Triple Point

Triple Point is a seed fund focused on investing in young B2B technology startups, with a focus on Fintech, Healthcare and SaaS.

Summary edit edit source

- The fund is a newer VCT from an established manager with a long track record of successful early stage investing.

- Triple Point previously backed LendInvest, Contis, Payment Sense and Capital on Tap in other funds, all that featured in The Sunday Times Tech Track 100.

- The fund managers together have decades of investment experience, and have a complementary mix of startup, financial and legal backgrounds.

About Triple Point edit edit source

Triple Point is an experienced investment firm founded in 2004, when it launched its first venture capital fund. Over the past 18 years, the business has grown rapidly, and today Triple Point’s venture capital trust fund represents Triple Point’s 23rd VCT offer. The wider Triple Point group manages over £2.5bn of private, institutional, and government capital and has over 170 employees. Through its history, Triple Point has provided over £490m of funding to 159 VCT/EIS qualifying companies.

Triple Point’s wider business encompasses five different investment strategies, of which venture capital is one. The VCT is Triple Point’s flagship venture fund, and is managed by a six-strong investment team led by partner Ian McLennan, who has significant experience in venture capital and private equity, and was previously the Global Head of Strategy at UBS. The investment team is also supported by an advisory committee, whose members include Christian Faes (Executive Chairman, LendInvest) and Charles Delingpole (CEO, ComplyAdvantage).

Key managers edit edit source

Ian McLennan

Ian is a Partner and Head of Venture at Triple Point. He joined the firm in 2009 and brings 33 years of investment experience to the firm from asset managers and banks including UBS, where he was the Global Head of Strategy, Brevan Howard and Mercury Asset Management (now part of BlackRock). Ian is responsible for the fund’s strategy, deal execution and portfolio management.

Seb Wallace

Seb is an Investment Director at Triple Point and a founding member of Triple Point’s Venture team alongside Ian and Daniel. He joined the firm in 2017 and leads Triple Point’s early-stage venture capital investments. He has over 9 years’ experience in startups and M&A, founding an events business before working in corporate M&A at Allen & Overy, where he completed deals for Google, Toyota AI Ventures and Facebook.

Daniel Cardenas-Clark

Daniel is an Investment Director at Triple Point and a founding member of Triple Point’s Venture team alongside Ian and Seb. He joined the firm in 2016 and focuses on early stage investments. He previously worked at start-ups including MarketFinance, Property Partner and Rocket Internet. He began his career founding a marketing agency which was profitable from the first month of trading and grew to 53 staff at its peak.

Investment strategy edit edit source

Triple Point is a B2B fund focused on investing in pre-seed and seed stage startups. At the point of investment, Triple Point investee companies are often young, typically less than 3 years old, and have annual revenues under £1m.

The fund follows a generalist B2B strategy, with a particular emphasis on fintech, insurance and healthcare. The fund currently has 34 portfolio companies across 11 sectors, with the majority of portfolio companies generating early revenues. When assessing businesses, Triple Point places particular emphasis on startups’ commercial relationships, which Triple Point calls its ‘challenge-led approach’, looking for early indications of corporate demand to offset some of the risks of early stage investing.

The fund invests tickets of between £150k-£1m into each new company in return for a ownership stake of between 5-20%, with follows-on where businesses are performing. The investment team targets 10-12 new investments per year and expects around a half of the current fundraise to go towards supporting its existing portfolio with follow-on investments. Over 2021, the fund made 11 new investments.

The investment team is composed of 6 investment professionals supported by a board of 4 directors and an investment committee of 7. The team has a range of backgrounds including ex-finance, startup and legal professionals. All members of Triple Point’s venture investment team have invested in Triple Point’s fund.

Triple Point operates a two-stage investment process. The first stage involves commercial analysis and founder meetings before a ‘opportunity evaluation meeting’ is held, where the deal team discuss an opportunity with the investment committee. If an opportunity passes this stage, further research is completed and a full investment committee paper written for consideration. If the investment committee approve the investment at this stage, an offer for investment is made.

Past investments edit edit source

HeyDoc edit edit source

Heydoc is a clinical record system built to enable medical clinicians and admin staff to complete their day-to-day work in one place rather than needing to use multiple systems. The software covers the entire patient journey, saving medical clinicians time and enabling them to spend more time treating patients.

