Fonterra Co-operative Group Limited

| |

| Type | Publicly listed cooperative |

|---|---|

| Industry | Manufacturing, retail |

| Predecessor | New Zealand Dairy Group Kiwi Co-operative Dairies |

| Founded | 16 October 2001[1] |

| Headquarters | , New Zealand |

Area served | Worldwide |

Key people | Miles Hurrell, (CEO) [2] |

| Products | Milk, butter, cheese, yoghurt |

| Brands |

|

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 19,608[4] |

| Website |

|

Overview edit edit source

Fonterra Co-operative Group Limited, together with its subsidiaries, collects, manufactures, and sells milk and milk-derived products. The company offers milk powders, butter, and cheese products. It also engages in the consumer goods and foodservice businesses. In addition, the company operates 66 Farm Source retail stores; and engages in farming of fresh milk. It provides its products primarily under the Anchor, Anmum, Anlene, NZMP, Farm Source, De Winkel, Fresh 'n Fruity, Kapiti, Mainland, Mammoth, Perfect Italiano, Piako, Primo, and Symbio brands. The company has operations in New Zealand, China, rest of Asia, Australia, the United States, Europe, Latin America, and internationally. Fonterra Co-operative Group Limited was incorporated in 2001 and is headquartered in Auckland, New Zealand.

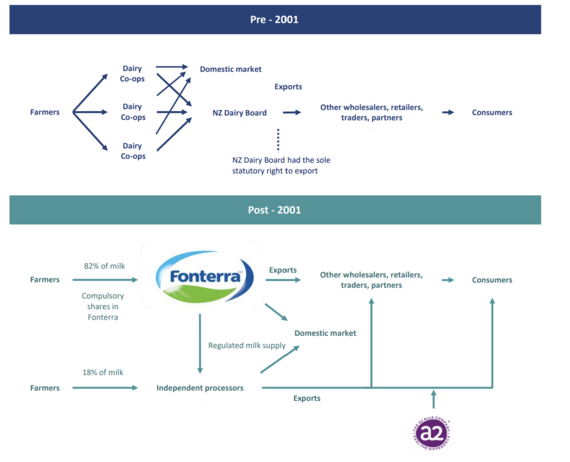

Fonterra was formed by the amalgamation of predecessors New Zealand Co-operative Dairy Group Ltd, Kiwi Co-operative Dairies Ltd and New Zealand Dairy Board in 2001. The establishment of Fonterra was seen as a state-backed national firm for the dairy industry[5].Prior to Fonterra being founded in 2001, the NZ Dairy Board was the only legal exporter of dairy. The uniting of these three companies was on the basis of implementation of the Dairy Industry Restructuring Act (DIRA) in 2001 which aimed to improve efficiency and international competitiveness of NZ milk and milk products. More importantly, it allowed for the merging of the three predecessors to form Fonterra, as well as removing the solitary export power from the NZ Dairy Board to allow other companies to export their dairy products internationally[5].

Mission Statement edit edit source

Fonterra Co-operative stands to get "Good Together" summing up their three simple goals: Healthy people, Healthy environment, Healthy business.

"Our Co-operative.

Empowering people.

To create goodness for generations.

You, me, us together.

Tātou, tātou"[6]

Brands edit edit source

- Anchor - products ranges from all forms of dairy milk, butters and cheeses. With subbrands -

- Anchor Boneeto - flavoured milk with nutritional boosts sold in Indonesia

- Anchor Food Professionals - B2B dairy products and ingredients to bakeries and foodservice professionals

- AnchorFernleaf - dairy products targeted for Southeast Asian market

- Anlene - number 1 milk brand across Southeast Asia

- Perfect Italiano - culinary cheese and ingredients using italian cheese-making techniques

- CalciYum - flavoured yoghurts and milk drinks target towards kids in NZ

- Mainland - cheese ranges

- Chesdale - sliced cheese brand targeted for kids

- Kapiti - crafted ice cream and cheeses

- NZMP - dairy ingredients sold to food manufacturers including standard dairy ingredients (milk powder and butter) to functional ingredients (proteins in sports drinks)

- Anmum Materna, Essential and Lacta - nutrition for women during pregnancy and infants

Operations edit edit source

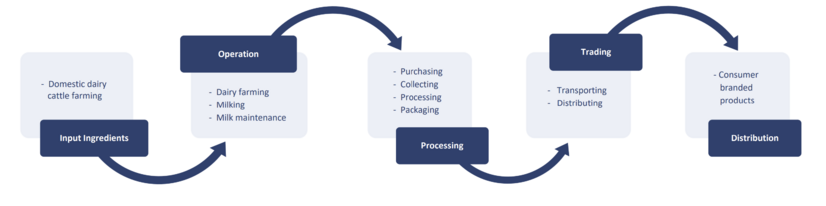

The dairy value chain illustrates the events of adding value from the initial farming and collecting of milk to the post-farm events of milk processing and distribution. Fonterra’s operation spans the dairy value chain in NZ, and also attempts to be overseas.

Previously, Fonterra had attempted to expand operations towards the “end” of the chain. Yet the costs, risks, intensivity of capital, and the necessity to move towards the end of the chain would be rather damaging to revenue. However, it seems inevitable to have operations near the “end” of the value chain given the highly perishable nature of milk. Milk volume collection by Fonterra in NZ is above 15 billion liters annually, well beyond the consumption capacity of the domestic market. Hence, additional volumes can only be dealt with by processing into export commodities[5].

Fonterra’s ingredients and foodservice segments were key performers, allowing the company to form partnerships with international customers including Nestles, Krafts etc. Further, Fonterra had to cut on operations such as China farms and milk pools which reduced brand image (i.e. lowering value rather than adding)[5].

Corporate Structure edit edit source

Equity Stake edit edit source

Fonterra operates majority as a co-operative where its farmers buy into Fonterra and sell the co-operative milk (i.e. ownership by its farmers). In return, the farms are paid for milk sold and given annual dividends from the co-operative.

edit edit source

Shares trading limited to farmers within the Co-operative. Following the introduction of “Flexible Shareholding” capital structure within the Co-operative in March 2023, “farmers who supply milk to Fonterra need to hold a minimum of one share for every three kilograms of milk solids (kgMS) supplied and can go up to a maximum of 4x their milk supply in shares”, doubling the maximum share allowance previously[8].

Currently, the three largest shareholders are Accident Compensation Corp, Craigsmore Dairy li Services Ltd, and Smartshares Ltd, which have 4.80, 1.93, and 1.80% shares respectively[9].

edit edit source

Shares listed on NZX and ASX freely traded like listed securities. However, outside investors not allowed to hold shares can invest in Shareholders’ Fund to gain economic rights (e.g. distributions and capital movements similar to shares).

