Sienna Sauce

Live, Love, Sauce It Up!

Summary edit edit source

- Young black female founder

- Featured on Shark Tank in February 2021 with offer from Kendra Scott

- B2B partnerships with FedEx, Verizon and Neiman Marcus

- $650K in projected revenue by end of 2021, which is 5x of 2020 revenue

- Retailing at HEB, Wegmans and other national chains

- Disrupting the $37.7B sauce market

Problem edit edit source

Condiments and sauces should add flavor, not unwanted salt and added sugar edit edit source

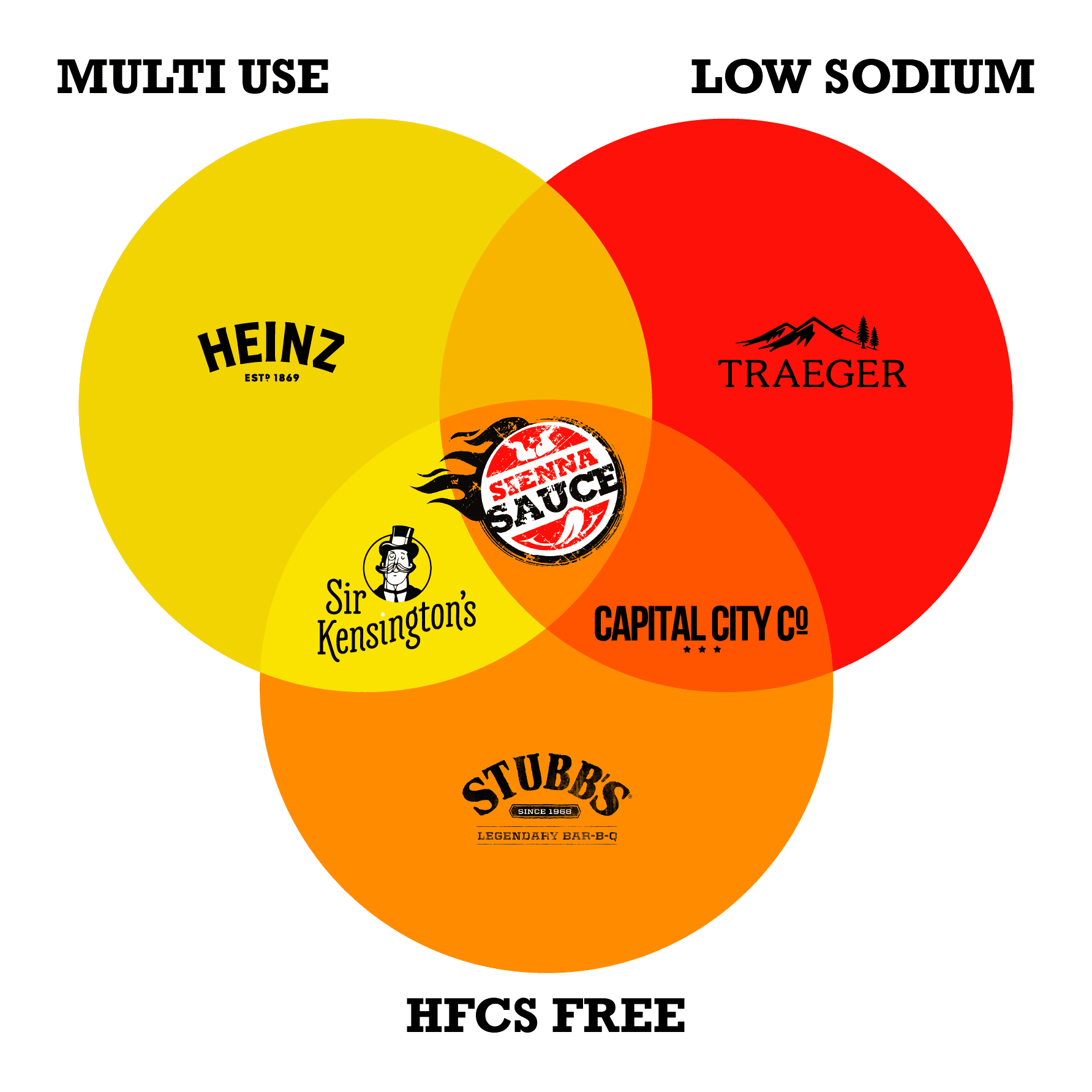

Condiments and sauces are a great way to liven up a dish; however so many offerings get their flavor from high fructose corn syrup and salt. For example, 2 tbsp of Sweet Baby Ray’s BBQ sauce has 290 mg of sodium and 2 tbsp of Heinz original ketchup has 320 mg. It’s time for a new-to-the-world brand to lead the way and create a better-for-you solution that isn’t short on flavor.

Solution edit edit source

Sienna Sauce is a great-tasting, health-conscious, everything sauce led by Tyla-Simone and Monique Crayton edit edit source

Sienna Sauce started when CEO Tyla-Simone Crayton began bottling her own sauce at 14 years old. In 2019 at 16 years of age, Tyla-Simone expanded it into a full-fledged business that now, in 2021, is ready to rocket into the stratosphere.

All Sienna Sauces pair perfectly with a variety of meat, seafood and veggies, work as an ingredient in family favorite recipes such as chili, pizza, pasta and rice dishes, and can be used as a dip or condiment. All Sienna Sauces are low in sodium, 100 mg or less per 2 tbsp serving, and use honey and other real food ingredients to create bold flavors, making it a guilt-free choice for sauce enthusiasts.

Product edit edit source

Guilt-free sauces that make you want more edit edit source

All of our gourmet sauces are entirely free of high-fructose corn syrup, low in sodium, and gluten-free. They are a wonderful complement to any protein – grilled, baked, or fried. They add rich flavors to your favorite pasta, rice, and vegetable dishes, and are a great substitute for sugar- and salt-filled condiments.

