Gryphon Online Safety

Invest in the future of intelligent home network protection.

Summary edit edit source

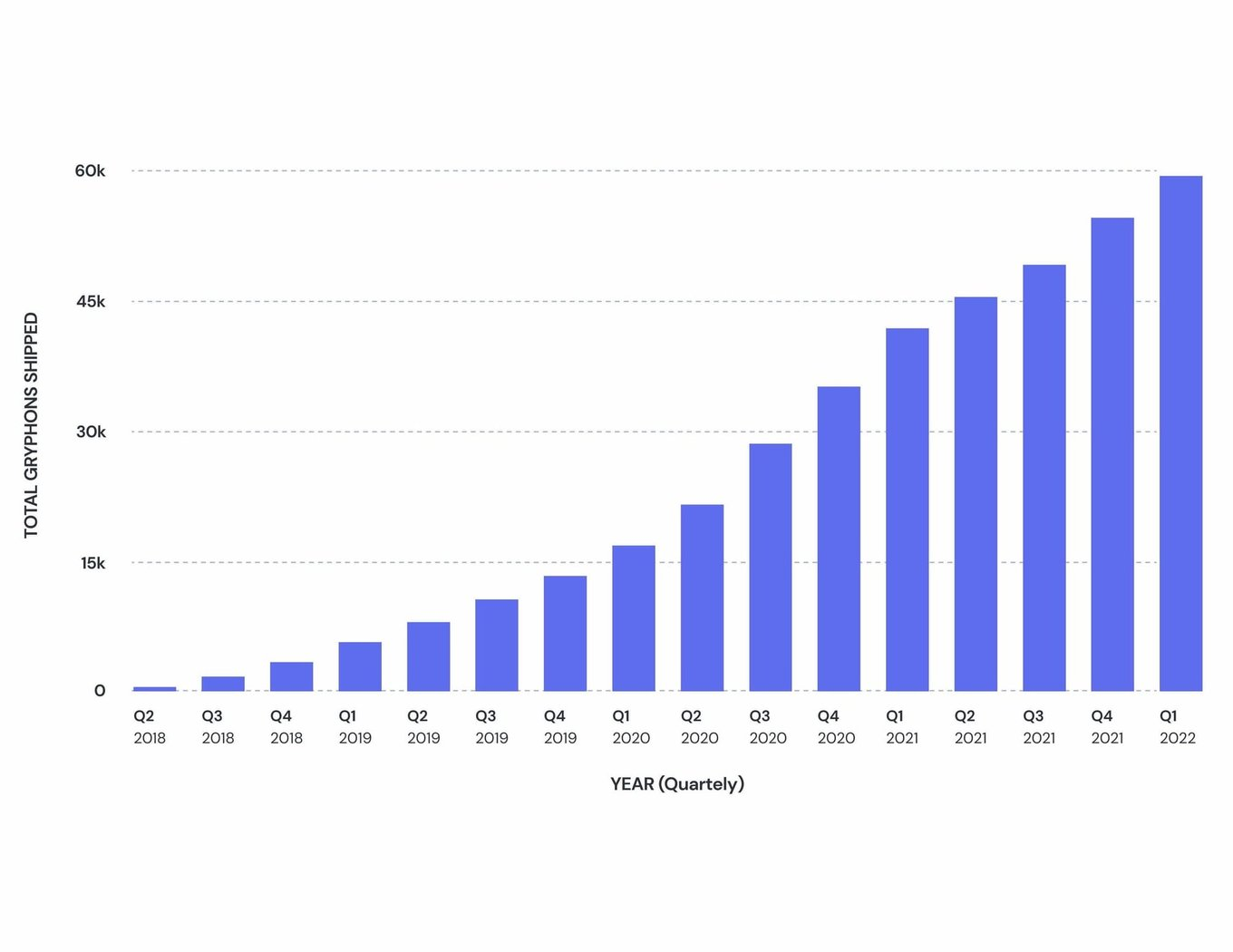

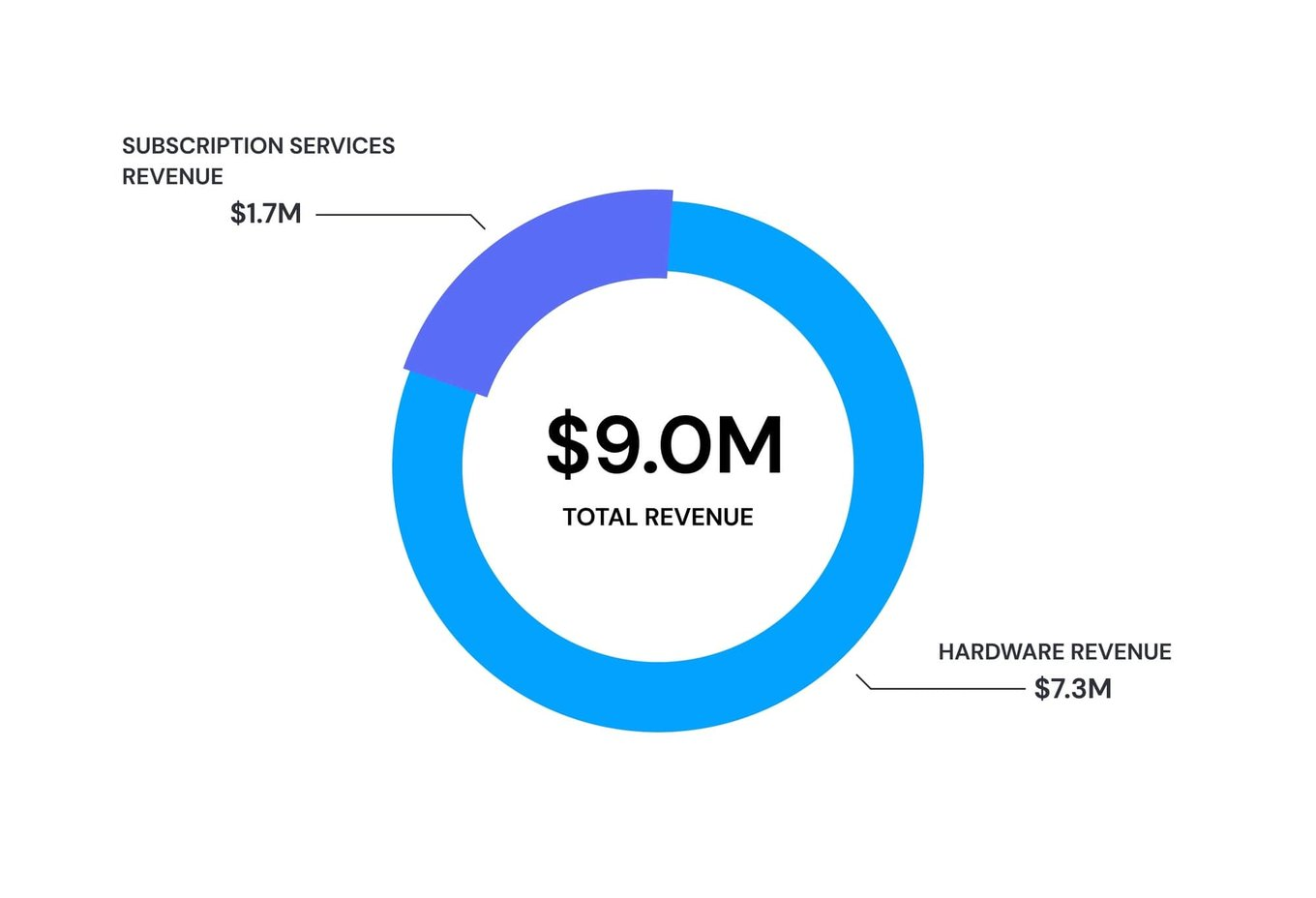

- Over $9M in total sales and over 55,000 Gryphons shipped

- 6 patents issued and other patents pending for home network protection

- Raised over $11M from noted angel groups, including ATI & Frontier Angels

- Founders behind disruptive tech such as MiFi mobile hotspot & Apple iPod

- Industry accolades from Tom's Guide, PC Mag, TechAeris, and Fatherly

- Recognized as one of the fastest-growing startups in Southern California

Problem edit edit source

Networks are getting more complicated, leading to security and privacy concerns edit edit source

- Average of 25 connected devices per US household

- 74 billion connected devices projected by 2025

- Most people don’t know what devices are actually connected on their networks

Digital parenting is more challenging than ever edit edit source

- Kids spend more than 7 hours per day in front of screens

- 90% of kids age 8–16 have seen inappropriate content online

- Screentime management is one of the toughest challenges faced by parents

More vulnerable devices lead to increased hacking edit edit source

- 70% of connected devices in the home are vulnerable to hacking

- 330% increase in hacking during COVID19

- Default network security in devices is inadequate

A solution is urgently needed edit edit source

- Fragmented market makes finding solutions difficult

- Existing solutions are ineffective and difficult to use

- COVID-19 driving surge in-home Internet usage and online threats

Solution edit edit source

Intelligent firewall made simple

Gryphon makes it easy to help protect you, your family, and every device in your home from digital threats online. No more worries about hackers, malware, or intrusions into your privacy. No more worries about your kids being exposed to inappropriate content or screen addiction.

Gryphon is a cloud-managed network protection service platform that's powerful yet simple. The platform combines an elegant high-performance mesh WiFi system, a simple to use App, and cloud-based machine learning that will continuously improve the protection over time and usage.

With the patent-pending Homebound™ app, Gryphon also provides on-the-go smartphone protection when your family is away from your home network.

