Revolut

Revolut is the digital banking alternative designed for your global lifestyle.

Summary[1] edit edit source

Revolut is addressing the global dissatisfaction with traditional banks by offering a digital banking alternative that caters to both consumers and businesses. A comprehensive survey involving 9,000 bank customers across nine countries unveiled a staggering 77% global dissatisfaction rate among customers towards their existing banks.

Revolut's innovative approach aims to create a financial environment where money flows seamlessly and at the individual's preferred pace, regardless of geographical location. Facilitating this vision, Revolut offers the swift setup of a current account within just 60 seconds. This account enables users to conveniently hold and exchange more than 30 different currencies at the interbank exchange rate. Moreover, Revolut allows for the effortless execution of international money transfers to any bank worldwide, free of charge. This global accessibility extends to spending as well, with a contactless MasterCard that permits fee-free transactions on a global scale.

The company has experienced rapid growth, amassing a customer base exceeding 750,000 individuals who have collectively transacted over $4.2 billion in just two years. Beyond serving individuals, Revolut has expanded its services to the corporate realm. The introduction of a business platform empowers companies to manage various financial aspects, including the ability to hold, exchange, and transfer more than 30 currencies at interbank rates. Additionally, the platform enables the issuance of corporate cards, facilitating free spending on a global scale.

Revolut's reach continues to expand, as it caters to over 12,000 global companies and scaling start-ups. With its dynamic and forward-moving stance within the fintech industry, Revolut is reshaping the financial landscape and offering a compelling alternative to outdated banking models.

The idea, mission and values[1] edit edit source

Revolut was launched in July 2015 by ex-finance professionals who have a distinctive ambition to build the future of money beyond banking. The idea came from a common frustration with exchange rate mark-ups, foreign transaction fees and a lack of technological innovation from the big banks.

Banks charge insane fees to spend or transfer your money in a foreign currency. A typical UK bank customer is charged up to £25 to transfer $500 to a bank in the United States with an exchange rate mark-up of 3-5%. For international card payments, banks charge as much as 6% on every transaction.

Today’s hyper-connected world deserves a financial partner just as progressive. One that adapts to your needs, gives you control and constantly pushes you into new exciting spaces. Revolut is a new Global Banking Alternative that enables free international money transfers, fee-free global spending - always at the interbank exchange rate.

What is the mission of Revolut?

Their main goals are to:

- Make banking services more convenient: Revolut aimed to simplify and streamline traditional banking processes, offering a user-friendly mobile app and various features that allowed customers to manage their finances more efficiently.

- Offer low-cost currency exchange: Revolut's app provided users with the ability to exchange and spend money in different currencies at interbank exchange rates without additional fees.

- Facilitate cryptocurrency trading: Revolut was one of the early fintech companies to allow users to buy, hold, and exchange cryptocurrencies through their platform.

- Enhance financial control and budgeting: The app offered tools for tracking expenses, setting budgets, and providing insights into users' spending habits, helping them manage their finances better.

- Provide a global presence: Revolut aimed to expand its services to various countries, offering international money transfers and borderless banking solutions to individuals and businesses worldwide.

What is the vision of Revolut?

Key components of Revolut's vision include:

- Accessibility: Revolut wanted to make financial services accessible to everyone, regardless of their location, income level, or financial background. By offering a wide range of services and eliminating unnecessary fees, they aimed to democratize finance and provide better financial opportunities for their customers.

- Innovation: Revolut sought to stay at the forefront of financial technology by continuously innovating and introducing new features and products. This included expanding into areas such as cryptocurrency, investment products, and business banking to cater to evolving customer demands.

- Global Reach: The vision of Revolut was to expand its services worldwide, providing seamless and borderless financial solutions to customers in different countries. Their international money transfer capabilities and multi-currency accounts were part of this strategy.

- Financial Control and Empowerment: Revolut's vision was centered on empowering its users to have greater control over their finances. By offering budgeting tools, spending insights, and customizable account features, they aimed to help customers make informed financial decisions and improve their financial well-being.

- Disruption of Traditional Banking: Revolut's ultimate vision was to challenge and disrupt the traditional banking model, offering an alternative that embraced digital technologies and customer-centric solutions.

Substantial accomplishments to date[1] edit edit source

In just two years, Revolut has grown to over 750,000 active users who have transacted over $4.2 billion to date. An average of 1,700 new customers sign up every day.

As a testament to the product, Revolut’s user acquisition is primarily driven by recommendations from friends and family. For an early growth comparison, TransferWise - a well-known Fintech unicorn launched in 2011 - only processed €10 million in client funds in their first year.

This crowdfunding is part of a $66m investment round from some of Europe's most well-known Venture Capital firms including Index Ventures, Balderton Capital and Ribbit Capital. The hot Fintech startup has also regularly attracted the attention of international media, with regular coverage in the Telegraph, Times, Financial Times and CityAM.

In July 2015, Revolut’s £1m crowdfunding campaign was oversubscribed by over 10,000 would-be-investors who pledged to invest £17m, all of whom were Revolut users.

Revolut was also notably:

- Nominated alongside Pokémon Go and WeChat for ‘The Best Overall Mobile App’ award at the largest Mobile Conference in the world.

- Selected from over 1,500 European FinTech’s to be named on the ‘Fintech50 2017’ list of the hottest European startups.

- Awarded the ‘Hottest FinTech Startup’ award at the Europas 2017.

Revenue breakdown[1] edit edit source

Revenue Streams Analysis:

The company's financial report showcases diverse revenue sources, each governed by specific recognition criteria as outlined in its accounting policies. The process of consolidation integrates subsidiary financial statements into the Group's consolidated financial statements up to defined dates. This consolidation eliminates inter-company transactions, balances, and unrealized gains, maintaining uniformity in applying group accounting policies to all entities and transactions.

Foreign Currency Translation:

Foreign currency translation involves converting foreign currency monetary items at closing rates and non-monetary items at historical or fair value exchange rates.

Revenues:

- Card and Interchange Fees: This category encompasses transaction-related fees like interchange fees from card issuing partners, merchant acquiring fees, cash withdrawal fees, and top-up fees. Revenue recognition occurs upon the completion of card transactions, representing a single performance obligation.

- Subscription Fees: Subscription revenue includes fees charged to both retail and business customers for monthly and annual subscriptions. The performance obligations within this category involve card delivery and payment processing services. Revenue for card delivery is recognized upon order placement, while subscription service revenue is acknowledged monthly.

- Foreign Exchange Fees: This section includes mark-up fees on market exchange rates and fair usage fees for additional exchange volumes. Revenue arises from currency exchange, and recognition takes place at the moment of exchange.

- Wealth: Revenue from cryptocurrency, commodities, trading, and vault products arises from acting as an agent to buy or sell assets on behalf of customers. This revenue stream is derived from exchange mark-ups, commissions, and fair usage fees, and recognition aligns with the execution of customer orders.