Sienna Sauce comes in three tempting flavors:

- Our signature sauce, Sweet & Tangy, will send your tongue into a frenzy with a rich sweetness and citrus finish.

- Lemon Pepper has a perfect balance of cracked black pepper with a pleasing, tangy punch of lemon zest.

- Spice It Up! delivers a fresh chili pepper flavor with just the right amount of amazing sweet and tangy heat.

Traction edit edit source

On path to reach $650K in revenue edit edit source

We pitched our product on Shark Tank on February 19, 2021 and received an on-air offer for a $100K investment from guest shark Kendra Scott. After our appearance on the show, we achieved over $300K in online sales in 48 hours. Since then, we’ve been showcased in a FedEx digital marketing campaign, chosen by Verizon as a sauce of choice in their corporate cafes, and featured on Kelly Clarkson, Good Morning America, and CNBC.

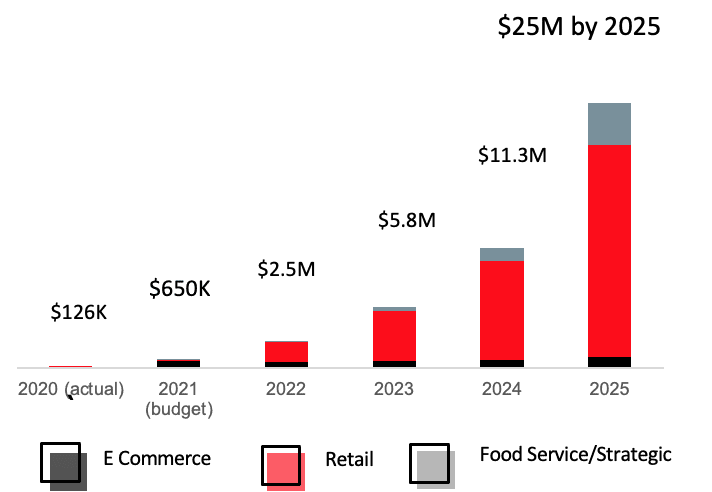

We are forecasted to achieve $650K in revenue this year, representing 5x YoY growth. We have 40K+ followers on social platforms. Plans for 2022 and beyond are to build our brand DTC and expand in grocery & mass retail, as well as strategic foodservice channels & venues.

Customers edit edit source

Our consumers are looking for an "everything sauce" for everyday meals

Our traditional consumers are families and individuals who are health conscious and flavor-driven. We provide an "everything sauce" for everyday meals, as our versatility replaces countless sauces and condiments. As of now, our platform has 300+ 5-star reviews for our products. We’ve even had clients tell us they put Sienna Sauce on everything!

Business model edit edit source

Sold via e-commerce, grocery retailers, and hospitality vendors edit edit source

Sienna Sauce sells DTC via our own website, Amazon, and Walmart.com, as well as to food retail & contract foodservice and hospitality distributors. Our sauce currently comes in three flavors, Sweet & Tangy, Lemon Pepper, and Spice It Up! The sauces are sold in 14.5 oz bottles and 155 oz jugs.

Across e-commerce platforms, the 14.5 oz is sold in 3-packs for $29.85, and exclusive to our website we sell the 155 oz for $65.95. In 2022, we'll add a new package format, a 5 oz single serve. The goal with the 5 oz is to increase consumer trials of Sienna Sauce and promote new usage occasions, specifically as a cooking ingredient. As such, the pouches will be marketed with multiple quick and easy, under 30-minute family-friendly recipes specific to each flavor.

To bolster our DTC business, we're launching a renewed digital effort to advance our omni-channel marketing and leverage our growing social presence to drive brand engagement and site sales.

Our plans call for 2022 to be a breakout year in food retail. We will build on our success in 60+ stores in Texas (e.g., H-E-B, Harvest Market,) and New Jersey/New York (e.g., Wegmans) through programs with KeHe. The 14.5 oz is our primary package for food retailers and has a $6.99 MSRP.

We have been sought out by two Fortune 50 companies to be incorporated into their corporate dining menus. Conservative projections have us expanding into XYZ US corporate dining venues by XYZ. We now have a business relationship with a top contract foodservice and hospitality vendor and are in discussions on how to expand in this channel. (…wave of corporate social responsibility efforts supporting).

And with the goal of further driving brand awareness and trial of Sienna Sauce, we will leverage invitations to participate in strategic programs such as World Market’s Spring ’22 gourmet sauces display program.

Working our multi-channel strategy, we are positioned for growth in 2022 and beyond.

Market edit edit source

The Sauces, Dressings and Condiments market is forecast to reach $181B by 2025

The sauces, dressings & condiments market in the US is projected to surpass $181B by 2025, and is currently growing at a CAGR of more than 4.8%. Our go-to-market plan is to continue to garner media coverage by staying newsworthy and continuing to innovate in all that we do. Another key facet is to master omni-channel marketing, and expand and win in food/mass retailers' competitions and retail shelves. As part of that, we're expanding our geographical footprint and introducing new packaging and flavors.

New label coming soon: edit edit source

Competition edit edit source

Sauce it up with Sienna Sauce edit edit source

Sienna Sauce is too big an idea to fit in one single box. It is a multi-use, multi-cultural product that is ready to multiply in sales by delivering a guilt-free sauce that works as a marinade, dip, condiment, ingredient, and yes, a barbecue sauce.

Vision and strategy edit edit source

Redefining the condiments industry edit edit source

At our core, we believe great flavor comes from what grows in the ground, not the lab.

