The Coca-Cola Company

Executive Summary edit edit source

Coca-Cola headquarters in Atlanta | |

| Type | Public |

|---|---|

| ISIN | [https://stockhub.co/index.php?title=Toollabs:isin/&language=en&isin=US1912161007 US1912161007] |

| Industry | Beverage |

| Founded | January 29, 1892 Atlanta, Georgia, U.S. |

| Founders |

|

| Headquarters | , U.S. |

Area served | Worldwide |

Key people |

|

| Brands | List of Coca-Cola brands |

| Revenue | |

| Total assets | |

| Total equity | |

| Owners |

|

Number of employees | |

| Subsidiaries | List of the Coca-Cola Company subsidiaries |

| Website | |

The Coca-Cola Company, a beverage company, manufactures, markets, and sells various nonalcoholic beverages worldwide. The company provides sparkling soft drinks; flavored and enhanced water, and sports drinks; juice, dairy, and plant based beverages; tea and coffee; and energy drinks. It also offers beverage concentrates and syrups, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products under the Coca-Cola, Diet Coke/Coca-Cola Light, Coca-Cola Zero Sugar, Fanta, Fresca, Schweppes, Sprite, Thumbs Up, Aquarius, Ciel, Dasani, glacéau smart water, glacéau vitamin water, Ice Dew, I LOHAS, Powerade, Topo Chico, AdeS, Del Valle, fair life, innocent, Minute Maid, Minute Maid Pulpy, Simply, Ayataka, BODYARMOR, Costa, FUZE TEA, Georgia, and Gold Peak brands. It operates through a network of independent bottling partners, distributors, wholesalers, and retailers, as well as through bottling and distribution operators. The company was founded in 1886 and is headquartered in Atlanta, Georgia.

History Of Coca-Cola edit edit source

The history of Coca-Cola is truly rich and fascinating. The distinguished beverage was invented in 1886 in Atlanta, Georgia, USA by pharmacist Dr. John S. Pemberton who envisioned it as a remedy for various ailments. Pemberton's bookkeeper, Frank M. Robinson, is credited with devising the iconic name of the beverage “Coca-Cola” and its signature script.

In 1888, Asa Candler, a businessman and pharmacist, acquired the rights to Coca-Cola's formula and embarked on an ambitious journey to promote and expand the brand. Through innovative marketing techniques, Candler transformed Coca-Cola into a popular beverage, appealing to a broader consumer base. He introduced tactics such as distributing free drink coupons and displaying Coca-Cola signage on buildings, effectively establishing the brand's visibility.

In 1919, the Coca-Cola Company was sold to a group of investors, led by Ernest Woodruff and his son Robert W. Woodruff. As president and chairman of the firm, Robert W. Woodruff’s run from the 1920s to the 1950s proved transformative for the company. Under his leadership, Coca-Cola international presence boomed through establishing bottling plants and distribution networks across the globe.

During World War II, Coca-Cola forged a successful collaboration with the American military by distributing drinks to soldiers as part of the firm's commitment to supporting the army. This further solidified Coca-Cola's status as a symbol of American culture and patriotism.

In the following years, Coca-Cola continued to diversify its product portfolio through introducing Diet Coke in 1982, which became an instant success and remains a popular choice for health-conscious consumers. Furthermore, Coca-Cola expanded its beverage offerings by acquiring multiple brands including Sprite, Fanta, Minute Maid, Power play, and Dasani.

Over time, the Coca-Cola Company shifted their focus towards sustainability and environmental responsibility, taking important steps to reduce its carbon footprint and promote recycling efforts. It also explored new markets and remained on track with emerging trends, such as entering the promising market for ready-to-drink teas and coffees

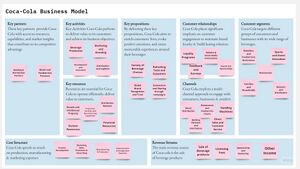

Business Model edit edit source

Coca-Cola's products encompass a wide spectrum, including carbonated soft drinks, juices, bottled water, sports drinks, and ready-to-drink teas and coffees. These beverages are sold under various well-known brands, such as Coca-Cola, Diet Coke, Sprite, Minute Maid, and Powerade, catering to a broad spectrum of consumer preferences and needs.

