Shoprite Holdings Limited

| Type | Public |

|---|---|

| JSE:SHP | |

| Industry | Retail |

| Founded | 1979 |

| Headquarters | Brackenfell, Western Cape , South Africa |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 152 000 (2023) |

| Website | https://www.shopriteholdings.co.za |

Summary edit edit source

Business Description edit edit source

Shoprite Holdings Limited, an investment holding company, primarily engages in the food retailing business in South Africa and internationally. The company operates through four segments: Supermarkets RSA, Supermarkets Non-RSA, Furniture, and Other Operating segments. It also offers clothing, general merchandise, cosmetic, and liquor products; furniture, home entertainment, and floor covering products; and liquors, electrical and household appliances, and soft furnishings. In addition, the company distributes various pharmaceutical products and surgical equipment to pharmacies, hospitals, clinics, dispensing doctors, and veterinary surgeons. As of July 04, 2021, it operated 2,913 stores under the Shoprite, Shoprite Hyper, Checkers, Checkers Hyper, Usave, Shoprite LiquorShop, Checkers LiquorShop, House & Home, OK Furniture & Power Express, MediRite Pharmacy, TransPharm, Computicket, Computicket Travel, Checkers Food Services, Freshmark, k'nect, OK Foods, OK Grocer, OK MiniMark, OK Express, Sentra, OK Liquor, and Megasave brands. Further, the company provides ticketing, and car rental and accommodation services; stadium management, capacity management, travel management, and access control solutions; and short-term insurance and treasury management services. Shoprite Holdings Limited was founded in 1979 and is based in Brackenfell, South Africa.

Shoprite Holdings Limited is listed on the Johannesburg Stock Exchange (JSE), the Namibian Stock Exchange (NSX) and the Lusaka Securities Exchange (LUSE). Additionally, Shoprite Holdings recently announced that it will be listed on a secondary South African stock exchange (the A2X) from Tuesday 11 April 2023. Its primary listing (that will be the basis of this investment report) is on the JSE where it carries the ticker symbol “SHP”. Shoprite is listed on the JSE under the “Food Retailers and Wholesalers” sector and the “Consumer Staples” industry. As of 2 August 2023, the current stock price of Shoprite is 258.68 ZAR and the market capitalization is around141.76 billion ZAR. Shoprite is part of the JSE Top 40 Index and is identified as a liquid stock that has a high trading volume.

Industry Overview and Competitive Positioning edit edit source

Shoprite belongs to the retail industry, specifically in the food retailer and wholesalers sector. This industry, which is highly competitive and dynamic, is driven by changing consumer preferences and technological advancements. Shoprite has addressed the industry dynamic of ever changing consumer preferences by continuously launching new products to retain existing clientele and attract new customers (particularly higher-income customers). In 2022, they launched 1 285 new products and five new store formats with the intention of growing their market share in the premium food retailer sector. In terms of technological advancements, Shoprite is at the forefront and the industry leader. This is evident when looking at the success of their digital commerce platform, called Checkers Sixty60. This was South Africa’s first on-demand grocery delivery service and has achieved a 75% share of the grocery delivery market.

Porter's Five Forces edit edit source

The “Porter's Five Forces” framework is used below to analyse the competitive intensity and attractiveness of the retail industry in which Shoprite operates in.

- Threat of new entrants: The retail industry has a low to moderate threat of new entrants. Barriers to entry include high capital requirements, economies of scale, and established distribution networks. However, online retailers such as “Takealot” as well as pharmacies such as “Dis-Chem” have increased their food product offerings and are disrupting traditional food retailers.

- Bargaining power of suppliers: The bargaining power of suppliers in the retail industry is moderate to high. Retailers depend on suppliers for product availability and quality. However, retailers may be able to negotiate lower prices by consolidating their purchasing power or by developing their own private-label brands. Shoprite being the market share leader inherently has considerable purchasing power as well as its own private-label brands.

- Bargaining power of buyers: The bargaining power of buyers in the retail industry is high. Consumers have numerous options for where to shop and are price-sensitive. By focussing on offering customers great value on high quality products, Shoprite has been able to attract and retain buyers as is evident by their 5.4% increase in average basket size.

- Threat of substitutes: The threat of substitutes in the retail industry is high. Consumers have numerous options for where to shop, including traditional brick-and-mortar stores, e-commerce platforms, and discount retailers. Shoprite has been able to retain its customers through its innovative digital commerce platform and increased product offerings.

- Competitive rivalry: Competitive rivalry in the retail industry is high. There are numerous players operating in the industry (such as Pick n Pay, Woolworths and Spar). Pick n Pay has recently posed a threat to Shoprite with its increased openings of its Boxer stores which aim to gain a larger portion of the lower-income market which Shoprite has dominated. Shoprite has however been able to maintain its market leadership position in South Africa, by being the largest retailer in terms of market capitalisation, sales and profit. Shoprite has even grown its market share to 32.1% in 2022. This was possible due to its industry leading digital commerce platform and the acquisition of the “Cambridge Food and Massfresh” businesses as well as the “Masscash Cash & Carry” assets.

