Starling Bank

| Type | Private |

|---|---|

| Industry | Financial Services |

| Founded | 18/6/2014 |

| Founders | Anne Boden |

Key people | John Mountain - Interim CEO |

| Revenue | +£452.8m (2023) |

| £194.6m (2023) | |

| Website | https://www.starlingbank.com/ |

Starling Bank (/ˈstɑːrlɪŋ/) is a British bank operating in the United Kingdom. It offers a range of mobile banking services, including current and business accounts, personal loans, and various other financial products. It has won multiple national rewards including, but not limited to, the “Best Business Banking Award” in 2023 & Which?'s “Banking Brand of the Year” [1].

History

Starling Bank was founded by Anne Boden, a former executive at Allied Irish Banks [2] with the aim of creating a modern, customer-centric banking experience. The bank received its banking licence from the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA) in July 2016 [3]. In May 2017, the bank launched its first mobile-only personal account, offering features such as real-time notifications and spending insights.

Recognition and Awards

Starling Bank's commitment to innovation and customer service has earned it several accolades and awards within the fintech industry. Notable awards include being named 'Best British Bank' at the British Bank Awards multiple times and 'Best Current Account Provider' by the British Banking Awards.

Strategy & Outlook edit edit source

The main mission of Starling Bank is to provide a user-friendly, customer-focused, and technologically advanced banking experience. They aim to empower individuals and businesses with innovative financial solutions, giving them more control over their money and helping them achieve their financial goals.

The vision of Starling Bank is to be a leading digital bank that revolutionizes the way people manage their money. They strive to create a seamless and personalized banking experience through cutting-edge technology, responsive customer service, and a commitment to transparency.

Starling Bank's values are centred around putting the customer first and fostering a positive banking experience. Main emphasis on transparency, accessibility, sustainability and gender equality[4].

Product Line edit edit source

Starling Bank is best known for its advanced mobile app, which provides customers with easy access to their financial information and allows them to manage their accounts seamlessly. Some key features and services offered by Starling Bank include:

| Offering Features | Comment(s) |

|---|---|

| Current Accounts | Offers personal and business current accounts with no monthly fees. Customers can make payments, set up direct debits, and use their debit card for purchases worldwide. |

| Overdraft Facility | Eligible customers can apply for an overdraft, with clear and transparent interest rates. |

| Personal Loans | The bank provides personal loan options to its customers, making it easier for them to access credit. |

| Savings Accounts | Starling Bank offers savings accounts, helping customers save money and earn interest on their balances. |

| Spending Insights | The mobile app provides detailed insights into spending habits, categorizing transactions and helping customers understand their financial behavior. |

| Foreign Currency Accounts | Customers can hold and spend money in various foreign currencies using Starling Bank's app, making it convenient for travelers. |

| Business Accounts | In addition to personal accounts, Starling Bank provides tailored business accounts with features such as invoicing and integration with accounting software. |

| Payments and Transfers | Customers can make domestic and international payments and transfers using the app, including support for Apple Pay, Google Pay, and Samsung Pay. |

Marketing and Partnerships

As an online bank, Starling engages the audience through social media platforms such as Twitter and tiktok. Advertisements are posted on TV, radio, podcasts and public transports. Starling Bank has collaborated with various fintech partners to enhance its offerings, including providing access to investment products and mortgage solutions. Partners include Weathlify, CreditLadder and Anorak.Sponsorship include hosting the Archery GB national finals[5], UEFA Women's EURO 2022[6], and Trillion Trees[7] also further increase the company's brand awareness.

Expansion & Innovations

As it is the first digital-only bank in the UK, all infrastructure are virtual and therefore solutions have to be implemented for normal services to function such a comprehensive spending insight, in app bills management, a Card Lock feature as well as free Virtual Credit Cards. Other innovation include using data and machine learning for system security, fraud detection and behavioural analytics to better combat fraud.

Starling Bank has identified a substantial £53 billion opportunity in the core banking software market by licensing its advanced technology through Engine, its banking platform SaaS business. In 2020, global spending on core banking software reached £53 billion, and many major players faced challenges maintaining outdated technology while competing with digital banks.

With its powerful technology and proven capability, Starling Bank is uniquely positioned to capture market share through Engine. Other businesses can leverage this platform to build successful, profitable, and highly scalable digital banks, benefiting from Starling's innovative solutions and expertise.

Starling bank has delivered a 6x increase in revenue relative to last year's FY [8] with a private evalutaion of $1.5 Billion [9]. Currently, Starling Bank current holds 9.4%[8] and 2.4%[8] in SME and retail market share respectively. While Starling Bank initially focused on the UK market, it has expressed intentions to expand its services to other countries. In 2020, it launched a beta version of its banking app in Ireland, marking its first step towards international expansion.

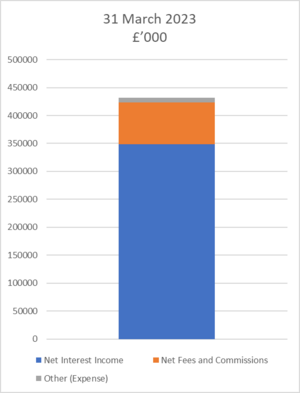

Main Income

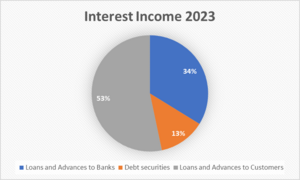

In 2023, Interest is the main source of income for Starling Bank, accounting for 84% of £414mil, with 53% of Interest Income generated from loans and advances to customers primarily for mortgage.

