Rocket Lab

The Gatekeepers of Space

Summary edit edit source

Deutsche Bank regards Rocket Lab as the highest quality space asset to enter the public market so far, having established itself as a clear leader in small rocket launch and having garnered strong momentum in satellite buses and related components, enabling access to space in multiple ways. Looking forward, the company will certainly need to execute across several fronts especially development of its larger Neutron rocket, which is slated to fly in 2024. Deutsche Bank thinks management generally guided out-years conservatively, leaving room to beat in the mid-term as backlog rolls on and the pipeline grows rapidly.

More broadly, Deutsche Bank continues to be very bullish about the prospects for the Space sector. While the "space" industry has existed for many decades, public interest diminished toward the latter part of 20th century and entrepreneurs mostly avoided the sector due to high barriers to entry, regulation, and limited deployment opportunities. However, in recent years, Deutsche Bank believes the emergence of a new "Space Race", both between industry titans (Musk vs. Bezos vs. Branson) and nations (the US vs. China), ensures that this will likely be the next frontier for growth investment, and progress should accelerate dramatically in the next 5-10 years. Unique to space, Deutsche Bank believes it is becoming evident to society that for human civilization to truly progress, we must explore the cosmos (<600 people have been to space), and the upcoming innovation will revolve around developing business models to support this endeavour. In the coming years, Deutsche Bank could envision multiple “space hype cycles” where valuations soar, but Deutsche Bank reminds investors that the path forward will likely be volatile.

Sizing the final frontier TAM edit edit source

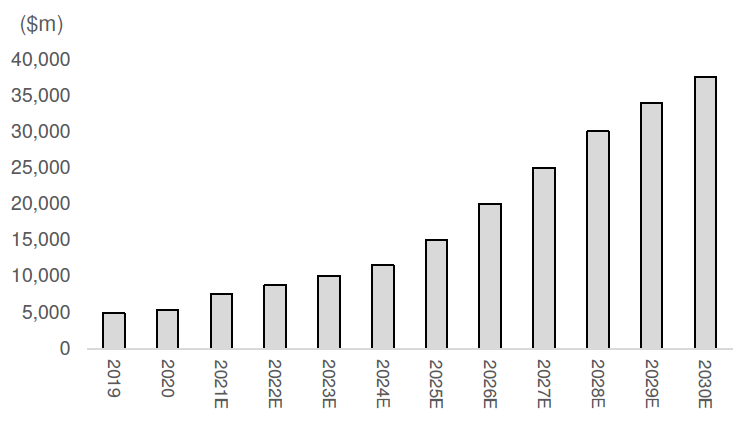

The overall “Space TAM” is generally agreed upon by industry participants and investors to be large and growing (i.e., $350-400bn now with potential to be over a trillion by end of the decade). Deutsche Bank takes a more precise approach by focusing on the launch services portion, which is the most near-term and direct revenue stream for companies such as Rocket Lab. Space launch services involve the delivering of satellites and other equipment into orbit - all the design, manufacturing, and testing related to the rocket. To achieve a successful launch, a rocket must not only make it into space but also carry a payload to a certain destination and deploy a satellite into orbit. Other missions involve providing supplies to a space station or landing on the Moon (NASA Artemis Program). For 2021, Deutsche Bank estimates the global launch market will come in at around $8bn and this will likely grow to $38bn by 2030, representing a 20% CAGR. Importantly, Deutsche Bank expects the market to be supply constrained for the rest of the decade as demand from corporates and governments increases.

A clear leader in small rockets, Rocket Lab has focused on small rockets since its inception, successfully launching its Electron rocket 19 times out of 21 attempts into space, leading to 105 satellites deployed and even recovering 2 rockets, which can be reused in the future after refurbishment, reducing costs. Rocket Lab is the second-most frequently launched private company after SpaceX. Moving forward, Rocket Lab announced plans to build a larger rocket called Neutron, which will have a 8,000kg payload capacity vs. Electron's 300kg, and be designed to be a constellation launcher while also being able to carry humans onboard. Positioning-wise, Deutsche Bank regards Rocket Lab as the clear #2 behind SpaceX, with a more practical focus on being "Gatekeeper" to orbit starting with small rockets (pathfinder and national security missions), and then expanding into medium-class rockets (constellations). Beyond the launch business, Rocket Lab is also striving to become a satellite platform, fully leveraging its ability to provide customers access to space. This includes selling its Photon family of spacecraft, a portfolio of standalone components, engineering/design services, and on-orbit constellation management services.

Growth accelerating, underpinned by robust backlog/pipeline edit edit source

With industry launch demand continuing to outpace supply, Deutsche Bank believes Rocket Lab is well positioned for growth given its strong track record of reliability and diverse business streams. Backlog (contracted revenue) exited September worth >$170m vs. just $60m at the end of 2Q20. Rocket Lab can turn around a launch in about 2 weeks at its site in New Zealand, constrained mainly by staffing/procedural limitations and more recently, COVID-19 lockdowns. Recent prominent wins include a 5-launch deal with Kineis to deploy a fleet of IoT constellations beginning in 2023 and a 3 Photon spacecraft tie-up with Varda Space where internal components will also be used. Customer mix is split 50% commercial, 20% civil, and 30% national security. Looking ahead, management sees a $4.4bn active pipeline opportunity across a broad range of customers and verticals, up significantly from just $2.2bn in March. Deutsche Bank believes Rocket Lab was on track to beat initial 2021 management forecasts set out in March before the very stringent COVID-19 lockdowns in New Zealand halted launch activity. However, this should set-up 2022 to mechanically outperform and Deutsche Bank expects 2023-24 to demonstrate solid growth as launch activity and component wins pick up momentum.

edit edit source

All in, Deutsche Bank initiates with a Buy rating and an $18 price target using a blended approach of 12.5x/27.5x 2025E Sales/Ebitda (using a haircut on Virgin Galactic's current multiples; implies a $19 stock price), and a ~$7.5bn market cap (equivalent to a $17 stock price) based on private and public comparables. Similar to many other SPACs, Rocket Lab has experienced considerable volatility in its share price.

The New Space Race edit edit source

While the "space" industry has existed for many decades, public interest diminished toward the latter part of 20th century and entrepreneurs mostly avoided the sector due to high barriers to entry, regulation, and limited deployment opportunities. However, in recent years, Deutsche Bank believes the emergence of a new "Space Race," both between industry titans (Musk vs. Bezos vs. Branson) and nations (the US vs. China), ensures that this will likely be the next frontier for growth investment, and progress should accelerate dramatically in the next 5-10 years. Unique to space, Deutsche Bank believes it is becoming evident to society that for human civilization to truly progress, we must explore the cosmos (<600 people have been to space), and the upcoming innovation will likely revolve around developing business models to support this endeavour. Said differently, getting people to the surface of Mars would embody the pinnacle of human ingenuity whereas monetizing the attention of every eyeball on a smartphone may certainly be highly lucrative, but Deutsche Bank wonders how much progress this represents for mankind.