Revenue Growth:

Revenue witnessed impressive growth of 190% year on year, reaching £636 million. This growth was driven by expanding customer numbers across Retail and Business ecosystems, including a notable 46% surge in retail customers. The company's acquisition strategies and organic growth further bolstered this expansion.

Gross Margin soared to nearly 70%, attributed to an increased share of revenue from higher-margin products such as Foreign Exchange and Wealth, coupled with enhanced margins in payment operations due to cost optimization efforts. The company demonstrated operating leverage, with operating expenses rising by 37%, while Gross Profit surged by 512% year-on-year.

The achievement of profitability in 2021 was significant, with reported profit from operations amounting to £59.1 million and total comprehensive income reaching £19.7 million for the year.

The company witnessed substantial growth in customer deposit balances, reaching £7.4 billion by December 2021, and loans and advances to customers surged to £17.8 million. The equity-to-total-assets ratio improved from 7.9% in 2020 to 12.5% in 2021, supported by an $800 million Series E equity funding round.

Additional Revenue Streams:

In addition to the aforementioned details, the company also derives revenue from other sources, such as:

- Gaining a portion of the revenue from the fee paid to MasterCard© by merchants for payment processing.

- Launching a paid Premium service in April 2017, resulting in customer sign-ups and additional revenue.

- Earning revenue through Revolut credit accessed from the app and promoting new start-ups.

- Generating revenue from Revolut for Business, a subscription-based web service catering to international payments and corporate travel management.

Use of proceeds[1] edit edit source

The funds raised will be used in two ways: (1) International expansion and (2) product development.

Starting in 2017, the fast-growing startup will be expanding internationally, with the aim of establishing itself as the number one platform for consumers and businesses for managing their finances. Revolut intends to initially expand its services across North America and Asia.

The equity raised will be used to hire a world-class team of International Expansion Managers, paying for the infrastructure and relevant licensing required to operate across new territories and to accelerate customer acquisition globally.

Revolut will also use the funds raised to accelerate product development for its consumer and business products. Currently some of Revolut’s services are made available in the Revolut app via partnerships with licensed third-parties. The funds raised will enable Revolut to apply for licences to provide these products in-house, which should in-turn increase profit.

Projects [1] edit edit source

As a rapidly growing fintech company operating in over 35 countries, Revolut acknowledges the significance of fostering strong relationships with its diverse stakeholders. With a user base exceeding 25 million and a workforce of over 5,000, Revolut's stakeholder network encompasses customers, regulators, investors, partners, suppliers, and employees, among others. Revolut considers stakeholder engagement a pivotal factor in achieving its long-term success, aligning with its responsibilities under section 172of the Companies Act 2006.

Customers: Revolut's customer-centric approach differentiates it within the industry. Through initiatives such as the "Deliver WOW" project, Revolut prioritizes positive customer interactions and has introduced a team of Customer Experience Managers. This team actively collaborates with product and service departments to enhance the customer journey and address feedback.

Partners and Suppliers: Given the complexity of the FinTech sector, partnerships play a vital role. Revolut engages in rigorous due diligence to cultivate beneficial partnerships that mitigate risks and provide opportunities for future growth and collaboration.

Investors: Revolut's investors have played an integral role in its growth journey. Revolut maintains open communication channels, providing regular updates on financial performance, strategy, and developments. The successful Series E funding round in 2021, raising $800 million and valuing the company at $33 billion, exemplifies the trust investors have in its mission and prospects.

Fraud Prevention and Customer Safety: Combatting fraud is a shared priority. Revolut actively engages with industry, law enforcement, regulators, and government bodies to address fraud collectively. Revolut's commitment to advanced machine learning technologies and education campaigns underscores its dedication to safeguarding customers' interests.

Employees: Revolut's employees are central to its success. Revolut fosters an inclusive and supportive work environment, offering wellbeing days and embracing flexible working. Its diversity and inclusion program reflects its commitment to global representation.

Donations and Community Engagement: Revolut is engaged in philanthropic efforts through its Donations platform. It enables customers to contribute to various charitable causes and partners with organizations such as the Royal British Legion, the RTÉ Toy Show appeal, and disaster relief initiatives.

Environmental Responsibility: Sustainability is paramount. Revolut actively manages its environmental impact, partnering with Watershed to assess its carbon footprint and implement strategies to reduce emissions. Its sustainable business travel policy and support for renewable energy sources underscore its commitment to environmental responsibility.

Maintaining High Standards: Revolut upholds high standards of business conduct. It prioritizes customer trust, invests in compliance training for its staff, engages in anti-bribery and corruption initiatives, and ensures transparency in its dealings with third parties. Its commitment to transparency, integrity, and providing exceptional service guides its interactions with all stakeholders.

Revolut's approach to projects and stakeholder engagement is underpinned by a commitment to excellence, transparency, and mutual benefit. By nurturing positive relationships with its stakeholders, Revolut not only builds trust but also enhances its ability to navigate challenges, capitalize on opportunities, and achieve sustainable growth. Through ongoing collaboration, Revolut remains dedicated to delivering value to all its stakeholders and shaping a positive impact on the global financial landscape.

Business and Operational Risks edit edit source

Understanding the risks is crucial for investors, stakeholders, and the company itself to make informed decisions and implement effective risk management strategies. The following are the risks that are related to Revolut.

Regulatory Compliance Risk: Revolut operates in multiple countries and is subject to a complex web of financial regulations, including anti-money laundering (AML) and know-your-customer (KYC) requirements. Non-compliance with these regulations could lead to severe penalties, fines, and reputational damage, potentially affecting Revolut's ability to operate in certain markets.

Cybersecurity Threats: As a leading fintech company, Revolut is a prime target for cybercriminals. The risk of data breaches, security vulnerabilities, and unauthorized access to sensitive customer information is a significant concern. A successful cyber attack could lead to financial losses, legal liabilities, and damage to customer trust.

Currency and Market Risks: Revolut's offerings, including foreign exchange and investment services, expose the company to currency exchange rate fluctuations and market risks. Sudden market changes could impact Revolut's revenue and profitability.

Licensing and Expansion Challenges: As Revolut plans to expand into new markets, obtaining the necessary licenses and regulatory approvals is critical. Delays, denials, or difficulties in meeting regulatory requirements could hinder Revolut's expansion plans and increase operational costs.

Dependence on Third-Party Providers: Revolut relies on various third-party service providers to offer certain features and services. Any disruptions, contractual disputes, or security breaches with these providers may adversely affect Revolut's operations and customer experience.

Credit and Default Risks: If Revolut offers credit products, such as loans or credit cards, it faces credit and default risks. Customer defaults could lead to potential financial losses and impact the company's overall financial health.

Financial Viability: As a fast-growing company, Revolut may face financial challenges, particularly if it expands aggressively without achieving sustainable profitability. Ensuring financial stability is crucial for long-term success and investor confidence.

