American Tower Corporation

| |

| Type | Public company |

|---|---|

| Industry |

|

| Founded | 1995 |

| Headquarters | Boston, Massachusetts , United States |

Key people | Tom Bartlett (Chairman, CEO and President) |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 6,378 (2021) |

| Subsidiaries | CoreSite |

| Website |

|

| Footnotes / references [1] | |

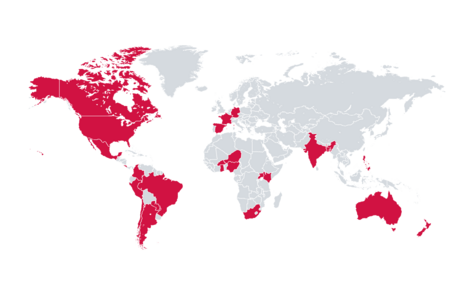

American Tower Corporation, one of the largest global REITs, is a leading independent owner, operator and developer of multitenant communications real estate with a portfolio of approximately 219,000 communications sites.

Pitch edit edit source

Team edit edit source

All the images and data has been taken from the AMT website.[5]

Market edit edit source

Total Addressable Market edit edit source

Here, the total addressable market (TAM) is the global commercial real estate market which, based on a number of assumptions and in terms of revenue, was valued at $35.0 trillion in 2022.[2]

Serviceable Available Market edit edit source

Here, the serviceable available market (SAM) is the global telecom tower market which, based on a number of assumptions and in terms of revenue, is valued at $50.4 billion in 2022.

Fastest Growing Region edit edit source

Asia-Pacific

Largest Region edit edit source

Asia-Pacific

Market Drivers edit edit source

- Increase in demand for highspeed internet services across the world.

- Digital transformation of businesses.

- Growing adoption of IoT-based devices.

- Launch of 5G connectivity.

Market Trends edit edit source

- Development and deployment of green and sustainable towers

- Solar powered towers

- Energy efficient construction and installation methods

- Infrastructure sharing between telecom providers (tower sharing and tower leasing)

- Lowers capital investment

- Boosts operational efficiencies

- “Smart” towers

- Remote monitoring

- Predictive maintenance

Competitors edit edit source

Competitive Advantage: edit edit source

American Towers is one of the only to provide data centre services in addition its tower-based infrastructure offerings.

Occupancy Rate: edit edit source

American Towers has an occupancy rate of 84.3%. This indicates the ratio of its assets which are currently being used, and the proportion of assets which are wasted/unused. [4] [5] [6]

Finance edit edit source

Sources:

