Copart Inc

Company Description[1] edit edit source

| |

| Type | Public |

|---|---|

| |

| Industry | Automotive |

| Founded | Vallejo, California (1982) |

| Headquarters | 14185 Dallas Parkway, Suite 300, Dallas, Texas, U.S. |

Number of locations | 200+ |

Key people | Willis J. Johnson (Chairman) Jay Adair (CEO) John North (CFO) |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 9,500 (2021) |

| Website | |

| Footnotes / references [2] | |

Copart, Inc. or simply Copart is a global provider of online vehicle auction and remarketing services to automotive resellers such as insurance, rental car, fleet and finance companies in 11 countries.

Copart, Inc. engages in the provision of online auctions and vehicle remarketing services. The company is headquartered in Dallas, Texas and currently employs 8,600 full-time employees. ), Oman, Bahrain, and Spain. The firm operates through two segments: United States and International. The firm provides vehicle sellers with a range of services to process and sell vehicles primarily over the Internet through its virtual bidding third generation Internet auction-style sales technology (VB3). Its vehicle sellers consist primarily of insurance companies, but also include banks, finance companies, charities, fleet operators, dealers and from individuals. The company sells the vehicles to licensed vehicle dismantlers, rebuilders, repair licensees, used vehicle dealers, exporters, and in some jurisdictions, to the general public.

[3]Operations edit edit source

The Idea behind Copart Inc edit edit source

The idea for Copart Inc came about through Willis J. Johnson's entrepreneurial spirit and his exposure to various business ventures throughout his life. Johnson's father was an entrepreneur who engaged in diverse businesses such as dairy farming, restaurants, and house construction. Growing up in such an environment, Johnson developed a strong work ethic and a passion for change.

Inspired by his father's entrepreneurial pursuits and armed with a desire to create something of his own, Johnson identified an opportunity in the salvage vehicle industry. He recognized that there was a demand for a more efficient and streamlined way to handle salvage vehicles and sell them to interested buyers. Salvage vehicles are vehicles that have been damaged or declared total losses by insurance companies.

With this insight, Johnson founded Copart in 1982, starting with just one salvage yard in California. He aimed to revolutionize the salvage vehicle auction process by introducing innovative technology and online platforms. By providing a convenient and accessible platform for buyers and sellers, Copart aimed to transform the industry and offer a global remarketing platform.

Over the years, Copart continued to evolve its auction technology and expand its operations, both domestically and internationally. The company's success can be attributed to Johnson's entrepreneurial vision, his passion for the auto auction industry, and his commitment to adapting and embracing technological advancements.

Copart Inc mission statement[4] edit edit source

To create value and opportunity through vehicle auctions and exchange.

Copart Inc key partnerships [5] edit edit source

| Insurance Companies | Copart, Inc. collaborates with insurance companies to provide optimal vehicle claims solutions. This partnership enables insurers to efficiently dispose of salvaged vehicles and maximize their returns. |

| Individual Vehicle Sellers | Copart, Inc. partners with individual vehicle sellers who wish to sell their vehicles on its platform. This partnership benefits sellers by providing access to a reliable and efficient selling process, while Copart offers a large audience base for vehicle sales. |

| Auctioneers | Copart, Inc. collaborates with auctioneers who bring expertise and knowledge in the auctioning business. Through this partnership, Copart provides a seamless and efficient auctioning process, while auctioneers gain exposure to Copart's extensive network of buyers. |

| Transportation &Logistics | Copart, Inc. partners with transportation and logistics companies to handle the movement of vehicles from various locations to its facilities. This partnership ensures timely and secure delivery of vehicles while minimizing transportation costs. |

| Vehicle Manufacturers | Copart, Inc. partners with vehicle manufacturers, offering them an opportunity to dispose of excess inventory. This partnership allows manufacturers to free up space and resources while providing an environmentally sustainable solution for inventory disposal. |

How Copart Inc works[6] edit edit source

| Copart Inc Operation Overview | |

| Vehicle Acquisition | Copart acquires vehicles primarily through partnerships with insurance companies, fleet owners, financial institutions, and other sellers. These vehicles are typically classified as salvage, used, or wholesale. |

| Vehicle Listings | Once Copart receives the vehicles, they are inspected, evaluated, and assigned a category based on their condition. The vehicles are then listed on the Copart website, providing detailed information such as make, model, year, mileage, and any existing damages. |

| Online Bidding | Interested buyers can browse the listings on Copart's website and participate in online auctions. Registered buyers have access to bid on the vehicles they are interested in. Bidding can take place manually or through Copart's proprietary software that automates the bidding process. |

| Virtual Auctions | Copart conducts virtual auctions where registered buyers can place bids in real-time. The auction process includes a specific duration during which bids can be placed. The highest bidder at the end of the auction wins the vehicle. |

| Vehicle Inspection | Prior to bidding, buyers have the opportunity to inspect the vehicles either in person at designated Copart facilities or by reviewing detailed inspection reports and photos available on the website. This allows buyers to assess the condition of the vehicle before placing a bid. |

| Vehicle Transportation | After the auction ends, the winning buyer is responsible for arranging transportation to move the purchased vehicle from the Copart location to their desired destination. |

