International Business Machines Corporation

Logo since 1972, designed by Paul Rand | |

| IBM | |

| Type | Public |

| ISIN | US4592001014 |

| Industry | Information technology |

| Predecessors | Bundy Manufacturing Company Computing Scale Company of America International Time Recording Company Tabulating Machine Company Computing-Tabulating-Recording Company |

| Founded | June 16, 1911 (as Computing-Tabulating-Recording Company) Endicott, New York, U.S.[1] |

| Founder | Herman Hollerith Charles Ranlett Flint Thomas J. Watson, Sr. |

| Headquarters | , U.S. |

Area served | 177 countries[2] |

Key people |

|

| Products | Automation Robotics Artificial intelligence Cloud computing Consulting Blockchain Computer hardware Software Quantum computing |

| Brands | |

| Services | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 288,300 (December 2022)[5] |

| Subsidiaries | List of subsidiaries |

| Website | Template:EditAtWikidata |

Headquartered in Armonk, New York, International Business Machines Corporation (IBM) is a global provider of integrated solutions and services. The company's operations are divided into four primary segments: Software, Consulting, Infrastructure, and Financing.

The Software segment specializes in hybrid cloud platforms and a suite of software solutions, including Red Hat's enterprise open-source solutions. It offers business automation, AIOps, integration and management tools, and application servers. Furthermore, this segment provides solutions for data and artificial intelligence, and an array of security software and services catering to threat, data, and identity management. Notably, it also delivers transaction processing software, playing a crucial role in the mission-critical and on-premise workloads of banking, airlines, and retail sectors.

IBM's Consulting segment is focused on facilitating business transformation. It provides strategic services, business process design, operations, data and analytics, and system integration services. Additionally, it offers technology consulting and application, along with cloud platform services.

The Infrastructure segment delivers both on-premises and cloud-based server and storage solutions tailored to clients' mission-critical and regulated workloads. It also offers support services for hybrid cloud infrastructure and provides remanufacturing and remarketing services for used equipment.

Finally, the Financing segment assists clients by providing a variety of services such as lease financing, instalment payment options, loan financing, and short-term working capital solutions.

Team edit edit source

Senior Leadership edit edit source

Arvind Krishna - Chief Executive Officer / Chairman edit edit source

Arvind Krishna is known for his strong leadership and technical expertise in the industry. Having joined IBM in 1990 and having has held various key roles within the company, Krishna has showcased his dedication and commitment to IBM's growth and success.

Krishna possesses a highly academic background, holding a Bachelor of Technology degree in Electrical Engineering from the Indian Institute of Technology, Kanpur, and a Ph.D. in Electrical Engineering from the University of Illinois at Urbana-Champaign. His academic prowess has been complemented by his forward-thinking vision, enabling him to stay at the forefront of technological innovations.

Krishna has been instrumental in shaping IBM's technology and cloud strategies. He played a crucial role in the company's acquisition of Red Hat, a major player in the open-source software and cloud computing space, which was a pivotal move to solidifying IBM's cloud computing capabilities[6].

As the CEO of IBM, Arvind Krishna has faced the ever-changing landscape of the technology industry head-on. He has focused on strengthening IBM's position as a leader in hybrid cloud solutions and artificial intelligence, while also driving initiatives in quantum computing and other emerging technologies.

Under his leadership, IBM has pursued a more client-centric approach, aiming to provide businesses with innovative solutions tailored to their specific needs. Additionally, Krishna has been an advocate for diversity and inclusion within the company, emphasising the importance of a diverse workforce to drive innovation and creativity.

Gary Cohn - Vice Chairman edit edit source

Gary D. Cohn is a prominent American business leader and investor who has previously held the position of Director of the U.S. National Economic Council, where he gained international recognition for his expertise in financial markets, the global economy, economic policy, and U.S. politics[7].

Currently, Mr. Cohn serves as the Vice Chairman of IBM, collaborating closely with the company's Executive Leadership Team to drive various business initiatives and external engagement efforts. His responsibilities encompass areas such as business development, public advocacy, and client relationship management.

From 2017 to 2018, Mr. Cohn was Assistant to the President for Economic Policy and Director of the National Economic Council. During this time, he notably served as the chief economic advisor to the U.S. President.

