EQS Group

Regulatory stimulus set for the second half of 2022

Summary edit edit source

EQS is in a strong position to build its client base as the EU whistleblowing directive comes into force across Europe. Delays in adoption of formal legislation are a frustration but do not detract from the strength of the underlying proposition. EQS retains its ambition to be the leading European cloud provider for global investor relations and corporate compliance solutions by 2025. The €45m raised in March will help fund the repayment of short-term bank and vendor loans during Q222. Edison Investment Research sees management’s targets of €130m of group revenues and EBITDA margins of at least 30% for FY25 as demanding but achievable.

| Year end | Revenue

(€m) |

EBITDA

(€m) |

PBT*

(€m) |

EPS*

(c) |

EV/EBITDA

(x) |

P/E

(x) |

|---|---|---|---|---|---|---|

| 12/20 | 37.6 | 4.8 | 0.4 | 4.1 | 67.6 | 711.7 |

| 12/21 | 50.2 | 1.7 | (5.9) | (69.8) | 184.6 | N/A |

| 12/22e | 70.0 | 7.5 | (0.0) | (0.1) | 42.9 | N/A |

| 12/23e | 90.0 | 18.0 | 10.5 | 68.5 | 17.9 | 42.8 |

German legislative adoption set for H222 edit edit source

While EQS conducts business across Europe, the German market is its largest (72% of FY21 revenue) and it is here that it has the greatest opportunity to grow its client base as the new whistleblowing regulation comes into force. The feedback and consultation period on the proposed legislation should now be complete. There is optimism that the law will be transposed prior to the summer and implemented in H222. The group’s experience in Denmark was that corporates rushed to comply at the last minute. It is likely that this pattern will be repeated in Germany.

Guidance revised but Edison Investment Research's forecasts are unchanged edit edit source

Q122 saw an uplift of 34% in revenue and a higher-than-expected EBITDA due to lower spending on marketing and sales. Revenue growth for the year is guided at 30–40%, down from 30–50% growth at the FY21 results, with forecast EBITDA of €6–10m (unchanged). Edison Investment Research maintains its revenue forecast at €70m, now at the higher-end, rather than mid-range. Any further slippages to the timetable would prompt us to review this. March’s €45m fund-raise has put the group onto a firm financial footing to continue with the investment needed to grasp the whistleblowing opportunity and start building out the bases for a similar offering for ESG reporting.

Valuation: DCF indicates meaningful upside edit edit source

EQS’s share price has retreated by 35% since the start of the year, while financial B2B company valuations have fallen by 32% and those of application software companies by the same percentage. Profitability is currently subdued by the additional investment phase, so traditional valuation multiples remain of limited use. For its DCF, Edison Investment Research has raised the WACC by 1% to 9% to reflect rising interest rates, rather than any company-specific reason. Using this and terminal growth of 2%, the DCF now indicates a value of €47.66/share, from Edison Investment Research's April figure of €57.93, a level still well above the current market price.

Investment summary edit edit source

Company description: Growing regtech provider edit edit source

EQS provides products and services that meet a market need for reliable, secure, trustworthy automation in compliance and investor relations (IR) – regulatory technology, or regtech for short. It has invested in building a cloud-based platform, COCKPIT, for both areas of the business, from which it derives Software-as-a-Service (SaaS) revenues. COCKPIT provides its clients with a dashboard from which to access the subscribed elements to manage their own workflows. It has 4,405 customers (as at end Q122), with 86% of revenues earned on a recurring basis and a churn of 5.7%. The more complex the corporate regulation framework, the greater the opportunity, with the current roll-out of the whistleblowing regulations across Europe widening the target market.

Valuation: DCF indicates valuation differential edit edit source

The share price is 35% lower than at end FY21, dipping below the €33 price at which shares were placed in the subscription over February/March 2022. Financial software companies and global application software peers have also retrenched over the period, each by 32%. With earnings remaining subdued ahead of the anticipated whistleblowing stimulus, EV/Sales is the only realistic peer comparison metric, with EQS shares trading at valuation between the two peer groups on current year and FY2 EV/Sales. Edison Investment Research has also looked at a DCF, using a WACC of 9% (up from 8% to reflect the poorer economic backdrop) and terminal growth of 2%. Based on management’s targets of €130m of revenue and a 30%+ EBITDA margin for FY25e, with revenue growth tailing off thereafter as the effects of scale take effect, the implied share price is €47.66. There is obviously an element of execution risk here. Even if the EBITDA margin were to be set at 25%, the implied share price would be €37.88, 29% above the current level.

Financials: Waiting for the whistleblowing tailwind edit edit source

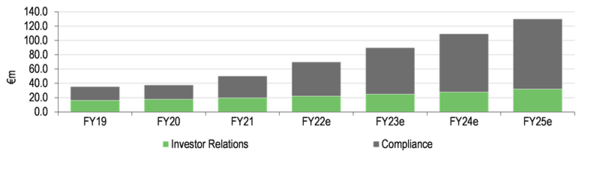

Management guidance is for FY22e revenue growth of 30–40% (was 30–50%) and EBITDA of €6.0–10.0m (unchanged). Edison Investment Research's forecasts are also unchanged following the Q122 results, albeit its revenue number now lies towards the top of the indicated range. The Q122 figures showed revenues up 34% to €14.1m, with benefit from the acquisition of Business Keeper (consolidated from July 2021) lifting that figure from 7%. Management’s ambition is to build to group revenues of €130m for FY25e, driven mostly by demand for compliance products and services as the suite offered through the COCKPIT platform builds and cross-selling becomes more prevalent. Whistleblowing is set to be the main stimulus for this growth as the EU regulation becomes law across Europe.

