Maybe

Summary edit edit source

Modern financial planning & wealth management.

- Modern financial planning & wealth management platform accessible to all

- Disrupting the $52B+ US financial planning market

- Raised $1.4M in a pre-seed round from 1,000+ investors

Problem edit edit source

Financial planning & wealth management is broken

- 😢 Money should be easy—Money management & investing are purposefully kept obtuse (the more complicated, the more middlemen are needed).

- 💸 Incentives are broken—Financial services and investment management fees to "help" customers range from thousands to millions.

- 🔥 Retirement isn't the goal—Consumers are no longer satisfied with the outcomes of "traditional" retirement, and want to know how to gain financial independence in the prime of their lives.

Solution edit edit source

Modern financial planning & wealth management tools accessible to everyone

- 🏫 Tools that teach—Empowerment through software and education

- 🔭 See the future—Set goals and see the path to reaching financial independence

- 🚫 No middlemen—Investment management without the middleman

Product edit edit source

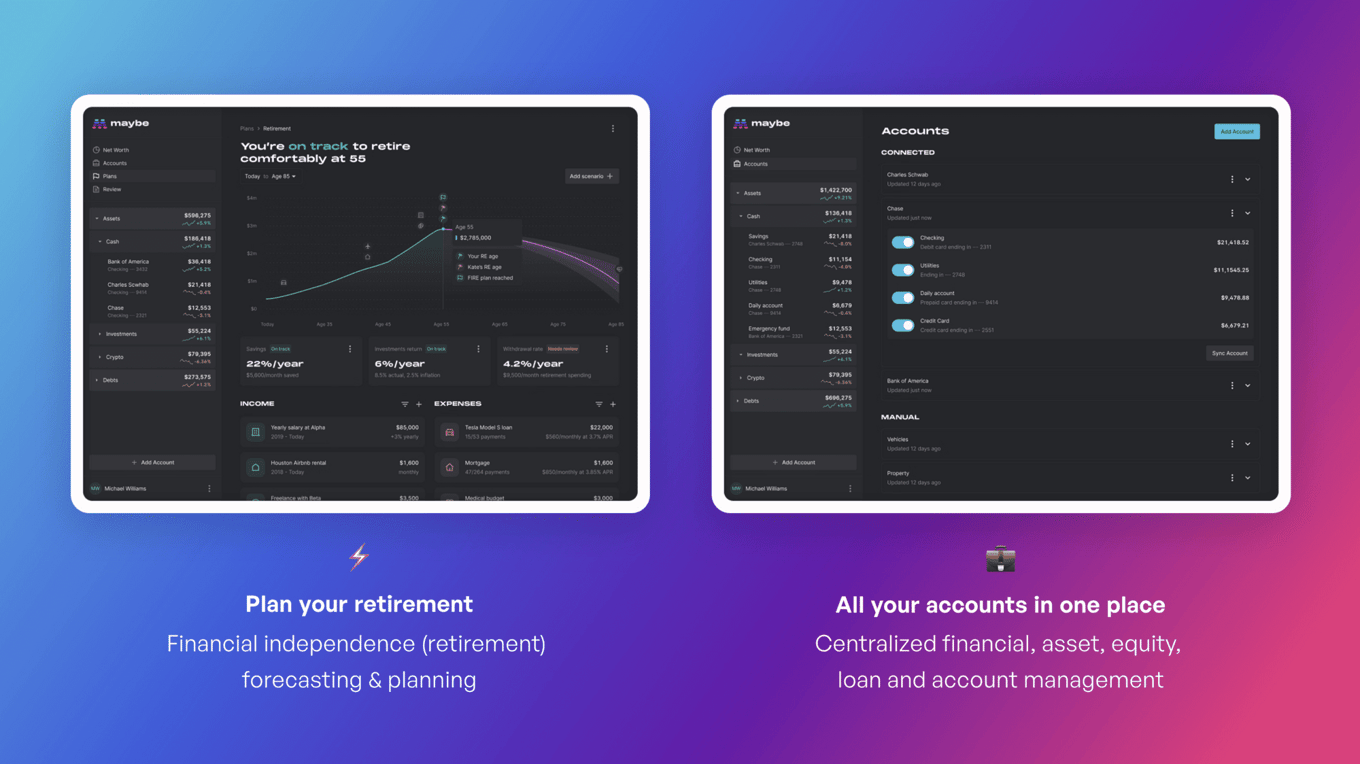

Consumer-focused financial management