Before his tenure in the White House, Mr. Cohn had a distinguished career at The Goldman Sachs Group, Inc. where he held the position of President and Chief Operating Officer from 2006 to 2016. During his time at Goldman Sachs, he assumed various leadership roles and served as a member of the firm's Board of Directors and Chairman of the Firm-wide Client and Business Standards Committee.

Jonathan Adashek - Chief Communications Officer / Senior Vice President edit edit source

Jonathan Adashek is a seasoned communications and marketing executive with a wealth of experience in the technology and automotive industries. He has held various senior leadership positions throughout his career and was appointed IBM's head of Marketing in January 2022[8].

Adashek's educational background includes a solid foundation in marketing and communications alongside a Bachelor of Arts degree in Political Science from the University of Wisconsin-Milwaukee. He has been recognised for his strategic thinking, creative storytelling, and ability to navigate complex business challenges.

As IBM's Chief Communications Officer, Jonathan Adashek was responsible for overseeing the company's global communications and public relations efforts. His role involved developing and executing communication strategies to enhance IBM's brand image, strengthen its market position, and effectively engage with stakeholders, including clients, employees, investors, and the general public.

Under his leadership, IBM's communications team focused on promoting the company's strategic initiatives, technological innovations, and contributions to various industries. Adashek's expertise played a significant role in managing the company's reputation and handling communication during important events, product launches, acquisitions, including the separation of Kyndryl in 2021[8].

Kelly C. Chambliss - Chief Operating Officer / Senior Vice President edit edit source

Kelly Chambliss holds the role of Senior Vice President (SVP) and Chief Operating Officer at IBM Consulting. In this capacity, she assumes responsibility for overseeing the operational performance of IBM Consulting on a global scale[9].

Before her current position, Kelly served as the Senior Vice President of IBM Consulting Americas and Strategic Sales. In this role, she led the global IBM Consulting Strategic Sales operation, where her primary focus was devising innovative client strategies and solutions. Her emphasis was on leveraging the potential of open hybrid cloud and AI technologies to meet clients' evolving needs.

Kelly's association with IBM began through the acquisition of PwC Consulting in 2002, where she had a significant role as a Partner.

Kelly is actively involved in promoting diversity and empowering women leaders as the executive sponsor for the Women at IBM Community.

Kelly Chambliss is an accomplished alumna of Virginia Tech, having graduated with a degree in Management Science and specialised in Decision Support Systems. During her time at the university, she was a key player on the NCAA Division I volleyball team and served as co-captain while on a full athletic scholarship.

Nickle J. LaMoreaux - Chief Human Resources Officer / Senior Vice President edit edit source

Nickle earned a Bachelor of Science degree in Industrial and Labor Relations from Cornell University and holds a Master of Business Administration from Duke University[10].

During her two decades at IBM, Nickle has held various leadership roles in HR, overseeing diverse organizations such as services, software, and emerging markets. In these capacities, she played a crucial role in fostering the company's growth by focusing on leadership development, talent acquisition, performance management, and skills enhancement. As VP of Compensation and Benefits,

Nickle spearheaded the global design and implementation of all compensation and benefits programs. Additionally, she was responsible for managing HR activities related to mergers, acquisitions, and divestitures, and she played a pivotal role in facilitating part of the Red Hat acquisition.

Sebastian Krause - Chief Revenue Officer / Senior Vice President edit edit source

Sebastian Krause serves as the Senior Vice President and Chief Revenue Officer at IBM. In this role, he is responsible for overseeing a wide array of critical areas within the company, including leading IBM's product and geography sales organisations, digital sales, global industries, and the technical sales community. Additionally, he heads the client engineering organisation, client success management, and sales enablement[11].

Sebastian's extensive expertise in Hybrid Cloud and Artificial Intelligence-driven automation strategies has been instrumental in guiding international clients through successful digital transformation journeys.

Beyond his role at IBM, Sebastian is a non-executive director at Trūata, a reputable provider of data anonymisation and privacy-enhancing technologies. He also serves as the Chairman of the supervisory boards for IBM Germany and IBM Central Holding.

Sebastian Krause's journey with IBM started in 1991 when he joined the company as a student trainee. Throughout his career, he has honed his skills and knowledge, earning a degree in Business Economics and Information Technology from the Technische Fachhochschule in Berlin. He also obtained an MBA from the Henley Management College in London.

James J. Kavanaugh - Chief Financial Officer / Senior Vice President edit edit source

As the CFO, James J. Kavanaugh supervises various critical functions, including accounting, controllership, financial planning and analysis, tax, internal audit, investor relations, corporate strategy, corporate development, treasury, and the IBM Financing business. His appointment to this position took place in January 2018, and he reports directly to IBM's CEO[12].