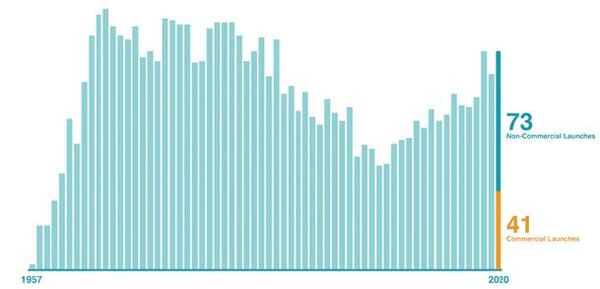

Figure 1: Global orbital launches declined as society lost interest but are now making a comeback[1]

Early on, commercial space efforts will cater to deploying large quantities of satellites into space for mostly practical purposes (broadband connectivity, earth observation to promote sustainability), and also tourism for the ultra wealthy. In the future, space “trips” could become common and beyond that, the colonization of Mars is already an aspirational goal and strategic priority for several companies and governments. Taken together, Deutsche Bank is extremely bullish on the potential of the Space sector. Recently, Deutsche Bank thinks the attention garnered by high-profile launches from Richard Branson, Jeff Bezos, and Inspiration4 (even had its own Netflix documentary) have been supportive of broader investor sentiment and should encourage greater public interest in space travel. SpaceX also indicated that it will "gear up" to fly 4-6 human Dragon missions per year at a minimum. At the same time, there have been two failed launches (Astra and Firefly) recently, which highlight the difficulty of achieving reliability with rockets. In the coming years, Deutsche Bank could envision multiple “space hype cycles” where valuations soar, but Deutsche Bank reminds investors that the path forward will likely be volatile, further exacerbated by the fact that many space-related companies chose to go public through the SPAC listing process.

Beyond launching commercial satellites into Earth orbit and enriching terrestrial life, Deutsche Bank believes the end-game is exploring the cosmos. To accomplish this, rockets will need to get bigger and more reliable. NASA is aiming to put astronauts on the Moon again in 2024 (for the first time in >50 years), and explore regions previously unknown (Project Artemis). These efforts will pave the way for ultimately reaching Mars. While the true business opportunity is not exactly clear, Deutsche Bank believes the governments of the world, especially the US and China, will allocate considerable capital toward this endeavour, allowing private companies to flourish in pursuit of this goal (Mars is 140m miles away, requiring a ~5-month journey). For example, even outside of rockets, we are witnessing a growing number of start-ups building applications and platforms to capture space data (Planet Labs, Spire, LeoLabs, to name a few).

For rocket launch, Deutsche Bank identifies the emergence of 6 disruptive companies that it believes will push the industry forward, with leaders that it consider to be modern-day “Space Cowboys”:

- Astra (Chris Kemp): small rocket, super high frequency of launches, focus on only payloads and no human occupation.

- Blue Origin (Jeff Bezos): space tourism (New Shepard) and heavy rockets for payloads (New Glenn).

- Relativity (Tim Ellis): fully 3D printed rockets (Terran 1 and Terran R) with potential to leverage tech for other use cases and off-planet manufacturing.

- Rocket Lab (Peter Beck): small and medium rockets for payloads and likely human occupation.

- SpaceX (Elon Musk): heavy rockets for payloads/humans (ultimately reach Mars).

- Virgin Galactic and Orbit (Richard Branson): space tourism and small rockets using a commercial airliner as a launching pad.

| Company | Astra | Blue Origin | Relativity | Rocket Lab | Space X | Virgin Orbit |

|---|---|---|---|---|---|---|

| Leadership | Chris Kemp | Jeff Bezos | Tim Ellis | Peter Beck | Elon Musk | Richard Branson |

| Affiliation | OpenStack, NASA | Amazon | Blue Origin | Tesla | Virgin Group | |

| HQ | Alameda, CA | Kent, WA | Long Beach, CA | Long Beach, CA | Hawthorne, CA | Mojave/Long Beach, CA |

| Headcount | 100 | 3.500 | 400 | 530 | 9,500 | 823/400 |

| Launch sites |

|

|

|

|

|

|

| Focus |

|

|

|

|

|

|

| Major customers |

|

|

|

|

|

|

| Key investors |

|

|

|

|

|

|

Sizing up the final frontier market edit edit source

The overall “Space TAM” is generally agreed upon by industry participants and investors to be large and growing (i.e., $350-400bn now with potential to be over a trillion by the end of the decade). Deutsche Bank takes a more precise approach by focusing on the launch services portion, which is the most near-term and direct revenue stream for companies such as Rocket Lab. Space launch services involve the delivering of satellites and other equipment into orbit - all the design, manufacturing, and testing related to the rocket. To achieve a successful launch, a rocket must not only make it into space but also carry a payload to a certain destination and deploy a satellite into orbit. Other missions involve providing supplies to a space station or landing on the Moon (NASA Artemis Program). For 2021, Deutsche Bank estimates the global launch market will come in at around $8bn and this will likely grow to $38bn by 2030, representing a 20% CAGR. And importantly, Deutsche Bank expects this market to be supply constrained for the rest of the decade as demand from corporates and governments increases.

Figure 3: Global launch TAM[3]

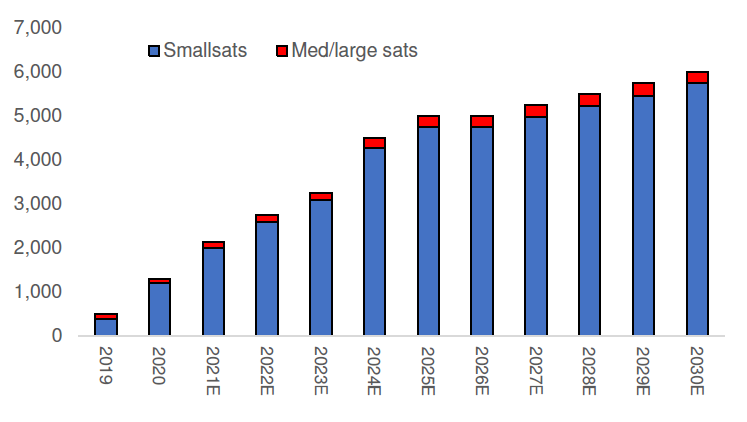

Figure 4: Global satellite deployments[4]

Competitively, SpaceX dominates the market, capturing approximately half the value when excluding Chinese and Russian missions due to it having the lowest cost ($50-60m per launch vs. legacy $150-200m). SpaceX achieved this leadership position in several ways:

- Commercial mindset with less bureaucracy: Boeing and Lockheed combined their launch businesses to form the United Launch Alliance (ULA) monopoly in the US, which has been plagued by inefficiencies (Boeing's Starliner has also been delayed for several years now).

- Modern clean sheet approach: SpaceX leverages the latest computer-aided design and engineering whereas competitors often have been using decades-old rocket techniques, including being reliant on Russian-made engines for the past two decades (ULA used RD-180 engine for Atlas V).

