Regional REIT

Return to the office gathers momentum.

Summary edit edit source

This note focuses on the outlook for income-driven returns from Regional REIT (RGL). With the ‘return to the office’ accelerating, RGL expects a positive demand-supply balance to generate rental growth, increased occupancy and valuation gains. Q122 DPS increased c 3% to 1.65p. Income risk is mitigated by portfolio diversification, while fully fixed or hedged borrowing costs protect against further interest rate increases.

| Year end | Net rental

income (£m) |

EPRA

earnings* (£m) |

EPRA

EPS* (p) |

NAV**/

share (p) |

DPS

(p) |

P/NAV

(x) |

Yield

(%) |

|---|---|---|---|---|---|---|---|

| 12/20 | 53.3 | 28.1 | 6.5 | 98.6 | 6.40 | 0.84 | 7.7 |

| 12/21 | 55.8 | 30.4 | 6.6 | 97.2 | 6.50 | 0.86 | 7.8 |

| 12/22e | 62.8 | 34.1 | 6.6 | 98.9 | 6.60 | 0.84 | 7.9 |

| 12/23e | 64.9 | 35.8 | 6.9 | 101.8 | 6.90 | 0.82 | 8.3 |

RGL anticipates positive office sector performance

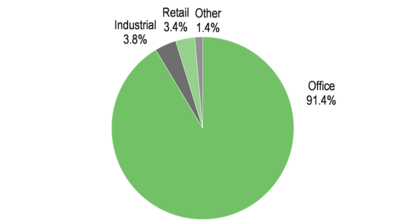

With portfolio repositioning effectively complete (offices are now 91.4% of portfolio value), RGL has become a pure-play regional office REIT, with a clear investor proposition that capitalises on the asset manager’s strong expertise and operational platform. RGL believes the office is an essential aspect of the working infrastructure and the sector is poised for recovery, particularly for good-quality regional assets with affordable rents. Strong demand by UK and international property investors provides support for this expectation. Despite its focus on regional offices, RGL’s portfolio remains highly diversified by property, tenant and region, mitigating income risks while with all borrowings are fixed or hedged at a blended cost of 3.4%.

Income-led total returns

Since listing in November 2015, RGL has consistently targeted a higher yield portfolio that would provide progressive, regular dividends with the potential for capital growth, supported by active asset management and capital recycling. Its dividend yield has been consistently one of the highest in the sector. RGL’s positive demand outlook suggests that with office leases typically shorter term (c five years to first break) and set on an open market basis, there should be opportunities for landlords to rebase rents towards current market levels, which may further adjust for inflation. Income upside potential from the existing portfolio is significant, with FY21 office estimated rental value (ERV) more than £20m above contracted rents, mostly reflecting space available for letting.

Valuation: High yield and fully covered DPS

Reflecting the potential impact of a deteriorating political and economic environment, Edison Investment Research has reduced its EPRA earnings forecasts by c 2% and the fully covered FY22 DPS to 6.6p (from 6.7p). This continues to reflect an attractive yield of 7.9% while the shares trade at a 14% discount to NAV.

Income-led total returns edit edit source

RGL came to market in November 2015 targeting a higher yield portfolio that would provide progressive, regular dividends with the potential for capital growth. Active asset management and capital recycling are key elements in sustaining asset yields. RGL’s dividend yield has been consistently one of the highest in the sector and quarterly dividends were maintained during the pandemic, albeit at a reduced level. Aggregate FY21 DPS of 6.5p was up 1.6% on FY20 (6.4p) and Q122 DPS of 1.65p has increased c 3% versus Q121, an annualised rate of 6.6p. Although RGL has typically paid three equal quarterly dividends followed by a higher Q4 dividend, Edison Investment Research has trimmed its FY22 fully covered DPS forecast to 6.6p from 6.7p previously. This may prove to be conservative but recognises the deterioration in the global economic and political environment. For FY23, Edison Investment Research forecasts a fully covered 6.9p (previously 7.1p).

| 2015* | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | Since IPO | |

|---|---|---|---|---|---|---|---|---|

| Opening NAV per share (p) | 100.0 | 106.8 | 106.1 | 105.4 | 115.2 | 112.6 | 98.6 | 100.0 |

| Closing NAV per share (p) | 106.8 | 106.1 | 105.4 | 115.2 | 112.6 | 98.6 | 97.2 | 97.2 |

| Dividends per share paid (p) | 0.00 | 6.25 | 7.80 | 8.00 | 8.20 | 7.45 | 6.30 | 44.00 |

| Total accounting return (%) | 6.8% | 5.1% | 6.7% | 16.8% | 4.9% | -5.8% | 5.0% | 41.2% |

| Average annual return (%) | 5.8% |

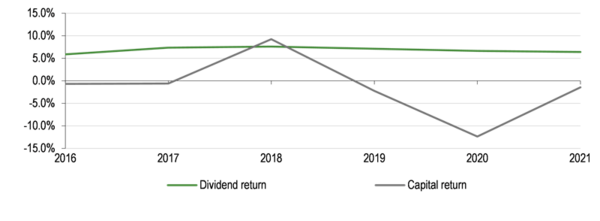

Accounting total return[3] has been positive in each year since listing other than in FY20 due to the pandemic. Total return up to end-FY21 amounts to 41.2% or an average annual return of 5.8%. Reflecting RGL’s strong income focus, its returns have all been generated by dividends paid with a good level of consistency, as shown in Exhibit 2.

Exhibit 2: Trend in dividend return and capital return[4]

With its Q122 update, RGL announced the introduction of a dividend reinvestment plan, the details of which are available on its website.

