Picton Property Income

Record FY22 with positive outlook

Summary edit edit source

Picton Property Income’s FY22 total earnings of £147m were the strongest since the company launched in 2005. Income gains and normalised rent collection underpinned DPS growth and while strong valuation uplifts mirrored broad market trends, Picton continued to build on its long-term record of portfolio outperformance. Returns are likely to moderate from the exceptional level of FY22, but Picton remains positive despite global economic and political challenges. The prospects for further uplifts in occupancy and rents are good with scope for accretive external growth.

| Year end | Net property income (£m) | EPRA earnings*(£m) | EPRA

EPS* (p) |

DPS

declared (p) |

NAV** per share (p) | P/NAV

(x) |

Yield

(%) |

|---|---|---|---|---|---|---|---|

| 03/21 | 33.5 | 20.1 | 3.7 | 2.93 | 97 | 0.96 | 3.2% |

| 03/22 | 35.4 | 21.2 | 3.9 | 3.45 | 120 | 0.77 | 3.7% |

| 03/23e | 37.1 | 21.6 | 4.0 | 3.60 | 130 | 0.71 | 3.9% |

| 03/24e | 38.6 | 22.7 | 4.2 | 3.66 | 133 | 0.69 | 4.0% |

Pandemic bounce back supports 28% NAV return edit edit source

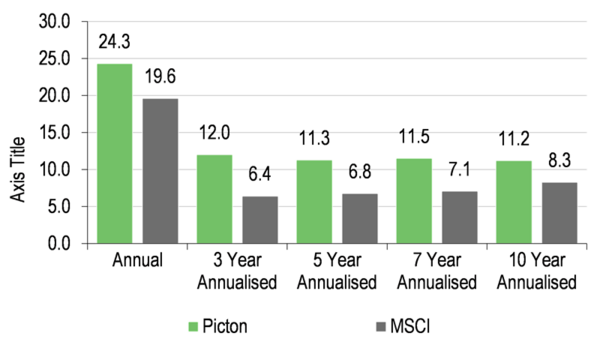

NAV per share increased to 120p (FY21: 97p), driven by a strong weighting to the industrial sector and asset management initiatives. Including DPS paid the FY22 total return was 28%. Having increased twice during the year, the annualised rate of quarterly DPS is back to the pre-pandemic level of 3.5p. EPRA earnings were up 5.5% to £21.2m or 3.9p per share, covering DPS by 1.15x. The ungeared property total return of 24.3% outperformed the MSCI UK Quarterly Property Index (19.6%) as it has done for the past nine years with upper-quartile performance over three, five and 10 years and since inception. Edison Investment Research's forecasts include an increase in NAV and slight reduction in EPS driven by cost inflation with DPS growth maintained.

Organic and acquisition-led growth potential edit edit source

The financial and operational performance continues to benefit from active asset management, including capex that aims to enhance the quality, sustainability and occupier appeal of assets, and sector positioning. The organic growth opportunity remains strong with an c £11m gap between passing rent and estimated rental value (ERV) at end FY22 and rents continuing to increase across most of the portfolio. Picton has seen no direct impact from the war in Ukraine at this point. Gearing is low (LTV: 21.2%) and primarily long-term fixed rate, with the average cost reduced by the FY22 refinancing. Additional undrawn facilities are available to support further accretive acquisitions. The company also continues to explore consolidation opportunities, leveraging its performance record and scalable platform where there is an opportunity to create additional value.

Valuation: Good yield with total return potential edit edit source

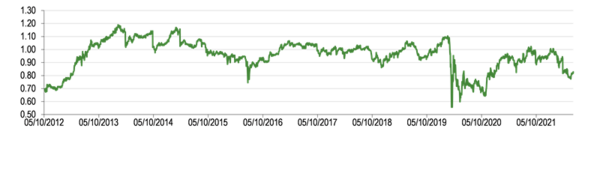

The current annualised rate of DPS (3.5p) represents a prospective yield of 3.8% with further growth reflected in Edison Investment Research's forecasts. The FY22 P/NAV is c 0.77x, which is below the five-and 10-year average of c 0.95x and a peak of c 1.1x.

Investment summary edit edit source

The strength of the FY22 result may be seen as exceptional, benefiting as it did from a bounce-back in property valuations as pandemic restrictions were progressively eased. Nonetheless, it was consistent with Picton’s track record of outperformance, driven by a total return strategy with a strong income focus. Despite growing headwinds from rising inflation, only partly explained by the war in Ukraine, Picton remains positive about the outlook. The underpinning for this optimism is covered throughout this report but in summary includes:

- Picton provides diversified exposure to UK commercial real estate with a well-established track record of performance.

- A significant 60% weighting to the industrial sector has been highly beneficial to recent performance and continues to benefit from a positive demand-supply balance and rising rents.

- Successful asset management is underpinned by the group’s occupier focus whereby it seeks to work closely with tenants to understand their needs, enhance occupancy, improve tenant retention and maximise income.

- Acquisitions made in FY22 (for an aggregate £23.5m before costs) and FY23 year to date (£13.7m) are yet to fully contribute to earnings and there is significant ‘reversionary’ growth potential embedded within the portfolio to support future income and capital values.

- All structural debt is long term and fixed rate, providing protection against increasing interest rates. Shorter-term, flexible, floating rate debt capacity is available for opportunistic acquisitions.

- Commercial real estate has traditionally provided a medium-term hedge against inflation as, at least in part, this is reflected in rental growth and valuations over time. Increasing building costs have a tendency to restrict new construction.

FY22 results in detail edit edit source

In this section, Edison Investment Research discusses the FY22 financial and operational performance. Its forecast and valuation analysis are discussed later in the report.

Key features of the FY22 financial results include:

- Rental income increased by £3.5m (9.8%) to £40.1m compared with £36.6m in FY21. The increase included acquisitions made during the year, increased occupancy and a £1.5m reduction in bad debt provisions compared with the prior year. Partly offset by lower non-recurring property income (primarily dilapidation receipts) and a slight inflation-driven increase in property expenses, net rental income increased £1.9m (6.0%) to £35.4m.

- Operating expense growth of £0.4m (6.8%) to £5.8m included a 6% increase in staff costs and additional costs relating to the development of the pathway to net zero carbon and other sustainability linked costs.

- Interest costs of £8.5m included additional amortisation costs and drawings under the revolving credit facility to fund acquisitions/investments. A debt refinancing at the year-end increased borrowing capacity by £49m, reduced the cost of borrowing and extended the average term. Edison Investment Research discusses this in detail later in this report.

