Pantheon Resources Plc

Pantheon Resources Plc, through its subsidiaries, engages in the exploration and production of oil and gas in the United States. Its primary assets are the Greater Alkaid project that covers 22,804 acres located in Alaska; and the Talitha project covering an area of approximately 44,463 acres. The company was incorporated in 2005 and is headquartered in London, the United Kingdom.

Assuming that Pantheon Resources increases its share of the global oil and gas exploration and production market by cccx to ccc% (from less than ccc%) and other assumptions, the expected return of an investment in the company over the next five years is ccc%, which equates to an annual return of ccc%. In other words, an £1,000 investment in the company is expected to return £ccc in five years time.

The degree of risk associated with an investment in Pantheon Resources is 'medium', with the shares having an adjusted beta that is 45% below the market (0.55 vs. 1).[1]

Accordingly, if your desired annual rate of return is ccc% or less over the next five years and/or one of your goals is to xxx (i.e. you share in the mission of Pantheon Resources), and you are both willing and able to accept the possibility of losing your entire investment amount, then an investment in the company is considered to be a 'suitable' one.

Operations edit edit source

Idea edit edit source

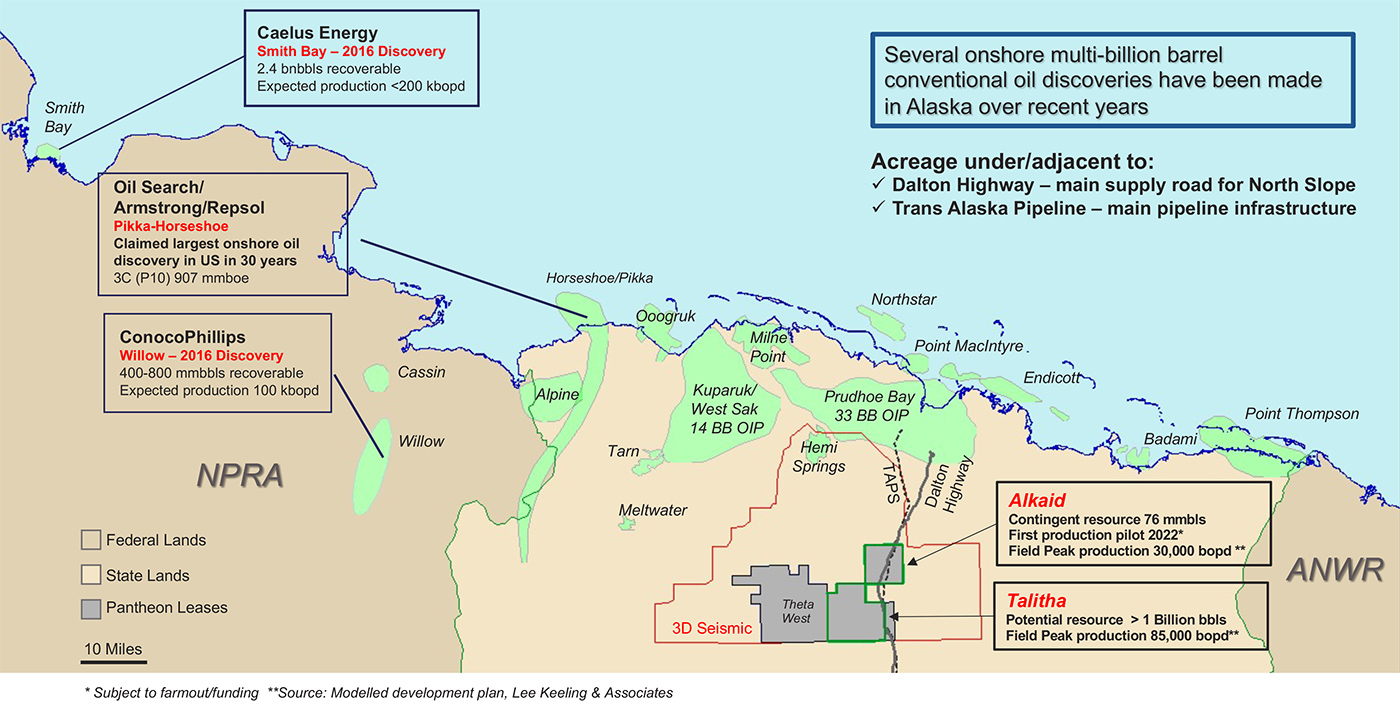

Founded in 2005, Pantheon Resources plc began as a UK-based exploration company targeting onshore USA basins, especially East Texas. However, in 2019, recognising the vast potential of the Alaska North Slope, Pantheon strategically acquired Great Bear Petroleum's assets. This move prompted a shift from East Texas to concentrate solely on Alaska, given its proximity to key Alaskan oil infrastructure and the immense opportunities it presented.

Projects edit edit source

ccc

Greater Alkaid edit edit source

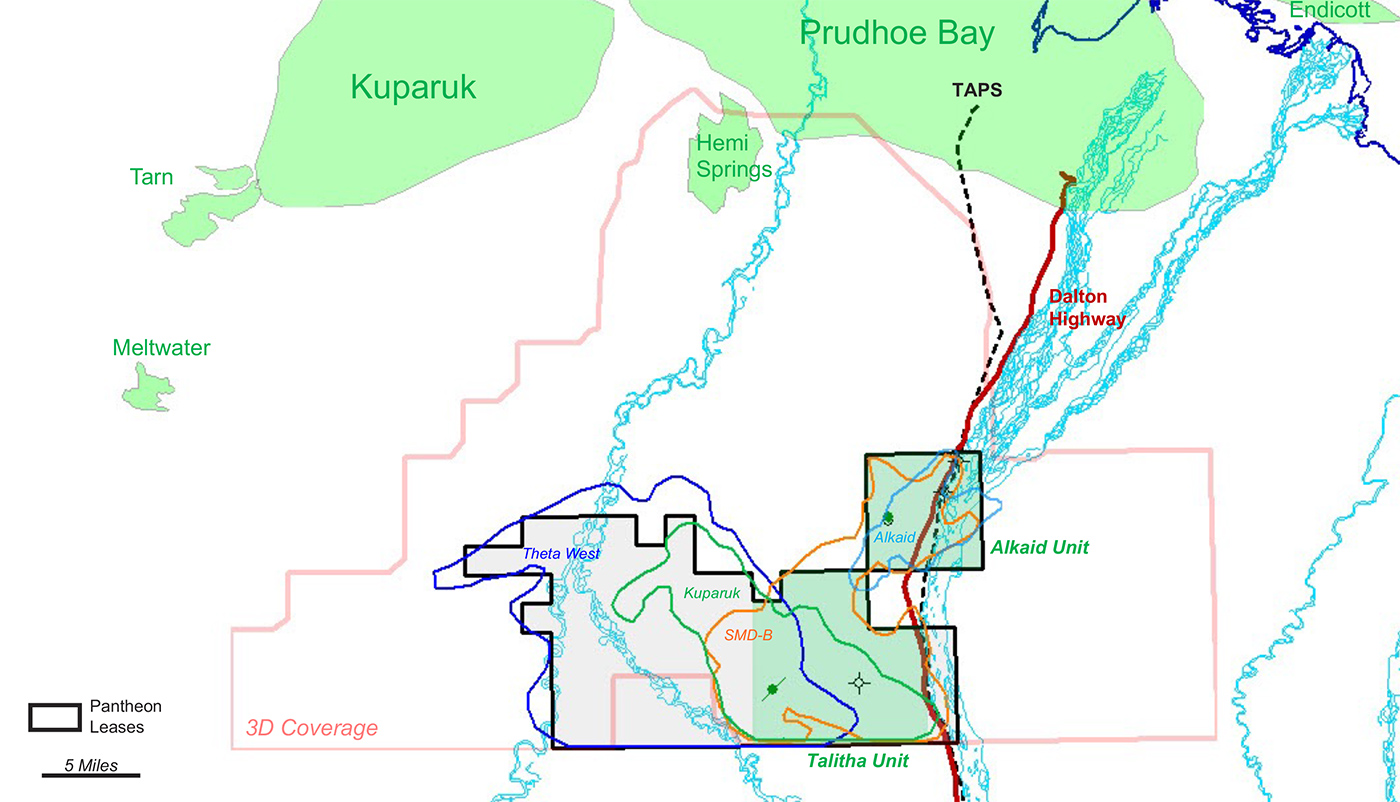

In 2015, the Alkaid #1 well was drilled close to both the Dalton Highway and the Trans Alaska Pipeline System (TAPS) – the main transportation route and significant export pipeline on the Alaska North Slope, respectively.[2] The drilling was halted before reaching its target depth due to environmental concerns: the nearby Sag River flooding led to the closing of the Dalton Highway.[2] While Alkaid was meticulously documented, no production tests were carried out then.[2] The well had shown promising signs, having encountered a 400-foot gross pay without an oil-water contact. Pantheon began activities again in 2019, successfully testing the Primary Zone of Interest.[2] The recent oil discovery at Talitha #A enhanced the potential for oil in the Greater Alkaid structure.[2]

Alkaid #1 Pay Intervals edit edit source

Comprehensive data from Alkaid well revealed a 400-foot gross pay, with 240 feet of net oil pay.[2] Expert consultations confirmed the potential of this project.[2] Notably, only a small fraction of the well’s capacity was accessed during the tests. Pantheon projects that optimally designed horizontal development wells could significantly increase oil production.[2] Advanced seismic imaging indicates even better reservoir potentials in the core.[2] The company envisions using an early production unit (EPU) to facilitate early cash flow and obtain valuable data.[2] A full-fledged Central Processing Unit (CPU) is in the pipeline for optimal resource utilisation.[2] Pantheon is keen to use unconventional oil production technologies, which has become standard across the Alaska North Slope.[2]

In 2020, an independent report on the Greater Alkaid oil accumulation cited 76.5 million barrels of recoverable reserves, valuing the project at $595m (considering a $55/Bbl oil price).[2] The company plans to commission a pilot test producer in 2022, which could provide immediate cash flow.[2] Alkaid’s strategic location offers year-round activity advantages.[2]

Alkaid #1 Highlights edit edit source

Pantheon secured a unit over Alkaid and outlined its proposed activities in a First Plan of Exploration (POE) in November 2020.[2] The plan includes reprocessing 3D seismic data and studying potential 'hot-tap' integrations into the TAPS.[2] Though there are no fixed drilling commitments, the POE proposes drilling two wells near the Dalton Highway for year-round operations.[2] Depending on the Alkaid #2 well results, the Alkaid #3 well will follow.[2]

