Teladoc Health, Inc.

| |

| Formerly |

|

|---|---|

| Type | Public |

| |

| Industry | Medical care |

| Founded | 2002 in Dallas, Texas, U.S. |

| Founders |

|

| Headquarters | Purchase, New York, U.S. |

Areas served | 130+ countries[1] |

Key people | Jason Gorevic (CEO) Mala Murthy (CFO) |

| Brands | Teladoc, Advance Medical, Best Doctors, Livongo, BetterHelp, InTouch Health, HealthiestYou,[2] MédecinDirect[3] |

| Services | Telemedicine, analytics |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 5,000 (2023)[6] |

| Website | teladochealth |

Teladoc Health, Inc. provides virtual healthcare services in the United States and internationally. The company offers a portfolio of services and solutions covering non-urgent, episodic, chronic, and complicated medical conditions, including diabetes, hypertension, chronic kidney disease, cancer, congestive heart failure, and mental health conditions. It offers a range of programs and services, including primary and specialty care telehealth solutions, chronic condition management, expert medical services, mental health solutions, and platform and program services. The company serves employers, health plans, hospitals and health systems, and insurance and financial services companies, as well as individual members. It offers its products and services under the Teladoc, Livongo, and BetterHelp brands. The company was formerly known as Teladoc, Inc. and changed its name to Teladoc Health, Inc. in August 2018. The company was incorporated in 2002 and is headquartered in Purchase, New York.

History of the company edit edit source

Teladoc health was first established in 2002 in Dallas, Texas and became a nationally recognised company in 2005. It allowed patients to consult with licensed doctors online at any time, solving the, whilst also offering corporations a service of paying a monthly fee in order for their employees to access the service. By 2013 Teladoc had raised $100M in funding, going public in 2015. After that Teladoc kept expanding, acquiring Best Doctors (a consultation firm that provides second opinions and medical award listings) in 2017. It expanded rapidly in years 2017-2021, providing near real-time surveillance data during the COVID-19 pandemic and later that year launching a diabetes management service through Dexcom. In 2022, it also became the telehealth portal for Mayo Clinic Health System in Winconsin. Now Teladoc has over 5000 employees, 56 million members and over 12000 corporate clients.

Operations edit edit source

What is the mission of the company? edit edit source

Teladoc Health's motto is "Empowering all people everywhere". The vision of the company is that anyone, anywhere in the world should have access to the best possible healthcare, in a way that suits one individually, using smart data and continuously improving their technologies. Currently the main focuses of the company include primary care, chronic condition care and mental health care.

What are the main offerings of the company? edit edit source

Teladoc health operates in the virtual healthcare segment, with offerings ranging from telemedicine to virtual mental health care, for individuals as well as for organizations

For individuals edit edit source

The company offers various membership plans, some covered by insurance and some costs being an add-on.

| Plan | Target Clientelle | Features |

|---|---|---|

| General medical | General public,

both adults and children |

care 24/7 for non-emergency conditions like cold & flu, sinus infections, allergies and more |

| Primary 360 | Individuals taking their healthcare especially seriously and seeking a personalised approach | Primary care provider and care team coordinate routine care and wellness screenings, tailored approach to healthcare |

| Mental Health | People struggling with- or wishing to improve their

mental health |

Choosing a therapist, psychologist or psychiatrist tailored to one's needs and scheduling virtual sessions up to 7 days per week |

| Specialist & expert

opinion |

Niche diagnoses, second opinions and surgery advise | Detailed report from a medical specialist in the appropriate field |

| Wellness Care | General public wishing to improve their health | Nutrition advice, sexual health, tobacco cessation, joint care |

For organizations edit edit source

Hospitals edit edit source

Teladoc Health provides the SoloTM virtual care platform for hospitals, aimed to simplify the patient and clinician experience, along with edit edit source

innovating technology for increased efficiency. The main focuses include: edit edit source

- Configurable workflows, from the simple to the comprehensive, remove complexity and focus on care delivery.

- Integration with existing IT systems, including EMRs, reduces point solutions and total cost of ownership.

- Anywhere, anytime care extends reach and increases patient access, engagement and satisfaction.

- 24/7 proactive monitoring and technical support for patients and care teams keep systems running smoothly and ease the burden on IT

In practice, enabling bedside and virtual nurse collaboration, also called "inpatient virtual care" has lead to a 44% increase in patients discharged before noon in the virtual nursing unit, 20% faster discharge from virtual nursing unit compared to traditional nursing unit, alltogether resulting in 40% cost savings.

Employers

More than half of the Fortune 500 companies including SAP, American Heart Association and Hyatt use Teladoc Health's services to provide better benefits and healthcare for their employees.