- EPRA earnings increased by £1.1m (5.5%) to £21.2m, or 3.9p per share, covering dividends paid by 1.15x.

- IFRS earnings of £147m included positive realised and unrealised property valuation movements of £129.8m (FY21: £13.8m) and £4.0m of early debt repayment fees resulting from refinancing. IFRS NAV and EPRA NTA increased to 120p versus 97p in FY21.

- EPRA NTA total return (change in NTA plus dividends paid) was 27.9%. Based on the DPS declared, Picton calculates a total return of 28.3%.

- A low loan to value ratio was maintained through the year (end-FY22: 21.2%).

| Year end March (£m unless stated otherwise) | FY22 | FY21 | FY22/FY21 | Edison FY22 forecast |

| Rental income | 40.1 | 36.6 | 9.8% | 39.2 |

| Other income | 0.2 | 1.5 | N/M | 0.3 |

| Net property operating costs | (2.5) | (2.4) | 3.9% | (2.5) |

| Void costs | (2.4) | (2.2) | 9.5% | (1.9) |

| Net property income | 35.4 | 33.5 | 6.0% | 35.0 |

| Total operating expenses | (5.8) | (5.4) | 6.8% | (5.6) |

| Net finance expense | (8.5) | (8.0) | 6.4% | (8.0) |

| EPRA earnings | 21.2 | 20.1 | 5.5% | 21.5 |

| Debt prepayment fees | (4.0) | 0.0 | 0.0 | |

| Profit on disposal of investment property | 0.0 | 0.9 | 0.0 | |

| Investment property valuation movements | 129.8 | 12.9 | 92.0 | |

| IFRS net profit | 147.0 | 33.8 | 113.5 | |

| EPRA EPS (p) | 3.9 | 3.7 | 5.5% | 3.9 |

| IFRS EPS (p) | 26.9 | 6.2 | 20.8 | |

| DPS declared (p) | 3.45 | 2.93 | 17.9% | 3.45 |

| DPS paid (p) | 3.38 | 2.75 | 3.38 | |

| Dividend cover (x) | 1.15 | 1.34 | 1.14 | |

| Net assets, IFRS & EPRA | 657.1 | 528.2 | 623.9 | |

| NAV per share, IFRS & EPRA (p) | 120 | 97 | 24.4% | 114 |

| NAV total return based on DPS paid (%) | 27.9% | 6.6% | 21,7% | |

| Carried value of investment properties | 830.0 | 665.4 | 778.0 | |

| Net LTV (%) | 21.2% | 20.9% | 20.1% |

Operationally, Edison Investment Research highlights:

- A total property portfolio return of 24.3% was ahead of the MSCI UK Quarterly Property Index return of 19.6%. This was driven by a strong weighting to the industrial sector, which continued to perform strongly, and asset management initiatives across the portfolio.

- Successful leasing activity, particularly the letting of recently refurbished assets, saw EPRA occupancy increase to 93% from 91% at the end of FY21. A total of 34 new lettings or lease agreements were completed, securing £4.9m pa of rent at an average 8% premium to the March 2021 ERV; 21 leases were renewed or regeared, retaining £2.2m pa of rent at an average 3% above the March 2021 ERV, and 12 rent reviews secured an additional £0.2m pa at an average 7% premium to the March 2021 ERV.

- On a like-for-like basis, passing rent increased by 2.1%, driven by lettings and asset management activity, valuations by 5.4% and ERV by 5.0%.

- Rent collection has now returned to normal levels at close to 100%.

- Two multi-let industrial assets were acquired for an aggregate £23.5m during the year and one small retail unit was sold for £0.7m, 16% ahead of the March 2021 valuation.

Returns driven by strong track record of portfolio outperformance edit edit source

Accounting returns have averaged 10.2% pa over the past 10 years edit edit source

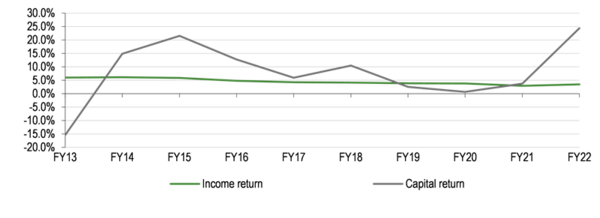

The accounting total return1 has been positive in each of the past 10 years other than in FY13 when Picton was negatively affected by a weak economic and sector performance combined with relatively high gearing at the time. Despite this, the cumulative 10-year return has been 164.4%, or an average 10.2% pa. Reflecting Picton’s total return investment strategy, capital returns have contributed c two-thirds of total returns.

| Year ending 31 March | FY13 | FY14 | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | Cumulative 10-year | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Opening NAV per share (p) | 58 | 49 | 56 | 69 | 77 | 82 | 90 | 93 | 93 | 97 | 58 | |||||||||

| Closing NAV per share (p) | 49 | 56 | 69 | 77 | 82 | 90 | 93 | 93 | 97 | 120 | 120 | |||||||||

| DPS paid (p) | 3.5 | 3.0 | 3.3 | 3.3 | 3.3 | 3.4 | 3.5 | 3.5 | 2.8 | 3.4 | 32.9 | |||||||||

| Income return/dividends paid | 6.0% | 6.1% | 5.9% | 4.8% | 4.3% | 4.2% | 3.9% | 3.8% | 2.9% | 3.5% | 56.8% | |||||||||

| Capital return/change in NAV | -15.4% | 14.9% | 21.6% | 12.7% | 5.9% | 10.5% | 2.6% | 0.7% | 3.7% | 24.4% | 107.6% | |||||||||

| NAV total return | -9.4% | 21.0% | 27.4% | 17.6% | 10.2% | 14.7% | 6.4% | 4.4% | 6.6% | 27.9% | 164.4% | |||||||||

| Average annual total return | 10.2% | |||||||||||||||||||

In common with the sector, the across-the-cycle income return has been much more stable than the capital return. Successful asset management is thus key to a sustainably enhancing total return.

