BYD Company Limited

Logo since 2022 | |

| Type | Public |

|---|---|

| SEHK: 1211 SZSE: 002594 | |

| Industry | Conglomerate |

| Founded | February 1995 |

| Founder | Wang Chuanfu |

| Headquarters | , |

Area served | Worldwide |

Key people | Wang Chuanfu (Chairman, CEO) |

| Products | Gasoline and electric cars, battery-powered bicycles, buses, trucks, forklifts, monorail train and buses, photovoltaic modules (solar panels), face masks, rechargeable batteries, and handset components. |

| Revenue | |

| Total assets | |

| Total equity | |

| Owner |

|

Number of employees | |

| Subsidiaries | |

| Website | www.byd.com |

BYD Company Limited, together with its subsidiaries, engages in the research, development, manufacture, and sale of automobiles and related products in the People's Republic of China and internationally. It operates through three segments: Rechargeable Batteries and Photovoltaic Products; Mobile Handset Components, Assembly Service and Other Products; and Automobiles and Related Products and Other Products. The company offers internal combustion, hybrid, and battery-electric passenger vehicles; buses, coaches, and taxis; logistics, construction, and sanitation vehicles; and vehicles for warehousing, port, airport, and mining operations. It also manufactures and sells lithium-ion and nickel batteries, photovoltaic products, and iron batteries primarily for mobile phones, electric tools, and other portable electronic instruments; mobile handset components, such as housings and electronic components; medical protection products; and automobiles, and auto-related molds and components, as well as provides assembly, and automobiles leasing and after sales services. In addition, it offers rail transit equipment; solar batteries and arrays; and urban rail transportation services. The company was founded in 1995 and is headquartered in Shenzhen, China.

The Idea edit edit source

BYD Company Ltd. was founded by Wang Chuanfu, a chemist and government researcher, in 1995. The idea for the company came about when Wang Chuanfu identified the future potential of rechargeable batteries, a market which was then dominated by Japanese companies

Initially focusing on batteries for mobile phones and digital cameras, BYD's breakthrough came when it entered the rapidly growing automobile industry. Recognizing the environmental implications of traditional fuel vehicles, BYD made the strategic decision to delve into electric vehicles (EVs) and became a pioneer in this sector.

The company introduced the world's first plug-in hybrid vehicle, the F3DM, in 2008. As the demand for cleaner energy alternatives grew, BYD expanded its operations further into the realm of electric buses, taxis, trucks, and forklifts. Today, BYD is a world leader in electric vehicle and battery technology, guided by its mission "to change the world by creating a complete, clean-energy ecosystem."

Mission Statement edit edit source

BYD's mission statement is:

"BYD’s (Build Your Dreams) mission is to change the world through technological innovation that reduces greenhouse gasses and our dependency on fossil fuels.

This mission reflects BYD's commitment to driving innovation in battery technology and promoting sustainable development.

Segments covered by BYD[11] edit edit source

Electric Vehicles edit edit source

BYD is a leading player in the global electric vehicle market, manufacturing a diverse range of products including electric cars, buses, trucks, and taxis. The company is well-known for its proprietary battery technology, which gives its electric vehicles a competitive edge in terms of range and efficiency.

Renewable Energy edit edit source

BYD has established itself in the renewable energy sector with solutions such as solar panels, energy storage systems, and rail transit. The company's renewable energy products are crucial components of its broader vision for a clean-energy ecosystem.

Batteries and Energy Storage edit edit source

As a top manufacturer of rechargeable batteries, BYD's products are used in a wide array of applications, from mobile phones and laptops to electric vehicles and energy storage systems. The company's cutting-edge battery technology is a key component of its success in the electric vehicle market.

Mobile Components edit edit source

BYD also operates in the electronics industry, supplying components for mobile phones, computers, and other digital devices. The company's clients include major global tech companies.

Automotive Components and Assembly edit edit source

BYD has significant operations in automotive parts manufacturing and assembly, supplying a wide range of components to both its own vehicle division and other automobile manufacturers.

Others edit edit source

Other sectors BYD is involved in include rail transit and LED lighting. The company also has significant investments in semiconductor technologies, a critical element for the development of its electric vehicles and renewable energy products.

In summary, BYD Company Ltd. represents a diverse conglomerate operating primarily in the electric vehicle and renewable energy sectors, while also maintaining significant operations in batteries, mobile components, and automotive parts. The company's mission and strategic focus on sustainability and innovation have positioned it as a leader in the global transition towards cleaner energy technologies.

Revenue Breakdown by Segment edit edit source

As of the first half of 2022, BYD Group reported a total revenue of approximately RMB 150,607 million, representing a significant year-on-year increase of 65.71%. The revenue was generated from various business segments, with notable variations in their contributions.

Automobiles and Related Products Segment edit edit source

The "Automobiles and Related Products" segment remains a core focus for BYD Group and is a pioneer and leader in the new energy vehicle industry. In the first half of 2022, this segment generated approximately RMB 109,267 million in revenue, representing a substantial year-on-year increase of 130.31%. The success of this segment can be attributed to BYD's commitment to technological innovation and continuous investment, which has allowed the Group to lead the scale and rapid development of the new energy vehicle industry.

Moreover, in the first half of 2022, BYD achieved significant market share in the domestic new energy vehicle market, reaching 24.7%, reflecting a remarkable 7.5 percentage point increment compared to 2021. This performance placed BYD in the No. 1 position globally for new energy vehicle sales, thereby leading the rise of Chinese independent brands in the electric vehicle sector.

Handset Components, Assembly Service, and Other Products Segment edit edit source

The "Handset Components, Assembly Service, and Other Products" segment contributed approximately RMB 41,070 million in revenue during the first half of 2022. However, this represents a year-on-year decrease of 4.78%. Despite the decrease in revenue, this segment continues to offer diverse products and services, catering to various market needs.

This segment engages in multiple market segments, including smart phones, smart wearables, computers, Internet of Things, smart homes, game hardware, robots, drones, communication equipment, electronic atomizers, new energy vehicles (automotive intelligent systems), medical and health equipment, and more. The Group's strategy involves diversifying its market layout while actively developing new channels for business growth.

Revenue Distribution edit edit source

The "Automobiles and Related Products" segment accounted for approximately 72.55% of the Group's total revenue during the first half of 2022, reflecting the significant impact of BYD's success in the new energy vehicle industry. On the other hand, the "Handset Components, Assembly Service, and Other Products" segment contributed around 27.27% of the Group's total revenue during the same period.

It is worth noting that historically, BYD's revenue mix has been relatively consistent over the past decade, with automobiles and related products contributing approximately 50% of total revenue, handset components and assembly services comprising about 40% of total revenue, and rechargeable battery and photovoltaics generating slightly less than 10% of the Group's total revenue.

Additionally, BYD has been actively diversifying its international presence, with overseas markets accounting for 30% of total revenue in 2021, indicating a strategic effort to expand its global reach and reduce dependency on the domestic Chinese market. However, the majority of the Group's revenues still come from the domestic Chinese market, including Hong Kong, Macau, and Taiwan, historically ranging from 84% to 90% of total revenue.

edit edit source

EV Market[12] edit edit source

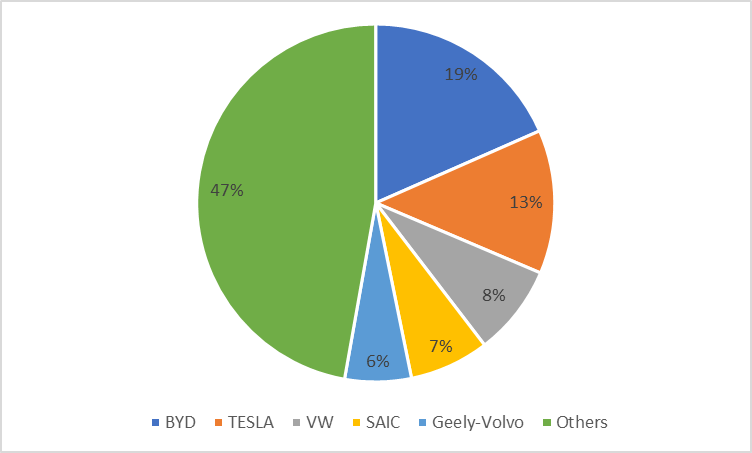

As a major car manufacturer in China, BYD Auto has always maintained a dominant position in the market in terms of sales, but only recently has it overtaken the previous global leader - Tesla. In 2022, the reported EV market share for BYD was 19%, 5% more than Tesla. This is a significant achievement for an automaker lacking the same international exposure as long-time leader Tesla and even VW Group. A testament to the Chinese market's rapidly rising dominance, with BYD's plans to expand internationally, it is inevitable that the gap will continue to grow.

| Statistic | Value |

|---|---|

| 2022 BYD Auto revenue | USD 59.2 Billion |

| 2022 Plug-in EV Sales | 1.85 Million |

| 2021 Plug-in EV Sales | 593,745 |

| Number of Consumer EV Models | 17 (5 in Europe) |

Battery Market[13] edit edit source

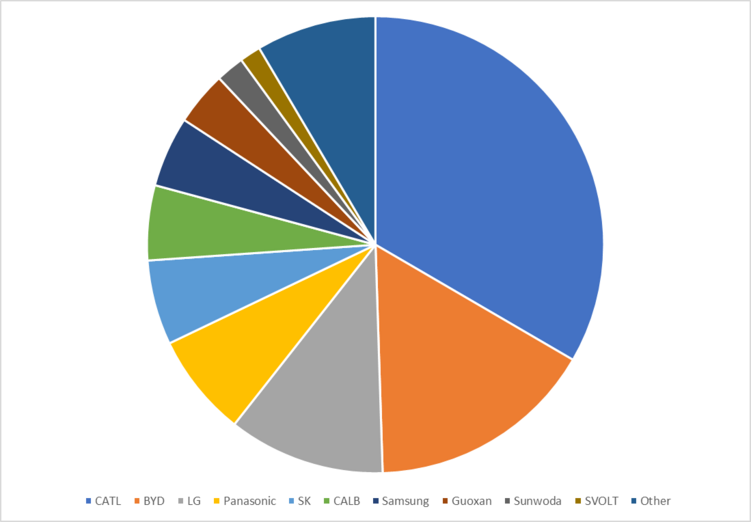

The batteries market is BYD's second major revenue stream. Although BYD started with batteries manufacturing, it has seen a great shift in recent years towards the EV market where business is much more profitable. Despite this, BYD remains a major player in the batteries market, cementing its place among well-known brands LG and Samsung. In July 2022, BYD overtook LG to become the second largest battery maker, with a market share of 16.1%, compared to LG's 11.1% and leader CATL's 33.4%. With the EV market rapidly growing and BYD contributing to energy storage projects all over the world, this market share is expected to grow further.

BYD Competitors edit edit source

1. Tesla, Inc. (Market Cap: 832.99 billion USD)

Tesla, Inc., founded in 2003 by Elon Musk and others, is a major American electric vehicle and clean energy company. Renowned for its innovative EVs, energy storage products, and solar energy solutions, Tesla poses a significant challenge to BYD in the global electric vehicle market.