Coca-Cola's value creation begins with its extensive network of suppliers, which provide the necessary raw materials like sweeteners, flavorings, and packaging materials. The company leverages its strong relationships with these suppliers to ensure consistent quality and availability of ingredients. Once the products are manufactured, Coca-Cola employs an intricate distribution system that spans both developed and emerging markets. This distribution network plays a crucial role in efficiently reaching retailers, restaurants, vending machines, and other outlets, ensuring widespread accessibility to its beverages. Coca-Cola's iconic branding and extensive marketing campaigns further enhance its value proposition by creating strong consumer recognition and loyalty. By tailoring its products to meet diverse tastes and offering convenient access, Coca-Cola successfully generates value by fulfilling the refreshment and hydration needs of consumers worldwide.

Growth of Coca-Cola edit edit source

Coca-Cola has experienced substantial historical growth, propelled by strong branding, effective marketing, and a vast distribution network. The company's iconic Coca-Cola brand has been a major driver of its growth, becoming synonymous with the soft drink category. Over the years, Coca-Cola has expanded its product lineup through acquisitions and partnerships, allowing it to diversify its offerings and reach a broader consumer base using the following ways:

1. Global Expansion:

Coca-Cola's historical growth is marked by its aggressive global expansion strategy. The company expanded into international markets early on, with its first bottling plants established in Canada (1897) and Cuba (1906). By 1929, Coca-Cola had established bottling operations in over 76 countries. Today, the company operates in more than 200 countries, making it one of the most geographically diverse beverage companies in the world.

2. Branding and Marketing:

Coca-Cola's success can be attributed, in large part, to its strong branding and marketing efforts. The company's iconic logo, distinct red color, and memorable advertising campaigns have helped it establish an emotional connection with consumers worldwide. The "Share a Coke" campaign, launched in 2011, where personalized names were printed on Coca-Cola bottles, was a tremendous success and contributed to increased sales and brand loyalty.

3. Diversification:

Coca-Cola's growth is not solely reliant on its flagship Coca-Cola brand. Over the years, the company has diversified its product portfolio through acquisitions and brand extensions. For example, in 1960, Coca-Cola acquired Minute Maid, a leading orange juice brand. In 2001, it purchased the energy drink brand, Monster Beverage Corporation. These acquisitions allowed Coca-Cola to enter new beverage categories and cater to changing consumer preferences.

4. Market Penetration:

Coca-Cola has demonstrated an impressive ability to penetrate new markets and introduce its products to a wide range of consumers. By tailoring its products to local tastes and preferences, Coca-Cola has gained acceptance in diverse cultural settings. An example of this is the introduction of different flavors to cater to regional preferences, such as Coca-Cola Vanilla, Cherry Coke, and others.

5. Emergence of Diet and Zero-Calorie Options:

As health-consciousness increased, Coca-Cola adapted its product line to include diet and zero-calorie options. Diet Coke was introduced in 1982, followed by Coca-Cola Zero in 2005, targeting consumers looking for reduced sugar or calorie-free alternatives. These products have helped the company appeal to a broader consumer base and address concerns about sugary beverages.

6. Bottling System:

Coca-Cola's efficient and extensive bottling system has played a crucial role in its growth. The company's franchised bottling partners handle the production, packaging, and distribution of its beverages, allowing Coca-Cola to focus on brand management and marketing. This system has enabled rapid expansion and ensured that Coca-Cola products are widely available globally.

7. Acquisitions and Partnerships:

The Coca-Cola Company has made strategic acquisitions and partnerships to strengthen its market position and expand its offerings. For instance, in 2018, the company acquired Costa Coffee, a popular coffee chain, to enter the ready-to-drink coffee market and diversify its beverage portfolio further.

