Aston Martin Lagonda Global Holdings plc

| |

Aston Martin Vanquish | |

| Type | Public limited company |

|---|---|

| LSE: AML FTSE 250 component | |

| Industry | Automotive |

| Founded | 15 January 1913 |

| Founders | |

| Headquarters | Gaydon, Warwickshire, England, United Kingdom |

Area served | Worldwide |

Key people |

|

| Products | |

| Brands |

|

| Revenue | |

Number of employees | 3,000 (2022) |

| Subsidiaries | Aston Martin Racing |

| Website |

|

| Footnotes / references [1][2] | |

Aston Martin Lagonda Global Holdings plc designs, develops, manufactures, markets, and sells luxury sports cars under the Aston Martin and Lagonda brand names worldwide. It also engages in the sale of parts; sale of vehicles; servicing of vehicles; and brand and motorsport activities. The company sells its vehicles through a network of dealers. It has strategic technology agreement with Mercedes-Benz AG. Aston Martin Lagonda Global Holdings plc was incorporated in 2018 and is headquartered in Gaydon, the United Kingdom.

Operations edit edit source

How did the idea of Aston Martin come about?

The idea of Aston Martin originated with two founders, Lionel Martin and Robert Bamford, who shared a passion for engineering and racing. In 1913, Lionel Martin, a successful racing driver, competed at Aston Hill Climb in Buckinghamshire, England, driving a Singer car. Inspired by his experience and seeking to create his own high-performance vehicles, Martin partnered with Robert Bamford, a skilled engineer, to establish a new automobile company.

The company was officially founded in 1913 and initially called "Bamford & Martin Ltd." The name Aston Martin was later adopted in 1914 when they combined Martin's surname with the name of the Aston Hill Climb event that had initially inspired him.

In the early years, Aston Martin focused on producing racing cars and sports cars that embodied their founders' vision of combining performance, style, and quality. However, due to the outbreak of World War I, production was temporarily halted, and the company turned its attention to manufacturing aircraft components for the war effort.

After the war, Aston Martin faced financial challenges, changing ownership, and periods of limited production. In the 1920s, the company introduced new models and gained recognition for their performance and success in various racing events. However, by the 1930s, financial difficulties resurfaced, leading to multiple ownership changes and struggles to maintain stability.

A significant turning point for Aston Martin came in 1947 when the company was acquired by industrialist David Brown. Under Brown's leadership, Aston Martin experienced a revitalization and began a new era of innovation and success. The DB series, starting with the iconic DB2, marked a new design direction and established Aston Martin as a premier luxury sports car manufacturer.

Over the years, Aston Martin continued to evolve and expand its product line-up, introducing notable models such as the DB4, DB5 (famously associated with James Bond), and later the DB9, Vantage, and Vanquish. The brand also ventured into motorsport, achieving notable successes in endurance racing, including multiple victories at the 24 Hours of Le Mans.

Throughout its history, Aston Martin has faced challenges, changes in ownership, and fluctuations in the market. However, the brand has remained true to its founding principles of delivering exceptional performance, craftsmanship, and luxury. Today, Aston Martin continues to be a symbol of automotive excellence, renowned for its distinctive design, engineering prowess, and rich heritage.

What's the mission of the company?

The mission of Aston Martin Holdings PLC is to be a globally recognized luxury automotive brand that embodies the spirit of British craftsmanship, innovation, and performance. Aston Martin strives to create exceptional and timeless sports cars that captivate enthusiasts and provide a unique ownership experience.

Key elements of Aston Martin's mission include:

- Exquisite Design and Craftsmanship: Aston Martin is committed to creating vehicles that showcase meticulous design, exquisite craftsmanship, and attention to detail. By blending traditional handcrafting techniques with advanced technology, Aston Martin aims to deliver cars that are not only visually stunning but also built to the highest standards of quality.

- Unparalleled Performance: Aston Martin vehicles are renowned for their exceptional performance, offering exhilarating driving experiences. Whether on the racetrack or the open road, Aston Martin strives to engineer cars that deliver outstanding power, agility, and handling, reflecting its rich motorsport heritage and relentless pursuit of automotive excellence.

- Timeless Elegance: Aston Martin vehicles exude timeless elegance, combining classic design cues with modern aesthetics. The brand aims to create cars that transcend trends and stand the test of time, appealing to individuals who appreciate understated luxury and sophistication.

- Personalisation and Exclusivity: Aston Martin recognizes the importance of personalisation and exclusivity, offering customers the ability to tailor their vehicles to their unique preferences. By providing bespoke options and limited production models, Aston Martin seeks to create a sense of exclusivity and individuality for its discerning clientele.

- Commitment to Innovation: Aston Martin is dedicated to pushing the boundaries of automotive technology and innovation. The brand continually invests in research and development to incorporate cutting-edge advancements, including electrification and sustainable solutions, while staying true to its core values of performance and luxury.

- Engaging the Aston Martin Community: Aston Martin aims to foster a strong and engaged community of enthusiasts, owners, and fans worldwide. The brand actively cultivates relationships with its customers, organizing exclusive events, driving experiences, and providing exceptional customer service to create a sense of belonging and strengthen the Aston Martin community.

Through its mission, Aston Martin aspires to be a globally recognized symbol of automotive excellence, embodying the passion, heritage, and craftsmanship that have defined the brand for over a century.

What are the main offerings of Aston Martins Holdings?

Aston Martin offers a range of high-performance luxury sports cars and grand tourers that combine stunning design, exceptional performance, and refined craftsmanship. The main offerings of the company include:

1. Sports Cars:

Aston Martin's sports cars embody the brand's racing heritage and commitment to exhilarating performance. These models are designed for pure driving pleasure, offering precise handling, powerful engines, and dynamic capabilities. Examples of Aston Martin sports cars include the Vantage, DB11, and DBS Superleggera.

2. Grand Tourers:

Aston Martin's grand tourers are designed for long-distance journeys in utmost comfort and style. These models prioritize luxurious interiors, advanced technologies, and high levels of refinement. Grand tourers from Aston Martin include the DB11 and DBS Superleggera Volante, offering open-top driving experiences.

3. Limited Edition and Special Edition Models:

Aston Martin frequently introduces limited edition and special edition models to create exclusivity and cater to collectors and enthusiasts. These unique offerings often feature bespoke design elements, enhanced performance, and limited production numbers. Examples include special editions like the DBS GT Zagato and limited-production models like the Valkyrie hypercar.

4. Luxury SUV:

Aston Martin has expanded its portfolio to include a luxury SUV called the DBX. The DBX represents Aston Martin's entry into the SUV segment, combining performance, versatility, and luxury. It offers ample space, advanced technologies, and off-road capabilities while maintaining the brand's signature design and driving experience.

5. Electrification:

As part of Aston Martin's commitment to sustainability and the future of automotive technology, the company has begun incorporating electrification into its offerings. The Aston Martin Rapide E, an all-electric vehicle, represents the brand's foray into electric powertrains. Aston Martin plans to introduce more electric and hybrid models in the future.

