Edinburgh Worldwide Investment Trust plc

Summary[1] edit edit source

ISIN Number: GB00BHSRZC82

SEDOL Number: BHSRZC8

1) Executive summary

The Edinburgh Worldwide Investment Trust, established in 1998, is a globally focused investment trust designed to provide investors with exposure to innovative and dynamic companies worldwide. Managed by experienced professionals, the trust seeks long-term capital growth by investing in companies with market caps under £4 billion, focusing on disruptive technologies and growth potential within the Global Smaller Companies sector. It invests in public equity markets across the globe. The fund seeks to invest in stocks of companies that are operating across diversified sectors. The fund benchmarks the performance of its portfolio against the MSCI All Countries World Index. Edinburgh Worldwide Investment Trust plc was formed in 1998 and is domiciled in the United Kingdom. The trust is managed by Baillie Gifford & Co Limited, and as of June 30, 2023, total assets of £802,524,045.74.

The trust's business model centres around investing in a diversified portfolio of innovative companies with potential for growth. The aim is to identify companies with disruptive technologies and growth opportunities across sectors and regions. Historical performance reveals a 10-year growth of 98%, with a notable increase in 2020-2021. Morningstar's 2-star rating based on historical returns suggests room for improvement.

A current low Net Asset Value (NAV) presents an attractive entry point for investors as it is currently trading at a discount, potentially leading to future value appreciation. However, the long-term nature of this investment, with a horizon of 10+ years, emphasises careful consideration. The trust's historical 10-year growth averaged 9%.

In conclusion, the Edinburgh Worldwide Investment Trust offers exposure to innovative companies in the global smaller companies' sector. Balancing potential growth with associated risks is crucial in assessing this opportunity. The trust's historical performance, future prospects, and the inherent risk profile should be meticulously evaluated before making an investment commitment. If you are looking for a risky addition in breakthrough technologies to your portfolio this could be a prospective fund given current valuation.

2) Introduction to the company (what they do, history, markets they operate in etc)

Started in 1998, the Edinburgh Worldwide Investment Trust is a globally focused investment trust designed to provide investors with exposure to dynamic and innovative companies across various sectors and regions around the world. Managed by experienced investment professionals, the trust aims to achieve long-term capital growth by investing in companies with a market cap of under £4 billion that are exhibiting strong growth potential, disruptive technologies, with all these businesses falling primarily within the AIC Investment Sector; Global Smaller Companies.

3) Details of the business model

The trust appointed Baillie Gifford & Co Limited (subsidiary of Baillie Gifford), as its primary fund manager. As of 30/06/2023 the trusts total assets stood at £802,524,045.74 with shareholders' funds equating for £703,426,841, approximately 88%.

From figure 1, 41% of the total trust's assets are invested in 10 companies with three of them having over 5% share:

SpaceX (Space Exploration Technologies Corp.): SpaceX is a pioneering private aerospace manufacturer founded by Elon Musk. It's known for innovations like reusable rockets and the Falcon and Starship spacecraft. The company aims to make space travel more accessible and affordable, with aspirations to reach Mars.

Alnylam Pharmaceuticals: Alnylam focuses on RNA interference (RNAi) therapeutics, using a cutting-edge approach to target disease-causing genes. Its innovative treatments have potential for rare genetic disorders, offering hope for patients who previously had limited treatment options.

Exact Sciences: Exact Sciences specializes in early cancer detection through non-invasive methods. Its flagship product, Cologuard, detects colorectal cancer and precancerous growths from stool samples. The company's technology underscores the importance of accessible and effective cancer screening methods.

This equates to roughly £329,034,859 invested in just ten companies. This can seem intimidating however the general benchmark for an individual stock percentage as part of portfolio is 5-10%, thus this trust appears to have successfully diversified their portfolio amongst a range of stocks and industries. However, as you can see from the descriptions above, these are all immature firms.

4) Industry overview

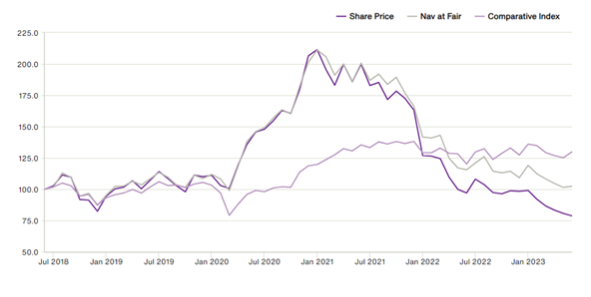

Figure 2 shows the share price, NAV at fair value and comparative index for the last 5 years. Most of this time the share price and NAV have traded within a similar range, but for the last year the range has widened, and the share price is trading at a 20% discount. This could make a good entry position for a willing investor.

The 2020/21 spike in evaluation has been attributed to Covid related “Winners” and the sharp decline attributed to market shift from growth stocks to traditional cyclical stocks.

EWI’s comparative index is the S&P Global Small Cap, and as indicated in figure 2 the fund have provided less growth in the five year cycle. It should be noted that Morningstar have downgraded EWI from three to two star and are not convinced this fund will beat the comparative index.

5) Where do you see the company / market going (new technology, changing landscape, political factors perhaps)

NAV value low indicating good time to invest. At the current price it is a good entry level position. Future value could rise as the low NAV value may make the stock appear as a lucrative investment. It should be noted, given the risk profile, that this is a long-term investment (10+ years).

Future growth is hard to predict and forecast, but management are not changing their longer term strategy and feel their portfolio is well position for the longer term. With many of the firms expected to grow the fund may benefit and grow as the companies do.

6) Financials

In figure 2, the historical 10-year performance of this fund it has had a 9% average annual increase, in this current climate, this could be considered average. With rising interest rates, banks are boasting higher returns to their clients on basic no-risk savings accounts, thus ponders the question, is the opportunity cost of a 1% - 3% higher return worth the risk? In the past it would be a lucrative investment option, as you can see from the approximate 500% increase from 2018 to 2020.

Return on assets (ROA) has experienced significant decline over the last 4 years, averaging -16.14%. Return on equity (ROE) and Return on investment is similar with -17.97%. This indicates that the trust unprofitable , however as we know that they are invested in immature firms, this figure may represent less of a issue.

7) Risks and considerations

When considering the risks of the fund, the individual companies must be considered. For EWI, primarily all these companies are startups, this means they are all likely heavily reliant on capital inputs (e.g., loans) for them to maintain a healthy cash flow and not encounter any liquidity issues. Around a third of the portfolio comprises firms that are not yet making a profit. With the current climate of high/rising interest rates, its likely these firms will be undergoing higher interest repayments. Higher interest repayments combined with firms not making a profit, increases the likelihood of defaults on loans and increasing the risk of startups failing. Should this occur, the value of the trust will fall as all investment into that company will be lost, bringing down the overall value of the trust.

What you are unable to see from the overview, is that all these firms are ‘risky’ stocks in their own right. They are all either, recent startups or companies still coming into maturity, e.g., Space Exploration Technologies. This can be deemed as risky, as a significant percentage of startups fail, especially ones with such high barriers to entry industries, such as space and pharmaceuticals.

The current fund beta of EWI stands at 0.8944, this indicates the fund has less momentum than the average S&P 500 fund. Despite many of the stocks within this fund being deemed risky, the fund still maintains a beta that is consistent with a portfolio that is less volatile than the market.

References and notes edit edit source

- ↑ Source: Yahoo Finance.