Boxabl

Housing meets mass production | Low-cost apartments that unfold in 1 hour

Summary edit edit source

There may be other available opportunities that are similar to this investment but have different attributes, characteristics, cost factors, and fees.

- Lowering the cost of home ownership through mass-produced dwelling units

- $55M+ previously crowdfunded

- 170,000 ft mass production factory is now online!

- Received 4,000+ paid deposits; 40+ patent filings

- Two purchase orders to deliver 156 homes to the federal government

- Over 90,000 people have "reserved" a Casita. Billions in potential revenue.

- Currently shipping houses!

Opportunity edit edit source

Factory promised, factory delivered

In 2020, we started raising money from investors to build a new type of house factory. We did just that; and now we are shipping houses.

We have proven our ability to execute. Now we want to take things to the next level.

Most car factories can build one car per minute. Isn’t it time we do that for houses?

Our tech will make that possible. Boxabl is now planning to take our housing revolution to the next level.

We are now seeking to raise $1.07B to build the world's largest and most advanced housing factory to make upscale housing affordable for everyone.

($500M Reg D equity, $500M debt, $70M Reg A+)

Concept edit edit source

A new way to build housing that's better, faster, and lower cost edit edit source

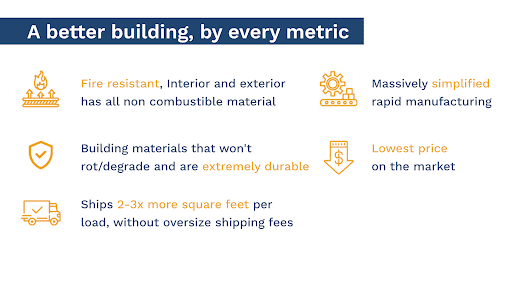

Our first innovation was solving the shipping problem. If you can't ship a product easily and affordably then it doesn't make sense to build it in a factory. This is one reason why modular construction has failed to gain market share and why most buildings are still built one at a time, by hand, in the field. Boxabl buildings fold up to ship highway legal, enabling massive scaling of factory built housing.