- Reusing rocket: the first stage of rocket accounts for the lion’s share of cost and reusing it is difficult but critical to lowering costs (i.e., can price lower, factoring in future utilization of rocket vs. just one-off).

- Captive demand: SpaceX is carrying a lot of its own Starlink small satellites, which is essentially creating captive demand; Deutsche Bank estimates this could be worth $1-2bn annually.

With SpaceX driving the cost of launch down, this has opened up space deployment to much wider set of business opportunities. In fact, 2021 saw record amounts of investment geared toward space sector start-ups. According to Seraphim Capital, 2Q21 saw $3.7bn of private investment, taking 1H21 to $6.4bn; this compares with 7.6bn in all of 2020, which was already a record in itself. In Deutsche Bank's view, this demonstrates an increasing desire to commercialize space, which should unlock many types of advancements in technology.

Both companies and governmental organizations are deploying more and more satellites to enable the following:

- Global broadband connectivity (alleviate coverage limitation of ground infrastructure).

- Earth observation (environmental sustainability, urbanization).

- IoT and M2M (monitoring billions of devices).

- National security (early warning detection system).

- Other services (weather, GPS, etc…).

Figure 5: Quarterly private investment tracker[5]

Collectively, Deutsche Bank believes these use cases involve developing a data platform in space that increasingly garners more commercial value with scale. According to Bryce Space & Technology, in 2010, only 70 satellites were launched globally whereas nearly 1,300 were launched in 2020. Similarly, based on estimates from Euroconsult, the cumulative number of satellites launched by 2030 will be >40k, compared with just 4-5k right now. Deutsche Bank believes demand for launch services will far outstrip supply through most of this decade as the industry tries to deliver reliable and frequent supply for customers. For example, SpaceX Starlink alone wants to send up 42k satellites into space to form a mega constellation (only ~1.7k deployed thus far). Amazon Kuiper has also announced plans to deploy over 3k satellites.

Small satellites driving growth edit edit source

In conjunction with this growth, there has been a major shift occurring as the industry moves from having a small number of large satellites in geostationary orbit (GEO; 35,800km altitude) to a large number of small satellites in low-earth orbit (LEO, <1,000km altitude). For context, a large satellite typically weighs thousands of kilograms whereas a small satellite could weigh tens to hundreds of kilograms. Bryce Space pegs the average mass of a satellite at 109kg as result of nearly 80% of satellites launched now being small size, defined as being <600kg. Deutsche Bank expects this trend to continue and +90% of new satellites launched will be of the smaller form factor (note: the FCC has filings for >50k LEO small satellites).

Why small satellites? The primary motives for using small satellites in LEO are speed, cost and efficiency.

- Speed: by being so much lower in orbit, it is faster to transmit data back to Earth (20-30 millisecond latency vs. 600 milliseconds for GEO), and more generally, signals transfer faster through open space than cables, allowing LEO satellites to rival ground-based network speed.

- Cost: smaller satellites are cheaper and easier to produce (<$500k vs. $100-200m); in relation, lower orbit environments are easier to accommodate.

- Efficiency: it is quicker and more cost effective to launch satellites into LEO; it also easier to deorbit LEO satellites (atmospheric drag pulls a satellite into the atmosphere causing it to burn up).

Rocket launch market evolving edit edit source

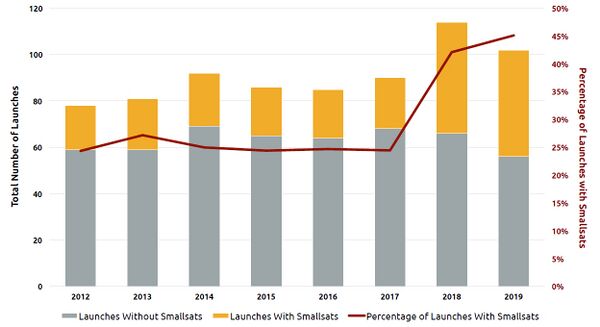

The shift to small satellites has implications for the rocket launch market. Historically, the frequency of launches has been exceedingly low and limited to large rockets made by quasi-governmental entities. Hence, customers had to plan very far ahead of time and were often subject to delays. In 2020, there were only 114 orbital space rocket launches globally, with a handful that either did not carry any meaningful payload or failed to reach their intended destination. More than 50% of small satellites launches in the past year were delayed, anywhere from 4 months to 2 years.

To address this, the industry has been leveraging ridesharing, allowing multiple parties to spread out the cost of a large rocket launch (e.g., Falcon 9, Soyuz, Arianespace 5, Atlas V). While this may be most cost-effective way of getting rockets into orbit, a large rocket can only deliver the payload to a single position (referred to as orbit inclination). From there, small satellites need to be moved to their intended altitude and orbit, which requires either an onboard propulsion system or an in-space shuttle (i.e., space tug “tows” satellite to right location). There are drawbacks to doing this. Onboard propulsion adds cost and weight to a payload. In-space shuttling is expensive and slow, often requiring weeks or months (adds >$10k cost per kg to rideshare launch). There is also an issue when it comes to inclination as a satellite cannot always be delivered to its correct orbit even if the altitude is achieved.

In this context, Deutsche Bank believes there will be growing demand for dedicated launches (i.e., 1 customer buys an entire launch to deliver to a specific position), tailored for small satellites and constellations (batch of small satellites) as costs come down and launch reliability and frequency increases. This will likely enable customers to have much higher degree of flexibility to deploy satellites and time-to-market (i.e., company or government does not need to wait on a heavy rocket launch schedule). Moreover, when satellites fail or break down, a dedicated launch vehicle can directly send up satellites to replace.

Breaking down the launch market edit edit source

In its framework, Deutsche Bank segments the launch TAM into 4 sizes:

- Small (<1,500kg): mostly dedicated satellite launches going forward.

- Medium (1,500-8,500kg): high usage for dedicated constellation launches.

- Heavy (8,500-30,000kg): large satellites, ride-share and some dedicated launches for large constellations.

- Super heavy (>30,000kg): ride-share; Moon and Mars missions.

| ($m) | 2021E | 2025E | 2030E |

|---|---|---|---|

| Small (<1,500kg) | 325 | 2,019 | 3,240 |

| Medium (1,500-8,500kg) | 2,000 | 4,000 | 7,000 |

| Heavy (8,500-30,000kg) | 5,175 | 7,000 | 14,000 |

| Super heavy (>30,000kg) | 0 | 1,981 | 13,260 |

| Total | 7,500 | 15,000 | 37,500 |

Deutsche Bank estimates the small rocket portion of the TAM is currently just $300-400m but this could grow rapidly to $2bn by mid-decade and to $3-4bn by 2030. This is predicated on small satellites making up +90% of deployments, average small sat payload weight increasing, and dedicated launches increasing as a % of the total. Deutsche Bank notes some government missions are not allowed to be part of ride-share, so they would have to fly dedicated even if price/kg is much higher.