System Outages and Technical Failures: One of the primary operational risks for Revolut is the occurrence of system outages or technical failures. As the company relies heavily on its mobile app and digital platforms, any disruptions or downtime could lead to service unavailability, transaction failures, and customer dissatisfaction. Such incidents may result from hardware failures, software glitches, or cyber attacks, and may cause reputational damage and financial losses.

Transaction Processing Issues: Efficient and accurate transaction processing is essential for Revolut's success. Errors in processing customer transactions, delays in fund transfers, or failures in payment processing could lead to customer complaints, regulatory scrutiny, and potential financial liabilities.

Customer Support Challenges: As Revolut continues to grow its customer base, providing timely and effective customer support becomes increasingly critical. Operational risks arise if the company cannot meet customer inquiries, complaints, and requests adequately. Poor customer support may lead to dissatisfaction, churn, and negative word-of-mouth, impacting Revolut's brand image and customer retention rates.

Scalability and Infrastructure Risks: As Revolut expands its operations and customer base, scalability becomes a critical concern. Rapid growth may strain the company's infrastructure, leading to performance issues, slower response times, and potential service outages. Ensuring that the infrastructure can handle increased demand and maintaining scalability is vital for sustained growth.

Internal Process Risks: Inefficient internal processes and lack of proper controls can introduce operational risks for Revolut. Errors in internal operations, compliance oversight, or inadequate risk management practices may expose the company to financial losses, regulatory issues, and reputational damage.

Business Continuity and Disaster Recovery: Having robust business continuity and disaster recovery plans is crucial for Revolut to ensure uninterrupted service delivery. Any major disruptions, whether due to natural disasters, cyber incidents, or other unforeseen events, may severely impact the company's operations and customer trust.

Managing business and operational risks is fundamental for Revolut's long-term success and sustenance in the competitive fintech industry. By implementing robust risk management strategies, investing in technology and infrastructure, and fostering a culture of compliance and customer-centricity, Revolut can mitigate these risks and build a resilient foundation for its business growth. Regular monitoring, continuous improvement, and adaptability to changing market dynamics will be essential to navigate these challenges successfully.

Market Trends and News edit edit source

Revolut Becomes UK's Most Valuable Fintech Startup (September 2021) Revolut raised $800 million in a funding round, reaching a valuation of $33 billion. This made it the most valuable fintech startup in the United Kingdom.

Revolut Expands to India and Other International Markets (August 2021) Revolut announced its expansion into India, allowing customers in the country to access its digital banking and financial services. The move marked the company's continued global expansion strategy.

Revolut Adds Dogecoin to its Cryptocurrency Offering (July 2021) As cryptocurrencies gained popularity, Revolut responded to customer demand by adding Dogecoin to its list of supported cryptocurrencies, further expanding its cryptocurrency offerings.

Revolut Faces Regulatory Scrutiny in Lithuania (June 2021) The Bank of Lithuania ordered Revolut to suspend some of its activities in the country due to compliance and regulatory concerns. The company worked with authorities to address the issues and ensure compliance with local regulations.

Revolut Introduces Open Banking Features (May 2021) Revolut rolled out Open Banking features in some markets, allowing customers to connect their external bank accounts and manage finances from a single platform.

Revolut Reports Strong Revenue Growth Despite Pandemic (March 2021) Despite the challenges posed by the COVID-19 pandemic, Revolut reported strong revenue growth for the fiscal year 2020, indicating the company's resilience and increasing user adoption during difficult times.

Revolut posts over £100m adjusted EBITDA with £26.3m profit in first full year of profitability[2]

First full year of profit generated £100.3m adjusted EBITDA and £26.3m in profit (Net Income) for 2021

Revenues tripled from £220m in 2020 to £636m for 2021

Gross Margin improved from 33% in 2020 to 70% for 2021

Revenues increased over 30% to more than £850m ($1bn+) in 2022

SWOT Analysis edit edit source

Strengths: edit edit source

Innovative Technology: Revolut is a user-friendly app and the innovative technology also offers features such as: real-time spending notifications, instant peer to peer transfers and built in budgeting tools.

Multi-Currency Accounts: Revolut provides users with the ability to hold and exchange multiple currencies at interbank rates which makes it easier for international users to manage their finances.

Low Fees: Revolut offers competitive foreign exchange rates and minimal fees for international transactions; this is considered significantly cheaper than traditional banks.

Quick Account Setup process is quicky and easy, often requiring only a few minutes and there is no need for physical visits to a bank branch.

Financial Products:

Revolut also offers a range of financial products such as cryptocurrency trading, stock trading and savings which means there are able to cater to more of the consumers' needs.

Weaknesses: edit edit source

Limited Customer Support: Some users have highlighted dissatisfaction with Revolut's customer support which includes delays in responses and the inability to resolve issues promptly.

Regulatory Challenges:

Revolut operates in multiple countries which means the company is exposed to various regulatory frameworks. The company will need to adapt to different regulations which is challenging and leads to compliance issues.

Dependence on App:

Revolut has a heavy reliance on its mobile app which can be a weakness for the company. If the app experiences technical glitches it will be a problem for consumers to conduct financial transactions. Consumers may also want to conduct financial transactions through traditional channels.

Opportunities: edit edit source

Global expansion:

Revolut has the opportunity to expand its range of services to new emerging markets so they are able to attract a larger customer base as digital banking becomes more popular in several regions.

Partnerships:

Revolut has the ability to collaborate with different fintech companies, e-commerce platforms or traditional financial institutions; this could potentially open up new revenue streams and enhance its service offerings.

Additional Financial Services:

Revolut can introduce more financial products such as loans, mortgages and insurance so Revolut as a company becomes more of a comprehensive services provider.

Threats: edit edit source

Competition: The digital banking and fintech industry is highly competitive with as there are established players with a large market share. Revolut will face the threat of losing market share to competitors.

Regulatory Changes: Regulation and compliance requirements in different countries which could potentially impact Revolut's operations and business model.

Cybersecurity Risks: As there is the presence of an online platform which handles financial transactions; Revolut faces the constant threat of cyberattacks, data breaches which could damage its reputation.

Industry analysis [2] edit edit source

Financial technology (Fintech) is undergoing remarkable growth, with projections indicating that the global fintech market is expected to expand from $245 billion to an estimated $1.5 trillion by 20301. This growth is driven by factors such as increased demand for user-friendly financial services and the adoption of cutting-edge technologies within the financial sector.

The global fintech market is anticipated to experience a substantial compound annual growth rate (CAGR) of 20.5% from 2020 to 2030, with the market size projected to reach $699.50 billion by 20302. This growth is attributed to the growing need for digital payment solutions, investments in technology-based solutions, supportive regulations, and the rise of Internet of Things (IoT) devices.

Moreover, the Asia-Pacific (APAC) region is expected to emerge as a dominant force in the fintech market, outpacing the United States by 20301. With a projected CAGR of 27%, APAC's growth will be primarily fueled by emerging markets such as China, India, and Indonesia, which have a large presence of fintech companies, a significant underbanked population, and a tech-savvy demographic. In contrast, North America is expected to maintain its fintech hub status, with the United States contributing about 32% of the global fintech revenue growth.

