Shopify Inc.

| |

| Type | Public |

|---|---|

| |

| ISIN | [https://stockhub.co/index.php?title=Toollabs:isin/&language=en&isin=CA82509L1076 CA82509L1076] |

| Industry | E-commerce |

| Founded | 2006 Ottawa, Ontario, Canada |

| Founders |

|

| Headquarters | Ottawa, Ontario , |

Area served | Worldwide |

| Services | Online shopping |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 11,600+[2] |

| Website |

|

Shopify Inc., a commerce company, provides a commerce platform and services in Canada, the United States, Europe, the Middle East, Africa, the Asia Pacific, and Latin America. The company's platform enables merchants to displays, manages, markets, and sells its products through various sales channels, including web and mobile storefronts, physical retail locations, pop-up shops, social media storefronts, native mobile apps, buy buttons, and marketplaces; and enables to manage products and inventory, process orders and payments, fulfill ship orders, new buyers and build customer relationships, source products, leverage analytics and reporting, manage cash, payments and transactions, and access financing. It also sells custom themes and apps, and registration of domain names; and merchant solutions, which include accepting payments, shipping and fulfillment, and securing working capital. The company was formerly known as Jaded Pixel Technologies Inc. and changed its name to Shopify Inc. in November 2011. Shopify Inc. was incorporated in 2004 and is headquartered in Ottawa, Canada.

The Idea edit edit source

In 2004, Tobias Lütke, Daniel Weinand, and Scott Lake wanted to create a website for their own store called Snowdevil. However, not satisfied with existing e-commerce platforms, Lütke build an e-commerce platform by himself and Snowdevil was launched. [3]In 2006, they officially launched Shopify which provides a set of tools merchants can use to build their own website. Initial products of Shopify assisted merchants to set up customized store templates, tracked orders in an RSS feed, and automated inventory organization. Also, payments could be processed through a PayPal or credit card processor integration. Shopify has redefined the point of sale (POS) for e-commerce. In 2013, Shopify launched Shopify payments. Instead of using third-party payment gateways, Shopify payments allowed merchants to use Shopify’s own payment. Furthermore, in 2017 they produced iPad POS that directly accepts debit and credit card payments. It is still widely used by physical business sites. [4]

Mission Statement edit edit source

Shopify’s mission is to make commerce better for everyone[1]. In their own words “We help people achieve independence by making it easier to start, run, and grow a business. We believe the future of commerce has more voices, not fewer, so we’re reducing the barriers to business ownership to make commerce better for everyone.”[1] Essentially, Shopify's fundamental mission revolves around the advancement of commerce for the collective benefit of all individuals. The company is deeply committed to empowering aspiring entrepreneurs, facilitating their path towards independence by offering comprehensive tools and resources necessary for the initiation, operation, and expansion of successful businesses. Operating within a user-friendly platform, Shopify strives to streamline the intricacies associated with entrepreneurship, thus rendering the endeavour more approachable and less daunting.

- Shopify focuses on supporting independent businesses during their early stages.

- The platform is designed to cater to various needs of entrepreneurs, including digital storefronts, inventory management, and seamless transactions.

- The company aims to promote growth by crafting a scalable platform to adapt to evolving businesses.

- Shopify values diversity and inclusivity, striving to provide equal opportunities in commerce.

- They achieve this by making tools affordable and accessible to all individuals, regardless of scale.

- Shopify's guiding principles are accessibility, empowerment, and inclusivity.

- https://www.shopify.com/uk/about

Segments edit edit source

Shopify provides various services and tools for merchants to realize their business idea in offline and online commerce. Here are services Shopify offers:[1]

Building e-commerce platform edit edit source

- Storefronts: Shopify assists merchants to personalize their websites in which it is easily accessible with IOS or Android.

- Creator tools: It empowers merchants through providing tools they need to not only produce content but build a thriving business

- Brands/logo growth tools: It helps the merchant to create its brand using easy-to-use tools and Shopify’s logo maker, slogan maker, QR code generator, and more tools for growth.

- Domain / hosting: It provides unlimited bandwidth so merchants do not have to worry about increasing traffic. Also, Shopify makes it easy to create and register a domain name for merchants’ new websites. Also, it offers blazing-fast server access and level 1 PCL compliance so that customers’ data is always kept secure.

- Back Office / Shopify Fulfillment Network / Deliver: Shopify’s users can buy and print shipping labels in Shopify so they can prepare packages in advance and skip the line at the post office. Also, it simplifies day-to-day work as it fulfills orders from the same place where merchants manage products, customers, and inventory. Shipping carriers that work with Shopify are USPS / UPS / DHL / Canada Post / Evri / DPD UK / Sendle / Poste Italiane/ Colissimo / Correos / Chronopost

- Banking: With Shopify’s banking solution, merchants can manage their account from one place, and it provides fast, easy access to funding so that it accelerates business's growth.

- Shop Pay & Installments: It enables customers to checkout quickly using encryption to save their details, allows them to pay in full at checkout, or lets them split payments into installments.

- Mobile App: Use the Shopify app to run your business wherever merchants are and manage the Shopify store on-the-go, respond to information in real-time, manage orders, and more.

For marketing edit edit source

- Social Channels Integrations / Sales Channels: Shopify allows merchants to sell products across different channels: social media like Facebook, Instagram, TikTok, Youtube, and popular marketplaces. Also, updates in Shopify website automatically sync to Facebook and Instagram so that merchants can easily create ads and shoppable posts

- Shop app: It assists customers in quick checkout, tracking order and shipment details. Furthermore, it brings other Shopify stores so that it helps customers to rediscover merchants’ business with Shop app

Managing Business edit edit source

- POS System: It provides tools for sales reporting, inventory management.

- Shopify Market: It is the only global e-commerce solution where merchants can sell products to multiple countries and scale internationally from one Shopify store.

- Messaging/ Inbox / Chat: Merchants can talk to customers and manage conversations from anywhere with Shopify Inbox. Also, merchants can create automated messages and get insights to focus on chats that convert.

- Marketing Insights & Analytics: Make informed decisions for the business using marketing insights and data provided by Shopify’s reports and analytics. Also this aids to manage B2B and DTC customers, orders, and inventory all from one place, with separate storefronts.

- Merchandising: From visual displays to product bundling, special offers, and more, merchandising can help merchants promote and sell products in your store.

- Central admin: It manages business easily from a central location. With Shopify’s Admin, you can access all of the different parts of your business from one place.

Revenue Breakdown by Segment edit edit source

Shopify includes two main revenue streams: Subscription Solutions and Merchant Solutions. Let's break down the key points about each revenue streams.

Subscription Solutions: edit edit source

- Subscription solutions revenue is generated through the sale of subscriptions to your platform, which includes variable platform fees.

- Additional sources of subscription solutions revenue come from the sale of subscriptions to POS Pro offering, themes, apps, and registration of domain names.

