Palantir Technologies, Inc.

| |

| Type | Public company |

|---|---|

| |

| Industry | Software |

| Founded | 2003 |

| Founders |

|

| Headquarters | Denver, Colorado, U.S. |

Key people |

|

| Products |

|

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | |

| Website |

|

| Footnotes / references [1][2] | |

Palantir Technologies, Inc. is a public American software company that specialises in big data analytics. It offers two primary software platforms: Palantir Gotham and Palantir Foundry. These platforms serve both government and commercial customers, aiding them in solving complex data analysis problems.

As of Q2 2023, the company displays consistent revenue growth, attributed to its growing customer base and the successful implementation and acceptance of its software platforms. This growth is seen in both the government sector and within commercial industries such as healthcare, energy, and finance.

However, Palantir's financial performance raises some concerns. Despite the company's growth in revenue, it continues to report net losses as it emphasises on expansion and market penetration. This strategy may yield benefits in the long run but contributes to financial uncertainty in the short term. Further, the risk associated with revenue concentration, particularly from government contracts, remains a significant factor.

Palantir's growth prospects stem from its unique value proposition and strategic partnerships. The company's growth strategy includes plans for deeper penetration into the commercial sector and geographic diversification, which could potentially mitigate the risk associated with revenue concentration.

Still, prospective investors must carefully consider the company's current valuation, future profitability, and inherent risks before investing. While Palantir exhibits a solid growth trajectory, the current stock price might already reflect high growth expectations.

Company Overview edit edit source

Background edit edit source

What does the Company do?

Palantir Technologies assists the world’s most important institutions in analysing large volumes of data to solve the most important real-world problems. Their applications are human driven and are described as ‘intelligence augmentation’, rather than artificial intelligence. Customers using their systems do not to be masters of machine learning and engineers from Palantir directly assist in the use of their systems.

Where did the Idea of the Company Come From?

The initial idea of the company came from the co-founder of Paypal, Peter-Thiel, who saw an opportunity to use Paypal’s fraud recognition systems to reduce terrorism. He felt that the available technology at the time (2004) was inadequate to solve real world problems and was also putting people’s data at risk.

What is the Companies Mission?

Palantir believes in augmenting human intelligence, not replacing it. They believe that machines are best used as a tool for human analysts rather than as their replacements.

What does Palantir Mean?

The name of the company comes from the ‘Palantiri’ seeing stones from ‘Lord of the Rings’, which were able to see events happening around the world.

Products edit edit source

Palantir has a variety of software solutions on offer with total of 367 customers from large institutions and world governments.[3]

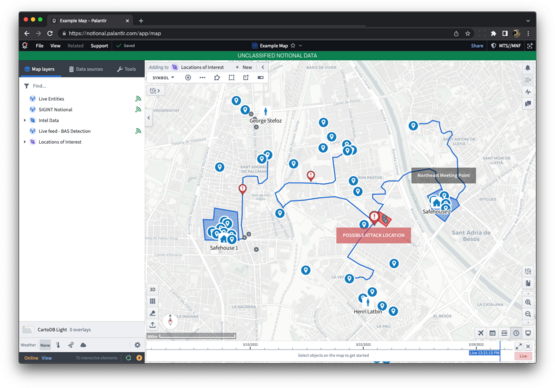

Palantir Gotham edit edit source

The flagship government product of Palantir. It is the result of the work between Palantir and the United States Intelligence community. This includes but is not limited to the central intelligence agency (CIA), the federal bureau of investigation (FBI), army intelligence and the national security agency (NSA) constituting a total of 16 American departments and military branches.[4] It uses a machine learning AI operating system to find hidden meaning within large datasets and predictively policing.[5] It also facilitates the hand-off between analysts and operations users (like confidential informants).[3] Little else is known about this work due to its secretive nature.