The growth trajectory of the fintech industry highlights a shift from the initial dominance of payment solutions to a new era characterized by Business-to-Business-to-X (B2B2X) and Business-to-Business (B2B) segments. B2B2X, including B2B2C and B2B2B models, is projected to experience a CAGR of 25%, reaching $440 billion in annual revenues by 2030. Meanwhile, the B2B fintech market is anticipated to grow at a CAGR of 32%, reaching $285 billion, catering to underserved small businesses.

Efficient regulation and partnerships between traditional financial institutions and fintech companies are vital for the sustainable growth of the fintech sector. These partnerships, referred to as "Value-based Partnerships," enable fintechs to maintain their independence while capitalizing on mutually beneficial commercial arrangements.

In conclusion, the fintech industry's trajectory of growth is characterized by the ascent of APAC, the emergence of new growth segments, and the importance of regulatory frameworks and strategic partnerships.

Competitive Landscape edit edit source

| Aspect | Revolut | Monzo | N26 | Starling Bank | |

|---|---|---|---|---|---|

| 1 | Market Presence | Global presence, millions of users | Primarily operates in the UK, large customer base | Strong presence in various countries | Primarily focused on the UK, growing customer base |

| 2 | Product Offerings | Multi-currency accounts, international money transfers, cryptocurrency & stock trading, insurance, savings accounts | Current accounts, savings accounts, personal loans, premium accounts, business accounts | Current accounts, savings accounts, insurance, investment products, premium metal card | Current accounts, savings accounts, insurance, investment products, premium metal card |

| 3 | International Expansion | Aggressively expanded to multiple markets | Limited European expansion, focused on the UK | Strong presence in Europe | Initially UK-focused, interest in international expansion |

| 4 | Competitive Advantage | Diverse product offerings, wide international presence | User-friendly app, vibrant community participation, partnered savings pot | Sleek user interface, seamless international banking | Excellent customer service, attractive “Marketplace” |

Examining the competitive landscape surrounding Revolut highlights its impressive global footprint, encompassing millions of users across numerous countries. A notable attribute of Revolut is its diverse suite of products, extending beyond conventional banking services. These offerings encompass multi-currency accounts, international fund transfers, cryptocurrency and stock trading, insurance provisions, and savings options. This varied array of services positions Revolut as a comprehensive financial services provider for its wide-ranging user base.

Revolut's competitive strength is also accentuated by its robust international expansion strategy. Unlike some peers with more localized focuses, Revolut has extended its operations to multiple markets worldwide, thereby establishing a significant global presence. This expansion has been facilitated by its technology-driven approach and innovative services that cater to evolving financial demands.

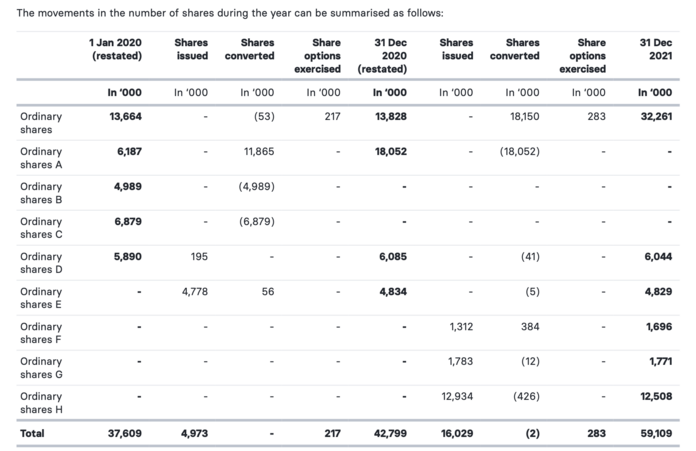

In comparison to Monzo, which primarily concentrates on the UK market, and N26, which has primarily targeted select European markets, Revolut's strategy is characterized by a broader geographical scope. Similarly, while Starling Bank operates within the UK and shows an inclination for international expansion, Revolut's expansive user base and comprehensive financial service offerings distinguish it within this competitive landscape. As of 31st December, 2021, there were 59,144,624 ordinary shares of Revolut.[3]

Management Team edit edit source

Corporate strategy edit edit source

Revolut has been consistently pursuing a strategic path that encompasses both innovation and global expansion, positioning itself as a leading player in the fintech industry. This strategy is evident in a series of significant milestones and decisions the company has made in recent years:

- Market Leadership and Valuation: In September 2021, Revolut achieved a significant milestone by raising $800 million in a funding round, resulting in a valuation of $33 billion. This accomplishment not only solidified Revolut's status as the most valuable fintech startup in the UK but also underscored its strategic focus on establishing itself as a key player in the global financial technology landscape.

- Global Expansion: Revolut's strategic intent to expand its services internationally was evident in its expansion into India and other international markets in August 2021. By enabling customers in India to access its digital banking and financial services, Revolut demonstrated its commitment to capturing new markets and enhancing its global footprint.

- Cryptocurrency Innovation: Recognizing the growing demand for cryptocurrencies, Revolut responded promptly to customer preferences. In July 2021, the company expanded its cryptocurrency offering by adding Dogecoin to its list of supported cryptocurrencies. This strategic move aligns with Revolut's goal of providing innovative financial products and staying relevant in the evolving landscape of digital assets.

- Navigating Regulatory Challenges: Demonstrating its adaptability and commitment to regulatory compliance, Revolut's response to regulatory scrutiny in Lithuania showcased its strategic capability to address compliance and regulatory concerns effectively. By collaborating with authorities and addressing issues, the company displayed its dedication to maintaining a strong regulatory standing in its operational markets.

- Open Banking and Customer-Centricity: In May 2021, Revolut introduced Open Banking features in select markets. This strategic initiative aimed to enhance customer experience by allowing them to connect external bank accounts and manage their finances seamlessly from a single platform. This customer-centric approach aligns with Revolut's commitment to providing holistic financial solutions.

- Resilience and Growth Amidst Challenges: Even in the face of the global COVID-19 pandemic, Revolut exhibited a strong strategic response. Despite the challenges posed by the pandemic, the company reported robust revenue growth for the fiscal year 2020, showcasing its resilience and ability to adapt to changing market conditions.

- Financial Performance and Margin Improvement: Revolut's corporate strategy is underscored by impressive financial achievements. Notably, the company's revenue tripled from £220 million in 2020 to £636 million in 2021. Additionally, the gross margin improved significantly from 33% in 2020 to an impressive 70% in 2021, reflecting the company's strategic focus on optimizing financial performance.

- Continued Growth Trajectory: Revolut's strategy is forward-looking, as evidenced by its projection for 2022. The anticipated revenue growth of over 30%, resulting in revenues exceeding £850 million ($1 billion+), reflects the company's ongoing commitment to sustainable expansion and financial success.