These offerings from Aston Martin showcase the brand's dedication to crafting exceptional vehicles that blend performance, luxury, and timeless design. Each model represents the epitome of automotive excellence, appealing to enthusiasts and individuals seeking a unique and exclusive ownership experience.

Table 1: Aston Martin Car Model Comparison

| Model | Type | Engine Options | Power Output (hp) | 0-60 mph (seconds) | Top Speed (mph) | Price Range (approx.) |

|---|---|---|---|---|---|---|

| Vantage | Sports Car | 4.0L V8 or 5.2L V12 | 503 - 690 | 3.5 - 3.6 | 195 - 205 | $139,000 - $198,000 |

| DB11 | Grand Tourer | 4.0L V8 or 5.2L V12 | 503 - 630 | 3.6 - 3.7 | 200 - 208 | $205,600 - $273,000 |

| DBS Superleggera | Grand Tourer | 5.2L V12 | 715 | 3.4 | 211 | $316,300 - $335,600 |

| Rapide AMR | Sports Sedan | 6.0L V12 | 580 | 4.2 | 205 | $204,600 |

| DBX | Luxury SUV | 4.0L V8 | 542 | 4.3 | 181 | $179,986 |

| Valkyrie | Hypercar | Hybrid V12 | 1,160 | <2.5 | 250+ | Price on Request |

Please note that the prices mentioned are approximate and may vary based on factors such as optional features, customization, and local market variations. It's always recommended to consult with an authorized Aston Martin dealer for the most accurate and up-to-date information regarding pricing and specifications.

What's the current strategy of the company?

Aston Martin's current strategy focuses on several key areas to drive growth, profitability, and sustainability. While specific details may have evolved since then, the following elements were part of Aston Martin's strategy at that time:

- Product Portfolio Expansion: Aston Martin aimed to expand its product portfolio by introducing new models and variants to appeal to a broader customer base. This included the launch of the DBX, Aston Martin's first luxury SUV, which marked an entry into a new segment. By diversifying its offerings, Aston Martin sought to capture new market opportunities and attract customers looking for different types of vehicles.

- Electrification and Sustainable Solutions: In line with industry trends and environmental consciousness, Aston Martin planned to incorporate electrification into its portfolio. The company aimed to develop and introduce electric and hybrid models to meet evolving regulatory requirements, address customer preferences, and contribute to a more sustainable future. The launch of the Rapide E, Aston Martin's first all-electric vehicle, exemplified this commitment to electrification.

- Improved Production Efficiency and Cost Management: To enhance operational efficiency and profitability, Aston Martin focused on streamlining its production processes and supply chain management. The company aimed to optimize manufacturing operations, improve productivity, and reduce costs while maintaining the highest standards of quality and craftsmanship. Effective cost management was crucial to ensure a sustainable business model.

- Enhanced Customer Experience: Aston Martin prioritized delivering an exceptional customer experience throughout the ownership journey. This included investing in personalized services, after-sales support, and building strong relationships with customers. The company aimed to create a sense of exclusivity, foster brand loyalty, and provide a comprehensive ownership experience that extended beyond the initial vehicle purchase.

- Brand Strengthening and Global Expansion: Aston Martin aimed to reinforce its brand positioning and further expand its global presence. This included marketing initiatives to increase brand desirability and awareness, engaging with existing and potential customers through various channels, and exploring new markets. Aston Martin sought to leverage its heritage, performance credentials, and luxury appeal to solidify its position as a leading luxury automotive brand.

Sales edit edit source

Sales Figures by Model edit edit source

| Year | Sport Sales | Grand Tourer (GT) Sales | Sports Utility Vehicle (SUV) Sales | Specials | Other | Total Sales | Wholesale Average Selling Price (£k) |

|---|---|---|---|---|---|---|---|

| 2023 Q1 | 582 | 669 | 18 | 0 | 1269 | 213 | |

| FY-22 | 1833 | 1271 | 3219 | 89 | 0 | 6412 | 201 |

| FY-21 | 1479 | 1589 | 3001 | 98 | 11 | 6178 | 162 |

| FY-20 | 691 | 1116 | 1516 | 43 | 28 | 3394 | 157 |

"Sales" refers to wholesales, or sales made to dealers

"Sport" refers to the Vantage model

"Grand Tourer (GT)" refers to the DB11 and DBS Superleggera models

"Sports Utility Vehicle (SUV)" refers to the DBX model and its derivatives

"Other" refers to prior generation models

How are cars bought at Aston Martin?

Buying a car at Aston Martin is a personalized and comprehensive process that focuses on providing customers with a premium experience. Here's an overview of how cars are bought at Aston Martin:

- Showroom Visit: Prospective buyers typically begin by visiting an Aston Martin showroom. These showrooms are designed to reflect the elegance and luxury associated with the brand. Customers can explore the various models on display, experiencing firsthand the craftsmanship, design, and features of Aston Martin cars.

- Consultation and Customisation: Aston Martin sales representatives engage in personalized consultations with customers to understand their preferences, requirements, and budget. They provide in-depth information about different models, performance specifications, available options, and customization possibilities. Customers can choose from a range of exterior colors, interior trims, and optional features to create a bespoke Aston Martin tailored to their tastes.

- Test Drive: To experience the performance and handling of Aston Martin cars, customers are offered test drives. This allows them to get a feel for the vehicle's power, responsiveness, and overall driving experience. Test drives can be arranged at the dealership or during specific events organized by Aston Martin.

- Financial Options: Aston Martin offers a variety of financial options to help customers purchase their desired vehicles. This may include financing plans, leasing options, and trade-in services. The sales team provides guidance on the available financing solutions, helping customers choose the option that best suits their needs and budget.

- Order Placement: Once the customer has decided on the specific Aston Martin model and customization details, an order is placed with the dealership. The sales team assists with the necessary paperwork and documentation, ensuring a smooth ordering process.

- Production and Delivery: After the order is confirmed, the customer's Aston Martin enters the production process. Aston Martin cars are meticulously handcrafted, and the manufacturing time can vary depending on the model and customization requirements. The customer is provided with regular updates on the production progress.

- Handover and After-Sales Support: When the vehicle is ready, the customer is invited to the dealership for a personalized handover. During this process, the sales team explains the features, controls, and maintenance requirements of the vehicle. They also provide information about the warranty coverage and after-sales support services available.

- Ownership Experience: Aston Martin aims to provide an exceptional ownership experience beyond the point of purchase. Customers gain access to exclusive events, owner clubs, and personalized support for any inquiries or service needs that may arise during ownership. Aston Martin strives to build long-lasting relationships with their customers, fostering a sense of community and pride in owning an Aston Martin.