Product edit edit source

Gryphon combines ultra-fast WiFi with a complete digital protection platform edit edit source

WiFi options edit edit source

Gryphon AX edit edit source

- Powered by the latest mesh WiFi 6 technology

- 40% boost in speed

- 40% increase in total WiFi capacity

Gryphon Tower edit edit source

- Up to 3,000 sqft of high-speed WiFi coverage

Gryphon Guardian edit edit source

- Up to 1,800 sqft of WiFi coverage

- Can be used to expand the coverage of the Gryphon Tower

Enterprise-grade home network security edit edit source

- Every connected device in your network is automatically protected—no additional software installations are needed

- Gryphon scans for vulnerabilities and infected devices that can be compromised by intruders to hack your network

- 24/7 filtering protects every device from being infected by dangerous malware and ransomware

- VPN support and end-to-end data encryption provides personal data protection for every user in your home

Powerful parental controls edit edit source

- Set daily screen time limits to promote healthy screen time

- Create daily internet schedules for homework and bedtime

- Limit access to websites and distracting apps

- Monitor website browsing history

- View usage insights based on web categories

Protection everywhere with HomeBound™ edit edit source

Extend Gryphon’s security and control to any network

- HomeBound™ is a patent-pending extension app of the Gryphon home WiFi system to route all mobile traffic back to Gryphon before going out

- Provides data encryption, privacy, and malware filtering for your family's smartphones when away from your network

- Parental controls work for your child’s smartphone as if they never left the home

Traction edit edit source

Company traction and growth edit edit source

Over 55k Gryphons sold edit edit source

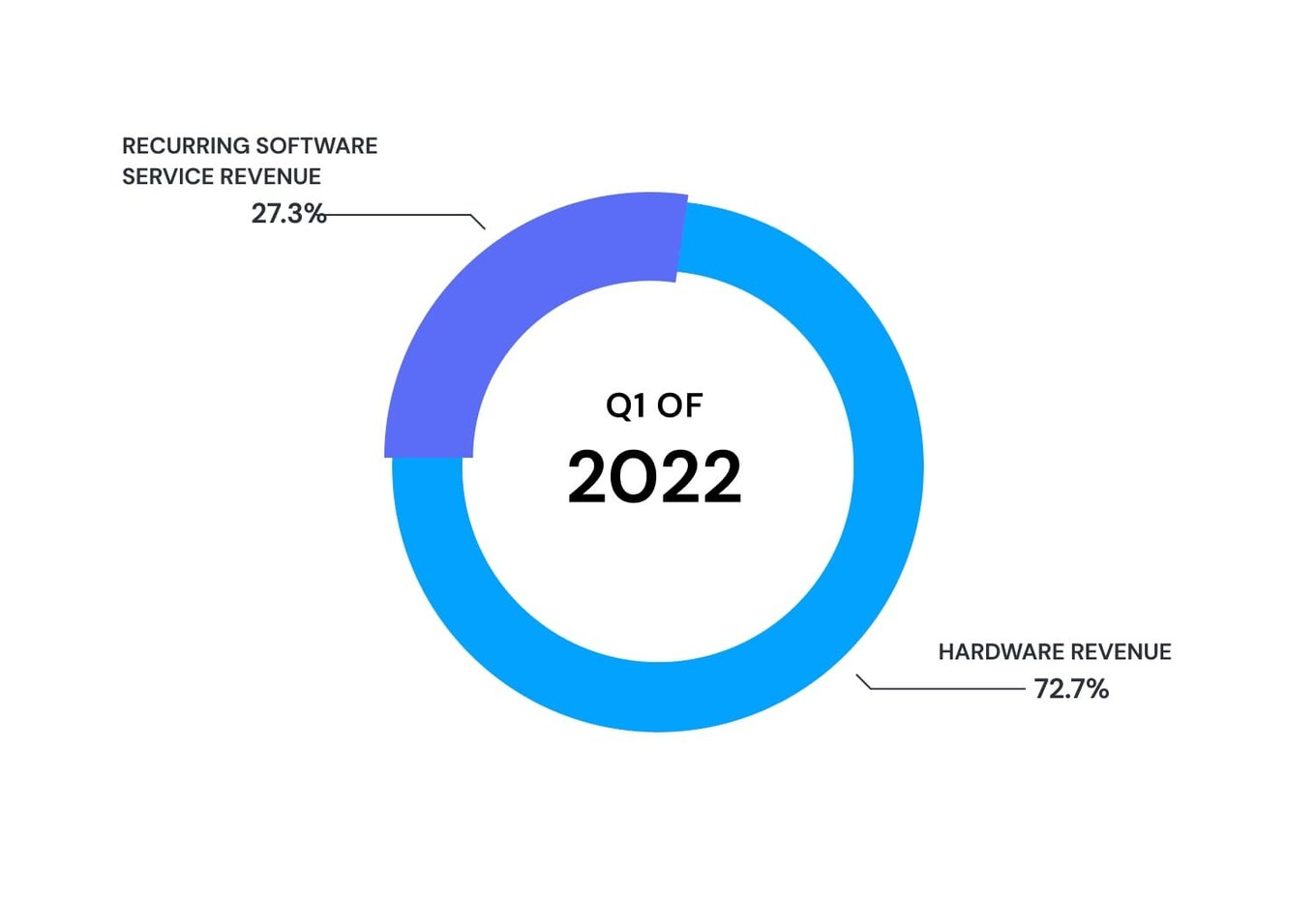

$9M total revenue with $1.7M+ from software services edit edit source

- Expansion to Canada with BestBuy Canada and Amazon Canada in Oct 2021

- Gryphon AX with WiFi 6 technology launched in Aug 2021

- Recognized by Connect w/ San Diego Venture Group as one of Southern California's fastest-growing start-ups three consecutive years