EBITDA margin is being held down currently (10.7% in FY22e) by the investment to grasp the whistleblowing opportunity and grow the client roster. The medium-term plan envisages its recovery to over 30% by FY25e, which Edison Investment Research regards as a challenging but feasible ambition. The Q122 fund-raise has put the balance sheet in a healthier position post the acquisitions, with gearing of under 10%. Given the high proportion of SaaS revenues, EQS should fundamentally have healthy operational cash conversion of around 100%, with the larger capital spend on building the cloud-based platform completed over FY17–20.

Sensitivities: Success of sales push edit edit source

Having put so much effort behind the whistleblowing opportunity, the delays have been a clear frustration, but the group’s financial strength has provided a strong buffer. Any further slippage to legal implementation may mean further revisions to forecasts. Reaching the FY25 targets also requires success in cross-selling and building recurring revenue streams.

Company description: Cloud-based regtech provider edit edit source

EQS’s business is split into two segments, Compliance and IR, and it has recently announced its intention to build a third leg on Sustainability Reporting. Compliance covers products that are required to fulfil a regulatory obligation, while IR includes products designed to facilitate digital investor and corporate communications. The introduction of sustainability reporting provision is also in response to forthcoming EU regulation, which will require companies to report various ESG metrics in specific formats. EQS is one of the largest global providers of digital solutions, designed to automate and simplify processes for those individuals working on the technical administrative aspects of running a corporate concern, enabling them to free up their time to deal with matters that require more than simple information processing. By ensuring that the cloud-based product suites provided are constantly updated for the latest regulatory compliance changes and delivered via intuitive interfaces, EQS should continue to add value for its users. Originally centred on investor relations (which in Germany and some other markets includes functions covered in other jurisdictions by the company secretary or equivalent), the group’s products and services have been expanded across the related areas of compliance.

EQS Group was founded in 2000 in Munich, initially building a strong market position in its home markets of Germany, Switzerland and Austria before starting to expand its presence in overseas territories. EQS looks to position itself as a partner with its client companies, working alongside them to solve issues and reduce inefficiencies, rather than simply as a supplier whose interest may not extend beyond the initial sales timeframe, with a growing emphasis on providing SaaS. The shift away from paper-based information to digital channels of communication between corporate entities and their various stakeholders has been a key driver of growth, accelerated by the pandemic. The honed business model is focused on building subscription and annually recurring incomes as a proportion of the whole, increasing the quality of the earnings.

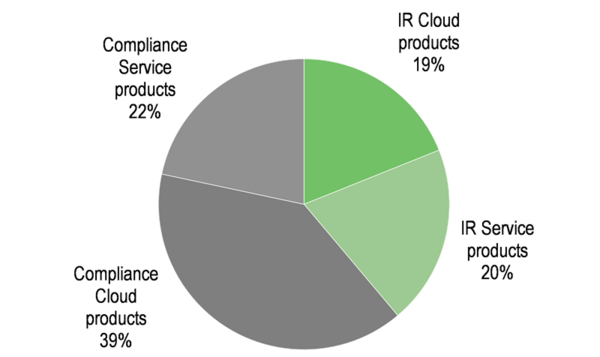

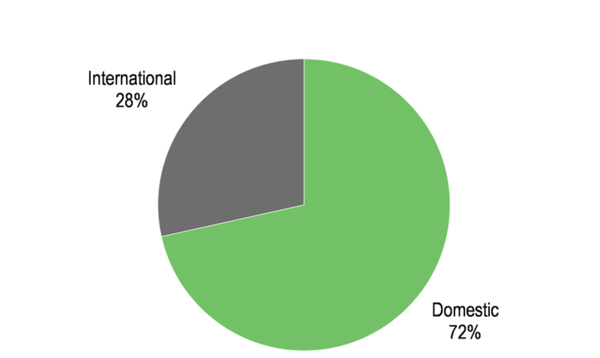

Exhibit 1: FY21 revenue by segment[2]

Exhibit 2: FY21 revenue by geography[2]

The group has added to its offering through acquisition as well as through internally developed platforms and tools and has used a combination of cash, debt and equity to fund both aspects. The purchase of Business Keeper in June 2021 was the largest acquisition to date, with a transaction price of €95m. This significantly scaled up the exposure to digital whistleblowing, making the combined group the clear market leader in Europe. It added over 300 customers and around 100 employees, the customers predominantly being large corporations, including 16 DAX-listed companies. Business Keeper currently generates annual recurring licence revenues (ARR) of approximately €10m and was previously EQS’s strongest competitor in Germany.

In addition to its headquarters in Berlin, Germany, EQS also has technology centres in Kochi (India) and Belgrade (Serbia), giving it access to a far wider pool of programming and technical talent.

Aiming for European market leadership edit edit source

Management has a clear goal. Its aim is for EQS to be the leading European cloud provider for global IR and corporate compliance solutions by 2025. The progress it has made in whistleblowing is not yet fully reflected in revenues (due primarily to the regulatory delays) but has given the group an entrée into a far greater number of corporates and so increased the lead pipeline for sales of the broader offering.

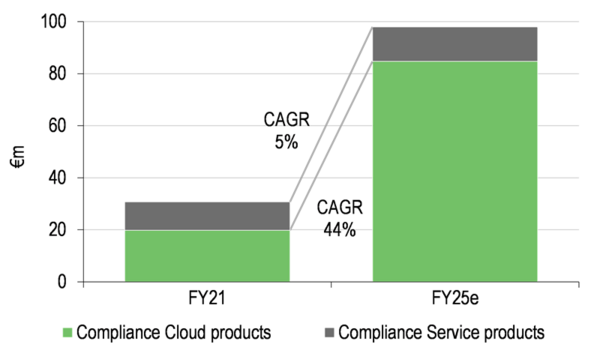

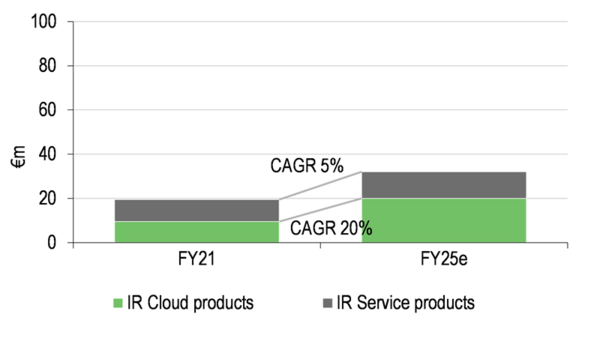

IR delivered 39% of group revenue in FY21, roughly equally split between cloud-based products and services. Compliance revenues, which make up the balance, are far more heavily skewed to cloud-based products.

