Ludus

Summary[1] edit edit source

Web-based tools for the performing arts trusted by 1,000+ organizations.

- Trusted by 1,000+ performing arts orgs

- Partnered with national & state associations: AACT, EdTA, WHSFA, & more

- Strong community of customer advocates accelerating growth

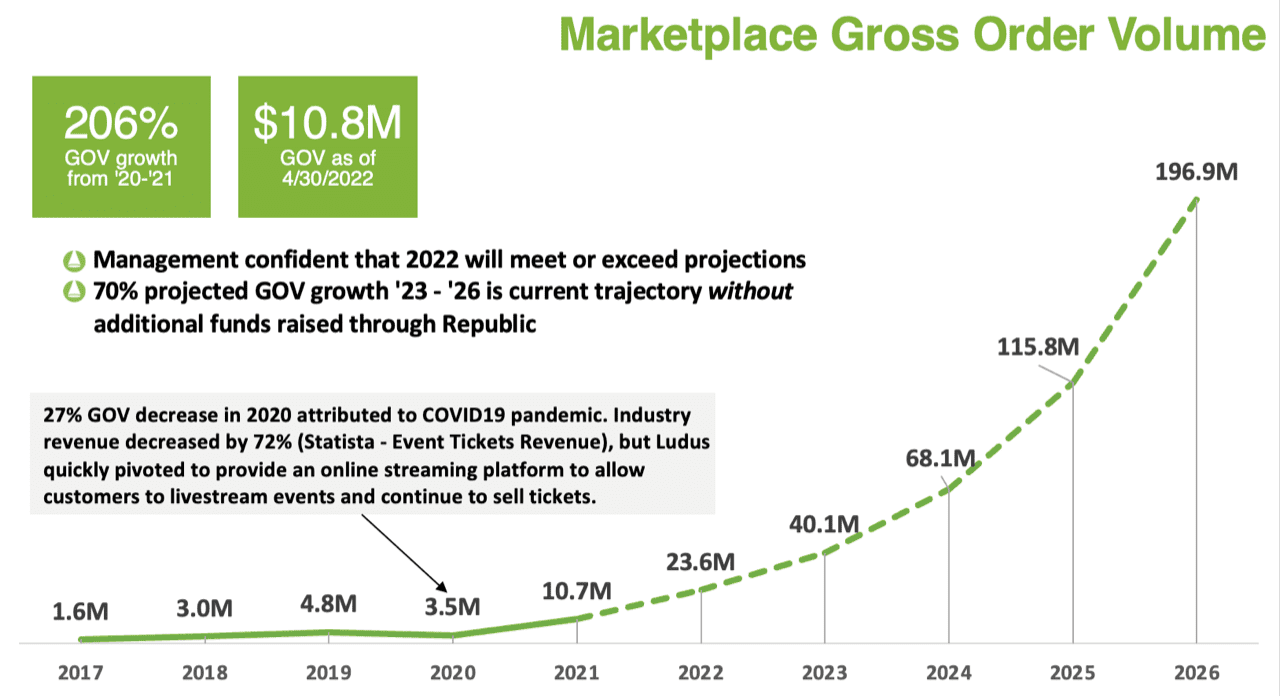

- $10.7M in Marketplace GOV for 2021 (up 206% from 2020)

- $10.8M in Marketplace GOV for 2022; projected $23.6M for 2022

- Estimated $4.8B market

Problem[1] edit edit source

Performing arts organizations have growing, complex, and unique needs

Performing arts organizations of all sizes — from 50-seat playhouses to 3,000+ seat performing arts centers — need ticketing, marketing, fundraising, patron management, and reporting tools to help them manage their growing and complex organizations. The issue is that the majority of solutions on the market are outdated, too expensive, and lack ease-of-use due to failure of adapting to the market's needs after years of little innovation.

As thousands of arts organizations are coming out of a pandemic, they are in need of something that reduces costs, removes complexities in their existing structures, and allows them to rebuild through flexible, easy-to-learn tools.