2. NIO Inc. (Market Cap: 22.67 billion USD)

NIO Inc., a Chinese electric vehicle manufacturer founded in 2014, has gained prominence for producing high-performance electric SUVs and a strong focus on battery-swapping technology. NIO's emphasis on providing premium electric mobility experiences puts it in direct competition with BYD in the Chinese EV market.

3. Panasonic Corporation (Market Cap: 4.36 trillion JPY)

Panasonic Corporation, a Japanese multinational electronics company, is a significant competitor to BYD in the battery and energy storage sector. The company manufactures a wide range of batteries, including lithium-ion batteries used in electric vehicles, which puts it in competition with BYD's battery division.

4. LG Chem Ltd. (Market Cap: 46.45 trillion KRW)

LG Chem, a South Korean chemical company, is a key player in the global battery industry. Known for producing lithium-ion batteries used in electric vehicles, energy storage systems, and various other applications, LG Chem is a notable competitor to BYD in this area.

5. Samsung Electronics Co., Ltd. (Market Cap: 477.17 trillion KRW)

Samsung Electronics, a renowned South Korean multinational conglomerate, has been expanding its presence in the electric vehicle market. The company's investments in battery technologies and plans to develop electric vehicle components pose a potential challenge to BYD's battery and EV business.

6. Sony Corporation (Market Cap: 16.66 trillion JPY)

Sony Corporation, a Japanese multinational conglomerate, has also entered the electric vehicle market with the development of EV batteries. Sony's reputation for producing high-quality electronics and its recent ventures into the EV segment make it a potential rival to BYD.

7. General Motors Company (Market Cap: 54.67 billion USD)

General Motors (GM), a prominent American automaker, has been investing heavily in electric vehicles and plans to transition to an all-electric line-up in the coming years. As GM expands its EV offerings, it may compete with BYD in both domestic and international markets.

8. Volkswagen Group (Market Cap: 67.76 billion EUR)

Volkswagen Group, a German automotive giant, is another major player in the electric vehicle market. With its ambitious electrification plans and a portfolio of electric models across its brands, Volkswagen's global reach and well-established reputation pose a competitive challenge to BYD in various regions.

9. Toyota Motor Corporation (Market Cap: 37.86 trillion JPY)

Toyota Motor Corporation, a Japanese multinational automotive manufacturer, is one of the largest automakers in the world. Known for its extensive range of vehicles, including hybrid and electric models, Toyota poses a significant competitive challenge to BYD. The company's global presence, reputation for reliability, and focus on sustainable mobility solutions put it in direct competition with BYD in various markets.

10. Honda Motor Co., Ltd. (Market Cap: 8 trillion JPY)

Honda Motor Co., Ltd., another prominent Japanese automotive manufacturer, is recognized for its diverse lineup of automobiles and motorcycles. Honda has also made strides in the electric vehicle segment, developing hybrid and electric models that compete with BYD's offerings. The company's commitment to innovation and environmentally friendly technologies places it as a key rival to BYD in the automotive industry.

BYD: On-going and future projects edit edit source

BYD has a number of on-going and future projects that are aimed at expanding its business and capturing new markets. These projects include:

New Battery Technologies edit edit source

BYD is investing heavily in the development of new battery technologies, such as solid-state batteries and lithium-air batteries. These new technologies have the potential to offer higher energy densities and longer battery life than traditional lithium-ion batteries.

Expansion of EV Production Capacity edit edit source

BYD is increasing its electric vehicle production capacity in order to meet the growing demand for electric vehicles. The company is also expanding its global footprint, opening new manufacturing plants in Europe and the United States. BYD is expected to sell 1.75 million EVs by the end of 2023, with a current total production capacity of 2.9 million units a year. This is expected to rise to 4.3 million units by the end of 2023.[14]

Renewable Energy Projects edit edit source

BYD is investing in a number of renewable energy projects, including solar and wind farms. The company is also developing new battery storage technologies that will help to integrate renewable energy into the grid. BYD's renewable energy projects are expected to generate 10 gigawatts of electricity by 2025. In recent years, BYD has committed to providing renewable energy systems for a number of clients worldwide. For example, the plan to implement a 543 MWh energy storage system (ESS) in Las Vegas using their Cube Pro liquid-cooled batteries was announced this year, a significant step towards the goal of achieving zero carbon emissions by 2050.[15] In addition, BYD is responsible for supplying the world's largest single-phase ESS in the US West Coast[16], with the energy storage market rapidly growing, BYD Energy Storage grows with it as a major player in the field.

New Vehicle Models edit edit source

BYD is planning on releasing a number of new vehicle models in the coming years. These models include the Dolphin, Ocean-X, Seal, Han EV, and Tang EV. A large variety of models tackling every vehicle market segment gives BYD much greater reach than the competition, and with much more affordable price points, BYD becomes a much more compelling entry point into EV for many compared to Tesla and other EV manufacturers. With the BYD Dolphin coming in at £25,490, the budget entry represents BYD's expansion into the European markets, which has never been a focus for Chinese automakers until recently.

These are just a few of the on-going and future projects that BYD is working on. The company is committed to innovation and growth, and it is well-positioned to be a major player in the global technology market.

BYD is a well-positioned company with a strong track record of innovation. The company's on-going and future projects are aimed at expanding its business and capturing new markets. These projects have the potential to make BYD a major player in the global technology market.

Leadership edit edit source

Chuan-Fu Wang edit edit source

President & CEO, Executive Chairman

Mr. Chuan-Fu Wang is the President, CEO, and Chairman of BYD Auto Co., Ltd., as well as an Executive Chairman and CEO of BYD Company Ltd. He co-founded Shenzhen BYD Battery Company Limited in 1995 and served as its General Manager. Mr. Wang is also an Executive Director of BYD Company Ltd. and holds director positions in various companies, including Shenzhen DENZA New Energy Automotive Co., Ltd. and Tianjin BYD Auto Co., Ltd. He is recognized as a technology expert and has received numerous awards, such as the Star of Asia and Zayed Future Energy Prize Lifetime Achievement Award. Mr. Wang holds degrees in metallurgy physical chemistry and material science.

Ya-Lin Zhou edit edit source

Chief Financial Officer, Vice President

Ms. Ya-Lin Zhou is the Chief Financial Officer and Vice President of BYD Company Limited since May 31, 2019. She also serves as the Chief Financial Officer of BYD Electronic (International) Company Limited since January 2016. Ms. Zhou joined BYD Company Ltd. in March 1999 and had been its Chief Accountant from November 2014 until May 31, 2019. She holds a Bachelor's Degree in economics from Jiangxi University of Finance and Economics, earned in 1999. Ms. Zhou is involved in various roles, serving as a Director and Supervisor in several companies, including BYD Auto Finance Company Limited and Shenzhen BYD Electric Car Investment Co., Ltd.

Qian Li edit edit source

Secretary to the Board, Company Secretary & GM of Investment Department

Mr. Qian Li is the Director of Sichuan Road & Bridge Co., Ltd. since June 13, 2022. He holds key positions at BYD Company Ltd., serving as Secretary to the Board, Company Secretary Authorised Representative, and General Manager of Investment Department. Mr. Li's association with BYD dates back to August 2005, and he also served as Chief Investment Officer. Additionally, he is the Joint Company Secretary of BYD Electronic International Company Ltd. since November 2007. Before joining BYD, Mr. Li worked at PricewaterhouseCoopers and Arthur Andersen as an Auditor and Business Consultant from July 1998 to August 2001. He has extensive experience in investment, finance, and information technology, and he holds an MBA from Guanghua School of Management, Peking University, and a Bachelor's Degree in Economics from Jiangxi University of Finance and Economics. Mr. Li is also a Supervisor of Tibet Shigatse Zhabuye Lithium High-Tech Co., Ltd.

Ownership Structure edit edit source

As of the 2023 Annual Report and Exchange Statement, these individuals have a greater than 0.1% share stake out of the 2,905,631,831 shares outstanding:

| Individual Shareholder | Share Stake (%) |

|---|---|

| Chuan-Fu Wang | 18.01 |

| Xiang-Yang Lv | 8.23 |

| Zuo-Quan Xia | 2.86 |

| Nian-Qiang Wang | 0.63 |

| Ke Li | 0.37 |

| Zhang Wei | 0.28 |

Companies, hedge funds and traditional investment with a share stake above 0.1%:

| Shareholder | Share Stake (%) |

|---|---|

| Youngy Investment Holding Group Co.Ltd. | 5.34 |

| Berkshire Hathaway Inc. (BRK.A-US) | 3.39 |

| BlackRock Inc. (BLK-US) | 2.29 |

| Himalaya Capital Management LLC | 1.88 |

| Vanguard Group Inc. | 1.48 |

| E Fund Management Co. Ltd. | 0.68 |

| First Seafront Fund Management Co., Ltd | 0.65 |

| Yinhua Fund Management Co. Ltd. | 0.59 |

| GF Fund Management Co. Ltd. | 0.50 |

| Mirae Asset Global Investments Co. Ltd. | 0.50 |

| China Universal Asset Management Co. Ltd. (560030-SHSE) | 0.47 |

| State Street Global Advisors Inc. | 0.46 |

| FMR LLC | 0.42 |

| Central Huijin Asset Management Ltd. | 0.41 |

| Norges Bank Investment Management | 0.39 |

| China Asset Management Co. Ltd. | 0.37 |

| Fullgoal Fund Management Co. Ltd. | 0.30 |

| Perseverance Asset Management LLP | 0.26 |

| National Council for Social Security Fund | 0.25 |

| Wanjia Asset Management Co. Ltd. | 0.22 |

| Zhong Ou Fund Management Co., Ltd | 0.22 |

| Invesco Great Wall Fund Management Co. Ltd | 0.22 |

| Amundi Asset Management SAS | 0.20 |

| Orient Fund Management Co. Ltd. | 0.20 |

| BYD Company Limited ESOP | 0.19 |

| Guotai Asset Mgmt Co. Ltd. | 0.18 |

| ICBC Credit Suisse Asset Management Co. Ltd. | 0.17 |

| Huatai-PineBridge Fund Management Co. Ltd. | 0.16 |

| First State Cinda Fund Management Co. Ltd. | 0.16 |

| BNPP Asset Management Holding | 0.15 |

| Goldman Sachs Asset Management LP | 0.14 |

| Hang Seng Investment Management Ltd. | 0.14 |

| ABC-CA Fund Management Co. Ltd. | 0.14 |

| Minsheng Royal Fund Management Co. Ltd. | 0.13 |

| UBS Asset Management AG | 0.13 |

| Geode Capital Management LLC | 0.13 |

| Harvest Fund Management Co. Ltd. | 0.12 |

| JP Morgan Asset Management | 0.12 |

| Essence Fund Management Co. Ltd | 0.12 |

| China Southern Asset Management Co. Ltd. | 0.11 |

| Credit Suisse Asset Management (Switzerland) Ltd. | 0.11 |

| Dimensional Fund Advisors LP | 0.10 |

| AllianceBernstein LP | 0.10 |

Corporate Strategy edit edit source

With its commitment to technological innovation and sustainability, BYD seeks to further solidify its status as a global player in green mobility and intelligent transportation solutions through diversification, vertical integration and global expansion. These are the most relevant areas identified in the interim report:

New Energy Vehicle Industry and Market Expansion edit edit source

In light of the prevailing trend of China's new energy vehicle industry, BYD is set to continue its focus on developing competitive products and expanding production capacity for new energy vehicles and core components. The Chinese government's support through policies such as tax exemptions for new energy vehicles further encourages BYD to actively meet market demand and improve its delivery capacity.