In summary, Revolut's corporate strategy is marked by its commitment to innovation, global expansion, customer-centricity, regulatory compliance, and financial performance. By effectively combining these elements, Revolut aims to position itself as a trailblazer in the fintech industry, capturing new markets and enhancing its status as a leader in the digital banking and financial services landscape.

Financials edit edit source

Financial Statement edit edit source

Financial statement data is only available until the year ending 31/12/2021.

Balance Sheet edit edit source

| Year End Date | 31/12/2018 | 31/12/2019 | 31/12/2020 | 31/12/2021 |

|---|---|---|---|---|

| All Values in £000 | ||||

| Assets | ||||

| Current Assets | ||||

| Cash & Cash Equivalents | 1,103,996 | 2,450,107 | 5,055,023 | 7,052,609 |

| Financial Assets at FVOCI | 0 | 0 | 0 | 1,236,481 |

| Investment in Commodities at FVTPL | 0 | 0 | 50,366 | 66,356 |

| Trade and Other Receivables | 0 | 0 | 153,242 | 206,880 |

| Inventories | 3,553 | 13,042 | 11,282 | 7,396 |

| Current Tax Assets | 0 | 0 | 3,856 | 7,291 |

| Loans & Advances to Customers | 41,442 | 59,089 | 415 | 4,870 |

| Derivative Financial Assets | 0 | 0 | 121 | 9,294 |

| Total Current Assets | 1,103,996 | 2,522,238 | 5,274,305 | 8,591,177 |

| Non-Current Assets | ||||

| Property, Equipment & Right-of-Use | 3,856 | 11,940 | 37,497 | 25,128 |

| Intangible Assets | 37,012 | 93,927 | 411 | 721 |

| Loans & Advances to Customers | 0 | 0 | 961 | 12,946 |

| Deferred Tax Assets | 0 | 0 | 345 | 1,783 |

| Total Non-Current Assets | 40,868 | 105,867 | 39,214 | 40,578 |

| Total Assets | 1,144,864 | 2,628,105 | 5,313,519 | 8,631,755 |

| Liabilities | ||||

| Current Liabilities | ||||

| Trade & Other Payables | 0 | 0 | 143,663 | 165,248 |

| Loans at Amortised Cost | 21,935 | 45,259 | 81,812 | 122 |

| Customer Liabilities | 927,685 | 2,362,385 | 4,637,230 | 7,361,196 |

| Current Tax Liabilities | 0 | 0 | 1,670 | 9,374 |

| Lease Liability | 0 | 0 | 5,985 | 5,161 |

| Derivative Financial Liabilities | 0 | 0 | 1,970 | 2,454 |

| Total Current Liabilities | 949,620 | 2,407,644 | 4,872,330 | 7,543,555 |

| Non-Current Liabilities | ||||

| Loans at Amortised Costs | 1,173 | 123,247 | 0 | 0 |

| Provisions for Liabilities | 0 | 905 | 1,788 | 1,812 |

| Lease Liability | 0 | 0 | 18,943 | 9,085 |

| Deferred Tax Liabilities | 0 | 0 | 18 | 243 |

| Total Non-Current Liabilities | 1,173 | 124,152 | 20,749 | 11,140 |

| Total Liabilities | 950,793 | 2,531,796 | 4,893,079 | 7,554,695 |

| Equity | ||||

| Share Capital | 0 | 0 | 0 | 0 |

| Share Premium | 247,677 | 248,814 | 697,444 | 1,287,452 |

| Accumulated Losses | (56,444) | (162,947) | (344,300) | (317,960) |

| Other Reserves | 1,838 | 10,442 | 67,296 | 107,568 |

| Total Equity | 194,071 | 96,309 | 420,440 | 1,077,060 |

| Total Liabilities & Equity | 1,144,864 | 2,628,105 | 5,313,519 | 8,631,755 |

Cash Flow Statement edit edit source

| Year End Date | 31/12/2018 | 31/12/2019 | 31/12/2020 | 31/12/2021 |

|---|---|---|---|---|

| All Values in £000 | ||||

| Operating Activities | ||||

| EBIT | (32,963) | (106,815) | (220,705) | 39,791 |

| Interest Expense | (16) | (1,249) | 17,373 | 21,026 |

| Interest Income | 1,107 | 2,052 | (2,129) | (1,726) |

| Operaitng Profit | (34,054) | (107,438) | (205,461) | 59,091 |

| Amortisation of Intangible Assets | 0 | 13 | 174 | 176 |

| Depreciation of Tangible Assets | 478 | 1,319 | 9,455 | 8,903 |

| Impairment of Intangible Assets | 0 | 0 | 0 | 7,278 |

| Impairment of Financial Assets | 0 | 0 | (220) | 1,034 |

| Share Based Payment Expense | 1,868 | 8,626 | 57,182 | 47,351 |

| Fair Value Losses on Customer

Liabilities in Respect of Cryptocurrencies |

49,161 | 63,887 | 38,659 | 0 |

| Increase in Provisions Net of

Payments Made |

0 | 0 | 10,625 | 6,913 |

| Net Fair Value Losses on Derivative

Financial Instruments |

26,501 | 7,549 | 1,850 | (8,689) |

| Operating Cash Flows Before

Changes in Customer Balances & Hedging Arrangements & Changes in Working Capital |

43,954 | (26,044) | (87,736) | 122,057 |

| Working Capital Movements | ||||

| Decrease in Inventories | 2,961 | 9,488 | 1,760 | 3,886 |

| Loans Extended to Directors | 0 | 0 | 0 | (3,200) |

| Loans Settled by Directors | 0 | 0 | 0 | 3,216 |

| Increase in Trade & other Receivables | 0 | 0 | (27,337) | (69,468) |

| Increase in Trade & other Payables | 0 | 0 | (1,147) | 94,489 |

| Operating Cash Flows Before

Changes in Customer Balances & Hedging Arrangements |

46,915 | (16,556) | (114,460) | 150,980 |

| Customer Balances & Hedging Arrangements | ||||

| Net Increase in E-Money in Issue | 702,671 | 1,378,558 | 2,263,427 | 2,174,430 |