Our mission is to provide health-conscious products that redefine the condiments industry and to encourage everyday cooks to live, love, and sauce it up!

Our vision is to become a household brand name admired for making the world more flavorful without the crutch of added sugar, salt, or synthetic ingredients. Further, we will inspire and support youth entrepreneurship.

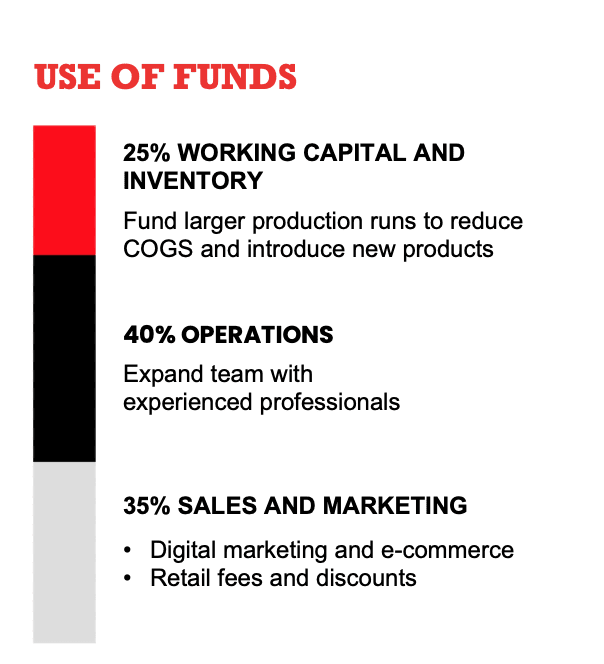

Funding edit edit source

We ran a successful campaign on Republic last year and are back to supercharge our business

We've also won capital prizes at Side Hustle Showdown and Revolt Pitch Competition.

Now, Sienna Sauce is raising funds that will go towards staffing, marketing and operational expenses for our retail and foodservice expansion.

Founders edit edit source

Sienna Sauce Team edit edit source

Tyla-Simone Crayton

Founder/CEO

Monique Crayton

President/COO

Linda Porter-Cox

CRO (Advisor)

Liz Doerr

Fractional CFO (Advisor)

Vanessa Louis

Strategist (Advisor)

Jabril Riddick

Lead Chef

Erica Younkin

Marketing (Advisor)

Dorcey Kuti

Lead Publicist

Gili Wolf

Art (Advisor)

Thy Nguyen

Graphic Designer

Risks edit edit source

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company will likely need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all our remaining assets, which could cause an Investor to lose all or a portion of their investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future because of, among other factors, our lack of revenues from sales, our business model, and our profitability, as well as the inherent business risks associated with our Company and present and future market conditions. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and we are just beginning to implement our business plan. There can be no assurance that we will ever operate profitably. The likelihood of our success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by early-stage companies. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties

The U.S. Securities and Exchange Commission does not pass upon the merits of the Securities or the terms of the Offering, nor does it pass upon the accuracy or completeness of any Offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it relates to this Offering. The U.S. Securities and Exchange Commission has not reviewed this Form C, nor any document or literature related to this Offering.

Global crises such as COVID-19 can have a significant effect on our business operations and revenue projections.

COVID-19 has had a global economic impact and may have and may continue to impact the Company. The responses to the effects of COVID-19 are varied and the full long-term impact is still unknown. Many companies have made adjustments including telework, supply chain adjustments, suspending or modifying operations, and others. While the Company has not seen a direct impact on its business as a result of COVID-19 and these changes, these changes in other companies, including vendors and other service providers to the Company, could have an adverse affect on the Company. If a major disruption to the Company’s business or operations occurs, the Company may not have sufficient access to capital and liquidity to continue to fund its operations through such events.

Shifting Consumer Tastes.

Consumer acceptance and desire for existing and emerging healthy foods, snacks and beverages are continually changing and are extremely difficult to predict. The Company is striving to be on the right side of this macro shift at. Increased consumer concerns about nutrition, healthy diets (some known as Paleo, KETO, Whole30, and Vegan regimens) and food allergies are ever changing. This brings to our business the risk that sales of our products may decline due to perceived health concerns, changes in consumer tastes or other reasons beyond the control of the Company. The consumer acceptance and resulting success of new products will be one of the keys to the success of the Company’s business plan. There can be no assurance that the Company will succeed in the development of any new products or that any new products developed by the Company will achieve market acceptance or generate meaningful revenue for the Company

Our capitalization structure may now or in the future make it difficult for the Securities to convert to equity due to lack of authorized or issuable equity interests in the Company.

Currently, the Company’s is authorized to issue 1,000,000 units (the “Membership Units”), which are governed by and subject to Title 3 of the Texas Business Organizations Code (the “Act”) and the “company agreement” (as such term is defined in the Act) (the “Company Agreement”). The Company’s Member has broad discretion to modify or amend the Company Agreement in her sole discretion. Changes to the Company’s capitalization structure may result in not having enough Membership Units to cause the Securities to convert to equity.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time, and the Company intends on implementing new lines of business in the near future. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. Additionally, most of our products require that we sell certain minimum quantities with limited returns to achieve profitability, and we may never achieve such results. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

Our products involve consumable food items, which subjects the Company to health and safety and related risks.