- Different pricing plans are offered to meet the needs of current and prospective merchants, allowing them to scale and receive more powerful tools as they upgrade to higher-priced options.

- Most of the Gross Merchandise Volume (GMV) comes from merchants subscribing to Shopify Plus plans, which offer advanced functionality and support for growing and scaling globally.

- Subscription plans typically have a one-month term, with the option for merchants to make an annual commitment.

- Subscription fees are paid at the start of the subscription period, except for Shopify Plus plans, which are paid in arrears on a ratable basis

Merchant Solutions: edit edit source

- Merchant solutions revenue is generated through various services offered to merchants, including payment processing fees, currency conversion fees, transaction fees, referral fees from partners, advertising revenue on the Shopify App Store, Shopify Capital, Shop Pay Installments, Shopify Balance, Shopify Shipping, service fees from Shopify Fulfillment Network, and sales of POS hardware, Shopify Email, and Shopify Markets.

- Shopify Payments is a fully integrated payment processing service that allows merchants to accept and process payment cards online and offline. It drives higher retention among merchants and eliminates the need for third-party payment gateways.

- Shopify Capital provides eligible merchants with access to financing and working capital through merchant cash advances and loans.

- Shop Pay Installments allows merchants to offer buyers interest-free or interest-bearing payment plans.

- Shopify Balance is a money management product that offers merchants a no-fee money management account and a card for spending.

- Shopify Shipping allows merchants to buy and print shipping labels and track orders directly within the Shopify platform.

- Shopify Fulfillment Network offers fast and reliable fulfillment services to independent businesses, leveraging logistics capabilities and partnerships.

- Shopify POS enables merchants to sell products and accept payments in person from a mobile device almost anywhere.

Additionally, Shopify Markets and Shopify Markets Pro are cross-border commerce product offerings designed to help merchants expand globally.

Overall, your business model aims to provide a comprehensive platform and a range of services to support merchants in their e-commerce operations while generating revenue through subscription fees, payment processing, financing, and various other solutions.

Projects edit edit source

In the fast-paced world of e-commerce, staying ahead of the curve is vital for success. Shopify, one of the leading e-commerce platforms, has consistently demonstrated its commitment to innovation and customer satisfaction. The company has several exciting projects in the pipeline aimed at further enhancing its platform and services. Let’s delve into some of these initiatives and see how they are paving the way for a better online shopping experience.

Expanding the App Marketplace edit edit source

Shopify’s App Marketplace has been a driving force behind the platform’s adaptability and versatility. In 2021, they were actively working to expand this marketplace, offering merchants an even broader range of third-party applications to extend their store’s functionalities. With a focus on quality and usefulness, the goal was to empower merchants to tailor their online stores to their specific needs, resulting in a more personalized shopping experience for customers.

Improving the Mobile App edit edit source

Recognizing the growing significance of mobile commerce, Shopify has been investing heavily in optimizing its mobile app. The objective was to provide merchants with a seamless experience to manage their businesses on the go. By improving the app’s user interface, performance, and adding new features, Shopify aimed to empower merchants with the tools they need, right at their fingertips, no matter where they are.

Enhanced Payment Options edit edit source

In a competitive digital landscape, providing a variety of payment options is crucial for attracting and retaining customers. Shopify acknowledged this importance and was working on expanding its payment options, allowing merchants to offer a wide array of payment gateways tailored to their target markets. This improvement aimed to minimize cart abandonment rates and streamline the checkout process, ultimately leading to increased sales and customer satisfaction.

Next-Level Analytics and Insights edit edit source

To stay competitive, merchants need access to valuable data and insights about their customers’ behavior. Shopify understood this necessity and was dedicated to enhancing its analytics and reporting tools. By offering more in-depth analytics, businesses could gain a deeper understanding of their audience, optimize their marketing strategies, and make data-driven decisions to boost their overall performance.

Sustainability and Green Initiatives edit edit source

In recent years, sustainability and environmental consciousness have become paramount concerns for businesses and consumers alike. As a responsible global player, Shopify demonstrated its commitment to sustainability by actively working on green initiatives. These efforts included exploring ways to reduce the carbon footprint of its data centers, improving packaging practices, and supporting merchants in adopting eco-friendly business practices.

The Team edit edit source

Tobi Lütke, Founder & Chief Executive Officer edit edit source

Tobi Lütke is the founder and Chief Executive Officer of Shopify. In 2004, Tobi began building software to launch an online snowboard store called Snowdevil. It quickly became obvious that the software was more valuable than the snowboards, so Tobi and his founding team launched the Shopify platform in 2006. He has served as CEO since 2008 at the company's headquarters in Ottawa, Canada. Tobi is an active advocate for sustainability, computer literacy, and education, and serves as a board member of Canada Learning Code, an organization working to give all Canadians access to digital skills. He also served as Chair of the Digital Industries Table, an advisory board commissioned by the federal government to provide recommendations on how to turn Canada into a digital leader.

Harley Finkelstein, President edit edit source

Harley Finkelstein is President at Shopify and has been with the company since 2010. He oversees Shopify’s commercial teams, growth & external affairs. Harley holds a Bachelor degree in Economics from Concordia University and a J.D./M.B.A. joint degree in Law and Business from the University of Ottawa. Prior to his current role, Harley was Shopify’s COO and has founded numerous startups and ecommerce companies.

Jeff Hoffmeister, Chief Financial Officer edit edit source

Jeff Hoffmeister is the Chief Financial Officer at Shopify and joined in October 2022. He previously worked in Morgan Stanley's Technology Investment Banking group for 22 years in their New York, London and Boston offices. His prior roles at Morgan Stanley included Head of the Americas Tech Banking team and Head of Technology Investment Banking for EMEA. Jeff began his professional career at PwC, serving in their auditing division. Jeff has significant experience leading high-profile tech companies in a variety of transactions, including initial public offerings, follow-on offerings of equity, debt and convertible notes, and both buyside and sellside M&A transactions. Notably, Jeff helped lead IPOs for dozens of companies, including Shopify. He graduated from Georgetown University with a Bachelor of Science in Business Administration and has a Master in Business Administration from the University of Virginia Darden School of Business. He also holds a license as a certified public accountant (CPA).

Kaz Nejatian, VP Product & Chief Operating Officer edit edit source

Kaz Nejatian is Shopify’s VP of Product and Chief Operating Officer and has been at Shopify since 2019. Prior to becoming COO, Kaz was VP of Product, Merchant Services, and Commercial. Kaz oversees a cross-functional team that develops and delivers tools for entrepreneurs to supercharge their growth on Shopify. These products give independent merchants access to commerce innovations that have historically only been available to big businesses. After working as a lawyer in his early career, Kaz parlayed his life interests of entrepreneurship, finance, and technology into co-founding and serving as the CEO of Kash, a payment technology company which was acquired in 2017 by one of the largest fintech companies in the U.S. Kaz then served as Product Lead for Payments and Billing at Facebook, reducing the barriers for businesses in cash-dependent markets to purchase digital ads without a credit card. Kaz is a graduate of Queen’s University’s School of Business and the University of Toronto Faculty of Law. Along with being a key player in making commerce better for everyone, he is also a husband and the proud father of three children.

