Olive Tree People

Established company in the fastest-growing segment in skincare

Summary edit edit source

- Established company with $21.2M in historical revenue and 4 brands

- Outpaces overall industry growth by 1400%

- Goal of 2023 Nasdaq listing

- Pioneering scientifically-proven active ingredients, no fillers

- Featured in Vogue, Elle, InStyle, Harper's Bazaar, & other leading media

- Story and products loved by celebrities on social media

- First US flagship store coming to Los Angeles in 2022

Problem edit edit source

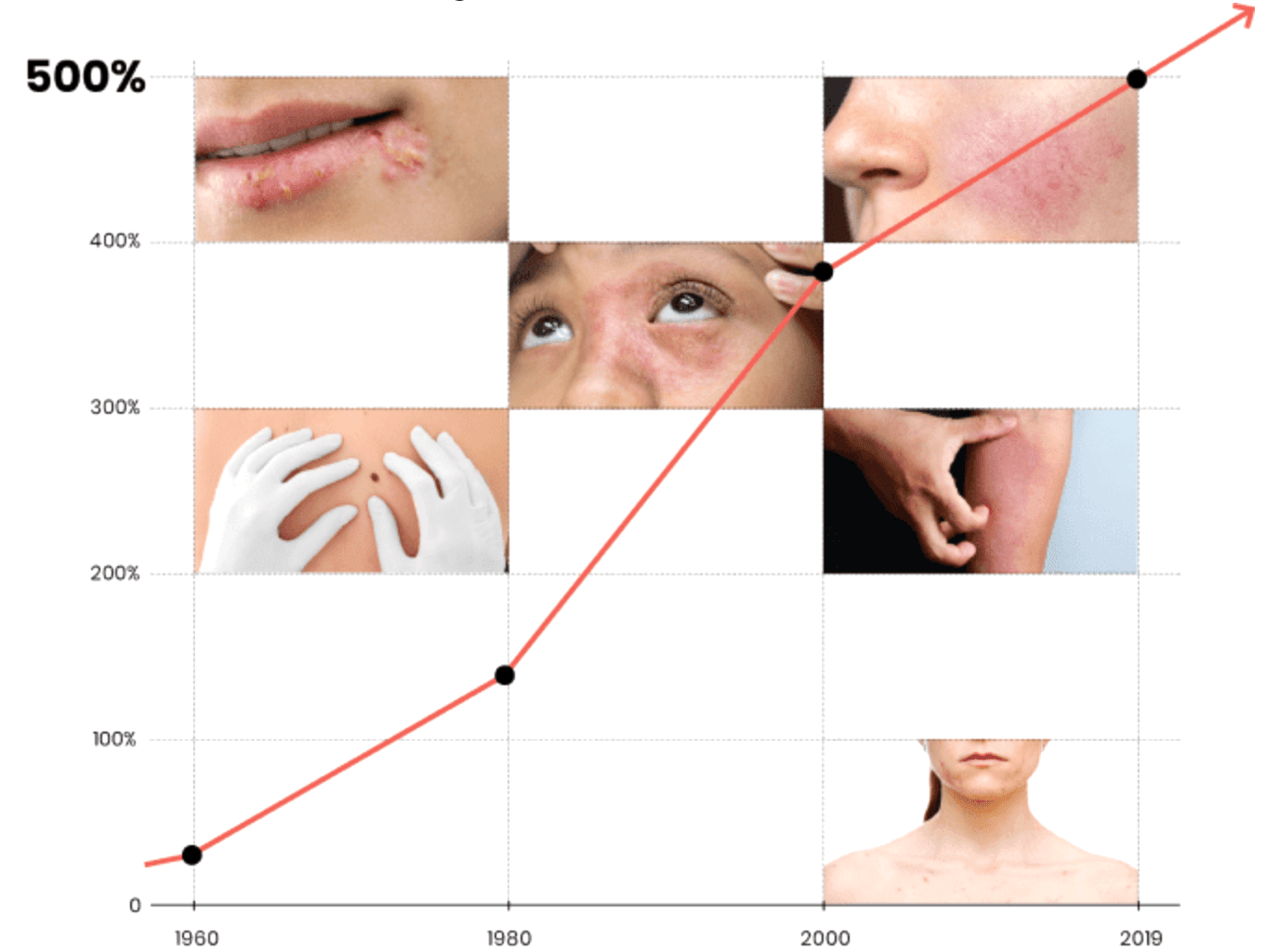

Skin diseases have increased by 500% in the last 25 years edit edit source

Now, 71% of customers are looking for the right skin care solutions

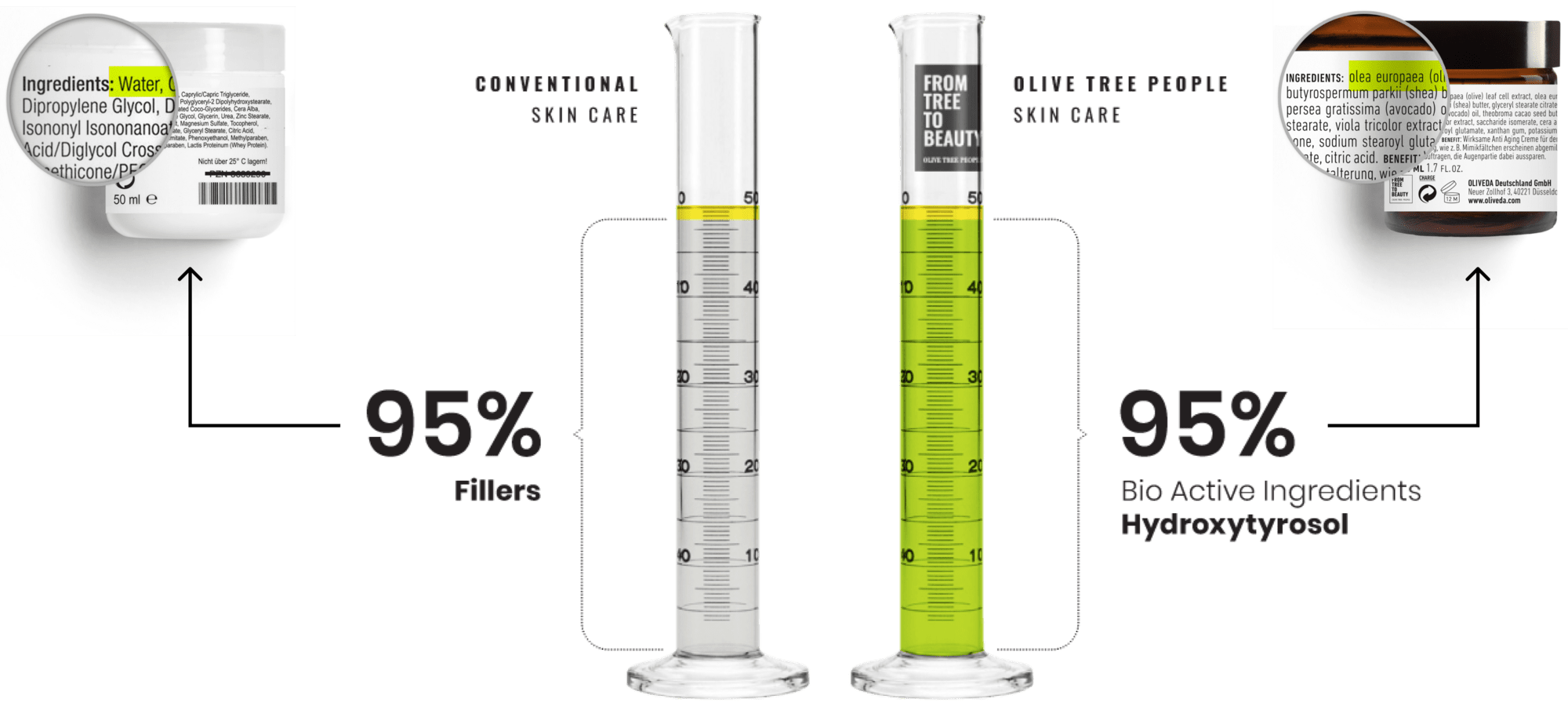

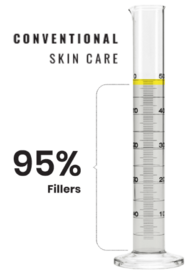

99% of skincare products worldwide (including organic cosmetics) contain up to 95% fillers: mineral oils, petroleum, distilled water and refined oil.* We believe that there’s a link between the fillers used in skincare products and the 5x rise in disfiguring and painful skin conditions.