| 2020 | 2025E | 2030E | |

|---|---|---|---|

| Satellites deployed | 1,282 | 5,000 | 6,000 |

| x % small size | 94% | 95% | 96% |

| x Avg payload mass (kg) | 120 | 170 | 250 |

| = Total payload | 144,720 | 807,500 | 1,440,000 |

| x % dedicated launch | 5% | 25% | 30% |

| x Avg cost per kg ($) | 25,000 | 10,000 | 7,500 |

| = Small launch TAM ($m) | 181 | 2,019 | 3,240 |

Ultimately, Deutsche Bank still sees medium/heavy rockets capturing the bulk of payload mass and wallet share due to scale (SpaceX Falcon 9 already getting <$3k/kg cost or $5k for ride-share, vs. small rockets >$20k). Deutsche Bank thinks the distinction between medium and heavy may get somewhat blurred going forward because there will be overlap of payloads. Technically, heavy rockets can service ALL the payloads, so it becomes a timing vs. weight optimization exercise (and also volumetric capacity for certain satellites). For the majority of small satellites, these will be part of constellations where batches of satellites will be launched to different orbital planes; this means a medium-size rocket may be more ideal than heavy. For example, a Telestat Lightspeed broadband constellation has 220 satellites (700kg each) operating at 20 different orbital planes and 11 satellites per plane or 7.7 ton payload. For superheavy rockets such as SpaceX’s upcoming Starship, Deutsche Bank thinks these will be better utilized for Moon transportation and deeper space missions (Mars). To illustrate this, SpaceX recently won NASA’s Artemis Program award to return to the moon; this will involve using multiple Starships in LEO as fuel tankers and also a customized Starship for lunar landing.

| Size | Companies |

|---|---|

| Small (<1,500kg) | ABL, Astra, Relativity, Firefly, Rocket Lab, Virgin Orbit |

| Medium (1,500-8,500kg) | Energia, Firefly, Northrop Grumman, Rocket Lab |

| Heavy (8,500-30,000kg) | Arianespace, CASC, Relativity, ULA**, SpaceX |

| Super heavy (>30,000kg) | Blue Origin, SpaceX |

Figure 9: Launches with and without small satellites[9]

Opportunities beyond launch services edit edit source

Beyond launch services, Deutsche Bank thinks there is an opportunity in the space systems market. Space systems involve providing hardware infrastructure for satellite development so customers can focus on creating value-add software and features for the payload instead of manufacturing satellites. This includes satellite components and constellation management services such as enabling the satellite to move around in space with propulsion. This should eventually eliminate bespoke investment in satellite bus development, creating more standardization. Deutsche Bank estimates this could be a $20bn market and larger rocket companies will look to consolidate the supply chain. For example, Rocket Lab acquired Sinclair Interplanetary last year, gaining strong capabilities in reaction wheels and star trackers that support rapid-schedule small satellite programs.

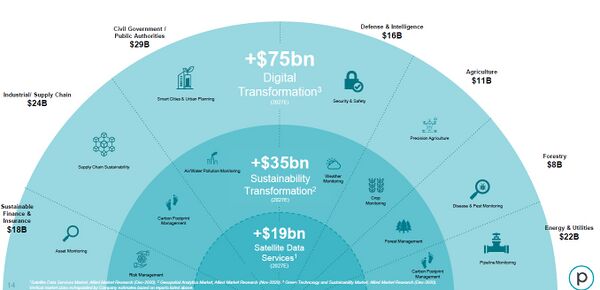

Another opportunity is the satellite data and analytics market. These companies design and operate satellites in space, leveraging software/analytics to sell subscription services to customers, often to provide insights about climate, weather, maritime, aviation and agriculture. These are customers for rocket launch companies. In theory, this market could be worth hundreds of billions, but Deutsche Bank does not think it is entirely serviceable, in part due to conflicts of interest. Deutsche Bank estimates the SAM for this market is at least around $10-15bn with potential to grow to $30-40bn by the end of the decade.

Separately, Deutsche Bank sees a space tourism market being cultivated by Virgin Galactic and Blue Origin. This will cater to ultra-high net worth individuals for the foreseeable future where Deutsche Bank estimates the TAM to be around $5-10bn longer term (295k UHNW individuals globally x $250k ticket price x 10% willing to travel to space per year). Longer term, rocket technology could potentially enable intra-earth trips to be much faster and cheaper using supersonic/hypersonic point-to-point travel. For example, SpaceX envisions a trip from New York City to Shanghai occurring in 40 minutes. There will certainly be many regulatory and environmental hurdles to work through but Deutsche Bank believes aviation is ripe for disruption after decades of stagnation.

Figure 10: Data and analytics potential TAM[10]

| Rocket launch | Ticker | Stock price | Market cap ($m) | Enterprise value | EV/sales | EV/Ebitda | ||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2022E | 2022E | 2022E | 2022E | 2022E | 2022E | 2022E | 2022E | |||||

| Astra | ASTR | 9.37 | 2,413 | 2,027 | 33.9x | 11.0x | 4.6x | 2.3x | -15.9x | -40.1x | 17.3x | 5.8x |

| ABL** | Private | 1,300 | ||||||||||

| Firefly** | Private | 1,000 | ||||||||||

| Relativity** | Private | 4,200 | ||||||||||

| Rocket Lab* | RKLB | 15.89 | 7,153 | 6,530 | 35.9x | 23.1x | 14.1x | 8.4x | -382.4x | 216.4x | 58.6x | 27.5x |

| SpaceX** | Private | 74,000 | ||||||||||

| Virgin Orbit* | NGCA | 9.90 | 3,632 | 3,186 | 45.5x | 9.6x | 3.5x | 2.1x | -21.1x | -187.4x | 13.9x | 6.3x |

| Systems & infrastructure | ||||||||||||

| Momentus* | MNTS | 10.27 | 892 | 840 | 5.5x | 1.4x | 0.7x | 0.4x | -46.7x | 7.9x | 2.1x | .7x |

| Redwire* | RDW | 11.07 | 753 | 693 | 2.9x | 1.6x | 0.9x | 0.5x | 21.6x | 10.8x | 5.6x | 2.8x |

| Data & analytics | ||||||||||||

| BlackSky* | BKSY | 12.80 | 1,891 | 1,520 | 13.3x | 6.7x | 3.9x | 2.8x | 1519.6x | 21.1x | 8.6x | 6.2x |

| Planet Labs* | DMYQ | 9.99 | 2,757 | 2,249 | 11.8x | 7.8x | 5.0x | 3.2x | -57.7x | -224.9x | 33.6x | 12.0x |

| Maxar | MAXR | 29.82 | 2,162 | 4,473 | 2.4x | 2.2x | 2.1x | 2.x | 9.3x | 8.1x | 7.0x | 6.7x |

| Satellogic* | CFV | 9.86 | 1,190 | 916 | 19.5x | 6.9x | 2.5x | 1.2x | -458.1x | 18.7x | 4.7x | 1.9x |

| Spire* | SPIR | 11.41 | 1,868 | 1,460 | 12.8x | 6.4x | 3.1x | 1.6x | 243.3x | 22.1x | 7.4x | 3.4x |

| Tourism | ||||||||||||

| Virgin Galactic | SPCE | 24.49 | 6,300 | 5,775 | 501.x | 102.3x | 30.1x | 14.5x | -26.2x | -39.4x | -177.7x | 38.8x |