The Company sells consumable food products, which subjects the Company to various health and safety laws and regulations, as well as associated risks. In particular, federal and local FDA regulations require that all food products shipped must be labeled with a "Best By" date, which, among other things, limits the shelf life of our inventory. If Company products are found to be out of compliance with such laws, or if out-of-compliance issues arise in the future, the Company could face civil and/or criminal penalties and fines. The Company also could become subject to various class action lawsuits seeking damages on behalf of consumers. Any claims against the Company for violations of health and safety laws could have a material adverse effect on its results of operations or cash flows and could impact the reputation of the Company in the market. Profitability is also at risk because our customers are sensitive to food price increases due to the unpredictability of future commodity costs. The Company operates in an environment where there are factors beyond its control related to weather, natural disasters, disease outbreaks, crop losses, animal shortages, etc. Price fluctuations in commodities are outside of the Company's control and can have a significant negative impact on gross margins.

We rely on other companies to provide components and services for our products.

We depend on suppliers and contractors to meet our contractual obligations to our customers and conduct our operations. In particular, we are dependent upon our co-packager to manufacture, label and ship our products. While we are confident in our ability to obtain alternative vendors to provide comparable services, any significant unexpected disruption in our partners’ operations could, for a substantial period of time, delay our productions schedules. Our ability to meet our obligations to our customers may be adversely affected if suppliers or contractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our products may be adversely impacted if companies to whom we delegate manufacture of major components or subsystems for our products, or from whom we acquire such items, do not provide components which meet required specifications and perform to our and our customers’ expectations. Our suppliers may be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two contractors or suppliers for a particular component. Our products may utilize custom components available from only one source. Continued availability of those components at acceptable prices, or at all, may be affected for any number of reasons, including if those suppliers decide to concentrate on the production of common components instead of components customized to meet our requirements. The supply of components for a new or existing product could be delayed or constrained, or a key manufacturing vendor could delay shipments of completed products to us adversely affecting our business and results of operations.

We rely on various intellectual property rights, including trademarks, in order to operate our business.

The Company relies on certain intellectual property rights, including, without limitation, trademarks (as described below), recipes and other Company trade secrets, to operate its business. The Company’s intellectual property rights may not be sufficiently broad or otherwise may not provide us a significant competitive advantage. In addition, the steps that we have taken to maintain and protect our intellectual property may not prevent it from being challenged, invalidated, circumvented, reverse engineered or designed-around, particularly in countries where intellectual property rights are not highly developed or protected. In some circumstances, enforcement may not be available to us because an infringer has a dominant intellectual property position or for other business reasons, or countries may require compulsory licensing of our intellectual property. Our failure to obtain or maintain intellectual property rights that convey competitive advantage, adequately protect our intellectual property or detect or prevent circumvention or unauthorized use of such property, could adversely impact our competitive position and results of operations. We also rely on nondisclosure and noncompetition agreements with employees, consultants and other parties to protect, in part, trade secrets and other proprietary rights. There can be no assurance that these agreements will adequately protect our trade secrets and other proprietary rights and will not be breached, that we will have adequate remedies for any breach, that others will not independently develop substantially equivalent proprietary information or that third parties will not otherwise gain access to our trade secrets or other proprietary rights. As we expand our business, protecting our intellectual property will become increasingly important. The protective steps we have taken may be inadequate to deter our competitors from using our proprietary information. To protect or enforce our intellectual property rights, we may be required to initiate litigation against third parties, such as infringement lawsuits. Also, these third parties may assert claims against us with or without provocation. These lawsuits could be expensive, take significant time and could divert management’s attention from other business concerns. The law relating to the scope and validity of claims in the industry in which we operate is evolving and, consequently, intellectual property positions in our industry are frequently uncertain. We cannot assure you that we will prevail in any of these potential suits or that the damages or other remedies awarded, if any, would be commercially valuable.

The Company’s success depends on the experience and skill of its management team and its key employees.

In particular, we are dependent on Monique Crayton, our COO and Tyla-Simone Crayton, our CEO. The Company has or intends to enter into employment agreements with Monique Crayton, and Tyla-Simone Crayton, however there can be no assurance that it will do so or that any of them will continued to be employed by the Company for a particular period of time. The loss of any of them could harm the Company's business, financial condition, cash flow and results of operations. Tyla-Simone Crayton has only recently graduated from high school and is currently attending a university full-time. As a student, Tyla-Simone is not expected to contribute her full time and attention to the Company.

Although dependent on certain key personnel, the Company does not have any key person life insurance policies on any such people.

We are dependent on certain key personnel in order to conduct our operations and execute our business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. The loss of such person could negatively affect the Company and our operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

Like any company, we face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) Company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and its financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company's financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, health and safety, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease and desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

The Company may implement new lines of business or offer new products and services within existing lines of business.

The Company may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, the Company may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be met, and price and profitability targets may not prove feasible. The Company may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. Thus, the Company could lose business, be forced to price products and services on less advantageous terms to retain or attract clients, or be subject to cost increases and, as a result, the Company’s business, financial condition or results of operations may be adversely affected.

We have limited commercial experience in marketing or selling any of our products, and unless we develop these capabilities, we may not be successful.

Even if we are able to develop and manufacture our products on a large scale, we have limited experience in operating our business in the volumes that will be necessary for us to achieve commercial sales and in marketing or selling our products to potential customers. We cannot assure you that we will be able to manufacture and deliver our products on a timely basis, in sufficient quantities, or on commercially reason.

Our small size and limited history negatively affect our ability to raise capital.

It is difficult for us to find any capital sources because of our relatively small capitalization, our losses to date, our current working capital position, our lack of sales and other factors. It is possible that we may not be able to raise sufficient funds in the future in order to survive and pursue our business plan.

Attempts to grow our business could have an adverse effect on the Company.

Because of our small size, we desire to grow rapidly in order to achieve certain economies of scale. To the extent that rapid growth does occur, it will place a significant strain on our financial, technical, operational and administrative resources. Our planned growth will result in increased responsibility for both existing and new management personnel. Effective growth management will depend upon our ability to integrate new personnel, to improve our operational, management and financial systems and controls, to train, motivate and manage our employees, and to increase our sources of raw materials, product manufacturing and packaging. If we are unable to manage growth effectively, our business, results of operations and financial condition may be materially and adversely affected. In addition, it is possible that no growth will occur or that growth will not produce profits for the Company.