The buying process at Aston Martin revolves around delivering a bespoke and unforgettable experience, combining luxury, performance, and exceptional customer service. From consultation to customization, production to handover, Aston Martin ensures that customers receive a seamless and tailored journey when purchasing their dream car.

Leasing and Outright Purchase Details

At Aston Martin, customers have the option to either lease or outright purchase their vehicles. Both options have their own advantages and considerations, providing customers with flexibility based on their preferences and financial circumstances. Here's an elaboration on leasing vs. outright purchase at Aston Martin:

Leasing:

- Lower Monthly Payments: Leasing typically involves lower monthly payments compared to financing or outright purchasing. This is because the lease payments cover the depreciation of the vehicle during the lease term, rather than the full purchase price.

- Access to Newer Models: Leasing allows customers to regularly upgrade to the latest Aston Martin models. At the end of the lease term, customers can return the vehicle and lease a new one, keeping them at the forefront of automotive technology and design.

- Maintenance and Warranty Coverage: Leased vehicles are often covered by the manufacturer's warranty for the duration of the lease. This provides peace of mind as maintenance and repair costs may be included in the lease agreement, reducing the owner's financial responsibility for routine servicing and certain repairs.

- Flexibility: Leasing offers flexibility at the end of the lease term. Customers can choose to return the vehicle and lease a new one, extend the lease period, or potentially purchase the vehicle outright. This allows customers to evaluate their preferences and financial situation before committing to a long-term ownership arrangement.

Outright Purchase:

- Ownership and Equity: Purchasing an Aston Martin outright provides full ownership of the vehicle. Owners have the freedom to customize, modify, or sell the car as they see fit. Additionally, as the vehicle is paid off over time, equity is built, offering the potential for a return on investment if the vehicle is sold in the future.

- No Mileage Restrictions: Lease agreements often come with mileage restrictions to protect the vehicle's value. When purchasing outright, there are no mileage limitations, allowing owners to drive the vehicle without concerns about excess mileage fees or penalties.

- Customisation: Outright ownership grants customers the freedom to personalize their Aston Martin to their preferences. There are no restrictions on modifications or alterations, enabling owners to create a truly unique and personalized driving experience.

- Long-Term Cost Savings: While the initial purchase price may be higher when outright buying an Aston Martin, in the long run, purchasing can be more cost-effective. Once the vehicle is fully paid off, owners no longer have monthly payments, unlike leasing, which requires continuous lease payments.

- Ownership Duration: Outright purchase is ideal for customers who intend to keep their Aston Martin for an extended period. It offers a long-term commitment to owning and enjoying the vehicle without the need for frequent upgrades or lease renewals.

It's important to consider personal preferences, financial circumstances, and individual driving habits when deciding between leasing and outright purchasing an Aston Martin. Consulting with Aston Martin's sales team can provide valuable insights and help customers make an informed decision that aligns with their needs and lifestyle.

Market edit edit source

Total Addressable Market

Here, the total addressable market (TAM) is defined as the global automotive market, and based on a number of assumptions, it is estimated that the size of the market as of 2023, in terms of revenue, is $3.8 trillion. [3]

Serviceable Available Market

Here, the serviceable available market (SAM) is defined as the global luxury sports car market, and based on a number of assumptions, it is estimated that the size of the market as of 2023, in terms of revenue, is $655 billion. [4]

Aston Martin, a renowned luxury car manufacturer, can take advantage of emerging markets in less developed countries in several ways. First, these markets typically have a burgeoning middle class with increasing disposable income, which could potentially afford and are attracted to luxury items such as Aston Martin cars. Additionally, increasing urbanization often leads to a higher demand for automobiles as infrastructures and road systems improve in these countries. Aston Martin can leverage its strong brand image and reputation for quality to draw in these new potential customers. By entering these markets early, they can also establish a strong presence and consumer loyalty before other luxury car manufacturers, giving them a competitive advantage. Furthermore, labour and production costs may be lower in these countries, enabling the company to potentially reduce costs and increase profits. Lastly, diverse markets provide opportunities for Aston Martin to learn and innovate, considering differing customer needs and preferences, and thereby enhancing their product portfolio and adaptability.

Competition edit edit source

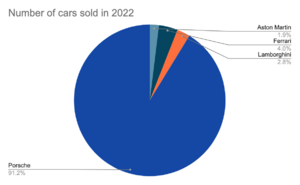

There are several other companies that compete with Aston Martin in the offering of luxury sports cars worldwide. Some notable examples include Ferrari, Rolls-Royce, Lamborghini, Bentley and Porsche. Although Aston Martin is unique in several ways, the other companies are much more diversified in the products and services they offer and will therefore have several streams of income which may be more reliable in the long run. Porsche appears to dominate the luxury sports car market, while the other companies target more niche buyers.

Ferrari, renowned for its sports cars, boasts a broader range of products and services. In addition to their automotive division, Ferrari operates museums in Modena and Maranello, captivating enthusiasts with a rich display of automotive history. Furthermore, their restaurant in Maranello offers a unique dining experience. Expanding beyond the automotive sector, Ferrari has ventured into the realm of entertainment by establishing theme parks in Abu Dhabi and Spain, attracting visitors seeking an immersive Ferrari-themed adventure. Additionally, Ferrari extends its brand reach through apparel and accessories, allowing enthusiasts to connect with the brand beyond the realm of automotive performance. Notably, they also provide financial services to clients, further diversifying their revenue streams. [5]

Rolls-Royce, while recognized for its luxurious vehicles, also engages in engineering and selling aero engines for commercial and military aircraft. This diversification into the aerospace industry demonstrates their commitment to cutting-edge engineering and technological innovation. By capitalizing on their expertise beyond the automotive sector, Rolls-Royce taps into additional revenue streams and widens its scope of influence. [6]

Within the Volkswagen Group, Lamborghini, Bentley, and Porsche operate as luxury sports car manufacturers. However, the group's portfolio encompasses a wider array of brands. Seat and Škoda, for instance, cater to the mass market with their offerings of regular passenger cars, showcasing the group's ability to target diverse customer segments. Moreover, the Volkswagen Group provides financial services for customer financing, supplementing their revenue generation beyond the sale of vehicles. [7]

| Aston Martin DBX | Ferrari 458 Italia | Lamborghini Urus | McLaren 570S | Porsche Cayenne S | |

|---|---|---|---|---|---|

| Price | ~$200,000 | ~$230,000 | ~$235,000 | ~$194,000 | ~$90,000 |

| Top Speed (miles/h) | 181 | 202 | 189 | 204 | 154 |

| 0-62mph | 3.9 | 3.4 | 3.6 | 3.2 | 6 |

| Power (hp) | 542 | 562 | 641 | 562 | 348 |

| Number of cars sold in 2022 | 3219 | - | 5367 | - | 95,604 |

By acknowledging the various revenue streams of these competitors, it becomes apparent that Aston Martin's specialization in luxury sports cars may offer a focused approach to the market. While the other companies exhibit broader diversification, the distinctive qualities, exclusivity, and craftsmanship associated with Aston Martin contribute to its unique appeal. Aston Martin's commitment to refining the art of luxury sports cars positions it as a distinctive brand in the automotive world.