The company remains dedicated to deepening research and development in core technologies for new energy vehicles. It aims to cover a wide market segment by emphasizing the mutual development of Battery Electric and Plug-in Hybrid electric technology. The introduction of new models like the 'WORLD-Seal,' 'DENCE D9,' and 'Tang DM-p,' along with continuous Over-The-Air (OTA) upgrades for existing models, showcases BYD's commitment to product innovation and technological advancements.

To enhance its position in the global market, BYD is actively collaborating with excellent dealer partners in various countries, entering markets in the Netherlands, Sweden, Germany, Thailand, Costa Rica, Japan, and more. The company plans to showcase its latest new energy passenger vehicle products at prestigious events such as the Paris Motor Show, solidifying its commitment to sustainability and green mobility on a global scale.

Public Transportation Solutions and Urban Rail Transit edit edit source

In addition to the new energy vehicle industry, BYD is a major player in the development of battery electric buses and urban rail transit. The company aims to empower low-carbon upgrades in public transportation systems worldwide and provide zero-emission public transportation solutions. Through innovative technologies and high-quality products, BYD is working towards the establishment of a global green mobility system and supporting the development of a low-carbon society.

In the field of urban rail transit, BYD stands at the forefront of world rail transit innovation. Leveraging its integrated innovation approach, the company extends its electric vehicle industry chain to the rail transit sector, focusing on promoting low-carbon and environmentally friendly urban rail transit products, such as the "SkyRail" and "SkyShuttle." These products contribute to the building of low-carbon transportation and the advancement of sustainable and intelligent transportation solutions in cities.

Market-oriented Approach and Strategic Investments edit edit source

BYD recognizes the importance of market-oriented operations and is actively cultivating more market-competitive businesses. The company aims to unleash the development potential of each business segment, enhance overall value, and make strategic investments in core areas of the industry chain. Collaborating with partners in upstream and downstream sectors of the industry chain will push forward BYD's marketization process and strengthen its market presence.

Handset Components and Assembly Business edit edit source

In the handset components and assembly business, BYD remains committed to technological advancement and increasing investment in research and development. The company seeks to strengthen core competitiveness by leveraging technological advantages and focusing on developing major customers and expanding market share. As the cross-industry integration of 5G and artificial intelligence technology drives market development, BYD plans to expand its product range and develop more high-quality intelligent products in areas like smart home devices, drones, and electronic atomization products.

Furthermore, with the automotive industry's shift towards electrification and intelligence, BYD aims to capitalize on this trend by increasing investment in research, development, and technological innovation. The deployment of new categories, such as smart cockpit, intelligent driving, intelligent networking, domain controller, and on-board acoustic systems, demonstrates BYD's commitment to staying at the forefront of automotive innovation and driving new business development.

Risks edit edit source

BYD Company Limited, often hailed as a leader in China's domestic market for new energy vehicles (NEVs), faces several challenges and risks that may impact its position and growth prospects in the industry. Despite its current market standing, BYD encounters formidable competition from both domestic and foreign automakers, making it essential for the company to address the following risks to maintain its competitive edge:

Intense Competition in the Chinese Market: edit edit source

The Chinese new energy vehicle market is experiencing rapid growth, attracting numerous players seeking to maximize their interests. Beijing Automotive Group, Geely, and other Chinese independent brands have made significant strides in developing EVs, posing a direct threat to BYD's market share. Additionally, well-established foreign automakers like Tesla, BMW, and Volkswagen, backed by substantial financial and technological resources, also compete for a share of this vast market. To stay ahead, BYD must not only focus on product quality but also refine its product after-sales and marketing strategies to retain customer loyalty and attract new buyers.

Subsidy-Driven Market Dynamics: edit edit source

Government subsidies play a crucial role in the Chinese EV market, encouraging consumers to adopt eco-friendly vehicles. Although BYD has benefited from subsidies, it faces stiff competition from other brands, particularly Tesla, which has secured significant financial support from various countries. This is evident from the fact that over the past 20 years, Tesla has successfully obtained various government subsidies, including tax breaks, loans, and other incentives, adding up to nearly $3 billion. Additionally, in 2020, Tesla's eligibility for significant financial support in China is highlighted by the substantial 2.1 billion yuan subsidy it received exclusively for new energy vehicles. These subsidies have helped Tesla and other competitors narrow the advantage that BYD might have gained, making it imperative for BYD to rely on continuous innovation and improvement rather than relying solely on subsidies.

Threats from Competitors: edit edit source

While BYD has managed to establish a prominent position in the Chinese auto market, the emergence of new players, such as Great Wall Motor, poses a challenge to its dominance. Additionally, global automotive giants like Toyota, Honda, and General Motors have also made substantial investments in research and development of new energy vehicles, potentially overtaking BYD's technological leadership. Furthermore, BYD's strong emphasis on independent research, development, and innovation, there are certain disparities between their technology and some international counterparts. BYD has not been particularly successful in assimilating cutting-edge technologies from global sources. In comparison, Tesla has established partnerships with numerous companies, enabling it to benefit from collaborations. Notably, approximately 50% of Tesla's batteries are supplied by CATL and LG, while Nidec Corp provides the Tesla motor. These esteemed manufacturers have played a crucial role in elevating Tesla's vehicle quality to exceptional levels.

Patent Disputes: edit edit source

BYD has faced patent disputes with companies like Foxconn and Sony in the past, indicating that future patent-related conflicts may arise, potentially affecting the company's development plans and intellectual property rights. Such disputes can lead to legal complications, financial losses, and reputational damage for BYD.

Lack of Innovation: edit edit source

The ability to innovate is crucial for any automotive company to stay relevant and competitive in a fast-evolving market. Some critics have raised concerns about BYD's innovation capabilities, as the company has experienced delays in launching its own innovative models. With emerging players like Chery and Geely actively investing in new energy vehicle design and manufacturing, BYD must strengthen its innovation efforts to keep pace with the evolving industry landscape. Failure to do so may lead to other companies surpassing BYD in terms of technological advancements and market share.

