Eli Lilly and Company

Overview & Background edit edit source

Overview

Eli Lilly and Company was founded in 1876 by Colonel Eli Lilly, a Civil War veteran and pharmacist. The company's original idea was to create high-quality, affordable medicines that would help people live healthier lives.

Lilly's first product was a pain reliever called Extract of Opium, which was sold under the brand name Lilly's Anodyne. The company quickly grew, and by the early 1900s, it was one of the leading pharmaceutical companies in the United States.

In the 1920s, Lilly developed insulin, a life-saving treatment for diabetes. Insulin was a major breakthrough, and it helped to solidify Lilly's reputation as a leading pharmaceutical company.

In the years since, Lilly has continued to innovate and develop new medicines. The company has also expanded its operations to other countries, and it is now a global pharmaceutical leader.

Idea

The idea behind Eli Lilly is to create high-quality, affordable medicines that help people live healthier lives. The company is committed to research and development, and it is constantly working to develop new treatments for diseases.

Lilly also believes in the importance of partnerships. The company collaborates with other pharmaceutical companies, academic institutions, and government agencies to accelerate the development of new medicines.

Mission Statement

The mission statement of Eli Lilly is to "create medicines that make life better." The company is committed to developing innovative medicines that address unmet medical needs. Lilly also believes in the importance of patient care, and it is committed to providing patients with access to high-quality medicines.

Here are some of the specific ways that Lilly is working to make life better:

- Developing new treatments for diseases such as cancer, diabetes, and Alzheimer's disease.

- Making medicines more affordable for patients.

- Improving the patient experience through patient support programs and educational resources.

- Advocating for policies that support innovation in the pharmaceutical industry.

Eli Lilly is committed to making a difference in the lives of patients around the world. The company is working to create a healthier future for everyone. Over the years it has become a global company with operations in over 125 countries. The company's headquarters are located in Indianapolis, Indiana.

In addition to its pharmaceutical business, Eli Lilly also has a philanthropic arm called the Lilly Endowment. The endowment supports a variety of charitable causes, including education, healthcare, and the arts.

Segments

Eli Lilly operates in three segments:

- Human Healthcare: This segment develops and markets medicines for a variety of diseases, including cancer, diabetes, and autoimmune disorders.

- Animal Health: This segment develops and markets medicines for livestock and companion animals.

- Biosimilars and Insulin: This segment develops and markets biosimilars, which are copies of biologic drugs, and insulin, a hormone that helps regulate blood sugar levels.

Revenue breakdown by segment edit edit source

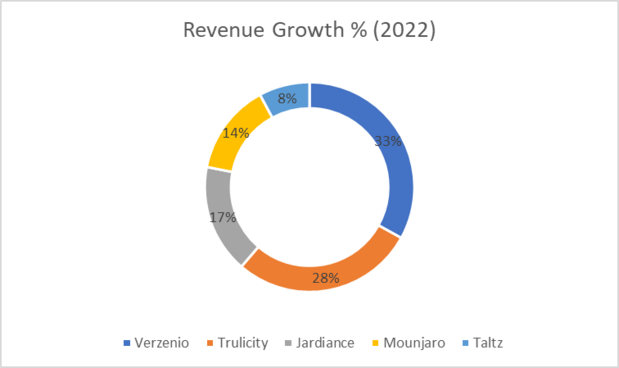

Human Healthcare: This segment generated $26.2 billion in revenue in 2022, accounting for 87% of the company's total revenue. The top-selling products in this segment were Trulicity, a diabetes drug, and Verzenio, a breast cancer drug.

| Product | Revenue Growth (USD millions) |

|---|---|

| Verzenio | 1133.6 |

| Trulicity | 967.8 |

| Jardiance | 575.3 |

| Mounjaro | 482.5 |

| Taltz | 269.2 |

Animal Health: This segment generated $1.5 billion in revenue in 2022, accounting for 5% of the company's total revenue. The top-selling products in this segment were Prascend, a treatment for equine Cushing's disease, and Zyess, a treatment for glaucoma in dogs.

Biosimilars and Insulin: This segment generated $2.3 billion in revenue in 2022, accounting for 8% of the company's total revenue. The top-selling products in this segment were Basaglar, a biosimilar version of Lantus, and Humalog, an insulin analogue.

Eli Lilly's revenue from the Human Healthcare segment has been growing steadily in recent years, driven by the success of new products such as Trulicity and Verzenio. The Animal Health segment has also been growing, albeit at a slower pace. The Biosimilars and Insulin segment is still relatively small, but it is expected to grow in the coming years.

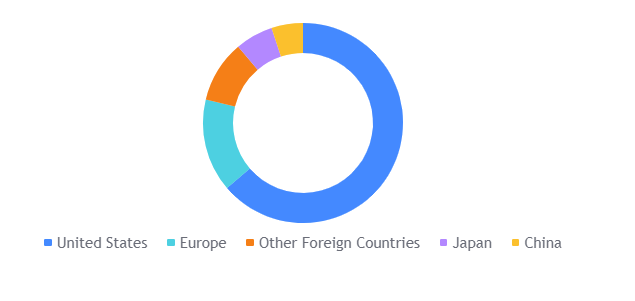

Revenue breakdown by market (2022):

- United States: The United States was Eli Lilly's largest market in 2022, generating $15.8 billion in revenue, or 56% of the company's total revenue.

- Europe: Europe was the second largest market for Eli Lilly in 2022, generating $6.7 billion in revenue, or 23% of the company's total revenue.

