Upshift

Fractional car subscriptions: Car when you need it, gone when you don't

Summary edit edit source

- Upshift: $19B fractional car subscription market for low mileage drivers

- Raising $3M: expand to DC market, electrify fleet & unmanned delivery tech

- 3X annual growth, 95% retention, $805 acquisition, $5,967 lifetime value

- 659,693 pounds CO2 reduced—like taking 70 vehicles off the road for a year

- Team built of people with decades of experience in mobility and tech

- $1.5M raised from MINI (BMW), Ford, Third Sphere, Climate Capital & angels

- Last campaign on Republic raised $707K from 3007 investors

Problem edit edit source

A car in the city is a waste of money edit edit source

124 million Americans drive less than 10,000 miles/year. They are spending ~ $10,000/year on car payments, maintenance, insurance and parking to have a car on standby.

You are locked into years of payments for a depreciating asset you hardly even use while contributing to ruining the planet. You are saddled with the burdens of dealing with car repairs, maintenance, and insurance claims.

Sources: https://newsroom.aaa.com/asset/your-driving-costs-fact-sheet-august-2021/ and https://www.metromile.com/blog/metromile-auto-insurance-2020/

Solution edit edit source

Fractional car subscriptions edit edit source

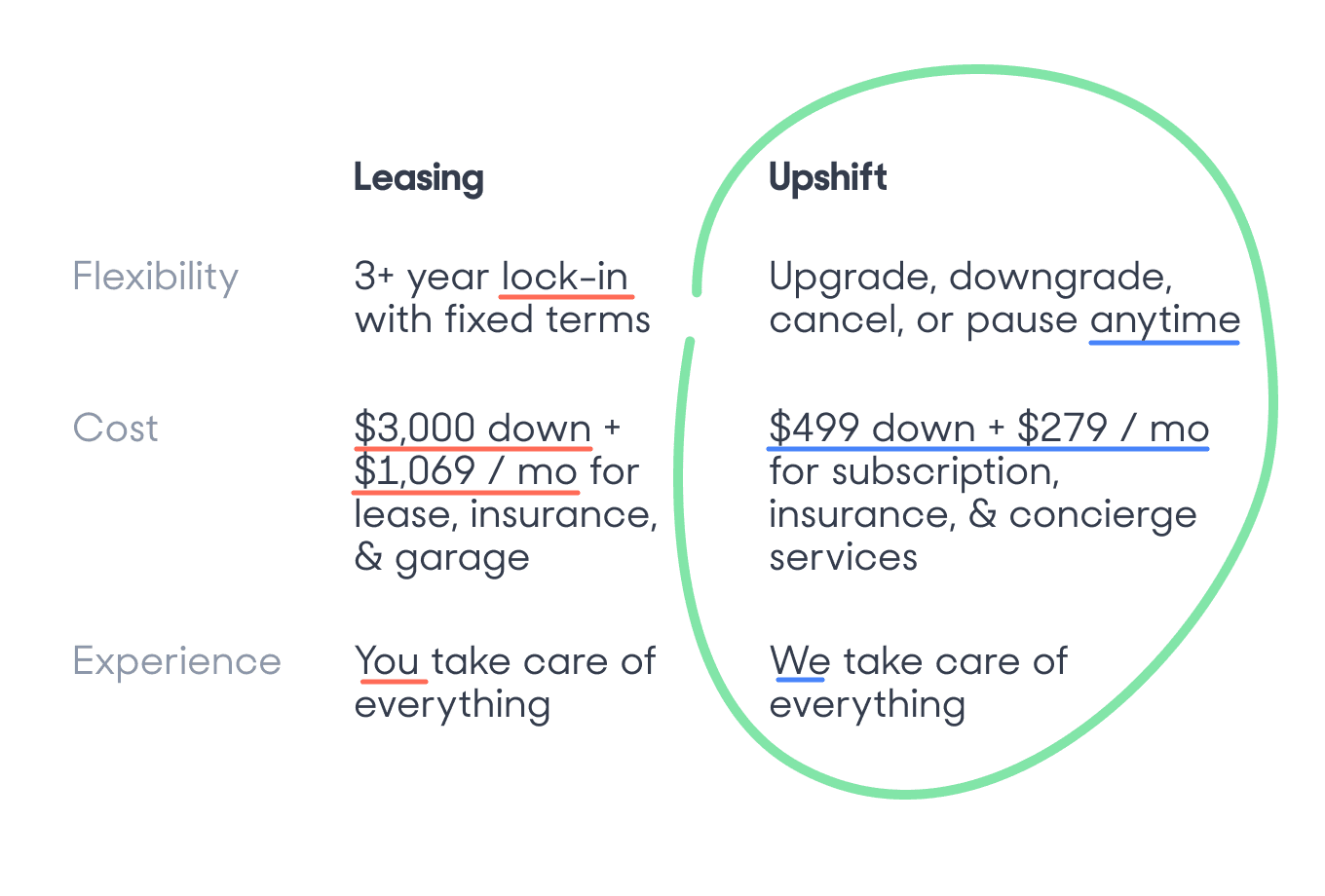

Upshift is a flexible, convenient, and affordable alternative to leasing a car.

Subscribe to a plan that you can upgrade, downgrade, cancel, or pause anytime and only pay for the days you drive. A hybrid or electric car will be seamlessly delivered and parked next to your doorstep on the days you need it. It will be waiting for you with your own driver profile already set up, clean, and fueled/charged.

At the end of your use just park it and walk away. We'll take it from there.

Product edit edit source

Easy to use, complex under the hood edit edit source

We've built a full technology stack to support members and operations: edit edit source

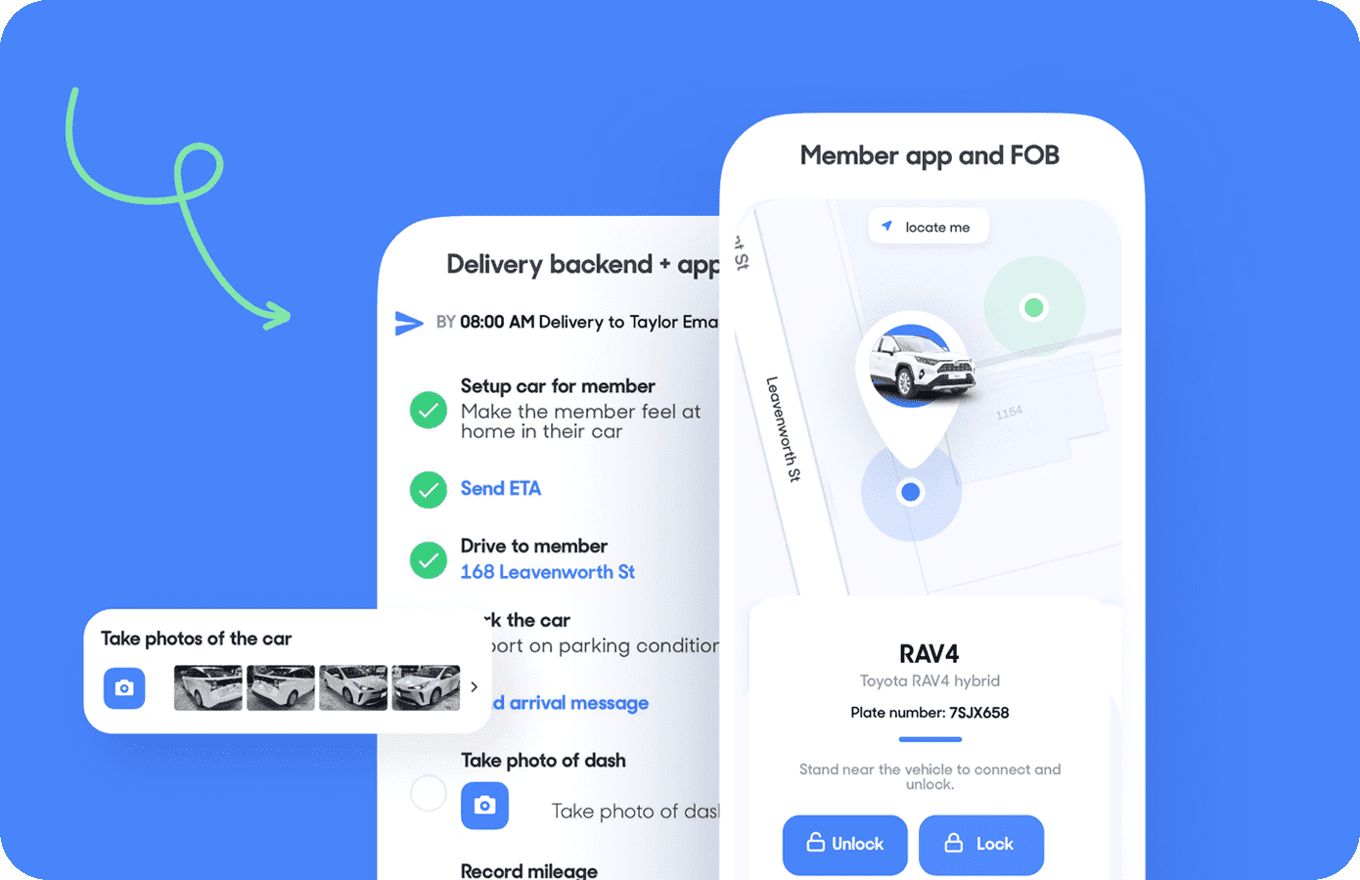

Member app: edit edit source

Available on the App Store and Google Play. App enables members to book, set preferences, locate, unlock and drive their car.

