Attn: Grace

Disrupting the $25B personal care market for women 40+

Summary edit edit source

- Groundbreaking bio-based, skin-safe line of women's incontinence products

- Launched national distribution in 2020 with a 10K person waiting list

- 71K bags sold via DTC and Amazon and 5X’d revenue in 2021

- Over $1M in trailing 12 month revenue and projecting $31M in 2023

- Powerful, first-mover advantage in a category set to grow by >40% by 2027

- Nationwide retail launch by Q4 2022; Targeting 3-5K doors by 2023

- As seen in Fast Company, TechCrunch, Business Insider, Forbes, Goop

Problem edit edit source

19M women in the US alone, and almost 50% of women 50+, live with bladder leaks

Yet the nearly $10B incontinence industry has only ever provided them with chemical-laden products that cause painful skin irritation.

If you are one of those 19M women with bladder leaks, you are likely using multiple disposable pads and/or briefs to avoid leaks, 24 hours a day, 7 days a week. That means that the top sheet of whatever products you are using (i.e. the all-important layer that sits right next to some of your most vulnerable, porous skin) is touching your skin all. the. time.

Conventional incontinence pads and briefs (think: Depend, Poise, Tena, and others) use top sheets that are made entirely from harsh chemicals and non-renewable resources:

- Conventional products use top sheets made from petroleum, treated with chlorine bleach, and embellished with synthetic dyes and fragrances.

- These ingredients cause varying degrees of skin irritation, ranging from mild discomfort to painful irritation, itchy rashes, and swollen, inflamed skin.

- Conventional products are made entirely from non-renewable resources that are deeply damaging to our environment and leave a massive carbon footprint.

Despite the remarkable innovation around cleaner, greener, more thoughtful options across virtually all CPG sectors, the incontinence and larger personal care category for women 40+ remains dominated by chemical-laden, outdated legacy products and stale, uninspired brands.

Not so fun fact: It’s so bad that the same big-box brands that stock the aisle where these products are sold call it the “Aisle of Death.”

We knew there had to be a better way. So we're building it.

Solution edit edit source

Clean, curated essentials for every aging woman edit edit source

At Attn: Grace, we believe in a world where women are seen and celebrated as we age; that personal care should actually be personal; and that while our needs may change over time, our standards only get higher.

We began with incontinence, where we had a personal connection and saw an opportunity to disrupt a painfully unevolved space.

We revolutionized how incontinence products are made, using our CLN Design™ technology to create the first-ever line of liners, pads, briefs and wipes that replace the plastics, petroleum and other toxins found in conventional products with a green PE (polyethylene) made from gentle, upcycled sugar cane waste.

The result is a product that provides absorption and moisture-wicking capabilities that outperform premium, big-box brands, without the painful skin irritation caused by conventional incontinence products.

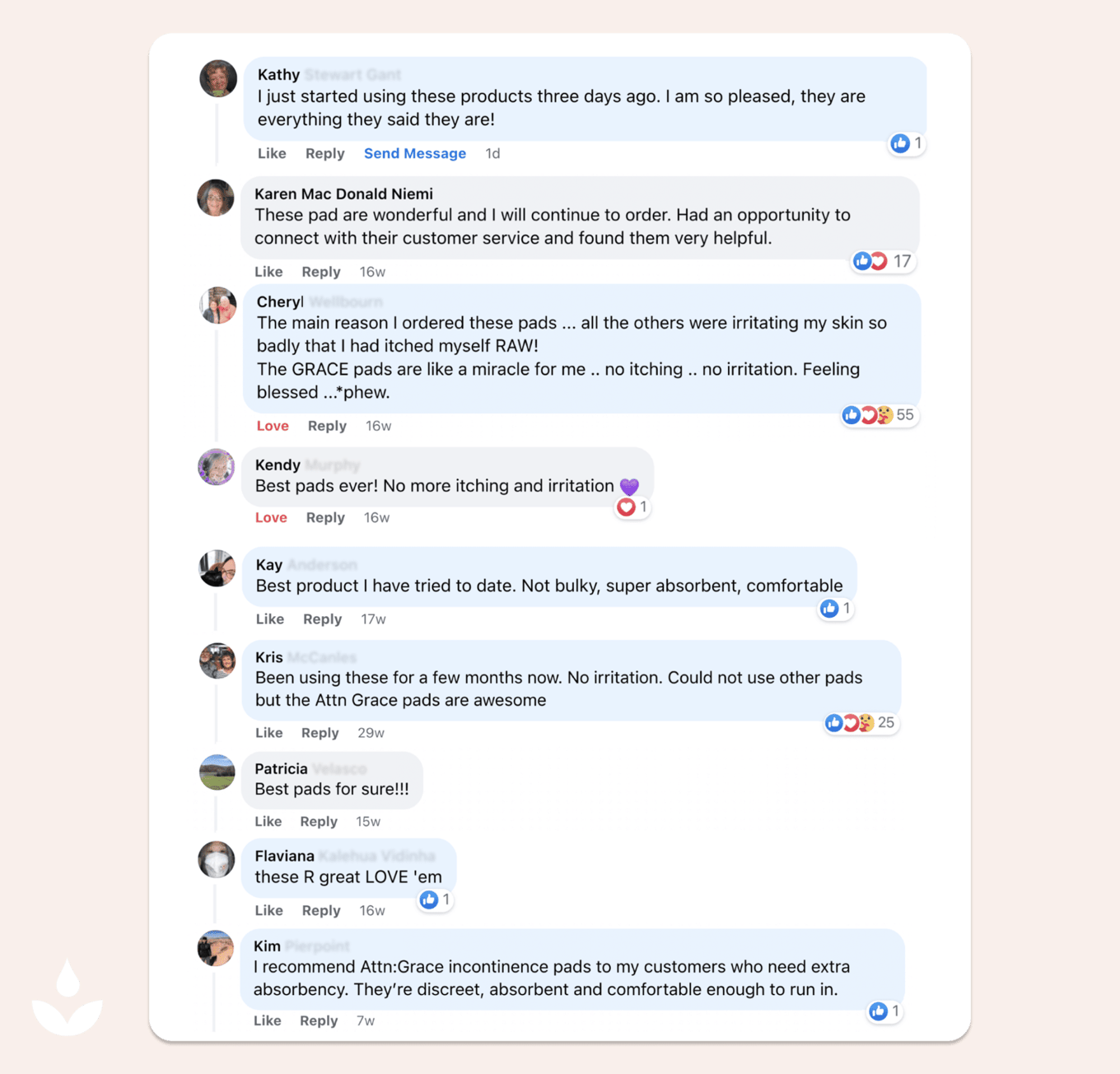

The most common response we get from women who try our products for the first time? "The difference is night and day."