For the Fees and Commissions Income, Customer card transaction revenue makes up for 83% of the £112mil. This then provides Starling with £74mil in Net Fees and Commissions. [8]

Compared to 2022, which also had a majority income in interests, there has been a significant increase in percentages of interest income from 65% in 2022[10]

Funding rounds edit edit source

Starling bank has had over 10 funding rounds, having raised an amount of $1.1 billion.[11] The fundings are displayed in the table below, with the most recent one being on April 26th, 2022, raising £130.5 million by lead investor Goldman Sachs.

| Date | Transaction | Money Raised (£ millions) | Lead Investor |

|---|---|---|---|

| 26/04/2022 | Series D | 130.5 | Goldman Sachs |

| 19/04/2021 | Series D | 50 | Goldman Sachs |

| 8/03/2021 | Series D | 272 | Fidelity Management and Research Company |

| 28/05/2020 | Venture Round | 44.3 | Chrysalis Investments, JTC |

| 10/02/2020 | Venture Round | 60 | - |

| 23/10/2019 | Venture Round | 30 | Chrysalis Investments |

| 27/03/2019 | Non Equity Assistance | - | Future Fifty |

| 22/02/2019 | Grant | 100 | Capability and Innovation Fund |

| 13/02/2019 | Series C | 75 | Harald McPike, Merian Global Investors |

| 24/04/2018 | Series B | 10 | - |

The latest issuance of shares was towards existing shareholders, increasing the Group's Share Capital by £553, which was further increased during 2022 by additional issuances.[12]

Corporate governance edit edit source

Starling Bank is governed by the Board, which is comprised by executive and non-executive directors. The Board is responsible for setting the strategies and decision-making in regard to the stakeholders interests, and also ensuring the company's evolving in alignment with its goals and values.

Chair of the Board edit edit source

David Sproul

David Sproul was appointed chair of the board in June 2021. He has over 30 years of leadership experience in the financial and professional services sectors. He is skilled in strategy, risk management, M&A, and organizational transformation. Sproul served as Global Deputy Chief Executive of Deloitte, preceded by an 8-year term as Chief Executive & Senior Partner of Deloitte UK and North West Europe. He led the firm's global expansion and worked towards a more inclusive culture. Currently, he holds positions as a director of Safanad and BusinessLDN, and he is a senior adviser to Bridgepoint Group.

Senior Independent Director edit edit source

Tracy Clarke

Tracy Clarke was appointed to the position in May 2021. She has extensive international banking and financial services experience, having spent 35 years at Standard Chartered Bank. Her roles spanned leadership, compliance, human resources, corporate affairs, brand, and marketing. She eventually reached the position of Chief Executive Officer for Europe and Americas and Global Chief Executive Officer for Private Banking. Clarke holds directorships in TP ICAP, England Netball, and Acin, and she chairs SchoolOnline, an online learning platform. Additionally, she serves as a director and chair of the board remuneration committee, and a member of the board audit committee for Haleon, a consumer healthcare company.

Independent Non-Executive Director edit edit source

Carolyn Clarke

Carolyn Clarke was appointed a director in October 2020. She is an expert in risk, assurance, control, compliance, and conduct. With a background that includes senior executive and board positions, she previously served as the Head of Audit, Risk, and Control at Centrica and had a 20-year career at PwC. Her specialization lies in assessing the influence of people, behaviors, and culture on organizational risks and outcomes. Clarke holds the position of Vice President at the Chartered Institute of Internal Auditors and chairs the audit committees for two green technology growth companies, Elcogen Group and Agilyx.

Independent Non-Executive Director edit edit source

Faisal Galaria

Faisal Galaria was appointed in June 2022, possessing over 25 years of experience leading teams in global consumer technology companies such as Spotify, Kayak, and Skype. He is well-versed in strategy, international growth, and digital transformation and has played a significant role in tech and Web3 IPOs in the UK and the US. In 2022, Galaria stepped down as the Chief Executive Officer of Blippar, one of the UK's first tech unicorns. He has also served as Senior Partner at Alvarez & Marsal, leading the Digital and Media practices across EMEA. Currently, he sits on the advisory board of Imperial College Business School.

Independent Non-Executive Director edit edit source

Ian Jenkins

Ian Jenkins was appointed a director in October 2021. He has more than 35 years of experience in banking and financial services, with roles as a chief financial officer, chief risk officer, and chief operating officer at various institutions, including Diem Networks, HSBC, Santander, and Credit Suisse. As a chartered accountant, he offers diverse expertise in finance, risk, operations, and strategy to the Board. Furthermore, he is a member of the Board Audit Committee and the Board Risk Committee.

Independent Non-Executive Director edit edit source

Marian Martin

Marian Martin was appointed a director in June 2019. She is a chartered accountant specializing in risk management. She served as the Chief Risk Officer of Virgin Money during a phase of substantial growth and strategic development, which included the company's listing on the London Stock Exchange. Apart from her current role at Starling, Martin holds non-executive director positions as the chair of the Board Risk Committee at Castle Trust and the chair of the Board Audit and Risk Committee at PPRO Holding.

