Meatech

A meat revolution

| Risk/return | Medium |

| Price per share | $4.6 |

| Asset class | Equities |

| Industry | Agritech |

| Country of incorporation | United States |

| Minimum investment amount | $4.6 |

| Maximum investment amount | $73 million |

| Current valuation | $73 million |

| Investor type | All |

| Tax schemes | N/A |

| Bid/ask spread | N/A |

| Commission amount | N/A |

| Market | Public |

Summary[1] edit edit source

MeaTech 3D (MeaTech) is developing proprietary three-dimensional printing technology to be used in conjunction with its cultured meat process, which will enable the manufacture of premium meat products such as marbled steak. Alternative meat demand is booming and cellular agriculture could represent a new solution to the ever-increasing demand for protein. Cellular meat has the potential to significantly disrupt both meat- and non-meat markets over the next several decades.

Meating demand

Global demand for protein has been driven by population increases and rising wealth in markets such as China, and global meat demand is expected to almost double over the next 20 years, according to Kearney. Growth, however, is set to be driven by the plant-based and cultured meat alternatives, with Kearney estimating that cell-based meat will account for 35% of the global meat market by 2040. The shift towards alternative meats (ie plant-based and cultured meat) is being driven by a number of factors, including widespread consumer concerns for animal welfare, the perceived and actual health benefits of some types of alternative meats and environmental and sustainability issues.

Printing the future?

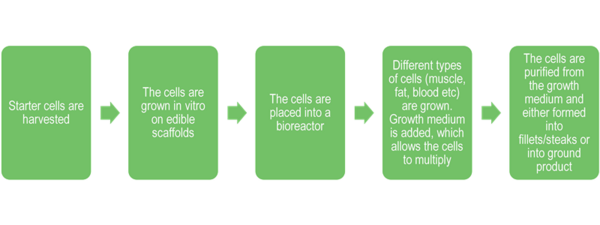

Cellular agriculture is the process of deriving conventional agricultural products directly from cell culture and fermentation, without the need for animals. Cultivated meat is created by harvesting stem cells from an animal, which are then allowed to grow in bioreactors so they multiply and differentiate to create muscle and fat tissue. The cells are eventually harvested and separated from the growth media and impurities. The tissue produced is biologically equivalent to the meat tissue that comes from the original animal. MeaTech is also developing a 3D printing process that uses the cultured muscle and fat cells as bio-inks. Using unique edible scaffolding materials, these are printed into a steak structure. The end product, therefore, will have the same structure and appearance as conventional meat. In December 2021, MeaTech printed a 3.67oz cultivated steak and in January 2022 it announced a new CEO to lead it from development stage to a production company.

Valuation: No listed peers at present

Due to MeaTech’s start-up nature, financial forecasts cannot be made with any certainty and management does not expect to report positive revenues or profits in the short to medium term. Uncertainty is compounded by regulatory risk, as cultured meat is not yet approved in most jurisdictions. As MeaTech is the first listed cultured meat company, it has no direct peers. Its net cash position was $30.6m at end H121. Given the free cash flow burn was $5.9m during the period, assuming no further acceleration in cash burn would suggest the company has enough cash for the next c 2.5 years. That said, the trend has clearly been an acceleration in cash burn and the intent to start to design and set up a pilot scale cultured chicken fat facility in Belgium during FY22 is likely to cause cash burn to accelerate.

Cellular agriculture could disrupt protein production[1] edit edit source

Meat protein in particular has witnessed a sharp increase in demand over the last decade, due to increasing consumption predominantly in China and India, yet global supply has been disrupted at times by outbreaks of disease. More recently, however, consumers have developed an increasing awareness of the unsustainability of conventional meat, providing significant scope for alternatives. While plant-based meat is currently the only commercially available alternative priced at a level that is affordable for consumers (albeit at a premium to mass market meat), Edison Investment Research believes cultivated meat could become a much more desirable alternative to conventional meat, and indeed could potentially replace it as consumers embrace cultivated meat.

