of its Board was diverse by race, gender or sexual orientation. Its management team works closely with its Global Inclusion and Diversity Committee to continue to increase diversity of its global workforce at all levels. In addition, Goldman Sachs has Inclusion and Diversity Committees across regions, which promote an environment that values different perspectives, challenges conventional thinking and maximizes the potential of all its people.

Goldman Sachs believes that increased diversity, including diversity of experience, gender identity, race, ethnicity, sexual orientation, disability and veteran status, in addition to being a social imperative, is vital to its commercial success through the creativity that it fosters. For this reason, Goldman Sachs has established a comprehensive action plan with aspirational diversity hiring and representation goals which are set forth below and are focused on cultivating an inclusive environment for all its colleagues.

Diverse leadership is crucial to its long-term success and to driving innovation, and Goldman Sachs have implemented and expanded outreach and career advancement programs for rising diverse executive talent. For example, Goldman Sachs are focused on providing diverse vice presidents the necessary coaching, sponsorship and advocacy to support their career trajectories and strengthen their leadership platforms, including through programs, such as its Vice President Sponsorship Initiative focused on high-performing women, Black, Hispanic/Latinx, Asian and LGBTQ+ vice presidents across the globe. Many other career development initiatives are aimed at fostering diverse talent at the analyst and associate level, including the Black Analyst and Associate Initiative, the Hispanic/Latinx Analyst Initiative and the Women’s Career Strategies Initiative. Its global and regional Inclusion Networks and Interest Forums are open to all professionals at Goldman Sachs to promote and advance connectivity, understanding, inclusion and diversity.

Progress Toward Aspirational Goals. Reflecting its efforts to increase diversity, the composition of its most recent partnership class was 29% women professionals, 24% Asian professionals, 9% Black professionals, 3% Hispanic/Latinx professionals, 3% LGBTQ+ professionals and 3% professionals who are military/veterans. The composition of its most recent managing director class was 30% women professionals, 28% Asian professionals, 5% Black professionals, 5% Hispanic/Latinx professionals, 3% LGBTQ+ professionals and 3% professionals who are military/veterans.

Goldman Sachs has also set forth the following aspirational goals:

- Goldman Sachs aims for analyst and associate hiring (which accounts for over 70% of its annual hiring) to achieve representation of 50% women professionals, 11% Black professionals and 14% Hispanic/Latinx professionals in the Americas, and 9% Black professionals in the U.K. In 2022, its analyst and associate hires included 44% women professionals, 10% Black professionals and 13% Hispanic/Latinx professionals in the Americas, and 17% Black professionals in the U.K.

- Goldman Sachs aims for women professionals to represent 40% of its vice presidents globally by 2025 and 30% of senior talent (vice presidents and above) in the U.K. by 2023, while also endeavoring for women employees to comprise 50% of all of its employees globally over time. As of December 2022, women professionals represented 33% of its vice president population globally and 31% of senior talent (vice presidents and above) in the U.K., and women employees represented 41% of all of its employees globally.

- Goldman Sachs aims for Black professionals to represent 7% of its vice president population in the Americas and in the U.K., and for Hispanic/Latinx professionals to represent 9% of its vice president population in the Americas, both by 2025. As of December 2022, Black professionals represented 4% of its vice president population in the Americas and 5% in the U.K., and Hispanic/Latinx professionals represented 6% of its vice president population in the Americas.

- Goldman Sachs aims to double the number of campus hires in the U.S. recruited from Historically Black Colleges and Universities (HBCUs) by 2025 relative to 2020.

The metrics above are based on self-identification.

Talent Development and Retention

Goldman Sachs seeks to help its people achieve their full potential by investing in them and supporting a culture of continuous development. Its goals are to maximize individual capabilities, increase commercial effectiveness and innovation, reinforce its culture, expand professional opportunities, and help its people contribute positively to their communities.

Instilling its culture in all employees is a continuous process, in which training plays an important part. Goldman Sachs offers its employees the opportunity to participate in ongoing educational offerings and periodic seminars facilitated by its Learning & Engagement team. To accelerate their integration into the firm and its culture, new hires have the opportunity to receive training before they start working and orientation programs with an emphasis on culture and networking, and nearly all employees participate in at least one training event each year. For its more senior employees, Goldman Sachs provide guidance and training on how to manage people and projects effectively, exhibit strong leadership and exemplify its culture. Goldman Sachs are also focused on developing a high performing, diverse leadership pipeline and career planning for its next generation of leaders. Goldman Sachs maintain a variety of programs aimed at employees’ professional growth and leadership development, including initiatives, such as its Vice President and Managing Director Leadership Acceleration Initiatives and Partner Development Initiative.

Enhancing its people’s experience of internal mobility is a key focus, as Goldman Sachs believe that this will inspire employees, help retain top talent and create diverse experiences to build future leaders.

Another important part of instilling its culture is its employee performance review process. Employees are reviewed by supervisors, co-workers and employees whom they supervise in a 360-degree review process that is integral to its team approach and includes an evaluation of an employee’s performance with respect to risk management, protecting its reputation, adherence to its code of conduct, compliance, and diversity and inclusion principles. Its approach to evaluating employee performance centers on providing robust, timely and actionable feedback that facilitates professional development. Goldman Sachs have directed its managers, as leaders at the firm, to take an active coaching role with their teams. Goldman Sachs have also implemented “The Three Conversations at GS” through which managers establish goals with their team members at the start of the year, check in mid-year on progress and then close out the year with a conversation on performance against goals.