- Centralized financial, asset, equity, loan, and account management

- Financial independence (retirement) forecasting & planning

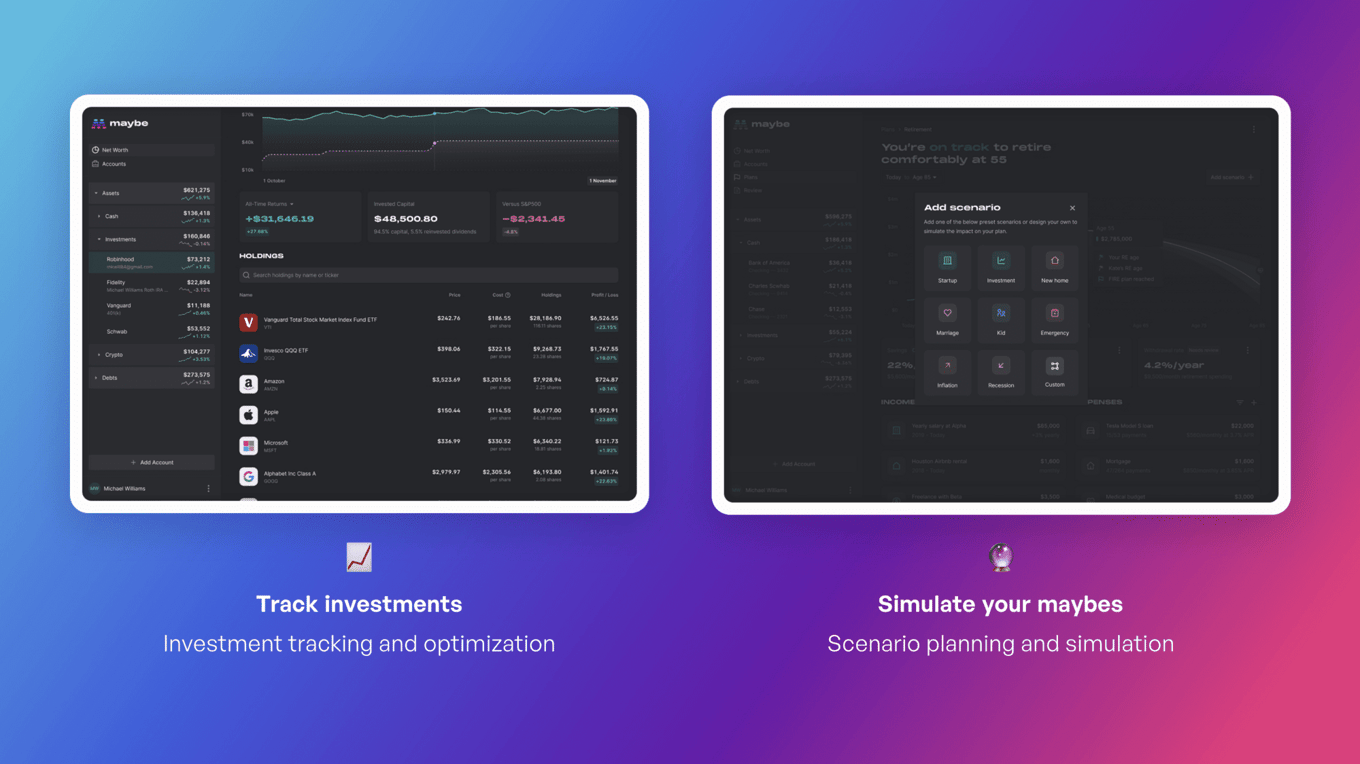

- Investment tracking and optimization

- Scenario planning and simulation

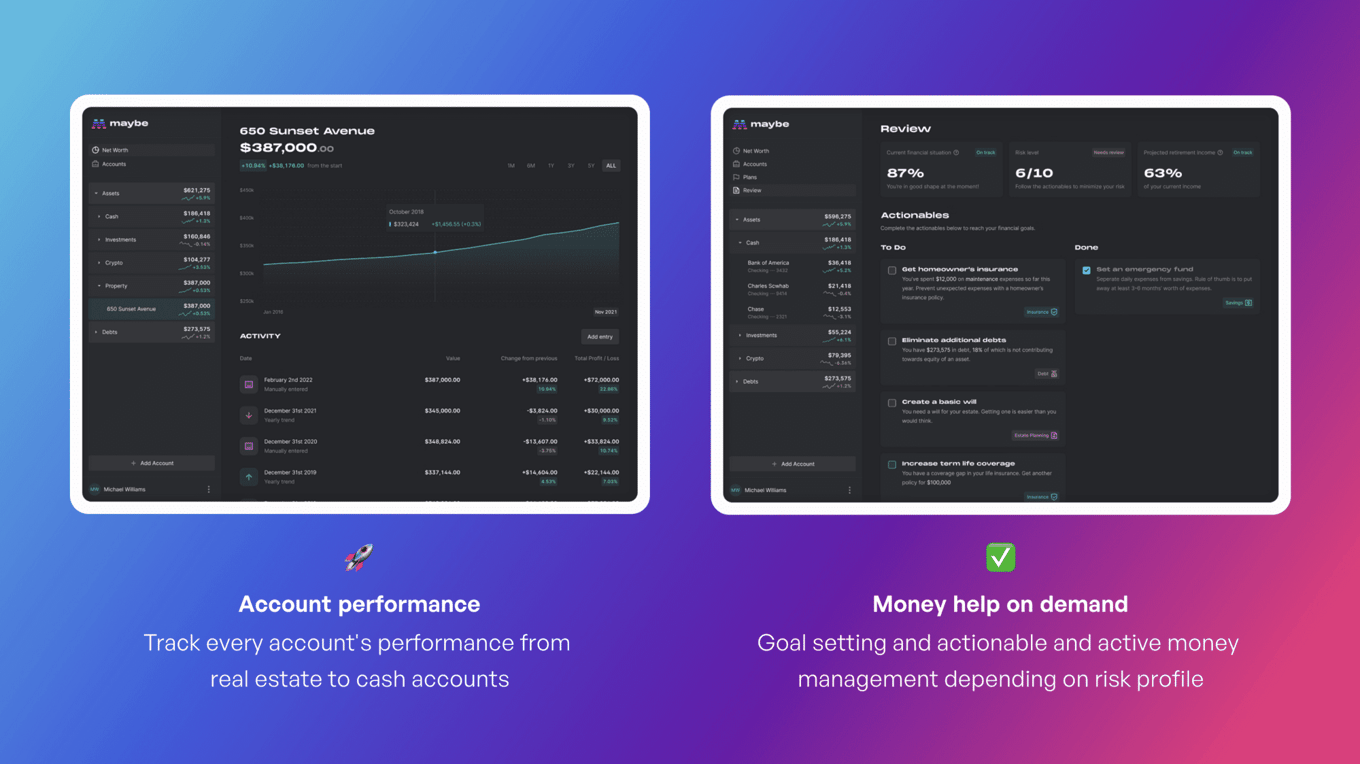

- Account performance tracking

- Goal setting and actionable, active money management

Traction edit edit source

What we've built

- Core Team — CEO, CFO, 3 Engineers, Designer, Content Marketer, and Community Manager

- Net Worth Dashboard — Connect all of your financial accounts and get a complete overview of your entire financial life in one place