Solution[1] edit edit source

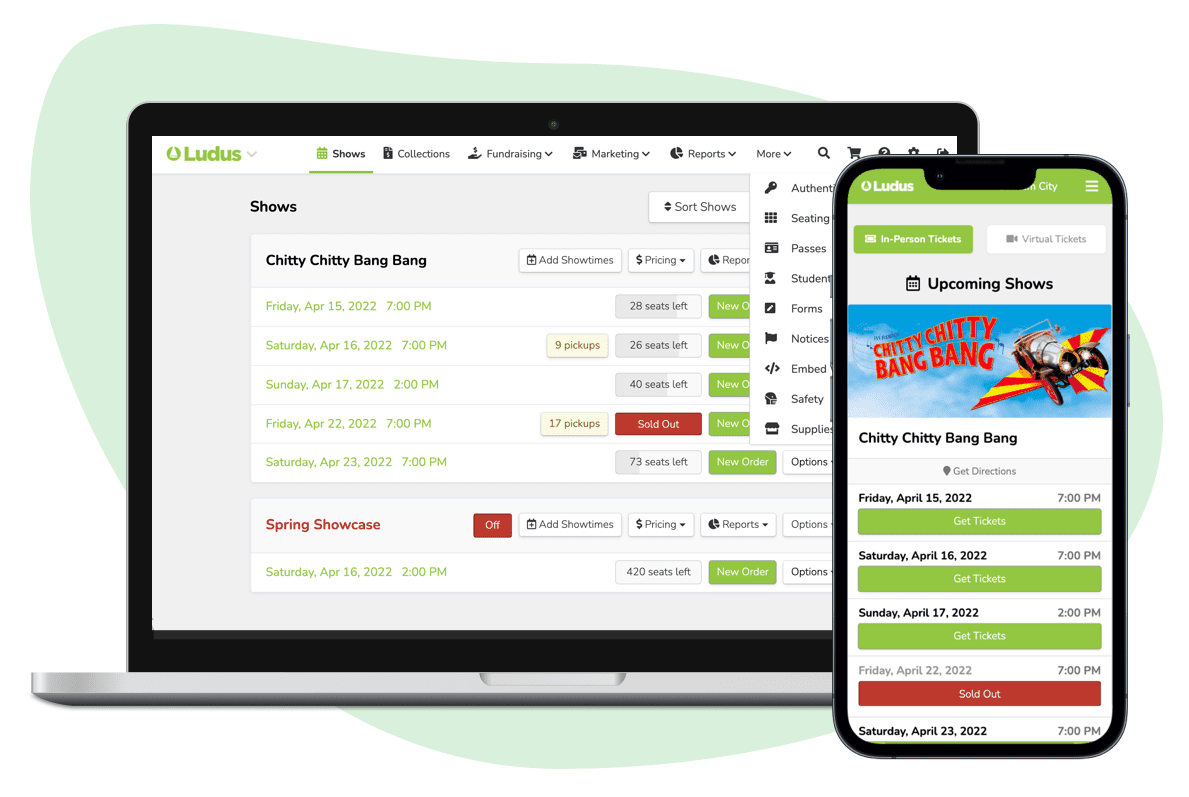

Web-based software for the performing arts that simply works

Built from the ground up for a director, Ludus is now trusted daily by 10,000+ directors, box office managers, and patrons across K-12, Colleges, Community Theatres, Non-Profits, and Performing Arts Centers of all sizes (as of April 2022).

Ludus creates web-based tools that allows arts organizations to manage their ticketing, marketing, fundraising, and more — the product thinks like its users, leading to ease-of-use and flexibility that grows with their organizations. Through our free pricing model, we are able to completely remove an expense from their income statement, allowing them to put that money toward growth and creative innovation (benefiting Ludus more and more over time).

Product[1] edit edit source

How it works edit edit source

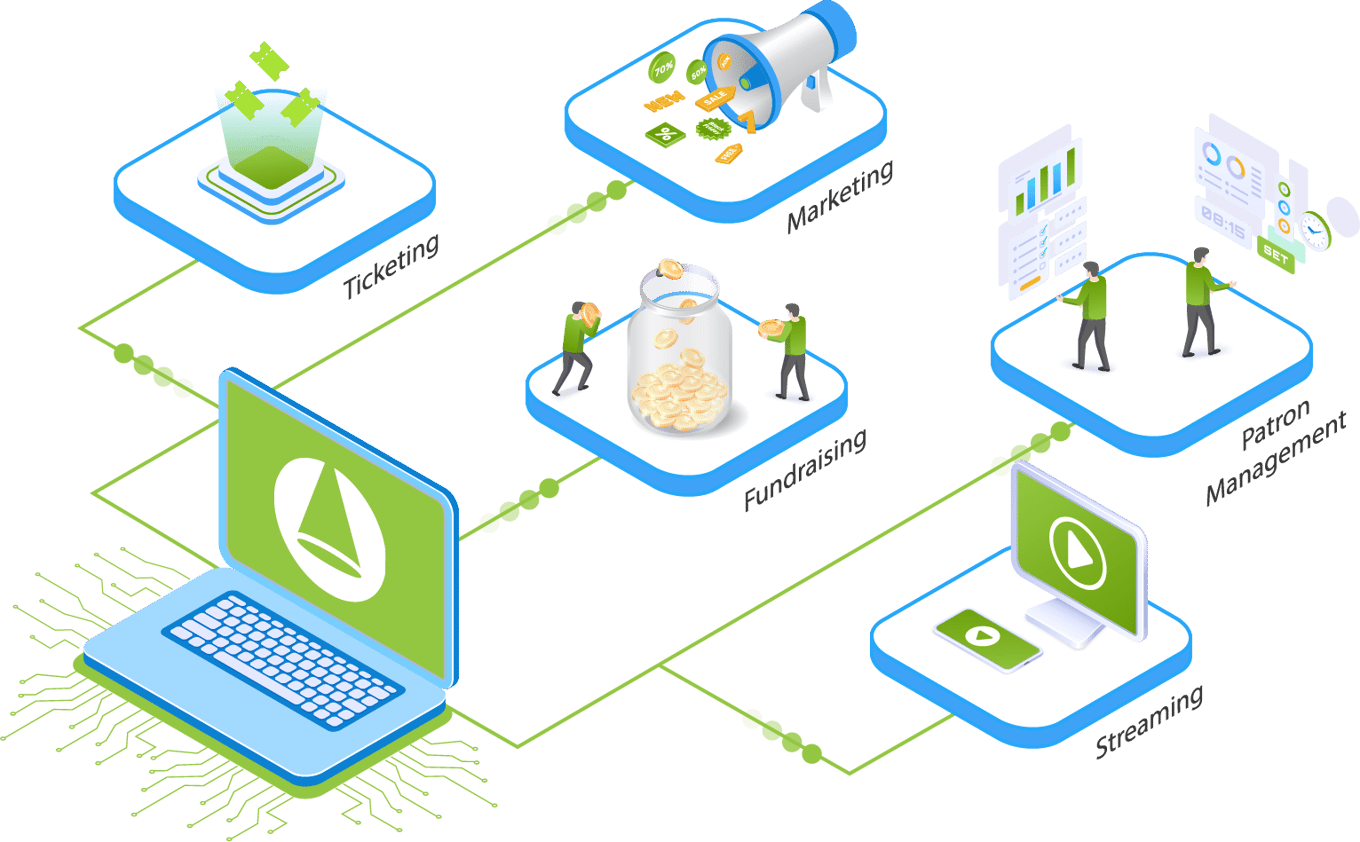

Ticketing edit edit source

Ludus started as a ticketing platform and continues to provide the best tools to manage online and in-person ticket sales. This includes a modern ticket buying/selling process, simple exchanges/refunds, box office point-of-sale features, activity logging for patron support, and much more.

Marketing edit edit source

Organizations can stay in touch with their patrons through our premium Marketing suite, giving them tools to craft beautiful emails using our drag-and-drop email designer and the ability to filter patrons into custom audiences based on dozens of parameters.

Fundraising edit edit source

Organizations can collect donations at checkout when patrons are buying tickets or any time via the Donate tab on their Ludus page. Fundraising tools include Fundraisers (custom campaign pages with goals), Levels for managing donor tiers, and recurring donations.

Collections edit edit source

Collections allows organizations to collect payments for things beyond ticket sales such as member dues, registrations, trips, venue rentals, and practically anything else.