The food retail industry is defensive and is thus able to be successful during this challenging economic environment. Even with the supply chain constraints and increased cost of food brought on by loadshedding, high unemployment and the Russian invasion of Ukraine; people will still need to buy food and therefore the food retail industry can be successful. Additionally, Shoprite within the retail industry can be successful as a result of its competitive advantages in its digital commerce platform, its considerable purchasing power, and its increasing product offerings as discussed above.

Valuation edit edit source

Unlevered Free Cash Flows edit edit source

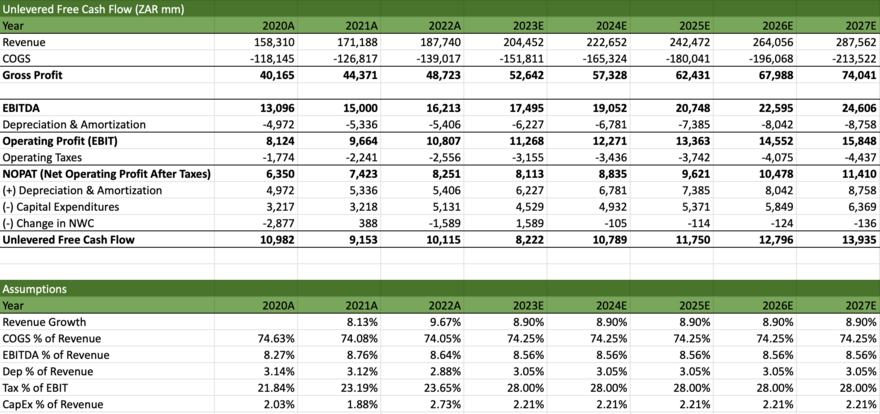

Some key assumptions were made for forecasting these line items from 2023 onwards. Revenue was grown at the 3-year historical average growth rate (8.90%). COGS (74.25%), EBITDA (8.56%), depreciation (3.05%) and capital expenditure (2.21%), were all forecasted at a 3-year average percentage of revenue. Tax was estimated as a percentage of EBIT and was thereafter forecasted at 28%, being the prevailing effective tax rate in South Africa.

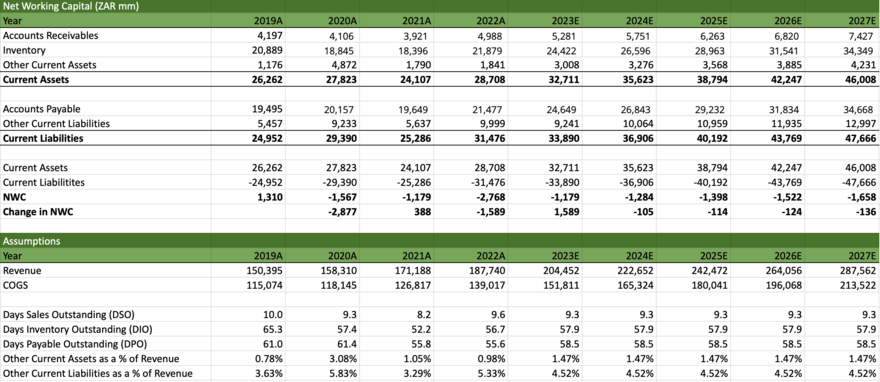

With respect to calculating Net Working Capital (NWC), Accounts Receivables was forecasted at a 4-year average percentage of Days Sales Outstanding (9.3). Inventory was forecasted at a 4-year average percentage of Days Inventory Outstanding (57.9). Accounts Payable was forecasted at a 4-year average percentage of Days Payable Outstanding (58.5). Other Current Assets (1.47%) as well as Other Current Liabilities (4.52%) were all forecasted at a 4-year average percentage of revenue. Thereafter, Current Assets and Current Liabilities were determined for each year, with their difference representing the NWC for each year. These NWC figures were then used to determine the Change in NWC from year to year.

Discounted Free Cash Flows edit edit source

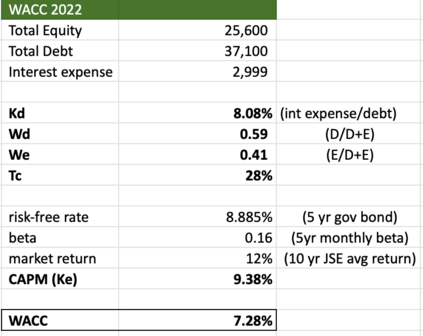

The weighted average cost of capital (WACC) is used as the discount rate in the DCF model, as free cash flows to the firm (FCFF) are used to calculate the enterprise value of the firm. The cost of equity (9.38%) was calculated using the capital asset pricing model (CAPM). The risk-free rate (8.885%) was assumed to be the 10-year treasury bond rate as it is considered to carry less risk than South African bonds. The beta (0.16) is the 5-year monthly historical beta of Shoprite. The market return (12%) is taken to be the 10-year average return of the JSE, where Shoprite is listed. The cost of debt (8.08%) is estimated as interest expense divided by total debt, as actual cost of debt was not found to be explicitly stated in the company’s report.