Our bodies evolve. It's high time the products we use to care for them do as well.

Product edit edit source

Clean ingredients, unparalleled performance, and a smaller environmental footprint

Launch collection: incontinence edit edit source

The concept behind our flagship product line is pretty straightforward: we've designed the cleanest, greenest, highest-performing liners, pads and briefs for women living with bladder leaks that the $10B incontinence market has ever seen.

Our products outperform all of the premium, big box brands, including Poise, Tena, Depend and Always Discreet Boutique.

Superior top sheet edit edit source

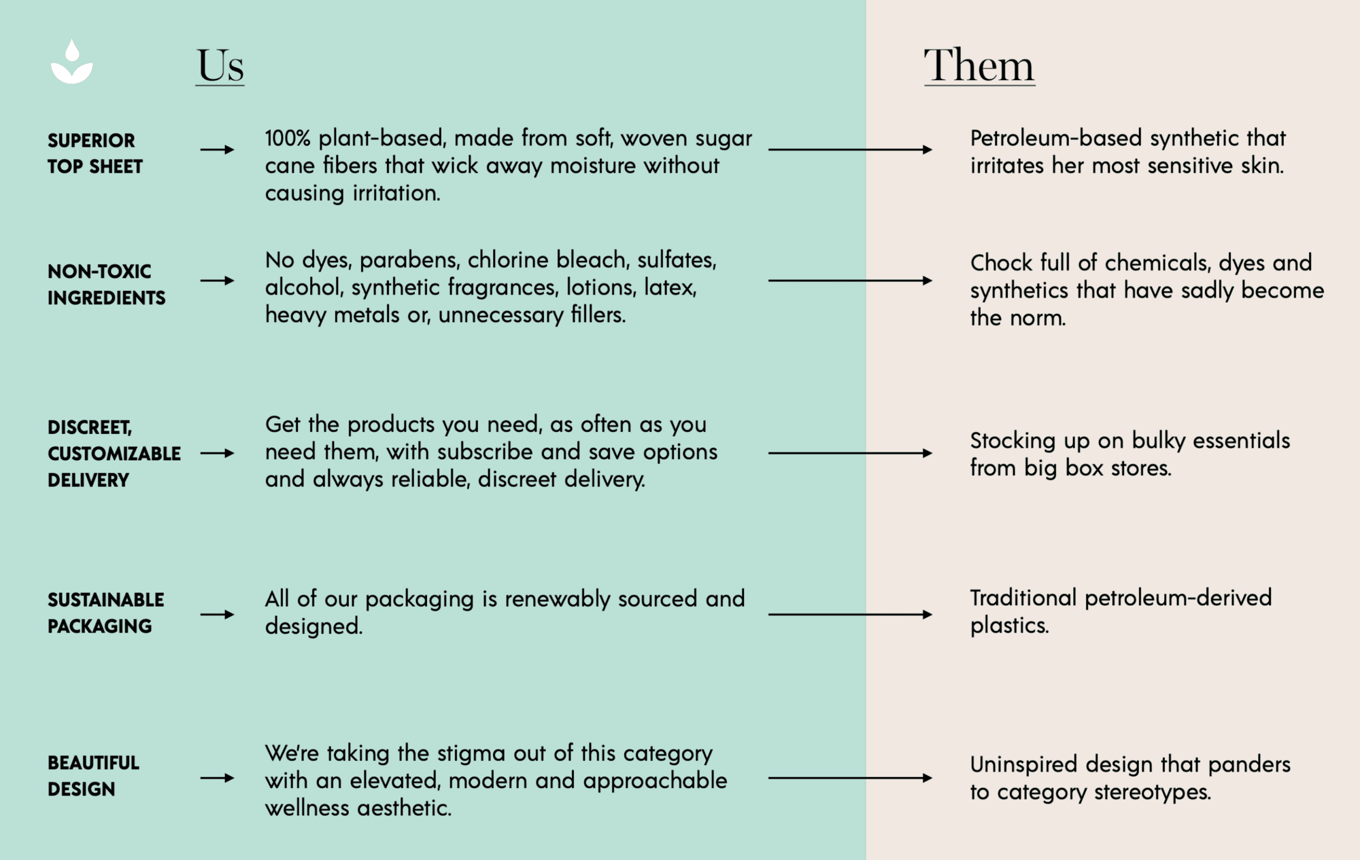

- 100% plant-based, made from soft, woven sugar cane fibers that wick away moisture without causing irritation.

Thinner, more thoughtful shape edit edit source

- Provides comfort, discretion and peace of mind, trapping leaks in a powerfully absorbent inner core.

The result? edit edit source

- No Leaks.

- No Odor.

- No Irritation.

And, no surprise, women are LOVING them: edit edit source

In a recent survey, 95% of women found our products to be more absorbent, more comfortable and cause less irritation than leading premium brands.

Fun facts: We were recently named One of the 25 Fastest-Growing DTC Brands by Business Insider and just landed a spot on Fast Company’s list of the Most Innovative Companies of 2022.

Our skin-safe promise™ edit edit source

Our products incorporate the cleanest, most sustainable materials possible without ever compromising on performance.

What that means for women: edit edit source

- We’ll never expose her skin to toxic chemicals.

- We’ll always be transparent about our ingredients, sourcing and manufacturing.

