Kombucha Town

Better live kombucha with the convenience of a can. Live happy, live healthy.

Summary edit edit source

- Pioneer in the industry with live kombucha in a can

- Selling at 1.2K+ stores across 20+ states, and internationally

- Retailing with Whole Foods, Natural Grocers, Safeway, Sprouts & more

- $555K+ in sales in 2021

- $8B+ TAM in 2027

- Specialty & wellness industry average growth of 81% -Oct '20

- Partners with One Tree Planted Foundation

Problem edit edit source

There are three big beverage pain points: edit edit source

- Sugary soda and energy drinks are causing epidemic-level diabetes and obesity.

- Plastic and glass bottles are a leading source of pollution.

- Artificial ingredients are causing cancer and autoimmune disorders even in healthy people.

The consumers of today are looking for a healthier, sustainable, and environmentally-friendly alternative to the sodas of yesterday.

Solution edit edit source

Kombucha Town is good for you and our planet edit edit source

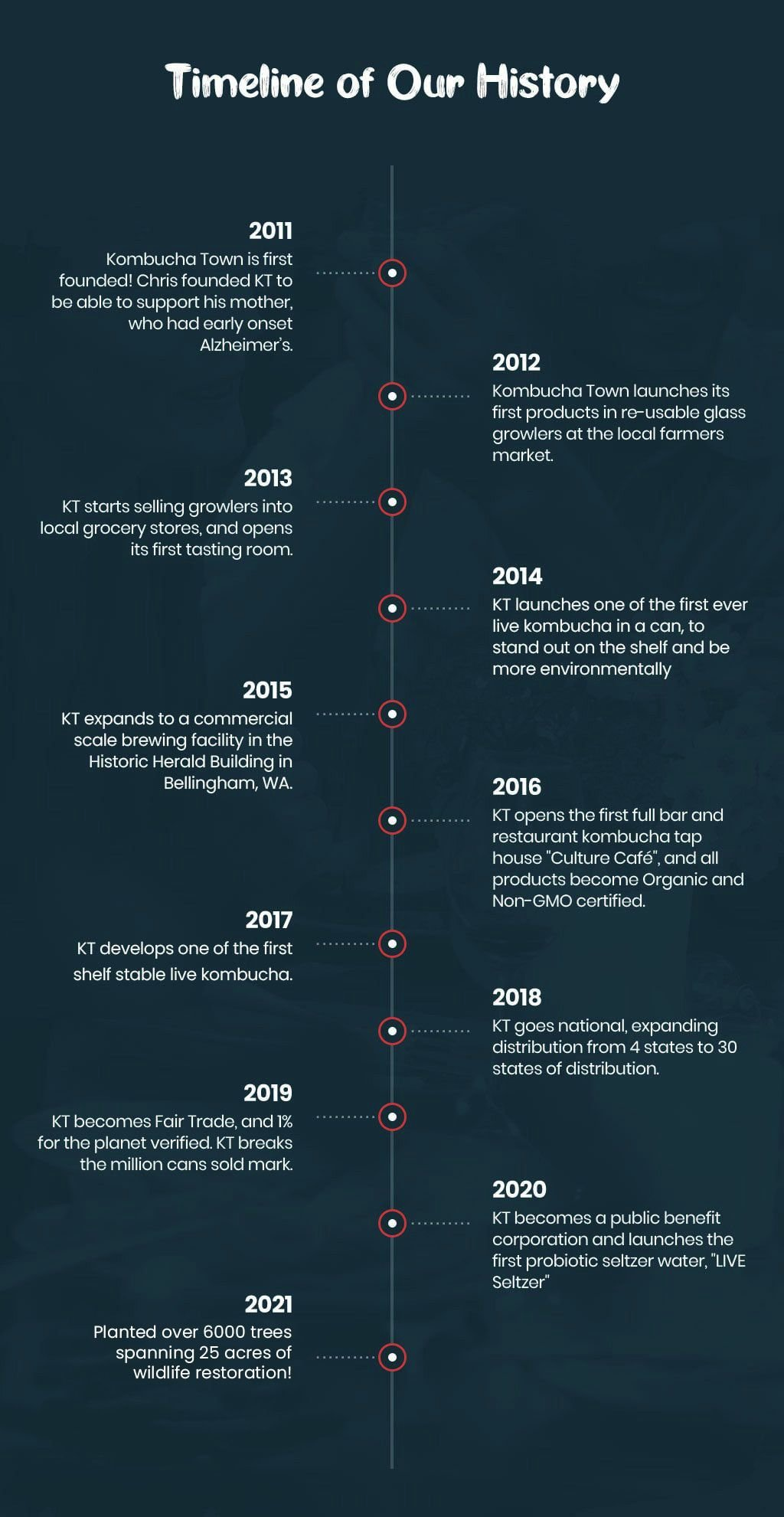

Real McCoy Tea Company, also known as Kombucha Town (KT), is a premier manufacturer and seller of fermented, ready-to-drink beverages. We are on a mission to replace soda with a healthy alternative. Brewed with a variety of fair-trade certified, non-GMO, and USDA Organic teas, sugar, and ingredients, our non-alcoholic kombucha blends are good for you and our planet. Our products are also sustainable, and actively give back to the community and environment. With each case of Kombucha Town purchased online, we plant a tree through the One Tree Planted Foundation.

Product edit edit source

3 unique, shelf-stable and delicious live-culture beverages lines edit edit source

KT produces 3 unique and differentiated product lines. All of our products are made with proprietary cultivation, harvesting, and processing methodology that includes only the strongest and most vibrant cultures from each batch into the final product. We are firm believers in quality of culture over quantity of culture to create the healthiest and most delicious products possible.

We also package exclusively in aluminum cans as they are by far the most environmentally-friendly option. They are also the most cost-effective and efficient to ship.

Traction edit edit source

KT is now selling at 1.2K+ stores across 20+ states edit edit source

KT has grown from a small mom-and-pop farmer's market business in Bellingham, WA, to being sold overseas and in over 20 states in just a few years. In 2014, we were one of the first to release a live kombucha product in environmentally-friendly aluminum cans. Since then, we've continued to be an innovation leader in the category with proprietary formulas, novel methods, and a state-of-the-art brewery. We now retail with Whole Foods, Natural Grocers, Safeway, Sprouts, and Kroger, and are in progress with 7-Eleven, Costco and Walmart.