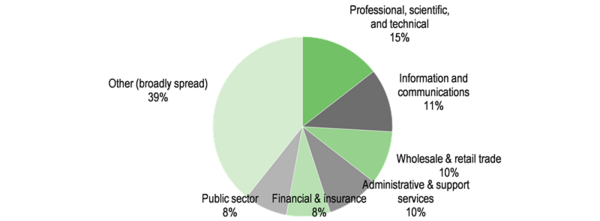

Highly diversified income base mitigates income risks edit edit source

A key element of RGL’s strategy since it listed in November 2015 has been to build a diversified portfolio that spreads income risk across a large number of occupiers and a broad a range of industries. Although now focused on the regional office sector, its portfolio remains highly diversified with 160 properties at end-Q122, let to more than 1,000 tenants, that can be fairly said to reflect the broad spread of the UK economy. The largest property at end-FY21 represented 3.0% of portfolio value and the largest tenant 1.8% of gross rent roll. The top 15 tenants represented just 16.4%.

| Tenant | Annualised gross rent (£m) | % gross rental income | WAULT to first break (years) | Property location | Market value (£) | % of portfolio | Annualised gross rent (£m) |

|---|---|---|---|---|---|---|---|

| Virgin Media | 1.8 | 2.5% | 1.8 | Bath Street Glasgow | 27.2 | 3.0% | 1.2 |

| NHS | 1.7 | 2.3% | 1.9 | Bear Brook Office Park, Aylesbury | 22.8 | 2.5% | 0.9 |

| TUI | 1.4 | 1.9% | 2.0 | Genesis Business Park, Woking | 22.7 | 2.5% | 1.4 |

| Sec. of State Communities & Local Govt. | 1.3 | 1.8% | 2.7 | Capital Park, Leeds | 21.5 | 2.4% | 1.8 |

| The Scottish Ministers | 1.3 | 1.8% | 1.7 | Eagle Court, Birmingham | 21.4 | 2.4% | 1.8 |

| Bank of Scotland | 1.3 | 1.7% | 0.8 | Aztec West, Bristol | 19.0 | 2.1% | 1.5 |

| EDF Energy | 1.0 | 1.4% | 1.7 | Manchester Green, Manchester | 18.9 | 2.1% | 1.3 |

| E.ON | 0.9 | 1.3% | 3.3 | Beeston Business Park, Nottingham | 18.9 | 2.1% | 1.8 |

| John Menzies | 0.9 | 1.2% | 1.6 | Hampshire Corporate Park, Eastleigh | 18.7 | 2.1% | 1.3 |

| NNB Generation | 0.9 | 1.2% | 1.6 | Norfolk House, Birmingham | 18.0 | 2.0% | 0.8 |

| James Howden | 0.8 | 1.1% | 9.9 | Portland Street, Manchester | 15.2 | 1.7% | 0.9 |

| SPD Development | 0.8 | 1.1% | 3.8 | Newstead Court, Nottingham | 14.5 | 1.6% | 0.9 |

| Hermes European Logistics | 0.8 | 1.1% | 2.0 | Templeton On The Green, Glasgow | 13.6 | 1.5% | 1.2 |

| Aviva | 0.8 | 1.1% | 2.9 | Ashby Park, Ashby De La Zouch | 13.5 | 1.5% | 1.1 |

| Matalan | 0.8 | 1.1% | 6.9 | The Lighthouse, Manchester | 13.3 | 1.5% | 0.7 |

| Total | 16.4 | 22.7% | 2.7 | Total | 279.1 | 30.8% | 18.8 |

In addition to monitoring the industry exposure of tenants (and prospective tenants when assessing acquisitions) at the broad sector level, RGL also undertakes detailed analysis based on Standard Industrial Classification (SIC) codes.

Exhibit 4: Income diversified by industry exposure (end FY21)[6]

Protected against increasing interest rates edit edit source

RGL’s debt portfolio is diversified across a range of lenders and comprises c £384m of secured bank debt and £50m in retail eligible bonds. The first debt maturity is not until August 2024 (the retail eligible bonds) and the debt portfolio’s weighted average maturity is a little more than five years. The bonds are fixed rate and unsecured and all bank debt is fixed rate or hedged with swaps and caps to a similar maturity as the underlying debt. In fact, at end-FY21, the bank debt was slightly more than fully hedged at 101.3%.

| £m | 31-Dec-21 |

|---|---|

| Total bank borrowings | 389.9 |

| Notional value of interest caps and swaps | 193.9 |

| Notional value of fixed rate bank borrowing | 201.0 |

| Total notional value of fixed/hedged debt | 394.9 |

| Hedge ratio | 101.3% |

Interest rate risk is virtually eliminated[8] with a weighted average effective interest rate, including hedging costs, of 3.4% at end-Q122. Net loan to value ratio (LTV) was 40.3%[9] at end-Q122, a reduction from 42.4% at end-FY21, primarily benefiting from disposals in the period. Gross borrowings were £434.1m and cash and equivalent balances were £82.3m.

Inflation hedge characteristics edit edit source

In Exhibit 2, Edison Investment Research showed the relative stability of the income returns generated by RGL. A similar pattern has historically been evident for portfolio returns[10] across the broad commercial real estate sector, although with a lower average level of income return. Edison Investment Research therefore believes it reasonable to expect medium-term rental growth to broadly match inflation. Over shorter periods, this may not be the case as the relationship will be influenced by the incidence and nature of rent reviews as well as the timing of lease maturities. For RGL, it is the relationship between office rents and inflation that is key, and Edison Investment Research discusses this in detail below.

Returning to the broad commercial property sector, as inflation rates have increased, investment flows into those companies with long, inflation-linked leases have remained strong. These generally provide a high level of income growth certainty and although indexed rent increases are typically capped at around 4%, below current inflation levels, this does have the additional advantage of ensuring rent levels remain affordable to tenants.