- We’ll always choose plant-based, renewable ingredients that are Naturally Better™.

Beautiful, discreet, earth-friendly packaging edit edit source

Our incontinence products are packaged in either a Green PE, or, in the case of our liners, a paper box sourced from sustainably forested tree-pulp. All of our packaging is fully recyclable.

Beyond incontinence edit edit source

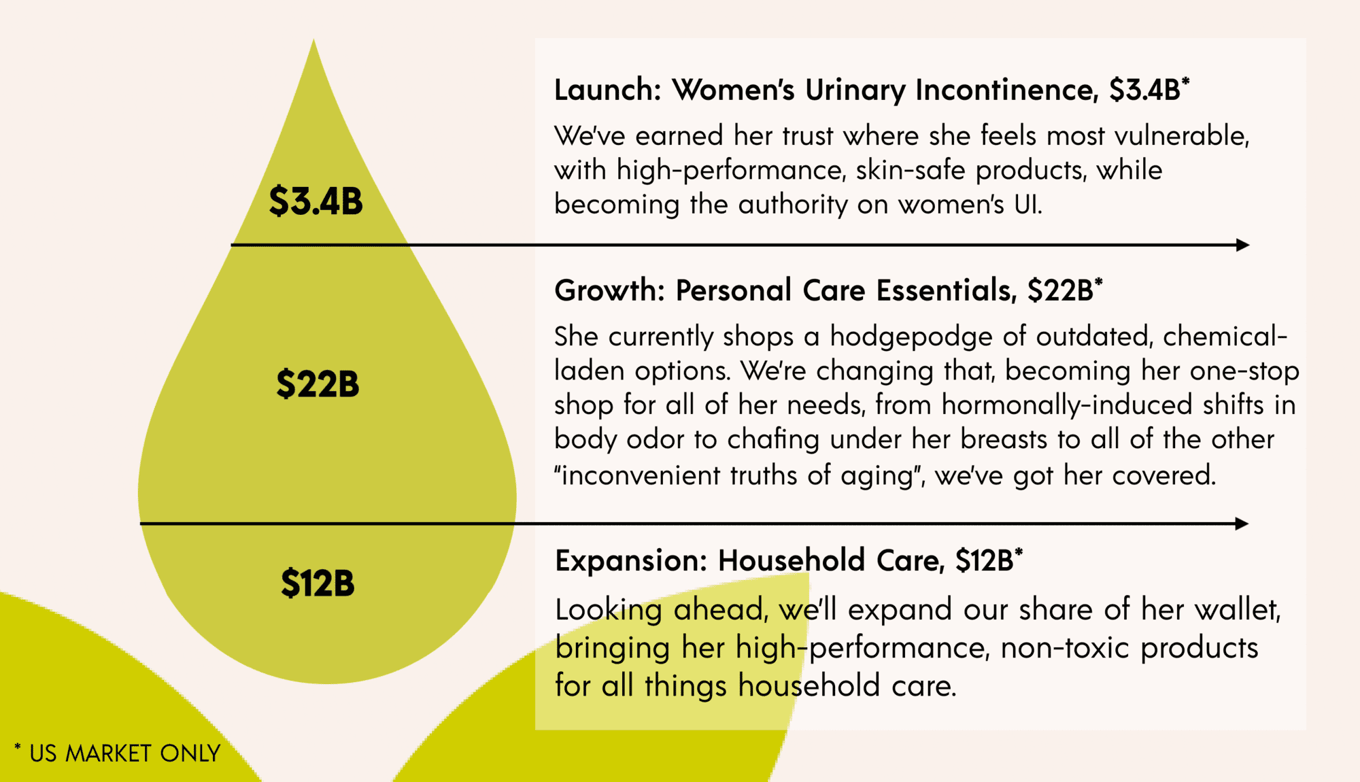

While the incontinence market alone presents a massive disruptive opportunity, we’re simultaneously expanding seamlessly into the larger $26 billion personal care market for women 40+, tackling what we affectionately call the “inconvenient truths” of aging.

Skin-safe accessories edit edit source

Having established ourselves as the new gold standard for incontinence care, we’re deepening our relationship with women and expanding their skin-safe routines.

All Natural Barrier Cream edit edit source

Gentle-yet-effective formula that naturally promotes rapid healing due to excessive dryness or prolonged wetness.

“INCREDIBLE. I call it my fix-it cream.” - Laura F.

All Natural Deodorant edit edit source

Nourish your skin while providing long-lasting odor protection — no harsh chemicals, no aluminum, no talc, and no synthetic fragrances.

“So glad I tried this. Works great on my super sensitive skin!” -Kathleen M.

Daily Renew Body Oil edit edit source

A powerful blend of omega-rich, antioxidant-filled botanical oils that deeply restore your skin from the inside out.

A powerful blend of omega-rich, antioxidant-filled botanical oils that deeply restore your skin from the inside out.

“Been using this daily before bed and my skin feels so much healthier and noticeably less dry.” - Joanne W.