Kearney forecasts that the global meat market (including alternative meat) will grow from c US$1tn in 2018 to US$1.8tn by 2040. It forecasts that plant-based meat will grow significantly over the next 10 years as conventional meat sales decline, but cultivated meat is expected to overtake plant-based meat by 2040.

Exhibit 1: Growth of the total global meat market by type, 2018–40e

File:Growth of the total global meat market by type, 2018–40e.png

Source: Kearney, Edison Investment Research

Protein consumption has witnessed a significant shift over the past five years, with the launch of plant-based meat alternatives such as Beyond Meat’s and Impossible Foods’ burgers. Meat alternatives have become more mainstream and acceptable to non-vegetarians, and the emergence of flexitarianism (to reduce – rather than eliminate – overall meat intake) has encouraged consumers to transition towards plant-based products. Indeed, protein consumption has become more flexible, as consumers make decisions based on ethical, environmental and health considerations. Food retailers and restaurants have adapted by offering more plant-based alternatives over time, with the latest addition being plant-based ‘Beyond Fried Chicken’ at KFC restaurants in January. The dairy segment has also been significantly disrupted by the advent of plant-based alternatives: what started as a transient fashion led to an increased uptake of plant-based dairy alternatives. This, in turn, led to increased availability of tasting and appealing alternatives, with consumers increasingly switching to what are perceived to be more ethical and healthier options.

Edison Investment Research believes cultivated meat and seafood has the potential to disrupt conventional farming and fishing industries in a similar way. If the technical hurdles of cost, scalability and regulatory risk prove surmountable, cultivated protein could be priced at a similar level to conventional protein, but with much cleaner and more sustainable credentials.

Cellular agriculture explained edit edit source

Cellular agriculture refers to the process of deriving conventional agricultural products directly from cell culture and fermentation, without the need for animals. This encompasses the concepts of cultivated meat, precision fermentation and the utilisation of microorganisms to grow animal-derived ingredients.

Cellular agriculture includes cultivated meat, which is created by painlessly harvesting stem cells from an animal. The cells are then placed in bioreactors and fed growth proteins, carbohydrates, vitamins and minerals, so they multiply to create the desired cell type, including muscle and fat tissue, which are the main components of the meat we consume. The tissue is biologically equivalent to the meat tissue that comes from the original animal.

The typical time spent in the bioreactor depends on the species but is much shorter than conventional livestock farming: beef cells take c 30 days to mature compared to around 24 months via conventional farming, while chicken cells take one to two weeks compared to the usual 12–16 weeks. The key difference from plant-based proteins, which is likely to make cultivated meat much more attractive to consumers, is that cultivated meat is equivalent to normal meat at the molecular level, thus providing the same taste and nutritional profile as traditional meat.

Exhibit 2: Cellular agriculture process

Source: Edison Investment Research

Creating a structure via 3D bioprinting edit edit source

The alternative meat market is becoming increasingly crowded, particularly on the plant-based side, as discussed above. Until now, however, offerings have largely been alternatives to minced meat products such as beef patties/burgers or chicken nuggets. The reason for this is that the fibrous texture and visual appearance of ‘structured’ meats such as a chicken breast or a sirloin steak are very hard to replicate. 3D printing is being used by several companies to create the fibrous structure and MeaTech is among these. MeaTech’s process uses its purified cultured cells to formulate bio-inks. These are then loaded with edible scaffolding materials into a 3D bioprinter and printed to create a cell structure as would be found in a conventional cut of meat. At scale, the printing process should be quick, taking a few minutes at most, depending on size and complexity of the cut. The printed cut of meat is then sent to an incubator to mature. The incubation period varies depending on the final product but is typically no longer than two to three weeks. MeaTech has a number of patents pending to cover its production process. It is using lab-scale bioreactors to produce its muscle and fat cells and is working towards pilot scale production.

In December 2021, MeaTech 3D reported a breakthrough with the printing of a 3.67oz (104g) cultivated steak consisting of real, living muscle and fat tissues, without utilising any soy or pea protein. Management believes this is the largest cultivated steak produced to date. The company plans to have a demo facility for beef products within the next two to three years and to commence the design and potentially the building of a pilot plant for cultured chicken fat production in 2022.

