NYC Opportunity Fund, LLC

Invest in a real estate fund focused on partnering with local operators in NYC

Summary edit edit source

- Fund focused on small/mid-size commercial and residential properties in NYC

- Experienced team with a proven ability to generate post-investment value

- Providing local operators with equity through joint venture structures

- Investing $1-$10 million of capital in $5-$50 million transactions

- Creating value through operational and strategic enhancement

- Disciplined approach to dispositions timed to maximize value

NYC Focused

NYC Opportunity Fund was formed to generate attractive, risk-adjusted returns for its investors by investing in small and mid-sized commercial and residential real estate assets in New York City.

Our Manager, NYC Recovery Manager, LLC is controlled by Stephen DeNardo, CEO of RiverOak (“RiverOak”) and James Nelson, Managing Director at Avison Young (collectively, the “Principals”).

Our Company seeks to build upon our Principals long established successful track record and to leverage our deep real estate investment experience and “on-the-streets” local knowledge of its targeted geography to generate superior risk adjusted returns by pursuing an investment strategy substantially similar to that of RiverOak’s prior five funds.

We endeavor to capitalize on the inefficiencies in the market by providing local sponsors/operators with equity through joint venture structures for small and mid-sized, value-added commercial and residential real estate assets located throughout New York City and its five boroughs.

New York City is a geographic area where our management team has significant real estate investment and property management expertise. They also have intimate knowledge of the local markets and have maintained extensive relationships and knowledge of the sponsors that focus on these geographic areas thus providing the Fund with proprietary sourcing capabilities.

We intend to focus on acquiring properties that we believe (1) can be purchased at a compelling value based on current market conditions and (2) have significant possibilities for capital appreciation.

Market edit edit source

Market Data

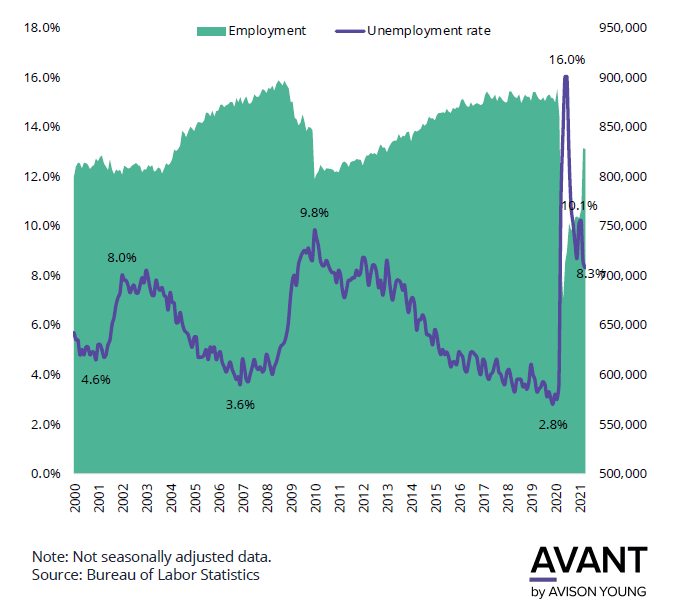

- Manhattan has already recaptured 110,000 jobs tightening the unemployment rate to 8.3% from a peak of 16% during 2020. Before the pandemic it sat at 2.8%. We anticipate job growth to surge once companies return to the office in large part this fall.

- Manhattan’s foot traffic has increased 352% since the low in April of 2020. We are seeing a meaningful increase in activity each week as the city comes back to life, especially its restaurants, cultural attractions, and night life.

- Tech is still growing as it is attracted to NYC’s talent pool. Facebook leased over 700,000 square feet during the midst of the pandemic. Google, which has 11,000 employees in New York, also plans to add 3,000 in the next few years and intends to return to its offices in West Chelsea in September.

- The luxury home market has had record months for contract signings as of late. In the second quarter, Manhattan apartment closings surged 152% from a year earlier, the biggest annual increase in data going back to 1990, according to a Miller Samuel report. The report also said the momentum is continuing as the number of contracts signed in the quarter soared 619% year-over-year to a record 4,633 transactions. Demand is likely to continue as foreign buyers, largely absent for over a year, eventually return.