Jess Hertz, General Counsel edit edit source

Jess Hertz is General Counsel at Shopify since 2021, where she oversees our global legal team. Jess is a U.S. lawyer with significant tech, policy, and operational experience. Before joining Shopify, she served as Deputy Assistant to the President and Staff Secretary to President Biden. She also served as General Counsel for the Biden-Harris Transition Team, where she oversaw all legal aspects for the presidential transition in 2020-2021. Prior to her work for the Biden administration, Jess led the North America regulatory team for Facebook, where she was responsible for managing the company's civil regulatory inquiries. Previous to her work at Facebook, Jess was a partner at Jenner & Block LLP, a Chicago-based private law firm. Jess earned her law degree from the University of Chicago Law School, and her undergraduate degree from Harvard College.

Tia Silas, Chief Human Resources Officer edit edit source

Tia Silas is Shopify’s Chief Human Resources Officer, joining in 2022 to oversee Culture, Internal Operations, Employee Experience & Talent teams. Prior to joining Shopify, Tia was EVP of Human Resources at Wells Fargo, where she was responsible for leading people strategies across a number of areas such as Global Technology, Strategy, Digital and Innovation, as well as the Corporate and Investment Bank. Tia also worked at IBM as the Global Chief Diversity & Inclusion Officer where she was responsible for driving diversity and inclusion strategies across the globe with hundreds of thousands of employees. Tia graduated from Cornell University with a B.S. in industrial and labor relations, and attained her MBA from New York University, Stern School of Business.

Andrew Dunbar, Chief Information Security Officer edit edit source

Andrew Dunbar is the Chief Information Security Officer at Shopify and has been with the company since 2012. He leads the team responsible for safeguarding the millions of merchants on the Shopify platform, educating all employees on the best security practices, and ensuring that Shopify implements innovative security techniques to meet the changing needs of commerce globally. Prior to joining Shopify, he worked as an IT Security Specialist and Programming Analyst for Global Affairs Canada (formerly known as the Department of Foreign Affairs, Trade, and Development). He began his journey in this space by completing a Bachelor’s of Engineering (Software) from Carleton University.

Glen Coates, VP Product edit edit source

Glen is the VP of Product, Core, leading the development of Shopify’s core commerce platform: the storefront, checkout, backoffice, marketing and analytics tools that all merchants get “in the box”. He also oversees the core developer platform that Shopify’s theme and app developers build the future of commerce on and Shopify’s partner ecosystem, which includes over 10,000 publicly available apps in the Shopify App Store. Glen’s work at Shopify is the culmination of a career in software engineering, commerce, and entrepreneurship. Originally a CompSci grad who cut his teeth in video game development, he moved from Sydney to San Diego in 2008 to run US distribution and ecommerce for an Australian eco products company. In 2010, he attended Columbia Business School for one whole day before quitting to start Handshake, a SaaS B2B ecommerce platform headquartered in New York. Glen joined Shopify in May 2019 when the company acquired Handshake. Glen has been in the Vice President role since October 2020.

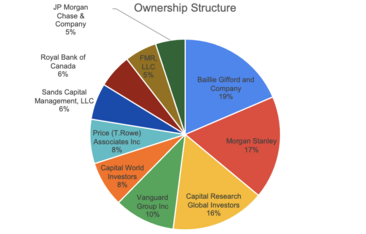

Ownership Structure edit edit source

| Holder | Shares | Date Reported | %Out | Value |

|---|---|---|---|---|

| Baillie Gifford and Company | 71,116,224 | Mar 30, 2023 | 5.92% | 4,859,727,101 |

| Morgan Stanley | 66,878,673 | Mar 30, 2023 | 5.57% | 4,570,154,058 |

| Capital Research Global Investors | 61,259,502 | Mar 30, 2023 | 5.10% | 4,186,168,013 |

| Vanguard Group Inc | 39,461,276 | Mar 30, 2023 | 3.28% | 2,696,586,259 |

| Capital World Investors | 29,575,096 | Mar 30, 2023 | 2.46% | 2,021,014,158 |

| Price (T.Rowe) Associates Inc | 28,790,842 | Mar 30, 2023 | 2.40% | 1,967,422,161 |

| Sands Capital Management, LLC | 23,648,206 | Mar 30, 2023 | 1.97% | 1,616,000,135 |

| Royal Bank of Canada | 22,052,119 | Mar 30, 2023 | 1.84% | 1,506,931,531 |

| FMR, LLC | 20,912,825 | Mar 30, 2023 | 1.74% | 1,429,077,877 |

| JP Morgan Chase & Company | 19,272,190 | Mar 30, 2023 | 1.60% | 1,316,965,086 |

| Investor type | Holding (%) |

|---|---|

| Institutional investors: | 64.99% |

| Mutual fund holders: | 41.34% |

| Other institutions: | 23.65% |

Risks edit edit source

Risks Related to Competitors edit edit source

Shopify's main competitors are Wix, BigCommerce, and Squarespace. These competitors offer similar services, but Shopify has some advantages, such as its low starting price and its SSL certificate. However, the competition is fierce, and Shopify could lose market share if it does not continue to innovate.

1. Wix: Wix is a website builder that offers e-commerce functionality. It has a drag-and-drop interface that makes it easy to use. Wix is best suited for small businesses that want to create an online store quickly.

2. SquareSpace: SquareSpace is a website builder that offers e-commerce functionality. It has beautiful templates and is easy to use. SquareSpace is best suited for small businesses that want to create an online store with a modern look.

3. BigCommerce: BigCommerce is an e-commerce platform that offers a range of features for online stores. It has a drag-and-drop interface and is easy to use. BigCommerce is best suited for medium-sized businesses that want to sell products online.

Risks Related to Financials edit edit source

Shopify has been growing rapidly, but it is still not profitable. The company has been investing heavily in growth, and this has led to a net loss of $1.9 billion in 2023. If Shopify cannot become profitable, its stock price could decline.

Risks Related to Operations edit edit source

Shopify's operations are complex. The company relies on a network of independent merchants, and it must ensure that these merchants are able to deliver products on time and in good condition. Shopify also relies on its website and payment processing systems, and any disruptions to these systems could hurt the company's business.

1. Inventory

It's worth noting that many of the independent shops on Shopify are based in the East. Each shop owner is self-employed, so it is difficult to have a mature delivering system like amazon. May face a series of problems such as tax problems, transaction fee, hoarding backlog, geopolitical events and even there are even small businesses that don't have physical storage. If the goods are not delivered in accordance with the specified time, this would lead to consumer disapproval of the entire Shopify platform.