Gotham is also offered to Commercial clients, including those in the financial services industry to detect fraud.[3]

Palantir Metropolis edit edit source

The main commercial product of Palantir. Palantir metropolis is designed to help financial institutions make sense of large amounts of data and extract valuable insights from it. It includes a range of tools and features that allow users to explore and analyse data, create visualisations, and build custom applications and workflows.[6] It does this by making use of a machine learning algorithm.[7]

However, Palantir Metropolis received controversy after it was revealed that JP Morgan had used it to spy on its own employees (to identify disgruntled employees) using data gathered from company-owned devices. This data included emails, search histories and GPS data. [7]

Nowadays it has been rebranded and semi-merged with the Palantir Foundry product.[8]

Palantir Foundry

This product was produced for the explicit purpose to analyse the operations of the UK NHS vaccination program.[9] It garnered considerable controversy due to Palantir's previous work with the US intelligence and hence extensive military ties.[10] This is the favoured software for commercial use due to its use of a graphical interface.[3]

Nowadays it has been rebranded and semi-merged with the Palantir Metropolis product to form the flagship commercial product of Palantir.

Palantir Apollo

This product is the main DevOps support product of Palantir. It is a continuous delivery system.[11] Its main function is to manage the deploying of the Gotham and Foundry products by allowing the linking of multiple public and private cloud networks, (hence allowing the bundling of the Gotham and Foundry Products).[12]

This allows Palantir Apollo to be sold as a software as a service (SaaS) product (subscription service similar to Netflix) and reduces the need for the company to act as consultants to its clients.

AIP (Artificial Intelligence Platform)

This is the newest product of Palantir aiming to integrate large language models (LLMs) like ChatGPT into its privately operated networks (of its clients).[13] However, after the company successfully demonstrated its us in war, where a military operator was able to deploy operations and receive responses via an AI chatbot, the CEO has said that AI poses serious potential risk and that human oversight must be required.[14]

Other

Palantir has also entered joint ventures with First Data to extract trends from customer transactions.[14]

Team edit edit source

Executive management edit edit source

Alexander Karp, Co-Founder, Chief Executive Officer, and Director edit edit source

Mr. Karp is one of our co-founders and has served in various positions with us since co-founding Palantir, most recently as our Chief Executive Officer, and has served as a member of our Board of Directors since 2003. Mr. Karp holds a B.A. from Haverford College, a J.D. from Stanford University, and a Ph.D. from Goethe University in Frankfurt, Germany.[15]

David Glazer, Chief Financial Officer and Treasurer edit edit source

Mr. Glazer has served in various positions with us since 2013, most recently as our Chief Financial Officer and Treasurer. Mr. Glazer holds a B.A. in History from Santa Clara University and a J.D. from Emory University School of Law.[15]

Stephen Cohen, Co-Founder, President, Secretary, and Director edit edit source

Mr. Cohen is one of our co-founders and has served in various positions with us since co-founding Palantir, most recently as our President and Secretary, and as a member of our Board of Directors since 2005. Mr. Cohen holds a B.S. in Computer Science from Stanford University.[15]

Shyam Sankar, Chief Technology Officer and Executive Vice President edit edit source

Mr. Sankar has served in various positions with us since 2006, most recently as our Chief Technology Officer and Executive Vice President. Mr. Sankar holds a B.S. in Electrical and Computer Engineering from Cornell University and a M.S. in Management Science and Engineering from Stanford University.[15]

Board of Directors edit edit source

Alexander Karp

Mr. Karp is one of our co-founders and has served in various positions with us since co-founding Palantir, most recently as our Chief Executive Officer, and has served as a member of our Board of Directors since 2003. Mr. Karp holds a B.A. from Haverford College, a J.D. from Stanford Law School, and a Ph.D. from Goethe University in Frankfurt, Germany.[15]

Alexander Moore

Mr. Moore has served as a member of our Board of Directors since July 2020. Mr. Moore initially joined us in February 2005 as one of the founding employees and served as our director of operations until March 2010. In February 2013, Mr. Moore co-founded NodePrime, a cloud automation company, where he served as Chief Operating Officer until its acquisition by Ericsson in April 2016. In May 2017, he joined 8VC, a venture capital fund, where he currently serves as partner. Mr. Moore holds a B.A. in Economics from Stanford University.[15]