Core Management Team edit edit source

edit edit source

Appointed to Fonterra Shareholders’ Fund board in November 2020 and became Chair in November 2022. Currently is Chair of AIG Insurance New Zealand Limited, and an Independent Director of Kiwibank Limited, and Kiwi Property Group Limited.

Miles Hurrell - CEO edit edit source

Appointed in 2018. Previously COO at Farm Source, managing the production process from farmers to the 70 retail stores. Also has held leadership roles globally within Fonterra Co-op before becoming Chief.

Neil Beaumont - CFO edit edit source

Joined Fonterra in 2023. Previously was CFRO of Canadian Pension Plan Investment Board, Canada’s largest investment fund, as well as roles at BHP, Australia and KPMG, Canada.

Anna Palairet - COO

Acting in June 2023. Prior careers spanned Australasia's largest multinational firms including 16 years at Air NZ. Rejoined dairy industry in October 2022 as Global Supply Chain director before becoming COO.

Corporate Strategy edit edit source

In the latest 2030 prospects report published by Fonterra, they have begun investing capital into new businesses and in 2027 is when they speculate for EBIT to be generated. The report indicates Fonterra investment plans in key areas including NZ milk, sustainability and innovation and sciences[10].

NZ milk edit edit source

“Focus on New Zealand Milk”

In 2030 prospect, Fonterra aims to prioritise the Farmgate milk price and refine it’s asset portfolio with focus on NZ. Regarding its distribution channels, Fonterra will grows its foodservice channel, continue thriving in its consumer channel, and reallocate resources in the ingredient channel to other higher value products[10].

By maintaining farmgate milk prices ensure the financials of its farmers and thus the functioning of the co-operative. The economy of scales of the co-operative will allow for lowering of manufacturing costs, in turn increasing milk prices. Reinvesting into research and innovations, such as the use of AI in quality control had allowed an increase in sustainability while reducing rework and quality costs for Fonterra (total of $77 million reduction from 2017 to 2021). Thus, Fonterra will continue to sustain milk prices[10].

Fonterra’s plan to restructure the distributing channels involves directing less milk to its ingredient distribution channels (NZMP brands), and diverting more milk into foodservice and consumer channels. The foodservice channel shows increases in demand in Fonterra’s key markets in Asia Pacific, while the consumer channel achieves highest gross margins for Fonterra. For the USA where tariffs negatively impact competitiveness of brands, Fonterra intends to partner with IP such as America’s dairy co-operatives[10].

Fonterra is also reviewing ownership of milk pools in Australia and Chile with aims to refine asset portfolio towards NZ farms instead. For Australia, there is also consideration to change the ownership structure of Fonterra Australia. The option given by Fonterra in the 2030 prospect includes an IPO of Fonterra Australia but with most stakes retained by the co-operative[10].

Sustainability edit edit source

“Be a leader in sustainability”

As a NZ firm, Fonterra embraces the spirits of indigenous Maori culture to protect Papatūānuku (mother nature). Fonterra declares itself to ensure its sustainability policies and actions are ahead of regulations and beyond consumer expectations.

Land and water edit edit source

By focusing on farm water and catchment sustainability, and reducing water use overall, Fonterra thrives for “Healthy freshwater, soil and ecosystems that are essential to the long-term success of our business, farmers’ businesses, and to communities”.

The farm environment plans (FEP) launched in 2018 aims to connect with their farmers to build frameworks and individualised action plans to minimise environmental footprints, with aim to reach 100% of farmers participating in FEP by 2025. Further, they aim to reduce 30% water use at manufacturing sites by bettering water efficiency[11].

Climate Change edit edit source

Fonterra aims to reduce 50% manufacturing emission of greenhouse gases (GHG) by 2030, and have no net increase in GHG emissions between 2015 to 2030. It also aims to have no emissions by 2050, in line with NZ’s goal to be completely carbon neutral by 2050.

Fonterra is both cutting emission at farms and manufacturing sites. The Fonterra Palmerston North Research and Development Centre are researching into “Kowbucha” which has prospects to reduce methane produced by farms to achieve low-carbon dairying. Further, Fonterra is transferring to using wood pellets as fuel source, committing to stopping coal use by 2037[12].

Science and Innovations edit edit source

“Be a leader in dairy innovation and science”

Acknowledging the use and advances in bioinformatics and biotechnology in understanding human health, Fonterra also sees the potential of research to be implemented into nutritional sciences. Fonterra have a team dedicated to exploring the nutritional science solutions and future to implement findings into the cooperation.

Market edit edit source

Dairy sector in NZ edit edit source

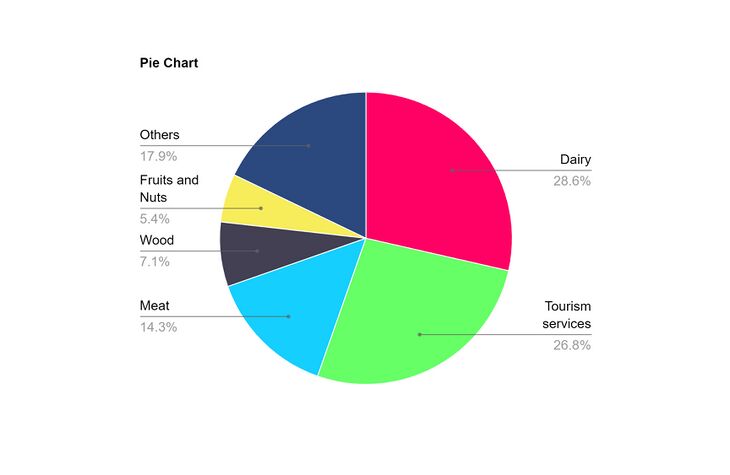

Fonterra operates in the dairy sector, which contributes 5.3% of NZ’s nominal GDP and 23% of NZ’s gross export value[13]. The dairy sector is critical to NZ’s economy, with it being the biggest export income for the country. Further, NZ being the largest milk exporter in the world, contributing 23.6% of global milk exports[14]. Pre-COVID (2020), the tourism industry was the largest exporter with $17.6 billion NZD; following with $17.1 billion export value was the dairy industry.

![Export value of dairy and tourism in NZ [3]. Comparison of two largest exporters of NZ. Following COVID-19, there is a sharp decline in tourism export value.](/images/thumb/8/84/Figure_1.png/527px-Figure_1.png)

Following the impact of COVID, the tourism industry earnings dropped significantly to $1.9 billion in 2021, yet the dairy industry earnings continued to thrive and currently dominated the export earning in NZ[16], maintaining the forecasted CAGR of 6.5% annually[5].

Challenges facing the dairy sector edit edit source

Post COVID-19 edit edit source

Although during COVID, the export value of NZ dairy products had continued to increase, the current recession state post COVID will likely embark on . Research suggests the positive correlation between disposable household income and milk consumption[17], hence inflation and unemployment will likely impact demand for milk and milk-products.