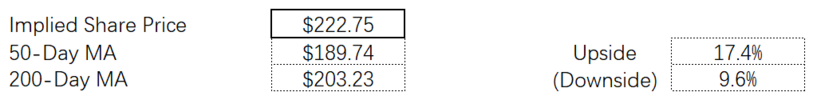

Valuation edit edit source

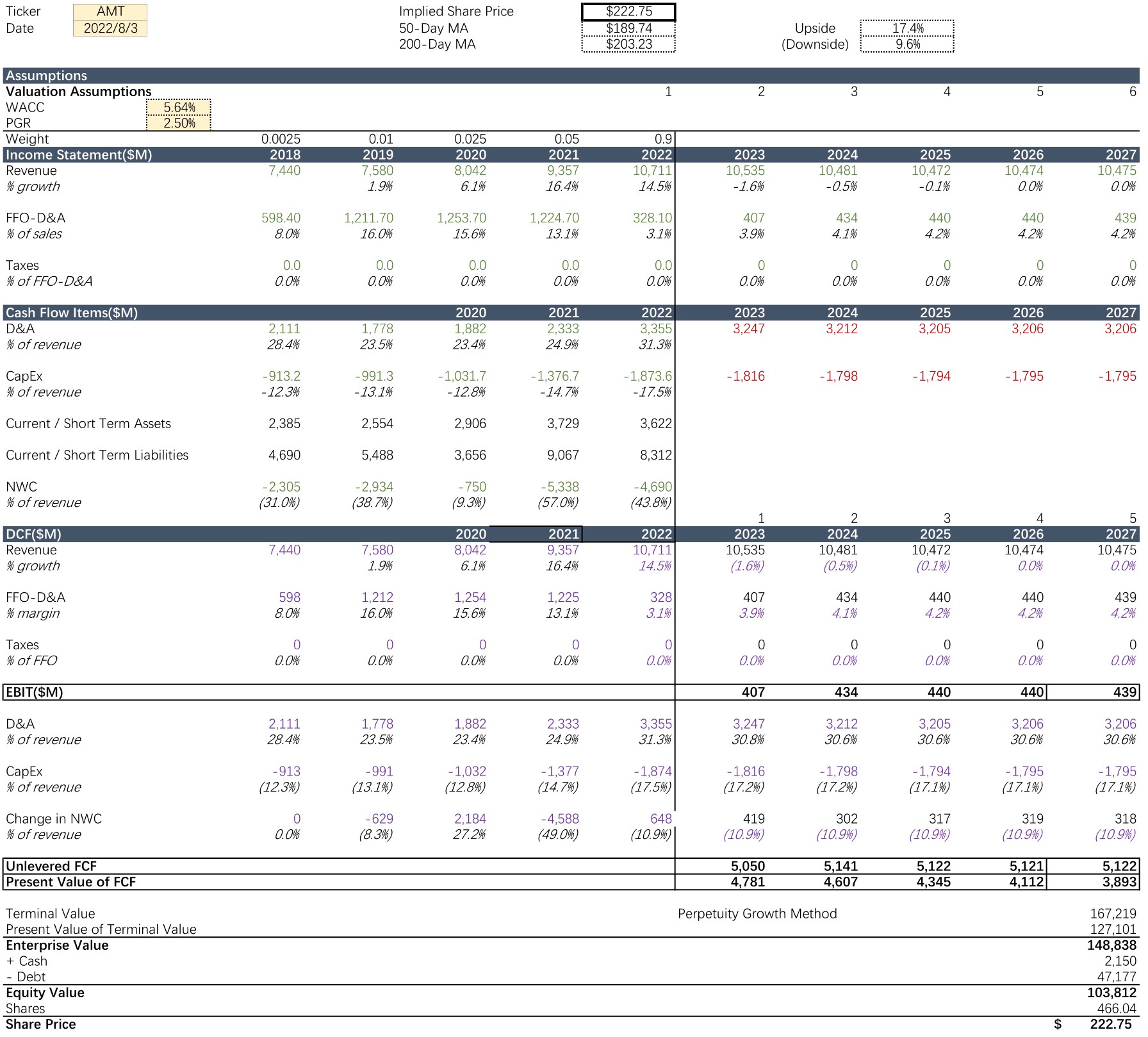

DCF edit edit source

Assumptions

- Perpetual Growth Rate: 2.5%

- 10% Market Return: aligning with the S&P 500 return

- Fund For Operations(FFO) replaces EBITDA since it gives a more accurate representation of REIT's PnL:

Cash Flow & Income Statement Items

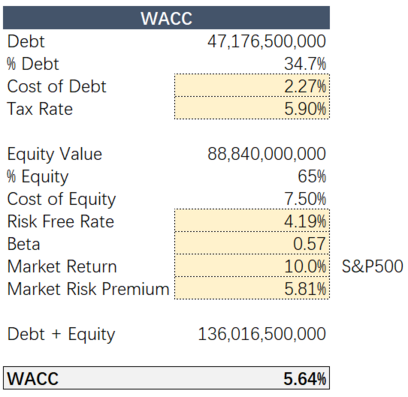

WACC

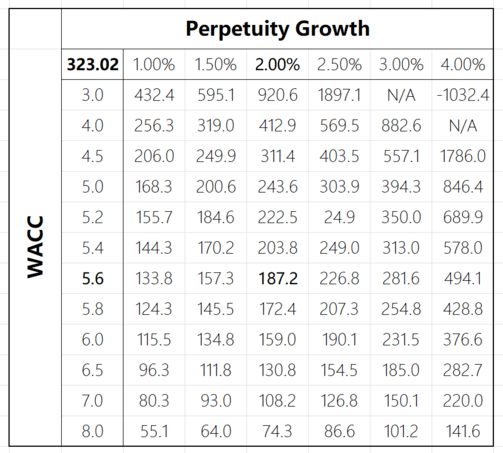

Sensitivity Analysis

Result

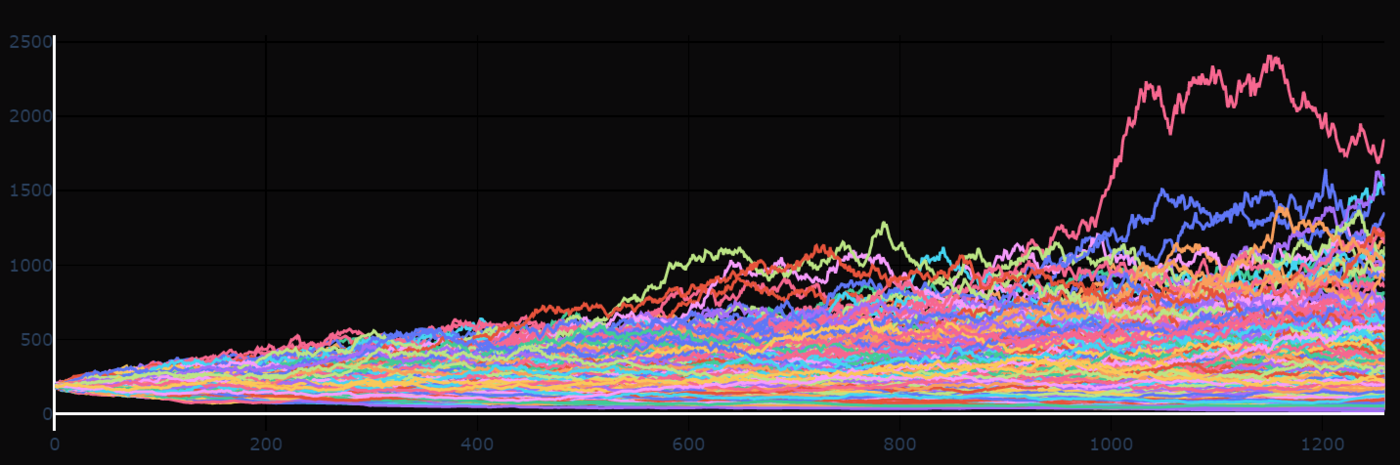

Sanity Check: Geometric Brownian Motion Simulation

Average log return: 7%; Annualised volatility: 30%

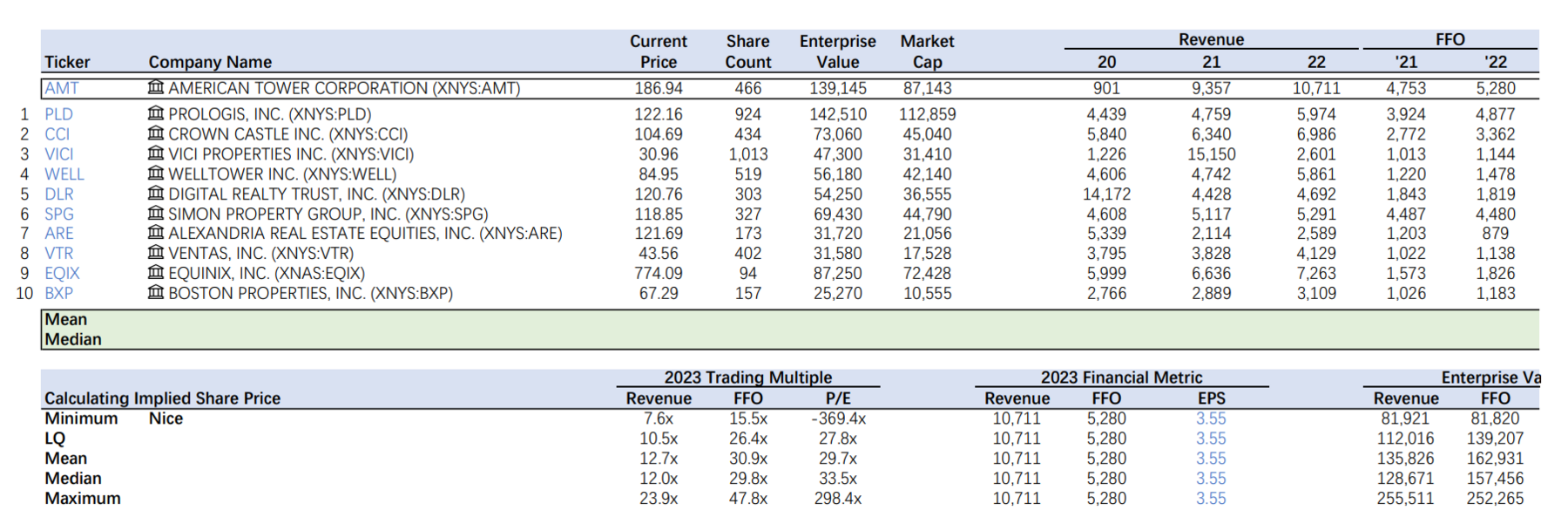

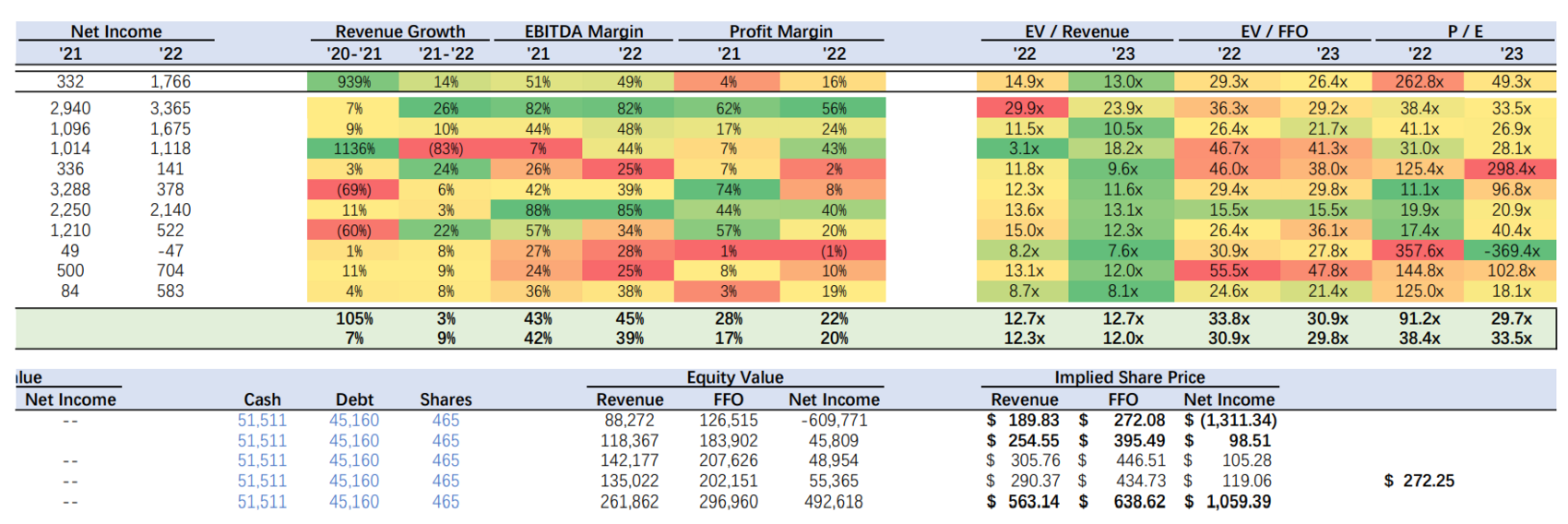

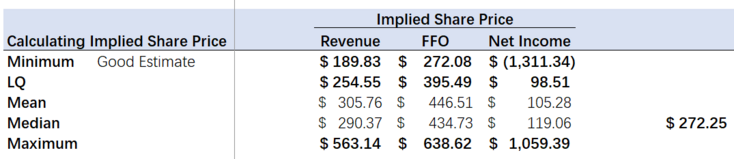

Trading Comp edit edit source

Assumptions

AMT, compared to its peers, operates at lower multiples with a significant market cap, therefore using the lower quartile and min of the multiples is more realistic in terms of modelling.

Risk edit edit source

Risks related to Ability to Sell:

- A significant decrease in leasing demand for American Tower communications infrastructure would materially and adversely affect their business and operating results, and this demand cannot be controlled

- A substantial portion of American Tower's current and projected future revenue is derived from a small number of customers, and the company is sensitive to adverse changes in the creditworthiness and financial strength of our customers

- With increasing competition within the same industry, American Tower's revenue may be materially and adversely affected

- American Tower's ability to achieve their return on investment criteria could be adversely affected by competition for assets

- American Tower's costs could increase and their revenues could decrease due to perceived health risks from radio emissions, especially if these perceived risks are substantiated

Risks related to Finance & Corporate:

- American Tower's growth, revenue and ability to generate positive cash flows could be materially and adversely affected if their customers consolidate their operations, exit their businesses or share site infrastructure to a significant degree

- American Tower's expansion initiatives involve a number of risks and uncertainties, including those related to integrating acquired or leased assets, that could adversely affect their operating results, disrupt their operations or expose them to additional risk

- American Tower's leverage and debt service obligations, including during a rising interest rates environment, may materially and adversely affect their ability to raise additional financing to fund capital expenditures, future growth and expansion initiatives and to satisfy their distribution requirements