An alternative perspective is that shorter-term, open-market leases with a typical term of five years to first break provide an opportunity for landlords to rebase rents towards market levels, which may further adjust for inflation. Good-quality properties, attractive to tenants, with affordable rents, and low capital values relative to replacement cost should have the capacity to benefit from open-market rental growth to mitigate the impacts of inflation. RGL’s portfolio exhibits many of these characteristics, is likely to benefit from a sustained return to the office, and benefits from material rent reversion potential based on existing rent levels. RGL’s weighted average lease length at end-FY21 was 4.8 years or 3.0 years to first break. In the current year, leases accounting for £8.1m/11% of gross contracted rental income expire or £14.1m/20% including tenant break options.

| Year | Lease expiry | Lease expiry to first break | |||

|---|---|---|---|---|---|

| £m | % | £m | % | ||

| 2022 | 8.1 | 11% | 14.1 | 20% | |

| 2023 | 9.7 | 14% | 16.9 | 24% | |

| 2024 | 8.7 | 12% | 14.7 | 21% | |

| 2025 | 7.5 | 11% | 8.2 | 12% | |

| 2026 | 6.4 | 9% | 6.6 | 9% | |

| 2027 | 5.6 | 8% | 2.0 | 3% | |

| 2028 | 5.7 | 8% | 1.1 | 2% | |

| 2029 | 6.9 | 10% | 1.8 | 2% | |

| 2030+ | 12.0 | 17% | 5.3 | 7% | |

| Total | 70.6 | 100% | 70.6 | 100% | |

Reversionary upside adds to income potential edit edit source

The externally estimated rental value (ERV) of RGL’s office portfolio was £86.3m at end-FY21, £22.4m or 35% above contracted rents,[12] representing significant potential to increase income. Most of this reversionary income potential (c £17m) related to occupancy improvement and the balance relates to the gap between existing rents and ERV as well as lease incentive run-off.

Although leasing activity has been challenging through the pandemic, it has begun to recover and RGL expects this to accelerate as the ‘return to the office’ gathers pace and as post-pandemic models for office usage become clearer. During Q122, RGL completed a number of lease renewals, achieving average rental uplifts of 13.6% versus previous rents and an average 11.7% uplift against ERV. Of the 44 units that came up for renewal in the period, 31 remain let (70.5%). Since 1 January 2022, it has exchanged on 20 new leases which, when fully occupied, will provide c £1.0m pa of rental income.

Offices are reopening and RGL remains positive edit edit source

With pandemic restrictions lifted, the return to the office is underway. A legacy of the pandemic will likely be a permanent acceleration in some of the trends that were already in place. Most tenants are expected to adopt a hybrid model of working, at least initially, whereby employees spend perhaps three days per week (typically Tuesday, Wednesday and Thursday) in the office and two days at home. RGL does not expect hybrid working to materially reduce space requirements as it must cater for peak usage. As an alternative, hot desking is typically unpopular with staff, who value their own space and the certainty of being in proximity to close colleagues. Hot desking may stifle the collaboration and creativity required by many employers. RGL expects any reduction in the demand for space driven by changes in working practices to be offset by a reduction in office density (the number of employees per square metre), accelerating a trend that was in place before the pandemic. This is likely to apply particularly to good-quality space at affordable rents. The trend has been driven by a recognition that to retain and attract staff, in many industries it is necessary for employers to offer better facilities (including relaxation areas and space for collaborative working and informal discussion) and quality accommodation. The experience of social distancing, driven by the pandemic, is only likely to reinforce this trend.

High yield not low quality edit edit source

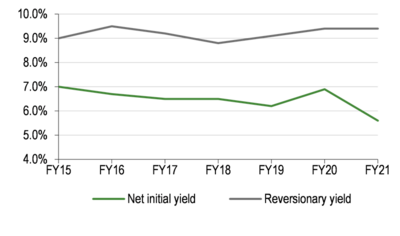

The relatively high yield on RGL’s office assets (reversionary yield of 9.6% at end-FY21 or net initial yield of 5.4%) is a key element of income generation and dividend strategy. In its capital markets webinar in November 2020 (available on RGL’s website), the asset manager emphasised that this high yield is not an indication of low asset quality. RGL’s sector strategy is to target the provision of high-quality regional offices, fit for national, multinational and regional companies of all sizes, in a cost-effective manner. Because these assets are not typically prime/grade A, they are often referred to as ‘secondary’. RGL challenges the usefulness of this phraseology, believing that it overlooks the high quality of most of the assets – built to a high specification, with raised access floors, air conditioned and refurbished to a high standard within the past 10 years. The asset manager believes these could be reasonably and better described as ‘grade A- or B’. For those assets it considers A-, achieved rents are 40–50% lower than for similar quality prime/grade A, although they are likely to be in more peripheral locations or well-located business parks. For those assets considered grade B, the gap to prime/grade A assets is 50–70%, while remaining very suitable and functional for most occupiers.

Edison Investment Research expects the key office portfolio statistics to be broadly similar to the position at the time of the webinar, all low-rise assets, mostly (62%) located in business parks, with an additional c 6% on the edge of towns. Low-rise offices that are less reliant on lift facilities and assets with good parking facilities, enabling staff to drive to work comfortably and avoid public transport, may well benefit in a post COVID-19 environment. Significantly driven by office working trends resulting from the pandemic, there is a ‘flight to quality’ underway across the sector. Additionally, the need to enhance the environmental performance of buildings, and maintain their attractiveness, has become a significant consideration for landlords and occupiers alike.

Enhancing sustainability edit edit source

RGL’s ESG Working Party was formed in 2020. In addition to preparing the company’s sustainability policy and its relevant key performance indicators, in 2021 the working party oversaw its response to the Task Force on Climate-Related Financial Disclosures (TCFD) and prepared its first GRESB Standing Investment Assessment. The first GRESB assessment resulted in RGL being awarded one green star and, building on this work, the 2022 GRESB submission is currently in progress. RGL is additionally working towards an EPRA Sustainability Best Practice report and continues to engage with accredited bodies with the intention of ensuring that all relevant data are taken into consideration by them.

Within its overall ESG framework, RGL is targeting an EPC rating[13] of B or better for all properties by 2030. To this end, it is undertaking a portfolio-wide updated EPC audit, following which individual EPC property plans will be revised and implemented. RGL already requires an independent environment report for all potential acquisitions.

| Rating | Rated areas |

|---|---|

| A-B | 9.92% |

| C-E | 83.40% |

| Other* | 6.68% |

The company expects that most of the investment required to meet its EPC targets will form part of the existing rolling programme of capital expenditure, including investment provided by tenants that are also seeking to enhance their environmental performance. In some case, properties will be sold.