Awards and industry recognition edit edit source

Best Security-Focussed Mesh Router

Best Security-Focussed Mesh Router

2019 Best WiFi Mesh Network Systems · Top 10 List

2019 Best WiFi Mesh Network Systems · Top 10 List

"The Best Parental Control Hardware Around"

"The Best Parental Control Hardware Around"

Best of CES 2019 · Best Router for Family Safety and Privacy

Best of CES 2019 · Best Router for Family Safety and Privacy

What press is saying edit edit source

Customers edit edit source

What customers are saying:

Business model edit edit source

Multiple revenue channels

Direct to consumer sales channels edit edit source

- Gryphon website

- Recurring software service revenue

- Online marketplaces

Amazon (US, Canada, and United Kingdom)

Amazon (US, Canada, and United Kingdom)

Growing service revenue edit edit source

License and service edit edit source

- Software license and term sheets

- 87% gross margin on service

Data intelligence edit edit source

- 12+ managed devices per home (average)

- 330k+ internet-connected devices being protected

- 11M+ malware and intrusions blocked

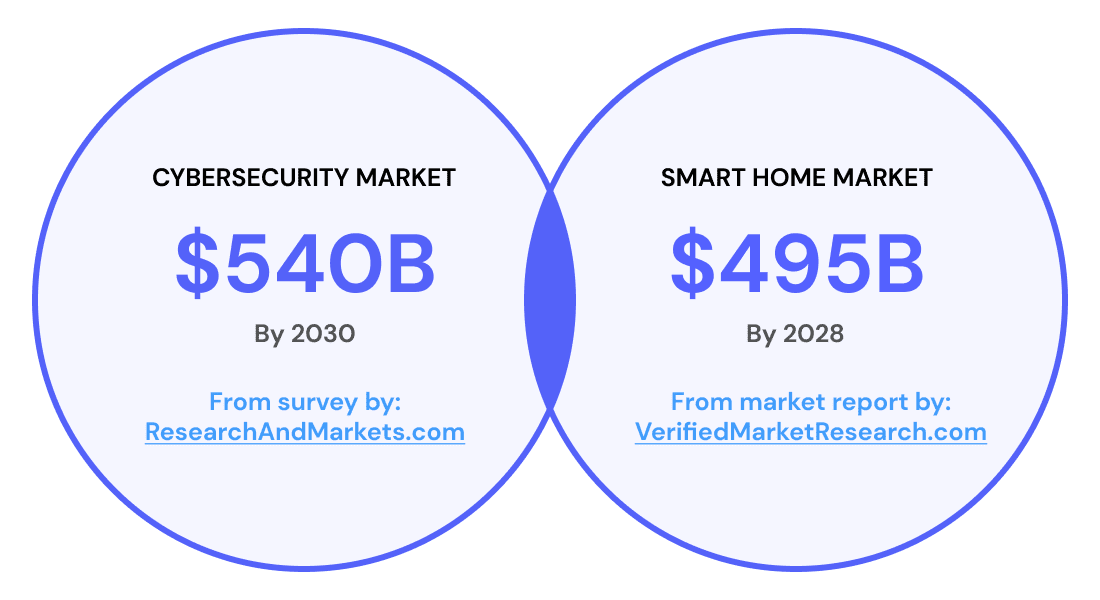

Market edit edit source

Complex home networks + WFH + distance learning = robust market opportunity edit edit source

- Growing number of connected “smart” devices in the home

- Increasing awareness of privacy issues and screentime addiction

- Work from home and remote learning

Smart Home Market growing at 23.6% CAGR edit edit source

"Increasing trend of remote working practices to boost demand for solutions."-Fortune Business Insights edit edit source

Competition edit edit source

A leader in total home network protection

- End-to-end solution built from the ground up to help protect your home network and your privacy

- 6 patents issued

- 3 trademarks issued

- Industry veterans with over 100 years of combined experience in wireless technology and product design

Vision and strategy edit edit source

Gryphon was started due to an incident with John's daughter where she accidentally stumbled on some nasty content while searching for princesses on her iPad. This is a worry that all parents are facing today.

We founded Gryphon with the vision to make the internet a safer place for families and small businesses—by creating an affordable and easy-to-use platform that combines the latest in network protection, machine learning, and wireless connectivity.

Just like the personal computer revolution, we believe this is the beginning of a revolution in personal home network protection.