Alexandra Schiff

Ms. Schiff has served as a member of our Board of Directors since July 2020. Ms. Schiff worked as a reporter for The Wall Street Journal from June 2004 to March 2005 and April 2013 to June 2020. From 2006 to 2009, she served as a staff writer and then contributing editor at Condé Nast Portfolio, a magazine that was formerly part of Condé Nast, a global media company. She has written for publications including The New York Times, Vanity Fair, and Bloomberg Businessweek. She is currently working on her second book for Simon & Schuster. Ms. Schiff holds a B.A. in English from Duke University.[15]

Peter Thiel

Mr. Thiel is one of our co-founders and has served as the Chairman of our Board of Directors since 2003. He has served as president of Thiel Capital, an investment firm, since 2011 and as a partner of Founders Fund, a venture capital firm, since 2005. In 1998, Mr. Thiel co-founded PayPal, Inc., an online payment company, where he served as Chief Executive Officer, President, and Chairman of its Board of Directors from 2000 until its acquisition by eBay in 2002. Mr. Thiel has served on the board of directors of AbCellera Biologics Inc., a biotechnology company, since 2020, and previously served on the board of directors of Meta Platforms, Inc., a technology company, from 2005 to 2022. Mr. Thiel holds a B.A. in Philosophy from Stanford University and a J.D. from Stanford Law School.[15]

Lauren Friedman Stat

Ms. Stat has served as a member of our Board of Directors since January 2021. Ms. Stat brings a wide range of business and leadership experience, including 15 years of experience at Accenture, from October 2005 to January 2021, where she served as a senior advisor to Fortune 100 companies, helping her clients develop new strategies, optimize operations, and manage large-scale change. During her tenure at Accenture, she developed deep healthcare expertise and held multiple roles, including leadership of sales pursuits, management of global operations, and responsibility for the growth and profitability of a segment of business.

Ms. Stat has served on the board of directors of The Lorelton, a non-profit retirement and assisted living facility since December 2021 and Tree3, a startup empowering influencers to curate a storefront from millions of products across stores and allow their followers to purchase from a single shopping cart since January 2022, and has served as Chairwoman of the board of directors of Valkyrie, a company that builds AI solutions since September 2022. Ms. Stat served as an Executive in Residence for Notley, a social impact community and venture organization, from June 2021 to June 2022, and has served as Fractional Chief Administration Officer and Advisor at Friendly Force, a satellite communications technology company, since December 2021, and Managing Member and Chief Executive Officer of Figa Jewelry since July 2022. She holds a B.S. in Science, Technology, and Society with a dual concentration in Math and Chemistry from Stanford University.[15]

Eric Woersching

Mr. Woersching has served as a member of our Board of Directors since June 2022. Mr. Woersching currently serves as a private consultant for early stage software companies, where he focuses on corporate strategy, FP&A, analytics, operations and executive recruiting. From 2020 to 2022, Mr. Woersching served as the Vice President of Revenue Operations at EasyPost, where he was responsible for analytics, operations and corporate strategy, and Senior Advisor to the CEO, where he focused on corporate development, M&A and fundraising. From 2017 to 2019, Mr. Woersching was a general partner at Initialized Capital, a venture capital firm, where he served on the board of directors of several private technology companies. He holds both a B.S. and M.S. in Electrical Engineering from Stanford University and is a Chartered Financial Analyst.[15]

Market edit edit source

Total Addressable Market edit edit source

Here, the total addressable market (TAM) is defined as the global Government software market and the global big data analytics market, and based on a number of assumptions, it is estimated that the size of the market as of 2023, in terms of revenue, is $325.525 billion USD.[16][17]

Serviceable Available Market edit edit source

Here, the serviceable available market (SAM) is defined as the software market for US allies (due to the secretive nature of the projects) and the US and UK big data analytics market, and based on a number of assumptions, it is estimated that the size of the market as of 2023, in terms of revenue, is $83.507 billion USD.