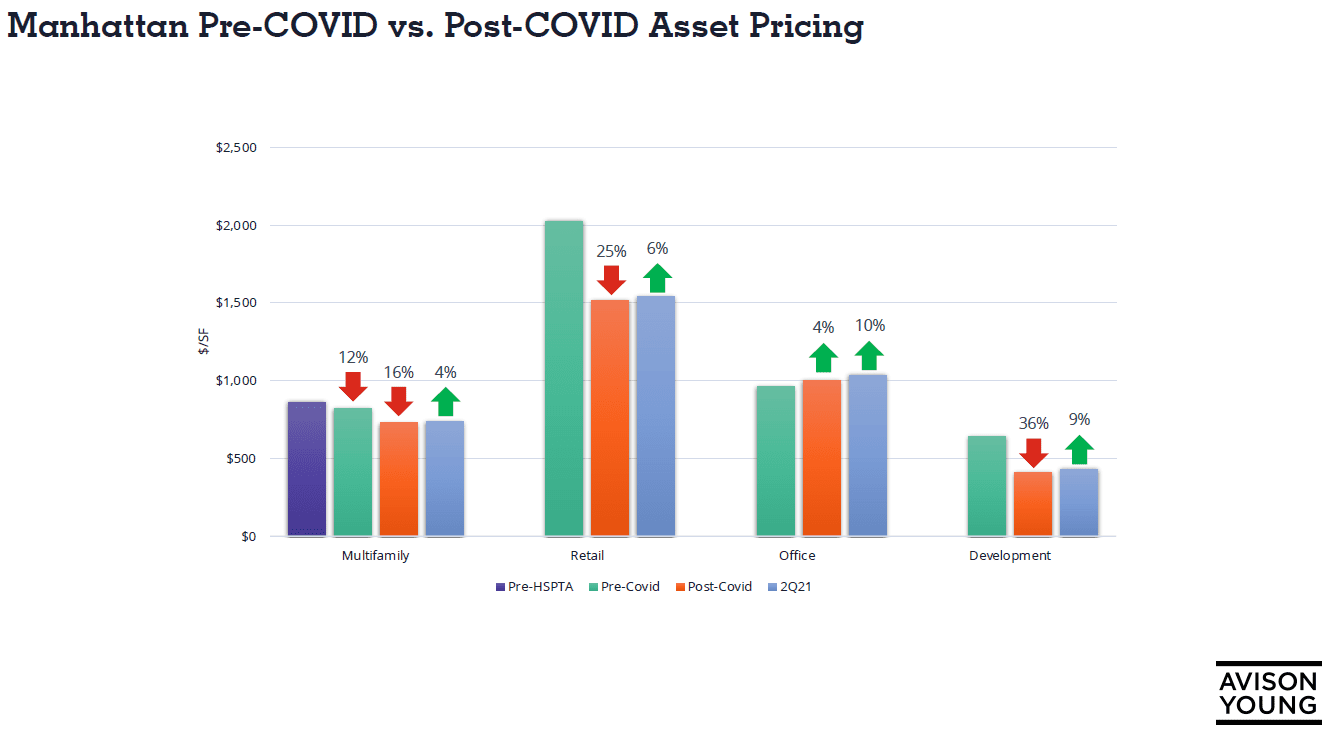

- Manhattan sales pricing has shifted in the buyer’s favor with pricing dropping 24% for multifamily, 19% for retail and 25% for land when comparing 1Q18-1Q20 vs 2Q20-2Q22. Only office has appreciated in value due to the small sampling of outlier sales which occurred.

- Pricing has already begun to recover. According to Avison Young’s Tri-State Investment Sales Report for 2Q21, Manhattan multi-family sales values increased 4% to $742/SF in the 2nd quarter compared to the trailing 4-quarter average; retail was up 6% to $1,545/SF; office pricing rose 10% to $1,039/SF; and development sites increased by 9% to $434/BSF.

- NYC’s sales activity picked up in the 2nd quarter with a total of 103 sales, the most since the 1st quarter of 2020. That being said there is large pent-up demand as the 10 year quarterly average is more than double that. Further, 2022 NYC total dollar volume is projected to be at only $7.8B, the lowest sales volume since the depths of the financial crisis in 2009. The 10 year average is more than 4.5x this amount.

Asset types edit edit source

Multi-family edit edit source

- Manhattan offers exceptional value with average capitalization rates of 4.67%. This allows for positive leverage when mortgage rates are still widely available in the 3 percent range.

- Residential rents are already recovering nicely. Concessions are burning off and landlords are returning to the 90% occupancy that they historically enjoyed.

