Pfizer Inc.

| |

| Type | Public |

|---|---|

| Industry | |

| Founded | 1849 in New York City |

| Founders | |

| Headquarters | The Spiral, New York City , U.S. |

Area served | Worldwide |

Key people | Albert Bourla (CEO) |

| Products | |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | c. 83,000 (2022) |

| Website | pfizer |

| Footnotes / references [1] | |

Pfizer Inc., a pioneering biopharmaceutical powerhouse, boasts an extensive operational footprint that spans across more than 150 countries globally. This intricate network encompasses an array of cutting-edge manufacturing plants and innovative research and development (R&D) centers. This sprawling infrastructure empowers Pfizer to not only engage in groundbreaking scientific exploration but also to orchestrate the seamless production of its diverse product portfolio.

Central to Pfizer's operational prowess is its masterful supply chain management, a linchpin in the company's global operations. Facilitating the distribution of a wide spectrum of offerings—ranging from groundbreaking medical breakthroughs and revolutionary vaccines to products catering to consumer health and animal well-being—this intricate supply chain network connects healthcare professionals and patients on a global scale. Leveraging state-of-the-art technologies and strategic acumen, Pfizer navigates the intricate web of supply chain intricacies with unparalleled efficiency.

Engrained in Pfizer's DNA is an unwavering commitment to quality control, exemplified by its strict adherence to internationally recognized benchmarks like the esteemed Good Manufacturing Practices (GMP). Each facet of Pfizer's operational lifecycle, commencing from the inception of groundbreaking R&D initiatives to the culmination of product dispatch, is subjected to meticulous scrutiny in alignment with these rigorous standards. Routine audits and comprehensive inspections are seamlessly integrated into the operational framework to ensure a steadfast commitment to quality benchmarks and to catalyze an ongoing trajectory of process enhancement.

How did the idea of the company come about? edit edit source

The inception of the company's concept can be traced back to a pivotal moment when two visionary minds, Charles Pfizer and Charles Erhart, converged their expertise. In 1849, they established Pfizer, a pharmaceutical colossus with an enduring legacy.

The seeds of this transformative venture germinated from the synthesis of two diverse backgrounds: Charles Pfizer, a chemist of remarkable acumen, and his cousin Charles Erhart, an adept confectioner. It was in their shared recognition of an uncharted opportunity that the idea for the company began to crystallize.

Harnessing Pfizer's profound understanding of chemistry and Erhart's knack for culinary craftsmanship, they perceived a horizon where the fusion of these disciplines could engender chemicals of profound medical import. This prescient insight led to the pioneering notion of manufacturing and marketing compounds for medical applications.

The inaugural strides were marked by the production and distribution of santonin, a potent antiparasitic medication. This initial foray swiftly unfurled into a tapestry of diversified pharmaceutical offerings. Their operations rapidly extended beyond santonin, encompassing an array of innovative pharmaceutical products that began to reshape the healthcare landscape.

In this convergence of scientific expertise and entrepreneurial spirit, Pfizer sprang forth. The pioneering journey embarked upon by Charles Pfizer and Charles Erhart reverberates as a testament to the serendipitous union of distinct talents, birthing a pharmaceutical titan that would leave an indelible mark on the annals of medicine and human well-being.

Mission edit edit source

Pfizer's unwavering mission is to pioneer the discovery, development, and delivery of pioneering medicines and vaccines, catalyzing a profound positive impact on the global populace's health and well-being. Fueled by an unrelenting commitment, Pfizer aspires to ascend as a beacon of leadership within the biopharmaceutical domain, steering progress through the expansion of scientific horizons, substantial investments in research and development, and the provision of superlative healthcare solutions.

Pfizer's mission is an intricate tapestry interwoven with several pivotal threads:

- Discovery and Development: At the heart of Pfizer's journey lies an indomitable dedication to unraveling scientific mysteries and fashioning transformative medicines and vaccines. Through substantial investments in cutting-edge research, the company drives forward the boundaries of scientific understanding, embracing the challenge of illuminating new pathways toward potential treatments for diverse diseases and conditions.

- Innovation: Pfizer's aspirations encompass a relentless pursuit of innovation that redefines the healthcare landscape. With a resolute focus on novel therapies, advanced technologies, and ingenious solutions, the company seeks to bridge gaps in medical care, ushering in a new era of improved health outcomes and enhanced patient well-being.

- Global Impact: Pfizer's mission extends beyond geographical confines, echoing across continents in a resonant call for global well-being. Embracing a mantle of responsibility, the company endeavors to channel its scientific prowess to ameliorate the health and lives of individuals worldwide. This noble pursuit involves ensuring equitable access to medicines and vaccines, particularly among underserved populations, and forging collaborative partnerships with healthcare stakeholders to address pressing global healthcare challenges.

- Patient-Centered Approach: At the very core of Pfizer's mission lies a profound dedication to placing patients at the vanguard of its endeavors. With an empathetic compass, the company keenly observes patient needs, crafts treatments that resonate, and orchestrates interventions that elevate patient outcomes and quality of life to new echelons.

By steadfastly adhering to these guiding tenets, Pfizer embarks on a transformative odyssey, committed to the realization of its mission: to unearth, nurture, and disseminate innovative medicines and vaccines that reverberate across the annals of healthcare, scripting stories of progress and elevating the tapestry of human existence.