Team edit edit source

Leadership edit edit source

Executive Chairman - Lawrence Stroll edit edit source

Lawrence Stroll became Executive Chairman of Aston Martin Lagonda Global Holdings plc in April 2020 after leading the Yew Tree Consortium investment in the Company.

Mr. Stroll began his career over 30 years ago when his family acquired the Pierre Cardin children’s wear licence for Canada. Shortly thereafter, he acquired the licence for Polo Ralph Lauren children’s wear in Canada and launched Polo Ralph Lauren men’s, women’s and children’s apparel throughout Europe under the company Poloco S.A. In 1989, Mr. Stroll and Mr. Chou formed Sportswear Holdings Limited to acquire Tommy Hilfiger Corporation, where Mr. Stroll served on the board of directors from 1992 to 2002 and was the company’s Co-Chairman from 1998 to 2002. Sportswear Holdings Limited also acquired Pepe Jeans London Corporation in 1991, of which Mr. Stroll was Group Chief Executive Officer from 1993 through 1998. Mr. Stroll also served as the Co-Chairman of Hackett Ltd., a major men’s clothing retailer and a subsidiary of Pepe, from 2007 until 2012. In 2003, Sportswear Holdings Limited acquired a majority interest in Michael Kors Holdings Limited, where Mr. Stroll served as Co-Chairman from 2003 to 2011, when Mr. Stroll and Mr. Chou led Michael Kors’ successful IPO, and continued as a director until 2014.

Mr. Stroll has been an active investor in the automotive and motorsport sectors, leading a consortium to acquire the BWT Racing Point F1™ team in 2018, which has been rebranded as the Aston Martin Cognizant F1™ team from 2021.

Chief Executive Officer - Amedeo Felisa edit edit source

Mr Amedeo Felisa joined Aston Martin Lagonda in May 2022 as Chief Executive Officer, having previously served as a non-Executive Director of AML, Felisa is appointed an Executive Director of Aston Martin Lagonda Global Holdings plc.

Felisa has spent his entire career in automotive and engineering with over 26 years in leadership roles at Ferrari, including eight as CEO, guiding the Italian-based global luxury automotive OEM through its turnaround and growth phase as the engineering and product-development force behind every new model.

Felisa holds a degree in mechanical engineering from the Milan Politecnico University.

Executive Vice President and Chief Creative Officer - Marek Reichman edit edit source

Mr. Reichman joined Aston Martin Lagonda in 2005 and is the Executive Vice President and Chief Creative Officer responsible for design developments.

During his professional career he has held design roles at Ford, BMW, Land Rover, Rover Cars and Nissan. Prior to joining Aston Martin Lagonda, he was Design Director at Ford North America.

Mr. Reichman holds a BA in Industrial Design from Teesside University and an MDes in Vehicle Design from the Royal College of Art, London. In 2011, Mr. Reichman received an honorary doctorate from Teesside University.

Chief Financial Officer - Doug Lafferty edit edit source

Mr Doug Lafferty is Chief Financial Officer at Aston Martin Lagonda, having joined the Company in May 2022.

Prior to joining Aston Martin, Lafferty was the Chief Financial Officer of FTSE 250-listed fuel retailer Vivo Energy plc. He previously spent three years as Chief Financial Officer for Williams Grand Prix Holdings plc and 16 years in a wide range of senior finance and leadership roles at British American Tobacco.

Lafferty is a member of CIMA and holds a BSc Hons in Management Studies from Royal Holloway, University of London.

Group Chief Technical Officer - Roberto Fedeli edit edit source

Mr Roberto Fedeli is Group Chief Technical Officer at Aston Martin Lagonda, having joined the Company in June 2022.

Fedeli is a proven leader in the luxury high-performance sports cars sector. He is considered the creator of Ferrari LaFerrari, the Italian company's first hybrid supercar as well as some of its most iconic models during his 26-year tenure. Fedeli brings his extensive knowledge, passion for innovation and his most recent experiences in the implementation of electrification technologies during his time at BMW.

Fedeli holds a Master’s degree in aerospace engineering from the University of Pisa.

Global Chief Brand and Commercial Officer - Marco Mattiacci edit edit source

Mr Marco Mattiacci joined Aston Martin Lagonda in February 2022 as Global Chief Brand and Commercial Officer, having previously worked as an advisor to the Company.

Mattiacci spent over a decade in senior leadership positions at Ferrari – including spells as President and CEO of Ferrari North America, President and CEO of Ferrari Asia Pacific, and Managing Director and Team Principal of the Scuderia Ferrari Formula One™ racing team.

Prior to working with Aston Martin, Mattiacci spent five years as a senior advisor to management consulting firm McKinsey & Company and private equity firms, providing counsel on automotive and mobility topics. His experience extends to electric mobility, having previously worked and advised EV start-up companies.

The luxury automotive leader – who in 2012 was named winner of the prestigious Automotive Executive of the Year Award in the United States - studied economics at the University La Sapienza. He later attended Columbia University Business School before being accepted into the INSEAD international executive program in Singapore.

Executive Consultant to the CEO - Michael Straughan edit edit source

In 2023 Michael Straughan began a new position as Executive Consultant to the CEO, having originally joined Aston Martin in 2020 as Chief Operating Officer.

Michael has spent more than 30 years within the automotive and luxury industries, holding senior positions in Volvo Cars, LDV, Jaguar Land Rover, before joining the board of Bentley Motors and then subsequently becoming COO of luxury yacht manufacturer Sunseeker in 2017.

Michael has a proven track record of delivery, turnaround and restructuring, creating shareholder value.

Vice President and General Counsel - Michael Marecki edit edit source

Mr. Marecki joined Aston Martin Lagonda in July 2007 and is Vice President and General Counsel. Prior to his current position, Mr. Marecki worked from 1988 until June 2007 for Ford Motor Company, latterly as the Assistant General Counsel, Environment and Safety. Mr. Marecki holds a Juris Doctor from Georgetown University Law Center and a Bachelor of Arts from Fordham University.

Chief People Officer - Simon Smith edit edit source

Mr Simon Smith joined Aston Martin Lagonda in April 2022 as Chief People Officer.

Smith has extensive HR experience across the engineering and manufacturing sector, starting his career with Peugeot and spending a significant part of his career at both Alstom and Rolls Royce. More recently Smith has held transformation and strategy leading HR roles at Johnson Matthey and Legal and General Modular Homes.

Smith is a fellow of the CIPD, is a qualified Executive Coach and holds a BA Hons in Politics and International Relations from Lancaster University.

Chief Industrial Officer - Vincenzo Regazzoni edit edit source

Vincenzo Regazzoni is Chief Industrial Officer of Aston Martin and was appointed in 2023 to oversee all manufacturing operations.