- Japan: Japan was the third largest market for Eli Lilly in 2022, generating $2.8 billion in revenue, or 9% of the company's total revenue.

- China: China was the fourth largest market for Eli Lilly in 2022, generating $1.7 billion in revenue, or 6% of the company's total revenue.

- Rest of the World: The Rest of the World (ROW) was the fifth largest market for Eli Lilly in 2022, generating $2.2 billion in revenue, or 7% of the company's total revenue.

| Market | Revenue (in billions of USD) | Percentage of total revenue |

|---|---|---|

| United States | 15.8 | 56% |

| Europe | 6.7 | 23% |

| Japan | 2.8 | 9% |

| China | 1.7 | 6% |

| Rest of the World | 2.2 | 7% |

Eli Lilly's revenue from the United States has been declining in recent years, due to increasing competition from generic drugs. However, the company's revenue from Europe, Japan, and China has been growing. Eli Lilly is also expanding its presence in the ROW, particularly in emerging markets such as India and Brazil.

Overall, Eli Lilly is a global pharmaceutical company with a strong presence in the United States, Europe, Japan, and China. The company is well-positioned to continue growing in the years to come, driven by the expansion of its presence in emerging markets and the launch of new products.

DCF Valuation edit edit source

| Unlevered Free Cash Flow (mn) | Net Working Capital (mn) | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E | Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E | |

| Revenue | 24,556 | 22,320 | 24,540 | 28,318 | 28,541 | 29,516 | 30,772 | 32,082 | 33,447 | 34,871 | Accounts Receivables | 6,205 | 5,542 | 6,929 | 8,127 | 8,559 | 8,088 | 8,433 | 8,792 | 9,166 | 9,556 | |

| COGS | (6,430) | (4,721) | (5,483) | (7,313) | (6,630) | (6,561) | (7,307) | (7,618) | (7,943) | (8,281) | Merchandise Inventory | 4,112 | 17,641 | 18,536 | 19,621 | 24,388 | 18,527 | 20,633 | 21,512 | 22,427 | 23,382 | |

| Gross Profit | 18,126 | 17,598 | 19,057 | 21,006 | 21,912 | 22,954 | 23,464 | 24,463 | 25,505 | 26,590 | Other Current Assets | 2,147 | 2,539 | 2,872 | 2,531 | 2,954 | 3,017 | 3,145 | 3,279 | 3,419 | 3,564 | |

| Operating Expenses | (5,307) | (5,595) | (6,086) | (7,026) | (7,191) | (8,140) | (7,477) | (7,795) | (8,127) | (8,473) | Current Assets (without cash) | 12,463 | 25,721 | 28,337 | 30,279 | 35,901 | 29,632 | 32,211 | 33,582 | 35,012 | 36,502 | |

| Selling, General, Administrative | (6,390) | (6,004) | (5,869) | (6,142) | (6,068) | (6,515) | (7,372) | (7,686) | (8,013) | (8,354) | ||||||||||||

| Total Operating Expenses | (11,697) | (11,599) | (11,955) | (13,168) | (13,258) | (14,656) | (14,849) | (15,481) | (16,140) | (16,827) | Accounts Payable and Accrued Expenses,Current | 7,489 | 7,171 | 8,725 | 9,529 | 12,207 | 9,736 | 10,843 | 11,304 | 11,786 | 12,287 | |

| Operating Profit (EBITDA) | 6,429 | 5,999 | 7,101 | 7,838 | 8,653 | 8,299 | 8,616 | 8,983 | 9,365 | 9,764 | Financial Liabilities, Current | 1,131 | 1,499 | 9 | 1,538 | 1,501 | 1,055 | 1,100 | 1,147 | 1,196 | 1,247 | |

| D&A | 1,609 | 1,233 | 1,324 | 1,548 | 1,523 | 7,431 | 183 | 184 | 186 | 188 | Provisions, Current | 1,055 | 916 | 997 | 958 | 1,060 | 1,154 | 1,204 | 1,255 | 1,308 | 1,364 | |

| EBIT | 4,820 | 4,767 | 5,778 | 6,290 | 7,131 | 868 | 8,433 | 8,798 | 9,179 | 9,575 | Defferred Liabilities, Current | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | |

| Operating Taxes | (564) | (628) | (1,036) | (574) | (562) | (783) | (821) | (856) | (892) | (930) | Other Current Liabilities | 0 | 15,085 | 17,005 | 19,600 | 23,606 | 17,048 | 17,774 | 18,531 | 19,319 | 20,142 | |

| NOPAT (Net Operating Profit After Taxes) | 4,256 | 4,139 | 4,741 | 5,716 | 6,569 | 85 | 7,612 | 7,942 | 8,286 | 8,645 | Current Liabilities | 9,675 | 24,671 | 26,736 | 31,625 | 38,374 | 28,994 | 30,921 | 32,237 | 33,609 | 35,040 | |

| (+) Depreciation & Amortization | 1,609 | 1,233 | 1,324 | 1,548 | 1,523 | 7,431 | 183 | 184 | 186 | 188 | ||||||||||||

| (-) Capital Expenditures | (2,379) | (1,687) | (747) | (1,023) | (15) | (573) | 216 | 218 | 220 | 222 | Assumptions | |||||||||||

| (-) Change in NWC | -- | (6,727) | 3,046 | (1,581) | (2,503) | (258) | 653 | 55 | 57 | 60 | Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E | |