*Of 1000 skincare products tested, 990 included water and refined oils on their ingredient list

Solution edit edit source

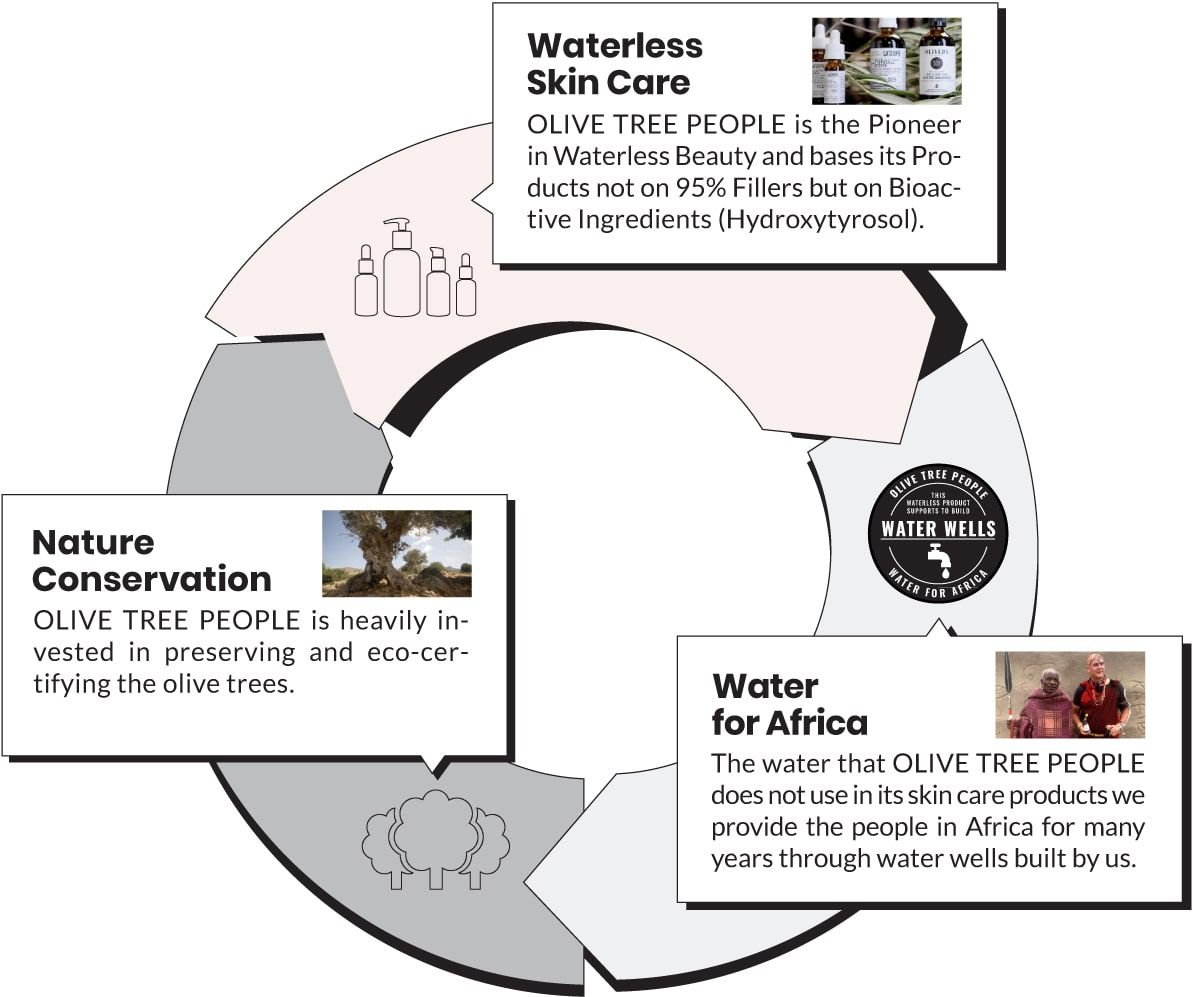

The future of skin care is in pioneering active ingredients and 0% filler

The future of skin care and beauty is a concept called “waterless,” which to us means “filler-free.” Studies from the world’s leading market research institutes show that 98%* of consumers prefer filler-free skincare products.

Pioneering active ingredients edit edit source

Hydroxytyrosol—a molecule found in mountain olive trees—protects tree cells for up to 4,000 years. We source directly from our own privately-owned nature preserve of over 30,000 mountain olive trees. Approved by the FDA as safe for use and the European Food Safety Authority (ESFA), it’s a perfect replacement for the fillers that make up 95% of the contents of other skin care products.