Clear leader in small rockets, but preparing to size up edit edit source

Rocket Lab has focused on small rockets since its inception, successfully launching its Electron rocket 19 times out of 21 attempts into space, leading to 105 satellites deployed and even recovering 2 rockets (first stage, only reusable small rocket on the market), which can be reused in the future after refurbishment. Rocket Lab is the second-most frequently launched private company after SpaceX. Moving forward, Rocket Lab announced plans to build a larger rocket called Neutron, which will have a 8,000kg payload capacity vs. Electron's 300kg, and be designed to be a constellation launcher while also being able to carry humans onboard. Positioning-wise, Deutsche Bank regards Rocket Lab as the clear #2 in launch behind SpaceX, with a more practical focus on being "Gatekeepers" to orbit starting with small rockets (pathfinder and national security missions), and then expanding into medium-class rockets (constellations) and also providing satellite systems capabilities to enable even greater access to the final frontier.

| Mar-21 | Jul-21 | Current | |

|---|---|---|---|

| Launches | 18 | 20 | 21 |

| Failures | 1 | 2 | 2 |

| Recovered | 1 | 2 | 2 |

| Satellites deployed | 97 | 104 | 105 |

| Captive | 1 | 2 | 2 |

Electron strong flight heritage edit edit source

Diving into more detail, Rocket Lab designed Electron for manufacturability and reliability, understanding that customers would pay up for a dedicated small rocket launch (>$25k per kg vs. ride-share SpaceX Falcon 9's $5k). Electron is a two-stage vehicle with third kick stage standing at 18m tall with a diameter of 1.2m. The design involves use of advanced carbon composite material for the entire structure and propellant tanks, reducing wait by up to 40%. The kick stage allows for satellites to be placed in a circular orbit after launch, which enables them to maintain a consistent altitude and is also capable of engine restarts to deliver multiple payloads to a range of orbits, and also deorbiting to avoid becoming space junk.

Also unique to Electron, the company believes it created the world's first 3D printed and electric pump-fed engine. The rocket uses 10 Rutherford engines (9 in the first stage, 1 single vacuum in the second stage) that make use of electric motors and high-performance lithium polymer batteries to drive liquid oxygen and kerosene fuel pumps. Electric pumps are simpler than traditional gas generator cycles yet still achieve high efficiency. Operationally, Electron takes off from the company's private launch complex in Mahia, New Zealand (referred to as Launch Complex 1 or LC1). Typically, US government missions cannot be launched abroad but the two countries signed a bilateral treaty to drop this restriction. LC1 is also the first private FAA-licensed orbital launch site.

Figure 13: Electron design[12]

| Company | Rocket Lab | Virgin Orbit | Astra |

|---|---|---|---|

| Rocket | Electron | Launcherone | 3.3 |

| Height (m) | 18 | 21 | 17 |

| Diameter | 1.2 | 1.8 | 1.3 |

| Payload to LEO (kg) | 300 | 500 | 50 |

| Engine | 9x Rutherford/single vacuum | Newton3+4 | 5x Delphin/single ether |

| Price | $6-13m | $12m | <$4m |

| per kg | 26,667 | 24,000 | 75,000 |

| Reuseable | Yes | No | No |

| Structure | Carbon composite | Carbon composite | Metal |

| Sites | Mahia, NZ | Mounted to 747 jet | Kodiak, AK |

| Launches | 21 | 2 | 2 |

| Satellites deployed | 105 | 7 | 0 |

| Own satellites | 2 | 0 | 0 |

Larger Neutron rocket will be the key to the future edit edit source

In order to expand the market opportunity (by 2-4x, in Deutsche Bank's view), Rocket Lab will build a much larger 46m tall medium-class rocket capable of carrying 8,000kg payloads to LEO or 1,500kg to Mars/Venus. Management believes this size will be able to handle 98% of future satellite launches, targeting commercial and government constellations, representing an alternative to SpaceX Falcon 9 and also legacy carriers such as Soyuz and Antares. Constellation satellites need to be launched in batches to different orbital planes; this cannot be addressed by heavy rockets. Neutron will also have the ability to carry humans, which could be used for crew resupply for the International Space Station. There is also the issue of SpaceX operating its own Starlink satellite constellation, meaning it would likely always prioritize captive deployments.

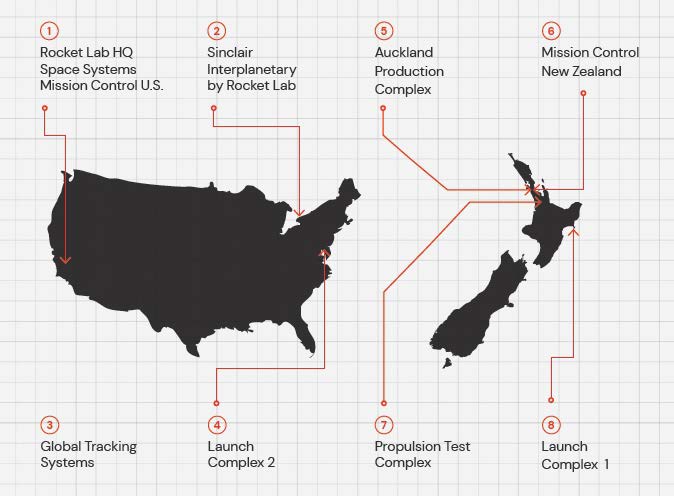

The rocket will be reusable (first stage) and have propulsive landing capabilities (i.e., launch and then come back to land on an ocean platform). While building a larger rocket will take time ($200m development program, maiden voyage in 2024), Rocket Lab anticipates leveraging existing know-how to reduce costs (expertise in avionics, software, communications, GNC, infrastructure). Operationally, Neutron will lift off from Rocket Lab's other site in Wallops Island, Virginia (Mid-Atlantic Regional Spaceport or Launch Complex 2). The launch pad and integration/control facility have already been built, but delays involving the Flight Safety System software certification with NASA have caused delays with December being the most realistic launch window now. Collectively, Rocket Lab will have potentially 132 launch slots annually from its sites (120 in LC1 across 2 pads, 12 in LC2 with potential to expand).

Figure 15: Mahia, New Zealand (LC1)[12]

Figure 16: Wallops, Virginia (LC2)[12]

Vertical integration edit edit source

In respect to production, Rocket Lab has focused on vertical integration (~90% inhouse), essentially controlling the process from raw material to orbit across 3 global sites. In Auckland, the company houses its launch vehicle R&D and manufacturing facilities along with its propulsion test sites (i.e., place to test-fire engines). Rocket Lab can assemble composite tanks, fairings, electrical harnesses, kick stages and much more here. Moreover, Mission Control Center for Electron is based here along with workstations for payload processing. Long Beach is home to engine and avionics manufacturing, utilizing specialized automated equipment and 3D printing. Rocket Lab is also expanding space systems manufacturing capabilities at this location, supporting Sinclair's existing footprint in Toronto.

