Nuance Communications, Inc.

| Formerly | ScanSoft, Inc. |

|---|---|

| Type | Subsidiary |

| Industry | Software |

| Founded | 1992 as Visioneer |

| Headquarters | Burlington, Massachusetts, U.S. |

Key people | Chairman and CEO Mark Benjamin |

| Products | IVR,Natural Language Understanding,OCR, speech synthesis, speech recognition, PDF, consulting, government contracts |

Number of employees | 6,500+ (2021) |

| Parent | Microsoft |

| Website |

|

Nuance Communications, Inc is a multinational software technology company that specialises in AI-powered speech recognition and Natural Language Processing(NLP) solutions that have various applications in the healthcare industry. It is a pioneer in cognitive and conversational artificial intelligence (AI) innovations. These innovations infuse intelligence into daily work and life, amplifying human intelligence to boost productivity and enhance security. In the past two decades, Nuance has achieved significant milestones, including generating over $1 billion in annual appropriate reimbursement for healthcare organisations, saving enterprises over $1 billion annually, and estimated savings of $2 billion per year in fraud prevention.[1]

Operations edit edit source

History of the company edit edit source

Originally incorporated as Visioneer in 1992, the company merged with ScanSoft, Inc. its largest competitor at the time in 1999. In 2005, ScanSoft acquired and merged with Nuance Communications, Inc and changed its name to the same. Under this name, the company had was a key player in the development of voice recognition software and speech-to-text technology. As of March 4th 2022, Nuance Communications Inc. is a subsidiary of Microsoft Corp. It is based in Burlington, Massachusetts, but it has established a significant presence in the Seattle area through various acquisitions such as Saykara[2], VoiceBox, Swype, and several others.

Mission of the company edit edit source

At its core, Nuance aims to use advanced conversational AI to help improve productivity, enhance customer experiences, and enable seamless human-machine interactions across various industries, including healthcare, automotive, financial services, and more. Its website states its mission statement as, "amplifying your ability to help others"[3]. According to Nuance CEO Mark Benjamin, “We are committed to innovating new and cutting-edge AI solutions that help make healthcare more personal, affordable, effective and accessible, while also continuing to improve the patient and clinician experience."[4] It is trusted by 77 percent of U.S. hospitals and 85 percent of the Fortune 100 across the globe.

Main offerings of the company edit edit source

The company offers an array of solutions under three primary segments: Healthcare, Enterprise, and Other.

The Healthcare segment focuses on improving and simplifying clinical documentation through solutions that comprehend and analyse clinical speech and language. It also focuses on improving care quality, reducing physician burnout, integrating quality measures, and facilitating reimbursement. This segment provides products like Dragon Medical One, a cloud-based speech recognition solution, and Nuance Dragon Ambient eXperience (Nuance DAX), an AI powered clinical documentation solution. These tools enhance clinical documentation efficiency, accuracy and accessibility.

The Enterprise segment employs speech, natural language understanding, and AI to automate customer solutions across various channels, including voice, mobile, web, and messaging. This segment delivers intelligent engagement solutions and utilises Conversational AI, Engagement AI, and Security AI to better interact with customers. Examples include virtual assistant and chatbots for enhanced customer service to achieve the best possible business outcomes.

The Other segment consists mainly of voicemail transcription services.

Serving a diverse range of industries, from healthcare and financial services to telecommunications, government, and retail, Nuance markets and sells its innovative solutions directly and through an extensive network of resellers. These resellers encompass system integrators, independent software vendors, value-added resellers, distributors, hardware vendors, telecommunications carriers, and e-commerce websites globally.

Acquisition by Microsoft edit edit source

On March 4th 2022, Microsoft Corp completed the acquisition of Nuance Communications Inc. in all cash transaction valued at $18.8[5] billion, inclusive of Nuance’s net debt. This is the third largest acquisition in Microsoft history after Activision-Blizzard and LinkedIn.