With the increase in home internet usage driven by the pandemic, our mission to protect our online activities is more important than ever!

Web without worry—that's our promise and our mission.

Funding edit edit source

Founders edit edit source

John Wu

Co-Founder and CEO

MiFi Inventor, ex-Motorola

Executive with over 23 years of experience in wireless and IoT at global companies like Novatel Wireless and Motorola. Led high impact teams with over 120 professionals and successfully shipped multiple products with over 4 million units annually. One of the key inventors of MiFi mobile hotspot - selected by Time Magazine as one of the top gadgets of the century. John holds 25 patents with others pending.

Arup Bhattacharya

Co-Founder and CTO

Built the chip and SW that powered the Apple iPods

Seasoned software and multimedia executive with over 30 years of experience in technology innovation. Led MiFi software development at Novatel Wireless. An executive at PortalPlayer where he developed multiple generations of the media chip that powered the Apple iPods and helped lead the company to IPO and eventual acquisition by NVDIA.

Gryphon Online Safety Team edit edit source

John Wu

CEO and Co-Founder

Arup Bhattacharya

CTO and Co-Founder

Allan Chua

VP of Marketing and Business Development

Cathy Hoving

Senior Finance Manager

Sarah Kimmel

Tech Support Manager, Family Tech Vlogger

Rob Randolph

Digital Marketing

Abe Chomali

Amazon Marketing

Dennis Devlin

Consumer Security Advocate, Former CISO

Peter Townshend

Legal Counsel

Sanjeev Kumar

Outside Board Member, Former COO of PortalPlayer

Jeff Wallace

Investor, Startup Advisor and Speaker

Santosh Mokashi

Investor and Advisor, SVP HCL Technologies

Angel Saad Gómez

Investor and Advisor, Venture Partner at Oak Investments

Risks edit edit source

The Company’s success depends on the experience and skill of the founders and key employees.

In particular, the Company is dependent on John Wu and Arup Bhattacharya. The loss of our founders or any key members of the team could harm the Company’s business, financial condition, cash flow and results of operations.

The Company uses Qualcomm components.

The Company’s reliance on a single chipset supplier poses risks of shortages, price increases, changes, delay and other issues that could disrupt and adversely affect its business.

Our financials were prepared on a “going concern” basis.

Our financial statements were prepared on a “going concern” basis. Certain matters, as described below and in Note 12 to the accompanying financial statements indicate there may be substantial doubt about the Company's ability to continue as a going concern. The Company has incurred losses from inception of $6,784,961 which raises substantial doubt about the Company's ability to continue as a going concern. The ability of the Company to continue as a going concern is dependent upon management's ability to raise additional capital from the issuance of debt or the sale of stock, its ability to commence profitable sales of its flagship product, and its ability to generate positive operational cash flow.

The Company has a limited operating history upon which you can evaluate its performance, and has not yet generated profits. Accordingly, the Company’s prospects must be considered in light of the risks that any new company encounters.

The Company was initially formed as a Delaware limited liability company on January 30, 2014, under the name “Griffin Innovations LLC” and which filed a certificate of conversion in Delaware on June 19, 2014, under which the Company was converted into Delaware corporation under the name “Gryphon Online Safety, Inc.” on June 19, 2014, and it has not yet generated sustained profits. The likelihood of its creating a viable business must be considered in light of the problems, expenses, difficulties, complications, and delays frequently encountered in connection with the growth of a business, its operation in a competitive industry, and the continued development of its technology and products. The Company anticipates that its operating expenses will increase for the near future, and there is no assurance that it will be profitable in the near future. You should consider the business, operations, and prospects in light of the risks, expenses, and challenges faced as an emerging growth company.

The Company depends on one primary product.

The Company’s primary product is a secure WiFi router. Although the Company is developing other products, the Company’s survival in the near term depends on its ability to sell its primary product to a sufficient number of customers to make a profit. The Company’s current base of customers is still small, and the Company will only succeed if it can attract more customers for its primary product.

We may not be successful in obtaining additional issued patents.

Our success depends significantly on our ability to obtain, maintain and protect our proprietary rights to the technologies used in our services. We have filed multiple non-provisional and provisional patent applications, as detailed under “The Company’s Business”. Filing a non-provisional or provisional patent application only indicates that we are pursuing protection, but the scope of protection, or whether a patent will even be granted, is still undetermined. We have one issued patent and are minimally protected from our competitors. Moreover, any patents issued to us may be challenged, invalidated, found unenforceable or circumvented in the future. Any intellectual enforcement efforts the Company seeks to undertake, including litigation, could be time-consuming and expensive and could divert management’s attention.

We rely on various intellectual property rights, including patents and trademarks in order to operate our business.

Such intellectual property rights, however, may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

There are existing companies in the Wi-Fi protection space that could introduce similar or enhance existing services.

Other competitors that have significant funding may be able to cross sell products and services to its customers. If a larger, better funded company markets or creates a comparable service at a lower price point or with better features, the Company could be negatively impacted.