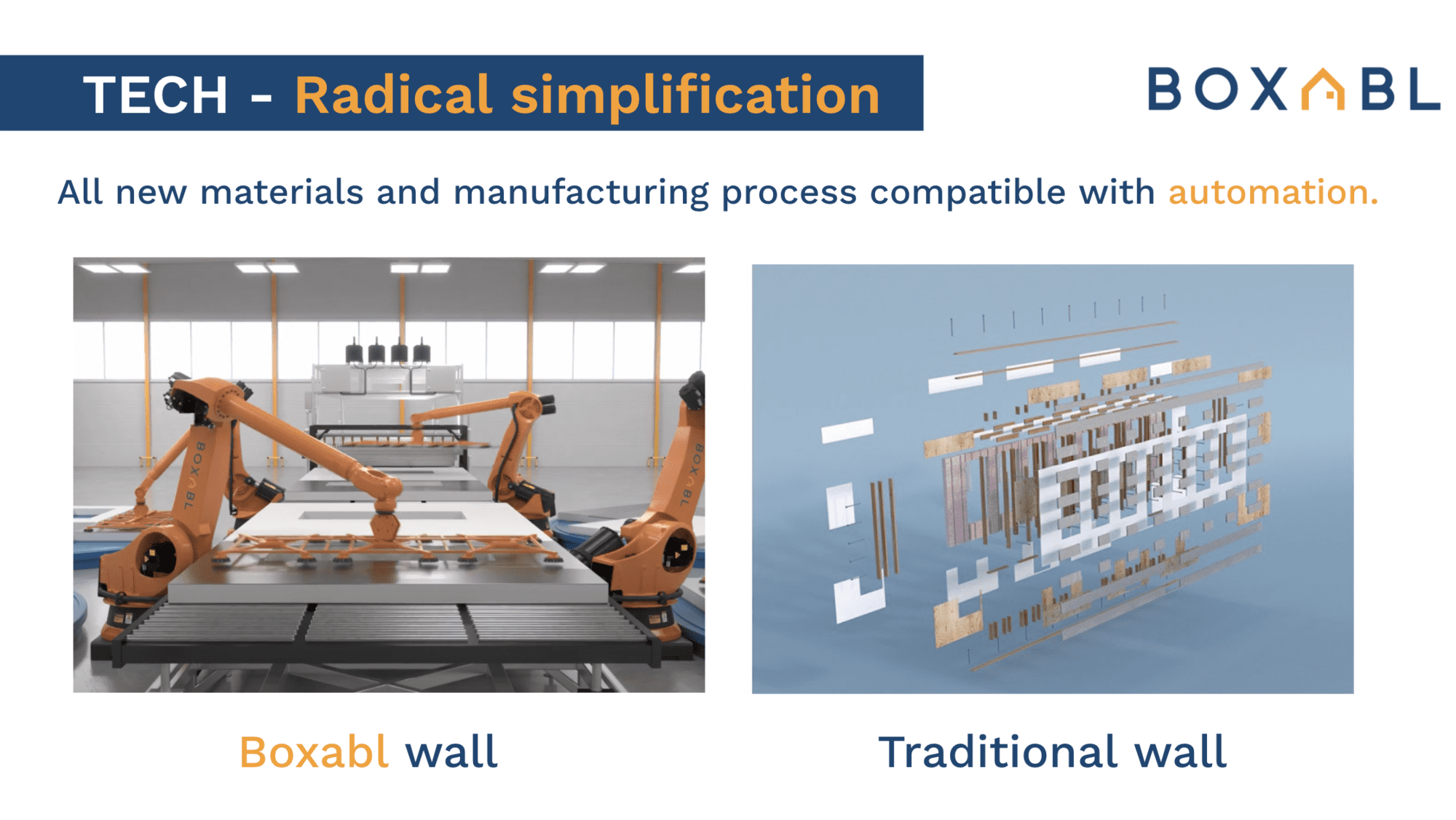

We re-engineered the rooms. We picked all new building materials and manufacturing equipment that will enable us to mass produce housing by following best-in-class automobile methods.

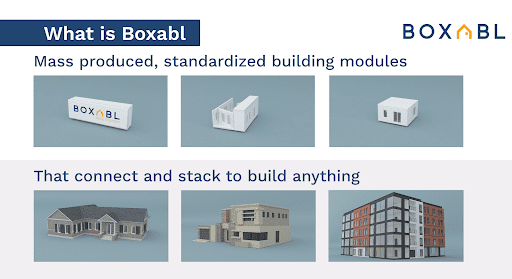

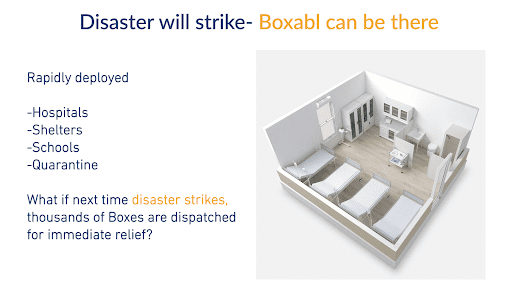

Boxabl's different sized room modules can stack and connect to build almost any building, almost anywhere on the planet. We think our product is a solution for a large portion of the worldwide housing market. This includes, multi family, single family residential, disaster relief, military, workforce housing, and much more.

Product edit edit source

A better building by every metric edit edit source

Boxabl's first and flagship product, the Casita, is a mass produced, 20' x 20' pre-fab studio apartment that unfolds from a shipping container size. We can install it in any customer's backyard in less than a day. The product is fully finished in the factory and includes washer, dryer, fridge, stove, bathroom, kitchen, electric, HVAC, and more. It is turnkey and ready to go, just add your bed and couch.

The Boxabl Casita should be more durable, energy efficient, higher quality and more upscale than traditional buildings. All our testing indicated these are stronger, safer, and more sustainable buildings.