Acquisition Rationale edit edit source

Microsoft's acquisition of Nuance builds upon their previous successful partnership, initially announced in 2019. By integrating Nuance's solutions into the Microsoft Cloud for Healthcare and leveraging Nuance's expertise and relationships with EHR systems providers, Microsoft aims to enhance healthcare providers' capabilities through ambient clinical intelligence and other cloud services. Nuance's expertise in AI and customer engagement also extends beyond healthcare, which will benefit Microsoft in providing advanced solutions to other industries as well. The acquisition of Nuance by Microsoft is expected to expand Microsoft's total addressable market (TAM) in the healthcare provider domain, effectively increasing it to almost $500 billion.[6]The acquisition aligns with Microsoft's strategy to focus on specialised cloud services for different sectors.

According to Microsoft CEO, Satya Nadella, "Nuance provides the AI layer at the healthcare point of delivery and is a pioneer in the real-world application of enterprise AI.” “AI is technology’s most important priority, and healthcare is its most urgent application. Together, with our partner ecosystem, we will put advanced AI solutions into the hands of professionals everywhere to drive better decision-making and create more meaningful connections, as we accelerate growth of Microsoft Cloud for Healthcare and Nuance."[7]

How is this acquisition beneficial for both Microsoft and Nuance? edit edit source

On the whole, acquiring Nuance is extremely beneficial for both parties. In the long term, Microsoft will acquire Nuance's technology, staff and skills, clients and IP(intellectual property). Stu Patterson, ex-CEO, SpeechWorks, told the Boston Globe that Nuance: “… has more intellectual property around speech than anybody on earth.” [8] The biggest benefits for Microsoft are however expansion in the healthcare market and strengthening Industry-Specific Cloud Strategy.

For Nuance, on the other hand, this acquisition gives it access to a much larger market due to Microsoft's vast customer base and global reach as well as more financial strength and stability. This can fuel further innovation, research, and development of cutting-edge products and services.

Also, by integrating Nuance's conversational AI and healthcare solutions into Microsoft's product portfolio, there are opportunities to create synergies and cross-selling between Nuance's offerings and Microsoft's existing suite of products. These synergies could include complementary product offerings, streamlined operations and cross-selling opportunities among others.

Market edit edit source

Total Addressable Market (TAM) edit edit source

TAM represents the entire potential market demand for a product or service without any limitations. Here, the TAM is defined as the global healthcare market. It is estimated that the revenue in the healthcare market is projected to reach $57.86 billion in 2023 (based on a number of assumptions).[9]

Serviceable Available Market (SAM)[10] edit edit source

SAM represents the portion of the TAM that a company can realistically target and serve based on its resources, capabilities, and market strategy. Here, the SAM is defined as the healthcare AI market. As of 2022, the AI in healthcare market was valued at over $9 billion (based on a number of assumptions). As of 2023, the market for AI in healthcare is expected to close at $12.63 billion. However, from 2023 to 2031, the market is expected to grow by nearly 15x.

Serviceable Obtainable Market (SOM) edit edit source

SOM represents the portion of the SAM that a company can practically and effectively capture under existing market conditions and constraints. Here, the SOM is defined as the healthcare AI market in North America. In 2022, the AI in healthcare market was predominantly led by North America, with the region holding the largest revenue share of 58.0%, which is around $5.22 billion (based on a number of assumptions). [11]

Competition edit edit source

The AI in healthcare market is filled with promising prospects. Companies are utilising a range of technological advancements to enhance patient outcomes and decrease treatment expenses. The increasing elderly population worldwide, lifestyle changes, and higher incidence of chronic illnesses have led to a significant rise in the need for early disease diagnosis and better disease comprehension. To meet these demands, healthcare systems are extensively adopting and incorporating Artificial Intelligence (AI) and machine learning (ML) algorithms. Some key players in this field who are competitors for Nuance and now Microsoft too after the acquisition are:

- IBM Corporation - In April 2023, IBM Corporation partnered with Moderna Inc. to integrate AI and quantum computing into mRNA development. The collaboration involves investments in generative AI to enhance product design, utilising the MoLFormer AI model to optimise mRNA and lipid nanoparticles.

- NVIDIA Corporation - In March 2023, NVIDIA Corporation and Medtronic Plc. joined forces with Cosmo Pharmaceuticals to advance AI capabilities in colonoscopy procedures. Medtronic plans to integrate NVIDIA's AI technology into its GI Genius Intelligent Endoscopy Module, creating the GI Genius AI Access platform for healthcare AI innovation.