- That being said, net effective rents are still off 20-30% from before Covid. Rent growth over the next few years should be substantial.

- Although multi-family pricing rose 4% to $742/SF in 2Q21 compared to the trailing 4 quarters, it is still 24% below 2018-2019 pricing offering considerable value

Our multifamily strategy will be to invest in properties that are mostly or entirely fair market to take advantage of this rent recovery. Further, we will target tax protected classes or properties with tax abatements where real estate tax increases are capped.

Retail edit edit source

- Retail offers similar opportunity with pricing dropping by 24% since the pandemic.

- That being said residential neighborhoods have fared better than more touristy locations. According to the REBNY’s Spring 2021 Manhattan Retail Report, average asking rents dropped by less than 15% on the Upper East Side compared to rents in the Spring of 2019.

- There will be even greater opportunities for high street retail, as the pendulum has surely swung too far as the drop in tourism has a major short term impact. For example, SoHo average asking rents have fallen by nearly 40%

- The average price per square foot for Manhattan retail properties sold in 2Q21 rose 6 percent compared to the trailing 4-quarter average, which is a positive sign.

The company’s retail strategy will be to buy significantly discounted or distressed vacant retail. The company will also look at occupied retail to take advantage of cap rates that have reached well into the 5% range and in some cases even higher.

Office edit edit source

- Office properties have been the most surprising asset class. Sales values have increased since the pandemic, rising 8% from pre-pandemic levels. That being said, these averages were drawn over only 5 sales per quarter during the pandemic, compared to some of the pre-COVID quarters which had more than triple the amount of sales.

- Although the 2Q21 availability rate of 19.2% represents a post-2000 high and net effective rents have dropped 10.8% from April 2020 to June 2021, we have already seen signs of stabilizing since March 2021, signaling that demand has incrementally risen.

- There has no doubt been a flight to quality with 82.8% of the leasing activity happening at Trophy and Class A properties compared to a combined 72% pre-pandemic level.

- 1.5 MSF of sublet space has already come off the market as companies rethink their plans.

The company’s strategy is to invest in boutique offices in the most sought out neighborhoods, especially in within walking distance of good transportation. Opportunities will no doubt arise from owners who are facing high vacancy and are unable to refinance at their current levels.

Development edit edit source

Although the fund will stay away from ground up development due to its inherent risks, it should be noted that the dearth of land sales will create a supply shortage in future years.

Opportunity edit edit source

Headlines create fear, which create buying opportunities.

Those with the vision to see beyond the fear may have a once-in-a-lifetime chance to buy real estate at deeply discounted prices.

The Company seeks to capitalize on the significant inefficiencies in the small and mid-sized segment of the market largely focused on the boroughs of New York City. Many of these geographies are covered by local developers/operators who generally face a dearth of capital for transactions with total capitalizations ranging from $2 million to $50 million. Often, these developers/operators are in the process of growing their own company platforms and are thus unable to invest more than 20% of the required equity. Even when utilizing moderate leverage, such transactions still require additional equity investment of $5 million to $15 million. Equity requirements in this range are typically found to fall into the “funding gap”.

The Manager believes that these transactions are too small for larger real estate funds who must deploy capital in far greater amounts and who typically are looking for significantly larger transactions. However, transactions of this size also prove to be too large and unwieldy for “friends and family” equity. The Manager believes that this “funding gap” leaves very few other sources of available, organized capital for this transaction niche and results in limited competition for the Company. RiverOak has been providing sponsor equity in this small and mid-sized niche for over 16 years, is a well-recognized provider of capital and has developed a programmatic process for deploying equity capital of this size in an efficient manner.

Strategy edit edit source

Capitalizing on the inefficiencies in the market. edit edit source

Investing in “under the radar” small and mid-sized assets that can be acquired at a discount resulting from our proprietary sourcing capabilities and where we can add value through the implementation of repositioning and/or renovation strategies.

Our company seeks to provide equity to “best-in class” local sponsors/operators through joint venture structures for investments that offer significant appreciation potential through intensive property management, leasing, repositioning, redevelopment, repurposing and the opportunistic use of capital. These assets are generally more management-intensive than other asset categories, and therefore, generally exhibit greater opportunities to create value.

Target Investment Profile: edit edit source

- Acquisition Size: $2 million to $50 million total capitalization

- Equity Investment by Company: $500,000 to $10 million

- Geographic Scope: The 5 boroughs of New York City

- Holding Period: The expected hold period for any asset is three to five years as determined by the business plan for the asset. The time frame will correspond to the time frame the Manager believes is required to create and harvest value.