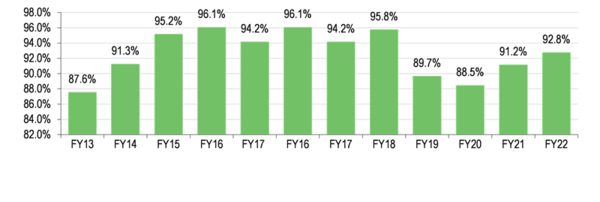

Exhibit 3: Income provides a relatively more stable bedrock to performance[4]

A trend decline in the cost ratio,2 the result of economies of scale and tight cost control, has further supported returns, while gearing has also steadily reduced with the end-FY22 net loan to value ratio (LTV) at 21.2%. With a strong balance sheet, Picton continues to explore opportunities for further growth. This includes property acquisitions, but the company is also conscious of the significant discounts that exist across parts of the REIT sector and the opportunities that this may provide. The open-ended sector has in some cases faced challenges that emanate from the long-term nature of real estate investment and the mismatch between asset liquidity and variable capital.

| FY13 | FY14 | FY15 | FY16 | FY17 | FY18 | FY19 | FY20 | FY21 | FY22 | |

|---|---|---|---|---|---|---|---|---|---|---|

| nvestment property (£m) | 386.4 | 423.0 | 540.9 | 654.6 | 624.4 | 683.8 | 685.8 | 664.6 | 682.4 | 849.3 |

| Net LTV | 54.5% | 47.7% | 30.1% | 34.6% | 27.3% | 26.7% | 24.7% | 21.7% | 20.9% | 21.2% |

| Cost ratio | 1.7% | 1.7% | 1.2% | 1.1% | 1.2% | 1.2% | 1.1% | 1.1% | 1.0% | 1.0% |

Consistently positive portfolio returns edit edit source

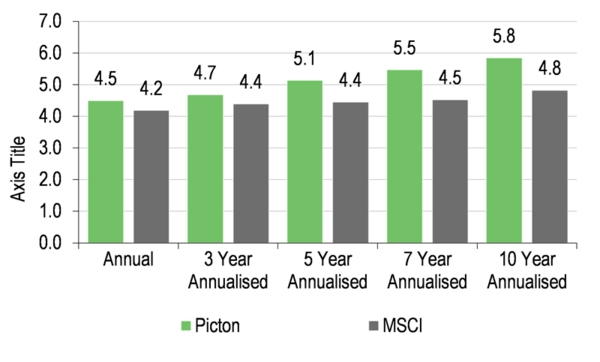

The key driver of Picton’s performance has been the consistently strong property portfolio return, measured before the impact of gearing or non-property costs. The company has outperformed the MSCI Quarterly Property Index for the past nine years and produced an upper-quartile performance over three, five and 10 years and since inception. The FY22 total return of 24.3% compared with 19.6% for the market was only marginally outside the upper-quartile return starting at 24.9%.

Exhibit 6 also demonstrates the relative stability of property income returns over the longer term.

Exhibit 5: Total property return versus index[6]

Exhibit 6: Property income return versus index[7]

Exhibit 6: Property income return versus index[7]

Among the factors supporting this strong performance, Edison Investment Research notes:

- Successful asset management underpinned by the group’s occupier focus whereby it seeks to work closely with tenants to understand their needs, enhance occupancy, improve retention and maximise income. Reflecting the market-wide “flight to quality” in the office sector in particular, portfolio investment has been stepped up, reaching £9.6m in FY22 compared with an average £5.1m pa in the preceding three years. The FY22 investment was principally across eight key projects, all aimed at enhancing space to attract occupiers, improve sustainability credentials, and grow income.

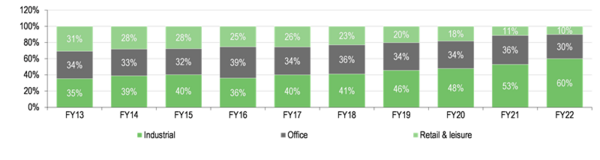

- Although Picton maintains a diversified portfolio its unconstrained approach to portfolio construction has enabled it to make strategic adaptations to sector and asset positioning in response to changing market conditions. The significant weighting to the industrial property sector (60%) and a highly selective exposure to the retail property sector (65% of the retail total) continues to benefit performance. The evolution of Picton’s portfolio positioning over time can be seen in Exhibit 7.

Exhibit 7: Sector positioning through time[8]

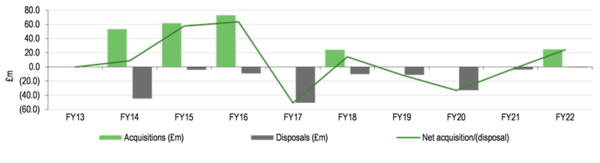

Picton’s approach to buying and selling assets is predominantly opportunistic and driven by asset rather than sector selection. Significant transactional activity in recent years reflects capital recycling and other strategic portfolio changes. During FY14–17 Picton took advantage of positive market conditions (increasing rents and rising valuations) to significantly grow and reposition the portfolio. This included the disposal of central London assets and other non-core properties, deliberately increasing the average lot size while reducing gearing. Ahead of the pandemic, Picton was a net seller of assets, reducing an already low high street retail exposure and further reducing gearing. Taking advantage of the market recovery, in FY22 (and FY23 year to date) it has been a net buyer and continues to monitor further opportunities across all market sectors.

Exhibit 8: Opportunistic approach to acquisitions and disposals overlaid with strategic positioning[9]

Significant organic growth potential embedded in the portfolio edit edit source

The end-FY22 ERV of £49.8m was £11.1m or 29% ahead of the annualised contracted rent roll of £38.7m. Void reduction represents £3.6m of the potential upside, with the balance comprising the upside from lease incentive run-off (c £4.5m) and the potential to increase existing rents to market levels at lease expiry (c £3.0m).

| £m unless stated otherwise | Passing rent | ERV | Occupancy | Reversion | ||

|---|---|---|---|---|---|---|

| Total | Void reduction | Other* | ||||

| Industrial | 17.6 | 23.4 | 98% | 5.8 | 0.3 | 5.5 |

| Office | 14.0 | 19.3 | 87% | 5.3 | 2.7 | 2.6 |

| Retail and leisure | 7.1 | 7.1 | 93% | 0.0 | 0.5 | (0.5) |

| 38.7 | 49.8 | 93% | 11.1 | 3.6 | 7.5 | |

By sector, the greatest potential is within the industrial and office sectors. With occupancy close to full in the industrial sector, the upside is from reversion to market rents (which continue to increase) while in the office sector, despite strong letting progress in FY22, considerable upside remains from void reduction. In retail and leisure, retail warehouse parks (65% of Picton’s sector exposure) are trading well and driving overall sector rent growth, but there remains an oversupply of space in high street retail and rents remain above market levels.

