Johnson & Johnson

| |

| Type | Public |

|---|---|

| ISIN | [https://stockhub.co/index.php?title=Toollabs:isin/&language=en&isin=US4781601046 US4781601046] |

| Industry | |

| Founded | January 1886 in New Brunswick, New Jersey, United States |

| Founders | |

| Headquarters | Johnson and Johnson Plaza, , |

Area served | Worldwide |

Key people | |

| Products | List of Johnson & Johnson products and services |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | |

| Subsidiaries | |

| Website |

|

| Footnotes / references [1] | |

Johnson & Johnson (J&J) is a multinational corporation hailing from the United States, specializing in pharmaceuticals and medical technologies. Its headquarters are situated in New Brunswick, New Jersey, and it's publicly traded on the New York Stock Exchange. The company's common stock is part of the Dow Jones Industrial Average, and it holds the 40th position on the 2023 Fortune 500 list, showcasing the largest corporations in the United States. Johnson & Johnson boasts a global workforce of around 130,000 employees, with Joaquin Duato currently serving as the chairman and chief executive officer.

Founded in 1886 by three brothers, Robert Wood Johnson, James Wood Johnson, and Edward Mead Johnson, the company initially focused on selling pre-packaged sterile surgical dressings. In 2023, Johnson & Johnson underwent a significant transformation, spinning off its consumer healthcare business group into a new publicly traded entity called Kenvue. The company's exclusive dedication now lies in the development and manufacture of pharmaceutical prescription drugs and medical device technologies. It stands as one of the world's most valuable firms and is among the select few U.S.-based companies with a coveted AAA credit rating.

Headquartered in New Brunswick, New Jersey, with its consumer division located in Skillman, New Jersey, Johnson & Johnson's vast corporate structure encompasses approximately 250 subsidiary companies operating in 60 countries, with products distributed in over 175 nations. In the calendar year 2021, the company achieved worldwide sales totaling $93.8 billion.

In November 2021, Johnson & Johnson made a strategic announcement of its intention to split into two publicly traded companies: one with a primary focus on consumer products and the other dedicated to pharmaceuticals and medical technologies.

Company mission edit edit source

At Johnson & Johnson they believe good health is the foundation of vibrant lives, thriving communities and forward progress. For more than 135 years, their company mission has been to keep people well at every age and every stage of life. In the present day, as the world’s largest and most diversified healthcare products company, Johnson & Johnson is committed to improving access and affordability, creating healthier communities, and putting a healthy mind, body and environment within reach of everyone, everywhere.

There employees across the world are blending heart, science and ingenuity to profoundly change the trajectory of health for humanity.

One of their main company statements involves #HealthForAll which involves:

- Health Partner: a digital platform designed to help patients prepare physically, mentally and emotionally for surgery

- Targeting Unmet Medical Needs: cancer, infectious disease, serious mental illness, pulmonary hypertension...

- Thinking Locally and Globally: with programmes such as Born On Time (focused on preventing preterm birth) and NurseConnect (helps to build peer support and learning communities among nurses and midwives in South Africa)

- Accelerating Innovation as they believe that when people are healthy, entire communities thrive

- Putting Safety First: development of Yale University Open Data Access Project which enables scientists around the world to access data from clinical trials

- Raising the Bar on Research

- Tackling Healthcare Disparities: Genius Plaza (a multicultural education platform that educates children and their parents about healthy behaviours and nutrition)

ESG Highlights edit edit source

Championing Global Health Equity:

• In 2022, we Ranked #2 in the Access to Medicine Index and were featured as an Index top-three performer for the sixth consecutive year, reflecting our decades-long deliberate and focused strategy to enable access to our innovative medicines and technologies.

• Expanded our network of global health discovery centers that aim to accelerate science to tackle pandemic threats with a new center in Singapore to advance dengue and zika research.

• Since 2019, Johnson & Johnson Impact Ventures, a fund within the Johnson & Johnson Foundation, has invested in companies and supported entrepreneurs innovating to improve health equity for underserved patients around the world. In 2022, it received its first return on investment and has reinvested the financial returns into new investments.

• In 2022, the Johnson & Johnson Center for Health Worker Innovation advanced several initiatives, including a $15 million commitment from the Johnson & Johnson Foundation to the Africa Frontline First Catalytic Fund to support community health workers across 10 African countries.

• Through Our Race to Health Equity the $100 million, five-year initiative, by the end of 2022, Johnson & Johnson committed over $52 million in programs focused on closing the racial health gap, with investments in community health centers, community health workers, health literacy education and community engagement, increasing the racial and ethnic diversity of the health care talent pipeline and workforce.

Empower our Employees:

• More than 130,000 employees (92%) responded to Our Credo Survey ― a testament to our values-driven culture.

• Launched J&J Learn, a dynamic learning and development ecosystem that empowers employees to provide our workforce with continuous opportunities for reskilling, upskilling and development.

• Introduced the Company’s evolved enterprise DEI strategy, which recognizes how DEI accelerates our ability to meet the changing needs of the communities we serve, while driving innovation and growth within our business to serve diverse markets around the world.

• In recognition of the Company’s commitment to help employees balance their personal and professional responsibilities, Johnson & Johnson extended its paid parental leave benefit globally from 8 to 12 weeks for all eligible employees. In the U.S., the benefit was effective on January 1, 2022, with retroactive coverage for new family additions as of July 1, 2021.

• Enhanced mental health resources for employees and their families.

Advance Environmental Health:

• For the fifth consecutive year, Johnson & Johnson was recognized with a CDP A-List rating for our leadership in climate action.

• Finalized a deal to source 100% renewable electricity for our operations in Brazil.

• Expanded our single-use device hospital recycling program to six European countries and three categories within MedTech.

• Joined a collaboration of pharmaceutical companies, known as Activate, to support active pharmaceutical ingredient suppliers in their decarbonization efforts.

• Expanded our U.S. Safe Returns program (pharma) to Switzerland with more countries planned for 2023.

Lead with Accountability and Innovation:

• Included in the FTSE4Good Index Series for the 22nd year, which measures the performance of publicly traded companies demonstrating ESG practices, scoring in the 97th percentile in our sector in 2022.

• Ranked 1st in the pharmaceuticals sector for Moody’s ESG Scorecard in 2022.