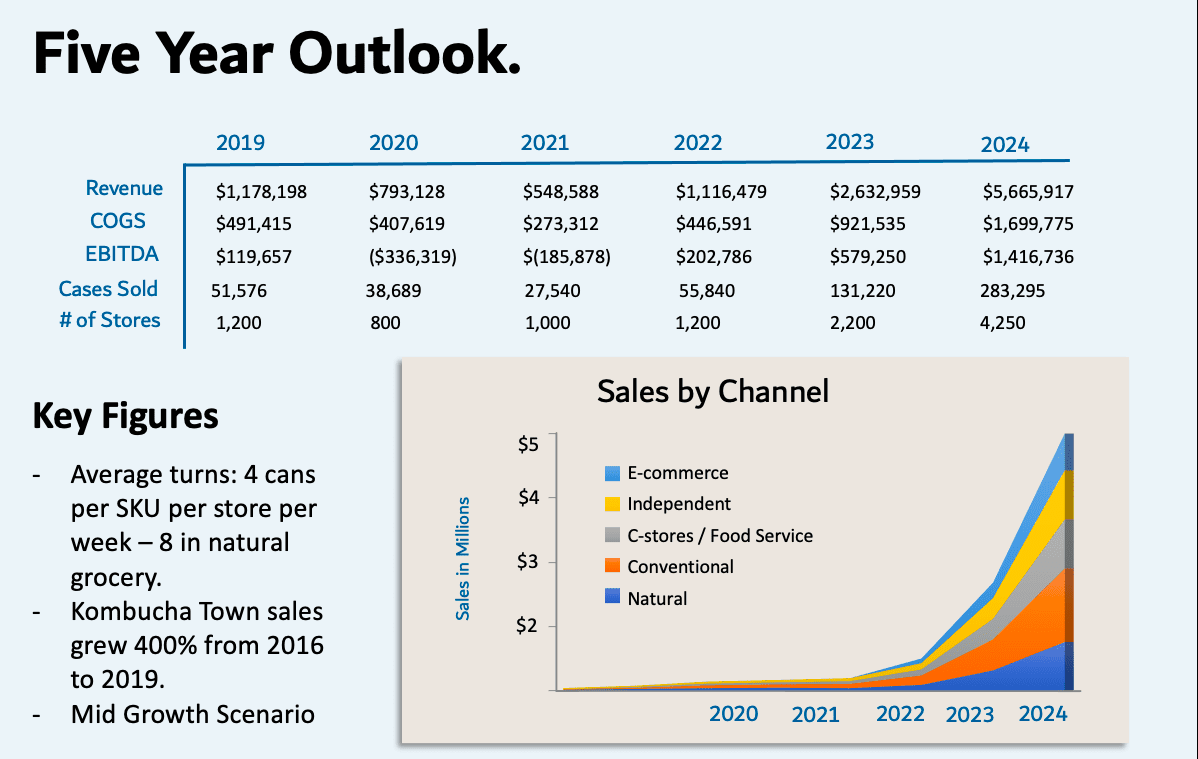

"Key figures – average turns" as of end the of July 2020

Customers edit edit source

Sharing a core value of environmentalism with customers edit edit source

The primary demographic consuming kombucha is 65% female and 35% male, between 25-45 years old. As Gen Z comes of age and gains more buying power, they will become not only the largest generation of consumers in history, but also have grown up drinking kombucha and other functional beverages. This is an opportunity to cultivate a strong multigenerational customer base for leading beverage brands like KT over the next 10-20 years. Our customers today are conscious consumers who value mission-driven brands, specialty products, and an active lifestyle. They love us because we are built on environmentalism, which is a shared core value that will never fall out of fashion.

Business model edit edit source

1.2M+in sales in 2019 edit edit source

KT has a strong presence in natural and conventional retail across the US. We achieved $555K+ in sales in 2021, and are forecasted to return to pre-COVID numbers this year. We grew 400% in sales from 2016-2019, and reached $1.2M in sales in 2019. Year to date*, 2022 case sales are up 100% over 2021 case sales.

Exclusive packaging in cans also allows for strong compatibility with C-store and foodservice channels where bulky glass bottles don’t work. Cans are also optimal for D2C fulfillment through our website and online retailers. In 2022, we will be updating our formulation to reduce sugar content by over 50%. We'll also update our branding across all our products.