The App edit edit source

- Customers can use the app to access their medical history, as well as request visits just by a few finger taps

- 4 Apps, integrating with each other, each with a different purpose - Teladoc Health Patient, Teladoc Health Provider, Teladoc medical advice and Teladoc myStrength

- Available to download on Google Play and App Store

- For example, it was widely used by Ralph Lauren to aid employees in managing their chronic health conditions and mental health

Social responsibility and impact standing 2022 edit edit source

- 1 in 4 Americans have access to Teladoc Healthcare services

- $18M financial aid has been used to cover therapy costs for low-income individuals

- 57% members say that without the services they would have gone to an emergency room or urgent care center

- 50 million visits hit in 2022

- Incredibly high employee satisfaction at over 90%

Market edit edit source

Total addressable market edit edit source

The total addressable market in this case is the healthcare provision, the value being estimated at USD 1.6 Trillion.

Serviceable available market edit edit source

Here the serviceable available market is defined as the global virtual healthcare market. This market is according to Grand View Research was USD 211.0 billion in 2022 and is expected to reach USD 245.3 billion in 2023.

Serviceable obtainable market edit edit source

Here the serviceable obtainable market is defined as the US virtual healthcare market. This is currently valued at $5.6 billion.

Industry demand drivers edit edit source

- Increasing prevalence of cancer globally - as predicted by Cancer Research UK, by 2040 we will see a 54.9% increase in new cancer cases worldwide. This will put increased pressure on the healthcare industry and hence increase demand.

- Shortages in healthcare facilities - according to WHO, by 2030 healthcare facilities will be short of 15 million qualified professionals, increasing the demand for virtual care.

- Constantly developing technologies and AI - with technology, be it medtech or technology in general developing rapidly and that contributing to significant development of virtual healthcare, of course, there will be an increased demand for it.

Competition edit edit source

Teladoc Health holds a 10.50% market share within the telehealth market in the US in 2023. It ranks as the 5th company by market share after Zoom, Cisco System and others, with a market penetration of 6.91%. Most hospitals have some sort of telehealth solutions in place, according to data from Definitive Healthcare’s HospitalView product, 65.53% of hospitals have a telemedicine solution installed.

Team edit edit source

Leadership edit edit source

Financials edit edit source

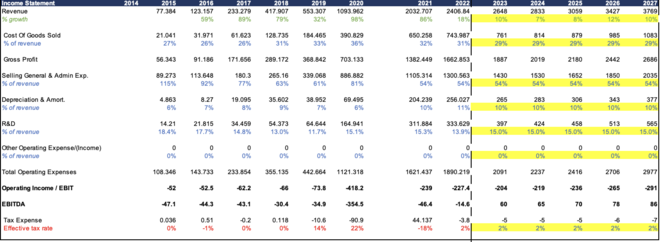

Historic edit edit source

Most recent quarter edit edit source

In the second quarter of 2023, ending June 30th 2023, Teladoc Health's net loss totalled $65.2 million, $0.40 per share a 98% decrease from second quarter 2022 results. Net revenue grew 10% year-over year in second quarter, coming in at $652.4 million. The adjusted EBITDA was $72.155 million, 54% increase from 2022.