Prior to becoming CFO, Kavanaugh held the position of Senior Vice President, Transformation & Operations, starting in January 2015. In this role, he played a key role in facilitating IBM's transformation into a data-driven cognitive enterprise.

Before his role in Transformation & Operations, Kavanaugh served as IBM's Controller from May 2008 to January 2015. His journey with IBM began in 1996 when he joined the company from AT&T Corporation, where he held the position of Chief Financial Officer, Americas Global Services.

Beyond his responsibilities at IBM, James J. Kavanaugh is a member of the Board of Directors of T-Mobile US. He earned his Master of Business Administration from The Ohio State University and holds a Bachelor of Science degree from the University of Dayton.

Robert D. Thomas - Chief Commercial Officer / Senior Vice President edit edit source

Rob Thomas holds the position of Senior Vice President Software and Chief Commercial Officer at IBM. In this capacity, he leads IBM's software business, overseeing critical aspects such as product design, product development, and business development. Additionally, Rob has global responsibilities for IBM's revenue and profit, which includes worldwide sales, strategic partnerships, and ecosystem management[13].

Throughout his career at IBM, Rob has taken on various leadership roles, with his most recent position being the Senior Vice President of IBM Global Markets. Having spent over two decades at IBM, Rob has gained diverse experiences across different divisions within the company, including IBM Consulting, IBM Microelectronics, and IBM Software.

Rob's professional journey with IBM's software business began in 2007, with a focus on data and analytics, a field in which he has excelled and driven innovation.

Originally from Florida, Rob pursued his studies at Vanderbilt University, earning a BA in Economics. Subsequently, during his pursuit of an MBA at the University of Florida, he delved into equity research, gaining expertise in applied economics, finance, and financial analysis. Outside of his professional endeavours, Rob actively serves on the board of Domus in Stamford, CT; an organisation dedicated to assisting underprivileged children in Fairfield County.

Financials edit edit source

Historic performance edit edit source

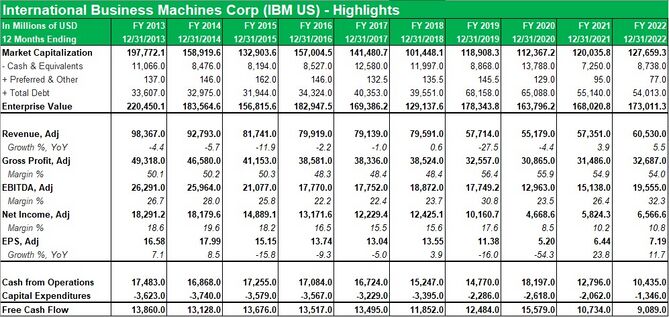

(Figures are rounded for simplicity of reading)

The above image shows the primary financial highlights attributed to IBM over the past 10 years. A general decline is seen within most items such as market cap, enterprise value and revenues over the past 10 years. However, a potential increase in all items can also be envisioned, which is attributed to the recovery from the COVID-19 pandemic of 2019. This change may also be due to the change of CEO which occurred in 2019.

Forecasts edit edit source

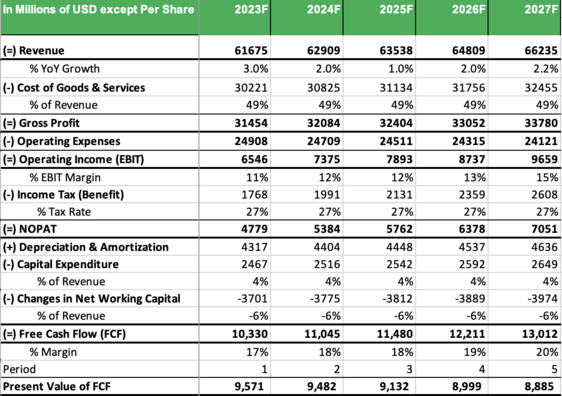

(Figures are rounded for simplicity of reading)

The above image shows items from the income statement adjusted to arrive at the free cash flows to the firm for the next five financial years. This five year DCF valuation forecast can be used to understand how the firm will perform in the upcoming years. Several assumptions are made to arrive at this data, including the weighted average cost of capital and the perpetual growth rate for the next five years.