• Achieved a MSCI "A" ESG Rating in 2022.

• Ranked #9 on Drucker Institute’s Top 250 Best-Managed Companies of 2022.

Macroeconomic Analysis and Markets edit edit source

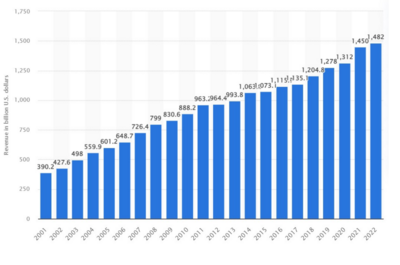

The pharmaceutical industry is responsible for the research, development, production, and distribution of medications. The market has experienced significant growth during the past two decades, and pharma revenues worldwide totalled 1.48 trillion U.S. dollars in 2022.

Pharma industry by country edit edit source

Several prominent pharmaceutical companies are based in the United States, which explains why the country boasts the world's largest national pharmaceutical market. China has emerged as a significant contender in the industry, experiencing robust annual growth rates in its burgeoning pharmaceutical market in recent years. Nevertheless, forecasts for pharmaceutical sales indicate that the well-established markets of North America and Europe will continue to be at the forefront in 2025.

How much do companies spend on R&D? edit edit source

Above all other industries, the pharmaceutical sector places significant reliance on research and development, with firms allocating roughly 20 percent or more of their sales earnings towards R&D endeavours. This proportion can soar even higher for companies that center their operations on research and generate relatively modest sales figures. Uncovering novel drugs holds paramount importance for the sustained expansion of pharmaceutical enterprises, and the sales of new branded medications can yield substantial contributions to overall revenues. Conversely, the expiration of patent protections can lead to severe repercussions, as the presence of generic drugs introduces a formidable challenge for these companies.

All eyes on pharma and biotech edit edit source

Shortly following the onset of the COVID-19 pandemic's global impact, it became evident that the absence of novel treatments, notably vaccines, would result in a perpetual cycle of lockdowns and crises. As a result, pharmaceutical companies garnered heightened public attention, facing mounting pressure to deliver swift outcomes.

Products edit edit source

Johnson & Johnson offers its products in two main sectors MedTech and Pharmaceutical products.

MedTech edit edit source

In the MedTech sector JNJ focuses on transforming the future of medical intervention with the aim of allowing the global population to live their best life possible. For more than a century they have driven scientific innovation to meet global needs.

Orthopaedics: edit edit source

Major focus on helping patients along their journey from the early intervention to surgical replacement to then helping them return to living a fulfilling and active live. edit edit source

- Joint Reconstruction : extensive portfolio of hip, knee and shoulder replacement. Fully equipped from operating room products, bone cements and accessories.

- Trauma : medical devices used to treat orthopaedic trauma. The company has a complete stock of screws, plates, nails and fixation products to treat fractures and deformities related to extremities and pelvis.

- Spine: extensive portfolios on spinal care solutions including treatments in thoracolumbar, cervical, aging, spine, interbody fusion and arthroplasty.

- Sports Medicine: DePuy Synthes Mitek is a global leader in orthopaedic sports medicine devices used to treat traumatic and degenerative pathologies of soft tissues and joint injuries related to physical activity.

- Power Tools: involving air, electric and battery driven systems that help large and small bones and offer high speed.

- CMF ( cranio- maxillofacial devices) : products to treat patients who have conditions affecting their face, head, neck and thorax.

- Biomaterials: innovative products that complement metal implants used in trauma, spine, cranio-maxillofacial surgical procedures. Their final mission is to repair, protect and strengthen the structural core of the human body.

Surgery:

Provide trusted surgical systems and instruments to provide the safest and most effective treatment. Ethicon: represents the products and services of Ethicon Inc. Created the first sutures to perform surgeries with minimal invasive procedures.

- Energy: complete energy portfolio for open and laparoscopic procedures to help improve patients outcome by extensive knowledge of tissues and energy sciences.

- Endomechanical: offers advanced tissue management, surgical stapling and endocutter technologies.

- Biosurgery: portfolio of adjunctive hemostats aids surgery by focusing on biosurgery technolgies to minimise intra- and postoperative complications such as problematic bleeing.

- Wound Closure: specialised medical products for every type of tissue including skin, fascia and organs.

- Breast Aesthetics: science based products for both surgical and non-surgical medical procedures in two strategic areas the breast and body aesthetics.

- Ear, Nose and Throat: innovative devices to aid conditions such as chronic sinusitis.

Interventional Solutions:

Tools to treat heart rhythm disorders and neurovascular care.

- Arrhythmias: treating irregular heartbeats in hospitals and teaching institutions. Biosense Webster is the global leader in the science of diagnosing and treating heart disorders.

- Neurovascular and Stroke: Cerenovus is a global leader in neurovascular care and offers a broad portfolio of devices used to treat hemorrhagic and ischemic stroke.

Vision:

' Help protect the most precious human sense-eyesight'

Encourage patients to preserve and enhance sight for life. JNJ's eye health products are available in 103 countries.

Pharmaceutical Products edit edit source

Janssen Pharmaceutical Companies address complex diseases faced. Investments made in a transformative future, changing the way diseases are prevented, intercepted, treated and cured.

Immunology:

- Mission is to redefine treatments for immune diseases by delivering transformational and accessible therapies to patients with autoimmune disease.

- Delivery of novel medicines.

- Innovative biological and oral therapies in core areas: rheumatoid arthritis, inflammatory bowel diseases and psoriasis.

- Ongoing efforts in discovery, biomarkers, clinical research and external innovation.

Cardiovascular & Metabolic Disease:

- Work to eliminate diabetes and cardiovascular diseases by developing new therapies.

- Targeting underlying disease pathways and mechanism of actions.

Pulmonary Hypertension:

- Transform into a long-term, manageable condition so patients can live a normal life.

- Developing a thorough understanding of pulmonary arterial hypertension to develop complex pathways and molecular mechanisms to create tailored machines to improve patient outcomes.

Infectious Diseases & Vaccines:

- Discovering and developing transformational therapies and vaccines to prevent and treat diseases such as HIV, viral hepatitis, respiratory syncytial virus, influenza and Ebola.