Milk substitutes (plant and synthetic protein liquids) edit edit source

An international increase in the demand for non-dairy milk (e.g. oat, soy, almond milk) due to shifts in eating habits (e.g. vegan), environmental concerns, animal rights etc are likely to see larger impacts of the dairy industry; 8.76% CAGR of the milk substitute market is expected as of 2023 - 2028[18].

As of now, Fonterra has not yet diversified into plant-based alternatives and markets the higher nutritional value of dairy milk compared. However, in 2022, Fonterra had begun to invest in non-dairy products, including a start up that develops non-dairy via precision fermentation methods[19]; a method that involves GMO yeast to brew components of milk, and is prospected to taste alike to regular dairy milk[20].

Environmental enforcements edit edit source

Freshwater National Policy Statement, 2020 and the National Environmental Standards for Freshwater released to local councils by the NZ government puts in place criterias for farm plans and restricts high-risk farm practices such as controlling nitrogen emissions. Further, self-enforcing voluntary agreements between farmers and the government put measures on farming practices such as fencing off dairy cattle from waterways to preserve fresh waterways[5].

Pressure will also be applied to companies in the dairy sector as NZ aims for carbon neutral by 2050. Fonterra is NZ’s second largest coal user, with roughly a third of Fonterra’s manufacturing sites use coal as the main energy source. Sites in the South Island of NZ having no access to natural gas, making the transition to cleaner fuel options difficult[5].

Fonterra claims in its 2030 prospect to invest $1 billion NZD to improving water treatment and efficiency, and reduce carbon emissions to align pace with NZ’s 2050 carbon neutral goal[11].

Market Segment edit edit source

The dairy sector can be segmented based on product type, distribution channel and geographically[21].

Product types edit edit source

The core dairy products dealt with by Fonterra include milk, cheese, butter, and other milk derivatives (powders, flavoured drink, yoghurt etc).

In NZ, Fonterra is undoubtedly the largest milk collector, collecting 3.5 billion liters annually, as well as having a market share of 82% for processing milk as of 2017. However, this is still a performance decrease following competition introduced by DIRA as well as Fonterra’s performance itself, as market share had dropped from 96% in 2001 when DIRA was established.

Cheese is also a growing market in Australasia[22], with Mainland cheese by Fonterra being claimed the second most popular cheese in NZ[23].

Distribution Channel edit edit source

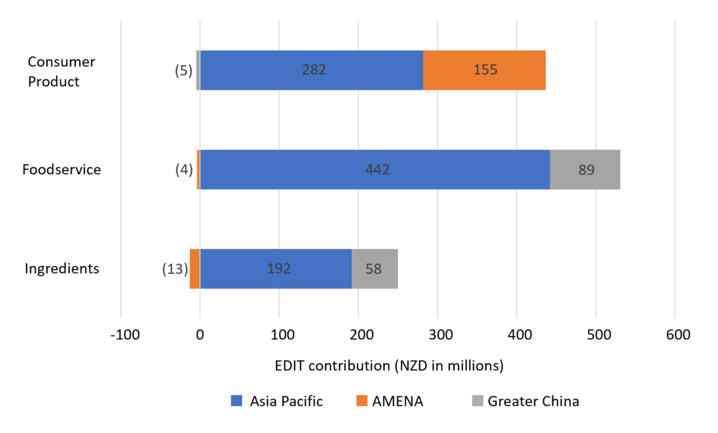

Fonterra divides it distribution channels into three categories: products distributed directly to consumers via retails stores, supermarkets etc (i.e. consumer products); products distributed to foodservices directly (i.e. foodservice); products distributed as ingredients to other value-adding companies (i.e. ingredients). These distribution channels are both local and international.

Geographically edit edit source

Geographically, the international firm focuses largely on markets in Australasia, China, Indonesia and South East Asia, with specific brands unique to these areas. Emerging markets include those in the African, Middle Eastern, European and North Asian and American (AMEND) areas.

From the revenue profile of market segments, it can be seen that ingredients supply are driving most of the revenue of Fonterra. In the 2030 prospect, Fonterra does claim plan to expand its foodservices channels in existing key markets in Asia Pacific. In Asia pacific regions, particularly Indonesia and Malaysia where general income is increasing and dairy products been viewed as premium products, Fonterra aims to double its efforts to expand these foodservice channels (such as local bakeries) to meet growing demands.

Financials edit edit source

Key financial ratios [25] edit edit source

1) Efficiency ratios

| Revenue/Employee | 4,460,358 |

| Income Per Employee | 121,648 |

| Receivables Turnover | 10.79 |

| Total Asset Turnover | 1.27 |

2) Liquidity ratios

| Current Ratio | 1.34 |

| Quick Ratio | 0.57 |

| Cash Ratio | 0.04 |

3) Profitability ratios

| Gross Margin | 14.01 |

| Operating Margin | 5.86 |

| Pretax Margin | 3.57 |

| Net Margin | 2.73 |

| Return on Assets | 3.47 |

| Return on Equity | 9.08 |

| Return on Total Capital | 11.15 |

| Return on Invested Capital | 5.46 |

4) Capital Structure ratios

| Total Debt to Total Equity | 76.26 |

| Total Debt to Total Capital | 43.27 |

| Total Debt to Total Assets | 28.15 |

| Interest Coverage | 5.12 |

| Long-Term Debt to Equity | 70.68 |

| Long-Term Debt to Total Capital | 40.1 |

| Long-Term Debt to Assets | 0.26 |

Valuations edit edit source

DCF edit edit source

Income Statement[26] edit edit source

| NZD in Billions | Historical | Projected | ||||||||

| Income Statement | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue | 20.44 | 19.26 | 20.28 | 20.57 | 22.95 | 23.67 | 24.41 | 25.17 | 25.96 | 26.77 |

| % Growth | -5.77% | 5.30% | 1.43% | 11.57% | 3.13% | 3.13% | 3.13% | 3.13% | 3.13% | |

| Cost of Goods Sold | 16.84 | 15.79 | 16.61 | 16.94 | 19.1 | |||||

| Gross Profit | 3.06 | 2.91 | 3.05 | 2.98 | 3.22 | 3.04 | 3.04 | 3.04 | 3.04 | 3.04 |