Goldman Sachs believe that its people value opportunities to contribute to their communities and that these opportunities enhance their job satisfaction. Goldman Sachs also believe that being able to volunteer together with colleagues and support community organizations through completing local service projects strengthens its people’s bond with us. Community TeamWorks, its signature volunteering initiative, enables its people to participate in high-impact, team-based volunteer opportunities, including projects coordinated with hundreds of non-profit partner organizations worldwide. During 2022, its people volunteered approximately 86,000 hours of service globally through Community TeamWorks, with approximately 17,000 employees partnering with approximately 500 nonprofit organizations on approximately 1,200 community projects.

Wellness

Goldman Sachs recognizes that for its people to be successful in the workplace they need support in their personal, as well as their professional, lives. Goldman Sachs has created a strong support framework for wellness, which is intended to enable employees to better balance their roles at work and their responsibilities at home. Goldman Sachs provide a number of policies for its employees that support taking time away from the office when needed, including 20 weeks of parental leave, family care leave and bereavement leave. In 2022, Goldman Sachs also enhanced its vacation policies for its employees, allowing managing directors to take time off, when needed, without a fixed vacation day entitlement and adding a minimum of two additional vacation days for all other employees, as well as setting a minimum annual expected vacation usage of 15 days. For longer-tenured employees, Goldman Sachs offer an unpaid sabbatical leave. Goldman Sachs also continue to advance its resilience programs, offering its people a range of counselling, coaching, medical advisory and personal wellness services. Goldman Sachs increased the availability of these resources during the COVID-19 pandemic, and continued to evolve and strengthen virtual offerings to enhance access to support, with the aim of maintaining the physical and mental well-being of its people, and enhancing their effectiveness and productivity.

In addition, to support the financial wellness of its employees, Goldman Sachs offer a variety of resources that help them manage their personal financial health and decision-making, including financial education information sessions, live and on-demand webinars, articles and interactive digital tools.

Global Reach and Strategic Locations

As a firm with a global client base, Goldman Sachs takes a strategic approach to attracting, developing and managing a global workforce. Its clients are located worldwide and Goldman Sachs are an active participant in financial markets around the world. As of December 2022, Goldman Sachs had headcount of 48,500, offices in over 35 countries and 52% of its headcount was based in the Americas, 19% in EMEA and 29% in Asia. Its employees come from over 180 countries and speak more than 150 languages as of December 2022.

In addition to maintaining offices in major financial centres around the world, Goldman Sachs has established key strategic locations, including in Bengaluru, Salt Lake City, Dallas, Singapore, Warsaw and Hyderabad. Goldman Sachs continue to evaluate the expanded use of strategic locations, including cities in which Goldman Sachs do not currently have a presence.

As of December 2022, 41% of its employees were working in strategic locations. Goldman Sachs believes its investment in these strategic locations enables us to build centers of excellence around specific capabilities that support its business initiatives.

Sustainability

Goldman Sachs have a long-standing commitment to sustainability. Its two priorities in this area are helping clients across industries decarbonize their businesses to support their transition to a low-carbon economy (Climate Transition) and to advance solutions that expand access, increase affordability, and drive outcomes to support sustainable economic growth (Inclusive Growth). Its strategy is to advance these two priorities through its work with its clients, and with strategic partners whose strengths and areas of focus complement its own, as well as through its supply chain.

Goldman Sachs have established a Sustainable Finance Group, which serves as the centralized group that drives climate strategy and sustainability efforts across its firm, including commercial efforts alongside its businesses, to advance Climate Transition and Inclusive Growth. Goldman Sachs have also created the role of Global Head of Sustainability and Inclusive Growth, which, like its One Goldman Sachs initiative, is intended to facilitate the application of its full capabilities across both Climate Transition and Inclusive Growth. Its sustainable finance-related efforts continue to evolve. For example, Goldman Sachs recently launched the Sustainable Banking Group, a group focused on supporting its corporate clients in reducing their direct and indirect carbon emissions.

Its activities relating to sustainability present both financial and nonfinancial risks, and Goldman Sachs have processes for managing these risks, similar to the other risks Goldman Sachs face. Goldman Sachs have integrated oversight of climate-related risks into its risk management governance structure, from senior management to its Board and its committees, including the Risk and Public Responsibilities committees. The Risk Committee of the Board oversees firmwide financial and nonfinancial risks, which include climate risk, and, as part of its oversight, receives updates on its risk management approach to climate risk. The Public Responsibilities Committee of the Board assists the Board in its oversight of its firmwide sustainability strategy and sustainability risks affecting us, including with respect to climate change. As part of its oversight, the Public Responsibilities Committee receives periodic updates on its sustainability strategy, and also periodically reviews its governance and related policies and processes for sustainability and climate change-related risks. Goldman Sachs have also implemented an Environmental Policy Framework to guide its overall approach to sustainability issues. Goldman Sachs apply this Framework when evaluating transactions for environmental and social risks and impacts. Its employees also receive training with respect to environmental and social risks, including for sectors and industries that Goldman Sachs believe have higher potential for these risks. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Risk Management — Other Risk Management — Climate Risk Management” in Part II, Item 7 of this Form 10-K for further information about its climate risk management.