Financials edit edit source

Historical & Forward financials [17] edit edit source

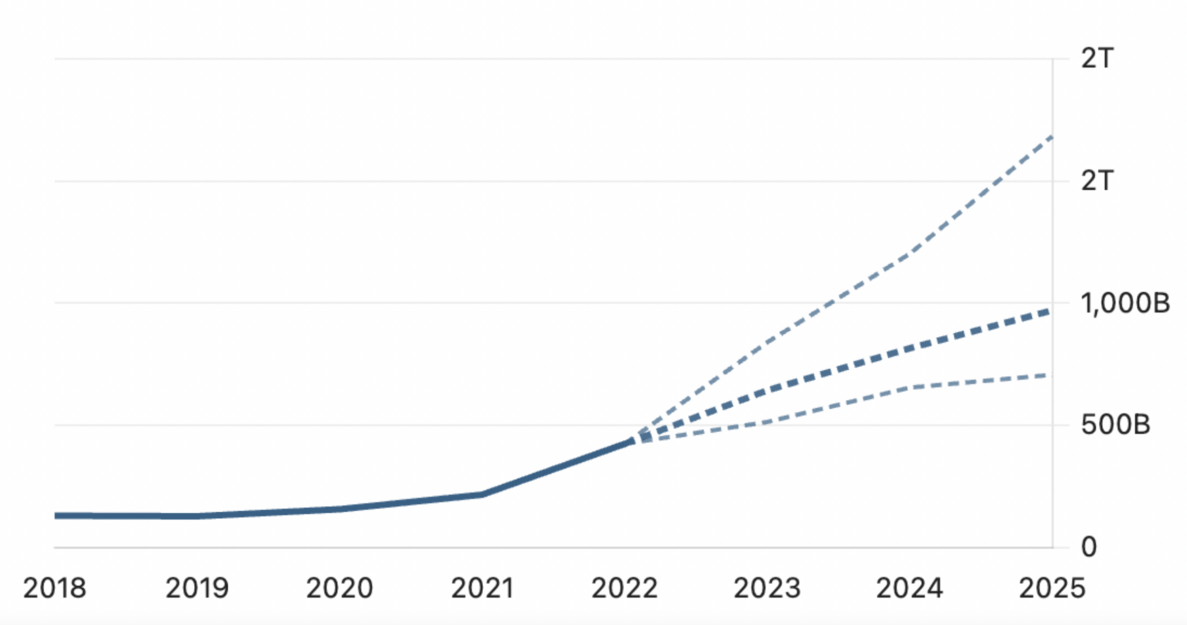

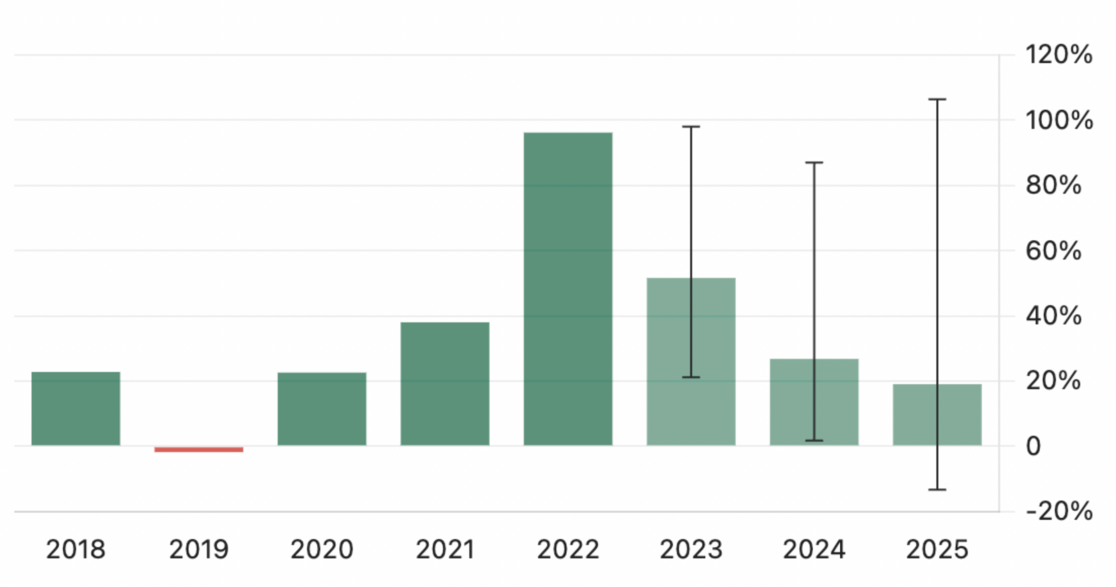

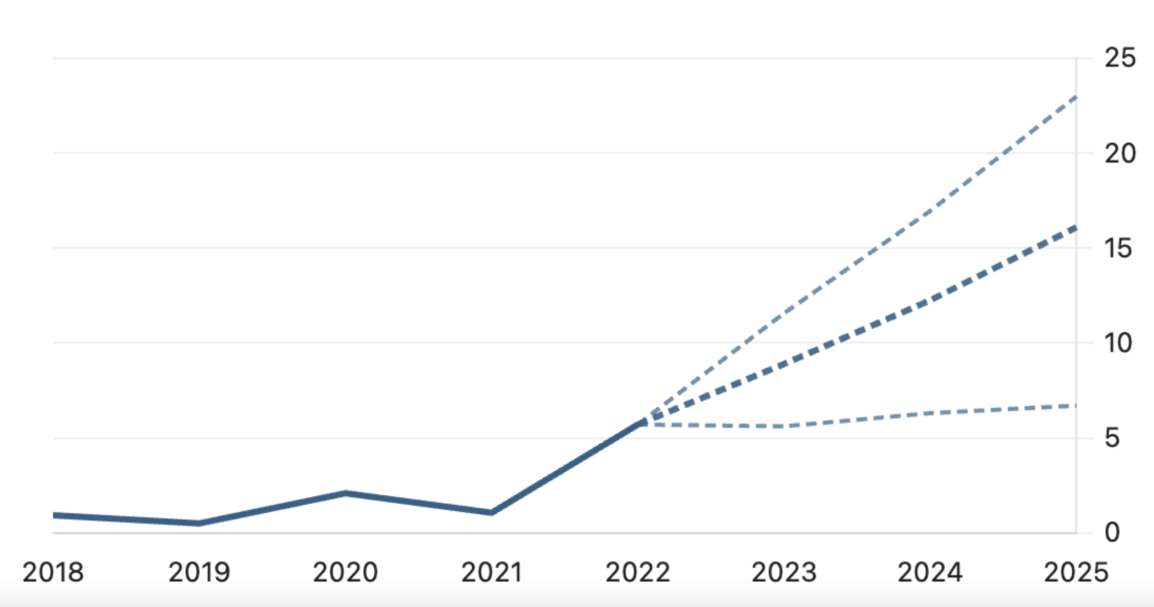

The revenue has grown rapidly since 2018 with the exception of 2019 where negative revenue (CNY -127.74B) and growth rate was observed (-1.78%). Analysts expect the revenue on average to be CNY 645.5B (2023), CNY 814.6B (2024) and CNY 938.0B (2025). This translates to average revenue growth of 52.2%, 26.2% and 15.2% respectively.

Analysts predict that the revenue can optimistically grow up to 1.4T in 2024 and 2025. However, more pessimistic forecasts suggest that 2024 and 2025 may witness a negative growth of -10.6% and -23.7% respectively for the first time since 2019. On average, the revenue is expected to grow for the next three years but at a slower rate compared to the previous three years.

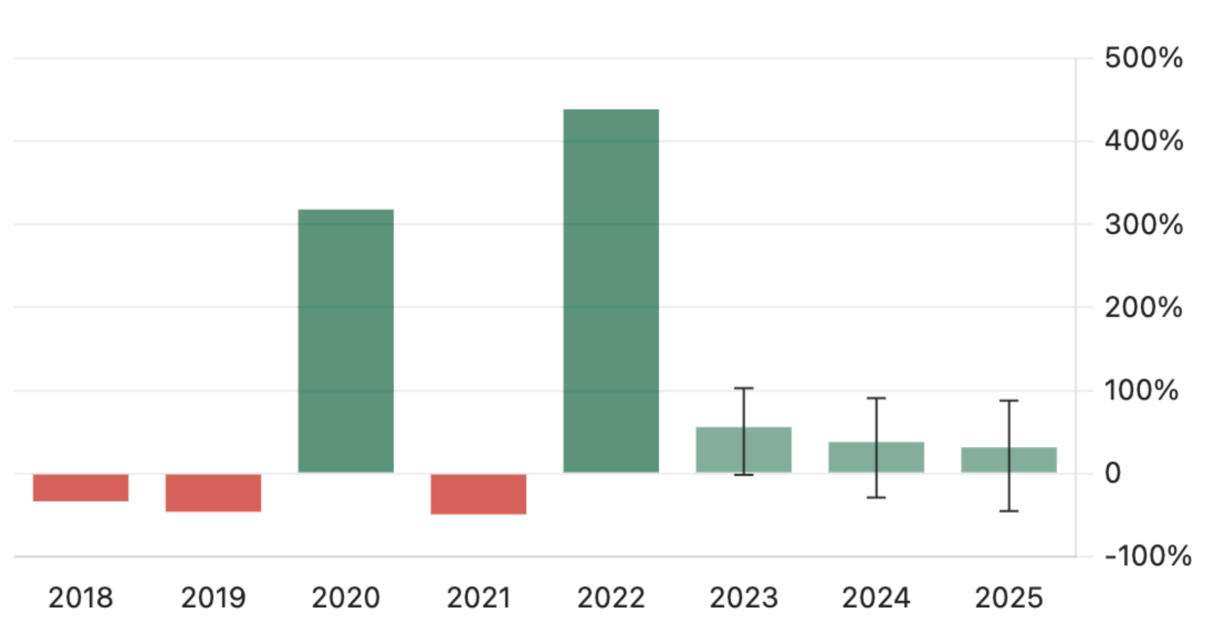

The earnings per share and the respective growth rate has been very volatile since 2018. Analyst expect a more controlled constant growth over the next three years. Analysts expect the EPS, on average, to be CNY 8.77 (2023), CNY 12.07 (2024) and CNY 15.68 (2025). This translates to an average revenue growth of 53.7%, 37.5% and 30.0% respectively.

For 2025, high EPS growth forecasts can be as steep as 90.9% whereas conservative EPS growth forecasts can be as low as -46.0%. The spread in analysts' expectations remains high for all the forecasted years just as with the revenue.

Financial Ratios edit edit source

The following table summarises how the evolution of the key financial ratios since 2013. [17]

| Year | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt / Equity Ratio | 0.2 | 0.37 | 0.92 | 1.26 | 1.07 | 1.03 | 0.82 | 1.17 | 1.19 | 1.14 |

| Debt / EBITDA Ratio | 0.49 | 1.63 | 2.12 | 4.22 | 3.67 | 3.98 | 2.82 | 3.61 | 4.8 | 4.73 |

| Debt / FCF Ratio | 0.5 | 1.26 | 1.56 | -12.15 | -11.13 | -6.72 | -2.84 | -4.46 | -3.53 | -7.46 |

| Quick Ratio | 0.44 | 0.66 | 0.67 | 0.67 | 0.11 | 0.09 | 0.1 | 0.1 | 0.09 | 0.13 |

| Current Ratio | 0.72 | 0.97 | 1.05 | 0.99 | 0.99 | 0.98 | 1 | 0.82 | 0.77 | 0.68 |

| Asset Turnover | 0.86 | 0.73 | 0.78 | 0.65 | 0.67 | 0.59 | 0.71 | 0.69 | 0.62 | 0.69 |

| Interest Coverage | 16.36 | 3.98 | 3.91 | 2.05 | 1.36 | 2.31 | 3.33 | 2.09 | -0.13 | 0.1 |

| Return on Equity (ROE) | 14.97% | 3.20% | 10.57% | 2.84% | 5.04% | 7.39% | 9.86% | 8.74% | 1.71% | 2.55% |

| Return on Assets (ROA) | 3.37% | 1.03% | 2.99% | 0.83% | 1.43% | 2.28% | 3.48% | 2.44% | 0.46% | 0.72% |

| Return on Capital (ROIC) | 13.36% | 5.05% | 9.70% | 4.83% | 3.01% | 4.24% | 5.34% | 3.76% | -0.27% | 0.21% |

Between 2021 and 2022, some of the financial ratios have changed drastically. The Debt/EBITDA ratio has decreased by 70% from 1.63 to 0.49 as the company's earnings has increased significantly in relation to its debt, putting the business in a better position to pay off the incurred debt. [18]

The Debt/FCF ratio has also plummeted from 1.26 to 0.5 by 60%. This is another coverage ratios which reinforces that the cash generated by the company puts it in a healthy position to cover all its debt. [19]

The return on equity has increased by 11.77% in 2022. Return on equity is the ratio of net income to shareholder's equity. Higher net income stems from the growth in revenue which ultimately increases the return on equity. [20]

The significant growth in revenue over last year fuels the optimistic forecasts (for revenue and EPS) and the substantial changes observed in the financial ratios. The new product range offered by BYD to its customers that are looking for an affordable transition to electric vehicles, entry into the European market and government policies promoting the transition to sustainable transportation have been the fundamental driving factors in revenue growth observed since 2021.

Valuation edit edit source

DCF edit edit source

BYD Company is valued using a DCF (Discounted Cash Flow) model followed by relative valuation.

DCF model is used to value the company intrinsically by projecting its future cash flows. Different line items from the financial statements including revenue, taxes, EBIT, D&A, capex and changes in net working capital are forecasted using available values from the previous 5 years.

| HKD millions | 2018 | 2019 | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E | 2026E | 2027E |

|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 151,502 | 143,075 | 173,547 | 256,840 | 479,772 | 642,980 | 815,310 | 970,590 | 1,155,444 | 1,375,504 |

| % growth | 0.00% | -5.56% | 21.30% | 47.99% | 86.80% | 34.02% | 26.80% | 19.05% | 19.05% | 19.05% |

| EBIT | 14,671 | 5,099 | 11,123 | 5,073 | 22,435 | 31,053 | 42,574 | 57,351 | 61,471 | 64,741 |

| % margin | 3.56% | 6.41% | 1.98% | 4.68% | 4.83% | 5.22% | 5.91% | 5.32% | 5.32% | |

| Taxes | 982 | 354 | 976 | 664 | 3,915 | 4,330 | 4,788 | 5,295 | 5,856 | 6,476 |

| % of EBIT | 6.69% | 6.94% | 8.77% | 13.09% | 17.45% | 10.59% | 10.59% | 10.59% | 10.59% | 10.59% |

| EBIAT | 13,689 | 4,745 | 10,147 | 4,409 | 18,520 | 26,723 | 37,786 | 52,056 | 55,615 | 58,265 |

| D&A | 11,165 | 11,158 | 14,067 | 17,004 | - | 19,641 | 21,108 | 22,686 | 24,381 | 26,204 |

| % of sales | 7.37% | 7.80% | 8.11% | 6.62% | - | 7.47% | 7.47% | 7.47% | 7.47% | 7.47% |

| Capex | -113,330 | -45,007 | -13,230 | -23,389 | -21,133 | (15,748) | (11,736) | (8,746) | (6,517) | (4,857) |

| % of slaes | -74.80% | -31.46% | -7.62% | -9.11% | -4.40% | -25.48% | -25.48% | -25.48% | -25.48% | -25.48% |

| Changes in NWC | 114,906 | 53,277 | 24,093 | -1,849 | -5,741 | -6,447 | -7,240 | -8,131 | -9,131 | -10,254 |

| % of sales | 75.84% | 37.24% | 13.88% | -0.72% | -1.20% | 12.30% | 12.30% | 12.30% | 12.30% | 12.30% |

| Unlevered FCF | -203,382 | -82,381 | -13,109 | -127 | 3,128 | 37,063 | 54,399 | 74,127 | 82,610 | 89,866 |

These parameters are used to calculate the cost of equity (9.51%) using the CAPM (Capital Asset Pricing Model). The cost of debt (5.4%) is also estimated using analysts' expectations.