Overview of IR offering edit edit source

Within IR, the group provides (cloud-based) products such as its Newswire service, investor data management, CRM, mailing and roadshow management tools, which are increasingly served via its COCKPIT cloud platform. The IR COCKPIT has a similar interface to the Compliance COCKPIT, shown below, albeit with different tiles.

External to the platform are various cloud services, such as websites, tools, reports, webcast, virtual AGM facilities and various media options which were of particular value in communicating with the relevant stakeholders during the periods of lockdown over the course of the COVID-19 pandemic. This aspect of group revenue is also sensitive to the general health of equity and bond markets, so has been affected by the dip in sentiment caused by the invasion of Ukraine. In particular, it is also affected by the health of the IPO market, which has been detrimental to performance in recent periods.

Over the last couple of years, management has focused on migrating existing clients for IR products onto the COCKPIT platform, both as a benefit to efficiency but also as a precursor to cross-selling. The other key advantage of moving customers onto the platform is that it builds recurring SaaS revenues. By end March 2022, the group had IR SaaS COCKPIT contracts in place with 964 companies. The total number of IR SaaS customers stood at just over 2.5 thousand, up 372 on end Q121.

Overview of Compliance offering edit edit source

EQS’s Compliance segment provides tools for companies to fulfil their regulatory obligations. These products include News (Disclosure), Insider Manager, Integrity Line, Policy Manager, Approval Manager, Third Party Manager and Rulebook. These are increasingly being offered as part of the Compliance COCKPIT, with an intuitive client interface, as illustrated in Exhibit 3.

The group also provides various cloud services, including regulatory filing in XML and XBRL formats and legal entity identifier issuance. These are separately reported as they are not necessarily conducted via the COCKPIT.

Exhibit 3: Compliance COCKPIT client interface[3]

The whistleblowing opportunity edit edit source

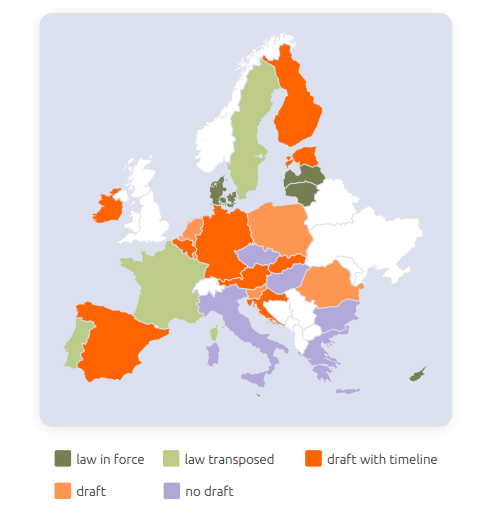

EU regulation regarding the provision of secure procedures for corporate whistleblowing was put in place in 2019, with a requirement for it to be incorporated into the legislative framework of member states by the end of 2021. Since then, the timeframe has slipped, with eight countries having adopted the relevant laws (although none has yet transposed the provisions into their national legal and institutional systems), 17 countries are listed as ‘delayed’ and one, Hungary, has yet to start the legislative process. Denmark was the earliest country to adopt the law, passing the necessary legislation in June 2021 with implementation on 17 December 2021. Due to the delays, the EU served a notice of infringement on Denmark in January 2022.

Exhibit 4: Current status of whistleblowing legislation as at April 2022[3]

This whistleblowing regulation applies to organisations with more than 50 employees. Those with over 250 employees must comply within two years; those with 50 to 250 have a maximum of a further two years. Reporting can be via an online system or via more traditional communications, with obvious major advantages to the former in terms of process and confidentiality.

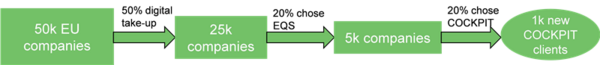

Exhibit 5: Whistleblowing market and conversion targets[4]

The acquisitions first of Integrity Line and subsequently of Got Ethics and then Business Keeper have given EQS a highly credible proposition in this burgeoning market. Management estimates that there are 50k companies within the EU that will need to address their systems, with the likely conversion rates as shown in Exhibit 5.

The timeframe is dictated by the regulation, so this is an inherently time-limited opportunity. Management made a strategic call to go after this market and then use sales as a bridgehead to sell in a wider range of products and services. It quantified the FY21 investment in additional sales and marketing at €5.6m, with €0.83m having been spent on this effort in FY20.

Competitive positioning edit edit source

EQS is well-placed to achieve its targeted penetration in Europe, being the largest continental provider. In Germany, Business Keeper was the main competitor (with around half the number of customers of EQS), with a smaller Dutch operator also in the EU market. The largest player in the market is US-based NavexGlobal, with another US company OneTrust also targeting European corporates. Tackling the European market is obviously complicated for US companies by the requirements to operate in a variety of languages and to guarantee that data will be retained within the EU. Smaller companies and start-ups looking to enter this market are unlikely to be able to obtain the correct certifications or have built a reputation for data security and integrity.