| Selling and General Expenses | 2.10 | 1.81 | 1.87 | 1.86 | 1.87 | |||||

| Administration expense | ||||||||||

| R&D | 0.095 | 0.096 | 0.098 | 0.110 | 0.115 | |||||

| Other Expenses | ||||||||||

| D&A | 0.539 | 0.561 | 0.627 | 0.642 | 0.635 | 0.635 | 0.635 | 0.635 | 0.635 | 0.635 |

| EBITDA | 1.51 | 1.66 | 1.81 | 1.77 | 1.98 | 1.25 | 1.27 | 1.29 | 1.31 | 1.33 |

| EBIT | (0.740) | (0.097) | 1.080 | 1.160 | 1.400 | 0.613 | 0.632 | 0.652 | 0.672 | 0.693 |

| % Sales | -3.62% | -0.50% | 5.33% | 5.64% | 6.10% | 2.59% | 2.59% | 2.59% | 2.59% | 2.59% |

| Taxes | 0.042 | 0.080 | 0.175 | 0.103 | 0.169 | 0.074 | 0.076 | 0.079 | 0.081 | 0.084 |

| % EBIT | -5.68% | -82.47% | 16.20% | 8.88% | 12.07% | 12.07% | 12.07% | 12.07% | 12.07% | 12.07% |

Cash Flow Items[27] edit edit source

| D&A | 0.539 | 0.561 | 0.627 | 0.642 | 0.635 | 0.688 | 0.709 | 0.732 | 0.754 | 0.778 |

| % sales | 2.64% | 2.91% | 3.09% | 3.12% | 2.77% | 2.91% | 2.91% | 2.91% | 2.91% | 2.91% |

| % Capex | -51.33% | 85.00% | 142.50% | 116.94% | 114.21% | 81.46% | 81.46% | 81.46% | 81.46% | 81.46% |

| CAPEX | (1.050) | 0.660 | 0.440 | 0.549 | 0.556 | 0.632 | 0.652 | 0.673 | 0.694 | 0.715 |

| % sales | -5.14% | 3.43% | 2.17% | 2.67% | 2.42% | 2.67% | 2.67% | 2.67% | 2.67% | 2.67% |

| Change in NWC | 0.179 | (0.078) | (0.106) | (0.171) | (1.600) | -0.372 | -0.383 | -0.395 | -0.408 | -0.421 |

| % sales | 0.88% | -0.40% | -0.52% | -0.83% | -6.97% | -1.57% | -1.57% | -1.57% | -1.57% | -1.57% |

| % change in sales | 6.61% | -10.39% | -58.97% | -67.23% | -32.49% | -32.49% | -32.49% | -32.49% | -32.49% |

WACC edit edit source

| WACC | Reasons | |

| Risk free rate | 4.742% | 5 year NZ bond rate[28] |

| Market risk premium | 7% | |

| Levered beta | 1.41 | From average of selected beta range (0.92-1.89)[29] |

| Cost of equity | 14.61% | |

| Cost of debt | 6.35% | From average of range[30] |

| Share price (NZD) | 3.12 | |

| Share outstanding (billions) | 1.61 | |

| Value of equity (billions) | 5.023 | |

| Value of debt (billions) | 4.931 | Long term + Short term debts[31] |

| Internal WACC | 10.52% | |

Discounted Cash Flow Statement edit edit source

DCF completed on the 208th day of 2023.

| DCF | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 |

| Revenue | 20.44 | 19.26 | 20.28 | 20.57 | 22.95 | 23.67 | 24.41 | 25.17 | 25.96 | 26.77 |

| % growth | -5.77% | 5.30% | 1.43% | 11.57% | 3.13% | 3.13% | 3.13% | 3.13% | 3.13% | |

| EBIT | (0.740) | (0.097) | 1.080 | 1.160 | 1.400 | 0.613 | 0.632 | 0.652 | 0.672 | 0.693 |

| % margin | -3.62% | -0.50% | 5.33% | 5.64% | 6.10% | 2.59% | 2.59% | 2.59% | 2.59% | 2.59% |

| Taxes | 0.042 | 0.080 | 0.175 | 0.103 | 0.169 | 0.074 | 0.076 | 0.079 | 0.081 | 0.084 |

| % EBIT | -5.68% | -82.47% | 16.20% | 8.88% | 12.07% | 12.07% | 12.07% | 12.07% | 12.07% | 12.07% |

| EBIAT | (0.698) | (0.017) | 1.255 | 1.263 | 1.569 | 0.674 | 0.674 | 0.674 | 0.674 | 0.674 |

| D&A | 0.539 | 0.561 | 0.627 | 0.642 | 0.635 | 0.688 | 0.709 | 0.732 | 0.754 | 0.778 |

| % sales | 2.64% | 2.91% | 3.09% | 3.12% | 2.77% | 2.91% | 2.91% | 2.91% | 2.91% | 2.91% |

| CAPEX | (1.050) | 0.660 | 0.440 | 0.549 | 0.556 | 0.632 | 0.652 | 0.673 | 0.694 | 0.715 |

| % sales | -5.14% | 3.43% | 2.17% | 2.67% | 2.42% | 2.67% | 2.67% | 2.67% | 2.67% | 2.67% |

| Change in NWC | 0.179 | (0.078) | (0.106) | (0.171) | (1.600) | -0.372 | -0.383 | -0.395 | -0.408 | -0.421 |

| % sales | 0.88% | -0.40% | -0.52% | -0.83% | -6.97% | -1.57% | -1.57% | -1.57% | -1.57% | -1.57% |

| Unlevered FCF | 0.712 | (0.038) | 1.548 | 1.527 | 3.248 | 1.102 | 1.115 | 1.129 | 1.143 | 1.158 |

