Ubisoft Entertainment SA

Company Overview edit edit source

| |

Ubisoft headquarters in France | |

| Type | Public |

|---|---|

| Industry | Video Games |

| Founded | 28 March 1986; 37 Years Ago |

| Founders | Christian Guillemot Claude Guillemot Gérard Guillemot Michel Guillemot Yves Guillemot |

| Headquarters | Saint-Mandé, France |

Key people | Yves Guillemot (Chairman, CEO) Frédérick Duguet (CFO) |

| Revenue | |

| Total assets | |

| Total equity | |

Number of employees | 20,665 (2022) |

| Website | |

Ubisoft Entertainment SA was founded by the five Guillemot brothers in 1986 in Saint-Mandé, France, to create and supply video games worldwide.[1] Ubisoft produce and publish video games for consoles, PC, smartphones, and tablets in both physical and digital formats in Europe, North America, and internationally. Notable game franchises include, Assassin's Creed, Far Cry, Tom Clancy's, Watch Dogs, Prince of Persia, For Honor, Just Dance, and Rayman.

The company also has a presence in the Movies and Entertainment industry through its Ubisoft Film & Television division, which has the mission "to bring Ubisoft’s award-winning games into new areas of entertainment and to create original stories set in the world, culture and community of gaming"[2]. The division has a pipeline of projects, including the films “Just Dance” (Screen Gems), the live-action “Assassin’s Creed” (Netflix) series, the current “Mythic Quest” (Apple TV+) series and “Rabbids Invasion” (season 4 on Netflix).[3]

Ubisoft has a “high-value licensing partnership on mobile” with Tencent announced last July, where Tencent will be the publisher of the Assassin’s Creed mobile game set in China. Ubisoft also has a collaboration with Playcrab; and collaboration with Disney and Lucasfilm Games.

Operations edit edit source

Business Model and Strategy edit edit source

Ubisoft has a unique production organisation in the video game industry, which allows the company to produce and own all of its most significant franchises, enter new market segments organically, and release high quality new content and games on a regular basis. This has allowed the organisation to grow and benefit from recurring revenues. Therefore, Ubisoft has sought to take advantage of their position for the last decade and expand their portfolio of franchises with titles such as Just Dance, Brawlhalla, and The Crew.

However, Ubisoft has recently chosen to shift their focus onto their core franchises with emphasis on long-term player engagement through long-lasting Live games. This means the company will be focusing on franchises that have already been proven to be successful and will grant them greater control over their timing and quality of releases, reducing the perceived execution risks of their pipeline. This has been the top concern for investors, which has resulted in Ubisoft trading at a steep discount relative to peers.[4]

The above chart shows the top twelve games by Steam's current players, clearly showing a player preference towards service and living games.[5]

Ubisoft's new strategy was showcased at last year's Ubisoft Forward event, where the company announced a considerable addition of new content (e.g., quests, events etc) within its most popular franchise, Assassin's Creed. The franchise is one of Ubisoft's longest lasting and most valuable, with the last three entries being released on time and at a respectable quality. Furthermore, the last release, Assassin's Creed Valhalla (2020), has generated over $1bn in revenue for the company through successfully implementing and monetising a live-service model, which adds post-launch content. This is a key point for Ubisoft, as the company's new IPs, (e.g., Skull & Bones) and non-core IPs (e.g., Prince of Persia), have been delayed numerous times and have longer development timelines, which burdens cash flows and increases execution risks. Therefore, as Ubisoft shift their focus onto core IPs (Assassin's Creed, Far Cry, Tom Clancy's, etc) , perceived execution risks and cost inefficiencies should reduce over time. While it may take significant time for Ubisoft to successfully implement this strategy, Ubisoft has one of the largest development capabilities in the world and a strong track record with their core IPs.

Management Team edit edit source

Chief Executive Officer, Chairman - Yves Guillemot

Yves Guillemot founded Ubisoft in 1986 alongside his brothers. From Ubisoft's infant days, Yves knew that making unique products in-house and building their own brands was crucial for Ubisoft to succeed. His idea to use new technology as a chance to be creative, make brands, and gain a big part of the market worked well over time. By concentrating on organic growth and being efficient, he made a company known for its amazing teamwork and strong competitiveness, with most of the production happening in cost-competitive countries. Ubisoft is one of the pioneers and a leader of the open world genre, which has become one of the industry’s most popular gaming segments.