| Increase in Negative Customer Balances | 0 | 0 | (7,687) | (8,186) |

| Decrease in Net Settlement Balances | 0 | 0 | 17,447 | (63,979) |

| Increase in Customer Liabilities in

Respect of Cryptocurrencies |

0 | 0 | 136,142 | 0 |

| Increase in Cryptocurrencies | 22,742 | 56,128 | (135,970) | 0 |

| Increase in Customer Liabilities in

Respect of Commodities |

0 | 0 | 49,904 | 15,543 |

| Increase in Investment in Commodities

at FVTPL |

0 | 14 | (50,366) | (15,990) |

| Net Increase in Loans & Advances

to Customers |

0 | 0 | (1,389) | (16,440) |

| Net Increase in Customer Deposits | (7,923) | 10,696 | 49,875 | 533,970 |

| R&D Credit | 0 | 0 | 1,342 | 3,856 |

| Tax Expense | (482) | (2,060) | (301) | (9,901) |

| Effect of Exchange Rates | (676) | (32) | 0 | 0 |

| Net Operating Cash Flows | 659,779 | 1,279,292 | 2,207,964 | 2,764,283 |

| Investing Activities | ||||

| Purchases of Property & Equipments | (3,931) | (9,404) | (6,236) | (1,684) |

| Developing or Acquiring

Intangible Assets |

0 | (85) | (6) | (5,168) |

| Interest Received | 1,107 | 2,052 | 2,129 | 1,726 |

| Purchase of Financial Assets at FVOCI | 0 | 0 | 0 | (1,242,842) |

| Net Investing Cash Flows | (2,824) | (7,437) | (4,203) | (1,247,968) |

| Financing Activities | ||||

| Proceeds from Issue of Ordinary Shares

Net of Transaction Costs |

181,143 | 0 | 448,535 | 601,878 |

| Proceeds from Exercise of Share Options | 0 | 137 | 95 | 0 |

| Interest Paid (Including on Lease Liabilities) | (16) | (452) | (18,329) | (19,213) |

| Principal Payments on Lease Liabilities | 0 | 0 | (3,759) | (4,740) |

| Loans Repaid | 0 | 119,456 | (37,734) | (81,690) |

| Net Financing Cash Flows | 181,127 | 119,231 | 388,808 | 496,235 |

| Cash & Cash Equivalents (Beginning of Year) | 220,914 | 1,059,001 | 2,462,986 | 2,592,568 |

| Effect of Exchange Rates | 5 | 20 | (531) | (14,964) |

| Net Increase in Cash & Cash Equivalents | 838,082 | 1,391,086 | 2,592,568 | 2,012,550 |

| Cash & Cash Equivalents (End of Year) | 1,059,001 | 2,450,107 | 5,055,023 | 7,052,609 |

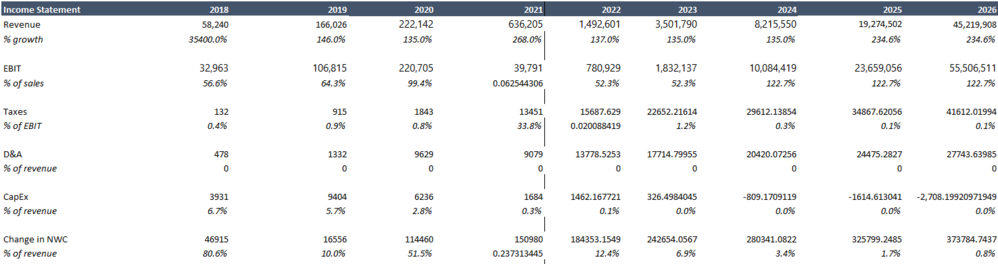

Financial Forecast edit edit source

Data from 2022 onwards was forecasted assuming a linear growth model. A 3-year historical average was used to assume the following margins.

| Year End Date | 31/12/2022 | 31/12/2023 | 31/12/2024 | 31/12/2025 | 31/12/2026 | 31/12/2027 |

|---|---|---|---|---|---|---|

| All Values in £000 | ||||||

| Revenue | 1,492,601 | 3,501,790 | 8,215,550 | 19,274,502 | 45,219,908 | 106,090,426 |

| Growth over Prior Year | 134.61% | 134.61% | 134.61% | 134.61% | 134.61% | 134.61% |

| Gross Profit | 459,870 | 1,078,902 | 2,531,211 | 5,938,474 | 13,932,254 | 32,686,460 |

| Margin | 30.81% | 30.81% | 30.81% | 30.81% | 30.81% | 30.81% |

| Operating Profit | (726,598) | (1,704,671) | (3,999,330) | (9,382,827) | (22,013,051) | (51,644,820) |

| Margin | (48.68%) | (48.68%) | (48.68%) | (48.68%) | (48.68%) | (48.68%) |

| EBIT | (780,929) | (1,832,137) | (4,298,376) | (10,084,419) | (23,659,056) | (55,506,511) |

| Margin | (52.32%) | (52.32%) | (52.32%) | (52.32%) | (52.32%) | (52.32%) |

| Net Profit | (799,885) | (1,876,609) | (4,402,713) | (10,329,205) | (24,233,349) | (56,853,860) |

| Margin | (53.59%) | (53.59%) | (53.59%) | (53.59%) | (53.59%) | (53.59%) |

| Total Comprehensive Income | (722,568) | (1,695,217) | (3,977,148) | (9,330,786) | (21,890,958) | (51,358,375) |

| Margin | (48.41%) | (48.41%) | (48.41%) | (48.41%) | (48.41%) | (48.41%) |

FORECAST.EST function was also used in MS Excel to produce forward financials using linear regression. This method would be more robust than using simply the average of historical data.

2023 Q1 Financial statement: edit edit source

| Return on Equity | Return on Assets |

|---|---|

| 6.29% | 0.29% |

Return on Equity (ROE) of 6.29%: Revolut's ROE indicates that the company generated a profit of approximately 6.29 cents for every dollar of shareholder equity invested. This suggests a moderate level of profitability in relation to the equity invested by shareholders.

Return on Assets (ROA) of 0.29%: The ROA of 0.29% indicates that Revolut generated a profit of around 0.29 cents for every dollar of assets. This figure implies a relatively low efficiency in generating profit from its total assets.

| Capital adequacy | Liquidity coverage |

|---|---|

| 23.48% | 1008.80% |

Capital Adequacy of 23.48%: Revolut's high capital adequacy ratio indicates that the company has a significant capital buffer to absorb potential losses and risks. This reflects the company's strong financial position and ability to withstand adverse economic conditions.

Liquidity Coverage of 1008.80%: The very high liquidity coverage ratio indicates that Revolut holds more than enough high-quality liquid assets to cover its short-term obligations. This signifies a robust liquidity position, which is important for maintaining operational stability and meeting immediate financial needs.

Statement of financial position:

| Cash and balances with central banks | Due from banks | Derivatives | Equity instruments at FVOCI | Debt instruments at amortized cost | Loans and unauthorized overdrafts | Property, plant and equipment | Intangible assets | Other assets | Total assets |

|---|---|---|---|---|---|---|---|---|---|

| 7407004 | 14806 | 12545 | 25 | 1467787 | 328589 | 1409 | 3192 | 352169 | 9587526 |

Liabilities:

| Derivatives | Due to customers | Lease Liabilities | Other liabilities | Provisions | Total Liabilities |

|---|---|---|---|---|---|

| 10760 | 9024039 | 1444 | 88554 | 130 | 9124927 |

Valuation edit edit source

Overview edit edit source

Revolut's valuation has been subject to fluctuations in recent years. In 2021, the company achieved a valuation of $33 billion following an $800 million funding round. This valuation has since become a benchmark for assessing the company's performance.