At 92.8% at end-FY22, EPRA occupancy is in line with the five- and 10-year averages but remains c 3pp below recent peaks. The top five voids within the portfolio accounted for c £2.5m (65%) of the upside potential from void reduction. In part, the current level of occupancy reflects the recent increase investment in refurbishment and asset repositioning, including sustainability projects. More than half of the vacant buildings were under refurbishment with the remainder available to let and being actively marketed. Even if void reduction were to stall there would still be an opportunity for rental income to increase through reversionary capture3 as well as from a full-period contribution from recently acquired assets.

Exhibit 7: 10-year portfolio occupancy trend[11]

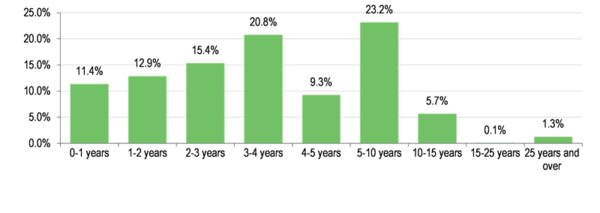

While lease maturities reflect an element of income risk, they also provide an opportunity to reset rents towards or ahead of ERV, as was the case in FY22. Across the portfolio, the FY22 weighted average lease term (WAULT) to first termination was 4.8 years with c 40% of rental income due to mature over the next three years (Exhibit 10), representing a reasonable balance of risk and opportunity in Edison's view. In the industrial sector, 41 lease events are forecast for the coming year, with an overall ERV that is 10% higher than the current passing rent of £2.7m, proving the opportunity to grow income. In the office sector the focus will be on reducing voids although 33 lease events are forecast with an average ERV 4.0% above passing rent.

Exhibit 11: Lease maturity profile[12]

Across the broad UK commercial property sector, over the medium term, income returns have been relatively stable compared with the volatility displayed by capital values. Edison Investment Research therefore believes it reasonable to expect medium-term rental growth to broadly match inflation. Over shorter periods, this may not be the case as the relationship will be influenced by the incidence and nature of rent reviews as well as the timing of lease maturities.

As inflation rates have increased, investment flows into those companies with long, inflation-linked leases have remained strong. These generally provide a high level of income growth certainty and although indexed rent increases are typically capped at around 4%, below current inflation levels, this does have the additional advantage of ensuring rent levels remain affordable to tenants.

An alternative perspective is that shorter-term, open-market leases with a typical term of five years to first break provide an opportunity for landlords to rebase rents towards market levels, which may further adjust for inflation. Good-quality properties, attractive to tenants, with strong sustainability credentials should have the capacity to benefit from open-market rental growth to mitigate the impacts of inflation.

Sustainability enhancement and path to net zero carbon edit edit source

During FY22 Picton published its net zero carbon pathway and became a signatory to the Better Buildings Partnership (BBP) Climate Commitment.4 The pathway sets out the company’s plan to achieve net zero carbon (NZC) for both operational and embodied emissions5 by 2040, 10 years ahead of the government target, including the emissions of occupiers. Alignment with the BBP NZC pathway framework will provide transparency to this approach. Picton will initially focus on Scope 1 and 2 emissions but also intends to work with occupiers to reduce the most significant part of the portfolio’s emissions, which fall under Scope 3.

From 2040 onwards, all operational emissions will be reduced as much as possible through energy efficiency measures and renewable energy, with any residual emissions offset. From 2040 onwards, all completed refurbishment projects will have reduced their embodied and operational carbon as much as possible, with any residual emissions offset at practical completion.

71% of properties (by ERV) are currently rated EPC6 A-C, up from 64% in 2021, with the remainder rated D or E. From 2023, MEES7 regulations prohibit the leasing of space that is rated F or G and it is proposed that from 2027 a rating of at least C will be required. The company expects that most of the investment required to meet its EPC targets will form part of the existing rolling programme of asset enhancement and will work with occupiers that share similar environmental performance goals.

Inflation protection from predominantly long-term fixed rate debt edit edit source

Picton’s balance sheet is strong and substantially protected against further interest rate increases. Following a late-FY22 debt refinancing, both the company’s long-term credit facilities are fixed rate with a blended average cost of 3.7% and a blended average maturity of c 10 years. A shorter term, floating rate revolving credit facility8 of £50m, providing flexibility to take advantage of further growth opportunities when identified, was c £5m drawn at end-FY22. The £13.7m acquisition of a mixed use property in London announced on 16 May was funded by existing cash resources (£38.5m at end-FY22).

The refinancing included the extension of Picton’s Canada Life facility from £80m to £129m. The new £49m tranche was priced at 3.25% and the cost of the original £80m tranche was reduced to a similar level from 4.1%, a reduction of c 20%. Out of the proceeds, the £31m that had been drawn from the shorter-term, floating rate NatWest RCF to fund recent acquisitions was substantially repaid (£4.9m outstanding at end-FY22), although the entire £50m facility remains available to the company. As a result, total debt facilities increased to £264m, with £222m drawn at end-FY22. The redemption fee to reset the interest rate on the £80m tranche was £4m, equivalent to a modest 0.8p reduction in NAV per share.

| Lender | Canada Life | Aviva | NatWest RCF |

|---|---|---|---|

| Amount drawn | £129m | £85m | £4.9m |

| Undrawn | Fully drawn | Fully drawn | £45.1m |

| Maturity | Jul-31 | Jul-32 | May-25 |

| Interest rate | Fixed 3.25% | Fixed 4.38% | SONIA +1.5% |

| Commitment fee | N/A | N/A | 0.60% |

| LTV covenant | 65% | 65% | 55% |

| Interest cover covenant | 1.75x | N/A | 2.5x |

| Debt service cover ratio covenant | N/A | 1.4x | N/A |

Portfolio summary edit edit source

At 31 March 2022 (end-FY21), the externally assessed fair value of the investment portfolio was £849.3m (the balance sheet value includes an adjustment for lease incentives and finance leases), comprising 47 assets let to more than individual occupiers, reflecting a net initial yield of 4.0% and a reversionary yield of 5.4%.