Under Yves’ tenure, Ubisoft launched numerous videogame brands, which are some of the most recognisable of all time ─ with Assassin's Creed being one of them. The company’s unique capacity as a creator of blockbuster entertainment franchises has created massive value for Ubisoft’s shareholders. Over the past 30 years Yves has led Ubisoft in its evolution from a local video game distributor, to a global entertainment leader. [6]

Chief Financial Officer - Frederick Duguet

Frederick Duguet has been Ubisoft’s chief financial officer since January 2019. Prior to this, he was the chief financial planning officer for a decade, where he acquired detailed knowledge of the company, as well as an in-depth understanding of the video game industry. He also has comprehensive experience in management and finance acquired from his tenure with other major international groups, such as Procter & Gamble and L’Oréal between 2002 and 2009. Prior to joining Ubisoft, he was finance director for L’Oréal’s luxury products division in France.[7]

Executive VP of Operations & Director - Claude Guillemot

Claude Guillemot co-founded Ubisoft in 1986 and sits on Ubisoft’s Board of Directors as Executive Vice President of Operations. With 30 years of experience in the videogame industry, he brings valuable knowledge to the board. His skills as an entrepreneur and his deep understanding of hardware and distribution networks have helped Ubisoft to be at the forefront with every new hardware release, which has played a vital role in Ubisoft's long-term success.

Claude Guillemot also serves as the President and CEO of Guillemot Corporation, a company that specializes in making devices and accessories for PC, mobile, and consoles. Since 1997, he has been leading the expansion of Guillemot Corporation by establishing research and development centres in Europe and North America, along with logistics hubs in France, the USA, and China.[8]

Executive VP of Administration & Director - Christian Guillemot

Christian Guillemot co-founded Ubisoft in 1986. He sits on the Board of Directors as Executive Vice President of Administration. With 30 years of experience in the videogame industry, he brings valuable expertise to the Board. Christian Guillemot was responsible for setting up and bringing together Ubisoft's offices in different countries, and he played a major role when the company became publicly traded on the stock exchange in 1996. His deep understanding of new gaming platforms, as well as his knowledge of accounting, taxes, and legal matters, makes him a crucial voice on the Board.

Christian Guillemot is the President and CEO of Advanced Mobile Applications (AMA). He co-founded AMA in 2004, and it has since become a top company that creates and releases lifestyle games and apps for smartphones, tablets, interactive TV, and the internet of things. Recently, they have also been working with Google to develop telehealth and tele-expertise services in growing markets.

Chief People Officer - Anika Grant

Anika Grant has an experience in leading HR transformation in major, fast-paced and customer-focused organizations across various sectors. She also brings an exceptional knowledge of international HR management, most recently as the Global HR Director for Dyson’s Global Markets. prior to this, she held the position of Senior Director HR at Uber.

Chief Portfolio Officer - Sandrine Caloiaro

Sandrine Caloiaro is the Chief Portfolio Officer at Ubisoft Entertainment Sa.

Upcoming Titles edit edit source

| Title | Platform(s) | |

|---|---|---|

| F1Q | For Honor: Year 7 - Season 2 | PC, Console |

| Mighty Quest Rogue Palace | Mobile (Netflix) | |

| Riders Republic: Season 7 | PC/Console/Cloud | |

| Rocksmith+ | Mobile | |

| Tom Clancy's Rainbow Six Siege: Year 8 - Season 2 | PC/Console/Cloud | |

| The Crew 2: Season 8 - Episode 2 | PC/Console/Cloud | |

| Tom Clancy's The Division 2: Year 5 - Season 1 | PC/Console/Cloud | |

| Trackmania Next | Console | |

| FY24 | Assassin's Creed: Mirage | PC/Console/Cloud |

| Avatar: Frontiers of Pandora | PC/Console/Cloud | |

| Tom Clancy's Rainbow Six Mobile | Mobile | |

| Tom Clancy's The Division Resurgence | Mobile | |

| The Crew Motorfest | PC/Console/Cloud | |

| Skull and Bones | PC/Console/Cloud | |

| XDefiant | PC/Console/Cloud | |

| "Another large game" | TBA |

Emphasised (bold) is what is viewed as the 5 most highly-anticipated titles on Ubisoft's FY24 release slate.