- Restrictive covenants in the agreements related to their: securitisation transactions, credit facilities and debt securities could materially and adversely affect their business by limiting flexibility, and may be prohibited from paying dividends on their common stock, which may jeopardise American Tower's qualification for taxation as a REIT

- The transition to SOFR based loans may adversely affect American Tower's cost to obtain financing

- Rising inflation may adversely affect American Tower by increasing costs beyond what they can recover through price increases

Risks related to Legal and Regulatory:

- American Tower's business, and that of their customers, is subject to laws, regulations and administrative and judicial decisions, and changes thereto, that could restrict their ability to operate our business as they currently do or impact their competitive landscape

- If American Tower fail to remain qualified for taxation as a REIT, they will be subject to tax at corporate income tax rates, which may substantially reduce funds otherwise available, and even if they qualify for taxation as a REIT, they may face tax liabilities that impact earnings and available cash flow

- Complying with REIT requirements may limit American Tower's flexibility or cause us to forego otherwise attractive opportunities

- American Tower could have liability under environmental and occupational safety and health laws

- If American Tower are unable to protect their rights to the land under our towers and buildings in which their data centers are located, it could adversely affect their business and operating results

- If American Tower are unable or choose not to exercise their rights to purchase towers that are subject to lease and sublease agreements at the end of the applicable period, their cash flows derived from those towers will be eliminated

Risks related to Tech & Innovation:

- New technologies, changes, or lack thereof, in American Tower's or a customer’s business model could make their communications infrastructure leasing business less desirable and result in decreasing revenues and operating results

- If American Tower, or third parties on which they rely, experience technology failures, including cybersecurity incidents or the loss of personally identifiable information, they may incur substantial costs and suffer other negative consequences, which may include reputational damage

Risks related to Macro & Political Reasons:

- American Tower's foreign operations are subject to economic, political and other risks that could materially and adversely affect their revenues or financial position, including risks associated with fluctuations in foreign currency exchange rates

- American Tower may be adversely affected by regulations related to climate change

- American Tower's towers, fiber networks, data centers or computer systems may be affected by natural disasters (including as a result of climate change) and other unforeseen events for which their insurance may not provide adequate coverage or result in increased insurance premiums

In the most recent earnings report American Tower disclosed 24 risk factors, two more since last quarter's report, including the following risk distributions:

| Risk Distribution | Description | Risks | Overall Percentage |

|---|---|---|---|

| Ability to sell | Risks related to the company’s ability to sell goods and services | Demand - 13%

Competition - 8% Sales & Marketing 4% Brand / Reputation 0% |

25% |

| Finance & Corporate | Financial and accounting risks. Risks related to the execution of corporate activity and strategy | Debt & Financing - 17%Corporate Activity and Growth - 4%

Share Price & Shareholder Rights - 0% Accounting & Financial Operations - 0% |

20.8% |

| Legal & Regulatory | Litigation, compliance, new legislation, and taxation risks | Regulation - 8%Environmental / Social - 8%

Taxation & Government Incentives - 4% Litigation & Legal Liabilities - 0% |

20.8% |

| Tech & Innovation | Risks related to the company’s reliance on technology and ability to make innovative products | Technology - 8%Trade secrets - 4%

Innovation - 0% Cyber Security - 0% |

12.5% |

| Macro & Political | Risks related to catastrophic events or geopolitical conditions that may disrupt the company’s business | Economy & Political Environment - 4%Natural and Human Disruptions - 4%

Capital Markets - 4% International Operations - 0% |

12.5% |

| Production | Risks related to the company’s ability to manufacture goods and services | Cost - 8%Manufacturing - 0%

Employment / Personnel - 0% Supply Chain - 0% |

8.3% |

References edit edit source

- ↑

- ↑ https://www.statista.com/statistics/1189630/commercial-real-estate-market-size-global/#statisticContainer

- ↑ https://www.americantower.com/Assets/beta.americantower.com/uploads/images/company/GlobalPresenceMap2023-1.png

- ↑ craft.co

- ↑ https://www.digitaljournal.com/pr/news/newsmantraa/telecom-towers-market-2023-is-booming-with-top-key-players-china-tower-corporation-american-tower-corporation-mer-sba-communications-crown-castle

- ↑ https://www.coherentmarketinsights.com/market-insight/telecom-towers-market-2826#

5. ↑ https://www.americantower.com/company/leadership-team/index.html

6. https://www.tipranks.com/stocks/amt/risk-factors

7. https://americantower.gcs-web.com/static-files/01aa59a6-d202-4bcf-b8d6-8ef19df4c3ef