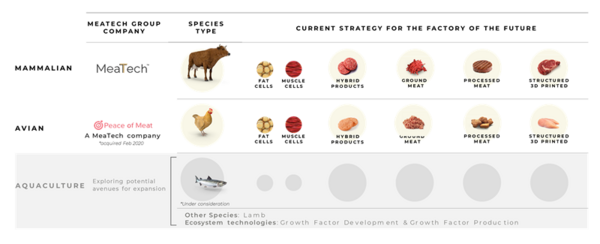

Edison Investment Research notes that MeaTech is also working on hybrid products, whereby cultured fat cells are added to plant-based protein to create meatier textures that are generally preferred by consumers.

Exhibit 3: MeaTech’s cultured steak vision

File:MeaTech’s cultured steak vision.png

Source: MeaTech 3D.

Peace of Meat: The hybrid opportunity edit edit source

MeaTech began its R&D with beef cultured products and acquired Peace of Meat (POM) in February 2020. POM is based in Belgium and focuses on avian products, s`pecifically cultured chicken fat. The acquisition of POM enabled MeaTech to accelerate its commercialisation plans as POM was slightly more advanced in terms of its scale-up. In addition, POM broadened MeaTech’s cell lines and the number of species it can grow, as POM has a non-GMO immortal chicken cell line that grows in suspension. Cultured chicken fat has a large potential market in hybrid products, as mentioned above and can be used together with plant-based materials to recreate a more convincing ‘meaty’ texture and taste. Hybrid products are a useful steppingstone towards the creation of fully cultured meat, both in terms of technical challenges and cost.

The opportunities and challenges of cellular meat edit edit source

Over the last few years, there has been significant progress in producing cultivated meat. In terms of the product, while taste is of paramount importance, texture and appearance are also essential to the consumer experience, as discussed above. The overwhelming advantage of cultured meat is the fact that it is biologically identical to conventional meat while its use of resources is substantially lower.

At present, most production processes are still operating at lab scale. Cost remains a major hurdle, with the growth medium proving to be the most expensive part of the process, although this is expected to decline as volumes grow. Regulation is also a barrier, as cultivated food requires approval in most jurisdictions, in some cases by several regulatory bodies (eg in the United States approval for cultivated meat is required by both the US Department of Agriculture (USDA) and the Food and Drug Administration (FDA)). At present, Singapore is the only jurisdiction globally where cultivated meat is approved for sale, with chicken being the first meat available to Singaporean consumers, although currently only in a single restaurant.

There are a number of companies which are active in the cultured meat space, though limited information is available as they are privately held. There are also a number of companies involved in 3D printing, with some choosing to 3D print plant-based steaks (eg Redefine Meat’s 3D printed plant-based meats are being sold in high end restaurants in several countries in Europe). While products are still either at the prototype stage or selectively distributed, it is impossible to judge how consumers will react to the various competing products. MeaTech’s intention to recreate a steak by 3D printing should place it in good stead compared to conventional alternatives, assuming the taste, texture, aroma and overall consumer experience are comparable to that of conventional steak. This of course also assumes all regulatory hurdles are cleared and the cost is at a level that is acceptable to the consumer.

Resource use edit edit source

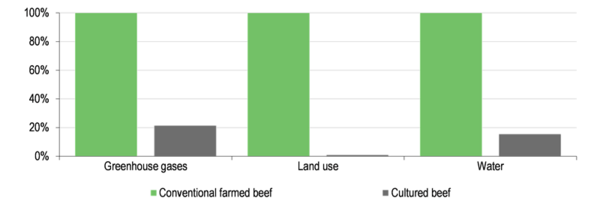

Conventional livestock farming is well-known for causing carbon emissions and for its use of land, water and energy. In contrast, cellular agriculture is much less resource-intensive. For example, each kilogram of conventional farmed meat produces on average 14kg of CO2 emissions, versus 3kg for cultured meat (source: MeaTech).