Illustrative post of conventional skin care

The European Food Safety Authority (ESFA) confirms that hydroxytyrosol effectively protects human cells from oxidative stress and thus prevents the breakdown of the body's own beauty molecules, collagen and hyaluronic acid. At the same time, it supports the cells in forming new collagen.

Illustrative post of conventional skin care

Our hydroxytyrosol-based product led to a significant improvement in our customers’ complexion and well-being.

*"98% of consumers" – based on internal survey of Olive Tree People customers

Product edit edit source

128 unique formulas and 4 protected trademarks edit edit source

OLIVEDA Olive Tree Pharmacy* edit edit source

86 filler-free, highly effective formulas for premium skin care and unique beauty and immune boosters.

LA DOPE Holistic Beauty Therapy edit edit source

Premium skincare inside and out with the synergy of hemp and hydroxytyrosol.

THE INTUITION of Nature edit edit source

An entry-level skincare line, starting at just $9.95 — the first filler-free line in this price segment.

OLIVE re:connected to nature edit edit source

A wearable that vibrates with the resonant frequency of an olive tree or hemp plant. It gives users all the psychological benefits of hugging a tree, 24/7. We believe that connecting with a tree has real, positive effects, helping people redefine themselves in harmony with nature, promoting their uniqueness and strengths, creating real self-confidence.

*OLIVEDA Olive Tree Pharmacy is a branding title and not a licensed pharmacy

Traction edit edit source

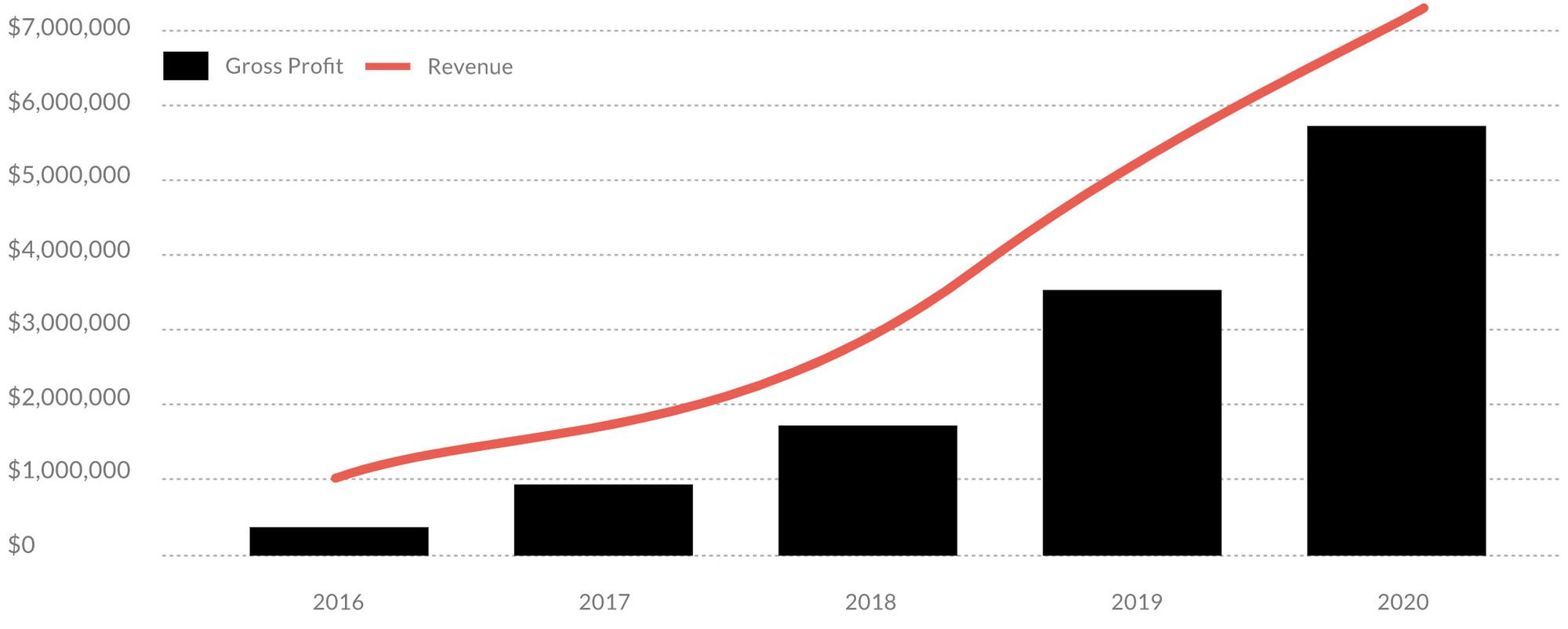

Olive Tree People is growing edit edit source

We grew over 330% in 2016–2020, 1400% faster than the average across our industry, with $21.2M in historical gross revenue over that same period.