| Year end March | FY22 | FY21 |

|---|---|---|

| Portfolio valuation | £849m | £682m |

| Number of properties | 47 | 46 |

| Average lot size | £18.1m | £14.8m |

| EPRA net initial yield | 4.0% | 4.8% |

| Net reversionary yield | 5.4% | 6.3% |

| Annualised rental income | £38.7m | £36.5m |

| Annualised reversionary income | £49.8m | £45.4m |

| Occupancy as % of ERV | 93% | 91% |

| WAULT | 4.8 years | 4.9 years |

Despite active positioning, the diversity of the portfolio and occupier base spreads risk and is a key factor in supporting a stable income stream. Industrial property and retail warehouse assets represent c two-thirds of the portfolio by value and have been strong drivers of performance.

| Portfolio allocation (%) | Valuation (£m) | Like-for-like valuation change (%) | |

|---|---|---|---|

| Industrial weighting | 60.0 | 509.7 | 34 |

| o/w South East | 44.0 | ||

| o/w Rest of UK | 16.0 | ||

| Office weighting | 30.0 | 251.1 | 2 |

| o/w London City & West End | 11.0 | ||

| o/w Rest of UK | 10.0 | ||

| o/w South East | 9.0 | ||

| Retail & Leisure weighting | 10.0 | 88.5 | 17 |

| o/w Retail Warehouse | 7.0 | ||

| o/w High Street Rest of UK | 2.0 | ||

| o/w Leisure | 1.0 | ||

| Total | 100.0 | 849.3 | 21 |

Although the pandemic has significantly accelerated some of the ongoing structural shifts in the property market, market fundamentals and consensus point to a continuation of existing trends. In this context Picton believes its portfolio is well placed in respect of both its sector allocations and the quality of its assets, although it expects FY23 returns to slow from the exceptional level of FY22, with less polarisation across sectors.

Demand for industrial properties remains robust with supply constrained, reflected in a high level of occupancy and growing ERVs for Picton’s smaller multi-let estates. Key drivers of occupational demand are the continued growth of e-commerce and the importance of managing supply chains. Picton expects its industrial assets to continue to contribute strongly to performance.

Although the pandemic has raised many questions about the future role of the office, Picton believes the ‘death of the office’ has been vastly overstated and notes the important role that the office plays in company culture and productivity, being a place for both concentrated work and collaboration, connection, innovation and social interaction. Most office occupiers are now working on a flexible basis, with staff typically present in the office for two to three days a week, but the company has seen no significant reduction in the overall floorspace demanded. A ‘flight to quality’ is leading to occupiers wanting to upgrade their space, attract staff and enhance their ability to meet their own sustainability targets. With a limited market supply, Picton expects a pick-up in rental growth for good quality space. For similar but opposite reasons, poor quality space is in less demand.

Retail warehousing valuations have been improving, with retailers preferring out of town sites over the high street, not least because of the convenience to shoppers including ease of parking and ability to support online purchases through click and collect. Picton’s retail warehouse assets are now fully occupied. Although high street retail has begun to stabilise an oversupply of floor space remains.

Significant NAV uplift and modest changes to income forecasts edit edit source

The FY22 NAV was well ahead of Edison Investment Research's forecast while recurring EPRA earnings were broadly in line with its expectations (Exhibit 1). For FY23, Edison's forecast for NAV is increased while its EPRA earnings are very modestly reduced, driven mainly by the impact of inflation on property and administrative costs. Edison Investment Research has not changed its DPS forecast.

| Net property income (£m) | EPRA earnings (£m) | EPRA EPS (p) | EPRA NAV/share (p) | DPS declared (p) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Old | New | % chg | Old | New | % chg | Old | New | % chg | Old | New | % chg | Old | New | % chg | |

| FY23e | 35.8 | 37.1 | 3.4 | 21.9 | 21.6 | (1.4) | 4.0 | 4.0 | (1.5) | 117 | 130 | 10.6 | 3.60 | 3.60 | 0.0 |

| FY24e | N/A | 38.6 | N/A | N/A | 22.7 | N/A | N/A | 4.2 | N/A | N/A | 133 | N/A | N/A | 3.66 | N/A |

Our last published forecasts included a part-year FY22 contribution from the acquisition of the Madleaze Trading Estate in Gloucester in October 2021 (initial annualised rental income of £0.75m) but did not reflect the acquisition of Mill Place Trading Estate, also in Gloucester, in February 2022 (initial annualised rental income of £0.68m). The refinancing that was completed at the end of March 2022 had no material impact on FY22. Edison Investment Research's revised forecasts also include the May 2022 acquisition of the Charlotte Terrace mixed-use property in Hammersmith Road, London (initial annualised rent of £0.5m). Edison Investment Research expects further accretive net acquisition investment but have not assumed this in its forecasts.

Forecast growth in gross rent roll is primarily driven by reversionary capture in industrial and further void reduction in offices, partly offset by rent pressure in retail, where for some properties current rents are above market levels. At the group level Edison Investment Research looks for annualised rent roll to increase from £38.7m at end-FY22 to £41.4m at end-FY23 and £41.4m at end-FY24. Edison Investment Research estimates this implies an increase in portfolio occupancy from 93% at end-FY22 to 95% by end-FY24. Edison forecast 3.5% growth in net rental income in FY23 with the underlying growth rate held back by a non-repeat of rent provision reversals, at least not on the same scale as in FY22)9.

Increased inflation suppresses Edison Investment Research's forecasts and although the March 2022 refinancing has lowered the average cost of debt, average debt has increased with recent investment.

Although Edison Investment Research forecasts only a modest increase in FY23 EPRA EPS, given the strong level of dividend cover Edison continues to anticipate an increase in FY23 DPS to 0.9p per quarter or an annualised 3.6p (versus a Q422 annualised annualise rate of 3.5p). For FY24, Edison forecasts aggregate DPS of 3.66p.

Although the UK commercial property market has entered FY23 with good momentum, particularly for the industrial sector, Edison Investment Research is conscious of the economic and political challenges that are evident in the UK and globally and assume a significant slowdown in capital growth in FY23 and in FY24. This may prove to be overly prudent. Edison has assumed gross like-for-like revaluation gains of 4.5% in FY23 and just 0.5% in FY24. Adjusting for capex and acquisition costs this represents gains per share of 8.9p in FY23 and 2.8p in FY24 or total returns of 10.8% and 5.5% respectively including DPS paid.

Edison Investment Research estimates that each 1% increase/decrease in the total portfolio value is equivalent to an increase/decrease in NAV per share of c 1.7p.