8. Financial Performance:

Coca-Cola's financial performance reflects its historical growth. Over the years, the company has consistently reported revenue growth, with occasional fluctuations influenced by economic conditions and market dynamics. Its ability to generate strong cash flows has supported investments in marketing, research, and product development.

While the consumption of traditional carbonated soft drinks has seen some decline in certain markets due to health concerns and changing consumer preferences, Coca-Cola has been actively adapting to these challenges. The company has been focusing on healthier options, including low-calorie and sugar-free beverages, and expanding into non-carbonated categories like bottled water, sports drinks, and ready-to-drink teas. Moreover, the emerging markets in Asia, Africa, and Latin America present significant growth opportunities for the company as disposable incomes rise and consumer preferences evolve.

Competitive Landscape edit edit source

The competitive landscape of The Coca-Cola Company is characterized by intense rivalry and competition within the non-alcoholic beverage industry. As one of the largest and most iconic beverage companies in the world, Coca-Cola faces competition on multiple fronts, both from established players and emerging brands. Here's a more in-depth analysis of the competitive landscape:

1. Major Competitors

a. PepsiCo: Coca-Cola's primary and longstanding rival is PepsiCo. The rivalry between Coca-Cola and Pepsi, often referred to as the "Cola Wars," has been a defining feature of the industry for decades. PepsiCo, like Coca-Cola, has a diversified portfolio of beverages and snacks, including Pepsi, Mountain Dew, Gatorade, Tropicana, and Lay's, among others.

b. Dr Pepper Snapple Group (now part of Keurig Dr Pepper): Dr Pepper Snapple Group was another significant competitor before its merger with Keurig Green Mountain in 2018, forming Keurig Dr Pepper. The company's beverage brands include Dr Pepper, 7UP, Snapple, and Mott's, which compete in various segments of the non-alcoholic beverage market.

2. Regional and Local Competitors

Coca-Cola faces competition from regional and local beverage companies worldwide, especially in specific markets. These companies often have a strong presence in their respective regions and can offer locally relevant flavors and products, providing competition in niche segments.

3. Healthier Beverage Brands

In recent years, the trend toward healthier lifestyles has led to increased demand for beverages perceived as healthier and more natural. Companies like Nestlé Waters, Danone, and various fruit juice brands have capitalized on this trend, presenting competition to Coca-Cola's traditional sugary soft drinks.

4. Energy Drink Brands

Energy drinks have gained popularity among young consumers seeking a boost in energy and focus. Brands like Red Bull and Monster Beverage Corporation (partially owned by Coca-Cola) have become significant competitors in this segment.

5. Non-Carbonated Beverages

Coca-Cola's primary product is carbonated soft drinks, but the company faces competition from non-carbonated beverage categories such as bottled water, ready-to-drink teas, fruit juices, and sports drinks.

6. Private Label Brands

Many retailers offer their own private label or store-brand beverages, which are often cheaper alternatives to branded products. These private labels compete on price and convenience, presenting a challenge to branded beverages.

7. Health and Regulatory Challenges

Public health concerns related to sugary beverages have prompted governments and health organizations to implement policies such as sugar taxes and labeling requirements. These challenges can affect the demand for Coca-Cola's products and create opportunities for healthier beverage alternatives.

Coca-Cola's competitive advantage lies in its strong brand recognition, global distribution network, and marketing expertise. The company's ability to innovate and diversify its product portfolio has allowed it to adapt to changing consumer preferences and trends. Additionally, its long-established presence in various markets and strategic partnerships with bottling companies provide a competitive edge.