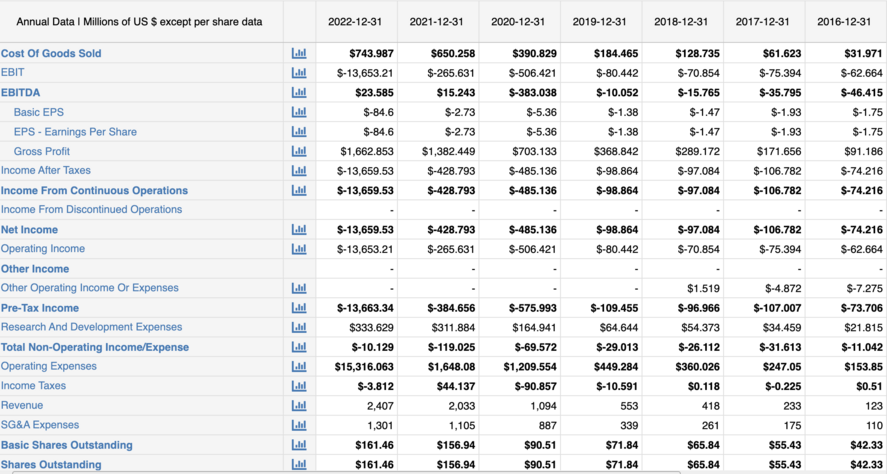

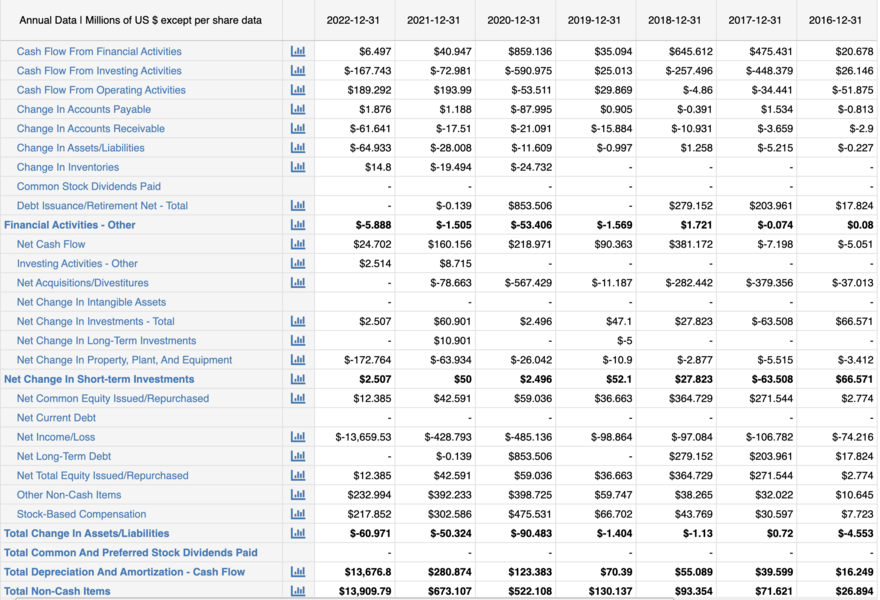

Most recent year edit edit source

In FY ending 2022, cash flow from operating activities was $189.3 million, and free cash flow was $16.5 million respectively. The revenue increased by 18% since 2021, totalling at $2406.840 million.

All periods edit edit source

Historic Financials edit edit source

| Year | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 |

|---|---|---|---|---|---|---|---|---|

| Revenues

($' million) |

77.384 | 123.157 | 233.279 | 417.907 | 553.307 | 1093.96 | 2033 | 2406 |

| Net profits

($' million) |

-58.020 | -74.216 | -106.782 | -97.084 | -98.864 | -485.14 | -429 | -1365 |

| Total assets

($' million) |

229.737 | 303.670 | 824.391 | 1528.88 | 1602.83 | 17755.28 | 17735 | 4345.00 |

| Employees | 600 | 670 | 1231 | 2242 | 2400 | 4400 | 5100 | 5600 |

Financial forecast edit edit source

Risks associated with Teladoc Health edit edit source

- Economic conditions, such as the cost of living crisis in the UK and the risen to 3.2% inflation in the US may result in altered consumer behaviour, with patients being less willing to turn to healthcare professionals for non-urgent matters.

- Moreover, due to the abovementioned economic conditions, in order to cut costs, employers may be more likely to stop their company plans with Teladoc Health or deciding in the negative direction when thinking about acquiring one.

- With rapidly developing AI, Teladoc Health may lose to its' competitors if they implement it more rapidly, optimising the experience even further.

- Another risk associated with Teladoc is that the company's journey to profits is long and difficult, with many analysts forecasting the first full profitable year to be 2025.

- Teladoc Health operates in various countries and earns revenue in different currencies. Exchange rate fluctuations can impact the company's financial results when converting foreign earnings back into the reporting currency.

- Labour strikes, such as NHS staff strikes may damage the efficiency and quality of the services provided by Teladoc, in turn tarnishing its' reputation

Valuation edit edit source

What's the expected return on an investment in the company? edit edit source

Financial Projections

Using historical and projected financial data, we estimated future Free Cash Flows (FCFs) for Teladoc Health:

| Year | 2023 | 2024 | 2025 | 2026 | 2027 |

|---|---|---|---|---|---|

| FCF | $17.9M | 48.5M | 51.8M | 56.0M | 62.7M |

Terminal value = 1091.5

Discounted cash flow valuation

Assumptions and Methodology:

Our DCF valuation involved the following steps:

- Projecting the Free Cash Flows (FCF) for the next five years.

- Calculating the Terminal Value, using both the perpetuity growth method.

- Discounting projected FCFs and Terminal Value to the present value using a calculated Weighted Average Cost of Capital (WACC) of 7.86%.

- Deriving the Equity Value by adjusting the Enterprise Value for net debt.

- Establishing the Equity Value per Share by dividing total equity value by shares outstanding.