Valuation and performance edit edit source

The current level of quarterly DPS (0.875p) represents an annualised rate of 3.5p or a 3.8% yield. Edison Investment Research forecasts further increases in quarterly DPS during FY23 and FY24.

The current P/NAV10 per share is 0.77x. Although there has been a significant recovery from the early pandemic levels this is well below the 10-year average of 0.95x and a high of c 1.1x.

Exhibit 16: 10-year P/NAV* history[17]

Exhibit 17 shows a summary performance and valuation comparison of Picton and what Edison Investment Research considers to be its closest diversified income-oriented peers. Over three years, Picton’s share price performance is ahead of the group average, which shows a wide spread of performances, in some cases reflecting differing financial and operational performance during the pandemic. As market conditions have normalised, over 12-months the Picton share price performance is below the average. Based on 12-month trailing DPS declared, Picton shares trade on a lower yield than the group average, which in part reflects its strategy of balancing sustainable dividends with the capital requirements of active management, as well as relatively low gearing. With its share price failing to keep pace with NAV growth, Picton’s P/NAV is now below the peer, average having been at a meaningful premium a year ago. The company’s strong track record of property level performance, the future income and valuation growth potential embedded in its portfolio, and its strong balance sheet with relatively modest gearing are all potential triggers for Picton’s share price to re-rate.

| Price (p) | Market cap (£m) | P/NAV (x)* | Trailing yield (%)** | Share price performance | ||||

|---|---|---|---|---|---|---|---|---|

| 1 month | 3 months | 12 months | 3 years | |||||

| AEW REIT | 118 | 187 | 1.04 | 6.8 | -3% | 0% | 26% | 24% |

| BMO Real Estate Investments | 88 | 212 | 0.69 | 4.5 | -7% | 2% | 25% | -10% |

| BMO Commercial Property Trust | 116 | 841 | 0.81 | 3.9 | -4% | 0% | 32% | -21% |

| Circle Property | 235 | 67 | 0.86 | 1.5 | -1% | 3% | 20% | 15% |

| Custodian | 103 | 454 | 0.86 | 5.1 | 4% | 1% | 4% | -14% |

| Ediston Property | 81 | 172 | 0.84 | 6.2 | 4% | 3% | 18% | -27% |

| LondonMetric | 240 | 2350 | 0.92 | 3.9 | -3% | -12% | 2% | 29% |

| Palace Capital | 268 | 124 | 0.69 | 4.9 | 0% | 11% | 3% | -19% |

| Regional REIT | 77 | 397 | 0.79 | 8.5 | -10% | -13% | -11% | -18% |

| Schroder REIT | 54 | 265 | 0.71 | 5.5 | -3% | -3% | 13% | -13% |

| Standard Life Investment Property | 79 | 309 | 0.74 | 4.8 | -2% | -3% | 10% | -17% |

| UK Commercial Property REIT | 80 | 1037 | 0.72 | 3.6 | -8% | -1% | 0% | -9% |

| Average | 0.81 | 5.0 | -2% | -1% | 13% | -7% | ||

| Picton | 93 | 507 | 0.77 | 3.7 | -2% | -3% | 5% | 2% |

| UK property sector index | 1,668 | -5% | -13% | -5% | -8% | |||

| UK equity market index | 3,882 | -5% | -6% | -3% | -8% | |||

Additional details on the company and management edit edit source

Picton Property Income is an internally managed UK REIT that invests in a diversified portfolio of commercial property assets from the main commercial property sector across the UK. It is total return driven with an income focus and aims to generate attractive returns through proactive management of the portfolio, investing in assets where it believes there are opportunities to enhance income and/or value. Its dividend policy is to distribute most of the recurring income earnings to shareholders via quarterly dividends, maintaining full cover, and generating surplus cash for reinvestment back into the portfolio. The company’s aim is to be one of the consistently best-performing diversified UK REITS.

Leadership and governance edit edit source

The board comprises six members: four non-executive and two executive directors. The non-executive directors bring considerable experience from across the real estate, real estate financing and financial services sectors. The board is chaired by Lena Wilson CBE who brings a wide range of business and board experience to the group; she is on a number of boards in a non-executive capacity, including NatWest Group and Argentex Group, and is chair of Chiene + Tait LLP; she was chief executive of Scottish Enterprise from 2009 until 2017 and prior to that, was a senior investment adviser at The World Bank. The other non-executives are Mark Batten (chair of the audit and risk committee and the senior independent director), Maria Bentley (chair of the remuneration and nominations committees) and Richard Jones (chair of the property and valuation committee).

The executive board members are CEO Michael Morris and FD Andrew Dewhirst. Michael Morris has more than 25 years’ experience in the UK commercial property sector and has worked with the group since it was launched in 2005. Andrew Dewhirst joined Picton in 2011 and has over 30 years’ experience in the real estate and financial services sector. Brief biographies of the key members of the leadership team may be found on page 15 and detailed board biographies may be found on the company website.

Including the CEO and CFO, the broader Picton management team comprises nine individuals, of whom five are property professionals.

Sensitivities edit edit source

The commercial property market is cyclical, historically exhibiting substantial swings in valuation through cycles. Income returns are significantly more stable, but still fluctuate according to tenant demand and rent terms. From a sector viewpoint Edison Investment Research also highlights the increased risks and uncertainties that attach to development activity, including planning consents, timing, construction risks and the long lead times to completion and eventual occupation. Picton is not a developer, but is exposed to similar but lesser uncertainties, as it actively invests in improvements to existing assets with the aim of enhancing long-term income growth and returns. More generally, Edison Investment Research notes the sensitivity to:

- Economic risk: the war in Ukraine and sharply rising inflation, to a much lesser extent reflected in interest rates, are creating a high level of uncertainty regarding the global and UK economic outlook. Although the incidence and impact of the pandemic has substantially eased, there remains some uncertainty about the potential emergence of new strains.

- Sector risk: some of the inherent cyclical risk to vacancy in commercial property can be mitigated by portfolio diversification. Picton invests across the main UK commercial property sectors, with a portfolio that is well diversified by property and by individual occupiers. As at end-FY22 public sector entities represented the largest tenant groups by contracted rent (5.0%) and the largest individual tenant for 3.6%. The 10 largest assets accounted for 55% of portfolio value. Significant reversionary income potential provides the potential for rental income growth even if market level rent growth slows.

- Energy performance considerations: a failure to successfully meet regulatory and/or tenant expectations for energy performance enhancement would likely affect Picton’s ability to let properties on satisfactory terms and may make properties unlettable.