Traction edit edit source

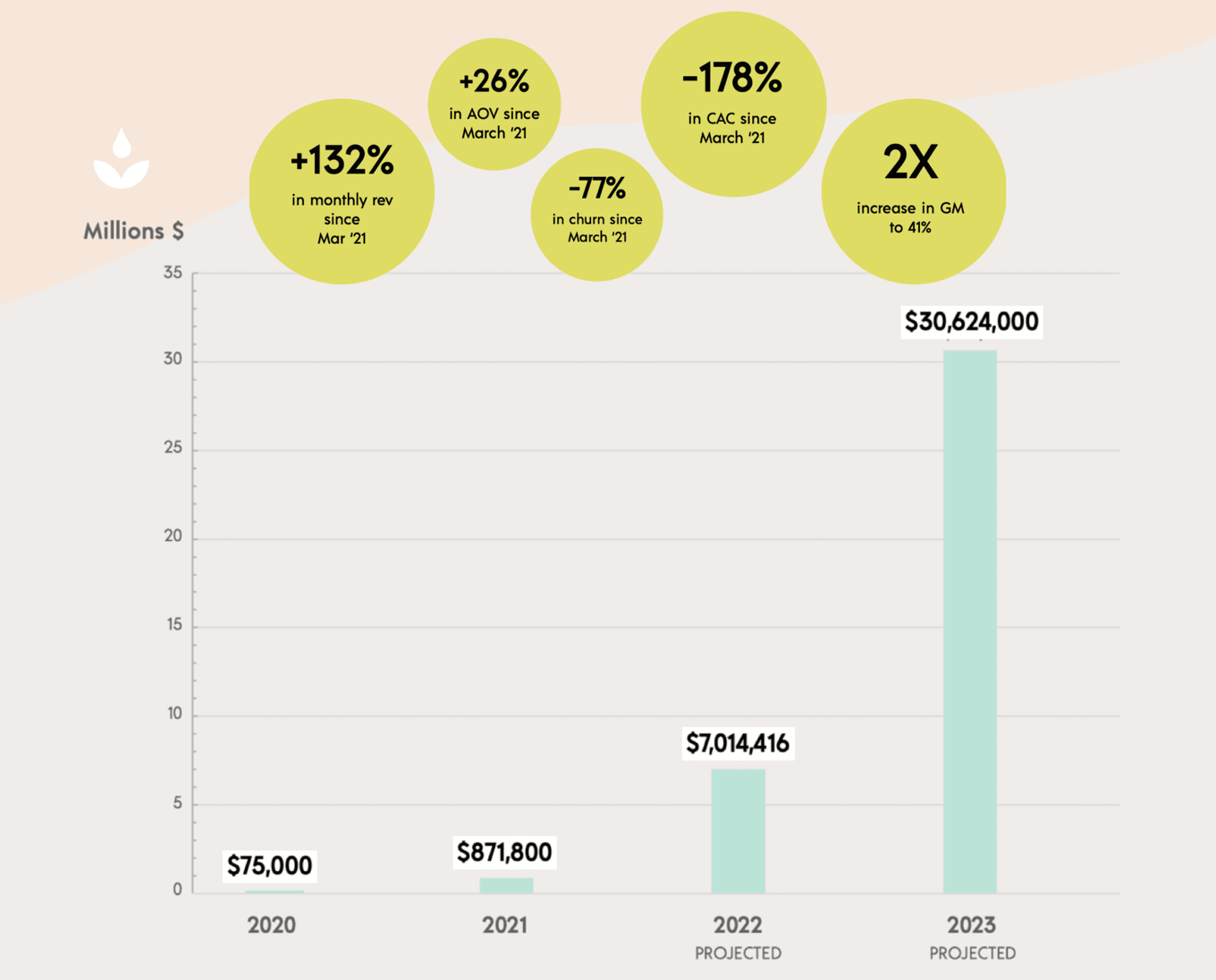

Scaling to $30M+ ARR over the next 21 months edit edit source

We nailed product-market fit out of the gate with a product that outperforms big-box premium brands, and that she needs to use every day, multiple times a day.

- In the last 12 months alone, more than 8K women have made the switch from conventional big-box brands to our skin-safe, eco-conscious products.

- 5x increase in revenue since January 2021

- Closed 2021 (our first full year of sales) just under $1M in revenue

- Drove a 273% increase in total net sales from Q1 to Q4

- >80% of our revenue comes from subscription purchasers

- Increased our AOV by 92% over the last 12 months

- 11X increase in Amazon sales since June ’21 launch

- > 53% decrease in CAC

- Approaching break-even CAC to first AOV

We are projecting $3M in total DTC revenue for 2022, in addition to several contracts with major retailers to bring our products closer to our customers.

We’re capitalizing on a powerful first-mover advantage to drive exponential growth in the natural incontinence and larger personal care category for older women.

And...we're getting noticed. edit edit source

Customers edit edit source

She was nobody's brand darling. Until now.

We believe in a world where women are seen and celebrated as we age. One collection, one conversation, at a time, we’re building the world we want to see, alongside Naturally Better™ solutions for her changing needs.

