Direxion Daily Real Estate Bear 3X Shares ETF

Overview edit edit source

| DRV | |

| Type | 3x Inverse Leveraged ETF |

| Founded | 16th July 2009 |

| Founder | Direxion |

| Capital ratio | Expense ratio: 1.08% (as of 16/08/2022) |

| Website | https://www.direxion.com/product/daily-real-estate-bull-bear-3x-etfs |

DRV, Direxion Daily Real Estate Bear 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the Real Estate Select Sector Index (IXRETR).

The Idea edit edit source

Investment thesis of this product is betting against the real estate market, especially REITs (real estate investment trusts), companies with ownership of incoming producing real estate.

| Data | Value (as of 16/08/2023) |

|---|---|

| Current Price | $49.20 |

| AUM | $128.35B |

| Beta | -2.90 |

| Expense Ratio | 1.08% |

| Yield | 2.76% |

| 52 week range | $35.23 - $84.94 |

| Net Asset Value | 47.68 |

Investment Thesis edit edit source

As mentioned above, DRV is a product to maximise exposure and gains in deteriorating REITS, more precisely commercial real estate market. There are multiple catalysts which may potential lead to underperformance of REITs which are listed below.

Commercial Real Estate Debt Crisis edit edit source

Following the US regional bank turmoil on May 2023 with collapse of Silicon Valley Bank, First Republic Bank, Signature Bank and many more, commercial real estate debt crisis raises concerns. These type of smaller regional banks are responsible for over 80% of the commercial real estate loans in the United States.[2] Failure of these regional banks were caused by the banks forced to sell the bonds (mainly US Treasury) at significant losses as deposit requests were skyrocketing. Having bought those bonds when federal funds rate was hovering near zero, and rapid increase of interest rates led to rising bond yields, conversely to falling bond prices.[3]

Major lenders struggling to lend more CRE loans, borrowers also struggle to refinance and forced to stay at high interest rates. $1.5 Trillion of CRE loans are due to mature by 2025, and failing to refinance may lead to delinquencies and defaults which caused the financial crisis in 2008.[4]

Office Vacancy Rates edit edit source

Office buildings, playing a major role in commercial real estate, had its vacancy rates at its all time high in the United States. Combination of corporations struggling to pay rent with rising delinquencies, and the emphasis of work life balance by workers forcing corporations to offer hybrid and remote working environment increased office vacancy rates.[5] High vacancy rates lead to devaluation of those buildings which play a negative role in refinancing the CRE loans before maturity. Falling prices of CRE buildings will devalue asset prices of REITs' balance sheet and negatively impact the performance of REITs. Conversely, DRV will outperform with REITs struggling.

Chinese Real Estate Crisis edit edit source

Evergrande, second largest Chinese property company filed for Chapter 15 bankruptcy as they struggled to manage over $300B of debt.[6] Investor sentiment on real estate market have deteriorated rapidly which benefits the performance of DRV. Along with economic data shock in Chinese economy, institutional and individual investors are keeping a distance from risky assets amid economic stagnation.

Ownership edit edit source

Main institutional ETF and options ownership.

| Investor | Shares | Options (if applicable) |

|---|---|---|

| Susquehanna International Group | 93,300 | Call |

| Citadel Advisors Llc | 87,500 | Call |

| Susquehanna International Group | 66,700 | Put |

| Jane Street Group | 48,587 | |

| Virtu Financial LLC | 37,722 | |

| Barclays Plc | 21,190 | |

| Cutler Group LC | 11,000 | Call |

| Morgan Stanley | 6,790 | |

| Bank of America Corp | 1,367 | |

| Simplex Trading Llc | 1,158 | |

| Belpointe Asset Management LLC | 500 | |

| Qube Research & Technologies Ltd | 111 | |

| Fmr Llc | 80 | |

| Bank of Montreal | 64 |

Real Estate Select Sector Index (IXRETR) edit edit source

The Real Estate Select Sector Index represents the performance of the securities of companies in industries including real estate management, real estate investment trusts (REITs) and real estate development. This index however is not directly investable, thus using leveraged ETF can act as an alternative.