- Intel Corporation

- GE HealthCare

- BenevolentAI

Leadership edit edit source

Executive Team[12] edit edit source

Chief Executive Officer - Mark Benjamin edit edit source

Mark Benjamin joined Nuance in April 2018 as the CEO and a director. He has extensive experience in the technology industry, with a successful track record in driving growth initiatives related to cloud, SaaS, mobile, big data, and IoT solutions. Before joining Nuance, Mark held the position of president and chief operating officer at NCR Corporation. There, he was responsible for overseeing sales, solutions management, business and product development, services, and supply chain operations. Mark holds a bachelor's degree in international finance and marketing from the University of Miami.

Chief Technology Officer - Joe Petro edit edit source

In September 2018, Joe Petro assumed the position of Executive Vice President and Chief Technology Officer. In this capacity, he is responsible for supervising research, platform development, application development, dev ops, and cloud readiness for the company. Joe joined Nuance in 2008 as the Senior Vice President of Healthcare Research and Development. He holds a Bachelor of Science degree in mechanical engineering from the University of New Hampshire and a Master of Science degree in mechanical engineering from Kettering University.

Chief Financial Officer - Dan Tempesta edit edit source

Dan Tempesta has been serving as the Executive Vice President and Chief Financial Officer of Nuance since July 2015. In this role, he is responsible for overseeing all financial and accounting operations, as well as tax, treasury, investor relations, order management, and procurement. He joined Nuance in 2008 and has held various senior finance positions, including Chief Accounting Officer and Senior Vice President of Finance. Dan holds a degree in Business Administration and Accounting from the Isenberg School of Management at the University of Massachusetts Amherst.

Chief Strategy Officer - Peter Durlach edit edit source

As the head of corporate strategy, Peter's primary responsibility is to advance Nuance's overall strategic direction and portfolio, aligning with emerging trends in key vertical markets such as healthcare, financial services, telecommunications, retail, and government. Additionally, he oversees the development of disruptive AI-powered solutions through new strategic innovations. He holds a BS in business administration from the University of Vermont.

Other people of importance edit edit source

Chief Executive Officer of Microsoft- Satya Nadella edit edit source

Satya Nadella is the Chairman and CEO of Microsoft. He assumed the role of CEO in February 2014. He joined Microsoft in 1992 and prior to becoming CEO, Nadella served as the Executive Vice President of Microsoft's Cloud and Enterprise group. During this tenure, he successfully led the company's transition to cloud-based infrastructure and services. He completed his undergraduate studies in electrical engineering at Mangalore University, followed by a master's degree in computer science from the University of Wisconsin - Milwaukee and an MBA from the University of Chicago.

Microsoft Cloud + AI Executive Vice President - Scott Guthrie edit edit source

As the Executive Vice President of the Microsoft Cloud + AI Group, Scott Guthrie oversees Microsoft's cloud computing infrastructure, artificial intelligence platform, and the development of industry-specific cloud solutions. This includes managing products and services like Microsoft Azure (the global cloud computing platform) and Microsoft Business Applications . Additionally, he is responsible for a range of developer tools such as Visual Studio, Visual Studio Code, and GitHub, along with core commerce capabilities, infrastructure, and compliance solutions across the Microsoft Cloud. The recent acquisition of Nuance Communications adds expertise to the company's expanding portfolio.

How does leadership change after the acquisition? edit edit source

As part of Microsoft, Mark Benjamin will still remain CEO of Nuance and will report to Guthrie. This arrangement follows a similar model employed by Microsoft with LinkedIn, where acquired companies maintain a level of autonomy and independence within the Microsoft structure.

Board of Directors[13] edit edit source

Keith Ranger Dolliver edit edit source

Mr. Keith Ranger Dolliver currently holds the positions of President, Treasurer & Director at Nuance Communications, Inc., starting from March 04, 2022. Prior to this role, he served as Vice President, Deputy General Counsel of Corporate, External & Legal Affairs, and Assistant Secretary at Microsoft Corporation. He is also the Chief Executive Officer of GroupMe Inc. and Vice President of LinkedIn Corporation. Mr. Dolliver obtained his J.D. from the University of Chicago Law School and holds a B.A. from Swarthmore College.