Working as an advisor to Aston Martin prior to his appointment, Regazzoni has more than two decades of experience in the low volume, ultra-luxury automotive segment, including his most recent position as Chief Manufacturing Officer of Ferrari.

Chief Procurement Officer - Giorgio Lasagni edit edit source

Giorgio Lasagni is Chief Procurement Officer of Aston Martin, joining the business in 2023.

With a focus on strengthening strategic relationships, Lasagni leads Aston Martin’s procurement function, supply chain governance and strategy.

Having established best in class purchasing and supplier development functions in the high-performance automotive sector and other industries, Lasagni’s career includes roles as Purchasing and Supplier Development Director at Ferrari and Engine Manufacturing Director for Ferrari and Maserati.

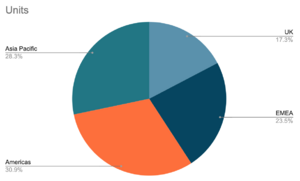

Majority Stakeholders in Aston Martin[8] edit edit source

| Name | Country | Equities | % | Valuation (£M) |

|---|---|---|---|---|

| Lawrence Stroll - Yew Tree consortium | Canada | 153,322,131 | 21.06% | 692 |

| Public Investment Fund | Saudi Arabia | 130,459,510 | 17.92% | 589 |

| Shu Fu Li - Geely | China | 125,706,398 | 17.27% | 567 |

| Invesco Advisers, Inc. | USA | 73,181,970 | 10.05% | 330 |

| Mercedes-Benz Group AG | Germany | 68,194,802 | 9.37% | 308 |

Financials edit edit source

Most recent quarter

The first quarter financial results for 2023 indicate a positive trajectory for the company's revenue, which has increased by 27% year-on-year, reaching £296 million. This revenue growth can be primarily attributed to the successful mix dynamics from the DBX707 and V12 Vantage, increased volumes and robust pricing dynamics in the core portfolio. Furthermore, there was a year-on-year increase in the Aston Martin Valkyrie programme deliveries, with the company delivering 18 vehicles in the first quarter of 2023, compared to 14 in the same period in 2022.

In terms of gross profit, there has been a 21% year-on-year increase, amounting to £102 million in 2023, compared to £84 million in 2022. This occurred despite a slight decrease in the gross margin from 36% in Q1 2022 to 34% in Q1 2023. The gross profit increase is primarily due to the favourable mix and higher volumes of core models. However, this increase was offset by heightened expenses in manufacturing, logistics, and other costs.

The operating loss in this quarter was £51 million, which included a significant £19 million year-on-year increase in depreciation and amortisation. This increase was predominantly driven by higher Aston Martin Valkyrie programme deliveries and the continuing accelerated amortisation of capitalised development costs, in preparation for the introduction of the next generation of sports cars in 2023.

The pre-tax loss for the first quarter of 2023 was £74 million, which is lower than the £112 million loss reported in Q1 2022. The reduction in loss is due to lower year-on-year net financing charges, influenced by a beneficial non-cash foreign exchange revaluation

| Income Statement | Q1 2023 | Q1 2022 | % change |

|---|---|---|---|

| Revenue (£m) | 295.9 | 232.7 | 27.2 |

| Gross Profit (£m) | 101.9 | 84 | 21.3 |

| Gross Margin (%) | 34.4 | 36.1 | -4.7 |

| Operating Profit (£m) | -50.9 | -47.7 | -6.7 |

| Net Profit before tax (£m) | -74.2 | -111.6 | 33.5 |

Last 5 years

| Balance Sheet | FY-22 | FY-21 | FY-20 | FY-19 | FY-18 |

|---|---|---|---|---|---|

| Total Assets (£m) | 3,104.3 | 2,842.5 | 2,794.8 | 2,231.1 | 1,970.2 |

| Total Liabilities (£m) | 2,331.8 | 2,182.1 | 1,990.7 | 1,901.5 | 1,520.8 |

| Net Assets (£m) | 772.5 | 660.4 | 804.1 | 329.6 | 449.4 |

In the Fiscal Year of 2022, noteworthy improvements were seen in financial performance with a significant increase in revenue and gross profit. The company's total annual revenue surged by 26% to £1.4 billion, driven primarily by favourable pricing dynamics and a robust product mix within the core portfolio. In addition, fourth-quarter revenue saw a substantial growth of 46% year-on-year to reach £524 million.

The year was marked by considerable progress, with the core Average Selling Price (ASP) for the fiscal year showing a surge of 18% from £150,000 in FY-21 to £177,000 in FY-22. This upward trend was also reflected in the fourth quarter of the year, where the core ASP climbed 21% to £184,000 from £152,000 in the same period in the previous year.

Contributing to this impressive growth was the successful delivery of 80 Aston Martin Valkyrie programme vehicles throughout 2022, with 36 of these deliveries occurring in the fourth quarter. Moreover, the weakening of the GBP against major currencies led to an advantageous foreign exchange environment for ASPs.

The company's gross profit was another area of noteworthy progress, having increased by 31% year-on-year to £451 million. This is a marked increase from £344 million in 2021, and the gross margin also showed improvement, rising to 33% from 31% in the previous year. This positive change was a result of improved pricing and gross margin for core models, although the impact was somewhat offset by a decrease in the gross margin for Special models.

However, the year was not without its challenges. The company recorded an operating loss of £142 million, primarily due to a £96 million year-on-year increase in depreciation and amortisation costs. These costs were largely driven by increased deliveries of the Aston Martin Valkyrie programme and accelerated amortisation of capitalised development costs ahead of the launch of the next generation of sports cars.

The net loss for the year stood at £528 million, significantly impacted by a £156 million negative non-cash foreign exchange revaluation of US dollar-denominated debt, as the GBP significantly weakened against the US dollar over the course of the year.

Financial Forecasts

| Income Statement | FY-23 | FY-24 | FY-25 | FY-26 | FY-27 |

|---|---|---|---|---|---|

| Revenue (£m) | 1630.2 | 1858.4 | 2081.4 | 2289.5 | 2404.0 |

| Gross Profit (£m) | 554.3 | 659.7 | 749.3 | 847.1 | 913.5 |

| Gross Margin (%) | 34% | 36% | 36% | 37% | 38% |

| EBIT(£m) | -114.1 | 65.0 | 187.3 | 229.0 | 264.4 |

Forecast highlights:

The financial forecast highlights a promising trajectory for the company over the next few years. Revenue is projected to exhibit steady growth over the three fiscal years from 2023 to 2027. It is anticipated to surge from £1,630.2 million in the fiscal year 2023 to an impressive £2,404.0 million in 2027. This reflects a compound annual growth rate (CAGR) of 11.8%.

Simultaneously, the company's gross profit is set to improve significantly. It is predicted to escalate from £554.3 million in the fiscal year 2023 to a substantial £913.5 million in 2025.