Non-Executive Director edit edit source

Lázaro Campos

Lázaro Campos was appointed a director in June 2018. He is an experienced fintech investor and entrepreneur with over 30 years of global finance expertise. Previously, he held the position of Chief Executive Officer at SWIFT, leading its transformation into a commercially driven, innovative, and customer-centric cooperative until 2012. Additionally, Campos co-founded FinTechStage, a company focused on creating innovative ecosystems for global financial services organizations. Finally, he is a member of the Board Remuneration Committee and the Board Nomination Committee.

Non-Executive Director edit edit source

Marcus Traill

Marcus Traill is a director since December 2015. He started as an analyst at Bank of New Zealand and Owens Group. Later, he joined McPike Global Family Office (MGFO) and QuantRes, co-leading the Private Investments division of MGFO and contributing to various financial market quantitative trading strategies at QuantRes. He also managed the group's operations. Currently, Traill is a partner at Altered Capital, a venture capital and private equity fund manager. He is additionally a member of the Board Risk Committee, the Board Audit Committee and the Board Remuneration Committee.

Chief Executive Officer

Anne Boden MBE

After an distinguished global career in financial services, Anne Boden MBE founded Starling Bank in 2014. Among her notable past positions, she served as the Chief Operating Officer of Allied Irish Banks, Head of EMEA, Global Transaction Banking at RBS, and Executive Vice President Europe, Transaction Banking at ABN AMRO. Boden, who holds a computer science background, is a Fellow of the Royal Chartered Institute of IT and joined the Prime Minister's Business Council and the Mayor of London's Business Advisory Board in February 2022. In recognition of her contributions to financial technology, she was awarded an MBE in 2018.

Chief Financial Officer edit edit source

Declan Ferguson

Declan Ferguson became a part of Starling Bank in 2017 and was appointed to the role of Chief Financial Officer in 2022. In this capacity, he oversees the Bank's financial operations, including capital and liquidity management. Additionally, Declan handles strategic and corporate development, capital raising, and long-term financial and business planning for the Bank. Before joining Starling, he received training as a chartered accountant at PwC, where he led engagements related to turnaround, restructuring, and sale of European banks, as well as large loan portfolios and credit-related transactions involving UK and European banks.

Market and Industry edit edit source

Overview of the industry edit edit source

According to recent research by Global Markets Insights (GMI), the neobanking market size exceeded $45 billion during 2021 and is predicted to grow significantly at a CAGR of 45% from 2022-2028.

Key market drivers edit edit source

- Technology Adoption: With the increase in smartphone and internet usage worldwide, more people have access to and comfort with digital platforms. This broad technology adoption makes it possible for neobanks to reach a large customer base.

- Customer Demand for Convenience: Today's customers expect convenience, speed, and personalized services. They are increasingly turning to digital banking as it offers 24/7 access to banking services from any location. This shift in consumer behavior is driving the growth of the industry.

- Cost effective: Digital banking platforms typically require less physical infrastructure and personnel than traditional banks, resulting in lower operating costs. This allows digital banks to offer competitive rates and fees, attracting more customers.

- Regulatory Support: In many parts of the world, regulatory changes have made it easier for neobanks to operate. For instance, open banking regulations have enabled neobanks to integrate more smoothly with other financial systems and services.

- Dissatisfaction with Traditional Banks: There's a growing sentiment among certain customer groups, particularly younger generations, that traditional banks don't meet their needs or aren't aligned with their values. This has created an opportunity for neobanks to offer an alternative.

- COVID-19 Impact: The ongoing COVID-19 pandemic has further accelerated the shift towards digital banking. Social distancing measures and an overall increase in online activities have increased demand for digital banking services provided by neobanks.

- User-friendly Interface:the interface of neobanking app are becoming more and more convenient and user-friendly, which will attract more customs.

- Increasing Mobile Penetration: As the technology development, most people get used to use mobile app. The increase in mobile phone penetration has made people more and more accustomed to and like to handle business on mobile phones, including banking services.

Key challenges in the industry edit edit source

Although the digital banking industry is rapidly growing, there are some substantial challenges in which the industry faces and must look to resolve or combat.

- Lack of face to face customer support - Neobanks offer all their customer support services digitally and while this may be quick and imminent, it is inconvenient for consumers who prefer face-to-face interactions. Complex banking scenarios can be made easier with the involvement of a personal banker which can help consumers with their options and find solutions tailored to their needs, which is may be difficult through an online service.

- Cybersecurity - With digital banks operating completely online, they are vulnerable to fraud and cyber attacks. Fraud complaints against Starling, Revolut and Monzo have increased at a rate higher than customer growth, and higher than complaints at traditional banks. A neobank with poor security and customer protections would conceivably lose the public's trust and enormous business and revenue. Challenges such as account takeovers, chargeback fraud and loan fraud are all examples of criminal activity that digital banks are at risk from.

- Shifting banking habits - As a result of the pandemic, there has been a massive surge in online banking amongst traditional banks slowing down the leakage of consumers. While traditional banks offer services both in physical branches and now digitally, consumers will be less inclined to shift to neobanks unless they have a unique differentiating factor.

- Lack of knowledge among rural customers - Lack of knowledge among rural customers is indeed a key challenge in the expansion of neobanking. Despite the opportunities for greater financial inclusion, a variety of factors can create barriers for rural customers:

- Digital Literacy: Many rural customers may not have the necessary digital skills to use neobanking services. They may not be familiar with how to use mobile apps, understand online security practices, or navigate digital banking platforms.