| Year Count | 0.57 | 1.57 | 2.57 | 3.57 | 4.57 | |||||

| Present FCF | 1.059 | 1.115 | 1.129 | 1.143 | 1.158 |

| Sum FCF | 5.585 | |

| Terminal growth rate | 4% | Average perpetuity growth rate[32] |

| Terminal value | 17.070 | |

| Enterprise value | 22.655 | |

| Net debt | 4.931 | |

| Equity value | 17.724 | |

| Shares | 1.61 | |

| Fair share price in NZD | 11.01 | |

| Current share price in NZD | 3.12 |

Relative Valuation edit edit source

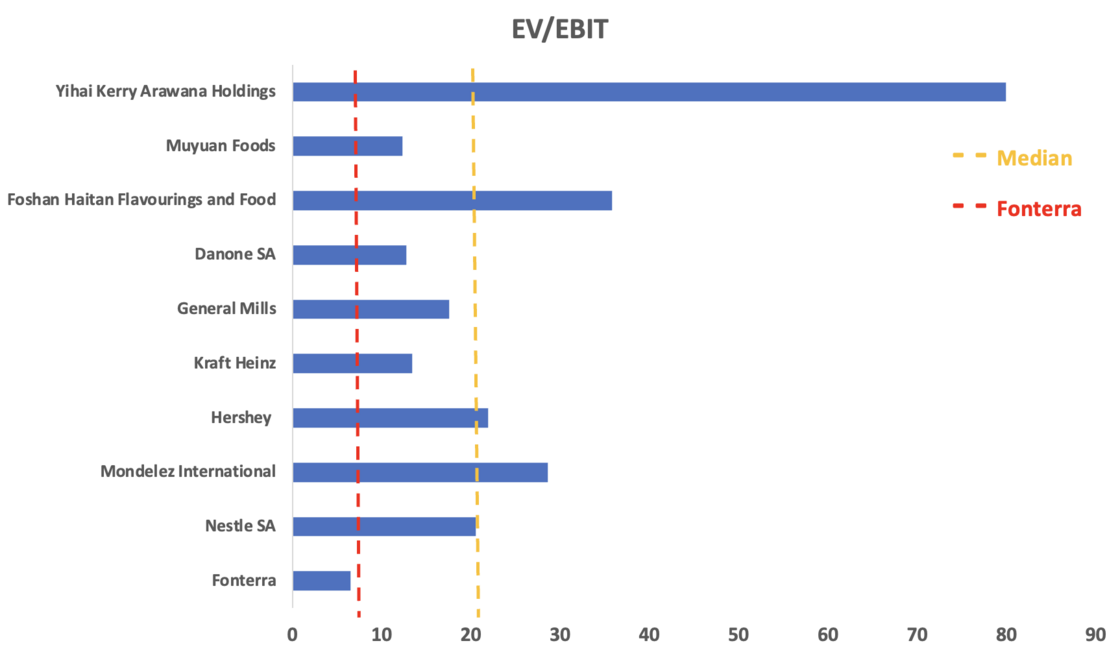

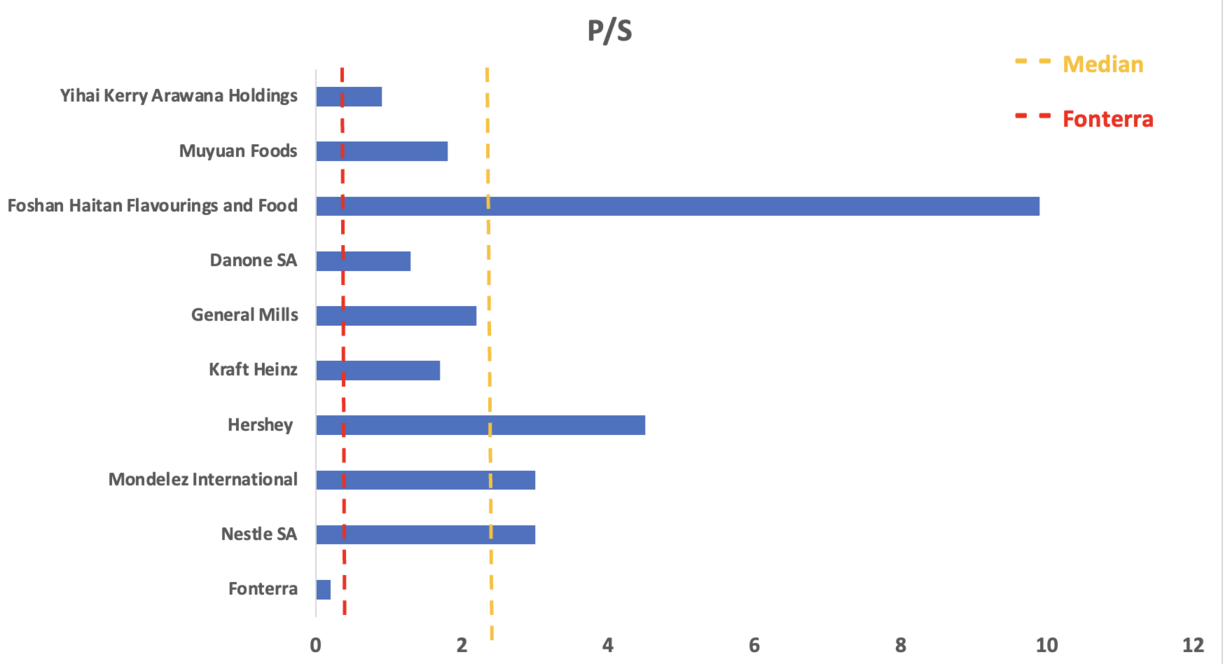

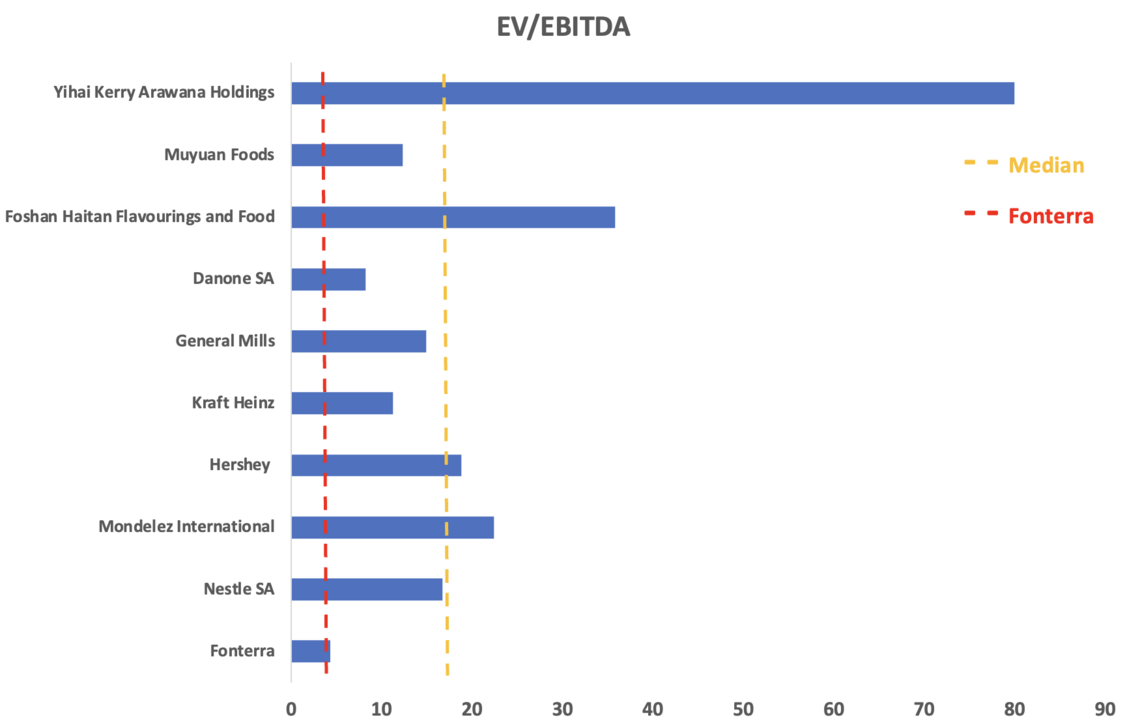

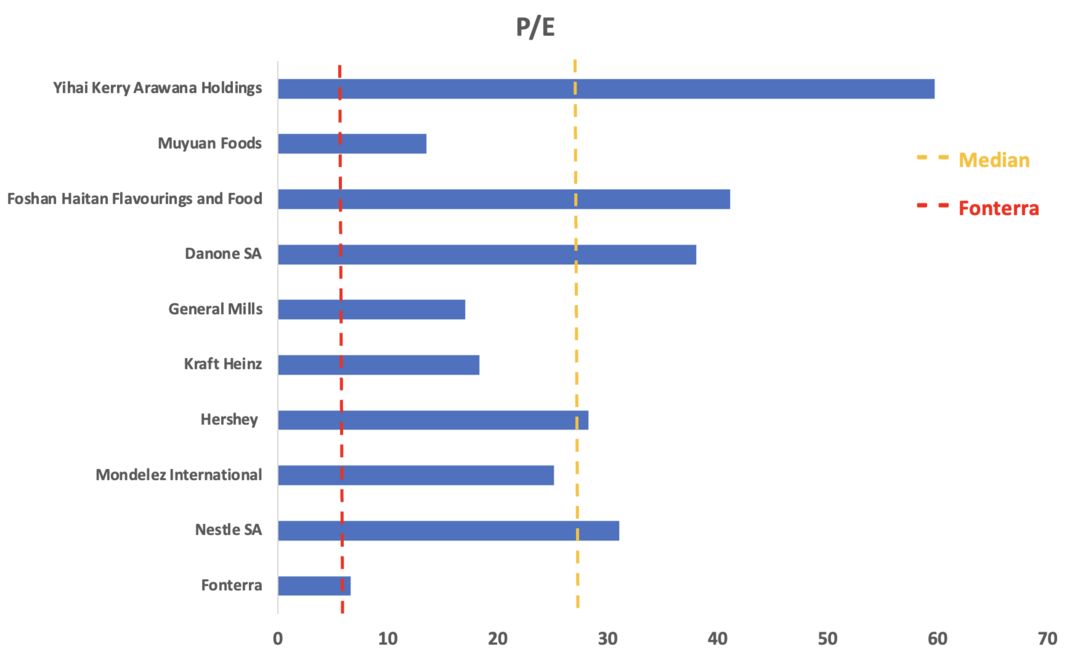

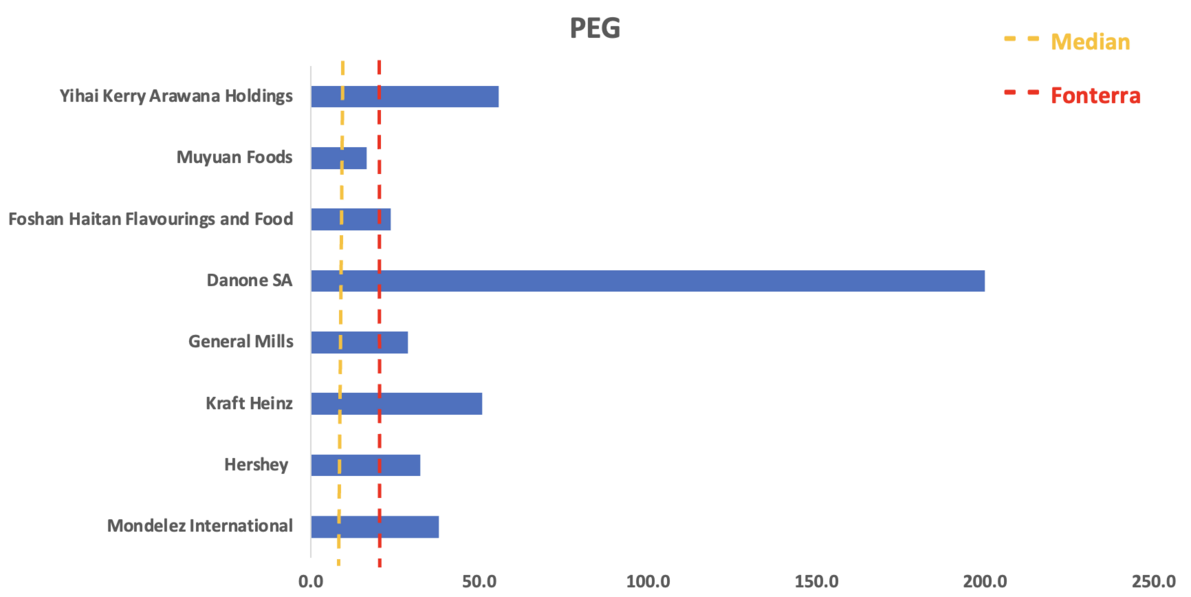

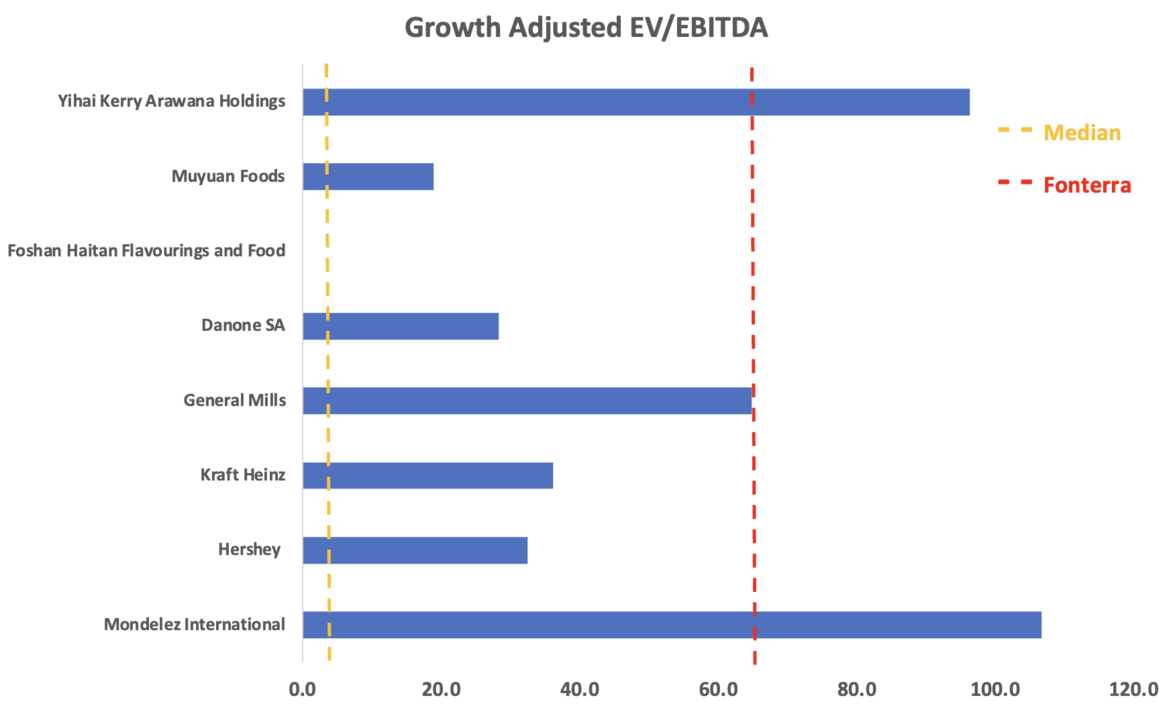

Trading comparable analysis was used to compare Fonterra to its competitors in the market. A range of different multiples are used to evaluate the current share price of Fonterra.[33]

