Citigroup Inc.

Summary edit edit source

Operations edit edit source

Citigroup Inc., a diversified financial services holding company, provides various financial products and services to consumers, corporations, governments, and institutions in North America, Latin America, Asia, Europe, the Middle East, and Africa. The company operates in two segments, Global Consumer Banking (GCB) and Institutional Clients Group (ICG). The GCB segment offers traditional banking services to retail customers through retail banking, Citi-branded cards, and Citi retail services. It also provides various banking, credit card, lending, and investment services through a network of local branches, offices, and electronic delivery systems. The ICG segment offers wholesale banking products and services, including fixed income and equity sales and trading, foreign exchange, prime brokerage, derivative, equity and fixed income research, corporate lending, investment banking and advisory, private banking, cash management, trade finance, and securities services to corporate, institutional, public sector, and high-net-worth clients. As of December 31, 2020, it operated 2,303 branches primarily in the United States, Mexico, and Asia. Citigroup Inc. was founded in 1812 and is headquartered in New York, New York.

Market edit edit source

Citigroup has a global presence

Does business in nearly 160 countries

More than 230,000 employees worldwide

77 countries with trading floors

Competition edit edit source

What makes Citi stand out?

- Comprehensive services - offer a wide range of services under one roof compared to specialised competitors

- Mitigates risks for the corporation, if one sector experiences a downturn, other sectors might remain stable or perform well

- Citi is able to cater a diverse clientele, including individual consumers, corporations and institutional investors

- Stronger customer relationships, as clients are more likely to develop stronger ties with an institution that caters to multiple aspects of their financial needs

Team edit edit source

- CEO Jane Fraser

- First woman to head a major US bank

- Studied at the University of Cambridge and Harvard

- Worked at McKinsey & Company for 10 years

- CFO Mark Mason

- One of the few black executives on Wall Street

- MBA from Harvard Business School

- COO Anand Selvakesari

- CEO of ICG Paco Ybarra

Financials edit edit source

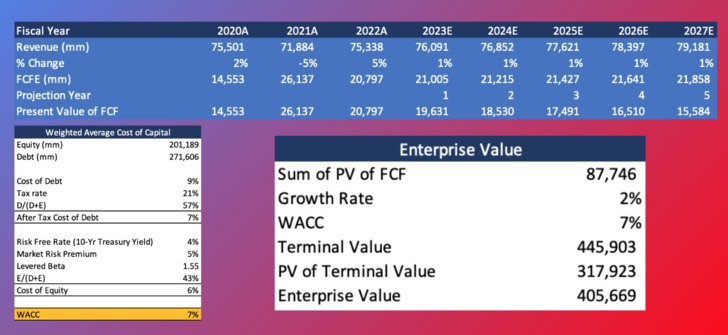

Results of the DCF.

Risks edit edit source

- Credit risk - borrowers defaulting

- Market risk - changes in market prices can affect the value of its investment portfolios

- Operational risks - failures in internal technological systems, cybersecurity breaches

- Regulatory and compliance risk - Citigroup operates in a highly regulated industry, failure to comply can result in fines, legal actions

- Reputational risk - ethical concerns, involvement in controversial activities can lead to a loss of customer trust and reduced business opportunities

- Geopolitical and Macroeconomic risk - Citigroup's global operations expose it to currency fluctuations and geopolitical tensions