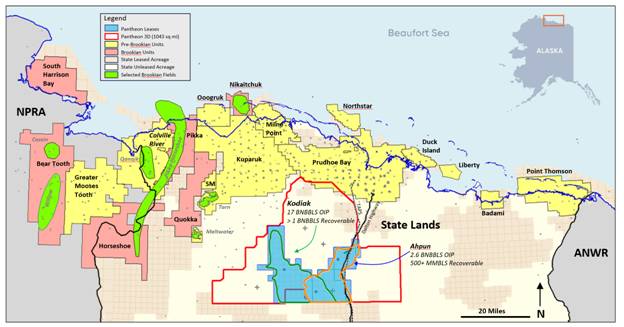

GBP, a significant exploration leaseholder, controls over 250,000 acres, positioned south of North America's major oil fields, Prudhoe Bay and Kuparuk.[2] The region, blanketed by 3D seismic data, hosts several discoveries and promising exploration prospects.[2] Pantheon holds complete interest in all its ventures.[2]

Talitha edit edit source

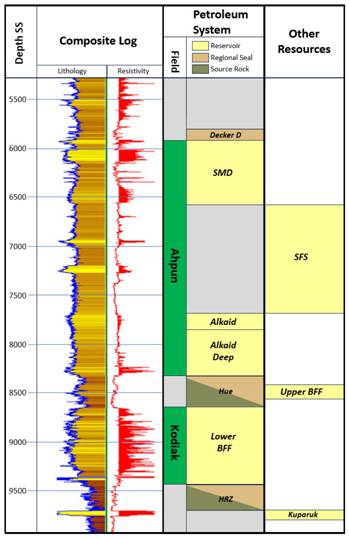

The Talitha #A well, drilled in 2021, appraised an oil accumulation initially discovered by the Pipeline State #1 well in 1988.[3] While the original well in 1988 showed significant oil potential, it was halted due to economic reasons and lack of advanced technology.[3] However, high-resolution 3D seismic data acquired in 2013 reignited interest in the area.[3] The Talitha #A well confirmed oil presence across several zones, and recent tests in 2022 further validated the well's promising prospects.[3]

Key Findings edit edit source

- The Talitha #A well, located eight miles west of the Dalton Highway and TAPS, identified movable light oil across multiple horizons, with over a billion barrels of recoverable oil potential.[3]

- Its proximity to existing infrastructure offers economic advantages, potentially allowing for faster production ramp-up with minimised capital expenditure.[3]

- The well reached a depth of c. 10,456 ft, revealing five potentially productive zones. Challenges arose during testing due to operational issues and inclement weather, but significant findings were still achieved.[3]

Specific Zones and Results edit edit source

- Basin Floor Fan (BFF): Tests indicated quality oil with sustained production rates.[3] Future developments would potentially be at structurally higher positions for better results.[3]

- Slope Fan System (SFS): Testing showed producible oil, with implications for resource and oil recovery estimates. The success here suggests potential for other areas of the North Slope.[3]

- Shelf Margin Deltaic (SMD): Testing faced challenges from blockages and weather, but earlier data and the success of the deeper zones have kept the company's optimism intact for the potential of this zone.[3]

- Kuparuk: As the deepest oil formation, the Kuparuk provided significant findings.[3] It's a regional producer with an adjacent giant oilfield, the Kuparuk Field.[3] The Talitha #A well showed promising signs, although testing encountered issues.[3]

Conclusion edit edit source

The data from Talitha #A has increased confidence in the commercial viability of these zones.[3] Pantheon remains encouraged by the analysis and sees potential for further exploration and drilling.[3] The discovery augments the prospectivity of adjacent potential oil-bearing structures, which will be explored in future programs.[3]

Kodiak edit edit source

The Kodiak project, previously known as Theta West, is a significant appraisal project for Pantheon Resources. The project has garnered attention due to its potential to rival the immense hydrocarbon pore volume plays outside the renowned Prudhoe Bay Oilfield in the Alaska North Slope (ANS). Geologically, the Kodiak field can be likened to the deepwater offshore regions in the Gulf of Mexico, West Africa, and recent discoveries off Guyana's coast.[4]

Independent Expert Report (IER) Findings edit edit source

An Independent Expert Report (IER) by Netherland, Sewell & Associates (NSAI) on the Kodiak project has provided a contingent resource estimate. The 2C (best estimate) for the Kodiak field stands at a staggering 962.5 million barrels of marketable liquids. This comprises both oil and natural gas liquids (NGLs). The NGLs are of significant value as they can be blended with the oil, yielding approximately 90% of the Alaska North Slope (ANS) price per barrel.[4]

| Resource Category | Oil (million bbls) | NGLs (million bbls) | Residual Gas (BCF) | Total Marketable Liquids[5] (million bbls) |

|---|---|---|---|---|

| Low Estimate (1C) | 145.4 | 292.4 | 2,151.7 | 437.8 |

| Best Estimate (2C) | 314.6 | 647.9 | 4,465.2 | 962.5 |

| High Estimate (3C) | 647.8 | 1,366.4 | 8,822.7 | 2,014.2 |

Field Development and Infrastructure edit edit source

The Kodiak project spans an area of 126,000 acres, which includes recently awarded additional acreage. The field is defined by the hydrocarbon bearing horizons contained within the large basin floor fan system. This system stretches from the Hue Shale top seal to the underlying HRZ shale. The field's vastness and potential make it one of the largest basin floor fan systems discovered onshore in recent decades.[4]

Pantheon's proprietary 3D seismic data and three wells (Pipeline State 1, Talitha-A, and Theta West-1) have confirmed the field's potential. The company plans to further develop the Kodiak project, focusing on the recently acquired "chimney acreage" and the delineation provided by the seismic data.[4]

Appraisal and Future Plans edit edit source

Pantheon intends to drill the next Kodiak appraisal well in the recently acquired leases, northwest of Theta West-1. This drilling aims to encounter a reservoir section with improved reservoir characteristics, potentially yielding higher flow rates and hydrocarbon recovery rates. The company's detailed geological model, which takes into account data from nearby producing fields, supports this approach.[4]

To address the contingencies highlighted in NSAI's evaluation, Pantheon plans to cut full cores and acquire a comprehensive suite of wireline logs and fluid samples in future appraisal wells. This granular data could potentially lead to future increases in recoverable resource estimates.[4]

Conclusion edit edit source

The Kodiak project represents a transformative opportunity for Pantheon Resources. With nearly one billion barrels of recoverable liquids, the project's potential is immense. The close proximity to existing infrastructure, combined with the vast resource base, positions Pantheon advantageously for future growth and development. The forthcoming appraisal activities and the company's strategic approach to the Kodiak field further underscore its potential as a world-class project in a prime location.[4]

Strategy edit edit source

Pantheon's primary strategy is to maximize shareholder value through the following means:

- High Working Interest Maintenance: Pantheon retains a 100% working interest through the evaluation process of its assets. This high stake allows the company to have significant control over its projects and potential returns.

- Strategic Drilling and Farm-outs: The company aims to prove up its assets through targeted drilling. Where appropriate, Pantheon may pursue farm-outs, partnering with other entities to share the costs and risks of exploration and development.

- Asset Monetisation: Pantheon's endgame is to monetize its assets, either through a sale or other means, at the opportune moment. This "prove up and sell" approach is designed to offer investors a chance to capitalize on high-impact, risk-managed drilling.

Team edit edit source

Pantheon boasts a seasoned board and a robust advisory group, all of whom are shareholders with established track records in the oil and gas sector. They have a rich history of building profitable companies for acquisition. Additionally, Pantheon's board and management team have extensive experience with oil and gas operations in Alaska.

David Hobbs, Executive Chairman[6] edit edit source

- Experience: Graduated as a Petroleum Engineer from Imperial College in 1984. Worked at British Gas, Monument Oil & Gas, and Hardy Oil and Gas. Former Chief Energy Strategist at Cambridge Energy Research Associates (CERA) and part of the leadership team at King Abdullah Petroleum Studies and Research Center (KAPSARC) in Riyadh, Saudi Arabia.[7]

- Education: Petroleum Engineer from Imperial College.[7]

- Prominent Roles: Drilling engineer at British Gas; commercial and business development roles at Monument Oil & Gas and Hardy Oil and Gas; Chief Energy Strategist at CERA; leadership role at KAPSARC.[7]

- Pantheon Committees: Details to be confirmed.[7]

- Current Directorships: SV-Pleione Limited, Polar Energy LLC.[7]

Jay Cheatham, Chief Executive Officer[8] edit edit source

- Experience: Over five decades encompassing all aspects of the petroleum business.[8]

- Prominent Roles: Senior Vice President and District Manager for ARCO's eastern District; President of ARCO International; President and CEO of Rolls-Royce Power Ventures.[8]

- Specialties: Operational expertise with significant financial acumen; formerly served as CFO for ARCO's Oil & Gas, and CEO of Petrogen Fund.[8]

- Pantheon Committees: Member of the Remuneration and Nominations, Audit, Conflicts, and Anti-Corruption and Bribery Committees.[8]

Justin Hondris, Director of Finance and Corporate Development[8] edit edit source

- Experience: Over 15 years in public company management, specifically in the upstream oil and gas sector.[8]

- Background: Corporate finance, private equity, and capital markets in the UK and internationally; previous private equity involvement.[8]

- Responsibilities: Manages Pantheon's financial, legal, administrative, and corporate development functions.[8]

- Pantheon Committees: Chairs the Anti-Corruption and Bribery Committee. Member of the Remuneration and Nominations and Conflicts Committees.[8]

Robert (Bob) Rosenthal, Technical Director[8] edit edit source

- Experience: Over 40 years globally as an Exploration Geologist and Geophysicist.[8]

- Key Roles: Senior exploration roles at Exxon and BP, gaining expertise in the geology of North Slope of Alaska and Texas.[8]

- Current Engagement: Since 1999, he has operated a successful consulting business, leading exploration initiatives for various private and public entities.[8]

Jeremy Brest, Non-Executive Director[8] edit edit source

- Experience: Over 25 years in investment banking and financial advisory.[8]