- Access to Technology: Even if they are digitally literate, some rural customers may not have access to the necessary technology. They might not own a smartphone or have a reliable internet connection, both of which are crucial for accessing neobanking services.

- Trust in Digital Platforms: Many rural customers are used to traditional banking methods and may be hesitant to trust digital platforms with their money. This is especially the case if they are not familiar with digital security measures.

- Understanding of Financial Products: Financial literacy is another significant challenge. Rural customers might lack understanding of the various financial products and services offered by neobanks, making them less likely to take advantage of these services.

To overcome these challenges, neobanks can invest in initiatives aimed at enhancing digital and financial literacy. This could involve conducting workshops, offering online tutorials, or partnering with local organizations to provide training. Additionally, they can design their platforms to be as user-friendly and intuitive as possible, making them more accessible to users with varying levels of digital literacy.

Neobanks can also work to build trust with customers by implementing robust security measures and transparently communicating these measures to customers. They could provide resources to educate customers about online security and how they protect customer data.

Risk assessment of the industry edit edit source

Starling bank defines risk as any unexpected future event that could damage their ability to achieve strategic, financial or overall business objectives, including damage to earnings capacity, capital positioning, business reputation, cash flows, or poor customer outcomes.

The following are the important risks that have been identified:

- Operational risk - the risk of loss, whether direct or indirect, to which the bank is exposed due to insufficient or failed internal processes. They encompass the following sub-categories:

- Internal fraud;

- People;

- Customers, Products & Business Practises;

- Legal;

- Outsourcing and third parties

Starling has a suite of operational risk policies in which they go over the identification, management and reporting of the risks associated with the identified sub-categories of operational risk.

- Credit risk - the risk of financial loss to a consumer's failure to repay a loan or failure to follow contractual obligations. The bank has corresponding strategies for the different credit risk types in order to manage them. The bank is exposed to Retail & Commercial Credit Risk, and Wholesale Credit Risk:

- Retail and Commercial Credit Risk - this is the current or prospective risk of a customer of the bank not following their contractual obligations. This risk is associated with the lending facilities which Starling offers to its Mortgage, SME and retail customers.

- Wholesale credit risk - this arises from balance sheet management and investments in highly rated debt securities which are included within the High Quality liquid Asset portfolio. Starling does not try to heavily depend on any wholesale party to an extent in which a failure by that party would have a severe impact on the bank. Starling mitigates wholesale credit risk by operating within a limit framework set by the board.

- Liquidity Risk Management - this is the risk that starling, over a specific horizon, will become unstable to settle obligations when due. The primary causes of liquidity and funding risk for Starling are customer funding risk, in which the customer deposits balances fall, and the risk that Starling's liabilities do not grow as planned while assets grow faster than the business pla

Industry Trends and Outlook edit edit source

- Key Trends of digital banking industry

- Digital transformation: Digital adoption in the banking industry is increasing as more consumers use online and mobile banking services due to the COVID-19 pandemic. As a result, banks have stepped up investment in digital infrastructure to meet this demand.

- User Experience (UX): Digital banking focuses on improving the user experience by providing intuitive, easy-to-use interfaces and instant services to attract and retain customers.

- Artificial intelligence and automation: Artificial intelligence (AI) and automation are increasingly being used in digital banking to improve customer service (via AI chatbots), fraud detection, risk management, and personalization.

- Open Banking: Through the Open Banking api, customers can share their financial data with third-party providers to create personalized financial products and services. This is driving more collaboration and innovation within the industry.

- Blockchain and cryptocurrencies: While still in its early stages, the use of blockchain technology for secure transactions and the integration of cryptocurrencies into banking services are potential growth areas.

- 5G Technology: The implementation of 5G networks was expected to greatly improve the speed and efficiency of digital banking services, including faster transactions, improved customer service, and enhanced capabilities for mobile banking apps.

- Future Outlook of digital banking industry

- Increased competition: As traditional banks invest in digital transformation and tech companies such as Google and Apple enter the financial services industry, the digital banking market is expected to become more competitive.

- Increased regulation: As digital banking becomes more popular, it is likely to attract more regulatory attention to ensure customer data protection and financial stability.

- New business models: With the emergence of open banking, new banks and fintech companies are likely to transform from independent entities into platforms hosting a range of financial products and services.

- Cybersecurity: With the increase in digital banking, cybersecurity is expected to become more important. Banks need to invest in advanced security measures to protect customer data and maintain trust.

- Sustainable and inclusive banking: Digital banks are likely to focus more on socially responsible investment, green finance, and reaching out to the unbanked or unbanked.

- Fintech as a Service: Similar to the concept of Bank as a Service (BaaS), Fintech as a service may be an upcoming trend where fintech functions are offered to traditional banks or other fintech companies in a modular, service-oriented manner.

- Decentralized Finance (DeFi): DeFi aims to eliminate intermediaries in financial transactions using blockchain technology, and while still in its infancy, it could impact how financial transactions are conducted in the future.

- Key Trends of neobanking industry

- Growing user base: New banks are gaining popularity, especially among young, digitally savvy consumers who value convenience and user-friendly interfaces. The COVID-19 pandemic has further accelerated digital adoption in banking.

- Artificial Intelligence and data-driven services: New banks are leveraging artificial intelligence and data analytics to personalize services and improve customer experiences. This includes personalized financial advice, budgeting tools, and predictive analytics.

- Regulatory technology (RegTech): New banks use regulatory technology to ensure compliance with financial regulations. This could include automated reporting tools, authentication technologies, and fraud detection.