Exhibit 4: Resource use of conventionally farmed beef compared to cultured beef

Source: MeaTech 3D, Edison Investment Research

In addition, while conventional farming of livestock and fish uses most of the antibiotics produced worldwide, cellular agriculture requires minimal or no antibiotics. Food safety is also improved with cultured meat, due to the absence of mass slaughtering and the clean environment in which the cells are cultured. This reduces the likelihood of contamination from pathogens such as salmonella or E. coli and also results in the benefit of a longer shelf life for the finished product.

Scale

Cell culture and fermentation have been used for the last 20–30 years in the healthcare sector. Cellular agriculture for food production is a relatively new concept and the technology is still developing. At present, cellular agriculture is mostly being undertaken in labs (with quantities below 1000L), and therefore requires scaling up to pilot stage (c 5,000L), and then full commercial production (>20,000L), in order to reduce costs and manufacture meaningful quantities.

Scaling up always presents challenges, both predictable and unforeseen, as the different conditions need to be optimised. One of the problems when it comes to scaling up cell culture is the increased pressure in the larger bioreactors, particularly at the bottom. If the bioreactors are too large, this pressure can cause damage to the cell structure, thereby causing the process to break down. Unless a workaround can be found, this could ultimately limit the size of the largest bioreactors that can be used on a commercial scale, which in turn would be likely to have cost implications in the long run. Similarly, processes may need to be adapted as cellular agriculture moves to commercial scale.

Extending the technology from one type of cell/product to the next is also far from straightforward, as each different cell line is likely to require a different growth medium and particular growing conditions. Purification of the cells from the ‘soup’ in the bioreactor may also differ. Lastly, the scale-up phase may present different challenges depending on the various characteristics of each type of cell.

As discussed above, MeaTech plans to have a demo facility for beef products within the next two to three years. A cultured chicken fat pilot plant is also expected in this timeframe. In September 2021, MeaTech announced that it had manufactured over 500g of cultivated fat biomass in a single production run, and, as discussed above, in December 2021 it announced it had printed 3.67oz (104g) of cultured steak.

Cost

Currently the main cost challenge within cellular agriculture is the cost of the growth medium, which needs to be optimised for each cell line. At present, most growth media are available in lab-scale quantities only, thus making them cost-prohibitive on an industrial scale. For obvious reasons, both the specific characteristics of cell lines and the growth media they require are considered commercially sensitive and proprietary information, therefore there is not much public information available. In February 2020, the Good Food Institute (GFI) published a paper in which it estimated that the cost per litre for standard growth medium was $377, which translated to a cost per kg of meat of c $8,600. The paper discusses various scenarios under which this could be improved, including reducing the concentration of certain ingredients (by optimising the process), replacing some ingredients with cheaper alternatives, and reducing procurement costs by improving sourcing. In addition, the bio-fermentation process could improve and thus require a lower average volume of medium. The GFI estimated that under the most optimistic scenario, the cost per litre would fall to $0.24, allowing the cost per kg of meat to fall to $1.37 (the two main drivers of this being reducing the concentration of the growth factors required and scaling up the two most expensive ones such that their cost is significantly reduced).

The much-touted number in the alternative protein industry is the cost of the first cultivated meat burger, which is placed at around €250,000 (it was developed by a Dutch scientist in 2013, although the CEO of Mosa Meat has subsequently stated that the real number is ‘a bit higher’). The cost has come down significantly but, for the product to become a viable alternative to conventional meat, something in the region of cost parity is required. As Nick Halla, senior VP International at Impossible Foods, has said, ‘you’ll buy the product once based on novelty, you’ll come back if the taste is good and if there are benefits such as nutrition and sustainability, and you’ll buy it in the long run if the value is right.’

The other side of the equation in terms of achieving anything close to price parity is the cost of conventional meat. Edison Investment Research notes that COVID-19 has driven up prices as the meat industry in many regions has suffered from labour shortages and increased freight costs. As concerns regarding climate change and sustainability come to the fore, Edison Investment Research could see governments start to reduce some farming subsidies or indeed introduce some form of taxation on carbon emissions caused by farming. This would cause cost increases for conventionally farmed produce.