The ESG opportunity edit edit source

The EU has existing regulation on non-financial disclosures, whereby large companies (defined as having over 500 employees) must report information on

- Environmental matters

- Social matters and treatment of employees

- Respect for human rights

- Anti-corruption and bribery

- Diversity on company boards (in terms of age, gender, educational and professional background)

In April 2021, the EU Commission moved forward with a proposal for a Corporate Sustainability Reporting Directive (CSRD). This adds the following components:

- Extension of the scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises).

- Requirement for the audit (assurance) of reported information.

- Introduction of more detailed reporting requirements, and a requirement to report according to mandatory EU sustainability reporting standards.

- Requirement for companies to digitally ‘tag’ the reported information, so it is machine readable and feeds into a European single access point.

It is anticipated that the first set of standards would be adopted by October 2022, with the intention to translate into national legislative frameworks by mid-2023. However, as has been the case for the whistleblowing regulation, it would be wise to treat this timetable with a degree of scepticism.

ESG COCKPIT to come? edit edit source

The programme referred to above is clearly compatible with the corporate COCKPIT approach adopted in EQS’s existing business model. Standardised data entry with dashboards to build into a company’s workflow and ensure that deadlines are met, and that the information is compliant with regulatory requirements – this is all very familiar territory.

However, the working expertise to design and build the required elements is not a resource currently available in-house. Hence, EQS was in discussions to acquire a pioneering sustainability consultancy, DFGE, as announced in February 2022. Both parties were unable to meet on price but are still open to collaboration in future.

EQS is now set on building a software solution internally and has recruited an MD, Tomas Krick, who had previously built up the ESG offering at Deloitte, Germany.

Management steeped in financial markets and IR edit edit source

EQS has a very experienced leadership team that has worked together for many years. The group’s CEO is Achim Weick, who began his career at Commerzbank. Subsequently, he co-founded investor relations manager CMC Capital Markets Consulting. Achim is the originator, founder and largest shareholder of EQS and has been on the board since its foundation. COO Christian Pfleger joined EQS in 2001, initially as a client relationship manager, moving to project management from 2003. In 2007, he took over responsibility for products and services. André Silverio Marques was appointed to the main board as CFO in July 2018, having been finance director since 2015. He previously ran the group’s Russian businesses and, before that, oversaw the IR, business development and corporate finance activities. The other key member of the management team is Marcus Sultzer, who joined the group in 2007 and oversaw business development in Russia and the CIS from 2009 and Asia-Pacific from 2013. As well as being international managing director, in charge of operations in Asia, Russia, Switzerland and UAE, he is the group’s chief revenue officer. Fuller biographies of management are given on page 16.

EQS’s own ESG priorities edit edit source

EQS provides products and services that facilitate the good governance of other corporate entities and corporate integrity is at the heart of its operating culture. It has recently published its own maiden ESG report. As part of this, management has committed to the UN Sustainable Development Goals of

- Gender equality

- Decent work and economic growth

- Responsible consumption and production

- Climate action

- Peace, justice and strong institutions

Edison Investment Research would particularly draw attention to the sustainability goals set out on pages 35–36 of the report, which highlights the intention to link management remuneration to meeting the set ESG criteria.

Sensitivities edit edit source

The key sensitivity currently is the success or otherwise of the conversion of the sales pipeline for the whistleblowing and subsequent conversion into broader client status, as illustrated in Exhibit 5. Delays to the roll-out of this legislation across the EU have already had a short-term negative impact on revenues and the exact timing will influence EQS’s quarterly financial results over the next year or so.

While all businesses have been affected by the COVID-19 pandemic, the effect on EQS was not entirely detrimental. The transition to working from home was comparatively straightforward, as might be expected. While there were some drawbacks in terms of slower sales conversion cycles, there were also benefits. These included the boost to virtual meeting hosting within the IR offering, with virtual AGMs allowed for the first time under German company law. Management anticipates some benefit from this experience to be retained as conditions revert, given the advantages of cost and additional reach.

There are various other factors that will influence EQS’s financial performance, each of which may vary considerably across the operating territories. These include:

- The number of listed companies, itself a factor of the environment for de-listings and/or IPOs. The European IPO market remains challenging, following a stronger, catch-up year in FY21. Q122 saw just 28 IPOs raising £2.7bn versus 89 in Q121 raising £23.1bn (Source: PwC).

- The number of companies of sufficient scale to benefit from automation of reporting.

- Corporate activity that prompts the need for information dissemination.

- The regulatory environment – the more complex the system and the greater the number and extent of changes to those systems, the greater the requirement for corporates to access relevant expertise. The introduction of additional regulation, such as that for whistleblowing and that proposed for ESG reporting, can create a new market, while others like market abuse regulations can reinvigorate previously dull markets.

- Requirements for corporates to make information available in a digital format, either through regulation or user demand.

- Data security, including the General Data Protection Regulation, can restrict competition from providers that do not have similar levels of auditory clearance, or which may not hold their data within the relevant jurisdiction, and sets a higher barrier to entry.

- Currency: around 28% of revenues are generated in currencies other than the euro, mostly in hard currencies such as the Swiss franc, sterling, Hong Kong dollar and the US dollar. Expenses are predominantly in Euro. Currency exposure is not hedged, as the main impact is on valuation, a non-cash item. In FY21, the net financial benefit from currency translation was €722k, versus a loss of €205k in FY20.

Valuation edit edit source

The current restraints on profitability stemming from the investment programme make conventional peer-based valuation less useful, so Edison Investment Research supplements this with a DCF-based approach.