Figure 17: Auckland facilities[12]

Figure 18: Long Beach HQ[12]

Figure 19: Neutron designed to carry more and be an alternative to Falcon 9[14]

Figure 20: Global locations and capabilities[12]

Space systems gaining fast traction edit edit source

Beyond the launch business, Rocket Lab is also striving to become a satellite platform, fully leveraging its ability to provide customers access to space. This includes selling its Photon family of spacecraft, portfolio of standalone components, engineering/design services, and on-orbit constellation management services. With this diverse set of offerings, Deutsche Bank believes Rocket Lab can capture more of the value chain, giving it greater runway for growth and diversity of income streams.

Photon is a versatile and customizable small spacecraft with use-cases across low/medium orbit, geosynchronous orbit, and interplanetary missions. Photon can be integrated as the upper stage of Electron (kick-stage) during launch, eliminating parasitic mass (i.e., full use of fairing volume for payloads). NASA is using Photon for its CAPSTONE lunar mission and also to study Mars. These spacecrafts can also fly on other launch vehicles, meaning even if Rocket Lab does not win the launch contract, it can garner value from the satellite. Pricing can vary significantly, from a few million to >$10m depending on complexity and scope.

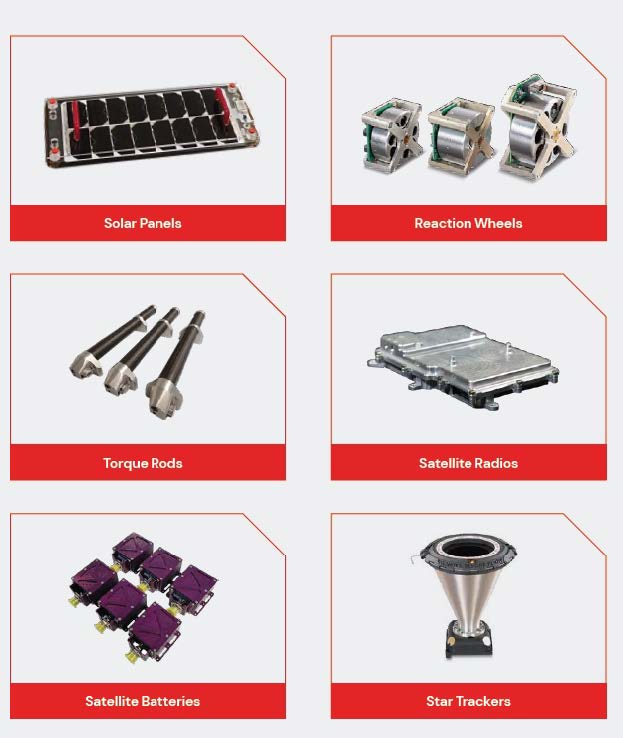

On the components side, Rocket Lab sells reaction wheels, torque rods, solar panels, satellite radios/batteries, and star trackers. The company essentially entered this market through the acquisition of Sinclair Interplanetary, providing Rocket Lab with a greater degree of vertical integration (Sinclair had content on nearly 100 satellites when the deal closed). In doing so, Rocket Lab can now essentially be a high-volume supplier to other aerospace companies for components. Historically, the supply chain has experienced long lead times and high prices. Moving forward, management sees an opportunity to take over other small private suppliers (often generating very healthy margins), and scale up operations, benefitting both its internal needs and ever-growing merchant business. For example, Rocket Lab is constructing a new reaction wheel production plant with up to 2,000 units per year of capacity to satisfy high demand from constellations. Deutsche Bank notes the price of a reaction wheel ranges from $15k to $80k.

- Reaction wheels are motor-driven flywheels used to store angular momentum on a spacecraft. Many spacecraft use three or four reaction wheels to provide agile 3-axis pointing control. Some configurations use a single wheel, called a “momentum wheel,” for stable Earth-pointing control. All Rocket Lab reaction wheels incorporate an onboard digital processor with speed and torque control loops.

- Star trackers are optical sensors that determine a spacecraft’s pointing direction and rotation rate by looking at the stars. Rocket Lab's star trackers are fully-integrated units, where one box includes the lens, detector, processor, and all of the power supply and support circuits. A catalog of more than two million possible star triangles is loaded before launch, allowing the processor to determine the direction from any single image.

- Torque rods are long bars of special alloy steel, wound with coils of fine copper wire. When a current is passed through the wire, it becomes an electromagnet that generates a twisting force against the Earth’s magnetic field. Magnetic torque rods are used in low Earth orbit to remove angular momentum from reaction wheels, avoiding the requirement to expend irreplaceable propellant.

- Batteries include both the high-capacity, high-voltage batteries used to power the pumps in the Rutherford rocket engine used by Electron and other batteries used for small spacecraft.

Rocket Lab also conducts space systems engineering works with customers to develop, design and manufacture full spacecraft solutions; this is typically project driven over a period of time. Related to that, Rocket Lab can provide constellation management services where it performs command and control operations, utilizing ground station infrastructure to deliver data to spacecraft constellation operator customers following launch. Longer term, the company will aim to offer some sort of data & analytics software/service, but Deutsche Bank notes this is a tricky balance given conflicts of interest with major launch customers.

Figure 21: Photon spacecraft[15]

Figure 22: Types of space components[12]

Growth accelerating, underpinned by robust backlog edit edit source

With industry launch demand continuing to outpace supply, Deutsche Bank believes Rocket Lab is well positioned for growth given its strong track record of reliability and diverse streams of business. Backlog (contracted revenue) exited September worth >$170m vs. just $60m at the end of 2Q20. Rocket Lab can turn around a launch in about 2 weeks at LC1 in New Zealand, constrained mainly by staffing/procedural limitations and more recently, COVID-19 lockdowns. Recent prominent wins include a 5-launch deal with Kineis to deploy a fleet of IoT constellations beginning in 2023 and a 3 Photon spacecraft tie-up with Varda Space where internal components will also be used. Customer mix is split 50% commercial, 20% civil, and 30% national security. Looking ahead, management sees a $4.4bn active pipeline opportunity across a broad range of customers and verticals, up significantly from just $2.2bn in March.

Near-term financials constrained by COVID-19, but Deutsche Bank sees upside to midterm outlook edit edit source

Deutsche Bank believes Rocket Lab was on track to beat initial 2021 management forecasts set out in March before the very stringent COVID-19 lockdowns in New Zealand halted launch activity. However, this should set up 2022 to mechanically outperform and Deutsche Bank expects 2023-24 to demonstrate solid growth as launch activity and component wins pick up momentum.

Revenue: Deutsche Bank expects Rocket Lab's revenue to ramp up in 2022 as the company's manifest gets executed and backlog rolls on; Deutsche Bank forecasts +$180m in sales, up >200% YoY. Beyond that, Deutsche Bank forecasts nearly $800m in sales by 2025 (>90% CAGR), above management’s forecast of $749m, driven mainly by a higher number of Electron launches. Deutsche Bank assumes an average launch price of >$7m with some small declines progressing forward to account for a higher number of bulk discounts given out to multi-launch customers. In conjunction, Deutsche Bank assumes Space Systems tracks roughly in line with management's outlook considering it should be naturally more predictable based on contracts and orders (i.e., launches can be delayed due to weather or issues with payloads).