As a leading financial institution, Goldman Sachs acknowledge the importance of Climate Transition and Inclusive Growth for its business. In February 2021, Goldman Sachs issued its inaugural sustainability bond of $800 million, and in June 2022 Goldman Sachs issued its second benchmark sustainability bond of $700 million. These issuances align with its sustainable finance framework for future issuances and fund a range of on-balance sheet sustainable finance activity. Goldman Sachs believe Goldman Sachs can advance sustainability by partnering with its clients across its businesses, including by developing new sustainability-linked financing solutions, offering strategic advice, or co-investing alongside its clients in clean energy companies. Goldman Sachs have announced a target to deploy $750 billion in sustainable financing, investing and advisory activity by the beginning of 2030. As of December 2022, Goldman Sachs achieved approximately 55% of that goal, with the majority dedicated to Climate Transition.

With respect to Climate Transition, Goldman Sachs have announced its commitment to align its financing activities with a net-zero-by-2050 pathway. In that context, Goldman Sachs have set an initial set of targets for 2030 focused on three sectors — power, oil and gas, and auto manufacturing — where Goldman Sachs see an opportunity to proactively engage its clients and investors, deploy capital required for transition, and invest in new commercial solutions to drive decarbonization in the real economy. Carbon neutrality is also a priority for the operation of its firm and its supply chain. In 2015, Goldman Sachs achieved carbon neutrality in its operations and business travel, ahead of its 2020 goal announced in 2009. Goldman Sachs have expanded its operational carbon commitment to include its supply chain, targeting net-zero carbon emissions by 2030.

In addition to Climate Transition, its approach to sustainability also centres on Inclusive Growth where Goldman Sachs seek to drive solutions that expand access, increase affordability, and drive outcomes to advance sustainable economic growth. Goldman Sachs have sponsored initiatives, such as One Million Black Women, Launch With GS, the Urban Investment Group, 10,000 Women and 10,000 Small Businesses. An overarching theme of its sustainability strategy is promoting diversity and inclusion as an imperative for us, as well as for its clients and their boards. These efforts are further strengthened by strategic partnerships that Goldman Sachs have established in areas where Goldman Sachs have identified gaps or believe Goldman Sachs are able to drive even greater impact through collaboration. Goldman Sachs believe its ability to achieve its sustainability objectives is critically dependent on the strengths and talents of its people, and Goldman Sachs recognize that its people are able to maximize their impact by collaborating in a diverse and inclusive work environment. See “Business — Human Capital Management” for information about its human capital management goals, programs and policies.

Leadership edit edit source

| Name | Title | Description |

|---|---|---|

| David Solomon | Chairman and CEO | Mr Solomon has been Chairman of the Board since January 2019 and Chief Executive Officer and a director since October 2018. He had previously served as President and Chief or Co-Chief Operating Officer from January 2017 and Co-Head of the Investment Banking Division from July 2006 to December 2016. Helping to develop strategy, embody core values and enhance the firm's culture, David has over 20 years of leadership experience at Goldman Sachs. |

| John E. Waldron | President and COO | Mr Waldron has been President and Chief Operating Officer since October 2018. He had previously served as Co-Head of the Investment Banking Division from December 2014. Prior to that he was Global Head of Investment Banking Services/Client Coverage for the Investment Banking Division and had oversight of the Investment Banking Services Leadership Group, and from 2007 to 2009 was Global Co-Head of the Financial Sponsors Group. He is also a member of the Board of Directors of Cleveland Clinic and Lincoln Center for Performing Arts in New York City. |

| Denis Coleman | CFO | Mr Coleman joined Goldman Sachs in 1996 as an analyst and has since worked his way up to Chief Financial Officer, a post he has held since January 2022. He had previously served as Deputy Chief Financial Officer from September 2021 and, prior to that, Co-Head of the Global Financing Group from June 2018 to September 2021. From 2016 to June 2018, he was Head of the EMEA Financing Group, and from 2009 to 2016 he was Head of EMEA Credit Finance in London. |

| John F. W. Rogers | Executive VP and Board Secretary | John Rogers has been an Executive Vice President since April 2011 and Chief of Staff and Secretary to the Board since December 2001. He is in charge of corporate functions which includes public, investor and government relations. Mr Rogers has had a wide range of roles prior to joining Goldman Sachs including Under Secretary of State for Management, Assistant Secretary of the Treasury and to the President of the United States. He is also chairman of the board of a few companies such as the Atlantic Council and the White House Historical Association. |

| Ericka Leslie | CAO (Admin) | Ms Leslie has been Chief Administrative Officer since February 2022. She had previously served as Global Head of Operations and Platform Engineering for the Global Markets Division from March 2020, as Global Head of Operations for the Securities Division from January 2019 and as Head of Global Operations for the Commodities business from September 2008. |

| Philip Berlinski | Global Treasurer | Mr Berlinski has been Global Treasurer since October 2021; he also serves as Chief Executive Officer of Goldman Sachs Bank USA. He had previously served as Chief Operating Officer of Global Equities from May 2019. Prior to that, he was Co-Head of Global Equities Trading and Execution Services from September 2016 to May 2019. |