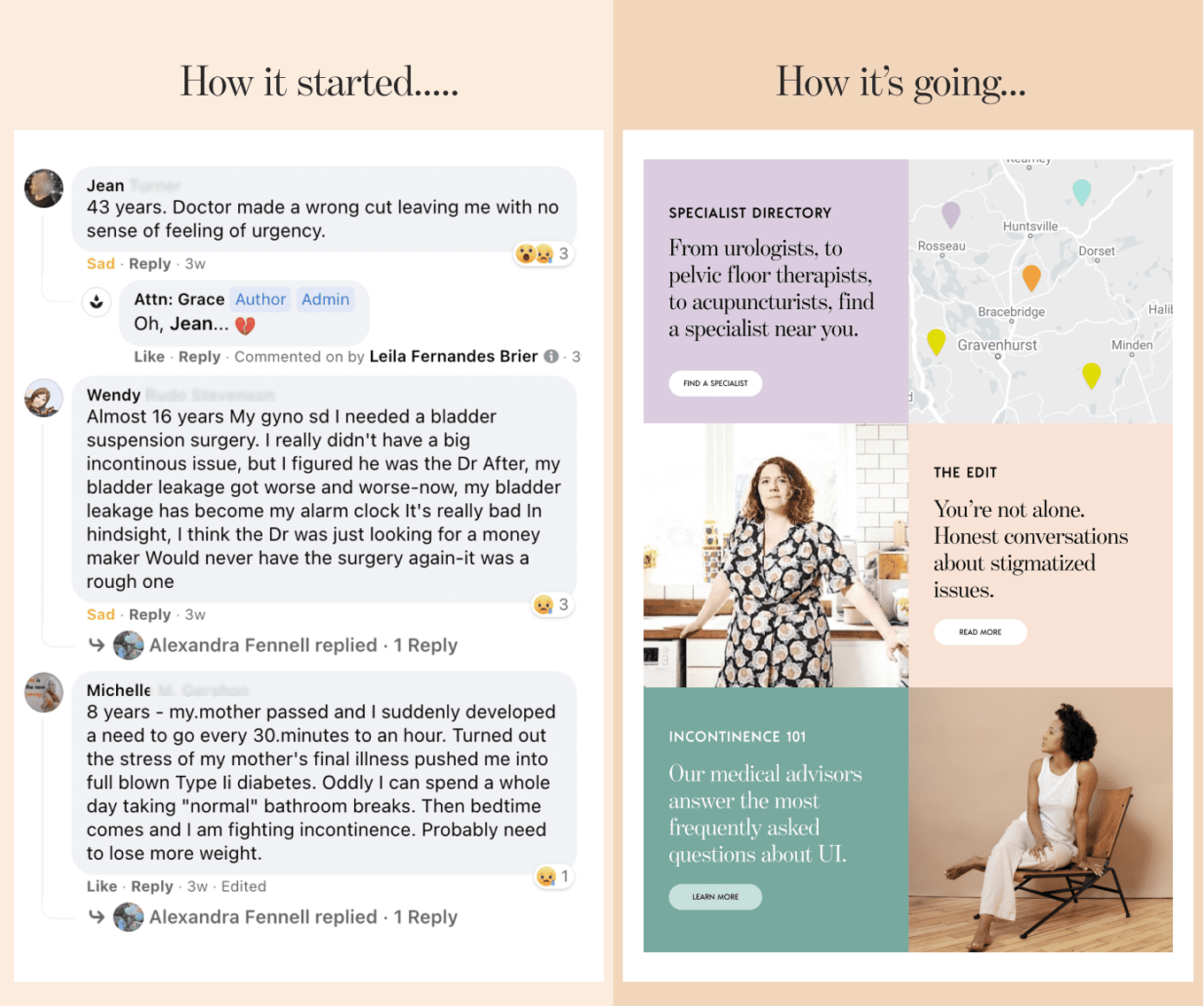

We started with UI, one of the most highly stigmatized health issues affecting women today edit edit source

This has presented a powerful opportunity to build a uniquely personal relationship with our customers via our DTC model:

- ...away from the bright lights of pharmacy aisles

- ...grounded in trust

- ...supported by a community-and-conversation driven approach

- ...and an authentic ''for us, by us'' model.

Culture and community edit edit source

We're giving women not just something to buy, but something to buy into. Through multiple touchpoints, we've created a welcoming, rich, dynamic, safe space for women to connect on all things related to our health and wellness as we age.

- Customer engagement: We bring a stellar, human-centric approach to building and maintaining customer relationships.

- Our resource library: Knowing the incontinence journey is a lonely and highly stigmatized one, we've earned her trust by providing access to information about her health and wellness, including a nation-wide, searchable database of health and wellness practitioners who can directly support her, and facilitating conversations around the sometimes uncomfortable realities of aging as a woman in our culture. We're living up to our promise of "a better way" and empowering her around her wellness journey.

- Content series and social media: We're adding depth and texture to what it means to be aging, building credibility through deep understanding and expert connections, as well as rich storytelling that honors women as the multidimensional protagonists that they are.