2. Technology and payment

Shopify heavily depends on websites and payment processing to do business. Server failures, system interruption or other technical issues could hurt sales while a data breach or failure to protect customers’ payment information may leave the company exposed to penalties under consumer-protection laws, while also harming the brand’s finances and reputation.

Risks Related to Markets edit edit source

The global economy is facing some headwinds, such as rising inflation and interest rates. This could dampen consumer spending, which could hurt Shopify's business.

Risks Related to Growing the Business edit edit source

Shopify is focused on growing its business by expanding into new markets and by offering new services. This could be a risky strategy, as it could lead to increased costs and decreased profitability.

Shopify is focused on releasing more tools that help more types of businesses growth their sales, both online and offline. It also rolled out a handheld tool called POS Go with a built-in barcode scanner, card reader and inventory tracker to power in-person sales. But such an approach would also increase R&D costs, manufacturing costs, and thus might make Shopify's net profit even lower

Furthermore, Shopify may have to be flexible in the way that it charges sellers for their services in order to show a clear ROI for their clients. This could potentially affect Shopify's reputation and thus their stock price.

Overall, Shopify is a high-growth company with a lot of potential. However, there are also some risks associated with investing in the company. Investors should carefully consider these risks before investing in Shopify.

Financial Statements edit edit source

Historical and Forward Financials edit edit source

| Year | Revenue (in thousands) | Gross Profit (in thousands) | Gross Margin (%) | Operating loss (in thousands) | Operating Margin (%) | Net Loss (in thousands) |

|---|---|---|---|---|---|---|

| 2012 | 23,713 | 18,937 | 79.86% | 1,514 | 6.38% | 1,232 |

| 2013 | 50,252 | 36,739 | 73.11% | 4,269 | 8.50% | 4,837 |

| 2014 | 1,05,018 | 61,795 | 58.84% | 21,615 | 20.58% | 22,311 |

| 2014 | 18,810 | 11,628 | 61.82% | 5,972 | 31.75% | 6,365 |

| 2015 | 37,348 | 21,566 | 57.74% | 3,476 | 9.31% | 4,530 |

| 2016 | 3,89,330 | 2,09,495 | 53.81% | 37,165 | 9.55% | 37,173 |

| 2017 | 6,73,304 | 3,80,253 | 56.48% | 49,157 | 7.30% | 34,742 |

| 2018 | 10,73,229 | 5,96,267 | 55.56% | 91,920 | 8.56% | 80,204 |

| 2019 | 15,78,173 | 8,65,643 | 54.85% | 1,41,147 | 8.94% | 1,11,580 |

| 2020 | 29,29,491 | 15,41,520 | 52.62% | 90,153 | 3.08% | 3,27,233 |

| 2021 | 46,11,856 | 24,81,144 | 53.80% | 2,68,643 | 5.83% | 28,99,915 |

| 2022 | 55,99,864 | 27,54,119 | 49.18% | 8,22,299 | 14.68% | 34,70,917 |

| 2023 | 5010392 | 2582010 | 51.53% | 605946 | 12.09% | 2517205 |

| 2024 | 5538876 | 2853442 | 51.52% | 658022 | 11.88% | 2789184 |

| 2025 | 6067359 | 3124873 | 51.50% | 710098 | 11.70% | 3061163 |

| 2026 | 6595842 | 3396305 | 51.49% | 762173 | 11.56% | 3333143 |

| 2027 | 7124326 | 3667736 | 51.48% | 814249 | 11.43% | 3605122 |

Income statement edit edit source

| 2022 | 2021 | 2020 | 2019 | 2018 | |

|---|---|---|---|---|---|

| Sales/Revenue | 5600 | 4612 | 2929 | 1578 | 1073 |

| Sales Growth | 0.2142 | 0.5743 | 0.8563 | 0.4705 | - |

| Cost of Goods Sold (COGS) incl. D&A | 2883 | 2174 | 1426 | 729 | 488 |

| COGS excluding D&A | 2792 | 2108 | 1356 | 693 | 461 |

| Depreciation & Amortization Expense | 91 | 66 | 70 | 36 | 27 |

| Depreciation | 36 | 42 | 38 | 17 | 17 |

| Amortization of Intangibles | 54 | 24 | 32 | 19 | 10 |

| COGS Growth | 0.3262 | 0.5246 | 0.9556 | 0.4931 | - |

| Gross Income | 2717 | 2438 | 1504 | 849 | 585 |

| Gross Income Growth | 0.1144 | 0.6214 | 0.771 | 0.4517 | - |

| Gross Profit Margin | 0.4852 | - | - | - | - |

| SG&A Expense | 3381 | 2110 | 1374 | 985 | 673 |

| Research & Development | 1472 | 847 | 531 | 344 | 226 |

| Other SG&A | 1909 | 1264 | 844 | 641 | 447 |

| SGA Growth | 0.602 | 0.5355 | 0.3954 | 0.4644 | - |

| EBIT | -664 | 328 | 129 | -136 | -88 |

| Unusual Expense | 3133 | -2778 | -99 | - | - |

| Non Operating Income/Expense | 99 | 23 | -2 | -8 | -6 |

| Non-Operating Interest Income | 79 | 15 | 23 | 48 | 29 |

| Interest Expense | 3 | 3 | 9 | - | - |

| Interest Expense Growth | 0.0017 | -0.6155 | 0 | - | - |

| Gross Interest Expense | 3 | 3 | 9 | - | - |

| Interest Capitalized | - | - | - | - | - |

| Pretax Income | -3623 | 3141 | 240 | -96 | -65 |

| Pretax Income Growth | -2.1536 | 12.066 | 3.5086 | -0.4843 | - |

| Pretax Margin | -0.647 | - | - | - | - |

| Income Tax | -162 | 226 | -79 | 29 | - |

| Income Tax - Current Domestic | 1 | 2 | -54 | 63 | - |

| Income Tax - Current Foreign | 24 | 33 | 20 | 2 | - |

| Income Tax - Deferred Domestic | -180 | 192 | 13 | -14 | - |

| Income Tax - Deferred Foreign | -7 | -1 | -57 | -22 | - |

| Consolidated Net Income | -3460 | 2915 | 320 | -125 | -65 |

| Minority Interest Expense | - | - | - | - | - |

| Net Income | -3460 | 2915 | 320 | -125 | -65 |

| Net Income Growth | -2.1872 | 8.1223 | 3.5593 | -0.9339 | - |

| Net Margin | -0.6179 | - | - | - | - |

| Net Income After Extraordinaries | -3460 | 2915 | 320 | -125 | -65 |

| Net Income Available to Common | -3460 | 2915 | 320 | -125 | -65 |

| EPS (Basic) | -2.73 | 2.34 | 0.27 | -0.11 | -0.06 |

| EPS (Basic) Growth | -2.1688 | 7.7504 | 3.4181 | -0.8085 | - |

| Basic Shares Outstanding | 1266 | 1247 | 1196 | 1130 | 1057 |

| EPS (Diluted) | -2.73 | 2.29 | 0.26 | -0.11 | -0.06 |

| EPS (Diluted) Growth | -2.1942 | 7.8429 | 3.343 | -0.8081 | - |

| Diluted Shares Outstanding | 1266 | 1274 | 1235 | 1130 | 1057 |

| EBITDA | -574 | 394 | 199 | -100 | -61 |

| EBITDA Growth | -2.4566 | 0.9766 | 2.9861 | -0.6525 | - |

| EBITDA Margin | -0.1024 | - | - | - | - |

| EBIT | -664 | 328 | 129 | -136 | -88 |

Balance Sheet edit edit source

| Fiscal year is January-December. All values USD Millions. | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Net Income before Extraordinaries | - | - | - | - | - |