- Current & Past Roles: Founder of Framework Capital Solutions, a boutique advisory firm; Former head of structuring for Indonesia at Credit Suisse and a derivatives trader at Goldman Sachs.[8]

- Pantheon Committees: Member of the Audit, Remuneration and Nominations, Conflicts, and Anti-Corruption and Bribery Committees.[8]

Allegra Hosford Scheirer, Independent Non-Executive Director[9] edit edit source

- Experience: Internationally recognised expert in petroleum system analysis with significant experience in basin modelling, organic geochemistry, geophysical techniques, and machine learning. Evaluated numerous oil and gas provinces globally, including the Alaska North Slope.[9]

- Education: Ph.D. in marine geology and geophysics from the Massachusetts Institute of Technology.[9]

- Prominent Roles: Scientist at Stanford University for 15 years; worked with the Energy Resources Program at the U.S. Geological Survey ("USGS"); independent adviser for Great Bear Petroleum.[9]

- Pantheon Committees: Details to be confirmed. Current Directorships: Geomodelling Solutions LLC.[9]

Market edit edit source

Total Addressable Market edit edit source

Here, the total addressable market (TAM) is defined as the global market for oil and gas exploration and production, which includes every potential consumer or business that could use or buy oil and gas, and based on a number of assumptions, it is estimated that the size of the market as of today (3rd September 2023), in terms of revenue, is $5.3 trillion.[10]

Serviceable Available Market edit edit source

Here, the serviceable available market (SAM) is defined as the oil and gas exploration and production market in the Alaskan North Slope, and based on a number of assumptions, it is estimated that the size of the market as of today (3rd September 2023) is 3.6 billion barrels of oil and 8.9 trillion cubic feet of natural gas conventional resources, which equates to around $242.7 billion in terms of revenue.[11]

Serviceable Obtainable Market edit edit source

Here, the serviceable obtainable market (SOM) is defined as the Alaskan North Slope oil and gas exploration and production market in which the company holds lease licenses, and based on a number of assumptions, it is estimated that the size of the market as of today (3rd September 2023), in terms of revenue, is $ccc billion.

Financials edit edit source

Most recent edit edit source

After the interim results' period end, the company raised approximately $22 million, net of fees, on 16th May 2023.[12]

On 15th June 2023, to address its obligations for the senior unsecured convertible bonds due 2026, the company settled a quarterly principal of US$2.45 million and interest of US$367,500 by issuing 15,172,320 new Ordinary Shares. This arrangement reduces the Convertible Bond's outstanding principal to US$34.30 million.[13]

On 7th September 2023, Pantheon Resources plc announced a private placement of 11.9 million new shares at £0.1878 each, raising $2.793 million from IPGL Limited. The amount will be used to cover a bond repayment, making the placement cash-neutral for Pantheon. The new shares, constituting 1.3% of the pre-placement share capital, will be issued around 29 September 2023.[14]

Accordingly, since the company's interim results, the company has raised raise a total of $27.243 million.

Interim results edit edit source

Profit and loss edit edit source

| 2021[15] | 2022[15] | |

|---|---|---|

| Currency | USD | USD |

| Continuing operations | ||

| Revenue | - | 455,309 |

| Production royalties | - | (57,101) |

| Facilities commissioning and operations | - | (837,503) |

| Cost of sales | - | (183,296) |

| Gross loss | - | (622,590) |

| Administration expenses | (3,150,888) | (3,699,831) |

| Share Based payment expense | (2,013,966) | (2,935,897) |

| Operating loss | (5,174,854) | (7,258,318) |

| Convertible Bond - Interest Expense | (570,295) | (3,151,102) |

| Convertible Bond - Revaluation of Derivative Liability | (200,531) | 7,937,855 |

| Interest receivable | 143 | 152,492 |

| Loss before taxation | (5,945,537) | (2,319,073) |

| Taxation | 1,497,945 | 743,097 |

| Loss for the year | (4,447,592) | (1,575,796) |

| Other comprehensive income for the year | ||

| Exchange differences from translating foreign operations | 844,484 | (97,473) |

| Total comprehensive loss for the year | (3,603,108) | (1,673,449) |

| Loss per share from continuing operations: | ||

| Basic and diluted loss per share | (0.66)¢ | (0.21)¢ |

Balance sheet edit edit source

| 2021[15] | 2022[15] | |

|---|---|---|

| Currency | USD | USD |

| Assets | ||

| Non-current assets | ||

| Exploration & evaluation assets | 195,662,187 | 274,321,398 |

| Property, plant and equipment | 4,245 | 66,199 |

| Total non-current assets | 195,666,432 | 274,387,597 |

| Current assets | ||

| Trade and other receivables | 275,315 | 2,823,089 |

| Cash and cash equivalents | 92,667,269 | 16,335,676 |

| Total current assets | 92,942,584 | 19,158,765 |

| Total assets | 288,609,016 | 293,546,363 |

| Liabilities | ||

| Current liabilities | ||

| Convertible Bond – Debt | - | 9,929,027 |

| Trade and other payables | 1,120,647 | 6,336,999 |

| Provisions | 1,250,000 | 5,282,866 |

| Lease Liabilities | 4,702 | 60,007 |

| Other Liabilities | - | - |

| Deferred tax liability | 2,207,792 | 940,306 |

| Total current liabilities | 4,583,141 | 22,549,205 |

| Non-current liabilities | ||

| Lease Liabilities | - | 2,956 |

| Convertible Bond – Debt | 39,734,584 | 19,228,219 |

| Convertible Bond – Derivative | 16,023,781 | 3,587,629 |

| Total non-current liabilities | 55,758,365 | 22,818,804 |

| Total liabilities | 60,341,506 | 45,368,009 |

| Net assets | 228,267,510 | 248,178,354 |

| Equity | ||

| Capital and reserves | ||

| Share capital | 10,418,381 | 10,848,761 |

| Share premium | 249,429,603 | 272,264,411 |

| Retained losses | (40,778,990) | (49,647,328) |

| Currency reserve | 2,079,046 | 395,605 |

| Share based payment reserve | 7,119,470 | 14,316,906 |

| Shareholders’ equity | 228,267,510 | 248,178,354 |

Cash flow edit edit source

ccc

| Year | 2021[15] | 2022[15] |

|---|---|---|

| Currency | USD | USD |

| Net outflow from operating activities | (2,446,588) | (6,722,549) |

| Cash flows from investing activities | ||

| Interest received | 143 | 152,492 |

| Funds used for drilling, exploration and leases | (6,707,468) | (36,601,678) |

| Advance for Performance Bond | - | - |

| Interest paid | (7,961) | - |

| Property, plant and equipment | - | (3,033) |

| Net cash outflow from investing activities | (6,715,286) | (36,452,218) |

| Cash flows from financing activities | ||

| Proceeds from share issues | 42,140,595 | 1,756,018 |

| Issue costs paid in cash | (946,710) | - |

| Proceeds from Convertible Bond | 55,000,000 | - |

| Repayment of borrowing and leasing liabilities | (28,218) | (29,696) |

| Net cash inflow from financing activities | 96,165,667 | 1,726,323 |

| Increase in cash & cash equivalents | 87,003,793 | (41,448,445) |

| Cash and cash equivalents at the beginning of the year | 5,663,476 | 57,784,121 |

| Cash and cash equivalents at the end of the year | 92,667,269 | 16,335,677 |

Full-year results edit edit source

Profit and loss edit edit source

| Year | 2018[16] | 2019[17] | 2020 (restated)[18] | 2021[8] | 2022[8] |

|---|---|---|---|---|---|

| Currency | USD | USD | USD | USD | USD |

| Year since incorporation | 13 | 14 | 15 | 16 | 17 |

| Continuing operations | |||||

| Revenue | 1,009,570 | 724,589 | - | - | - |

| Production royalties | (244,783) | (205,458) | - | - | - |

| Depletion of developed oil & gas assets | (88,293) | (148,485) | - | - | - |

| Cost of sales | (562,986) | (737,208) | - | - | - |

| Gross profit/(loss) | 113,508 | (366,562) | - | - | - |

| Administration expenses | (1,922,917) | (3,438,239) | (3,667,635) | (5,034,361) | (7,430,653) |

| General & Administrative expenses – Vision | - | (1,744,730) | - | - | - |

| Impairment of exploration & evaluation assets | (6,805,537) | (34,138,156) | (130,112) | - | - |

| Share Based payments expense | - | - | - | (3,211,038) | (8,256,575) |

| Impairment of developed oil & gas assets | - | (13,092,684) | - | - | - |

| Impairment of property plant and equipment | - | (1,397,950) | - | - | - |

| Impairment of Goodwill | - | (796,236) | - | - | - |

| Depreciation of production & pipeline facilities | (145,516) | (275,665) | - | - | - |

| Operating loss | (8,760,462) | (55,250,222) | (3,797,747) | (8,245,400) | (15,687,228) |

| Convertible Bond - Interest Expense | - | - | - | - | (4,640,537) |

| Convertible Bond - Revaluation of Derivative Liability | - | - | - | - | 4,310,773 |

| Gain on bargain purchase | - | 100,757,286 | - | - | - |

| Less: deferred tax thereon | - | (28,783,396) | - | - | - |

| Interest receivable | 6,858 | 25,781 | 23,759 | 4,234 | 42,674 |

| Loss before taxation | (8,753,604) | 16,749,449 | (3,773,988) | (8,241,165) | (15,974,318) |

| Taxation | - | 18,757,633 | 965,681 | 1,573,094 | 2,022,334 |

| Loss for the year from Continuing Operations after Taxation | - | - | (2,808,307) | (6,668,071) | (13,951,984) |

| Loss for the year from discontinued operations | - | - | (14,170,288) | (54,415) | - |

| Loss for the year | (8,753,604) | 35,507,082 | (16,978,595) | (6,722,487) | (13,951,984) |

| Other comprehensive income for the year Exchange differences from translating foreign operations | 277,183 | (179,284) | (47,800) | 1,503,199 | (741,484) |

| Total comprehensive loss for the year | (8,476,421) | 35,327,798 | (17,026,395) | (5,219,288) | (14,693,468) |

| Loss per share from continuing operations: | |||||

| Basic and diluted loss per share | (3.72)¢ | 10.54¢ | (0.56)¢ | (1.17)¢ | (1.93)¢ |