Where Copart Inc primarily generates revenue[7] edit edit source

Copart Inc generates revenue primarily through the fees it charges to buyers and sellers participating in its online vehicle auctions. While specific financial details and revenue breakdowns are not publicly available for Copart Inc, here are the key areas where the company is expected to generate the most revenue:

| Copart Inc Primary Revenue Stream | |

| Buyer Fees | Copart charges fees to buyers for participating in auctions and purchasing vehicles. These fees can include a buyer's premium, transaction fees, and other related charges. The buyer's premium is typically a percentage of the winning bid price. |

| Seller Fees | Copart also earns revenue through fees charged to sellers who list and sell vehicles through the platform. These fees may include listing fees, transaction fees, and additional services such as vehicle storage or transportation. |

| Additional Services | Copart offers various additional services to buyers and sellers, such as vehicle transportation, storage, and vehicle history reports. These services may incur additional charges, contributing to the company's revenue streams. |

| Value-Added Services | Copart may provide value-added services to buyers and sellers, including vehicle inspections, appraisals, and title services. These services can generate revenue through service fees. |

It's important to note that the exact revenue breakdown between these sources can vary based on factors such as market conditions, regional differences, and the volume and types of vehicles being auctioned. Additionally, Copart's expansion into international markets may also impact revenue distribution.

Copart Inc Management[8] edit edit source

Founder & Executive Chairman: Willis Johnson edit edit source

Willis J. Johnson is the distinguished founder of Copart, Inc., where he held the position of Chief Executive Officer from its inception in 1982 until February 2010. His leadership also extended to the role of President at Copart, Inc., a position he occupied from 1986 until May 1995.

Co-CEO & Director: Jay Adair edit edit source

Mr. A. Jayson Adair, also known as Jay, is the Co-Chief Executive Officer at Copart, Inc. since April 01, 2022. He previously held the position of Chief Executive Officer from February 2010 to April 01, 2022, and served as President from November 1996 to February 2010. His association with Copart, Inc. dates back to September 1992 when he became a Director, contributing to the company's growth and success.

Co-Chief Executive Officer: Jeff Liaw edit edit source

Mr. Jeffrey Liaw, also known as Jeff, is currently the Co-Chief Executive Officer at Copart, Inc. since April 01, 2022. He has a diverse background within the company, previously serving as President from September 03, 2019, until April 01, 2022. Mr. Liaw's roles at Copart, Inc. have included Chief Executive Officer of North America from 2021, Senior Vice President of Finance from January 04, 2016, until September 03, 2019, and Chief Financial Officer from January 4, 2016, until 2020. Prior to joining Copart in 2016, he held various positions at FleetPride, Inc. and TPG Capital, L.P., where he focused on Energy and Industrial investing practice areas. He also has significant experience as an Independent Director in several prominent companies. Mr. Liaw earned his B.A. and B.B.A. from the University of Texas in 1999 and an M.B.A. from Harvard University in 2005.

Chief Legal Officer and Corporate Secretary: Paul Kirkpatrick edit edit source

Paul Kirkpatrick is the leader of Copart's legal department, serving as General Counsel and Chief Legal Officer. He brings a wealth of experience to the role, having previously held similar positions at BayoTech, Inc., Omnitracs (including during its acquisition by Solera Global Holdings), and as a longstanding member of Commercial Metals Company, a Fortune 500 NYSE listed company. With a strong background in corporate law, commercial contracts, real estate, compliance, litigation, and government affairs, Paul plays a crucial role in guiding Copart through various legal matters. He earned his law degree from the Dedman School of Law at Southern Methodist University and holds a bachelor's degree in History from Baylor University. Paul joined Copart in 2022, contributing his expertise to the company's legal affairs.

Chief Operating Officer: Steve Powers edit edit source

Steve Powers is the Chief Operations (COO) of Copart, overseeing a team of over 5,000 employees across 200+ locations. As COO, he is responsible for optimizing processes and technology to deliver exceptional service to Copart's customers. With a tenure that dates back to 1995, Powers initially joined Copart through the acquisition of New England Recovery (NER) and has since held various leadership roles within the company. Before assuming the position of COO in 2020, he served as the VP of Operations for Copart's Eastern Division from 2010. Powers' extensive experience and dedication contribute to the efficient and customer-centric operations at Copart.

Chief Technology Officer: Rama Prasad edit edit source

Rama Prasad is the Chief Technology Officer (CTO) at the company since 2014, bringing with him over a decade of executive experience in the technology industry. Prior to his role as CTO, Prasad served as the Senior Vice President and Chief Information Officer of Gogo Inc. His extensive technology background includes positions at prominent companies like Orbitz, US Cellular, Ameritech (AT&T), and Sprint. He holds a Master of Science in Computer Science from the University of Missouri - Rolla, a bachelor's degree in engineering from Osmania University, and is a graduate of the Executive Management Program at Northwestern University. With his wealth of expertise, Prasad plays a pivotal role in driving technological innovation and advancements within the company.

Chief Financial Officer: Leah Stearns edit edit source

Leah Stearns is the Chief Financial Officer (CFO) at Copart, responsible for overseeing the finance and accounting functions to support the company's ongoing profitable growth. With a wealth of experience as a Fortune 500 executive, she previously served as CFO of CBRE, a global leader in commercial real estate services and investments, and held financial and operational leadership positions at American Tower. Leah earned her MBA from Boston College's Carroll School of Management and holds a bachelor's degree in finance from Boston University's Questrom School of Business. She joined Copart in 2022, bringing her expertise and financial acumen to contribute to the company's success.