Investment strategy and portfolio overview edit edit source

High-yielding portfolio with returns enhanced by active asset management and capital recycling edit edit source

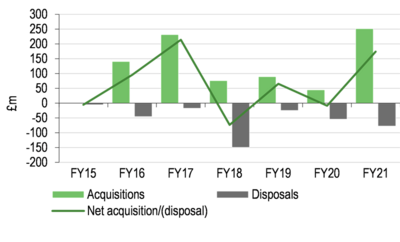

Since it listed in November 2015, RGL’s consistent strategy has been to build a highly diversified portfolio of higher-yielding investments in the regions, outside the M25 motorway which, including gearing (target LTV of c 40%), would provide progressive, regular dividends with the potential for capital growth. Active asset management and capital recycling are key elements in sustaining asset yields. RGL seeks to acquire under-managed properties where there are opportunities to create additional value through lease renewals and rent increases, minimising voids through effective marketing of vacant space, enhancing the tenant mix and covenant strength, and through refurbishment, extension or change of use. When properties have met their return objectives they are assessed for sale (or to hold if their income and capital growth outlook looks strong). By definition, capital recycling tends to suppress reported occupancy but provides the opportunity to reallocate resources to new value-creating investments.

Exhibit 8 shows the extent of capital recycling, which Edison Investment Research notes is determined primarily by asset management plans and not trading. The reversionary yield on the portfolio, which assumes full occupancy and market-level rents, has been consistently in the range or 9% or more. Lower occupancy and increased non-recoverable property costs reduced the net initial yield in FY21, although the reversionary yield increased.

Exhibit 8: Active capital recycling[15]

Exhibit 9: High portfolio yield maintained[16]

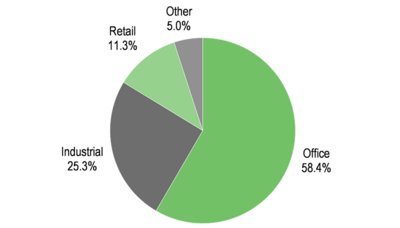

While these core elements of strategy have remained unchanged, from late 2020 the company repositioned itself as a specialist regional office investor. This change of focus reflected RGL’s continuing positive outlook for relative returns in the regional office sector, and a desire to capitalise on the investment manager’s strong expertise and operational platform while providing a clear proposition to investors. The office sector now represents 91.4%[17] of the portfolio by value compared with 58.4% at IPO. Also in line with post-IPO strategy, a significant c 35% weighting to Scotland has been reduced to c 17%, with a corresponding increase in England and Wales from c 65% to c 83%.

Exhibit 10: Sector positioning by value at IPO[18]

Exhibit 11: Sector positioning by value at Q122[19]

Financial and portfolio overview edit edit source

Portfolio overview edit edit source

The portfolio was externally valued at end-FY21 at £906.1m and on a pro forma basis[20] was c £874m at end-Q122. Q122 included £33.5m (before costs) of disposals. Subsequent transactions have taken the year-to-date total for disposals to £69.2m with acquisitions amounting to £48.2m. The blended net initial yield on disposals of 5.9% compares with 8.7% on acquisitions, locking in an accretive yield spread.

| 31-Mar-22 | 31-Dec-21 | 31-Dec-20 | |

|---|---|---|---|

| Q122 | FY21 | FY20 | |

| Valuation | c £874m | £906.1m | £732.4m |

| Number of properties | 160 | 168 | 153 |

| Number of property units | 1,438 | 1,511 | 1,245 |

| Number of tenants | 1,035 | 1,077 | 898 |

| Contracted rents | £68.5m | £72.1m | £64.2m |

| Estimated rental value, ERV | N/A | £94.6m | 76.6 |

| WAULT to first break (years) | N/A | 3.0 | 3.2 |

| EPRA occupancy | 81.6% | 81.8% | 89.4% |

| Net initial yield | N/A | 5.6% | 6.9% |

| Reversionary yield | N/A | 9.4% | 9.4% |

Gross contracted rent roll was £68.5m at end-Q122, down from £72.1m at end-FY21, while EPRA occupancy was little changed at 81.6% versus 81.8%. Edison Investment Research estimates that the reduction in gross rent roll during Q122 was split broadly equally between disposals and additions to properties under refurbishment. The latter reduce the current rent roll but are excluded from EPRA ERV.

Positive FY21 return driven by fully covered dividends

Results for the year to 31 December 2021 (FY21) were published on 29 March 2022. Exhibit 13 provides a summary of the FY21 financial performance. DPS increased from 6.4p to 6.5p and was fully covered by EPRA EPS of 6.6p. The period included the £236m (before costs) acquisition of the Squarestone portfolio, adding an initial £21.9m to annualised rent roll. Net property revaluation losses reduced significantly (from £56.1m to £7.7m) with like-for-like property valuation growth of 1.1% offset by £15.4m of property acquisition costs primarily the result of the Squarestone acquisition. Additionally, the fair value movement on interest rate hedging instruments swung from a £2.5m loss to a £6.0m gain because of rising market interest rates. As a result, IFRS net earnings were £28.8m versus a loss of £31.0m in FY21. Held back by property acquisition costs, EPRA net tangible assets (NTA) per share were slightly lower at 97.2p (FY20: 98.6p) but, including dividends paid, the accounting total return was 5.0%.

| £m unless stated otherwise | FY21 | FY20 | FY21/FY20 |

|---|---|---|---|

| Rental income | 65.8 | 62.1 | 5.9% |

| Non-recoverable property costs | (9.9) | (8.8) | 12.9% |

| Net rental income | 55.8 | 53.3 | 4.8% |

| Administrative & other expenses | (10.6) | (11.3) | -6.6% |

| Operating profit before gains/(losses) on property | 45.2 | 42.0 | 7.8% |

| Unrealised and realised property gains/(losses) | (7.7) | (56.1) | |

| Operating profit | 37.6 | (14.1) | |

| Net finance expense | (14.9) | (14.0) | 6.1% |

| Impairment of goodwill | 0.0 | (0.6) | |

| Change in fair value of interest rate derivative | 6.0 | (2.5) | |

| Profit before tax | 28.8 | (31.2) | |

| Tax | 0.0 | 0.2 | |

| IFRS net profit | 28.8 | (31.0) | |

| Adjust for: | |||

| Unrealised and realised property gains/(losses) | 7.7 | 56.1 | |

| Impairment of goodwill | 0.0 | 0.6 | |

| Change in fair value of interest rate derivative | (6.0) | 2.5 | |

| EPRA earnings | 30.4 | 28.1 | 8.0% |

| Basic IFRS EPS (p) | 6.3 | (7.2) | |

| EPRA EPS (p) | 6.6 | 6.5 | 1.5% |

| DPS (p) | 6.50 | 6.40 | 1.6% |

| EPRA NTA per share (p) | 97.2 | 98.6 | -1.4% |

| Accounting total return | 5.0% | -5.8% | |

| Investment properties | 906.1 | 732.4 | 23.7% |

| Net debt | (383.8) | (298.8) | |

| Net LTV | 42.4% | 40.8% |

Relatively modest forecast reductions reflect global economic and political outlook