The resulting WACC (Weighted Average Cost of Capital) calculated internally is 9.51%. WACC is used as the discounting factor in order to project the calculated free cash flows and the terminal value to its respective present value.

The terminal growth rate is estimated to be 1.0% in order to obtain the terminal value. The enterprise value is obtained by summing the present value of free cash flow forecasts and the terminal value. Net debt is deducted from the enterprise value to obtain the equity value.

| Assumptions | Value | Explaination |

|---|---|---|

| Risk free rate (5 year US Bond) | 4.7% | US 5 Year Treasury Note rate [21] |

| Market risk premium | 5.2% | Analysts' expectations [21] |

| Levered beta | 0.88 | Analysts' expectations [21] |

| Cost of equity | 9.8% | CAPM (Capital Asset Pricing Model) |

| Cost of debt | 5.4% | Analysts' expectations [21] |

| Shares outstanding (latest reported) | 2.9 B | BYD 2022 interim report [22] |

| Market capitalization | 789,501 [23] | |

| Total debt | 39,956 | |

| Total capital | 829,458 | |

| % debt capital | 4.82% | |

| % equity capital | 95.18% | |

| Terminal growth rate | 1% | Analysts' expectations [21] |

| Tax rate | 22.50% [21] | |

| Internally calculated WACC | 9.51% |

All financial figures for the DCF are reported in HKD (Hong Kong Dollar). As per the currency exchange rate on 28/07/23, 1 HKD is equivalent to 0.13 US Dollars. [24]

The implied share price for BYD Company is $44.13 (HK$ 344.24), while the closing share price on 28/07/23 was $34.77 (HK$ 271.20).

| Present vale of FCF | 262,479 |

| Present value of TV | 710,899 |

| Enterprise value | 973,378 |

| Net debt | -28,746 |

| Equity value | 100,2124 |

| Shares | 2.9 B |

| Current share price (HKD) | 271.20 |

| Current share price ($) | 34.77 |

| Implied share price (HKD) | 344.24 |

| Implied share price ($) | 44.13 |

Sensitivity analysis is conducted to investigate the impact of WACC ranging from 6.5% and 10.0% and terminal growth rate between 0% and 2.5%.

| Terminal

Growth Rate |

WACC | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 6.50% | 7.00% | 7.50% | 8.00% | 9.51% | 8.50% | 9.00% | 9.50% | 10.00% | ||

| 0.0% | $465.53 | $431.79 | $402.57 | $377.02 | $316.39 | $354.50 | $334.49 | $316.61 | $300.53 | |

| 0.5% | $497.33 | $458.61 | $425.44 | $396.72 | $329.54 | $371.60 | $349.45 | $329.79 | $312.20 | |

| 1.0% | $534.92 | $489.90 | $451.83 | $419.22 | $344.24 | $390.98 | $366.28 | $344.51 | $325.17 | |

| 1.5% | $580.03 | $526.88 | $482.62 | $445.19 | $360.77 | $413.13 | $385.36 | $361.08 | $339.66 | |

| 2.0% | $635.16 | $571.26 | $519.01 | $475.49 | $379.51 | $438.69 | $407.16 | $379.85 | $355.97 | |

| 2.5% | $704.07 | $625.50 | $562.68 | $511.30 | $400.92 | $468.50 | $432.31 | $401.30 | $374.45 | |