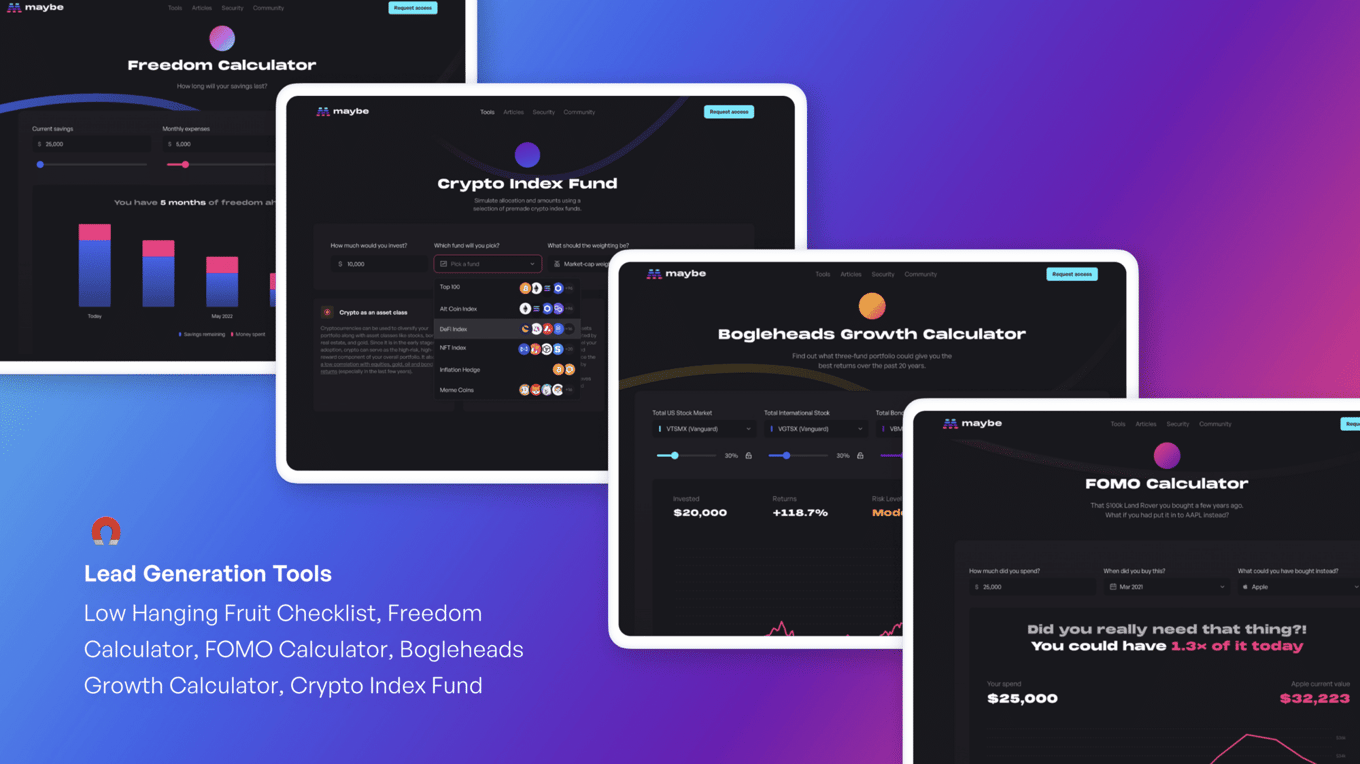

- Five Mini-Tools — Low Hanging Fruit Checklist, Freedom Calculator, FOMO Calculator, Bogleheads Growth Calculator, Crypto Index Fund

- Thriving Communities — 10,000-member early access list and active Discord, TikTok, and Twitter engagement.