Assumptions edit edit source

In order to obtain the results seen in the forecasts section above, some assumptions were made within the calculations, including that of the weighted average cost of capital, and the long term growth rate observed by IBM. These assumptions are presented within this section.

Weighted Average Cost of Capital (WACC) edit edit source

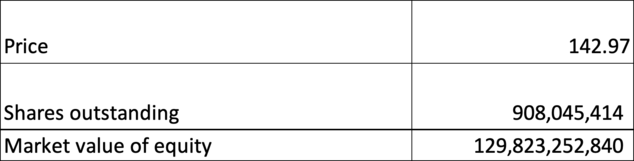

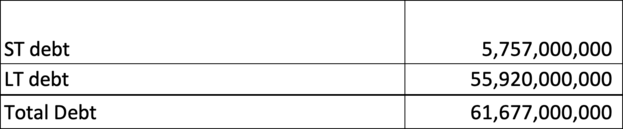

As of 27/07/2023, the closing price of 142.97 is used to calculate the market capitalisation.

Additionally, the total debt within IBM can be seen below:

Adding both the total debt and the market cap provides a calculation of the volume. Volume is used to calculate the percent of equity and debt within the capital structure by dividing each component by the volume. This results in the current capital structure of 68% equity to 32% debt.

Furthermore, the cost of equity and the pre tax cost of debt[14] has been used to calculate the current weighted average cost of capital. The values are 9.52% and 5.43% respectively. This leads to a WACC calculation of 7.99%.

(Cost of equity was calculated using the CAPM formula)

edit edit source

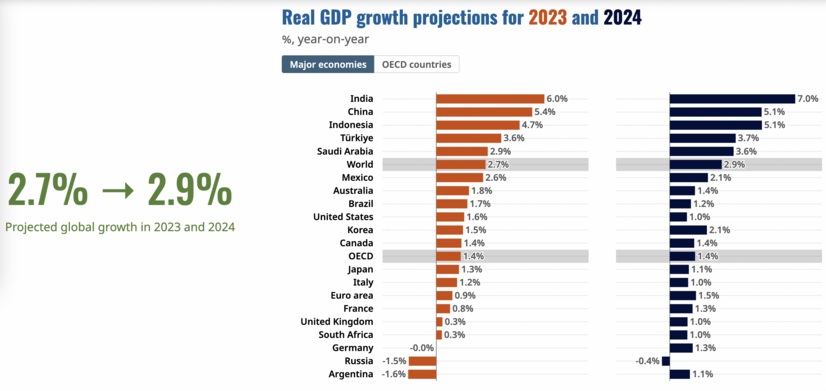

The perpetual growth rate for the firm has been taken as the forecast of the world GDP growth estimate[15], and is shown below:

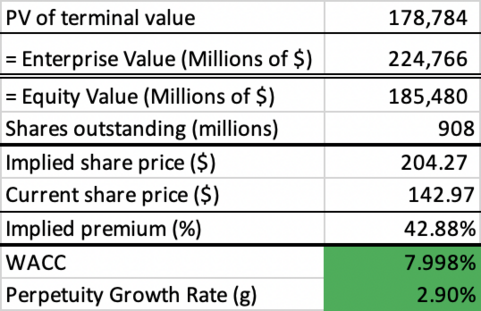

Using this data, the terminal value (TV) has been calculated. By discounting the TV and adding it to the PV of FCF, the enterprise value is calculated. Several adjustments are then made to obtain the equity value (such as taking away net debt and adding minority interests). This is then divided by current shares outstanding to obtain the implied share price of $204.27 to be reached by 31/12/2023, resulting an implied premium of 52.69%. The above mentioned data and the WACC & growth rates used to obtain this data is presented below.

Looking forward edit edit source

Within this next section, I cover the sensitivity analysis, peer group comparison, and product lines from a future perspective for IBM. Any and all recent updates which will effect the company in future years will be discussed here, including changes to the product line, valuation in terms of considering the company by comparing it to its peers to see if it is over or under-valued and how the forecasted share price may change with time depending on updates and revisions being made to either the capital structure (which will effect the WACC) or the growth rate (due to changes in the world economic outlook forecasts).

Sensitivity analysis edit edit source

The purpose of a sensitivity analysis is to provide the reader with more depth of knowledge of the valuation process. In a situation in which the reader agree with the general principles and methodologies of valuation utilised by the analyst, but disagrees with some of the calculated or estimated numbers due to the assumptions used to arrive at said numbers, the sensitivity analysis provides further scenarios that can be considered by the reader of the valuation.