Regulation

As discussed above, cultivated meat is not currently approved for sale in any jurisdiction apart from Singapore. That said, as cellular agriculture becomes closer to commercial viability, Edison Investment Research would expect more regulators to examine and approve the product. Edison Investment Research notes that regulation changes by jurisdiction, but also by product: for example, cultivated seafood would only require approval by the FDA in the United States, while cultivated meat requires both FDA and USDA approval in the United States. Edison Investment Research notes that in the EU, approval would be required both by the European Food Safety Authority via the Novel Food Regulation and individual countries. Furthermore, approval will be required for each different product and, potentially, using different components (such as edible scaffolds) would require a new safety review each time. Farming lobbies are powerful worldwide, especially in the United States and the EU. Edison Investment Research would expect farmers to lobby aggressively against the approval of cellular agriculture, and potentially try and dissuade consumers from switching to cultivated food.

MeaTech’s vision: A B2B service[1] edit edit source

MeaTech is targeting a broad range of cell types and cultured products, through both research and development (R&D) and acquisitions. While MeaTech began its R&D with beef cultured products, it acquired Peace of Meat in February 2020, as previously mentioned, which focuses on avian products. In July 2021, MeaTech announced it was launching development of cultivated pork cells. MeaTech’s development of fat and muscle cells for each class of meat is aimed at eventually developing hybrid products (which, as a reminder, contain a mix of plant-based and cultured meat), ground meat products, processed meat and structured 3D printed meat. Edison Investment Research illustrates this in Exhibit 5.

Exhibit 5: Cultured products targeted by MeaTech

Source: MeaTech 3D

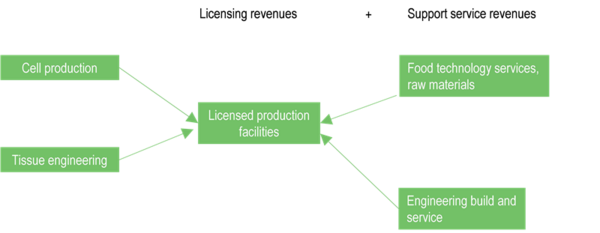

MeaTech’s current focus is on developing its proprietary 3D printing technology and cell culturing processes and building a demo facility. As previously mentioned, MeaTech has nine patents pending covering key aspects of both the cell culturing and 3D printing process. In the longer term, MeaTech intends to out-license its technology to interested food manufacturers or retailers. The business model will be to obtain revenue streams both from licensing the process and from support services. The latter will encompass engineering services in terms of helping to operate the plants and the technology, food technology services to help optimise the finished product, but also the supply of cell lines and scaffolding materials.

Edison Investment Research believes MeaTech could out-license its technology to different customers (food manufacturers and/or retailers) in different regions, probably giving either product or geographical exclusivity to each customer.

Exhibit 6: MeaTech future revenue stream model

Source: MeaTech 3D

In terms of geography, MeaTech is based in Israel but also has operations in Belgium, at its subsidiary, POM. In March 2022, MeaTech announced it was expanding its operation into the US to accelerate its go-to-market strategy. Its California-based office will include activities in R&D, business development and investor relations. It has recently moved into new headquarters in Rehovot (Israel), which is the epicentre of Israel’s foodtech sector.

Management[1] edit edit source

The senior leadership team at MeaTech comprises:

Arik Kaufman, CEO and co-founder: Arik has founded various NASDAQ- and TASE-traded food technology firms. He is founding partner of BlueSoundWaves collective led by Ashton Kutcher, Guy Oseary and Effie Epstein. He has extensive experience in the food tech and biotech industries.

Omri Schanin, COO and co-founder: Omri has a successful history of entrepreneurship in a variety of high-tech sectors including medical devices and medication.

Guy Hefer, CFO: Guy has broad international experience and joined MeaTech in October 2020. Prior to this he was the CFO of a tech-focused holding company. Before that he was an investment banker in Israel and the UK.

Dan Kozlovski, CTO: Dan has over 10 years’ experience working in high-tech companies in the printing market such as HP-Indigo and Nano Dimension. He is an expert in 3D CAD.