| Cash & Short Term Investments | 5053 | 7768 | 6388 | 2455 | 1970 |

| Cash Only | 1649 | 2503 | 2704 | 650 | 411 |

| Cash & Short Term Investments Growth | -0.3495 | 0.2161 | 1.6018 | 0.2465 | - |

| Cash & ST Investments / Total Assets | 0.4697 | 0.5823 | 0.8229 | 0.7036 | 0.8719 |

| Total Accounts Receivable | 858 | 668 | 422 | 241 | 133 |

| Accounts Receivables, Net | 203 | 127 | 64 | 41 | 24 |

| Accounts Receivables, Gross | 288 | 175 | 87 | 54 | 27 |

| Bad Debt/Doubtful Accounts | -85 | -48 | -24 | -12 | -3 |

| Other Receivables | 655 | 541 | 358 | 199 | 109 |

| Accounts Receivable Growth | 0.2843 | 0.5845 | 0.7513 | 0.8068 | - |

| Accounts Receivable Turnover | 6.53 | 6.9 | 6.95 | 6.56 | 8.06 |

| Other Current Assets | 113 | 103 | 68 | 49 | 26 |

| Prepaid Expenses | 48 | 50 | 25 | 21 | 13 |

| Miscellaneous Current Assets | 65 | 53 | 43 | 28 | 13 |

| Total Current Assets | 6023 | 8539 | 6878 | 2745 | 2129 |

| Net Property, Plant & Equipment | 486 | 302 | 211 | 246 | 62 |

| Property, Plant & Equipment - Gross | 640 | 402 | 311 | 292 | 92 |

| Computer Software and Equipment | 40 | 24 | 24 | 18 | 14 |

| Other Property, Plant & Equipment | 225 | 181 | 167 | 140 | 77 |

| Accumulated Depreciation | 154 | 100 | 100 | 46 | 30 |

| Machinery & Equipment | 0 | - | - | - | - |

| Computer Software and Equipment | 17 | 15 | 15 | 11 | 8 |

| Other Property, Plant & Equipment | 136 | 85 | 85 | 35 | 23 |

| Total Investments and Advances | 1953 | 3956 | 173 | - | - |

| Other Long-Term Investments | 1953 | 3956 | 173 | - | - |

| Intangible Assets | 2226 | 495 | 448 | 479 | 64 |

| Net Goodwill | 1836 | 357 | 312 | 312 | 38 |

| Net Other Intangibles | 390 | 138 | 136 | 167 | 26 |

| Other Assets | 27 | - | - | - | - |

| Deferred Charges | 27 | - | - | - | - |

| Total Assets | 10757 | 13340 | 7763 | 3489 | 2259 |

| Assets - Total - Growth | -0.1936 | 0.7185 | 1.2247 | 0.5447 | - |

| Asset Turnover | 0.46 | - | - | - | - |

| Return On Average Assets | -0.2872 | - | - | - | - |

| All values USD Millions. | 2022 | 2021 | 2020 | 2019 | 2018 |

| ST Debt & Current Portion LT Debt | 18 | 16 | 10 | 9 | - |

| Short Term Debt | 18 | 16 | 10 | 9 | - |

| Accounts Payable | 364 | 284 | 169 | 91 | 61 |

| Accounts Payable Growth | 0.2809 | 0.6833 | 0.864 | 0.4773 | - |

| Income Tax Payable | 57 | 80 | 74 | 121 | - |

| Other Current Liabilities | 417 | 323 | 186 | 95 | 77 |

| Accrued Payroll | 68 | 72 | 62 | 32 | 14 |

| Miscellaneous Current Liabilities | 349 | 251 | 124 | 63 | 63 |

| Total Current Liabilities | 856 | 703 | 438 | 316 | 139 |

| Total Current Assets FOR CALCULATION PURPOSES ONLY | 6023 | 8539 | 6878 | 2745 | 2129 |

| Total Assets FOR CALCULATION PURPOSES ONLY | 10757 | 13340 | 7763 | 3489 | 2259 |

| Inventories FOR CALCULATION PURPOSES ONLY | - | - | - | - | - |

| Cash & Short Term Investments FOR CALCULATION PURPOSES ONLY | 5053 | 7768 | 6388 | 2455 | 1970 |

| Current Ratio | 7.04 | 12.15 | 15.69 | 8.68 | 15.35 |

| Quick Ratio | 7.04 | 12.15 | 15.69 | 8.68 | 15.35 |

| Cash Ratio | 5.9 | 11.05 | 14.57 | 7.76 | 14.2 |

| Long-Term Debt | 1378 | 1158 | 903 | 143 | - |

| Long-Term Debt excl. Capitalized Leases | 913 | 911 | 758 | - | - |

| Non-Convertible Debt | 913 | 911 | 758 | - | - |

| Deferred Taxes | -25 | 135 | -53 | -11 | 1 |

| Deferred Taxes - Credit | 16 | 183 | - | 9 | 5 |

| Deferred Taxes - Debit | 41 | 48 | 53 | 19 | 4 |

| Other Liabilities | 268 | 163 | 21 | 6 | 24 |

| Deferred Tax Liability-Untaxed Reserves | - | - | - | - | - |

| Other Liabilities (excl. Deferred Income) | - | - | - | - | 22 |

| Deferred Income | 268 | 163 | 21 | 6 | 2 |

| Total Liabilities | 2518 | 2207 | 1362 | 474 | 168 |

| Non-Equity Reserves | - | - | - | - | - |

| Total Liabilities / Total Assets | 0.2341 | 0.1654 | 0.1755 | 0.1358 | 0.0745 |