Patron Management (CRM) edit edit source

Whether a patron buys tickets, makes a donation, or buys a season pass, they'll have a profile filled with all of their information and activity. Ludus customers can quickly see who their top patrons are, what types of shows they like, and categorize them into Groups for easy organization.

Reporting edit edit source

All reports in Ludus are real-time and flexible, giving organizations full insight into their sales, patron data, and more using our powerful (yet simple) browser-based spreadsheets.

Customization edit edit source

Customization and branding is important to organizations, so we give them the tools to design their Ludus pages using our designer or custom CSS. Going beyond, organizations can upgrade to our premium Embed Widget to embed Ludus right into their own websites for an extra fee.

COVID and safety edit edit source

Organizations are still feeling the negative effects of the pandemic and the challenges it has brought to the performing arts community. Ludus offers safety features to help host safe, socially distant shows in-person including Seat Buffering for automatic social distancing and Arrival Times for staggered arrival.

Streaming edit edit source

Organizations can reach a new audience far and wide with our streaming platform, AnywhereSeat, allowing an organization to sell virtual tickets to virtual events (such as live streams and pre-recorded videos).

Fast and friendly support edit edit source

Oftentimes it's nice to talk to a real person who understands what your job consists of. At Ludus, we offer real-time support through our chat widget, step-by-step guides, videos, help articles, and our 888 phone number.

Traction[1] edit edit source

206% increase in Marketplace GOV compared to 2020

In 2021, Ludus processed over $10.7 million in Marketplace Gross Order Value ("Marketplace GOV"). This is a 206% increase in Marketplace GOV compared to 2020.

As of 4/30/2022 Ludus has processed $10.8 million in Marketplace Gross Order Value.

70% projected GOV growth '23–'26

Customers[1] edit edit source

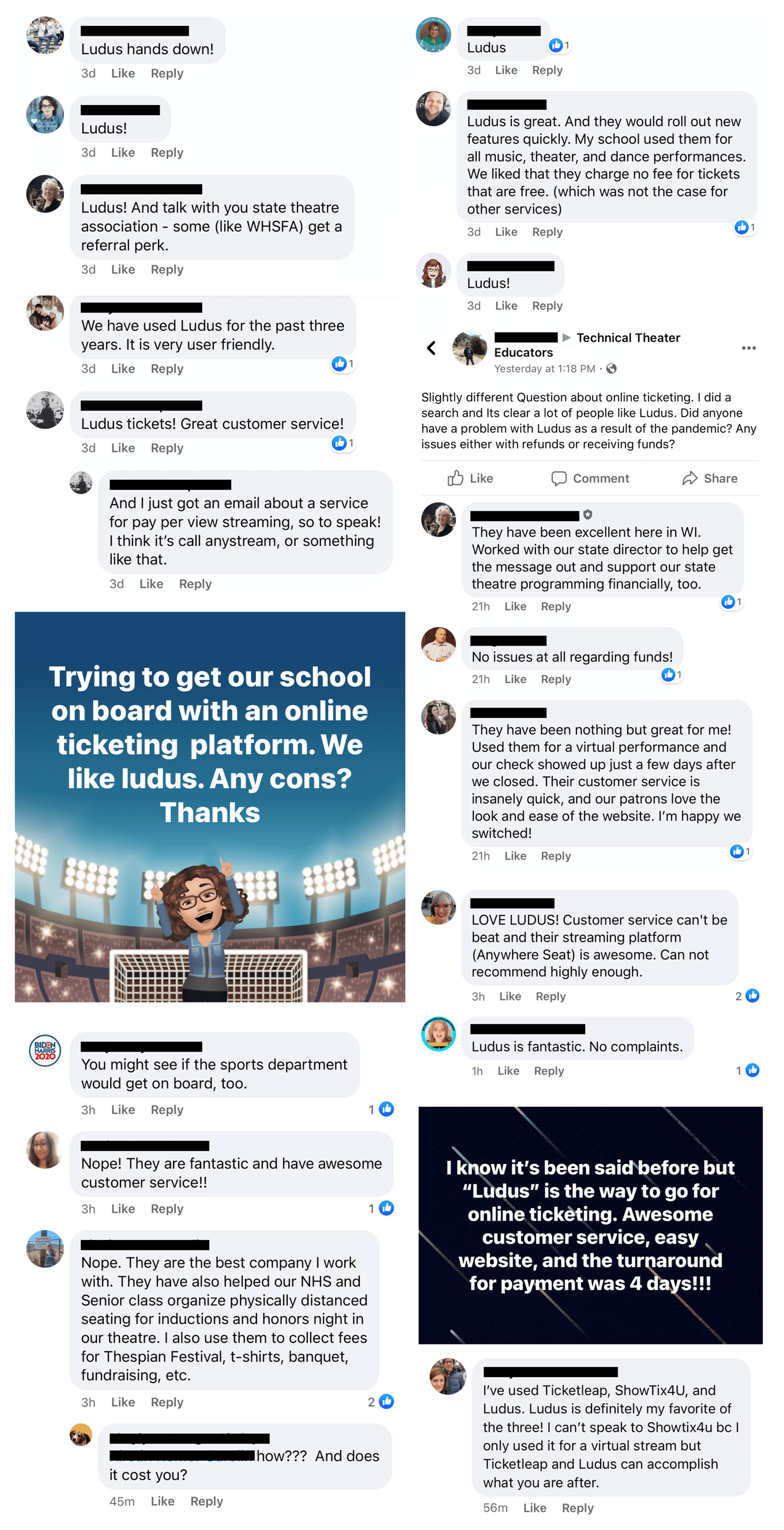

Why we are set to win

We have built a strong community of advocates (we commonly refer to them as our “Army of Advocates”) that recommend and fight for Ludus within their circles. This is due to offering a product that is beyond what is currently offered within our market, with the perfect business model, and a focus on next-level customer support.

But donʼt just take our word for it:

A collection of screenshots gathered from Facebook, showing advocacy for Ludus among our customers. Ludus has taken over comment threads in our market's Facebook Groups when ticketing is brought up.

Based on reviews given by our customers through Capterra.com, common themes were ease-of-use, customer support, and simple pricing that doesn't break the budget.

Business model[1] edit edit source

How we make money edit edit source

Ludus operates based on a convenience fee model with additional premium add-on features available to customers. Our main source of revenue is through the ticketing fee which makes up 89% of our revenue, with the other 11% being multiple complementary revenue streams (as of 12/31/2021).