Products edit edit source

Pfizer offers a wide range of products and services in the healthcare sector. Its main offerings include prescription medications, vaccines, and consumer healthcare products. It has developed and marketed numerous successful drugs across various therapeutic areas, including cardiovascular diseases, oncology, immunology, neurology, and rare diseases. Some well-known Pfizer products include Viagra, Lipitor, Lyrica, Prevnar, and Xeljanz. It also has a significant presence in the field of vaccines, with notable contributions like the COVID-19 vaccine developed in collaboration with BioNTech. Additionally, Pfizer offers over-the-counter healthcare products for consumers, such as pain relievers, vitamins, and personal care items.

Offering Categories edit edit source

The main offerings of Pfizer can be categorised into three primary areas: prescription medications, vaccines, and consumer healthcare products. Here's an overview of each category:

1. Prescription Medications edit edit source

Pfizer's prowess in pharmacology is epitomized by its comprehensive lineup of prescription drugs that span a myriad of therapeutic domains. Among its distinguished offerings are:

- Lipitor (atorvastatin): A potent agent employed to regulate cholesterol levels.

- Viagra (sildenafil): A trailblazing solution for addressing erectile dysfunction.

- Lyrica (pregabalin): A prescription champion against neuropathic pain, fibromyalgia, and specific seizures.

- Celebrex (celecoxib): A notable nonsteroidal anti-inflammatory drug (NSAID) efficacious in pain alleviation and inflammation management.

- Xeljanz (tofacitinib): A pharmacological gem revered for mitigating rheumatoid arthritis and diverse autoimmune disorders.

2. Vaccines edit edit source

Pfizer's luminous legacy extends to the realm of vaccines, where it holds an instrumental role in safeguarding public health. Noteworthy among its vaccine innovations are:

- COVID-19 Vaccine (in partnership with BioNTech): A groundbreaking defense against the global pandemic, forged through collaborative genius, aimed at thwarting the perils of COVID-19.

- Prevnar 13 (pneumococcal 13-valent conjugate vaccine): A beacon of protection against pneumococcal ailments, encompassing life-saving prevention against pneumonia and its ilk.

3. Consumer Healthcare Products edit edit source

In the sphere of consumer well-being, Pfizer unfurls an array of accessible over-the-counter products, nurturing health on an individual level. A selection of these offerings includes:

- Advil (ibuprofen): A trusty companion for pain alleviation and fever mitigation.

- Centrum: A constellation of multivitamin and mineral supplements, meticulously tailored to nourish and fortify.

- Caltrate: A herald of bone health, championing wellness through meticulously formulated calcium supplements.

- ChapStick: A beloved lip care classic, tenderly shielding and nurturing lips.

The fulcrum of Pfizer's product realm orbits around these key categories, catering to the diverse needs of individuals and the global healthcare landscape. Notably, the products mentioned might vary based on geographic regions and dynamic market trends.

Main Products (Key Revenue-Generating Products) edit edit source

Pfizer's flagship products stand as vanguards of medical innovation, diligently sculpted to make indelible marks on health and well-being. The main products of the company in terms of revenues are Comirnaty, Paxlovid, Elliquis, Prevnar family, Ibrance, Vyndagel family, Xeljanz, Xtandi, and Inlyta.

Comirnaty: An mRNA-based COVID-19 vaccine developed in partnership with BioNTech, designed to champion the fight against the pandemic. Both companies share the developmental endeavor's financial burden.

Paxlovid: A prescription beacon of hope, specifically tailored to combat moderate COVID-19 manifestations in high-risk adults, strategically poised to curtail progression to severe stages.

Elliquis: A groundbreaking Novel Oral Anticoagulant birthed in collaboration with Bristol Myers Squibb, engineered to provide an alternative to the traditional warfarin treatment.

Prevnar: A lineage of pneumococcal vaccines championing the protection of individuals across generations against the perils of Streptococcus pneumoniae infections.

Ibrance: A pharmaceutical masterpiece, poised to address the relentless progression of HR+, HER2- breast cancer as it metastasizes to distant domains within the body.

Vyndaqel: A remarkable entity set to battle the rare affliction known as transthyretin amyloidosis, ushering in hope and healing for those ensnared by this ailment.

Xtandi: A trailblazing androgen receptor inhibitor, carefully devised to impede the androgen receptor pathway's aberrant steps within tumor cells, an achievement borne from collaboration with Astellas.

Inlyta: A strategic intervention meticulously designed to stunt tumor growth by attenuating the blood supply, forging a potent weapon against cancer's insidious advance.

The revenue contribution as of December 2022 can be seen in the table below:

| Product | Revenues | % of Total Revenues |

|---|---|---|

| Comirnaty | $37,806 | 37.68% |

| Paxlovid | $18,933 | 18.87% |

| Eliquis | $6,480 | 6.46% |

| Prevnar family | $6,337 | 6.31% |

| Ibrance | $5,120 | 5.1% |

| Vyndagel family | $2,447 | 2.44% |

| Xeljanz | $1,796 | 1.79% |

| Inlyta | $1,003 | 0.01% |

Comirnaty and Paxlovid together accounted for 57% of 2022 total revenues, which shows a high concentration level in the company's revenue stream. Revenue generation of these two products is not expected to be at similar levels moving forward since the pandemic is coming to an end.

Research and Development: edit edit source

R&D is at the centre of what Pfizer does since it helps the company fulfil its purpose of changing patients' lives. The main areas that the company focuses are inflammation and immunology, internal medicine, oncology, diseases, vaccines, and anti-infectives. As of 31st January 2023, Pfizer had the following numbers of projects in various stages of R&D:

| Phase 1 | Phase 2 | Phase 3 | Registration |

|---|---|---|---|

| 34 | 37 | 23 | 16 |

Phase 1 refers to experimental products tested for the first time in human clinical trials. Phase 2 refers to products with several trials conducted on product's effectiveness, ideal dosage and delivery method. During Phase 3, test results of earlier trials on larger populations are conducted and risks-benefit analysis is the main focus. Registration refers to applications filed with appropriate regulatory authorities.