Edison Investment Research's previously published forecasts can be seen in Exhibit 14. Recognising the increased challenge to the UK growth outlook and accelerated inflationary environment, for RGL Edison Investment Research has slightly reduced forecast net rental income and slightly increased borrowing costs in respect of the small amount of variable rate debt that is hedged using caps rather than swaps. The Q122 average debt cost was 3.4% versus 3.3% at end-FY21. To maintain full dividend cover, Edison Investment Research has reduced its forecast FY22 DPS to 6.6p from 6.7p (FY21: 6.5p) and FY23 to 6.9p from 7.1p.

| Net rental income (£m) | EPRA earnings (£m) | EPRA EPS (p) | EPRA NTA/share (p) | DPS (p) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| New | Old | % chg. | New | Old | % chg. | New | Old | % chg. | New | Old | % chg. | New | Old | % chg. | |

| 12/22e | 62.8 | 63.1 | (0.4) | 34.1 | 34.6 | (1.6) | 6.6 | 6.7 | (1.6) | 98.9 | 99.0 | (0.1) | 6.60 | 6.70 | (1.5) |

| 12/23e | 64.9 | 65.4 | (0.8) | 35.8 | 36.7 | (2.4) | 6.9 | 7.1 | (2.4) | 101.8 | 101.0 | 0.8 | 6.90 | 7.10 | (2.8) |

Edison Investment Research continues to assume no net acquisitions and disposals for the year, but within this reflect the year-to-date transactions and the positive yield spread that these have locked in.[24] The driver of its forecasts is net rental income, where in FY22 and FY23 Edison Investment Research now assumes a slower benefit from letting activity but offset in FY22 by the positive impact of transactions. Edison Investment Research continues to forecast a relatively modest increase in EPRA occupancy[25] (to c 84% by end-FY23) but note that this excludes properties under refurbishment and development. Edison Investment Research expects refurbishment activity to increase during the forecast period[26] as RGL continues to enhance the attractiveness of its assets and meet its energy performance targets, in line with sector trends.

With EPRA earnings distributed in full and acquisitions and disposals matched by value, Edison Investment Research's property revaluation assumptions (1.5% pa gross of acquisition costs and capex) leave year-end LTV at approximately 42%. A reduction in LTV towards RGL’s medium-term target of c 40% would appear to require a stronger revaluation uplift than Edison Investment Research assumes or additional net property disposals. Revaluation gains may benefit from leasing progress and/or an improvement in external valuer sentiment as improving investment volumes provide more transactional evidence of underlying market valuations. Disposals would be likely to reduce the rental base.

Edison Investment Research estimates that a 1% increase/decrease in the FY22e value of investment properties increases/decreases EPRA NTA by c 1.9%.

Valuation edit edit source

Based on Edison Investment Research's FY22 DPS forecast of 6.6p, RGL provides a highly attractive 7.9% dividend yield, one of the highest in the sector, if not the highest.

In Exhibit 15, Edison Investment Research shows a comparison with a selected group of peers comprising mid-market diversified property investors and focused office sector investors, many of which are significantly larger than RGL with primarily central London exposure. To ease comparison, the data are based on 12-month trailing DPS declared and last published EPTA NTA/NAV. On this trailing basis (and Edison Investment Research forecasts on a prospective basis), RGL’s dividend yield continues to be at the very top end of both this selected peer group and the broad UK property sector (Edison Investment Research estimates c 4.0% on an unweighted trailing average basis). This is reflected in a narrower discount to NAV.

| Price

(p) |

Market

cap (£m) |

P/NAV*

(x) |

Yield**

(%) |

Share price performance | ||||

|---|---|---|---|---|---|---|---|---|

| One month | Three months | 12 months | From 12-month high | |||||

| Circle Property | 237 | 68 | 0.86 | 1.5 | -6% | 5% | 22% | -7% |

| Custodian | 99 | 436 | 0.83 | 5.3 | -1% | -1% | 2% | -9% |

| Derwent London | 2,932 | 3,292 | 0.74 | 2.6 | -3% | -1% | -12% | -21% |

| Great Portland Estates | 650 | 1,650 | 0.78 | 1.9 | -6% | -2% | -8% | -19% |

| Land Securities | 766 | 5,683 | 0.72 | 4.8 | 1% | 1% | 7% | -7% |

| Picton | 98 | 535 | 0.81 | 3.5 | -4% | 1% | 15% | -11% |

| Real Estate Investors | 38 | 68 | 0.65 | 8.1 | 0% | 3% | 2% | -9% |

| Schroder REIT | 54 | 267 | 0.77 | 5.2 | -6% | 11% | 22% | -9% |

| Palace Capital | 274 | 127 | 0.76 | 4.8 | -7% | 10% | 9% | -10% |

| UK Commercial Property REIT | 85 | 1,105 | 0.76 | 3.3 | -3% | 15% | 17% | -9% |

| BMO Commercial Property Trust | 118 | 856 | 0.82 | 3.7 | 7% | 16% | 46% | 0% |

| BMO Real Estate Investments | 92 | 221 | 0.72 | 4.4 | -1% | 12% | 30% | -6% |

| Workspace | 709 | 1,358 | 0.76 | 3.5 | 2% | -6% | -21% | -30% |

| Average | 0.77 | 4.0 | -2% | 5% | 10% | -11% | ||

| Regional REIT | 83 | 429 | 0.86 | 7.8 | 0% | 0% | -6% | -11% |

| UK property sector index | 1,767 | -8% | -1% | 1% | -13% | |||

| UK equity market index | 4,164 | -1% | 3% | 3% | -4% | |||

Additional company details, management and fees edit edit source

RGL is a UK-based REIT that aims to provide an attractive total return to shareholders, targeting a medium-term total return of at least 10% pa, with a strong focus on income supported by the potential for additional capital growth. It listed on the Main Market of the London Stock Exchange (LSE) in November 2015, having been formed by the combination of two UK commercial property investment funds previously created by the external asset and investment managers. London & Scottish Property Investment Management (LSPIM) is the asset manager, responsible for the day-to-day management of the asset and debt portfolios. Toscafund Asset Management (Toscafund) is the investment manager, responsible for management functions of the company.