| P/S | P/E | EV/EBITDA | EV/EBIT | Earnings Growth | EBITDA Growth | PEG | Growth Adjusted EV/EBITDA | |

|---|---|---|---|---|---|---|---|---|

| Fonterra | 0.2 | 6.6 | 4.3 | 6.5 | 69.1% | 6.2% | 9.6 | 69.2 |

| Nestle SA | 3 | 31 | 16.7 | 20.5 | - | - | - | - |

| Mondelez International | 3 | 25.1 | 22.4 | 28.6 | 66.0% | 21.0% | 38.0 | 106.7 |

| Hershey | 4.5 | 28.2 | 18.8 | 21.9 | 87.0% | 58.0% | 32.4 | 32.4 |

| Kraft Heinz | 1.7 | 18.3 | 11.2 | 13.4 | 36.0% | 31.0% | 50.8 | 36.1 |

| General Mills | 2.2 | 17 | 14.9 | 17.5 | 59.0% | 23.0% | 28.8 | 64.8 |

| Danone SA | 1.3 | 38 | 8.2 | 12.7 | 19.0% | 29.0% | 200.0 | 28.3 |

| Foshan Haitan Flavourings and Food | 9.9 | 41.1 | 35.8 | 35.8 | 174.0% | 0.0% | 23.6 | - |

| Muyuan Foods | 1.8 | 13.5 | 12.3 | 12.3 | 82.0% | 65.0% | 16.5 | 18.9 |

| Yihai Kerry Arawana Holdings | 0.9 | 59.7 | 79.9 | 79.9 | 107.0% | 83.0% | 55.8 | 96.3 |

| Median | 2.2 | 28.2 | 16.7 | 20.5 | 70.0% | 111.0% | 2.1 | 3.1 |

| Mean | 3.1 | 30.2 | 24.5 | 27.0 | 78.8% | 38.8% | 55.7 | 54.8 |

| Lower Quartile | 1.7 | 18.3 | 12.3 | 13.4 | 53.3% | 22.5% | 27.5 | 30.3 |

| Upper Quartile | 3.0 | 38.0 | 22.4 | 28.6 | 92.0% | 59.8% | 52.1 | 80.5 |

| Min | 0.2 | 6.6 | 4.3 | 6.5 | 19.0% | 0.0% | 9.6 | 18.9 |

| Max | 9.9 | 59.7 | 79.9 | 79.9 | 174.0% | 83.0% | 200.0 | 106.7 |

The valuation multiples are expressed in the bar charts with the industry median and the respective valuation multiple value for Fonterra.

EV/EBIT

EV/EBIT – The ratio evaluated the enterprise value of the company (considering all debts and liabilities) with respect to the operating earnings of the company. The average EV/EBITDA ratio in the industry is 20.5 while the EV/EBITDA ratio of Fonterra is 6.5. A low EV/EBITDA ratio suggests an undervaluation.

P/S

P/S – Price to Sales ratio evaluates how much an investor values each dollar of sale generated by the company. The average P/S ratio in the industry is 2.2 while the P/S ratio of Fonterra is 0.2. A low P/S ratio suggests that the investors are willing to pay a lower price per dollar of sale generated implying an undervaluation.

EV/EBITDA

EV/EBITDA – The ratio evaluates the enterprise value of the company (considering all debts and liabilities) with respect to the operating performance of the company. The average EV/EBITDA ratio in the industry is 16.7 while the EV/EBITDA ratio of Fonterra is 4.3. A low EV/EBITDA ratio suggests an undervaluation.

P/E

P/E – Price to Earnings ratio shows how much an investor is willing to pay per dollar of earnings generated. It portrays an investor’s expectation of the future earnings of the company. The average P/E ratio in the industry is 28.2 while the P/S ratio of Fonterra is 6.6. A low P/E ratio suggests that the investors are willing to pay a lower price per dollar of EPS generated implying an undervaluation.

PEG

PEG is the ratio of P/E to earnings growth rate. A PEG ratio greater than 1 indicates that the stock is overvalued while a PEG ratio smaller than 1 indicates the stock is undervalued. As a result of high earnings forecasts for Fonterra, the PEG ratio for Fonterra (9.6) is noticeably higher than the industry median (2.1).

Growth Adjusted EV/EBITDA

The growth adjusted EV/EBITDA is the ratio of EV/EBITDA to the growth in EBITDA. The growth adjusted EV/EBITDA for Fonterra (69.2) is significantly higher than the industry median (3.1).

Risk Assessment edit edit source

Dairy Industry Restructuring Act (DIRA) edit edit source

The initial implementation of DIRA in 2001 lifted controls on exporting NZ dairy, effectively opening up competition of NZ dairy internationally. However, the near monopsony state of Fonterra Co-op with farmers decrease competition domestically. DIRA sets out requirements, specifically section 4(f) of the Act specifically states to regulate Fonterra to push overall contestability and efficiency of NZ dairy[5].

As of July 2020, amendments of the act mostly relaxed certain regulation on Fonterra. However, as set out in the amended DIRA, Fonterra is required to supply milk to Goodman Fielder (main milk distribution competitor in NZ) that can support half of the total supply of the NZ domestic dairy market. These amendments are reviewed every 4 to 6 years and could be changed accordingly[5].

Transmitted Diseases edit edit source

In 2013, Fonterra had to recall products worldwide to contamination of food-borne botulism disease. This lead to the temporary banning of NZ dairy imported into markets, including key market in Asia Pacific such as China and Vietnam[34]. It was not until 2020 were reports stated that the contamination was due to C. sporogenes which is incapable of producing the botulism toxin[35]. It can be seen that market takes great notice when it comes to food safety where the whole milk industry at the time took a hit, including French dairy firm Danone[36].

Other disease that affect cows include Bovine Tuberculosis, which has also been reported such as that affecting herd in the westcoast of NZ in 2021[37]. These cattle-borne disease take a direct hit on milk yield.