Peer context edit edit source

As the internal investment is continuing to affect profitability, the most reliable of the traditional multiples is EV/Revenue (although Edison Investment Research also shows EV/EBITDA and P/E). There is a wide range of multiples for the financial software peer group. For FY1, EQS is trading at 6.6x sales versus the average for the peer group of 8.5x.

| Price (reporting currency) | Market | YTD | EV/ Sales (x) | EV/EBITDA (x) | PE (x) | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| cap (m) | % | FY0 | FY1 | FY2 | FY0 | FY1 | FY2 | FY0 | FY1 | FY2 | ||

| Euromoney (£) | 1086 | 1,169 | 17 | 3.7 | 3.1 | 2.8 | 15.4 | 12.7 | 10.7 | 23.7 | 19.5 | 16.5 |

| Thomson Reuters (U$) | 126.44 | 61,592 | -16 | 8.1 | 7.7 | 7.3 | 26 | 22.2 | 18.4 | 50.3 | 40.3 | 29.7 |

| Envestnet (U$) | 54.14 | 2,988 | -32 | 2.9 | 2.6 | 2.3 | 13.3 | 13.7 | 11.1 | 22.4 | 25 | 19.7 |

| Swissquote Group (€) | 101.5 | 1,544 | -49 | 8.8 | 9.1 | 8.1 | 17.3 | 14.9 | 9.3 | 9.1 | 8.1 | |

| Globaldata (£) | 1085 | 1,264 | -24 | 7.9 | 6.7 | 6.3 | 23.2 | 19.6 | 17.2 | 32 | 27.5 | 23.9 |

| MSCI (U$) | 397.39 | 32,237 | -35 | 17.5 | 15.5 | 14 | 29.85 | 27.2 | 24.4 | 39.9 | 34.9 | 30.4 |

| S&P Global (U$) | 321.3 | 109,223 | -32 | 14.4 | 9.7 | 8.9 | 25.7 | 19.4 | 17.3 | 23.5 | 25.7 | 21.5 |

| Marketaxess Holding (U$) | 270.04 | 10,192 | -34 | 14.1 | 13 | 11.6 | 22.3 | 21.1 | 21.9 | 39.9 | 38.2 | 33.6 |

| Average | -26 | 9.7 | 8.4 | 7.7 | 22.3 | 19.2 | 17.0 | 30.1 | 27.5 | 22.9 | ||

| Median | -32 | 8.5 | 8.4 | 7.7 | 23.2 | 19.5 | 17.3 | 27.9 | 26.6 | 22.7 | ||

| EQS (€) | 29.3 | 294.0 | -32 | 8.5 | 6.4 | 4.6 | 67.6 | 184.6 | 42.9 | N/A | N/A | 42.8 |

| Premium/(discount) | 1% | -24% | -40% | 204% | 864% | 152% | N/A | N/A | 87% | |||

| Application software peers | -27 | 4.2 | 3.6 | 3.3 | 19.7 | 17.9 | 14.0 | 29.2 | 27.5 | 26.2 | ||

| Premium/(discount) | 103% | 78% | 39% | 243% | 931% | 206% | N/A | N/A | N/A | |||

Edison Investment Research has also looked at a broader global set of quoted application software peers, which are, in general, rated at roughly 50% lower across EV/Revenue, EV/EBITDA and P/E. EQS shares trade at valuation between the two groups (financial software peers and application software peers) on FY1 and FY2 EV/Revenue. As would be expected by the suppression of short-term profitability to boost the longer-term potential, EQS trades at a considerable premium on EV/EBITDA (and for FY2 P/E) across both peer sets.

For illustrative purposes, closing the discount on FY2 EV/Revenue would imply a share price of €51. Obviously, the relatively small scale and early stage of business development warrant a considerable discount. A 25% discount, for example, would imply a share price of €38.35, which is still 31% above the level at which the shares are currently trading.

DCF also points to value above current price edit edit source

Management has outlined its views on the medium-term revenue growth outlook, with Compliance growing at a CAGR of 34% from FY21 through to FY25 and IR growing at a more modest 13%. From the current mix (and assuming no further M&A), this equates to group revenue growth of 27%. On the basis of this forecast, management anticipates EBITDA margins exceeding 30% by the end of the forecast period.

In view of the rising interest rates globally, and not for any company-specific reasons, Edison Investment Research has increased the WACC at which Edison Investment Research calculates the DCF from 8% to 9%. If Edison Investment Research applies these assumptions to the DCF, assume that margins are sustainable at that level and that growth tails off by 200bp per year beyond FY25e simply through scale, then at a WACC of 9% and a terminal growth rate of 2%, the implied value per share is €47.66. In April, at the lower WACC, Edison Investment Research derived a figure of €57.93. Obviously, there is an element of execution risk here, with the bulk of the value accruing well beyond Edison's explicit forecast period (to FY23e).

| Terminal growth rate | ||||||

| 0.00% | 1.00% | 2.00% | 3.00% | 4.00% | ||

| WACC | 12.50% | 25.28 | 26.49 | 27.93 | 29.68 | 31.84 |

| 12.00% | 26.83 | 28.21 | 29.86 | 31.89 | 34.41 | |

| 11.50% | 28.53 | 30.11 | 32.01 | 34.36 | 37.34 | |

| 11.00% | 30.41 | 32.21 | 34.41 | 37.17 | 40.71 | |

| 10.50% | 32.47 | 34.55 | 37.11 | 40.36 | 44.61 | |

| 10.00% | 34.76 | 37.17 | 40.17 | 44.03 | 49.18 | |

| 9.50% | 37.32 | 40.11 | 43.66 | 48.29 | 54.61 | |

| 9.00% | 40.17 | 43.45 | 47.66 | 53.28 | 61.14 | |

| 8.50% | 43.39 | 47.26 | 52.31 | 59.21 | 69.17 | |

| 8.00% | 47.03 | 51.63 | 57.77 | 66.36 | 79.24 | |

Financials edit edit source

EQS’s Q122 figures showed revenues ahead by 34% to €14.11m, with the growth boosted by the inclusion of the revenues generated by Business Keeper (a previous acquisition, Got Ethics, was consolidated from January 2021 and is therefore included in the comparative figure). Stripping Business Keeper revenues out, the organic growth rate was nearer 7%. In normal trading, this would be a disappointing degree of progress, but it should be remembered that the group is very focused on driving sales in whistleblowing solutions and these, as explained above, have been slow with the timing slippage on the implementation of the legislation.