Neuroscience:

- Main mission is to reduce the burden and devastation caused by serious neuropsychiatric and neurodegenerative diseases such as Alzheimer's disease and myasthenia gravis. This is done by identifying synergies among neuropsychiatric and neurodegenerative diseases to maximise the potential clinical values of their treatments and developing therapies designed to modify disease with the goal to address unmet needs.

Oncology:

- JNJ envisions a world where cancer is preventable, curable and where the aim is to develop solutions to prolong and improve patient lives by delivering diagnostics and therapeutic solutions.

Key Professionals edit edit source

Executive Committee edit edit source

| Name | Role | Background |

|---|---|---|

| Joaquin Duato | Chairman of the Board and CEO | Before becoming CEO in 2022, he served as Vice Chairman of the Executive Committee where he provided strategic direction for the Pharmaceuticals and Consumer Health sectors. During the Covid-19 pandemic he spearheaded the company's rapid response to safeguard employee health and ensured lifesaving medicine and products reached patients.

He believes in the power of technology to accelerate healthcare processes, combining his scientific expertise with AI and ML. He has a dual citizenship in Spain and US giving him a deep appreciation of diversity. Education: he earned an MBA from ESADE, Barcelona, and a Master of International Management in Arizona. |

| Vanessa Broadhurst | Executive Vice President and Global Corporate Affairs | Leads the Corporation's global marketing, communication and philanthropy functions and oversees JNJ Health & Wellness Solutions and Global Public Health.

In her previous job as Company Group Chairman, Global Commercial Strategy for Pharmaceuticals, she led a team focused on commercialisation and launching strategies. She had oversight of global value and access, global commercial data sciences, and global medical affairs across the portfolio of pharmaceutical products. Vanessa joined Johnson & Johnson to lead global commercial strategy for Anemia and Oncology Supportive Care for the pharmaceutical group in 2005. Vanessa received a Master of Business Administration from the Ross School of Business at University of Michigan where she was a Consortium Fellow, and a Bachelor of Arts degree from the University of Colorado, Boulder. |

| Peter Fasolo | Executive Vice President, Chief H.R. Officer | Responsible for global talent, recruiting, diversity and inclusion, compensation, benefits, employee relations and all aspects of the human resources agenda for the Company. Peter first joined Johnson & Johnson in 2004 as Worldwide Vice President, Human Resources for Cordis Corporation. He was then named Vice President, Global Talent Management, with responsibility for executive assessment and development. He left Johnson & Johnson in 2007 to join Kohlberg Kravis Roberts & Co. (KKR) as Chief Talent Officer for the portfolio companies owned by the firm. He returned to Johnson & Johnson in September 2010 as Vice President, Global Human Resources.

Peter earned a Ph.D. in Organizational Behavior from the University of Delaware, a Master of Arts degree in Industrial Psychology from Fairleigh Dickinson University and a Bachelor of Arts degree in Psychology from Providence College. |

| Liz Forminard | Executive Vice President, General Counsel | Is responsible for shaping legal strategy worldwide, oversees the company's ESG strategy. With deep global experience, including responsibility for the legal function in each region and a global assignment in the Asia Pacific region, Liz has built and led global teams who share her passion for the role legal can play in driving innovation and enabling positive patient outcomes.

Liz holds a B.A. degree from Cornell University and a J.D. from the University of Pennsylvania School of Law. |

| William N. Hait | Executive Vice President, Chief External Innovation and Medical Officer | In this role Bill is responsible for leading external sourcing and creation of transformational innovation to help Johnson & Johnson achieve its mission to improve human health. He also oversees the Research and Development Management Committee.

Bill joined Johnson & Johnson in 2007 and served as Global Therapeutic Area Head for Oncology from 2009 to 2011, and then as Global Head, Janssen Research & Development, from 2011 through 2018. Under his leadership, the company launched more than 20 new products and numerous line extensions, transforming the lives of millions of people around the world. Bill graduated from the University of Pennsylvania. He then received an M.D. and Ph.D. cum Laude from the Medical College of Pennsylvania (former Women’s Medical College), received house staff and fellowship training at the Yale New Haven Hospital and joined the Yale University School of Medicine faculty in 1984. |

| Ashley McEvoy | Executive Vice President, Worldwide Chairman, MedTech | Under Ashley’s leadership, the $27B organization of almost 60,000 employees, nearly half of the Fortune #36 company’s employee base, drives innovation to save lives and ignite all that’s possible in every human, everywhere.

With a presence in almost every operating room in the world and more than 75 million procedures each year, Johnson & Johnson MedTech is comprised of twelve $1B platforms. Ashley has more than 25 years of experience working at Johnson & Johnson. In her time leading MedTech, she has strengthened the division’s core portfolio, spearheaded the company’s entrance into telehealth, robotics, and digital surgery, and doubled the value of its pipeline to $10 billion in 2020 from 2018. Ashley also led the deployment of $10B in capital across M&A activity in recent years to bolster the portfolio. This targeted business transformation strategy ultimately accelerated performance and led to revenue growth from 1.5% in 2017 to nearly 5% in 2021. It also resulted in market share gains in a majority of MedTech’s platforms, which enjoy #1 or #2 market position today. |

| John C. Reed | Executive Vice President, Pharmaceuticals, R&D | John believes there is no limit to what science can do to advance medicine and restore health. His mission is to focus the best research and development teams in the world at the intersection of unmet medical need and innovation to change the trajectory of human health.

Previously, John served as CEO of Sanford-Burnham Medical Research Institute (now Sanford Burnham Prebys) where he established multiple therapeutic area-aligned research centers and platform technology centers. John holds a Bachelor of Arts in Chemistry from the University of Virginia, Charlottesville and an M.D. and Ph.D. (Immunology) from the University of Pennsylvania School of Medicine. |

| James Swanson | Executive Vice President, Chief Information Officer | Based at Johnson & Johnson’s USA headquarters, Jim is responsible for accelerating Johnson & Johnson’s business outcomes and advancing human health with technology and digital innovation.