Traction edit edit source

Our first customer is the US federal government edit edit source

After our video showcasing our Casita product went viral on Twitter, we received over 4,000 paid deposits from customers and 90,000 no-deposit Casita reservations.

We also have 2 purchase orders from the federal government totaling over $9M.

Since our inception we have filed 40+ patents, creating a strong and defensible IP.

Customers edit edit source

We will provide anyone, anywhere with quick and affordable housing solutions edit edit source

Our products were built to solve the housing crisis in the US. However, they also have many use cases including disaster relief, military, multi-family, residential, hospital units, and more. Our customizable building blocks mean that we also appeal to developers looking for affordable ways to build multi-family apartments in a fast and affordable way.

Business model edit edit source

Creating housing at a price that can’t be ignored edit edit source

Creating housing at a price that can’t be ignored. Nothing left from old building methods. All new: materials, engineering, equipment, scale, automation, shipping and SOLUTIONS.

Market edit edit source

We think we can build any building type, anywhere on the planet

But we are starting with a 20x20 studio apartment

We think we can build any building type, anywhere on the planet. But we are starting with a 20x20 studio apartment. Popularity and demand for backyard accessory dwelling units (ADU) is skyrocketing in California and other places. Recent changes in zoning laws have made the permitting process easier and faster, allowing these buildings to be built in more places.

Beyond the ADU market, is general building construction. The planned Boxabl building system should be able to construct almost any building type almost anywhere on the planet. This means in the future our potential total attainable market size is very large. Today, most buildings are built by hand, one at a time, in the field. We hope that our building system can change this and bring building construction into the factory.

Vision and strategy edit edit source

Our vision edit edit source

To solve the world's housing crisis by rapidly producing buildings on a massive scale

Our vision is to solve the world's housing crisis by rapidly producing buildings on a massive scale. Creating housing is slow and expensive. Boxabl has the technology to rapidly produce housing at a speed and cost that can change the world. We are starting BIG with a massive, 4-acre factory that is on track to produce thousands of housing units.

If most car factories can build one car per minute, why does it take a single family home 7 months to be built?

Founders edit edit source

"I can't think of a larger market to disrupt or a product with a bigger potential upside. We can change housing on a scale the world has never seen. "

-Galiano Tiramani, Boxabl Founder.

"We want to rebuild the entire world with Boxabl. We think the system can produce any building type anywhere on the planet."

-Paolo Tiramani, Boxabl Founder

Boxabl Team edit edit source

Paolo Tiramani

Founder & CEO

An industrial designer and mechanical engineer Paolo holds over 150 patent filings which have generated more than $1billion in retail sales in a variety of industries.

Kyle Denman

Lead Engineer

Kyle is the senior engineer spearheading development of the Boxabl technology. A graduate in Mechanical Engineering from Stonybrook University he holds over 20 civil engineering and automotive mechanical patents.

Galiano Tiramani

Founder

Galiano is an entrepreneur who has founded successful startups. Notably a cryptocurrency exchange and ATM network which acts as a custodian for customer funds with an annual trade volume in excess of $10m.

Risks edit edit source

The company’s auditor has prepared its audit report on the basis of the company continuing to operate as a going concern.

The company’s auditor has issued a “going concern” opinion on the company’s financial statements. The company incurred a net loss of $1,162,792 for year ended December 31, 2020, and has limited revenues, which creates substantial doubt about its ability to continue as a going concern.

You will not have significant influence on the management of the company.

The day-to-day management, as well as big picture decisions will be made exclusively by our executive officers and directors. You will have a very limited ability, if at all, to vote on issues of company management and will not have the right or power to take part in the management of the company and will not be represented on the board of directors of the company. Accordingly, no person should purchase our stock unless he or she is willing to entrust all aspects of management to our executive officers and directors.

We may not be able to effectively manage our growth, and any failure to do so may have an adverse effect on our business and operating results.

We have received substantial interest in our Casita Boxes and will strive to meet that demand. This will require significant scaling up of operations, including acquiring additional facilities space, and skilled labor. To date, we have limited experience manufacturing our products at a commercial scale. If we are unable to effectively manage our scaling up in operations, we could face unanticipated slowdowns and problems and costs that harm our ability to meet production demands.