There are existing companies in the Wi-Fi protection space that could introduce similar or enhance existing services.

Other competitors that have significant funding may be able to cross sell products and services to its customers. If a larger, better funded company markets or creates a comparable service at a lower price point or with better features, the Company could be negatively impacted.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

Through our operations, we collect and store certain personal information that our customers provide to purchase products or services, enroll in promotional programs, register on our website, or otherwise communicate and interact with us.

We may share information about such persons with vendors that assist with certain aspects of our business. Security could be compromised and confidential customer or business information misappropriated. Loss of customer or business information could disrupt our operations, damage our reputation, and expose us to claims from customers, financial institutions, payment card associations and other persons, any of which could have an adverse effect on our business, financial condition and results of operations. In addition, compliance with tougher privacy and information security laws and standards may result in significant expense due to increased investment in technology and the development of new operational processes.

An intentional or unintentional disruption, failure, misappropriation or corruption of our network and information systems could severely affect our business.

Such an event might be caused by computer hacking, computer viruses, worms and other destructive or disruptive software, "cyber attacks" and other malicious activity, as well as natural disasters, power outages, terrorist attacks and similar events. Such events could have an adverse impact on us and our customers, including degradation of service, service disruption, excessive call volume to call centers and damage to our plant, equipment and data. In addition, our future results could be adversely affected due to the theft, destruction, loss, misappropriation or release of confidential customer data or intellectual property. Operational or business delays may result from the disruption of network or information systems and the subsequent remediation activities. Moreover, these events may create negative publicity resulting in reputation or brand damage with customers.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

Like others in our industry, we continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including "bugs" and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

The Company has not filed a Form D for its offerings of convertible notes in 2016 and 2017.

The SEC rules require a Form D to be filed by companies within 15 days after the first sale of securities in the offering relying on Regulation D. Failing to register with the SEC or get an exemption may lead to fines, the right of investors to get their investments back, and even criminal charges. There is a risk that a late penalty could apply.

If we do not respond to technological changes or upgrade our websites and technology systems, our growth prospects and results of operations could be adversely affected.

To remain competitive, we must continue to enhance and improve the functionality and features of our websites and technology infrastructure. As a result, we will need to continue to improve and expand our hosting and network infrastructure and related software capabilities. These improvements may require greater levels of spending than we have experienced in the past. Without such improvements, our operations might suffer from unanticipated system disruptions, slow application performance or unreliable service levels, any of which could negatively affect our reputation and ability to attract and retain customers and contributors. Furthermore, in order to continue to attract and retain new customers, we are likely to incur expenses in connection with continuously updating and improving our user interface and experience. We may face significant delays in introducing new services, products and enhancements. If competitors introduce new products and services using new technologies or if new industry standards and practices emerge, our existing websites and our proprietary technology and systems may become obsolete or less competitive, and our business may be harmed. In addition, the expansion and improvement of our systems and infrastructure may require us to commit substantial financial, operational and technical resources, with no assurance that our business will improve.

The COVID-19 pandemic has affected how we are operating our business, and the duration and extent to which this will impact our future results of operations and overall financial performance remains uncertain.

The COVID-19 pandemic is having widespread, rapidly evolving, and unpredictable impacts on global society, economies, financial markets, and business practices. Federal and state governments have implemented measures to contain the virus, including social distancing, travel restrictions, border closures, limitations on public gatherings, work from home, and closure of non-essential businesses. To protect the health and well-being of our employees, partners and third-party service providers, we have implemented a near company-wide work-from-home requirement for most employees until further notice, made substantial modifications to employee travel policies, and cancelled or shifted our conferences and other marketing events to virtual-only for the foreseeable future. While we continue to monitor the situation and may adjust our current policies as more information and public health guidance become available, such precautionary measures could negatively affect our customer success efforts, sales and marketing efforts, or create operational or other challenges, such as a reduction in employee productivity because of the work from home requirement, any of which could harm our business and results of operations. Further, if the COVID-19 pandemic has a substantial impact on our employees, partners or third-party service providers’ health, attendance or productivity, our results of operations and overall financial performance may be adversely impacted. Additionally, if employees, partners or third-party services providers return to work during the COVID-19 pandemic, the risk of inadvertent transmission of COVID-19 through human contact could still occur and result in litigation.

Beginning in March 2020, the U.S. and global economies have reacted negatively in response to worldwide concerns due to the economic impacts of the COVID-19 pandemic. Although we have not yet experienced a material increase in customers cancellations or a material reduction in our retention rate in 2020, we may experience such an increase or reduction in the future, especially in the event of a prolonged economic down turn as a result of the COVID-19 pandemic. A prolonged economic downturn could result adversely affect demand for our offerings, retention rates and harm our business and results of operations, particularly in light of the fact that our solutions are discretionary purchases and thus may be more susceptible to macroeconomic pressures, as well impact the value of our Securities, ability to refinance our debt, and our access to capital. Additionally, we have faced supply chain and shipping issues as a result of the COVID-19 pandemic that could impact our ability to meet customer demands for our products.

