Intuitive Surgical, Inc.

Summary[1] edit edit source

| |

| Type | Public |

|---|---|

| |

| Industry | Medical Appliances & Equipment |

| Founded | 1995 |

| Headquarters | Sunnyvale, California, U.S. |

Key people |

|

| Products | da Vinci Surgical System |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 12,120 (December 2022) |

| Website | intuitive |

| Footnotes / references [2] | |

Intuitive Surgical, Inc. develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally. The company offers the da Vinci Surgical System to enable complex surgery using a minimally invasive approach; and Ion endoluminal system, which extends its commercial offerings beyond surgery into diagnostic procedures enabling minimally invasive biopsies in the lung. It also provides a suite of stapling, energy, and core instrumentation for its surgical systems; progressive learning pathways to support the use of its technology; a complement of services to its customers, including support, installation, repair, and maintenance; and integrated digital capabilities providing unified and connected offerings, streamlining performance for hospitals with program-enhancing insights. The company was incorporated in 1995 and is headquartered in Sunnyvale, California.

Operations edit edit source

Da Vinci edit edit source

The da Vinci surgical system facilitates robotic-assisted minimally invasive procedures. The term "robotic" can be misleading – the surgery itself is conducted by your surgeon, who operates the da Vinci instruments through a console.

The da Vinci system instantly translates a surgeon's manual inputs at the console, causing the instruments to bend, rotate, and execute the procedure. These instruments possess articulated wrists that mimic human hand movements, but with an expanded range of motion. Augmented by the da Vinci vision system, the surgical area is displayed in highly magnified, 3D high-definition views. The instruments' compact size enables surgeons to perform operations through a small number of minor incisions.

The da Vinci system is just one facet of a broader spectrum. As the creators of da Vinci, Intuitive's offerings extend well beyond the surgical system itself. This encompasses comprehensive and continuous education, training, and assistance for surgeons, OR staff, and hospital care units.

Hub edit edit source

Intuitive Hub is a device that grants you the ability to capture videos and engage in collaborative efforts during surgical operations. A surgeon and a team member are seen discussing a case video in an office setting.

The device simplifies the process of recording case videos and capturing images from da Vinci systems in an automated manner. This enables you to conveniently store, categorize, and appraise complete procedural recordings or pre-edited segments. Key moments within the procedure are automatically bookmarked, streamlining your experience as you access these resources through your web browser, without necessitating any media downloads.

- My Intuitive

Market edit edit source

Summary of Global Market edit edit source

The global medical robotic systems market is valued at USD 21.2 billion in 2022 and is projected to grow at a CAGR of 16.9% from 2023 to 2030. The increasing demand for accurate laparoscopic surgeries, advancements in medical equipment like motion sensors and 3D-imaging, and rising per capita healthcare spending in emerging economies are driving market growth. Robotic minimally invasive surgeries are gaining popularity due to their advantages, such as smaller incisions and quicker recovery. However, the high cost of robotic systems, like da Vinci and CyberKnife, is a challenge for widespread adoption. The COVID-19 pandemic temporarily impacted the market with bans on elective surgeries and economic disruptions, but the market is expected to recover as medical robot adoption returns to pre-pandemic levels.

Developing countries offer significant opportunities for growth, driven by increasing surgical procedures and favorable regulatory strategies. Despite challenges, the medical robotic systems market is set to grow robustly in the coming years. The surge in demand for robotic minimally invasive surgeries is majorly due to the advantages it offers, such as lesser cuts, smaller incisions, reduced pain, decreased scarring, higher safety, and quicker recovery periods. Moreover, the procedures provide advanced visualization capabilities to surgeons using HD cameras for better control and higher accuracy. While the high cost of robotic systems poses a restraint, the market's continuous technological advancements, including motion sensors, robotic catheter control systems, data analytics, and remote navigation, are expected to fuel further growth. Overall, with a focus on emerging markets and improvements in healthcare infrastructure, the medical robotic systems market is projected to expand significantly and provide transformative possibilities in the field of surgery.[3]