Jim rejoined Johnson & Johnson in 2019 from Bayer Crop Science, where he served as a member of the Executive Leadership Team, Chief Information Officer, and Head of Digital Transformation. Previously, he served as Chief Information Officer at Monsanto for five years, before the company was acquired by Bayer. Prior to that role, Jim spent nine years working as Vice President and Chief Information Officer for Johnson & Johnson Pharmaceutical. Jim holds a bachelor's degree in Bioscience and Biotechnology and a master's degree in Computer Science, both from Drexel University. |

| Jennifer Taubert | Executive Vice President, Worldwide Chairman, Pharmaceuticals | Jennifer has been a leader in shaping the global strategy of transformational medical innovation for the Janssen Pharmaceutical Companies of Johnson & Johnson, successfully delivering vital new medicines for millions of people living with cancer, immune-related diseases, heart disease, pulmonary hypertension, infectious diseases and serious mental illness. Under her leadership, Janssen has become the second-largest innovative pharmaceutical business globally, with more than $50 billion in worldwide revenue.

Since joining Johnson & Johnson in 2005, her focus has been on reaching increasing numbers of patients around the world with the Company’s transformational therapies. Jennifer received a bachelor’s degree in Pharmacology from the University of California, Santa Barbara and a Master of Business Administration from the Anderson Graduate School of Management, University of California, Los Angeles. |

| Kathryn E. Wengel | Executive Vice President, Chief Technical Operations & Risk Officer | She has significant healthcare, operations and global business expertise – with more than three decades of experience in leadership positions at Johnson & Johnson. In her current role, Kathy is responsible for the continued strengthening of the Company’s core technical operations and risk management capabilities. She leads key technical operations functions, including: Procurement, Engineering & Property Services, Sustainability and cross-sector Supply Chain teams focused on standards, services, strategic programs and data science, as well as critical risk functions, including: Quality & Compliance, Health Care Compliance, Environmental Health & Safety, Global Security and Global Brand Protection.

Kathy holds a BSE degree in civil engineering and operations research from Princeton University. |

| Joseph J. Wolk | Executive Vice President, Chief Financial Officer | A strategic role in the overall management of the organization and leading the development and execution of the business’ global long-term financial strategy. Joe leads the worldwide Finance and Global Services organizations, which includes approximately 9,000 colleagues around the globe. He has been with Johnson & Johnson for 25 years, assuming the role of Chief Financial Officer in 2018.

Joe holds a Bachelor of Science degree in Finance from St. Joseph’s University, where he serves on the University’s Board of Trustees and was recently inducted into the University’s Haub School of Business Hall of Fame for his excellence in business management. He earned his Juris Doctor degree from Temple University School of Law and is also a Certified Public Accountant (CPA). |

Risks edit edit source

As with any investment, investing in Johnson & Johnson carries a level of risk. Overall, based on the Johnson & Johnson's adjusted beta (i.e. 0.71)[2], the degree of risk associated with an investment in Johnson & Johnson is 'medium'.

Here, to estimate the adjusted beta, we used the iShares MSCI World ETF to represent the market portfolio; and in terms of the time period and frequency of observations, we used five years of monthly data (i.e. 60 observations in total), which is supported by a study and is the most common choice. The beta value in a future period has been found to be on average closer to the mean value of 1.0, and because valuation is forward-looking, it is logical to adjust the raw beta so it more/most accurately predicts a future beta. In addition, here, we have assumed that for an investment to be considered 'medium' risk, it must have a beta value of between 0.5 and 1.5. Further information about the beta ratings can be found in the appendix section of this report.

Risks that Johnson & Johnson is exposed to: edit edit source

Risks Related to Our Business, Industry and Operations:

- The Company’s businesses operate in highly competitive product markets and competitive pressures could adversely affect the Company’s earnings.

- Interruptions and delays in manufacturing operations could adversely affect the Company’s business, sales and reputation

- The Company relies on third parties to manufacture certain of our products. Any failure by or loss of a third party manufacturer could result in delays and increased costs, which may adversely affect our business.

- Counterfeit versions of our products could harm our patients and have a negative impact on our revenues, earnings, reputation and business.

- Global health crises, pandemics, epidemics, or other outbreaks could adversely disrupt or impact certain aspects of the Company’s business, results of operations and financial condition

Risks Related to Government Regulation and Legal Proceedings:

- Global sales in the Company’s Pharmaceutical and MedTech segments may be negatively impacted by healthcare reforms and increasing pricing pressures

- The Company is subject to significant legal proceedings that can result in significant expenses, fines and reputational damage.

- The Company faces significant regulatory scrutiny, which imposes significant compliance costs and exposes the Company to government investigations, legal actions and penalties

- Changes in tax laws or exposures to additional tax liabilities could negatively impact the Company’s operating results.

Risks Related to Our Intellectual Property

- The Company faces increased challenges to intellectual property rights central to its business.

Risks Related to Product Development, Regulatory Approval and Commercialization

- Significant challenges or delays in the Company’s innovation and development of new products, technologies and indications could have an adverse impact on the Company’s long-term success

Risks Related to Financial and Economic Market Conditions:

- The Company faces a variety of financial, economic, legal, social and political risks associated with conducting business internationally.

- Failure to maintain a satisfactory credit rating could adversely affect our liquidity, capital position, borrowing costs and access to capital markets

- The Russia-Ukraine War, and actions taken in response to the Russia-Ukraine War, could adversely affect our business, results of operations or financial condition.

Financials edit edit source

Income Statement edit edit source

| USDm | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E | 2026E | 2027E |

|---|---|---|---|---|---|---|---|---|

| Assumptions: | ||||||||

| Revenue growth | - | 14% | 1% | 7.5% | 7.5% | 7.5% | 7.5% | 7.5% |

| Cost of sales % revenues | - | 5% | 4% | 4.5% | 4.5% | 4.5% | 4.5% | 4.5% |

| Research and Development as % gross profit | - | 21% | -1% | 9.9% | 9.9% | 9.9% | 9.9% | 9.9% |

| General and administrative expenses % gross profit | - | 12% | 0% | 6.2% | 6.2% | 6.2% | 6.2% | 6.2% |

| Other operating income as % of gross profit | - | 300% | -13% | 143.5% | 143.5% | 143.5% | 143.5% | 143.5% |

| Pretax Income % | - | 43% | -9% | 17.2% | 17.2% | 17.2% | 17.2% | 17.2% |

| Taxes % of profit before tax | - | 6% | 99% | 52.7% | 52.7% | 52.7% | 52.7% | 52.7% |