| Common Equity (Total) | 8239 | 11133 | 6401 | 3016 | 2091 |

| Common Stock Par/Carry Value | 8747 | 8040 | 6115 | 3256 | 2216 |

| Additional Paid-In Capital/Capital Surplus | 30 | 161 | 261 | 63 | 75 |

| Retained Earnings | -522 | 2938 | 15 | -304 | -188 |

| Other Appropriated Reserves | -16 | -6 | 9 | 1 | -12 |

| Common Equity / Total Assets | 0.7659 | 0.8346 | 0.8245 | 0.8642 | 0.9255 |

| Total Shareholders' Equity | 8239 | 11133 | 6401 | 3016 | 2091 |

| Total Shareholders' Equity / Total Assets | 0.7659 | 0.8346 | 0.8245 | 0.8642 | 0.9255 |

| Total Equity | 8239 | 11133 | 6401 | 3016 | 2091 |

| Liabilities & Shareholders' Equity | 10757 | 13340 | 7763 | 3489 | 2259 |

Cash flow statement edit edit source

| Fiscal year is January-December. All values USD Thousands. | 2022 | 2021 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|

| Net Income before Extraordinaries | -3460418 | 2914659 | 319509 | -124842 | -64553 |

| Net Income Growth | -2.1872 | 8.1223 | 3.5593 | -0.9339 | - |

| Depreciation, Depletion & Amortization | 90520 | 66308 | 70060 | 35651 | 27052 |

| Depreciation and Depletion | 36172 | 41828 | 38192 | 16779 | - |

| Amortization of Intangible Assets | 54348 | 24480 | 31868 | 18872 | - |

| Deferred Taxes & Investment Tax Credit | -186571 | 190963 | -41998 | -37918 | - |

| Deferred Taxes | -186571 | 190963 | -41998 | -37918 | - |

| Investment Tax Credit | - | - | - | - | - |

| Other Funds | 3518292 | -2506578 | 177719 | 177549 | 102914 |

| Funds from Operations | -38177 | 665352 | 525290 | 50440 | 65413 |

| Extraordinaries | - | - | - | - | - |

| Changes in Working Capital | -98271 | -160924 | -100332 | 20175 | -56089 |

| Receivables | -127908 | -338377 | -141867 | -130392 | -83343 |

| Inventories | - | - | - | - | - |

| Accounts Payable | 36541 | 138175 | 118588 | 84563 | 20641 |

| Income Taxes Payable | -3941 | 45263 | -105890 | 64648 | - |

| Other Accruals | - | - | - | - | - |

| Other Assets/Liabilities | -2963 | -5985 | 28837 | 1356 | 6613 |

| Net Operating Cash Flow | -136448 | 504428 | 424958 | 70615 | 9324 |

| Net Operating Cash Flow Growth | -1.2705 | 0.187 | 5.018 | 6.5735 | - |

| Net Operating Cash Flow / Sales | -0.0244 | 0.1094 | 0.1451 | 0.0447 | 0.0087 |

| All values USD Thousands. | 2022 | 2021 | 2020 | 2019 | 2018 |

| Capital Expenditures | -50018 | -50788 | -41995 | -62397 | -41545 |

| Capital Expenditures (Fixed Assets) | -50018 | -50788 | -41733 | -56759 | -27950 |

| Capital Expenditures (Other Assets) | - | - | -262 | -5638 | -13595 |

| Capital Expenditures Growth | 0.0152 | -0.2094 | 0.327 | -0.5019 | - |

| Capital Expenditures / Sales | -0.0089 | -0.011 | -0.0143 | -0.0395 | -0.0387 |

| Net Assets from Acquisitions | -1753748 | -59627 | - | -265512 | -19397 |

| Sale of Fixed Assets & Businesses | - | - | - | - | - |

| Purchase/Sale of Investments | 1243882 | -2237375 | -1889853 | -241566 | -749691 |

| Purchase of Investments | -5646285 | -7987599 | -5611258 | -2718604 | -2447955 |

| Sale/Maturity of Investments | 6890167 | 5750224 | 3721405 | 2477038 | 1698264 |

| Other Uses | -525538 | - | - | - | - |

| Other Sources | 366855 | - | - | - | - |

| Net Investing Cash Flow | -718567 | -2347790 | -1931848 | -569475 | -810633 |

| Net Investing Cash Flow Growth | 0.6939 | -0.2153 | -2.3923 | 0.2975 | - |

| Net Investing Cash Flow / Sales | -0.1283 | -0.5091 | -0.6594 | -0.3608 | -0.7553 |

| All values USD Thousands. | 2022 | 2021 | 2020 | 2019 | 2018 |

| Change in Capital Stock | 17549 | 1649762 | 2649400 | 736351 | 1072182 |

| Repurchase of Common & Preferred Stk. | - | - | - | - | - |

| Sale of Common & Preferred Stock | 17549 | 1649762 | 2649400 | 736351 | 1072182 |

| Proceeds from Stock Options | - | 1541168 | 2578591 | 688014 | 1041688 |

| Other Proceeds from Sale of Stock | 17549 | 108594 | 70809 | 48337 | 30494 |

| Issuance/Reduction of Debt, Net | - | - | 907950 | - | - |

| Change in Current Debt | - | - | - | - | - |

| Change in Long-Term Debt | - | - | 907950 | - | - |

| Issuance of Long-Term Debt | - | - | 907950 | - | - |

| Net Financing Cash Flow | 17549 | 1649762 | 3557350 | 736351 | 1072182 |

| Net Financing Cash Flow Growth | -0.9894 | -0.5362 | 3.8311 | -0.3132 | - |

| Net Financing Cash Flow / Sales | 0.0031 | 0.3577 | 1.2143 | 0.4666 | 0.999 |

| Exchange Rate Effect | -16198 | -7005 | 3221 | 1742 | -1867 |

| Miscellaneous Funds | - | - | - | - | - |

| Net Change in Cash | -853664 | -200605 | 2053681 | 239233 | 269006 |

| Free Cash Flow | -186466 | 453640 | 383225 | 13856 | -18626 |

| Free Cash Flow Growth | -1.411 | 0.1837 | 26.6577 | 1.7439 | - |

| Free Cash Flow Yield | -0.0042 | - | - | - | - |

Key Ratios edit edit source

| Year | Current | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

| 83,120 | 44,152 | 1,72,966 | 1,37,999 | 45,858 | 14,810 | 10,027 | 3,813 | 1,965 | |

| Market Cap Growth | - | -74.47% | 25.34% | 200.92% | 209.65% | 47.71% | 162.98% | 94.04% | - |

| Enterprise Value | 78,693 | 40,495 | 1,66,371 | 1,32,523 | 43,555 | 12,865 | 9,088 | 3,420 | 1,775 |

| PE Ratio | -31.87 | -12.76 | 59.34 | 431.91 | -367.33 | -229.42 | -250.69 | -107.84 | -104.57 |

| PS Ratio | 14.02 | 7.88 | 37.51 | 47.11 | 29.06 | 13.8 | 14.89 | 9.79 | 9.57 |

| PB Ratio | 9.79 | 5.36 | 15.54 | 21.56 | 15.21 | 7.08 | 10.02 | 9.29 | 10.06 |

| EV/Sales Ratio | 13.33 | 7.23 | 36.07 | 45.24 | 27.6 | 11.99 | 13.5 | 8.79 | 8.65 |