Overall, for the FY24 slate Ubisoft have Assassin’s Creed Mirage (AAA but smaller than usual), Avatar: Frontiers of Pandora (AAA), Skull and Bones (AAA), The Crew Motorfest (AAA), Prince of Persia The Lost Crown, Just Dance 24, Rainbow Six Mobile, The Division Resurgence (mobile) and XDefiant (mobile). Star Wars Outlaws (AAA) is expected to release in FY25 and there remains “another large game” as well that has yet to be announced.[9]

Reactions to the Trailers of Ubisoft's Key Releases edit edit source

Gamer and critic commentary (from Reddit, Twitter, Youtube, IGN, and other sites)

Assassin’s Creed Mirage edit edit source

Pros:

• High praise for the return to the original style of the Assassin’s Creed games, applauding the increased emphasis on stealth elements in the gameplay.

• The story has garnered lots of enthusiasm - almost no negative feedback.

• The game is considered visually impressive.

Cons:

• Many gamers pointed to the character models not looking very up-to-date, as though they come from an earlier generation of games.

• Negative feedback around the parkour system and seems to be taken directly from Assassin’s Creed Valhalla - fans hoped for a parkour system similar to that of Assassin's Creed Unity

• Some general sentiment that not enough was shown in the trailers in terms of world size, combat, and game style.

Overall:

There is a fair bit of excitement about this game and no real red flags in the commentary seen.

Avatar: Frontiers of Pandora edit edit source

Pros:

• Comments on the gameplay were mostly positive.

• Gamers and critics view the world as beautiful and well-realised.

• Gamers like the fact that there is an option for two-player co-op.

Cons:

• Gamers and critics believe the game will be too similar to the Far Cry series. This has raised lots of familiar commentary about Ubisoft’s games all being too similar to each other and not innovative enough.

• Some negative feedback around the quality of how the characters look - although these comments also pointed to the fact that there is still time before the December release date for more polish.

Overall:

It was much harder to find commentary from gamers on this gameplay trailer than for Mirage or Star Wars Outlaws - this is a movie not a video game franchise for now. But from what commentary there was, it was a mixture of praise for the world created and complaints that it is a “reskinned Far Cry”

Star Wars Outlaws edit edit source

Pros:

- Positive feedback around the world shown, story, characters and gameplay elements.

Cons:

- General negative feedback around the potential lack of character customisation available, so gamers will all have to play as the same character with no variation. It is not totally clear that this is the case.

Overall:

- Gamers are very excited for an open-world Star Wars game. There was enthusiasm for the elements of Grand Theft Auto and also Uncharted in the gameplay - but set in the Star Wars universe. There are no real red flags in the commentary, with the lack of customisation the one commonly-appearing gripe. Some commented that the game did not feel like a reskin of other Ubisoft games (unlike Avatar).

Overall edit edit source

Overall, the reaction to these three games is positive, with Star Wars Outlaws especially capturing the imagination of gamers. Delivery is going to be challenging with so many projects coming quite close to each other. But it is hard to dwell on negatives when the community has reacted pretty well to the major games on show at Ubisoft Forward.[10]

Film and Television edit edit source

Alongside its strategy to refocus on core franchises, Ubisoft are pursuing an ambitious strategy to capitalise on the power of transmedia synergies, evident through a significant partnership with Netflix. The collaboration with Netflix aims to create multiple TV series based on their core franchises, which include popular titles like Assassin's Creed, The Division, Splinter Cell, and Far Cry, among others.

Although detailed information about these TV series projects is scarce at this stage, Ubisoft sees this move as a crucial step in solidifying their core assets and tapping into the potential of transmedia synergies. It's a well-established fact that transmedia ventures can substantially enhance the value of a franchise and indirectly impact game sales. Recent successes of game-based TV series, such as The Witcher, Cyberpunk 2077 (developed by Netflix and owned by CD Projekt), and The Last of Us (produced by Sony and HBO), have demonstrated this phenomenon.