Benjamin Owen Orndorff edit edit source

Mr. Benjamin Owen Orndorff has been serving as a Director at Nuance Communications, Inc. since March 04, 2022. Additionally, he holds the position of Managing Director at 6 Wunderkinder GmbH. Furthermore, he has been a Director at LinkedIn Australia Pty Ltd since January 26, 2017.

Financials edit edit source

Historic key financials [14] edit edit source

| For the Fiscal Period Ending | 12 months

Sep-30-2020A |

12 months

Sep-30-2021A |

12 months

Dec-31-2021A |

| Currency (in millions) | USD | USD | USD |

| Total Revenue | 1,283.8 | 1,362.4 | 1,338.1 |

| Growth Over Prior Year | 1.0% | 6.1% | 5.5% |

| Gross Profit | 790.4 | 853.1 | 821.6 |

| Margin % | 61.6% | 62.6% | 61.4% |

| EBITDA | 170.1 | 186.7 | 133.6 |

| Margin % | 13.2% | 13.7% | 10.0% |

| EBIT | 79.1 | 98.7 | 45.4 |

| Margin % | 6.2% | 7.2% | 3.4% |

| Earnings from Cont. Ops. | (13.0) | (17.4) | (81.9) |

| Margin % | (1.0%) | (1.3%) | (6.1%) |

| Net Income | 21.4 | (26.7) | (99.2) |

| Margin % | 1.7% | (2.0%) | (7.4%) |

Risks edit edit source

Prior to getting acquired by Microsoft, Nuance used to be a publicly traded company. In 2022, Microsoft agreed to purchase all the publicly traded shares of Nuance Communications Inc. at a price of $56.00 per share. This meant that Microsoft would pay Nuance shareholders $56.00 in cash for each share that they owned. This type of acquisition is commonly referred to as an "all-cash transaction" because the consideration is paid in cash rather than through a combination of cash and stock. As a result of this acquisition, Nuance will cease to be a publicly traded company.

As a result of Nuance's recent acquisition, it encounters various risks and challenges related to the process. Some of these include:

Integration Issues - Integrating two large companies with different cultures, systems, and processes can be complex and may take time to complete. The success of the acquisition depends on how well the integration is managed.

Synergy Realisation - Achieving the expected synergies and benefits from the acquisition may require careful planning and execution. Ensuring that the integration enhances the overall value of the combined entity is a significant challenge.

Cultural Differences - Nuance and Microsoft might have different corporate cultures, and aligning these cultures could be challenging. Ensuring that employees from both companies work cohesively is crucial for a successful integration.

Regulatory Approval - The acquisition may require regulatory approvals from government authorities, both domestically and internationally and delays in obtaining these could impact the timeline of the acquisition. For instance, Britain's antitrust regulator, The Competition and Markets Authority (CMA), initially expressed concerns about potential reduced competition in the UK market.

Valuation edit edit source

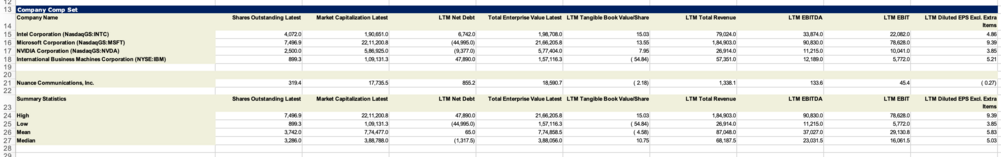

Comparable Analysis (Before Acquisition)[15] edit edit source

Financial Data edit edit source

| Company Comp Set | |||||||||

| Company Name | Shares Outstanding Latest | Market Capitalization Latest | LTM Net Debt | Total Enterprise Value Latest | LTM Tangible Book Value/Share | LTM Total Revenue | LTM EBITDA | LTM EBIT | LTM Diluted EPS Excl. Extra Items |

| Intel Corporation (NasdaqGS:INTC) | 4,072.0 | 1,90,651.0 | 6,742.0 | 1,98,708.0 | 15.03 | 79,024.0 | 33,874.0 | 22,082.0 | 4.86 |

| Microsoft Corporation (NasdaqGS:MSFT) | 7,496.9 | 22,11,200.8 | (44,995.0) | 21,66,205.8 | 13.55 | 1,84,903.0 | 90,830.0 | 78,628.0 | 9.39 |