Molten Ventures, a tech-focused investment firm, has marked down its stake in Revolut by 40%. This reduction is based on its internal valuation of Revolut in both March 2022 and March 2023. Molten Ventures, which owns less than 5% of Revolut, valued its stake at £91.3 million in March 2022. However, the most recent valuation in March 2023 places the value of the stake at £54.5 million. This valuation shift indicates the challenges faced by Revolut in maintaining its valuation amid regulatory uncertainties and concerns about revenue transparency.

What's the Current Value of Revolut edit edit source

As at its last Series E fundraise of $800M in July 2021 , Revolut was valued at $33bn[5]. The E round saw investments from Softbank, Tiger Global, etc. and placed Revolut as the most valued fintech in the UK and the second top in Europe just behind Klarna at the time[6]. Having only been valued at $5.5bn in its last raise in 2020, this represents about 6x increase on its previous valuation within just 12 months.

| Year | Valuation ($bn) |

|---|---|

| 2017 | 0.4 |

| 2018 | 1.7 |

| 2020 | 5.5 |

| 2021 | 33 |

| 2022 |

Sources: Pitchbook, Company data[7]

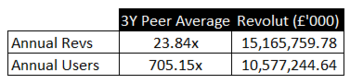

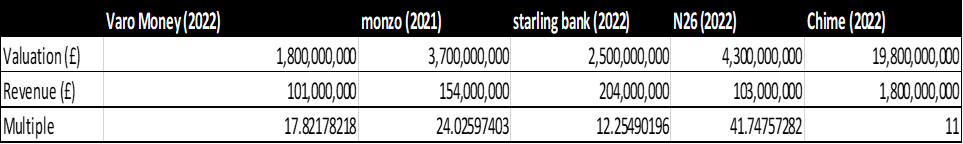

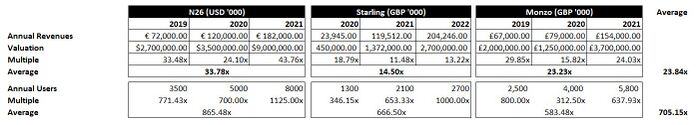

To understand the intrinsic value of Revolut, the stockhub user has decided to compare the performance of Revolut with its comparables or close competitors. For the purpose of this report, the close comps selected are Monzo, Starling Bank, and N26.

- Monzo: Monzo was established in 2015, at about the same time of Revolut. Recently valued at $3.7bn in its last round in 2021, Monzo currently has 7 million users and generated £440mn revenue in 2021[8]. Not profitable since it commenced operation.

- Starling Bank: Within a two year period, Revolut, Starling Bank and Monzo were all launched. Starling Bank was launched in 2014 and is currently one of the three top challenger neobanks operating in the UK. As at March 2022, Starling Bank had 2.7 Million active customers and generated £188mn total income in 2022[9].

- N26: N26 is one of the neobanks that launched in the mid 2010s. Founded in Munich and received a banking license in 2016. Currently has other services such as basic current account, savings and insurance. As with Revolut, N26 currently does not have a UK banking license but operates across Europe with over eight million customers across 24 countries[10].

For context, in 2021, Revolut reported £636mn annual revenues a total of 15mn registered users. Using annual revenues and users multiple of peer companies, the estimated value of Revolut is shown in the table below.

Judging by the value of comparables, the Stockhub User estimates the fair value of Revolut to be between the $10bn - $20bn mark. However, given the fact that Revolut and some of its comparables are private companies, investors might have thought differently about Revolut and thought it was a reasonable valuation ($33bn) to invest in at the time. Notable factors in the Revolut valuation:

- UK banking license: While Revolut peers such as Monzo and Starling bank both having licenses to operate as banks in the UK, Revolut has not been granted a UK banking license since it started the process in January 2021. Investors might have assumed Revolut to receive a banking license sooner rather than later thereby gaining access to cheaper capital and other revenue pools such as mortgages, deposit bank accounts, etc. However, the process has taken much longer, and till the point of writing this report, Revolut is yet to secure a UK banking license. On the other hand, as with Revolut, N26 does not possess a UK banking license.

- Tech Boom at the time of Fundraise: Generally, 2021 was a good year for tech companies to raise. Given the recent market conditions including the liquidation of SVB and Credit Suisse amongst others, 2023 has seen a downward revaluation in the prices of tech companies with the Nasdaq index losing a third of its value in 2022 alone. As such, some of the Revolut investors have now reevaluated their positions and even marked it down internally.[12] Given the private nature of Revolut, the 'downward revaluation' of Revolut is non-existent until Revolut go on the market to raise capital at a value lower than its current $33bn valuation (down round). The Stockhub user expects Revolut to wait till market conditions are much favorable before accessing the market for further capital either through a further round or an IPO.

- Crypto Offering: In 2021, crypto trading accounted for 30% of Revolut's revenues, but this dropped to around 5% in 2022 as the crypto boom ended.[12] With the loss of high-margin revenues from crypto and trading, it is imperative for Revolut to find other strong recurrring revenues streams to shore up profits, however, the Stockhub user believes that would be tough especially as they do not have a UK banking license yet.

From the points listed above, it is obvious that investors might have been paying a tech premium for Revolut. It's smooth interface, brand, ability to launch products fast and higher-margin revenue streams like crypto were its unique selling point over a traditional bank. It remains what happens with the UK banking license and other revenue streams that Revolut will be able to spring up. However, given the need to hold on to current valuations and make even more revenues, the Stockhub user is less bullish on an investment in Revolut till some of the issues outlined above are addressed.

Utilising a valuation multiple derived from the average multiple of comparable companies to Revolut also offers a means of valuation. In this instance the valuation multiple (21.3700462) applied to Revolut's 2021 revenue (£636,205,000) provides a valuation of 13.6 billion.

However, this method also bears notable limitations that should be acknowledged. One of the primary weaknesses is the assumption that valuation multiples from comparable companies are uniformly applicable to Revolut. In reality, various factors influence valuation multiples, such as growth prospects, risk factors, market sentiment, and qualitative aspects unique to each company. The small data set of comparable companies used in your analysis might not capture the full diversity of the fintech landscape, potentially leading to skewed results.

Furthermore, relying solely on valuation multiples and historical data overlooks the complex web of factors that contribute to a company's valuation. Elements such as profit margins, growth rates, competitive advantages, and macroeconomic conditions play a significant role in determining a company's worth. By excluding these factors, the estimation may lack a comprehensive understanding of Revolut's true valuation potential. Additionally, the method doesn't account for fluctuations in market sentiment and investor perceptions, which can have a substantial impact on valuation multiples.

An important aspect often disregarded is the forward-looking nature of valuation. Companies are valued based on their future growth potential and strategic direction, elements that are difficult to capture through historical data alone. Your method also runs the risk of being influenced by outliers within the comparable set, potentially skewing the calculated average. Overall, while your approach provides a starting point for valuation estimation, it's essential to recognize its limitations and consider incorporating a more comprehensive analysis that accounts for the multifaceted dynamics impacting a company's valuation.