For instance, the TV series adaptation of The Last of Us led to a remarkable 239% surge in sales for The Last of Us: Part 1 (released in 2013), causing it to re-enter the UK sales charts at an impressive No. 20 spot. Similarly, The Witcher 3 experienced a staggering 554% increase in physical sales following the launch of its TV series on Netflix, as reported by the NPD Group.

Ubisoft's partnership with Netflix to develop TV series based on their core franchises represents a strategic move aimed at not only bolstering franchise value but also driving game sales through the indirect influence of transmedia ventures.[11]

Market edit edit source

Total Addressable Market edit edit source

Here, the total addressable market (TAM) is defined as the gaming market, and based on a number of assumptions, it is estimated that the size of the market as of April 2023, in terms of revenue, is $252.1 billion, up from $229.39 billion in 2022. The gaming market is also estimated to grow to $401.32 billion in 2027.[12]

As Ubisoft has a film & television division, It can also be argued that given the company's mission around television, the total addressable market includes the film and television market; and research suggests that as of April 2023, the estimated size of that market is $283.5 billion, up from $267.61 billion in 2022. the film & television market is also estimated to grow to $344.84 billion in 2027.[13] Therefore, Ubisoft's total current addressable market can be estimated to be $535.6 billion.

Serviceable Obtainable Market edit edit source

Here, the serviceable obtainable market (SOM) is defined as the US and European gaming market, and based on a number of assumptions, it is estimated that the size of the market as of June 2023, in terms of revenue, is $139.59 billion.

Competition edit edit source

Conglomerates edit edit source

Microsoft and Sony

Ubisoft is a prominent game developer and publisher known for franchises like Assassin's Creed, Far Cry, Watch Dogs, and Tom Clancy's series. However, the gaming industry is dominated by the 'Big 3' video game companies Microsoft, Sony, and Nintendo. They accounted for 29% of total gaming industry revenue in 2022, with Sony having the largest market share with a gaming revenue of $28.2 billion compared to Microsoft's $16.2 billion. The major advantage these players have is that they own and operate the major gaming platforms: the Nintendo Switch is one of the best-selling gaming consoles of all time, and current-gen consoles Sony’s PlayStation 5 and Microsoft’s Xbox Series X/S were both released in November 2020 and are very competitive. To date, the PlayStation 5 has sold almost 38 million units, compared to nearly 22 million Xbox X/S console sales. However, Nintendo would not be a competitor for Ubisoft as they exclusively operate on the Nintendo Switch.[14] Alongside being hardware manufacturers, Sony publishes iconic franchises like God of War, Uncharted, and The Last of Us, and Microsoft develop and publish notable franchises such as Halo, Forza Motorsport, and Gears of War.

Tencent

Tencent is a technology conglomerate based in China, and it is one of the world's largest and most valuable companies. While Tencent has diverse business interests, including social media, entertainment, and technology, it has a strong presence in the gaming industry through its gaming division, Tencent Games. Tencent is known for its investment strategy, where it acquires stakes in various game development companies around the world, giving it a vast and diverse gaming portfolio. Tencent has a considerable focus on mobile gaming, which has become a massive segment of the gaming market. Furthermore, Tencent has a strong presence in the online multiplayer gaming space, particularly through its ownership of Riot Games and its flagship title, League of Legends, which is a major player in the esports scene. However, Ubisoft has traditionally focused on PC and console gaming, setting it apart from Tencent. Tencent reported a gaming revenue of $13.9 billion

Pure-play Competitors edit edit source

Activision Blizzard

Activision Blizzard is another major player in the industry, responsible for iconic franchises such as Call of Duty, World of Warcraft, Candy Crush, and Overwatch. They have a strong foothold in the first-person shooter, and online multiplayer markets, and are considered the most dominant pure-play gaming company across platforms, which overlaps with Ubisoft's games. Activision Blizzard is currently in the process of being acquired by Microsoft. Activision Blizzard reported a revenue of $7.36 billion in 2022.

Electronic Arts (EA)

Electronic Arts is one of the largest and most established video game publishers in the world. It is an American company and It has a diverse portfolio of franchises, including FIFA, Madden NFL, Battlefield, and The Sims. EA's extensive resources and successful sports titles often compete with Ubisoft's offerings. EA announced in November 2022 that it had struck a partnership with the film studio Marvel to develop at least three action oriented games. With Marvel being responsible for producing some of the most famous movies such as Avengers and Thor, the possibilities for these titles are endless. EA reported a revenue of $7.29 billion in 2022.