| NVIDIA Corporation (NasdaqGS:NVDA) | 2,500.0 | 5,86,925.0 | (9,377.0) | 5,77,404.0 | 7.95 | 26,914.0 | 11,215.0 | 10,041.0 | 3.85 |

| International Business Machines Corporation (NYSE:IBM) | 899.3 | 1,09,131.3 | 47,890.0 | 1,57,116.3 | ( 54.84) | 57,351.0 | 12,189.0 | 5,772.0 | 5.21 |

| Nuance Communications, Inc. | 319.4 | 17,735.5 | 855.2 | 18,590.7 | ( 2.18) | 1,338.1 | 133.6 | 45.4 | ( 0.27) |

| Summary Statistics | Shares Outstanding Latest | Market Capitalization Latest | LTM Net Debt | Total Enterprise Value Latest | LTM Tangible Book Value/Share | LTM Total Revenue | LTM EBITDA | LTM EBIT | LTM Diluted EPS Excl. Extra Items |

| High | 7,496.9 | 22,11,200.8 | 47,890.0 | 21,66,205.8 | 15.03 | 1,84,903.0 | 90,830.0 | 78,628.0 | 9.39 |

| Low | 899.3 | 1,09,131.3 | (44,995.0) | 1,57,116.3 | ( 54.84) | 26,914.0 | 11,215.0 | 5,772.0 | 3.85 |

| Mean | 3,742.0 | 7,74,477.0 | 65.0 | 7,74,858.5 | ( 4.58) | 87,048.0 | 37,027.0 | 29,130.8 | 5.83 |

| Median | 3,286.0 | 3,88,788.0 | (1,317.5) | 3,88,056.0 | 10.75 | 68,187.5 | 23,031.5 | 16,061.5 | 5.03 |

We can see that in terms of market cap and revenue, Nuance is far below the median and mean of its competitors.

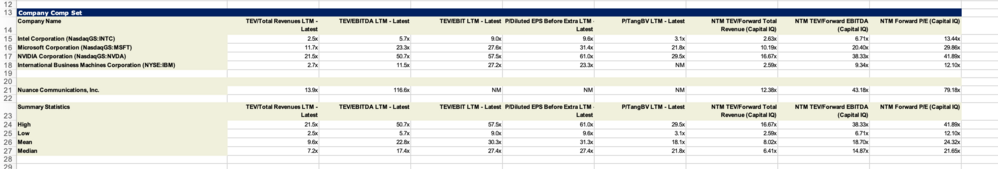

Trading Multiples edit edit source

| Company Comp Set | ||||||||

| Company Name | TEV/Total Revenues LTM - Latest | TEV/EBITDA LTM - Latest | TEV/EBIT LTM - Latest | P/Diluted EPS Before Extra LTM - Latest | P/TangBV LTM - Latest | NTM TEV/Forward Total Revenue (Capital IQ) | NTM TEV/Forward EBITDA (Capital IQ) | NTM Forward P/E (Capital IQ) |

| Intel Corporation (NasdaqGS:INTC) | 2.5x | 5.7x | 9.0x | 9.6x | 3.1x | 2.63x | 6.71x | 13.44x |

| Microsoft Corporation (NasdaqGS:MSFT) | 11.7x | 23.3x | 27.6x | 31.4x | 21.8x | 10.19x | 20.40x | 29.86x |

| NVIDIA Corporation (NasdaqGS:NVDA) | 21.5x | 50.7x | 57.5x | 61.0x | 29.5x | 16.67x | 38.33x | 41.89x |

| International Business Machines Corporation (NYSE:IBM) | 2.7x | 11.5x | 27.2x | 23.3x | NM | 2.59x | 9.34x | 12.10x |

| Nuance Communications, Inc. | 13.9x | 116.6x | NM | NM | NM | 12.38x | 43.18x | 79.18x |

| Summary Statistics | TEV/Total Revenues LTM - Latest | TEV/EBITDA LTM - Latest | TEV/EBIT LTM - Latest | P/Diluted EPS Before Extra LTM - Latest | P/TangBV LTM - Latest | NTM TEV/Forward Total Revenue (Capital IQ) | NTM TEV/Forward EBITDA (Capital IQ) | NTM Forward P/E (Capital IQ) |