ESG analysis edit edit source

Environmental edit edit source

| Sustainability Plans | TARGET | FY19 | FY20 | FY21 | FY22 [Target] |

| Farm Environment Plans (FEPs) | 100% (2025) | 23% | 34% | 53% | 71% [68%] |

| Reduce water use at manufacturing sites

(FY18 baseline) |

30% reduction (2030) | 3.9% increase | 2.9% reduction | 2.6% reduction | 6.6% reduction [8%] |

| Decrease GHG emission (FY18 baseline) | 30% reduction (2030) | 1.8% increase | 3.5% reduction | 6.6% reduction | 11.2% reduction [6.6%] |

In FY22, Fonterra had no fines related to not complying to environmental laws and regulation, except a notice where "a mixing chamber at one of nutrient management farms in New Zealand malfunctioned and an unknown volume of wastewater was discharged to a nearby stream"[38].

Social edit edit source

Fonterra puts importance on diversity and inclusion, including the incorporation of the indigenous Māori culture into its work culture, the closing of the gender pay gap and gender equality in the workforce, and anti-discrimination.

Courses have been launched to improve accuracy and usage of Māori language. Transparency is given regarding gender pay gap, with gender pay gap of 5.1% in 2022, lower than the national medium of 9.2%. A total of 23 discrimination complaints had been brought to attention via HR and management teams, and “The Way We Work Hotline” across the globe. Of which some involved substantiation, and then of which some involved disciplinary actions.

Governance edit edit source

Fonterra has anti-corruption measures with annual internal audits that assess the business for potential fraud and unethical professional practice.

Fonterra forbids contribution to political parties and candidates.

As a co-operative in NZ, Fonterra is taxed indirectly where income is passed to farmer shareholders who then pay their earnings in the form of income tax.

ESG Risk Ratings edit edit source

![ESG risk rating of key dairy sector companies [5]. Risk ratings of NZ domestic (orange) and other top 10 international dairy companies (blue) compared to Fonterra (grey), according to sustainalytics: 0-10, negligible risk; 10-20, low risk; 20-30, medium risk; 30-40, high risk; 40-50, severe risk.](/images/1/10/ESG_risk_rating_of_key_dairy_sector_companies.png)

Fonterra has a ESG Risk Rating of 24.3 (medium ESG risk), which is comparably lower than both domestic and international competitors.

References edit edit source

- ↑

- ↑

- ↑ 3.0 3.1 3.2 3.3 3.4

- ↑

- ↑ 5.00 5.01 5.02 5.03 5.04 5.05 5.06 5.07 5.08 5.09 https://www.productivity.govt.nz/assets/Inquiries/frontier-firms/a977484e51/The-dairy-sector-in-NZ-TDB-Advisory.pdf

- ↑ https://www.fonterra.com/nz/en/careers/life-at-fonterra.html

- ↑ https://www.productivity.govt.nz/assets/Inquiries/frontier-firms/a977484e51/The-dairy-sector-in-NZ-TDB-Advisory.pdf

- ↑ https://www.fonterra.com/nz/en/investors/investor-services/shares-and-units.html

- ↑ https://www.marketscreener.com/quote/stock/FONTERRA-SHAREHOLDERS-FUN-103506239/company/

- ↑ 10.0 10.1 10.2 10.3 10.4 https://www.fonterra.com/content/dam/fonterra-public-website/fonterra-new-zealand/documents/pdf/long-term-aspirations/fonterra-2021-long-term-aspirations-booklet.pdf

- ↑ 11.0 11.1 https://www.fonterra.com/nz/en/embracing-sustainability/our-commitments/land-and-water.html

- ↑ https://www.fonterra.com/nz/en/embracing-sustainability/our-commitments/climate-change.html

- ↑ https://www.treasury.govt.nz/publications/research-and-commentary/rangitaki-blog/feu-special-topic-medium-term-outlook-dairy-exports

- ↑ https://www.worldstopexports.com/top-milk-exporting-countries/

- ↑ https://figure.nz/chart/EdaXEBTxUQsijkEQ

- ↑ https://figure.nz/chart/EdaXEBTxUQsijkEQ

- ↑ https://www.frontiersin.org/articles/10.3389/fsufs.2023.1084067/full

- ↑ https://www.statista.com/outlook/cmo/food/dairy-products-eggs/milk-substitutes/worldwide

- ↑ https://www.stuff.co.nz/business/farming/129691125/fonterra-takes-first-step-into-nondairy-products

- ↑ https://www.peta.org/blog/what-is-precision-fermentation/#:~:text=Precision%20fermentation%20is%20the%20process,the%20same%20taste%20and%20texture.

- ↑ https://www.mordorintelligence.com/industry-reports/dairy-products-market

- ↑ https://www.expertmarketresearch.com/reports/australia-and-new-zealand-cheese-market

- ↑ https://www.tasteatlas.com/most-popular-cheeses-in-new-zealand

- ↑ https://www.fonterra.com/content/dam/fonterra-public-website/fonterra-new-zealand/documents/pdf/financial-results/fy22/2022_Annual_Results_Investor_Pack_Final.pdf

- ↑ https://www.wsj.com/market-data/quotes/NZ/XNZE/FCG/financials

- ↑ https://www.marketwatch.com/investing/stock/fcg/financials?countrycode=nz

- ↑ https://www.marketwatch.com/investing/stock/fcg/financials/cash-flow?countrycode=nz

- ↑ https://www.marketwatch.com/investing/bond/tmbmknz-05y?countrycode=bx

- ↑ https://finbox.com/NZSE:FCG/models/wacc/

- ↑ https://valueinvesting.io/FCG.NZ/valuation/wacc

- ↑ https://www.marketwatch.com/investing/stock/fcg/financials/balance-sheet?countrycode=nz

- ↑ https://finbox.com/NZSE:FCG/models/ddm-sg/

- ↑ https://www.alphaspread.com/security/nzx/fcg/relative-valuation

- ↑ https://www.theguardian.com/world/2013/aug/05/fonterra-botulism-import-ban

- ↑ https://www.nzherald.co.nz/business/fonterra-botulism-crisis-was-false-alarm/EFYWUIQZSJP5LW36HOZDONOV6A/

- ↑ https://www.ft.com/content/ba16c570-d648-11e7-8c9a-d9c0a5c8d5c9

- ↑ https://www.nzherald.co.nz/the-country/news/tb-outbreak-affects-west-coast-herds/V2P3PSWNUBW6AUETNMDLH757HM/

- ↑ https://www.fonterra.com/content/dam/fonterra-public-website/fonterra-new-zealand/documents/pdf/sustainability/2022/fonterra-sustainability-report-2022.pdf

- ↑ https://www.sustainalytics.com/esg-ratings