| Brian J. Lee | CRO (Risk) | Mr Lee has been Chief Risk Officer since November 2019. He had previously served as Controller and Chief Accounting Officer from March 2017 and, prior to that, he had served as Deputy Controller from 2014. |

| Sheara J. Fredman | CAO (Accounting) | Ms Fredman has been Controller and Chief Accounting Officer since November 2019. She had previously served as Head of Regulatory Controllers from September 2017 and, prior to that, she had served as Global Product Controller. As Controller, she is responsible for overseeing product control and internal and external reporting for regulatory information. |

| Kathryn Ruemmler | CLO (Legal) and General Counsel | Ms. Ruemmler has been the Chief Legal Officer, General Counsel and Secretary since March 2021, and was previously Global Head of Regulatory Affairs from April 2020. From June 2014 to April 2020, Ms Ruemmler was a Litigation Partner at Latham & Watkins LLP, a global law firm, where she was Global Chair of the White Collar Defense and Investigations practice. She served as White House Counsel to President Barack Obama. |

| Name | Title | Incumbent | Other Directorships |

|---|---|---|---|

| David Solomon | Chairman and CEO | October 2018 | N/A |

| Michele Burns | Director | October 2011 | Anheuser-Busch InBev, Cisco Systems Inc, Etsy Inc |

| Mark Flaherty | Director | December 2014 | N/A |

| Kimberly Harris | Director | May 2021 | N/A |

| Kevin Johnson | Director | October 2022 | N/A |

| Ellen Kullman | Director | December 2016 | Amgen Inc, Dell Technologies Inc |

| Lakshmi Mittal | Director | June 2008 | ArcelorMittal S.A. |

| Thomas Montag | Director | July 2023 | N/A |

| Adebayo Ogunlesi | Lead Director | October 2012 | Topgolf Callaway Brands Corp, Kosmos Energy Ltd |

| Peter Oppenheimer | Director | March 2014 | N/A |

| Jan Tighe | Director | December 2018 | General Motors Company, Huntsman Corporation, IronNet Inc |

| Jessica Uhl | Director | July 2021 | General Electric Company |

| David Viniar | Director | January 2013 | N/A |

| John F. W. Rogers | Secretary to the Board | April 2011 | Atlantic Council, American Academy in Rome, White House Historical Association |

Financials and Valuation edit edit source

Historic edit edit source

Most Recent Quarter edit edit source

During the 3 months ended 31st June 2023, net income decreased by $2.016 billion to $1.071 billion on revenues of $10.895 billion from $12.224 billion, representing a respective decrease of 65% and of 11% compared to the previous quarter.

Most Recent Year edit edit source

For the fiscal year 2022, Goldman Sachs reported a net income of $11.3 billion. The annual revenue was $47.4 billion, a decrease of 20.2% over the previous year.