- 13-point gross margin expansion

- 84% repeat customer rate

- 502% customer lifetime revenue

- 1400% faster than the beauty industry overall

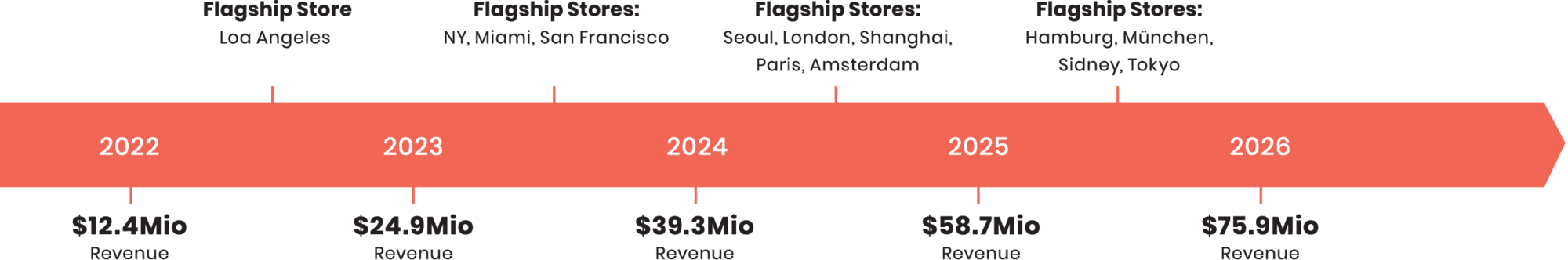

Projected Olive Tree People revenue, 2022-2026 edit edit source

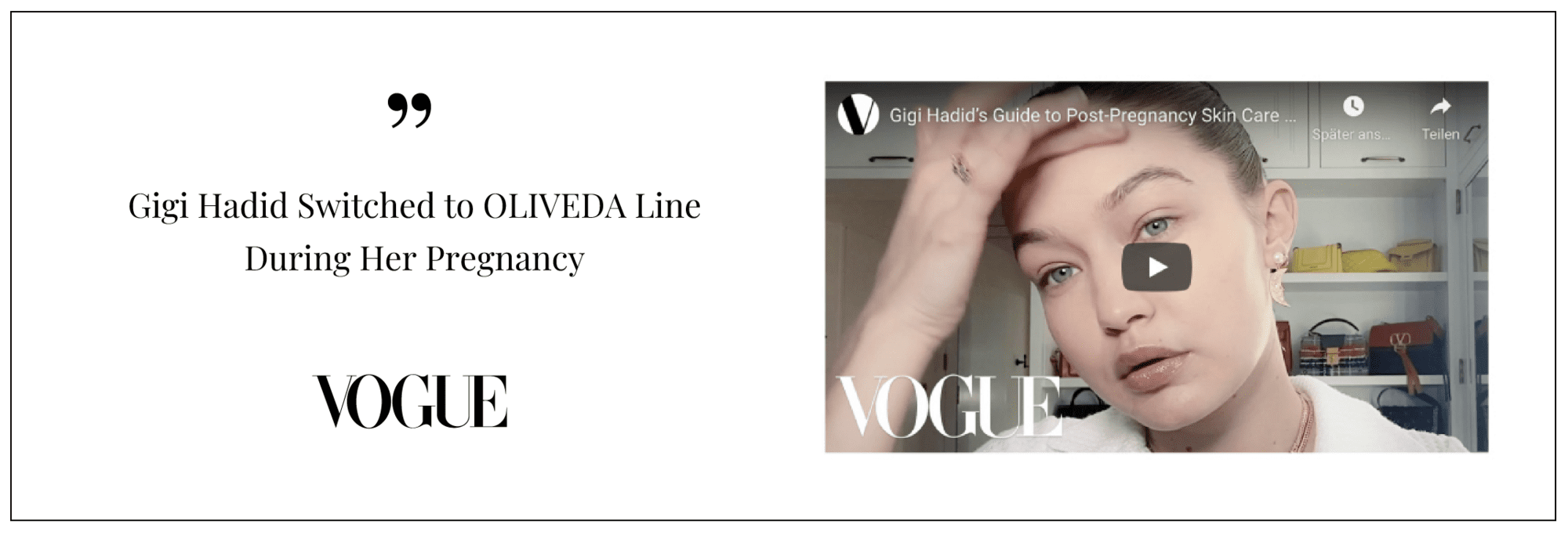

A press favorite edit edit source

Featured in Vogue, Elle, InStyle, Cosmopolitan, Glamour, Harper‘s Bazaar and many other notable media outlets.

35,861,325 people reached in 2020

Traction stats as of 12/31/2020

Customers edit edit source

A thriving social media presence with 302K+ followers across all our social media channels, including customers, celebrities, and influencers edit edit source

Sensational before/after results after 6-8 weeks edit edit source

"I have switched my entire facial care.

Why? Because it made me a new person."

Studies clearly show that 98% of all customers, after being informed, decide on Waterless Beauty/Skin Care with thousands of phenomenal 5-star reviews and against 95% fillers.

Thousands of 5 Stars Reviews

"98% of consumers would decide against fillers" – study based on internal survey of Olive Tree People customers

Business model edit edit source

Beauty revolution edit edit source

Olive Tree People products are currently distributed through 650 retail stores and 2 flagship stores in Europe. Retail points of presence include Douglas, known as “the Sephora of Europe,” and Müller, a well-known German retail chain.

Other revenue channels include:

- QVC Europe

- Amazon.de

- Direct sales on our website

Influencers with 1M+ reach, including Gigi Hadid’s unpaid endorsement, are a major source of customer education and sales referrals.

The major goal for 2022 is to expand into the US, both in terms of physical presence in retail/flagship stores and in terms of brand awareness.