| Loss per share from discontinued operations: | |||||

| Basic and diluted loss per share | - | - | (2.83)¢ | (0.01)¢ | - |

Balance sheet edit edit source

| 2018[16] | 2019[17] | 2020[18] | 2021[8] | 2022[8] | |

|---|---|---|---|---|---|

| Currency | USD | USD | USD | USD | USD |

| Year since incorporation | 13 | 14 | 15 | 16 | 17 |

| Assets | |||||

| Non-current assets | |||||

| Exploration & evaluation assets | 43,498,422 | 160,887,260 | 156,097,609 | 188,954,719 | 237,722,294 |

| Developed oil & gas assets | 13,736,007 | 6,961,445 | - | - | - |

| Property, plant and equipment | 2,237,698 | 2,494,464 | 658,898 | 30,308 | 91,691 |

| Total non-current assets | 59,472,127 | 170,343,169 | 156,756,507 | 188,985,027 | 237,813,985 |

| Current assets | |||||

| Trade and other receivables | 700,939 | 1,843,649 | 74,167 | 109,876 | 2,498,447 |

| Cash and cash equivalents | 3,399,290 | 1,853,986 | 4,802,965 | 5,663,477 | 57,784,121 |

| Total current assets | 4,100,229 | 3,697,635 | 4,877,132 | 5,773,353 | 60,282,568 |

| Total assets | 63,572,356 | 174,040,804 | 161,633,639 | 194,758,380 | 298,096,553 |

| Liabilities | |||||

| Current liabilities | |||||

| Convertible Bond – Debt | - | - | - | - | 10,001,704 |

| Trade and other payables | 316,976 | 1,410,347 | 388,092 | 1,107,090 | 6,377,986 |

| Provisions | - | 1,335,863 | 1,335,863 | 1,250,000 | 5,285,440 |

| Lease Liabilities | - | - | 46,311 | 32,788 | 60,297 |

| Other Liabilities | - | - | - | - | 1,964,441 |

| Deferred tax liability | - | 10,025,763 | 5,293,296 | 3,705,737 | 1,683,403 |

| Total current liabilities | 316,976 | 12,771,973 | 7,063,562 | 6,095,615 | 25,373,271 |

| Non-current liabilities | |||||

| Lease Liabilities | - | - | 27,914 | - | 30,004 |

| Convertible Bond – Debt | - | - | - | - | 20,474,664 |

| Convertible Bond – Derivative | - | - | - | - | 12,816,226 |

| Total non-current liabilities | - | - | 27,914 | - | 33,320,894 |

| Total liabilities | 316,976 | 12,771,973 | 7,091,476 | 6,095,615 | 58,694,166 |

| Net assets | 63,255,380 | 161,268,831 | 154,542,163 | 188,662,765 | 239,402,388 |

| Equity | |||||

| Capital and reserves | |||||

| Share capital | 3,852,673 | 7,966,075 | 8,568,721 | 9,739,203 | 10,720,459 |

| Share premium | 106,678,805 | 164,044,720 | 173,687,092 | 208,683,936 | 264,879,196 |

| Retained losses | (48,137,398) | (12,630,316) | (29,608,911) | (36,331,398) | (48,466,591) |

| Currency reserve | (41,554) | (220,838) | (268,637) | 1,234,562 | 493,078 |

| Share based payment reserve | 902,854 | 2,163,898 | 2,163,898 | 5,336,462 | 11,776,246 |

| Non controlling interests | - | (54,708) | - | - | - |

| Shareholders’ equity | 63,255,380 | 161,268,831 | 154,542,163 | 188,662,765 | 239,402,388 |

Cash flow edit edit source

| Year | 2018[16] | 2019[17] | 2020[18] | 2021[8] | 2022[8] |

|---|---|---|---|---|---|

| Currency | USD | USD | USD | USD | USD |

| Year since incorporation | 13 | 14 | 15 | 16 | 17 |

| Net outflow from operating activities | (2,082,803) | (5,513,085) | (5,707,802) | (3,098,495) | (941,506) |

| Cash flows from investing activities | |||||

| Interest received | 6,858 | 25,781 | 25,881 | 4,295 | 42,674 |

| Funds used for drilling, exploration and leases | (10,679,594) | (10,579,750) | (1,591,591) | (24,973,399) | (45,267,175) |

| Developed oil & gas assets | (495,183) | (523,934) | - | - | - |

| Decommissioning Provision (Exploration & Evaluation) | - | 676,464 | - | - | - |

| Decommissioning Provision (Developed Oil & Gas Assets) | - | 409,400 | - | - | - |

| Advance for Performance Bond | - | - | - | - | (2,400,000) |

| Property, plant and equipment | 208,682 | (312,637) | - | - | (3,368) |

| Acquisition of a subsidiary (Great Bear), net of cash acquired | - | (6,098,215) | - | - | - |

| Acquisition of a subsidiary, (Vision Resources LLC) net of cash acquired | - | 1,920 | - | - | - |

| Disposal | - | - | (1,134) | - | - |

| Net cash outflow from investing activities | (10,959,237) | (16,400,971) | (1,566,844) | (24,969,105) | (47,627,869) |

| Cash flows from financing activities | |||||

| Proceeds from share issues | 12,596,484 | 21,259,057 | 10,816,383 | 30,181,084 | 46,739,796 |

| Issue costs paid in cash | (537,360) | (890,304) | (571,364) | (1,197,275) | (994,694) |

| Proceeds from Convertible Bond | - | - | - | - | 55,000,000 |

| Repayment of borrowing and leasing liabilities | - | - | (21,394) | (55,698) | (55,083) |

| Net cash inflow from financing activities | 12,059,124 | 20,368,753 | 10,223,625 | 28,928,111 | 100,690,020 |

| Increase in cash & cash equivalents | (982,916) | (1,545,304) | 2,948,979 | 860,511 | 52,120,645 |

| Cash and cash equivalents at the beginning of the year | 4,382,206 | 3,399,290 | 1,853,986 | 4,802,965 | 5,663,476 |

| Cash and cash equivalents at the end of the year | 3,399,290 | 1,853,986 | 4,802,965 | 5,663,476 | 57,784,121 |

Risks edit edit source

As with any investment, investing in Pantheon Resources Plc carries a level of risk. Overall, based on the Pantheon Resources Plc's adjusted beta (i.e. 0.55)[1], the degree of risk associated with an investment in Pantheon Resources Plc is 'medium'.

Here, to estimate the adjusted beta, we used the iShares MSCI World ETF to represent the market portfolio; and in terms of the time period and frequency of observations, we used five years of monthly data (i.e. 60 observations in total), which is supported by a study and is the most common choice. The beta value in a future period has been found to be on average closer to the mean value of 1.0, and because valuation is forward-looking, it is logical to adjust the raw beta so it more/most accurately predicts a future beta. In addition, here, we have assumed that for an investment to be considered 'medium' risk, it must have a beta value of between 0.5 and 1.5. Further information about the beta ratings can be found in the appendix section of this report.

The key risks can be found below. For us, currently, the biggest risk to the valuation of the company relates to the ability to adequately source sufficient funding to meet the company’s working capital requirements (i.e. liquidity risk).

- Liquidity Risk: The primary liquidity risk is the ability to adequately source sufficient funding to meet the company’s working capital requirements. Funding availability, and hence risk, within the capital markets remains volatile.[8]

- Oil & Gas Price Risk: Future oil and gas sales revenues are subject to the volatility of the underlying commodity prices throughout the year. Over the past year the energy sector has been impacted by volatility in commodity prices, which may continue to impact the group going forward.[8]

- Currency Risk: Most capital expenditures for the year (and future years), as well as possible future operational revenues from oil sales were or will be denominated in US dollars. The group keeps the majority of its cash resources denominated in US dollars to minimise volatility and foreign currency risk.[8]

- Credit Risk: The group’s credit risk is primarily attributable to its cash balances. The credit risk on liquid funds is limited because the third parties are large banks with a minimum investment grade credit rating. The group’s total credit risk amounts to the total of other receivables and cash and cash equivalents.[8]

- Lease Obligations: The group leases properties for oil and gas exploration, requiring annual payments. Any default can lead to lease termination, which would adversely impact business and financial operations. Pantheon has actively participated in annual lease sales and secured 40,000 leases in November 2022. These leases have a 10-year life and favorable terms.[8]

- Lease Renewal: Leases may be terminated if the group fails to meet specific obligations, like timely exploration. Not renewing these leases can significantly harm the business. However, the group has obtained unitisation for certain projects to possibly extend their initial lease term.[8]

- Licensing and Permissions: The group needs various approvals for developing their leases. Failure to obtain these permissions can hamper the group's ability to operate. To counter this, the group employs personnel experienced in navigating regulatory requirements.[8]

- Political and Regulatory Changes: Changes in the political environment, particularly in the Northern Slope Borough, Alaska, and the U.S., can adversely affect operations. New regulations or stricter enforcement of current ones can pose challenges. However, Pantheon's projects are on state lands, thus less affected by federal policy changes.[8]

- Legal Proceedings: The group might face legal challenges that can be costly and can damage its reputation. They engage with legal counsel proactively to mitigate potential risks.[8]

- Relationships with Stakeholders: The oil and gas sector often faces scrutiny. Failure to manage relationships with communities and environmental groups might adversely affect the group’s reputation and operations. The group endeavors to conduct operations responsibly and legally.[8]

- Regulatory Changes: Amendments to existing laws regarding oil and gas exploration could adversely affect the group's business. They continuously monitor potential regulatory shifts and maintain relationships with regulatory agencies.[8]

- Supply Chain Disruptions: Global events, like the Covid-19 pandemic and the Russia/Ukraine conflict, have affected the supply chain and caused inflation. The group plans its operations meticulously and orders equipment in advance to minimise disruptions.[8]

Valuation edit edit source

Absolute Valuation edit edit source

What's the expected return of an investment in the company? edit edit source

The Stockhub users estimate that the expected return of an investment in the company over the next five years is ccc%, which equates to an annual return of ccc%. In other words, an £1,000 investment in the company is expected to return £ccc in five years time. The assumptions used to estimate the return figure can be found in the table below.