| Top Ten Holdings | Ticker | Market Capitalisation | Holding Percentage (%) |

|---|---|---|---|

| Prologis REIT | PLD | $114.21B | 12.21 |

| American Tower Class A REIT | AMT | $88.84B | 9.75 |

| Equinix Inc Common Stock REIT | EQIX | $75.35B | 7.91 |

| Crown Castle International | CCI | $46.4B | 5.33 |

| Public Storage | PSA | $49.15B | 4.98 |

| Realty Income REIT | O | $40.64B | 4.34 |

| Welltower Inc. | WELL | $41.54B | 4.34 |

| Simon Property Group REIT | SPG | $46.43B | 4.07 |

| CoStar Group | CSGP | $32.63B | 3.92 |

| Digital Realty | DLR | $35.94B | 3.58 |

IXRETR also has various sectors within Real Estate illustrated below.

| Sector Weighting | Type of Sector | Holding Percentage (%) |

|---|---|---|

| Telecom Tower REITs | REIT | 17.79 |

| Industrial REITs | REIT | 12.21 |

| Multi-Family Residential REITs | Residential | 11.55 |

| Retail REITs | Commercial | 11.52 |

| Data Centre REITs | REIT | 11.49 |

| Health Care REITs | REIT | 7.56 |

| Self Storage REITs | REIT | 7.15 |

| Other Specialised REITs | REIT | 5.19 |

| Research and Consulting Services | Service provider | 3.92 |

| Office REITs | Commercial | 2.81 |

| Real Estate Services | Service provider | 2.71 |

| Timber REITs | REIT | 2.65 |

| Single Family Residential REITs | Residential | 2.16 |

| Hotel & Resort REITs | Commercial | 1.29 |

Real Estate Investment Trusts (REITs) edit edit source

Real estate investment trusts, short for REITs were established in the United States in 1960 in order to provide accessability for individual investors with small sum of money in the real estate market.[8] These products allow investors to invest in large scale and income producing real estate and REITs are corporations which own incoming producing real estate, mostly commercial real estate.[9] Real Estate is considered as a safe haven amongst investors with relatively low risk compared to equities and other volatile investments including cryptocurrencies.

Leveraged ETFs edit edit source

Leveraged ETFs (exchange traded funds) are products which utilises financial derivatives such as future contracts, options and swaps in order to deliver the desired return of a particular index. [10]

Due to the high risk, TMF is typically used by traders to profit from the index's short term trends or through technical analysis. Therefore leveraged ETFs have the potential to provide significant gains as well as losses, and provide both long and short exposure to a certain index.

Typical holdings of an leveraged ETF include a signficant proportion invested in short term securities and a smaller position on volatile derivatives. Large amount of cash is generally used to meet financial obligations caused by the losses on the derivatives. This is held by maintaing a constant leverage ratio.

Macroeconomics edit edit source

Mortgage Rates edit edit source

Mortgage rates are heavily correlated with the US Federal Funds Rate (interest rates) and therefore the US 10 year treasury yields. Graph below displays the positive correlation between 30 year fixed mortgage and 10 year treasury yield in the United States.

Mortgage rates as of 22/08/2023, have surpassed 7% and reached the highest level since 2000[13]. High mortgage rates drastically decreases the affordability in the residential real estate sector which mainly consists of housing.

U.S. Case Shiller Index edit edit source

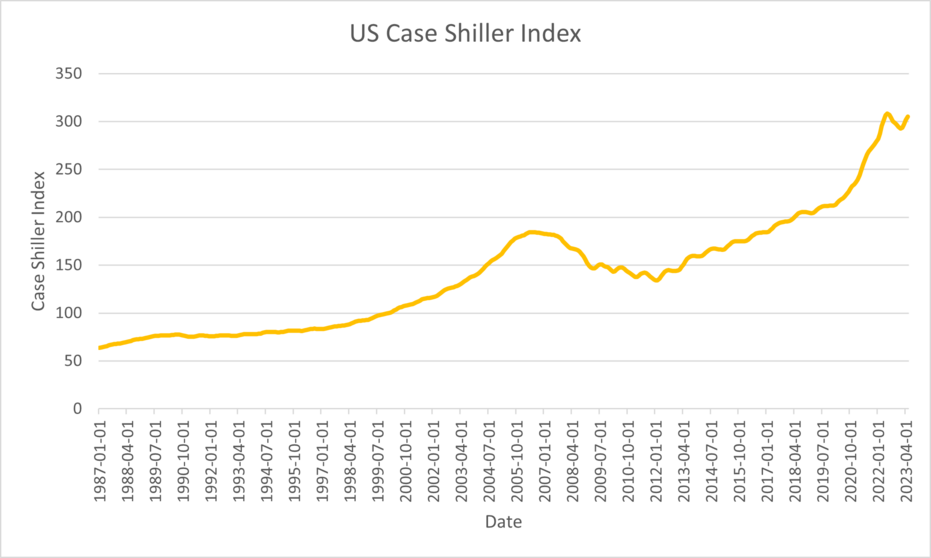

S&P Case Shiller Index indicates the benchmark of mean single family home prices in the United States. This index was devleoped in the 80s by Allan Weiss, Karl Case and Robert Shiller to be utilised as a barometer of the US residential market.[15]