Credit Kudos (exited) edit edit source

Credit Kudos, which sold to Apple in March 2022, is a new credit reference agency using financial and behavioural data from Open Banking APIs to help consumer lenders make faster, more reliable credit decisions than data from incumbent credit reference agencies alone.

Vyne edit edit source

Vyne uses Open Banking APIs to transfer money directly from consumer bank accounts to the bank accounts of online merchants for the purchase of goods or services. This method of delivery bypasses the traditional debit/credit card network and the fees applied by each intermediary.

Ryde edit edit source

Ryde provide a fully integrated delivery management platform combining the best of fleet management software, third party logistics software and a flexible workforce to ecommerce companies using deliveries, enabling them to more effectively manage their demand by supplementing their own fleet with third party drivers.

Quit Genius edit edit source

Quit Genius provides an online digital therapeutics tool that helps users quit smoking, vaping and alcohol use. Their app product provides behaviour tracking and encouragement to users. Alongside the app, users gain access to physical therapeutics and a therapist. The B2B product is sold to large US employers and the NHS.

Ably edit edit source

Ably is a real time data delivery service provider that provides a cloud-based network for companies to stream and manage their data via realtime APIs. These APIs are capable of connecting to any device at any time while enabling developers to build apps on top to make use of real time data.

As this Fund is a VCT, upon investing you will gain access to both the fund's current investee companies along with new investments made by the fund. Please note that some of the companies set out above are past investments by the fund and are presented for indicative purposes only.

Track record edit edit source

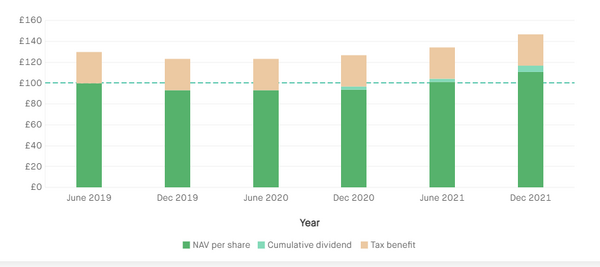

The below chart shows Triple Point’s historic performance, rebased to show performance over time as if you had invested £100 at the beginning of the period.

Each green bar represents the value of the fund at the end of the relevant period. This is known as the fund’s net asset value (or NAV). The smaller turquoise bar displays the cumulative dividends issued by the fund over the displayed period. Dividends are distributed by the fund to all investors and, together with the NAV, form the fund’s total return.

Total return from an investment in Triple Point[1]

Fund fees edit edit source

Overall edit edit source

Expected annualised fee: 2.75%

This is the expected total fee of the fund, averaged across a 5 year hold period. This figure is an estimate only and below we set out the actual fees payable. Please note this figure does not include performance fees (as they are not guaranteed to be payable).

Breakdown edit edit source

The fund manager does not charge fees to investee companies. Further receives an initial commission (0.0%) and a trail commission (0.5%) on funds processed for the fund manager. Commission is paid by the fund manager, so there is no additional charge to you. The Expected Annualised Fee set out above is intended as a fee estimate only. In the 2021 financial year, Triple Point's fund had an ongoing charges ratio of 3.03% excluding any initial or performance fees (which are charged separately).

Expert view edit edit source

The view is provided by Tax Efficient Review

Triple Point are a large and highly regarded tax efficient investment house and after 3 years of making investments within the venture share class of this VCT there appears to be some momentum building. We would like to see some positive exits occur within the portfolio and given the relatively small size of the VCT, these could have a meaningful impact on returns.

Since March 2020, the Venture Fund has paid out two dividends totalling 6p per share and the NAV has risen to 108.43p per share, a total return over the period of c.23%. This reflects a number of portfolio companies having seen growth accelerate through Covid (e.g. HeyDoc and Ably) as reliance on digital services increased. A number of these companies have completed further funding rounds at significantly higher valuations. All of these funding rounds have included new and independent third party investors.

What does impress about this VCT is that they only increase investee company valuations when a 3rd party independent investor participates in a funding round. Unquoted equity positions are difficult to value and when a 3rd party investor participates with their money it helps to give credence to the valuations in place.

References edit edit source

- ↑ Based on having invested £100 in June 2019.