Delivery app: edit edit source

Supports logistics, including tracking damage, parking, cleanliness, and members’ personal car preferences.

Vehicle telematics integration: edit edit source

Allows real time vehicle data and ability to locate, unlock, lock, and enable vehicle from apps or backend.

Dispatch and fleet management software: edit edit source

Manages delivery job assignments, damage reporting, trip data, and real time fleet and delivery status.

Backend: edit edit source

Handles billing, reservations, accounts, and day credit accounting.

Traction edit edit source

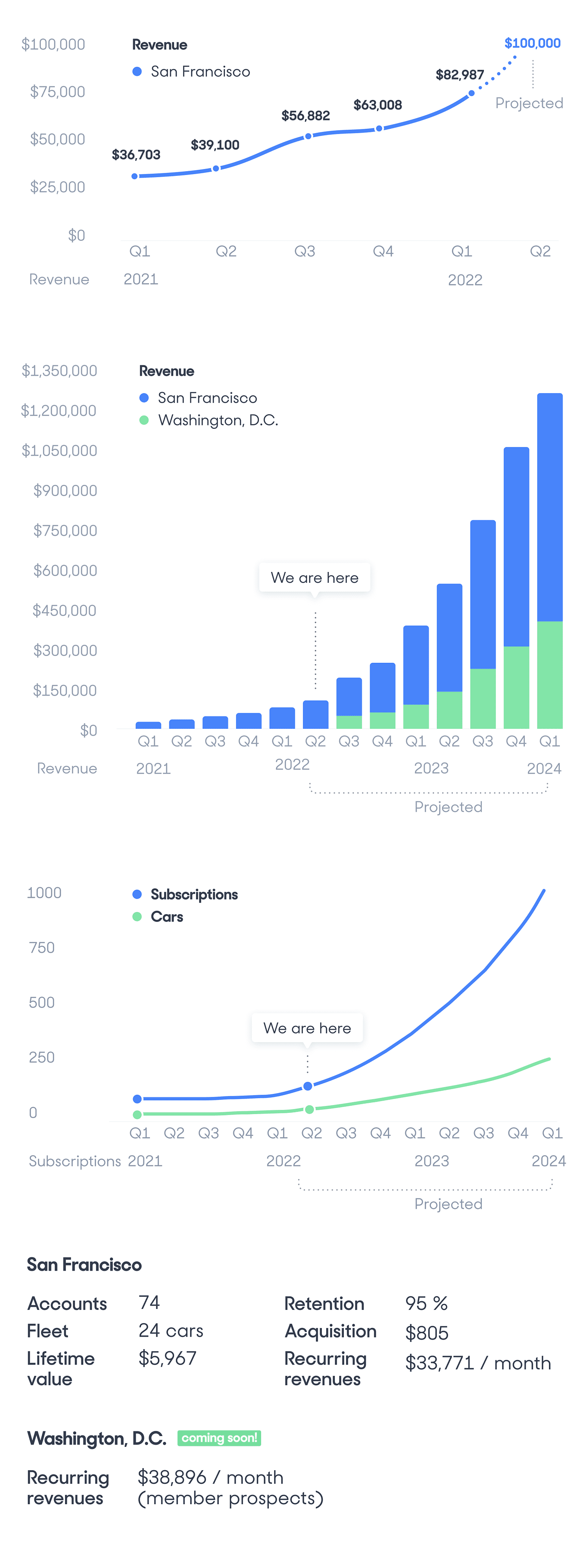

3x revenue growth YoY

We are currently operating in San Francisco. Our quarterly revenue is growing as follows:

Quarterly Revenues: edit edit source

| 2021 | 2022 |

|

|

Current Snapshot & Projections:* edit edit source

* Click here for important information regarding Financial Projections which are not guaranteed.

Customers edit edit source

Urbanites seeking simplicity edit edit source

Our members are 28–43 year old urban professionals without kids, and 55–65 year old urban empty nesters who drive less than 10,000 miles/year.

They are frequent renters on carshare and rental car who find those options expensive, unreliable, and unpredictable. They are considering leasing a car and looking for flexibility, without all the headaches.

Our average member spends $442/month over 13.5 months for $5,967 lifetime value. Some have spent up to $19,000 or been members 5.5 years. 10% of Upshift members have invested $105,000 in the company.