Decreased demand in the housing industry would adversely affect our business.

Demand for new housing construction is tied to the broader economy and factors outside the company’s control. Should factors such as the COVID-19 pandemic result in continued loss of general economic activity, we could experience a slower growth in demand for our Boxes.

Our future success is dependent on the continued service of our senior management and in particular our Founder and Chief Executive Officer Paolo Tiramani.

Any loss of key members of our executive team could have a negative impact on our ability to manage and grow our business effectively. This is particularly true of our Founder and Chief Executive Officer Paolo Tiramani, who designed and patented our core intellectual property. The experience, technical skills and commercial relationships of our key personnel provide us with a competitive advantage, particularly as we are building our brand recognition and reputation.

We have a limited operating history with a history of losses and we may not achieve or maintain profitability in the future.

The company has operated at a loss since inception and historically relied on contributions from its owners to meet its growth needs. Further we have only recently begun to record revenue from the sale of Boxes, our sole intended product. We expect to make significant future investments in order to develop and expand our business, which we believe will result in additional capital expenses, marketing and general and administrative expenses that will require raising funds in this and other securities offerings to cover these additional costs until we are able to generate significant revenue.

If we cannot raise sufficient funds, we will not succeed.

We are offering shares of our Non-Voting Series A-2 Preferred Stock to raise up to $68,500,000 in this Offering, plus up to $1,000,000 of our Non-Voting Series A-1 Preferred Stock, and $500,000 of our Non- Voting Series A Preferred Stock. Even if the maximum amount is raised, we are likely to need additional funds in the future in order to continue to grow, and if we cannot raise those funds for whatever reason, including reasons relating to the company itself or to the broader economy, the company may not survive. If we raise a substantially lesser amount than our aggregate $70,000,000 goal of proceeds to the company, we will have to find other sources of funding for some of the plans outlined in “Plan of Operations”.

The company has realized significant operating losses to date and expects to incur losses in the future.

The company has operated at a loss since inception, and these losses are likely to continue. Boxabl’s net loss for 2020, as reflected in its audited financial statements, was $1,162,792, and its net loss for 2019 was $707,547. As we increased activity in 2021, our net loss for the six-month period ended June 30, 2021 increased to $2,110,815. Until the company achieves profitability, it will have to seek other sources of capital in order to continue operations.

If we do not protect our brand and reputation for quality and reliability, or if consumers associate negative impressions of our brand, our business will be adversely affected.

As a new entrant in the highly competitive home construction market, our ability to successfully grow our business is highly dependent on the reputation we establish for quality and reliability. To date, we have built a positive reputation based on our demonstration products for trade shows and conferences. As we expand operations to selling Boxes, we will need to deliver on the quality and reliability that is expected of us. If potential customers create a negative association about our brand, whether warranted or not, our business could be harmed.

We depend upon our patents and trademarks licensed from a related party. Any failure to protect those intellectual property rights, or any claims that our technology infringes upon the rights of others may adversely affect our competitive position and brand equity.

Our future success depends significantly on the intellectual property created by our founder and which is owned by a related entity, Build IP LLC. If Build IP LLC is unable to protect that intellectual property from infringement, or if it is found to infringe on others our business would be materially harmed as competitors could utilize our same building and shipping designs.

We have recently outfitted our initial manufacturing facility to begin production as the scale necessary to make the business viable.

A portion of the proceeds from this offering will be used to further outfit our initial manufacturing space in the Las Vegas area for our Boxes and to refine the manufacturing process. Our business relies on being able to produce our Boxes at scale, which can only be done once we refined our manufacturing process for specialization of functions. If we are not able to refine our processes to achieve production at scale, our financial results may be negatively impacted.

We have accepted deposits for a product we are not yet able to produce at scale.