| EV/EBITDA Ratio | -31.89 | -11.48 | 51.82 | 414.77 | -723.93 | -343.06 | -547.07 | -159.92 | -153.6 |

| EV/EBIT Ratio | -30.16 | -11.19 | 52.92 | 531.26 | -454.57 | -199.29 | -227.24 | -96.74 | -94.45 |

| EV/FCF Ratio | -1841.91 | -217.17 | 343.09 | 346.05 | 5299.92 | -399.28 | -555.5 | -279.92 | -336.12 |

| Debt / Equity Ratio | 0.17 | 0.17 | 0.11 | 0.14 | 0.05 | 0.01 | - | - | - |

| Asset Turnover | 0.54 | 0.5 | 0.37 | 0.49 | 0.55 | 0.56 | 0.71 | 1.06 | 1.21 |

| Interest Coverage | -720.52 | -1034.4 | 900.11 | 27.46 | - | - | - | - | - |

| Return on Equity (ROE) | -22.50% | -39.10% | 27.90% | 6.30% | -4.90% | -3.70% | -4.70% | -11.80% | -14.30% |

| Return on Assets (ROA) | -17.60% | -31.10% | 23.50% | 5.40% | -4.30% | -3.40% | -4.20% | -9.60% | -11.10% |

| Return on Capital (ROIC) | -25.00% | -45.00% | 31.40% | 7.10% | -5.10% | -4.40% | -5.80% | -18.40% | -32.20% |

Valuation edit edit source

| DCF | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1,073 | 1,578 | 2,929 | 4,612 | 5,600 | 8,562 | 13,090 | 20,014 | 30,599 | 46,783 | |

| % growth | - | 47.06% | 85.61% | 57.46% | 21.42% | 52.89% | 52.89% | 52.89% | 52.89% | 52.89% | |

| 0 | 0 | 0 | 0 | 0 | |||||||

| EBIT | -88 | -136 | 129 | 328 | -664 | 347 | 367 | 388 | 410 | 434 | |

| % margin | -8.20% | -8.62% | 4.40% | 7.11% | -11.86% | 5.76% | 5.76% | 5.76% | 5.76% | 5.76% | |

| 0 | 0 | 0 | 0 | 0 | |||||||

| Taxes | 0 | 29 | -79 | 226 | -162 | 231 | 235 | 240 | 245 | 250 | |

| % of EBIT | 0.00% | -21.32% | -61.24% | 68.90% | 24.40% | 2.00% | 2.00% | 2.00% | 2.00% | 2.00% | |

| 0 | 0 | 0 | 0 | 0 | |||||||

| EBIAT | -88 | -165 | 208 | 102 | -502 | 116 | 132 | 148 | 166 | 184 | |

| D&A | 27 | 36 | 70 | 66 | 91 | 93 | 95 | 96 | 98 | 100 | |

| % of sales | 2.52% | 2.28% | 2.39% | 1.43% | 1.63% | 1.93% | 1.93% | 1.93% | 1.93% | 1.93% | |

| 0 | 0 | 0 | 0 | 0 | |||||||

| Capex | -42 | -62 | -42 | -51 | -50 | (49) | (48) | (47) | (46) | (46) | |

| % of slaes | -3.87% | -3.93% | -1.43% | -1.11% | -0.89% | -1.84% | -1.84% | -1.84% | -1.84% | -1.84% | |

| 0 | 0 | 0 | 0 | 0 | |||||||

| Changes in NWC | -56 | -20 | -100 | -161 | (199) | (304) | (464) | (710) | (1,085) | ||

| % of sales | -3.55% | -0.68% | -2.17% | -2.88% | -2.32% | -2.32% | -2.32% | -2.32% | -2.32% | ||

| Unlevered FCF | -135 | 256 | 217 | -300 | 359 | 482 | 661 | 927 | 1,324 | ||

| Year count | 0.52 | 1.52 | 2.52 | 3.52 | 4.52 | ||||||

| Discount factor | 0.94 | 0.82 | 0.72 | 0.64 | 0.56 | TV | |||||

| Present value of FCF | 335 | 396 | 479 | 591 | 742 | 7988.051624 |

| WACC | |

| Risk free rate (5 year US Bond) | 4.17% |

|---|---|

| Market risk premium | 4.72% |

| Levered beta | 2.043 |

| Cost of equity | 13.81% |

| Cost of debt | 4.72% |

| Share price | 65.02 |

| Shares outstanding (latest reported) | 1,266.27 |

| Market capitalization | 82332 |

| Total debt | 1396 |

| Total capital | 83728 |

| % debt capital | 1.67% |

| % equity capital | 98.33% |

| Internally calculated WACC | 13.66% |

| Terminal growth rate | 4% |

| % of EV | ||

|---|---|---|

| Present vale of FCF | 2544 | 24.15% |

| Present value of TV | 7988 | 75.85% |

| Enterprise value | 10,532 | |

| (-) Net Debt | -252.00 | |

| Equity Value | 10784 | |

| Shares | 1,266 | |

| Share Price | 8.52 | |

| Current Share Price | 65.02 |

Sensitivity Analysis edit edit source

| WACC | ||||||||

|---|---|---|---|---|---|---|---|---|

| 8.516 | 12.00% | 12.50% | 13.00% | 13.66% | 14.00% | 14.50% | 15.00% | |

| 2.5% | $ 9.054 | $ 8.561 | $ 8.116 | $ 7.590 | $ 7.344 | $ 7.007 | $ 6.698 | |

| Terminal | 3.0% | $ 9.465 | $ 8.925 | $ 8.440 | $ 7.870 | $ 7.604 | $ 7.242 | $ 6.911 |

| Growth | 3.5% | $ 9.923 | $ 9.328 | $ 8.797 | $ 8.178 | $ 7.890 | $ 7.499 | $ 7.143 |

| Rate | 4.0% | $ 10.439 | $ 9.780 | $ 9.195 | $ 8.517 | $ 8.204 | $ 7.780 | $ 7.396 |

| 4.5% | $ 11.023 | $ 10.288 | $ 9.639 | $ 8.894 | $ 8.551 | $ 8.089 | $ 7.672 | |

| 5.0% | $ 11.692 | $ 10.863 | $ 10.139 | $ 9.314 | $ 8.936 | $ 8.431 | $ 7.977 |