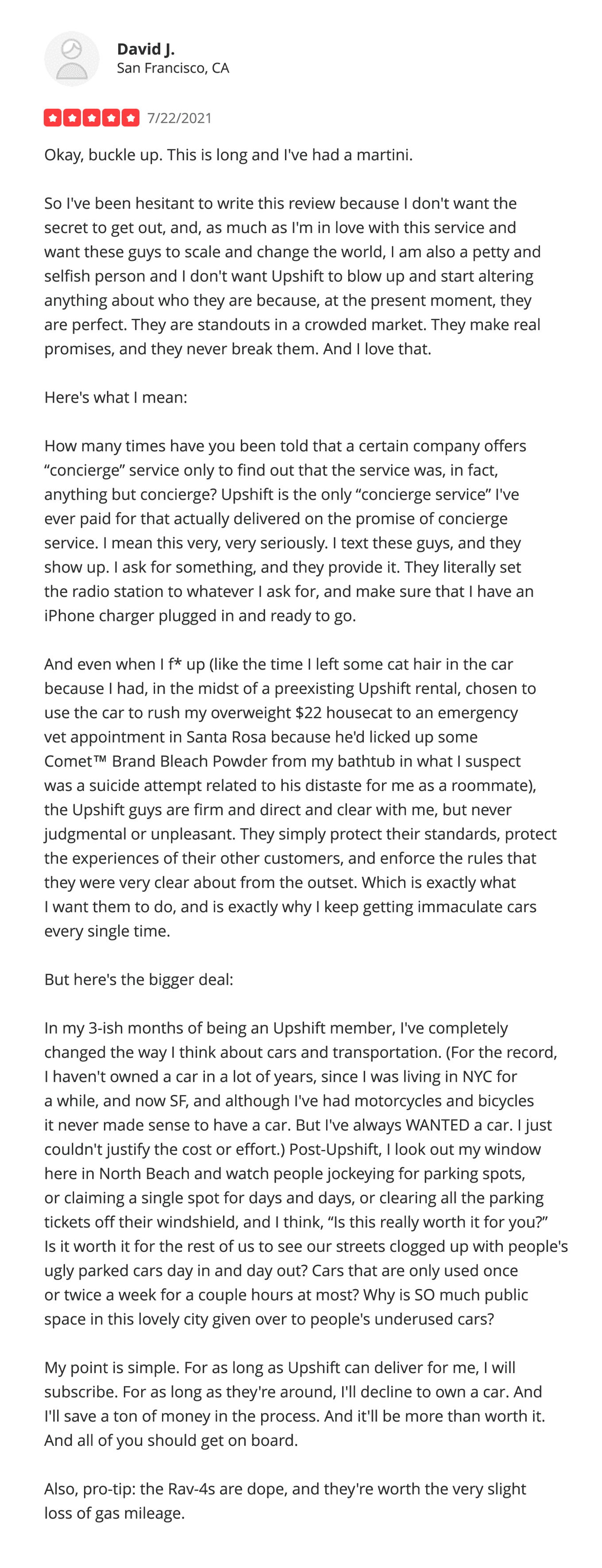

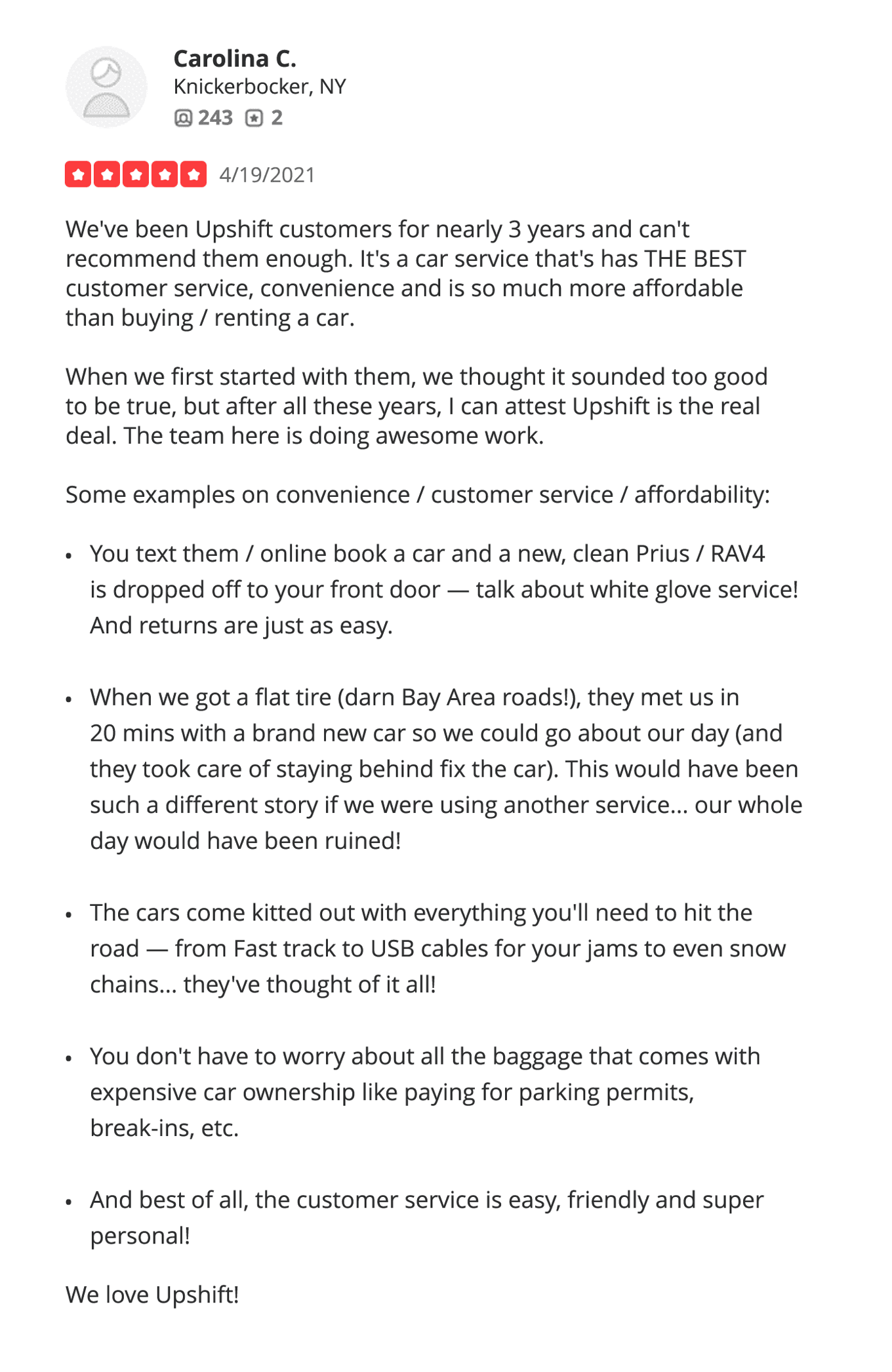

Our growth is solidified with 95% retention and solid 5 star reviews. Our members love us. Read our recent Yelp and Google reviews below, it will make you smile!

Glowing customer reviews edit edit source

Business model edit edit source

Fractional car subscriptions with simple, transparent pricing edit edit source

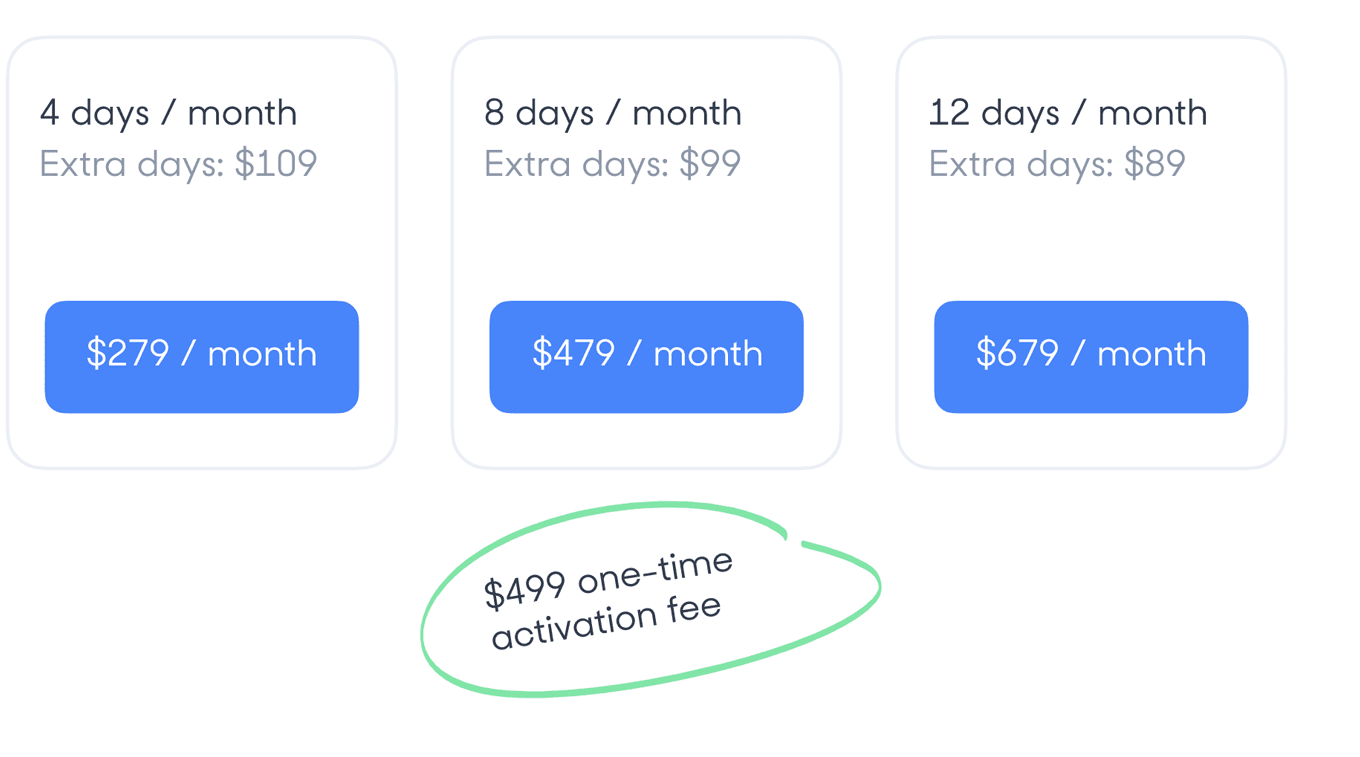

Our simple, transparent, all-inclusive monthly pricing means no big down payment, no hidden fees and no long term commitments. Subscribers drive any days they like and days roll over 1 month before expiring.

On day one every new member pays $499 one-time activation fee, with 3 available subscriptions:

- $279/month for 4 days/month

- $479/month for 8 days/month

- $679/month for 12 days/month

i.e: Every new subscriber, on day one, is worth at least $758.

Additional revenue streams:

- $89-109/day charge for days beyond your plan.

- $49/month: share your plan with a significant other.

- $49/month: pause your plan and retain your days.

Market edit edit source

Unlocking a $19B market edit edit source

- In the top 10 US cities, we see an opportunity to replace 3.5M cars being driven <10,000 miles/year.

- $442/month per account. Average 13.5 month retention. Average LTV of $5,967 per account.

- 3.5M cars x $442/member/month is a $19B market opportunity for fractional car subscriptions in the top 10 US markets.

- Based on our expansion requests, we see further opportunity to expand internationally and into smaller cities and suburbs as an alternative to having a second or third car.

Expanding the market, big opportunity edit edit source

Current demographic represents ~½ of cars in cities (~3.5m cars in top 10 US markets). Developing our unmanned delivery tech will enable our expansion to lower density markets (smaller cities, suburbs) to replace 2nd and 3rd cars, and address an additional 120M cars driven <10,000 miles/year segment.