*YTD Jan 2022

Market edit edit source

an 8B kombucha market by 2027 edit edit source

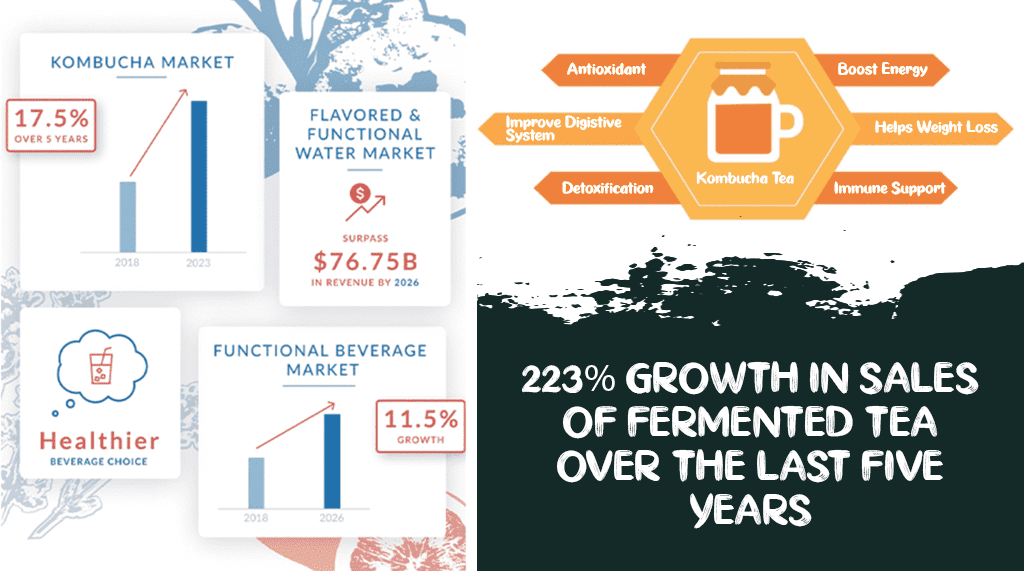

The kombucha market has been the shining star of functional beverage categories averaging 20-30% YoY growth for over a decade. The industry is also projected to continue to average 17% or more growth over the next five years and was a top trend in 2020. The current size of the global kombucha market is estimated at $1B with the United States making up 39.4% of sales. The global market is forecasted to grow to over $8B by 2027.

Competition edit edit source

KT outperforms growth for many top national brands edit edit source

In recent years, the kombucha industry has seen many new entries, as well as the rise of several national brands. These are: GT Dave’s, KeVita, Health-Ade, and Brew Dr. Kombucha.

Most of these brands are seeing growth in sales but a decline in velocity (-3%), as growth is in new distribution and not sell-through in stores. This is indicative of poor product quality and branding, which doesn't inspire or motivate consumers to repeat purchases.

Our velocity is over 13% growth, making it a faster-growing brand than many top national brands. Our shelf-stable products enable us to have a multi-channel growth strategy that maximizes our market depth and penetration.