Balance Sheets edit edit source

| Year Ended December | ||

|---|---|---|

| $ in millions | 2022 | 2021 |

| Assets | ||

| Cash and cash equivalents | 241,825 | 261,036 |

| Securities purchased under

agreements to resell |

225,117 | 205,703 |

| Securities borrowed | 189,041 | 178,771 |

| Customer and other receiveables | 135,448 | 160,673 |

| Trading assets | 301,245 | 375,916 |

| Investments | 130,629 | 88,719 |

| Loans | 179,286 | 158,562 |

| Other assets | 39,208 | 34,608 |

| Total assets | 1,441,799 | 1,463,988 |

| Liabilities | ||

| Deposits | 386,665 | 364,227 |

| Securities sold under agreements

to repurchase |

110,349 | 165,883 |

| Securities loaned | 30,727 | 46,505 |

| Other secured financings | 13,946 | 18,544 |

| Customer and other payables | 262,045 | 251,931 |

| Trading liabilities | 191,324 | 181,424 |

| Unsecured short-term borrowings | 60,961 | 46,955 |

| Unsecured long-term borrowings | 21,455 | 24,501 |

| Total liabilities | 1,324,610 | 1,354,062 |

| Shareholders' Equity | ||

| Preferred stock | 10,703 | 10,703 |

| Common stock | 9 | 9 |

| Share-based awards | 5,696 | 4,211 |

| Additional paid-in capital | 59,050 | 56,396 |

| Retained earnings | 139,372 | 131,811 |

| Accumulated other comprehensive

loss |

(3,010) | (2,068) |

| Stock held in treasury | (94,631) | (91,136) |

| Total shareholders' equity | 117,189 | 109,926 |

| Total | ||

| Total liabilities and shareholders'equity | 1,441,799 | 1,463,988 |

Earnings Statements edit edit source

| Year Ended December | ||

|---|---|---|

| $ in millions | 2022 | 2021 |

| Revenues | ||

| Investment banking | 7,360 | 14,136 |

| Investment management | 9,005 | 8,171 |

| Commissions and fees | 4,034 | 3,590 |

| Market making | 18,634 | 15,357 |

| Other principal transactions | 654 | 11,615 |

| Total non-interest revenues | 39,687 | 52,869 |

| Interest income | 29,024 | 12,120 |

| Interest expense | 21,346 | 5,650 |

| Net interest income | 7,678 | 6,470 |

| Total net revenues | 47,365 | 59,339 |

| Provision for credit losses | 2,715 | 357 |

| Operating Expenses | ||

| Compensation and benefits | 15,148 | 17,719 |

| Transaction based | 5,312 | 4,710 |

| Market development | 812 | 553 |

| Communications and technology | 1,808 | 1,573 |

| Depreciation and amortization | 2,455 | 2,015 |

| Occupancy | 1,026 | 981 |

| Professional fees | 1,887 | 1,648 |

| Other expenses | 2,716 | 2,739 |

| Total operating expenses | 31,164 | 31,938 |

| Pre-tax earnings | 13,486 | 27,044 |

| Provision for taxes | 2,225 | 5,409 |

| Net earnings | 11,261 | 21,635 |

| Preferred stock dividends | 497 | 484 |

| Net earnings applicable to common shareholders | 10,764 | 21,151 |

Income Statements edit edit source

| Year Ended December | ||

|---|---|---|

| $ in millions | 2022 | 2021 |

| Net earnings | 11,261 | 21,635 |

| Currency translation | (47) | (42) |

| Debt valuation adjustment | 1,403 | 322 |

| Pension and postretirement

liabilities |

(172) | 41 |

| Available-for-sale securities | (2,126) | (955) |

| Other comprehensive income /

(loss) |

(942) | (634) |

| Comprehensive income | 10,319 | 21,001 |

Cash Flow Statements edit edit source

| Year Ended December | ||

|---|---|---|

| $ in millions | 2022 | 2021 |

| Cash Flows From Operating Activities | ||

| Net earnings | 11,261 | 21,635 |

| Depreciation and amortization | 2,455 | 2,015 |

| Deferred income taxes | (2,412) | 5 |

| Share-based compensation | 4,083 | 2,348 |

| Provision for credit losses | 2,715 | 357 |

| Customer and other receivables

and payables, net |

35,014 | 21,971 |

| Collateralized transactions, net | (100,996) | (70,058) |

| Trading assets | 45,278 | 15,232 |

| Trading liabilities | 8,062 | 26,616 |

| Loans, held for sale, net | 3,161 | (5,556) |

| Other, net | 87 | (8,267) |

| Net cash provided by / (used for)operating activities | 8,708 | 6,298 |

| Cash Flows From Investing Activities | ||

| Purchase of property, leasehold

improvements and equipment |

(3748) | (4,667) |

| Proceeds from sales of property,

leasehold improvements and equipment |

2,706 | 3,933 |

| Net cash used for business acquisitions | (2,115) | - |

| Purchase of investments | (60,536) | (39,912) |

| Proceeds from sales and paydowns of

investments |

12,961 | 45,701 |

| Loans (excluding loans held for sale), net | (25,228) | (35,520) |

| Net cash used for investing activities | (75,960) | (30,465) |

| Cash Flows From Financing Activities | ||

| Unsecured short-term borrowings, net | 321 | 2,137 |

| Other secured financings (short-term), net | (2,283) | (1,320) |

| Proceeds from issuance of other secured

financings (long-term) |

1,800 | 4,795 |

| Repayment of other secured financings

(long-term), including the current portion |

(3,407) | (6,590) |

| Proceeds from issuance of unsecured

long-term borrowings |

84,522 | 92,717 |

| Repayment of unsecured long-term

borrowings, including the current portion |

(42,806) | (52,608) |

| Derivative contracts with a financing element,

net |

1,797 | 1,121 |

| Deposits, net | 28,074 | 103,538 |

| Preferred stock redemption | - | (2,675) |

| Common stock repurchased | (3,500) | (5,200) |

| Settlement of share-based awards in

satisfaction of withholding tax requirements |