Trend: Post-COVID behavior change edit edit source

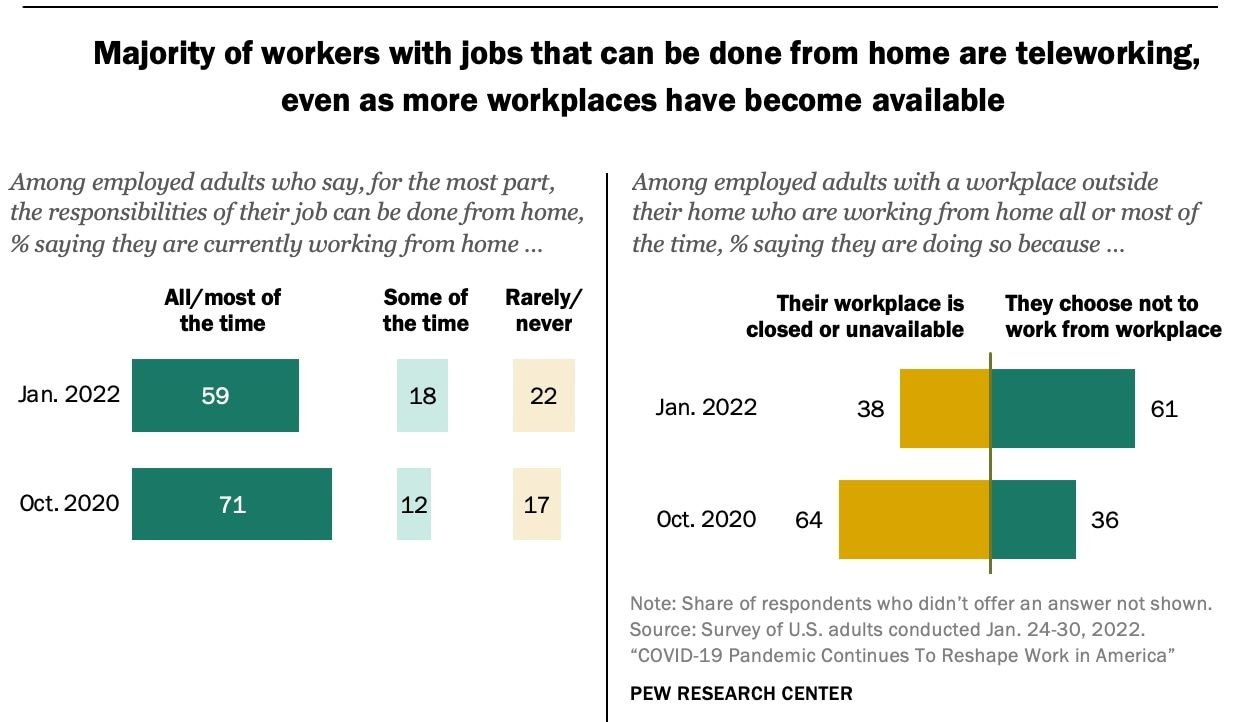

“Two years into the COVID-19 pandemic, roughly six-in-ten U.S. workers who say their jobs can mainly be done from home (59%) are working from home all or most of the time.”

This study from Pew Research Center (Feb 16, 2022) shows that "hybrid work" is here to stay. People no longer need a car to commute every day.

Trend: High demand for green cars edit edit source

- Vehicle supply constraints are driving up the cost of cars

- $5/gallon gas is driving demand for hybrid and electric cars

Trend: The world is unstable edit edit source

- traditional car financing locks you into expensive 6 year terms

- no one knows what the world will be like in 6 months

People need an affordable, flexible, green alternative to car leasing. A car when you need it, that's gone when you don't. That's Upshift.

Source:

Competition edit edit source

Redefining car leasing

Upshift vs leasing edit edit source

Rental car delivery-services edit edit source

Company Example(s): Kyte

Value: rental car company that provides the convenience of delivery of a car for the day

Missing: Car delivery-services do not provide vehicle personalization, consistency, or predictability (see reviews above for reference, our members tell it best). Upshift does.

Car subscription services edit edit source

Company Example(s): Fair, Hertz My Car, Subscribe with Enterprise, Porsche Drive, Audi Select, etc.

Value: subscription services that offer flexibility to have a car month-to-month.

Missing: Car subscription services do not provide concierge services like handling parking, refueling/charging, cleaning, repairs, and maintenance when you are not using it. Upshift does

edit edit source

Company Example(s): Zipcar, Turo, Getaround

Value: easy access to a car by the hour, parked near you

Missing: Carshare services are not affordable and do not offer consistent availability in every location, especially during peak times. Cars are often dirty, unmaintained, or low on gas. Upshift cars are affordable, offer consistent availability and are clean, maintained, and fully fueled or charged.

Rental car edit edit source

Company Example(s): Enterprise, Avis, Hertz

Value: rent a car by the day or week, mostly at airports

Missing: locations and hours are inconvenient, and cars tend to be generic and entry level.

These service providers could and might pivot into our space but won't be able to easily do so, and it's not their business model either.

Vision and strategy edit edit source

There when you need it, gone when you don't—scaled edit edit source

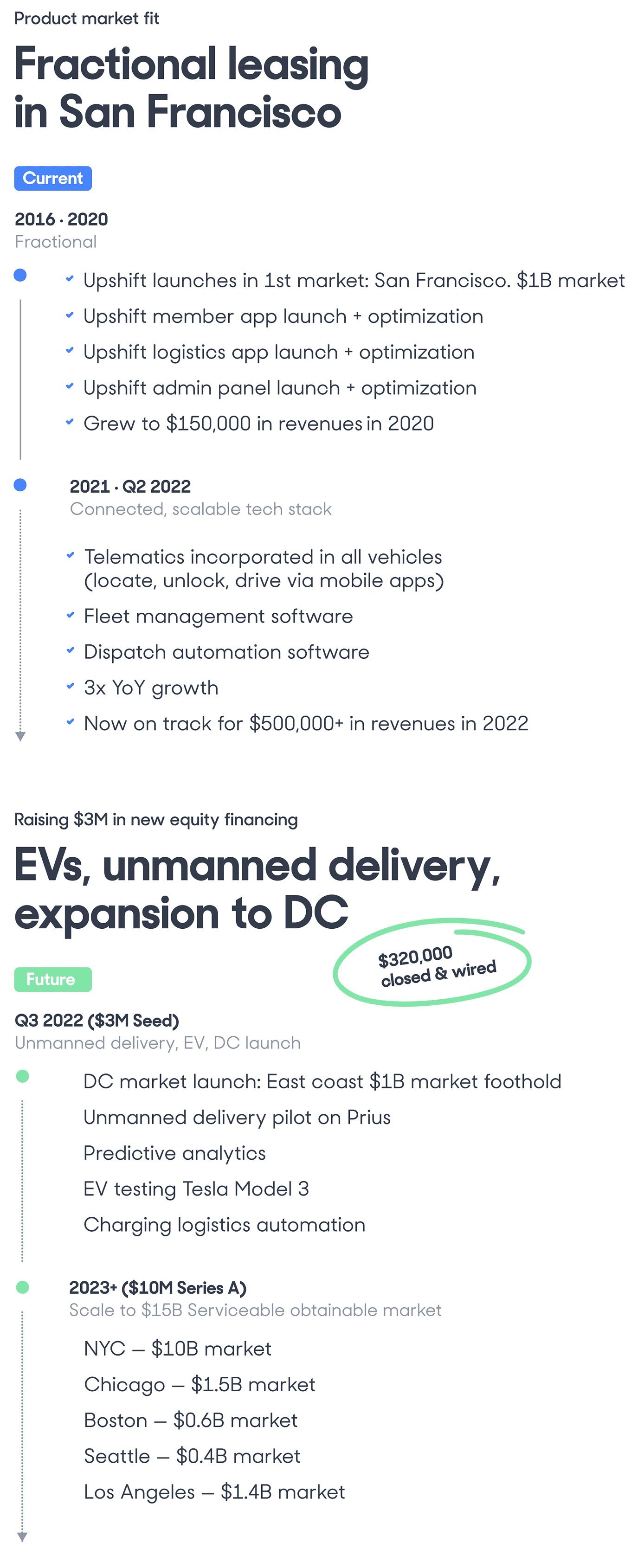

We are now raising $3M to scale up in San Francisco, launch the DC market, integrate drive-by-wire vehicle delivery technology (teleoperations), and to electrify our fleet. Launching DC will give us an east-coast presence in another $1B addressable market.

The ability to deliver unmanned vehicles remotely will help us scale. We'll have remote-controlled fleets. A remote driver (drive-by-wire) will cut operational costs, shorten delivery times, and enable expansion into lower density markets (mentioned above in the market section) that are already signaling that they want our product with expansion requests.

Our fractional car subscription already:

- replaces 4 cars for every car we add (4 members per car)

- reduces vehicle miles traveled by 47% by incentivizing less driving (usage based pricing)

- cuts emissions in half with an all hybrid fleet (46 MPG fleet average)

Our driving is net zero, and we are making our cities more livable by reducing the number of cars sitting underutilized on our streets.

Electrifying our fleet will further reduce our carbon footprint as we scale making our operations net negative emissions. We plan to 5x the business in the next 12 months before raising a $10M Series A to launch 5 additional markets so we can scale our impact.*

Impact edit edit source

Upshift is a vehicle for change edit edit source

We believe that:

- We need a healthy planet. All our cars are hybrids and reduce gas consumption by 1/2, and we are transitioning to EVs. We have eliminated 655,877 pounds CO2 to date, equivalent to taking 70 vehicles off the road for 1 year.

- Streets are for people, not cars. Every shared car we put on the road takes 4 cars off the road.

- Everyone deserves dignity and respect. Our concierges are employees and we pay $25/hr+ with pathways to growth and equity in the business.

- Diversity is strength. Our team is 69% minority and/or women and we aim to grow that way.