- Collaborative approach: Many new banks have adopted a collaborative approach, forming partnerships with other fintech companies, technology providers and even traditional banks to provide a wider range of services.

- Focus on underserved markets: Many new banks are focusing on markets that are traditionally underserved by traditional banks. This could include low-income consumers, small businesses, or gig economy workers.

- Future outlook of neobanking industry

- New Regulations: As the digital banking industry evolves, new regulations might be introduced that could impact neobanks' operations. For example, regulations related to data privacy, open banking, or digital currencies.

- Resilience and Recovery Measures: Neobanks may need to focus on resilience and recovery measures to manage operational and financial risks, including cybersecurity threats and economic downturns.

- Digital Currencies: With the rise of cryptocurrencies, some neobanks might start offering services related to digital currencies, such as trading, storage, or payment services.

Planning & News edit edit source

- Starling plans to list on the public markets in the future but in 'no hurry' : The group reported a pre-tax profit of £195million for the year to the end of March, representing a six fold increase on the £32million reported last year. It is among the few UK digital banks that are profitable. However, Boden, the boss, said she said she was in 'no hurry' to launch an initial public offering because it was not a good a time for businesses to be going public.[23]

- Starling Bank boss Anne Boden stepping down as chief executive on 30th, June: The founder of Starling Bank will step down as chief executive next month due to concerns the top job conflicts with her position as part-owner of the bank. Ariane Vickman joins the fintech industry as Starling's head of public affairs from UK Finance, where she was most recently a principal of public affairs and public policy. She was a part of the pressure group and one of its predecessors, the British Banking Association, since 2015.[24]

Ownership Structure of digital banking industry edit edit source

Private limited companies include characteristics such as main private individuals involved in the business and financial institutions investing through issuance of private shares. Representative of this type, Starling Bank is partly owned by Anne Boden, the founder, Harry McPike, a global private investor, and then multiple financial institutions such as Goldman Sachs, Jupiter, Fidelity, Railpen, Qatar Investment Authority and Millennium Management.[25]

| Name | Current Shares | % of total shares | Share Type | Type |

|---|---|---|---|---|

| Jtc Starling Holdings Limited | 310,453,524 | 27% | Ordinary B | Company |

| The Starling Fs Employee Benefit Trust | 116,490,698 | 10% | Ordinary A | Other |

| Jtc Starling Holdings Limited | 111,903,794 | 10% | Ordinary C | Company |

| Chrysalis Investments Limited | 101,821,636 | 9% | Ordinary C | Company |

| Qatar Holding Llc | 77,224,213 | 7% | Ordinary D | Company |

| Anne Elizabeth Boden | 56,861,845 | 5% | Ordinary | Person |

| Railways Pension Trustee Company Limited | 47,110,580 | 4% | Ordinary D | Company |

| Wsgg Holding S.a R.l. | 32,500,130 | 3% | Ordinary D | Company |

| Qatar Holding Llc | 31,636,961 | 3% | Ordinary C | Company |

| Chrysalis Investments Limited | 31,352,623 | 3% | Ordinary B | Company |

Competitve Analysis edit edit source

Revolut:

Offerings: Revolut is a digital banking platform that provides a range of financial services, including multi-currency accounts, international money transfers, cryptocurrency trading, budgeting tools, and insurance options.

User Base: Revolut has a large and rapidly growing user base across various countries.

Features: Revolut offers unique features like "Round-Up," which rounds up transactions to the nearest whole number and saves the spare change into a separate account.

Strengths: Revolut's strength lies in its extensive international presence, multi-currency capabilities, and diverse range of financial services.

Monzo:

Offerings: Monzo is known for its user-friendly mobile banking app, offering personal and business accounts with features like instant spending notifications, budgeting tools, and fee-free spending abroad (up to a limit).

User Base: Monzo has a large user base, particularly in the UK, and has expanded its services internationally.

Features: Monzo provides budgeting tools that categorize expenses, and customers can create "Pots" to save for specific goals.

Strengths: Monzo's strengths include its user-friendly app, strong brand presence, and effective community engagement.

N26:

Offerings: N26 is a digital bank that operates primarily in Europe and the United States, offering personal and business accounts with features like mobile payments, real-time spending insights, and various savings options.

User Base: N26 has a significant presence in Europe and has expanded its services in the US.

Features: N26 offers unique perks and benefits based on the account type, such as travel insurance and discounts from partner brands.

Strengths: N26's strengths include its streamlined account setup process, competitive exchange rates, and growing list of partner services.

Starling Bank Salient Features:

Innovative Features: Starling Bank was among the first banks to introduce cutting-edge features like "Pulse" (real-time spending insights) and "Spaces" (savings goals within accounts), enabling users to manage their finances effectively.

Integrated Marketplace: Starling Bank's "Marketplace" offers a variety of third-party financial services and products through its app, delivering a comprehensive and customizable banking experience for customers.

Business Banking Solutions: Starling Bank focuses significantly on business banking, providing entrepreneurs and small businesses with a suite of tailored services, setting it apart from some competitors.

Transparent Pricing Structure: Starling Bank maintains a transparent pricing structure, charging no hidden fees for basic services, resulting in a more affordable and user-friendly experience.

Positive Customer Experience: Starling Bank enjoys a positive reputation due to its excellent customer service, intuitive app design, and responsiveness to client feedback, fostering a loyal customer base.