Serviceable Obtainable Market edit edit source

Here, the serviceable obtainable market (SOM) is defined as the US software defence market and US data analytics markets and based on a number of assumptions, it is estimated that the size of the market as of 2023, in terms of revenue, is $10 billion USD.

Competition edit edit source

Due to the nature of data analytics, a fast-paced, fast-growth market, shaped by constant changes within AI and machine learning technology, Palantir has been facing intense competition from both large software producers seeking to expand into data processing, well-established competitors and from startups innovating and developing new software. Although Palantir has established itself well within the market, its high costs, dependence upon large institutions and public controversy and criticism[18] may threaten its position long term.

Main Competitors: edit edit source

1. Cognizant edit edit source

Information technology and consulting company. Founded in 1994, 2021 recorded revenue of 18.5 billion[19].

Competitor within big data analytics solutions, providing IT consulting and outsourcing of business processes from healthcare to banking companies. It provides companies with data analytics, using machine learning and AI to process data and offer solutions, similar to Palantir’s Gotham platform.

2. Alteryx edit edit source

Data Science and Analytics company. Founded in 1997, 2022 recorded revenue of 855.4 million[20].

Alteryx Intelligence Suite product analyses complex data, generating simple structured reports to generate insights and make predictions. Intelligence Suite is a direct competitor of Palantir’s Foundry product. Alteryx Intelligence Suite although is more focused on specific industries, which gives it an edge in those in comparison to Palantir’s general-purpose data platform.

4. Splunk edit edit source

Monitoring, analyzing and visualizing machine-generated data. Founded 2003, 2022 recorded revenue of 1.25 billion[21].

Splunk offers Security Information and Event Management tools. It has specialised in machine-generated data, in comparison to Palantir that is able to process all types of data. Splunk analyses and monitors information and operational events within a company, increasing security and making troubleshooting and problem solving easier.

5. IBM Watson Studio edit edit source

IBM, a leading software developer, has developed IBM Watson Studio, which offers data preparation solutions. IBM was founded in 1911, generating a revenue of 60.53 billion in the year of 2022[22].

One of the top competitors of Palantir Foundry, offering AI adoption for business, streamlining workflows by offering the development, training and management of AI and machine learning models, which are then able to analyse, visualise, clean and organise companies data, to help solve business problems and achieve analytics goals.

6. Datadog edit edit source

Datadog is a cloud-native company that focuses on analyzing machine data. The firm's product portfolio, delivered as software-as-a-service, allows a client to monitor and analyze its entire IT infrastructure. Datadog's platform can ingest and analyze large amounts of machine-generated data in real time, allowing clients to utilize it for a variety of different applications throughout their businesses.

Their last recorded revenue was $1.65 billion, growing 63% year-on-year.

Financials edit edit source

Historic Financials[23] edit edit source

| Year | 1 | 2 | 3 | 4 | 5 |

|---|---|---|---|---|---|

| Year End Date | 31/12/2018 | 31/12/2019 | 31/12/2020 | 31/12/2021 | 31/12/2022 |

| Income Statement | |||||

| Revenues

($'million) |

595 | 743 | 1,093 | 1,542 | 1,906 |

| Net profits

($'million) |

-598 | -588 | -1,166 | -520 | -374 |

| Balance Sheet | |||||

| Total Current Assets ($'million) | 1,220 | 1,214 | 2,257 | 2,863 | 3,042 |

| Total Assets

($'million) |

1,431 | 1,594 | 2,471 | 3,247 | 3,461 |

| Total Current Liabilities ($'million) | 532 | 729 | 604 | 660 | 588 |

| Total Liabilities ($'million) | 923 | 1,447 | 1,168 | 956 | 819 |

| Total Equity ($'million) | 508 | 146 | 1,523 | 2,291 | 2,565 |

| Total Liabilities and Equity ($'million) | 1,431 | 1,594 | 2,691 | 3,247 | 3,461 |