Breakdown of revenue streams edit edit source

| Ticketing | 5% + $0.75/ticket when a patron pays using a card. |

| Marketing | $99/yr OR an additional $0.05 added onto ticketing fees |

| Embed Widget | $99/yr OR an additional $0.05 added onto ticketing fees |

| Fundraising | 3.5% + $0.50/donation |

| Collections | 5% + $0.75/collection registration |

| Add-Ons | 5% + $0.75/item |

| AnywhereSeat (Streaming) | 5% + $0.75/virtual ticket |

| Mailed Tickets | $3.50 extra to receive thermal tickets in the mail |

Market[1] edit edit source

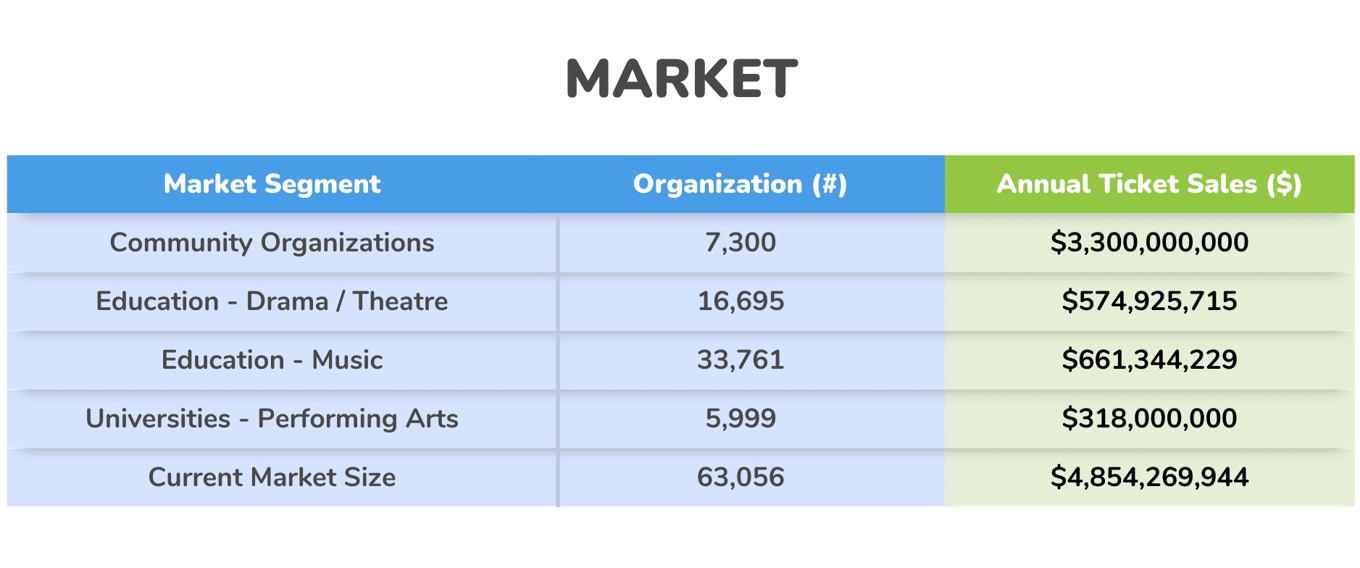

Estimated $4.8B+ market in ticketing for education and community organizations

Below are our estimates based on public figures and internal sales data (the market we operate in does not make finding exact figures easy, especially within the K-12 education world):