Team Dynamics edit edit source

Pfizer boasts a diverse and talented team of researchers, scientists, clinicians, and professionals across various functions. Collaboration and cross-functional teamwork are emphasized, fostering a culture of innovation and knowledge sharing. Pfizer's team comprises individuals with diverse backgrounds, expertise, and perspectives, facilitating the development of ground-breaking offerings. The company promotes a supportive and inclusive work environment, enabling employees to thrive and contribute to Pfizer's success.

Executive Team

Albert Bourla serves as the Chairman and CEO of Pfizer, leading the company in its mission to make breakthroughs that positively impact patients' lives by driving scientific and commercial innovation in healthcare. With over 30 years of experience at Pfizer, he has held senior positions across diverse markets and disciplines, gaining a global perspective on patient needs and healthcare systems. Albert has a strong commitment to ensuring equitable access to medicines and vaccines worldwide. Since becoming CEO in 2019, he has accelerated Pfizer's transformation into a science-driven and innovative company, increasing investment in R&D and digital innovation. Under his leadership, Pfizer has embodied its core values of courage, excellence, equity, and joy. Notably, during the COVID-19 pandemic, Albert led Pfizer's remarkable response, investing billions of dollars to develop a safe and effective vaccine in record time. The company also delivered the first FDA-authorized oral antiviral treatment for COVID-19. Albert has further strengthened Pfizer's commitment to Environmental, Social, and Governance (ESG) principles and has been recognized for his leadership and achievements in the healthcare industry. He holds a Doctor of Veterinary Medicine and a Ph.D. in the Biotechnology of Reproduction. Albert is actively involved in various organizations and serves on multiple boards, contributing to the advancement of global healthcare and business.

Sally Susman holds the position of Executive Vice President and Chief Corporate Affairs Officer at Pfizer. In her role, she is responsible for engaging with Pfizer's external stakeholders and overseeing various areas, including communications, corporate responsibility, global policy, government relations, investor relations, and patient advocacy. Sally also serves as the vice chair of the Pfizer Foundation and co-chair of Pfizer's Political Action Committee. Prior to joining Pfizer in 2007, Sally held senior positions in communications and government relations at Estée Lauder Companies and the American Express Company. She also has a background in government service, where she focused on international trade issues for eight years. Sally's involvement extends beyond Pfizer, as she serves on the board of UL Solutions, a global leader in applied safety science, and co-chairs the board of The International Rescue Committee. Additionally, she is a member of the Council on Foreign Relations.

Payal Sahni holds the role of Executive Vice President and Chief People Experience Officer at Pfizer, responsible for overseeing the global talent strategy, diversity and inclusion efforts, total rewards, and colleague experience. With a career spanning over two decades at Pfizer, she has held various HR leadership positions, including Senior Vice President of Human Resources for Pfizer Biopharmaceuticals Group, where she led HR strategy for multiple business units and corporate functions. Payal has played a vital role in managing HR strategy during mergers and acquisitions, spearheading transformations, and supporting Pfizer's evolving business structure. She holds a Bachelor of Arts in Psychology from Rider University and a Master of Arts in Psychology from Fairleigh Dickinson University.

William Pao, M.D., Ph.D., serves as the Chief Development Officer and Executive Vice President at Pfizer. In his role, he leads the Global Product Development organization, which is responsible for advancing Pfizer's pipeline of innovative medicines across various therapeutic areas, including inflammation and immunology, internal medicine, anti-infectives, oncology, and rare diseases. William has an impressive background in translational medicine, targeted cancer therapeutics, and personalized medicine. Prior to joining Pfizer, he held leadership positions at Roche, where he oversaw the discovery and early development of a diverse portfolio of therapeutic candidates. William's ground-breaking research has contributed to our understanding of lung cancer and other malignancies, and he has been recognized for his contributions to cancer genomics and personalized medicine. He has published extensively and served as an advisor to notable medical associations and research journals. William holds undergraduate and doctoral degrees from Harvard and Yale University, respectively, and has completed his medical training and oncology fellowship at New York-Presbyterian Hospital/Weill-Cornell Medical School and Memorial Sloan-Kettering Cancer Center.

Mike McDermott serves as the Chief Global Supply Officer and Executive Vice President at Pfizer. In his role, he leads the Pfizer Global Supply (PGS) team, responsible for overseeing the company's internal and external manufacturing and supply chain activities. Mike and his team ensure the continuous supply of Pfizer's extensive product portfolio, including medicines and vaccines distributed to over 185 countries worldwide. The PGS network consists of 36 global manufacturing sites and approximately 31,000 colleagues, working together with over 300 contract manufacturers to produce around 50 billion doses annually. With over 30 years of industry experience, Mike joined Pfizer in 1989 and has held various positions in divisions such as Consumer Healthcare, Biotechnology, Supply Chain, Finance, and Marketing. He became the President of PGS in 2018 and assumed his current role in 2022. In addition to his professional endeavors, Mike is a passionate advocate for Diversity, Equity, and Inclusion, implementing impactful changes within PGS and serving as the Executive Sponsor of Pfizer's Women's Resource Group. Mike holds Bachelor of Science and Master of Science degrees in Industrial Engineering from the New Jersey Institute of Technology. Mike serves on the Executive Committee of the National Association of Manufacturers and is a member of the Pharmaceutical Manufacturers Forum.