Comparables edit edit source

| SHOP | SNOW | MDB | VRSN | NET | AKAM | |

| Company Name | Shopify Inc. | Snowflake Inc. | MongoDB, Inc. | VeriSign, Inc. | Cloudflare, Inc. | Akamai Technologies, Inc. |

| Industry | Internet Services and Infrastructure | Internet Services and Infrastructure | Internet Services and Infrastructure | Internet Services and Infrastructure | Internet Services and Infrastructure | Internet Services and Infrastructure |

| Price | 66.17 | 174.8 | 410.58 | 211.88 | 65.39 | 92.8 |

| Market Cap | 84.00B | 57.33B | 28.92B | 22.27B | 22.10B | 14.06B |

| Enterprise Value | 80.54B | 52.56B | 28.25B | 23.04B | 21.96B | 16.24B |

| Revenue | 5.90B | 2.27B | 1.37B | 1.44B | 1.05B | 3.63B |

| Revenue Growth (YoY) | 22.30% | 60.46% | 39.82% | 6.77% | 44.17% | 3.02% |

| Revenue Per Share | 4.65 | 7.06 | 19.74 | 13.53 | 3.21 | 22.98 |

| ROE | -21.03% | -15.95% | -44.00% | NM | -32.55% | 11.51% |

| ROA | -8.25% | -12.47% | -13.45% | 42.00% | -8.11% | 6.70% |

| Price/Sales | 14.23 | 24.76 | 20.80 | 15.66 | 20.37 | 4.04 |

Corporate Strategy edit edit source

Ecosystem Development edit edit source

Shopify has built an extensive ecosystem beyond its core e-commerce platform, integrating various apps, plugins, and third-party solutions. This approach enables merchants to customize their online stores with ease and access specialized functionalities. Moreover, Shopify's ecosystem fosters a vibrant community of developers, partners, and experts who contribute to the platform's growth and innovation. This mutually beneficial approach enhances Shopify's appeal to customers and strengthens its position in the market.

International Expansion edit edit source

Global expansion constitutes a vital element of Shopify's corporate strategy. The company actively seeks opportunities to expand its services and products into new markets. By enabling multi-currency transactions, offering localized language support, and complying with regional regulations, Shopify empowers merchants worldwide to engage in cross-border commerce. This international focus not only opens new revenue streams but also diversifies risks associated with regional market fluctuations.

Acquisitions and Strategic Partnerships edit edit source

To maintain its competitive edge and stay at the forefront of e-commerce innovation, Shopify pursues strategic acquisitions and partnerships. Integrating cutting-edge technologies and talented teams, Shopify enhances its offerings and keeps abreast of market trends. These collaborations enable the company to introduce new features and tools to its platform more rapidly, benefiting both Shopify and its customers.

Embracing New Sales Channels edit edit source

Recognising the ever-changing e-commerce landscape, Shopify embraces new sales channels to empower merchants with omnichannel capabilities. Integrations with social media platforms, marketplaces, and in-person point-of-sale systems enable merchants to broaden their reach and enhance customer engagement. This adaptability ensures Shopify remains a relevant and invaluable partner for businesses seeking to thrive in the digital age.

Shopify's corporate strategy centre around empowering entrepreneurs and businesses in the e-commerce space. Through its customer-centric approach, platform diversification, ecosystem development, international expansion, strategic acquisitions, and integration of new sales channels, it has solidified its position as a leading e-commerce platform. Hence, Shopify's coherent and adaptable strategy positions it for long-term success in the dynamic and competitive world of e-commerce. With a robust foundation, a thriving ecosystem, and a history of consistent growth, Shopify appears well-positioned to deliver value to its stakeholders and capitalise on the ever-growing e-commerce market.

ESG Factors edit edit source

Environmental edit edit source

Carbon neutral since inception

• Shopify has purchased carbon offsets to cover the entire operational footprint

Renewable-powered home offices

• Shopify purchased renewable energy certificates for their office buildings and employee home-office electricity use around the world

Carbon-neutral platform

• The platform runs entirely on Google Cloud, which means merchants’ online stores are powered by renewable energy

Carbon-neutral corporate travel

• Shopify has purchased carbon removal for all corporate travel

Social[6] edit edit source

- Shopify exists to lower the barriers to business ownership for entrepreneurs of all ages and backgrounds. We support the entire entrepreneurial journey—from discovery and development to growth and success.

- But we know the playing field is far from level. Socioeconomics, race, and gender are just a few of the factors affecting who can participate and how.

- Our merchant education and equitable entrepreneurship programs are designed to improve accessibility, instill an innovation mindset, and empower business owners to thrive. We believe entrepreneurship is an opportunity for everybody—and the future of commerce should be as diverse as it is bright.

Governance edit edit source

- As a merchant-first, product-centered, mission-driven company, the core values of entrepreneurship are at the heart of our culture. We foster this spirit of entrepreneurship within the Shopify community by encouraging creativity, diverse perspectives, and bold innovation.

- By recruiting, developing, and supporting a diverse workforce that reflects the Shopify ecosystem, and by fostering a healthy work-life balance, we’re creating space where our employees can show up as their authentic and best selves.

Investment Thesis edit edit source

Strengths edit edit source

- Wide Market Reach: Shopify serves businesses of all sizes, from small and medium-sized enterprises to large corporations, enabling the company to tap into a vast and diverse customer base.

- Innovative Ecosystem and Partnerships: The Shopify ecosystem benefits from a vibrant community of developers, designers, and third-party app providers, fostering continuous innovation and expanding the platform's functionality.

- User-Friendly Platform: Shopify's user-friendly interface and intuitive design allow merchants with limited technical expertise to set up and manage their online stores easily.

- Scalability and Customization: The platform is highly scalable, enabling businesses to grow and adapt to changing needs while offering a wide array of customization options to create unique online shopping experiences.

- Strong Financial Performance: Shopify has exhibited consistent revenue growth and impressive financial results, driven by an expanding merchant base and increased average revenue per user. Its subscription-based business model, coupled with transaction and payment processing fees, provides a diversified revenue stream.

- Global Market Presence: Shopify has a strong international presence, enabling merchants to operate in multiple countries and currencies. As e-commerce adoption continues to grow worldwide, Shopify is well-positioned to benefit from global market expansion.

- Expanding Merchant Base: The company has had successful continuous efforts to expand its merchant base, attracting new entrepreneurs and established brands. As the e-commerce market grows, Shopify will benefit from a broader customer base.

Challenges edit edit source

- Intense Competition: The e-commerce market is highly competitive, with established players and new entrants vying for market share. Shopify faces competition from platforms like WooCommerce, BigCommerce, and Wix.

- Reliance on Third-Party Partners: While the developer ecosystem is a strength, it also poses a risk as the quality and reliability of third-party apps and services can impact the user experience.

- Regulatory and Compliance Risks: As the company expands globally, it must navigate varying regulatory environments and compliance requirements, especially concerning data protection, taxation and payment processing, which could add complexities and costs.

- Margin Pressure: As Shopify expands its services and offerings, it may face margin pressure due to increased operating costs.

- Market Saturation: While e-commerce continues to grow, there might be limitations on the number of merchants entering the market or switching platforms. As the market matures, Shopify might experience slower growth rates and increased competition for market share.