- Funding risks: Picton’s current borrowings are overwhelmingly fixed rate and long term, protecting the company from rising interest rates. Additional shorter-term, floating rate borrowing facilities provide flexibility to fund opportunistic acquisitions.

- Management risk: as Picton is internally managed there is some management risk. With a relatively small team, the loss of any senior member has the potential to be disruptive and if any of the directors were to leave, they would need to be replaced.

| Year end 31 March (£m) | 2018 | 2019 | 2020 | 2021 | 2022 | 2023e | 2024e |

|---|---|---|---|---|---|---|---|

| IFRS | IFRS | IFRS | IFRS | IFRS | IFRS | IFRS | |

| PROFIT & LOSS | |||||||

| Rents receivable, adjusted for lease incentives | 41.4 | 40.9 | 37.8 | 36.6 | 40.1 | 41.6 | 42.9 |

| Other income | 1.4 | 1.1 | 1.2 | 1.5 | 0.2 | 0.5 | 0.5 |

| Service charge income | 5.9 | 5.7 | 6.7 | 5.3 | 6.2 | 6.9 | 7.2 |

| Revenue from properties | 48.8 | 47.7 | 45.7 | 43.3 | 46.5 | 49.1 | 50.5 |

| Property operating costs | (2.6) | (2.3) | (2.3) | (2.4) | (2.5) | (2.6) | (2.7) |

| Property void costs | (1.8) | (1.4) | (3.0) | (2.2) | (2.4) | (2.5) | (2.1) |

| Recoverable service charge costs | (5.9) | (5.7) | (6.7) | (5.3) | (6.2) | (6.9) | (7.2) |

| Property expenses | (10.3) | (9.4) | (12.0) | (9.9) | (11.1) | (12.0) | (12.0) |

| Net property income | 38.4 | 38.3 | 33.6 | 33.5 | 35.4 | 37.1 | 38.6 |

| Administrative expenses | (5.6) | (5.8) | (5.6) | (5.4) | (5.8) | (6.2) | (6.6) |

| Operating Profit before revaluations | 32.9 | 32.5 | 28.1 | 28.1 | 29.7 | 30.9 | 32.0 |

| Revaluation of investment properties | 38.9 | 10.9 | (0.9) | 12.9 | 129.8 | 48.7 | 15.5 |

| Profit on disposals | 2.6 | 0.4 | 3.5 | 0.9 | 0.0 | 0.0 | 0.0 |

| Operating Profit | 74.4 | 43.7 | 30.7 | 41.8 | 159.5 | 79.6 | 47.5 |

| Net finance expense | (9.7) | (9.1) | (8.3) | (8.0) | (8.5) | (9.3) | (9.3) |

| Debt repayment fee | 0.0 | (3.2) | (4.0) | ||||

| Profit Before Tax | 64.7 | 31.4 | 22.4 | 33.8 | 147.0 | 70.3 | 38.1 |

| Taxation | (0.5) | (0.5) | 0.1 | 0.0 | 0.0 | 0.0 | 0.0 |

| Profit After Tax (IFRS) | 64.2 | 31.0 | 22.5 | 33.8 | 147.0 | 70.3 | 38.1 |

| Adjust for: | |||||||

| Investment property valuation movement | (38.9) | (10.9) | 0.9 | (12.9) | (129.8) | (48.7) | (15.5) |

| Profit on disposal of investment properties | (2.6) | (0.4) | (3.5) | (0.9) | (0.0) | 0.0 | 0.0 |

| Exceptional income /expenses | 0.0 | 3.2 | 0.0 | 0.0 | 4.0 | 0.0 | 0.0 |

| Profit After Tax (EPRA) | 22.6 | 22.9 | 19.9 | 20.1 | 21.2 | 21.6 | 22.7 |

| Fully diluted average Number of Shares Outstanding (m) | 539.7 | 541.0 | 546.2 | 546.8 | 547.3 | 545.6 | 545.6 |

| EPS (p) | 11.89 | 5.75 | 4.14 | 6.20 | 26.93 | 12.88 | 6.99 |

| EPRA EPS (p) | 4.19 | 4.25 | 3.66 | 3.68 | 3.88 | 3.95 | 4.15 |

| Dividend declared per share (p) | 3.43 | 3.50 | 3.25 | 2.93 | 3.45 | 3.60 | 3.66 |

| Dividends paid per share (p) | 3.400 | 3.500 | 3.500 | 2.750 | 3.375 | 3.575 | 3.645 |

| Dividend cover (x) EPRA EPS/DPS declared | 1.22 | 1.21 | 1.13 | 1.26 | 1.13 | 1.10 | 1.13 |

| Dividend cover (x) - paid dividends | 1.22 | 1.21 | 1.05 | 1.34 | 1.15 | 1.11 | 1.14 |

| Total return | 14.7% | 6.4% | 4.4% | 6.6% | 27.9% | 10.8% | 5.5% |

| EPRA cost ratio including direct vacancy costs) | 23.7% | 22.9% | 28.3% | 26.9% | 26.0% | 26.5% | 26.1% |

| BALANCE SHEET | |||||||

| Fixed Assets | 670.7 | 676.1 | 654.5 | 669.5 | 834.4 | 906.2 | 930.8 |

| Investment properties | 670.7 | 676.1 | 654.5 | 665.4 | 830.0 | 901.9 | 926.4 |

| Other non-current assets | 0.0 | 0.0 | 0.0 | 4.1 | 4.4 | 4.4 | 4.4 |

| Current Assets | 50.6 | 39.5 | 41.2 | 42.9 | 61.4 | 41.9 | 37.2 |

| Debtors | 19.1 | 14.3 | 17.6 | 19.6 | 22.9 | 22.0 | 22.0 |

| Cash | 31.5 | 25.2 | 23.6 | 23.4 | 38.5 | 19.9 | 15.2 |

| Current Liabilities | (22.3) | (23.3) | (20.4) | (19.9) | (20.3) | (20.2) | (20.2) |

| Creditors/Deferred income | (21.6) | (22.5) | (19.5) | (18.9) | (19.3) | (19.3) | (19.3) |

| Short term borrowings | (0.7) | (0.8) | (0.9) | (0.9) | (1.1) | (1.0) | (1.0) |

| Long Term Liabilities | (211.7) | (192.8) | (166.0) | (164.4) | (218.4) | (219.4) | (220.3) |