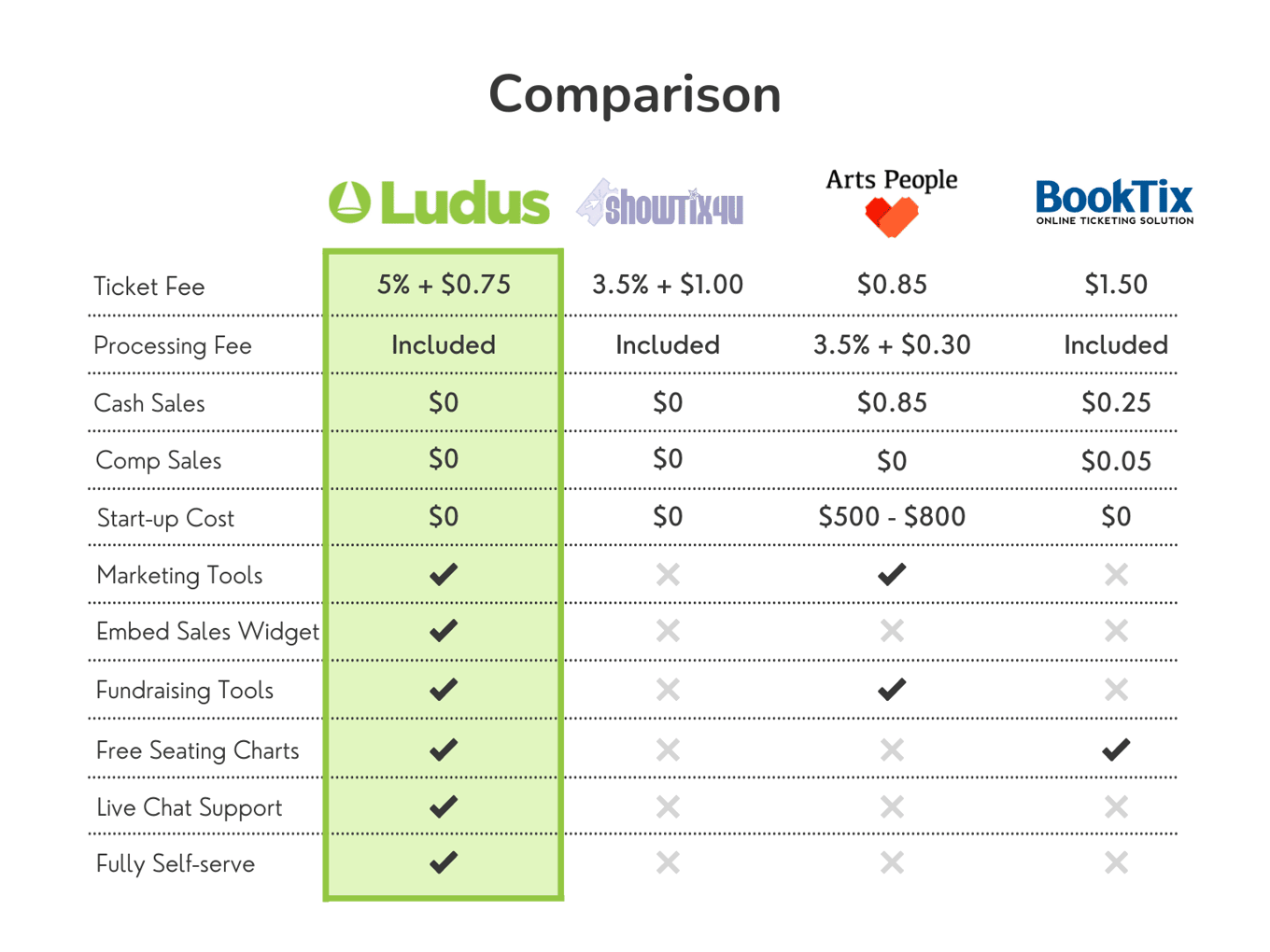

Competition[1] edit edit source

More than just ticketing

Ticketing is a saturated market, which is why we have a focus on being more than ticketing—turning our competitors into features.

Our main competitors include BookTix, ShowTix4U, ThunderTix, SeatYourself, and ArtsPeople. A common theme within their names is they are stuck on ticketing ("Tix")—while we envision building tools to run performing arts organizations end-to-end (ticketing, marketing, fundraising, collections, patron/volunteer management, and streaming).

Based on publicly accessible or provided information

Vision and strategy[1] edit edit source

Where we are heading edit edit source

Ludus is in a unique financial position to not require outside capital to fund day-to-day operations. All outside capital will directly go into further accelerating growth and increasing the gap between our product's offerings and the competition.

We are partnered with a number of state and national associations within our market, positioning Ludus as a leader.

Investment utilization edit edit source

- Increase team size — with the additional outside capital, we plan on hiring an additional 5 employees focused in product development and sales to accelerate our product's offerings.

- Partnerships — with increased resources, we will focus on putting effort into partnering with more state and national associations which lead to increased growth.

Founders[1] edit edit source

Zachary Collins : Co-Founder & CEO

Zachary taught himself web development at the age of 12. He was named a Teen Entrepreneur to Watch by TechCrunch and a Top Young Web Developer by .net Magazine. He help cofound a startup in Portland, OR at 17 and started Ludus a few years later in his college dorm room.

Kevin Schneider : Co-Founder & President

Kevin is an award-winning theatre director with over 32 years of teaching and directing experience. Previous winner of Michigan Theatre Teacher of the Year, member of the Speeches Coaches Hall of Fame, director of 24 state title-winning theatre productions and current president of the state speech and theatre association.

Ludus Team[1] edit edit source

Zachary Collins

Co-founder & CEO

Kevin Schneider

Co-founder & President

Sasa Kukic

Vice President Finance & Strategy

Ben St. John

Technology Advisor

Collin Stiner

LAMP Developer

Jacquie Shannon

Customer Success Manager

Ethan Henry

Customer Success Specialist

Kaghen Miller

Customer Acquisition Specialist

Risks[1] edit edit source

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

Factors adversely affecting the event market could impact our results of operations.

We help organize, promote and sell tickets and registrations to a broad range of events. Our business is directly affected by the success of such events and our revenue is impacted by the number of events, types of events and ticket prices of events. Adverse trends in one or more event industries could adversely affect our business. A decline in attendance at or reduction in the number of events may have an adverse effect on our revenue and operating income.

The ongoing global COVID-19 pandemic and the preventative and protective actions that governments, other third parties or we have taken or may in the future take in respect of COVID-19, including government lockdowns and quarantine measures, have resulted, and will continue to result, in business disruption and reduced operations. Upon worsening COVID-19 infection rates in certain locations as a result of the delta and omicron variants, some national, regional and local governmental authorities have either re-imposed some or all of the earlier restrictions or imposed other restrictions, in an effort to prevent the spread of COVID-19. Further, negative public perception of the health risks from COVID-19, even in areas where local authorities have not re-imposed lockdown or quarantine measures, has caused and may continue to cause individuals to change their behaviors to reduce their risk of exposure to COVID-19, including by limiting their time gathering with others.

In late 2020 and early 2021, vaccines for combating COVID-19 were approved by health agencies and began to be administered. While a significant portion of the population has been vaccinated, vaccine availability is still limited, and vaccine uptake, including booster vaccination, has been limited. Further, the rate of “breakthrough” COVID-19 cases in fully or partially vaccinated individuals may affect consumer behavior and the live event market and adversely affect our business.

There is significant uncertainty regarding the extent and duration of the impact that the COVID-19 pandemic will have on our business. The extent to which COVID-19 impacts our business, results of operations and financial condition will depend on future developments, which are highly uncertain and cannot be predicted, including new information that may emerge concerning the long-term health impact of COVID-19, the emergence or severity of new variants, the actions taken to contain outbreaks or mitigate the impact of COVID-19, whether on a national, regional or local level, the distribution, uptake and efficacy of vaccines, and changes in consumer behavior and the live event market in response to COVID-19, both during and after the acute stage of the COVID-19 pandemic. The full extent to which COVID-19 impacts our business, results of operations and financial condition cannot be predicted at this time and the impact of COVID-19 may persist for an extended period of time or become more pronounced.

In addition, our business depends on discretionary consumer and corporate spending. During periods of economic slowdown and recession such as the worldwide recession triggered by the COVID-19 pandemic, as well as other periods of economic instability or uncertainty, consumers have historically reduced their discretionary spending. In addition, as a result of labor and materials shortages and supply chain delays exacerbated by COVID-19, many regions have experienced and are continuing to experience rising consumer prices. With the rise in prices of essential goods and services, consumers have historically reduced their discretionary spending. The impact of economic slowdowns and rising consumer prices on our business is difficult to predict, but they may result in reductions in ticket and registration sales and our ability to generate revenue. Many factors related to discretionary consumer and corporate spending, including employment, fuel prices, interest and tax rates and inflation, can adversely impact our results of operations.