Moreover, the company's gross margin is on a progressive path, forecasted to achieve the corporate target of 40% in 2025. This is a reflection of consistent year-on-year growth and the result of the company's strategic move to raise its average selling price. This adjustment is in response to the company's transition into the ultra-luxury segment of the market.

Finally, the forecast predicts a remarkable turnaround in net profits. By 2025, the company is expected to return to profitability, estimating a net profit of £71.6 million. This overall positive financial outlook serves as an encouraging indicator of the company's potential in the coming years.

Risks edit edit source

Each risk is scored according to the risk matrix at the bottom of this section edit edit source

edit edit source

- Aston Martin's revenue could plummet without sufficient demand for high-end luxury motor vehicles. C1

- Aston Martin's performance in Formula 1 could negatively affect the overall brand reputation, subsequently affecting demand. A1

- Aston Martin may be impacted by macroeconomic conditions resulting from the global COVID-19 pandemic. B1

- Aston Martin may experience delays in launching and ramping the production of its products and features, or Aston Martin may be unable to control its manufacturing costs. B1

- Aston Martin may be unable to grow its global product sales, delivery and installation capabilities and its servicing and vehicle charging networks, or Aston Martin may be unable to accurately project and effectively manage its growth. B2

- Aston Martin's suppliers may fail to deliver components according to schedules, prices, quality and volumes that are acceptable, or Aston Martin may be unable to manage these components effectively. C1

- With growing focus on electric powertrains, Aston Martin may face difficulties in adapting its demand base to the new landscape, given the traditional 'personality' of its motor vehicles. B2

- If Aston Martin is not able to maintain a unique identity with its products, it will find it a lot more difficult to differentiate itself from its competitors, and the demand base could deteriorate. C2

- Aston Martin may face increased costs due to supply chain issues or adverse macroeconomic conditions. Hiked interest rates to combat inflation result in increased debt. C3

- An inability to shift a sufficient share of its sales to electric vehicles by 2035 would mean that maintaining the sales volume in the EU will no longer be possible, under the EU's 2035 ban on combustion engine vehicle sales[9]. C2

edit edit source

- Aston Martin is supplied powertrains and electric/electronics architecture, for some of its products, by Mercedes-Benz AMG. Any disruption to Mercedes' production could pose a limiting-factor risk to AML's production efficiency strategy.[10] C1

- Aston Martin faces risks associated with maintaining and expanding its international operations, including unfavourable and uncertain regulatory, political, economic, tax and labour conditions. B1

- Aston Martin's business may suffer if its products or features contain defects, fail to perform as expected or take longer than expected to become fully functional. B2

- Aston Martin may be required to defend or insure against product liability claims. A1

- Aston Martin will need to maintain public credibility and confidence in its long-term business prospects in order to succeed. A1

- If Aston Martin is unable to attract, hire and retain key employees and qualified personnel, its ability to compete may be harmed. B2

- Aston Martin's information technology systems or data, or those of its service providers or customers or users could be subject to cyber-attacks or other security incidents, which could result in data breaches, intellectual property theft, claims, litigation, regulatory investigations, significant liability, reputational damage and other adverse consequences. C1

- Additional funds may not be available to Aston Martin when it needs or want them. B1

- Aston Martin may be negatively impacted by any early obsolescence of its manufacturing equipment. B1

- Aston Martin holds and may acquire digital assets that may be subject to volatile market prices, impairment and unique risks of loss. A1

- There is no guarantee that Aston Martin will have sufficient cash flow from its business to pay its indebtedness or that it will not incur additional indebtedness. C3

- Aston Martin is exposed to fluctuations in currency exchange rates. B2

- Increased scrutiny and changing expectations from stakeholders with respect to the company's ESG practices may result in additional costs or risks. B2

- Aston Martin's operations could be adversely affected by events outside of its control, such as natural disasters, wars or health epidemics. C1

edit edit source

- Demand for Aston Martin's products and services may be impacted by the status of government and economic incentives supporting the development and adoption of such products. B1

- Aston Martin could be subject to liability, penalties and other restrictive sanctions and adverse consequences arising out of certain governmental investigations and proceedings. C1

- Aston Martin may face regulatory challenges to or limitations on its ability to sell vehicles directly. C1

edit edit source

- Aston Martin's financial results may vary significantly from period to period due to fluctuations in its operating costs and other factors. C3

- Aston Martin may fail to meet its publicly announced guidance or other expectations about its business, which could cause its stock price to decline. B2

Risk Matrix edit edit source

| Impact | ||||

|---|---|---|---|---|

| Low | Medium | High | ||

| Likelihood | Low | A1 | B1 | C1 |

| Medium | A2 | B2 | C2 | |

| High | A3 | B3 | C3 | |

Valuation edit edit source

What's the expected return of an investment in the company? edit edit source

The Stockhub users estimate that the expected return of an investment in Aston Martin Lagonda Global Holdings plc over the next five years is negative 15%. This value was arrived at through the use an intrinsic valuation in the form of a discounted cash flow model and a relative valuation by conducting comparable company analysis.

Assuming that a suitable return level of five years is 10% per year (based of the S&P 500 returns) and Aston Martin Lagonda achieves its return level of negative 15%, then the company can be considered 'overvalued'.

What are the assumptions used to estimate the return? edit edit source

Key Inputs edit edit source

| Description | Value | Commentary |

|---|---|---|

| Valuation Model | Discounted Cash Flow and Comparable Company Analysis | Two main approaches can be used to estimate the value of an investment:

Research has suggested that to estimate the expected return of an investment over a long-term investment horizon, a discounted cash flow model provides an accurate projection. For completeness a comparable company analysis has been conducted, however the accuracy of the analysis is limited due to the fact that very public companies operate in the same market segment as Aston Martin with the majority of luxury car brands falling under larger parent companies. |

| Financial Projections | Stockhub, CapitalIQ [11], Yahoo Finance[12] | To improve the reliability of financial projections, a mixture of sources was used when projecting key financial metrics such as revenue. However, most analyst projections only predicted the first two years and therefore further projections were made using the Stockhub user's understanding of the company and long-term predictions. |

| Discount Rate | WACC | [13]The weighted average cost of capital was used as the discount rate as it expresses the return that both bondholders and shareholders demand to provide the company with capital. The cost of equity and cost of debt have been calculated in the tables provied below using values taken from the company's financial statements, beta for the stock, and expected market returns. |