LSPIM is a privately owned co-investing asset management and property development business. Based in Glasgow, with regional offices in Leeds, Manchester and London, it has the resources to operate a fully integrated asset management platform, the benefits of which have been demonstrated by strong rent collection through the pandemic. The senior management team is highly experienced with a proven track record of adding value to property portfolios across cycles, through intensive property management, focusing on income generation.

Management fees are set at 1.1% of net assets up to £500m and 0.9% above £500m, split equally between LSPIM and Toscafund. In addition, a property management fee of 4% of annual gross rental income is payable to LSPIM. An additional incentive is provided to the managers by way of a performance fee, set at 15% of total EPRA NAV per share return (EPRA NAV growth plus dividends declared) above an 8% hurdle, subject to a high-water mark. The performance fee is calculated annually and the intention is that one-third be paid in cash and two-thirds in shares (where new shares may be issued at above NAV). Performance fees were last accrued/paid during FY18; market conditions since have particularly suppressed capital returns. With the current high-water mark at 115.5p, Edison Investment Research does not anticipate performance fees being generated in the near term.

At the FY21 AGM, Massy Larizadeh was appointed to the board of RGL with effect from 1 June 2022, its seventh member. She has over 30 years of experience across the financial services and commercial real estate sectors and, with a particular interest in environmental, social and governance issues, will act as chair to RGL’s ESG Working Party. The board is chaired by Kevin McGrath, a chartered surveyor with more than 30 years’ experience in the property sector and property asset management. Other members are William Eason, with extensive investment management and board experience; Daniel Taylor, founder and CEO of Westchester Capital, an investment and advisory firm specialising in real estate; Frances Daley, a chartered accountant with considerable experience in corporate finance and senior finance roles; Stephen Inglis (representing LSPIM) and Tim Bee (representing Toscafund).

edit edit source

The two principal shareholders are OMP-SS5 and Majik Property Holdings with shareholdings of 35.3m/6.9% and 47.1m/9.1% respectively. Both holdings originate from the acquisition of a £236m regional office portfolio from Squarestone Growth LLP, announced on 31 August 2021. The consideration was part settled by the issue of 84.2m new RGL shares at 98.6p per shares. Of the shares issued, 74.6m shares were subject to lock-up arrangements, one-third for nine months, a further third for 15 months and the final third for 21 months.

Sensitivities edit edit source

The commercial property market is cyclical, historically exhibiting substantial swings in valuation through cycles. Income returns are significantly more stable, but still fluctuate according to tenant demand and rent terms. From a sector viewpoint, Edison Investment Research also highlights the increased risks and uncertainties that attach to development activity, including planning consents, timing, construction risks and the long lead times to completion and eventual occupation. RGL is not a developer but on a significantly lesser scale is exposed to similar uncertainties as it actively invests in improvements to existing assets with the aim of enhancing long-term income growth and returns. Edison Investment Research considers the main sensitivities to include:

- Economic risk: the war in Ukraine and sharply rising inflation, to a much lesser extent reflected in interest rates, are creating a high level of uncertainty regarding the global and UK economic outlook. Although the incidence and impact of the pandemic has substantially eased, there remains some uncertainty about the potential emergence of new strains.

- Sector risk: some of the inherent cyclical risk to vacancy in commercial property can be mitigated by portfolio diversification and, although RGL is focused on the office sector, its income risk continues to be well diversified across a broad number of occupiers, operating across a range of industries, by property and by geographic region. The pandemic has increased uncertainty about how offices will be used and may negatively affect structural demand, contrary to RGL’s expectations.

- Energy performance considerations: a failure to successfully meet regulatory and/or tenant expectations for energy performance enhancement would likely affect RGL’s ability to let properties on satisfactory terms and may make properties unlettable. In such circumstances, conversion to alternative use may offer mitigation.

- Funding risks: RGL has a good spread of secured and unsecured borrowing facilities with no near-term maturities (first in August 2024) and an average duration of more than five years. All debt is fixed rate or hedged against rising interest rates. Any significant increase in long-term interest rates may be expected to negatively affect market-wide property valuations and hence LTV ratios as well as NAV.

- Management risk: RGL is externally managed and is dependent on the ability of its asset manager to execute successfully on its strategy. Although Stephen Inglis, Derek McDonald and Simon Marriot, respectively CEO, managing director and investment director of the asset manager, LSPIM, are significantly involved in the management of the RGL portfolio, Edison Investment Research notes that LSPIM is backed by an experienced and growing team.

| Year end 31 December (£m) | 2018 | 2019 | 2020 | 2021 | 2022e | 2023e |

|---|---|---|---|---|---|---|

| INCOME STATEMENT | IFRS | IFRS | IFRS | IFRS | IFRS | IFRS |

| Rental & other income | 62.1 | 64.4 | 62.1 | 65.8 | 73.4 | 75.7 |

| Non-recoverable property costs | (7.7) | (9.4) | (8.8) | (9.9) | (10.5) | (10.8) |

| Net rental & related income | 54.4 | 55.0 | 53.3 | 55.8 | 62.8 | 64.9 |

| Administrative expenses (excluding performance fees) | (10.5) | (10.9) | (11.3) | (10.6) | (11.9) | (12.2) |

| Performance fees | (7.0) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| EBITDA | 36.8 | 44.1 | 42.0 | 45.2 | 51.0 | 52.7 |

| EPRA cost ratio | 40.1% | 31.6% | 32.4% | 31.2% | 30.5% | 30.3% |

| EPRA cost ratio excluding performance fee | 28.6% | 31.6% | 32.4% | 31.2% | 30.5% | 30.3% |