(1,595) | (985) |

| Dividends and dividend equivalents paid on

common stock, preferred stock and share-based awards |

(3,682) | (2,725) |

| Proceeds from issuance of preferred stock,

net of issuance costs |

- | 2,172 |

| Other financing, net | 361 | 361 |

| Net cash provided by financing activities | 59,602 | 134,738 |

| Effect of exchange rate changes on cash

and cash equivalents |

(11,561) | (5,377) |

| Movements In Balance Sheets | ||

| Net increase/(decrease) in cash and cash equivalents | (19,211) | 105,194 |

| Cash and cash equivalents, beginning balance | 261,036 | 155,842 |

| Cash and cash equivalents, ending balance | 241,825 | 261,036 |

| Supplemental Disclosures | ||

| Cash payments for interest, net of capitalized interest | 19,022 | 5,521 |

| Cash payments for income taxes, net | 4,555 | 6,195 |

Segment Operating Results edit edit source

| Year Ended December | |||

|---|---|---|---|

| $ in millions | 2022 | 2021 | 2020 |

| Global Banking & Markets | |||

| Net revenues | $32,487 | $36,734 | $30,469 |

| Provision for credit losses | 468 | (171) | 1,216 |

| Operating expenses | 17,851 | 19,542 | 18,884 |

| Pre-tax earnings | $14,168 | $17,363 | $10,369 |

| Net earnings to common | $11,458 | $13,535 | $7,428 |

| Average common equity | $69,951 | $60,064 | $54,749 |

| Return on average common equity | 16.4% | 22.5% | 13.6% |

| Asset & Wealth Management | |||

| Net revenues | 13,376 | 21,965 | 13,757 |

| Provision for credit losses | 519 | (169) | 1,395 |

| Operating expenses | 11,550 | 11,406 | 9,469 |

| Pre-tax earnings | 1,307 | 10,728 | 2,893 |

| Net earnings to common | 979 | 8,459 | 2,083 |

| Average common equity | 31,762 | 29,988 | 24,963 |

| Return on average common equity | 3.1% | 28.2% | 8.3% |

| Platform Solutions | |||

| Net revenues | 1,502 | 640 | $334 |

| Provision for credit losses | 1,728 | 697 | 487 |

| Operating expenses | 1,763 | 990 | 630 |

| Pre-tax earnings/(loss) | (1,989) | (1,047) | $(783) |

| Net earnings/(loss) to common | (1,673) | (843) | $(596) |

| Average common equity | 3,574 | 1,777 | $864 |

| Return on average common equity | (46.8)% | (47.4)% | (69.0)% |

| Total | |||

| Net revenues | 47,365 | 59,339 | $44,560 |

| Provision for credit losses | 2,715 | 357 | 3,098 |

| Operating expenses | 31,164 | 31,938 | 28,983 |

| Pre-tax earnings | 13,486 | 27,044 | $12,479 |

| Net earnings to common | 10,764 | 21,151 | $8,915 |

| Average common equity | 105,287 | 91,829 | $80,576 |

| Return on average common equity | 10.2% | 23.0% | 11.1% |

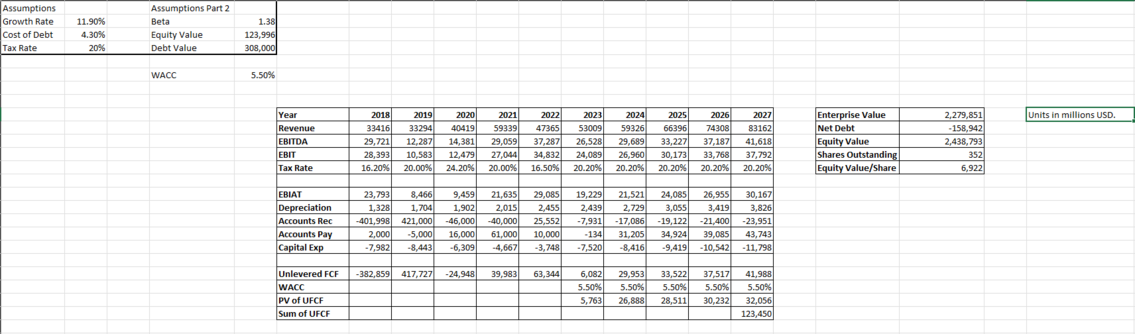

DCF Model

| Sensitivity Table | ||||||

| Growth Rate | ||||||

| 446.36 | 10.90% | 11.40% | 11.90% | 12.40% | 12.90% | |

| WACC | 4.50% | 446.36 | 446.36 | 446.36 | 446.36 | 446.36 |

| 5.00% | 446.36 | 446.36 | 446.36 | 446.36 | 446.36 | |

| 5.50% | 446.36 | 446.36 | 446.36 | 446.36 | 446.36 | |

| 6.00% | 446.36 | 446.36 | 446.36 | 446.36 | 446.36 | |

| 6.50% | 446.36 | 446.36 | 446.36 | 446.36 | 446.36 | |

The fair value for Goldman's share price is approximately $446.36. Goldman's current share price is $354.51 therefore Goldman is 26% undervalued by the market.

Competition edit edit source

The financial services industry and all of its businesses are intensely competitive, and Goldman Sachs expects them to remain so. Its competitors provide investment banking, market-making and asset management services, private banking and lending, commercial lending, point-of-sale financing, credit cards, transaction banking, deposit-taking and other banking products and services, and make investments in securities, commodities, derivatives, real estate, loans and other financial assets. Its competitors include brokers and dealers, investment banking firms, commercial banks, credit card issuers, insurance companies, investment advisers, mutual funds, hedge funds, private equity funds, merchant banks, consumer finance companies and financial technology and other internet-based companies. Some of its competitors operate globally and others regionally, and Goldman Sachs competes based on a number of factors, including transaction execution, client experience, products and services, innovation, reputation and price.

Goldman Sachs has faced, and expects to continue to face, pressure to retain market share by committing capital to businesses or transactions on terms that offer returns that may not be commensurate with their risks. In particular, corporate clients seek such commitments (such as agreements to participate in their loan facilities) from financial services firms in connection with investment banking and other assignments.

Consolidation and convergence have significantly increased the capital base and geographic reach of some of its competitors and have also hastened the globalization of the securities and other financial services markets. As a result, Goldman Sachs have had to commit capital to support its international operations and to execute large global transactions. To capitalize on some of its most significant opportunities, Goldman Sachs will have to compete successfully with financial institutions that are larger and have more capital and that may have a stronger local presence and longer operating history outside the U.S.