| High | 21.5x | 50.7x | 57.5x | 61.0x | 29.5x | 16.67x | 38.33x | 41.89x |

| Low | 2.5x | 5.7x | 9.0x | 9.6x | 3.1x | 2.59x | 6.71x | 12.10x |

| Mean | 9.6x | 22.8x | 30.3x | 31.3x | 18.1x | 8.02x | 18.70x | 24.32x |

| Median | 7.2x | 17.4x | 27.4x | 27.4x | 21.8x | 6.41x | 14.87x | 21.65x |

The TEV/Total Revenues multiple reflects whether a company overvalues or undervalues or its stocks or whether its valuation is fair. If a company's theoretical enterprise value is high in proportion to its actual revenue, its ratio is large, meaning it's overvalued. The lower the better, in that, a lower EV/R multiple signals a company is undervalued. From the above data we can come to the conclusion that Nuance is overvalued relative to its competitors.

Nuance also has a higher TEV/EBITDA . A high EV/EBITDA means that there is a potential the company is overvalued.The enterprise value to earnings before interest, taxes, depreciation, and amortisation ratio (TEV/EBITDA) compares the value of a company—debt included—to the company’s cash earnings less non-cash expenses.

At the time of Acquisition[16] edit edit source

The day after Microsoft announced its plans to acquire Nuance, Microsoft stock had risen 6 cents to $255.91, while “Nuance stock blasted 16 percent higher to $52.85,” Seitz reported.

When a company purchases another, it is common for the stock price of the acquiring company to experience a temporary decline, while the stock price of the target company tends to surge. The decline in the acquiring company's share price is often due to paying a higher price than usual for the target company or taking on debt to fund the acquisition. Microsoft did acquire Nuance for $56.00 per share, which was a 23% premium to the closing price of Nuance on Friday, April 9 2021, in an all-cash transaction valued at $19.7 billion, inclusive of Nuance’s net debt.

However, in the long term, acquisitions generally have a positive impact on the acquiring company's share price.

References edit edit source

- ↑ https://technologymagazine.com/ai-and-machine-learning/who-are-nuance-microsofts-latest-acquisition

- ↑ https://www.crunchbase.com/organization/nuance/company_financials

- ↑ https://www.nuance.com/en-gb/company-overview/what-we-do.html

- ↑ https://www.geekwire.com/2022/microsofts-19-7b-nuance-deal-is-finally-final-nearly-a-year-after-it-was-announced/

- ↑ https://www.microsoft.com/investor/reports/ar22/index.html

- ↑ https://news.microsoft.com/2021/04/12/microsoft-accelerates-industry-cloud-strategy-for-healthcare-with-the-acquisition-of-nuance/

- ↑ https://news.microsoft.com/2021/04/12/microsoft-accelerates-industry-cloud-strategy-for-healthcare-with-the-acquisition-of-nuance/

- ↑ https://vux.world/why-is-microsoft-acquiring-nuance-really-the-bigger-picture/

- ↑ https://www.statista.com/outlook/dmo/ecommerce/beauty-health-personal-household-care/health-care/worldwide#:~:text=Revenue%20in%20the%20Health%20Care,US%2457.86bn%20in%202023.

- ↑ https://finance.yahoo.com/news/ai-healthcare-market-reach-us-114100721.html

- ↑ https://www.grandviewresearch.com/industry-analysis/artificial-intelligence-ai-healthcare-market#:~:text=North%20America%20dominated%20artificial%20intelligence,share%20of%2058.0%25%20in%202022.

- ↑ https://www.nuance.com/en-gb/company-overview/leadership.html

- ↑ https://www.capitaliq.com/CIQDotNet/Company/BoardMembers.aspx?CompanyId=346200&limitFunctions=3

- ↑ https://www.capitaliq.com/CIQDotNet/Financial/KeyStats.aspx?CompanyId=346200

- ↑ https://www.capitaliq.com/CIQDotNet/Comps/Comparables.aspx?companyId=346200&statekey=2e40e3785da849c5bd1f8c40bb66289c

- ↑ https://www.hcinnovationgroup.com/analytics-ai/artifical-intelligence-machine-learning/article/21218486/stock-market-analysts-observers-react-to-microsofts-acquisition-of-nuance