Her wellness journey matters edit edit source

Business model edit edit source

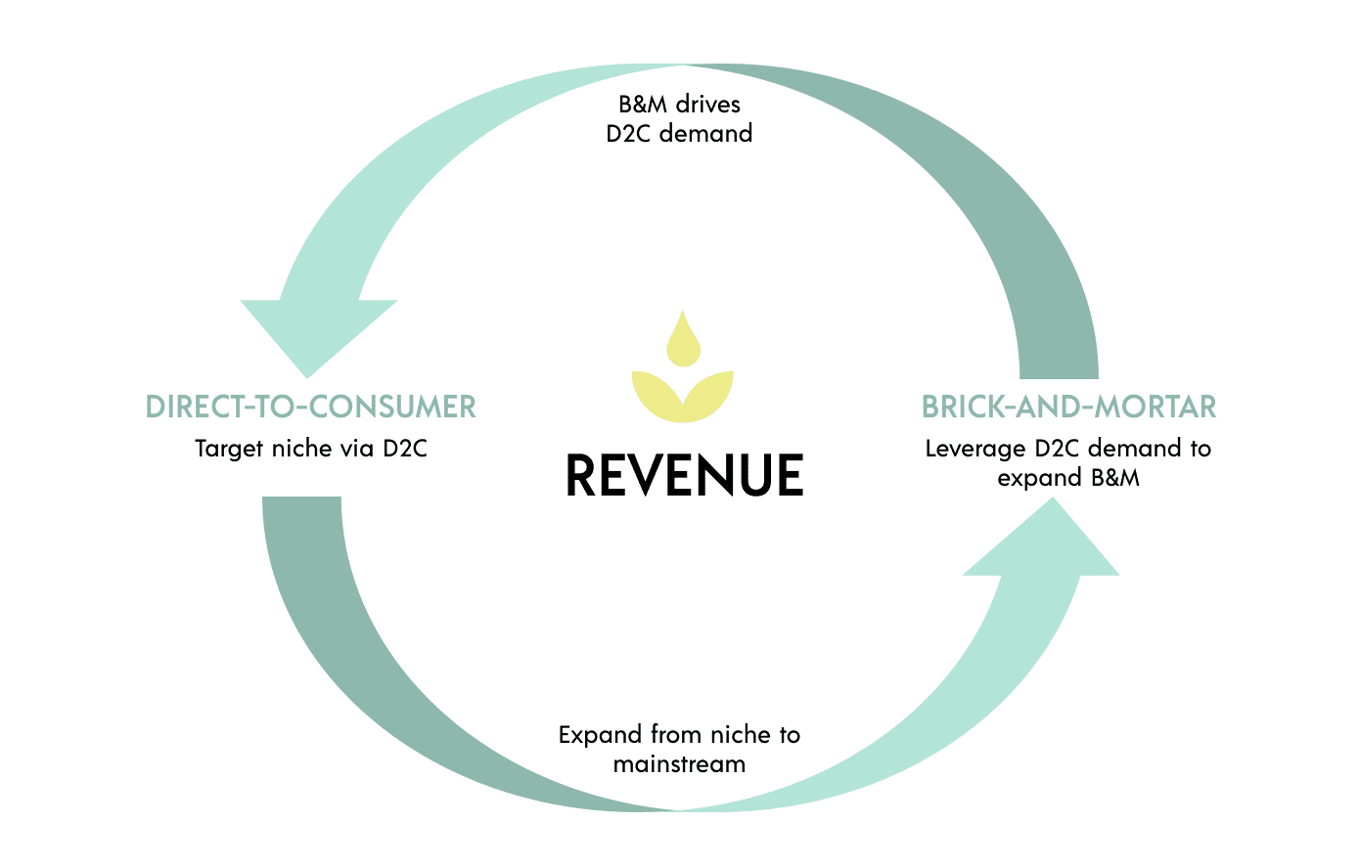

Launching a DTC business for everyday essentials during a pandemic fostered both impressive growth and deep customer relationships.

This growth is further fueled by (1) a product customers love and need to use daily and typically multiple times a day, making it ideal for a subscription/repeat purchase model; (2) our rapid expansion across our DTC and Amazon channels; (3) upcoming strategic expansion to brick-and-mortar retail.

This year, we’re on track to:

- 10x our growth on our DTC channel

- 10x our growth on Amazon

- Launch into at least 5 new e-commerce channels

- Launch into 150+brick-and-mortar stores nationwide

A strong e-commerce business, ready to expand edit edit source

We've launched and achieved our current traction on DTC channels alone with ~80% of our revenue attributed to subscriptions.

In June’21, we launched on Amazon, and we are excited to launch on big box e-commerce sites nationwide in Q3 of 2022.

In the last year, we've achieved:

- 5x increase in revenue since January 2021

- >53% decrease in CAC

- Over 80% of monthly revenue coming from subscriptions

- 2X improvement in AOV since January 2021

- 2X improvement in GM from June to December

- 3000+ stores by 2023

We’ve established a strong customer base, giving us the leverage we need to rapidly expand into brick-and-mortar retail over the next 18 months.

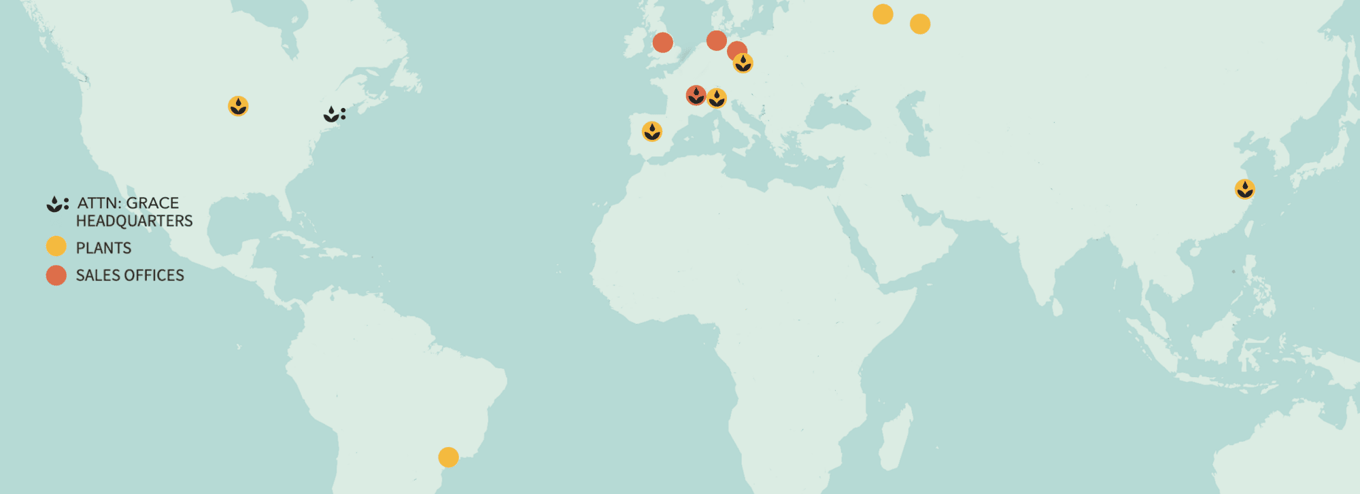

And we're ready to scale with the support of our world-class manufacturing partners.

- Fast-growing, global partner with 9 facilities world-wide 100%

- Family-owned, 100% carbon neutral factories

- Dedicated focus on sustainability and resource efficiency

- Uninterrupted access to the cleanest, most innovative raw materials

- New, patented packaging design will enable us to be first-to-market with 100% recycled bags. (Q3 2022)

Our Global Presence edit edit source

Market edit edit source

“In any industry, the first brand to transform its outreach to the 50-plus set could win over millions of consumers — consumers with more money to spend than their children.”

– Harvard Business Review edit edit source

Attn: Grace has a hugely strategic, first-mover advantage in the personal care category for older women.

There are currently 63 million women over the age of 50 in the U.S. alone

- At least 50% of those women (31.5 million women) are living with urinary incontinence (a $10B market)

- All of those women have personal care needs that are either unmet entirely or grossly underserved (a $25B market)

Unlike the personal care space for younger women that has been disrupted by dozens of innovative personal care startups—including Billie, Thinx, This is L and others—the personal care space for older women is massive and still virtually untouched.