| Total Debt ($'million) | 0 | 396 | 457 | 260 | 249 |

Financial Forecasts

| Year | 6 | 7 | 8 |

|---|---|---|---|

| Year End Date | 31/12/2023 | 31/12/2024 | 31/12/2025 |

| Income Statement | |||

| Revenues

($'million) |

2,210 | 2,620 | 3,150 |

| Net profits

($'million) |

115 | 211 | 403 |

| Balance Sheet | |||

| Total Assets

($'million) |

4,173 | 5,221 | 6,576 |

Key Inputs edit edit source

| Description | Value | Commentary |

|---|---|---|

| What’s the estimated current size of the total addressable market? | $325,525,000,000[17][16] | Here, the total addressable market (TAM) is defined as the global Government software market and the global big data analytics market. |

| What growth stage is the company in? | Maturity | A company goes through four/ five stages of growth. To determine the stage of growth a company is currently in, we examined Palantir's cash flow, revenue and growth patterns. After analysis, we determined Palantir to be in its maturity stage of growth. |

| What is the estimated company lifespan? | 50 years | Although Palantir is not considered a large organisation (>10,000 employees), only having 3,838 employees, considering its revenue of $1,906 billion, we will assume it to be a large corporation, which research has shown to have an average lifespan of around 50 years.[24] |

| Estimated annual growth of the big data analytics market. (CAGR) | 13.5% | The big data analytics market is expected to grow annually with an averaged CAGR of 13.5% within the forecast period of 2023 to 2030.[25] |

| Which distribution function do you want to use to estimate company revenue? | Gaussian | Research has suggested that the revenue pattern of companies is similar to the pattern produced by the gaussian distribution. |

Sustainability and ESG Outlook edit edit source

CO2 Emissions edit edit source

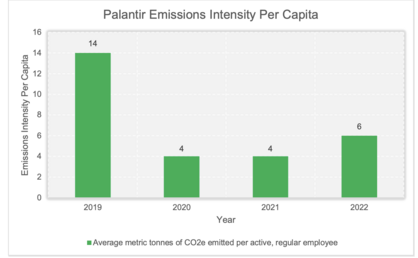

Palantir achieved carbon neutrality across its global operations in 2022, continuing to fulfill the commitments outlined in its 2021 Climate Pledge. In areas where the company could not reduce its emissions, it accounted for the balance of emissions through the purchase and retirement of credible, verifiable carbon removal credits and purchase of sustainable aviation fuel.

Palantir’s 2022 top-line emissions tabulations increased relative to 2021, as can be expected for many corporations returning to work and business travel following the lifting of pandemic restrictions. However, an analysis of emissions intensity per capita shows a reduction of nearly 57% per employee in 2022 compared to the baseline year of 2019. This is a significant sustainability advancement for 2022, as Palantir grew its global headcount by 31% relative to 2021. [26]

ESG edit edit source

According to the Sustainalytics Comprehensive Framework ESG Risk ratings, Palantir Technologies has a risk rating of 23.1 thereby categorising the company under the “Medium Risk” category. [27]

Note: Sustainalytics classifies a company as a part of its comprehensive universe or core universe primarily by its market capitalisation as well as its inclusion in major global and regional indexes. Sustainalytics' Core Framework covers 20-30 management indicators, whereas its Comprehensive Framework covers over 70 management indicators. [27]

Environmental edit edit source

In terms of Energy, Transition, Resource Efficiency & Circularity , Palantir technologies has a leading position and emits 20.44% less greenhouse gas emissions than the rest of the industry. [28]

Social edit edit source

- The UK NHS used Foundry to build data dashboards that gave local and national leadership the true picture of infection spread and critical care capacity. At the end of 2020, the NHS used Foundry to unite vaccination events, supply chain, allocation, and performance KPIs to deliver England’s fast, efficient, and equitable national COVID-19 vaccination programme. Impact: Over 770,000 vaccines were administered in a single day. [29]

- The World Food Programme (WFP) operates one of the most complex, consequential supply chains on Earth — deploying thousands of trucks, aircraft, and ships to deliver life-saving assistance to over 100 million people each year.Since 2019, WFP has partnered with Palantir to integrate many existing systems into a collaborative, operational platform called DOTS, enabling staff to rapidly surface the information they need, anticipate bottlenecks in advance, and identify alternative paths to continue delivering. [30]