| NWC | 8,662 | 1,934 | 4,981 | 3,400 | 896 | 638 | 1,290 | 1,345 | 1,403 | 1,462 | Revenue | 24,556 | 22,320 | 24,540 | 28,318 | 28,541 | 29,516 | 30,772 | 32,082 | 33,447 | 34,871 | |

| Current Assets (non cash) | 20,550 | 13,710 | 17,462 | 18,452 | 18,035 | 29,632 | 32,211 | 33,582 | 35,012 | 36,502 | COGS | (6,430) | (4,721) | (5,483) | (7,313) | (6,630) | (6,561) | (7,307) | (7,618) | (7,943) | (8,281) | |

| Current Liabilitites | 11,888 | 11,775 | 12,482 | 15,053 | 17,138 | 28,994 | 30,921 | 32,237 | 33,609 | 35,040 | ||||||||||||

| Unlevered Free Cash Flow | 8,244 | 13,786 | 3,767 | 9,867 | 10,610 | 8,347 | 6,926 | 7,854 | 8,195 | 8,551 | Days Sales Outstanding (DSO) | 91.0 | 89.4 | 101.6 | 103.3 | 108.0 | 98.7 | 98.7 | 98.7 | 98.7 | 98.7 | |

| Days Inventory Outstanding (DIO) | 230.2 | 1345.2 | 1217.0 | 965.9 | 1324.3 | 1016.5 | 1016.5 | 1016.5 | 1016.5 | 1016.5 | ||||||||||||

| Assumptions | Days Payable Outstanding (DPO) | 419.3 | 546.8 | 572.9 | 469.1 | 662.8 | 534.2 | 534.2 | 534.2 | 534.2 | 534.2 | |||||||||||

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E | ||||||||||||

| Revenue Growth | -9.1% | 9.9% | 15.4% | 0.8% | 4.3% | 4.3% | 4.3% | 4.3% | 4.3% | Other Current Assets as a % of Revenue | 8.74% | 11.38% | 11.70% | 8.94% | 10.35% | 10.22% | 10.22% | 10.22% | 10.22% | 10.22% | ||

| Financial Liabilities, Current as a % of Revenue | 4.6% | 6.7% | 0.0% | 5.4% | 5.3% | 3.58% | 3.58% | 3.58% | 3.58% | 3.58% | ||||||||||||

| COGS % of Revenue | -26.2% | -21.2% | -22.3% | -25.8% | -23.2% | -23.7% | -23.7% | -23.7% | -23.7% | -23.7% | Provisions, Current as a % of Revenue | 4.3% | 4.1% | 4.1% | 3.4% | 3.7% | 3.91% | 3.91% | 3.91% | 3.91% | 3.91% | |

| OE% of Revenue | -21.6% | -25.1% | -24.8% | -24.8% | -25.2% | -24.3% | -24.3% | -24.3% | -24.3% | -24.3% | Defferred Liabilities, Current as a % of Revenue | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| SG&A % of Revenue | -26.0% | -26.9% | -23.9% | -21.7% | -21.3% | -24.0% | -24.0% | -24.0% | -24.0% | -24.0% | Other Current Liabilities as a % of Revenue | 0.0% | 67.6% | 69.3% | 69.2% | 82.7% | 57.76% | 57.76% | 57.76% | 57.76% | 57.76% | |

| Tax % of EBIT | -8.8% | -10.5% | -14.6% | -7.3% | -6.5% | -9.5% | -9.5% | -9.5% | -9.5% | -9.5% | ||||||||||||

| Fixed Assets Schedule | Unlevered Free Cash Flow (mn) | |||||||||||||||||||||

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E | Fiscal Year | 1903A | 1903A | 1902A | 1903A | 1902A | 2023E | 2024E | 2025E | 2026E | 2027E | |

| Beginning PP&E | 8,920 | 8,405 | 8,682 | 8,985 | 10,144 | 3,364 | 3,397 | 3,431 | 3,465 | Unlevered Free Cash Flow | 8,244 | 13,786 | 3,767 | 9,867 | 10,610 | 8,347 | 6,926 | 7,854 | 8,195 | 8,551 | ||

| D&A | 1,609 | 1,233 | 1,324 | 1,548 | 1,523 | 7,431 | 183 | 184 | 186 | 188 | ||||||||||||

| CapEx | 10,529 | 718 | 1,601 | 1,851 | 2,681 | 651 | 216 | 218 | 220 | 222 | Projection Year | 1 | 2 | 3 | 4 | 5 | ||||||

| Ending PP&E | 8,920 | 8,405 | 8,682 | 8,985 | 10,144 | 3,364 | 3,397 | 3,431 | 3,465 | 3,499 | Present Value of Free Cash Flow | 8,930 | 7,928 | 9,617 | 10,737 | 11,986 | ||||||

| Assumptions | Implied Share Price Calculation | Sensitivity Table | ||||||||||||||||||||