Assuming that a suitable return level over five years is ccc% per year or less, and Pantheon Resources achieves its expected return level (of ccc%), then an investment in the company is considered to be an 'suitable' one.

| Project | Net present value ($million) | Comment |

|---|---|---|

| Greater Alkaid | $595 million[19] | |

| Talitha | N/A | |

| Theta West | N/A | |

| Total | $595 million |

What are the assumptions used to estimate the return? edit edit source

ccc

Sensitivity analysis edit edit source

The main inputs that result in the greatest change in the expected return of the Pantheon Resources investment are, in order of importance (from highest to lowest):

- The size of the total addressable market (the default size is $ccc);

- Pantheon Resources peak market share (the default share is ccc%); and

- The discount rate (the default time-weighted average rate is ccc%).

The impact of a 50% change in those main inputs to the expected return of the Pantheon Resources investment is shown in the table below.

| Main input | 50% worse | Unchanged | 50% better |

|---|---|---|---|

| The discount rate | ccc% | ccc% | ccc% |

| The size of the total addressable market | ccc% | ccc% | ccc% |

| Pantheon Resources peak market share | ccc% | ccc% | ccc% |

Appendix edit edit source

Cost of equity edit edit source

| Input | Input value | Additional information |

|---|---|---|

| Risk-free rate (%) | 4.297% | Here, the risk free rate is the US 30 year treasury bond, and is calculated as at 3rd September 2023. Research suggests that for the risk-free rate, it's best to use one that has the same or similar maturity to the estimated remaining lifespan of the company. Here, we have assumed that the estimated lifespan of the company is 30 years years or longer, so we have used the longest maturity, which is 30 years. |

| Beta | 0.5508 | Here, to estimate the adjusted beta, we used the iShares MSCI World ETF to represent the market portfolio; and in terms of the time period and frequency of observations, we used five years of monthly data (i.e. 60 observations in total), which is supported by a study and is the most common choice. The beta value in a future period has been found to be on average closer to the mean value of 1.0, and because valuation is forward-looking, it is logical to adjust the raw beta so it more/most accurately predicts a future beta. |

| Equity risk premium (%) | 7.98% | Research suggests that for the region of equity risk premium, it's best to use one that is the same or similar to the region of the beta market portfolio. Here, the region of the beta market portfolio is the world/global, so we have used the world/global region for the equity risk premium, and is calculated as at 5th January 2023. |

| Cost of equity (%) | 8.69% | Cost of equity = Risk-free rate + Beta x Equity risk premium. |

Relative valuation edit edit source

As noted earlier in this report, research suggests that in terms of estimating the expected return of an investment over a period of 12-months or more, the approach that is more accurate is the discounted cash flow approach, so that's the approach that Stockhub suggests using to determine the estimated value of the company (the valuation based on the discounted cash flow approach can be found in the valuation section of this report); nevertheless, for completeness purposes, separately, the valuation of the company is also estimated using the relative valuation approach.

What's the expected return of an investment in Pantheon Resources using the relative valuation approach? edit edit source

Stockhub estimates that the expected return of an investment in Pantheon Resources over the next 12-months is 185%. In other words, an £1,000 investment in the company is expected to return £2,849 in one year time. The assumptions used to estimate the return figure can be found in the table below.

What are the assumptions used to estimate the return figure? edit edit source

ccc

| Description | Value | Commentary |

|---|---|---|

| Which type of multiple do you want to use? | Price-to-book value | The price-to-book value is really the only available commonly used value, so we suggest using that. |

| In regards to the price-to-book value multiple, for the book value figure, which year to you want to use? | Year 1 | Research suggests that when using the relative valuation approach, it's best to use a time period of 12 months or less. Accordingly, for the book value figure, we suggest using Year 1, which is on 12th September 2024. |

| In regards to the price-to-book value multipl, what multiple figure do you want to use? | 1.54x | Here, we suggest using a multiple of 1.54x, which is in-line with the multiples of Pantheon Resources's peers (for details on the peers can be found in the table below). |

| What is the estimated compound annual growth rate of the book value between one year from now and the most recent value? | 46.37% | One year from now is 12th September 2024, and the most recent book value date is 31st December 2022. For simplicity, we based the estimate on the CAGR of Pantheon Resources over the last five years, which is 46.37%. The most recent value is $248,178,354 (as at 31st December 2022). |

| What's the current market capitalisation of the company? | £205.44 million | As at 12th September 2023, the market capitalisation of Pantheon Resources Plc is £205.44 million. |

| Which time period do you want to use to estimate the expected return? | Between now and one year time | Research suggests that when using the relative valuation approach, it's best to estimate the expected return of the company between now and one year time. |

| What's the FX rate? | $1.25 | The current FX rate of GBPUSD is $1.25. |

| Market capitalisation (local) | Cash | Debt | Enterprise value | Proved reserves | Probable reserves | Possible reserves | EV/Proved Reserves | EV/Proved + Probable Reserves | EV/Proved + Probable + Possible Reserves | |

|---|---|---|---|---|---|---|---|---|---|---|

| Pantheon Resources Plc | ||||||||||

| 88 Energy Limited | ||||||||||

| Brookside Energy Limited | ||||||||||

| Diversified Gas & Oil PLC | ||||||||||

| ConocoPhillips |

| Name | Ticker | 2Y Corr | Mkt Cap (USD) | BF P/E | BF EV/EBITDA | BF EV/EBIT | BF EV/Rev | LF P/BV |

|---|---|---|---|---|---|---|---|---|

| Pantheon Resources PLC | PANR LN | 248763255.1 | -- | -- | -- | -- | 0.8599 | |

| EnQuest PLC | ENQ LN | 0.2638 | 342484769.1 | 1.3755 | 1.4467 | 2.0561 | 0.9302 | 0.7375 |

| Harbour Energy PLC | HBR LN | 0.2596 | 2362103778 | 6.4952 | 0.9316 | 1.8074 | 0.6763 | 1.6824 |

| Serica Energy PLC | SQZ LN | 0.223 | 1227222775 | -- | -- | -- | -- | 1.7056 |

| Gulf Keystone Petroleum Ltd | GKP LN | 0.2189 | 250637412.4 | 2.1706 | 0.9949 | 1.756 | 0.6632 | 0.453 |

| OKEA ASA | OKEA NO | 0.2091 | 372011265.3 | 3.0588 | 0.3939 | 0.5296 | 0.2736 | 1.8361 |

| BLUENORD ASA | BNOR NO | 0.2079 | 1243069610 | 7.3107 | 2.866 | 3.71 | 1.9001 | 1.7456 |

| Tullow Oil PLC | TLW LN | 0.1981 | 666476192.9 | 2.2878 | 2.685 | 3.7652 | 2.0689 | -- |

| DNO ASA | DNO NO | 0.1976 | 921463861.7 | 5.3441 | 1.3689 | 1.9461 | 0.8614 | 0.7003 |

| Genel Energy Plc | GENL LN | 0.1923 | 287304379.2 | 0.4852 | 1.2792 | 9.3474 | 0.8072 | 0.6281 |

| Capricorn Energy PLC | CNE LN | 0.0962 | 283070688.1 | -- | -- | -- | -- | 0.2424 |

| Mean (Including PANR LN) | 745873453.2 | 4.0061 | 1.4958 | 3.1147 | 1.0226 | 1.0214 | ||

| Current Premium to Comps Mean | -- | -- | -- | -- | -15.8058 | |||

| Name | Ticker | 2Y Corr | Mkt Cap (USD) | BF P/E | BF EV/EBITDA | BF EV/EBIT | BF EV/Rev | LF P/BV |

|---|---|---|---|---|---|---|---|---|

| Pantheon Resources PLC | PANR LN | 249401660.5 | -- | -- | -- | -- | 0.8621 | |

| Bonterra Energy Corp | BNE CN | 0.2145 | 201202900.1 | 5.7932 | -- | -- | 5.3528 | 0.5485 |

| Canacol Energy Ltd | CNE CN | 0.2055 | 291229291.5 | 4.4749 | 3.991 | 6.2457 | 2.7131 | 0.8688 |

| Journey Energy Inc | JOY CN | 0.1826 | 250649018.6 | 10.0903 | 3.2022 | -- | -- | 1.1123 |

| Gran Tierra Energy Inc | GTE US | 0.1772 | 242916614 | 3.0209 | 1.6716 | 2.4108 | 1.0112 | 0.5344 |

| Reconnaissance Energy Africa L | RECO CN | 0.1628 | 201636539 | -- | -- | -- | -- | 3.7743 |

| Evolution Petroleum Corp | EPM US | 0.1535 | 298752800.3 | 9.5026 | 5.339 | 5.8633 | 2.5077 | 3.1245 |

| Alvopetro Energy Ltd/CA | ALV CN | 0.149 | 258641189.1 | 5.3166 | -- | 5.022 | 3.4221 | 2.8451 |

| Amplify Energy Corp | AMPY US | 0.1002 | 277732974.3 | 1.8069 | 4.1816 | 6.8549 | 1.2493 | 0.7737 |

| CGX Energy Inc | OYL CN | 0.099 | 239180966.5 | -- | -- | -- | -- | 4.342 |

| Global Tech Industries Group I | GTII US | 0.0407 | 290690567.5 | -- | -- | -- | -- | 24.9919 |

| Mean | 254730411.1 | 4.407 | 3.991 | 5.6339 | 2.3821 | 1.4639 | ||

| Current Premium to Comps Mean | -- | -- | -- | -- | -41.1063 |

| Name | Ticker | 2Y Corr | Mkt Cap (USD) | BF P/E | BF EV/EBITDA | BF EV/EBIT | BF EV/Rev | LF P/BV |

|---|---|---|---|---|---|---|---|---|

| Pantheon Resources PLC | PANR LN | 248743297.3 | -- | -- | -- | -- | 0.8599 | |

| Jadestone Energy PLC | JSE LN | 0.2226 | 256103808.5 | 12.1425 | 0.8699 | 1.7002 | 0.3279 | 1.7301 |

| Gulf Keystone Petroleum Ltd | GKP LN | 0.2189 | 250617304.2 | 2.1706 | 0.9949 | 1.756 | 0.6632 | 0.4529 |

| Genel Energy Plc | GENL LN | 0.1924 | 287281329.3 | 0.4852 | 1.2792 | 9.3474 | 0.8072 | 0.6281 |

| Journey Energy Inc | JOY CN | 0.1826 | 250722843.5 | 10.0903 | 3.2022 | -- | -- | 1.1123 |

| Gran Tierra Energy Inc | GTE US | 0.1772 | 242916614 | 3.0209 | 1.6716 | 2.4108 | 1.0112 | 0.5344 |