Governance edit edit source

With regards to ethics and compliance, Palantir’s code of conduct adequately addresses corruption and bribery. The company has 2 female directors , which equals the industry average. The CEO to Employee pay ratio is 27:1 , which is 75.69% below than the industry average. [28]

Valuation edit edit source

Following a DCF valuation with a WACC of 10.5%, we found that the expected return of an investment in the company over the next five years is 55%. In other words, an £1,000 investment in the company is expected to return £1,550 in five years time.

Assuming that a suitable return level over five years is 10% per year and Palantir achieves its expected return level, then an investment in the company is considered to be a 'suitable' one.

Risks edit edit source

edit edit source

- The company has a history of losses ; operating expenses are estimated to increase further and the company may not be able to maintain profitability in the future.[31]

- Sale efforts involve considerable time and expenses , sales cycles are long and often unpredictable[31]

- Historically, existing customers have expanded their relationships with Palantir, which has resulted in a limited number of customers accounting for a substantial portion of its revenue. If existing customers do not make subsequent purchases or renew their contracts, or if relationships with the largest customers are impaired or terminated, Palantir's revenue could decline, and the results of operations would be adversely impacted.[31]

- Results of operations and key business measures are likely to fluctuate significantly on a quarterly basis in future periods and may not fully reflect the underlying performance of the business, which makes future results difficult to predict and could cause results of operations to fall below expectations.[31]

- Seasonality may cause fluctuations in results of operations and financial position[31]

- Palantir's platforms are complex and may have a lengthy implementation process, and any failure of platforms to satisfy its customers or perform as desired could harm business, results of operations, and financial condition.[31]

- New and existing platforms and changes to existing platforms could fail to attain sufficient market acceptance for many reasons, including:

- Failure to predict market demand accurately in terms of product functionality and to supply offerings that meet this demand in a timely fashion;

- Product defects, errors, or failures or inability to satisfy customer service level requirements;

- Negative publicity or negative private statements about the security, performance, or effectiveness of platforms or product enhancements;

- Delays in releasing to the market our new offerings or enhancements to existing offerings, including new product modules;

- Introduction or anticipated introduction of competing platforms or functionalities by competitors;[31]

- The competitive position of Palantir's platforms depends in part on its ability to operate with third-party products and services, and if its not successful in maintaining and expanding the compatibility of platforms with such third-party products and services, its business, financial condition, and results of operations could be adversely impacted.[31]

- If Palantir is unable to hire, retain, train, and motivate qualified personnel and senior management, including Alexander Karp, one of its founders and Chief Executive Officer, and deploy personnel and resources to meet customer demand around the world, business could suffer.[31]

- Reputation and business may be harmed by news or social media coverage of Palantir, including but not limited to coverage that presents, or relies on, inaccurate, misleading, incomplete, or otherwise damaging information.[31]

- Pricing structures for Palantir's platforms and services change from time to time, which could adversely impact the business, financial condition, and results of operations[31]

- If customers are not able or willing to accept Palantir's product-based business model, instead of a labour-based business model, business and results of operations could be negatively impacted.[31]

- Palantir does not work with the Chinese communist party and have chosen not to host its platforms in China, which may limit its growth prospects.[31]

- In the future, Palantir may not be able to secure the financing necessary to operate and grow business as planned, or to make acquisitions.[31]

Risks to the Class A Common Stock edit edit source

- Trading price of Class A common stock is likely to be volatile and may decline, regardless of the company’s operating performance. Factors that could affect the stock price include:

- price and volume fluctuations in the overall stock market from time to time;

- volatility in the trading prices and trading volumes of technology stocks;

- changes in operating performance and stock market valuations of other technology companies generally, or those in industry in particular;

- sales or expected sales of shares of Class A common stock by us or company’s stockholders;

- short-selling of Class A common stock or related derivative securities;

- Changes to the management

- General macroeconomic volatilities[31]