- Leverage: Not to exceed 70% of aggregate acquisition costs or aggregate fair market value across the entire portfolio.

Proprietary Sourcing from an Established Network: edit edit source

As prominent leaders in the real estate industry, the Principals have cultivated deep and long-standing relationships with a substantial number of New York’s real estate owners, investors, operators, lenders and managers. This broad network of industry contacts will assist the Manager in sourcing proprietary transactions that are typically off-market or not widely marketed.

Operations edit edit source

A Systematic Process with a Disciplined Approach edit edit source

An emphasis on sponsor/operator evaluation and analyzing real-time market information and trends to determine an asset’s risk and return profile and appropriate acquisition.

Our management team has developed a systematic research process that is detailed and disciplined with an emphasis on sponsor/operator evaluation and analyzing real-time market information and trends to determine an asset’s risk and return profile and appropriate acquisition. The local market expertise and knowledge of the Principals plays a critical role in supporting and enhancing the Fund’s investment strategy. We believe that sponsor/operator selection is one of the most important determinants of success. The Principals have long and extensive relationships with a broad range of New York City sponsors/operators with whom they have invested and for whom they have provided services, providing the Company with crucial insight of potential joint venture partners with whom the Company may consider investing.

Superior In-House Operating and Value Enhancement Execution: edit edit source

We believe our platform will uniquely position the Company to pursue properties in which an improvement or a more effective asset management strategy can unlock value. An aggressive operations strategy, as determined by the local sponsor/operator and agreed to by the Company, will be determined prior to investing in an asset. Each business plan will be implemented with the intention of maximizing revenue, minimizing expenses and increasing value through growth in net operating income. The business plan generally will seek to identify the asset’s unique attributes, strengths and weaknesses, strategies and objectives. This business plan will be implemented by the sponsor/operator and closely monitored and evaluated by RiverOak, who has more than three decades of experience overseeing similar asset management strategies.

Exit Strategies to Optimize Monetization: edit edit source

The Company will be highly focused on developing exit strategies that will maximize value from the time of acquisition and throughout the holding period. The Manager believes that a shorter holding period is consistent with the strategy and risk and return profile of the Company. RiverOak has historically sought to sell investments once their value enhancement strategy has been implemented and the property stabilized. This practice has generally led to shorter holding periods and strong internal rates of return (“IRRs”) for RiverOak and its investors while also allowing for upside potential for the next investor, typically a core buyer who RiverOak believes will have the opportunity to benefit from the completed strategy.

Disposition Strategies edit edit source

A disposition strategy for each investment is defined during the acquisition and due diligence process. In certain situations where the sponsor/operator prefers to hold the asset longer than the Company, we will ensure its exit strategy by structuring a buy/sell agreement or put option prior to making an investment. Since the future rarely unfolds exactly as expected, the exit strategy is monitored closely and reevaluated regularly during the holding period.

Highlights edit edit source

We believe that the Company will generate significant long-term capital gains for investors through its ability to effectively source high quality real estate properties and thereafter create value by working hand-in-hand with the local real estate sponsors to create post-investment value. We also believe that the Company represents an attractive and differentiated investment opportunity for the following reasons:

Experienced Team with Proven Ability to Generate Post-Investment Value edit edit source

The Principals have extensive experience in both sourcing and financing transactions. Moreover, the Manager believes that RiverOak distinguishes itself with its ability to apply its extensive operating experience with real estate assets to play an important role in enhancing the value of its investments. RiverOak works alongside their sponsor-partners to provide the appropriate strategic insight and direction to assist those sponsors in making appropriate enhancements to properties to ensure that they maximize their value and position them for future growth.

Track Record of Proven Results edit edit source

Over the last 22 years of its investment activity, the RiverOak team has invested over $160 million in over 60 different real estate transactions in both New York City and along the Northeast corridor. By making value investments with sponsors with which they have established relationships, the RiverOak team has provided strategic direction for value enhancement to maximize returns.

Attractive and Robust Target Market edit edit source

The Company is targeting New York City, one of the world’s most attractive and diverse real estate markets. New York City is known for its vitality, diversity and its ability to ride out the economic vagaries by its spectrum of industries, attractiveness to immigrants and overall increase in population including young millennials and empty nesters. By targeting the “cities within the city” the Manager believes the Company is able to take advantage of opportunities in an underserved market – the “other” Manhattan, Brooklyn, Queens, the Bronx and Staten Island – each being comparable in size and diversity to many other large cities in the United States.