- Content Marketing Machine — Weekly, in-depth articles on personal finance

Customers edit edit source

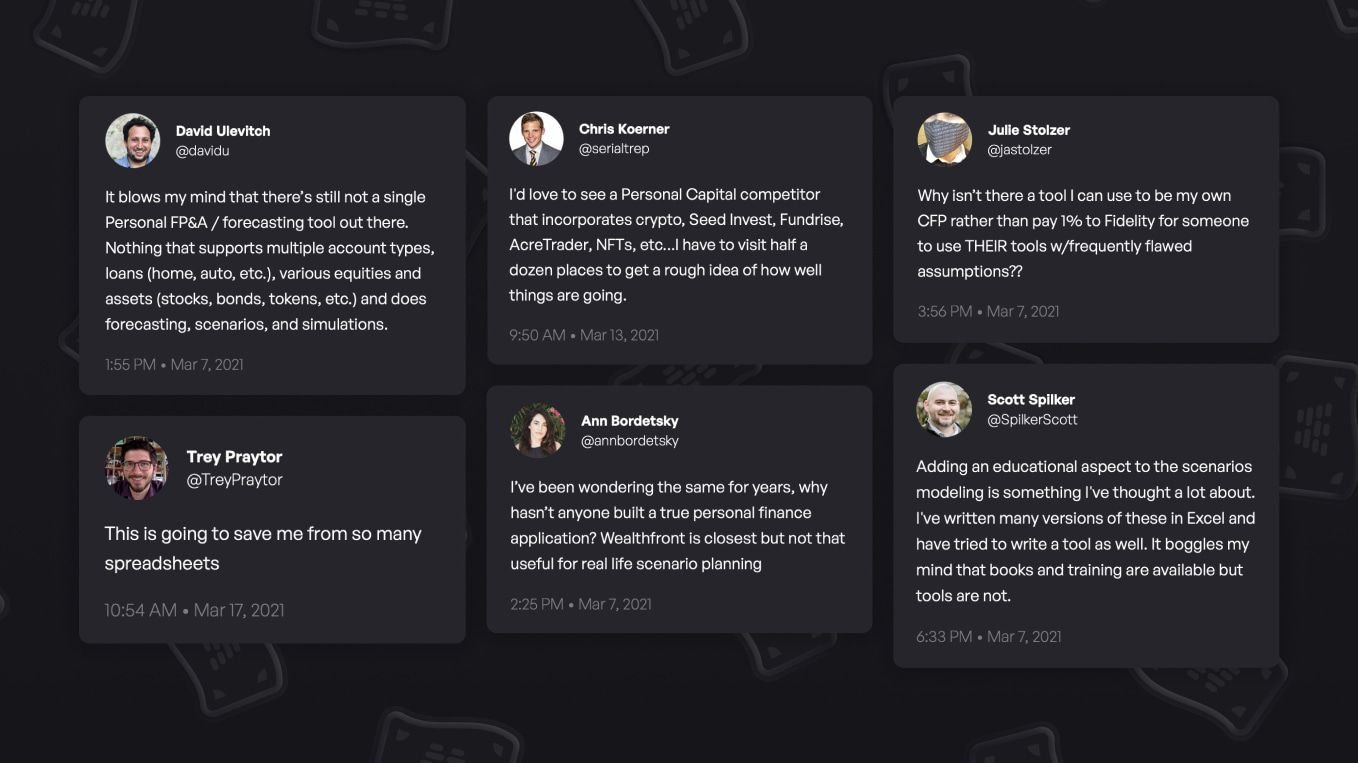

Maybe is for anyone who wants control over their financial future

Maybe was created to answer consumers' desires for a modern financial suite. In fact, many of our users were already hacking their own tools together. We’re simply a next logical choice for concerned millennials looking to solve their financial confusions with a modern, technology-focused offering. We aren’t a budgeting tool or a simple stock tracker—it's the entire view of your finances and investments that helps clients understand where they've been and where they’re going.