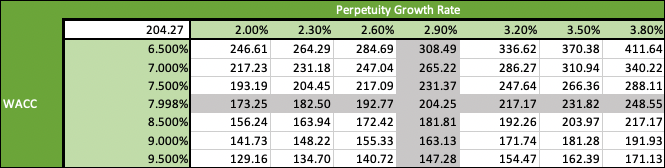

Firstly, the implied premium has been sensitised. It should be noted that even tiny changes to the WACC or growth rate can lead to large changes in the future share price.

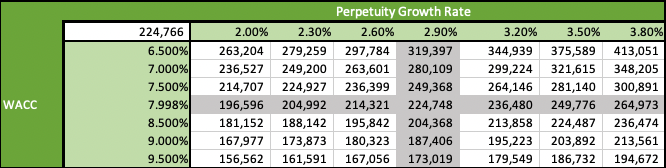

Next, the enterprise value has been sensitised. It should be noted that these values are still in millions of dollars.

With the inclusion of this sensitivity analysis, the reader can get a better understanding of the large scale changes that can occur at different estimations of both the growth rate and the WACC. It also allows the reader to keep either one of the variables constant, while changing the other, incase they agree with the justifications for one variable but not the other.

Peer group comparison edit edit source

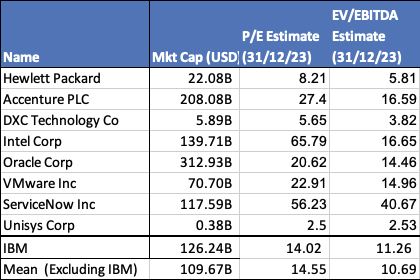

IBM has a large variety of potential competitors due to their diverse range of services offered. A list of similar companies can be seen below.

Taking the Price to Earnings ratio and Enterprise value to EBITDA multiple for IBM, and comparing it with the mean of IBM's identified peer companies, it can be seen that IBM is undervalued when considering the PE ratio, but overvalued when looking at the EV/EBITDA multiple.

Product lines edit edit source

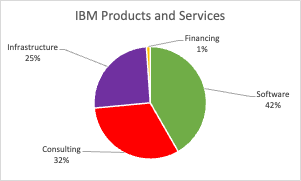

As of 2023, IBM operates within 3 inter-related industries and a fourth which is less related to the rest of the business. The primary business lines are:

- Software

- Consulting

- Infrastructure

Additionally, IBM also contains a Financing division, which makes up only 1% of its revenues.

The overall business line sizes are summarised below in the pie chart:

Recently, IBM separated a large portion of their infrastructure business into a separate company named Kyndryl. This move was performed in order to keep up with the growing competition within the managed infrastructure business that deals with hybrid cloud management services. This will allow IBM to refine their business, to grow into a firm with a focus on the software and consulting industry. Financing operations have also been winding down as the company believes that it can best deliver results with their software and consulting divisions.

References edit edit source

- ↑ "Certificate of Incorporation of Computing-Tabulating-Recording-Co", Appendix to Hearings Before the Committee on Patents, House of Representatives, Seventy-Fourth Congress, on H. R. 4523, Part III, United States Government Printing Office, 1935 [Incorporation paperwork filed June 16, 1911], archived from the original on August 3, 2020, retrieved July 18, 2019

- ↑ "IBM Is Blowing Up Its Annual Performance Review". Fortune. February 1, 2016. Archived from the original on October 29, 2020. Retrieved July 22, 2016.

- ↑

- ↑

- ↑ 5.0 5.1 5.2 5.3 5.4 5.5

- ↑ https://newsroom.ibm.com/Arvind-Krishna

- ↑ https://newsroom.ibm.com/Gary-Cohn-2

- ↑ 8.0 8.1 https://newsroom.ibm.com/Jonathan-Adashek

- ↑ https://newsroom.ibm.com/Kelly-Chambliss

- ↑ https://newsroom.ibm.com/Nickle-LaMoreaux

- ↑ https://newsroom.ibm.com/Sebastian-Krause

- ↑ https://newsroom.ibm.com/James-J-Kavanaugh

- ↑ https://newsroom.ibm.com/Rob-Thomas

- ↑ 14.0 14.1 Source: Bloomberg LLP

- ↑ https://www.oecd.org/economic-outlook/june-2023/