Matching the Needs of an Underserved and Underfinanced Market Segment edit edit source

The Company’s investment strategy serves the needs of an underserved and underfinanced market segment. The projects it targets are of the size for which family and friends financing are typically not available and yet are too small for financing to be provided by the larger institutional fund managers. By applying its institutional framework for providing partnership financing to this segment of the market The Manager believes it is one of the few players in this segment. The dearth of competitors allows the Manager to be highly selective with whom they choose to provide partnership financing. The Manager is able to select those investment opportunities for which it feels present the best opportunity to generate returns for its investment.

Partnering with Well-Established Sponsors edit edit source

The Manager believes that Principals’ longstanding network of relationships and its focus on its market segment uniquely positions it to be able to be selective and provide partnership financing to only those sponsors that they know are value buyers, are willing to work alongside RiverOak to make value improvements and position the properties to maximize the potential value for which other investors will want to invest.

Creating Value Through Operational and Strategic Enhancement edit edit source

Most investors provide little more than financing to real estate sponsors. The Manager believes that RiverOak stands unique in being able to provide operational and strategic enhancement to the sponsors to which it provides partnership financing. RiverOak’s ability to add value comes from its extensive experience with a variety of different property types in repositioning and repurposing. RiverOak works hand-in-hand with the sponsors to maximize value.

Disciplined Approach to Dispositions Timed to Maximize Value edit edit source

The Manager believes that RiverOak has consistently maintained a highly disciplined approach to timing of dispositions so as to maximize the returns to its investors. Timing can be crucial, so RiverOak regularly evaluates each of its holdings to determine the progress of property value enhancements, neighborhood developments and general macroeconomic direction. In general, RiverOak has held onto its investments for 44 months. However, with respect to Company investments, the Manager will not hesitate to exit earlier or hold longer if it sees a clear path to maximizing returns to its investors.

Sponsor edit edit source

The managing member of the Company is NYC Recovery Manager, LLC a joint-venture between RiverOak and James Nelson.

Principals edit edit source

Stephen DeNardo is Chief Executive Officer of RiverOak, which he founded in 1999. During the past three decades, Mr. DeNardo has successfully been involved in all phases of real estate investing, development and management across all asset types. As a partner or principal in two national companies and a senior member of the management team in two additional companies, his experience includes more than $10 billion of acquisition, disposition, development and financing of commercial real estate throughout the United States and Canada. Mr. DeNardo also serves on the Brookfield Property Partners Board and is the Chairman of its Audit Committee.

Prior to founding RiverOak, Mr. DeNardo was Partner and Senior Vice President of ING Realty Partners, where he managed a $1.5 billion portfolio in the U.S. and Canada. Before joining ING Realty, he was President of ARES Realty Capital, a division of Mutual of NY, where he led the turnaround team and managed a $7 billion portfolio of diversified debt and equity assets, and a Partner at First Winthrop Corporation, where he was responsible for 30 million square feet of commercial real estate across the U.S. Mr. DeNardo started his real estate career in New York City managing the Chrysler Building. He has held a license as a Certified Public Accountant since 1978 and received a B.S. in Accounting from Fairleigh Dickinson University.

James Nelson has served as a Principal and Head of Avison Young’s Tri-State Investment Sales group since February 2018, where he leads a group of three dozen professionals in the sale of multi-family, office, development and retail properties. Prior to joining Avison Young, James served as Vice Chairman of Cushman & Wakefield from 2015 until 2018, where his team was ranked the number one investment sales broker nationwide in 2016. Previously, James was a partner at Massey Knakal and was named the company’s youngest partner in 2004. James has also served as a Principal of River Oak NYC I, LLC since 2012 and River Oak NYC II, LLC since 2015. Each of these entities are private equity funds focused on multifamily properties in New York City. Throughout his over 20-year career, James has been involved in the sale of approximately 500 property and loan sales for an aggregate value of over $5 billion dollars. James is the Chairman of REBNY’s Commercial Board of Directors, on the Board of Governors for the Young Men’s/Women’s Real Estate Association of New York (YMWREA) and is a Board Member of the Counselors of Real Estate and SparkYouth NYC.