Goldman Sachs also competes with smaller institutions that offer more targeted services, such as independent advisory firms. Some clients may perceive these firms to be less susceptible to potential conflicts of interest than Goldman Sachs are, and, as described below, its ability to effectively compete with them could be affected by regulations and limitations on activities that apply to Goldman Sachs but may not apply to them.

A number of its businesses are subject to intense price competition. Efforts by its competitors to gain market share have resulted in pricing pressure in its investment banking, market-making, consumer, wealth management and asset management businesses. For example, the increasing volume of trades executed electronically, through the internet and through alternative trading systems, has increased the pressure on trading commissions, in that commissions for electronic trading are generally lower than those for non-electronic trading. It appears that this trend toward low-commission trading will continue. Price competition has also led to compression in the difference between the price at which a market participant is willing to sell an instrument and the price at which another market participant is willing to buy it (i.e., bid/offer spread), which has affected its market-making businesses. The increasing prevalence of passive investment strategies that typically have lower fees than other strategies Goldman Sachs offers has affected the competitive and pricing dynamics for its asset management products and services. In addition, Goldman Sachs believes that Goldman Sachs will continue to experience competitive pressures in these and other areas in the future as some of its competitors seek to obtain market share by further reducing prices, and as Goldman Sachs enters into or expand its presence in markets that rely more heavily on electronic trading and execution. Goldman Sachs and other banks also compete for deposits on the basis of the rates Goldman Sachs offer. Increases in short-term interest rates have resulted in and are expected to continue to result in more intense competition in deposit pricing.

Goldman Sachs also competes on the basis of the types of financial products and client experiences that Goldman Sachs and its competitors offer. In some circumstances, its competitors may offer financial products that Goldman Sachs does not offer and that its clients may prefer, including cryptocurrencies and other digital assets that Goldman Sachs cannot or may choose not to provide. Its competitors may also develop technology platforms that provide a better client experience.

The provisions of the U.S. Dodd-Frank Wall Street Reform and Consumer Protection Act (Dodd-Frank Act), the requirements promulgated by the Basel Committee on Banking Supervision (Basel Committee) and other financial regulations could affect its competitive position to the extent that limitations on activities, increased fees and compliance costs or other regulatory requirements do not apply, or do not apply equally, to all of its competitors or are not implemented uniformly across different jurisdictions. For example, the provisions of the Dodd-Frank Act that prohibit proprietary trading and restrict investments in certain hedge and private equity funds differentiate between U.S.-based and non-U.S.-based banking organizations and give non-U.S.-based banking organizations greater flexibility to trade outside of the U.S. and to form and invest in funds outside the U.S.

Likewise, the obligations with respect to derivative transactions under Title VII of the Dodd-Frank Act depend, in part, on the location of the counterparties to the transaction. The impact of regulatory developments on its competitive position has depended and will continue to depend to a large extent on the manner in which the required rulemaking and regulatory guidance evolve, the extent of international convergence, and the development of market practice and structures under the evolving regulatory regimes, as described further in “Regulation” below.

Goldman Sachs also face intense competition in attracting and retaining qualified employees. Its ability to continue to compete effectively has depended and will continue to depend upon its ability to attract new employees, retain and motivate its existing employees and to continue to compensate employees competitively amid intense public and regulatory scrutiny on the compensation practices of large financial institutions. Its pay practices and those of certain of its competitors are subject to review by, and the standards of, the FRB and other regulators inside and outside the U.S., including the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) in the U.K. Goldman Sachs also compete for employees with institutions whose pay practices are not subject to regulatory oversight. See “Regulation — Compensation Practices” and “Risk Factors — Competition — Its businesses would be adversely affected if Goldman Sachs are unable to hire and retain qualified employees” in Part I, Item 1A of this Form 10-K for further information about such regulation.

Goldman Sachs's Competitors

Each bank has a distinct business model that differentiates them from the rest. Further down, there is a summary of their comparative valuations and respective market shares in different divisions within banking.

Morgan Stanley: In 2012, Morgan executives made changes to their business model. The company reduced headcount from fixed-income activities and added employees to its equities trading unit. They focused their business on wealth management rather than derivatives. It has focused its strategy on being more conservative and cautious, and has moved away from high-risk and high-reward trading and into more dependable money management. With Institutional securities and Wealth management being its largest branch. Morgan Stanley Wealth Management is the third largest in the world. While Goldman depends most of trading revenue, Morgan Stanley's brokerage and investment banking arms dominate.

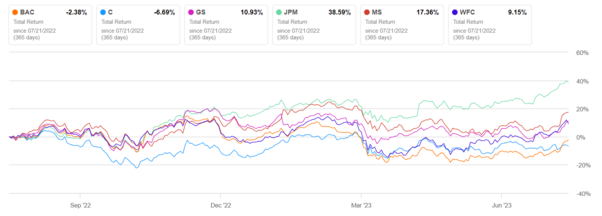

JP Morgan Chase: In 2022 both companies saw their stock prices fall with rising inflations and Federal Reserve interest rate hikes. The Dow Jones industrial average dropped 8.8% during the year, Goldman Sachs stock fell 10.2% and JP Morgan's stock price was lowered by 15.6%. JP Morgan's Market Cap is 3.5 times the size of GS, but GS pays a higher dividend yield than JP Morgan Chase. JP Morgan deals with industry competition by acquiring smaller banks, thereby removing some potential competition from the market place, as well as by being one of the world's oldest, largest and best-known financial institutions. It has also differentiated itself from competitors by focusing on its lending business within consumer banking which has benefitted from the Fed hiking up interest rates, moreover it has benefitted from loan book generating more revenue as interest rates have gone up.