These factors have led management to narrow the range of expectations for revenue growth for the FY22 year from 30–50% to 30–40% growth, equivalent to €65–75m moving to €65–70m. Edison Investment Research's previous estimate was for €70m, which now lies at the top end of the range. Provided that the German whistleblowing legislation does proceed as currently anticipated, Edison Investment Research is comfortable with maintaining its forecast at this level.

With the Q122 results, the group provided some valuable insight into the client recruitment process, timescales and costings, summarised in Exhibit 8 below. As this is styled ’fast track’, Edison Investment Research imagines that it is not always so straightforward. What is clear though is the length of the expected retention, which reflects how complex it can be to switch suppliers once the systems are embedded. The €67k lifetime value is calculated using Q122 data, taking an average ARR of €4.3k for those 25 years, building in an annual inflationary increase of 3% and discounting at 8%, with a 4% churn rate built-in.

| Stages | Awareness | Consideration | Acquisition | Lifetime value |

|---|---|---|---|---|

| Touchpoints | Paid search | Landing page | Demo | |

| Website | Product page | Negotiation | ||

| Demo request | Signing | |||

| Timeframe | 2 weeks | 1 week | 2 weeks | 25 years |

| Cost attribution | €760 | €560 | €1,120 | €67,000 |

Using the less-optimised cost of customer acquisition achieved in Q122 of around €11k, the ratio of lifetime value to acquisition cost is 6.1x, as shown in the Q122 results presentation. With scale, it is not unreasonable to suggest that customer acquisition costs should fall (at least until the market is highly penetrated), lifting this ratio further.

| €m | Q122 | Q121 | % change | Full year guidance | |

|---|---|---|---|---|---|

| Investor Relations revenues | |||||

| Cloud-products | 2.56 | 2.20 | 16% | ||

| Service-products | 2.25 | 2.68 | -16% | ||

| Total Investor Relations | 4.81 | 4.88 | -1% | ||

| Compliance revenues | |||||

| Cloud-products | 7.19 | 3.53 | 104% | ||

| Service-products | 2.12 | 2.14 | -1% | ||

| Total Compliance | 9.31 | 5.67 | 64% | ||

| Group revenues | 14.12 | 10.55 | 34% | +30–40% | |

| EBITDA | 0.25 | 0.31 | -19% | €6–10m | |

| EBIT | (1.77) | (0.97) | 83% | ||

| Personnel expenses | 9.41 | 7.05 | 34% | ||

| New SaaS customers | 216 | 158 | 37% | 2,500–3,500 | |

| Total customers | 4,405 | 3,260 | 35% | ||

| New ARR | 1.81 | 1.44 | 26% | €11.0–16.0m | |

| ARR | 12.1 | 10.5 | 15% |

EBITDA performance in Q122 was in fact better than anticipated, reflecting lower costs as pressure was taken off the sales and marketing pedals as the urgency of tackling the German opportunity dissipated with the legislative delays.

As can be seen in Exhibit 9 above, personnel expenses are the group’s largest expense item at 67% of Q122 revenue, with the year-on-year comparison reflecting the additional employees from last year’s acquisition of Business Keeper. ‘Other’ expenses in Q122 of €2.79m including €0.6m of consulting costs relating to the fundraise in March. Excluding this additional consulting cost, the increase in other expenses was 31%, more in line with the underlying growth in group revenue.

Guidance for new ARR and for EBITDA were maintained at €11–16m and €6–10m respectively and Edison Investment Research is also holding its EBITDA revenue forecast at €7.5m, which falls in the lower half of the range, implying a slightly more cautious assumption on margin.

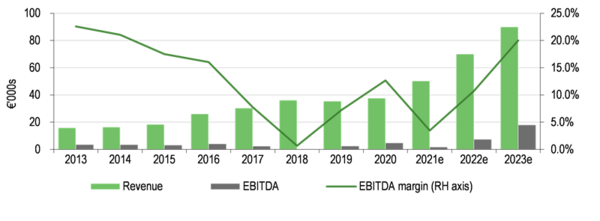

Exhibit 10: Historical revenue progression and forecast by segment[7]