The food condiments category in which we participate is highly competitive. If we are unable to compete effectively, our results of operations could be adversely affected.

The food condiments product category in which we participate is highly competitive. There are numerous brands and products that compete for shelf space and sales, with competition based primarily upon brand recognition and loyalty, product packaging, quality and innovation, taste, nutrition, breadth of product line, price and convenience. We compete with a significant number of companies of varying sizes, including divisions or subsidiaries of larger companies. We face strong competition from competitors’ products that are sometimes sold at lower prices. Price gaps between our products and our competitors’ products may result in market share erosion and harm our business. A number of our competitors have broader product lines, substantially greater financial and other resources and/or lower fixed costs than we have. Our competitors may succeed in developing new or enhanced products that are more attractive to customers or consumers than our products. These competitors may also prove to be more successful in marketing and selling their products or may be better able to increase prices to reflect cost pressures. We may not compete successfully with these other companies or maintain or grow the distribution of our products. We cannot predict the pricing or promotional activities of our competitors or whether they will have a negative effect on us. Many of our competitors engage in aggressive pricing and promotional activities. There are competitive pressures and other factors which could cause our products to lose market share or decline in sales or result in significant price or margin erosion, which would have a material adverse effect on our business, financial condition and results of operations. Virtually all of the manufacturers, distributors and marketers of food condiments have substantially greater management, financial, research and development, marketing and manufacturing resources than we do. Competitors in the food condiments category include, among others: Heinz, Hunts and Sweet Baby Ray's and store-owned, private label brands, Primal Kitchen, Sir Kensington, G Hughes, Organicville, and New Primal. Brand loyalty to existing products may prevent us from achieving certain sales objectives. Additionally, the long-standing relationships maintained by existing premium food condiment manufacturers may prevent us from obtaining recommendations for our products. In addition, we compete with private label food condiment brands, as well as premium food condiment brands. In addition, there are limited barriers to prevent the entry of such other brands into the supermarket and mass merchant distribution channel, and in the event we fail to meet sales goals determined by them for our products they could cease shelving our products in their stores or replace our products with those of our competitors. The entrance into the supermarket or mass merchant distribution channel of an existing or new premium food condiment brand by any of our competitors could have a material adverse effect on the Company. If we are not successful in competing in these markets, we may not be able to attain our business objectives.

If our products do not gain market acceptance, it is unlikely that we will become profitable.

The market for food condiments is competitive and subject to changing consumer preferences, including sensitivities to product ingredients and nutritional claims. At this time, our products are largely unproven in the commercial arena. Market acceptance may depend on many factors, including factors beyond our control, including but not limited to: • price • aroma • taste • ingredients • nutritional claims; and • word-of-mouth recommendations.

Neither the Offering nor the Securities have been registered under federal or state securities laws.

No governmental agency has reviewed or passed upon this Offering or the Securities. Neither the Offering nor the Securities have been registered under federal or state securities laws. Investors will not receive any of the benefits available in registered Offerings, which may include access to quarterly and annual financial statements that have been audited by an independent accounting firm. Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering based on the information provided in this Form C and the accompanying exhibits.

Food condiment safety, quality, and health concerns could adversely affect our business.

We could be adversely affected if consumers lose confidence in the safety and quality of our owned brand or vendor-supplied products and supplies. Adverse publicity about these types of concerns, whether valid or not, may discourage consumers from buying the products in our locations or cause vendor production and delivery disruptions. The actual or perceived sale of contaminated food condiments by our vendors or us could result in product liability claims against our vendors or us and a loss of consumer confidence, which could have an adverse effect on our sales and operations. In addition, if our products are alleged to pose a risk of injury or illness, or if they are alleged to have been mislabeled, misbranded, or adulterated, or to otherwise be in violation of governmental regulations, we may need to find alternate ingredients for our products, delay production of our products, or discard or otherwise dispose of our products, which could adversely affect our results of operations. If this occurs after the affected product has been distributed, we may need to withdraw or recall the affected product. Given the difficulty in converting food condiment customers, if we lose customers due to a loss of confidence in safety or quality, it may be difficult to reacquire such customers

Product recalls and product liability, as well as changes in product safety and other consumer protection laws, may adversely impact our operations, merchandise offerings, reputation, financial condition, results of operations, and cash flows.

We are subject to regulations by a variety of federal, state, and international regulatory authorities, including regulations regarding the safety and quality of our products. We purchase merchandise from different vendors. One or more of our vendors, including manufacturers of our owned or private label brand products, might not adhere to product safety requirements or our quality control standards, and we might not identify the deficiency before merchandise ships to our customers. Any issues of product safety or allegations that our products are in violation of governmental regulations, including, but not limited to, issues involving products manufactured in foreign countries, could cause those products to be recalled. If our vendors fail to manufacture or import merchandise that adheres to our quality control standards, product safety requirements, or applicable governmental regulations, our reputation and brands could be damaged, potentially leading to increases in customer litigation against us. Further, to the extent we are unable to replace any recalled products, we may have to reduce our merchandise offerings, resulting in a decrease in sales. If our vendors are unable or unwilling to recall products failing to meet our quality standards, we may be required to recall those products at a substantial cost to us. Moreover, changes in product safety or other consumer protection laws could lead to increased costs to us for certain merchandise, or additional labor costs associated with readying merchandise for sale. Long lead times on merchandise ordering cycles increase the difficulty for us to plan and prepare for potential changes to applicable laws. In the event that we are unable to timely comply with regulatory changes or regulators do not believe we are complying with current regulations applicable to us, significant fines or penalties could result, and could adversely affect our reputation, financial condition, results of operations, and cash flows.