Relative Valuation edit edit source

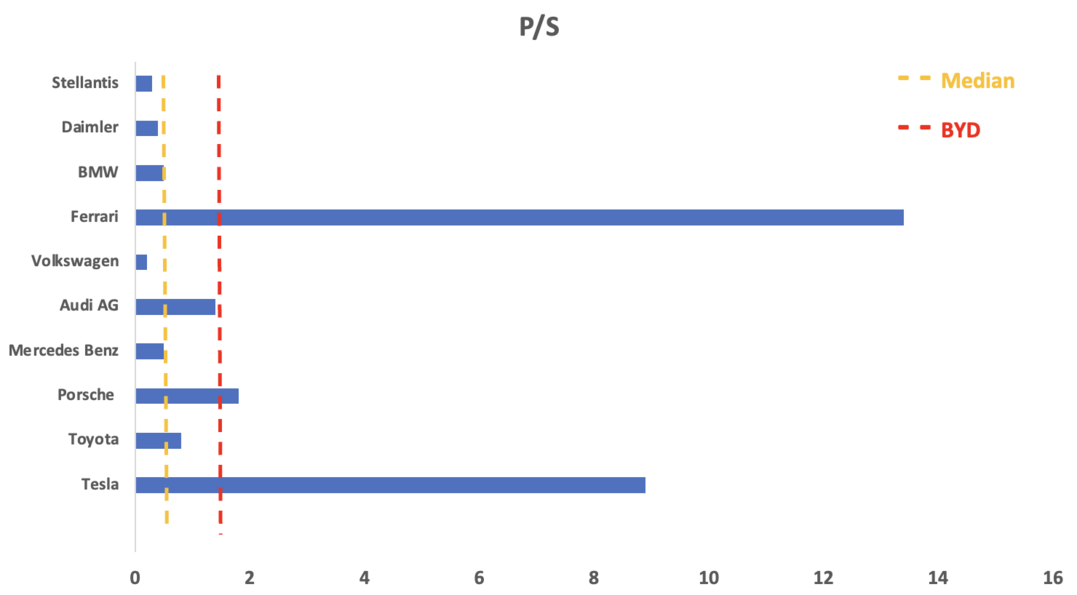

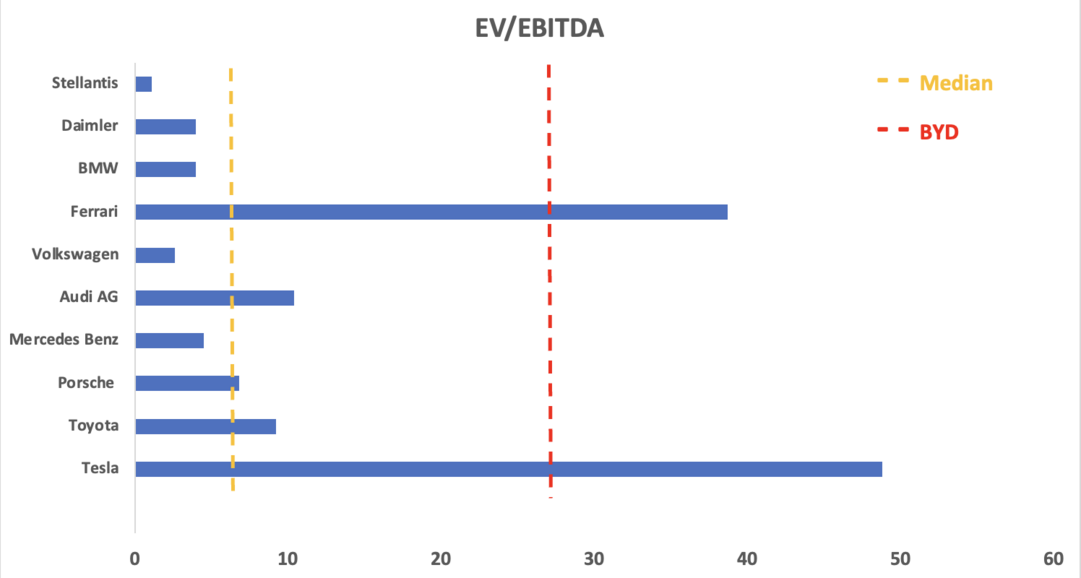

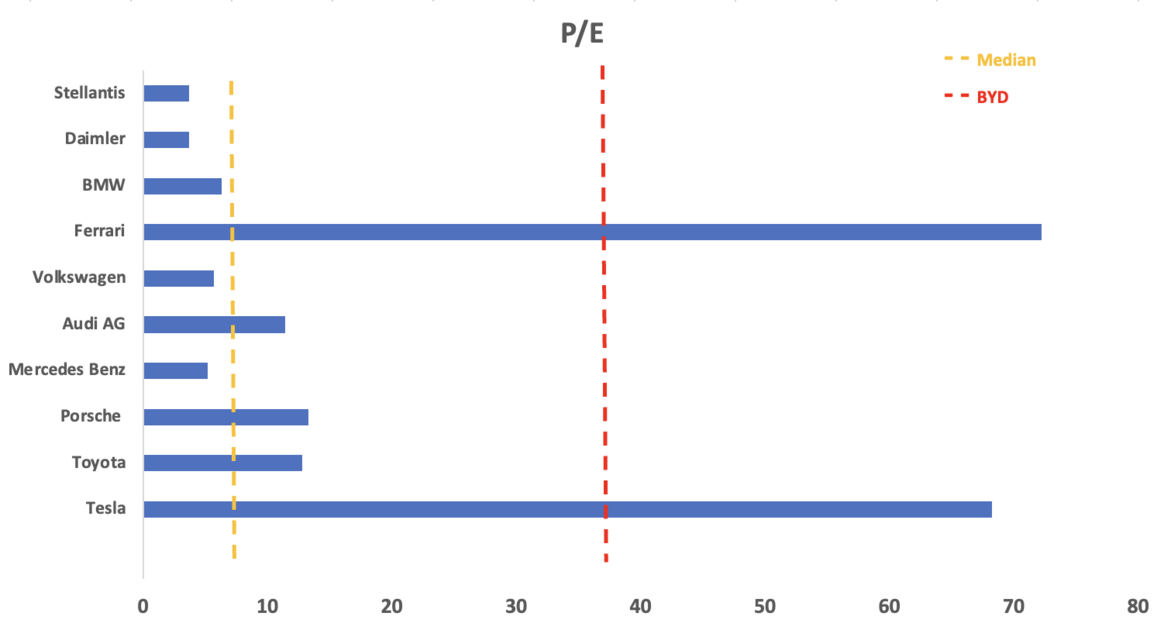

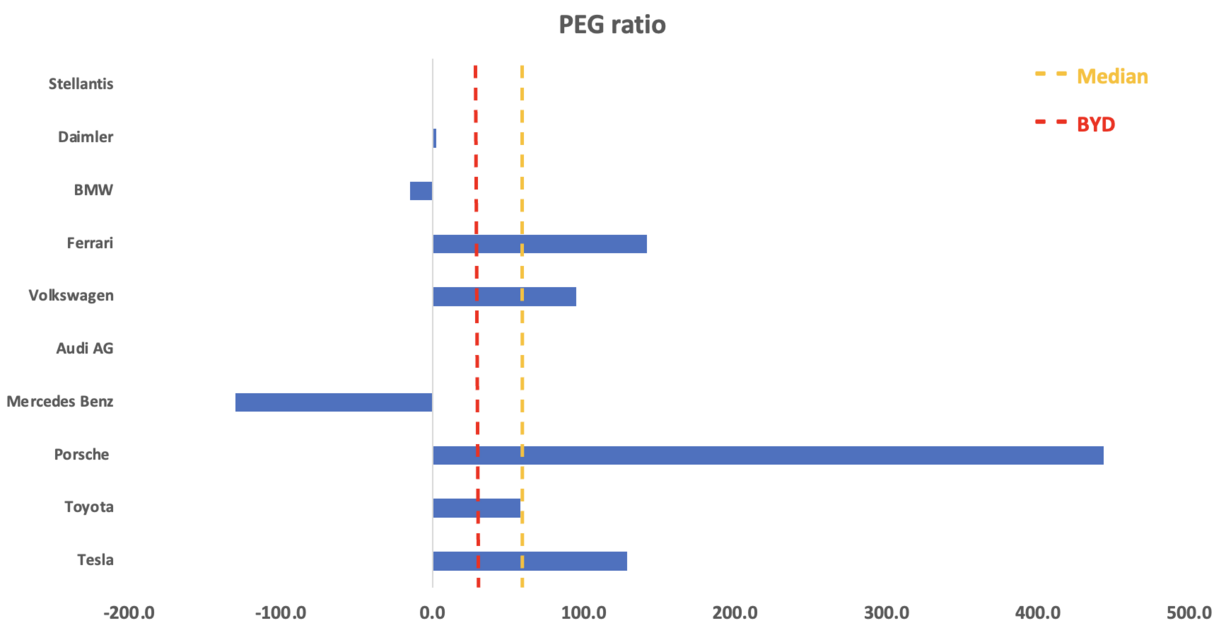

Trading comparable analysis was used to compare BYD to its competitors in the market. A range of different multiples are used to evaluate if the current share price of BYD is fairly priced or under/overvalued . [25]

| Company | P/S | P/E | EV/EBITDA | EV/EBIT | PEG | Growth adjusted EV/EBITDA |

|---|---|---|---|---|---|---|

| BYD Co | 1.6 | 38.0 | 29.5 | 29.5 | 21.8 | 8.7 |

| Tesla | 8.9 | 68.2 | 48.8 | 64.7 | 128.7 | 55.5 |

| Toyota | 0.8 | 12.8 | 9.2 | 16.1 | 58.2 | -460.0 |

| Porsche | 1.8 | 13.3 | 6.8 | 9.4 | 443.3 | 170.0 |

| Mercedes Benz | 0.5 | 5.2 | 4.5 | 6.1 | -130.0 | 64.3 |

| Audi AG | 1.4 | 11.4 | 10.4 | 10.4 | - | - |

| Volkswagen | 0.2 | 5.7 | 2.6 | 6.3 | 95.0 | -37.1 |

| Ferrari | 13.4 | 72.2 | 38.7 | 56.0 | 141.6 | 82.3 |

| BMW | 0.5 | 6.3 | 4.0 | 6.3 | -14.7 | 30.8 |

| Daimler | 0.4 | 3.7 | 4.0 | 5.4 | 2.5 | - |

| Stellantis | 0.3 | 3.7 | 1.1 | 1.5 | 0.1 | 26% |

| Median | 0.7 | 8.9 | 5.7 | 7.9 | 58.2 | 43.1 |

| Mean | 2.8 | 20.3 | 13.0 | 18.2 | 80.5 | -11.8 |

| Lower Quartile | 0.4 | 5.3 | 4.0 | 6.2 | 0.1 | -9.1 |

| Upper Quartile | 1.7 | 13.2 | 10.1 | 14.7 | 128.7 | 68.8 |

| Min | 0.2 | 3.7 | 1.1 | 1.5 | -130.0 | -460.0 |

| Max | 13.4 | 72.2 | 38.7 | 56.0 | 443.3 | 170.0 |

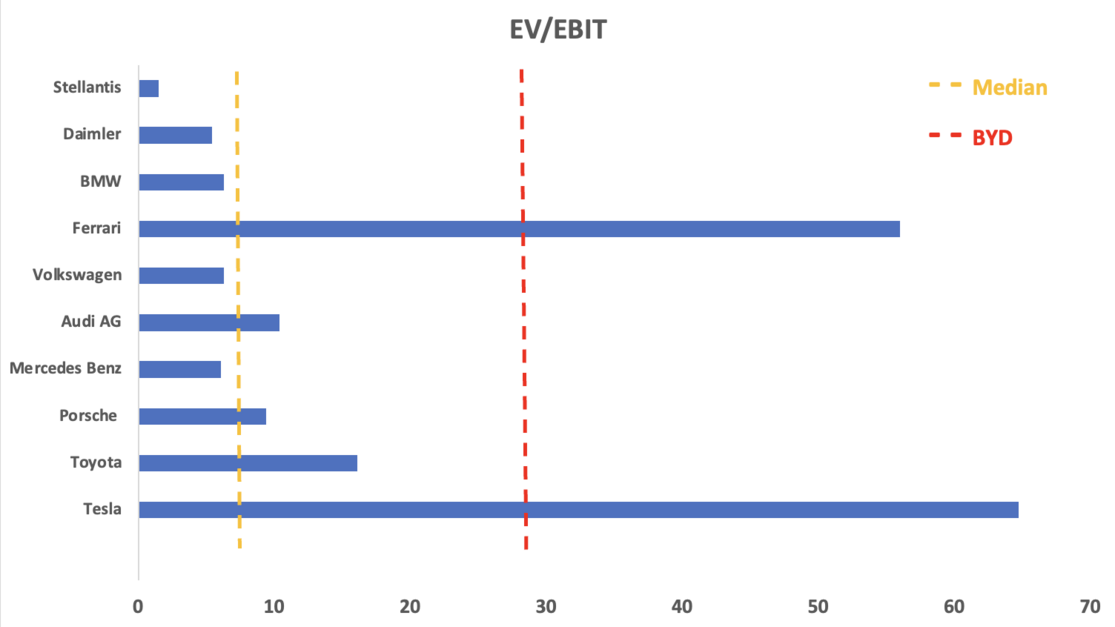

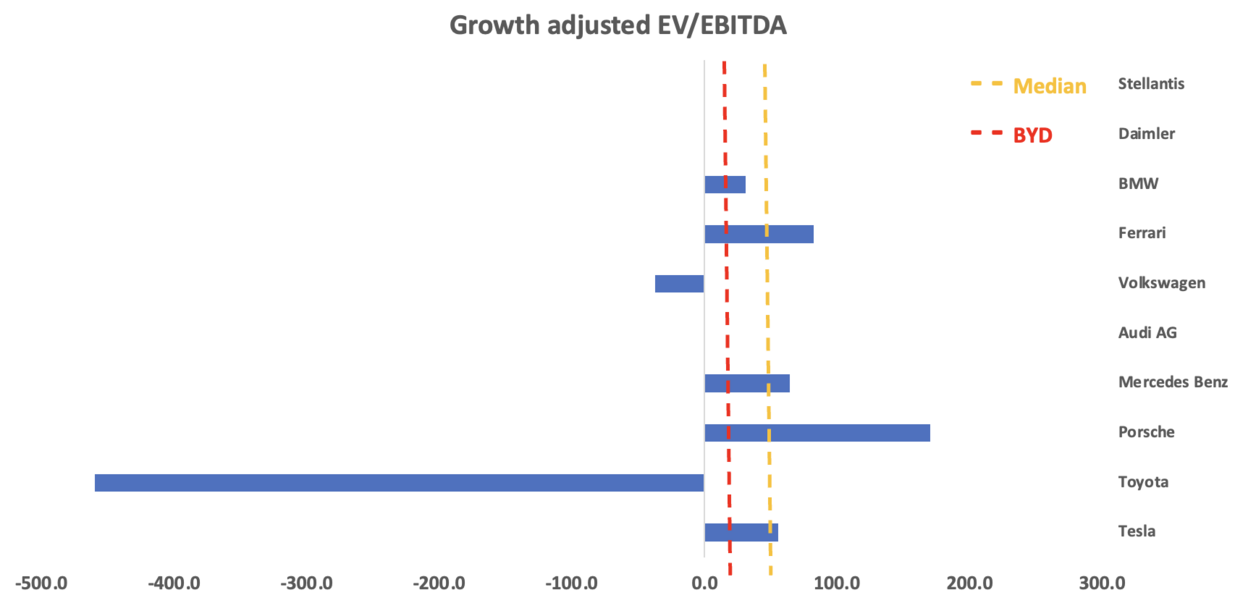

The valuation multiples are expressed in the bar charts with the industry median and the value of the respective multiple for BYD, highlighted using a dotted line.

EV/EBIT

EV/EBIT – The ratio evaluates the enterprise value of the company (considering all debts and liabilities) with respect to the operating earnings of the company. The average EV/EBITDA ratio in the industry is 7.9 while the EV/EBITDA ratio of BYD is 29.5. A high EV/EBITDA ratio implies an overvaluation. [26]

P/S

P/S – Price to Sales ratio evaluates how much an investor values each dollar of sale generated by the company. The average P/S ratio in the industry is 0.7 while the P/S ratio of BYD is 1.6. A high P/S ratio suggests that the investors are willing to pay a higher price per dollar of sale generated implying an overvaluation. [27]

EV/EBITDA

EV/EBITDA – The ratio evaluates the enterprise value of the company (considering all debts and liabilities) with respect to the operating performance of the company. The average EV/EBITDA ratio in the industry is 5.7 while the EV/EBITDA ratio of BYD is 29.5. A high EV/EBITDA ratio suggests an overvaluation. [28]

P/E

P/E – Price to Earnings ratio shows how much an investor is willing to pay per dollar of earnings generated. It portrays an investor’s expectation of the future earnings of the company. The average P/E ratio in the industry is 8.9 while the P/S ratio of BYD is 38.0. A high P/E ratio suggests that the investors are willing to pay a higher price per dollar of EPS generated implying an overvaluation. [29]

PEG

PEG is the ratio of P/E to the growth rate of earnings. A PEG ratio greater than 1 indicates that the stock is overvalued while a PEG ratio smaller than 1 indicates the stock is undervalued. As a result of high earnings forecasts for BYD, the PEG ratio for BYD (21.8) is noticeably lower than the industry median (58.2). [30]

Growth Adjusted EV/EBITDA

The growth adjusted EV/EBITDA is the ratio of EV/EBITDA to the growth in EBITDA. The growth adjusted EV/EBITDA for BYD (8.7) is noticeably smaller than the industry median (43.1).