Another valuation for Revolut is derived from the median valuation of the comparable companies which would value Revolut at £3.7 billion. The choice to use the median valuation as an estimation tool carries certain merits. Notably, the median is less sensitive to outliers than the mean, making it a robust option when dealing with a small data set where extreme values could disproportionately affect results. This resistance to outliers ensures that the calculated median is more reflective of the central tendency of the data, providing a reliable point of reference for valuation.

However, this method also brings with it a set of limitations that warrant consideration. One of the most significant drawbacks lies in its lack of contextualization. By relying solely on the median valuation of the comparable companies, this approach fails to account for the unique attributes, growth prospects, risk profiles, and competitive advantages that differentiate each fintech entity. Consequently, it may oversimplify Revolut's valuation by overlooking the intricate factors that contribute to its worth.

Furthermore, the median valuation approach assumes a static snapshot of valuations, disregarding the dynamic nature of market sentiment, regulatory changes, economic conditions, and company-specific developments that can impact valuations over time.

In conclusion, while the median valuation approach offers certain advantages, such as its resilience to outliers and ease of use, it falls short in providing a comprehensive and accurate estimation of Revolut's true valuation. To enhance the reliability of your valuation analysis, a more comprehensive approach that considers a broader range of factors is recommended. This ensures a more nuanced understanding of Revolut's position within the fintech landscape and its corresponding market value.

Environmental, social, and governance [1] edit edit source

Revolut has shown commitment to addressing the global climate crisis and promoting sustainability through their Tech Zero initiative. Their focus on Environmental, Social, and Governance (ESG) factors highlights their dedication to creating a positive impact on the world while promoting accountability, transparency, and progress.

Environmental Initiatives:

Carbon Footprint Measurement and Reduction: Revolut is actively monitoring and reducing their carbon footprint. Partnering with Watershed, they measure emissions in real-time, following industry standards like the Greenhouse Gas Protocol. In 2021, the net corporate emissions were 16,833 metric tons of CO2e, a reduction of 8.61% from 2020.

Emissions Breakdown and Reduction Strategies: They are transparent about emissions sources, dividing them into categories such as Goods & Services, Products, Offices, Employees, and Cloud. Moreover, they are committed to reducing their carbon footprint per £1 million revenue. In 2021, their carbon footprint per revenue dropped by over 68% compared to 2020.

Renewable Energy and Energy Efficiency: Revolut are driving sustainability through 100% renewable energy usage at the London and Vilnius offices. They have also adopted energy-efficient practices, such as closing one floor of the London headquarters to reduce energy consumption.

Sustainable Travel and Transportation: Revolut's sustainable business travel policy has been formulated to effectively mitigate emissions associated with travel, while concurrently encouraging employees based in the UK to actively engage in the Cycle to Work scheme, promoting eco-friendly modes of transportation.

Social Initiatives:

Employee Engagement: Revolut places emphasis on empowering its employees to play a pivotal role in advancing sustainability endeavors. This is facilitated through options like remote work or adopting environmentally conscious commuting alternatives. The company has taken dedicated strides to curtail the ecological impact stemming from remote work and daily commutes.

Partnerships and Donations: Collaboration is at the heart of Revolut's approach. The company actively aligns with non-governmental organizations (NGOs) and collectives that center their efforts on critical issues such as climate change, sustainability, equitable refugee support, and fundamental rights. Noteworthy is the Revolut Donations platform which has enabled customers to generously contribute over £1 million to initiatives dedicated to environmental conservation and climate-conscious causes.

Sustainable Business Practices: A cornerstone of Revolut's operations resides in adhering to stringent waste management protocols, specifically addressing electronic waste (e-waste). By practicing responsible waste disposal, efficient recycling procedures, and refurbishment initiatives, the company ensures a conscientious approach to its ecological footprint. Special emphasis is directed towards the efficient management of e-waste to tangibly reduce the technological impact.

Governance Initiatives:

Tech Zero Commitment - Revolut proudly stands as a member of the Tech Zero coalition, committing itself to ambitious objectives concerning the measurement and reduction of scope 1-3 emissions. The company has set forth a resolute target of halving its emissions by 2030, with a subsequent overarching aim to achieve carbon neutrality by 2050.

Accountability and Reporting: The bedrock of Revolut's operational ethos is the steadfast dedication to transparency and accountability. This is evidently underscored by the annual disclosure of comprehensive reports. These reports offer intricate insights into the company's carbon footprint, strategies for emission reduction, and commendable progress towards the overarching ambition of attaining net zero emissions. The annual presentation of these reports to the Board, alongside their public accessibility on the official Revolut website, attests to the company's unwavering commitment to this endeavor.

Executive Responsibility: To ensure the unequivocal prioritization of sustainability objectives within the organizational hierarchy, Revolut has judiciously appointed a distinguished member of its executive team. This designated executive shoulders the responsibility of driving the company's net zero targets, symbolizing the senior leadership's unequivocal dedication to the cause.

Overall, Revolut's multifaceted ESG initiatives substantiate its resolute commitment towards effecting tangible and measurable positive impacts across the spheres of environment, society, and governance. The enthusiastic alignment with Tech Zero manifests as a testament to the company's resolute stance in the face of ambitious yet feasible sustainability objectives. The transparent disclosure, meticulous measurement methodologies, and proactive reduction strategies collectively underscore the company's determined efforts in combatting climate change while simultaneously championing judicious business practices. As Revolut continues its evolutionary journey, its unswerving commitment to a sustainable future remains resolute and unwavering.

Appendix edit edit source

Valuation edit edit source

Trading Comps

Actions edit edit source

To invest in Revolut, click here.

To contact Revolut, click here.

References and notes edit edit source

- ↑ 1.0 1.1 1.2 1.3 1.4 Source: the company and Seedrs.

- ↑ [1]

- ↑ https://my.pitchbook.com/profile/104383-72/company/profile#private-ownership

- ↑ https://assets.revolut.com/pdf/Revolut_Ltd_YE_2021_Annual%20Report.pdf

- ↑ https://www.revolut.com/fr-FR/news/revolut_raises_800m_series_e_funding_from_softbank_vision_fund_2_and_tiger_global/

- ↑ https://sifted.eu/articles/revolut-33bn-valuation

- ↑ https://www.revolut.com/fr-FR/news/revolut_raises_800m_series_e_funding_from_softbank_vision_fund_2_and_tiger_global/

- ↑ https://www.businessofapps.com/data/monzo-statistics/

- ↑ https://www.statista.com/statistics/1089562/key-financial-figures-for-starling-bank-united-kingdom/

- ↑ https://www.businessofapps.com/data/n26-statistics/

- ↑ https://pitchbook.com/profiles/company/64126-90#funding

- ↑ 12.0 12.1 https://sifted.eu/articles/revolut-33bn-valuation