PESTLE Analysis

Political

- Regulation and compliance: Starling Bank, as a financial institution, operates under the scrutiny of various financial regulations, such as those imposed by financial authorities like the Financial Conduct Authority (FCA) in the UK. Changes in regulations can impact the bank's operations and may require adaptations.

- Brexit implications: As a UK-based bank, Brexit might have introduced changes in trade, financial regulations, and economic conditions, affecting Starling Bank's international expansion plans and access to the European market.

Economic

- Interest rates: Fluctuations in interest rates set by central banks can affect Starling Bank's borrowing and lending practices, influencing its profit margins and customer lending rates.

- Economic growth: The overall economic performance of the UK and the countries where Starling Bank operates can impact customer spending habits and their demand for financial services.

Social

- Digital banking adoption: The extent to which people embrace digital banking and mobile apps affects Starling Bank's potential customer base and growth prospects.

- Customer preferences and trust: Customer expectations regarding user experience, security, and transparency can shape Starling Bank's reputation and market positioning.

Technological

- Fintech innovation: The emergence of new financial technologies and innovative solutions can disrupt the banking industry and may require Starling Bank to invest in R&D or partnerships to stay competitive.

- Cybersecurity: With the growing threat of cyberattacks, ensuring robust cybersecurity measures is critical to maintain customer trust and protect sensitive data.

Legal

- Data protection and privacy laws: Compliance with data protection regulations, such as GDPR in Europe, is crucial for handling customer data responsibly and avoiding potential legal consequences.

- Anti-money laundering (AML) and Know Your Customer (KYC) regulations: Stringent adherence to AML and KYC practices is essential for Starling Bank to prevent fraudulent activities and maintain regulatory compliance.

- Environmental: Sustainability and green initiatives: Consumer preferences for environmentally responsible businesses may drive the demand for sustainable banking products or services. Starling Bank's commitment to eco-friendly practices could influence customer decisions.

Historical Financial Data edit edit source

Income Statement edit edit source

| Amounts in Thousands, USD (except Ratios, Multiples & per share items) | FY 2018 | FY 2019 | FY 2021 | FY 2022 | FY 2023 | Mar-2023 |

| Gross Profit | ||||||

| Total Revenue | 1,810 | 23,844 | 142,002 | 302,232 | 610,539 | 610,539 |

| Operating (Income)/Expenses | ||||||

| Wages and Salaries | 17,025 | 40,116 | 87,884 | 114,658 | 143,271 | 143,271 |

| Directors' Remuneration | 1,262 | 1,429 | 3,047 | 3,468 | 3,539 | 3,539 |

| Depreciation | 268 | 595 | 3,439 | 3,150 | 3,842 | 3,842 |

| Amortization | 2,125 | 3,316 | 5,755 | 5,570 | 9,345 | 9,345 |

| Depreciation, Amortization and Depletion | 2,393 | 3,911 | 9,194 | 8,720 | 13,187 | 13,187 |

| Total Operating Profit/(Loss) | ||||||

| Total Operating Profit/(Loss) | 0 | 0 | 0 | 0 | 0 | |

| Pretax Income | ||||||

| Pretax Income | (35,987) | (68,198) | (41,048) | 43,778 | 234,292 | 234,292 |

| Provision for Income Tax | ||||||

| Provision for Income Tax | (2,393) | (1,957) | (10,616) | (17,600) | 62,295 | 62,295 |

| Other Net of Taxes Adjustments | ||||||

| Other Net of Taxes Adjustments | 0 | 0 | 0 | 0 | 0 | 0 |

| Non-Controlling/Minority Interests | ||||||

| Non-Controlling/Minority Interests | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Income Available to Common Stockholders | ||||||

| Net Income Available to Common Stockholders | (33,594) | (66,241) | (30,431) | 61,378 | 171,998 | 171,998 |

| Gross Dividends | ||||||

| Total Gross Dividends | 0 | 0 | 0 | 0 | 0 | 0 |

| Profitability Metrics | ||||||

| EBITDA | (33,594) | (64,287) | (31,854) | 52,497 | 247,479 | 247,479 |

| EBITA | (33,862) | (64,882) | (35,293) | 49,348 | 243,638 | 243,638 |

| EBIT | (35,987) | (68,198) | (41,048) | 43,778 | 234,292 | 234,292 |

| EBITDAR | (33,594) | (64,287) | (31,854) | 52,497 | 247,479 | 247,479 |

| Tax Effect of Unusual Items | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Unusual Items | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Unusual Items Excluding Goodwill | 0 | 0 | 0 | 0 | 0 | 0 |

| Income After Taxes | (33,594) | (66,241) | (30,431) | 61,378 | 171,998 | 171,998 |