Source: https://www.researchgate.net/publication/224247227_Greenhouse_Gas_Emission_Impacts_of_Carsharing_in_North_America

Funding edit edit source

$2.4M raised from investors including carmakers and VCs edit edit source

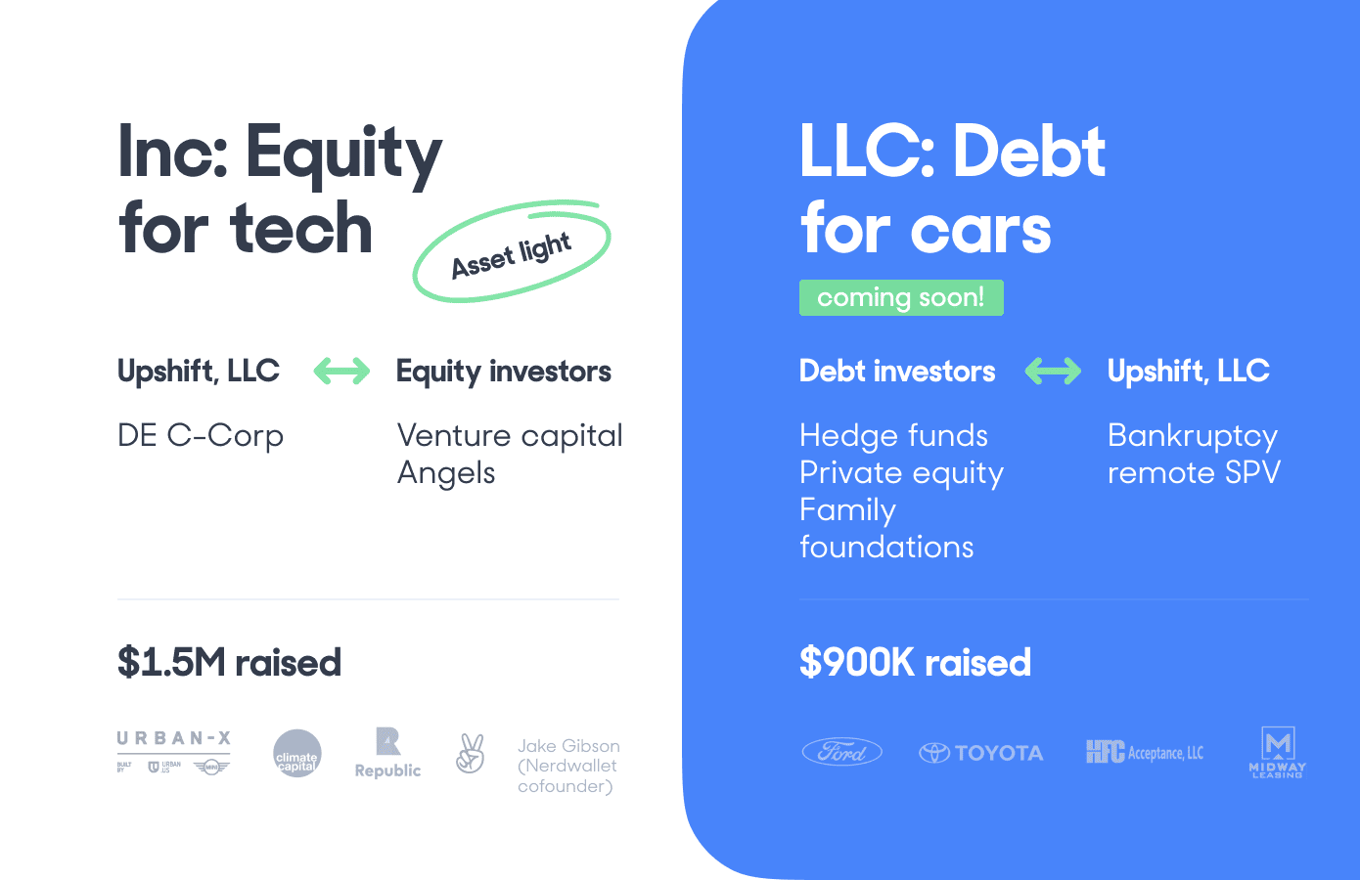

We have raised $1.5M from MINI (BMW), Ford, Third Sphere, Climate Capital, previous Republic campaign (3007 investors), AngelList syndicate, and Jake Gibson (Nerdwallet cofounder).

The money was used for building our technology, proving product market fit and funded our go to market operations in San Francisco.

We have raised $900K in debt financing for purchasing the vehicles. Investors include HFCA and Toyota Financial Services.

We plan to incorporate a new Upshift, LLC to take on future debt financings to scale our fleet and create a firewall between debt and equity financings.

Equity funding edit edit source

Republic campaign funds will be equity financing used for development of technology and go-to-market, not to buy cars.

Structure explained edit edit source

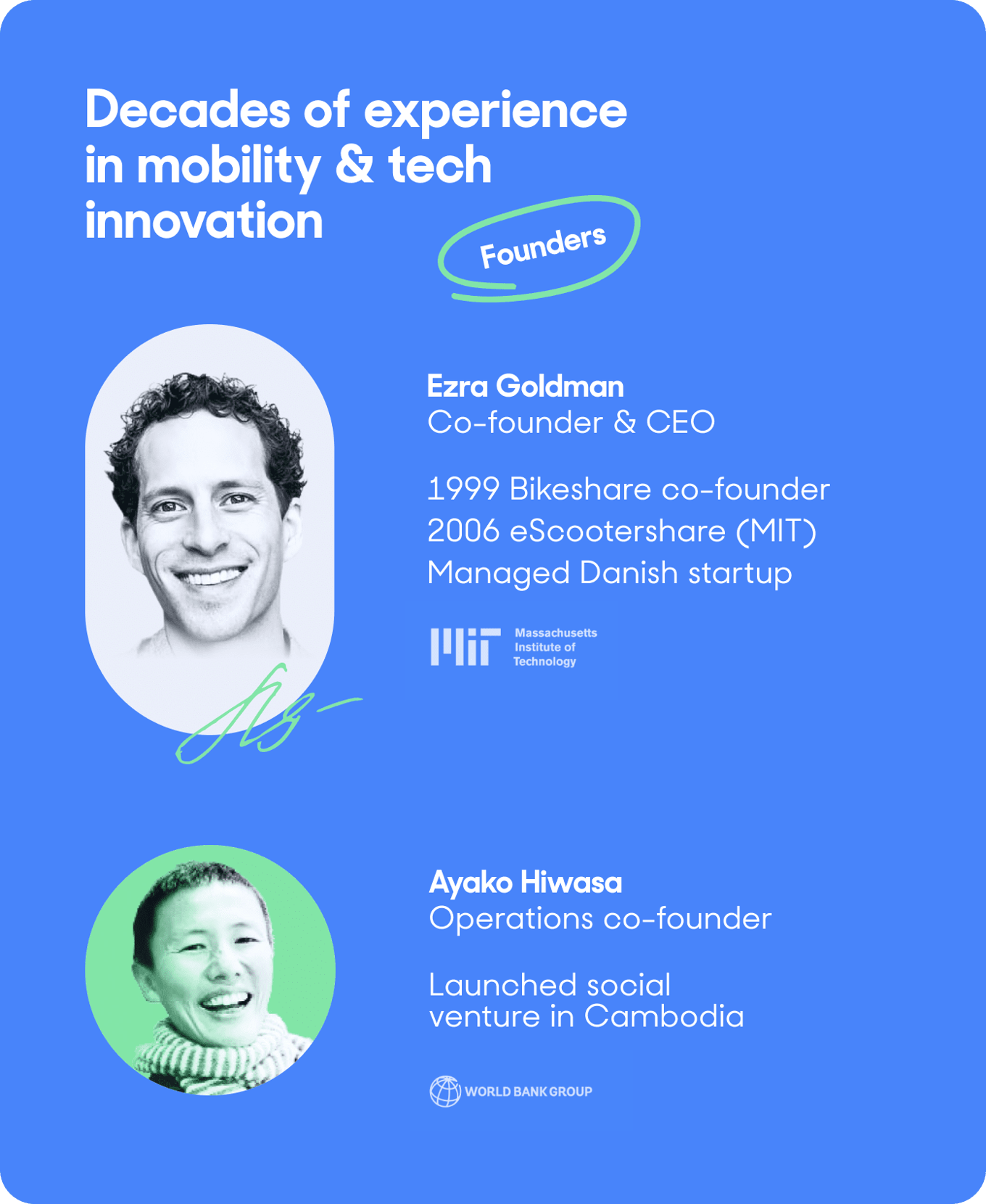

Founders edit edit source

Ezra Goldman & Ayako Hiwasa

Background

Ezra co-founded a dockless bike-share in 1999 and helped design a shared folding electric scooter at the MIT Media Lab with Piaggio in 2006 while doing his Master's in City Planning. Ezra has consulted on innovation for HP and was managing director of a tech startup in Copenhagen, where he also was a PhD candidate studying why Danish people ride bicycles.

Ayako moved to Cambodia from Japan after college to launch a social enterprise when she could barely speak English, let alone Khmer. She now holds two Master's degrees, has consulted for the World Bank, and advised Stanford University students. She has a sharp mind for process improvement and a passion for creating delightful experiences.