However, the competitive landscape is continually evolving, and consumer preferences are shifting toward healthier and more sustainable choices. To maintain its market leadership, Coca-Cola must continue to invest in research, innovation, and marketing, while addressing environmental and health concerns to stay relevant in an increasingly competitive beverage industry. Coca-Cola has consistently maintained a strong market position globally throughout the years. The company's extensive distribution network and brand recognition have allowed it to maintain a substantial market share in various regions. Despite the challenges posed by health concerns and changing preferences, Coca-Cola has demonstrated resilience through diversification and continuous product innovation.

Financials edit edit source

Coca-Cola Historical 2013-2022 edit edit source

| Cocacola_Financial Model | ||||||||||

| Start | Jan-13 | Jan-14 | Jan-15 | Jan-16 | Jan-17 | Jan-18 | Jan-19 | Jan-20 | Jan-21 | Jan-22 |

| End | Dec-13 | Dec-14 | Dec-15 | Dec-16 | Dec-17 | Dec-18 | Dec-19 | Dec-20 | Dec-21 | Dec-22 |

| Count | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| Statement of Income | ||||||||||

| Revenue | 46,854 | 45,998 | 44,294 | 41,863 | 35,410 | 31,856 | 37,266 | 33,014 | 38,655 | 43,004 |

| COGS | (18,421) | (17,889) | (17,482) | (16,465) | (13,256) | (11,770) | (14,619) | (13,433) | (15,357) | (18,000) |

| Gross Profit | 28,433 | 28,109 | 26,812 | 25,398 | 22,154 | 20,086 | 22,647 | 19,581 | 23,298 | 25,004 |

| Selling, General and Administrative expenses | (17,310) | (17,218) | (16,427) | (15,262) | (12,496) | (10,307) | (12,103) | (9,731) | (12,144) | (12,880) |

| Other Operating Charges | (895) | (1,183) | (1,657) | (1,510) | (2,157) | (1,079) | (458) | (853) | (846) | (1,215) |

| Operating Income | 10,228 | 9,708 | 8,728 | 8,626 | 7,501 | 8,700 | 10,086 | 8,997 | 10,308 | 10,909 |

| Interest income | 534 | 594 | 613 | 642 | 677 | 682 | 563 | 370 | 276 | 449 |

| Interest expense | (463) | (483) | (856) | (733) | (841) | (919) | (946) | (1,437) | (1,597) | (882) |

| Equity income | 602 | 769 | 489 | 835 | 1,071 | 1,008 | 1,049 | 978 | 1,438 | 1,472 |

| Other income | 576 | (1,263) | 631 | (1,234) | (1,666) | (1,121) | 34 | 841 | 2,000 | (262) |

| Income Before Income Taxes | 11,477 | 9,325 | 9,605 | 8,136 | 6,742 | 8,350 | 10,786 | 9,749 | 12,425 | 11,686 |

| Income taxes | (2,851) | (2,201) | (2,239) | (1,586) | (5,560) | (1,623) | (1,801) | (1,981) | (2,621) | (2,115) |

| Income (loss) from discontinued oppertions | 101 | (251) | ||||||||

| Consolidated Net Income | 8,626 | 7,124 | 7,366 | 6,550 | 1,283 | 6,476 | 8,985 | 7,768 | 9,804 | 9,571 |

| Less: Net income attributable to noncontrolling interest | (42) | (26) | (15) | (23) | (35) | (42) | (65) | (21) | (33) | (29) |

| Net Income Attributable to Shareowners | 8,584 | 7,098 | 7,351 | 6,527 | 1,248 | 6,434 | 8,920 | 7,747 | 9,771 | 9,542 |