For this analysis, we will utilize the Perpetuity Growth Method to calculate the terminal value. Key assumptions include:

For this analysis, we will utilize the Perpetuity Growth Method to calculate the terminal value. Key assumptions include:

Perpetuity Growth Rate: 2.0%

Final Year FCF: $17.9 million (2023 projection)

Discounted Cash Flow (DCF) Valuation

The present value of projected Free Cash Flows and the terminal value are calculated using the WACC of 7.86%:

Key Findings

Projected Free Cash Flows (2023-2027): We observed a trend of increasingly positive FCFs over the five-year period, starting from 17.9M in 2023 and rising to 62.7 by 2027.

Terminal Value: Our method rendered a Terminal Value of 1091.5M, indicative of long-term positive growth.

Enterprise Value: The aggregated present value of FCFs and the NPV of the Terminal Value provided an Enterprise Value of 931.59M.

Equity Value and Per Share: Adjusting for a net debt of 627.014M, we determined an Equity Value of 304.6M. Dividing this by the outstanding shares (758M), we derived an Equity Value per Share of 0.40

Market Comparison: Contrasting our valuation with the current market price, TDOC’s shares are trading at £25.08, suggesting a substantial divergence from our intrinsic valuation.

Conclusion

The DCF valuation analysis indicates a substantial discrepancy between the calculated equity value per share and the current share price. The negative value suggests that the market price may be significantly overvalued, warranting a cautious outlook for potential investors. It's important to reevaluate the underlying assumptions and data used in this analysis to ensure accuracy in assessing Teladoc Health's true intrinsic value. However, there are a few considerations to take into account:

Assumptions Re-evaluation: Our model paints a rather pessimistic picture. It’s essential to ensure growth rates, WACC, and terminal values are congruent with long-term industry expectations.

External Factors: Mergers, divestitures, and other corporate maneuvers could heavily influence TDOC's valuation and may not be captured in our model.

Sensitivity Analysis: We recommend a deeper dive into sensitivity analyses. Varying assumptions, especially WACC and the perpetuity growth rate, can lead to a wide range of valuations, and experts should ascertain the robustness of our findings against these variations.

Complementary Valuation Methods: DCF, while powerful, is just one lens through which to view valuation. A holistic approach might involve peer group comparisons or precedent transaction analysis.

In summary, while our DCF suggests overvaluation, experts are advised to consider the assumptions carefully, employ sensitivity analyses, and juxtapose these findings against other valuation methodologies to make a well-informed decision

Financial statements edit edit source

Income Statement:

Balance Sheet:

Cash flow statement:

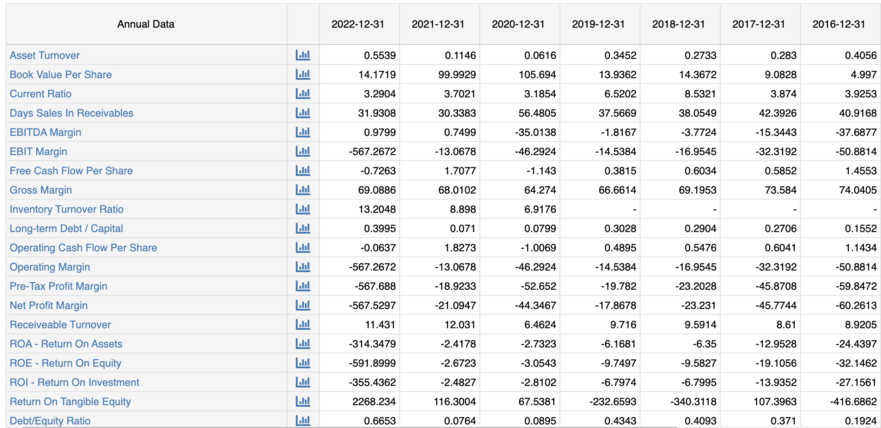

Financial ratios:

References edit edit source

- ↑ Teladoc Health Reports First Quarter 2019 Results, Teladoc, April 30, 2019, retrieved November 25, 2019

- ↑ Cite error: Invalid

<ref>tag; no text was provided for refs namedCitationA3 - ↑ Teladoc Health acquires MédecinDirect to secure French foothold, Les Echos, March 19, 2019, retrieved November 26, 2019

- ↑

- ↑ 5.0 5.1 5.2 5.3 5.4

- ↑

- ↑ https://www.macrotrends.net/stocks/charts/TDOC/teladoc-health/financial-statements

- ↑ https://www.macrotrends.net/stocks/charts/TDOC/teladoc-health/balance-sheet

- ↑ https://www.macrotrends.net/stocks/charts/TDOC/teladoc-health/cash-flow-statement

- ↑ https://www.macrotrends.net/stocks/charts/TDOC/teladoc-health/financial-ratios