Chief Sales Officer: Rob Vannuccini edit edit source

Rob Vannuccini is the Chief Sales Officer (CSO) at Copart, where he leads one of the automotive remarketing industry's top sales teams. With a tenure at Copart since 1994, he has held various positions within the company, including Vice President of National Accounts and Midwest Regional Account Manager. Prior to becoming CSO in 2010, he gained valuable experience and leadership skills as the Midwest Regional Manager of NER Auction Systems and the Assistant Vice President of Fleet Financial Group. Rob holds a bachelor's degree in Business Administration in Banking and Finance from Hofstra University, and his extensive expertise contributes significantly to Copart's continued success in sales and remarketing.

Ownership [9] edit edit source

Ownership breakdown edit edit source

| Owner Type | Number of Shares | Ownership Percentage |

|---|---|---|

| Institutions | 395,731,618 | 82.9% |

| Individual Insiders | 42,830,902 | 9.0% |

| General Public | 38,491,678 | 8.1% |

| Private Companies | 195,478 | 0.04% |

| State or Government | 190,160 | 0.04% |

- Institutions: This category includes large financial institutions, investment firms, and mutual funds that hold a significant portion of Copart's shares, amounting to 82.9% of the total shares. These institutional investors often manage funds on behalf of their clients, and their substantial ownership signifies strong interest and confidence in Copart's potential.

- Individual Insiders: This refers to company insiders, such as executives, directors, and employees, who hold shares in Copart. They collectively own 9.0% of the shares, indicating that employees and key personnel have a vested interest in the company's success.

- General Public: The general public, which includes individual retail investors, collectively holds 8.1% of Copart's shares. These are individual investors who buy and sell shares through brokerage accounts and are not part of any specific institutional or insider group.

- Private Companies: Private companies own a small percentage of Copart's shares, totaling 0.04%. These could be other businesses or entities that have invested in the company.

- State or Government: This category represents government entities or sovereign wealth funds that own a minor share of Copart, amounting to 0.04%. These entities may invest in companies as part of their investment strategies or as part of their sovereign wealth management.

edit edit source

| Ownership | Name | Shares | Current Value | Change % | Portfolio % |

|---|---|---|---|---|---|

| 10.14% | The Vanguard Group, Inc. | 48,430,611 | $4.3b | 0.89% | 0.08% |

| 8.07% | BlackRock, Inc. | 38,505,590 | $3.4b | 0.35% | 0.07% |

| 5.69% | Willis Johnson | 27,167,350 | $2.4b | -5.23% | N/A |

| 4.54% | Principal Global Investors, LLC | 21,670,906 | $1.9b | -1.09% | 1.15% |

| 4.19% | Capital Research and Management Company | 20,001,567 | $1.8b | -2.32% | 0.10% |

| 3.78% | AllianceBernstein L.P. | 18,054,505 | $1.6b | 3.05% | 0.57% |

| 3.37% | State Street Global Advisors, Inc. | 16,069,306 | $1.4b | -1.10% | 0.07% |

| 3.23% | A. Adair | 15,416,496 | $1.4b | -2.58% | N/A |

| 1.95% | Geode Capital Management, LLC | 9,296,080 | $829.2m | 2.17% | 0.09% |

| 1.74% | JP Morgan Asset Management | 8,286,031 | $739.1m | 5.49% | 0.11% |

| 1.54% | Heitman Real Estate Securities LLC | 7,362,576 | $656.7m | 0.00% | 2.37% |

| 1.29% | FMR LLC | 6,174,766 | $550.8m | -2.82% | 0.04% |

| 1.22% | William Blair Investment Management, LLC | 5,843,882 | $521.3m | 8.11% | 0.81% |

| 1.10% | Wellington Management Group LLP | 5,275,406 | $470.6m | 3.61% | 0.08% |

| 0.91% | Northern Trust Global Investments | 4,332,531 | $386.5m | -0.82% | 0.07% |

| 0.88% | Bessemer Investment Management LLC | 4,221,881 | $376.6m | -0.71% | 0.70% |

| 0.88% | Norges Bank Investment Management | 4,218,721 | $376.3m | 0.00% | 0.04% |

| 0.83% | Massachusetts Financial Services Company | 3,980,863 | $355.1m | 4.07% | 0.08% |

| 0.83% | BNY Mellon Asset Management | 3,939,203 | $351.4m | -2.40% | 0.07% |

| 0.78% | Brown Brothers Harriman & Co., Asset Management Arm | 3,729,925 | $332.7m | -11.87% | 2.06% |

| 0.73% | The London Company of Virginia, LLC | 3,494,739 | $311.7m | -0.81% | 1.71% |

| 0.71% | Boston Partners Global Investors, Inc. | 3,406,903 | $303.9m | -18.96% | 0.22% |

| 0.69% | Eaton Vance Management | 3,302,842 | $294.6m | 18.70% | 0.09% |

| 0.59% | Invesco Capital Management LLC | 2,821,189 | $251.7m | 8.53% | 0.16% |

| 0.58% | Managed Account Advisors LLC | 2,772,580 | $247.3m | 11.56% | 0.06% |

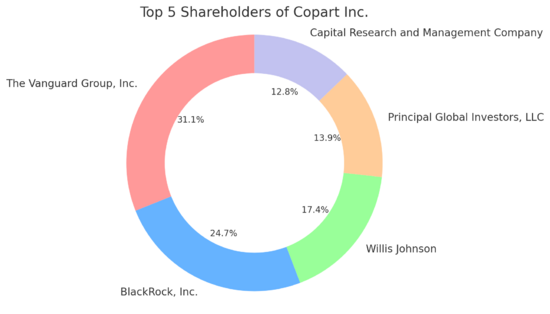

The top shareholders table provides information on the largest 25 shareholders who own significant portions of Copart, along with the number of shares they hold and their ownership percentages.