| % basic net earning per share | 42% | -14% | 14% | 14.0% | 14.0% | 14.0% | 14.0% | |

| % diluted net earning per share | 42% | -14% | 14% | 14% | 14% | 14% | 14% | |

| % average share outstanding basic | 0% | 0% | 0% | 0% | 0% | 0% | 0% | |

| % average share outstanding diluted | 0% | 0% | 0% | 0% | 0% | 0% | 0% | |

| Total Revenue | 82,584 | 93,775 | 94,943 | 102,064 | 109,719 | 117,947 | 126,793 | 136,303 |

| Cost of Sales | (28,427) | (29,855) | (31,089) | (4,593) | (4,937) | (5,308) | (5,706) | (6,134) |

| Gross Profit | 54,157 | 63,920 | 63,854 | 97,471 | 104,781 | 112,640 | 121,088 | 130,169 |

| Operating Expenses | (34,243) | (39,373) | (39,368) | 124,132 | 133,442 | 143,450 | 154,209 | 165,775 |

| Research & Development | (12,159) | (14,714) | (14,603) | (9,681) | (10,407) | (11,187) | (12,026) | (12,928) |

| Selling, General & Administrative | (22,084) | (24,659) | (24,765) | (6,058) | (6,512) | (7,001) | (7,526) | (8,090) |

| Other Operating Income (Expenses) | (181) | (900) | (783) | 139,871 | 150,361 | 161,638 | 173,761 | 186,793 |

| Operating Income | 19,914 | 24,547 | 24,486 | 221,603 | 238,223 | 256,090 | 275,297 | 295,944 |

| Interest Income | (111) | (53) | (490) | |||||

| Interest expense, net of portion capitalised | (210) | (183) | (276) | |||||

| Other Income/Expenses Net | (2,899) | (489) | (1,871) | |||||

| Restructuring | (247) | (252) | (321) | |||||

| Pretax Income | 16,447 | 23,570 | 21,528 | 25,220 | 29,545 | 34,612 | 40,548 | 47,502 |

| Tax Provision | (1,783) | (1,898) | (3,784) | (13,291) | (15,570) | (18,241) | (21,369) | (25,034) |

| Net Income from Continuing Operations | 14,664 | 21,672 | 17,744 | 11,929 | 13,975 | 16,372 | 19,179 | 22,469 |

| Gross profit margin % | 65.6% | 68.2% | 67.3% | 95.5% | 95.5% | 95.5% | 95.5% | 95.5% |

| Operating profit margin % | 24.1% | 26.2% | 25.8% | 217.1% | 217.1% | 217.1% | 217.1% | 217.1% |

| Net profit margin % | 17.8% | 23.1% | 18.7% | 11.7% | 12.7% | 13.9% | 15.1% | 16.5% |

| Net Earning per Share | ||||||||

| Basic | 5.59 | 7.93 | 6.83 | 7.79 | 8.88 | 10.12 | 11.54 | 13.15 |

| Diluted | 5.51 | 7.81 | 6.73 | 7.67 | 8.75 | 9.97 | 11.37 | 12.96 |

| Average Shares Outstanding | ||||||||

| Basic | 2,632.80 | 2,632.10 | 2,625.20 | 2,618.35 | 2,626.20 | 2,619.34 | 2,627.20 | 2,620.33 |

| Diluted | 2,663.90 | 2,674.00 | 2,670.70 | 2,663.73 | 2,656.76 | 2,649.82 | 2,642.90 | 2,635.99 |

Cash Flow edit edit source

| USDm | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E | 2026E | 2027E |

|---|---|---|---|---|---|---|---|---|

| Assumptions | ||||||||

| D&A as % of prior year long term assets | - | 2% | -6% | -1.7% | -1.7% | -1.7% | -1.7% | -1.7% |

| Stock based compensation % growth | - | 7% | 75% | 41.0% | 41.0% | 41.0% | 41.0% | 41.0% |

| Common stock repurchased % growth | - | -7% | 28% | 10.5% | 10.5% | 10.5% | 10.5% | 10.5% |

| Dividend payout ratio | - | 5% | 6% | 5.6% | 5.6% | 5.6% | 5.6% | 5.6% |

| Cash Flows from operating activities | ||||||||

| Net Income from Continuing Operations | 14,714 | 20,878 | 17,941 | 11,929 | 13,975 | 16,372 | 19,179 | 22,469 |

| Depreciation & Amortization | 7,231 | 7,390 | 6,970 | (2,298) | (2,398) | (2,505) | (2,621) | (2,746) |

| Asset write-downs | 233 | 989 | 1,216 | 813 | 813 | 958 | 950 | 883 |

| Stock based compensation | 1,005 | 1,135 | 1,138 | 1,605 | 2,262 | 3,190 | 4,498 | 6,342 |

| Provision & Write off of Assets | 63 | (48) | (17) | - | - | - | - | - |

| Operating Gains Losses | (111) | (617) | (380) | (1,837) | (833) | (952) | (1,083) | (1,226) |

| Deferred Tax provision | (1,141) | (2,079) | (1,663) | |||||

| Other non-cash items | (1,148) | - | - | |||||

| Change in working capital | 2,690 | (4,238) | (4,011) | |||||

| Operating Cash Flow | 23,536 | 23,410 | 21,194 | 10,211 | 13,819 | 17,062 | 20,923 | 25,722 |

| Cash Flows from investing activities | ||||||||

| Investments in property, plant and equipment | (3,347) | (3,652) | (4,009) | 535 | 549 | 564 | 579 | 595 |

| Business Acquisitions, net | (7,323) | (60) | (17,652) | (2,620) | - | - | - | - |

| Purchases of investments | (8,952) | (5,388) | 9,225 | (2,565) | (2,917) | (3,316) | (3,771) | (4,287) |

| Other investing activities | (1,203) | 417 | 65 | |||||

| Investing Cash Flow | (20,825) | (8,683) | (12,371) | (4,650) | (2,368) | (2,752) | (3,192) | (3,692) |

| Other investing activities | - | (11) | 1 | - | - | - | - | - |

| Cash Flows from financing activities | ||||||||

| Debt repayment (increase in debt) | 7,095 | (990) | 7,452 | (6,000) | (5,307) | (4,829) | (4,395) | (3,999) |