Market edit edit source

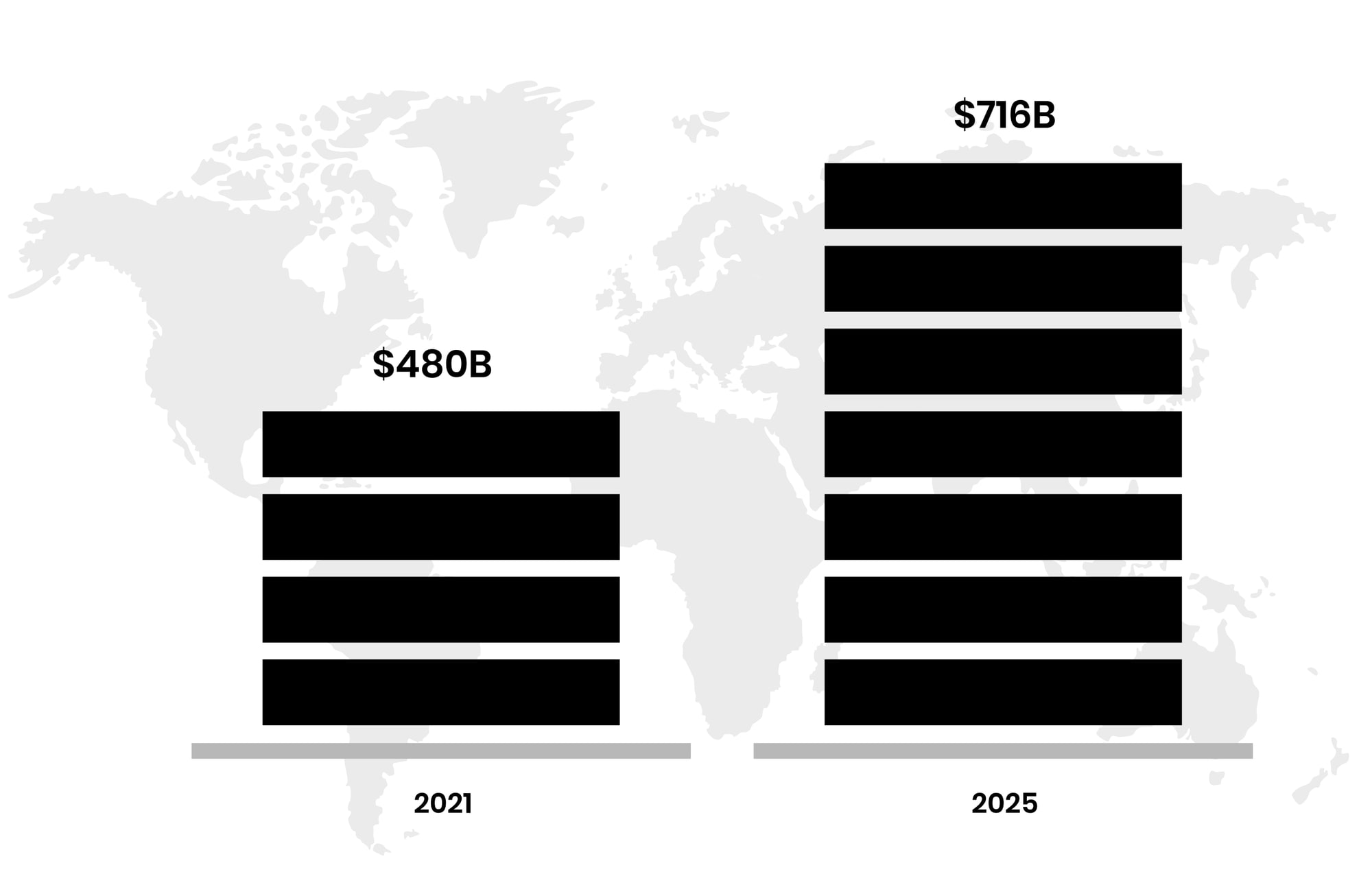

A $480B beauty industry projected to grow to $716B by 2026 edit edit source

Most of the spend in the market is in the entry-level segment, representing a blue ocean space for our entry-level brand, THE INTUITION of Nature.

Given that 99%* of our competitors are based on water and refined mineral oils, which 98% of consumers would prefer to avoid, we believe that our overall growth potential is huge. If only 5% of the overall market spend goes to waterless products by 2026, we can project $35B in yearly revenue for ourselves and other waterless companies.

With our 3 amazing waterless, no-filler brands (and one wearable line), ranging from entry-level to premium, we are well positioned in every segment of the waterless skincare space.

*99% of 1000 skincare products tested

Competition edit edit source

edit edit source

In OLIVE TREE PEOPLE products, the globally unique molecule Hydroxytyrosol, which can also be found in our mountain olive trees, replaces the fillers (water and refined oils) that make up 95% of the content in other skin care products.

The Future of Skin Care/Beauty is Waterless, according to Forbes, Vogue, Harper's Bazaar and the world's leading market research institutes. Studies* show that 98% of all customers, after being informed, decide for Waterless Beauty.

*Study based on internal survey of 800 Olive Tree People customers

Vision and strategy edit edit source

Projected Olive Tree People revenue, 2022-2026 edit edit source

An Olive Tree Society edit edit source

We already have a strong presence in Europe. Now, our sights are set on the US. This year, we are opening up our first US flagship store in Los Angeles, CA. This is a first step to establishing a stronger brand presence in the US market.

Next steps over 2022-2023 are to push into 2000 retail points of presence and open flagship stores in New York, San Francisco, and Miami.

In 2023, we plan to file for listing on the NASDAQ stock exchange.

This is more than a business strategy. Our mission is to make ancient formulas based on earthly wisdom and the life-force of the mountain olive trees, accessible to everyone. We are working to create a natural cycle that makes it possible to protect and preserve the millennia-old high culture of our trees.

With love and dedication, we act to contribute to a society that is developing more and more into an “Olive Tree Society”—a society that, like the olive tree, is a symbol for life, love, and peace.

Founders edit edit source

Thomas Lommel

By age 29, Thomas had founded a group of companies with over 1,000 employees. Then, he developed a chronic illness that left him reliant on daily medication. Thomas used olive tree products to heal himself and quit medication in 176 days. This started him on a years-long journey that led to the development of an olive therapy spa and Olive Tree People skincare products. He developed the original olive-leaf elixir that his products are based on while living in a treehouse in an olive tree in Arroyomolinos de Léon, Andalusia, Spain.

Olive Tree People isn’t just a business that’s firmly established in the European market — it’s a labor of love. Thomas wants to bring the same power and wisdom that healed him 20 years ago to the US market.

Disclaimers edit edit source

Risks of early stage investment. Not an offer to buy or sell securities. This is a long-term speculative illiquid investment. Investment is not FDIC or SiPC insured. You may lose money.

Your investment is binding and irrevocable, although we reserve the right to reject it for any reason or no reason at all. Funds committed will remain in an escrow account maintained by Prime Trust, LLC until such time as a closing occurs. We will not be issuing share certificates; your investment will be solely recorded in book-entry electronic form by Action Stock Transfer Corporation, our transfer agent and registrar. Securities offered through OpenDeal Broker LLC, a registered broker dealer, member of FINRA (www.finra.org), member of SIPC (www.sipc.org). We will pay OpenDeal Broker LLC, a registered broker-dealer – a 6% cash commission. We have also agreed to pay a 2% securities commission, plus certain offering costs. Please review OpenDeal Broker LLC’s Form CRS. OpenDeal Broker LLC may require additional documents or information from you to complete your purchase, you will be contacted by a registered representative in this event.

An offering statement relating to Olive Tree People Inc.’s Common Stock has been filed with the Securities and Exchange Commission and became qualified on July 28, 2021. Prior to making any investment in Olive Tree People Inc.’s Common Stock, you should review a copy of the offering circular, or contact Olive Tree People Inc. by phone at (424) 252-4251. No offer to sell any securities, and no solicitation of an offer to buy any securities, is being made in any jurisdiction in which such offer, sale or solicitation would not be permitted by applicable law.

Olive Tree People Team edit edit source

Thomas Lommel

Founder/CEO

Claudia Schwahlen

CFO

Dr. Setareh Maleknia

Director (Corporate Secretary)

Andrew Beyer

Investor relations

Risks edit edit source

The cosmetics and holistic health industries are highly competitive, and if we are unable to compete effectively our results will suffer.