Early days

Ezra drove for rideshare and Ayako did gig work to pay the rent while bootstrapping the company in the beginning. This inspired them to hire the Upshift concierge team as W2 employees, pay 1.5x minimum wage ($25/hr in SF), treat everyone with dignity and respect, and make concierges core team members.

Upshift Team edit edit source

Ezra Goldman

Founder

20+ years in shared mobility (including dockless bike share in 1999 and scooter share in 2006) & MIT MCP ( Urban Planning).

Ayako Hiwasa

Co-founder

Worked at World Bank, advised students at Stanford d.School

Keith Reinbolt

Growth marketing

Lena Belogolova

Behavioral scientist

Alex Belikov

Art direction & product design

Rabendra Sharma

Backend engineer

Anil Chudasama

Mobile engineer

Tehreem Javid

Operations

Nick Traverso

Operations assistant

Joan Reuter

Concierge

Kelly Johnson

Concierge

Arjun Arora

Advisor: Partner @500 Startups, EIR @Expa, Founder @ReTargeter

Al Lieb

Advisor: Cofounding CEO/CTO @eVite @Clearslide @Gixo

Michael Wang

Advisor: Product Design @Facebook @Lyft @Github

David Brook

Advisor: Cofounder of 1st carshare in North America, helped launch Car2Go, Turo

Griff Long

Advisor: VP Operations @Zipcar, @Equinox, Sr Global Dir Carshare Operations @Hertz, COO @Orange Theory

Byron Shaw

Advisor: Founding Managing Director @GM Ventures, @GM Advanced Technology Silicon Valley Office

Bradley Walsh

Advisor: Senior Manager @Allstate, SVP @Santander & Sr Dir @Cox Automotive (Vehicle Financing)

Edward West

Advisor: Partner @Salmon Nation Capital, Dir Strategy @Earthbanc, Cofounder @Mission Motors (EV motorcycles) @Hylo

Risks edit edit source

We have a limited operating history upon which you can evaluate our performance, and accordingly, our prospects must be considered in light of the risks that any new company encounters.

The Company is still in an early phase and is just beginning to implement its business plan. There can be no assurance that it will ever operate profitably. The likelihood of its success should be considered in light of the problems, expenses, difficulties, complications and delays usually encountered by companies in their early stages of development. The Company may not be successful in attaining the objectives necessary for it to overcome these risks and uncertainties.

We rely on other companies to provide services for the Company.

We depend on suppliers and subcontractors to meet our contractual obligations to our customers and conduct our operations. For example, we purchase our vehicle fleet from Toyota. Our ability to meet our obligations to our customers may be adversely affected if suppliers or subcontractors do not provide the agreed-upon supplies or perform the agreed-upon services in compliance with customer requirements and in a timely and cost-effective manner. Likewise, the quality of our services may be adversely impacted if companies, such as Toyota, fail to perform to our and our customers’ expectations. Our suppliers may be unable to quickly recover from natural disasters and other events beyond their control and may be subject to additional risks such as financial problems that limit their ability to conduct their operations. The risk of these adverse effects may be greater in circumstances where we rely on only one or two subcontractors or suppliers. We currently rely exclusively on Toyota and its Prius hybrid and RAV4 SUV hybrid to supply us with vehicle fleet. Continued unavailability of those models at acceptable prices, or at all, may adversely affect our business and results of operations.

Although dependent on certain key personnel, the Company does not have any key man life insurance policies on any such people.

The Company is dependent on certain key personnel in order to conduct its operations and execute its business plan, however, the Company has not purchased any insurance policies with respect to those individuals in the event of their death or disability. Therefore, if any of these personnel die or become disabled, the Company will not receive any compensation to assist with such person’s absence. Specifically, the Company is dependent on Ezra Goldman. The loss of such person could negatively affect the Company and its operations. We have no way to guarantee key personnel will stay with the Company, as many states do not enforce non-competition agreements, and therefore acquiring key man insurance will not ameliorate all of the risk of relying on key personnel.

The Company is not subject to Sarbanes-Oxley regulations and may lack the financial controls and procedures of public companies.

The Company may not have the internal control infrastructure that would meet the standards of a public company, including the requirements of the Sarbanes Oxley Act of 2002. As a privately-held (non-public) company, the Company is currently not subject to the Sarbanes Oxley Act of 2002, and it’s financial and disclosure controls and procedures reflect its status as a development stage, non-public company. There can be no guarantee that there are no significant deficiencies or material weaknesses in the quality of the Company’s financial and disclosure controls and procedures. If it were necessary to implement such financial and disclosure controls and procedures, the cost to the Company of such compliance could be substantial and could have a material adverse effect on the Company’s results of operations.

Damage to our reputation could negatively impact our business, financial condition and results of operations.

Our reputation and the quality of our brand are critical to our business and success in existing markets, and will be critical to our success as we enter new markets. Any incident that erodes consumer loyalty for our brand could significantly reduce its value and damage our business. We may be adversely affected by any negative publicity, regardless of its accuracy. Also, there has been a marked increase in the use of social media platforms and similar devices, including blogs, social media websites and other forms of internet-based communications that provide individuals with access to a broad audience of consumers and other interested persons. The availability of information on social media platforms is virtually immediate as is its impact. Information posted may be adverse to our interests or may be inaccurate, each of which may harm our performance, prospects or business. The harm may be immediate and may disseminate rapidly and broadly, without affording us an opportunity for redress or correction.

The current difficulty of acquiring automobiles may adversely affect the financial performance of the Company.

Currently, there is an increased difficulty to acquire automobiles due to a supply chain and chip shortages. The Company relies on the acquisition of automobiles to grow its business. The difficulty of acquiring automobiles may adversely impact the Company’s financial performance.

The amount of capital the Company is attempting to raise in this Offering may not be enough to sustain the Company’s current business plan.

In order to achieve the Company’s near and long-term goals, the Company may need to procure funds in addition to the amount raised in the Offering. There is no guarantee the Company will be able to raise such funds on acceptable terms or at all. If we are not able to raise sufficient capital in the future, we may not be able to execute our business plan, our continued operations will be in jeopardy and we may be forced to cease operations and sell or otherwise transfer all or substantially all of our remaining assets, which could cause a Purchaser to lose all or a portion of his or her investment.

We may face potential difficulties in obtaining capital.

We may have difficulty raising needed capital in the future as a result of, among other factors, our lack of revenues from sales, as well as the inherent business risks associated with our Company and present and future market conditions. Future sources of revenue may not be sufficient to meet our future capital requirements. We will require additional funds to execute our business strategy and conduct our operations. If adequate funds are unavailable, we may be required to delay, reduce the scope of or eliminate one or more of our research, development or commercialization programs, product/service launches or marketing efforts, any of which may materially harm our business, financial condition and results of operations.

We may not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

Currently, our authorized capital stock consists of 10,000,000 shares of common stock, of which 7,462,316 shares of common stock are issued and outstanding. Unless we increase our authorized capital stock, we may not have enough authorized common stock to be able to obtain funding by issuing shares of our common stock or securities convertible into shares of our common stock. We may also not have enough authorized capital stock to issue shares of common stock to investors upon the conversion of any security convertible into shares of our common stock, including the Securities.

Changes in government regulations or imposition of new regulations could adversely impact our business.

The Company may be subject to franchise and consumer protection laws in the future. The vehicle subscriptions are gaining increasing government scrutiny. In March 2018, Indiana enacted a temporary ban on car subscriptions. In California, where many car subscription services are offered, a bill passed the state Assembly that would restrict subscription business to franchisees, only to be amended in later readings to remove the language regarding subscription services. Lawmakers in New Jersey are reportedly considering similar changes. How the subscription programs are structured—and the involvement of dealers and automakers in the subscription programs—will be an area of development as the programs expand to a greater number of cities and states around the country. Although the Company’s fractional car subscription model may differ from those subscription programs, California, where the Company operates, and other states may attempt to regulate or ban fractional subscription services. California is among the first states to look at how to treat vehicles in the growing number of subscription programs. Modifications to existing requirements or imposition of new requirements or limitations could have an adverse impact on our business.

We may implement new lines of business or offer new products and services within existing lines of business.

As an early-stage company, we may implement new lines of business at any time. There are substantial risks and uncertainties associated with these efforts, particularly in instances where the markets are not fully developed. In developing and marketing new lines of business and/or new products and services, we may invest significant time and resources. Initial timetables for the introduction and development of new lines of business and/or new products or services may not be achieved, and price and profitability targets may not prove feasible. We may not be successful in introducing new products and services in response to industry trends or developments in technology, or those new products may not achieve market acceptance. As a result, we could lose business, be forced to price products and services on less advantageous terms to retain or attract clients, or be subject to cost increases. As a result, our business, financial condition or results of operations may be adversely affected.

Our business could be negatively impacted by cyber security threats, attacks and other disruptions.