| Gain on disposal of investment properties | 23.1 | 1.7 | (1.1) | 0.7 | 0.0 | 0.0 |

| Change in fair value of investment properties | 23.9 | (3.5) | (54.8) | (8.3) | 9.0 | 14.1 |

| Change in fair value of right to use asset | 0.0 | (0.2) | (0.2) | (0.0) | (0.2) | (0.2) |

| Operating Profit (before amort. and except.) | 83.8 | 42.0 | (14.1) | 37.6 | 59.8 | 66.6 |

| Net finance expense | (15.7) | (13.7) | (14.0) | (14.9) | (16.9) | (16.9) |

| Fair value movement in interest rate derivatives & goodwill impairment | (0.1) | (2.0) | (3.1) | 6.0 | 0.0 | 0.0 |

| Profit Before Tax | 67.9 | 26.3 | (31.2) | 28.8 | 42.9 | 49.6 |

| Tax | (0.6) | 0.3 | 0.2 | 0.0 | 0.0 | 0.0 |

| Profit After Tax (FRS 3) | 67.4 | 26.5 | (31.0) | 28.8 | 42.9 | 49.6 |

| Adjusted for the following: | ||||||

| Net gain/(loss) on revaluation/disposal of investment properties | (47.0) | 1.9 | 55.9 | 7.6 | (9.0) | (14.1) |

| Other EPRA adjustments | 0.5 | 2.6 | 3.2 | (6.0) | 0.2 | 0.2 |

| EPRA earnings | 20.9 | 31.0 | 28.1 | 30.4 | 34.1 | 35.8 |

| Performance fees | 7.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Adjusted earnings | 27.9 | 31.0 | 28.1 | 30.4 | 34.1 | 35.8 |

| Period end number of shares (m) | 372.8 | 431.5 | 431.5 | 515.7 | 515.7 | 515.7 |

| Fully diluted average number of shares outstanding (m) | 372.8 | 398.9 | 431.5 | 459.7 | 515.7 | 515.7 |

| IFRS EPS - fully diluted (p) | 18.1 | 6.6 | (7.2) | 6.3 | 8.3 | 9.6 |

| EPRA EPS, fully diluted (p) | 5.6 | 7.8 | 6.5 | 6.6 | 6.6 | 6.9 |

| Adjusted EPS (p) | 7.5 | 7.8 | 6.5 | 6.6 | 6.6 | 6.9 |

| Dividend per share (p) | 8.05 | 8.25 | 6.40 | 6.50 | 6.60 | 6.90 |

| Dividend cover | 93.1% | 94.2% | 101.7% | 101.7% | 100.1% | 100.6% |

| BALANCE SHEET | ||||||

| Non-current assets | 720.9 | 806.0 | 749.5 | 925.2 | 950.1 | 975.9 |

| Investment properties | 718.4 | 787.9 | 732.4 | 906.1 | 931.3 | 957.3 |

| Other non-current assets | 2.5 | 18.1 | 17.2 | 19.0 | 18.8 | 18.6 |

| Current Assets | 127.0 | 69.4 | 101.1 | 85.5 | 73.7 | 63.7 |

| Other current assets | 22.2 | 32.2 | 33.7 | 29.4 | 28.1 | 28.8 |

| Cash and equivalents | 104.8 | 37.2 | 67.4 | 56.1 | 45.5 | 35.0 |

| Current Liabilities | (83.7) | (36.2) | (49.1) | (58.4) | (62.4) | (62.9) |

| Borrowings | (0.4) | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 |

| Other current liabilities | (83.3) | (36.2) | (49.1) | (58.4) | (62.4) | (62.9) |

| Non-current liabilities | (334.7) | (355.5) | (380.9) | (449.9) | (450.4) | (450.9) |

| Borrowings | (285.2) | (287.9) | (310.7) | (383.5) | (384.5) | (385.5) |

| Other non-current liabilities | (49.5) | (67.6) | (70.3) | (66.4) | (65.9) | (65.4) |

| Net Assets | 429.5 | 483.7 | 420.6 | 502.4 | 511.0 | 525.8 |

| Derivative interest rate swaps & deferred tax liability | 1.0 | 2.6 | 5.0 | (1.0) | (1.0) | (1.0) |

| Goodwill | (1.1) | (0.6) | 0.0 | 0.0 | 0.0 | 0.0 |

| EPRA net tangible assets | 429.4 | 485.7 | 425.6 | 501.4 | 510.0 | 524.8 |

| IFRS NAV per share (p) | 115.2 | 112.1 | 97.5 | 97.4 | 99.1 | 102.0 |

| Fully diluted EPRA NTA per share (p) | 115.2 | 112.6 | 98.6 | 97.2 | 98.9 | 101.8 |

| CASH FLOW | ||||||

| Cash (used in)/generated from operations | 38.8 | 26.0 | 48.0 | 56.9 | 56.2 | 52.6 |

| Net finance expense | (11.9) | (12.2) | (12.5) | (13.1) | (15.5) | (15.5) |

| Tax paid | (1.5) | (0.8) | 0.2 | 0.0 | 0.0 | 0.0 |

| Net cash flow from operations | 25.4 | 13.0 | 35.7 | 43.8 | 40.6 | 37.1 |

| Net investment in investment properties | 100.6 | (25.6) | (0.3) | (98.3) | (16.1) | (12.0) |

| Acquisition of subsidiaries, net of cash acquired | (32.6) | (43.9) | 0.0 | 0.0 | 0.0 | 0.0 |

| Other investing activity | 0.2 | 0.2 | 0.1 | 0.0 | 0.0 | 0.0 |

| Net cash flow from investing activities | 68.2 | (69.4) | (0.2) | (98.2) | (16.1) | (12.0) |

| Equity dividends paid | (29.4) | (32.5) | (26.7) | (27.8) | (34.3) | (34.8) |

| Debt drawn/(repaid) - including bonds and ZDP | (50.5) | 3.5 | 22.2 | 73.8 | 0.0 | 0.0 |