Business model edit edit source

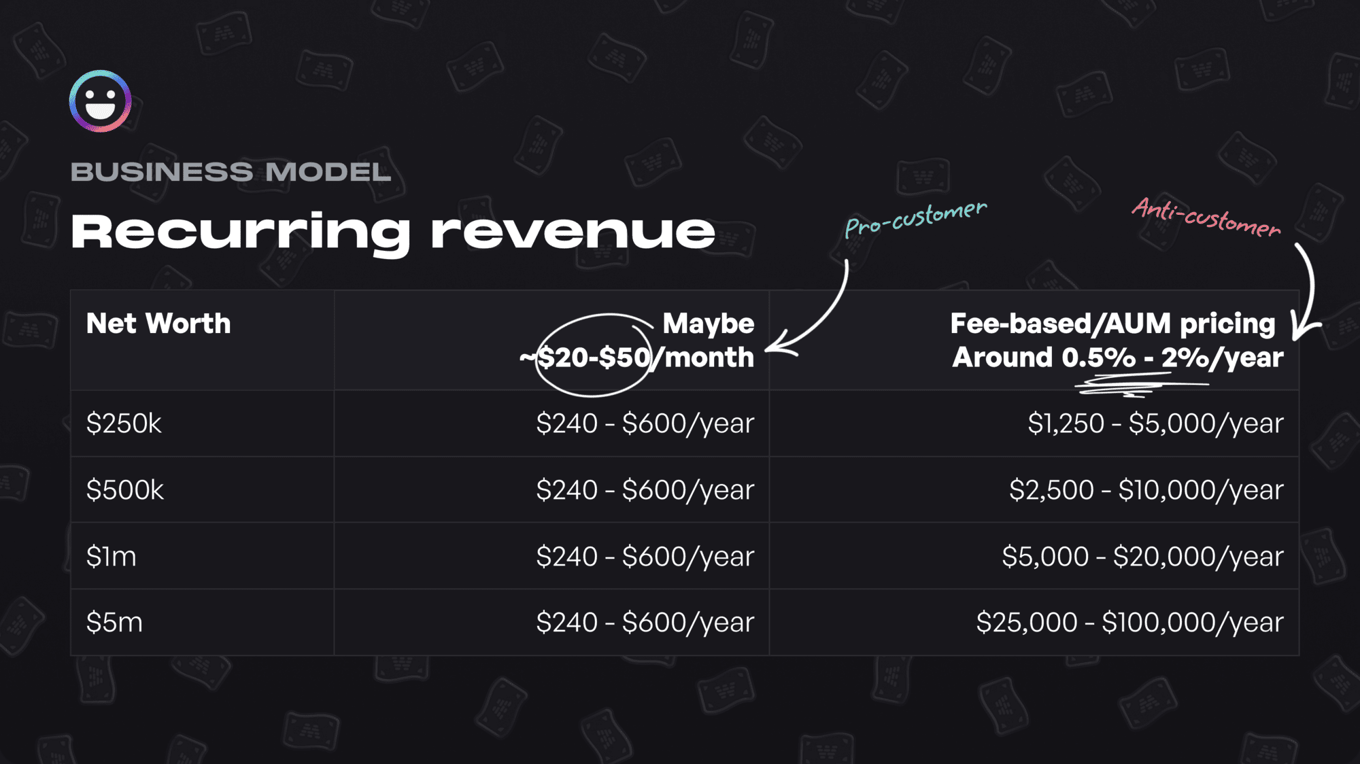

Maybe charges a monthly/annual SaaS fee

- 💰 Flat monthly/annual recurring fee for access to a suite of tools

- 🚫 No assets under management fees. Clear pricing based on feature usage.

- 😡 No harassing the user to upsell on financial services

Maybe utilizes a flat monthly/annual recurring fee for access to our suite of tools.

We provide clear pricing based on feature usage, not assets under management. We won’t be a middleman to other financial upsells like credit cards, insurance, or mortgages. We also will never harass the user to upsell them on financial services.

We’re intentionally incentivizing ourselves to build an amazing suite of tools worth paying for.

Market edit edit source

A multi-billion dollar market, ripe for disruption

Maybe is starting with the $52B+ US financial planning market with a projected 3.5% growth in 2021...a market dominated by over 263,000 financial advisors, which Maybe will replace.

That’s just the US market—we plan to support users all over the world. Financial management has become increasingly democratized. We believe that all ages and income levels can benefit from methodical, technology-enabled financial advice, not just the wealthy.

Competition edit edit source

Out with the old, in with the new

- 💼 Financial advisors—Incentivized towards complexity. Use outdated, unnecessarily difficult software with their clients.

- 📄 Spreadsheets—Difficult to set up, time-consuming to manage, and ripe for mistakes

- 🤖 Robo-advisors—Don’t solve the issue of financial literacy. You’re still left unempowered and overcharged for asset management fees.

Vision and strategy edit edit source

Maybe will launch the tools needed to visualize financial futures

- We're offering a holistic approach to financial management.

- Accounting for things like income, savings, returns, inflation, historical data and time, we believe we can show customers what’s financially possible when they ask “Maybe?” about their finances.

- Using this round of funding, we’ll be able to start answering the maybe’s of their life with our suite of financial planning & wealth management tools.

Funding edit edit source

Raising $2M in SAFE

Using this round of funding, we’ll be able to start answering the “maybes” of life with our suite of financial planning and wealth management tools. We have a $10M valuation cap.

We previously raised a $1.4M pre-seed round via Republic Reg CF, AngelList RUV and the founder.

Founders edit edit source

Josh Pigford

Co-Founder & CEO

Building software companies for over 15 years, most recently as the founder & CEO of Baremetrics (sold 2020).

Travis Woods

Co-Founder & CFO + CFP & CFA

10+ years as a CFP and CFA, building financial plans and investment strategies for clients of all sizes and stages of life.

Maybe Team edit edit source

Josh Pigford

Co-Founder & CEO

Building software companies for over 15 years, most recently as the founder & CEO of Baremetrics (sold 2020).

Travis Woods

Co-Founder & CFO + CFP & CFA

10+ years as a CFP and CFA, building financial plans and investment strategies for clients of all sizes and stages of life.

Zach Gollwitzer

Full-Stack Engineer

Tim Wilson

Full-Stack Engineer

Nick Arciero

Backend Engineer

Sophia Randazzo

Community Manager

Kevin Mark

Content Marketer

Justin Farrugia

Product Designer