| Common stock issued | (3,221) | (3,456) | (6,035) | (8,509) | (11,998) | (16,917) | (23,854) | (33,634) |

| Common stock repurchased | 1,114 | 1,036 | 1,329 | 1,469 | 1,623 | 1,793 | 1,981 | 2,189 |

| Dividends paid | (10,481) | (11,032) | (11,682) | (667) | (782) | (916) | (1,073) | (1,257) |

| Other financing activities | (627) | 395 | 65 | - | - | - | - | - |

| Financing Cash Flow | (6,120) | (14,047) | (8,871) | (13,708) | (16,464) | (20,870) | (27,340) | (36,701) |

| Cash | ||||||||

| Net change in cash | 17,238 | 9,304 | 7,329 | (12,798) | (7,381) | (9,313) | (12,800) | (18,363) |

| Cash at beginning of period | - | 17,238 | 26,542 | 33,871 | 21,073 | 13,692 | 4,380 | (8,420) |

| Cash at end of period | 17,238 | 26,542 | 33,871 | 21,073 | 13,692 | 4,380 | (8,420) | (26,783) |

Balance Sheet edit edit source

| USDm | 2020 | 2021 | 2022 | 2023E | 2024E | 2025E | 2026E | 2027E |

|---|---|---|---|---|---|---|---|---|

| Cash and Short Term Investments | -0.5% | 25.0% | -26% | -0.3% | ||||

| Accounts Receivable % Revenues | - | 13% | 26% | 19.3% | 19.3% | 19.3% | 19.3% | 19.3% |

| Inventory % Revenue | - | 11% | 20% | 15.6% | 15.6% | 15.6% | 15.6% | 15.6% |

| Other Current Assets | - | 18.0% | - | 18.0% | 18.0% | 18.0% | 18.0% | 18.0% |

| Net Property, Plant & Equipment (PPE) | - | 1% | 4% | 2.7% | 2.7% | 2.7% | 2.7% | 2.7% |

| Other Non-Current Assets | - | 35% | -8% | 13.7% | 13.7% | 13.7% | 13.7% | 13.7% |

| Goodwill | - | -9% | 15% | 2.8% | 2.8% | 2.8% | 2.8% | 2.8% |

| Accounts Payable % COGS | - | 4% | 5% | 4.4% | 4.4% | 4.4% | 4.4% | 4.4% |

| Other Current Liabilities | - | 3% | -7% | -2.1% | -2.1% | -2.1% | -2.1% | -2.1% |

| Short term debt % LT debt | - | 43% | 239% | 141.0% | 141.0% | 141.0% | 141.0% | 141.0% |

| Long Term Debt | - | -8% | -10% | -9.0% | -9.0% | -9.0% | -9.0% | -9.0% |

| Other Non-Current Liabilities | - | -10% | -15% | -12.5% | -12.5% | -12.5% | -12.5% | -12.5% |

| Cash and Short Term Investments | 25,186 | 31,608 | 23,519 | 23,401 | 23,284 | 23,168 | 23,052 | 22,937 |

| Accounts Receivable | 13,576 | 15,283 | 19,292 | 19,647 | 21,121 | 22,705 | 24,408 | 26,238 |

| Inventory | 9,344 | 10,387 | 12,483 | 15,871 | 17,061 | 18,341 | 19,716 | 21,195 |

| Other Current Assets | 3,132 | 3,701 | - | - | - | - | - | - |

| Total Current Assets | 51,238 | 60,979 | 55,294 | 58,920 | 61,466 | 64,214 | 67,176 | 70,370 |

| Net Property, Plant & Equipment (PPE) | 18,766 | 18,962 | 19,803 | 20,338 | 20,887 | 21,451 | 22,030 | 22,625 |

| Other Non-Current Assets | 15,097 | 20,439 | 18,725 | 21,290 | 24,207 | 27,523 | 31,294 | 35,581 |

| Goodwill | 89,795 | 81,638 | 93,556 | 96,176 | 98,868 | 101,637 | 104,483 | 107,408 |

| Total Non-Current Assets | 123,658 | 121,039 | 132,084 | 137,804 | 143,962 | 150,611 | 157,807 | 165,614 |

| Total Assets | 174,896 | 182,018 | 187,378 | 196,723 | 205,429 | 214,825 | 224,983 | 235,985 |

| Accounts Payable | 36,378 | 37,874 | 39,703 | 41,609 | 43,440 | 45,351 | 47,346 | 49,430 |

| Other Current Liabilities | 3,484 | 3,586 | 3,328 | 3,260 | 3,193 | 3,127 | 3,063 | 3,001 |

| Short term debt | 2,631 | 3,766 | 12,771 | 34,500 | 31,395 | 28,569 | 25,998 | 23,658 |

| Total Current Liabilities | 42,493 | 45,226 | 55,802 | 79,369 | 78,027 | 77,048 | 76,408 | 76,088 |

| Long Term Debt | 32,635 | 29,985 | 26,888 | 24,468 | 22,266 | 20,262 | 18,438 | 16,779 |

| Other Non-Current Liabilities | 36,488 | 32,784 | 27,884 | 24,399 | 21,349 | 18,680 | 16,345 | 14,302 |

| Total Non-Current Liabilities | 69,123 | 62,769 | 54,772 | 48,867 | 43,615 | 38,942 | 34,784 | 31,081 |

| Total Liabilities | 111,616 | 107,995 | 110,574 | 128,235 | 121,642 | 115,990 | 111,191 | 107,169 |

| Common Stock Equity | 63,278 | 74,023 | 76,804 | 68,488 | 83,787 | 98,835 | 113,792 | 128,815 |

| Noncontrolling interests in subsidiaries | - | - | - | |||||

| Equity + Liabilities | 174,896 | 182,018 | 187,378 | 196,723 | 205,429 | 214,825 | 224,983 | 235,985 |

Valuation edit edit source

Absolute Valuation edit edit source

What's the expected return of an investment in the company? edit edit source

The Stockhub users estimate that the expected return of an investment in the company over the next five years is negative 22.83%, which equates to an annual return of negative 4.96%. In other words, an £1,000 investment in the company is expected to return £774 in five years time. The assumptions used to estimate the return figure can be found in the table below.