As of the date of this offering circular, we have accepted deposits ranging for $100, $200, or $1,200 from approximately 4,000 prospective customers as of December 30, 2021. These deposits are being recorded as liabilities of the company and have not been maintained in a segregated account. As such, if the company is not able to deliver the requested product, we will be obligated to return the deposit, whether funds are available or not. If the prospective purchaser merely decides to not purchase a Box once they are available, they will forfeit their deposit.

Volatility in commodity prices and product shortages may adversely affect our gross margins.

Volatility in commodity prices and product shortages may adversely affect our gross margins. Our Boxes contain commodity-priced materials. Commodity prices and supply levels affect our costs. For example, steel is a key material in our Casita. The price of steel will vary based on the level of supply in the market, and demand from other users. Any shortages could adversely affect our ability to produce our Boxes and significantly raise our cost of their production. Further, our ability to pass on such increases in costs in a timely manner depends on market conditions, and the inability to pass along cost increases could result in lower gross margins.

We require additional capital in order to produce Casitas that have already been ordered from the company.

In December 2020, we received two purchase orders to deliver 156 Casitas, with the first Casita due on October 18, 2021, and the final one due the week of April 11, 2022. This delivery schedule has been revised by agreement between us and the purchaser to reflect delays in raw materials impacting global supply chains. In order to meet that delivery deadline we will be required to further outfit our manufacturing facility and refine our production processes. If we are unable to meet the delivery deadline, we may be required to repay amounts already paid under the purchase order, and the company’s reputation may be harmed.

We will rely on third-party builders to construct our Boxes on site as well as we intend to rely on third-party franchisees. The failure of those builders to properly construct homes and franchisee manufacturers to properly manufacture Boxes could damage our reputation, result in costly litigation and materially impact our ability to succeed.

We sell our Boxes to Boxabl trained and certified builders, who are then responsible for on-site building and assembly. Purchasers can also order directly from us, and they will need to engage their own builders. We may discover that builders are engaging in improper construction practices, negatively impacting the reliability of our Boxes. Further, we not only intend to manufacturer the Boxes at our own factories but also to rely on third-party franchisees to manufacture our Boxes. To the extent that we do, we cannot be certain that any such franchisees will act in a manner consistent with our standards and requirements and produce Boxes in accordance with our quality standards. We may discover that our franchisees do not end up operating their franchises in accordance with our standards or applicable law. The occurrence of such events by the builders or franchisees could result in liability to us, or reputational damage.

If an unknown defect was detected in our Boxes or Box designs, our business would suffer and we may not be able to stay in business.

In the ordinary course of our business, we could be subject to home warranty and construction defect claims. Defect claims may arise a significant period of time after a building with our Boxes has been completed. Although we maintain general liability insurance that we believe is adequate and may be reimbursed for losses by subcontractors that we engage to assemble our homes, an increase in the number of warranty and construction defect claims could have a material adverse effect on our results of operations. Furthermore, any design defect in our components may require us to correct the defect in all of the projects sold up until that time. Depending on the nature of the defect, we may not have the financial resources to do so and would not be able to stay in business. Even a defect that is relatively minor could be extremely costly to correct in every home and could impair our ability to operate profitably.

The housing industry is highly competitive and many of our competitors have greater financial resources than we do. Increased competition may make it difficult for us to operate and grow our business.

The housing industry is highly competitive and we compete with traditional custom builders, manufactured and modular home builders, and other innovative entrants. In addition, we compete with existing homes that are offered for sale, which can reduce the interest in new construction. Many of our competitors have significantly greater resources than we do, a greater ability to obtain financing and the ability to accept more risk than we can prudently manage. If we are unable to compete effectively in this environment, we may not be able to continue to operate our business or achieve and maintain profitability.

Government regulations may cause project delay, increase our expenses, or increase the costs to our customers which could have a negative impact on our operations.

We are subject to state modular home building codes, and projects are subject to permitting processes at the local level. If we encounter difficulties with obtaining state modular home approvals, we could experience increased costs in obtaining those approvals. Until state approvals are obtained, we would be limited in our ability to access that state market. Further, modular home codes may change over time, potentially increasing our costs, which we may not be able to pass on to customers, negatively impact our sales and profitability.