The duration and extent of the impact from the COVID-19 pandemic depends on future developments that cannot be accurately forecasted at this time, such as the severity and transmission rate of the disease, the extent and effectiveness of containment actions and the impact of these and other factors on our employees, customers, partners and third-party service providers. If we are not able to respond to and manage the impact of such events effectively and if the macroeconomic conditions of the general economy or the industries in which we operate do not improve, or deteriorate further, our business, operating results, financial condition and cash flows could be adversely affected.

We face substantial competition and our inability to compete effectively could adversely affect our sales and results of operations.

We operate in intensely competitive markets that experience frequent technological developments, changes in industry and regulatory standards, changes in customer requirements, and frequent new product introductions and improvements. If we are unable to anticipate or react to these competitive challenges, or if existing or new competitors gain market share in any of our markets, our competitive position could weaken, and we could experience a decline in our revenues that could adversely affect our business and operating results. To compete successfully, we must maintain an innovative research and development effort to develop new solutions and enhance our existing solutions, effectively adapt to changes in the technology or product rights held by our competitors, appropriately respond to competitive strategies, and effectively adapt to technological changes. If we are unsuccessful in responding to our competitors or to changing technological and customer demands, our competitive position and our financial results could be adversely affected.

Many of our competitors have greater financial, technical, marketing, or other resources than we do and consequently, may have the ability to influence customers to purchase their products instead of ours. Further consolidation within our industry or other changes in the competitive environment could result in larger competitors that compete with us. We also face competition from many smaller companies that specialize in particular segments of the market in which we compete.

Quality management plays an essential role in determining and meeting customer requirements and improving the Company products and services.

Our future success depends on our ability to maintain and continuously improve our quality management program. An inability to address a quality or safety issue in an effective and timely manner may also cause negative publicity, a loss of customer confidence in us or our current or future products, which may result in the loss of sales and difficulty in successfully launching new products. In addition, a successful claim brought against us in excess of available insurance or not covered by indemnification agreements, or any claim that results in significant adverse publicity against us, could have an adverse effect on our business and our reputation.

A majority of the Company is owned by a small number of owners.

Prior to the Offering, a small group of individuals and entities in excess of 30% of the Company. Subject to any fiduciary duties owed to our other owners or investors under Delaware law, these owners may be able to exercise significant influence over matters requiring owner approval, including the election of managers or managers and approval of significant Company transactions, and will have significant control over the Company’s management and policies. Some of these persons may have interests that are different from yours. For example, these owners may support proposals and actions with which you may disagree. The concentration of ownership could delay or prevent a change in control of the Company or otherwise discourage a potential acquirer from attempting to obtain control of the Company, which in turn could reduce the price potential investors are willing to pay for the Company. In addition, these owners could use their voting influence to maintain the Company’s existing management, delay or prevent changes in control of the Company, or support or reject other management and board proposals that are subject to owner approval.

If the Company cannot raise sufficient funds, it will not succeed.

Even if the maximum amount is raised, the Company is likely to need additional funds in the future in order to grow, and if it cannot raise those funds for whatever reason, including reasons relating to the Company itself or to the broader economy, it may not survive. If the Company raises a substantially lesser amount than the Maximum Raise, it will have to find other sources of funding for some of the plans outlined in “Use of Proceeds.”

Future fundraising may affect the rights of investors.

In order to expand, the Company is likely to raise funds again in the future, either by offerings of securities or through borrowing from banks or other sources. The terms of future capital-raising, such as loan agreements, may include covenants that give creditors greater rights over the financial resources of the Company.

Any valuation at this stage is difficult to assess.

The valuation for the Offering was established by the Company. Unlike listed companies that are valued publicly through market-driven stock prices, the valuation of private companies, especially early-stage companies, is difficult to assess, and you may risk overpaying for your investment.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early-stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

With shelter-in-place orders and non-essential business closings potentially happening throughout 2020, 2021, 2022 and into the future due to COVID-19, the Company’s revenue has been adversely affected.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. Our business currently does not generate any sales and future sources of revenue may not be sufficient to meet our future capital requirements. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

Currently, our authorized capital stock consists of 40,000,000 shares of common stock, of which 10,746,391 shares of common stock are issued and outstanding, and 19,137,353 shares of preferred stock, of which (i) 9,582,809 are designated as Series Seed Preferred Stock of which 9,136,468 are issued and outstanding, (ii) 9,100,000 are designated as Series A-1 Preferred Stock of which 5,616,525 are issued and outstanding, and (iii) 454,544 are designated as Series A-2 Preferred Stock of which 454,544 are issued and outstanding. Unless we increase our authorized capital stock, we may not have enough authorized common stock to be able to obtain funding by issuing shares of our common stock or securities convertible into shares of our common stock. We may also not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We rely on other companies to provide components and services for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate manufacture of major components or subsystems for our products, or from whom we acquire such items, do not provide components which meet required specifications and perform to our and our customers’ expectations. Our suppliers may be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two contractors or suppliers for a particular component. Our products may utilize custom components available from only one source. Continued availability of those components at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. The supply of components for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts.