edit edit source

- The Vanguard Group, Inc.: The Vanguard Group is the largest shareholder, owning 48,430,611 shares, which accounts for 10.14% of the company. With a current value of $4.3 billion, they have a significant stake in Copart.

- BlackRock, Inc.: BlackRock holds the second-largest position with 38,505,590 shares, representing 8.07% ownership. The total value of their shares is $3.4 billion.

- Willis Johnson: Willis Johnson is a noteworthy individual shareholder with 27,167,350 shares, making up 5.69% of the company. The value of his shares is $2.4 billion.

- Principal Global Investors, LLC: This institutional investor holds 21,670,906 shares, accounting for 4.54% ownership. The value of their shares is $1.9 billion.

- Capital Research and Management Company: Capital Research and Management Company owns 20,001,567 shares, representing 4.19% of the company. The total value of their shares is $1.8 billion.

Market edit edit source

Market capitalization of Copart (CPRT)[10] edit edit source

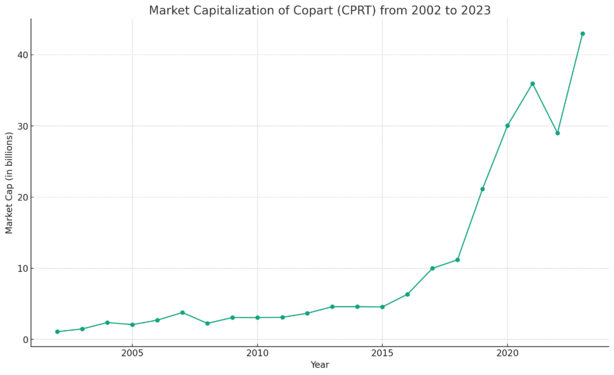

As of July 2023, Copart's market capitalization stands at $42.98 Billion, positioning the company as the 423rd most valuable company in the world based on market cap data. Market capitalization, often referred to as market cap, represents the total market value of a publicly traded company's outstanding shares and is a widely used metric to gauge a company's overall worth.

This is the line chart displaying the Market Capitalization of Copart Inc (CPRT) from 2002 to 2023. As seen from the chart, there's been significant growth, particularly in the recent years.

Key insights from the chart include:

- Increasing Trend: Overall, Copart's market cap has generally increased over the period from 2002 to 2023, suggesting a growing company value. This is a positive sign for the company and its shareholders.

- Significant Growth Periods: There are periods of significant growth, notably around 2019 to 2020 and 2022 to 2023. In 2019 to 2020, the market cap nearly doubled from around $21.13 billion to $30.04 billion. Similarly, in 2022 to 2023, the market cap rose sharply from $29 billion to $42.98 billion.

- Periods of Decline: There are also periods where the market cap declined. For instance, the market cap fell from $35.96 billion in 2021 to $29 billion in 2022. Another notable dip occurred in 2008, where the market cap fell from $3.08 billion in 2007 to $2.26 billion, likely due to the global financial crisis during that time.

- Steady Growth in Early Years: From 2002 to 2006, there was a steady growth in market cap, suggesting a period of steady growth for the company.

- Current Position: As of July 2023, Copart has a market cap of $42.98 billion. This makes Copart the world's 423rd most valuable company by market cap according to the provided data.

Market capitalization for similar companies or competitors[11] edit edit source

| Name | Symbol | Market Cap | Market Cap Difference |

|---|---|---|---|

| CarMax | KMX | $12.94 B | -69.64% |

| Rush Enterprises | RUSHA | $3.54 B | -91.77% |

| America's Car-Mart | CRMT | $0.73 B | -98.30% |

| Lithia Motors | LAD | $8.04 B | -81.31% |

| Sonic Automotive | SAH | $1.74 B | -95.96% |

| Penske Automotive | PAG | $11.38 B | -73.55% |

| OPENLANE Corporate | KAR | $1.67 B | -96.10% |

| Group 1 Automotive | GPI | $3.50 B | -91.85% |

| AutoNation | AN | $6.71 B | -84.40% |

Given these comparisons, it's clear that Copart has a significantly larger market cap than any of its listed competitors. This implies that investors value Copart's business more highly, which could be due to a number of factors such as stronger financial performance, better growth prospects, more effective business strategies, or lower risk. As such, Copart can be considered a market leader in its industry. However, it's important to note that while market cap is a useful measure of company size and market leadership, it doesn't tell the whole story, and other factors should also be considered when evaluating a company's market position and performance.