ESG Factors edit edit source

Environmental Factors: edit edit source

Carbon Footprint and Climate Change: BYD has committed to being carbon neutral by increasing resources spent on carbon-neutral development and hopes to achieve carbon neutrality in its entire value chain[31]. The company is investing in renewable energy projects, manufacturing energy-efficient vehicles, and developing new battery technologies. BYD continues to be one of the few automakers in China consistently meeting the yearly fuel consumption targets set by the government.[32]

Waste Reduction and Recycling: BYD is working towards reducing waste and increasing recycling rates. It has introduced initiatives like the BYD Zero Waste program, which aims to achieve zero waste in its manufacturing facilities, and the BYD Battery Recycling program, which recycles used batteries from its electric vehicles.

Sustainable Supply Chain: BYD aims to promote sustainability throughout its supply chain by encouraging suppliers to adopt environmentally responsible practices. The company focuses on responsible sourcing, reducing packaging waste, and optimizing transportation to minimize environmental impact.

Social Factors: edit edit source

Workforce Development: BYD is committed to creating a diverse, inclusive, and safe work environment for its employees. The company invests in workforce development programs, training initiatives, and career advancement opportunities.

Labour Practices: BYD has been praised for its labor practices, which are considered to be some of the best in the industry. The company provides its employees with competitive wages, benefits, and opportunities for advancement.

Community Engagement: BYD supports local communities through various initiatives, including philanthropy, job creation, and infrastructure development. The company also engages in disaster relief efforts and supports educational programs in underserved communities. In 2020, BYD spent 21.0 Million RMB on charity expenses.[33]

Governance Factors: edit edit source

Board Structure and Independence: BYD's board is composed of directors with diverse backgrounds and expertise. The company emphasizes the importance of independent directors and maintains a strong governance structure.

Transparency and Reporting: BYD publishes an annual sustainability report that provides detailed information on its ESG initiatives, progress, and challenges. The company strives to maintain transparency in its reporting and regularly engages with stakeholders. In 2020, the Group provided 651 class hours of anti-corruption and self-discipline training sessions.[34]

Data Privacy and Security: BYD is committed to protecting customer data and complying with relevant regulations. The company has a robust data privacy and security program in place.

BYD has made significant strides in addressing environmental, social, and governance challenges. The company has a strong commitment to reducing its carbon footprint, promoting workforce development, engaging with communities, and maintaining strong governance practices. However, there are still areas where BYD can improve, such as increasing its disclosure of ESG data and strengthening its data privacy and security practices. By continuing to prioritize ESG factors and implementing sustainable practices, BYD can further strengthen its position as a responsible corporate citizen and contribute to a more sustainable and inclusive future.

Appendix edit edit source

Income Statement [35] edit edit source

| Fiscal year is February-January. All values HKD Millions. | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Sales/Revenue | 479772 | 256840 | 173547 | 143075 | 151502 |

| Sales Growth | 0.868 | 0.4799 | 0.213 | -0.0556 | - |

| Cost of Goods Sold (COGS) incl. D&A | 412993 | 229396 | 144385 | 123464 | 130622 |

| COGS excluding D&A | - | 212393 | 130318 | 112307 | 119457 |

| Depreciation & Amortization Expense | - | 17004 | 14067 | 11158 | 11165 |

| Depreciation | - | 13442 | 10579 | 9435 | 8991 |

| Amortization of Intangibles | - | 3529 | 3453 | 1675 | 2143 |

| Amortization of Deferred Charges | - | 33 | 35 | 48 | 31 |

| COGS Growth | 0.8003 | 0.5888 | 0.1694 | -0.0548 | - |

| Gross Income | 66779 | 27443 | 29162 | 19611 | 20880 |

| Gross Income Growth | 1.4333 | -0.0589 | 0.487 | -0.0608 | - |

| Gross Profit Margin | 0.1392 | - | - | - | - |

| SG&A Expense | 48282 | 21518 | 16564 | 13551 | 13147 |

| Research & Development | - | 8905 | 7597 | 5626 | 5243 |

| Other SG&A | - | 12613 | 8967 | 7925 | 7904 |

| SGA Growth | 1.2438 | 0.2991 | 0.2224 | 0.0307 | - |

| Other Operating Expense | -3938 | 853 | 1474 | 962 | 1617 |

| EBIT | 22435 | 5073 | 11123 | 5099 | - |

| Unusual Expense | 290 | 43 | 446 | -44 | 522 |

| Non Operating Income/Expense | - | 1778 | 440 | 334 | 3735 |

| Non-Operating Interest Income | - | 945 | 390 | 414 | 255 |

| Interest Expense | 1661 | 2272 | 3564 | 4555 | 4123 |

| Interest Expense Growth | -0.2692 | -0.3624 | -0.2176 | 0.105 | - |

| Gross Interest Expense | - | 2282 | 3623 | 4766 | 4398 |

| Interest Capitalized | - | 9 | 59 | 210 | 276 |

| Pretax Income | 25311 | 5620 | 7944 | 3236 | 5461 |

| Pretax Income Growth | 3.5035 | -0.2925 | 1.4548 | -0.4074 | - |

| Pretax Margin | 0.0528 | - | - | - | - |

| Income Tax | 3915 | 664 | 976 | 354 | 982 |

| Income Tax - Current Domestic | - | 666 | 864 | 528 | 849 |

| Income Tax - Deferred Domestic | - | -2 | 112 | -174 | 133 |

| Equity in Affiliates | -798 | -175 | -210 | -479 | -266 |

| Consolidated Net Income | 20598 | 4781 | 6758 | 2403 | 4212 |

| Minority Interest Expense | 1268 | 1111 | 2000 | 572 | 919 |

| Net Income | 19330 | 3670 | 4758 | 1831 | 3293 |

| Net Income Growth | 4.2669 | -0.2287 | 1.5991 | -0.4441 | - |

| Net Margin | 0.0403 | - | - | - | - |

| Net Income After Extraordinaries | 19330 | 3670 | 4758 | 1831 | 3293 |

| Net Income Available to Common | 19330 | 3670 | 4758 | 1831 | 3293 |

| EPS (Basic) | - | 1.28 | 1.74 | 0.67 | 1.21 |

| EPS (Basic) Growth | 0 | -0.2675 | 1.5993 | -0.4441 | - |

| Basic Shares Outstanding | 2911 | 2873 | 2728 | 2728 | 2728 |

| EPS (Diluted) | - | 1.28 | 1.74 | 0.67 | 1.21 |

| EPS (Diluted) Growth | 0 | -0.2675 | 1.5991 | -0.4441 | - |

| Diluted Shares Outstanding | 2911 | 2873 | 2728 | 2728 | 2728 |

| EBITDA | 46123 | 22076 | 25190 | 16257 | 17281 |

| EBITDA Growth | 1.0893 | -0.1236 | 0.5496 | -0.0593 | - |

| EBIT | 22435 | 5073 | 11123 | 5099 | - |

Balance Sheet [36] edit edit source

| Fiscal year is February-January. All values HKD Millions. | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Assets | |||||

| Cash & Short Term Investments | 80948 | 68702 | 17957 | 14189 | 14885 |

| Cash Only | 57789 | 61722 | 17127 | 14150 | 14884 |

| Cash & Short Term Investments Growth | 0.1782 | 2.826 | 0.2656 | -0.0467 | - |

| Cash & ST Investments / Total Assets | 0.1453 | 0.1893 | 0.0751 | 0.0647 | 0.0668 |