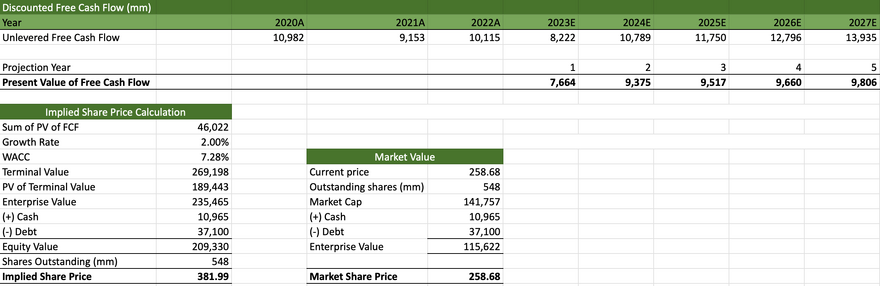

Having completed a forecast and calculated the WACC, the DCF method was implemented to arrive at an enterprise value of 235 465 000 000 ZAR. The terminal value was calculated using a perpetual growth rate of 2%, which is estimated to be in line with South Africa’s future GDP growth rate. After discounting the cash flows using the WACC and arriving at an enterprise value, an equity value of 209 330 000 000 ZAR was then estimated. Thereafter, an implied share price of 381.99 ZAR was calculated by dividing the equity value by the number of shares outstanding (548 million shares). Based on this valuation and relative to the actual share price of 258.68 ZAR, Shoprite would be viewed as being undervalued and a buy recommendation would be issued.

Risks edit edit source

Shoprite faces a variety of risks that could potentially impact its financial performance and operations on a day-to-day basis. Shoprite conducts its primary operations in South Africa and thus faces the challenges of loadshedding. Loadshedding is an energy crisis currently faced by South Africa whereby the country experiences nationwide rolling blackouts on a daily basis. The threat of no electricity inhibits some of Shoprite's operations. For instance, this renders some key IT systems unavailable. To manage this risk, Shoprite has implemented data recovery methods as well as increasing its investment in alternate energy sources such as solar power, generators and inverters. Another core risk faced by Shoprite are the breakdowns or interruptions in the supply chain. Supply chain interruptions, such as the Russian invasion of Ukraine or loadshedding, mean that Shoprite is unable to fully satisfy their customers’ demands. Shoprite manages this risk by implementing business continuity plans, such as opening certain locations along the supply chain, so as to ensure an uninterrupted supply of goods.

Lastly, Shoprite belongs to the food retail industry, which is largely a defensive industry. This means that the risks associated with changes in the macroeconomic environment (such as changes inflation and unemployment) are to some extent mitigated due to the nature of the industry. For example, during challenging economic times, individuals may have less disposable income for luxury goods but will still need to purchase necessary items from the food retail industry. This is illustrated by Shoprite’s ability to maintain its gross margins during the recent challenging economic conditions. Therefore, although there are several risks that pose a threat to the food retail industry, Shoprite displays and ability to manage these risks and remains a buy recommendation.

Conclusion edit edit source

After conducting the above report analysis, Shoprite is identified as a buy recommendation at its current market price. This is because Shoprite, as the leading retailer by market share in the industry, is continuing to grow its market share through acquisitions of retail businesses, launching new products as well as due to the success of its digital commerce platform. Additionally, the DCF valuation identified Shoprite as being undervalued and thus a buy recommendation as of 2 August 2023. Lastly, Shoprite's risks were analysed during these challenging economic times. Risks such as supply chain constraints and unavailability of key systems were identified as potential threats. However, Shoprite demonstrated an effective management to mitigate these risks and thus retained its buy recommendation.

Potential Limitations edit edit source

The report suggests that Shoprite is undervalued and is thus a buy investment recommendation. However, this recommendation is based on a variety of assumptions. For instance, when forecasting for the DCF valuation, revenue was grown at the 3-year historical average growth rate. A historic growth rate may not be ideal (particularly one based on COVID years) and instead a growth rate based on a combination of food inflation and GDP could be more appropriate. There are many of these assumptions related to the forecasted line items and discount rates used when conducting the DCF valuation. It is also worth noting that the calculations, results and ratios are based on Shoprite’s audited 2022 financial report and therefore may have some limitations in their 2023 predictive ability and analysis.