We face vigorous competition from companies throughout the world, including multinational consumer product companies. Most of these competitors have significantly greater resources than we do, as well as significantly greater brand-recognition. Competition in the cosmetics and holistic health industries is based on a variety of factors including pricing of products, innovation, perceived value, promotional activities, advertising, special events, new product introductions, e-commerce initiatives and other activities. It is difficult for us to predict the timing and scale of our competitors’ actions in these areas. Our ability to compete depends on the continued strength of our brands, our ability to attract and retain key talent and other personnel, the efficiency of our contracted manufacturing facilities and distribution network. Our Company has a growing reputation that could be negatively impacted by social media and many other factors. If our reputation is adversely affected, our ability to attract and retain customers and consumers could be impacted.

The Company does not own any intellectual property.

While “Oliveda” is a registered trademark in the United States, this trademark is registered to Thomas Lommel, our Chief Executive Officer and Founder, who allows Oliveda International Inc. to use the trademark. “LA Dope” is also a registered trademark in Germany, registered again to Thomas Lommel, who allows Oliveda International to use this trademark. While the Company (through its wholly-owned subsidiary, Oliveda Deutschland GmbH) and Oliveda International Inc. are parties to license agreements for use of each of these trademarks by the Company, there is no guarantee that the Company will continue to have access to these trademarks in the future. Loss of access to these trademarks would significantly harm the Company’s operations.

Our inability to anticipate and respond to market trends and changes in consumer preferences could adversely affect our financial results.

Our success depends to a large degree on our ability to anticipate and react to changes in consumer tastes for skin, body, hair, and holistic health products. We must continually work to develop and market new products, maintain and enhance the recognition of our brands, achieve a favorable mix of products, successfully manage our inventories, and modernize and refine our approach as to how and where we market and sell our products. Consumer tastes cannot be predicted with certainty and can change rapidly. If we are unable to anticipate and respond to sudden challenges that we may face in the marketplace, our financial results will suffer. In addition, from time to time, sales growth or profitability may be concentrated in a relatively small number of our brands or products, which increases the risk that our operating results may suffer in the event such products or brands fall out of favor with our customers.

Acquisitions may expose us to additional risks.

We continuously review acquisition and strategic investment opportunities that would expand our current product offerings, our distribution channels, increase the size and geographic scope of our operations or otherwise offer growth and operating efficiency opportunities. There can be no assurance that we will be able to identify suitable candidates or consummate these transactions on favorable terms. If required, the financing for these transactions could result in an increase in our indebtedness, dilute the interests of our stockholders or both. We do not intend to use the proceeds from this Offering to acquire other businesses – however, if we were to issue equity to acquire another company, investors in this Offering could suffer dilution as a result.

An economic downturn or economic uncertainty in the United States may adversely affect consumer discretionary spending and demand for our products.

Our operating results are affected by the relative condition of the United States economy as many of our products may be considered discretionary items for consumers. In an economic downturn, our customers may reduce their spending and purchases due to job loss or fear of job loss, foreclosures, bankruptcies, higher consumer debt and interest rates, reduced access to credit, falling home prices, increased taxes, and/or lower consumer confidence. Consumer demand for our products may not reach our targets, or may decline, when there is an economic downturn or economic uncertainty. Current, recent past, and future conditions may also adversely affect our pricing and liquidation strategy; promotional activities, product liquidation, and decreased demand for consumer products could affect profitability and margins. Online customer traffic is difficult to forecast. As a consequence, sales, operating, and financial results for a particular period are difficult to predict, and, therefore, it is difficult to forecast expected results for future periods. Any of the foregoing factors could have a material adverse effect on our business, results of operations, and financial condition. Additionally, many of the effects and consequences of U.S. and global financial and economic conditions could potentially have a material adverse effect on our liquidity and capital resources, including the ability to raise additional capital, if needed, or could otherwise negatively affect our business and financial results. For example, global economic conditions may also adversely affect our suppliers’ access to capital and liquidity with which to maintain their inventory, production levels, and product quality and to operate their businesses, all of which could adversely affect our supply chain. Market instability could make it more difficult for us and our suppliers to accurately forecast future product demand trends, which could cause us to carry too much or too little merchandise in various product categories.

If the technology-based systems that give our customers the ability to shop with us online do not function effectively, our operating results could be materially adversely affected.

A portion of our customers shop with us through our e-commerce website, www.oliveda.com. While many of our products are sold in retail stores, increasingly, customers are using tablets and smart phones to shop online, and we do plan on increasing our product offerings on e-commerce websites in the future. Any failure on our part to provide an attractive, effective, reliable, user-friendly e-commerce platform that offers a wide assortment of merchandise with rapid delivery options and that continually meet the changing expectations of online shoppers could place us at a competitive disadvantage, result in the loss of sales, harm our reputation with customers, and could have a material adverse impact on our business and results of operations.

The novel coronavirus (COVID-19) pandemic may have an impact on our business, financial condition and results of operations.

The COVID-19 pandemic has rapidly escalated in the United States, creating significant uncertainty and economic disruption, and leading to record levels of unemployment nationally. Numerous state and local jurisdictions have imposed, and others in the future may impose, shelter-in-place orders, quarantines, shut-downs of non-essential businesses, and similar government orders and restrictions on their residents to control the spread of COVID-19. The extent to which COVID-19 ultimately impacts our business, financial condition and results of operations will depend on future developments, which are highly uncertain and unpredictable, including new information which may emerge concerning the severity and duration of the COVID-19 outbreak and the effectiveness of actions taken to contain the COVID-19 outbreak or treat its impact, among others. In addition to the COVID-19 disruptions possibility adversely impacting our business and financial results, they may also have the effect of heightening many of the other risks described here under “Risk Factors,” including risks relating to changes due to our limited operating history; our ability to generate sufficient revenue and positive cash flow; our relationships with third parties, and many other factors. We will endeavor to minimize these impacts, but there can be no assurance that we will be successful in doing so.

Changes in laws, regulations and policies that affect our business could adversely affect our financial results.

Our business is subject to numerous laws, regulations and policies around the world. Changes in these laws, regulations and policies, including the interpretation or enforcement thereof, that affect our business could adversely affect our financial results. These changes include accounting standards, laws and regulations relating to tax matters, trade, data privacy (e.g., General Data Protection Regulation (GDPR)), anti-corruption, advertising, marketing, distribution, customs matters, product registration, ingredients, chemicals, packaging, selective distribution, environmental or climate change matters.

Our success depends to a significant degree on the quality, efficacy and safety of our products.