| Alvopetro Energy Ltd/CA | ALV CN | 0.149 | 258717367.9 | 5.3166 | -- | 5.022 | 3.4221 | 2.8451 |

| Touchstone Exploration Inc | TXP CN | 0.1276 | 199349168.4 | 16.338 | 3.3236 | 5.7614 | 2.0963 | 2.5903 |

| La Francaise De L'energie SACA | FDE FP | 0.1153 | 227020391.8 | 11.7018 | 7.3477 | 9.0049 | 4.3978 | 2.8113 |

| Amplify Energy Corp | AMPY US | 0.1002 | 277732974.3 | 1.8069 | 4.1816 | 6.8549 | 1.2493 | 0.7737 |

| CGX Energy Inc | OYL CN | 0.099 | 239251413.6 | -- | -- | -- | -- | 4.342 |

| Capricorn Energy PLC | CNE LN | 0.0962 | 283047977.8 | -- | -- | -- | -- | 0.2423 |

| Coelacanth Energy Inc | CEI CN | 0.0954 | 260548386.6 | -- | -- | -- | -- | 3.7122 |

| Kistos Holdings PLC | KIST LN | 0.0891 | 253019056.7 | -- | -- | -- | -- | 2.2992 |

| Cohen Development Gas & Oil Lt | CDEV IT | 0.0795 | 211048552.1 | -- | -- | -- | -- | 6.5187 |

| Hindustan Oil Exploration Co L | HOE IN | 0.0428 | 255827680.6 | -- | -- | -- | -- | 2.2394 |

| Mean (Including PANR LN) | 250121760.4 | 9.0748 | 2.7631 | 5.3661 | 2.0603 | 1.4934 | ||

| Current Premium to Comps Mean | -- | -- | -- | -- | -42.4215 | |||

| Name | Ticker | 2Y Corr | Mkt Cap (USD) | BF P/E | BF EV/EBITDA | BF EV/EBIT | BF EV/Rev | LF P/BV |

|---|---|---|---|---|---|---|---|---|

| Pantheon Resources PLC | PANR LN | 248743297.3 | -- | -- | -- | -- | 0.8599 | |

| Saturn Oil & Gas Inc | SOIL CN | 0.2403 | 289188348.4 | 1.6041 | 0.8074 | -- | 0.6336 | 0.6728 |

| Bonterra Energy Corp | BNE CN | 0.2145 | 201232526.3 | 5.7932 | -- | -- | 5.3528 | 0.5485 |

| Canacol Energy Ltd | CNE CN | 0.2055 | 291272173.8 | 4.4749 | 3.991 | 6.2457 | 2.7131 | 0.8688 |

| Journey Energy Inc | JOY CN | 0.1826 | 250685925.6 | 10.0903 | 3.2022 | -- | -- | 1.1123 |

| Gran Tierra Energy Inc | GTE US | 0.1772 | 242916614 | 3.0209 | 1.6716 | 2.4108 | 1.0112 | 0.5344 |

| Reconnaissance Energy Africa L | RECO CN | 0.1628 | 201666229.1 | -- | -- | -- | -- | 3.7743 |

| Evolution Petroleum Corp | EPM US | 0.1535 | 298752800.3 | 9.5026 | 5.339 | 5.8633 | 2.5077 | 3.1245 |

| Alvopetro Energy Ltd/CA | ALV CN | 0.149 | 258679272.9 | 5.3166 | -- | 5.022 | 3.4221 | 2.8451 |

| Lucero Energy Corp | LOU CN | 0.132 | 324574582.1 | 6.5686 | 2.2905 | 4.647 | 1.4365 | 0.9152 |

| Touchstone Exploration Inc | TXP CN | 0.1276 | 199319815.1 | 16.338 | 3.3236 | 5.7614 | 2.0963 | 2.5903 |

| Amplify Energy Corp | AMPY US | 0.1002 | 277732974.3 | 1.8069 | 4.1816 | 6.8549 | 1.2493 | 0.7737 |

| CGX Energy Inc | OYL CN | 0.099 | 239216184.9 | -- | -- | -- | -- | 4.342 |

| Coelacanth Energy Inc | CEI CN | 0.0954 | 260510022 | -- | -- | -- | -- | 3.7122 |

| San Juan Basin Royalty Trust | SJT US | 0.08 | 309016317.5 | -- | -- | -- | -- | 81.0503 |

| Empire Petroleum Corp | EP US | 0.0627 | 181790240 | -- | -- | -- | -- | 9.6501 |

| Mean (Including PANR LN) | 254706082.7 | 8.384 | 2.7073 | 5.6339 | 1.945 | 1.5358 | ||

| Current Premium to Comps Mean | -- | -- | -- | -- | -44.0125 |

Sensitivity analysis edit edit source

The main inputs that result in the greatest change in the expected return of the Pantheon Resources investment are, in order of importance (from highest to lowest):

- The compound annual growth rate of the Pantheon Resources book value (the default figure is 46.37%);

- The price-to-book value multiple (the default multiple 1.57x); and

- Pantheon Resources most recent book value figure (the default figure is $248,178,354, or £198,542,683 at the current exchange rate of $1.25).

The impact of a 50% change in those main inputs to the expected return of the Pantheon Resources investment is shown in the table below.

| Main input | 50% worse | Unchanged | 50% better |

|---|---|---|---|

| The compound annual growth rate of the Pantheon Resources book value between one year ahead and the most recent value | 113% | 185% | 266% |

| The price-to-book value multiple | 42% | 185% | 327% |

| Pantheon Resources most recent book value figure | 42% | 185% | 327% |

Significant holdings edit edit source

| Number of Ordinary Shares | % of Share Capital | |

|---|---|---|

| Vidacos Nominees Limited | 100,084,318 | 11.34 |

| Interactive Brokers LLC | 80,121,067 | 9.08 |

| Lynchwood Nominees Limited | 67,134,041 | 7.60 |

| Vidacos Nominees Limited | 38,521,840 | 4.36 |

| Vidacos Nominees Limited | 34,549,659 | 3.91 |

| Barnard Nominees Limited | 29,352,283 | 3.32 |

| Barnard Nominees Limited | 27,714,204 | 3.14 |

Capital structure edit edit source

The Company has 919,111,769 ordinary fully paid shares in issue.[14] The number of ordinary shares not in public hands amounts to 6,956,691[22], equivalent to 0.76% of the issued allotted and fully paid ordinary shares.[23]

edit edit source

| Exercise price (£) | Number of share options exercisable into ordinary shares on issue | Expiry Date | Share options as a % of issued shares |

|---|---|---|---|

| 0.30 | 4,825,000 | 30 September 2024 | 0.62% |

| 0.27 | 7,000,000 | 6 July 2030 | 0.90% |

| 0.33 | 12,430,000 | 27 January 2031 | 1.60% |

| 0.671 | 21,705,000 | 18 January 2027 | 2.80% |

edit edit source

| Exercise price (£) | Number of share warrants exercisable into non-voting shares | Expiry date | Share options as a % of issued shares |

|---|---|---|---|

| 0.30 | 4,803,921 | 30 September 2024 | 1.29% |

Beta risk profile edit edit source

| Beta value | Risk rating |

|---|---|

| 0 to 0.50 | Low |

| 0.50 to 1.50 | Medium |

| 1.50 to 3.00 | High |

| 3.00 and above | Extremely high |

Pantheon Resources beta calculation edit edit source

| Date | iShares MSCI World ETF unit price (USD) | Pantheon Resources plc share price (GBP) | iShares MSCI World ETF unit price change (%) | Pantheon Resources plc share price change (%) |