Market segmentation analysis & dynamics[12] edit edit source

| Segmentation | Details |

|---|---|

| By Type | The vehicle auction market is divided into two primary segments: Whole Car and Salvage Vehicle. The Whole Car segment held the largest share of the market in both value and volume in 2022 and is expected to be the fastest growing segment in the forecast period. This growth is attributed to factors such as the rising popularity of online car auction platforms, which offer 24/7 availability and wider geographic reach, leading to an increase in bidding instances and an overall increase in the resale value of popular car makes. |

| By Distribution Channel | The distribution channels for the whole car auction market are primarily Online and Physical. In 2022, the online whole car auction market held the largest market share, attributed to the benefits it provides to both buyers and sellers. |

| Dynamics | Details |

|---|---|

| Growth Drivers | The growth of the US vehicle auction market is projected to be supported by a number of factors. These include an increase in the average lifespan of vehicles, a rise in internet users, an increase in vehicle accidents, and an increase in revenue per auctioned car pricing. As vehicles age, they are more likely to be considered total losses by insurance companies. These older vehicles are often the first choice for insurers, who then sell them to dismantlers, rebuilders, and recyclers through auctions provided by vehicle auction service providers. This trend not only drives higher revenues for vehicle auction providers, but also supports overall market growth. |

| Challenges | The market also faces several challenges, including fluctuations in the supply of used vehicles and vulnerability to economic conditions. The online segment in particular may be affected by fraudulent activities. |

| Trends | The vehicle auction market is expected to experience rapid growth during the forecast period, driven by emerging trends such as the integration of online auctions with artificial intelligence (AI), and the extensive use of data and analytics to streamline operations. AI platforms leverage machine learning and algorithms to provide clear, actionable intelligence to bidders, thereby making the auction process more efficient. As a result, the integration of online auctions with AI is expected to lead to higher dealer participation in vehicle auctions, providing an opportunity for auction service providers to increase their profitability. |

A simplified summary of the market analysis:

Market Segmentation:

- Type: The vehicle auction market is divided into 'Whole Car' and 'Salvage Vehicle'. 'Whole Car' is currently the dominant and fastest growing segment. The rise of online car auction sites has significantly contributed to its growth.

- Distribution Channel: The market operates via two main channels: 'Online' and 'Physical'. In 2022, online auctions held the largest market share owing to their convenience and benefits to both buyers and sellers.

Market Dynamics:

- Growth Drivers: The growth of the US vehicle auction market is being driven by several factors such as the increase in the average lifespan of vehicles, rise in internet users, increase in vehicle accidents, and an increase in revenue per auctioned car pricing. The longer lifespan of vehicles has increased their chances of being sold at auctions, leading to higher revenues for auction service providers.

- Challenges: The market faces challenges such as fluctuations in the supply of used vehicles and vulnerability to economic conditions. Online auctions are particularly susceptible to fraudulent activities.

- Trends: The market is expected to grow rapidly due to emerging trends like the integration of online auctions with artificial intelligence (AI) and the extensive use of data and analytics to streamline operations. AI has made the auction process more efficient, attracting more dealers to participate in vehicle auctions.

In essence, the vehicle auction market is expanding, driven by the rise of online platforms and technological integrations. However, investors should also be mindful of potential challenges such as supply fluctuations and economic vulnerabilities. Despite these challenges, the market presents numerous opportunities for growth and profitability.

Financials edit edit source

Financial Statements edit edit source

| Income Statement - (USD 'MM) | |||||||||||

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Revenue | 1,046 | 1,163 | 1,146 | 1,268 | 1,448 | 1,806 | 2,042 | 2,206 | 2,693 | 3,501 | |

| Cost of Revenue | (625) | (695) | (663) | (724) | (816) | (1,043) | (1,144) | (1,198) | (1,349) | (1,895) | |

| Gross Profit | 421 | 469 | 483 | 545 | 632 | 762 | 898 | 1,008 | 1,343 | 1,606 | |

| Gross Margin, % | 40.2% | 40.3% | 42.2% | 42.9% | 43.6% | 42.2% | 44.0% | 45.7% | 49.9% | 45.9% | |

| EBITDA | 344 | 333 | 399 | 469 | 521 | 662 | 808 | 924 | 1,265 | 1,513 | |

| EBITDA, % | 32.9% | 28.6% | 34.8% | 37.0% | 36.0% | 36.6% | 39.6% | 41.9% | 47.0% | 43.2% | |

| Operating Income (EBIT) | 283 | 275 | 344 | 406 | 461 | 584 | 716 | 816 | 1,136 | 1,375 | |

| EBIT, % | 27.0% | 23.6% | 30.1% | 32.0% | 31.9% | 32.4% | 35.1% | 37.0% | 42.2% | 39.3% | |

| Profit Before Tax | 277 | 270 | 332 | 396 | 440 | 563 | 705 | 801 | 1,122 | 1,341 | |

| Earnings Before Tax, % | 26.5% | 23.2% | 29.0% | 31.2% | 30.4% | 31.2% | 34.5% | 36.3% | 41.7% | 38.3% | |

| Net Profit After Tax | 180 | 179 | 220 | 270 | 394 | 418 | 592 | 700 | 936 | 1,090 | |

| Profit Margin, % | 17.2% | 15.4% | 19.2% | 21.3% | 27.2% | 23.1% | 29.0% | 31.7% | 34.8% | 31.1% | |

| Cash Flow Statement - (USD 'MM) | |||||||||||

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Net Income | 180 | 179 | 220 | 270 | 394 | 418 | 592 | 700 | 936 | 1,090 | |