Our success depends to a significant degree on the quality, efficacy and safety of our products. If our products are found to be defective or unsafe, our product claims are found to be deceptive, or our products otherwise fail to meet our consumers’ expectations, our relationships with customers or consumers could suffer, the appeal of one or more of our brands could be diminished, and we could lose sales and become subject to liability or claims, any of which could result in a material adverse effect on our business. In addition, third parties may sell counterfeit versions of some of our products. These counterfeit products may pose safety risks, may fail to meet consumers’ expectations, and may have a negative impact on our business.

Our future success depends on our key executive officers and our ability to attract, retain, and motivate qualified personnel.

Our future success largely depends upon the continued services of our executive officers and management team, especially our Chief Executive Officer, Thomas Lommel. If one or more of our executive officers are unable or unwilling to continue in their present positions, we may not be able to replace them readily, if at all. Additionally, we may incur additional expenses to recruit and retain new executive officers. If any of our executive officers joins a competitor or forms a competing company, we may lose some or all of our customers. Finally, we do not maintain “key person” life insurance on any of our executive officers. Because of these factors, the loss of the services of any of these key persons could adversely affect our business, financial condition, and results of operations, and thereby an investment in our stock. In addition, our continuing ability to attract and retain highly qualified personnel, especially employees with experience in branding and marketing, will also be critical to our success because we will need to hire and retain additional personnel as our business grows. There can be no assurance that we will be able to attract or retain highly qualified personnel. We face significant competition for skilled personnel in our industries. This competition may make it more difficult and expensive to attract, hire, and retain qualified managers and employees. Because of these factors, we may not be able to effectively manage or grow our business, which could adversely affect our financial condition or business. As a result, the value of your investment could be significantly reduced or completely lost.

Our information technology and websites may be susceptible to cybersecurity breaches, outages and other risks.

We rely on information technology (outsourced and in-house) that support our business processes, including product development, marketing, sales, order processing, production, distribution, finance and intracompany communications throughout the world. We have e-commerce, m-commerce and other Internet websites in the United States and many other countries. These systems may be susceptible to outages due to fire, floods, power loss, telecommunications failures, break-ins and other events. Despite the implementation of network security measures, our systems may be vulnerable to constantly evolving cybersecurity threats such as malware, break-ins and similar disruptions from unauthorized tampering. The occurrence of these or other events could disrupt or damage our information technology and adversely affect our business. Insurance policies that may provide coverage with regard to such events may not cover any or all of the resulting financial losses.

Failure to adequately maintain the security of our electronic and other confidential information could materially adversely affect our business.

We are dependent upon automated information technology processes. As part of our normal business activities, we collect and store certain information that is confidential, proprietary or otherwise sensitive, including personal information with respect to customers, consumers and employees. We may share some of this information with vendors who assist us with certain aspects of our business. Moreover, the success of our e-commerce and m-commerce operations depends upon the secure transmission of confidential and personal data over public networks, including the use of cashless payments. Any failure on the part of us or our vendors to maintain the security of our confidential data and personal information, including via the penetration of our network security and the misappropriation of confidential and personal information, could result in business disruption, damage to our reputation, financial obligations to third parties, fines, penalties, regulatory proceedings and private litigation with potentially large costs, and also result in deterioration in our employees’, consumers’ and customers’ confidence in us and other competitive disadvantages, and thus could have a material adverse effect on our business. In addition, a security or data privacy breach could require that we expend significant additional resources to enhance our information security systems and could result in a disruption to our operations. Furthermore, third parties including our suppliers and customers may also rely on information technology and be subject to such cybersecurity breaches. These breaches may negatively impact their businesses, which could in turn disrupt our supply chain and/or our business.

We are subject to risks related foreign currency exchange rates.

We operate on a global basis, with a majority of our fiscal 2020 net sales and operating income generated outside the United States. Oliveda Deutschland GmbH, the Company’s operating subsidiary, is based in Germany, and its functional currency is in Euros. The translation from the subsidiary’s functional currency to United States Dollars for financial statement presentation resulted in a foreign currency translation gain of $131,401 for the year ended December 31, 2020, but it resulted in a loss of $18,285 for the year ended December 31, 2019, and could again lead to a loss in the future. Such foreign currency translation losses could have a material adverse effect on our business.

Our business involves the potential for product liability and other claims against us, which could affect our results of operations and financial condition and result in product recalls or withdrawals.

We face exposure to claims arising out of alleged defects in our products, including for property damage, bodily injury or other adverse effects. We do not currently maintain product liability insurance, which puts us at a greater risk of harm to our business operations should we receive a monetary judgment against us in relation to a product liability lawsuit. We intend on obtaining product liability insurance in the future. However, even with product liability insurance, we would not be covered against all types of claims, particularly claims other than those involving personal injury or property damage or claims that exceed the amount of insurance coverage. Further, we may not be able to maintain such insurance in sufficient amounts, on desirable terms, or at all, in the future. In addition to the risk of monetary judgments not covered by insurance, product liability claims could result in negative publicity that could harm our products' reputation and in certain cases require a product recall. Product recalls or product liability claims, and any subsequent remedial actions, could have a material adverse effect on our business, reputation, brand value, results of operations and financial condition.

Our failure to comply with regulations could lead to investigations or actions by government regulators and negative publicity.

The labeling, distribution, importation, marketing and sale of our products are subject to, in certain instances, regulation by various federal agencies, including the Federal Trade Commission, Consumer Product Safety Commission, the Food and Drug Administration (“FDA”) and state attorneys general in the United States, as well as by various other federal, state, provincial, local and international regulatory authorities in the locations in which our products are distributed or sold. FDA approval is not required for the Company’s external cosmetics products. The law does not require cosmetic products and ingredients, except for color additives to be approved by FDA before they go on the market. The Company does not use color additives. Certain of the Company’s products are meant to be ingested – and for those products, the Company has sought and received FDA approval. Nonetheless, if we fail to comply with the FDA’s regulations (or any of the other regulations listed above), we could become subject to significant penalties or claims or be required to recall products, which could negatively impact our results of operations and disrupt our ability to conduct our business, as well as damage our brand image with consumers. In addition, the adoption of new regulations or changes in the interpretation of existing regulations may result in significant unanticipated compliance costs or discontinuation of product sales and may impair the marketing of our products, resulting in significant loss of net revenues.

Security breaches and other disruptions could compromise our information and expose us to liability, which would cause our business and reputation to suffer.