Increases in the cost of raw materials, or supply disruptions, could have a material adverse effect on our business.

Our raw materials consist of steel, foams, and plastics, which primarily are sourced from, or dependent on materials sourced domestic vendors who may source their material from overseas. The costs of these materials may increase due to increased tariffs or shipping costs or reduced supply availability of these materials more generally. Further, global or local natural disruptions, including the COVID-19 pandemic, may impact the supply chain, including limiting work in factories producing the materials into useable forms or impacts on the supply chain. Disruptions in supply could result in delays in our production line, delaying delivery of products. Further, we may not be able to pass through any increased material costs to our customers which could have a material adverse effect on our ability to achieve profitability. To the extent that we are able to pass through increased costs, it may lessen any competitive advantage that we have based on price.

The company has broad discretion in the use of proceeds in this Offering.

The company has broad discretion on how to allocate the proceeds received as a result of this Offering and may use the proceeds in ways that differ from the proposed uses discussed in this offering circular. If the company fails to spend the proceeds effectively, its business and financial condition could be harmed and there may be the need to seek additional financing sooner than expected.

Any valuation at this stage is difficult to assess.

The valuation for this offering was established by the company based on the best estimates of management, and is not based on historical financial results. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially early stage companies, is difficult to assess and you may risk overpaying for your investment.

We include projections of future plans and performance in this offering circular. Projections rely on the occurrence of stated assumptions and should not assumptions not be correct or not occur, then the stated projections may be inaccurate.

We include projected timelines in our “Plan of Operations” and include projected cost comparisons on our offering page. Those projections will only be achieved if the assumptions they are based on are correct. There are many reasons why the assumptions could be inaccurate, including customer acceptance, competition, general economic conditions and our own inability to execute our plans. Potential investors should take the assumptions in consideration when reading those projections, and consider whether they think they are reasonable.

This investment is illiquid.

There is no currently established market for reselling these securities and the company currently has no plans to list any of its shares on any over-the-counter (OTC) or similar exchange. If you decide that you want to resell these securities in the future, you may not be able to find a buyer. You should assume that you may not be able to liquidate your investment for some time, or be able to pledge these shares as collateral.

We expect to raise additional capital through equity and/or debt offerings to support our working capital requirements and operating losses.

In order to fund future growth and development, we will likely need to raise additional funds in the future through offering equity or debt that converts into equity, which would dilute the ownership percentage of investors in this offering. See “Dilution.” Furthermore, if we raise capital through debt, the holders of our debt would have priority over holders of equity, including the Series Seed Preferred Stock, and we may be required to accept terms that restrict our ability to incur more debt. We cannot assure you that the necessary funds will be available on a timely basis, on favorable terms, or at all, or that such funds if raised, would be sufficient. The level and timing of future expenditures will depend on a number of factors, many of which are outside our control. If we are not able to obtain additional capital on acceptable terms, or at all, we may be forced to curtail or abandon our growth plans, which could adversely impact our business, development, financial condition, operating results or prospects.

Investors will be immediately diluted following the conversion of outstanding convertible notes.

During 2021, we have sold convertible promissory notes to investors pursuant to Rule 506(c) of Regulation D. These notes convert at a discount into the shares of the company’s Series A-1 Preferred Stock. As a result of the conversion of these notes following the closing of any sales in this offering, the equity position of investors will be immediately diluted.

We may have offered securities in violation of the Securities Act of 1933, which could give certain purchasers of our shares the right to seek refunds.