Aamir Malik holds the position of Executive Vice President and Chief Business Innovation Officer at Pfizer. In this role, he is responsible for shaping the company's strategy, business development, commercial development, portfolio management, pipeline prioritization, and the establishment of new business ventures. Before joining Pfizer, Aamir served as the Managing Partner of McKinsey & Company's United States operations and led the Global Pharmaceutical and Medical Products Practice at the firm. With 25 years of experience at McKinsey, Aamir has contributed to the development of innovative growth strategies, facilitated mergers and acquisitions, and implemented impactful programs to enhance patient outcomes and improve performance in the life science industry. He has advised numerous Boards, CEOs, and top management teams in the field. Aamir holds a Bachelor of Science degree in Finance from Indiana University and is an active advocate for improving the lives of individuals with food allergies.

Doug Lankler has been a part of Pfizer since 1999 and currently holds the position of general counsel. Before assuming this role, Doug served as Pfizer's chief compliance and risk officer starting in 2006. Prior to joining Pfizer, he worked at the United States Department of Justice as an Assistant U.S. Attorney in the Southern District of New York. Doug's exceptional service in this role earned him the United States Attorney General's Distinguished Service Award. He obtained his education from the State University of New York at Albany and Cornell Law School.

Rady Johnson holds the position of Executive Vice President and Chief Compliance, Quality, and Risk Officer at Pfizer. In this role, he has overall responsibility for the company's global compliance program, Regulatory Quality Assurance organization, global security efforts, and Office of the Ombuds. Since joining Pfizer in 1994, Rady has held various leadership positions, including leading the Regulatory Law practice group, Corporate Regulatory and Healthcare Law Audit functions, and establishing the Legal Division's Global Products Counsel practice group. He also served as Senior Vice President and Associate General Counsel for the innovative segments of Pfizer's Worldwide Biopharmaceuticals Business. Before joining Pfizer, Rady worked in private practice with the law firm of Hogan & Hartson, specializing in food and drug law. He previously worked as a Certified Public Accountant at Arthur Anderson, focusing on the healthcare and hospitality industries. Rady is a graduate of the University of Richmond and the Georgetown University Law Center.

Financials edit edit source

Historic financials edit edit source

| 12 Months Ending | 12/31/2006 | 12/31/2007 | 12/31/2008 | 12/31/2009 | 12/31/2010 | 12/31/2011 | 12/31/2012 | 12/31/2013 | 12/31/2014 | 12/31/2015 | 12/31/2016 | 12/31/2017 | 12/31/2018 | 12/31/2019 | 12/31/2020 | 12/31/2021 | 12/31/2022 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue, GAAP | 48,371.00 | 48,418.00 | 48,296.00 | 49,934.00 | 67,039.00 | 65,259.00 | 54,657.00 | 51,452.00 | 49,605.00 | 48,851.00 | 52,824.00 | 52,546.00 | 53,647.00 | 40,905.00 | 41,908.00 | 81,288.00 | 100,330.00 |

| Net Income, GAAP | 19,337.00 | 8,144.00 | 8,104.00 | 8,635.00 | 8,257.00 | 10,009.00 | 14,570.00 | 22,003.00 | 9,135.00 | 6,960.00 | 7,215.00 | 21,308.00 | 11,153.00 | 16,026.00 | 9,616.00 | 21,979.00 | 31,372.00 |

| Margin % | 40 | 16.8 | 16.8 | 23.2 | 17.7 | 19.7 | 22.3 | 23.5 | 23.1 | 21.4 | 24.4 | 23.7 | 25.2 | 17.4 | 23.9 | 27.7 | 35.4 |

| Total assets | 115,546.00 | 115,268.00 | 111,148.00 | 212,949.00 | 195,014.00 | 188,002.00 | 185,798.00 | 172,101.00 | 167,566.00 | 167,381.00 | 171,615.00 | 171,797.00 | 159,422.00 | 167,594.00 | 154,229.00 | 181,476.00 | 197,205.00 |

| EV/EBITDA | 8.43 | 7.08 | 5.12 | 10.66 | 7.09 | 7.46 | 8.2 | 9.28 | 10.48 | 12.68 | 12.48 | 12.03 | 13.38 | 12.46 | 17.56 | 13.63 | 7.48 |

| Average | 9.28 | 8.05 | 5.93 | 4.77 | 9.91 | 7.71 | 7.89 | 9.02 | 9.16 | 11.14 | 12.74 | 12.83 | 12.71 | 12.09 | 11.83 | 19.82 | 11.54 |

| High | 10.29 | 9.03 | 7.62 | 10.66 | 11.58 | 8.41 | 8.75 | 9.99 | 10.5 | 12.67 | 14.26 | 13.87 | 14.56 | 13.46 | 17.54 | 27.97 | 13.08 |

| Low | 8.09 | 6.78 | 4.27 | 3.27 | 7.09 | 6.7 | 7.26 | 8.33 | 8.34 | 10.17 | 11.32 | 11.99 | 11.22 | 10.43 | 9.65 | 13.61 | 7.48 |

| Price to Book Ratio | 2.59 | 2.37 | 2.08 | 1.63 | 1.6 | 2 | 2.25 | 2.57 | 2.75 | 3.08 | 3.31 | 3.04 | 3.94 | 3.43 | 3.24 | 4.3 | 3.01 |

| Return on Common Equity | 28.26 | 11.96 | 13.24 | 11.71 | 9.29 | 11.78 | 17.83 | 27.94 | 12.38 | 10.24 | 11.61 | 32.58 | 16.56 | 25.33 | 15.22 | 31.3 | 36.3 |

| Total Debt to Total Equity | 11.17 | 20.18 | 29.93 | 53.8 | 49.86 | 47.13 | 45.86 | 47.62 | 51.22 | 59.85 | 70.33 | 60.69 | 65.47 | 84.24 | 65.02 | 53.44 | 40.71 |

| Last Price | 24.55 | 21.55 | 16.79 | 17.24 | 16.6 | 20.51 | 23.77 | 29.04 | 29.53 | 30.6 | 30.79 | 34.33 | 41.38 | 37.14 | 36.81 | 59.05 | 51.24 |

| Dividends per Share | 0.96 | 1.16 | 1.28 | 0.8 | 0.72 | 0.8 | 0.88 | 0.96 | 1.04 | 1.12 | 1.2 | 1.3 | 1.38 | 1.46 | 1.53 | 1.57 | 1.6 |