Vision and strategy edit edit source

Scaling distribution across the country edit edit source

KT is planning on scaling our growth through current retail partnerships and distribution at 2K+ stores across America*. We will continue to grow online sales through Amazon and our website at the same time. We are currently in negotiations with a strategic e-commerce growth partner that will help optimize and proliferate our online presence, driving online sales to 10-15% of our total revenue.

As part of our growth mission, we will continue to promote and bolster our environmental mission with the One Tree Planted Foundation. We will use the environmental appeal to sell into environmentally conscientious retailers to increase pull-through and brand loyalty from consumers.

Funding edit edit source

Raising to grow revenue to $5M edit edit source

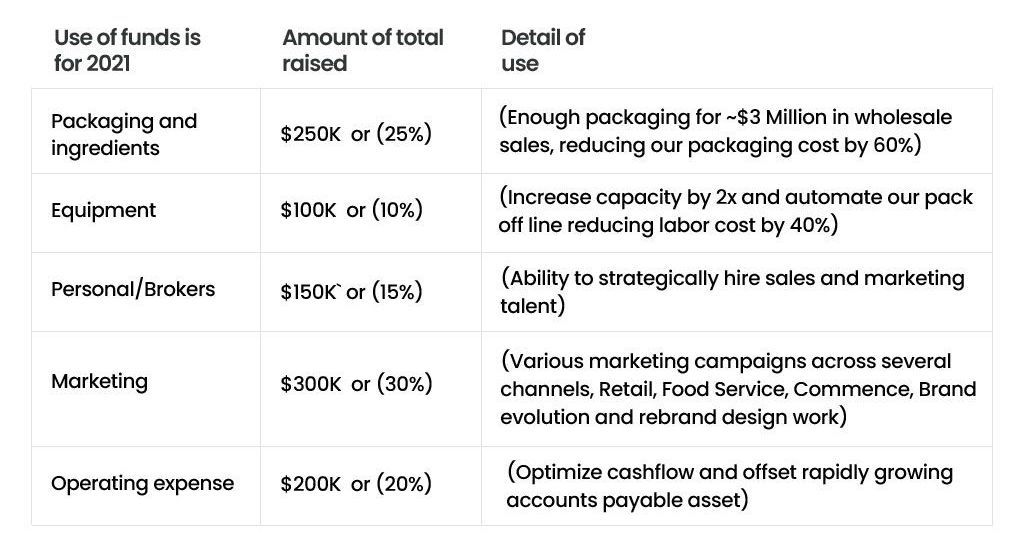

Kombucha Town has raised $1.5M to date, and is raising new funds to support our expansion. With your investment, we will be able to increase manufacturing capacity from 12K to over 20K cases per month.

Founders edit edit source

From the founder edit edit source

Kombucha Town Team edit edit source

Chris McCoy

Founder & CEO

Caring for my Mom, inspired me to start a business that would empower people to live happy, healthy lives. Since then, KT has been brewing delicious beverages and innovating, with sustainability and social responsibility in mind every step of the way

Rae Gay

Executive Director

Rae learned about brewing Kombucha and fermenting vegetables while living at an EcoVillage. She brings her passion for microbes and community together at Kombucha Town through media creation and marketing.

Aaron Murphy

Creative Director

After a many years of traveling as a crew person on TV shows for Discovery, History, Bravo and more , I've chosen to use my wide range of technical skills to help tell the stories of businesses and organizations doing good in the world.

Jesse Shumway

Production Director

Beginning his Brewing and canning career with Reverend Nat's Hard Cider in Portland, Jesse was enticed by Bellinghams' sustainable reputation and outdoor adventurous lifestyle. Now he ensures high quality 'Adventure Beverages' for Kombucha Town!

Ben Esget

Advisors

Ben has been the financial advisor to Kombucha town since 2016. He is the Founder/CEO of Wealth mark financial services. One of the top performing asset management and hedge funds in the country for several years running.

Joseph Bisacca

Advisors

He has been Kombucha Town’s top advisor since 2017, bringing decades of operational experience to the table from craft micro brewing to large international macro brewing operations.

Stephanie Lind

Advisors

Stephanie Lind and her firm EloHI strategic partners have formally engaged with Kombucha Town adding their extensive experience and network of resources to assist in growing the organization.