|---|---|---|---|---|

| 01/10/2018 | 85.25 | 16.24 | ||

| 01/11/2018 | 86.21 | 17.1 | 1% | 5% |

| 01/12/2018 | 78.87 | 16 | -9% | -6% |

| 01/01/2019 | 84.96 | 23.375 | 8% | 46% |

| 01/02/2019 | 87.49 | 24.75 | 3% | 6% |

| 01/03/2019 | 88.79 | 28.6 | 1% | 16% |

| 01/04/2019 | 92.09 | 21.425 | 4% | -25% |

| 01/05/2019 | 86.76 | 21.25 | -6% | -1% |

| 01/06/2019 | 91.02 | 21.25 | 5% | 0% |

| 01/07/2019 | 91.86 | 18.68 | 1% | -12% |

| 01/08/2019 | 89.84 | 17.9 | -2% | -4% |

| 01/09/2019 | 91.78 | 16.03 | 2% | -10% |

| 01/10/2019 | 94.12 | 16.25 | 3% | 1% |

| 01/11/2019 | 96.76 | 16.5 | 3% | 2% |

| 01/12/2019 | 98.78 | 16.5 | 2% | 0% |

| 01/01/2020 | 97.73 | 16.5 | -1% | 0% |

| 01/02/2020 | 89.67 | 11.95 | -8% | -28% |

| 01/03/2020 | 77.93 | 13 | -13% | 9% |

| 01/04/2020 | 86.36 | 13.75 | 11% | 6% |

| 01/05/2020 | 90.7 | 15.95 | 5% | 16% |

| 01/06/2020 | 92.14 | 13.775 | 2% | -14% |

| 01/07/2020 | 96.65 | 21.15 | 5% | 54% |

| 01/08/2020 | 102.96 | 22.35 | 7% | 6% |

| 01/09/2020 | 99.52 | 37.2 | -3% | 66% |

| 01/10/2020 | 96.53 | 31 | -3% | -17% |

| 01/11/2020 | 108.94 | 37.4 | 13% | 21% |

| 01/12/2020 | 112.41 | 43.5 | 3% | 16% |

| 01/01/2021 | 111.49 | 36.3 | -1% | -17% |

| 01/02/2021 | 114.27 | 39.1 | 2% | 8% |

| 01/03/2021 | 118.49 | 35.7 | 4% | -9% |

| 01/04/2021 | 123.61 | 34.25 | 4% | -4% |

| 01/05/2021 | 125.6 | 29.4 | 2% | -14% |

| 01/06/2021 | 126.57 | 41.25 | 1% | 40% |

| 01/07/2021 | 128.83 | 55.3 | 2% | 34% |

| 01/08/2021 | 132.02 | 59.7 | 2% | 8% |

| 01/09/2021 | 126.46 | 71.6 | -4% | 20% |

| 01/10/2021 | 133.84 | 77.6 | 6% | 8% |

| 01/11/2021 | 131.1 | 69.6 | -2% | -10% |

| 01/12/2021 | 135.32 | 77.3 | 3% | 11% |

| 01/01/2022 | 128.32 | 79.6 | -5% | 3% |

| 01/02/2022 | 124.58 | 142 | -3% | 78% |

| 01/03/2022 | 128.16 | 117.6 | 3% | -17% |

| 01/04/2022 | 117.42 | 123.2 | -8% | 5% |

| 01/05/2022 | 117.94 | 100.6 | 0% | -18% |

| 01/06/2022 | 106.88 | 89.4 | -9% | -11% |

| 01/07/2022 | 115.57 | 117 | 8% | 31% |

| 01/08/2022 | 110.28 | 133.7 | -5% | 14% |

| 01/09/2022 | 99.95 | 104.1 | -9% | -22% |

| 01/10/2022 | 107.42 | 100.1 | 7% | -4% |

| 01/11/2022 | 115.44 | 72.95 | 7% | -27% |

| 01/12/2022 | 109.25 | 42.52 | -5% | -42% |

| 01/01/2023 | 117.01 | 50.15 | 7% | 18% |

| 01/02/2023 | 113.98 | 57.1 | -3% | 14% |

| 01/03/2023 | 117.67 | 23.64 | 3% | -59% |

| 01/04/2023 | 119.79 | 18.67 | 2% | -21% |

| 01/05/2023 | 118.6 | 15.74 | -1% | -16% |

| 01/06/2023 | 124.52 | 12.71 | 5% | -19% |

| 01/07/2023 | 128.54 | 10.8 | 3% | -15% |

| 01/08/2023 | 125.7 | 25 | -2% | 131% |

| 01/09/2023 | 125.91 | 22.42 | 0% | -10% |

| Pantheon Resources | |

|---|---|

| Beta | 0.3262 |

| Adjusted beta | 0.5508 |

Glossary edit edit source

ccc

| Term | Definition |

|---|---|

| /Net pay | The net thickness of an oil reservoir which is capable of producing hydrocarbons. |

| AMI | Area of mutual interest. |

| Anticline | A structure in the subsurface in which rock layers have been folded to produce an arch or dome. |

| Appraisal well | A well drilled to evaluate the extent of a discovery made by a previous well drilled on the same trap. |

| Barrel (BBL) | A unit of measurement commonly used in quoting liquid hydrocarbon volumes.

|

| Basin | A depression in the earth's surface containing relatively thick deposits of sedimentary rocks. |

| BCF | Billion cubic feet, or 28.317 cubic meters. A unit commonly used in quoting volumes of natural gas. |

| BCFG | Billion cubic feet of gas. |

| Behind pipe | A productive reservoir which is isolated from the well bore by the casing. |

| BHL | Bottom hole location. |

| BO | Barrel of oil. |

| BOE | Barrel of oil equivalent. Used when converting oil and gas into an equivalent unit of volume. Typically, a figure of 6000 CFG per BBLO is used. |

| BOPD | Barrels of oil per day, a unit commonly used to describe daily rates of liquids production from a flowing well. |

| BTU | British Thermal Unit. A unit index of energy content in gas. |

| Casing | Steel pipe which lines the well bore from surface. The casing isolates subsurface fluids from the well bore and prevents rock material from sloughing off the sides of the well bore. |

| CFG | Cubic feet of gas |

| Charge risk | A general term for risk that a source rock exists, that it has been is or still is generating hydrocarbons, that a trap was in place before generation , and that a conduit exists between the source rock and the reservoir. |

| Clastic | A modifier describing rocks that were deposited by the mechanical action of water, i.e., being carried in suspension and then dropped when the energy in the flow becomes too weak to support the material. Typically, sandstone and shale. |

| Closure | On an isolated structural high, the area enclosed by the lowest closing contour. |

| Condensate | A hydrocarbon phase which separates out from natural gas and condenses into liquids when the hydrocarbons are produced. |

| Cretaceous | Late Mesozoic time; roughly 140 to 65 million years ago. |

| Darcy | 1000 millidarcies (see definition for mD below). |

| Deposition | The process of depositing unconsolidated sediments, usually in a basin. |

| DHC | Dry hole cost. The cost of an unsuccessful well. |

| Dip | The angle that a rock surface forms with respect to the horizontal. Can be referenced as degrees, in the case of depth, or, in the case of seismic reflection data, in time (e.g. milliseconds per km ). |

| Dipmeter | A tool used in logging a well which measures the dip of rock surfaces in the borehole of the well. |

| DMO | Dip Moveout . A correction applied to seismic trace processing to account for dip. (See dip above). |

| DOGGR | California Department of Conservation/Division of Oil, Gas, and Geothermal Resources |

| Dry hole | A well in which no commercial hydrocarbons were discovered. |

| Exploration well | A well drilled into a previously undrilled or noncommercial trap to test for the presence of a new hydrocarbon accumulation. |

| Facies | An association of rock types which share a common trait. In the case of sedimentary rocks, usually used with reference to the environment in which the sediments were deposited (for example, deltaic). |

| Fault | Any brittle failure of rock layers along which rocks are displaced on one side relative to the other. |

| Fault trap | A structural trap where at least one of the components of closure is formed by offset of rock layers across a fault. |

| Fold | Deformation of a rock surface. |

| Formation | A formal term used to reference a genetically related rock unit (e.g. the Monterey Formation). |

| Four way dip | A simple structure in which rock surfaces dip in all four directions, thus creating structural closure. Often forms a hydrocarbon trap. |

| Geology | The study of the earth and the processes affecting its crust. |

| Geophysics | The study of rock properties and stratigraphy through the use of analytical methods involving various types of data collection and interpretation. |

| GIP | Gas in place. The volume of natural gas stored in a subsurface accumulation . Differs from recoverable reserves in that some of this gas will not be recovered to the surface due to properties of the rock and/or gas, and in situ pressure. |

| GOR | Gas-oil ratio: the volume of dissolved gas per barrel of oil. |

| Horizon | A term describing a layer of rock, most typically associated with a seismic reflection. |

| Hydrocarbons | A compound of the elements hydrogen and carbon, in either liquid or gaseous form. Natural gas and petroleum are mixtures of hydrocarbons. |

| Lithology | The physical, sedimentary, or mineralogical characteristics of a rock. |

| Marine | Used as a modifier of sedimentary rock to denote deposition in the ocean. |

| Mature | Used in association with source rock. A description applied to organic rich rock which is capable, because of sufficient temperature and burial depth, of generating hydrocarbons. |

| mD | Millidarcy , a unit of measurement used to describe permeability, i.e., the tendency for liquids to flow through a rock unit. A high permeability indicates a good reservoir. |

| Migration | The movement of hydrocarbons from the source rock to the reservoir. |

| MMBLS | Million barrels. |

| MMBO | Million barrels of oil. |

| MMBTU | Million British Thermal Units. |

| MMCFD | Million cubic feet of gas per day. A measure of gas flow rates from a producing well. |

| Monte Carlo | A methodology for estimating a given quantity based on the statistical distribution of input values on which the quantity depends. Typically, the output quantity is calculated several thousand times (each calculation is called a trial), for each trial using input parameter values extracted randomly according to their statistical distributions. The result is a statistical distribution of output values. |

| MSCF | Thousand standard cubic feet at atmospheric conditions. |

| N/G | Net to gross ratio. The percentage of a gross thickness of reservoir with sufficient permeability such that it is capable of flowing hydrocarbons. |

| Oil | Liquid hydrocarbons, generally more viscous and darker in color than condensates. |

| oil field | A subsurface accumulation of hydrocarbons. |

| oil window | The depth interval in which source rock can actively generate mobile oil. |

| OIP | Oil in place. The volume of oil held in a reservoir in the subsurface . Not all of this oil can be recovered. |

| OWC | Oil-water contact, which marks the base of an oil accumulation. |

| P10 | In a Monte Carlo simulation, a measure of the high end expectation of a particular parameter's occurrence. For example, a P10 net pay of 150 ft means that there is a 10 per cent. probability that at least 150 ft of net pay will be encountered in a given trial in the simulation. |

| P50 | In a Monte Carlo simulation, the median value of a particular parameter's occurrence. For example, a P50 net pay of 50 ft means that half of the trials in the simulation encountered a value less than 50 ft. |

| P90 | In a Monte Carlo simulation, a measure of the low end expectation of a particular parameter's occurrence. For example, a P90 net pay of 25 ft means that there is a 90 per cent. probability that at least 25 ft of net pay will be encountered in a given trial in the simulation. |

| Permeability | A measure of the ability of liquids to flow through a porous solid. (See mD ). |

| Petroleum | (See Hydrocarbons). |

| PINS | Padre Island National Seashore. |

| Pipeline | A pipe through which any hydrocarbon or its products is delivered to an end user. |

| Porosity | The percentage of open pore space in a rock. |

| POS | Probability of success (technical, as opposed to commercial). |

| Potentially Recoverable Hydrocarbons | The volume of hydrocarbons that are estimated to be producible from a given trap. Used in the context of a prospect or an undeveloped hydrocarbon accumulation. |

| Prospect | An undrilled or poorly understood, and therefore hypothetical, hydrocarbon trap. |

| PSDM | Pre-stack depth migration. A seismic processing technique which utilises rock velocity models to iteratively arrive at a depth converted seismic data volume. |

| PSTM | Pre-stack time migration. A seismic processing technique which approximates PSDM but does not build a depth model. The seismic data volume is in two way travel time. |

| Reflector | An event observed on a seismic section that usually corresponds to a buried rock surface. |

| Reserves | The volume of oil or gas that can be recovered from the subsurface. Generally used in the context of commerciality. |

| Reservoir | A porous rock unit in which hydrocarbons occur in an oil field. |

| Risk | A measure of uncertainty relating to the likelihood of finding hydrocarbons, or, the likelihood that any or all of the individual geological elements required for the accumulation of hydrocarbons is met. |

| Sandstone | A sedimentary rock composed primarily of sand sized grains, usually quartz. A common hydrocarbon reservoir rock. |

| SCF | Standard cubic feet. See MSCF |

| Seal | An impermeable rock unit that prevents hydrocarbons from escaping from the reservoir. |

| Sediment | Generally, water borne debris that settles out of suspension. |

| Sediment rock | A type of rock formed by aggregation of sediments. |

| Seismic reflection | An event observed on seismic data that corresponds to a given rock layer in the subsurface. |