| Year end December (€k) | FY19 | FY20 | FY21 | FY22e | FY23e |

|---|---|---|---|---|---|

| Investor Relations | |||||

| Cloud-products | 5,286 | 7,849 | 9,504 | 11,642 | 13,680 |

| Growth (%) | 0% | 48% | 21% | 23% | 18% |

| Service-products | 8,717 | 9,818 | 10,012 | 10,513 | 11,038 |

| Growth (%) | 0% | 13% | 2% | 5% | 5% |

| Discontinued operation (ARIVA.DE AG) | 2,072 | 0 | 0 | 0 | 0 |

| Total Investor Relations | 16,075 | 17,667 | 19,516 | 22,155 | 24,718 |

| Growth (%) | 10% | 10% | 14% | 12% | |

| Like-for-like growth (%) | 26% | ||||

| Compliance | |||||

| Cloud-products | 9,332 | 10,696 | 19,826 | 34,244 | 48,280 |

| growth (%) | 0% | 15% | 85% | 73% | 41% |

| Service-products | 8,535 | 9,273 | 10,881 | 13,601 | 17,002 |

| Growth (%) | 0% | 9% | 17% | 25% | 25% |

| Discontinued operation (ARIVA.DE AG) | 1,425 | 0 | 0 | 0 | 0 |

| Total Compliance | 19,292 | 19,969 | 30,707 | 47,845 | 65,282 |

| Growth (%) | 4% | 54% | 56% | 36% | |

| Like-for-like growth (%) | 12% | ||||

| Group revenue | 35,367 | 37,636 | 50,223 | 70,000 | 90,000 |

| growth | 6% | 33% | 39% | 29% | |

| Like-for-like growth (%) | 18% | 14% | |||

| EBITDA | 2,554 | 4,760 | 1,742 | 7,500 | 18,000 |

| Growth (%) | 86% | -63% | +331% | +140% | |

| EBITDA margin (%) | 7.2% | 12.6% | 3.5% | 10.7% | 20.0% |

Management’s medium-term guidance is for IR revenues to build at a CAGR of 13% over FY21–25e. This seems reasonable in ‘normal’ capital markets, with the ongoing migration to digital methodologies within business and continuing progress in cross-selling products within the IR COCKPIT.

Exhibit 12: IR segment growth target[3]

Exhibit 13: Compliance segment growth target[3]

The growth forecast in the Compliance segment combines organic growth at a CAGR of 22% FY21–25e, with the addition of (growing) Business Keeper revenues coupled with synergies quantified by management at €5–10m to FY25e.

Exhibit 14: Long-term revenue and EBITDA record and forecasts[7]

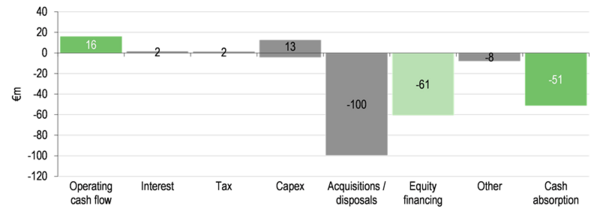

Cash flow dominated by M&A edit edit source

With the emphasis on recurring revenues, the underlying cash requirements of the business are relatively modest and the broad spread of clients with relatively small contract values minimises the credit risk. The comparatively low level of operating cash flow is really just a reflection of the concentration of resource into investing to build out the medium and longer-term prospects.

This is clearly shown in the aggregation exercise below where Edison Investment Research has looked at the sources and uses of cash for the five years FY17–21, where the scale of the M&A is apparent. As indicated above, Business Keeper was the largest acquisition to date by some margin, at a cost of €95m, of which €80m was paid in FY21 with the balance due in FY22.

Exhibit 15: Sources and uses of cash FY17–21[7]

During FY21, the group raised €43.9m in three capital raises, in February, July and December. These were for €13.6m at €38.00 per share, €22.4m at €38.00 and €7.7m at €41.00.

During Q122, the group carried out a further fund-raise of €45m gross, in part to facilitate the requirements of a new prospective cornerstone investor, Gerlin NV’s Teslin fund. To satisfy this, the deal was structured to be underwritten by other key investors, which only subscribed to the extent that, with a rump placing, they would end up where they wanted to be, thereby avoiding dilution. So, although visually a take up of 9.7% looks poor, this does not represent the underlying degree of support from existing shareholders. Gerlin took 42% of the issue and now has a 6.1% holding in the enlarged equity.

The other advantage of the transaction was that it did not require the major input of investment bankers, saving €2–3m on the deal.

An additional element of the rationale for this latest placing was to contribute to the funding of the potential proposed acquisition of a German firm (DFGE) in the ESG reporting space. This deal did not come to fruition due to differing expectations of the two parties (the then target has more of a consulting ethos), but future collaboration remains on the cards. The funds originally earmarked for this have been reallocated to the ongoing investment in whistleblowing plus the internal development of the ESG offering.

Reinforced balance sheet edit edit source

The proceeds of the recent placing are being applied to the repayment of bridging finance (ie a €50m loan from Commerzbank with a 12-month term from June 2021), with a refinancing underway that will provide a more suitable financial structure for an acquisitive, growth company.

This is particularly important to get right if management is to capitalise on the further opportunity in ESG cloud-based products for the corporate market.

At end Q122, net debt was €27.83m, down from €74.37m at the end of FY21. This figure includes lease liabilities. Stripping these out, net debt would be €22.33m (end FY21: €68.34m). Edison Investment Research's current modelling indicates a figure for end FY22e of €47.2m including leases, post the payment of the €15m of deferred consideration for Business Keeper. This represents net debt/EBITDA of 6.3x and gearing of 15%.

| €'000s | 2020 | 2021 | 2022e | 2023e | ||

| Year end 31 December | IFRS | IFRS | IFRS | IFRS | ||

| INCOME STATEMENT | ||||||

| Revenue | 37,636 | 50,223 | 70,000 | 90,000 | ||

| Cost of Sales | 0 | 0 | 0 | 0 | ||

| Gross Profit | 37,636 | 50,223 | 70,000 | 90,000 | ||

| EBITDA | 4,760 | 1,742 | 7,500 | 18,000 | ||

| Operating Profit (before amort. and excepts.) | 819 | (4,417) | 1,517 | 12,018 | ||

| Amortisation of acquired intangibles | (656) | (1,090) | (1,150) | (1,149) | ||