| Total Accounts Receivable | 89254 | 74331 | 71955 | 72684 | 81541 |

| Accounts Receivables, Net | - | 65430 | 65714 | 64800 | 72249 |

| Accounts Receivables, Gross | - | 68509 | 68561 | 66856 | 73890 |

| Bad Debt/Doubtful Accounts | - | -3079 | -2847 | -2056 | -1640 |

| Other Receivables | - | 8901 | 6241 | 7884 | 9292 |

| Accounts Receivable Growth | 0.2008 | 0.033 | -0.01 | -0.1086 | - |

| Accounts Receivable Turnover | 5.38 | 3.46 | 2.41 | 1.97 | 1.86 |

| Inventories | 88817 | 53034 | 37225 | 28604 | 30026 |

| Finished Goods | - | 21757 | 19663 | 11269 | 9651 |

| Work in Progress | - | 17566 | 11753 | 12285 | 13396 |

| Raw Materials | - | 13711 | 5809 | 5050 | 6979 |

| Other Current Assets | 11342 | 7129 | 5187 | 4175 | 4888 |

| Prepaid Expenses | - | 2491 | 859 | 406 | 367 |

| Miscellaneous Current Assets | - | 4638 | 4328 | 3769 | 4520 |

| Total Current Assets | 270360 | 203197 | 132324 | 119652 | 131339 |

| Net Property, Plant & Equipment | 222385 | 115830 | 73085 | 68065 | 61543 |

| Property, Plant & Equipment - Gross | - | 178510 | 127766 | 112987 | 100183 |

| Buildings | - | 30392 | 26808 | 23689 | 22228 |

| Machinery & Equipment | - | 87349 | 76576 | 64112 | 56438 |

| Construction in Progress | - | 39015 | 7246 | 11941 | 11043 |

| Transportation Equipment | - | 2463 | 2202 | 1891 | 1574 |

| Other Property, Plant & Equipment | - | 17366 | 13812 | 10537 | 8208 |

| Accumulated Depreciation | - | 62680 | 54680 | 44922 | 38640 |

| Buildings | - | 6170 | 5314 | 4280 | 3675 |

| Machinery & Equipment | - | 46315 | 41302 | 34540 | 30061 |

| Transportation Equipment | - | 1246 | 1062 | 775 | 586 |

| Other Property, Plant & Equipment | - | 8950 | 7002 | 5327 | 4318 |

| Total Investments and Advances | 24853 | 13628 | 8613 | 6853 | 6107 |

| LT Investment - Affiliate Companies | 17386 | 9670 | 6480 | 4542 | 4061 |

| Other Long-Term Investments | - | 3958 | 2133 | 2311 | 2046 |

| Long-Term Note Receivable | 1655 | 1528 | 2220 | 1461 | 2525 |

| Intangible Assets | 28038 | 24191 | 19866 | 20654 | 19117 |

| Net Goodwill | - | 81 | 78 | 74 | 75 |

| Net Other Intangibles | - | 24111 | 19788 | 20580 | 19042 |

| Other Assets | 3047 | 1104 | 129 | 464 | 315 |

| Deferred Charges | - | 95 | 80 | 156 | 234 |

| Tangible Other Assets | - | 1010 | 49 | 308 | 81 |

| Total Assets | 557196 | 362922 | 239130 | 219439 | 222896 |

| Assets - Total - Growth | 0.5353 | 0.5177 | 0.0897 | -0.0155 | - |

| Liabilities & Shareholders' Equity | |||||

| ST Debt & Current Portion LT Debt | 16781 | 37333 | 43559 | 75757 | 82235 |

| Short Term Debt | - | 21451 | 30028 | 65973 | 73469 |

| Current Portion of Long Term Debt | - | 15882 | 13531 | 9785 | 8766 |

| Accounts Payable | 157675 | 89494 | 50962 | 25191 | 28671 |

| Accounts Payable Growth | 0.7618 | 0.7561 | 1.023 | -0.1214 | - |

| Income Tax Payable | 2354 | 1055 | 669 | 290 | 260 |

| Other Current Liabilities | 197450 | 81668 | 30998 | 19602 | 21997 |

| Dividends Payable | - | - | 12 | 11 | 11 |

| Accrued Payroll | - | 7149 | 5716 | 4230 | 4396 |

| Miscellaneous Current Liabilities | - | 74519 | 25270 | 15360 | 17589 |

| Total Current Liabilities | 374259 | 209550 | 126189 | 120841 | 133163 |

| Current Ratio | 0.72 | 0.97 | 1.05 | 0.99 | 0.99 |

| Quick Ratio | 0.49 | 0.72 | 0.75 | 0.75 | 0.76 |

| Cash Ratio | 0.22 | 0.33 | 0.14 | 0.12 | 0.11 |

| Long-Term Debt | 14922 | 18505 | 33597 | 30045 | 20737 |

| Long-Term Debt excl. Capitalized Leases | - | 16773 | 32597 | 29431 | 20321 |

| Non-Convertible Debt | - | 16773 | 32597 | 29431 | 20321 |

| Provision for Risks & Charges | 7123 | 17 | - | - | - |

| Deferred Taxes | -1873 | -1595 | -1631 | -1580 | -1508 |

| Deferred Taxes - Credit | 4985 | 1850 | 1262 | 711 | 442 |

| Deferred Taxes - Debit | 6858 | 3445 | 2893 | 2290 | 1950 |

| Other Liabilities | 19618 | - | 271 | 236 | 1591 |

| Other Liabilities (excl. Deferred Income) | - | - | 271 | 236 | 1591 |

| Total Liabilities | 420907 | 229922 | 161318 | 151833 | 155934 |

| Non-Equity Reserves | - | 5481 | 2690 | 2497 | 2192 |

| Total Liabilities / Total Assets | 0.7554 | 0.6335 | 0.6746 | 0.6919 | 0.6996 |

| Common Equity (Total) | 124657 | 116295 | 66135 | 58578 | 58503 |

| Common Stock Par/Carry Value | - | 3561 | 3235 | 3052 | 3111 |

| Additional Paid-In Capital/Capital Surplus | - | 73774 | 28764 | 27138 | 27666 |

| Retained Earnings | 45969 | 32363 | 28997 | 23553 | 23375 |

| Cumulative Translation Adjustment/Unrealized For. Exch. Gain | - | -374 | -287 | -205 | -225 |

| Unrealized Gain/Loss Marketable Securities | - | 261 | -292 | 216 | -51 |

| Other Appropriated Reserves | - | 6711 | 5718 | 4825 | 4627 |

| Common Equity / Total Assets | 0.2237 | 0.3204 | 0.2766 | 0.2669 | 0.2625 |

| Total Shareholders' Equity | 124657 | 116295 | 66135 | 58578 | 58503 |

| Total Shareholders' Equity / Total Assets | 0.2237 | 0.3204 | 0.2766 | 0.2669 | 0.2625 |

| Accumulated Minority Interest | 11632 | 11223 | 8987 | 6532 | 6267 |

| Total Equity | 136289 | 127518 | 75121 | 65110 | 64770 |

| Liabilities & Shareholders' Equity | 557196 | 362922 | 239130 | 219439 | 222896 |

Cash Flow Statement [37] edit edit source

| Fiscal year is February-January. All values HKD Millions. | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Operating Activities | |||||

| Net Income before Extraordinaries | 20598 | 4781 | 6758 | 2403 | 4212 |

| Net Income Growth | 3.308 | -0.2925 | 1.8127 | -0.4296 | - |

| Depreciation, Depletion & Amortization | 23688 | 17004 | 14067 | 11158 | 11165 |

| Depreciation and Depletion | - | 13442 | 10579 | 9435 | 8991 |

| Amortization of Intangible Assets | - | 3562 | 3488 | 1723 | 2174 |

| Deferred Taxes & Investment Tax Credit | -661 | -2 | 41 | -102 | 133 |

| Deferred Taxes | - | -2 | 41 | -102 | 133 |

| Other Funds | 5397 | 4012 | 6073 | 4910 | 4869 |

| Funds from Operations | 49021 | 25795 | 26939 | 18368 | 20379 |

| Changes in Working Capital | 114906 | 53277 | 24093 | -1849 | -5741 |

| Receivables | - | 1666 | 1741 | 9149 | -5195 |

| Inventories | - | -15539 | -7531 | 322 | -7800 |

| Accounts Payable | - | 67004 | 29795 | -11320 | 7253 |

| Other Assets/Liabilities | - | 146 | 88 | - | - |

| Net Operating Cash Flow | 163927 | 79073 | 51032 | 16519 | 14638 |

| Net Operating Cash Flow Growth | 1.0731 | 0.5495 | 2.0893 | 0.1285 | - |

| Net Operating Cash Flow / Sales | 0.3417 | 0.3079 | 0.2941 | 0.1155 | 0.0966 |

| Investing Activities | |||||

| Capital Expenditures | -113330 | -45007 | -13230 | -23389 | -21133 |

| Capital Expenditures (Fixed Assets) | - | -45007 | -13230 | -23389 | -21133 |

| Capital Expenditures Growth | -1.5181 | -2.4018 | 0.4343 | -0.1067 | - |

| Capital Expenditures / Sales | -0.2362 | -0.1752 | -0.0762 | -0.1635 | -0.1395 |

| Net Assets from Acquisitions | - | - | - | - | -32 |

| Sale of Fixed Assets & Businesses | 312 | 1264 | 401 | 462 | 5207 |

| Purchase/Sale of Investments | -12168 | -10964 | -3677 | -828 | -941 |

| Purchase of Investments | - | -21208 | -24147 | -3011 | -2962 |

| Sale/Maturity of Investments | - | 10244 | 20470 | 2183 | 2021 |

| Other Uses | -30092 | -3839 | - | - | -44 |

| Other Sources | 14889 | 3579 | - | - | - |

| Net Investing Cash Flow | -140389 | -54967 | -16507 | -23755 | -16944 |

| Net Investing Cash Flow Growth | -1.5541 | -2.33 | 0.3051 | -0.402 | - |

| Net Investing Cash Flow / Sales | -0.2926 | -0.214 | -0.0951 | -0.166 | -0.1118 |

| Financing Activities | |||||

| Cash Dividends Paid - Total | -355 | -510 | -184 | -631 | -456 |

| Common Dividends | - | -510 | -184 | -631 | -456 |

| Change in Capital Stock | - | -169 | - | - | - |

| Sale of Common & Preferred Stock | - | -169 | - | - | - |

| Proceeds from Stock Options | - | -169 | - | - | - |

| Issuance/Reduction of Debt, Net | -19086 | -20496 | -27524 | 11733 | 11227 |

| Change in Long-Term Debt | - | - | 2243 | 22643 | 16666 |

| Issuance of Long-Term Debt | - | - | 2243 | 22643 | 16666 |

| Other Funds | -3220 | 40935 | -4352 | -3143 | -5850 |

| Other Uses | - | -4036 | -7498 | -4072 | -5863 |

| Other Sources | - | 44971 | 3146 | 929 | 13 |

| Net Financing Cash Flow | -22663 | 19433 | -32233 | 7769 | 4921 |

| Net Financing Cash Flow Growth | -2.1662 | 1.6029 | -5.1487 | 0.5787 | - |

| Net Financing Cash Flow / Sales | -0.0472 | 0.0757 | -0.1857 | 0.0543 | 0.0325 |

| Exchange Rate Effect | 709 | -53 | 26 | 60 | 8 |

| Net Change in Cash | 1585 | 43486 | 2320 | 593 | 2624 |

| Free Cash Flow | 50597 | 34066 | 37802 | -6871 | -6495 |

| Free Cash Flow Growth | 0.4853 | -0.0988 | 6.502 | -0.0578 | - |

| Free Cash Flow Yield | 0.0896 | - | - | - | - |

References edit edit source

- ↑

- ↑

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 3.6 3.7

- ↑ 4.0 4.1

- ↑ "Berkshire Hathaway sells $58.9 million worth of shares in China's BYD".

- ↑ "Berkshire Hathaway sells $58.9 MLN worth of shares in China's BYD". Reuters. 8 May 2023.

- ↑

- ↑ 8.0 8.1

- ↑ "Samsung sells $1.3 bn stake in China's BYD, keeps watchers puzzled".

- ↑

- ↑ Company Website

- ↑ [1]

- ↑ [2]

- ↑ BYD eyes overtaking Tesla this year as world's top EV maker - Nikkei Asia

- ↑ BYD to help light up Las Vegas with massive storage system (electrek.co)

- ↑ BYD supplies, world's largest single-phase energy storage plant commissioned in the U.S. - TechGoing

- ↑ 17.0 17.1 https://stockanalysis.com/stocks/byddf/forecast/

- ↑ https://www.investopedia.com/terms/d/debt_edbitda.asp#:~:text=Debt%2FEBITDA%E2%80%94earnings%20before%20interest,pay%20off%20its%20incurred%20debt.

- ↑ https://www.investopedia.com/terms/c/cash-flowtodebt-ratio.asp

- ↑ https://www.investopedia.com/terms/r/returnonequity.asp

- ↑ 21.0 21.1 21.2 21.3 21.4 21.5 https://valueinvesting.io/BYD/valuation/wacc

- ↑ https://www.bydglobal.com/sitesresources/common/tools/generic/web/viewer.html?file=%2Fsites%2FSatellite%2FBYD%20PDF%20Viewer%3Fblobcol%3Durldata%26blobheader%3Dapplication%252Fpdf%26blobkey%3Did%26blobtable%3DMungoBlobs%26blobwhere%3D1600575229843%26ssbinary%3Dtrue

- ↑ https://finance.yahoo.com/quote/1211.HK/key-statistics/

- ↑ https://www.xe.com/currencyconverter/convert/?Amount=1&From=HKD&To=USD

- ↑ https://www.alphaspread.com/security/hkex/1211/relative-valuation

- ↑ https://www.investopedia.com/terms/e/ebit-ev-multiple.asp

- ↑ https://www.investopedia.com/terms/p/price-to-salesratio.asp

- ↑ https://www.investopedia.com/terms/e/ev-ebitda.asp

- ↑ https://www.investopedia.com/terms/p/price-earningsratio.asp

- ↑ https://www.investopedia.com/terms/p/pegratio.asp

- ↑ BYD Sets Net-Zero Target and Takes Steps to Reduce Emissions (just-auto.com)

- ↑ Despite Beijing’s net zero pledge and BYD’s success, China’s big carmakers delay decarbonization - Greenpeace East Asia

- ↑ 2020 CSR Report

- ↑ 2020 CSR Report

- ↑ https://www.wsj.com/market-data/quotes/BYDDF/financials/annual/income-statement

- ↑ https://www.wsj.com/market-data/quotes/BYDDF/financials/annual/balance-sheet

- ↑ https://www.wsj.com/market-data/quotes/BYDDF/financials/annual/cash-flow