| Depreciation & Amortization | 57 | 54 | 49 | 50 | 57 | 79 | 85 | 104 | 123 | 139 | |

| Deferred income taxes | (4) | (11) | 4 | 6 | 20 | 17 | 23 | 23 | (8) | 17 | |

| Stock-based compensation | 20 | 22 | 18 | 21 | 21 | 23 | 23 | 23 | 41 | 39 | |

| Change in working capital | (46) | (8) | (22) | (16) | (21) | (8) | (74) | 66 | (96) | (125) | |

| Other non-cash items | (7) | 26 | (4) | 2 | 20 | 6 | (3) | 1 | (6) | 17 | |

| Operating Cash Flow | 199 | 263 | 265 | 332 | 492 | 535 | 647 | 918 | 991 | 1,177 | |

| Investments in PPE | (130) | (82) | (79) | (174) | (172) | (288) | (375) | (604) | (463) | (337) | |

| Acquisitions | (84) | (14) | (5) | - | (164) | (7) | - | (12) | (5) | (109) | |

| Investment purchases | - | - | - | (21) | - | - | - | - | - | (375) | |

| Sales/Maturities of investments | - | - | - | 21 | - | - | - | - | - | 375 | |

| Other Investing Activites | 6 | 4 | 2 | 1 | 1 | 6 | 18 | 14 | 3 | 4 | |

| Investing Cash Flow | (208) | (92) | (82) | (173) | (336) | (288) | (356) | (601) | (465) | (442) | |

| Debt repayment | (97) | (75) | (350) | (338) | (7) | (231) | - | (1) | (1) | (417) | |

| Dividends payments | - | - | - | - | - | - | - | - | - | - | |

| Common Stock Repurchased | (15) | (1) | (237) | (458) | - | - | (365) | - | - | - | |

| Common Stock Issuance | - | - | - | - | - | - | - | - | - | 28 | |

| Other Financing Activites | 46 | (1) | 708 | 347 | (100) | 49 | (5) | (26) | 42 | 6 | |

| Financing Cash Flow | (66) | (77) | 120 | (448) | (107) | (182) | (370) | (27) | 41 | (383) | |

| Cash at beginning of period | 140 | 64 | 159 | 456 | 156 | 210 | 275 | 186 | 478 | 1,048 | |

| Net cash flow / Change in cash | (76) | 95 | 297 | (300) | 54 | 64 | (88) | 291 | 571 | 336 | |

| Cash at end of period | 64 | 159 | 456 | 156 | 210 | 275 | 186 | 478 | 1,048 | 1,384 | |

| Balance Sheet Statement - (USD 'MM) | |||||||||||

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Cash and cash equivalents | 64 | 159 | 456 | 156 | 210 | 275 | 186 | 478 | 1,048 | 1,384 | |

| Short Term Investments | - | - | - | - | - | - | - | - | - | - | |

| Cash and Short Term Investments | 64 | 159 | 456 | 156 | 210 | 275 | 186 | 478 | 1,048 | 1,384 | |

| Account Receivables | 192 | 199 | 222 | 285 | 318 | 367 | 387 | 377 | 501 | 628 | |

| Inventory | 11 | 7 | 9 | 10 | 10 | 17 | 21 | 20 | 45 | 59 | |

| Other Current Assets | 40 | 47 | 48 | 48 | 49 | 51 | - | - | - | 131 | |

| Total Current Assets | 306 | 412 | 735 | 499 | 587 | 709 | 687 | 964 | 1,703 | 2,202 | |

| Goodwill | 267 | 284 | 272 | 260 | 340 | 337 | 333 | 344 | 356 | 402 | |

| Intangible Assets | 18 | 25 | 18 | 12 | 76 | 65 | 55 | 48 | 46 | 55 | |

| Goodwill and Intangible Assets | 285 | 309 | 290 | 272 | 416 | 402 | 388 | 391 | 402 | 457 | |

| Long Term Investments | - | - | - | - | - | - | - | - | - | - | |

| Property, Plant & Equipment Net | 678 | 692 | 700 | 817 | 944 | 1,163 | 1,428 | 2,060 | 2,416 | 2,602 | |

| Other non-current Assets | 35 | 56 | 46 | 38 | 34 | 33 | 44 | 40 | 42 | 48 | |

| Total non-current Assets | 1,028 | 1,095 | 1,065 | 1,151 | 1,395 | 1,599 | 1,860 | 2,492 | 2,860 | 3,106 | |

| Total assets | 1,334 | 1,507 | 1,800 | 1,650 | 1,983 | 2,308 | 2,548 | 3,455 | 4,562 | 5,309 | |

| Short Term debt | 92 | 80 | 54 | 76 | 82 | 1 | 1 | 26 | 22 | 22 | |

| Account Payables | 71 | 62 | 58 | 77 | 71 | 134 | 271 | 319 | 370 | 399 | |

| Deferred revenue | 30 | 32 | 38 | 45 | 56 | 67 | 6 | 8 | 21 | 20 | |

| Other Current Liabilities | 45 | 70 | 64 | 81 | 93 | 75 | 3 | 4 | 8 | - | |

| Total current liabilities | 239 | 244 | 213 | 279 | 302 | 277 | 282 | 356 | 421 | 441 | |