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E | Sum of PV of FCF (5 year projected Assumption) | 49,198 | ||||||||||

| D&A as a % of Beginning PP&E (to revenue) | 5.5% | 5.4% | 5.5% | 5.3% | 5.4% | 5.4% | 5.4% | 5.4% | 5.4% | Growth Rate | 3.57% | Growth Rate | ||||||||||

| CapEx as a % of Beginning PP&E (to revenue) | 3.2% | 6.5% | 6.5% | 9.4% | 6.4% | 6.4% | 6.4% | 6.4% | 6.4% | WACC | 6.99% | 530.15 | 2.57% | 3.07% | 3.57% | 4.07% | 4.57% | |||||

| Terminal Value | 259,198 | WACC | 5.99% | 543.20 | 483.96 | 483.96 | 543.20 | 735.20 | ||||||||||||||

| PV of Terminal Value | 184,924 | 6.49% | 631.11 | 550.05 | 550.05 | 631.11 | 920.11 | |||||||||||||||

| Enterprise Value | 234,122 | 6.99% | 631.11 | 550.05 | 550.05 | 631.11 | 920.11 | |||||||||||||||

| (+) Cash | 2,212 | 7.49% | 543.20 | 483.96 | 483.96 | 543.20 | 735.20 | |||||||||||||||

| (-) Debt | 16,239 | 7.99% | 428.97 | 393.81 | 393.81 | 428.97 | 530.15 | |||||||||||||||

| Weighted Average Cost of Capital (WACC) | (-) Minority Interest | -6,498 | ||||||||||||||||||||

| Market Cap (mn) | 525,970 | Equity Value | 226,593 | |||||||||||||||||||

| Book value of debtDebt (mn) | 16,239 | Diluted Shares Outstanding (mm) | 940.30 | |||||||||||||||||||

| Implied Share Price | 530.15 | |||||||||||||||||||||

| Cost of Debt | 9.24% | Current Price | 552.35 | |||||||||||||||||||

| Tax Rate (5 year average) | 19.64% | Upside | -4.02% | |||||||||||||||||||

| D/(D+E) | 2.99% | Valuation | FALSE | |||||||||||||||||||

| After Tax Cost of Debt | 7.43% | |||||||||||||||||||||

| Risk Free Rate (10-Yr Treasury Yield) | 4.19% | |||||||||||||||||||||

| S&P500 Market Return yearly for last 10 years 2012-2022 | 13.79% | |||||||||||||||||||||

| Market Risk Premium | 9.60% | |||||||||||||||||||||

| Beta | 0.29 | |||||||||||||||||||||

| E/(D+E) | 97.01% | |||||||||||||||||||||

| Cost of Equity | 6.97% | |||||||||||||||||||||

| WACC | 6.99% | |||||||||||||||||||||

Key Projects edit edit source

Eli Lilly is involved with a highly diversified product range in pharmaceuticals, offering solutions for various medical conditions and collaborating with a large number of companies as summarised below. Details are in the following section.

Overview of all products offered by Eli Lilly

Diabetes Medications

- Basaglar

- Humalog U-100, U-200

- Humalog Mix 75/25, Mix 50/50

- Insulin lispro, lispro protamine, lispro mix 75/25

- Humulin

- Humulin 70/30, N, R, U-500

- Jardiance, Trajenta, Trulicity for type 2 diabetes.

Cancer Treatments

- Alimta for non-small cell lung cancer (NSCLC) and malignant pleural mesothelioma.

- Cyramza for various cancer types including metastatic gastric cancer, NSCLC, and hepatocellular carcinoma.

- Erbitux for colorectal cancers and head and neck cancers.

- Retevmo for metastatic NSCLC, medullary thyroid cancer, and thyroid cancer.

- Tyvyt for classic Hodgkin's lymph and non-squamous NSCLC.

- Verzenio for metastatic breast cancer and early breast cancer.

Other Medical Conditions (Rheumatological, Dermatological, Psychiatric & Urologic)

- Olumiant for rheumatoid arthritis.

- Taltz for plaque psoriasis, psoriatic arthritis, ankylosing spondylitis, and axial spondylarthritis.

- Cymbalta for depressive disorder, anxiety, fibromyalgia, and chronic pain.

- Emgality for migraine prevention and cluster headache.

- Zyprexa for schizophrenia, bipolar I disorder, and bipolar maintenance.

- Cialis for erectile dysfunction and benign prostatic hyperplasia.

- Forteo for osteoporosis.

COVID-19 Medications

- Bamlanivimab and etesevimab.

- Bebtelovimab.

Collaborations

The company collaborates with various organizations including:

- Incyte Corporation

- Boehringer Ingelheim Pharmaceuticals, Inc.

- AbCellera Biologics Inc.

- Junshi Biosciences

- Regor Therapeutics Group

- Lycia Therapeutics, Inc.

- Kumquat Biosciences Inc.

- Entos Pharmaceuticals Inc.

- Foghorn Therapeutics Inc.

Most successful products

- Trulicity (dulaglutide) is a once-weekly injectable GLP-1 receptor agonist that is being developed for the treatment of type 2 diabetes. The drug was approved by the FDA in 2014 and is currently the top-selling diabetes drug in the world.

- Trulicity (dulaglutide) has generated $6.9 billion in sales overall since 2014.

- Verzenio (abemaciclib) is an oral CDK4/6 inhibitor that is being developed for the treatment of breast cancer. The drug was approved by the FDA in 2017.

- Verzenio (abemaciclib) has generated $7.4 billion in sales overall since 2017.

- Humalog (insulin lispro) is a fast-acting insulin analog that is being developed for the treatment of diabetes. The drug was approved by the FDA in 1996 and is currently the most widely used insulin analog in the world.

- Cymbalta (duloxetine) is a selective serotonin and norepinephrine reuptake inhibitor (SNRI) that is being developed for the treatment of depression, anxiety, and chronic pain. The drug was approved by the FDA in 2004.

- Prozac (fluoxetine) is a selective serotonin reuptake inhibitor (SSRI) that is being developed for the treatment of depression. The drug was approved by the FDA in 1986 and is currently the most widely prescribed antidepressant in the world.