Projections edit edit source

| 12 Months Ending (Millions USD) | 2023P | 2024P | 2025P | 2026P | 2027P |

|---|---|---|---|---|---|

| Revenue | 70,231 | 56,185 | 56,185 | 61,803 | 67,984 |

| Cost of Revenue | (21,503) | (17,202) | (17,202) | (18,922) | (20,815) |

| Gross Profit | 48,728 | 38,983 | 38,983 | 42,881 | 47,169 |

| Research & Development | (12,606) | (13,906) | (15,339) | (16,920) | (18,665) |

| Selling, General & Administrative | (10,975) | (8,780) | (8,780) | (9,658) | (10,624) |

| EBITDA | 25,147 | 16,297 | 14,863 | 16,302 | 17,880 |

| Amortization of intangible assets | (3,552) | (3,552) | (3,552) | (3,552) | (3,552) |

| EBIT (Operating Income) | 21,595 | 12,744 | 11,311 | 12,750 | 14,328 |

| Other income/(deductions)––net | (975) | (1,733) | (1,733) | (1,733) | (1,733) |

| Acquired in-process research and development expenses | (1,606) | (1,285) | (1,285) | (1,413) | (1,554) |

| Restructuring charges and certain acquisition-related costs | (963) | (770) | (770) | (847) | (932) |

| Income before provision (EBT) | 18,051 | 8,957 | 7,523 | 8,757 | 10,109 |

| Provisions/(benefit) for taxes on income | (2,058) | (1,021) | (858) | (998) | (1,152) |

| Net income for common share holders | 15,968 | 7,901 | 6,631 | 7,723 | 8,921 |

Market edit edit source

Total addressable market size edit edit source

Research shows that approximately 95% of the world has health issues or problems [1]. Currently, the world population is at 7.8 billion people. This means that 95% of 7.8 billion people is 7 billion, 410 and million is the addressable market size [2].

According to Statista, the global pharmaceutical industry had an annual revenue of $1.42 trillion in 2021 [3].

In terms of market share, Pfizer held 5% of the world's prescription drug market in 2019 [4].

Serviceable addressable market size edit edit source

The landscape of the healthcare industry in the United States, as of 2021, is a tapestry woven with remarkable complexity and colossal economic significance, boasting a staggering valuation of $808 billion [5]. Within this expansive realm, a multitude of players, both established and emerging, partake in a symphony of innovation, research, and patient care that resonates across medical disciplines.

Serviceable Obtainable Market edit edit source

Here, the serviceable obtainable market size is the patient population that was treated with Pfizer vaccines and medicines. This is estimated to be about 1.3 billion patients around the world [6]

In 2022, the industry is expected to generate 1.14 trillion U.S. dollars in prescription drug revenue worldwide ([7].

Competition edit edit source

Despite Pfizer being among the leaders of the pharmaceutical industry, several other large, global drug manufacturers are in competition with Pfizer. These companies include Johnson and Johnson, Amgen, Novo Nordisk, Merck and Co, AbbVie Inc, and Eli Lilly and Co.

In FY 2022, Pfizer made $31.37 billion in net income out of $100.33 billion in annual revenue. The company's market capitalization was $227 billion as of market close on 24th March 2023 [8]. Market cap is used to determine a company's size and then evaluate the company's financial performance to other companies of various sizes. In investing, companies with larger market capitalizations are often safer investments as they represent more established companies with generally longer history in business carrying less risk than small-cap companies.

- Johnson and Johnson: Johnson and Johnson is known for its health products, pharmaceuticals and medical devices.

- Novo Nordisk A/S (NVO): Novo Nordisk is a Norweigan pharmaceutical company that focuses on treating diabetes, obesity and other serious chronic diseases and conditions. Ozempic was Novo Nordisk's top selling drug in 2022 which is an insulin therapy delivered by injection.

- Eli Lilly and Co: Eli Lilly is a global drug manufacturing company which focuses on discovering, developing, manufacturing and marketing human pharmaceutical products. The company's top selling drug in FY 2022 was Trulicity which is used to treat type 2 diabetes.

- Abbvie Inc.: AbbVie is a global biopharmaceutical company engaged in research and development, manufacturing, commercializing and selling innovation medicines and therapies. Its medical products span a range of healthcare-related areas such as immuology, oncology, neuroscience, etc.

- Merck and Co. Inc: The company offers prescription medicines, vaccines, biologic therapies, and animal health products. Its two operating segments are pharmaceutical and animal health.

Overall, Pfizer's largest competitor is Johnson and Johnson. Johnson and Johnson may not generate the same amount of revenue from its products but its market cap and total revenue make it a strong competitor.