Regional Specifics edit edit source

Asia Pacific dominated the medical robotic systems market in 2022, holding over 52.8% of the revenue share. The region's growth is driven by factors such as an increasing geriatric population with weak bone density levels, rising incidents of injuries, improving healthcare infrastructure, and a growing adoption of minimally invasive surgeries. The implementation of advanced technologies, such as developed software, imaging systems, and capsule robot systems, is expected to further fuel market growth. Japan, Singapore, Thailand, South Korea, and China are actively investing in medical robotics, with China supporting the development of robotic medical devices and surgical robots by numerous Medtech manufacturers. For instance, SS Innovations, a Chinese robotics company, is building an inexpensive, modular robotic surgical system capable of controlling complex motion, showcasing the region's commitment to advancements in medical robotics technology.

edit edit source

The global surgical robotics market was valued at $5,460.5 million in 2020, with Intuitive Surgical, Inc. as the dominant player, holding an impressive 79.82% market share. The company's significant market presence and widespread penetration in different regions contributed to its market dominance.

Main Competition edit edit source

CRM Surgical edit edit source

CRM Surgical, formerly known as Cambridge Medical Robotics, is a private UK-based medical technology company that specializes in developing the Versius robotic surgical system. Versius is designed to assist surgeons in performing a wide range of laparoscopic procedures with enhanced precision and flexibility. The modular and portable design of the system allows for easy setup and adaptability in various surgical environments. With 3D high-definition visualization, haptic feedback, and versatile instruments, Versius aims to make robotic-assisted surgery more accessible. Recently, the company achieved a significant milestone by raising an impressive $1 billion in funds, leading to a valuation of over $3 billion, reflecting strong investor confidence in its technology and potential for growth in the medical robotics industry. As a private company, CRM Surgical operates independently and is not publicly traded on any stock exchange.[4]

Med Robotics edit edit source

Medrobotics is a medical technology company known for its Flex® Robotic System, the world's first endoluminal robotic platform with a steerable and shapeable robotic scope. The system enables clinicians to navigate complex anatomy with crystal clear 3D HD visualization through a single entry point, providing access to hard-to-reach anatomical locations that might otherwise be inaccessible with traditional surgical instruments. Medrobotics aims to expand endoluminal treatment options, offering patients improved access to minimally invasive procedures. The Flex® Robotic System received FDA clearances for ENT applications in July 2015 and for transanal applications in May 2017, while the CE mark was issued in March 2014, highlighting its compliance with European regulations.

Verb Surgical edit edit source

Verb Surgical™ is a cutting-edge medical technology company focused on revolutionizing the future of surgery through machine learning, robotic surgery, advanced visualization, and data analytics. Founded with support from Verily and Ethicon (a Johnson & Johnson company), Verb Surgical collaborates with physicians worldwide to enhance surgical tools and capabilities, aiming to achieve improved patient outcomes, cost reduction, and increased hospital efficiency. With a strong commitment to innovation and partnership with Verily and Johnson & Johnson, the company is dedicated to making a significant impact on patient lives by leveraging technology, data, and clinical expertise to create transformative possibilities in the field of surgery.

Masor Robotics edit edit source

Asensus Surgical edit edit source

Key Individuals edit edit source

Gary S. Guthart, Ph.D. Chief Executive Officer and Member of the Board of Directors edit edit source

Gary S. Guthart, Ph.D., is the CEO of Intuitive and a Board of Directors member since 2010, leveraging over 25 years of experience in medical, engineering, scientific, and management fields. He joined Intuitive in 1996 as a control systems analyst, steadily rising to become President and COO. Prior to Intuitive, Guthart contributed to foundational technology for computer-enhanced surgery at SRI International and worked on algorithms for large-scale system control. He holds a B.S. in engineering from the University of California, Berkeley, and earned M.S. and Ph.D. degrees in engineering science from the California Institute of Technology. Additionally, Guthart serves on the Boards of Directors for Illumina and the Silicon Valley Leadership Group.

Dave Rosa President edit edit source

Dave Rosa is the President of Intuitive, where he oversees the core business and drives product and commercial excellence. He joined Intuitive in 1996 and has held various senior leadership positions, including Executive Vice President and Chief Strategy and Growth Officer. Rosa is a strong advocate for da Vinci technology and has been involved in its development since the beginning. Prior to Intuitive, he contributed to the development of trans-esophageal transducers for Acuson Corporation. Rosa also serves on the board of directors for Kardium and as chairman of the board of the joint venture between Intuitive Surgical and Fosun Pharma. He holds a B.S. in mechanical engineering from California Polytechnic University at San Luis Obispo and an M.S. in mechanical engineering from Stanford University, and he holds multiple patents.