This market power of people over age 50, who are responsible for more than half of consumer spending in the United States:

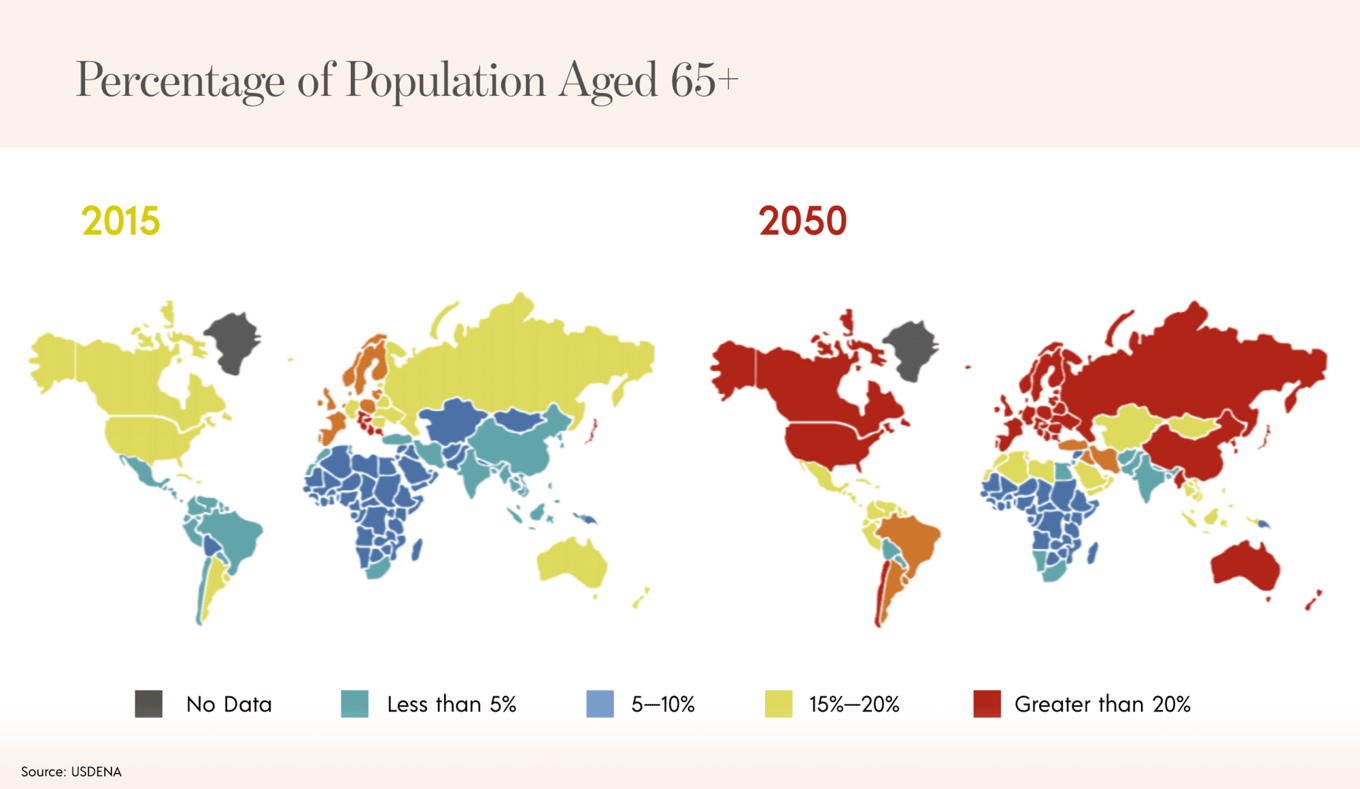

For the first time in US history, the elderly, those 65+, are projected to outnumber children, a 92% increase (from 2016 to 2060). (United State Census Bureau).

- Today’s 50+ consumer controls nearly 50% of consumer spending (Harvard Business Review)

- 59% of older consumers express a preference for natural incontinence products, while 58% believe that brands should offer more sustainable incontinence products (source)

- Americans age 50 and up contribute so much to the U.S. economy that they’d constitute the world’s third-largest economy if they were counted as their own country, a major new AARP study finds (source)

- Positive growth across adult incontinence will occur over the next five years with a projection of $14 billion in retail sales by the year 2025 (source)

- Growth in the adult-diaper market is outpacing that of every other paper-based household staple (Bloomberg)

- An uptick in adult incontinence sufferers has made this category not only the fastest growing absorbent hygiene category, but also the most rapidly proliferating segment as manufacturers work hard to meet the ever changing needs of these consumers (source)

Competition edit edit source

The incontinence category is dominated by two incumbents, edit edit source

P&G and Kimberly Clark, who together own ~64% of the market: edit edit source

All of these legacy products use the same chemical-laden design, including petroleum-based top sheets that are treated with chlorine bleach, synthetic dyes and synthetic fragrances.

And they're all bulky and uncomfortable. We routinely hear from our customers that other incontinence pads feel "like a mattress" between their legs.

The handful of startups that have entered the space are white-labeling the same legacy options and fail to provide any actual innovation at the product level.

Competitive landscape: edit edit source

How we're raising the bar: edit edit source

"The difference is night and day."

Vision and strategy edit edit source

Becoming the market leader in personal care for women 40+ edit edit source

The category is up for grabs, and here's how we are going to win it.

Proof point: The Honest Company

1. Launch (key market gap):

Diapers (take care of baby)

2. Scale (demographic breadth):

Home Cleaning Care (take care of your home)

3. Expand (share of wallet depth):

Beauty (take care of mama, too)

Our Exit Opportunities edit edit source

Unlike the personal care space for younger women that has been disrupted by dozens of innovative personal care startups, including Billie, Thinx, This is L and others, the personal care space for older women is massive and still virtually untouched.

Attn: Grace is disrupting a massive, sleepy category that is dominated by two of the world's biggest CPG giants, Kimberly Clark and P&G.

Much like what Harry's and Dollar Shave Club did in the razor space (where Gillette and Edgewell had historically dominated market share), we're forging an entirely new way of engaging with our consumer—providing her with products that are far superior to current big-box offerings, and supporting her with impeccable customer service, content and community.

There are any number of possible exit scenarios for Attn: Grace, including acquisition by a CPG conglomerate (P&G, Kimberly Clark, Unilever, Edgewell, others), a medical supply conglomerate (Medline, Cardinal Health), a pharmaceutical company like J&J and many others.

