3ti Energy Hubs

| Copyrighted | This is a logo of an organization, item, or event, and is protected by copyright. The use of low-resolution images on the English-language Wikipedia, hosted on servers in the United States by the non-profit Wikimedia Foundation, of logos for certain uses involving identification and critical commentary may qualify as non-free use under the Copyright law of the United States. Any other uses of this image, on Wikipedia or elsewhere, may be copyright infringement. Certain commercial use of this image may also be trademark infringement. See Wikipedia:Non-free content and Wikipedia:Logos.

Use of the logo here does not imply endorsement of the organization by Wikipedia or the Wikimedia Foundation, nor vice versa. |

| Template:Uploader information | |

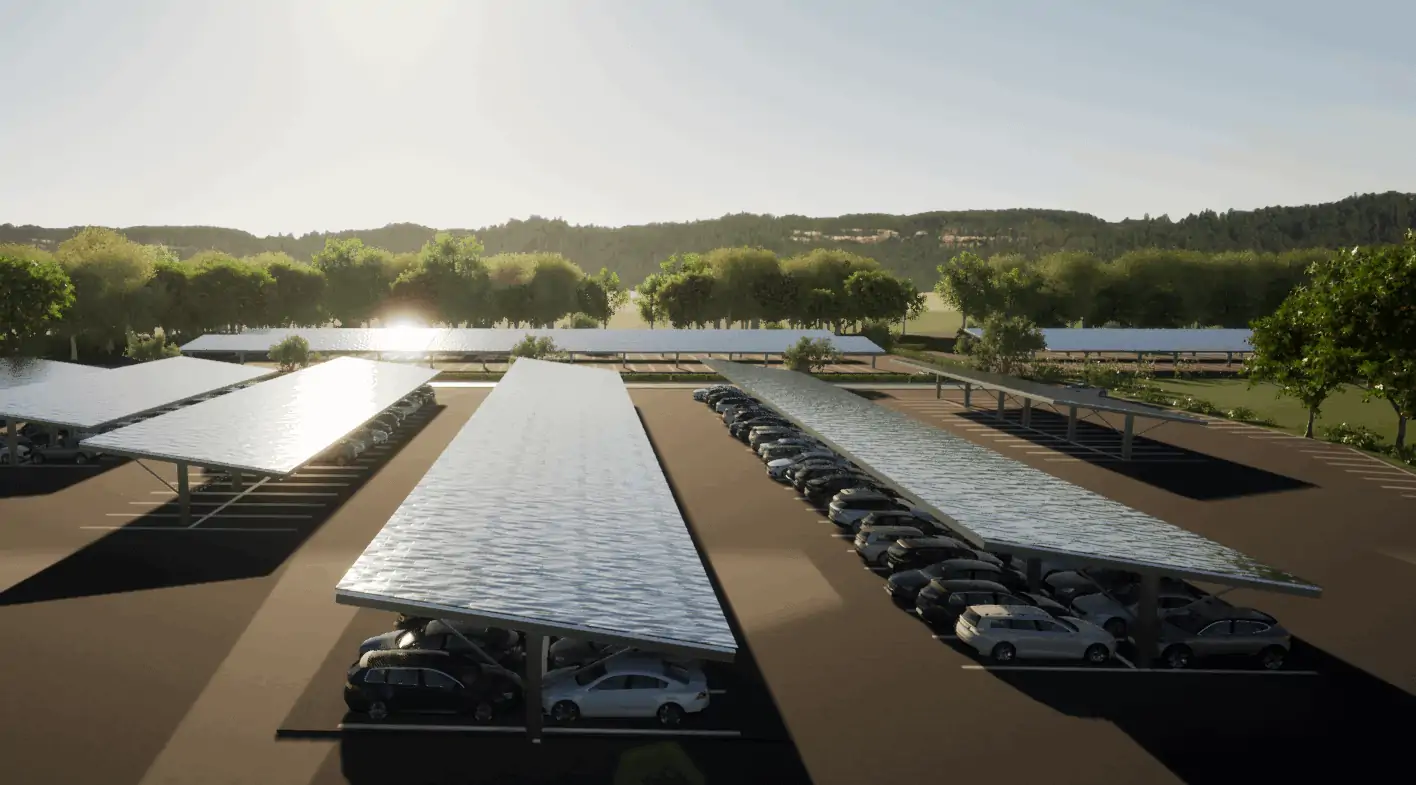

Charge electric vehicles & power your organisation with a solar car park

Summary edit edit source

3ti combines solar power, batteries and EV charge points in car parks, turning them into renewable energy power stations and EV charging hubs. Initial consultations underway with MoD, Bentley, Barclays and on behalf of the NHS. £7.8m turnover to date. Raising to roll out pop-up mini solar carpark Papilio3, develop technology and grow the team.