Dr. Myriam J. Curet, M.D., F.A.C.S., Executive Vice President and Chief Medical Officer edit edit source

Myriam J. Curet, M.D., F.A.C.S., is the Executive Vice President and Chief Medical Officer for Intuitive, a role she has held since November 2017. With a background in general surgery and a distinguished medical career spanning over two decades, Dr. Curet joined Intuitive in 2005 as Chief Medical Advisor, later becoming Senior Vice President and Chief Medical Officer in 2014. She received her M.D. from Harvard Medical School and completed her general surgery residency program at the University of Chicago. Throughout her tenure at Intuitive, Dr. Curet has played a crucial role in shaping the company's medical strategy and advancing the use of robotic-assisted surgery across various fields. Her commitment to innovation and patient-centered care has solidified Intuitive's position as a global leader in the medical robotics industry.

Jamie Samath, Chief Financial Officer edit edit source

Jamie Samath is the Chief Financial Officer at Intuitive, where he has held various finance-related roles since joining the company in 2013, including Senior Vice President of Finance, Corporate Controller, and Principal Accounting Officer. Before his tenure at Intuitive, Samath served in finance roles at Atmel Corporation, including Vice President of Finance and Corporate Controller. He also worked in various finance positions at National Semiconductor. Samath holds a B.A. in business studies from London Metropolitan University and is a certified public accountant.

Brian Miller, Ph.D., Executive Vice President and Chief Digital Officer edit edit source

Brian Miller, Ph.D., is the Executive Vice President and Chief Digital Officer at Intuitive, responsible for overseeing the company's digital business strategy, solutions, operations, product management, infrastructure, privacy, security, and network operations. With over 20 years of experience in robotics and digital technology, Miller has been instrumental in creating clinical and operational value for customers and driving new business value for the company. His career at Intuitive began with the merger of Computer Motion in 2003, where he had developed software for early robotic surgical systems. Throughout his tenure, Miller has held various engineering roles, earning patents for key innovations in robotic surgical systems and surgeon training simulations. He holds a B.S. in electrical and computer engineering from Iowa State University, an M.S., and Ph.D. in mechanical engineering from Northwestern University, with a focus on haptic interfaces and robotics, and has also completed the Advanced Management Program at Harvard Business School.

Bob De Santis, Executive Vice President and Chief Strategy and Corporate Operations Officer edit edit source

Bob DeSantis is the Executive Vice President and Chief Strategy and Corporate Operations Officer at Intuitive, where he oversees strategic planning and corporate operational management for the business. Having joined Intuitive in 2013, DeSantis has held various leadership roles, including Vice President for instruments & accessories New Product Introduction and Chief Product Officer, where he led global teams responsible for developing and manufacturing the company's robotic platforms and related functions. With a background in mechanical engineering, DeSantis has been involved in the research and development of laparoscopic technologies, contributing to the advancement of minimally invasive surgery. He holds a B.S. and M.S. in mechanical engineering from the State University of New York, Buffalo, and has a certificate in innovation management from the Massachusetts Institute of Technology.

Gary Loeb, General Counsel and Chief Compliance Officer edit edit source

Gary Loeb is the General Counsel and Chief Compliance Officer at Intuitive, leading a global organization responsible for legal, compliance, and corporate governance. With extensive experience in patent strategy, collaborations, licensing, clinical and medical affairs, ethics, legal operations, compliance, and regulatory matters, Loeb previously held positions in intellectual property and litigation at Genentech and served as General Counsel for various medical diagnostic and therapeutic firms, including Mammoth Biosciences. He holds a B.S. in biological sciences and a B.A. in English from Stanford University and obtained his J.D. from Columbia Law School.