On September 19, 2021, an article was published by the Las Vegas Review Journal featuring an interview with the company’s CEO, Paolo Tiramani. The article includes a discussion of the fundraising efforts of the company, and does not include the legends required by Rule 255(b) under Regulation A under the Securities Act of 1933. The article is included as an exhibit to the offering statement of which this offering circular forms a part. While we believe the article is not an offering of securities, it is possible that another party may consider the article to be an offer, and raise a claim that the company violated Section 5 of the Securities Act of 1933 related to sales of securities in this offering. Liability for violations of Section 5 of the Securities Act is determined under Section 12(a)(1) of the Securities Act, which provides that any person who violates Section 5 is liable to any purchaser, who may recover the consideration paid, with interest. Section 13 of the Securities Act limits the time period for recovery under such violation as one year after the violation upon which it is based, which would be September 19, 2022—one year from the publishing of the article. Section 12(a)(1) is a strict liability provision, and does not require a showing that the investor was influenced by the article. As such, up to September 19, 2022, we may be confronted with claims to rescind any investment made. This will create a degree of uncertainty regarding our financial position and any claims by investors may harm our financial position whether or not we are able to assert a successful defense to any claim.

By executing the subscription agreement in this offering, investors will join as Stockholders under our Stockholders Agreement.

The company has established a Stockholders Agreement between itself, Paolo Tiramani, Galiano Tiramani, and each new stockholder to the company. The agreement provides for among, other items, control of the directorships of the company by Paolo Tiramani and Galiano Tiramani, and restrictions on transfer of the securities in this offering. As such, this agreement places contractual restrictions on the ability of investors to exercise rights traditionally associated with equity ownership in a company. For instance, an investor would not be able to resell or otherwise dispose of their shares in the company without complying with Article III of the Stockholders Agreement, which establishes certain permitted transfers, and transfers that must be approved by the company’s Board of Directors.

The Stockholders Agreement places limitations on the transferability of our securities.

Pursuant to Article III of the Stockholders Agreement, investors will not be allowed to transfer shares acquired in this offering, except under limited circumstance following approval of the Board of Directors of the company. Investors should note that these restrictions on transferability are in addition to any restrictions provided by statute or regulation. This means that investors will not be able to dispose of their shares on their own volition without satisfying the requirements of the Stockholders Agreement.

The Stockholders Agreement ensures that the company will be controlled by Paolo Tiramani and Galiano Tiramani while the agreement is in place.

Under the Stockholders Agreement, each of Paolo Tiramani and Galiano Tiramani have the sole right to appoint one director, as well as jointly appoint a third director. No other stockholder currently has any right to appoint directors to the company’s board of directors. This means that investors will have no control over the management of the company, or policy setting role of the board of directors. Instead, investors must rely on the efforts of Paolo Tiramani and Galiano Tiramani.

Investors who are married will be required to deliver a spousal consent to the Stockholders Agreement.

The company requires that a married investor provide a spousal consent to the Stockholders Agreement. A spousal consent is important to the company because in the event of dissolution of a marriage, or death of the investor with the spouse inheriting the securities in this offering, the spouse taking possession of the shares will be bound by the terms of the Stockholders Agreement, providing certainty to the company for the enforcement of the agreement. The company requires that the spousal consent be provided to the company within 15 days of confirmation of an investment in the company. While non-receipt of a spousal consent when necessary may result in equitable remedies pursuant to the Stockholders Agreement, it is not a condition of the investment or being a stockholder of the company. This means that investors whose shares are transferred by reason of dissolution of marriage or death of the investor may be in breach of the Stockholders Agreement if no spousal consent was provided to the company.

Investors in this offering may not be entitled to a jury trial with respect to claims arising under the subscription agreement or Stockholders Agreement, which could result in less favorable outcomes to the plaintiff(s) in any action under these agreements.