- Prozac (Fluoxetine) has generated ~$21 billion for Eli Lilly since it was approved. It continues to be a source of revenue since the expiration of its patent in 2001.

- Mounjaro (tirzepatide) is a once-weekly injectable medication that is used to treat type 2 diabetes. Tirzepatide was approved by the U.S. Food and Drug Administration (FDA) in 2022. It is the first dual GLP-1 and GIP receptor agonist to be approved for the treatment of type 2 diabetes. It has also shown to be very effective in weight loss.

- Tirzepatide has generated $4.8 billion in sales since its approval in 2022, and is one of Eli Lilly's most promising drugs for future revenue.

Many of these products are in the top 10 best-selling drugs in the world. They are all innovative medicines that address unmet medical needs. They are also all relatively new drugs, which means that they have the potential to generate even more revenue in the years to come.

Eli Lilly is a research-intensive pharmaceutical company with a strong track record of innovation. The company has a number of promising projects in development, and it is well-positioned to continue growing in the years to come.

Future project collaboration details

Incyte Corporation: Eli Lilly and Incyte Corporation are collaborating on the development of new cancer drugs. The companies are currently developing a combination therapy of baricitinib and pembrolizumab for the treatment of relapsed or refractory diffuse large B-cell lymphoma (DLBCL).

Boehringer Ingelheim Pharmaceuticals, Inc.: Eli Lilly and Boehringer Ingelheim Pharmaceuticals, Inc. are collaborating on the development of new diabetes drugs. The companies are currently developing a once-weekly injectable GLP-1 receptor agonist called tirzepatide.

AbCellera Biologics Inc.: Eli Lilly and AbCellera Biologics Inc. are collaborating on the development of new antibody-based treatments for COVID-19. The companies are currently developing a combination therapy of bamlanivimab and etesevimab.

Junshi Biosciences: Eli Lilly and Junshi Biosciences are collaborating on the development of new cancer drugs. The companies are currently developing a combination therapy of fulvestrant and durvalumab for the treatment of breast cancer.

Regor Therapeutics Group: Eli Lilly and Regor Therapeutics Group are collaborating on the development of new treatments for Alzheimer's disease. The companies are currently developing a drug called donanemab, which is a monoclonal antibody that targets amyloid beta plaques.

Lycia Therapeutics, Inc.: Eli Lilly and Lycia Therapeutics, Inc. are collaborating on the development of new treatments for atopic dermatitis. The companies are currently developing a drug called lebrikizumab, which is an anti-IL-13 monoclonal antibody.

Kumquat Biosciences Inc.: Eli Lilly and Kumquat Biosciences Inc. are collaborating on the development of new treatments for cancer. The companies are currently developing a drug called pirtobrutinib, which is an oral Bruton's tyrosine kinase inhibitor.

Entos Pharmaceuticals Inc.: Eli Lilly and Entos Pharmaceuticals Inc. are collaborating on the development of new treatments for rheumatoid arthritis. The companies are currently developing a drug called ozanimod, which is a sphingosine 1-phosphate receptor modulator.

Foghorn Therapeutics Inc.: Eli Lilly and Foghorn Therapeutics Inc. are collaborating on the development of new treatments for pain. The companies are currently developing a drug called FV-100, which is a small molecule that targets the NMDA receptor.

Valuation edit edit source

| Unlevered Free Cash Flow (mn) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E |

| Revenue | 24,556 | 22,320 | 24,540 | 28,318 | 28,541 | 29,516 | 30,772 | 32,082 | 33,447 | 34,871 |

| COGS | (6,430) | (4,721) | (5,483) | (7,313) | (6,630) | (6,561) | (7,307) | (7,618) | (7,943) | (8,281) |

| Gross Profit | 18,126 | 17,598 | 19,057 | 21,006 | 21,912 | 22,954 | 23,464 | 24,463 | 25,505 | 26,590 |

| Operating Expenses | (5,307) | (5,595) | (6,086) | (7,026) | (7,191) | (8,140) | (7,477) | (7,795) | (8,127) | (8,473) |

| Selling, General, Administrative | (6,390) | (6,004) | (5,869) | (6,142) | (6,068) | (6,515) | (7,372) | (7,686) | (8,013) | (8,354) |

| Total Operating Expenses | (11,697) | (11,599) | (11,955) | (13,168) | (13,258) | (14,656) | (14,849) | (15,481) | (16,140) | (16,827) |

| Operating Profit (EBITDA) | 6,429 | 5,999 | 7,101 | 7,838 | 8,653 | 8,299 | 8,616 | 8,983 | 9,365 | 9,764 |

| D&A | 1,609 | 1,233 | 1,324 | 1,548 | 1,523 | 1,467 | 506 | 511 | 517 | 522 |

| EBIT | 4,820 | 4,767 | 5,778 | 6,290 | 7,131 | 6,832 | 8,109 | 8,471 | 8,848 | 9,242 |

| Operating Taxes | (564) | (628) | (1,036) | (574) | (562) | (783) | (821) | (856) | (892) | (930) |

| NOPAT (Net Operating Profit After Taxes) | 4,256 | 4,139 | 4,741 | 5,716 | 6,569 | 6,049 | 7,288 | 7,615 | 7,956 | 8,312 |

| (+) Depreciation & Amortization | 1,609 | 1,233 | 1,324 | 1,548 | 1,523 | 1,467 | 506 | 511 | 517 | 522 |

| (-) Capital Expenditures | (2,379) | (1,687) | (747) | (1,023) | (15) | (573) | 599 | 605 | 611 | 617 |