Statement of Financial Position edit edit source

| Statement of Financial Posititon | |||||||||||

| Assets | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Current Assets | |||||||||||

| Cash and Cash Equivalents | 10,414 | 8,958 | 7,309 | 8,555 | 6,006 | 8,926 | 6,480 | 6,795 | 9,684 | 9,519 | |

| ShortTerm Investment | 6,707 | 9,052 | 8,322 | 9,595 | 9,352 | 2,025 | 1,467 | 1,771 | 1,242 | 1,043 | |

| Total Cash, Cash Equivalent and Short term | 17,121 | 18,010 | 15,631 | 18,150 | 15,358 | 10,951 | 7,947 | 8,566 | 10,926 | 10,562 | |

| Marketable securities | 3,147 | 3,665 | 4,269 | 4,051 | 5,317 | 5,013 | 3,228 | 2,348 | 1,699 | 1,069 | |

| Trade accounts recievable, less allowance | 4,873 | 4,466 | 3,941 | 3,856 | 3,667 | 3,396 | 3,971 | 3,144 | 3,512 | 3,487 | |

| Inventories | 3,277 | 3,100 | 2,902 | 2,675 | 2,655 | 2,766 | 3,379 | 3,266 | 3,414 | 4,233 | |

| Prepaid Expenses and other current assets | 2,886 | 3,066 | 2,752 | 2,481 | 2,000 | 1,962 | 1,886 | 1,916 | 2,994 | 3,240 | |

| Assets held for sale | 679 | 3,900 | 2,797 | 219 | |||||||

| Assets held for sale - Discontinued operations | 7,329 | 6,546 | |||||||||

| Total current assets | 31,304 | 32,986 | 33,395 | 34,010 | 36,545 | 30,634 | 20,411 | 19,240 | 22,545 | 22,591 | |

| Equity method investments | 10,393 | 9,947 | 12,318 | 16,260 | 20,856 | 19,407 | 19,025 | 19,273 | 17,598 | 18,264 | |

| Other investments | 1,119 | 3,678 | 3,470 | 989 | 1,096 | 867 | 854 | 812 | 818 | 501 | |

| Other noncurrent assets | 4,661 | 4,407 | 4,207 | 4,248 | 4,560 | 4,139 | 6,075 | 6,184 | 6,731 | 6,189 | |

| Deffered income tax assets | 2,667 | 2,412 | 2,460 | 2,129 | 1,746 | ||||||

| Property, plant and equipment | 14,967 | 14,633 | 12,571 | 10,635 | 8,203 | 8,232 | 10,838 | 10,777 | 9,920 | 9,841 | |

| Trademarks with indefitite lives | 6,744 | 6,533 | 5,989 | 6,097 | 6,729 | 6,682 | 9,266 | 10,395 | 14,465 | 14,214 | |

| Bottlers Franchise rights with indefinite lives | 7,415 | 6,689 | 6,000 | 3,676 | 138 | 51 | 109 | ||||

| Goodwill | 12,312 | 12,100 | 11,289 | 10,629 | 9,401 | 10,263 | 16,764 | 17,506 | 19,363 | 18,782 | |

| Other intangible assets | 1,140 | 1,050 | 854 | 726 | 368 | 274 | 627 | 649 | 785 | 635 | |

| Total Non-Current Assets | 58,751 | 59,037 | 56,698 | 53,260 | 51,351 | 52,582 | 65,970 | 68,056 | 71,809 | 70,172 | |

| Total Assets | 90,055 | 92,023 | 90,093 | 87,270 | 87,896 | 83,216 | 86,381 | 87,296 | 94,354 | 92,763 |

| LIABILITIES AND EQUITY | |||||||||||

| Current Liabilities | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Accounts payable and accrued expenses | 9,577 | 9,234 | 9,660 | 9,490 | 8,748 | 8,932 | 11,312 | 11,145 | 14,619 | 15,749 | |

| Loans and notes payable | 16,901 | 19,130 | 13,129 | 12,498 | 13,205 | 13,194 | 10,994 | 2,183 | 3,307 | 2,373 | |

| Current maturities of long-term dept | 1,024 | 3,552 | 2,677 | 3,527 | 3,298 | 4,997 | 4,253 | 485 | 1,338 | 399 | |

| Accrued income taxes | 309 | 400 | 331 | 307 | 410 | 378 | 414 | 788 | 686 | 1,203 | |