| Seismic survey | A tool employing an energy source, such as dynamite, and recording devices used to measure the travel time from a rock layer to the surface. The primary tool used to detect hydrocarbon traps. |

| Shale | A very fine grained rock often thinly layered. An important seal rock. |

| Show | An indication while drilling that hydrocarbons are present in the well. |

| Silt/siltstone | A rock whose grain size is intermediate between sand and shale. |

| Source/source rock | An organic rich rock (typically shale) capable of generating hydrocarbons under certain conditions of temperature and pressure. |

| STB | Stock tank barrel, the volume of a barrel of oil at the earth's surface as opposed to the corresponding volume in the subsurface. |

| Stratigraphy | The study of the vertical and horizontal distribution of stratified rocks, with respect to their age, lateral equivalence, and environment of deposition. |

| Structural trap | Generally, a hydrocarbon trap formed by dipping rock layers and/or faults. |

| Structure | A geological feature usually higher in elevation than the surrounding rock, formed by local deformation of the rock layers. |

| TCF | Trillion cubic feet of gas. |

| Tertiary | A period of geological time from approximately 2 to 65 million years ago. Subdivided into the Pliocene, Miocene, Oligocene, Eocene, and Paleocene. |

| Total depth (TD) | The final depth reached when drilling a well. |

| Trap | A structure capable of retaining hydrocarbons. |

| Trend | A particular direction in which similar geological features are repeated. |

| TVD | True vertical depth. The vertical depth below a given datum. |

| Unconformity | A break in the succession of sedimentary deposition, commonly associated with erosion of underlying rock units. Often marked by rock surfaces which are non-parallel above and below the unconformity. |

| Unrisked | Associated with an estimate of possible hydrocarbons for which a discount attributable to risk has not been applied. |

| Updip | Toward a higher elevation on a rock surface. |

| Uplift | Elevation by means of geological activity of one surface or area relative to another. |

| Well log | A device which records rock physical parameters in the well bore during or after drilling, or, the data obtained by these devices. |

References and notes edit edit source

- ↑ 1.0 1.1 Research shows that an investment has two main types of risks: 1) non-systematic and 2) systematic. Systematic risk is the risk related to the overall market, and non-systematic risk is the risk that's specific to an individual investment. Evidence shows that taking on non-systematic risk is inefficient, and it's, therefore, best to eliminate it; and in most cases, elimination is fairy easy to do [by holding a diversified portfolio of investments (i.e. around 15 investments)]. Accordingly, when assessing the riskiness of an investment, it’s best to look at the systematic risk only (i.e. ignore the non-systematic risk). A key measure of systematic risk is beta, and a main way to determine the riskiness of an investment is to compare the beta of the investment with the beta of the market, which is 1. For estimating an asset's beta, in terms of time period, and frequency of observations, the most common choice is five years of monthly data, yielding 60 observations. One study of U.S. stocks found support for five years of monthly data over alternatives. The beta value in a future period has been found to be on average closer to the mean value of 1.0, the beta of an average-systematic-risk security, than to the value of the raw beta. Because valuation is forward looking, it is logical to adjust the raw beta so it more accurately predicts a future beta.

- ↑ 2.00 2.01 2.02 2.03 2.04 2.05 2.06 2.07 2.08 2.09 2.10 2.11 2.12 2.13 2.14 2.15 2.16 2.17 2.18 2.19 2.20 2.21 https://www.pantheonresources.com/about-pantheon/projects/greater-alkaid

- ↑ 3.00 3.01 3.02 3.03 3.04 3.05 3.06 3.07 3.08 3.09 3.10 3.11 3.12 3.13 3.14 3.15 3.16 https://www.pantheonresources.com/about-pantheon/projects/talitha

- ↑ 4.0 4.1 4.2 4.3 4.4 4.5 4.6 https://polaris.brighterir.com/public/pantheon_resources/news/rns/story/rmvz29r

- ↑ Pantheon addition of Oil & NGLs.

- ↑ https://polaris.brighterir.com/public/pantheon_resources/news/rns/story/xel4enr

- ↑ 7.0 7.1 7.2 7.3 7.4 https://polaris.brighterir.com/public/pantheon_resources/news/rns/story/xleqqjw

- ↑ 8.00 8.01 8.02 8.03 8.04 8.05 8.06 8.07 8.08 8.09 8.10 8.11 8.12 8.13 8.14 8.15 8.16 8.17 8.18 8.19 8.20 8.21 8.22 8.23 8.24 8.25 8.26 8.27 8.28 8.29 8.30 8.31 8.32 8.33 8.34 8.35 https://www.pantheonresources.com/investors/financial-reports/673-final-results-for-the-year-ended-30-june-2022/file

- ↑ 9.0 9.1 9.2 9.3 9.4 https://polaris.brighterir.com/public/pantheon_resources/news/rns/story/rmvm22r

- ↑ https://www.ibisworld.com/global/market-size/global-oil-gas-exploration-production/#:~:text=The%20market%20size%2C%20measured%20by,is%20%245.3tr%20in%202023.

- ↑ To estimate the revenue from 3.6 billion barrels of oil and 8.9 trillion cubic feet (Tcf) of natural gas, you would need to know the prevailing market prices for both commodities. Please note that oil and gas prices can fluctuate significantly based on various factors, so this is a very general estimate. 1) Oil: Let's use an average price of $60 per barrel, which is a rough average for Brent crude over various periods in the late 2010s and early 2020s. 3.6 \text{ billion barrels} \times $60/\text{barrel} = $216 \text{ billion} 2) Natural Gas: Natural gas prices can be more region-specific than oil prices. In the U.S., the Henry Hub spot price is a common benchmark. Let's use an average price of $3 per thousand cubic feet (Mcf) for simplicity, though this price can vary widely. 8.9 \text{ Tcf} \times $3/\text{Mcf} = $26.7 \text{ billion} Adding these together: $216 \text{ billion (from oil)} + $26.7 \text{ billion (from gas)} = $242.7 \text{ billion} So, based on these rough price estimates, 3.6 billion barrels of oil and 8.9 Tcf of natural gas could equate to approximately $242.7 billion in revenue. However, it's essential to consider several factors: 1) Extraction Costs: The revenue figures above don't account for the costs of extracting, refining, transporting, and selling the oil and gas. These costs can be substantial. 2) Price Fluctuations: Oil and gas prices can fluctuate significantly based on global demand, geopolitical events, technological advancements, and other factors. 3) Taxes and Royalties: Governments often take a share of the revenue in the form of taxes, royalties, or other fees.

- ↑ https://polaris.brighterir.com/public/pantheon_resources/news/rns/story/w03k7zw

- ↑ https://polaris.brighterir.com/public/pantheon_resources/news/rns/story/x5zjy8x

- ↑ 14.0 14.1 https://www.investegate.co.uk/announcement/rns/pantheon-resources--panr/private-placement/7740310

- ↑ 15.0 15.1 15.2 15.3 15.4 15.5 https://polaris.brighterir.com/public/pantheon_resources/news/rns/story/xp8nljr

- ↑ 16.0 16.1 16.2 https://www.pantheonresources.com/investors/financial-reports/648-pantheon-resources-annual-report-and-financial-statements-year-ended-30-june-2019/file

- ↑ 17.0 17.1 17.2 https://www.pantheonresources.com/investors/financial-reports/654-final-results-for-the-year-ended-june-2020/file

- ↑ 18.0 18.1 18.2 https://www.pantheonresources.com/investors/financial-reports/660-final-results-for-the-year-ended-30-june-2020/file

- ↑ chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/http://www.pantheonresources.com/investors/presentations/645-investor-presentation-january-2020/file

- ↑ As of 23 June 2022, CHONS LLC was the registered holder of 38,068,993 shares, representing 4.95% of the share capital of the Company. These shares were held through one or more nominees accounts which may or may not be wholly in the top shareholder list presented above. Pantheon has been advised by Farallon Capital Management LLC, the discretionary investment manager of CHONS LLC that it qualifies for an investment manager exemption pursuant to DTR 5.1.5 R (1)(a) in the FCA Rules. The practical effect of the investment manager exemption is that, where a person is acting as investment manager to another person, the applicable disclosure thresholds under the DTRs are only at 5%, 10% and 1% increments above 10%. Accordingly, the referenced shareholdings are subject to change without additional notification and therefore cannot be considered accurate apart from on the referenced date. On 3 August 2021, Mr Michael Spencer and IPGL Limited advised they were the registered holder of 25,888,710 shares representing 3.7% of the share capital of Pantheon on that date, and were the holder of 7,816,200 Financial instruments of similar economic effect, representing 1.13% of the registered share capital of Pantheon at that time. These shares were held through one or more nominees accounts which may or may not be wholly in the top shareholder list presented above. The referenced shareholdings are only considered accurate on the referenced data and are not expected to be updated until the next reporting threshold (higher or lower) is crossed. On 1 April 2022, Mr Sanjay Motwani notified of a direct holding in 3,271,788 ordinary shares and an indirect holding in 19,851,474 ordinary shares, collectively representing 3.05% of the share capital of Pantheon on that date. These shares were held through one or more nominees accounts which may or may not be wholly in the top shareholder list presented above. The referenced shareholding(s) are only considered accurate on the referenced data and are not expected to be updated until the next reporting threshold (higher or lower) is crossed.

- ↑ https://www.pantheonresources.com/investors/significant-holdings

- ↑ 22.0 22.1 22.2 https://www.pantheonresources.com/investors/capital-structure

- ↑ The calculation here is 6,956,691 divided by 919,111,769.

- ↑ The share options are exercisable into ordinary shares upon exercise, whereas the warrants are convertible on a 1:1 basis into non-voting shares upon exercise. Non voting shares are further convertible into ordinary shares on a 1:1 basis. The Ordinary Shares of the Company have not been nor will they be registered under the United States Securities Act of 1933, as amended ("Securities Act"), or under the securities laws of any state of the United States or under the applicable securities laws of Australia, the Republic of South Africa, the Republic of Ireland, Japan or Canada. Accordingly, subject to certain exceptions, the Ordinary Shares may not, directly or indirectly, be offered, sold, transferred, taken up or delivered, directly or indirectly, in the United States, Australia, the Republic of South Africa, the Republic of Ireland, Japan or Canada or for the benefit of any US person (as defined in Regulation S under the Securities Act).