| Net equity issuance | (1.2) | 60.5 | 0.0 | (0.1) | 0.0 | 0.0 |

| Other financing activity | 47.7 | (42.7) | (0.8) | (2.7) | (0.9) | (0.9) |

| Net cash flow from financing activity | (33.4) | (11.2) | (5.3) | 43.2 | (35.2) | (35.7) |

| Net Cash Flow | 60.2 | (67.6) | 30.1 | (11.2) | (10.6) | (10.6) |

| Opening cash | 44.6 | 104.8 | 37.2 | 67.4 | 56.1 | 45.5 |

| Closing cash | 104.8 | 37.2 | 67.4 | 56.1 | 45.5 | 35.0 |

| Balance sheet debt | (374.6) | (337.1) | (360.1) | (433.1) | (434.3) | (435.4) |

| Unamortised debt costs | (5.8) | (6.9) | (6.0) | (6.9) | (5.7) | (4.5) |

| Closing net debt | (275.5) | (306.8) | (298.8) | (383.8) | (394.4) | (405.0) |

| LTV | 38.3% | 38.9% | 40.8% | 42.4% | 42.4% | 42.3% |

| Name | Desciption |

|---|---|

| Independent non-executive chairman: Kevin McGrath | Kevin McGrath, OBE DL, is a chartered surveyor with more than 30 years’ property experience. In addition to RGL, he is chairman of M&M Property Asset Management, having previously been managing director and senior adviser of F&C REIT Asset Management, and before that was a founding equity partner in REIT Asset Management, a property investment, finance and asset management partnership. He is also chairman of INTCAS, an independent technology and support service company. Prior to REIT Asset Management, he was a senior investment surveyor with Hermes Investment Management. |

| CEO London & Scottish Property Investment Management: Stephen Inglis | Stephen Inglis, CEO of London & Scottish Property Investment Management, the asset manager of RGL, serves as NED on the board of Regional REIT. He has over 30 years’ experience in the commercial property market, the majority of which has been working in the investment and development sector. His career to date has been split between London and Scotland, giving him wide knowledge of the UK property market. He is a chartered surveyor and became a member of RICS in 2001 and is also a member of the Investment Property Forum. Since June 2013, he has acquired or sold approximately 250 assets in deals totalling in excess of £1.2bn. |

| MD London & Scottish Property Investment Management: Derek McDonald | Derek McDonald is managing director of London & Scottish Property Investment Management, the asset manager of RGL, which he joined in 2015. He spent 27 years at Bank of Scotland/Lloyds Banking Group in a variety of senior roles in corporate banking, including time in the bank’s corporate banking business in the US, the UK real estate joint ventures business, the European real estate business, the UK business support unit and the Irish business support unit, which dealt with high-value real estate lending. He has led a significant number of high-value transactions at both REVCAP and Lloyds Banking Group and has had line responsibility for large teams of professionals. He has significant experience in building and leading multi-jurisdictional businesses. |

| Investment director, London & Scottish Property Investment Management: Simon Marriott | Simon Marriott is investment director for London & Scottish Property Investment Management, asset manager to RGL, which he joined in 2017. He has over 30 years’ experience in the property industry sourcing, transacting and asset managing, most recently at Cromwell Property Group where he was head of investments and UK real estate. Prior to Cromwell, Simon held a number of senior roles including director of real estate transactions at PwC, senior vice president and managing director of investments at Oxford Properties and head of separate accounts at Invista REIM, managing funds with assets under management of over £2.5bn. He is a chartered surveyor and a member of RICS since 1992, as well as a member of the Investment Property Forum. |

| Shareholder name | Shareholder amount (%) |

|---|---|

| OMP-S55 | 6.89 |

| Majik Property Holdings | 9.13 |

Actions edit edit source

To invest in Regional REIT, click here.

To contact Regional REIT, click here.

Notes edit edit source

- ↑ Note: *EPRA earnings exclude revaluation movements, gains/losses on disposal and other non-recurring items. EPRA EPS is fully diluted. **NAV is EPRA net tangible assets per share.

- ↑ Source: Regional REIT data, Edison Investment Research. Note: *NAV is defined as EPRA net tangible assets (NTA) per share.

- ↑ The change in EPRA NTA/NAV plus dividends paid.

- ↑ Source: Regional REIT data, Edison Investment Research.

- ↑ Source: Regional REIT. End-FY21.

- ↑ Source: Regional REIT.

- ↑ Source: Regional REIT, FY21 Annual Report.

- ↑ There is a small interest rate exposure on the c £66m notional value of caps which we estimate represents a maximum uplift to total borrowing costs of c 4bp.

- ↑ Net borrowings as a percentage of the FY21 externally assessed property value adjusted for subsequent property transactions and capex.

- ↑ The return generated at portfolio level before the impact of gearing and excluding corporate costs.

- ↑ Source: Regional REIT.

- ↑ For the portfolio as a whole, ERV of £94.6m was similarly £22.5m ahead of £72.1m of contracted rent.

- ↑ Energy Performance Certificate.

- ↑ Source: Regional REIT. Note: *Other includes areas that are non-rated, in most cases reflecting recently acquired or earmarked for disposal.

- ↑ Source: Regional REIT data, Edison Investment Research.

- ↑ Source: Regional REIT data, Edison Investment Research.

- ↑ As at Q122.

- ↑ Source: Regional REIT.

- ↑ Source: Regional REIT.

- ↑ Adjusted for acquisitions, disposals and capex but excluding any revaluation.

- ↑ Source: Regional REIT.

- ↑ Source: Regional REIT data.

- ↑ Source: Edison Investment Research.

- ↑ This includes £69.2m of reported disposals at a 5.9% net initial yield (NIY), £48.2m of reported acquisitions at an 8.7% NIY and c £20m of assumed acquisitions at an NIY of 8.5%.

- ↑ The ERV of occupied space versus total ERV.

- ↑ Our assumption of increased refurbishment activity has a positive impact on EPRA occupancy by reducing EPRA ERV, although the properties are unavailable to let during the period.

- ↑ Source: Company data, Edison Investment Research, Refinitiv prices as at 1 June 2022. Note: *Based on last reported EPRA NTA or NAV per share. **Based on trailing 12-month DPS declared.

- ↑ Source: Regional REIT historical data, Edison Investment Research.

- ↑ Source: Regional REIT, 22 March 2022.