Kara Andersen Reiter, Intuitive Senior Vice President, Litigation, Privacy, and Employment Law edit edit source

Kara Andersen Reiter is the Senior Vice President of Litigation, Privacy, and Employment Law at Intuitive. She joined the company in 2015 as Assistant General Counsel and later held positions as Senior Vice President, General Counsel, and Chief Compliance Officer. With a background in litigation and experience in the medical device industry, Andersen Reiter has been a valuable asset to Intuitive. She earned her J.D. from UCLA School of Law and her B.A. from Brown University. Additionally, as a Fulbright scholar, she obtained a D.E.A. (a master's-level degree) in family law from the Universite de Lyon III after completing her law degree.

Marshall L. Mohr, Executive Vice President, Global Business Services edit edit source

Marshall L. Mohr is the Executive Vice President of Global Business Services at Intuitive. He joined the company in March 2006 as Senior Vice President and Chief Financial Officer, later becoming Executive Vice President and Chief Financial Officer in June 2018. Prior to Intuitive, Mohr held positions as Vice President and CFO of Adaptec, Inc., and as an audit partner with PricewaterhouseCoopers, where he managed the firm's technology industry group in the west region and led the accounting and audit advisory practice in Silicon Valley. He currently serves on the board of directors of Plantronics, Inc. (Poly) and Pacific Biosciences of California, Inc., and is a board member of the joint venture between Intuitive Surgical and Fosun Pharma in Shanghai, China. Mohr holds a B.B.A. in accounting and finance from Western Michigan University.

Majority Stake Holders edit edit source

| Name | Equities | % | Valuation |

|---|---|---|---|

| The Vanguard Group, Inc. | 17,800,947 | 5.080 % | 6 087 M $ |

| T. Rowe Price Associates, Inc. (Investment Management) | 11,603,541 | 3.312 % | 3 968 M $ |

| Geode Capital Management LLC | 6,117,781 | 1.746 % | 2 092 M $ |

| Fidelity Management & Research Co. LLC | 5,913,266 | 1.688 % | 2 022 M $ |

| JPMorgan Investment Management, Inc. | 4,528,044 | 1.292 % | 1 548 M $ |

| Capital Research & Management Co. (World Investors) | 4,376,155 | 1.249 % | 1 496 M $ |

| AllianceBernstein LP | 4,003,505 | 1.143 % | 1 369 M $ |

| Edgewood Management LLC | 3,888,946 | 1.110 % | 1 330 M $ |

| Norges Bank Investment Management | 3,469,428 | 0.9901 % | 1 186 M $ |

| BlackRock Advisors LLC | 3,033,180 | 0.8656 % | 1 037 M $ |

Finances edit edit source

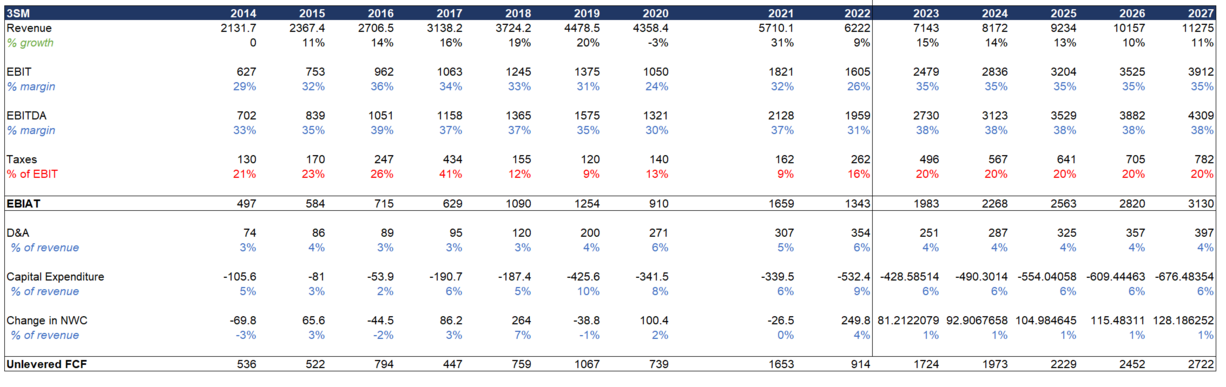

Some key assumptions were made for forecasting these line items from 2023 onwards. Revenue was grown at the mean value of the CapitalIQ analyst projections. COGS (35%), EBITDA (38%), depreciation (4%) and capital expenditure (6%), were either forecasted at a 7-year average percentage of revenue excluding 2020 and 2021 or if more applicable the mean value of CapitalIQ analyst projections. Tax was estimated as a percentage of EBIT and was thereafter forecasted at 20%, being the general forecast consensus.