In addition, the occurrence and threat of extraordinary events, such as public health concerns, epidemics and pandemics (including the COVID-19 pandemic), terrorist attacks, mass-casualty incidents, natural disasters or similar events. These concerns have led to numerous challenging operating factors. These challenges may impact the customer experience and lead to fewer events and as a result may harm our results of operations.

Any adverse condition, including those described above, that could lead to unsatisfied customers and require refunds or chargebacks or increase complexity and costs for customers and us, would harm our business, results of operations and financial condition.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

With shelter-in-place orders and non-essential business closings potentially happening throughout 2020, 2021, 2022 and into the future due to COVID-19, the Company’s revenue has been adversely affected.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

We rely on other companies to provide components and services for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate manufacture of major components or subsystems for our products, or from whom we acquire such items, do not provide components which meet required specifications and perform to our and our customers’ expectations. Our suppliers may be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two contractors or suppliers for a particular component. Our products may utilize custom components available from only one source. Continued availability of those components at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. The supply of components for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company relies on certain intellectual property rights to operate its business. The Company’s intellectual property rights may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. In order to protect or enforce our patent rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the technology field in which we operate is still evolving and, consequently, intellectual property positions in our industry are generally uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

The Company’s success depends on the experience and skill of the managers, its executive officers and key employees.

We are dependent on our managers, executive officers and key employees. These persons may not devote their full time and attention to the matters of the Company. The loss of our managers, executive officers and key employees could harm the Company’s business, financial condition, cash flow and results of operations.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

If we do not continue to maintain and improve our platform or develop successful new solutions and enhancements or improve existing ones, our business will suffer.

Our ability to attract and retain customers depends in large part on our ability to provide a user-friendly and effective platform, develop and improve our platform and introduce compelling new solutions and enhancements. Our industry is characterized by rapidly changing technology, new service and product introductions and changing demands of customer. We spend substantial time and resources understanding customers’ needs and responding to them. Building new solutions is costly and complex, and the timetable for commercial release is difficult to predict and may vary from our historical experience. Customers may not be satisfied with our enhancements or perceive that the enhancements do not adequately meet their needs. The success of any new solution or enhancement to our platform depends on several factors, including timely completion and delivery, competitive pricing, adequate quality testing, integration with our platform, customer awareness and overall market acceptance and adoption. If we do not continue to maintain and improve our platform or develop successful new solutions and enhancements or improve existing ones, our business, results of operations and financial condition could be harmed.

Our software is complex, and we may in the future, discover previously undetected errors.

The software underlying our platform is complex and we in the future, detect previously undetected errors or vulnerabilities, some of which may only be discovered after the code has been used in a production environment to deliver products and services. Any real or perceived errors, failures, bugs or other vulnerabilities discovered in our platform could result in negative publicity and damage to our reputation, loss of customers, loss of or delay in market acceptance of our platform, loss of competitive position, loss of revenue or liability for damages, overpayments and/or underpayments, any of which could harm the confidence of customers on our platform, our business, results of operations and financial condition. In such an event, we may be required or may choose to expend additional resources in order to help correct the problem.

In addition, our platform relies on third party partners for the development tool chain, managed infrastructure, and platform services. These include disciplines like security, payment processing, cloud computing, data processing and storage, as well as various processes in our software development life cycle. There can be no assurance that the provisions in our agreements with our partners that attempt to limit our exposure to events like downtime, data breaches, and malicious actors would fully protect us from liabilities or damages. Such disruptions in our vendor supply chain would be time-consuming and costly, especially engineering, and result in delays in our product delivery and business strategy.

Any significant system interruption or delays could damage our reputation, result in a potential loss of customers and adversely impact our business.

Our ability to attract and retain customers depends on the reliable performance of our technology, including our websites, applications, information and related systems. System interruptions, slow-downs and a lack of integration and redundancy in our information systems and infrastructure may adversely affect our ability to operate our technology, handle sales, process and fulfill transactions, respond to customer inquiries and generally maintain cost-efficient operations.

We also rely on affiliate and third-party computer systems, broadband and other communications systems and service providers in connection with the provision of services generally, as well as to facilitate, process and fulfill transactions. Any interruptions, outages or delays in our systems and infrastructures, our businesses, our affiliates’ and/or third-party systems we use, or deterioration in the performance of these systems and infrastructures, could impair our ability to provide services, fulfill orders and/or process transactions. We may experience in the future experience, occasional system interruptions caused by outages by our partners that made, or may make, some or all systems or data unavailable or prevented, or may prevent, us from efficiently providing services or fulfilling orders.

In addition, fire, flood, power loss, telecommunications failure, hurricanes, tornadoes, earthquakes, acts of war or terrorism, natural disasters and similar events or disruptions may damage or interrupt computer, broadband or other communications systems and infrastructures at any time. Climate change is expected to continue to cause adverse weather conditions, increased weather variability and natural disasters to become more frequent and less predictable. Any of these events could cause system interruptions, outages, delays and loss of critical data, and could prevent us from providing services, fulfilling orders and/or processing transactions.

In some instances, we may not be able to identify the cause or causes of these performance problems within a period of time acceptable to customers. It may become increasingly difficult to maintain and improve our platform performance, especially during peak usage times, as the features of our platform become more complex and the usage of our platform increases. Any of the above circumstances or events may harm our reputation, cause customers to stop using our platform, impair our ability to increase revenue, impair our ability to grow our business, subject us to financial penalties and liabilities under our service level agreements and otherwise harm our business, results of operations and financial condition.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts.

In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.

Our industry is highly fragmented. We compete against traditional solutions to event management and may face significant competition from both established and new companies. If we are not able to maintain or improve our competitive position, our business could suffer.

We operate in a market that is highly fragmented. We compete with a variety of competitors to secure new and retain existing customers, including traditional solutions to event management, local or specialized market competitors, products offered by large technology companies that have entered into or may enter the market, or other ticketing competitors. If we cannot successfully compete in the future with existing or potential competitors, our business, results of operations and financial condition will be harmed.

Some of our current and potential competitors have significantly more financial, technical, marketing and other resources, are able to devote greater resources to the development, promotion, sale and support of their services, have more extensive customer bases and broader customer relationships, have longer operating histories and greater name recognition than we do.