We continue to face advanced and persistent attacks on our information infrastructure where we manage and store various proprietary information and sensitive/confidential data relating to our operations. These attacks may include sophisticated malware (viruses, worms, and other malicious software programs) and phishing emails that attack our products or otherwise exploit any security vulnerabilities. These intrusions sometimes may be zero-day malware that are difficult to identify because they are not included in the signature set of commercially available antivirus scanning programs. Experienced computer programmers and hackers may be able to penetrate our network security and misappropriate or compromise our confidential information or that of our customers or other third-parties, create system disruptions, or cause shutdowns. Additionally, sophisticated software and applications that we produce or procure from third-parties may contain defects in design or manufacture, including “bugs” and other problems that could unexpectedly interfere with the operation of the information infrastructure. A disruption, infiltration or failure of our information infrastructure systems or any of our data centers as a result of software or hardware malfunctions, computer viruses, cyber-attacks, employee theft or misuse, power disruptions, natural disasters or accidents could cause breaches of data security, loss of critical data and performance delays, which in turn could adversely affect our business.

Security breaches of confidential customer information, in connection with our electronic processing of credit and debit card transactions, or confidential employee information, may adversely affect our business.

Our business requires the collection, transmission and retention of personally identifiable information, in various information technology systems that we maintain and in those maintained by third parties with whom we contract to provide services. The integrity and protection of that data is critical to us. The information, security and privacy requirements imposed by governmental regulation are increasingly demanding. Our systems may not be able to satisfy these changing requirements and customer and employee expectations, or may require significant additional investments or time in order to do so. A breach in the security of our information technology systems or those of our service providers could lead to an interruption in the operation of our systems, resulting in operational inefficiencies and a loss of profits. Additionally, a significant theft, loss or misappropriation of, or access to, customers’ or other proprietary data or other breach of our information technology systems could result in fines, legal claims or proceedings.

The use of individually identifiable data by our business, our business associates and third parties is regulated at the state, federal and international levels.

The regulation of individual data is changing rapidly, and in unpredictable ways. A change in regulation could adversely affect our business, including causing our business model to no longer be viable. Costs associated with information security – such as investment in technology, the costs of compliance with consumer protection laws and costs resulting from consumer fraud – could cause our business and results of operations to suffer materially. Additionally, the success of our online operations depends upon the secure transmission of confidential information over public networks, including the use of cashless payments. The intentional or negligent actions of employees, business associates or third parties may undermine our security measures. As a result, unauthorized parties may obtain access to our data systems and misappropriate confidential data. There can be no assurance that advances in computer capabilities, new discoveries in the field of cryptography or other developments will prevent the compromise of our customer transaction processing capabilities and personal data. If any such compromise of our security or the security of information residing with our business associates or third parties were to occur, it could have a material adverse effect on our reputation, operating results and financial condition. Any compromise of our data security may materially increase the costs we incur to protect against such breaches and could subject us to additional legal risk.

We operate in a highly regulated environment, and if we are found to be in violation of any of the federal, state, or local laws or regulations applicable to us, our business could suffer.

We are also subject to a wide range of federal, state, and local laws and regulations, such as local licensing requirements, and retail financing, debt collection, consumer protection, environmental, health and safety, creditor, wage-hour, anti-discrimination, whistleblower and other employment practices laws and regulations and we expect these costs to increase going forward. The violation of these or future requirements or laws and regulations could result in administrative, civil, or criminal sanctions against us, which may include fines, a cease-and-desist order against the subject operations or even revocation or suspension of our license to operate the subject business. As a result, we have incurred and will continue to incur capital and operating expenditures and other costs to comply with these requirements and laws and regulations.

There is currently no regulatory environment for remote vehicle teleoperations, and the status of regulations may impact our business.

Remote vehicle teleoperations is substantively different from fully autonomous driving and is not bound by any autonomous vehicle regulations. We have had multiple high-level meetings with the California Department of Motor Vehicles, California Department of Highway Patrol, San Francisco Municipal Transportation Authority, and the San Francisco Department of Public Works. There may be regulations in the future for remote vehicle teleoperations and we are in close contact with the relevant agencies to help shape it.

State and federal securities laws are complex, and the Company could potentially be found to have not complied with all relevant state and federal securities law in prior offerings of securities.

Remote vehicle teleoperations is substantively different from fully autonomous driving and is not bound by any autonomous vehicle regulations. We have had multiple high-level meetings with the California Department of Motor Vehicles, California Department of Highway Patrol, San Francisco Municipal Transportation Authority, and the San Francisco Department of Public Works. There may be regulations in the future for remote vehicle teleoperations and we are in close contact with the relevant agencies to help shape it.

The U.S. Securities and Exchange Commission does not pass upon the merits of any securities offered or the terms of the offering, nor does it pass upon the accuracy or completeness of any offering document or literature.

You should not rely on the fact that our Form C is accessible through the U.S. Securities and Exchange Commission’s EDGAR filing system as an approval, endorsement or guarantee of compliance as it related to this Offering.

Neither the Offering nor the Securities have been registered under federal or state securities laws, leading to an absence of certain regulation applicable to the Company.

No governmental agency has reviewed or passed upon this Offering, the Company or any Securities of the Company. The Company also has relied on exemptions from securities registration requirements under applicable state securities laws. Investors in the Company, therefore, will not receive any of the benefits that such registration would otherwise provide. Prospective Investors must therefore assess the adequacy of disclosure and the fairness of the terms of this Offering on their own or in conjunction with their personal advisors. Compliance with the criteria for securing exemptions under federal securities laws and the securities laws of the various states is extremely complex, especially in respect of those exemptions affording flexibility and the elimination of trading restrictions in respect of securities received in exempt transactions and subsequently disposed of without registration under the Securities Act or state securities laws.

The Company's management may have broad discretion in how the Company uses the net proceeds of the Offering.

Unless the Company has agreed to a specific use of the proceeds from the Offering, the Company’s management will have considerable discretion over the use of proceeds from the Offering. You may not have the opportunity, as part of your investment decision, to assess whether the proceeds are being used appropriately.

The Company has the right to limit individual Investor commitment amounts based on the Company’s determination of an Investor’s sophistication.

The Company may prevent any Investor from committing more than a certain amount in this Offering based on the Company’s determination of the Investor’s sophistication and ability to assume the risk of the investment. This means that your desired investment amount may be limited or lowered based solely on the Company’s determination and not in line with relevant investment limits set forth by the Regulation CF rules. This also means that other Investors may receive larger allocations of the Offering based solely on the Company’s determination.

The Company has the right to extend the Offering Deadline.

The Company may extend the Offering Deadline beyond what is currently stated herein. This means that your investment may continue to be held in escrow while the Company attempts to raise the Target Offering Amount even after the Offering Deadline stated herein is reached. While you have the right to cancel your investment in the event the Company extends the Offering Deadline, if you choose to reconfirm your investment, your investment will not be accruing interest during this time and will simply be held until such time as the new Offering Deadline is reached without the Company receiving the Target Offering Amount, at which time it will be returned to you without interest or deduction, or the Company receives the Target Offering Amount, at which time it will be released to the Company to be used as set forth herein. Upon or shortly after the release of such funds to the Company, the Securities will be issued and distributed to you.

The Company may also end the Offering early.

If the Target Offering Amount is met after twenty-one (21) calendar days, but before the Offering Deadline, the Company can end the Offering by providing notice to Investors at least five (5) business days prior to the end of the Offering. This means your failure to participate in the Offering in a timely manner, may prevent you from being able to invest in this Offering – it also means the Company may limit the amount of capital it can raise during the Offering by ending the Offering early.

The Company has the right to conduct multiple closings during the Offering.

If the Company meets certain terms and conditions, an intermediate close of the Offering can occur, which will allow the Company to draw down on seventy percent (70%) of the proceeds committed and captured in the Offering during the relevant period. The Company may choose to continue the Offering thereafter. Investors should be mindful that this means they can make multiple investment commitments in the Offering, which may be subject to different cancellation rights. For example, if an intermediate close occurs and later a material change occurs as the Offering continues, Investors whose investment commitments were previously closed upon will not have the right to re-confirm their investment as it will be deemed to have been completed prior to the material change.

The Securities will not be freely tradable under the Securities Act until one (1) year from the initial purchase date. Although the Securities may be tradable under federal securities law, state securities regulations may apply, and each Investor should consult with their attorney.

You should be aware of the long-term nature of this investment. There is not now and likely will not ever be a public market for the Securities. Because the Securities have not been registered under the Securities Act or under the securities laws of any state or foreign jurisdiction, the Securities have transfer restrictions and cannot be resold in the United States except pursuant to Rule 501 of Regulation CF. It is not currently contemplated that registration under the Securities Act or other securities laws will be effected. Limitations on the transfer of the Securities may also adversely affect the price that you might be able to obtain for the Securities in a private sale. Investors should be aware of the long-term nature of their investment in the Company. Each Investor in this Offering will be required to represent that they are purchasing the Securities for their own account, for investment purposes and not with a view to resale or distribution thereof.