The food condiment category is price competitive and is characterized by high fixed costs. A reduction in prices for the industry could affect the demand for our products and services.

The food condiment category is highly competitive and characterized by a large number of competitors ranging from small to large companies with substantial resources. Many of our potential competitors have substantially larger customer bases, greater name recognition, greater reputation, and significantly greater financial and marketing resources than we do. In the future, aggressive marketing tactics implemented by our competitors could impact our limited financial resources and adversely affect our ability to compete in these markets. Price competition exists in the food condiment category. There are many food condiment brands that could discount their product prices which could result in lower revenues for the entire industry. A shortfall from expected revenue levels would have a significant impact on our potential to generate revenue and possibly cause our business to fail.

The loss of any of our key merchandise vendors, or of any of our distribution arrangements with certain of our vendors, could negatively impact our business.

We purchase significant amounts of products from a number of vendors with limited supply capabilities. There can be no assurance that our current supply vendors will be able to accommodate our anticipated growth and expansion of our locations and e-commerce business. As a result of the disruptions resulting from COVID-19, some of our existing vendors have not been able to supply us with products in a timely or cost-effective manner. While these disruptions have so far proven to be temporary, an inability of our existing vendors to provide products or other product supply disruptions that may occur in the future could impair our business, financial condition, and results of operations. To date, vendor-related supply challenges have not had a material effect on our business or our sales and profitability. We do not maintain long-term supply contracts with any of our merchandise vendors. Any vendor could discontinue selling to us at any time. Although we do not materially rely on any particular vendor, the loss of any of our significant vendors could have a negative impact on our business, financial condition, and results of operations. We continually seek to expand our base of vendors and to identify new products. If we are unable to identify or enter into distribution relationships with new vendors or to replace the loss of any of our existing vendors, we may experience a competitive disadvantage, our business may be disrupted, and our results of operations may be adversely affected.

As a food production company, all of our products must be compliant with regulations by the U.S. Food and Drug Administration (“FDA”), as well as the United States Department of Agriculture (“USDA”), and in addition a number of our products rely on independent certification that they are non-GMO, gluten-free, “no high fructose corn syrup” and “less sugar”. Any non-compliance with the FDA, or USDA, or the loss of any such certification could harm our business.

We must comply with various FDA and USDA rules and regulations, including those regarding product manufacturing, food safety, required testing and appropriate labeling of our products. It is possible that regulations by the FDA and USDA and their interpretation thereof may change over time. As such, there is a risk that our products could become non-compliant with the applicable regulations and any such non-compliance could harm our business. In addition, we rely on independent certification of our non-GMO, gluten-free, “no high fructose corn syrup” and “less sugar” claims, and must comply with the requirements of independent organizations or certification authorities in order to label our products as such. Currently, the FDA does not directly regulate the labeling of non-GMO products as such. The FDA has defined the term “gluten-free,” and we must comply with the FDA’s definition if we include this label on our products. Our products could lose their non-GMO and gluten-free certifications if our raw material suppliers lose their product certifications for those specified claims. The loss of any of these independent certifications, including for reasons outside of our control, could harm our business. We also must comply with state rules and regulations, including Proposition 65 in California, which requires a specific warning on or relating to any product that contains a substance listed by the State of California as having been found to cause cancer or birth defects or other reproductive harm, unless the level of such substance in the product is below a safe harbor level established by the State of California. Interpretation and application of such rules, including potential differences in application on a state-by-state basis, may give rise to uncertainty as to the appropriate labeling and formulation of our products. In addition, the FDA has adopted labeling guidelines that will affect the labeling of both the front and back of many of our products. We are continually reviewing and revising our labeling activities in advance of new or changed requirements in anticipation of any rules coming into effect and in response to industry litigation trends. The imposition or proposed imposition of additional product labeling or warning requirements may reduce overall consumption of our products, lead to negative publicity (whether based on scientific fact or not) or leave consumers with the perception (whether or not valid) that our products do not meet their health and wellness needs, resulting in adverse effects on our business, financial condition or results of operations.

We rely on co-packers to provide our supply of treat products. Any failure by co-packers to fulfill their obligations or any termination or renegotiation of our co-packing agreements could adversely affect our results of operations.

We have supply agreements with co-packers that require them to provide us with specific finished products. We rely on co-packers as our sole-source for products. We also anticipate that we will rely on sole suppliers for future products. The failure for any reason of a co-packer to fulfill its obligations under the applicable agreements with us or the termination or renegotiation of any such co- packing agreement could result in disruptions to our supply of finished goods and have an adverse effect on our results of operations. Additionally, from time to time, a co-packer may experience financial difficulties, bankruptcy or other business disruptions, which could disrupt our supply of finished goods or require that we incur additional expense by providing financial accommodations to the co-packer or taking other steps to seek to minimize or avoid supply disruption, such as establishing a new co- packing arrangement with another provider. During an economic downturn, our co-packers may be more susceptible to experiencing such financial difficulties, bankruptcies or other business disruptions. A new co-packing arrangement may not be available on terms as favorable to us as the existing co- packing arrangement, if at all.

As our business increases in size, we will need to locate and contract qualified co-packers with sufficient dedicated space for gluten-free, “no high fructose corn syrup” and “less sugar” products, and there is no assurance that we will be able to do so.

If demand for gluten-free, “no high fructose corn syrup” and “less sugar” products grows, we will need to increase our production through additional co-packers to ensure that we have sufficient supply to meet increasing demand. There is no assurance that we will be able to find available, qualified co-packers or that we will be able to negotiate contracts with them on commercially reasonable terms or at all.