Gross margin: Deutsche Bank expects gross margin to improve materially in the coming years, growing to 30-40% in 2022-23E vs. just ~10% in 2021E (Non-GAAP basis, excludes SBC), and nearly 50% by 2025E. Management is aiming for a 55% gross margin in the long term. For an Electron launch, Deutsche Bank thinks the normalized economics at 1 launch per month suggest a c.20% gross margin, assuming a $7.5m price, $2m bill-of-materials, $2m fixed overhead ($24m spread over 12 rockets), and $2m in direct labour. When increasing to 2 launches per month likely around 2H23, this overhead declines to $1m per rocket, labour to $1.5m, while BoM likely declines by c.8% per year, implying a ~40% gross margin.

Ultimately once Rocket Lab is at 3 rockets per month, the gross margin should be closer to 50% with upside as vertical integration increases, quality/yields improve, and reusability of the rocket's first stage gets incorporated (driving costs to ~$3.5m per launch vs. 2019's $8.2m). The larger Neutron rocket could be initially dilutive but should be accretive longer term considering it was purpose-built for reusability and leverages past learnings. For Space Systems, gross margins are already quite high on a relative basis, averaging 65% in 1H21. Management believes this should trend downwards somewhat from elevated levels as it prices more aggressively to garner higher volumes.

| ($000) | 2022E | 2023E | 2025E |

|---|---|---|---|

| Launch price | 7,500 | 7,200 | 7,100 |

| Fixed overhead | 2,000 | 1,000 | 667 |

| Bill of materials | 2,000 | 1,840 | 1,557 |

| Direct labor | 2,000 | 1,500 | 1,500 |

| Gross profit | 1,500 | 2,860 | 3,376 |

| Gross margin | 20% | 40% | 48% |

Opex: Deutsche Bank expects both R&D and SG&A as a % of sales to trend downwards toward management's long-term target of 15-20% and 10-12%.

In terms of capital intensity, Deutsche Bank believes Rocket Lab has raised enough cash as part of the SPAC listing to achieve its main business objectives, getting nearly $780m in gross proceeds (before transaction fees and management redemption). The company has been extremely cash efficient, having reached orbit multiple times with minimal spending. Looking ahead, the company will need to spend on developing Neutron ($60-70m of anticipated capex with some portion potentially shared by local government similar to the Virginia/Wallops situation), and expanding capabilities in Space Systems, which management has indicated would likely involve M&A. Depreciation is expected to about 4-5% of revenue.

| 2021E | 2022E | 2023E | 2024E | 2025E | 2026E | 2027E | |

|---|---|---|---|---|---|---|---|

| Launch

# of Electron launches |

6 | 17 | 22 | 30 | 38 | 40 | 42 |

| avg revenue ($000) | 7,013 | 7,250 | 7,250 | 7,200 | 7,200 | 7,100 | 7,000 |

| # of Neutron launches | 1 | 3 | 10 | 16 | |||

| avg revenue ($000) | 30,000 | 44,000 | 40,000 | 38,500 | |||

| Launch revenue | 42,080 | 122,018 | 157,905 | 244,770 | 404,586 | 682,290 | 908,180 |

| Space systems

Photon/engineering services |

8,563 | 40,000 | 65,000 | 97,500 | 120,000 | 130,000 | 126,500 |

| Component sales | 5,392 | 20,000 | 60,000 | 120,000 | 240,000 | 360,000 | 540,000 |

| System revenue | 13,955 | 60,000 | 125,000 | 217,500 | 360,000 | 490,000 | 666,500 |

| Data & analytics | 10,000 | 20,000 | 30,000 | ||||

| Gross margin

Launch |

-22.1% | 17.5% | 32.5% | 37.5% | 37.5% | 40.0% | 42.5% |

| Space systems | 30.3% | 52.5% | 55.0% | 57.5% | 60.0% | 60.0% | 60.0% |

| Data & analytics | 30.0% | 50.0% | 70.0% | ||||

| Gross margin | -9.1% | 29.0% | 42.4% | 46.9% | 47.9% | 48.4% | 50.3% |

| Total revenue ($000) | 56,035 | 182,018 | 282,905 | 462,270 | 774,586 | 1,192,290 | 1,604,680 |

| Gross margin (GAAP) | -9.1% | 29.0% | 42.4% | 46.9% | 47.9% | 48.4% | 50.3% |

| Ebitda (Non-GAAP) | (43,187) | (17,077) | 30,174 | 111,505 | 237,099 | 393,212 | 569,076 |

| margin | -77.1% | -9.4% | 10.7% | 24.1% | 30.6% | 33.0% | 35.5% |

| EPS (Non-GAAP) | (0.29) | (0.09) | (0.00) | 0.16 | 0.39 | 0.64 | 0.89 |

Premium valuation warranted for highest quality listed space launch asset edit edit source

Considering the space industry is truly a frontier market, Deutsche Bank looks at valuation from two different perspectives. Using a traditional framework, Deutsche Bank looks at the closest public comp, which, in its view, is Virgin Galactic (SPCE). While the businesses are very different (rocket launch vs. space tourism), Deutsche Bank believes the reputations (multiple successful launches establishing credibility), and investor profiles (aerospace, disruptive tech) share similarities and Deutsche Bank feels comfortable using Virgin Galactic's multiples as a reference point. SPCE is currently trading at 14.5x 2025E consensus EV/Sales and 39x EV/Ebitda. Due to consensus estimates being somewhat few (5 of them getting pulled into Bloomberg for 2025), and inherently volatile, Deutsche Bank takes a haircut and use a 12.5x multiple on its 2025E Sales, blended with 27.5x Ebitda, translating into a $19 share price. Deutsche Bank believes the long-term multiple will be predicated upon how much success Rocket Lab can achieve beyond small rocket launch (i.e., Neutron and Space Systems).

Perhaps a more practical but subjective approach would be to triangulate the valuation based on recent private market round fundraising and deal transactions. Deutsche Bank believes rocket launch companies that are perceived to possess compelling technology and reputable management can fairly “easily” garner a low $1bn market cap without having demonstrated orbital ability (e.g., ABL, Firefly). After reaching orbit, the valuation likely increases 2-3x depending on circumstances (Virgin Orbit seeking >$3bn listing). And then as the company continues to show progress, the valuation would rise based on consistency and platform differentiation. Relativity appears to be an exception at +$4bn even though it has not reached orbit due to its 3D printing technology having a much broader use case than just rockets.

In this context, Deutsche Bank believes Rocket Lab should have a floor around the $5-6bn range (correlates to a $12 stock price) given its solid track record in rocket launch execution (90% success rate since inception). As it continues to demonstrate its satellite and potentially one day its application/analytics capabilities, this should add more value on top; success in Neutron could also give the valuation a boost. Deutsche Bank subjectively estimates this optionality could be worth another $2-2.5bn, implying a stock price of about $17.