That being said, Pfizer is different from other companies because Pfizer continually emphasises innovation and its multi-billion dollar investment in R and D results in a strong and differentiated product pipeline. The organizational effectiveness of the company is constantly improving by continuously educating patients, physicians, payers and global health authorities on the benefits and risks of medicines and vaccines. Pfizer continues to evaluate, adapt and improve the organisation and business practice in order to meet customer and public needs. Pfizer establishes a "first-to-market" for biosimilar products to provide customers a lower-cost alternative immediately when available as well as providing the company with higher sales and profitability until other competitors enter the market. Pfizer's intellectual property and continuous medicine development are its competitive advantages over other companies [9].

| Company name | Market Cap | FY 2022 Revenue | FY 2022 Net income | Top drug by revenue (FY 2022) | Revenue from top drug (FY 2022) |

|---|---|---|---|---|---|

| Johnson and Johnson | $423 billion | $95 billion | $17.9 billion | Darzalex | $7.9 billion [10] |

| Novo Nordisk A/S (NVO) | $349 billion [11] | $43.5 billion | $16.9 billion | Ozempic | $5.7 billion [12] |

| Eli Lilly and Co | $440 billion [13] | $28.5 billion | $6.2 billion | Trulicity | $5.7 billion [14] |

| Abbvie Inc | $242 billion [15] | $58.1 billion | $11.8 billion | Humira | $18.6 billion [16] |

| Merck and Co. Inc | $289 billion | $59.3 billion | $16.4 billion | Keytruda | $20.9 billion [17] |

Valuation edit edit source

Three different methods were used for the valuation: discounted cash-flow analysis (DCF), comparable company analysis and the dividend discount model. Since Pfizer is a late-stage company which is mature, established and its dividends are relatively stable and predictable, DDM could help us produce the closest to reality results. The DDM assumes a constant or stable dividend growth rate, which aligns well with the characteristics of Pfizer.

Using this method, under our base case, we found a value per share of $31.10. Thus the company is trading at a premium of 16% (market value per share right now is $36.85) compared to its intrinsic value. The assumptions taken for this method were the following:

| Description | Value | Commentary |

|---|---|---|

| Stage 1 growth | 2.5% | This value was selected based on the growth rate of Pfizer's dividends over the last 3 years. |

| Stage 2 growth | 2% | Stage 2 growth rate represents the perpetual growth rate. It is usually between 2-3% since it ranges between historical inflation rate and global GDP growth rate. |

| Cost of equity | 7.46% | The cost of equity was calculated based on the CAPM. 10-year US Treasury, average market rate of return and beta of Pfizer were all used in order to come up with this number. |

Using the DCF valuation method, under our base case, we found a value per share of $34.04. Thus the company is trading at a premium of 7.6% (market value per share right now is $36.85) compared to its intrinsic value calculated using DCF. DCF is an assumption-based model and the accuracy of those assumptions can significantly impact the valuation results. The assumptions used are included in the following table:

| Description | Value | Commentary |

|---|---|---|

| Revenue growth (% change) | -30% for year 1, -20% for year 2, 0% for year 3, 10% for years 4 and 5 | The revenue growth is expected to fall by 30% for 2023, as highlighted by the company's published 10K annual report. We expect the revenue growth to continue falling by 20% for 2024 as demand for COVID-19 will keep decreasing and Pfizer's main source of revenue is coronavirus products (57% of total revenue for 2022). Then, for the following years we expect the company to develop new products and boost its revenue streams by 10%, as 119 products are in either clinical phases or registration. |

| Cost of sales (% of Revenue) | 31% | The historical average of COGS as a percentage of revenue was calculated. |

| SG&A (% of Revenue) | 16% | The historical median of SG&A as a percentage of revenue was preferred here, since there was a large difference between 2020 and 2022 results. |

| R&D expenses growth (% change) | 10% | From 2021 to 2022, the company raised its R&D expenses by 10%. Therefore, we expect the R&D expenses growth to increase by 10% each year, since Pfizer is focusing on creating new drugs and medication and R&D is at the center of what the company is doing. |

| Acquired in-process research and development expenses (% of revenue) | 2% | The historical average as a percentage of revenue was selected. |

| Amortization of intangible assets ($ millions) | $3,552 | The historical average in millions of dollars was selected. |

| Other (income)/deductions-net ($ millions) | $975 for the 1st year, and $1733 for the next 4 years | Pfizer issued $31 billion of debt on May 2023 and since it will need to pay around $1516 mil. more each year, we expect this element of the income statement to rise moving forward as it is dominated by interest expenses. |

| Restructuring charges and certain acquisition-related costs (% of revenue) | 1% | The historical average as a percentage of revenue was selected. |

| Tax(% of Income before provision) | 11.4% | As of Q1 2023, Pfizer's effective tax rate is 11.4%. |

| Capital Expenditures ($ millions) | $3736 mil. for year 1, $4236 mil. for year 2, $4736 mil. for year 3, $5236 mil. for year 4, $5736 for year 5 | Pfizer increased its Capex from 2020 to 2022 by $500 mil. each year, so we expect this trend to continue. |

| Accounts Receivable (Days) | 46 days | The historical average of Accounts Receivable (days) was used. Accounts receivable (days) is calculated as (Accounts Receivable/Revenues)*365. |

| Accounts Payable (Days) | 70 days | The historical average of Accounts Payable (days) was used. Accounts payable (days) is calculated as (Accounts Payable/COGS)*365. |

| Inventory (Days) | 102 days | The historical average of Inventory (days) was used. Inventory (days) is calculated as (Inventory/COGS)*365. |

| Discount rate | 7.01% | Discount rate was calculated using the WACC formula. Cost of equity was the same as before (DDM), whereas cost of debt was selected as the cost of borrowing the latest $31 billion (5% on average). Debt was calculated as short-term + long-term debt and for the equity part the current market capitalization was used. |

| Perpetual growth rate | 3% | In order to calculate the terminal value, a growth rate of 3% in perpetuity was used. |

Our last method for valuing Pfizer was comparable company analysis. Price/earnings and Enterprise Value/EBITDA ratios were used. Earnings of 2022 were multiplied by the median P/E ratio of the competitors (i.e. Merck, GSK, J&J, Abbvie, Amgen, Eli Lilly). The implied market cap was $631,442 million. This divided by shares outstanding resulted in an implied price per share of $112.38 which is significantly higher than the current one of $36.85. Thus the company seems undervalued when using this method. This may mean that investors may not be fully recognizing the company's earnings potential or growth prospects, leading to a lower valuation compared to its peers.