Balance Sheet edit edit source

| Amounts in Thousands, USD (except Ratios, Multiples & per share items) | FY 2018 | FY 2019 | FY 2021 | FY 2022 | FY 2023 | Mar-2023 |

| Assets | ||||||

| Cash and Cash Equivalents | 0 | 0 | 0 | 0 | 0 | 0 |

| Trade and Other Receivables, Current | 280,400 | 1,519,237 | 9,623,647 | 15,518,188 | 16,862,198 | 16,862,198 |

| Other Current Assets | 1,867 | 6,935 | 24,644 | 0 | 0 | 0 |

| Total Current Assets | 282,268 | 1,526,172 | 9,648,291 | 15,518,188 | 16,862,198 | 16,862,198 |

| Net Property, Plant and Equipment | 787 | 3,089 | 8,818 | 7,755 | 19,172 | 19,172 |

| Net Intangible Assets | 16,899 | 20,726 | 23,243 | 84,203 | 94,715 | 94,715 |

| Total Non-Current Assets | 17,686 | 23,815 | 40,429 | 120,838 | 119,664 | 119,664 |

| Total Assets | 299,954 | 1,549,987 | 9,688,719 | 15,639,026 | 16,981,862 | 16,981,862 |

| Liabilities | ||||||

| Trade and Other Payables, Current | 258,609 | 1,305,486 | 9,385,728 | 14,858,807 | 15,953,999 | 15,953,999 |

| Current Debt | 0 | 0 | 0 | 0 | 0 | 0 |

| Capital Lease Obligations, Current | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Current Liabilities | 263,907 | 1,460,267 | 9,492,396 | 14,889,909 | 15,999,007 | 15,999,007 |

| Long Term Debt | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Non-Current Liabilities | 258 | 2,033 | 2,749 | 183,714 | 121,746 | 121,746 |

| Total Liabilities | 264,166 | 1,462,300 | 9,495,145 | 15,073,623 | 16,120,753 | 16,120,753 |

| Equity | ||||||

| Paid in Capital | 6 | 9 | 12 | 14 | 15 | 15 |

| Surplus/Revenue Reserve | (51,267) | (118,989) | (158,747) | (92,536) | 89,682 | 89,682 |

| Other Reserves/Accum. Comp. Inc | 87,049 | 206,668 | 352,308 | 657,924 | 771,413 | 771,413 |

| Total Equity | 35,788 | 87,687 | 193,574 | 565,403 | 861,109 | 861,109 |

| Financial Health Metrics | ||||||

| Total Debt | 0 | 0 | 0 | 0 | 0 | 0 |

| Net Debt | 0 | 0 | 0 | 0 | 0 | 0 |

| Total Capital Lease Obligations | 0 | 0 | 0 | 0 | 0 | 0 |

| Common Equity Book Value | 18,889 | 66,961 | 170,331 | 481,200 | 766,394 | 766,394 |

| Total Liabilities & Equity | 299,954 | 1,549,987 | 9,688,719 | 15,639,026 | 16,981,862 | 16,981,862 |

| Net Tangible Assets | 283,055 | 1,529,261 | 9,665,476 | 15,554,823 | 16,887,147 | 16,887,147 |

| Tangible Book Value | 18,889 | 66,961 | 170,331 | 481,200 | 766,394 | 766,394 |

| Working Capital | 18,360 | 65,905 | 155,895 | 628,279 | 863,191 | 863,191 |

| Invested Capital | 35,788 | 87,687 | 193,574 | 565,403 | 861,109 | 861,109 |

| Number of Employees | 193 | 193 |

Ratios edit edit source

| Amounts in Thousands, USD (except Ratios, Multiples & per share items) | FY 2018 | FY 2019 | FY 2021 | FY 2022 | FY 2023 | Mar-2023 |

| Efficiency | ||||||

| Cash to Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Total Asset Turnover | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 | 0.10 |

| Sales Per Full Time Employee | 9 | 124 | ||||

| Margins | ||||||

| EBITDAR Margin | -1,855.66% | -269.61% | -22.43% | 17.37% | 40.53% | 40.53% |

| EBITDA Margin | -1,855.66% | -269.61% | -22.43% | 17.37% | 40.53% | 40.53% |

| EBITA Margin | -1,870.47% | -272.11% | -24.85% | 16.33% | 39.91% | 39.91% |

| Operating Margin | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | |

| EBIT Margin | -1,987.86% | -286.01% | -28.91% | 14.48% | 38.37% | 38.37% |

| EBT Margin | -1,987.86% | -286.01% | -28.91% | 14.48% | 38.37% | 38.37% |

| Growth Rates | ||||||

| Revenue % Growth | 4,121.88% | 1,287.19% | 103.36% | 129.17% | 129.17% | |

| EBITDA % Growth | 434.78% | 434.78% | ||||

| EBIT % Growth | 507.13% | 507.13% | ||||

| Leverage | ||||||

| Debt to Equity | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Total Debt to Equity | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Long Term Debt to Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Debt to Assets | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Long Term Debt to Invested Capital | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Total Debt to Invested Capital | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Equity Multiplier | 8.38 | 17.68 | 50.05 | 27.66 | 19.72 | 19.72 |

| Financial Health | ||||||

| Current Ratio | 1.07 | 1.05 | 1.02 | 1.04 | 1.05 | 1.05 |

| Quick Ratio | 1.06 | 1.04 | 1.01 | 1.04 | 1.05 | 1.05 |

| Capital Expenditure to EBITDA | 0.00 | 0.00 | 0.00 | |||

| Capital Expenditure to Sales | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Dividend Metrics | ||||||

| Retention Rate | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Other Ratios | ||||||

| Book Value to EBITDA | 9.17 | 3.10 | 3.10 | |||

| Book Value to EBIT | 10.99 | 3.27 | 3.27 | |||

| Book Value to Revenue | 10.43 | 2.81 | 1.20 | 1.59 | 1.26 | 1.26 |

Valuation edit edit source

Starling Bank has raised a total of $1.1B in funding over 11 rounds. Their latest funding was raised on Apr 26, 2022 from a Series D round with a total of £130.5M raised. The pre-money valuation was £2.5B and the major investors included Goldman Sachs, Fidelity, Qatar Investment Authority and RPMI Railpen.