Simon Fried, Head of Business: Simon has broad experience covering tech, retail, fast-moving consumer goods, finance and strategy consulting. Before joining MeaTech in December 2019, he was co-founder of CBO and US president of Nano Dimension.

Financials[1] edit edit source

MeaTech is still in its early stages and hence does not have any revenues, nor is it expecting to have any in the shorter term.

Edison Investment Research provides summary financials below.

| Year ending December ($ 000) | 2019 | 2020 | H12021 |

|---|---|---|---|

| R&D expenses | (166) | (2,491) | (2,146) |

| Marketing expenses | 0 | (506) | (600) |

| General and administrative expenses | (256) | (5,380) | (3,983) |

| Public listing expenses | 0 | (10,164) | 0 |

| Operating profit/(loss) | (422) | (18,541) | (6,729) |

| Net financing income/(expense) | (1) | 17 | (89) |

| Net profit/(loss) | (423) | (18,524) | (6,818) |

| Source: MeaTech 3D | |||

R&D expenses were $2.5m in FY20 and $2.1m in H121, reflecting MeaTech’s increased investment to expand its cultured meat technology capabilities. Operating losses in FY20 were affected by listing expenses. Edison Investment Research believes the cash flow statement is more relevant, given MeaTech is an early stage company. Free cash flow is obviously negative as the company is loss-making. Free cash flow burn has been accelerating as MeaTech has stepped up its investments to expand its capabilities.

For completeness, Edison Investment Research also provides a summary balance sheet.