| Long Term debt | 296 | 223 | 592 | 564 | 551 | 399 | 400 | 493 | 496 | 98 | |

| Deferred Revenue Non Current | - | - | - | - | - | - | - | - | - | 80 | |

| Deferred Tax Liabilities Non Current | 8 | 7 | 5 | 4 | 3 | 20 | 49 | 72 | 64 | 80 | |

| Other non-current Liabilities | 140 | 85 | 474 | 398 | 373 | 248 | 209 | 257 | 199 | (199) | |

| Total non-current liabilities | 334 | 259 | 622 | 597 | 582 | 449 | 487 | 610 | 612 | 242 | |

| Total liabilities | 572 | 503 | 835 | 875 | 884 | 727 | 769 | 966 | 1,033 | 683 | |

| Common Stock | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Retained earnings | 441 | 619 | 625 | 491 | 745 | 1,162 | 1,338 | 1,938 | 2,868 | 3,956 | |

| Other Income/Loss | (47) | (20) | (69) | (109) | (101) | (108) | (133) | (121) | (101) | (169) | |

| Other Stockholders Equity | 369 | 405 | 408 | 392 | 453 | 527 | 573 | 673 | 762 | 839 | |

| Total shareholders equity | 762 | 1,003 | 964 | 774 | 1,098 | 1,581 | 1,778 | 2,490 | 3,529 | 4,626 | |

| Minority Interest | - | - | - | - | 1 | - | - | - | - | - | |

| Total Equity | 762 | 1,003 | 964 | 774 | 1,098 | 1,581 | 1,778 | 2,490 | 3,529 | 4,626 | |

| Total debt | 389 | 303 | 646 | 640 | 633 | 400 | 401 | 518 | 518 | 119 | |

| Total Investments | - | - | - | - | - | - | - | - | - | - | |

| Net Debt | 325 | 144 | 190 | 485 | 423 | 125 | 215 | 40 | (530) | (1,265) | |

Valuation edit edit source

DCF edit edit source

| Operating Data - (USD 'MM) | ||||||||||

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| A/F | Actual | Actual | Actual | Actual | Actual | Forecast | Forecast | Forecast | Forecast | Forecast |

| Revenue | 1,806 | 2,042 | 2,206 | 2,693 | 3,501 | 4,142 | 4,899 | 5,796 | 6,857 | 8,111 |

| Revenue Growth, % | 13.1% | 8.0% | 22.1% | 30.0% | 18.3% | 18.3% | 18.3% | 18.3% | 18.3% | |

| EBITDA | 662 | 808 | 924 | 1,265 | 1,513 | 1,777 | 2,103 | 2,487 | 2,943 | 3,481 |

| EBITDA, % | 36.6% | 39.6% | 41.9% | 47.0% | 43.2% | 42.9% | 42.9% | 42.9% | 42.9% | 42.9% |

| Depreciation | 77 | 91 | 108 | 129 | 138 | 187 | 222 | 262 | 310 | 367 |

| Depreciation, % | 4.3% | 4.5% | 4.9% | 4.8% | 3.9% | 4.5% | 4.5% | 4.5% | 4.5% | 4.5% |

| EBIT | 584 | 716 | 816 | 1,136 | 1,375 | 1,590 | 1,881 | 2,225 | 2,632 | 3,114 |

| EBIT, % | 32.4% | 35.1% | 37.0% | 42.2% | 39.3% | 38.4% | 38.4% | 38.4% | 38.4% | 38.4% |

| Balance Sheet Data - (USD 'MM) | ||||||||||

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| A/F | Actual | Actual | Actual | Actual | Actual | Forecast | Forecast | Forecast | Forecast | Forecast |

| Total Cash | 275 | 186 | 478 | 1,048 | 1,384 | 1,131 | 1,338 | 1,583 | 1,873 | 2,216 |

| Total Cash, % | 15.2% | 9.1% | 21.7% | 38.9% | 39.5% | 27.3% | 27.3% | 27.3% | 27.3% | 27.3% |

| Account Receivables | 367 | 387 | 377 | 501 | 628 | 751 | 889 | 1,052 | 1,244 | 1,472 |

| Account Receivables, % | 20.3% | 18.9% | 17.1% | 18.6% | 18.0% | 18.1% | 18.1% | 18.1% | 18.1% | 18.1% |

| Inventories | 17 | 21 | 20 | 45 | 59 | 55 | 65 | 77 | 91 | 107 |

| Inventories, % | 0.9% | 1.0% | 0.9% | 1.7% | 1.7% | 1.3% | 1.3% | 1.3% | 1.3% | 1.3% |

| Accounts Payable | 134 | 271 | 319 | 370 | 399 | 547 | 647 | 766 | 906 | 1,072 |

| Accounts Payable, % | 7.4% | 13.3% | 14.4% | 13.7% | 11.4% | 13.2% | 13.2% | 13.2% | 13.2% | 13.2% |

| Capital Expenditure | (288) | (375) | (604) | (463) | (337) | (495) | (559) | (594) | (653) | (701) |

| Capital Expenditure, % | 15.9% | 18.3% | 27.4% | 17.2% | 9.6% | 18.1% | 18.1% | 18.1% | 18.1% | 18.1% |

| Build Up Free Cash Flow - (USD 'MM) | ||||||||||

| Year | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| A/F | Actual | Actual | Actual | Actual | Actual | Forecast | Forecast | Forecast | Forecast | Forecast |