In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future

The Company could potentially be found to have not complied with securities law in connection with this Offering related to “Testing the Waters.”

Prior to filing this Form C, the Company engaged in “testing the waters” permitted under Regulation Crowdfunding (17 CFR 227.206), which allows issuers to communicate to determine whether there is interest in the offering. All communication sent is deemed to be an offer of securities for purposes of the antifraud provisions of federal securities laws. Any Investor who expressed interest prior to the date of this Offering should read this Form C thoroughly and rely only on the information provided herein and not on any statement made prior to the Offering. The communications sent to Investors prior to the Offering are attached as Exhibit E. Some of these communications may not have included proper disclaimers required for “testing the waters”.

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Company’s Certificate of Incorporation, provides that, unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will be the sole and exclusive forum for substantially all disputes between the Company and its stockholders, which could limit the stockholders’ ability to obtain a favorable judicial forum for disputes with the Company or its directors, officers, or employees.

The Company’s Certificate of Incorporation provides that, unless the Company consents in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware will be the exclusive forum for any derivative action or proceeding: (i) brought on the Company’s behalf, (ii) any action asserting a claim of breach of a fiduciary duty owed by any director, officer or other employee of the Company to the Company or the Company’s stockholders, (iii) any action asserting a claim against the Company, its directors, officers or employees arising pursuant to any provision of the Delaware General Corporation Law or the Company’s certificate of incorporation or the Bylaws of the Company, or (iv) any action asserting a claim against the Company, its directors, officers or employees governed by the internal affairs doctrine. However, any action as to which the Court of Chancery in the State of Delaware determines that: (i) there is an indispensable party not subject to the jurisdiction of the Court of Chancery, (ii) it is vested in the exclusive jurisdiction of a court or forum other than the Court of Chancery, or (iii) for which the Court of Chancery does not have subject matter jurisdiction, the Court of Chancery of the State of Delaware shall not be the sole and exclusive forum for any stockholder. This choice of forum provision does not apply to (i) suits brought to enforce any liability or duty created by the Securities Exchange Act of 1934, as amended, or the rules and regulations promulgated thereunder, or any other claim for which the federal courts have exclusive jurisdiction and (ii) unless the Company consents in writing to the selection of an alternative forum, the federal district courts of the United States of America shall, to the fullest extent permitted by law, be the exclusive forum for the resolution of any complaint asserting a cause of action arising under the Securities Act of 1933, as amended, or the rules and regulations promulgated thereunder. Accordingly, the Company’s exclusive forum provision will not relieve the Company of its duties to comply with the federal securities laws and the rules and regulations thereunder, and the Company’s stockholders will not be deemed to have waived the Company’s compliance with these laws, rules and regulations.

Any person or entity purchasing or otherwise acquiring any interest in any of the Company’s securities shall be deemed to have notice of and consented to these provisions. These exclusive-forum provisions may limit a stockholder’s ability to bring a claim in a judicial forum of its choosing for disputes with the Company, its directors, officers or other employees, which may discourage lawsuits against the Company and its directors, officers and other employees. If a court were to find the choice of forum provision contained in the certificate of incorporation to be inapplicable or unenforceable in an action, the Company may incur additional costs associated with resolving such action in other jurisdictions, which could harm the Company’s business, results of operations, and financial condition. Even if the Company was successful in defending against these claims, litigation could result in substantial costs and be a distraction to management and other employees.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be affected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE ((Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into Series A-1 Preferred Stock (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into Series A-1 Preferred Stock. The Company is under no obligation to convert the Securities into Series A-1 Preferred Stock. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors will not have voting rights, even upon conversion of the Securities into Series A-1 Preferred Stock.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into Series A-1 Preferred Stock (the occurrence of which cannot be guaranteed). Upon such conversion, the Series A-1 Preferred Stock will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders or the party holding the Series A-1 Preferred Stock on behalf of the Investors are required to enter into a proxy agreement with its designee to vote their Series A-1 Preferred Stock with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company.

The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the Conversion Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the Conversion Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company.

The forgoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

The conversion price of the Securities is $1.2331 per share. Upon any conversion of the Securities, including in connection with any equity financing, liquidity event or dissolution event, as defined in and in accordance with the Securities, the purchase amount of the Securities will convert at $1.2331 per share, irrespective of the valuation or capitalization of the Company. The Securities provide no valuation cap or discount, nor provide any other downside protection to the Investors, including in the event any equity financing, liquidity event or dissolution event would result in a lower conversion price. Lastly, the Company may issue additional securities prior to any equity financing, liquidity event or dissolution event which, although reducing the price per share of the capital stock of the Company, will not result in any adjustment to the conversion price of the Securities.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred stock, have been paid in full. Neither holders of the Securities nor holders of Series A-1 Preferred Stock can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.