Take-Two Interactive

Take-Two Interactive is an American firm that owns a variety of game development platforms. is known for its Grand Theft Auto series, Red Dead Redemption, and NBA 2K. It focuses on both open-world and sports genres, presenting competition for Ubisoft's various game offerings. Take-Two Interactive grew its mobile platform with its acquisition of game developer Zynga for $12 billion. The firm's gaming pipeline is one of the largest in the industry, as it is expected to release up to 38 mobile games by the end of 2025. Take-Two Interactive reported a revenue of $4.3 billion in 2022.

Square Enix

Square Enix is a Japanese company with a long and storied history in the gaming industry, with a global presence and a strong focus on narrative-driven games. Some of their most famous franchises include Final Fantasy, Dragon Quest, Kingdom Hearts, Tomb Raider, and NieR, among others. Square Enix reported a revenue of $2.6 billion in 2022.

CD Projekt Red

Known for The Witcher series and Cyberpunk 2077, CD Projekt Red is a rising competitor, especially in the realm of open-world RPGs. CD Projekt Red reported a revenue of $2.04 billion in 2022.

Indie-game Developers edit edit source

The rise of indie game development has added to the competitive landscape. Smaller studios and independent developers create unique and innovative games that can sometimes compete with AAA titles from major publishers. Ubisoft faces competition from indie games that cater to niche markets or provide fresh gaming experiences.

Financials edit edit source

Stock Performance edit edit source

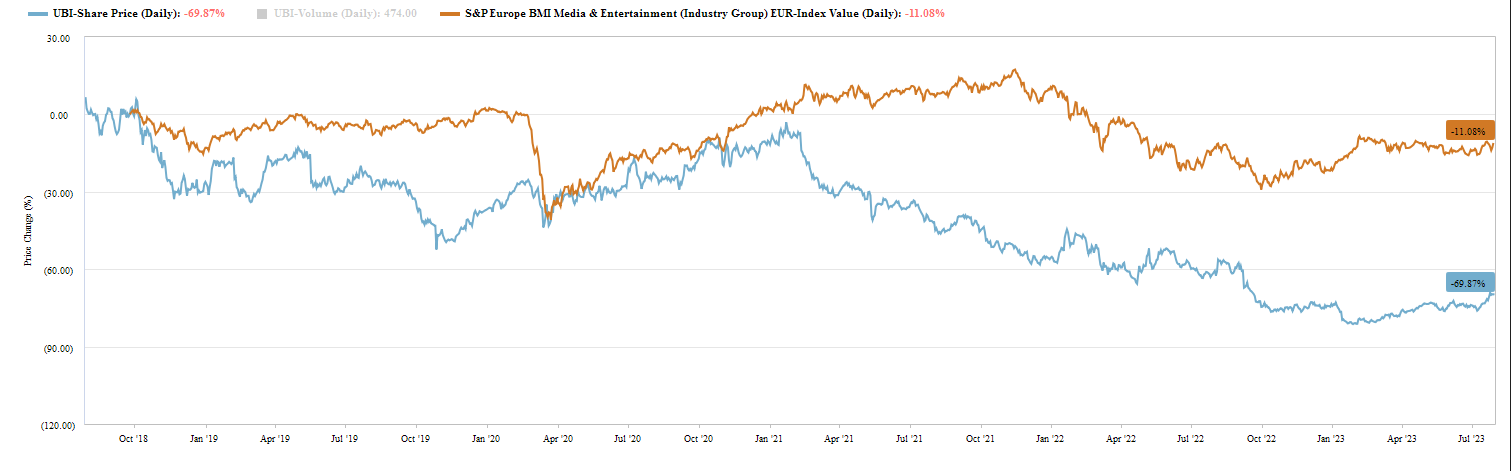

Ubisoft's current share price is ~ €29 per share. Ubisoft has traded at a discount to peers over the past few years due to execution risk stemming from production delays, which constrains cash flows. While this is partly justified, it can be argued that the discount is oversized.