Investors in this offering will be bound by the subscription agreement and Stockholders Agreement, both of which include a provision under which investors waive the right to a jury trial of any claim they may have against the company arising out of or relating to these agreements. By signing these agreements, the investor warrants that the investor has reviewed this waiver with his or her legal counsel, and knowingly and voluntarily waives the investor’s jury trial rights following consultation with the investor’s legal counsel. If we opposed a jury trial demand based on the waiver, a court would determine whether the waiver was enforceable based on the facts and circumstances of that case in accordance with the applicable state and federal law. To our knowledge, the enforceability of a contractual pre-dispute jury trial waiver in connection with claims arising under the federal securities laws has not been finally adjudicated by a federal court. However, we believe that a contractual pre-dispute jury trial waiver provision is generally enforceable, including under the laws of the State of Nevada, which governs the subscription agreement. In determining whether to enforce a contractual pre-dispute jury trial waiver provision, courts will generally consider whether the visibility of the jury trial waiver provision within the agreement is sufficiently prominent such that a party knowingly, intelligently and voluntarily waived the right to a jury trial. We believe that this is the case with respect to the subscription agreement. You should consult legal counsel regarding the jury waiver provision before entering into the subscription agreement. If you bring a claim against the company in connection with matters arising under the subscription agreement or Stockholders Agreement, including claims under federal securities laws, you may not be entitled to a jury trial with respect to those claims, which may have the effect of limiting and discouraging lawsuits against us. If a lawsuit is brought against us under one of these agreements, it may be heard only by a judge or justice of the applicable trial court, which would be conducted according to different civil procedures and may result in different outcomes than a trial by jury would have had, including results that could be less favorable to the plaintiff(s) in such an action. Nevertheless, if this jury trial waiver provision is not permitted by applicable law, an action could proceed under the terms of the subscription agreement or Stockholders Agreement with a jury trial. No condition, stipulation or provision of the subscription agreement or Stockholders Agreement serves as a waiver by any holder of our shares or by us of compliance with any substantive provision of the federal securities laws and the rules and regulations promulgated under those laws.

Our Articles of Incorporation, Stockholders Agreement, and subscription agreement each include a forum selection provision, which could result in less favorable outcomes to the plaintiff(s) in any action against our company.

Articles of Incorporation Our Articles of Incorporation includes a forum selection provision that requires any claims against us by stockholders involving, with limited exceptions: · brought in the name or right of the Corporation or on its behalf; · asserting a claim for breach of any fiduciary duty owed by any director, officer, employee or agent of the company to the company or the company’s stockholders; · arising or asserting a claim arising pursuant to any provision of Chapters 78 or 92A of the Nevada Revised Statutes or any provision of these Articles of Incorporation (including any Preferred Stock designation) or the bylaws; · to interpret, apply, enforce or determine the validity of these Articles of Incorporation (including any Preferred Stock designation) or the bylaws; or · asserting a claim governed by the internal affairs doctrine. Any of the above actions are required to be brought in the Eighth Judicial District Court of Clark County, Nevada. If the Eighth Juridical District Court of Clark County does not have jurisdiction, then the matter may be adjudicated in another state district court in the State of Nevada, or in federal court located within the State of Nevada. This forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. Note, this provision does not apply to any suits brought to enforce any liability or duty created by the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, or to any claim for which the federal courts have exclusive jurisdiction.

Stockholders Agreement

Our Stockholders Agreement includes a forum selection provision that requires any suit, action, or proceeding based in contract or tort arising from the Stockholders Agreement be brought in the Eighth Judicial District Court of Clark County, Nevada. If the Eighth Juridical District Court of Clark County does not have jurisdiction, then the matter may be adjudicated in another state district court in the State of Nevada, or in federal court located within the State of Nevada. This forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision may not be used to bring actions in state courts for suits brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

Subscription Agreement

Our subscription agreement for each manner of investing and class of security includes a forum selection provision that requires any suit, action, or proceeding arising from the subscription agreement be brought in a state of federal court of competent jurisdiction located within the State of Nevada. This forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes and may discourage lawsuits with respect to such claims. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision may not be used to bring actions in state courts for suits brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. Investors will not be deemed to have waived the company’s compliance with the federal securities laws and the rules and regulations thereunder.

Using a credit card to purchase shares may impact the return on your investment.

Investors in this offering have the option of paying for their investment with a credit card. Transaction fees charged by your credit card company (which can reach 5% of transaction value if considered a cash advance) and interest charged on unpaid card balances (which can reach almost 25% in some states) add to the effective purchase price of the shares you buy. See “Plan of Distribution and Selling Securityholders.” The cost of using a credit card may also increase if you do not make the minimum monthly card payments and incur late fees. These increased costs may reduce the return on your investment.