| Long term borrowings | (210.0) | (191.1) | (164.2) | (162.7) | (215.8) | (216.8) | (217.7) |

| Other long term liabilities | (1.7) | (1.7) | (1.7) | (1.7) | (2.6) | (2.6) | (2.6) |

| Net Assets | 487.4 | 499.4 | 509.3 | 528.2 | 657.1 | 708.6 | 727.5 |

| NAV/share (p) | 90 | 93 | 93 | 97 | 120 | 130 | 133 |

| Fully diluted EPRA NTA/share (p) | 90 | 93 | 93 | 97 | 120 | 130 | 133 |

| CASH FLOW | |||||||

| Operating Cash Flow | 35.1 | 34.8 | 21.4 | 26.0 | 28.1 | 32.5 | 32.7 |

| Net Interest | (9.1) | (8.6) | (7.9) | (7.5) | (8.1) | (8.4) | (8.4) |

| Tax | (0.3) | (0.8) | 0.1 | 0.1 | 0.0 | 0.0 | 0.0 |

| Net cash from investing activities | (17.8) | 10.3 | 25.0 | (1.3) | (33.8) | (23.2) | (9.1) |

| Ordinary dividends paid | (18.5) | (18.9) | (19.0) | (15.0) | (18.4) | (19.5) | (19.9) |

| Debt drawn/(repaid) | 9.2 | (22.6) | (27.2) | (1.8) | 52.2 | 0.0 | 0.0 |

| Net proceeds from shares issued/repurchased | (0.9) | (0.4) | 6.1 | (0.6) | (0.7) | 0.0 | 0.0 |

| Other cash flow from financing activities | (4.0) | ||||||

| Net Cash Flow | (2.4) | (6.3) | (1.6) | (0.2) | 15.2 | (18.6) | (4.7) |

| Opening cash | 33.9 | 31.5 | 25.2 | 23.6 | 23.4 | 38.5 | 19.9 |

| Closing cash | 31.5 | 25.2 | 23.6 | 23.4 | 38.5 | 19.9 | 15.2 |

| Debt as per balance sheet | (210.7) | (192.0) | (165.1) | (163.7) | (216.8) | (217.7) | (218.6) |

| Un-amortised loan arrangement fees | (3.4) | (2.7) | (2.3) | (2.6) | (2.0) | (1.1) | (0.2) |

| Closing net (debt)/cash | (182.5) | (169.5) | (143.9) | (142.8) | (180.3) | (198.9) | (203.6) |

| Net LTV | 26.7% | 24.7% | 21.7% | 20.9% | 21.2% | 23.4% | 24.0% |

Leadership team edit edit source

Non-executive chair: Lena Wilson CBE

Lena Wilson joined the board on 1 January 2021 as chair designate, assuming that role in February 2021, and is also chairman of the nomination committee. She brings a wealth of business experience to the role and currently serves as non-executive director on a number of boards, including NatWest Group and Argentex Group and is also Chair of Chiene + Tait LLP. Previously, Lena was chief executive of Scottish Enterprise from 2009 until 2017 and prior to that, was a senior investment advisor at The World Bank.

Chief executive: Michael Morris

Michael Morris was appointed to the board in October 2015. He has over 25 years’ experience in the UK commercial property sector and has worked with the group since launch in 2005. As chief executive he is responsible for the implementation of the company’s strategy. Prior to this, he worked in private practice, then becoming a senior director and fund manager at ING Real Estate Investment Management (UK). He is a member of the Investment Property Forum and has obtained the Investment Management Certificate and the IPF Diploma in Property Investment.

Finance director: Andrew Dewhirst

Andrew Dewhirst joined the group in March 2011 and became finance director and joined the board in 2018. Previously he was finance director of the group’s investment management subsidiary and was director of client accounting at ING Real Estate Investment Management (UK), a role he had held since 2006. At ING he was responsible for the accounting and administration of all the UK real estate vehicles and separate client accounts. He has over 30 years’ experience in the real estate and financial services sector and is an associate member of the Institute of Chartered Accountants in England and Wales and a member of the Investment Property Forum.

Head of asset management: Jay Cable

As head of asset management and a member of the executive committee, Jay Cable is responsible for overseeing all asset management activities in respect of the group’s property portfolio. He has worked for the group since launch in 2005, having formerly been a director at ING Real Estate Investment Management (UK). He has over 18 years of real estate experience and is a member of the Royal Institute of Chartered Surveyors and of the Investment Property Forum.

| Principal shareholders (source: FY22 Annual Report, data as at 5 May 2022) | (%) |

|---|---|

| Investec Wealth & Investment | 16.2 |

| Ameriprise Financial | 9.3 |

| BlackRock | 5.6 |

| The Vanguard Group | 4.1 |

| Tilney Smith & Williamson | 3.8 |

| Brewin Dolphin | 3.2 |

References edit edit source

- ↑ Note: *EPRA earnings exclude revaluation gains/losses and other exceptional items. **NAV measure is net tangible assets (NTA), currently the same as IFRS NAV.

- ↑ Source: Picton Property Income reported data, Edison Investment Research FY22 forecast.

- ↑ Source: Picton Property Income data, Edison Investment Research.

- ↑ Source: Picton Property Income data, Edison Investment Research.

- ↑ Source: Picton Property Income data.

- ↑ Source: Picton Property Income, MSCI. Note: Data to 31 March 2022. *Annualised percentage returns.

- ↑ Source: Picton Property Income, MSCI. Note: Data to 31 March 2022. *Annualised percentage returns.

- ↑ Source: Picton Property Income data.

- ↑ Source: Picton Property Income data.

- ↑ Source: Picton Property Income data and Edison Investment Research estimates. Note: Columns may not total due to rounding. *Includes £4.5m of rent free ‘run-off’ and £3.0m upside from contracted rents to market rents.

- ↑ Source: Picton Property Income data.

- ↑ Source: Picton Property Income.

- ↑ Source: Picton Property Income, as at 31 March 2022.

- ↑ Source: Picton Property Income.

- ↑ Source: Picton Property Income.

- ↑ Source: Edison Investment Research.

- ↑ Source: Company NAV data, Refinitiv prices at 17 June 2022. Note: *EPRA NAV/NTA.

- ↑ Source: Company data, Refinitiv prices at 17 June 2021. Note: *Based on last reported EPRA NAV/NTA. **Based on trailing 12-month DPS declared.

- ↑ Source: Picton Property Income historical data, Edison Investment Research forecasts.