| Year ending December ($ 000) | 2019 | 2020 | H121 |

|---|---|---|---|

| Cash & cash equivalents | 975 | 9,043 | 24,782 |

| Other | 309 | 149 | 147 |

| Receivables | 38 | 131 | 1,174 |

| Total current assets | 1,322 | 9,323 | 26,103 |

| Net fixed assets | 127 | 906 | 2,206 |

| Intangible assets | 0 | 0 | 9,930 |

| Other assets | 239 | 2,732 | 1,958 |

| Total non-current assets | 366 | 3,638 | 14,094 |

| Payables | 295 | 1,347 | 1,932 |

| Other | 109 | 496 | 210 |

| Total current liabilities | 404 | 1,843 | 2,142 |

| Long-term lease liabilities | 92 | 0 | 102 |

| Total non-current liabilities | 92 | 0 | 102 |

| Total net assets | 1,491 | 15,631 | 43,808 |

| Source: MeaTech 3D | |||

| Year ending December ($ 000) | 2019 | 2020 | H121 |

|---|---|---|---|

| Net profit/(loss) | (423) | (18,524) | (6,818) |

| Depreciation & amortisation | 21 | 213 | 278 |

| change in fair value of derivatives & other investments | 0 | (110) | (401) |

| Share-based payments | 0 | 3,958 | 2,313 |

| Public listing expenses | 0 | 10,164 | 0 |

| Change in receivables | (36) | 5 | (782) |

| Change in payables | 251 | 462 | 457 |

| Other | 14 | 0 | 0 |

| Net cash from operating activities | (173) | (3,832) | (4,953) |

| Purchase of fixed assets | (126) | (681) | (902) |

| Free cash flow | (299) | (4,513) | (5,855) |

| Change in restricted deposit | (41) | (6) | (337) |

| Acquisitions | 0 | (1,188) | (4,848) |

| Other | (86) | 0 | 0 |

| Net cash from investing activities | (253) | (1,875) | (6,087) |

| Proceeds from issuance of shares & warrants | 1,670 | 14,887 | 27,143 |

| Issuance costs | (8) | (819) | (1,145) |

| Repayment of lease liability | (14) | (140) | (134) |

| Proceeds from exercise of share options | 0 | 2,776 | 3,196 |

| Proceeds from other financing activities | 0 | 641 | 73 |

| Net cash from financing activities | 1,648 | 17,345 | 29,133 |

| Increase in cash & cash equivalents | 1,222 | 11,638 | 18,093 |

| FX | 21 | 644 | (1,012) |

| Cash & cash equivalents at start of the period | 31 | 1,274 | 13,556 |

| Cash & cash equivalents at end of the period | 1,274 | 13,556 | 30,637 |

| Source: MeaTech 3D | |||

Valuation[1] edit edit source

MeaTech is still in its early stages, hence without revenues or profits expected in the shorter term, it is hard to value. Furthermore, as MeaTech is the first listed cultured meat company, it has no direct peers. The closest listed peers are in the alternative protein segment, namely Beyond Meat, Oatly and Burcon Nutrascience. While none of these are expected to be profitable in the shorter term, MeaTech’s peers do generate revenues at present. Edison Investment Research notes that both Beyond Meat and Oatly have recently reduced their expectations for FY22 due to slower growth/consumer uptake and rising raw material costs. Based on consensus, Oatly is trading on a FY22e EV/sales multiple of c 3.0x and Beyond Meat is trading on c 5.5x. In Edison Investment Research's view, it would therefore not be unreasonable to assume that MeaTech could achieve a similar low-to-mid single-digit multiple once there is a track record of a few years of strong revenue growth.

More meaningfully, Edison Investment Research notes that MeaTech’s net cash position was $30.6m at end H121. Given the free cash flow burn was $5.9m during the period, assuming no further acceleration in cash burn would suggest the company has enough cash for the next c 2.5 years. That said, the trend has clearly been an acceleration in cash burn, and the company’s plan to start the design of a pilot scale cultured chicken fat facility in Belgium during FY22 is likely to cause cash burn to accelerate further.

| Market cap (m) | EV (m) | EV/Sales (x) - 2021a | EV/Sales (x) - 2022e | EV/EBITDA (x) - 2021a | EV/EBITDA (x) - 2022e | |

|---|---|---|---|---|---|---|

| Oatly | $3,178 | $2,782 | 4.4 | 3.0 | (21.6) | (21.2) |

| Beyond Meat | $2,702 | $3,099 | 6.7 | 5.3 | (36.1) | (24.1) |

| Burcon Nutrascience | C$114 | C$105 | 1047.9 | 588.7 | (30.5) | (23.6) |

| Peer group average | 353.0 | 199.0 | (29.4) | (23.0) | ||

| MeaTech | US$83 | US$52 | N/A | N/A | N/A | N/A |

| Source: Refinitiv, Edison Investment Research. Note: Priced at 10 March 2022. | ||||||

Sensitivities edit edit source

The company’s financial performance and hence its share price will be sensitive to the following factors:

- Regulatory risks: Cellular meat has so far only been approved for sale in Singapore, hence the sector faces uncertainty in terms of gaining approval for its products. As discussed above, approval varies by jurisdiction and is necessary for every product.

- Scientific and technological progress: as discussed, MeaTech’s technology is still being developed. It also needs to be scaled up to commercial scale before it can be licensed to any potential customers. There is the risk of delays, setbacks and increased costs before full commercial scale is achieved.

- Competition: a significant number of companies operate in the cultivated meat segment and there is the risk that one or more competitors develop a superior product and/or conquer the market by launching their products significantly earlier than MeaTech.

- Cash burn assumptions: given the absence of revenues or profits and hence the absence of financial guidance, the share price will be sensitive to the market’s view of future growth. Cash burn will also be a determinant of share price performance and thus the cost of building any facilities.

- Raw materials costs: rising raw material costs are affecting most companies in the consumer staples space and MeaTech is likely to witness cost inflation in its raw materials.

- Economic outlook: despite cellular meat having strong long-term growth drivers from demographic changes and consumer demand for more sustainable food sources, the demand for meat (both conventional and alternative) is vulnerable to changes in the macroeconomic outlook and consumer incomes. This is especially likely to be the case in the nearer term, as cellular meat is likely to be sold at a premium when launched initially.

- Changing consumer preferences: MeaTech may be exposed to changes in consumer tastes and preferences, with consumers choosing to shun cultured meat products.

Actions edit edit source

To invest in Meatech, click here

To contact Meatech, click here.

References and notes edit edit source