When using the second multiple, we multiplied EBITDA of 2022 by the median EV/EBITDA ratio of Pfizer's competitors. The implied enterprise value was $623,056 million. Next, net debt was subtracted and we arrived at a $587,644 million market capitalization. This divided by shares outstanding resulted in an implied price of $104.58, which is again significantly higher than the current market price.

Sensitivity Analysis edit edit source

Sensitivity analysis provides valuable insights into the potential outcomes and risks associated with models which are based on a wide range of assumptions. As such, it is crucial to be implemented for models, such as DDM and DCF.

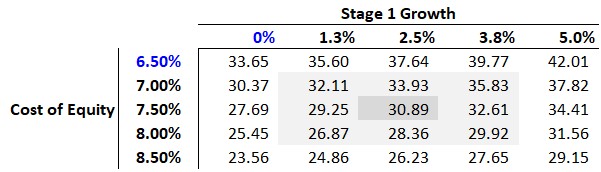

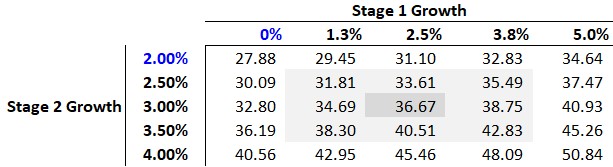

For the DDM model, stage 1 growth rate and cost of equity were selected for the sensitivity analysis table. As expected, when cost of equity increases, the intrinsic value per share decreases and when growth rate increases, intrinsic value per share increases. Furthermore, the relationship between the two different growth rates was tested.

Under our bull case (stage 1 growth rate = 3.75%), intrinsic value per share rises to $32.83, whereas under our bear case (stage 1 growth rate = 1.25%) intrinsic value per share drops to $29.45. It is observed that changes in stage 2 growth rate affect the outcome much more than changes in stage 1 growth rate. Therefore, value per share using DDM is more sensitive to changes in stage 2 growth rate compared to changes in stage 1 growth rate. That is due to the nature of this model, as stage 1 growth rate is limited to a specific time frame while stage 2 growth rate (or perpetual growth rate of dividend) is typically used to capture the long-term growth of prospects of the company. Since it assumes growth into perpetuity, even small changes can have a significant impact on the stock's value.

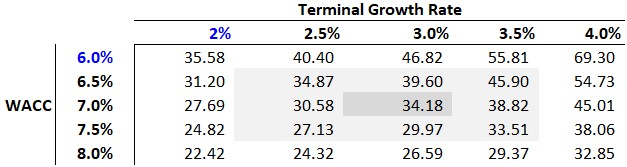

For the DCF model, discount rate and terminal growth rate were selected for the sensitivity analysis table and revenue growth was used for the scenario analysis. As expected, discount rate and value per share are negatively related, whereas terminal growth rate and value per share move in the same direction.

Regarding scenario analysis, three different cases were used in order to come up with the results. Our base case was highlighted above, whereas for our bull and bear cases changes were made in the revenue growth line. Revenue growth line for the downside case was projected to be -30%, -20%, -7%, 10%, 10% for the next 5 years. Revenue growth line for the upside case was projected to be -30%, -15%, 5%, 10%, 10%, implying that a significant number of products that are in the first stages will get approved. Under our upside case, Pfizer's share price would be worth $45.35, while under our downside case, Pfizer's share price would be worth $24.47.

Risks edit edit source

The risks or uncertainties associated with the business include the following:

- Risks related to business, industry and operations

The company faces competitions from other competitors including Johnson & Johnson and generic drug manufacturers which can erode sales and market share. Competition for the top drugs including Lyrica, which made 4.6 billion in 2018 has lost patent inclusivity. Pfizer relies heavily on key products, where concentration product risk can pose a problem with the example of Comirnaty developed for COVID-19, which has seen a steep decline in sales due to reduced demand. Pzfier's total annual sales crossed the $100 billion mark for the first time in 2022 although $56 billion of the sales came from Cormirnaty, meaning a potential decline in sales over the upcoming years.

| Risk |

|---|

| The outcome to meet anticipated pre-clinical and clinical endpoints, and to be able to meet regulatory approval with the possibility of potential unfavourable pre-clinical or clinical data. |

| Able to address comments and concerns from regulatory authorities and to be able to obtain approval for new products. |

| Claims and concerns in regards to the safety of efficiacy of products and product candidates. |

| Competition from new product entrants, including but not limited to; generic products, private label products and biosimilars. |

| Impact of public health outbreaks impacting on business, operations and financial conditions. |

| Impact of increased presence of counterfeit medicines or vaccines in the pharmaceutical supply chain. |

| Impact of increased presence of counterfeit medicines or vaccines in the pharmaceutical supply chain. |

2. Risks related to Government Regulation and Legal Proceedings

Legislations involving Medicare and other U.S healthcare reform influencing spending reductions on health programs that may be implemented can significantly impact future sales. Any regulation on pharmaceutical product pricing, IP, restrictions on interactions with industry stakeholders and pricing pressures for Pfzier products.