- Although Palantir currently is not considered to be a “controlled company” under the New York Stock Exchange (“NYSE”) corporate governance rules, it may in the future become a controlled company due to the concentration of voting power among its Founders and their affiliates.[31]

- The company is not inclined to pay cash dividends in the foreseeable future; intends to retain future earnings for the purpose of expansions.[31]

- The multiple class structure of common stock has the effect of concentrating voting power with certain stockholders, in particular, Founders and their affiliates, which will effectively eliminate investor’s ability to influence the outcome of important transactions, including a change in control. The Founder Voting Trust Agreement and the Founder Voting Agreement have a similar effect.[31]

- In certain circumstances in the future, the Founders and their affiliates could have voting power that exceeds 49.999999% of the Voting Power.[31]

edit edit source

- A significant portion of Palantir’s business depends on sales to the public sector, and failure to receive and maintain government contracts or changes in the contracting or fiscal policies of the public sector has adversely affected and could continue to adversely affect business, results of operations, financial condition, and growth prospects.[31]

- The company derives a portion of its revenue from programs with governments and government agencies that are subject to security restrictions (ex: contracts involving classified information, classified contracts, and classified programs), which preclude the dissemination of information and technology that is classified for national security purposes under applicable law and regulation. This may limit investor insight into portions of the company’s business.[31]

- The U.S. government may procure non-commercial developmental services rather than commercial products, which could materially impact our future U.S. government business and revenue.[31]

- Because Palantir generates a substantial portion of its revenue from contracts with governments and government agencies, and in particular from contracts with the U.S. government and government agencies, its results of operations could be adversely affected by government spending caps or changes in government budgetary priorities, as well as by delays in the government budget process, program starts, or the award of contracts or orders under existing contract vehicles, including as a result of a new U.S. administration. Current U.S. government spending levels for defence-related and other programs may not be sustained beyond government fiscal year 2023[31]

edit edit source

- The business is subject to complex and evolving U.S. and non-U.S. laws and regulations regarding privacy, data protection and security, technology protection, and other matters. Many of these laws and regulations are subject to change and uncertain interpretation, and could result in claims, changes to business practices, monetary penalties, increased cost of operations, or otherwise harm to business.[31]

- More generally, some observers have noted the CCPA could mark the beginning of a trend toward more stringent privacy legislation in the United States, as observed with the subsequent adoption of state-level comprehensive consumer privacy legislation, including the following (collectively, the “State Privacy Laws”):

- the Virginia Consumer Data Protection Act, which was enacted in March 2021 and became effective on January 1, 2023;

- the Colorado Privacy Act, which was enacted in June 2021, and will become effective on July 1, 2023;

- the Utah Consumer Privacy Act, which was enacted in March 2022, and will become effective December 31, 2023;

- Connecticut’s Act Concerning Personal Data Privacy and Online Monitoring, which was enacted in May 2022 and most of which will become effective July 1, 2023; and

- Iowa’s Act Relating to Consumer Data Protection, which was enacted in March 2023 and will become effective January 1, 2025.[31]

- Failure to comply with governmental laws and regulations could harm business, and the company has been, and expect to be, the subject of legal and regulatory inquiries, which may result in monetary payments or may otherwise negatively impact our reputation, business, and results of operation.[31]

- Palantir has previously been, and are currently, or in the future may become, involved in a number of legal, regulatory, and administrative inquiries and proceedings, and unfavourable outcomes in litigation or other of these matters could negatively impact business, financial conditions, and results of operations.[31]

- Governmental trade controls, including export and import controls, sanctions, customs requirements, and related regimes, could subject the company to liability or loss of contracting privileges or limit its ability to compete in certain markets.[31]

References and notes edit edit source

- ↑

- ↑ Bursztynsky, Jessica (19 August 2020). "Palantir to relocate headquarters from Silicon Valley to Colorado" (in English). CNBC. Archived from the original on 28 October 2020. Retrieved 5 October 2020.