In the ordinary course of our business, we collect and store sensitive data, including intellectual property, our proprietary business information, and financial and other personally identifiable information of our customers and employees. The secure processing, maintenance, and transmission of this information is critical to our operations and business strategy. Despite our security measures, our information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, or other disruptions. Any such breach could compromise our networks and the information stored there could be accessed, publicly disclosed, lost, or stolen. Advanced attacks are multi-staged, unfold over time, and utilize a range of attack vectors with military-grade cyber weapons and proven techniques, such as spear phishing and social engineering, leaving organizations and users at high risk of being compromised. The vast majority of data breaches, whether conducted by a cyber attacker from inside or outside of the organization, involve the misappropriation of digital identities and user credentials. These credentials are used to gain legitimate access to sensitive systems and high-value personal and corporate data. Many large, well-known organizations have been subject to cyber-attacks that exploited the identity vector, demonstrating that even organizations with significant resources and security expertise have challenges securing their identities. Any such access, disclosure, or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, regulatory penalties, a disruption of our operations, damage to our reputation, or a loss of confidence in our business, any of which could adversely affect our business, revenues, and competitive position.

Organizations face growing regulatory and compliance requirements.

New and evolving regulations and compliance standards for cyber security, data protection, privacy, and internal IT controls are often created in response to the tide of cyber-attacks and will increasingly impact organizations. Existing regulatory standards require that organizations implement internal controls for user access to applications and data. In addition, data breaches are driving a new wave of regulation with stricter enforcement and higher penalties. Regulatory and policy-driven obligations require expensive and time-consuming compliance measures. The fear of non-compliance, failed audits, and material findings has pushed organizations to spend more to ensure they are in compliance, often resulting in costly, one-off implementations to mitigate potential fines or reputational damage. Any substantial costs associated with failing to meet regulatory requirements, combined with the risk of fallout from security breaches, could have a material adverse effect on our business and brand.

Our business is subject to seasonality.

Christmas season is the time of year we tend to see our most sales. As such, our sales, financial performance, working capital requirements and cash flow may experience volatility during at this time.

We rely on third party manufacturers to produce our products.

We use third party manufacturers to make our products. In many cases, third party manufacturers are not obligated under contracts that fix the term of their commitments, and they may discontinue production upon little or no advance notice. Manufacturers also may experience problems with product quality or timeliness of product delivery. The loss of a contract manufacturer may force us to shift production to other providers, and possibly cause manufacturing delays, disrupt our ability to fill orders or require us to suspend production until we find another third party manufacturer. We are not able to control the manufacturing efforts of these third party manufacturers as closely as we control our business. Should any of these manufacturers fail to meet our standards, we may face regulatory sanctions, additional product liability claims or customer complaints, which could harm our reputation and our business.

A disruption in our supply chain could adversely affect our business.

We rely on third-party suppliers for the raw materials needed to produce our products. Some of our products rely on a single or a limited number of suppliers. Changes in the financial or business condition of our suppliers could subject us to losses or adversely affect our ability to bring products to market. Further, the failure of our suppliers to deliver goods and services in sufficient quantities, in compliance with applicable standards, and in a timely manner could adversely affect our customer service levels and overall business. In addition, any increases in the costs of goods and services for our business may adversely affect our profit margins if we are unable to pass along any higher costs in the form of price increases or otherwise achieve cost efficiencies in our operations.

Our results of operations could be materially harmed if we are unable to accurately forecast demand for our products.

To ensure adequate inventory supply, we forecast inventory needs and estimate future demand for particular products on our behalf. Our ability to accurately forecast demand for our products could be affected by many factors, including an increase or decrease in demand for our products or for products of our competitors, our failure to accurately forecast acceptance of new products, product introductions by competitors, unanticipated changes in general market conditions, and weakening of economic conditions or consumer confidence in future economic conditions. Inventory levels in excess of customer demand may result in inventory write-downs or write-offs and the sale of excess inventory at discounted prices or in less preferred distribution channels, which could impair our brand image and have an adverse effect on gross margin, which ultimately impacts our revenues. In addition, if we underestimate the demand for our products, our manufacturers may not be able to produce products to meet our customer requirements, and this could result in delays in the shipment of our products and our ability to recognize revenue, lost sales, as well as damage to our reputation and distributor relationships.

This investment is illiquid.

There is no currently established market for reselling these securities. If you decide that you want to resell these securities in the future, you may not be able to find a buyer. Although the Company intends to apply in the future for quotation of its Common Stock on an over-the-counter market, or similar, exchange, there are a number of requirements that the Company may or may not be able to satisfy in a timely manner. Even if we obtain that quotation, we do not know the extent to which investor interest will lead to the development and maintenance of a liquid trading market. You should assume that you may not be able to liquidate your investment for some time, or be able to pledge these shares as collateral.

The company is controlled by its founder.

The Company is currently wholly-owned by Oliveda International, Inc., of which Thomas Lommel, our CEO, is the majority stockholder. As such, Mr. Lommel has significant control over the Company and its board of directors for stockholder actions. At the conclusion of this Offering, Oliveda International, Inc. will continue to hold a significant portion of the company’s voting rights. Therefore, investors in this Offering will not have the ability to impact elections of directors or matters presented to a vote of stockholders. See “Securities Being Offered.”

The subscription agreement has a forum selection provision that requires disputes be resolved in state or federal courts in the State of California, regardless of convenience or cost to you, the investor.

In order to invest in this Offering, investors agree to resolve disputes arising under the subscription agreement in state or federal courts located in the State of California for the purpose of any suit, action or other proceeding arising out of or based upon the agreement. Section 22 of the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability created by the Securities Act or the rules and regulations thereunder. We believe that the exclusive forum provision applies to claims arising under the Securities Act, but there is uncertainty as to whether a court would enforce such a provision in this context. Section 27 of the Exchange Act creates exclusive federal jurisdiction over all suits brought to enforce any duty or liability created by the Exchange Act or the rules and regulations thereunder. As a result, the exclusive forum provision will not apply to suits brought to enforce any duty or liability created by the Exchange Act or any other claim for which the federal courts have exclusive jurisdiction. You will not be deemed to have waived the Company’s compliance with the federal securities laws and the rules and regulations thereunder. This forum selection provision may limit your ability to obtain a favorable judicial forum for disputes with us. Although we believe the provision benefits us by providing increased consistency in the application of California law in the types of lawsuits to which it applies and in limiting our litigation costs, to the extent it is enforceable, the forum selection provision may limit investors’ ability to bring claims in judicial forums that they find favorable to such disputes, may increase investors’ costs of bringing suit and may discourage lawsuits with respect to such claims. Alternatively, if a court were to find the provision inapplicable to, or unenforceable in an action, we may incur additional costs associated with resolving such matters in other jurisdictions, which could adversely affect our business, financial condition or results of operations.