| Risks |

|---|

| The impact of any U.S. healthcare reform involving cost controls affecting publicly funded health programs that may be implemented. |

| Governmental regulations affecting operations. |

3. Risks involving Intellectual Property, Technology and Security

Potential breakdown of the IT infrastructure can cause significant risk. Another risk that could be taken in consideration is patent applications being granted on a timely basis, and a risk to products, patents and IP under any claims of patent infringement.

| Risks |

|---|

| Business disruption, theft of information that result in an integrity comprimise resulting from a cyber-attack. |

| Risks to products, patents and other IP including, claims of invalidity, patent infringemen and pressure or regulatory action by the government or large stakeholders. |

Catalysts edit edit source

Pfizer Inc., a pharmaceutical and biotechnology juggernaut founded in 1849, stands as a beacon of medical innovation and healthcare solutions. This comprehensive report delves into the catalysts that have driven Pfizer's progress, resilience, and transformation over its illustrious history. Through pivotal news events, strategic collaborations, technological breakthroughs, and investor confidence, Pfizer has continually propelled itself to the forefront of the healthcare industry.

Pharmaceutical Innovation and Breakthroughs edit edit source

At the heart of Pfizer's legacy lies a rich history of pharmaceutical innovation. The discovery of groundbreaking medicines has not only transformed patient outcomes but also solidified Pfizer's status as a global pharmaceutical leader. Throughout its journey, Pfizer's dedication to research and development has resulted in pioneering advancements that have reshaped medical landscapes and improved the quality of life for countless individuals. For instance, the development of the cholesterol-lowering drug Lipitor, which became the best-selling drug in pharmaceutical history, showcases Pfizer's ability to address critical health challenges and revolutionize treatment approaches. Similarly, the introduction of the antipsychotic medication Geodon brought new hope to patients and healthcare providers alike, underscoring Pfizer's commitment to enhancing mental health care.

Vaccine Development and Healthcare Solutions edit edit source

Pfizer's contributions to healthcare extend beyond traditional pharmaceuticals, notably demonstrated through its vaccine development initiatives. The collaboration with BioNTech in the development of the first authorized COVID-19 mRNA vaccine, Comirnaty, has been a game-changing achievement in global health. This historic milestone showcases Pfizer's ability to harness cutting-edge technology and respond rapidly to emerging healthcare challenges. The successful creation and distribution of Comirnaty during the global pandemic have solidified Pfizer's position as a critical player in safeguarding public health. Furthermore, Pfizer's ongoing commitment to vaccine research and development underscores its dedication to addressing evolving health threats and providing comprehensive healthcare solutions.

Strategic Collaborations and Mergers edit edit source

Strategic collaborations and mergers have been pivotal in Pfizer's growth and diversification strategies. The 2009 acquisition of Wyeth not only broadened Pfizer's product portfolio but also strengthened its presence in areas such as vaccines, biotechnology, and consumer healthcare. This strategic move allowed Pfizer to tap into new markets and expand its capabilities to better serve diverse patient needs. Similarly, Pfizer's collaboration with Sangamo Therapeutics to develop gene therapies showcases its commitment to exploring innovative treatment modalities. These strategic initiatives position Pfizer at the forefront of biopharmaceutical innovation, where groundbreaking therapies and treatments are shaping the future of healthcare.

Technological Advancements and Digital Health edit edit source

In the era of digital transformation, Pfizer has embraced technological advancements to enhance healthcare delivery. The integration of digital health solutions, data analytics, and artificial intelligence in clinical trials and patient care exemplify Pfizer's dedication to advancing patient outcomes. By leveraging technology, Pfizer aims to optimize drug development processes, streamline patient experiences, and improve treatment efficacy. Such efforts underscore Pfizer's commitment to not only pharmaceutical innovation but also the broader landscape of healthcare services, where technology is becoming an increasingly vital component.

Investor Confidence and Support edit edit source

Pfizer's growth journey has been sustained by the unwavering confidence and support of both institutional and individual investors. Institutional investors, including mutual funds and pension funds, have shown resilience in their commitment to Pfizer's long-term potential. These investors recognize Pfizer's history of innovation, its position as a healthcare leader, and its ability to navigate complex and dynamic market conditions. Simultaneously, individual investors' contributions reinforce Pfizer's role as a favored investment choice, reflecting their trust in the company's capacity for innovation and healthcare leadership. The collaborative relationship between Pfizer and its investors remains integral to the company's continued success.

Global Impact and Vaccine Diplomacy edit edit source

Pfizer's response to global health crises extends beyond its products. The company's commitment to equitable vaccine distribution and healthcare access has made a profound impact on the international stage. By collaborating with governments and international organizations, Pfizer has demonstrated its dedication to vaccine diplomacy and healthcare equity. The successful development and distribution of the COVID-19 vaccine have showcased Pfizer's ability to mobilize resources, expertise, and networks to address urgent global health challenges. This commitment solidifies Pfizer's position as a responsible global corporate citizen and underscores its role in shaping global health outcomes.

Conclusion edit edit source

Pfizer Inc.'s journey is one marked by innovation, resilience, and transformative impact. Through pioneering pharmaceutical breakthroughs, strategic collaborations, technological integration, and investor confidence, Pfizer has forged a path that redefines healthcare possibilities. As the company continues to navigate an evolving landscape, its commitment to innovation and patient well-being remains unwavering. Pfizer's legacy as a beacon of healthcare excellence is a testament to its enduring dedication to medical progress and its ability to shape the future of healthcare for generations to come. In an era of unprecedented health challenges and technological advancements, Pfizer's role as a leader and innovator positions it at the forefront of global healthcare transformation.