| Exceptionals | 0 | 110 | 0 | 0 | ||

| Share-based payments | 0 | 0 | 0 | 0 | ||

| Reported operating profit | 163 | (5,397) | 367 | 10,869 | ||

| Net Interest | (396) | (1,461) | (1,530) | (1,459) | ||

| Joint ventures & associates (post tax) | 0 | 0 | 0 | 0 | ||

| Exceptionals | 0 | 0 | 0 | 0 | ||

| Profit Before Tax (norm) | 423 | (5,878) | (13) | 10,559 | ||

| Profit Before Tax (reported) | (233) | (6,858) | (1,163) | 9,410 | ||

| Reported tax | (599) | 229 | 407 | (3,293) | ||

| Profit After Tax (norm) | 296 | (5,682) | (9) | 6,863 | ||

| Profit After Tax (reported) | (832) | (6,629) | (756) | 6,116 | ||

| Minority interests | (34) | 0 | 0 | 0 | ||

| Discontinued operations | 0 | 0 | 0 | 0 | ||

| Net income (normalised) | 296 | (5,682) | (9) | 6,863 | ||

| Net income (reported) | (866) | (6,629) | (756) | 6,116 | ||

| Average Number of Shares Outstanding (m) | 7.2 | 8.1 | 10.0 | 10.0 | ||

| EPS - normalised (€) | 0.04 | (0.70) | (0.00) | 0.68 | ||

| EPS - normalised fully diluted (c) | 4.12 | (69.77) | (0.08) | 68.47 | ||

| EPS - basic reported (€) | (0.12) | (0.81) | (0.08) | 0.61 | ||

| Dividend per share (c) | 0.00 | 0.00 | 0.00 | 0.00 | ||

| Revenue growth (%) | 6.4 | 33.4 | 39.4 | 28.6 | ||

| EBITDA Margin (%) | 12.6 | 3.5 | 10.7 | 20.0 | ||

| Normalised Operating Margin (%) | 2.2 | (8.8) | 2.2 | 13.4 | ||

| BALANCE SHEET | ||||||

| Fixed Assets | 39,007 | 168,468 | 167,934 | 178,614 | ||

| Intangible Assets | 31,016 | 160,386 | 160,342 | 172,685 | ||

| Tangible Assets | 7,216 | 7,351 | 6,813 | 4,975 | ||

| Investments & other | 775 | 731 | 779 | 954 | ||

| Current Assets | 17,086 | 18,369 | 36,092 | 42,681 | ||

| Stocks | 0 | 0 | 0 | 0 | ||

| Debtors | 3,923 | 7,018 | 9,589 | 12,082 | ||

| Cash & cash equivalents | 12,074 | 8,653 | 23,806 | 27,902 | ||

| Other | 1,089 | 2,697 | 2,697 | 2,697 | ||

| Current Liabilities | (12,381) | (89,171) | (80,698) | (71,365) | ||

| Creditors | (2,747) | (3,197) | (3,515) | (4,270) | ||

| Tax and social security | (56) | (214) | (552) | (552) | ||

| Short term borrowings (includes lease debt) | (3,278) | (73,095) | (61,095) | (61,095) | ||

| Other | (6,300) | (12,665) | (15,536) | (5,448) | ||

| Long Term Liabilities | (10,768) | (27,426) | (22,438) | (29,438) | ||

| Long term borrowings (includes lease debt) | (7,641) | (9,927) | (7,423) | (14,423) | ||

| Other long term liabilities | (3,127) | (17,499) | (15,015) | (15,015) | ||

| Net Assets | 32,943 | 70,240 | 100,890 | 120,492 | ||

| Minority interests | 0 | 0 | 0 | 0 | ||

| Shareholders' equity | 32,943 | 70,240 | 100,890 | 120,492 | ||

| CASH FLOW | ||||||

| Operating Cash Flow | 3,765 | (1,306) | 4,627 | 11,498 | ||

| Working capital | 1,294 | (1,149) | (2,253) | (1,738) | ||

| Exceptional & other | 1,037 | 4,721 | 1,175 | 4,806 | ||

| Tax | (154) | (229) | 407 | (3,293) | ||

| Operating Cash Flow | 5,942 | 2,037 | 3,956 | 11,273 | ||

| Capex | (2,008) | (3,149) | (3,250) | (3,250) | ||

| Acquisitions/disposals | 0 | (96,428) | (15,000) | (7,000) | ||

| Net interest | (157) | (1,636) | 0 | 0 | ||

| Equity financing | 9,124 | 43,929 | 45,374 | 0 | ||

| Dividends | 0 | 0 | 0 | 0 | ||

| Other | 414 | (2,772) | (3,927) | (3,927) | ||

| Net Cash Flow | 13,315 | (58,019) | 27,153 | (2,904) | ||

| Opening net debt/(cash) including lease liabilities | 13,472 | (1,155) | 74,370 | 47,217 | ||

| FX | (199) | 126 | 0 | 0 | ||

| Other non-cash movements | 1,511 | (17,631) | 0 | 0 | ||

| Closing net debt/(cash) including lease liabilities | (1,155) | 74,370 | 47,217 | 50,122 |

Management team edit edit source

CRO: Marcus Sultzer

In July 2018, Marcus became the chief revenue officer of EQS Group and is responsible for global revenues and marketing. Marcus joined EQS Group in 2007 and has taken a leading role in its international expansion. From 2009 to 2012, he was based in Moscow, starting and developing the group’s Russian operations. This was followed by a four-year chapter in Asia in a similar role. Marcus studied economics and holds an MBA.

| Principal shareholders | (%) |

| Investm. F. Langfr. Inv. | 24.0 |

| Achim Weick (CEO) | 15.3 |

| Danske Bank | 6.7 |

| Gerlin NV | 6.1 |

| Berenberg European Micro | 3.2 |

| ProfitlichSchmidlin Fonds UI | 3.1 |

References edit edit source

- ↑ Note: *PBT and EPS are normalised, excluding amortisation of acquired intangibles, exceptional items and share-based payments.

- ↑ 2.0 2.1 Source: EQS Group accounts.

- ↑ 3.0 3.1 3.2 3.3 3.4 3.5 Source: EQS Group.

- ↑ Source: EQS Group, Edison Investment Research.

- ↑ Source: Refinitiv. Note: Prices as at 16 June 2022.

- ↑ Source: Edison Investment Research.

- ↑ 7.0 7.1 7.2 7.3 Source: EQS Group accounts, Edison Investment Research.

- ↑ Source: Company accounts, Edison Investment Research.