A large portion of our sales involves the sale of gluten-free, “no high fructose corn syrup” and “less sugar” products.

While gluten-free, “no high fructose corn syrup” and “less sugar” products are currently popular and sales of gluten-free, “no high fructose corn syrup” and/or “less sugar” products generally have been increasing rapidly, there is no assurance that consumers will continue to be interested in gluten-free, “no high fructose corn syrup” and “less sugar” products. Consumers may in the future choose to purchase other products which they perceive to be healthier or more “trendy” at a future time. Consumers may prefer products with fewer carbohydrates, additional protein and more fiber, or may no longer require the health benefits provided by gluten-free, “no high fructose corn syrup” and “less sugar” products. In addition, our business could be adversely affected if larger, well-capitalized (or private-equity backed) companies elected to provide gluten-free, “no high fructose corn syrup” and “less sugar” products in the food condiment category. We have limited experience in the gluten-free, “no high fructose corn syrup” and “less sugar” business and with any of such product lines.

If we do not manage our supply chain effectively, including inventory levels, our business, financial condition and results of operation may be adversely affected.

The inability of any supplier, co-packer, third-party distributor or transportation provider to deliver or perform for us in a timely or cost-effective manner could cause our operating costs to increase and our profit margins to decrease. We must continuously monitor our inventory and product mix against forecasted demand or risk having inadequate supplies to meet consumer demand as well as having too much inventory on hand that may reach its expiration date and become unsaleable. If we are unable to manage our supply chain effectively and ensure that our products are available to meet consumer demand, our operating costs could increase and our profit margins could decrease.

Failure by our transportation providers to deliver our products on time or at all could result in lost sales.

We use third-party transportation providers for our product shipments. We rely on one such provider for almost all of our shipments. Transportation services include scheduling and coordinating transportation of finished products to our customers, shipment tracking and freight dispatch services. Our use of transportation services for shipments is subject to risks, including increases in fuel prices, which would increase our shipping costs, and employee strikes and inclement weather, which may impact the ability of providers to provide delivery services that adequately meet our shipping needs, including keeping our products adequately refrigerated during shipment. Any such change could cause us to incur costs and expend resources. Moreover, in the future we may not be able to obtain terms as favorable as those we receive from the third-party transportation providers that we currently use, which in turn would increase our costs and thereby adversely affect our business, financial condition and results of operations.

We may face difficulties as we expand into countries in which we have no prior operating experience.

We may face difficulties as we expand into countries in which we have no prior operating experience. We may choose to expand our global footprint by entering into new markets. As we expand our business into new countries we may encounter regulatory, personnel, technological and other difficulties that increase our expenses or delay our ability to become profitable in such countries. This may have an adverse effect on our business.

A decline in consumer spending or a change in consumer preferences or demographics could reduce our sales or profitability and adversely affect our business.

Our sales depend on consumer spending, which is influenced by factors beyond our control, including general economic conditions, disruption or volatility in global financial markets, changes in interest rates, the availability of discretionary income and credit, weather, consumer confidence, unemployment levels, and government orders restricting freedom of movement. We may experience declines in sales or changes in the types of products and services sold during economic downturns. Our business could be harmed by any material decline in the amount of consumer spending, which could reduce our sales, or a decrease in the sales of higher-margin products, which could reduce our profitability and adversely affect our business. The success of our business depends in part on our ability to identify and respond to evolving trends in demographics and consumer preferences. Failure to timely identify or effectively respond to changing consumer tastes, preferences and spending patterns could adversely affect our relationship with our customers, the demand for our products and services, our market share and our profitability.

The growth of our business depends in part on our ability to accurately predict consumer trends, successfully introduce new products and services, improve existing products and services, and expand into new offerings.

Our growth depends, in part, on our ability to successfully introduce, improve, and reposition our products to meet the requirements of our customers. This, in turn, depends on our ability to predict and respond to evolving consumer trends, demands and preferences. Our ability to innovate is affected by the technical capability of our product development staff and third-party consultants in developing and testing new products, including complying with governmental regulations, our attractiveness as a partner for outside research and development scientists and entrepreneurs, the success of our management and sales team in introducing and marketing new products and service offerings, and our ability to leverage our digital and data capabilities to gather and respond to consumer feedback. We may be unable to determine with accuracy when or whether any of our products or services now under development will be launched, and we may be unable to develop or otherwise acquire product candidates or products. Additionally, we cannot predict whether any such products or services, once launched, will be commercially successful. If we are unable to successfully develop or otherwise acquire new products or services, our business, financial condition, and results of operations may be materially adversely affected.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

While the Company has provided its expected and intended uses for any proceeds raised by the Company in this Offering, the Company’s management has considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately and must rely on the experience and judgment of the managers of the Company to determine how to use the proceeds.

We face various risks as an e-commerce retailer.

As part of our growth strategy, we have made significant investments to grow our e-commerce business. We may require additional capital in the future to sustain or grow our e-commerce business. Business risks related to our e-commerce business include our inability to keep pace with rapid technological change, failure in our security procedures or operational controls, failure or inadequacy in our systems or labor resource levels to effectively process customer orders in a timely manner, government regulation and legal uncertainties with respect to e-commerce, and collection of sales or other taxes by one or more states or foreign jurisdictions. If any of these risks materialize, they could have an adverse effect on our business. In addition, as other internet retailers have increased market share in recent years, we have faced increased competition, and may continue to face increased competition in the future, from internet retailers who enter the market. Our failure to positively differentiate our product and services offerings or customer experience from these internet retailers could have a material adverse effect on our business, financial condition and results of operations.