| Liabilities held for sale | 58 | 1,133 | 710 | 37 | |||||||

| Liabilities held for sale - discontinued operations | 1,496 | 1,722 | |||||||||

| Total Current Liabilities | 27,811 | 32,374 | 26,930 | 26,532 | 27,194 | 29,223 | 26,973 | 14,601 | 19,950 | 19,724 | |

| Long-term dept | 19,154 | 19,063 | 28,407 | 29,684 | 31,182 | 25,364 | 27,516 | 40,125 | 38,116 | 36,377 | |

| Other noncurrent liabilities | 3,498 | 4,389 | 4,301 | 4,081 | 8,021 | 7,638 | 8,510 | 9,453 | 8,607 | 7,922 | |

| Deffered income taxliabilities | 6,152 | 5,636 | 4,691 | 3,753 | 2,522 | 1,933 | 2,284 | 1,833 | 2,821 | 2,914 | |

| Total NonCurrent Liabilities | 28,804 | 29,088 | 37,399 | 37,518 | 41,725 | 34,935 | 38,310 | 51,411 | 49,544 | 47,213 | |

| Total Liabilities | 56,615 | 61,462 | 64,329 | 64,050 | 68,919 | 64,158 | 65,283 | 66,012 | 69,494 | 66,937 | |

| Common stock | 1,760 | 1,760 | 1,760 | 1,760 | 1,760 | 1,760 | 1,760 | 1,760 | 1,760 | 1,760 | |

| Capital surplus | 12,276 | 13,154 | 14,016 | 14,993 | 15,864 | 16,520 | 17,154 | 17,601 | 18,116 | 18,822 | |

| Reinvested earnings | 61,660 | 63,408 | 65,018 | 65,502 | 60,430 | 63,234 | 65,855 | 66,555 | 69,094 | 71,019 | |

| Accumulated other comprehensive income | (3,432) | (5,777) | (10,174) | (11,205) | (10,305) | (12,814) | (13,544) | (14,601) | (14,330) | (14,895) | |

| Treasurer stock | (39,091) | (42,225) | (45,066) | (47,988) | (50,677) | (51,719) | (52,244) | (52,016) | (51,641) | (52,601) | |

| Equity Attributable to shareowners of the Coca-Cola | |||||||||||

| Equity attributable to noncontrolling interests | 267 | 241 | 210 | 158 | 1,905 | 2,077 | 2,117 | 1,985 | 1,861 | 1,721 | |

| Total Equity | 33,440 | 30,561 | 25,764 | 23,220 | 18,977 | 19,058 | 21,098 | 21,284 | 24,860 | 25,826 | |

| Total Liabilities and Equity | 90,055 | 92,023 | 90,093 | 87,270 | 87,896 | 83,216 | 86,381 | 87,296 | 94,354 | 92,763 | |

Coca-Cola Fiancial Forecast edit edit source

| Cocacola_Financial Model | |||||||

| Start | Jan-22 | Jan-23 | Jan-24 | Jan-25 | Jan-26 | Jan-27 | |

| End | Dec-22 | Dec-23 | Dec-24 | Dec-25 | Dec-26 | Dec-27 | |

| Count | 0 | 1 | 2 | 3 | 4 | 5 | |

| Forecasted FS | |||||||

| Statement of Income | |||||||

| Revenue | 43,004 | 46,014 | 48,821 | 51,653 | 54,690 | 57,944 | |

| COGS | (18,000) | (18,910) | (19,693) | (20,442) | (22,060) | (23,813) | |

| Gross Profit | 25,004 | 27,104 | 29,128 | 31,210 | 32,630 | 34,131 | |

| Selling, General and Administrative expenses | (12,880) | (13,809) | (14,681) | (15,564) | (16,513) | (17,530) | |

| Other Operating Charges | (1,215) | (1,215) | (1,215) | (1,215) | (1,215) | (1,215) | |