Discounted Cash Flow Model edit edit source

| Current Share Price: 3.21 | |||||||||||

| £ million | Historical | Projected | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | Notes | |

| Income Statement | |||||||||||

| Revenue | 1096.5 | 997.3 | 611.8 | 1095.3 | 1381.5 | 1630.2 | 1858.4 | 2081.4 | 2289.5 | 2404.0 | Projections based of Stockhub user's opinion as well as analyst projections from CapitalIQ and Yahoo Finance |

| % growth | 25% | -9% | -39% | 79% | 26% | 18% | 14% | 12% | 10% | 5% | High investment from previous years into a new factory and electric vehicles likely to cause significant increases in revenue during the first few years before subsiding. |

| Cost Of Goods Sold | 660.7 | 642.7 | 500.7 | 751.6 | 930.8 | 1075.9 | 1198.7 | 1332.1 | 1442.4 | 1490.5 | |

| % of revenue | 60% | 64% | 82% | 69% | 67% | 66% | 65% | 64% | 63% | 62% | Used previous years as a starting point however a key goal for new chairmen Lawrence Stroll is to reduce costs and increase overall profitability which is demonstrated by the decreasing cost of goods sold as a proportion of revenue. |

| Gross Profit | 435.8 | 354.6 | 111.1 | 343.7 | 450.7 | 554.3 | 659.7 | 749.3 | 847.1 | 913.5 | |

| % of revenue | 40% | 36% | 18% | 31% | 33% | 34% | 36% | 36% | 37% | 38% | |

| Selling General & Admin Exp. | 310.0 | 331.3 | 336.7 | 419.3 | 570.0 | 668.4 | 594.7 | 562.0 | 618.2 | 649.1 | Aston Martin reports D&A within this expense band. High D&A linked to the Valkyrie R&D is highly prevalent in the first yeasrs of projection but these costs are likely to reduce in the future alongside cost cutting measures. |

| % of revenue | 28% | 33% | 55% | 38% | 41% | 41% | 32% | 27% | 27% | 27% | |

| Total Operating Expenses | 290.0 | 350.3 | 336.7 | 419.3 | 570.0 | 668.4 | 594.7 | 562.0 | 618.2 | 649.1 | |

| % of revenue | 26% | 35% | 55% | 38% | 41% | 41% | 32% | 27% | 27% | 27% | |

| Operating Income/ EBIT | 145.8 | 4.3 | -225.6 | -75.6 | -119.3 | -114.1 | 65.0 | 187.3 | 229.0 | 264.4 | |

| EBITDA | 245.8 | 139 | -68.8 | 133.7 | 188.8 | 239.9 | 394.0 | 480.3 | 549.5 | 601.0 | |

| Tax Expense | (11.10) | 0.10 | (55.50) | (24.50) | 32.70 | 8.0 | 4.6 | 35.6 | 43.5 | 50.2 | Over the past years Aston Martin has not generated positive earnigns and hence have not paid Tax. The effective tax rate at 7.3% differs from the 19% standard UK tax rate mainly due to movement in unprovided deferred tax and derecognition of deferred tax related to losses, accelerated capital allowances and a restriction on the amount of interest that can be deducted for tax purposes. Hence for the final years of projection when the company becomes profitable, the tax rate is raised to 19%. |

| Effective tax rate | 16% | 0% | 12% | 11% | -7% | 7% | 7% | 19% | 19% | 19% | |

| EBIAT | - 122.1 | 60.5 | 151.7 | 185.5 | 214.2 | Earnings before interest and after tax | |||||

| Cashflow | |||||||||||

| D&A | 100 | 134.7 | 156.8 | 209.3 | 308.1 | 354.0 | 329.0 | 293.0 | 320.5 | 336.6 | D&A costs are high, primarily driven by higher year-onyear Aston Martin Valkyrie programme deliveries and, to a lesser extent, by accelerated amortisation of capitalised development costs ahead of the next generation of sports car launches. However this has again been projected to decrease in later years due to effects from the Valkyrie programme becoming negligable. |

| % of revenue | 9% | 14% | 26% | 19% | 22% | 22% | 18% | 14% | 14% | 14% | |

| Capital Expenditure | -101.9 | -82.2 | -81 | -40.7 | -58.6 | -244.5 | -278.8 | -208.1 | -229.0 | -192.3 | Significant increase in capital expenditure has been experienced in past 3 years related to future product launches, as well as adverse movements in working capital, which were impacted by supply chain and logistics disruptions. This expenditure is likely to remain high from future electric car launches however forcasted to decreases to pre-pandemic levels.[14] |

| % of revenue | 9% | 8% | 13% | 4% | 4% | 15% | 15% | 10% | 10% | 8% | |

| Change in NWC | -43.5 | 5.3 | 16.3 | -46.8 | -34.9 | 48.9 | 55.8 | 62.4 | 68.7 | 72.1 | Simple average was taken spanning 8 years into the past. |

| % of revenue | -4% | 1% | 3% | -4% | -3% | 3% | 3% | 3% | 3% | 3% | |

| Unlevered FCF | -61.53 | 54.98 | 174.15 | 208.35 | 286.32 | ||||||

| WACC | Notes | |

|---|---|---|

| Weights | ||

| Total Debt | 1200.5 | |

| Market Cap | 2430 | |

| Total | 3630.5 | |

| Wd | 0.33 | Weight of debt calculated as the total debt as a proportion of total capital. |

| We | 0.67 | Weight of equity calculated as the market cap as a proportion of total capital |

| Debt | ||

| Total Debt | 1200.5 | Cost of debt was calculated by taking interest expenses from the income statement and dividing this by the total debt making note of the fact that debt is a tax deductable item. |

| Interest Expense | -201.9 | |

| Rate | 17% | |

| Effective Tax Rate | 7% | |

| Rd(1-t) | 15.6% | |

| Equity | ||

| Risk Free Rate | 4.5% | Capital asset pricing model was used to calculate the cost of equity. Risk free rate of the UK Gilt Yield was used. |

| Beta | 2.05 | Beta for the stock was found from Yahoo Finance[15] |

| Market Rate | 10% | Current market rate was calculated as the average returns of teh S&P 500 over the past 50 years. |

| Re | 15.8% | |

| Discount Rate | 15.73% | |

| Perpetuity Growth Rate | 2.0% | A perpetuity growth rate of 2% was used as this is sufficiently low to ensure that the company is not projected to increase in size far faster than the global economy in the very long term. |

| DCF | 2023 | 2024 | 2025 | 2026 | 2027 | Terminal Value (Perpetuity Growth) | Notes | |

|---|---|---|---|---|---|---|---|---|

| £ million | ||||||||

| FCF | - 61.5 | 55.0 | 174.2 | 208.3 | 286.3 | 2,127.0 | The terminal value of the company was calculated using the Gordon Growth Model[16]. | |

| PV of FCF | 354.29 | |||||||

| Terminal Value | 2,126.96 | |||||||

| NPV of TV | 1024.52 | |||||||

| Enterprise Value | 1378.81 | |||||||

| Net Debt | 520.4 | |||||||

| Equity Value | 1899.2 | |||||||

| Shares Out | 698 | |||||||

| Equity Value per Share | 2.72 | |||||||

| Current share price | 3.21 | |||||||

| Difference | -15% |

Sensitivity Analysis edit edit source

A sensitivity analysis was also conducted to reflect how changes in the required rate of return and perpetuity growth rate would affect the intrinsic value of the company.