Valuation edit edit source

| € Million | Historical | Projected | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Income Statement | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024E | 2025E | 2026E | 2027E | 2028E |

| Revenue | 1,464 | 1,394 | 1,460 | 1,732 | 1,846 | 1,595 | 2,224 | 2,125 | 1,814 | 2,143 | 2,291 | 2,433 | 2,605 | 2,770 |

| % growth | (4.77%) | 4.73% | 18.63% | 6.56% | (13.59%) | 39.44% | (4.43%) | (14.63%) | 18.13% | 6.88% | 6.22% | 7.06% | 6.33% | |

| EBIT | 92 | 192 | 262 | 295 | 83 | 257 | 351 | (164) | (487) | 353 | 417 | 482 | 557 | 637 |

| % revenue | 6.26% | 13.78% | 17.93% | 17.01% | 4.51% | 16.09% | 15.78% | (7.70%) | (26.86%) | 16.48% | 18.20% | 19.80% | 21.40% | 23.00% |

| Taxes | 53 | 30 | 51 | 69 | 48 | 46 | 133 | 114 | (109) | 74 | 88 | 101 | 117 | 134 |

| % of EBIT | 57.84% | 15.44% | 19.66% | 23.50% | 58.19% | 17.81% | 37.79% | (69.46%) | 22.38% | 21.00% | 21.00% | 21.00% | 21.00% | 21.00% |

| EBIAT | 279 | 329 | 381 | 440 | 503 | |||||||||

| Cash Flow Items | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024E | 2025E | 2026E | 2027E | 2028E |

| D&A | 511 | 463 | 475 | 544 | 584 | 619 | 659 | 672 | 1,287 | 774 | 838 | 902 | 978 | 1,053 |

| % revenue | 34.91% | 33.20% | 32.51% | 31.41% | 31.66% | 38.84% | 29.62% | 31.63% | 70.94% | 36.13% | 36.59% | 37.08% | 37.54% | 38.00% |

| CapEx | (535) | (541) | (545) | (610) | (662) | (756) | (850) | (946) | (1070) | (1000) | (1051) | (1079) | (1125) | (1163) |

| % revenue | (36.55%) | (38.77%) | (37.33%) | (35.22%) | (35.87%) | (47.40%) | (38.22%) | (44.51%) | (58.98%) | (46.66%) | (45.88%) | (44.34%) | (43.17%) | (42.00%) |

| Change in NWC | (39) | 241 | 22 | 17 | (352) | (32) | (50) | 154 | 43 | (24) | (26) | (28) | (29) | (31) |

| % revenue | (2.69%) | 17.26% | 1.50% | 0.96% | (19.09%) | (1.98%) | (2.23%) | 7.24% | 2.36% | (1.13%) | (1.13%) | (1.13%) | (1.13%) | (1.13%) |

| Free Cash Flow | 78 | 142 | 231 | 323 | 424 | |||||||||

| PV of Free Cash Flow | 71 | 118 | 174 | 221 | 263 | |||||||||

| Terminal Value | 6,236 | |||||||||||||

| Present Value of Terminal Value | 3,872 | |||||||||||||

| Enterprise Value | 4,718 | |||||||||||||

| (-) Net Debt | 971 | |||||||||||||

| (-) Minority Interest | 4 | |||||||||||||

| Equity Value | 3,743 | |||||||||||||

| #Shares | 126 | |||||||||||||

| Share Price | 29.83 | |||||||||||||

| Sensitivity Analysis | WACC | |||||||

|---|---|---|---|---|---|---|---|---|

| 8.5% | 9.0% | 9.5% | 10.0% | 10.5% | 11.0% | 11.50% | ||

| Terminal growth rate | 2.0% | € 34.56 | € 31.18 | € 28.26 | € 25.71 | € 23.46 | € 21.47 | € 19.70 |

| 2.5% | € 37.68 | € 33.81 | € 30.50 | € 27.63 | € 25.13 | € 22.93 | € 20.97 | |

| 3.0% | € 41.37 | € 36.88 | € 33.08 | € 29.83 | € 27.02 | € 24.56 | € 22.40 | |

| 3.5% | € 45.80 | € 40.50 | € 36.09 | € 32.36 | € 29.17 | € 26.42 | € 24.01 | |

| 4.0% | € 51.22 | € 44.85 | € 39.65 | € 35.32 | € 31.66 | € 28.53 | € 25.83 | |

| 4.5% | € 57.99 | € 50.17 | € 43.92 | € 38.81 | € 34.57 | € 30.98 | € 27.91 | |

The above DCF outputs an implied share price of €29.93. A WACC of 10% and Terminal Growth Rate of 3% was used.