| (-) Change in NWC | -- | (6,727) | 3,046 | (1,581) | (2,503) | (405) | (371) | 5 | 5 | 6 |

| NWC | 8,662 | 1,934 | 4,981 | 3,400 | 896 | 492 | 121 | 126 | 131 | 137 |

| Current Assets (non cash) | 20,550 | 13,710 | 17,462 | 18,452 | 18,035 | 15,334 | 16,288 | 16,981 | 17,704 | 18,457 |

| Current Liabilitites | 11,888 | 11,775 | 12,482 | 15,053 | 17,138 | 14,842 | 16,167 | 16,855 | 17,572 | 18,320 |

| Unlevered Free Cash Flow | 8,244 | 13,786 | 3,767 | 9,867 | 10,610 | 8,493 | 7,567 | 7,517 | 7,857 | 8,211 |

| Assumptions | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E |

| Revenue Growth | -9.1% | 9.9% | 15.4% | 0.8% | 4.3% | 4.3% | 4.3% | 4.3% | 4.3% | |

| COGS % of Revenue | -26.2% | -21.2% | -22.3% | -25.8% | -23.2% | -23.7% | -23.7% | -23.7% | -23.7% | -23.7% |

| OE% of Revenue | -21.6% | -25.1% | -24.8% | -24.8% | -25.2% | -24.3% | -24.3% | -24.3% | -24.3% | -24.3% |

| SG&A % of Revenue | -26.0% | -26.9% | -23.9% | -21.7% | -21.3% | -24.0% | -24.0% | -24.0% | -24.0% | -24.0% |

| Tax % of EBIT | -8.8% | -10.5% | -14.6% | -7.3% | -6.5% | -9.5% | -9.5% | -9.5% | -9.5% | -9.5% |

| Fixed Assets Schedule | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E |

| Beginning PP&E | 8,920 | 8,405 | 8,682 | 8,985 | 10,144 | 9,329 | 9,421 | 9,514 | 9,608 | |

| D&A | 1,609 | 1,233 | 1,324 | 1,548 | 1,523 | 1,467 | 506 | 511 | 517 | 522 |

| CapEx | 10,529 | 718 | 1,601 | 1,851 | 2,681 | 651 | 599 | 605 | 611 | 617 |

| Ending PP&E | 8,920 | 8,405 | 8,682 | 8,985 | 10,144 | 9,329 | 9,421 | 9,514 | 9,608 | 9,703 |

| Assumptions | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E |

| D&A as a % of Beginning PP&E (to revenue) | 5.5% | 5.4% | 5.5% | 5.3% | 5.4% | 5.4% | 5.4% | 5.4% | 5.4% | |

| CapEx as a % of Beginning PP&E (to revenue) | 3.2% | 6.5% | 6.5% | 9.4% | 6.4% | 6.4% | 6.4% | 6.4% | 6.4% |

| Net Working Capital (mn) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E |

| Accounts Receivables | 6,205 | 5,542 | 6,929 | 8,127 | 8,559 | 8,088 | 8,433 | 8,792 | 9,166 | 9,556 |

| Merchandise Inventory | 4,112 | 3,191 | 3,980 | 3,886 | 4,310 | 4,229 | 4,710 | 4,910 | 5,119 | 5,337 |

| Other Current Assets | 2,147 | 2,539 | 2,872 | 2,531 | 2,954 | 3,017 | 3,145 | 3,279 | 3,419 | 3,564 |

| Current Assets (without cash) | 12,463 | 11,271 | 13,781 | 14,544 | 15,823 | 15,334 | 16,288 | 16,981 | 17,704 | 18,457 |

| Accounts Payable and Accrued Expenses,Current | 7,489 | 7,171 | 8,725 | 9,529 | 12,207 | 9,736 | 10,843 | 11,304 | 11,786 | 12,287 |

| Financial Liabilities, Current | 1,131 | 1,499 | 9 | 1,538 | 1,501 | 1,055 | 1,100 | 1,147 | 1,196 | 1,247 |

| Provisions, Current | 1,055 | 916 | 997 | 958 | 1,060 | 1,154 | 1,204 | 1,255 | 1,308 | 1,364 |

| Defferred Liabilities, Current | 0 | 1 | 2 | 3 | 4 | 3 | 3 | 3 | 3 | 3 |

| Other Current Liabilities | 2,213 | 2,189 | 2,750 | 3,028 | 2,370 | 2,894 | 3,017 | 3,146 | 3,280 | 3,419 |

| Current Liabilities | 11,888 | 11,776 | 12,484 | 15,056 | 17,142 | 14,842 | 16,167 | 16,855 | 17,572 | 18,320 |

| Assumptions | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 2018A | 2019A | 2020A | 2021A | 2022A | 2023E | 2024E | 2025E | 2026E | 2027E |

| Revenue | 24,556 | 22,320 | 24,540 | 28,318 | 28,541 | 29,516 | 30,772 | 32,082 | 33,447 | 34,871 |

| COGS | (6,430) | (4,721) | (5,483) | (7,313) | (6,630) | (6,561) | (7,307) | (7,618) | (7,943) | (8,281) |

| Days Sales Outstanding (DSO) | 91.0 | 89.4 | 101.6 | 103.3 | 108.0 | 98.7 | 98.7 | 98.7 | 98.7 | 98.7 |

| Days Inventory Outstanding (DIO) | 230.2 | 243.3 | 261.3 | 191.3 | 234.0 | 232.0 | 232.0 | 232.0 | 232.0 | 232.0 |