| Perpetuity Growth | ||||||

|---|---|---|---|---|---|---|

| WACC | $2.72 | 1.0% | 1.5% | 2.0% | 2.5% | 3.0% |

| 14.5% | £2.84 | £2.90 | £2.98 | £3.06 | £3.14 | |

| 15.0% | £2.74 | £2.80 | £2.87 | £2.94 | £3.02 | |

| 15.5% | £2.65 | £2.70 | £2.77 | £2.83 | £2.90 | |

| 15.7% | £2.61 | £2.67 | £2.73 | £2.79 | £2.86 | |

| 16.0% | £2.56 | £2.62 | £2.67 | £2.73 | £2.80 | |

| 16.5% | £2.48 | £2.53 | £2.58 | £2.64 | £2.70 | |

| 17.0% | £2.41 | £2.46 | £2.50 | £2.55 | £2.61 | |

Relative Valuation edit edit source

A relative valuation has been undertaken by using key metrics such as EV/Revenue and EV/EBITDA and comparing these across companies operating in the automotive industry. There are certain limitations to such a model; one key limitation of the model is how sensitive the final valuation is to the EV multiple. Due to the value of this multiple varying greatly between the car companies below, it is hard to land on an exact value which can be considered reliable. Similarly most car companies operating in the same segment as Aston Martin such as Porsche, Lamborghini , has been purchased by a larger parent company such as Volkswagen. Despite Aston Martin operating exclusively in the luxury car market, most other car manufactures operate across a much wider market and thus have vastly different factors driving their multiples. The most similar car company to Aston Martin would be Ferrari however due to the considerably prestige and history associated with the Ferrari brand, the company is able to operate in a manner which leads to considerably higher EV/Revenue and EV/EBITDA multiples. It must also be noted that outliers were excluded from averages such as Tesla with a EV/EBITDA of 50.72x.

| Market Data | Financials | Valuation | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Company | Ticker | Share Price | Shares Out | Equity Value | Net Debt | Enterprise Value | Revenue | EBITDA | EV/ Revenue | EV/EBITDA | ||

| Aston Martin Lagonda Global Holdings plc | LSE:AML | 3 | 699 | 2243 | 520 | 2763 | 1834 | 189 | 1.51x | 14.64x | ||

| Ferrari N.V. | NYSE:RACE | 314 | 181 | 56843 | 1340 | 58183 | 5799 | 1718 | 10.03x | 33.87x | ||

| Bayerische Motoren Werke Aktiengesellschaft | XTRA:BMW | 117 | 641 | 75215 | 81934 | 157148 | 161113 | 23949 | 0.98x | 6.56x | ||

| Mercedes-Benz Group AG | XTRA:MBG | 78 | 1070 | 82995 | 94353 | 177348 | 165843 | 23901 | 1.07x | 7.42x | ||

| Volkswagen AG | XTRA:VOW3 | 132 | 501 | 66086 | 171675 | 237761 | 317966 | 31371 | 0.75x | 7.58x | ||

| Renault SA | ENXTPA:RNO | 41 | 271 | 11058 | 45602 | 56660 | 50392 | 5099 | 1.12x | 11.11x | ||

| Stellantis N.V. | BIT:STLAM | 17 | 3169 | 54670 | -23902 | 30769 | 195082 | 27584 | 0.16x | 1.12x | ||

| KABE Group AB | OM:KABE B | 21 | 9 | 193 | -29 | 164 | 351 | 29 | 0.47x | 5.59x | ||

| China Motor Corporation | TWSE:2204 | 3 | 554 | 1733 | -149 | 1584 | 1001 | 87 | 1.58x | 18.12x | ||

| Honda Motor Co., Ltd. | TSE:7267 | 30 | 1649 | 49083 | 27144 | 76228 | 117252 | 14742 | 0.65x | 5.17x | ||

| Tesla, Inc. | NasdaqGS:TSLA | 272 | 3170 | 862072 | -16828 | 845244 | 86035 | 16666 | 9.82x | 50.72x | ||

| Aston Martin Lagonda Global Holdings plc Valuation | EV/ Revenue | EV/EBITDA |

|---|---|---|

| Ratio | 1.47x | 10.73x |

| Implied Enterprise Value | 2690.8 | 2025.1 |

| Net Debt | 520 | 520 |

| Implied Market Value | 2170 | 1505 |

| Shares Outstanding | 698.8 | 698.8 |

| Implied Value Per Share | £3.11 | £2.15 |

| Average | £2.63 | |

| Current share price | 3.21 | |

| Difference | -18% |

References and notes edit edit source

- ↑

- ↑ "Geely tries to grab wheel at Aston Martin". The Times. 5 October 2022. Retrieved 16 February 2023.

- ↑ https://www.ibisworld.com/global/market-size/global-car-automobile-sales/

- ↑ https://www.grandviewresearch.com/industry-analysis/luxury-car-market-report#:~:text=The%20global%20luxury%20car%20market%20size%20was%20estimated%20at%20USD,USD%201%2C046.87%20billion%20by%202030.

- ↑ https://uk.finance.yahoo.com/quote/RACE/profile?p=RACE

- ↑ https://uk.finance.yahoo.com/quote/RR.L/profile?p=RR.L

- ↑ https://uk.finance.yahoo.com/quote/VOW3.DE/profile?p=VOW3.DE

- ↑ https://www.marketscreener.com/quote/stock/ASTON-MARTIN-LAGONDA-GLOB-46472778/company/

- ↑ https://www.europarl.europa.eu/news/en/headlines/economy/20221019STO44572/eu-ban-on-sale-of-new-petrol-and-diesel-cars-from-2035-explained

- ↑ https://www.autoblog.com/2021/08/20/aston-martin-amg-v8-supply/?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAADGFzwuKNfSFeGptOhLFwfmGX0E5TjeZrUCLE59IsSl8GUcY8tOUWFojX2nIR5bp3GqV2pt_Vct-VVKE_sJuqrnhUZJZm4L-TkszaeyuHP0gUmwYtEk-E5U29p5bHYHp1alii4wZPVO_JRec9jxjGbgw1LAKuCtkkf71ZUfTF-nX

- ↑ https://www.capitaliq.com/CIQDotNet/Financial/IncomeStatement.aspx?CompanyId=111528564&statekey=69d310453ee44151ae14e948d1930696

- ↑ https://uk.finance.yahoo.com/

- ↑ https://www.investopedia.com/terms/w/wacc.asp

- ↑ https://www.astonmartin.com/-/media/corporate/documents/annual-reports/aston_martin_annual_report_2022.pdf?rev=6a462584d1c54890a85a324a2663c3d7&hash=9A3C425CE6101D99D4249E882AA19A4F

- ↑ https://uk.finance.yahoo.com/

- ↑ https://einvestingforbeginners.com/terminal-value-gordon-growth-model-daah/