- £7.8m turnover to date (10 months to April 2022: £3.46m, P&L: -£1.15m)

- Papilio3 enquiries from 90+ companies and expressions of interest from a UK car manufacturer

- Working with Bentley Motors, JP Morgan, Barclays, MoD & NHS

- 2.8m EV charge points required in the UK by 2035

Idea[1] edit edit source

3ti is generating clean energy today, for everyone’s tomorrow. The company turns car parks into renewable energy power stations and fast EV charging hubs. The electric vehicle market is growing rapidly with 14m EVs expected on UK roads by 2030.

40% of UK electricity is generated from fossil fuels and when EVs are rapid charged at peak times, this is what many drivers are unwittingly using.

Yet the amount of solar energy that falls on the world in just one hour is enough to power the entire planet for a year! 3ti thinks we should be using more of it.

The company combines three existing technologies in an innovative infrastructure that blends local mains electricity with solar energy, using a battery to feed fast EV charge points and is designed to deliver low-cost, low-carbon charging that is kinder on the planet.

3ti is raising to grow its team, develop its technology further and begin to roll out the first 30 of its pop-up, mini solar car parks - Papilio3 which allows the company to install up to 12 fast charge points in one go, in under 24 hours. Papilio3 needs no new grid connection, and in most cases, no planning permission.

The company has enquiries from 90+ companies and expressions of interest from a UK car manufacturer, a County Council, a leisure chain and a major health care provider.

Team[1] edit edit source

Whilst running a farm in former East Germany in the ‘90s, Tim witnessed first-hand the negative environmental impact of industrial air pollution & intensive farming. Becoming involved in growing oilseed rape for biodiesel production he was impressed by the rapid development of the German renewable energy sector, moving on to work in biogas, wind, and electricity generation from biomass & solar energy.

Ever since, through his work on large scale renewable energy projects in Europe, Tim has strived to build efficient clean energy solutions to “leave something better behind” for his children and grandchildren.

Tim Evans, CEO & Founder

Renewable energy professional with experience in sustainable energy projects across Europe. Tim has held senior roles with Estover Energy, Speyside Renewable & BTS Biogas Ltd.

Max Aitken, Executive Chair (part time)

Founder & CEO of Estover Energy & Director of Cherif Capital, Max is also President of Beaverbrook Canadian Foundation & a Beaverbrook Foundation Trustee in the UK.

Max Aitken has a number of other non-executive roles in renewable energy companies. Some of these are also in insolvency proceedings.

James Lee, Non-Exec. Director (part time)

Founder of solar development business Lightsource, in which BP bought a 43% stake in the business in 2017. James is a director for multiple companies including renewable energy investment & development company, Arilee.

James Lee has experience in a large number of other renewable energy companies, in executive and non-executive roles. These companies have had varying levels of success, and some have entered insolvency; some of these insolvency processes are ongoing at the moment but James has confirmed that he is not aware of any action that will affect his role at 3Ti.

Mark Potter, CTO

A Chartered Engineer, EV & Battery specialist, Mark is a former Chief Engineer at Protean Electric Automotive.

Risks edit edit source

As with any investment, investing in 3ti Energy Hubs carries a level of risk. Overall, based on the key risks highlighted below, the degree of risk associated with an investment in 3ti Energy Hubs is higher than in a company that's trading on a public market.

Early-stage investment edit edit source

3ti Energy Hubs is at one of the earliest stages of the business lifecycle, and the failure rate of companies at that stage is usually much higher than those at a later stage.

Illiquid investment edit edit source

The number of transactions in shares of private companies is usually significantly lower than in public companies, typically resulting in it taking longer to sell shares in private companies at a price that is at least equal to the price that the shares were bought at. Accordingly, the 3ti Energy Hubs investment opportunity is considered to be higher risk than more liquid companies.

Actions edit edit source

To invest in 3ti, click here.

To contact 3ti, click here.