Investors will not have voting rights, even upon conversion of the Securities and will grant a third-party nominee broad power and authority to act on their behalf.

In connection with investing in this Offering to purchase a Crowd SAFE (Simple Agreement for Future Equity), investors will designate Republic Investment Services LLC (f/k/a NextSeed Services, LLC) (“Nominee”) to act on their behalf as agent and proxy in all respects. The Nominee will be entitled, among other things, to exercise any voting rights (if any) conferred upon the holder of a Crowd SAFE or any securities acquired upon their conversion, to execute on behalf of an investor all transaction documents related to the transaction or other corporate event causing the conversion of the Crowd SAFE, and as part of the conversion process the Nominee has the authority to open an account in the name of a qualified custodian, of the Nominee’s sole discretion, to take custody of any securities acquired upon conversion of the Crowd SAFE. Thus, by participating in the Offering, investors will grant broad discretion to a third party (the Nominee and its agents) to take various actions on their behalf, and investors will essentially not be able to vote upon matters related to the governance and affairs of the Company nor take or effect actions that might otherwise be available to holders of the Crowd SAFE and any securities acquired upon their conversion. Investors should not participate in the Offering unless he, she or it is willing to waive or assign certain rights that might otherwise be afforded to a holder of the Crowd SAFE to the Nominee and grant broad authority to the Nominee to take certain actions on behalf of the investor, including changing title to the Security.

Investors will not become equity holders until the Company decides to convert the Securities into “CF Shadow Securities” (the type of equity securities issuable upon conversion of the Securities) or until there is a change of control or sale of substantially all of the Company’s assets.

Investors will not have an ownership claim to the Company or to any of its assets or revenues for an indefinite amount of time and depending on when and how the Securities are converted, the Investors may never become equity holders of the Company. Investors will not become equity holders of the Company unless the Company receives a future round of financing great enough to trigger a conversion and the Company elects to convert the Securities into CF Shadow Securities. The Company is under no obligation to convert the Securities into CF Shadow Securities. In certain instances, such as a sale of the Company or substantially all of its assets, an initial public offering or a dissolution or bankruptcy, the Investors may only have a right to receive cash, to the extent available, rather than equity in the Company. Further, the Investor may never become an equity holder, merely a beneficial owner of an equity interest, should the Company or the Nominee decide to move the Crowd SAFE or the securities issuable thereto into a custodial relationship.

Investors will not have voting rights, even upon conversion of the Securities into CF Shadow Securities.

Investors will not have the right to vote upon matters of the Company even if and when their Securities are converted into CF Shadow Securities (the occurrence of which cannot be guaranteed). Upon such conversion, the CF Shadow Securities will have no voting rights and, in circumstances where a statutory right to vote is provided by state law, the CF Shadow Security holders or the party holding the CF Shadow Securities on behalf of the Investors are required to enter into a proxy agreement with its designee to vote their CF Shadow Securities with the majority of the holder(s) of the securities issued in the round of equity financing that triggered the conversion right. For example, if the Securities are converted in connection with an offering of Series B Preferred Stock, Investors would directly or beneficially receive CF Shadow Securities in the form of shares of Series B-CF Shadow Preferred Stock and such shares would be required to be subject to a proxy that allows a designee to vote their shares of Series B-CF Shadow Preferred Stock consistent with the majority of the Series B Preferred Stockholders. Thus, Investors will essentially never be able to vote upon any matters of the Company unless otherwise provided for by the Company.

Investors will not be entitled to any inspection or information rights other than those required by law.

Investors will not have the right to inspect the books and records of the Company or to receive financial or other information from the Company, other than as required by law. Other security holders of the Company may have such rights. Regulation CF requires only the provision of an annual report on Form C and no additional information. Additionally, there are numerous methods by which the Company can terminate annual report obligations, resulting in no information rights, contractual, statutory or otherwise, owed to Investors. This lack of information could put Investors at a disadvantage in general and with respect to other security holders, including certain security holders who have rights to periodic financial statements and updates from the Company such as quarterly unaudited financials, annual projections and budgets, and monthly progress reports, among other things.

Investors will be unable to declare the Security in “default” and demand repayment.

Unlike convertible notes and some other securities, the Securities do not have any “default” provisions upon which Investors will be able to demand repayment of their investment. The Company has ultimate discretion as to whether or not to convert the Securities upon a future equity financing and Investors have no right to demand such conversion. Only in limited circumstances, such as a liquidity event, may Investors demand payment and even then, such payments will be limited to the amount of cash available to the Company.

The Company may never elect to convert the Securities or undergo a liquidity event and Investors may have to hold the Securities indefinitely.

The Company may never conduct a future equity financing or elect to convert the Securities if such future equity financing does occur. In addition, the Company may never undergo a liquidity event such as a sale of the Company or an initial public offering. If neither the conversion of the Securities nor a liquidity event occurs, Investors could be left holding the Securities in perpetuity. The Securities have numerous transfer restrictions and will likely be highly illiquid, with no secondary market on which to sell them. The Securities are not equity interests, have no ownership rights, have no rights to the Company’s assets or profits and have no voting rights or ability to direct the Company or its actions.

Equity securities acquired upon conversion of the Securities may be significantly diluted as a consequence of subsequent equity financings.

The Company’s equity securities will be subject to dilution. The Company intends to issue additional equity to employees and third-party financing sources in amounts that are uncertain at this time, and as a consequence holders of equity securities resulting from the conversion of the Securities will be subject to dilution in an unpredictable amount. Such dilution may reduce the Investor’s control and economic interests in the Company.

The amount of additional financing needed by the Company will depend upon several contingencies not foreseen at the time of this Offering. Generally, additional financing (whether in the form of loans or the issuance of other securities) will be intended to provide the Company with enough capital to reach the next major corporate milestone. If the funds received in any additional financing are not sufficient to meet the Company’s needs, the Company may have to raise additional capital at a price unfavorable to their existing investors, including the holders of the Securities. The availability of capital is at least partially a function of capital market conditions that are beyond the control of the Company. There can be no assurance that the Company will be able to accurately predict the future capital requirements necessary for success or that additional funds will be available from any source. Failure to obtain financing on favorable terms could dilute or otherwise severely impair the value of the Securities.

In addition, the Company has certain equity grants and convertible securities outstanding. Should the Company enter into a financing that would trigger any conversion rights, the converting securities would further dilute the equity securities receivable by the holders of the Securities upon a qualifying financing.

Equity securities issued upon conversion of the Securities may be substantially different from other equity securities offered or issued by the Company at the time of conversion.

In the event the Company decides to exercise the conversion right, the Company will convert the Securities into equity securities that are materially different from the equity securities being issued to new investors at the time of conversion in many ways, including, but not limited to, liquidation preferences, dividend rights, or anti-dilution protection. Additionally, any equity securities issued at the First Equity Financing Price (as defined in the Crowd SAFE agreement) shall have only such preferences, rights, and protections in proportion to the First Equity Financing Price and not in proportion to the price per share paid by new investors receiving the equity securities. Upon conversion of the Securities, the Company may not provide the holders of such Securities with the same rights, preferences, protections, and other benefits or privileges provided to other investors of the Company.

The forgoing paragraph is only a summary of a portion of the conversion feature of the Securities; it is not intended to be complete, and is qualified in its entirety by reference to the full text of the Crowd SAFE agreement, which is attached as Exhibit C.

There is no present market for the Securities and we have arbitrarily set the price.

The Offering price was not established in a competitive market. We have arbitrarily set the price of the Securities with reference to the general status of the securities market and other relevant factors. The Offering price for the Securities should not be considered an indication of the actual value of the Securities and is not based on our asset value, net worth, revenues or other established criteria of value. We cannot guarantee that the Securities can be resold at the Offering price or at any other price.

In the event of the dissolution or bankruptcy of the Company, Investors will not be treated as debt holders and therefore are unlikely to recover any proceeds.

In the event of the dissolution or bankruptcy of the Company, the holders of the Securities that have not been converted will be entitled to distributions as described in the Securities. This means that such holders will only receive distributions once all of the creditors and more senior security holders, including any holders of preferred stock, have been paid in full. Neither holders of the Securities nor holders of CF Shadow Securities can be guaranteed any proceeds in the event of the dissolution or bankruptcy of the Company.

While the Securities provide mechanisms whereby holders of the Securities would be entitled to a return of their purchase amount upon the occurrence of certain events, if the Company does not have sufficient cash on hand, this obligation may not be fulfilled.

Upon the occurrence of certain events, as provided in the Securities, holders of the Securities may be entitled to a return of the principal amount invested. Despite the contractual provisions in the Securities, this right cannot be guaranteed if the Company does not have sufficient liquid assets on hand. Therefore, potential Investors should not assume a guaranteed return of their investment amount.

There is no guarantee of a return on an Investor’s investment.

There is no assurance that an Investor will realize a return on their investment or that they will not lose their entire investment. For this reason, each Investor should read this Form C and all exhibits carefully and should consult with their attorney and business advisor prior to making any investment decision.