| Days Payable Outstanding (DPO) | 419.3 | 546.8 | 572.9 | 469.1 | 662.8 | 534.2 | 534.2 | 534.2 | 534.2 | 534.2 |

| Other Current Assets as a % of Revenue | 8.74% | 11.38% | 11.70% | 8.94% | 10.35% | 10.22% | 10.22% | 10.22% | 10.22% | 10.22% |

| Financial Liabilities, Current as a % of Revenue | 4.6% | 6.7% | 0.0% | 5.4% | 5.3% | 3.58% | 3.58% | 3.58% | 3.58% | 3.58% |

| Provisions, Current as a % of Revenue | 4.3% | 4.1% | 4.1% | 3.4% | 3.7% | 3.91% | 3.91% | 3.91% | 3.91% | 3.91% |

| Defferred Liabilities, Current as a % of Revenue | 0.0% | 0.0% | 0.0% | 0.0% | 0.0% | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% |

| Other Current Liabilities as a % of Revenue | 9.0% | 9.8% | 11.2% | 10.7% | 8.3% | 9.81% | 9.81% | 9.81% | 9.81% | 9.81% |

| Weighted Average Cost of Capital (WACC) | |||

|---|---|---|---|

| Market Cap (mn) | 520,210 | ||

| Book value of debtDebt (mn) | 16,239 | ||

| Cost of Debt | 9.24% | ||

| Tax Rate (5 year average) | 11.74% | ||

| D/(D+E) | 3.03% | ||

| After Tax Cost of Debt | 8.16% | ||

| Risk Free Rate (10-Yr Treasury Yield) | 4.19% | ||

| S&P500 Market Return yearly for last 10 years 2012-2022 | 13.79% | ||

| Market Risk Premium | 9.60% | ||

| Beta | 0.35 | ||

| E/(D+E) | 96.97% | ||

| Cost of Equity | 7.55% | ||

| WACC | 7.57% | ||

| Unlevered Free Cash Flow (mn) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Fiscal Year | 1900A | 1900A | 1900A | 1900A | 1900A | 2023E | 2024E | 2025E | 2026E | 2027E |

| Unlevered Free Cash Flow | 8,244 | 13,786 | 3,767 | 9,867 | 10,610 | 8,493 | 7,567 | 7,517 | 7,857 | 8,211 |

| Projection Year | 1 | 2 | 3 | 4 | 5 | |||||

| Present Value of Free Cash Flow | 9,136 | 8,756 | 9,356 | 10,518 | 11,825 | |||||

| Implied Share Price Calculation | Sensitivity Table | |||||||||

| Sum of PV of FCF (5 year projected Assumption) | 49,590 | |||||||||

| Growth Rate | 3.57% | Growth Rate | ||||||||

| WACC | 7.57% | 599.78 | 2.57% | 3.07% | 3.57% | 4.07% | 4.57% | |||

| Terminal Value | 212,743 | WACC | 6.57% | 612.85 | 556.89 | 556.89 | 612.85 | 780.78 | ||

| PV of Terminal Value | 147,729 | 7.07% | 693.07 | 619.75 | 619.75 | 693.07 | 927.80 | |||

| Enterprise Value | 197,319 | 7.57% | 693.07 | 619.75 | 619.75 | 693.07 | 927.80 | |||

| (+) Cash | 2,212 | 8.07% | 612.85 | 556.89 | 556.89 | 612.85 | 780.78 | |||

| (-) Debt | 16,239 | 8.57% | 502.75 | 467.48 | 467.48 | 502.75 | 599.78 | |||

| (-) Minority Interest | -6,498 | |||||||||

| Equity Value | 189,790 | |||||||||

| Diluted Shares Outstanding (mm) | 949.30 | |||||||||

| Implied Share Price | 599.78 | |||||||||

| Current Price | 548 | |||||||||

| Upside | 9.45% | |||||||||

| Valuation | TRUE | |||||||||

The result of base case of the DCF valuation indicating the implied shared price is 599.78, comparing to the current price, it has a 9.45% increase margin, where the growth rate and the WACC is 3.57% and 7.57% respectively. The Beta is 0.35, which indicating that it is less correlated to the S&P market, which is a typical number for medical companies on medicine that is not focusing on technologies such as medical devices and robotics. For the bull case and bear case, it has a 15.3% increase and -9.2% decrease respectively. In these 2 cases, a different approach has been applied by comparing the earnings using EBITDA and free cash flow equity. The 3-year EBITDA Growth Rate per share is 9.1, which is the same as the median of the range over the past 10 years, and also 52% higher than other companies in the biotechnology industry. The 3-year revenue growth rate per share is 9.8, which is also higher than the median of the range over the past 10 years of 6.5, and it is 62.6% better than other companies in the Biotechnology industry. Furthermore, the 3-year Book Growth rate per share is 60.3, which is almost at the highest value of the range over the past 10 years. Finally, the 3-year FCF Growth rate is 11 which is stronger than 51.2% of the companies in the Biotechnology industry.

Assumption: edit edit source

- The growth rate is obtained using the difference between the terminal value in the next 5 years comparing to the actual value in the past 5 years.

- WACC: Risk free rate taking the current 10 year treasury yield rate at 4.19%, S&P500 market return for the last 10 years from 2012-2022 of 13.79%.

- Base case: constant average of numbers in the next 5 years. The logic behind is that LLY is company focusing on medicine, which has a strong economic moat in the industry and a usually parking of money during a bear market according to the Dow's theory.