Assuming that a suitable return level over five years is negative 4.96% per year or less, and Johnson & Johnson achieves its expected return level (of negative 4.96%), then an investment in the company is considered to be an 'suitable' one.

What are the assumptions used to estimate the return? edit edit source

| Description | Value | Commentary |

|---|---|---|

| Which valuation model do you want to use? | Discounted cash flow | Research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more/most accurate is the absolute valuation approach, so that's the approach that we suggest using to determine the estimated value of the company. |

| Which type of discounted cash flow model do you want to use? | Dividend discount model | |

| How many distinct stage of growth do you want to use? | Two stages | For simplicity, we have used two stages here. |

| What is the transition between the two growth stages? | Smooth | We suggest a smooth transition, and, therefore, we suggest using the H-Model. |

| What is the expected lifespan of the business? | Perpetual | Again, for simplicity, we have assumed that the business continues forever. |

| What is the expected initial growth rate of dividends? | 5.93% | |

| What is the expected constant growth rate in dividends? | 3% | We note that the gross domestic product (GDP) growth rate in the last 20 years (2001 to 2022) is around 3% per year for the global economy. |

| What is the half life of the initial dividend growth rate? | 10 years | We suggest using 10 years. |

| Which financial forecasts to use? | Stockhub | Here, we have used the forecasts of Stockhub. |

| What is the required return on equity? | 9.98% | For estimating the required return on equity, we used the Capital Asset Pricing Model (CAPM), which provides an economically grounded and relatively objective procedure for required return estimation, and, therefore, it has been widely used in valuation. The calculation of the required return on equity (and the reasons behind the calculation) can be found in the table below. |

| What's the current value of the company? | 163.10 pence per share | As at 3rd September 2023, the current value of Johnson & Johnson is $163.10 per share. |

| Which time period do you want to use to estimate the expected return? | Between now and five years time | Research suggests that following a market crash, the average amount of time it takes for the price of a stock market to return to its pre-crash level (i.e. the recovery period) is at least three years. Accordingly, we suggest that to account for general market cyclicity, it's best to estimate the expected return of the company between now and five years time. |

Sensitivity analysis edit edit source

The main inputs that result in the greatest change in the expected return of the Johnson & Johnson investment are, in order of importance (from highest to lowest):

- The discount rate (the default rate is 9.98%).

- The initial growth rate (the default rate is 5.93%);

- The half life of the initial dividend growth rate (10 years); and

- The terminal growth rate (the default rate is 3%).

The impact of a 10% change in those main inputs to the expected return of the Johnson & Johnson investment is shown in the table below.

| Main input | 10% worse | Unchanged | 10% better |

|---|---|---|---|

| The default rate | (32.48)% | (22.83)% | (9.95)% |

| The initial growth rate | (28.73)% | (22.83)% | (16.62)% |

| The half life of the initial dividend growth rate | (24.54)% | (22.83)% | (21.12)% |

| The terminal growth rate | (24.50)% | (22.83)% | (21.01)% |

Appendix edit edit source

| Input | Input value | Additional information |

|---|---|---|

| Risk-free rate (%) | 4.297% | Here, the risk free rate is the US 30 year treasury bond, and is calculated as at 3rd September 2023[3]. Research suggests that for the risk-free rate, it's best to use one that has the same or similar maturity to the estimated remaining lifespan of the company. Here, we have assumed that the estimated lifespan of the company is 30 years years or longer, so we have used the longest maturity, which is 30 years. |

| Beta | 0.7116 | Here, to estimate the adjusted beta, we used the iShares MSCI World ETF to represent the market portfolio; and in terms of the time period and frequency of observations, we used five years of monthly data (i.e. 60 observations in total), which is supported by a study and is the most common choice. The beta value in a future period has been found to be on average closer to the mean value of 1.0, and because valuation is forward-looking, it is logical to adjust the raw beta so it more/most accurately predicts a future beta. |

| Equity risk premium (%) | 7.98% | Research suggests that for the region of equity risk premium, it's best to use one that is the same or similar to the region of the beta market portfolio. Here, the region of the beta market portfolio is the world/global, so we have used the world/global region for the equity risk premium, and is calculated as at 5th January 2023. |

| Cost of equity (%) | 9.98% | Cost of equity = Risk-free rate + Beta x Equity risk premium. |

Johnson & Johnson dividends edit edit source

| Financial year | Q1 | Q2 | Q3 | Q4 | Total | Dividend growth rate (%) |

|---|---|---|---|---|---|---|

| 2023 | 1.13 | 1.19 | 1.19 | 1.19 | 4.7 | 5.62% |

| 2022 | 1.06 | 1.13 | 1.13 | 1.13 | 4.45 | 6.21% |

| 2021 | 1.01 | 1.06 | 1.06 | 1.06 | 4.19 | 5.28% |

| 2020 | 0.95 | 1.01 | 1.01 | 1.01 | 3.98 | 6.13% |

| 2019 | 0.90 | 0.95 | 0.95 | 0.95 | 3.75 | 5.93% |

| 2018 | 0.84 | 0.90 | 0.90 | 0.90 | 3.54 |

| Median | Mean | Mode | |

|---|---|---|---|

| Growth rate | 5.93% | 5.83% | N/A |

Based on Johnson & Johnson's cash flows, the company is in the maturity stage of the business lifecycle.

| 2019 | 2020 | 2021 | 2022 | |

|---|---|---|---|---|

| Cash Flow from Operations | + | + | + | + |

| Cash Flow from Investing | - | - | - | - |

| Cash Flow from Financing | - | - | - | - |

Economic links to cash flow patterns edit edit source

| Cash flow type | Introduction | Growth | Shake out | Mature | Decline |

|---|---|---|---|---|---|

| Operating | - | + | +/- | + | - |

| Investing | - | - | +/- | - | + |

| Financing | + | + | +/- | - | +/- |

Beta risk profile edit edit source

| Beta value | Risk rating |

|---|---|

| 0 to 0.50 | Low |

| 0.50 to 1.50 | Medium |

| 1.50 to 3.00 | High |

| 3.00 and above | Extremely high |

Johnson & Johnson beta calculation edit edit source

| Date | iShares MSCI World ETF unit price (USD) | Johnson & Johnson plc share price (USD)[4] | iShares MSCI World ETF unit price change (%) | Johnson & Johnson plc share price change (%) |