All in, Deutsche Bank initiates with a Buy rating and an $18 price target using a blended approach of 12.5x/27.5x 2025E Sales/Ebitda (taking a haircut to SPCE's multiples; implies a $19 stock price), and a ~$7.5bn market cap (equivalent to a $17 stock price) based on private and public comparables.

Similar to many other SPACs, Rocket Lab has experienced considerable volatility in its share price. Deutsche Bank does believe for the stock to truly work, there will need to be greater long-term support from investors and this process could take time but Rocket Lab is, in Deutsche Bank's view, the highest quality publicly-traded space stock on the market now. Deutsche Bank sees the main risk for Rocket Lab being operational as it must execute on numerous launches coming up in 4Q/2022 and on the development of the larger Neutron rocket. Delays in the launch schedule and failed orbital attempts could hurt sentiment. In addition, there is political/regulatory risk considering space launch is still a highly-regulated industry. Industry-wise, the market for dedicated small launch rockets could turn out to be smaller than expected.

| 2025E | |

|---|---|

| Ebitda | $237 |

| Multiple | 27.5x |

| Enterprise value | $6,520 |

| Net debt (cash) | ($623) |

| Equity value | $7,143 |

| Per/share | $16 |

| 2025E | |

|---|---|

| Sales ($m) | $775 |

| Multiple | 12.5x |

| Enterprise value | $9,682 |

| Net debt (cash) | ($623) |

| Equity value | $10,305 |

| Per/share | $23 |

| Per share value | Market cap ($m) | |

|---|---|---|

| Rocket launch | $12 | 5,402 |

| Space systems | $4 | 1,666 |

| Apps & data | $1 | 450 |

| Total | $17 | 7,518 |

Company background edit edit source

History edit edit source

Rocket Lab was founded in 2006 by Peter Beck in New Zealand. Mr. Beck began building rockets at an early age in his spare time and is often considered a "selftaught" rocket scientist. The company successfully launched its first rocket in 2009 called the Atea-1, which is believed to be first commercially developed rocket to reach space from the Southern Hemisphere. Then beginning in 2013, developmental work began on Electron, which was designed to be a high launch rate small rocket; the company also shifted its registration to the US and received its first high-profile venture backing from Khosla Ventures. The first Electron test flight was in 2017 but didn't reach orbit due to a ground equipment issue. The second launch in January 2018 reached orbit and deployed CubeSats for Planet Labs and Spire. In 2020, Rocket Lab acquired Sinclair Interplanetary for about $12m in cash plus stock/earnouts.

SPAC listing edit edit source

Rocket Lab went public in late August 2021 via a SPAC listing. The sponsor was Vector Capital, a tech-only fund with a 25-year track record (39% gross IRR since inception, 100+ companies acquired since 1997), led by Alex Slusky. The deal raised about $777m in gross proceeds (before fees, which are expected to be ~$50m and management redemptions of about $40m) including a $467m PIPE led by Vector, Blackrock, and Neuberger Berman. Notable venture capital support also came from Bessemer and DCVC, who are both on the board of directors. The redemption rate for the deal was 3%. For the lockup, there is a customary 6-month period (2/25/22) for all employees (including C-suite and Peter Beck who owns +11% of the shares), sponsor, and pre-SPAC investors.

Management team edit edit source

Peter Beck – Founder, Chairman, CEO: Prior to founding Rocket Lab, Mr. Beck began his career in 1993 with an apprenticeship as a precision engineer at global appliance manufacturer Fisher & Paykel, before moving into production machinery design, product design and analysis. He later went to a government research institute in 2003 where he focused on advanced composites structures and materials for high-performance applications. While at the government lab, Mr. Beck led several complex engineering programs to optimize technologies including wind turbines and superconductors. An award-winning engineer, Mr. Beck has been presented with the Gold Medal from the Royal Aeronautical Society, Meritorious Medal from the New Zealand Division of the Royal Aeronautical Society and Cooper Medal and Pickering Medal from the Royal Society of New Zealand. In addition, in recognition of his outstanding contributions to aerospace, entrepreneurship and technical innovation, Mr. Beck was appointed as an adjunct professor in aerospace engineering by the University of Auckland.

Adam Spice – CFO: Mr. Spice has served as Chief Financial Officer since May 2018. Prior to that from January 2011 until May 2018, he was CFO at MaxLinear, Inc., a provider of radio frequency, analog and mixed signal integrated circuits for the connected home, wired and wireless infrastructure, and industrial and multimarket applications. From October 2009 to November 2010, Mr. Spice was the CFO of Symwave Corporation, a venture-backed fabless semiconductor company until its sale to Standard Microsystems Corporation (SMSC). From July 2000 until September 2009, he held a variety of financial and operational executive roles at Broadcom Corporation. From June 1996 until July 2000, Mr. Spice worked as a finance manager for Intel. He has a Bachelor’s of Business Administration from Brigham Young University and MBA from The University of Texas at Austin.

Shaun O'Donnell – EVP of Global Operations: Mr. O'Donnell has served as Executive Vice President, Global Operations since September 2019. He has been with Rocket Lab since September 2007 and is responsible for the day-to-day operations of Rocket Lab globally and manages cross-functional teams across the business. Prior to his current role, from August 2017 to December 2019, Mr. O'Donnell served as Vice President of Global Operations. From November 2016 to August 2017, he served as Vice President of New Zealand Operations. From September 2013 to November 2016, he was Head of the Guidance, Navigation and Control, Avionics department. From September 2007 to September 2013, Mr. O'Donnell served as a Senior Systems Engineer. Prior to Rocket Lab, he was a lead engineer at a contract engineering firm. Mr. O'Donnell holds an Electrical and Electronic Engineering degree from the University of Auckland.

Notes edit edit source

- ↑ Source : BryceTech.

- ↑ Source : Company reports, Deutsche Bank.

- ↑ Source : Allied Research, Company reports, Deutsche Bank.

- ↑ Source : BryceTech, Deutsche Bank, Euroconsult.

- ↑ Source : Seraphim Capital.

- ↑ *includes Starlink, China, Russia, etc… Source : Allied market research, Company reports, Deutsche Bank, Relativity.

- ↑ Source: BryceTech, Company reports, Deutsche Bank.

- ↑ Source: Company reports, Deutsche Bank. *some companies make multiple sizes of rockets **ULA is joint venture between Boeing and Lockheed Martin.

- ↑ Source : BryceTech.

- ↑ Source : Allied Market Research, Planet Labs.

- ↑ *SPAC transaction management forecasts

- latest private market round valuation

- ↑ 12.0 12.1 12.2 12.3 12.4 12.5 12.6 12.7 Source: Company reports.

- ↑ Source: Company reports, Deutsche Bank.

- ↑ Source : Rocket Lab.

- ↑ Source: Satnews.

- ↑ 16.0 16.1 16.2 16.3 16.4 Source: Company reports, Deutsche Bank.