We may also compete with potential entrants into the market that currently do not offer the same services but could potentially leverage their networks in the market in which we operate. These competitors may be better able to undertake more extensive marketing campaigns, build products and features faster than we can and/or offer their solutions and services at a discount to ours. Furthermore, some of our competitors may customize their products to suit a specific event type, category or customer. If we are unable to compete with such alternatives, the demand for our solutions could decline.

Our payments system depends on third-party providers and is subject to risks that may harm our business.

We rely on third-party providers to support our payments system. As a complex, multi-vendor system with proprietary technology added, our payment system relies on banks and third-party payment processors, including payment facilitators. Any of our payment providers and vendors that do not operate well with our platform could adversely affect these payments services and, in turn, our business.

We must also continually integrate various payment methods, including new features such as “buy now, pay later” functionality provided by third-party platforms. To enhance our acceptance, we may in the future adopt, locally-preferred payment methods, which may increase our costs and also require us to understand and protect against unique fraud and other risks associated with these payment methods. In addition, payment card networks and payment processing partners could increase the fees they charge us for their services, including in connection with an atten’s use of certain payment cards or other payment methods, which would increase our operating costs and reduce our margins. If we are unable to negotiate favorable economic terms with these partners, our business, results of operations and financial condition could be harmed.

Data loss or security breaches could harm our business, reputation, brand and results of operations.

Security breaches, computer malware and computer hacking attacks have become more prevalent across industries and may occur on our systems or those of our third-party service providers or partners. Despite the implementation of security measures, our internal computer systems and those of our third-party service providers and partners are vulnerable to damage from computer viruses, hacking and other means of unauthorized access, denial of service and other attacks, natural disasters, terrorism, war and telecommunication and electrical failures. Attacks upon information technology systems are increasing in their frequency, levels of persistence, sophistication and intensity, and are being conducted by sophisticated and organized groups and individuals with a wide range of motives and expertise. Furthermore, the prevalent use of mobile devices increases the risk of data security incidents. In addition, misplaced, stolen or compromised mobile devices used at events for ticket scanning, or otherwise, could lead to unauthorized access to the device and data stored on or accessible through such device.

In addition, our platform involves the storage and transmission of personal information of users of our platform in our facilities and on our equipment, networks and internal or third-party systems. Security breaches could expose us to litigation, remediation costs, increased costs for security measures, loss of revenue, damage to our reputation and potential liability. Additionally, outside parties may attempt to fraudulently induce customers to disclose sensitive information in order to gain access to customer data. We must continuously examine and modify our security controls and business policies to address the use of new devices and technologies, and the increasing focus by users and regulators on controlling and protecting user data. We may need to expend significant resources to protect against and remedy any potential security breaches and their consequences. Any security breach of our platform or systems, the systems or networks of our third-party service providers or partners, or any unauthorized access to information we or our providers and partners process or maintain, could harm our business, results of operations and financial condition.

If an actual or perceived breach of our security occurs, the market perception of the effectiveness of our security measures could be harmed, we could lose customers or we could face lawsuits, regulatory investigations or other legal or regulatory proceedings and we could suffer financial exposure due to such events or in connection with regulatory fines, remediation efforts, investigation costs, changes or augmentation of our security measures and the expense of taking additional system protection measures.

The reputation and brand of our platform is important to our success, and if we are not able to maintain and enhance our brand, our results of operations and financial condition may be adversely affected.

We believe that maintaining and enhancing our reputation and brand as a differentiated and category-defining ticketing company serving customers is critical to our relationship with our existing customers and to our ability to attract new customers. The successful promotion of our brand attributes will depend on a number of factors that we control and some factors outside of our control. If we do not successfully maintain and enhance our brand and successfully differentiate our platform from competitive products and services, our business may not grow, we may not be able to compete effectively and we could lose customers or fail to attract potential customers, all of which would adversely affect our business, results of operations and financial condition.

However, there are also factors outside of our control, which could undermine our reputation and harm our brand. Negative perception of our platform may harm our business, including as a result of complaints or negative publicity about us; events being unsuccessful, either as a result of lack of attendance or customer experience not meeting expectations; responsiveness to issues or complaints and timing of refunds and/or reversal of payments on our platform; actual or perceived disruptions or defects in our platform; security incidents; or lack of awareness of our policies or changes to our policies that customers or others perceive as overly restrictive, unclear or inconsistent with our values.

If we are unable to maintain a reputable platform that provides valuable solutions and desirable events, then our ability to attract and retain customers could be impaired and our reputation, brand and business could be harmed.

The Company could potentially be found to have not complied with securities law in connection with this Offering related to “Testing the Waters.”

Prior to filing this Form C, the Company engaged in “testing the waters” permitted under Regulation Crowdfunding (17 CFR 227.206), which allows issuers to communicate to determine whether there is interest in the offering. All communication sent is deemed to be an offer of securities for purposes of the antifraud provisions of federal securities laws. Any Investor who expressed interest prior to the date of this Offering should read this Form C thoroughly and rely only on the information provided herein and not on any statement made prior to the Offering. The communications sent to Investors prior to the Offering are attached as Exhibit D. Some of these communications may not have included proper disclaimers required for “testing the waters”.

Changes in Internet search engine algorithms and dynamics, search engine disintermediation, changes in marketplace rules or changes in privacy and consumer data access could have a negative impact on traffic for our sites or functionality of our product and ultimately, our business and results of operations.

We rely heavily on Internet search engines, such as Google, to generate traffic to our websites, principally through free or organic searches. Search engines frequently update and change the logic that determines the placement and display of results of a user’s search, such that the purchased or algorithmic placement of links to our websites can be negatively affected. In addition, a search engine could, for competitive or other purposes, alter its search algorithms or results causing our websites to place lower in organic search query results. If a major search engine changes its algorithms in a manner that negatively affects the search engine ranking of our websites or those of our partners, our business, results of operations and financial condition would be harmed. Furthermore, our failure to successfully manage our search engine optimization could result in a substantial decrease in traffic to our websites, as well as increased costs if we were to replace free traffic with paid traffic, which may harm our business, results of operations and financial condition.

In addition, changes to third parties’ privacy and consumer data access policies may in the future, negatively impact the functionality of our product. Third parties’ changes may render our products less effective, obsolete or require us to divert engineering resources to retool our products rather than releasing new functionality. This may ultimately harm our business, results of operations and financial condition.