Risks edit edit source

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

With shelter-in-place orders and non-essential business closings potentially happening throughout 2022 and into the future due to COVID-19, the Company’s revenue has been adversely affected. For example, in 2020, the Company saw a 43% decline in sales as many of our retail partners were shuttered by COVID-19, which resulted in a 33% loss for the year. Furthermore, the Company relies heavily on properly functioning supply chains in order to obtain ingredients and packaging for its products as well as to ensure timely distribution of its finished products to customers and resellers and global crises like COVID-19 have caused and may continue to cause significant delays in this regard.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

Currently, our authorized capital stock consists of 1,200,000 shares of common stock, of which 1,020,400 shares of common stock are issued and outstanding. Unless we increase our authorized capital stock, we may not have enough authorized common stock to be able to obtain funding by issuing shares of our common stock or securities convertible into shares of our common stock. We may also not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

In general, demand for our products is highly correlated with general economic conditions.

A substantial portion of our revenue is derived from discretionary spending by individuals, which typically falls during times of economic instability. Declines in economic conditions in the U.S. may adversely impact our consolidated financial results. Because such declines in demand are difficult to predict, we or the industry may have increased excess capacity as a result. An increase in excess capacity may result in declines in prices for our products.

We rely on other companies to provide components and services for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate manufacture of major components or subsystems for our products, or from whom we acquire such items, do not provide components which meet required specifications and perform to our and our customers’ expectations. Our suppliers may be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two contractors or suppliers for a particular component. Our products may utilize custom components available from only one source. Continued availability of those components at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. The supply of components for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company relies on certain intellectual property rights to operate its business. The Company’s intellectual property rights may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

The global kombucha market is highly competitive.

The Company operates in a very competitive industry. Other kombucha companies have much broader access to resources than we do. This could prohibit us from being able to achieve our benchmarks, stay relevant and differentiate ourselves in the market.

The Company’s success depends on the experience and skill of the board of directors, its executive officers and key employees.

We are dependent on our board of directors, executive officers and key employees. These persons may not devote their full time and attention to the matters of the Company. The loss of our board of directors, executive officers and key employees could harm the Company’s business, financial condition, cash flow and results of operations.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Future product recalls or safety concerns could adversely impact our results of operations.

We may be required to recall certain of our products should they be mislabeled, tampered with or damaged. We also may become involved in lawsuits and legal proceedings if it is alleged that the use of any of our products causes injury, illness or death. A product recall or an adverse result in any such litigation could have an adverse effect on our business, depending on the costs of the recall, the destruction of product inventory, competitive reaction and consumer attitudes. Even if a product liability or consumer fraud claim is unsuccessful or without merit, the negative publicity surrounding such assertions regarding our products could adversely affect our reputation and brand image. We also could be adversely affected if consumers in our principal markets lose confidence in the safety and quality of our products.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

Changes in government regulation could adversely impact our business.

The Company is subject to legislation and regulation at the federal and local levels and, in some instances, at the state level. The FCC and/or Congress may attempt to change the classification of or change the way that our online content platforms are regulated and/or change the framework under which Internet service providers are provided Safe Harbor for claims of copyright infringement, introduce changes to how digital advertising is regulated and consumer information is handled, changing rights and obligations of our competitors. We expect that court actions and regulatory proceedings will continue to refine our rights and obligations under applicable federal, state and local laws, which cannot be predicted. Modifications to existing requirements or imposition of new requirements or limitations could have an adverse impact on our business. Furthermore, our ability to sell our products is dependent on the FDA (Food and Drug Administration), FTC (Federal Trade Commission) and other relevant government laws and regulations. The laws and regulations concerning the selling of our products may be subject to change which may make selling our products no longer in the best interest of the Company. At such point the Company may no longer want to sell its products and therefore your investment in the Company could be adversely affected.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts.

In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE ((Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into CF Shadow Securities. The Company is under no obligation to convert the Securities into CF Shadow Securities. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into CF Shadow Securities (the occurrence of which cannot be guaranteed). Upon such conversion, the CF Shadow Securities will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders or the party holding the CF Shadow Securities on behalf of the Investors are required to enter into a proxy agreement with its designee to vote their CF Shadow Securities with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right. For example, if the Securities are converted in connection with an offering of Series B Preferred Stock, Investors would directly or beneficially receive CF Shadow Securities in the form of shares of Series B-CF Shadow Preferred Stock and such shares would be required to be subject to a proxy that allows a designee to vote their shares of Series B-CF Shadow Preferred Stock consistent with the majority of the Series B Preferred Stockholders. Thus, Investors will essentially never be able to vote upon any matters of the Company unless otherwise provided for by the Company.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company.

The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities.

In addition, the Company has certain equity grants and convertible securities outstanding. Should the Company enter into a financing that would trigger any conversion rights, the converting securities would further dilute the equity securities receivable by the holders of the Securities upon a qualifying financing.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the Conversion Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the Conversion Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company.

The forgoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred stock, have been paid in full. Neither holders of the Securities nor holders of CF Shadow Securities can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.