Alien Metals Ltd: IOCA signs agreement with Anglo American for exclusive right to negotiate up to US$15m project funding and 100% offtake

SummaryEdit

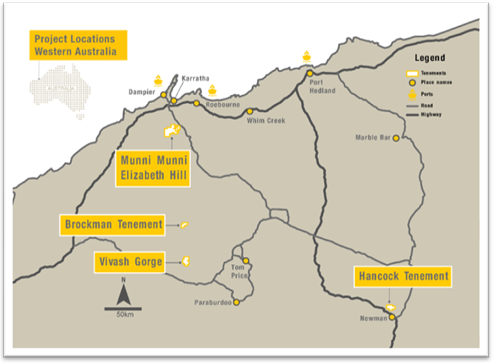

Alien Metals Ltd (LSE AIM:UFO), a global minerals exploration and development company, is pleased to announce that it has, through its wholly-owned subsidiary Iron Ore Company of Australia Pty Ltd ("IOCA"), entered into a mandate letter providing for an exclusive right to negotiate project funding and offtake arrangements ("Mandate Letter") with Anglo American (LSE: AAL; JSE: AGL), in relation to the Hancock iron ore project ("Hancock") located in the Pilbara, Western Australia (Figure 1).

Highlights:

- IOCA has granted Anglo American an exclusive right to negotiate and agree terms with IOCA for up to US$15 million in funding and 100% of offtake from the Hancock Project, including:

- US$10,000,000 in Advance Payment Facility

- 100% Offtake for Sinter Fines and Lump from the Hancock Project

- Offtake terms to include vessel prepayments for up to US$5,000,000 for the first 12 months

- Anglo American to receive an agreed royalty for 24 months.

- Exclusive right commences immediately and will conclude the earlier of 60 calendar days after IOCA delivers to Anglo American an agreed Base Case Financial Model together with all necessary supporting documents or such later date that the parties may agree upon.

- Anglo American is a leading, global mining company with a portfolio of competitive, world class operations, including annual production of more than 60Mt of premium quality iron ore from South Africa and Brazil.

Bill Brodie Good, CEO of Alien Metals, commented: "We are really pleased to have signed this Mandate Letter with a leading, global mining company of Anglo American's stature."

"The Mandate Letter provides a pathway to negotiate and agree the potential development debt funding, and a 100% offtake solution. This Mandate Letter supports our near-term production aspirations and, unlike conventional debt finance, the potential bespoke funding with offtake provides alignment between the parties for the pursuit of scale across multiple assets with a world class counterparty. The Board is continuing to assess development plans at Hancock which may reduce the initial capex requirement outlined in the October 2021 Scoping Study and will advise once this process is complete."

"We thank the Anglo American team for the interest in and support for our project and we look forward to working with them"

Figure 1: Location of Hancock Iron Ore Project, Western Australia

The key terms of the Mandate Letter are set out below:

- IOCA has granted Anglo American an exclusivity period of 60 calendar days after IOCA delivers to Anglo American an agreed Base Case Financial Model together with all necessary supporting documents or such later date that the parties may agree upon

- The parties have agreed to negotiate and, subject to due diligence satisfactory to Anglo American and Anglo American's internal approvals, agree legally binding documentation for:

- the provision by Anglo American of US$10 million of debt funding for Hancock repayable over two years; and

- offtake by Anglo American of 100% of iron ore products from Hancock, which will include vessel prepayments of up to US$5 million for the first 12 months, for an initial period of 3 years or longer should the minimum quantity not be delivered.

- Conditions precedent, customary for transactions of this nature, including but not limited to:

- new equity raised by Alien, and evidence that such amount has been utilized for Hancock in this case, of US$5 million;

- relevant reports, such as a technical report, environmental report, insurance report and legal due diligence report;

- documentation for mandatory hedging to be executed and provided by a third party or Anglo American; and

- permits, approvals, licenses in relation to the mining and construction and operation of the Project including, confirmed port allocation and permit to use main road.