| Operating Income | 10,909 | 12,080 | 13,232 | 14,431 | 14,902 | 15,386 | |

| Interest income | 449 | 454 | 460 | 466 | 471 | 477 | |

| Interest expense | (882) | (992) | (1,116) | (1,255) | (1,412) | (1,589) | |

| Equity income | 1,472 | 1,687 | 1,932 | 2,214 | 2,537 | 2,906 | |

| Other income | (262) | (12) | 238 | 488 | 738 | 988 | |

| Income Before Income Taxes | 11,686 | 13,216 | 14,746 | 16,343 | 17,236 | 18,168 | |

| Income taxes | (2,115) | (2,745) | (3,062) | (3,394) | (3,579) | (3,773) | |

| Consolidated Net Income | 9,571 | 10,472 | 11,684 | 12,949 | 13,657 | 14,396 | |

| Less: Net income attributable to noncontrolling interest | (29) | (29) | (29) | (29) | (29) | (29) | |

| Net Income Attributable to Shareowners | 9,542 | 10,443 | 11,655 | 12,920 | 13,628 | 14,367 |

Risks and Consideration edit edit source

Coca-Cola faces a spectrum of risks and challenges in its operations. Evolving consumer preferences towards healthier choices could impact the demand for sugary beverages, necessitating the company's ongoing efforts to offer healthier options and transparent nutritional information. Regulatory changes in the industry, environmental concerns, and competitive pressures also pose significant risks. The company is actively addressing these challenges by diversifying its product lineup, focusing on sustainability initiatives, and complying with evolving regulations. It also manages currency fluctuations, maintains robust supplier relationships, and safeguards its brand reputation through ethical practices and transparent communication.

To navigate these risks, Coca-Cola employs a multifaceted approach. This includes diversifying its product range, emphasizing sustainability, staying compliant with regulations, and adapting to changing consumer preferences. By strategically managing its supply chain, addressing environmental concerns, and fostering brand trust, Coca-Cola aims to mitigate potential disruptions and maintain its position in the global beverage market.

References edit edit source

- https://investors.coca-colacompany.com/financial-information/financial-results

- https://www.coca-colacompany.com/about-us

- https://www.sec.gov/Archives/edgar/data/21344/000002134423000011/ko-20221231.htm

- “About - the History of Coca Cola - Heartland Coca-Cola.” Heartland Coca-Cola, 13 July 2020, www.heartlandcocacola.com/about-our-history/. Accessed 5 Aug. 2023.

- Amin, Zarqoon. “Coca-Cola’s 9 Marketing Strategies to Achieve Global Success.” Squeeze Growth, 3 Aug. 2022, squeezegrowth.com/coca-cola-marketing-strategy/. Accessed 5 Aug. 2023.

- Coca-Cola Business Strategy. “Coca-Cola Business Strategy: Goals & Case Study | StudySmarter.” StudySmarter UK, 2014, www.studysmarter.co.uk/explanations/business-studies/business-case-studies/coca-cola-business-strategy/. Accessed 5 Aug. 2023.

- “Coca-Cola History.” Coca-Colacompany.com, 2022, www.coca-colacompany.com/about-us/history#:~:text=The%20Origin%20of%20Coca%E2%80%91Cola,of%20how%20it%20all%20began. Accessed 5 Aug. 2023.

- “Strategy Study: How Coca-Cola Became One of the Most Successful Brands in History.” Cascade.app, 2023, www.cascade.app/studies/how-coca-cola-became-successful. Accessed 5 Aug. 2023.

- “The Coca-Cola Company | History, Products, & Facts | Britannica.” Encyclopædia Britannica, 2023, www.britannica.com/topic/The-Coca-Cola-Company. Accessed 5 Aug. 2023.

- “The Evolution of the Coca-Cola Brand.” Investopedia, 2023, www.investopedia.com/financial-edge/1012/the-evolution-of-the-coca-cola-brand.aspx. Accessed 5 Aug. 2023.