Derek Eakin is Senior Vice President of RiverOak. As a member of the investment and asset management team, Mr. Eakin is responsible for sourcing and acquiring potential new opportunities as well as monitoring all aspects of financial and asset management support for the Company’s portfolio holdings. Prior to joining RiverOak, Mr. Eakin consulted with Starwood Capital Group and Luzern Associates. He was also a member of an investment sales brokerage team at Cushman & Wakefield in East Rutherford, New Jersey and a member of the production team at Goedecke & Co., LP’s mortgage brokerage firm. Mr. Eakin began his career in public accounting at PricewaterhouseCoopers, LLP, working primarily on institutional real estate assignments with the Boston Real Estate Group. He graduated with honors from the University of Connecticut with a B.S. in Accounting and a Masters in Accountancy.

Terms edit edit source

Offering edit edit source

We are offering a minimum of 20,000 and a maximum of 500,000 limited liability company membership interests in our Company (the “Investor Shares”), in accordance with Regulation D Rule 506(c) of the Securities Act of 1933, as amended (the “Securities Act”) and applicable to state law (the “Offering”). A purchaser of the Investor Shares may be referred to herein as an “Investor Member,” or collectively with the holders of Common Shares (as defined herein) as “Members.” The minimum investment amount per Investor is $25,000, which may be waived in the sole discretion of NYC Recovery Manager, LLC (the “Manager”).

The offering period of this placement will expire on the earlier to occur of: (i) the date on which the Maximum Offering Amount (as defined herein) has been subscribed for and accepted by the Company and a final closing is conducted; or (ii) December 31, 2021, unless extended in the sole discretion of the Company to a date not later than June 30, 2022 (the “Closing Date”).

Management Fees edit edit source

NYC Recovery Manager, LLC will receive the following fees for services related to the investment and management of the Fund's assets:

Asset Management Fee: 2.0% per annum of the members’ aggregate capital contributions.

Acquisition Fee: 1.0% of the gross purchase price of each property we acquire.

Performance Fee: 20% of distributions after investors receive a 6.0% annual return.

Term edit edit source

We intend to deploy the capital that we raise through this offering from the initial closing of the offering through December 31, 2025 (the “Investment Period”).

The term of the Fund shall be three years from the conclusion of the Investment Period (the “Term”). The Manager, however, may elect to extend the Term by no more than two (2) successive one (1) year periods (each a “Renewal Term”).

Returns edit edit source

Distributions edit edit source

The Manager may at any time, in its sole discretion, make and pay distributions of the Company’s Operating Cash Flow or Net Capital Proceeds (each as defined in the Operating Agreement) to the Members, pro rata, in proportion to their Shares. In determining cash flow available for distribution, the Manager may deduct any amounts necessary in its sole discretion to meet expenses and liabilities of the Company, including but not limited to the Management Fee, and establish reserves, therefore.

Distributions of Operating Cash Flow will be determined within thirty (30) days after the end of each fiscal year or at such times as the Manager deems appropriate, although the Manager does not expect to make any distributions of Operating Cash Flow until at least the end of the Investment Period. Each Member’s share of each such distribution of Operating Cash Flow will then be distributed among the Members as follows:

(i) First, one hundred percent (100%) to the Investor Members until each Investor Member has received an amount equal to his, her, or its Preferred Return, accrued through the date of distribution;

(ii) Second, eighty percent (80%) to the Investor Members and twenty percent (20%) to the holders of Common Shares.

“Preferred Return” means, with respect to Investor Members, a cumulative, non-compounded return of six percent (6.00%) per annum on such Investor Member’s Unreturned Capital Contribution.

“Unreturned Capital Contribution” means, with respect to an Investor Member, as of any date, an amount equal to the aggregate capital contribution made by such Investor Member according to the Operating Agreement, less the total distributions made to such Investor Member in return of such capital contributions pursuant to the Operating Agreement.

After the conclusion of the Investment Period and within thirty (30) days after a Capital Transaction or at such other times as the Manager deems appropriate, the Company shall distribute its Net Capital Proceeds as follows:

(i) First, one hundred percent (100%) to the Investor Members until each Investor Member has received an amount equal to his, her, or its Preferred Return, accrued through the date of distribution;

(ii) Second, one hundred percent (100%) to the Investor Members in proportion to each Investor Member’s Unreturned Capital Contribution, until the Unreturned Capital Contribution of all Investor Members has been reduced to zero.

(iii) Third, eighty percent (80%) to the Investor Members and twenty percent (20%) to the holders of Common Shares.