Investment Thesis edit edit source

Recommend a Neutral rating for Ubisoft. Despite having a strong line-up for FY2024, which includes four AAA titles, there are challenges to consider, such as a difficult market with fierce competition from other developers and the possibility of delays in game releases. However, Ubisoft does possess robust development capabilities and a diverse portfolio of brands that could drive revenue growth and margin expansion in the long term if current issues are resolved.

The company's new strategy offers significant upside potential, which could be underappreciated by the market. Ubisoft trades at a 50% discount compared to its gaming peers, well below the 5-year average discount of 33%. This discount seems to be influenced by investors' perception of elevated execution risk at the company.[15]

While a certain discount is warranted due to Ubisoft's track record, it can be argued that the current discount is disproportionately large, especially considering the potential of its new strategy and the associated transmedia effect. Although the strategy may take time to materialize fully, it could lead to substantial benefits for Ubisoft in the future.

Furthermore, Barclays reports that the largest AAA games have recently outperformed while smaller AAAs have underperformed: "Our 7 interviewees noted that improvements to the stickiness of the major games and their ability to keep gamers within their ecosystem were a major competitive factor in the AAA market. They also felt it was becoming more difficult to deliver success in 1-5m unit AAA games. They pointed to the squeezed consumer as exacerbating rather than creating this trend." This new trend reinforces the fact that Ubisoft's new strategy to focus on their core franchises, most of which are considered 'Mega games', synergises with structural changes in the industry and is the right path of action.[16]

However, consensus analyst reports don't seem to have the same opinion, and view the execution risk as significant. Furthermore, from gamer sentiment on the key franchise trailers, it can be seen that gamers are tired of recycled content. So, if Ubisoft focusing on their core franchises means recycling content, that could be met with significant negative reactions. Therefore, it may be prudent to sit and watch how Ubisoft develops over time.

Risks to Price Target edit edit source

Risks include:

• Better/worse than expected execution leading to a stronger/weaker release slate

• Better/worse reviews of large AAA games impacting sales

• Better/worse than expected macro and competitive environments in major markets

• Better/worse than expected sales from new sources of revenue including mobile & F2P

• FX changes

References edit edit source

- ↑ https://www.ubisoft.com/en-us/company/about-us/our-story

- ↑ https://www.ubisoft.com/en-us/entertainment/film-tv

- ↑ https://www.ubisoft.com/en-us/entertainment/film-tv

- ↑ Ubisoft Entertainment SA. (2023) Universal registration Document 2023. https://www.ubisoft.com/en-us/company/about-us/investors

- ↑ https://steamcharts.com/top

- ↑ https://www.crunchbase.com/person/yves-guillemot

- ↑ https://gamingcypher.com/frederick-duguet-appointed-as-chief-financial-officer-for-ubisoft/

- ↑ https://www.crunchbase.com/person/claude-guillemot

- ↑ Ubisoft Entertainment SA. (2023) Ubisoft reports full-year 2022-23 Earnings figures. https://www.ubisoft.com/en-us/company/about-us/investors

- ↑ Barclays. (2023) Ubisoft Entertainment SA: Star Wars Outlaws particularly well received at Ubisoft Forward

- ↑ Deutsche Bank. (2023) FY-23 Preview: Closing chapter

- ↑ https://www.researchandmarkets.com/reports/5783082/gaming-global-market-report?utm_source=CI&utm_medium=PressRelease&utm_code=hfhlgh&utm_campaign=1846074+-+Global+Gaming+Market+Report+2023%3a+Increasing+Proliferation+of+Mobile+Phones+is+Expected+to+Propel+Growth&utm_exec=jamu273prd

- ↑ https://www.researchandmarkets.com/reports/5781177/film-video-global-market-report#src-pos-6

- ↑ https://www.statista.com/topics/868/video-games/#topicOverview

- ↑ Deutsche Bank. (2023) Deutsche Bank FY-23 Preview Closing chapter

- ↑ Barclays. (2023) Ubisoft, Embracer and CD Projekt: Mega games getting bigger?