Discounted Cash Flow edit edit source

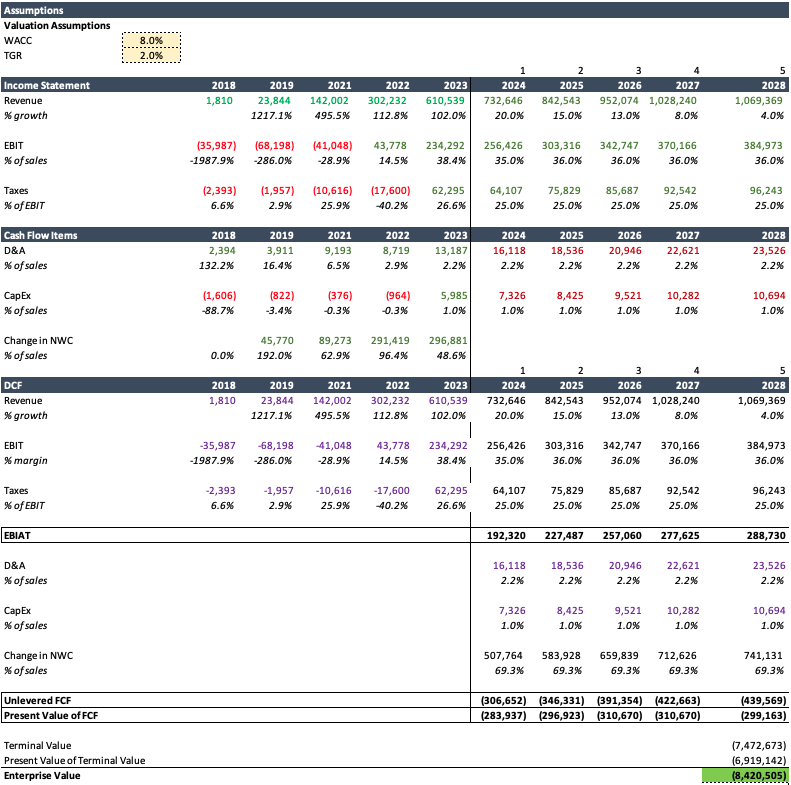

Using our analysis and the information from open sources, we came up with a potential valuation of nearly $8.4B in the next 5 years. This comes from the overall growth of the neobank industry, expansion of the geography and increased customer base. According to Stockhub's valuation, there is a potential upside.

In the Discounted Cash Flow model we have used the following assumptions:

- Revenue forecast: Starling Bank, for the last 5 years has shown a very rapid growth in their revenue. However, we have decided that according to analyst forecasts, the banking, fintech and neobank industry growth will be slowing down as a whole.

- The terminal growth rate (TGR) was assumed to be 2% in-line with analyst consensus.

- WACC: With the industry average for the cost of equity and the industry beta, we have assumed the WACC to be equal to 8%.

- Taxes, EBIT, D&A, CapEx: Were all assumed as a percentage of revenue and to be constant throughout the period of our forecast.

References edit edit source

- ↑ https://www.starlingbank.com/about/awards/

- ↑ https://www.weforum.org/people/anne-boden/

- ↑ https://www.starlingbank.com/news/starling-bank-receives-banking-licence/

- ↑ https://www.starlingbank.com/about/responsible-banking-our-values/

- ↑ https://archerygb.org/news/archery-gb-monlife-and-starling-bank-join-forces-to-host-archery-national-tour-finals-at-caldicot-castle

- ↑ https://www.starlingbank.com/news/starling-official-banking-partner-for-uefa-womens-euro-2022/

- ↑ https://www.starlingbank.com/blog/our-referrals-partnership-with-trillion-trees/

- ↑ 8.0 8.1 8.2 8.3 8.4 https://www.starlingbank.com/docs/annual-reports/Starling-Bank-Annual-Report-2023.pdf

- ↑ https://news.sky.com/story/jupiter-to-sell-100m-starling-bank-stake-at-steep-valuation-discount-12703112

- ↑ https://www.starlingbank.com/docs/annual-reports/Starling-Bank-Annual-Report-2022.pdf

- ↑ Starling Bank - Funding, Financials, Valuation & Investors (crunchbase.com)

- ↑ Starling-Bank-Annual-Report-2023.pdf (starlingbank.com)

- ↑ https://www.telegraph.co.uk/business/2021/07/16/starling-bank-picks-former-deloitte-chief-chairman/

- ↑ https://www.sc.com/uk/insights/what-makes-a-great-leader-2/

- ↑ https://events.icaew.com/pd/20424/climate-change-and-tcfd-the-role-of-internal-audit

- ↑ Board of Directors - Starling Bank

- ↑ Board of Directors - Starling Bank

- ↑ Board of Directors - Starling Bank

- ↑ Board of Directors - Starling Bank

- ↑ Board of Directors - Starling Bank

- ↑ Starling-Bank-Annual-Report-2023.pdf (starlingbank.com)

- ↑ Board of Directors - Starling Bank

- ↑ https://www.thisismoney.co.uk/money/markets/article-12124193/Starling-Bank-boss-steps-avoid-potential-conflict-interest.html

- ↑ https://www.efinancialcareers.com/news/2023/07/starling-bank-public-affairs-ariane-vickman

- ↑ About Starling Bank - Starling Bank