| Revenue | 1,806 | 2,042 | 2,206 | 2,693 | 3,501 | 4,142 | 4,899 | 5,796 | 6,857 | 8,111 |

| EBITDA | 662 | 808 | 924 | 1,265 | 1,513 | 1,777 | 2,103 | 2,487 | 2,943 | 3,481 |

| EBIT | 584 | 716 | 816 | 1,136 | 1,375 | 1,590 | 1,881 | 2,225 | 2,632 | 3,114 |

| Tax Rate, % | 25.7% | 16.1% | 12.6% | 16.5% | 18.7% | 16.0% | 16.0% | 16.0% | 16.0% | 16.0% |

| EBIAT | 434 | 601 | 713 | 949 | 1,118 | 1,336 | 1,581 | 1,870 | 2,212 | 2,617 |

| Depreciation | 77 | 91 | 108 | 129 | 138 | 187 | 222 | 262 | 310 | 367 |

| Accounts Receivable | (49) | (20) | 10 | (124) | (128) | (123) | (138) | (163) | (192) | (228) |

| Inventories | (7) | (4) | 1 | (25) | (14) | 4 | (10) | (12) | (14) | (17) |

| Accounts Payable | 63 | 137 | 48 | 51 | 29 | 148 | 100 | 118 | 140 | 166 |

| Capital Expenditure | (288) | (375) | (604) | (463) | (337) | (495) | (559) | (594) | (653) | (701) |

| UFCF | 231 | 431 | 276 | 517 | 806 | 1,057 | 1,196 | 1,482 | 1,802 | 2,204 |

| WACC, % | 10.0% | 10.0% | 10.0% | 10.0% | 10.0% | |||||

| PV UFCF | 961 | 989 | 1,113 | 1,231 | 1,368 | |||||

| SUM PV UFCF | 5,663 | |||||||||

| Valuation - (USD 'MM) | ||||||||||

| Terminal Value (Perpetuity Growth method) - (USD 'MM) | Intrinsic Value | |||||||||

| Long-term growth rate, % | 4.0% | Enterprise Value - (USD 'MM) | 29,380 | |||||||

| WACC, % | 10.0% | Net Debt - (USD 'MM) | -1,265 | |||||||

| Free cash flow (t + 1) | 2,292 | Equity Value - (USD 'MM) | 30,644 | |||||||

| Terminal Value | 38,197 | Shares Outstanding, MM | 482 | |||||||

| Present Value of Terminal Value | 23,717 | Equity Value Per Share, USD | 63.54 | |||||||

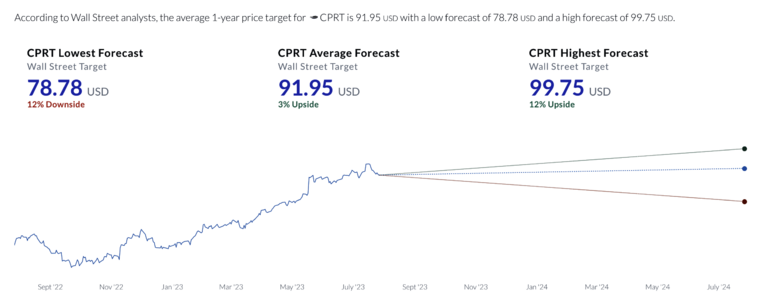

Wall Street price targets edit edit source

References edit edit source

- ↑ https://www.copart.com/aboutus/?intcmp=web_footer_aboutus_en

- ↑

- ↑ https://www.copart.com/content/us/en/about-copart/our-history?intcmp=web_footer_ourhistory_enhttps://global.copart.com/

- ↑ https://www.copart.co.uk/content/uk/en/landing-page/careers/who-copart-are#:~:text=To%20create%20value%20and%20opportunity%20through%20vehicle%20auctions%20and%20exchange.

- ↑ https://www.forbes.com/sites/giacomotognini/2020/11/16/how-to-make-a-billion-dollars-junkyard-cars-copart-salvage/https://blog.gitnux.com/companies/copart/

- ↑ https://www.copart.com/how-it-works/

- ↑ https://www.fool.com/investing/2021/03/29/how-copart-makes-money-from-car-crashes/https://d3.harvard.edu/platform-digit/submission/copart-the-monopoly-youve-never-heard-of/https://www.copart.com/ (member fees, service fees, etc)

- ↑ https://www.copart.com/content/us/en/about-copart/executive-team

- ↑ https://simplywall.st/stocks/gb/commercial-services/lse-0aci/copart-shares

- ↑ https://companiesmarketcap.com/copart/marketcap/

- ↑ https://companiesmarketcap.com/copart/marketcap/

- ↑ https://www.google.com/search?q=The+US+Vehicle+Auction+Market%3A+Analysis+By+Volume%2C+By+Type%2C+By+Distribution+Channel+Size+and+Trends+with+Impact+of+COVID-19+and+Forecast+up+to+2028&oq=The+US+Vehicle+Auction+Market%3A+Analysis+By+Volume%2C+By+Type%2C+By+Distribution+Channel+Size+and+Trends+with+Impact+of+COVID-19+and+Forecast+up+to+2028&aqs=chrome..69i57j69i60l2j69i61.433j0j7&sourceid=chrome&ie=UTF-8