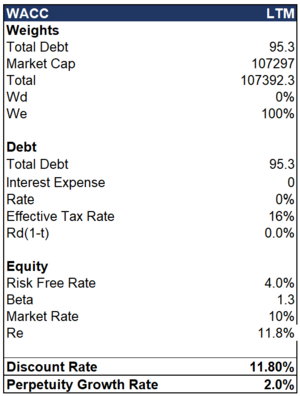

The weighted average cost of capital (WACC) is used as the discount rate in the DCF model, as free cash flows to the firm (FCFF) are used to calculate the enterprise value of the firm. The cost of equity (11.8%) was calculated using the capital asset pricing model (CAPM). The risk-free rate (4.084%) was assumed to be the U.S. 10 Year Treasury. The beta (1.3) is the 5-year monthly historical beta of ISRG according to Yahoo Finance. The market return (9.89%) is taken to be the 30-year average return of the NASDAQ, where ISRG is listed. While the 30-year average can be argued to be extensive, a more conservative valued seemed appropriate considering the 17% 5-year AAR and 14.8% 10-year AAR. The cost of debt (0%) was calculated as the company has no interest expense despite the $95 million in debt. This maybe due to ISRG having no debt till 2020 where total debt was reported as $80 million (2020), $87 million (2021) and $95 million (2022).

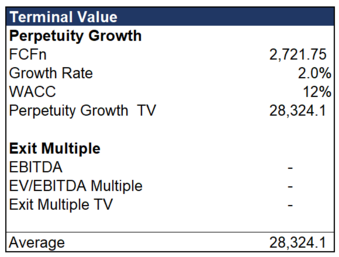

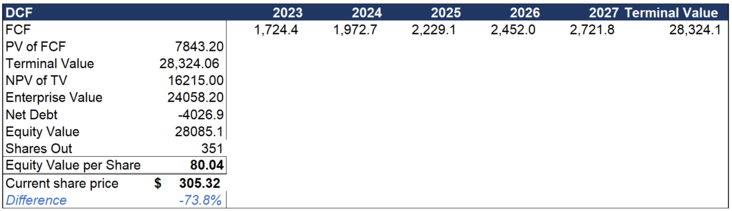

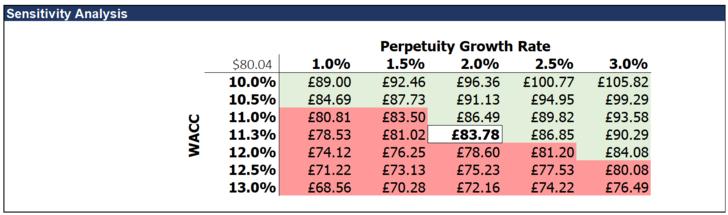

Having completed a forecast and calculated the WACC, the DCF method was implemented to arrive at an enterprise value of $24,058,196,080. The terminal value was calculated using a perpetual growth rate of 2%, which is estimated to be in line with US’s future GDP growth rate. After discounting the cash flows using the WACC and arriving at an enterprise value, an equity value of $28,085,096,080 was then estimated. Thereafter, an implied share price of $80.40 was calculated by dividing the equity value by the number of shares outstanding (351 million shares). Based on this valuation and relative to the actual share price of $305.32, ISRG would be viewed as being overvalued.

Risks edit edit source

References and notes edit edit source

- ↑ Source: Yahoo Finance.

- ↑

- ↑ Medical Robotic Systems Market Size, Share & Trends Analysis Report By Type (Surgical Robots, Exo-robots, Pharma Robots, Cleanroom Robots, Robotic Prosthetics, Medical Service Robots), By Region, And Segment Forecasts, 2023 - 2030

- ↑ https://www.ft.com/content/6a73e55b-5e5a-4017-b797-469aa4f8dde5

- ↑ https://uk.marketscreener.com/quote/stock/INTUITIVE-SURGICAL-INC-9740/company/