Customer acquisition and retention depend upon effective interoperation with operating systems, networks, protocols, devices, web browsers and standards that we do not control.

We make our platform available across a variety of operating systems and web browsers. We are dependent on the interoperability of our platform with popular devices, mobile operating systems and web browsers that we do not control, such as Android, iOS, Chrome and Firefox. In addition, we are dependent on protocols like email and push notification to communicate with our customers. Any changes, bugs or technical issues in such systems, devices, protocols or web browsers that degrade the functionality of our platform, make it difficult for customers to access or use our platform, impose fees related to our platform or give preferential treatment to competitive products or services could adversely affect usage of our platform. In the event that it is difficult for customers to access and use our platform, our business and results of operations could be harmed.

Our failure to successfully address the evolving market for transactions on mobile devices and to build mobile products could harm our business.

A significant and growing portion of customers access our platform through mobile devices. The number of people who access the Internet and purchase goods and services through mobile devices, including smartphones and handheld tablets or computers, has increased significantly in the past few years and is expected to continue to increase. If we are not able to provide customers with the experience and solutions they want on mobile devices, our business may be harmed.

While we have created mobile applications and versions of much of our web content, if these mobile applications and versions are not well received customers, our business may suffer. If we are unable to effectively anticipate and manage these risks, our business and results of operations may be harmed.

Our business is subject to a wide range of laws and regulations. Our failure to comply with those laws and regulations could harm our business.

We are subject to a number of U.S. federal and state laws and regulations that involve matters central to our business. For example, our platform is subject to an increasingly strict set of legal and regulatory requirements intended to help detect and prevent money laundering, terrorist financing, fraud and other illicit activity. The interpretation of those requirements by judges, regulatory bodies and enforcement agencies is changing, often quickly and with little notice. Changes in laws and regulations could impose more stringent requirements on us to detect and prevent illegal and improper activity by customers, which can increase our operating costs and reduce our margins. For example, to date, in the United States, platforms like ours are immune from liability resulting from the improper or illegal actions facilitated by the platform, but initiated by its users, under Section 230 of the Communications Decency Act (CDA). If the CDA is amended in a manner that reduces protections for our platform, we will need to increase our content moderation operations, which may harm our results of operations.

Our business may be subject to sales tax and other indirect taxes in various jurisdictions.

The application of indirect taxes, such as sales and use tax, amusement tax, value-added tax, goods and services tax, business tax and gross receipts tax, to businesses like ours and to customers is a complex and evolving issue. Significant judgment is required to evaluate applicable tax obligations and as a result, amounts recorded are estimates and are subject to adjustments. In many cases, the ultimate tax determination is uncertain because it is not clear how new and existing statutes might apply to our business.

One or more states, localities, the federal government may seek to impose additional reporting, record-keeping or indirect tax collection obligations on businesses like ours that facilitate online commerce. For example, taxing authorities in the United States have identified e-commerce platforms as a means to calculate, collect and remit indirect taxes for transactions taking place over the Internet, and are considering related legislation. An increasing number of jurisdictions have enacted laws or are considering enacting laws requiring marketplaces to report user activity or collect and remit taxes on certain items sold on the marketplace. Imposition of an information reporting or tax collection requirement could decrease customer activity on our platform, which would harm our business. New legislation could require us or customers to incur substantial costs in order to comply, including costs associated with tax calculation, collection and remittance and audit requirements, which could make using our platform less attractive and could adversely affect our business and results of operations.

We face sales and use tax and value-added tax audits in certain states and it is possible that we could face additional sales and use tax and value-added tax audits in the future in additional jurisdictions and that our liability for these taxes could exceed our reserves as state tax authorities could assert that we are obligated to collect additional amounts as taxes from customers and remit those taxes to those authorities. We could also be subject to audits and assessments with respect to state and local jurisdictions for which we have not accrued tax liabilities. A successful assertion that we should be collecting additional sales or other taxes on our services in jurisdictions where we have not historically done so and do not accrue for sales or other taxes could result in substantial tax liabilities for past sales, discourage customers from using our platform or otherwise harm our business and results of operations.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE ((Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into “Capital Interests” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into Capital Interests. The Company is under no obligation to convert the Securities into Capital Interests. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors may not have voting rights, even upon conversion of the Securities into Capital Interests and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE ((Simple Agreement for Future Equity) investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company.

The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the First Equity Financing Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the First Equity Financing Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company.

The forgoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred interests, have been paid in full. Neither holders of the Securities nor holders of Capital Interests can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.

If we cannot reach and attract customers, our business will be harmed.

The ongoing global COVID-19 pandemic and the preventative and protective actions that governments, other third parties or we have taken or may in the future take in respect of COVID-19, including government lockdowns and quarantine measures, have resulted, and will continue to result, in a significant decrease in the number of in-person events ticketed by our platform. With this significant drop in in-person event inventory, it is difficult for us to reach and attract customers. The extent to which COVID-19 impacts our ability to reach and attract new customers will depend on future developments, which are highly uncertain and cannot be predicted, including new information that may emerge concerning the long-term health impacts of COVID-19, the emergence or severity of new variants, the actions taken to contain outbreaks or mitigate the impact of COVID-19, the distribution, uptake and efficacy of vaccines, and changes in consumer behavior and the live event market in response to COVID-19, both during and after the acute state of the COVID-19 pandemic. The full extent to which COVID-19 impacts our business, results of operations and financial condition cannot be predicted at this time and the impact of COVID-19 may persist for an extended period of time or become more pronounced.

Further, we need to continue to provide a compelling platform to reach and attract customers. Several factors may impact a customer’s experience with our platform, including:

- our ability to provide an easy solution for customers to buy tickets or register for an event;

- outages or delays in our platform and other services;

- compatibility with other third-party services, and our ability to connect with other applications through our application programming interface (API);

- fraudulent or unsuccessful events that may result in a bad experience for customers; and

- breaches and other security incidents that could compromise the data of customers.

If customers become dissatisfied with their experiences on our platform or at an event, they may request refunds, provide negative reviews of our platform or decide not to attend future events on our platform, all of which would harm our business, results of operations and financial condition.

References and notes edit edit source