The graph displays upward trends during quantitative easing phase as printing money leading to currency devaluation, and liquidity gets injected into the real estate market in order for investors to preserve the wealth. This index tracks the purchase prices and resale prices of homes with two month lagging time. It is also calculated using a 3 month average which produces the lagging effect.

Other real estate valuation benchmarks include Housing Price Index and Home Price Index by CoreLogic.

Performance edit edit source

With daily rebalancing nature of DRV makes itself very risky and volatile security, as it maximises exposure to a certain index to deliver the desired outcome.

Between 21st Feb and 20th Mar, DRV had over 175% upside with the COVID lockdown and crash across most assets. Also between August and October in 2022, with surging mortgage rates topping over 7% in fixed 30 year. Real Estate Select Index struggled and thus DRV had an upside of 125%. Timing the entering and exiting positions are crucial when owning leveraged ETFs and therefore they are mainly utilised by traders.

Risk assessment edit edit source

Risks as a Leveraged ETF edit edit source

DRV, being a 3x inverse leveraged ETF, comes with a substantial risk as the product is leveraged with derivatives to achieve higher returns. These derivatives include future contracts, swaps and options with high volatility. Leveraged ETFs provide daily return of the desired multiple, and the return resets daily. Compounding returns can bring significant losses or gains. With the considerable risk, DRV is not considered appropriate for long term investment and mostly used for trading.[16]

Expense ratio also plays a role. Expense ratio indicate the annual percentage of an investor's investment for the ETF provider for providing the service as commission. 3x Leveraged ETF typically has a relatively high expense ratio which negatively impacts an investor's portfolio.

Macroeconomic risks edit edit source

Similar to TMF, the biggest risk which may put downward pressure on the performance of DRV is the resilience of the economy and the stability of the real estate market.

Strong labour market gives room for the federal reserve for more rate hikes as it indicates the strength of the economy.[17]

Housing Shortage edit edit source

- ↑ https://www.direxion.com/product/daily-20-year-treasury-bull-bear-3x-etfs

- ↑ https://thewire.in/banking/us-regional-banking-crisis-far-from-over

- ↑ https://www.wsj.com/articles/bond-selloff-adds-to-the-pressure-on-regional-banks-8752867f

- ↑ https://www.bloomberg.com/news/articles/2023-04-08/a-1-5-trillion-wall-of-debt-is-looming-for-us-commercial-properties

- ↑ https://www.axios.com/2023/04/13/office-vacancy-rate-remote-work-hybrid-work

- ↑ https://www.bbc.com/news/business-66540785

- ↑ https://fintel.io/so/us/drv

- ↑ https://www.reit.com/what-reit/history-reits#:~:text=History%20of%20REITs%20%26%20Real%20Estate%20Investing&text=U.S.%20REITs%20were%20established%20by,40%20countries%20around%20the%20world.

- ↑ https://www.investor.gov/introduction-investing/investing-basics/investment-products/real-estate-investment-trusts-reits#:~:text=What%20are%20REITs%3F,real%20estate%20or%20related%20assets.

- ↑ https://www.investopedia.com/terms/l/leveraged-etf.asp

- ↑ https://fred.stlouisfed.org/series/MORTGAGE30US

- ↑ https://fred.stlouisfed.org/series/DGS10#0

- ↑ https://www.cnbc.com/2023/08/21/mortgage-rates-hit-highest-point-since-2000.html

- ↑ https://fred.stlouisfed.org/series/CSUSHPINSA#0

- ↑ https://www.investopedia.com/terms/s/sp_case_shiller_us_nhpi.asp

- ↑ https://www.investopedia.com/articles/investing/121515/why-3x-etfs-are-riskier-you-think.asp

- ↑ https://www.cnbc.com/2023/07/07/jobs-report-june-2023-.html