Increases in raw materials, packaging, oil and natural gas costs and volatility in the commodity markets may adversely affect our results of operations.

Our financial results depend to a large extent on the costs of raw materials, packaging, oil and natural gas, and our ability to pass the costs of these materials onto our customers. Historically, market prices for commodity grains and food stocks have fluctuated in response to a number of factors, including economic conditions such as inflation, changes in U.S. government farm support programs, changes in international agricultural trading policies, impacts of disease outbreaks on protein sources and the potential effect on supply and demand as well as weather conditions during the growing and harvesting seasons. Fluctuations in paper, steel and oil prices, which affect our costs for packaging materials, have resulted from changes in supply and demand, general economic conditions and other factors. In addition, we have exposure to changes in the pricing of oil and natural gas, which affects our manufacturing, transportation and packaging costs. If there is any increase in the cost of raw materials, packaging, or oil and natural gas expenses, we may be required to charge higher selling prices for our products to avoid margin deterioration. We cannot provide any assurances regarding the timing or the extent of our ability to successfully charge higher prices for our products, or the extent to which any price increase will affect future sales volumes. Our results of operations may be materially and adversely affected by this volatility.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

The Company has conducted previous offerings of securities and may not have complied with all relevant state and federal securities laws. If a court or regulatory body with the required jurisdiction ever concluded that the Company may have violated state or federal securities laws, any such violation could result in the Company being required to offer rescission rights to investors in such offering. If such investors exercised their rescission rights, the Company would have to pay to such investors an amount of funds equal to the purchase price paid by such investors plus interest from the date of any such purchase. No assurances can be given the Company will, if it is required to offer such investors a rescission right, have sufficient funds to pay the prior investors the amounts required or that proceeds from this Offering would not be used to pay such amounts.

In addition, if the Company violated federal or state securities laws in connection with a prior offering and/or sale of its securities, federal or state regulators could bring an enforcement, regulatory and/or other legal action against the Company which, among other things, could result in the Company having to pay substantial fines and be prohibited from selling securities in the future.

The Company has engaged in selling Securities in reliance on Regulation Crowdfunding in the past. Investors may review all previously filed documentation through the U.S. Securities and Exchange Commission’s EDGAR filing system. Additionally, the Company made an appearance on Shark Tank, the ABC television series where an investment was agreed to but never consummated, because negotiations and due diligence did not proceed following the broadcast. The Company has also offered (but not formally granted) equity in the Company to one or more service providers. During the negotiations, offering, or sale of securities, the Company may not have complied with all applicable securities laws and regulations.

The Company could potentially be found to have not complied with securities law in connection with this Offering related to “Testing the Waters.”

Prior to filing this Form C, the Company engaged in “testing the waters” permitted under Regulation Crowdfunding (17 CFR 227.206), which allows issuers to communicate to determine whether there is interest in the offering. All communication sent is deemed to be an offer of securities for purposes of the antifraud provisions of federal securities laws. Any Investor who expressed interest prior to the date of this Offering should read this Form C thoroughly and rely only on the information provided herein and not on any statement made prior to the Offering. The communications sent to Investors prior to the Offering are attached as Exhibit D. Some of these communications may not have included proper disclaimers required for “testing the waters”.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may end the Offering early.

If the Target Offering Amount is met after 21 calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least 5 business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Securities will not be freely tradable under the Securities Act until one year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be affected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into CF Shadow Securities. The Company is under no obligation to convert the Securities into CF Shadow Securities. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities. Upon the conversion of the Securities into CF Shadow Securities (which cannot be guaranteed), the holders of the CF Shadow Securities will be required to enter into a proxy with the Intermediary to ensure any statutory voting rights are voted in tandem with the majority holders of whichever series of securities the CF Shadow Securities follow.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into CF Shadow Securities (the occurrence of which cannot be guaranteed). Upon such conversion, the CF Shadow Securities will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders are required to enter into a proxy agreement with the Intermediary to vote their CF Shadow Securities with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right. For example, if the Securities are converted in connection with an offering of Series B Membership Units, Investors would receive CF Shadow Securities in the form of shares of Series B-CF Shadow Membership Units and would be required to enter into a proxy that allows the Intermediary to vote their units of Series B-CF Shadow Membership Units consistent with the majority of the Series B unitholders. Thus, Investors will essentially never be able to vote upon any matters of the Company.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and therefore, holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company. The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities. In addition, the Company has certain equity grants and convertible securities outstanding. Should the Company enter into a financing that would trigger any conversion rights, the converting securities would further dilute the equity securities receivable by the holders of the Securities upon a qualifying financing.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the First Equity Financing Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the First Equity Financing Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company. The forgoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

A Crowd SAFE holder may lose their right to any appreciation or return on investment due to defaulting on certain notice and require action requirements in such Crowd SAFE; failure to claim cash set aside in this case may result in a total loss of principle.

The Crowd SAFE offered requires a holder to complete, execute and deliver any reasonable or necessary information and documentation requested by the Company or the Intermediary in order to effect the conversion or termination of the Crowd SAFE, in connection with an Equity Financing or Liquidity Event, within thirty (30) calendar days of receipt of notice (whether actual or constructive) from the Company. Failure to make a timely action may result in the Company declaring that the Investor is only eligible to receive a cash payment equal to their Purchase Amount (or a lesser amount in certain events). While the Company will set aside such payment for the investor, such payment may be subject to escheatment laws, resulting in a total loss of principle if the Investor never claims their payment.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred equity (if any), have been paid in full. Neither holders of the Securities nor holders of CF Shadow Securities can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.

The Company is a limited liability company, which provides considerable flexibility and non-standard terms among the owners.