- ↑ 3.0 3.1 3.2 3.3 https://d18rn0p25nwr6d.cloudfront.net/CIK-0001321655/71a5b9c1-b1b9-485e-a7d6-37c5de23cc45.pdf

- ↑ https://web.archive.org/web/20160302190119/http://www.dni.gov/index.php/intelligence-community/members-of-the-ic

- ↑ https://www.palantir.com/platforms/gotham/

- ↑ https://www.dailypalantir.com/post/palantir-overview-beginners#:~:text=Palantir%20Metropolis%20is%20designed%20to,build%20custom%20applications%20and%20workflows.

- ↑ 7.0 7.1 https://www.bloomberg.com/features/2018-palantir-peter-thiel/

- ↑ https://www.palantir.com/platforms/foundry/

- ↑ https://www.cnbc.com/2021/06/04/campaign-launched-to-get-palantir-out-of-nhs.html

- ↑ https://www.latimes.com/business/la-fi-palantir-sales-ipo-20190107-story.html

- ↑ https://www.palantir.com/platforms/apollo/

- ↑ https://blog.palantir.com/palantir-apollo-powering-saas-where-no-saas-has-gone-before-7be3e565c379

- ↑ https://www.palantir.com/platforms/aip/

- ↑ 14.0 14.1 https://www.wsj.com/articles/first-data-reports-first-quarterly-profit-in-more-than-seven-years-1423602902

- ↑ 15.00 15.01 15.02 15.03 15.04 15.05 15.06 15.07 15.08 15.09 Annual Report

- ↑ 16.0 16.1 https://www.statista.com/statistics/646404/worldwide-government-software-market-revenues/#:~:text=Worldwide%20government%20software%20market%20revenues%202019-2025&text=In%202020%2C%20the%20government%20software,over%20the%20next%20five%20years.

- ↑ 17.0 17.1 https://www.statista.com/statistics/1336002/big-data-analytics-market-size/

- ↑ BBC, by Natalie Sherman, https://www.bbc.com/news/business-54348456

- ↑ https://investors.cognizant.com/news-and-events/news/news-details/2022/COGNIZANT-REPORTS-FOURTH-QUARTER-AND-FULL-YEAR-2021-RESULTS/default.aspx

- ↑ https://investor.alteryx.com/news-and-events/press-releases/press-release-details/2023/Alteryx-Announces-Fourth-Quarter-and-Full-Year-2022-Financial-Results/default.aspx

- ↑ https://investors.splunk.com/news-releases/news-release-details/splunk-announces-fiscal-fourth-quarter-and-full-year-2023

- ↑ https://www.ibm.com/annualreport/

- ↑ https://investors.palantir.com/financials/sec-filings

- ↑ Stadler, Enduring Success, 3–5.

- ↑ https://www.fortunebusinessinsights.com/big-data-analytics-market-106179#:~:text=KEY%20MARKET%20INSIGHTS&text=The%20global%20big%20data%20analytics,13.5%25%20during%20the%20forecast%20period.

- ↑ https://www.palantir.com/assets/xrfr7uokpv1b/3ixc4SNiJKDBfW0SWDVPoC/eca496275ea78f07ff00db48def12f5f/2022_Carbon_Report_-_2023.05.22.pdf

- ↑ 27.0 27.1 https://www.sustainalytics.com/esg-rating/palantir-technologies-inc/2000116302

- ↑ 28.0 28.1 https://www.capitaliq.spglobal.com/web/client?auth=inherit&OPTIN=CIQ#company/sustainabilityOverview?Id=5148548

- ↑ https://www.palantir.com/impact/

- ↑ https://www.palantir.com/impact/world-food-programme/

- ↑ 31.00 31.01 31.02 31.03 31.04 31.05 31.06 31.07 31.08 31.09 31.10 31.11 31.12 31.13 31.14 31.15 31.16 31.17 31.18 31.19 31.20 31.21 31.22 31.23 31.24 31.25 31.26 31.27 https://www.sec.gov/ix?doc=/Archives/edgar/data/1321655/000132165523000011/pltr-20221231.htm#i906e7aef1c274338a29de70844f3334b_61