Citi Bank: Citibank launched the first fully integrated and certified mobile payment solution. Citibank focuses its activities mainly on its consumer banking services. The Institutional Clients Group, operates across three different areas: Services, Markets and Banking where the bank supports 90% of global Fortune 500 companies and the personal banking and wealth management division, makes up 87% of the companies revenue. Looking ahead into 2023 they are looking to complete sales in India, Indonesia, Taiwan and Vietnam, as well as further wind down progresses in Korea, Russia and China. Their main strategy is to lead with excellence and empathy, as well as prioritising their people.

Bank of America: Bank of America is an American multinational investment bank and financial services holding company. Bank of America's competitive advantage with respect to other banks is its: diversified business model, which allows it to be less vulnerable to economic downturns. During the 2008 financial crisis, the bank was able to rely on its wealth management and investment banking business; technological innovation; strong brand and a strong risk management, which helps it to identify and mitigate potential risk. On the other hand, one of the major weaknesses is its reputation: the bank has faced several scandals and controversies in the past as well as the banks dependence on the US market. In the Q2-23 earnings report the bank has reported a 2.9 billion net income in consumer banking and 2.7 billion in global markets, making these the leading divisions. It's main future strategy focuses on growth, and specifically growing within their risk framework.

Wells Fargo: Wells Fargo & Company is a leading financial service company, it has four operating segments: Consumer banking and Lending, Commercial Banking, Corporate and Investment Banking, and Wealth & Investment Management. It's strategic plan is to create a more focused Home Lending business aimed at serving bank customers, as well as individuals and families. For 2023 its main strategy focuses on investment, technology and a team. The company is exiting the Correspondent business and plans to reduce the size of its Servicing portfolio. Wells Fargo Strategic Capital is the primary merchant banking platform, their capital solutions include non-control equity, private credit, and investments in approved Small Business Investment Company funds. On the other hand, Wells Fargo has been subject to a series of lending scandals as well as the creation of over 3.5 million unwanted, fake accounts in 2013 by Wells Fargo's employees to get their bonus.

Key Competitors:

- Investment Banking: In the investment banking sector, Goldman Sachs faces stiff competition from several other major global financial institutions:

- JPMorgan Chase & Co.: JPMorgan is one of Goldman Sachs' primary competitors in investment banking. It boasts a robust global network and a diverse range of investment banking services.

- Morgan Stanley: Another major player in the investment banking industry, Morgan Stanley, competes directly with Goldman Sachs in providing advisory and capital-raising services to clients.

- Bank of America Corporation: Bank of America's investment banking arm, Bank of America Merrill Lynch, competes with Goldman Sachs in various financial advisory and capital markets activities.

- Citigroup Inc.: Citigroup's investment banking division is a significant competitor to Goldman Sachs, particularly in the areas of mergers and acquisitions and capital markets transactions.

- Trading and Sales: Goldman Sachs is a formidable force in the trading and sales arena, but it faces strong competition from other top-tier global investment banks:

- JPMorgan Chase & Co.: JPMorgan's vast trading operations, particularly in equities and fixed income, make it a key rival to Goldman Sachs in these markets.

- Morgan Stanley: Morgan Stanley's trading desk is another major competitor, engaging in activities similar to Goldman Sachs across various asset classes.

- Bank of America Corporation: Bank of America's trading and sales division, particularly its global markets segment, competes with Goldman Sachs in providing liquidity and trading services.

- Citigroup Inc.: Citigroup's trading arm, known as Citi Markets, is a strong competitor, particularly in foreign exchange and fixed income markets.

- Investment Management: In the investment management space, Goldman Sachs Asset Management (GSAM) competes with several major asset management firms:

- BlackRock, Inc.: BlackRock is the world's largest asset manager and a major competitor to GSAM, offering a wide range of investment products and solutions.

- Vanguard Group: Vanguard is renowned for its index funds and low-cost investment products, making it a significant competitor in the asset management industry.

- State Street Global Advisors: State Street is a major player in providing ETFs and other investment management services, competing with GSAM in various asset classes.

- JPMorgan Asset Management: JPMorgan's asset management arm is a direct competitor to GSAM, offering diverse investment strategies to institutional and individual clients.

- Consumer and Wealth Management: In the consumer banking and wealth management markets, Goldman Sachs' digital platform, Marcus by Goldman Sachs, faces competition from established players:

- JPMorgan Chase & Co. (Chase Private Client): JPMorgan's wealth management division, serving high-net-worth clients, is a formidable competitor.

- Morgan Stanley (Morgan Stanley Wealth Management): Morgan Stanley's wealth management business is a significant rival, catering to affluent individuals and families.

- Bank of America Corporation (Merrill Lynch Wealth Management): Merrill Lynch's wealth management unit competes with Marcus in serving high-net-worth clients.

- Wells Fargo & Co. (Wells Fargo Wealth Management): Wells Fargo's wealth management arm is another competitor in the high-net-worth client segment.