Recent analogous exits in the CPG space include: edit edit source

- Thinx, acquired by Kimberly Clark in 2022 (price undisclosed) (source: https://www.prnewswire.com/news-releases/kimberly-clark-acquires-majority-interest-in-thinx-301490258.html)

- Billie, acquired by Edgewell in 2021 for $310M (source: https://www.prnewswire.com/news-releases/edgewell-personal-care-announces-acquisition-of-billie-inc-301433210.html)

- This is L, acquired by P&G for a reported $100M in 2019 (source: https://www.forbes.com/sites/berenicemagistretti/2019/02/06/fembeat-pg-acquires-organic-period-care-startup-this-is-l/?sh=7168db237bb6)

- Dollar Shave Club, acquired by Unilever for $1B in 2016 (source: https://www.unilever.com/news/press-and-media/press-releases/2016/unilever-acquires-dollar-shave-club/)

Funding edit edit source

Founders edit edit source

A co-founder team driven by innovation and empathy, and expert in ownable differentiation

Mia (Left)

- 2-time Entrepreneur, previous successful exit

- Nominated for Forbes 50 over 50

- Cared for her aging mother with UI

Alex (Right)

- Patent Attorney within MD&D

- Inc. Female Founders 100

- Wellness Enthusiast

- Pelvic floor prolapse with UI

Attn: Grace Team edit edit source

Alexandra Fennell

Co-Founder

Alex is a passionate advocate for women’s health and an expert in ownable differentiation, having practiced patent law for many years. She is thrilled to now apply that experience to a mission and vision she cares so deeply about.

Mia Abbruzzese

Co-Founder

Mia is a two-time entrepreneur and CoFounder of Attn: Grace. A successful owner/operator of an e-commerce business, she sold her 1st company while caring for her aging mother, inspiring her to raise the bar and redefine personal care for older women.

Leila Fernandes Brier

Head of Brand and Culture

Leila has a storied career helping brands tap into cultural truths to find a meaningful place in the world. As Head of Brand & Culture at Attn: Grace, she translates the brand’s vision and values into marketing strategies that deliver.

Melissa Swinton

Customer Experience and Internal Operations

15+ years spent in digital marketing, product design, and project management. Her experience managing complex projects in a collaborative way uniquely qualify her to manage both the frontline & behind-the-scenes.

Lynda Kelly

Advisor

Established non-wovens expert & SVP at Suominen Corp.

Dr. Barbara Frank

Medical Advisor

Harvard-affiliated OB/GYN and star of our new “So Glad You Asked” Series

Dr. Jeannine Miranne

Medical Advisor

Harvard-affiliated Urogynecologist and author of our ‘Incontinence 101 content in our Resource Library.

Risks edit edit source

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

With shelter-in-place orders and non-essential business closings potentially happening throughout 2022 and into the future due to COVID-19, the Company’s revenue has been adversely affected. The COVID-19 pandemic delayed the company's March 2020 launch until late June 2020. Additionally, the Company’s products are manufactured in Europe and the pandemic caused delayed access to the inventory because of the ongoing supply chain issues.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

Currently, our authorized capital stock consists of 20,012,000 shares of common stock, of which 20,012,000 shares of common stock are issued and outstanding. Unless we increase our authorized capital stock, we may not have enough authorized common stock to be able to obtain funding by issuing shares of our common stock or securities convertible into shares of our common stock. We may also not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We rely on other companies to provide components and services for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate manufacture of major components or subsystems for our products, or from whom we acquire such items, do not provide components which meet required specifications and perform to our and our customers’ expectations. Our suppliers may be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two contractors or suppliers for a particular component. Our products may utilize custom components available from only one source. Continued availability of those components at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. The supply of components for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company relies on certain intellectual property rights to operate its business. The Company’s intellectual property rights may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

The Company’s success depends on the experience and skill of the board of directors, its executive officers and key employees.

We are dependent on our board of directors, executive officers and key employees. These persons may not devote their full time and attention to the matters of the Company. The loss of our board of directors, executive officers and key employees could harm the Company’s business, financial condition, cash flow and results of operations.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts.

In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.

The Company could potentially be found to have not complied with securities law in connection with this Offering related to “Testing the Waters.”

Prior to filing this Form C, the Company engaged in “testing the waters” permitted under Regulation Crowdfunding (17 CFR 227.206), which allows issuers to communicate to determine whether there is interest in the offering. All communication sent is deemed to be an offer of securities for purposes of the antifraud provisions of federal securities laws. Any Investor who expressed interest prior to the date of this Offering should read this Form C thoroughly and rely only on the information provided herein and not on any statement made prior to the Offering. The communications sent to Investors prior to the Offering are attached as Exhibit E. Some of these communications may not have included proper disclaimers required for “testing the waters.”

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE (Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into CF Shadow Securities. The Company is under no obligation to convert the Securities into CF Shadow Securities. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into CF Shadow Securities (the occurrence of which cannot be guaranteed). Upon such conversion, the CF Shadow Securities will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders or the party holding the CF Shadow Securities on behalf of the Investors are required to enter into a proxy agreement with its designee to vote their CF Shadow Securities with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right. For example, if the Securities are converted in connection with an offering of Series B Preferred Stock, Investors would directly or beneficially receive CF Shadow Securities in the form of shares of Series B-CF Shadow Preferred Stock and such shares would be required to be subject to a proxy that allows a designee to vote their shares of Series B-CF Shadow Preferred Stock consistent with the majority of the Series B Preferred Stockholders. Thus, Investors will essentially never be able to vote upon any matters of the Company unless otherwise provided for by the Company.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company.

The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities.

In addition, the Company has certain equity grants and convertible securities outstanding. Should the Company enter into a financing that would trigger any conversion rights, the converting securities would further dilute the equity securities receivable by the holders of the Securities upon a qualifying financing.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the First Equity Financing Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the First Equity Financing Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company.

The forgoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred stock, have been paid in full. Neither holders of the Securities nor holders of CF Shadow Securities can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.