|---|---|---|---|---|

| 01/10/2018 | 85.25 | 139.99 | ||

| 01/11/2018 | 86.21 | 146.9 | 1% | 5% |

| 01/12/2018 | 78.87 | 129.05 | -9% | -12% |

| 01/01/2019 | 84.96 | 133.08 | 8% | 3% |

| 01/02/2019 | 87.49 | 136.64 | 3% | 3% |

| 01/03/2019 | 88.79 | 139.79 | 1% | 2% |

| 01/04/2019 | 92.09 | 141.2 | 4% | 1% |

| 01/05/2019 | 86.76 | 131.15 | -6% | -7% |

| 01/06/2019 | 91.02 | 139.28 | 5% | 6% |

| 01/07/2019 | 91.86 | 130.22 | 1% | -7% |

| 01/08/2019 | 89.84 | 128.36 | -2% | -1% |

| 01/09/2019 | 91.78 | 129.38 | 2% | 1% |

| 01/10/2019 | 94.12 | 132.04 | 3% | 2% |

| 01/11/2019 | 96.76 | 137.49 | 3% | 4% |

| 01/12/2019 | 98.78 | 145.87 | 2% | 6% |

| 01/01/2020 | 97.73 | 148.87 | -1% | 2% |

| 01/02/2020 | 89.67 | 134.48 | -8% | -10% |

| 01/03/2020 | 77.93 | 131.13 | -13% | -2% |

| 01/04/2020 | 86.36 | 150.04 | 11% | 14% |

| 01/05/2020 | 90.7 | 148.75 | 5% | -1% |

| 01/06/2020 | 92.14 | 140.63 | 2% | -5% |

| 01/07/2020 | 96.65 | 145.76 | 5% | 4% |

| 01/08/2020 | 102.96 | 153.41 | 7% | 5% |

| 01/09/2020 | 99.52 | 148.88 | -3% | -3% |

| 01/10/2020 | 96.53 | 137.11 | -3% | -8% |

| 01/11/2020 | 108.94 | 144.68 | 13% | 6% |

| 01/12/2020 | 112.41 | 157.38 | 3% | 9% |

| 01/01/2021 | 111.49 | 163.13 | -1% | 4% |

| 01/02/2021 | 114.27 | 158.46 | 2% | -3% |

| 01/03/2021 | 118.49 | 164.35 | 4% | 4% |

| 01/04/2021 | 123.61 | 162.73 | 4% | -1% |

| 01/05/2021 | 125.6 | 169.25 | 2% | 4% |

| 01/06/2021 | 126.57 | 164.74 | 1% | -3% |

| 01/07/2021 | 128.83 | 172.2 | 2% | 5% |

| 01/08/2021 | 132.02 | 173.13 | 2% | 1% |

| 01/09/2021 | 126.46 | 161.5 | -4% | -7% |

| 01/10/2021 | 133.84 | 162.88 | 6% | 1% |

| 01/11/2021 | 131.1 | 155.93 | -2% | -4% |

| 01/12/2021 | 135.32 | 171.07 | 3% | 10% |

| 01/01/2022 | 128.32 | 172.29 | -5% | 1% |

| 01/02/2022 | 124.58 | 164.57 | -3% | -4% |

| 01/03/2022 | 128.16 | 177.23 | 3% | 8% |

| 01/04/2022 | 117.42 | 180.46 | -8% | 2% |

| 01/05/2022 | 117.94 | 179.53 | 0% | -1% |

| 01/06/2022 | 106.88 | 177.51 | -9% | -1% |

| 01/07/2022 | 115.57 | 174.52 | 8% | -2% |

| 01/08/2022 | 110.28 | 161.34 | -5% | -8% |

| 01/09/2022 | 99.95 | 163.36 | -9% | 1% |

| 01/10/2022 | 107.42 | 173.97 | 7% | 6% |

| 01/11/2022 | 115.44 | 178 | 7% | 2% |

| 01/12/2022 | 109.25 | 176.65 | -5% | -1% |

| 01/01/2023 | 117.01 | 163.42 | 7% | -7% |

| 01/02/2023 | 113.98 | 153.26 | -3% | -6% |

| 01/03/2023 | 117.67 | 155 | 3% | 1% |

| 01/04/2023 | 119.79 | 163.7 | 2% | 6% |

| 01/05/2023 | 118.6 | 155.06 | -1% | -5% |

| 01/06/2023 | 124.52 | 165.52 | 5% | 7% |

| 01/07/2023 | 128.54 | 167.53 | 3% | 1% |

| 01/08/2023 | 125.7 | 161.68 | -2% | -3% |

| 01/09/2023 | 125.91 | 160.48 | 0% | -1% |

| Johnson & Johnson | |

|---|---|

| Beta | 0.5508 |

| Adjusted beta | 0.7116 |

References edit edit source

- ↑

- ↑ Research shows that an investment has two main types of risks: 1) non-systematic and 2) systematic. Systematic risk is the risk related to the overall market, and non-systematic risk is the risk that's specific to an individual investment. Evidence shows that taking on non-systematic risk is inefficient, and it's, therefore, best to eliminate it; and in most cases, elimination is fairy easy to do [by holding a diversified portfolio of investments (i.e. around 15 investments)]. Accordingly, when assessing the riskiness of an investment, it’s best to look at the systematic risk only (i.e. ignore the non-systematic risk). A key measure of systematic risk is beta, and a main way to determine the riskiness of an investment is to compare the beta of the investment with the beta of the market, which is 1. For estimating an asset's beta, in terms of time period, and frequency of observations, the most common choice is five years of monthly data, yielding 60 observations. One study of U.S. stocks found support for five years of monthly data over alternatives. The beta value in a future period has been found to be on average closer to the mean value of 1.0, the beta of an average-systematic-risk security, than to the value of the raw beta. Because valuation is forward looking, it is logical to adjust the raw beta so it more accurately predicts a future beta.

- ↑ https://www.marketwatch.com/investing/bond/tmubmusd30y?countrycode=bx

- ↑ https://uk.finance.yahoo.com/quote/JNJ/history?period1=1535932800&period2=1693699200&interval=1mo&filter=history&frequency=1mo&includeAdjustedClose=true