Relative Valuation & Competitior Analysis edit edit source

The main competitors of NVO in the market includes: Wuxi biologics (HKG: 2269), Novo (NVO), Johnson & Johnson (JNJ), Merk Co (MRK), AstraZeneca (AZN), Pfizer (PFE).

The PE value of Eli Lilyis 72.19, where the most related competitor Novo (NVO) is 49.43, which is overvalued comparatively. In the recent update, the Eli Lily has beat the market expectation in the second-quarter earnings. Elil Lily saying that there is a surge in demand for Mounjaro, which they experienced delays in fulfilling the demand. This indicating that there is a huge increase in demand and so does the sales increase in the related drug. Therefore, the Jefferies analyst Akash Tewari upgraded shares of Eli Lilly to Buy from Hold and raised his price target from $430 to $615. He mentioned that NVO's product, weight-loss drug Wegovy in a trial, known as SELECT, has reduced the risk of heart attack and stroke in obese and overweight patients by 20%, exceeding expectations. These views from the market indicating more money will be entering the pharmaceutical industry and specifically the weight-loss drug. This news caused both LLY and NVO to rise over 15% in one day. On top of that, NVO has a lower PE value comparing to his industry and therefore a higher increase than its industry.

The financial strength of LLY includes: the cash-to-debt of 0.15, which is similar to its competitiors above, but the numbers are quite low. This could mean that the market has recently focusing on these area in the weight loss drug market, the R&D budget has increased. Looking at the current ratio and quick ratio of 1.13 and 0.87, which are currently under 1, but the industry has a similar number. The equity-to-asset and the debt-to-EBITDA is 0.32 and 0.31 respectively, they are both worse than the market by 73% and 68%. The Piotroski F-score, Altman Z-score and the Beneish M-score all points to the safe indicator, indicating NVO is not likely to be a manipulator on their financials. For the Profitability strength: the Gross Margin%, Net Margin%, ROA%, ROE%, ROCE% and ROIC% are all significantly better than the biotechnology industry by 89 to 99%. For the comparative indicators: the PE, PB, PEG, PS ratio is slightly lower than the industry.

Furthermore, the operating cash flow has a consistent increase in the past 10 years, much higher the the net income and they also have a negative financing and investing cash flow. The Free cash flow increase steadily over the past 10 years, which is a good sign.

Last but not least, the difference in ROIC to WACC % remains positive in the past 10 years except for 2017. The current ROIC-WACC% is still 15%.

Comparing to its competitor Wuxi (HKG:2269), for macro analysis, the M1 to M2 value in the China market is a negative value, indicating that the money is not coming out to the market, lower buying power. Also, thePPI remain very low, much lower than the expectation, which is currently at -4.40. The PPI to CPI ratio has a negative value of -4.10. These all indicating that the US market is healthier than the China market, the money is likely to buy other companies in the industry comparatively.

Corporate Strategy edit edit source

Eli Lilly's corporate strategy:

- Focus on innovation: Eli Lilly is committed to investing in research and development to discover and develop new medicines. The company has a strong track record of innovation, and it has launched several major new products in recent years, including Trulicity, Verzenio, and Taltz.

- Expand into new markets: Eli Lilly is expanding its presence in emerging markets such as China and India. The company is also investing in new channels of distribution, such as e-commerce and mobile health.

- Drive growth through partnerships: Eli Lilly is partnering with other companies to develop new products and technologies. The company has partnered with companies such as Alnylam Pharmaceuticals and Innoviva to develop new treatments for diseases such as Alzheimer's and hepatitis C.

- Strengthen its commercial capabilities: Eli Lilly is investing in its commercial capabilities to improve its ability to bring new products to market and to grow its existing business. The company is also investing in its digital capabilities to improve its ability to interact with patients and healthcare providers.

Eli Lilly's corporate strategy is focused on innovation, expansion, partnerships, and commercial capabilities. The company is well-positioned to continue growing in the years to come, driven by its strong pipeline of new products and its expanding presence in emerging markets.

Here are some of the specific goals of Eli Lilly's corporate strategy:

- Launch 10 new products by 2025.

- Generate $50 billion in revenue by 2025.

- Expand its presence in emerging markets to 50% of its total revenue by 2025.

- Partner with 100 companies by 2025.

- Improve its commercial capabilities by 20% by 2025.

Eli Lilly is committed to achieving these goals and to becoming a leading pharmaceutical company in the world.

Risks edit edit source

Research and Development Uncertainty

The pharmaceutical industry's research and development process is characterized by high uncertainty and substantial costs. Failures in drug discovery and development are common, leading to significant financial investments without guaranteed returns.

Revenue Replacement Challenges

There is a possibility that the company might have trouble introducing new products that make enough money to replace the ones losing protection or facing competition. If this challenge isn't managed effectively, it could have a negative impact on the company's overall financial performance.

Regulatory Approval Complexity

Tough rules from regulators about how well drugs work and how safe they are can make it hard to get new drugs approved. Delays and not being sure when approvals will happen in different places can mean we miss chances in the market and might have problems with keeping enough of our products in stock.

Revenue Predictability Concerns

The unpredictable nature of revenue growth rates and demand patterns for newly introduced products introduces uncertainty into financial forecasting and planning.

Challenges in Selling New Products from Business Growth

There's a risk that when new products are introduced through business growth, they might not turn out as expected. Issues like failed clinical tests, problems with accurate data, regulatory obstacles, and selling difficulties could make it tough to achieve the anticipated benefits.