- It is noted that whilst the terms of the Mandate Letter in particular as regards exclusivity, confidentiality and fees are expressed to be legally binding the indicative terms of any project funding and offtake are not and therefore are subject to definitive documentation.

Hancock Project Overview:

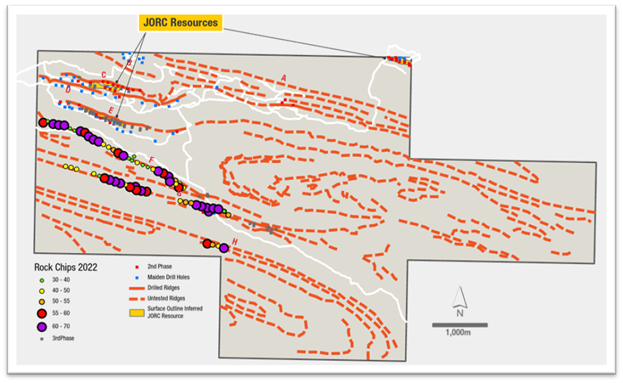

Hancock hosts a JORC compliant Inferred Mineral Resource of 10.4Mt @ 60.4% Fe (Announcement: 22 September 2021), and as announced earlier this year, the project hosts significant potential to find more direct shipping ore (DSO) grade material on the tenement across ridges F, G & H (announcement: 30 March 2022).

| Classification

Category |

Area | Mass

(Million tonnes) |

Average Value | |||||

|---|---|---|---|---|---|---|---|---|

| Fe | SiO2 | Al2O3 | P | LOI | MnO | |||

| % | % | % | % | % | % | |||

| Inferred | Sirius Extension | 7.8 | 60.1 | 4.1 | 3.72 | 0.17 | 5.2 | 0.05 |

| Ridge E | 1.5 | 61.2 | 4.8 | 3.38 | 0.13 | 3.5 | 0.02 | |

| Ridge C | 1.1 | 61.9 | 4.4 | 2.93 | 0.12 | 3.5 | 0.03 | |

| Total | 10.4 | 60.4 | 4.2 | 3.6 | 0.16 | 4.8 | 0.04 | |

Hosting DSO grade iron ore with low impurities, the Company are confident that future production from Hancock will be highly sought-after product; as such the Iron Ore Company of Australia ("IOCA") team is driving development plans forward on all fronts.

Figure 2: Location and results of rock chip sampling program, Hancock Iron Ore Project, Western Australia, March 2022

Being a high-grade DSO iron ore with low impurities, as evidenced in the Bulk Sample and Metallurgical test work to date (Announcement: 4th February 2022), the Company remains confident to be in production in 2023 given the high level of interest shown by all related parties at this stage in its development.

| Fe % | Al2O3% | Mn % | P % | SiO2 % | LOI % | |

|---|---|---|---|---|---|---|

| AM21BLK_C_001 | 59.63 | 2.59 | 0.015 | 0.08 | 5.09 | 3.91 |

| AM21BLK_C_002 | 60.5 | 3.17 | 0.016 | 0.081 | 5.29 | 3.18 |

| AM21BLK_C_003 | 63.03 | 2.86 | 0.015 | 0.078 | 3.96 | 2.31 |

| AM21BLK_C_004 | 62 | 3.15 | 0.016 | 0.091 | 4.5 | 2.89 |

| AM21BLK_C_005 | 62.25 | 2.81 | 0.015 | 0.092 | 4.15 | 2.84 |

| AM21BLK_C_006 | 64.31 | 1.94 | 0.01 | 0.096 | 3.23 | 2.18 |

| AM21BLK_C_007 | 63.97 | 2.23 | 0.011 | 0.101 | 3.2 | 2.29 |

| AM21BLK_C_008 | 62.78 | 2.82 | 0.013 | 0.108 | 3.85 | 2.66 |

| AM21BLK_C_009 | 61.57 | 3.31 | 0.012 | 0.106 | 4.4 | 3.12 |

| AVERAGE | 62.23% | 2.76% | 0.01% | 0.09% | 4.19% | 2.82% |

SourcesEdit

The company.